#installmentpayments

Explore tagged Tumblr posts

Text

Payment Installment App for ERPNext | Kanak Infosystems

Streamline your financial transactions with the Payment Installment App for ERPNext by Kanak Infosystems. Our app offers a hassle-free way to set up and manage payment installments, making it easier for your customers to pay and for you to track. Boost your business efficiency and customer loyalty with our cutting-edge solution!

#frappe#paymentinstallment#erpnext#paymentplan#installmentplan#customerpayments#installmentpayments#frappeframework#frappeapp#addonsforfrappe#erpnextapp#erpnextcustomization#configurepaymentplan#paymentplanconfiguration#financialmanagement

0 notes

Text

7 Tips for Managing Your Cash Loan Installment Payments Like a Pro

Have you ever taken a cash loan and found it difficult to manage the installment payments? Don't worry, you are not alone. Managing cash loan installment payments can be a challenging task, especially if you have limited knowledge of loan terms and financial planning. In this blog post, I'll share seven tips that have helped me manage my cash loan installment payments successfully.

Tip 1: Understand Your Loan Terms

When you apply for a cash loan, make sure to read and understand the loan terms before signing the agreement. It's essential to know the interest rate, fees, and repayment schedule for each installment. This information will help you plan your budget and avoid surprises later on. If you don't understand something, don't hesitate to ask your lender for clarification. For example, when I took out my first cash loan, I didn't read the fine print carefully and ended up paying more interest and fees than I expected. That's why I recommend taking the time to review the loan terms thoroughly before signing anything.

Tip 2: Create a Budget

Creating a budget is an important step in managing your cash loan installment payments. It helps you track your income and expenses and identify how much money you can allocate toward your loan payments. Start by listing all your monthly income sources, such as your salary or freelance payments. Then, list all your expenses, including rent/mortgage, utilities, groceries, transportation, and any other bills you have. This will help you identify how much money you have left to cover your loan payments. For example, if your monthly income is $3,000 and your expenses total $2,500, you have $500 left to allocate toward your loan payments. By creating a budget, you can make sure you have enough money to cover your loan payments and other essential expenses.

Tip 3: Prioritize Your Payments

Paying your loan installments on time is crucial to avoid late fees and penalties. Make sure to prioritize your loan payments over other expenses. This means setting aside enough money each month to cover your loan payments before spending money on other non-essential items. I recommend setting up automatic payments or reminders to help you stay on track. This way, you won't forget to make a payment, and you'll avoid late fees. If you're having trouble prioritizing your payments, consider working with a financial advisor who can help you create a plan that works for your unique situation.

Tip 4: Consider Refinancing or Consolidation

If you're struggling to make your loan payments, refinancing or consolidation may be an option. Refinancing means replacing your existing loan with a new one with better terms, such as lower interest rates. Consolidation means combining multiple loans into one to simplify your payments. These options may reduce your monthly payments and make it easier to manage your debt. However, it's important to do your research and make sure that refinancing or consolidation is the right choice for you. Make sure to compare interest rates, fees, and other terms before making a decision. Also, keep in mind that these options may have drawbacks, such as extending the repayment period and increasing the total cost of the loan.

Tip 5: Communicate with Your Lender

If you're having difficulty making your loan payments, it's essential to communicate with your lender. Ignoring your loan payments will only make the situation worse and damage your credit score. Your lender may be able to offer you payment options, such as deferment or forbearance, or modify your loan terms to make them more manageable. For example, if you've lost your job or experienced a significant life change, you can contact your lender to explain your situation and ask for assistance. Many lenders are willing to work with borrowers to find a solution that works for both parties. Just remember to be honest and open with your lender about your financial situation.

Tip 6: Set up Automatic Payments

Setting up automatic payments is an easy and convenient way to ensure that your loan payments are made on time. You can set up automatic payments through your bank account or your lender's website Most lenders offer this option, and it can help you avoid late payments and potential fees. Automatic payments also save you time and effort because you don't have to worry about manually making payments each month. To set up automatic payments, log in to your lender's website and look for the option to set up automatic payments. You'll need to provide your bank account information and choose the amount and frequency of payments. Make sure to double-check the information before submitting your request to avoid any mistakes.

Tip 7: Monitor Your Progress

It's important to monitor your loan progress regularly. Keep track of your loan balance, payments made, and remaining payments. This will help you stay on track and make sure you're making progress toward paying off your loan. You can use loan tracking tools to make this process easier. Many lenders offer online portals that allow you to view your loan details, including payment history and balance. You can also use personal finance apps to track your loan progress and set reminders for upcoming payments. When you reach a significant milestone, such as paying off a certain percentage of your loan or making all your payments on time for several months, celebrate your progress! This will help motivate you to keep going and reach your goal of paying off your loan.

Frequently Asked Questions

Q: What is a cash loan installment payment? A: A cash loan installment payment is a type of loan where a borrower receives a lump sum of money upfront and then repays the loan over a set time with regular payments, or installments. The payments typically include both principal and interest, and the loan terms can vary depending on the lender and borrower's agreement. Q: How can I manage my cash loan installment payments effectively? A: To manage your cash loan installment payments effectively, you should read and understand your loan terms, create a budget, prioritize your payments, consider refinancing or consolidation if necessary, communicate with your lender, set up automatic payments, and monitor your progress. Q: What happens if I miss a cash loan installment payment? A: If you miss a cash loan installment payment, you may be subject to late fees or other penalties, depending on the terms of your loan agreement. Additionally, missing payments can negatively impact your credit score, making it more difficult to obtain credit in the future. Q: Can I refinance or consolidate my cash loan installment payments? A: Yes, you may be able to refinance or consolidate your cash loan installment payments. Refinancing involves taking out a new loan to pay off your existing loan with better terms, such as a lower interest rate. Consolidation involves combining multiple loans into one to simplify your payments and potentially lower your interest rate. Q: What should I do if I can't make my cash loan installment payments? A: If you can't make your cash loan installment payments, you should communicate with your lender as soon as possible. They may be able to work with you to modify your payment plan or offer assistance to help you avoid defaulting on your loan. It's important to take action early to avoid negative consequences like late fees or damage to your credit score. If you are interested in learning more - Forex - Forex Bonus Offers - Forex Trading Courses & Lessons - Forex Video Tutorials

Conclusion of Cash Loan Installment Payment

Managing your cash loan installment payments can be challenging, but by following these seven tips, you can take control of your finances and avoid potential pitfalls. Remember to read and understand your loan terms, create a budget, prioritize your payments, consider refinancing or consolidation if necessary, communicate with your lender, set up automatic payments, and monitor your progress. With these tips, you'll be on your way to managing your cash loan installment payments like a pro! User Read the full article

#budgeting#cashloans#consolidation#creditscore#debtmanagement#Installment#installmentpayments#Loan#loanterms#personalfinance#refinancing

0 notes

Link

Looking for vivo v20 SE on installment? Sahoolatkar brings wide variety of Mobile phones on cash and easy installments.

0 notes

Photo

Property Sale Tips: Installment sales. With an installment sale of investment or business real estate over two or more years, you can defer tax on your gain until the tax years in which payments are actually received. However, if you sell the property to a related party who disposes of it within two years, the remaining tax is due immediately. Tip: To solve this problem, insert language in the legal agreement that does not allow the disposition of the property within two years. www.tanishamills.cpa.com #property #PropertySale #SellYourHome #SellingYourHome #TaxTips #TaxSavings #InstallmentSale #InstallmentPayment #PropertyTaxes (at San Diego, California) https://www.instagram.com/p/B1JqZ5Zp3yk/?igshid=sbqdvwapyapz

#property#propertysale#sellyourhome#sellingyourhome#taxtips#taxsavings#installmentsale#installmentpayment#propertytaxes

0 notes

Photo

IRS Assessment Statue of Expiration Date (ASED): ASED: Definition: The ASED defines how long the IRS has to assess tax for a specific module/period. In most cases the ASED is calculated as 3 years after the original return received date or return filed date whichever is later. Common Tolling (Law): • Filing amended Return within 60 days of ASED. • Voluntary extension of ASED. • Joint return after filing MFS. • Fraudulent Return. • Under reporting of tax (Under by 25%). #stephensbrostaxservice #taxresolution #offerincompromise #paymentplan #taxdebt #resolvingtaxliens #resolving #tax #debt #installmentpayment #uncollectible #status #accountant #taxsolution #savingmoney #savingmoneytips #operatingbusiness #successmindset #sucessfulwomen #successful #successsecrets #successgrowth #entrepreneurmindset #entrepreneurgoals #entrepreneurgrind #youngprofessionals #professionalwomen #professionalman #taxprofessional (at Elizabeth, New Jersey) https://www.instagram.com/p/Bv2JhU7nO4Z/?utm_source=ig_tumblr_share&igshid=tknmpch4c1tg

#stephensbrostaxservice#taxresolution#offerincompromise#paymentplan#taxdebt#resolvingtaxliens#resolving#tax#debt#installmentpayment#uncollectible#status#accountant#taxsolution#savingmoney#savingmoneytips#operatingbusiness#successmindset#sucessfulwomen#successful#successsecrets#successgrowth#entrepreneurmindset#entrepreneurgoals#entrepreneurgrind#youngprofessionals#professionalwomen#professionalman#taxprofessional

0 notes

Link

Vivo V20 Mobile phones are available on cash and easy monthly installments at Sahoolatkar.

Visit: www.sahoolatkar.com

0 notes

Link

https://www.sahoolatkar.com/product/samsung-a31s-128-gb-6-gb-ram-128-gb-rom-samsung-mobile-phone/

0 notes

Photo

Aloe Vera 2000 pocket sprung mattress from £150 FREE delivery https://bit.ly/3eKkerO #mattress #payl8r #payl8rpartner #bedroomdecor #klarnauk #furniture #uk #england🇬🇧 #manchester #london #paypal #klarnait #paybylaybuy #laybuy #laybuyuk #clearpay #clearpayit #amazon #doublebeds #splitit #splitpaymemts #installmentPayments #OnlineShopping #ShopOnline #BuyNowPayLater Just remember it’s not just a bed it’s personal www.laywellbeds.co.uk [email protected] https://www.instagram.com/p/CDH9sxeFVl_/?igshid=qjzop39eudko

#mattress#payl8r#payl8rpartner#bedroomdecor#klarnauk#furniture#uk#england🇬🇧#manchester#london#paypal#klarnait#paybylaybuy#laybuy#laybuyuk#clearpay#clearpayit#amazon#doublebeds#splitit#splitpaymemts#installmentpayments#onlineshopping#shoponline#buynowpaylater

0 notes

Photo

Aloe Vera 1000 pocket sprung mattress from £150 FREE delivery https://bit.ly/3eKkerO #mattress #payl8r #payl8rpartner #bedroomdecor #klarnauk #furniture #uk #england🇬🇧 #manchester #london #paypal #klarnait #paybylaybuy #laybuy #laybuyuk #clearpay #clearpayit #amazon #doublebeds #splitit #splitpaymemts #installmentPayments #OnlineShopping #ShopOnline #BuyNowPayLater Just remember it’s not just a bed it’s personal www.laywellbeds.co.uk [email protected] https://www.instagram.com/p/CC0n0WYlt_R/?igshid=10icyocp76xwz

#mattress#payl8r#payl8rpartner#bedroomdecor#klarnauk#furniture#uk#england🇬🇧#manchester#london#paypal#klarnait#paybylaybuy#laybuy#laybuyuk#clearpay#clearpayit#amazon#doublebeds#splitit#splitpaymemts#installmentpayments#onlineshopping#shoponline#buynowpaylater

0 notes

Photo

Lush Pocket ActiGel® 1000 Mattress from £350 free delivery https://bit.ly/3i7pjxk #mattress #payl8r #payl8rpartner #bedroomdecor #klarnauk #furniture #uk #england🇬🇧 #manchester #london #paypal #klarnait #paybylaybuy #laybuy #laybuyuk #clearpay #clearpayit #amazon #doublebeds #splitit #splitpaymemts #installmentPayments #OnlineShopping #ShopOnline #BuyNowPayLater Just remember it’s not just a bed it’s personal www.laywellbeds.co.uk [email protected] https://www.instagram.com/p/CCCSQzqFTT3/?igshid=15p5oegcw4l1t

#mattress#payl8r#payl8rpartner#bedroomdecor#klarnauk#furniture#uk#england🇬🇧#manchester#london#paypal#klarnait#paybylaybuy#laybuy#laybuyuk#clearpay#clearpayit#amazon#doublebeds#splitit#splitpaymemts#installmentpayments#onlineshopping#shoponline#buynowpaylater

0 notes

Photo

Royal -Super Orthopaedic Mattress https://bit.ly/2WLzJsu #mattress #payl8r #payl8rpartner #bedroomdecor #klarnauk #furniture #uk #england🇬🇧 #manchester #london #paypal #klarnait #paybylaybuy #laybuy #laybuyuk #clearpay #clearpayit #amazon #doublebeds #splitit #splitpaymemts #installmentPayments #OnlineShopping #ShopOnline #BuyNowPayLater Just remember it’s not just a bed it’s personal www.laywellbeds.co.uk [email protected] https://www.instagram.com/p/CABbfQVl0-M/?igshid=14oq0sbl8vzux

#mattress#payl8r#payl8rpartner#bedroomdecor#klarnauk#furniture#uk#england🇬🇧#manchester#london#paypal#klarnait#paybylaybuy#laybuy#laybuyuk#clearpay#clearpayit#amazon#doublebeds#splitit#splitpaymemts#installmentpayments#onlineshopping#shoponline#buynowpaylater

0 notes

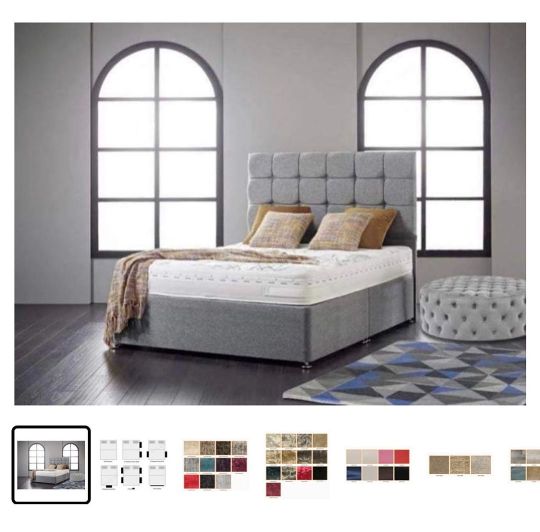

Photo

Divan Base With 24" Cube Headboard Staring from: £150 https://bit.ly/3esLL23 #mattress #payl8r #payl8rpartner #bedroomdecor #klarnauk #furniture #uk #england🇬🇧 #manchester #london #paypal #klarnait #paybylaybuy #laybuy #laybuyuk #clearpay #clearpayit #amazon #doublebeds #splitit #splitpaymemts #installmentPayments #OnlineShopping #ShopOnline #BuyNowPayLater Just remember it’s not just a bed it’s personal www.laywellbeds.co.uk [email protected] https://www.instagram.com/p/B_BUsFBlhP4/?igshid=23rzricdwuyz

#mattress#payl8r#payl8rpartner#bedroomdecor#klarnauk#furniture#uk#england🇬🇧#manchester#london#paypal#klarnait#paybylaybuy#laybuy#laybuyuk#clearpay#clearpayit#amazon#doublebeds#splitit#splitpaymemts#installmentpayments#onlineshopping#shoponline#buynowpaylater

0 notes

Photo

Natural Bespoke Luxury High End Divan Set - Pocket Spring Divan Base Staring from: £1299 https://bit.ly/2x1E9CI #mattress #payl8r #payl8rpartner #bedroomdecor #klarnauk #furniture #uk #england🇬🇧 #manchester #london #paypal #klarnait #paybylaybuy #laybuy #laybuyuk #clearpay #clearpayit #amazon #doublebeds #splitit #splitpaymemts #installmentPayments #OnlineShopping #ShopOnline #BuyNowPayLater Just remember it’s not just a bed it’s personal www.laywellbeds.co.uk [email protected] https://www.instagram.com/p/B-iRrLwFGmb/?igshid=90mmommy5tub

#mattress#payl8r#payl8rpartner#bedroomdecor#klarnauk#furniture#uk#england🇬🇧#manchester#london#paypal#klarnait#paybylaybuy#laybuy#laybuyuk#clearpay#clearpayit#amazon#doublebeds#splitit#splitpaymemts#installmentpayments#onlineshopping#shoponline#buynowpaylater

0 notes

Photo

Property Sale Tips: Installment sales. With an installment sale of investment or business real estate over two or more years, you can defer tax on your gain until the tax years in which payments are actually received. However, if you sell the property to a related party who disposes of it within two years, the remaining tax is due immediately. Tip: To solve this problem, insert language in the legal agreement that does not allow the disposition of the property within two years.

www.tanishamills.cpa.com

#property#PropertySale#SellYourHome#InstallmentPayment#SellingYourHome#TaxSavings#TaxTips#InstallmentSale#PropertyTaxes#Properties#Taxes#Taxed#PropertyTax#Installment#SAVE#SanDiego#SanDiegoCPA#SanDiegoAccountant#SanDiegoAccounting#AccountingFirm

0 notes

Photo

LIFE INSURANCE PROCEEDS: Life insurance proceeds paid upon the death of an insured are not taxable unless the policy was turned over for a price. This is true even if the proceeds were paid under an accident or health insurance policy or an endowment contract. However, interest income received as a result of life insurance proceeds may be taxable. If death benefits are paid in a lump sum or other than at regular intervals, include in income only the amount of benefits that are more than the amount payable at the time of the insured person’s death. If the benefit payable at the death is not specifically, include in income the benefit payment that are more than the present value of the payments at the time of death. Note: if insurance proceeds are paid because of the death of a spouse before October 23, 1986, and those payments are received in installments, exclude up to $1,000 a year of the interest included in the installments, even if the taxpayer remarries. When the other advisors stop. We start. Free consultation: 800-558-6821 #stephensbrostaxservice #lumpsumpayment #lifeinsurance @hollywoodplay #riphollywoodplay #installmentpayment #insurance #brooklyn #brookynbridge #hollywood #contract #taxable #nontaxable #interestincome #health #policy (at Tavern Lounge) https://www.instagram.com/p/BpsJswrnn_e/?utm_source=ig_tumblr_share&igshid=1cqmva2jqc50u

#stephensbrostaxservice#lumpsumpayment#lifeinsurance#riphollywoodplay#installmentpayment#insurance#brooklyn#brookynbridge#hollywood#contract#taxable#nontaxable#interestincome#health#policy

0 notes