#income tax slab budget for salaried class

Text

Income Tax Calculator Pakistan 2024

In this article, we delve into the Income Tax Calculator for Pakistan for the year 2024. Recent adjustments to tax rates, driven by the government's compliance with International Monetary Fund (IMF) conditions, have temporarily affected the salaried class. For those seeking a salary tax calculator for Pakistan or the FBR Tax Calculator for 2024, keep reading for detailed insights.

Income Tax Calculator Pakistan 2024

As per the latest tax regulations approved with the money bill, here’s a breakdown of the income tax structure:

Income up to Rs. 600,000 per annum (Rs. 50,000 per month): No tax is applicable.

Income between Rs. 600,000 and Rs. 1.2 million per annum (Rs. 50,000 to Rs. 100,000 per month): A tax rate of 2.5% applies on income exceeding Rs. 600,000.

Income from Rs. 1.2 million to Rs. 2.4 million per annum (Rs. 100,000 to Rs. 200,000 per month): A tax of Rs. 15,000 plus 12.5% on the amount exceeding Rs. 1.2 million is applicable.

Income between Rs. 2.4 million and Rs. 3.6 million per annum (Rs. 200,000 to Rs. 300,000 per month): A tax of Rs. 165,000 plus 20% on the amount above Rs. 2.4 million is imposed.

Income from Rs. 3.6 million to Rs. 6 million per annum (Rs. 300,000 to Rs. 500,000 per month): A tax of Rs. 405,000 plus 25% on the amount exceeding Rs. 3.6 million is charged.

Salary Tax Calculator Pakistan

If you're a salaried individual needing to calculate your annual tax obligations, the online Salary Tax Calculator can be very useful. This tool helps you estimate the taxes based on your total earnings and the prevailing tax rates. For an accurate calculation, simply use the provided online resources.

FBR Tax Calculator 2024

The FBR Tax Calculator for 2024 applies uniformly across government and semi-government employees. Notably, the Coalition Government's Budget Plan for 2024 adjusted the tax slabs, specifically exempting individuals earning up to Rs. 100,000 per month. For a detailed breakdown and to calculate your tax liability, use the FBR Tax Calculator link below.

For more information and to access the Salary Tax Calculator and FBR Tax Calculator for Pakistan 2024, please follow the provided links.

0 notes

Text

"Save As Much As ₹ 17,500": Finance Minister on New Tax Regime Slabs

Standard deduction in the new tax regime will be increased from ₹ 50,000 to ₹ 75,000, Finance Minister Nirmala Sitharaman said Tuesday as she announced the 2024 Union Budget.

Ms Sitharaman also announced revisions to tax slabs in the new regime. As a result, the Finance Minister told Parliament, salaried employees can save as much as ₹ 17,500 in the new regime.

It will also, she said, provide salaried individuals with higher tax savings and more disposable income.

Existing new tax regime slabs (effective for FY 2023-24) were as follows:

Income up to ₹ 3 lakh - Nil

Rs 3 lakh to ₹ 6 lakh - 5 per cent

Rs 6 lakh to ₹ 9 lakh - 10 per cent

Rs 9 lakh to ₹ 12 lakh - 15 per cent

Rs 12 lakh to ₹ 15 lakh - 20 per cent

Above ₹ 15 lakh - 30 per cent

The increase in standard deduction was one of the most anticipated ahead of the budget speech.

Industry experts speculated this could double to ₹ 1,00,000, but Ms Sitharaman fell slightly short.

In addition, deduction on family pension for pensioners will be increased from ₹ 15,000 to ₹ 25,000.

These tweaks will bring relief for around four crore salaried individuals and pensioners, she said.

Changes to income tax slabs, old and new, were in focus ahead of Ms Sitharaman's speech as the country's mammoth middle class clamoured for relief from tax burdens. There was little joy for the middle class in the interim budget - which pegged gross tax revenue at ₹ 38.31 lakh crore for 2024-25, an 11.46 per cent growth over the last fiscal - so all eyes were on the Finance Minister today.

Ms Sitharaman, however, had to walk a tight rope as she looks to stimulate growth and provide relief.

Another big expectation was a hike in exemption limit. Under the new regime, those earning under ₹ 3 lakh a year are exempt from paying tax. There was speculation this could be raised to ₹ 5 lakh.

There was, however, no such announcement.

There was also no changes announced for tax slabs under the old regime. This is amid speculation the government plans to do away with this option for next year.

The Finance Minister also announced a comprehensive review of the Income Tax Act of 1961, which will make it easier to read and understand, and reduce uncertainty and potential for litigation.

This will be completed in six months.

As part of this overhaul, Ms Sitharaman said tax authorities could only re-open assessments within three years from end of assessment and if the escaped income is ₹ 50 lakh and over.

Even then, the time limit for search cases is to be reduced from 10 years to six before year of search.

"A beginning is being made in the Finance Bill by simplifying the tax regime for charities, TDS rate structure, provisions for reassessment and search provisions and capital gains taxation," she said.

As per the proposal, two tax exemption regimes for charities will be merged into one.

The five per cent TDS, or Tax Deducted at Source, rate is being merged into the two per cent rate and the 20 per cent rate on repurchase of units by mutual funds, or UTI, is being withdrawn, she said.

The TDS rate on e-commerce operators will be reduced from one to 0.1 per cent, she added.

Also, Ms Sitharaman said she proposed to decriminalise delay for payment of TDS, or Tax deducted at Source, up to the due date of filing the concerned statement.

0 notes

Text

Income Tax Budget 2024: New Tax Slabs to Standard Deduction - Changes Under New Regime You Need to Know

Income Tax Budget 2024 On July 23, Finance Minister Nirmala Sitharaman unveiled the Budget 2024. The FM blazoned a borderline income duty cut for the middle class. She increased the standard deduction( a fixed deduction from a hand's total payment before calculating the applicable income duty rate) by 50 to ₹ 75,000 and acclimated duty crossbeams for taxpayers under the new income duty governance. Speaking on the budget, Prime Minister Narendra Modi stated that it" will act as a catalyst in making India the third- largest frugality in the world( from fifth largest moment) and will lay a solid foundation for a developed India.

The income tax slabs differ between the previous and current tax regimes. Furthermore, the slab rates under the previous tax regime were divided into three groups.

Indian residents under 60 years and non-residents aged 60 to 80 years:

Resident Senior Citizens

More than 80 years: Resident super seniors

Income Tax Budget 2024: Tax Slabs Under the New Regime

The Budget 2024 altered the tax slabs in the New Regime, giving taxpayers an additional opportunity to save Rs 17,500 in taxes. Furthermore, the standard deduction has been enhanced to Rs. 75,000 under this regime, while the family pension deduction has been adjusted to Rs. 25,000 from Rs. 15,000. This is applicable for the fiscal year 2024-25. The following is a comparison of the tax slabs after and before the budget

New income tax vs. old income tax slabs: On July 23, Finance Minister Nirmala Sitharaman presented the Narendra Modi 3.0 government's first budget. FM increased the standard deduction by 50% to ₹75,000 and adjusted tax slabs under the new income tax regime to benefit salaried individuals. The new tax slabs under the new income tax regime will be implemented from April 1, 2024 (Assessment Year 2025-26).

Income Tax Budget: Key income tax changes

Significant income Duty adaptations The standard deduction for salaried workers increased from ₹ 50,000 to ₹ 75,000. Pensioners can now abate ₹ 25,000/- from their family pension, over from ₹ 15,000. The 5% duty rate arbor increased from ₹ 5 lakh to ₹ 7 lakh. NPS- The benefit for social security of paid persons can accrue as a deduction of expenditure by employers towards NPS( the new pension system is intended to be enhanced from 10 to 14 percent of the hand's payment).

Read more

0 notes

Text

Decoding Budget 2023: All major budget announcements and their impact

On February 1, Finance Minister, Nirmala Sitharaman announced the Decoding Budget 2023. She raised the personal income tax rebate limit and doled out Sops on small savings.

Nirmala Sitharaman’s fifth budget comes when the economy is slowing and there is a need for increased spending on social sectors and ramping up incentives for local manufacturing.

The budget was also accompanied by significant tax announcements for the salaried class, with changes in tax slabs and a clear intention to shift to the new tax regime.

So, we are decoding the budget 2023 which will give you a complete scenario of the same. And, also know about the Budget for digital-first India.

Here are some major announcements of Decoding Budget 2023.

Capital Expenditure target upto 33%

The finance minister raised the capital expenditure (capex) target by 33% to Rs 10 lakh crore, which will be 3.3% of the GDP.

Capex is the money that a government spends on developing buildings, machinery, equipment, schools, and infrastructure.

For more reads : Financial Inclusion

0 notes

Text

Union Budget 2023–24 Highlights & Complete Budget Analysis

Union Finance Minister Nirmala Sitharaman presented the Budget 2023-24 on 1st February at 11 AM. This is the first budget in “Amrit Kaal” as India is going to turn 100 years old in 25 years and the last full-fledged budget before the elections next year.

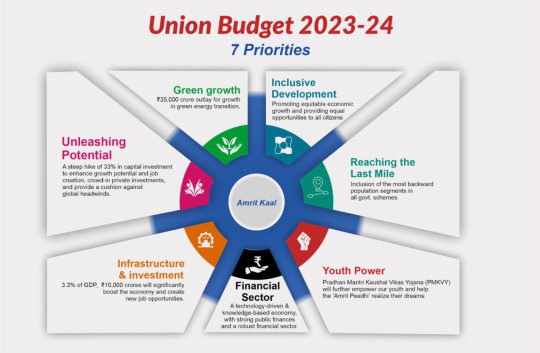

The finance minister said that our economy is on the right track and heading toward a bright future. Adopting seven priorities to guide India through the “Amrit Kaal”, including inclusive development, reaching the last mile, infrastructure and investment, unleashing the potential, green growth, youth power, and financial sector.

INCOME TAX CHANGES

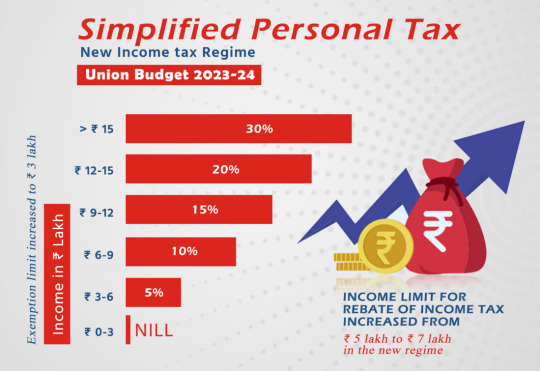

Govt. has tried to boost consumption through the middle class with a change in the tax slabs.

There are a few incentives to be offered to shift to the new tax regime. The old regime however remains acceptable.

There’ll be no Income Tax for salaries up to 7 LPA in the new tax regime as the rebate limit has increased from Rs 5 LPA to 7 LPA.

Individuals earning more than Rs 5 crore PA, pay a surcharge of 25% under the new regime as opposed to 37% under the old regime.

The tax collected at source (TCS) of 20% will be applied on foreign remittances to tax foreign holidays and expenses and realty investments abroad. This will exclude payments for education and health.

The idea behind slashing taxes is to increase the disposable income in the hands of the consumer, raise demand and boost consumption. The focus of the old regime was tax-saving instruments. The new generation is looking at different investment options, not necessarily tax saving.

WHAT GETS CHEAPER AND WHAT GETS COSTLIER

Hattrick of boosting Capital Expenditure, Slashing Taxes, and reducing Fiscal Deficit will benefit India’s economy a lot. The Capital Expenditure (CapEx) is going to raise by 33% to ₹10 lakh crore for the next fiscal year starting from 1st April, which is 3.3% of the country’s economic output. But, on an individual level, we all wait for the list of items that get costlier and cheaper.

Customs duty cut on components for TVs, Mobile phones to boost domestic production. Also on machinery and components for the manufacture of Lithium-ion batteries in the use of Electric Vehicles

Customs duty increase on Kitchen chimneys, Electric Vehicles, imitation jewelry, and precious metals. Cigarettes to become dearer.

OTHER SCHEMES AND BENEFITS

Marginalized sections Including Farmers, Women, and Sr. Citizens will be benefitted with the senior Citizen Deposit Limit increased to 30 lakhs from 15 lakhs and with a lock-in period of 5 years.

The Monthly Income Scheme limit was enhanced to Rs 9 lakhs from Rs. 4.5 Lakhs for individual accounts and 15 lakhs from 9 lakhs for joint accounts.

Mahila Samman Savings Certificate will be launched in March 2025. Max. deposit of Rs. 2 Lakh at a fixed interest rate of 7.5%, eligible for partial withdrawal.

The Agri credit is increased by 20 lakh crore and an Agriculture Accelerator Fund will be set up to encourage agri-startups by young entrepreneurs. They will improve mobility, facilitate trade, lead to job creation, and boost overall economic productivity. Capital investment outlay increased by 33 percent to ₹10 lakh crore, which is 3.3% of GDP.

The Green Energy Transition will get an outlay of ₹35,000 crores and a Green Credit Programme will be notified under the Environment Protection Act,1986.

“This will incentivize environmentally sustainable and responsive actions by companies, individuals, and local bodies, and help mobilize additional resources for such activities,”

Nirmala Sitharaman

0 notes

Text

The #Budget2023 presented for #AmritKaal marks a pivotal moment for India, as the government sets its eye on building a prosperous India for all.. As per Budget, India's estimated growth of 7.0% this year despite the challenges posed by the pandemic, war & global slowdown is a great success.

The budget presented by the finance minister, Nirmala Sitaraman sets a roadmap for a comprehensive plan for realizing the vision of India guided by the seven "Saptarishi" focus areas of inclusive development, reaching the last mile, infrastructure investment, unleashing potential, green growth, empowering the youth & strengthening the financial sector.

A pro-growth budget with effective roadmap with numbers, the budget laid big focus on capital expenditure that has gone up by 33%. Amount of inclusiveness in this budget from medium to long-term perspective, especially given the global inflationary market, will help maintain fiscal discipline, lead to capacity building and help accelerate India’s growth prospects. The announcement of decriminalizing 3400 legal provisions may not be quantifiable in terms of numeric but is a huge positive step towards reducing compliance burden and enhancing ease of doing business.

To address the 'access to credit' challenge & empower MSMEs, revamped Credit Guarantee Scheme will provide an infusion of Rs 9000 crore, enabling an additional collateral-free credit guarantee of Rs 2 lakh crore & lowering the cost of credit by 1%; this is great development for MSMEs that are still recovering from the impact of pandemic.

PM Vishwa Karma Kaushal Samman has been introduced to help traditional artisans integrate into the MSME value chain, with financial support, training & market linkages provided. Also, the much-awaited income tax slab change is a huge tax relief for the salaried middle class and will help further boost spends and consumption.

The focus of this budget is on wide-ranging reforms with the vision of a prosperous and inclusive India; Be it tax relief, ease of doing business, health & education, or #technology -driven

sustainable development, there are things for everyone.

Government's mission for Amrit Kaal includes a technology-driven and knowledge-based economy with a focus on facilitating opportunities to provide a strong impetus to job creation & strengthening macroeconomic stability. The Indian economy has not only made significant progress in Sustainable Development Goals but has also become more inclusive, making it a well-governed country on the path to continued growth.

1 note

·

View note

Text

Union Budget 2023: 5 Personal Income Tax Rules For Middle-Class People!!

Union Budget 2023: 5 Personal Income Tax Rules For Middle-Class People!!

Union Budget 2023 has finally considered to the revise the personal income tax rule that hasn’t been changed since 2014. The new rule was represented by Finance Minister Nirmala Sitharaman. The upcoming rules consider accounting for the benefits in the favor of hard-working middle-class people.

Also Read: OMG!! Here’s Why Adani Had to Withdraw Rs 20,000 Crore FPO!!

The 5 new rules will enrich finance management and thus favor people with low to medium-range salaries. Here’s a list of 5 new rules that will be commenced under the new Personal Income Tax rule.

5 Personal Income Tax Rules

Tax Rebate Increment

Tax Slabs Renewal

Allowances for Pensioners

Maximum Tax Management

Leave Encashment

Also Read: Nirmala Sitharaman presented the Union Budget 2023 in parliament today. She started with a list of beneficiaries for all the government schemes and private sectors. However, she lastly came to the prime topic that every middle-class person was waiting for i.e. personal income tax. She started with “Now, I come to what everyone is waiting for personal income tax. I have five major announcements to make in this regard. These primarily benefit our hard-working middle class.

Also Read: No Foldable iPad in 2024, 20.5-Inch Foldable Notebook Launch Confirmed!!

Tax Rebate Increment

Currently, those with income up to Rs 5 lakh do not have to pay any income tax in the old or new tax regimes. Now, the rebate limit has been increased to Rs 7 lakh in the new tax regime. Thus, people with income up to Rs 7 lakh won’t have to pay any income tax under the new tax regime.

Also Read: Is Hulk Hogan Doing Well? Kurt Angle Claimed About His Health is True or False?

Tax Slabs Renewal

The second scheme directly favors middle-class people. In 2020, the personal tax regime included six tax slabs starting from Rs 2.5 lakh. This year the tax structure will include only five slabs with an increased tax exemption limit of 3 lakhs. Here’s a list of new tax regimes:

Also Read: Indian Coast Guard Day: History and Significance…

Also Read: Union Budget 2023 Live Updates: Finance Minister Announces No Tax for Poeple With Income Less Than 7 Lacs!!

Allowances for Pensioners

The new tax regime will benefit pensioners as well. The government has announced extending the benefits of standard deductions to the new tax regime. Moreover, every salaried person with an income of Rs. 15.5 lakhs or more will benefit by Rs 52,500.

Also Read:See Why UAE Politician Sheikh Mohammed Al Maktoum Renamed Al Minhad as ‘Hind City’!!

Maximum Tax Management

Currently, our country pays the highest amount of tax in the world. We are currently paying a tax rate of 43.74 per cent. The new budget has announced to reduce of this surcharge from 37 per cent to 25 per cent. As a result, the new highest tax rate will be reduced to 39 per cent under the new tax regime.

Also Read: Super Bowl Game 2023: Chiefs Vs. Eagles Date, Time, and Predictions

Leave Encashment

The tax exemption for the retirement of non-government salaried employees was last changed in 2002. The limit of tax exemption has remained at Rs 3 lakh since then. The highest basic pay in 2002 was Rs 30,000. Now, under the new tax regime, the government has increased the limit to Rs 25 lakh considering the increase in the salaries of government employees.

Also Read: Hindenburg Replies to Adani’s Defense Report Threats!! See Conclusion!!

The revised personal income tax will provide major relief to all taxpayers in the new regime. An individual with an annual income of Rs 9 lakh will be required to pay only Rs 45,000/-. This is only 5 per cent of his or her income. It is a reduction of 25 per cent on what he or she is required to pay now, i.e. Rs 60,000/-. Similarly, an individual with an income of Rs 15 lakh would be required to pay only 1.5 lakhs or 10 per cent of his or her income, a reduction of 20 per cent from the existing liability of Rs 1,87,500/.

Also Read: Economic Survey 2023 Report Summary Explained by Finance Minister Nirmala Sitharaman…

0 notes

Text

The Budget 2023 presented by Financial Minister Nirmala Sitaraman was primarily focused on the middle class and income tax for individuals. The new regime offers lower tax rates, higher slabs and a standard deduction for salaried class. Taxpayers can opt for the old regime with deductions. Leave encashment tax exemption increased to Rs. 25 lakhs, presumptive taxation limits raised to Rs. 3 crores. Deduction for MSME payments only claimable after payment, startup time limit extended. Surcharge of 37% on over Rs. 5 crores reduced to 25%. If you need additional information regarding the Budget 2023 highlights and analysis and how it will impact you and your business, feel free to contact the ASC Group.

0 notes

Text

5 Big Changes Announced On Income Tax For Salaried Class

Home

Business

Budget 2023: 5 Big Changes Announced On Income Tax For Salaried Class

Budget 2023: Notably, FM Sitharaman tweaked the slabs to provide big relief to the middle class by announcing that no tax would be levied on annual income of up to Rs 7 lakh under the new tax regime.

Union Budget 2023: Nirmala Sitharaman presents Union Budget for fiscal 2024.

Budget 2023 Latest Update: Union…

View On WordPress

0 notes

Text

Budget 2023: How are the old and new income tax slabs different from each other?

Income tax slabs were last changed in 2014, when the personal tax exemption limit was also revised. While the 2020 budget introduced an optional new income tax regime that found few takers, the 2022 budget offered no relief for salaried professionals. The salaried class always looks forward to income tax exemption in every financial year. From the upcoming Budget 2023, taxpayers are expecting…

View On WordPress

0 notes

Text

Union Budget 2023: Expectations Of The Business And The Common Public

The Union Budget will be presented by Finance Minister Nirmala Sitharaman on February 1. For the fifth time, Sitharaman will propose the federal budget. It took the Finance Minister of 2022 nearly 1.5 hours to present the budget. Her 2 hours and 40 minutes 2021 budget address set a record for length in Indian history.

As the Union Budget for FY 2023–2024 approaches, the government is anticipated to pay attention to a number of significant topics. Undoubtedly, one of the areas of importance will be the expansion and development of the economy.

The upcoming Union Budget will be the last full-year budget from the Modi government before the upcoming Lok Sabha elections, which are anticipated to take place in early 2024. The primary objective of the finance minister, Nirmala Sitharaman, expected to sustain future growth while reducing the budget deficit and inflation.

Union Budget 2023: Expectations of the Business and the Common Public

1. Income Tax Slabs

With the exception of a new optional tax system, the salaried class in India hasn't traditionally had much to rejoice in the recent budgets of 2020. Individual taxpayers thus expect the next budget to offer some significant gains. Of particular note, economists contend that the Government has to consider raising the top tax rate threshold from Rs. 10 lakh to Rs. The highest tax rate can also be lowered from 30% to 25% to align it with corporate rates. This would presumably boost the common public's purchasing power populace and enable the country's demand for products and services to rise.

2. Banking Industry

Because they will be the primary sources of funding for all sectors to cover the government's significant capital expenditures, banks have received a considerable capital infusion. Consequently, the banking sector is not aggressively looking for support in the form of more money. But the sector is anxiously anticipating the government's plans for the privatization of public sector banks (PSBs). Experts predict that the quick privatization of PSBs would boost increased financial inclusion and operational efficiency.

3. MSME industry

Because 95% of Indian firms are micro-scale enterprises, the government must give boosting funding to MSMEs and startups as well as simplify taxation for them as a high priority. Aiming to reverse the slump it has seen over the previous two years and experience robust growth, the MSME sector, which has historically been the backbone of the Indian economy, has begun the new year with high expectations. The implementation of policies that would make it simpler for MSMEs to conduct business should be the objective of the budget for 2023.

Furthermore, it is imperative that policies be put into place to reduce input costs, boost liquidity, and enhance financial inclusion by providing small companies with access to reasonably priced financial products. To further promote small firms and empower entrepreneurs, support mechanisms such as startup-friendly laws to allow increased expenditure on innovation and tax relaxations should be implemented.

4. Stock markets

Equities markets throughout the world have seen turmoil recently. Even in the face of this uncertainty, the Indian equity market has remained an anomaly, beating both established and new competitors. Despite analysts' worries that high valuations may limit the Indian stock market in 2023, the Budget might support the market's rising momentum.

How? Market analysts believe that the elimination of the long-term capital gains tax (LTCG) would be the answer. Currently, if stock market gains are kept for a period longer than a year, they are subject to a 10% tax. However, stock market participants want this tax repealed. Notably, analysts believe that taking such action would significantly strengthen the markets and increase participation.

5. Real Estate Sector

Future prospects for the real estate industry, particularly the residential real estate market, seem bright after a protracted period of uncertainty. However, escalating inflation and rising loan rates have significantly lowered homebuyers' purchasing power. Real estate sector experts believe that the tax-deductible ceiling for house loan interest payments can be increased from Rs 2 lakh to Rs 5 lakh in order to offset this. A separate Section 80 C alternative for principal repayment of house loans can also be offered for Rs 4 lakh, analysts claim.

Read This Full ARTICLE, Click Here

0 notes

Text

Budget 2023: 80C to HRA, 6 changes expected by Salaried class

Budget 2023: 80C to HRA, 6 changes expected by Salaried class

Salaried employees are the biggest contributors to tax in India yet they receive very few tax exemptions. They now have big expectations from Budget 2023, which will be presented on February 1, 2023. However, some experts believe that it may not be a populist budget.

According to Some experts, salaried employees can expect rationalisation of income tax slab rates, both in terms of limits and tax…

View On WordPress

0 notes

Text

BLOG : ईमानदारी का इनाम भी तो मिले, आमदनी अठन्नी खर्चा रुपैया वाला अमृतकाल नहीं चाहिए

BLOG : ईमानदारी का इनाम भी तो मिले, आमदनी अठन्नी खर्चा रुपैया वाला अमृतकाल नहीं चाहिए

नई दिल्ली : अमीरों को रिबेट, गरीबों को सब्सिडी और मिडिल क्लास को मिला टीवी डिबेट। क्योंकि हम उम्मीद से थे। अभी भी हैं। उम्मीदें कम भी नहीं थी। एक झोला उम्मीदें थीं। सोच रहे थे इनमें से कुछ तो निर्मला सीतारमण के पिटारे में होगा। स्टैंडर्ड डिडक्शन (Standard Deduction) 50 हजार से एक लाख हो जाए, हाउसिंग लोन के ब्याज पर इनकम टैक्स छूट (Housing Loan Interest Deduction limit) की लिमिट दो लाख से तीन लाख…

View On WordPress

#Budget 2022#Budget 2022 Highlights#budget ki khas baaten#budget me income tax#budget me kya sasta hua#Headlines#income tax slab budget for salaried class#latest news#news#news in hindi#nirmala sitharaman budget bhashan#what in budget for salaried middle class#इनकम टैक्स स्लैब#बजट 2022#मुख्य खबरें Samachar

0 notes

Text

Budget 2022: सोशल मीडिया पर तो यही प्रतिक्रिया, वित्त मंत्री निर्मला सीतारमण ने बजट से किया निराश

Budget 2022: सोशल मीडिया पर तो यही प्रतिक्रिया, वित्त मंत्री निर्मला सीतारमण ने बजट से किया निराश

नई दिल्ली : वित्त मंत्री निर्मला सीतारमण ने बजट से निराश किया। कम से कम सोशल मीडिया पर तो यही प्रतिक्रिया आ रही है। रिएक्शंस से साफ है कि मिडल क्लास और सैलरीड क्लास को बजट नहीं पसंद आया। इनकम टैक्स स्लैब में कोई राहत नहीं मिली। आयकर दरों में भी बदलाव नहीं हुआ। सरकार ने बड़े इंतजार के बाद क्रिप्टोकरेंसी पर पत्ते खोल दिए हैं मगर भारी टैक्स लगाकर बहुतों के अरमानों पर पानी फेर दिया। इसके…

View On WordPress

#Budget 2022#Cryptocurrency#Income Tax Slabs#Middle Class#Nirmala Sitharaman#RahulGandhi#Salaried Class#tax

0 notes

Text

Budget 2022-23

By ~ Mehul Sharma

Since last morning , you have been hearing "Budget , budget and only budget " either from your parents or from your friends or seeing on the social media literally from everywhere .

Some people think that the budget is mainly for Stock Investors or those who take interest in finances BUT they don't know this budget directly influence everyone's life whether he/she is a poor or a middle class or a rich .

The Right wing is calling this budget as a 'MASTERSTROKE' while the Left wing is naming it as a 'ZERO SUM' Budget .

NAA PAKSH NAA VIPAKSH , BAAT KRUNGA

KEVAL NISHPAKSH

So let's start our discussion on the incomes and the expenditures that the government will be doing in the upcoming fiscal year :

1 . A good news and a bad news for Crypto Investors . Good news is that the govt has indirectly clarified that they will no longer be banning cryptocurrencies in India BUT they will regulate it by levying 30% tax and 1% TDS on every transaction of crypto assets .

2. RBI to issue Digital Rupee based on blockchain technology in 2022-23 . This will really help India to upgrade its technology and hold its grip in digital currencies .

3. By changes in custom duties ,

Imported goods will become more Costlier like headphones and earphones , solar cells , toys , X ray machines , umbrellas , loudspeakers and many more things

Here , we can conlude that Govt is clearly promoting MADE IN INDIA 🇮🇳🇮🇳 products .

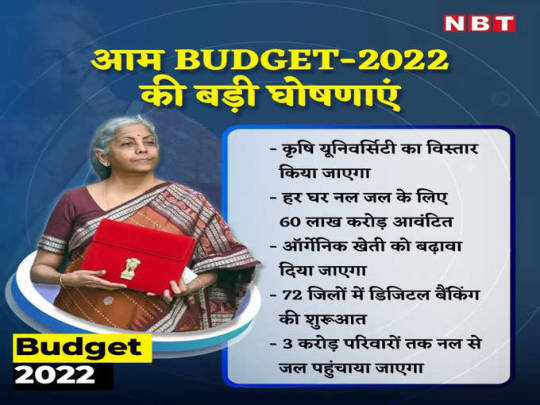

4 . Again this year , almost nothing for Middle Class people as no change in Income Tax slabs which they were expecting this year as they were hit hard during the pandemic .

5. Fostering MSMEs Competitiveness: The government has announced reduced import tariffs on inputs and increasing/imposing tariffs on end products. This will lead to a higher degree of protection and improved competitiveness for MSMEs . Moreover ease in credit system for them .

This clearly shows Govt is helping MSME's to grow as it is the most employed sector of India.

6 . NABARD start-up initiative: Individuals and FPOs are to be fostered aggressively through NABARD.

7. Self Reliance in Defense as FM has said 68% capital procurement budget in the sector was earmarked for domestic procurement as part of AATMARNIRBHAR BHARAT 🇮🇳🇮🇳

8. Almost ₹ 1 lack crore has been spent on Education further divided in the ratio of 3:2 in the primary and tertiary eduction .

9 . Health sector sees 45 % drop in expenditure as compared to FY 21-22 which is not a good sign for our medical sector .

Expenditure in the health sector is HIGHLY DISAPPOINTING from the Govt . We need to develop it a lot .

10. 400 new Vande Bharat Trains will be developed in next 3 years .

Moreover , around 25 tele Mental health centres will be developed thereby promoting Mental Health Programmes in India .

CONCLUSION :

Overall a Balanced Budget , almost nothing to do with middle class people and salaried employees .

Was very Beneficial to Startups , MSMEs , Infrastructure Sector , slightly for Farmers and Crypto haters 😂😂

Was very Disappointing for Health Sector , Importers of finished goods , Crypto Investors and Middle Class ( as usual )

5 notes

·

View notes

Text

Salary Tax Calculator Pakistan - Income Tax Slab FY 2019-2020

What is Income Tax?

Before Enrolment and Recording of your Annual Expense form, it is suggested that one ought to set up fundamental comprehension with respect to these procedures. Information on fundamental ideas would not just guarantee that the undertakings are performed effectively yet in addition in the recommended way.

Available Salary :

Available Salary implies Complete Pay diminished by gifts qualifying straight for reasonings and certain deductible remittances.

All out Pay :

All out Salary is the total of Pay chargeable to Assessment under each head of Pay.

HEAD OF Pay :

Under the Personal Expense Law, 2001, all Salary are extensively separated into following five heads of Pay:

Compensation;

Pay from property;

Pay from business;

Capital increases; and

Pay from Different Sources.

Occupant

Personal Tax is the duty that you pay on your salary. Annual Tax is paid by workers i.e., salaried class, independently employed and non-joined firms. Annual Tax is one of the significant sources through which an administration funds its exercises. The individual personal assessment income is just 1.1% of GDP in Pakistan (11% of all out-expense incomes) and just 2% of working age populace is enrolled as citizen.

Is Income Tax Calculator relevant on the entirety of my pay?

In the event that your pay is not exactly the exception edge of PKR 400,000 (regardless of whether you are a salaried or non-salaried individual), you don't need to make good on any annual duty. The edge has not changed under the Budget 2017-18.

Duty treatment of wedded couples in Pakistan is individual based and expense plans used to contrast somewhat for people before 2010. The assessment rate shifts somewhere in the range of 2% and 30% in Pakistan.

Call Us: 0300 8447469 / 0321 4554554

1 note

·

View note