#instant payout api

Explore tagged Tumblr posts

Text

Bulk Payout API & its role in simplifying finances

Bulk Payout API is a kind of an API that provides a convenient way to disburse payment to multiple recipients in a single transaction. Here we are going to throw some light on the structure and benefits of bulk payout APIs & how they can revolutionize your financial operations.

Understanding Bulk Payout APIs:

Bulk Payout APIs are software interfaces that enable businesses to send payments to multiple recipients in a single transaction in just one minute. These APIs work by integrating with the company's existing systems, allowing for seamless transfer of funds to multiple accounts at once. Key components of Bulk Payout APIs include authentication mechanisms, transaction processing engines, and reporting tools to track payment statuses.

Benefits of Bulk Payout APIs:

One of the primary advantages of Bulk Payout APIs is their time-saving potential. By automating the payment process, businesses can significantly reduce the manual efforts. This automation not only saves time but also minimizes the risk of errors.

Additionally, Bulk Payout APIs offer cost-effective solutions by consolidating multiple payments into a single transaction. This consolidation results in lower transaction fees and reduced administrative expenses, leading to significant cost savings for businesses.

In the age of digital commerce, efficiency is the currency of success. Embracing Bulk Payout APIs not only streamlines financial transactions but also unlocks the potential for businesses to focus on growth and innovation, leaving behind the constraints of manual payment processing.

Your Gateway to Efficient Financial Management in India

Discover the top providers of Bulk Payout APIs in India, including industry leaders like Razorpay, Cashfree, Waayupay and more. Unlock the potential of streamlined financial transactions and find the perfect solution to meet your business needs.

Use Cases:

Bulk Payout APIs find applications across various industries and business models. E-commerce platforms, for instance, leverage these APIs to streamline vendor payments, affiliate commissions, and supplier transactions. By automating the payout process, e-commerce businesses can enhance efficiency and build trust with their partners.

Implementation Considerations:

When implementing Bulk Payout APIs, businesses must consider several factors to ensure successful integration and operation. Integration ease, for example, is crucial, as businesses seek APIs that seamlessly integrate with their existing systems and infrastructure. Additionally, compliance with regulatory requirements such as Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations is paramount.

Furthermore, customization options play a vital role in tailoring Bulk Payout APIs to specific business needs and branding requirements. Businesses should seek APIs that offer flexibility and customization capabilities to align with their unique preferences and workflows.

Case Studies:

To illustrate the effectiveness of Bulk Payout APIs in real-world scenarios, let's consider a few case studies. Company A, an e-commerce platform, implemented a Bulk Payout API to automate its vendor payments. By consolidating multiple payments into a single transaction, Company A reduced its administrative workload by 50% and achieved significant cost savings on transaction fees.

In both cases, the implementation of Bulk Payout APIs resulted in tangible benefits, including increased efficiency, cost savings, and improved user experience.

Conclusion:

Bulk Payout APIs offer a powerful solution for businesses seeking to streamline their financial operations. By automating the process of disbursing payments to multiple recipients, these APIs save time, reduce costs, and enhance security. With applications across various industries, Bulk Payout APIs have become indispensable tools for optimizing financial workflows and driving business growth. As businesses continue to embrace digital transformation, Bulk Payout APIs will play a central role in shaping the future of financial transactions.

#payout api#instant payment#instant payout api#bulk payout#payment gateways#bulk payment api#bulk payout api

1 note

·

View note

Text

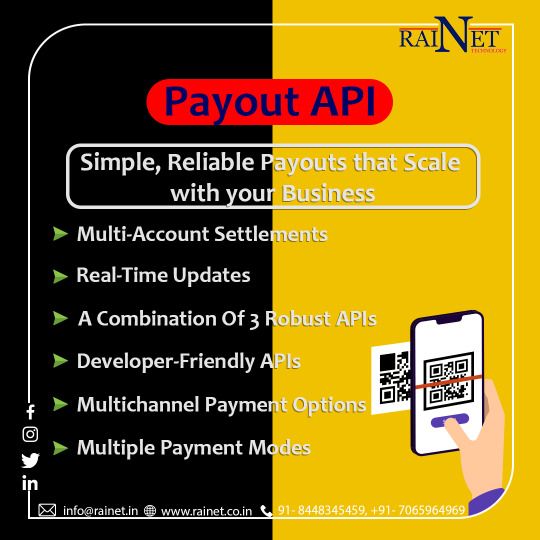

UPI Payout API

Rainet Technology has introduced an innovative service known as the UPI Payout API Service, revolutionising how businesses handle transactions in India. The UPI Payout service leverages the Unified Payments Interface (UPI) system, which is renowned for its seamless, real-time payment capabilities. This service is designed to facilitate bulk disbursements, making it an ideal solution for businesses that need to manage mass payouts efficiently.

The UPI Payout API enables companies to integrate this powerful payment solution directly into their existing systems, allowing for the automated processing of transactions. This integration significantly reduces the time and effort required to manage large-scale payments, whether for vendor payments, employee salaries, or customer refunds. By using the UPI Payout API, businesses can ensure that their transactions are secure, fast, and reliable, thus enhancing their operational efficiency and customer satisfaction.

Rainet Technology's UPI Payout API service stands out due to its robustness and ease of integration. The API is designed to be user-friendly, providing comprehensive documentation and support to assist businesses in the integration process. Moreover, it supports various types of transactions, ensuring flexibility and adaptability to different business needs. With the UPI Payout API, businesses can benefit from the extensive reach of UPI, which is widely accepted across India, ensuring that transactions can be made to virtually any bank account in the country.

In summary, the UPI Payout API service by Rainet Technology offers a cutting-edge solution for businesses looking to streamline their payment processes. By integrating the UPI Payout API, companies can automate and expedite their financial transactions, leading to improved efficiency and customer experience. This service not only underscores Rainet Technology's commitment to innovation but also highlights the transformative potential of UPI in the digital payment landscape.

Visit Website: https://rainet.co.in/payin-and-payout.php

#payin#payin api#payout#payout account#cashfree payout#payouts api#payouts#instant payout#instant withdrawal#pay in pay out#bbps api provider#bbps login#paytm upi integration api#upi api integration#upi integration#education portal development company#bbps#upi payment gateway#upi integration api#upi payment gateway integration

0 notes

Text

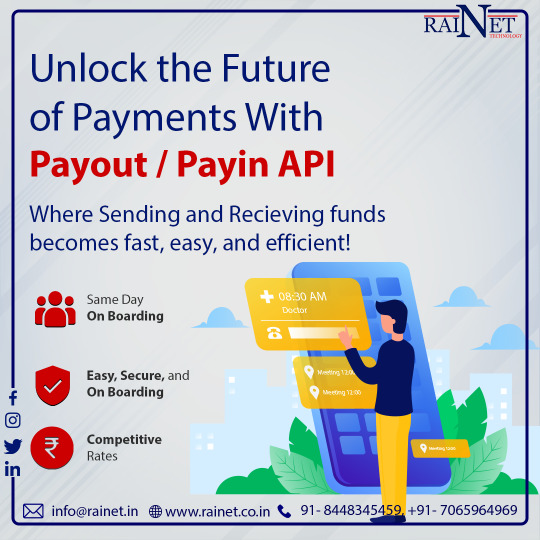

Payin API Provider

Rainet Technology is a leading Payin API Provider offering unparalleled solutions for integrating payment systems into your platform. With a focus on exceptional customer experience, ease of integration, and robust security measures, Rainet Technology stands out in the crowded market of payment solutions. Rainet Technology's Payin API delivers lightning-fast speed and reliability, ensuring real-time processing and eliminating the risk of transaction failures. Their payment solutions are highly customizable, catering to the unique needs of businesses across various industries. Rainet Technology's API can seamlessly integrate with existing systems, and it's scalable, allowing businesses to handle increased transaction volume effortlessly as they grow. Moreover, Rainet's Payin API is equipped with the latest security measures to secure sensitive data and protect transactions. If you're looking for a secure, flexible, and easy-to-use Payin API provider, look no further than Rainet Technology. Their advanced technology infrastructure and team of experts guarantee an unmatched payment experience for both businesses and their customers, driving growth, and success in today's competitive market.

Visit Website:https://rainet.co.in/payin-and-payout.php

#payin#payin api#payout#payout account#cashfree payout#payouts api#payouts#instant payout#instant withdrawal#pay in pay out#ios app development#api service#rainet technology private limited#mobile app development company#api provider#bbps service#android app developer company#paytm upi integration api#education portal development company#upi api integration

0 notes

Text

What are Payout Solutions and How Do They Simplify Business Payments?

In today’s rapidly evolving financial landscape, businesses are constantly looking for efficient, reliable, and cost-effective ways to manage payments. Whether it’s paying employees, suppliers, or customers, seamless and error-free payment processes are critical for operational success. This is where payout solutions come into play. A payout solution is an advanced payment processing system that automates and simplifies bulk payments, ensuring businesses can send funds securely and quickly.

What are Payout Solutions?

Payout solutions refer to platforms or systems that enable businesses to distribute payments to multiple beneficiaries seamlessly and efficiently. These beneficiaries can include employees, vendors, freelancers, customers, or even stakeholders. By leveraging modern technology, payout solutions allow businesses to process bulk payments through a single interface, eliminating manual processes and reducing the chances of errors.

Payout solutions are particularly essential for businesses that deal with large volumes of transactions daily. Sectors such as e-commerce, fintech, gig economy platforms, and other industries rely heavily on streamlined payout systems to ensure their financial operations run smoothly.

For example, companies can use a payout solution to disburse salaries, refunds, commissions, incentives, or vendor payments at scale with minimal human intervention.

How Do Payout Solutions Work?

A payout solution works as a bridge between a business and its payment recipients. It integrates with the business’s financial system or software and streamlines the process of transferring funds. Here’s a step-by-step breakdown of how payout solutions operate:

Integration: The payout system integrates with the business’s existing financial software or banking platform to access required data, such as payment amounts and recipient details.

Bulk Upload: Businesses upload payment details, including beneficiary names, account information, and amounts, into the platform. This can often be done via a file upload or API integration.

Payment Processing: The payout solution processes the payments using multiple payment modes, such as bank transfers, UPI, NEFT, IMPS, wallets, or card-based systems.

Verification and Approval: Before releasing funds, the system verifies all recipient details to avoid errors or payment failures. Businesses can also set up approval workflows to ensure security and compliance.

Disbursement: Payments are disbursed instantly or as scheduled, depending on the system’s configuration and business requirements.

Notifications: Once payments are completed, recipients are notified via email, SMS, or other communication channels. Additionally, businesses receive confirmation reports to maintain records.

How Payout Solutions Simplify Business Payments

Payout solutions offer a variety of features that help businesses simplify their payment processes. Some of the key benefits include:

Automation of Payments One of the most significant advantages of payout solutions is automation. Businesses no longer need to process payments manually, which can be time-consuming and prone to errors. Automated solutions allow bulk payments to be processed quickly and accurately.

Multiple Payment Modes Modern payout systems provide businesses with flexibility by supporting various payment methods, including bank transfers, UPI, mobile wallets, and more. This ensures payments can be sent according to the preferences of recipients.

Real-Time Processing Traditional payment methods often involve delays, especially when dealing with bulk transactions. Payout solutions offer real-time or near-instant payment processing, ensuring recipients receive funds promptly.

Cost and Time Efficiency Manual payment processes require significant time and resources, leading to operational inefficiencies. By using a payout solution, businesses can reduce administrative costs and save valuable time that can be allocated to core operations.

Improved Accuracy and Security Errors in payment processing can cause delays, mistrust, and additional costs. Payout solutions use robust verification mechanisms to minimize errors and enhance security. Additionally, many systems comply with financial regulations, ensuring safe transactions.

Seamless Reconciliation Payout solutions simplify the reconciliation of payments by providing detailed transaction records and reports. Businesses can easily track completed, pending, or failed transactions, making financial management more transparent and organized.

Enhanced Customer and Vendor Experience Fast and error-free payments improve the overall experience for customers, vendors, and employees. For instance, e-commerce platforms can use payout systems to ensure quick refunds, leading to improved customer satisfaction and loyalty.

Payment Solution Providers and Their Role

Payment solution providers play a crucial role in the success of payout systems. These providers offer the technology and infrastructure needed for businesses to handle complex payment processes efficiently. By offering robust platforms, they enable organizations to send bulk payments with speed, accuracy, and security.

Companies like Xettle Technologies are leading players in the payout solutions ecosystem. They provide advanced payout platforms designed to cater to businesses of all sizes, ensuring streamlined payment operations and financial management. With such providers, businesses can focus on growth while leaving their payment challenges to trusted experts.

Key Industries Benefiting from Payout Solutions

Several industries rely heavily on payout solutions to manage their financial operations, including:

E-commerce: Automating refunds, vendor payments, and cashbacks.

Fintech: Handling instant disbursements for loans and digital wallets.

Gig Economy Platforms: Paying freelancers, contractors, and service providers seamlessly.

Insurance: Disbursing claim settlements quickly to enhance customer trust.

Corporate Sector: Managing salaries, incentives, and reimbursements.

Conclusion

Payout solutions have revolutionized the way businesses manage their financial transactions. By automating and simplifying payment processes, businesses can save time, reduce costs, and improve accuracy while ensuring recipients receive funds promptly. Whether it’s paying employees, vendors, or customers, payout solutions offer a scalable and secure way to handle bulk payments effortlessly.

As payment solution providers like Xettle Technologies continue to innovate, businesses can look forward to more efficient and seamless financial operations. For organizations aiming to streamline their payouts, adopting a reliable payout solution is a step toward achieving operational excellence and enhanced financial management.

2 notes

·

View notes

Text

✅ PAN-Aadhaar Verification API: Streamline Compliance & Prevent Fraud

In today's digital landscape, verifying user identity quickly and accurately is essential for businesses operating in financial services, fintech, lending, insurance, and beyond. One key regulatory requirement in India is the linkage and verification of PAN (Permanent Account Number) with Aadhaar. The PAN-Aadhaar Verification API helps businesses meet this requirement with ease, speed, and security.

🔍 What is PAN-Aadhaar Verification API?

The PAN-Aadhaar Verification API allows businesses to verify whether a user's PAN is linked with their Aadhaar in real-time. This verification is conducted using government-approved data sources and ensures compliance with the latest KYC (Know Your Customer) and AML (Anti-Money Laundering) norms.

🚀 Key Advantages

1. Real-Time Verification

No more delays in manual checks. Get instant confirmation of PAN-Aadhaar linkage status for seamless user onboarding and transaction processing.

2. Government-Compliant

The API is aligned with regulatory standards, ensuring your business stays compliant with the latest income tax and KYC rules.

3. Bulk Verification Support

Need to verify thousands of users? The API supports high-volume, batch verification to save time and operational effort.

4. Fraud Prevention

Prevent identity fraud by verifying the authenticity of PAN-Aadhaar linkage before processing loans, payouts, or registrations.

5. Easy API Integration

The API is designed for fast integration with your platform—whether it's a mobile app, web portal, or internal system.

6. Cost-Efficient & Scalable

Automating verification reduces operational costs and scales effortlessly with your growing customer base.

💼 Who Should Use It?

NBFCs & Banks: For customer onboarding & loan disbursals

Fintech Platforms: For KYC and fraud checks

Insurance Providers: For policy issuance & verification

Payment Gateways: For user validation before transactions

HR & Payroll Firms: For employee onboarding & compliance

🔐 Why It Matters

The Indian government has made PAN-Aadhaar linkage mandatory for most financial and legal processes. Businesses that fail to comply risk penalties and operational disruptions. Automating this verification using a reliable API not only saves time but ensures regulatory compliance and data accuracy.

🌐 Conclusion

The PAN-Aadhaar Verification API is an essential tool for any digital-first business looking to streamline verification, reduce fraud, and ensure compliance. Whether you handle thousands of users or just a few, this API can greatly enhance your onboarding and KYC workflows.

Power your compliance with NifiPayments – Simple, Secure, Scalable. #DigitalIndia #PANVerification #AadhaarVerification #FintechSolutions #RegulatoryCompliance #NifiPayments #KYCAPI #APISolutions

0 notes

Text

How to Automate Mass Payments Using UPI Payout

Through UPI APIs, businesses can integrate payout automation into their systems. With preloaded payout data, scheduled transfers, and instant reconciliation, companies can manage thousands of payments without manual effort. It's ideal for platforms that operate on scale and need to disburse money frequently.

0 notes

Text

Ready to Launch the Next Dream11? Find the Best Fantasy Sports App Development Company in India

With the IPL, Kabaddi League, World Cup qualifiers, and now fantasy stock and opinion-based games joining the fray, the Indian fantasy sports market is exploding. Now is the perfect time to start your own fantasy sports app.

Selecting the best fantasy sports app development company India is the first (and most important) step for any startup, entrepreneur, or sports brand hoping to create the next Dream11, My11Circle, or MPL.

Let's go over what makes these apps so valuable in 2025 and how you can succeed with the right development partner!

🔍 Why Fantasy Sports Apps Are Booming in India

India is evolving into a fantasy gaming powerhouse and is no longer just a cricket-mad country! This is the reason:

In India, there are currently over 200 million active fantasy sports players, with that number predicted to rise to 350 million by 2027.

There will be significant seasonal traffic spikes due to the 2025 IPL and Pro Kabaddi.

Through fantasy apps, young people are moving from passive viewing to active participation.

Sports like tennis, hockey, fantasy football, and even esports are becoming more and more popular.

Due to this change in user behavior, there is a great need for fantasy apps that are rewarding, scalable, real-time, and well-designed.

👨💻 What a Good Fantasy Sports App Development Company in India Offers

A top-tier fantasy sports app development company goes beyond just building an app. It brings your vision to life with smart monetization, fan engagement tools, and compliance features.

Here’s what you should expect:

✅ 1. Real-Time Match Integration

Live scores, player stats, leaderboards, and auto-updates powered by fast APIs.

✅ 2. Multi-Sport Support

From cricket to kabaddi to football – build an app that can scale across leagues and seasons.

✅ 3. User Engagement & Gamification

Refer & earn, fantasy drafts, live contests, badges, points — turn every user into a loyal player.

✅ 4. Wallet & Payment Gateway Integration

Secure deposits, instant withdrawals, UPI and wallet compatibility, and KYC handling.

✅ 5. Admin Dashboard & Analytics

Complete control to manage contests, users, payouts, notifications, and in-app promotions.

✅ 6. Compliance & Legal Setup

Fantasy sports apps must comply with India’s skill-based gaming laws. Your dev partner should guide you through this.

✅ 7. Custom & White-Label Options

Whether you want a custom fantasy engine or want to go live fast with a white-label solution — you need flexibility.

🚀 Upcoming Fantasy Trends in 2025 You Should Capitalize On

✅ Fantasy Cricket for IPL 2025 ✅ Fantasy Kabaddi for PKL Season 11 ✅ Fantasy Football during Euro & ISL ✅ Fantasy Stock Trading (Probo-style) ✅ Opinion Trading Apps ✅ Women’s Sports Fantasy Leagues (WPL and more)

A smart developer will help you plug into these hot trends so you can attract more users and revenue.

🧩 Why Choose a Fantasy Sports App Development Company in India?

India is not just the biggest fantasy sports market — it's also home to the best tech talent and cost-effective development resources.

An Indian development partner gives you:

💡 Deep understanding of fantasy app logic & monetization

🏏 Local sports league knowledge

🔐 Legal compliance & risk advisory

💰 Affordable pricing for MVP and full product builds

🔥 Final Thoughts

In India, fantasy sports are the way of the future for digital interaction, not just a passing fad. The IPL, PKL, ISL, and even fantasy opinion trading apps are becoming more and more popular, so now is the ideal time to start your own fantasy app.

Invest in a reputable tech partner like IMG Global Infotech Pvt. Ltd., one of the top fantasy sports app development companies in India, if you're serious about creating a feature-rich, legally compliant, and scalable fantasy sports platform. They will assist you in moving quickly and profitably from concept to launch thanks to their extensive knowledge of real-time gaming, payment integration, and league customization.

The game is on. Are you ready to play your move?

❓ Frequently Asked Questions (FAQs)

Q1. How much does it cost to develop a fantasy sports app in India?

Answer: The cost ranges from ₹5 lakhs to ₹20 lakhs for an MVP, depending on features, platform, and design. Advanced apps with real-time APIs and custom games can cost more.

Q2. Can I launch an IPL-based fantasy app legally in India?

Answer: Yes, fantasy sports are legal in most Indian states under the category of “games of skill.” A good development partner will ensure your app is legally compliant.

Q3. What tech stack is used for fantasy app development?

Answer: Most fantasy apps use React Native or Flutter for frontend, Node.js or PHP for backend, and Firebase or AWS for database and hosting. Real-time APIs are used for live match data.

Q4. How do I earn revenue from a fantasy sports app?

Answer: Revenue can come from entry fees, in-app ads, premium contests, affiliate offers, or virtual store purchases.

Q5. Can I launch a fantasy app in just one sport?

Answer: Absolutely! Many successful apps start with a single sport like cricket and later scale to football, kabaddi, or esports.

0 notes

Text

Casino Merchant Accounts in Latin America: Your Complete Payment Solution Guide

Introduction to Casino Payment Processing in Latin America

The online casino industry in Latin America is experiencing explosive growth, with markets like Brazil, Mexico, and Argentina leading the charge. At Radiant Pay, we specialize in providing secure, reliable casino merchant accounts tailored to the unique needs of gaming operators across the region.

Why Casino Businesses Need Specialized Merchant Accounts

Challenges Facing Latin American Casino Operators

High-risk classification by traditional banks

Strict financial regulations varying by country

Payment method fragmentation across markets

Currency volatility in some countries

Key Benefits of a Dedicated Casino Merchant Account

Higher approval rates for player deposits

Faster payouts to winners (2-5 days vs 7-14)

Lower processing fees than pieced-together solutions

Built-in fraud prevention for gaming transactions

Multi-currency support for regional players

RadiantPay's Casino Merchant Account Solutions

We offer comprehensive payment processing designed specifically for Latin American gaming operators:

1. Core Account Features

High deposit acceptance rates (85%+)

Payouts in local currencies (BRL, MXN, ARS)

Chargeback protection (<1% target)

24/7 account management

2. Payment Method Coverage

Local cards are widely used in markets such as Brazil, Mexico, and Chile, offering instant processing times for transactions. Bank transfers are available across all countries but typically take between 1 to 3 days to process. E-wallets, which include various regional solutions, provide instant payments, making them a convenient option for users in supported areas. Cryptocurrency payments, such as Bitcoin and USDT, are processed within minutes, offering a fast and secure alternative. Lastly, vouchers like OXXO and PagoEfectivo are popular in specific regions and also enable instant transaction processing.

3. Country-Specific Solutions

Brazil: Pix payments integration

Mexico: SPEI bank transfers

Argentina: MercadoPago support

Colombia: PSE processing

Regional: Cross-border solutions

Latin American Casino Regulations Overview

Navigating the complex regulatory landscape:

1. Licensing Requirements

Country-specific gambling licenses

Payment processor approvals

Anti-money laundering compliance

2. Key Markets Breakdown

Brazil: Emerging regulated market

Mexico: Established licensing framework

Argentina: Province-by-province rules

Colombia: Coljuegos regulator

Chile: Developing legal framework

3. Financial Compliance

Player verification (KYC)

Transaction monitoring

Reporting obligations

Tax withholding requirements

Implementation Process

Getting your casino payment solution operational:

Documentation (Submit business paperwork)

Underwriting (Risk assessment)

Integration (API or plugin)

Testing (Deposit/withdrawal flows)

Launch (Go live with real transactions)

Why Latin American Casinos Choose RadiantPay

Regional Expertise - Local payment knowledge

95% Deposit Approval - Industry-leading rates

Fraud Prevention - AI-powered tools

Multi-Currency - 10+ LATAM currencies

Scalable Solutions - Grow without limits

Cost Structure & Fees

Transparent pricing for casino operators:

The setup fee typically ranges from $0 to $500, though it may be waived for high-volume accounts. A deposit fee of 2.5% to 5% is usually charged, depending on the risk level. Payout fees range between 1% and 3%, varying by payout method. Monthly fees fall between $50 and $300, often covering support services. Additionally, a foreign exchange (FX) fee of 1% to 2% applies for currency conversions.

Compared to alternatives: More features at competitive rates

Success Story: São Paulo Sportsbook

"After struggling with payment rejections, RadiantPay's solution increased our deposit success rate to 92% and reduced cashout times by 60%." - Carlos M., Operations Director

Getting Started with Your Casino Merchant Account

Analyze your player payment preferences

Prepare licensing documentation

Apply for your merchant account

Integrate payment solution

Launch and optimize performance

Ready to Solve Your Casino Payment Challenges? Contact Radiant Pay today for Latin American gaming payment solutions!

0 notes

Text

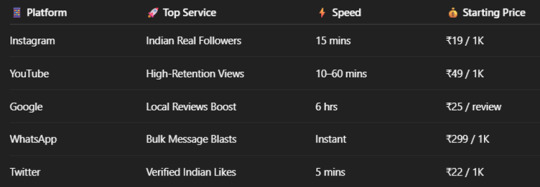

Boost your social presence in 2025 with India’s #1 SMM panel. Buy real followers, views & more from indianSMMservices.com — fast, cheap & trusted.

Why You're Losing Business Without the Right Social Growth Tool

In today’s cutthroat online world, being great isn’t enough—you need to look great online too. If your social proof doesn’t scream credibility, you’re losing followers, customers, and ultimately, cash.

That’s why the smartest Indian influencers, small business owners, startups, and freelancers are secretly using indianSMMservices.com to explode their online presence—overnight.

If you're not using this panel, you're already behind.

⚡ What is an SMM Panel & Why You MUST Use One in 2025

An SMM Panel (Social Media Marketing Panel) is a one-stop dashboard that delivers followers, likes, views, engagement, reviews, and more—instantly and automatically.

But not all panels are created equal. The #1 Indian smm panel for 2025 is clearly:

➡️ IndianSMMservices.com India's fastest-growing platform for real, instant & scalable social media growth.

🧨 What Makes indianSMMservices.com So Powerful?

✅ Real Indian Engagement

We deliver authentic Indian followers, YouTube views, Reels likes, and more. No bots. No drops.

✅ Lightning-Fast Delivery

98% of orders are fulfilled within 5–30 minutes. Beat the algorithm before your competitors even react.

✅ Insane Pricing (Starting ₹1.9/1K)

No fake pricing. Real results. At the lowest rates in the country.

✅ AI-Optimized Targeting

Our system filters by region, interest, or niche to help boost organic reach using AI smart delivery.

🧰 Use Case #1: Influencers Gaining 10K Followers in 2 Days (Proof)

“I grew from 1,800 to 12,300 followers in 48 hours before a brand pitch. Got the deal.” — Shruti Jain, Fashion Influencer

➡️ Tool Used: Instagram Real Indian Followers ➡️ Price: ₹139 for 10K ➡️ Bonus: 12% engagement boost (Reels + Story Views auto-included)

📦 Use Case #2: Digital Agencies Scaling Revenue 10X with Reseller Panel

“I resell services from IndianSMMservices.com with 200% markup. Clients happy. Money flowing.” — Karan Patel, SMM Freelancer, Surat

➡️ Tool Used: Reseller Panel + API Integration ➡️ Monthly Profit: ₹45K+ ➡️ Bonus: Automated order tracking for 35+ clients

🛠️ Best SMM Services for Indian Creators (2025 Picks)

📍 Check All Services

💸 Compare with Other Indian SMM Panels

💼 Who Should Use This SMM Panel?

🎯 Influencers – Grow fast, pitch confidently 🏢 Startup Founders – Gain investor attention via strong digital presence 🧑💼 Agencies – Resell and scale with zero inventory 👨🎓 Students & Freelancers – Start a passive income side hustle 🛍️ Small Biz Owners – Attract customers on social media platforms

🧭 How to Use indianSMMservices.com (Even If You're New)

✅ Go to indianSMMservices.com

✅ Create a free account

✅ Add funds (Paytm, UPI, Bank)

✅ Select your service (Instagram, YouTube, etc.)

✅ Paste your link and press Order Now

💬 Need help? Tap the Live WhatsApp Chat from dashboard.

💰 Bonus: Want to Earn ₹10K+ Monthly? Become an Affiliate or Reseller

🔗 Unique referral link

💸 Earn lifetime commissions

🎓 Training + dashboard support

🚀 Zero investment required

➡️ Join Affiliate Program Now

📣 FAQs (Schema-Optimized for Google Snippets)

✅ Is this panel legit and working in 2025?

Yes. We’ve served 100K+ Indian users, and deliver 100% working services with 24x7 support.

✅ Will I get banned for using these services?

No. All services are compliance-checked and risk-managed for safety.

✅ Can I withdraw affiliate/reseller earnings?

Yes. Payouts are processed weekly via UPI or Bank Transfer.

🔚 Final Verdict: It’s 2025. You Either Grow or Get Ignored

You’re just 2 minutes away from boosting your followers, views, credibility, and sales.

Don’t scroll. Don’t think too much. Your competitors are already using this.

👉 Sign Up Now & Start Growing »

1 note

·

View note

Text

How to Choose the Best MLM Software Provider in Patna on a Budget

Stable software is essential in MLM to keep track of your commissions, sales and as you build your network. Deciding on an MLM software provider in Patna that complies with your budget is not always easy for companies. Since there are lots of investment options with fancy features, how do you guarantee you’re spending your money well? read more This guide will help you pick the right MLM software solutions for your needs, pointing out how Patna-based MLM software helps you succeed. Let’s get started!

Understanding MLM Software Solutions A good MLM software eliminates manual work and automates activities like calculating commissions, handling genealogy charts and arranging payouts. Some of its main features are as follows: > Management systems designed for MLM commissions. > Instant access to analytics and reports. > Network marketing tools focused on helping new members. > Observing the status of both your in-house and shipped out items. Choosing service providers in Patna gives businesses help and customizations that match the local market trends.

Why Choose a Patna-Based MLM Software Company? Picking a Patna MLM software maker gives you multiple benefits: Local Expertise: They know the rules in your region and how customers respond to various marketing efforts. Cost-Effective Solutions: Because MLM software isn’t costly to maintain, it is a great option for any budget. Faster Support: When the network is close, the support team can react and update quickly. Many companies in Patna, like Camwel Solutions, offer MLM software development services that grow with your network.

Key Features of the Best MLM Software Provider in Patna Look especially for these factors when deciding on a provider:

Powerful Commission Management Systems Top MLM software providers in Patna should give companies flexible systems to manage payouts, bonuses and figures that update instantly.

You can customize your MLM Plan Tools. Try to find software that lets you adapt compensation plans, membership frameworks and promotions based on your business style.

Tools that Making Network Marketing Simple For smooth work, you need dashboards that are easy to use, support on mobile devices and provide automatic reports.

How ready a system is for growth and how secure it is. The software needs to adapt to your business’s needs and must include data encryption and several access control systems.

Evaluating Affordability: Finding Budget-Friendly Options You can get quality results without spending a lot of money. Let’s talk about how you can save money: Compare Pricing Models: Select plans that you pay for yearly over those you have to buy upfront.

Prioritize Essential Features: Keep the main features and don’t add on things you don’t really need. Seek Free Demo: Have a look at them in advance to ensure they are suitable. As local providers offer fair pricing, the best MLM software provider in Patna is both cost-effective and offers high performance.

MLM Commission Management Systems: What You Need to Know Strong MLM commission management is the core of your business. See that your software performs the following tasks: > Allows for the use of binary, matrix and unilevel commission structures. > Manages the process of taking out taxes and making payouts. Delivers open reports for distributors. > Camwel from Patna links these systems with local banking requirements so that payments go smoothly.

Customization and Scalability: MLM Plan Customization Tools Since your strategy might shift as MLM develops, your software should change as well. With customization tools, you are able to set up your MLM business in a custom way: > You can modify compensation plans without the need for code. > Offer members additional product or membership choices. > Use external APIs such as payment gateways, in your integrations. Being highly flexible is one of the main qualities of Patna’s leading MLM software providers.

Top MLM Software Providers in Patna: A Comparative Look While many companies in Patna develop MLM software, these are the features that set some apart.: > Camwel Solutions: Provides a range of plans and stand-by support available at any time. > Works with people starting new businesses by providing low-cost packages. Look at their work samples, read what previous clients share and check their post-purchase support service.

You need to weigh affordability, what the software does and any knowledge from local experts before making a selection. Select providers that include commission management, network marketing tools and the ability to change your MLM plan to improve your business’s future. Working together with a Patna MLM software company helps you achieve growth within your budget.

Prepared to use the leading MLM software provider for your business in Patna? Contact us today to learn about software that helps you succeed, without breaking the bank. Let’s start constructing your network marketing business together.

FAQ

What exactly is MLM software and why should I get it for my business? With this software, companies can keep track of commissions, manage new member registration, see sales progress and expand their networks. It automates tough tasks, saves your time and makes sure all the data is correct—that’s why it is necessary for operating an efficient MLM business.

Which software provider near Patna has the most affordable MLM tools? Compare the costs of providers, concentrate on what you need and check to see if there are any free trials. Local firms such as Camwel Solutions deliver plans that are both cost-efficient and come with good customer support.

What kind of features are necessary in MLM software? The main elements of this platform are: > Systems used to handle commissions > MLM tools that can be changed to fit your business. > Analysis and reporting in real time > Mobile-friendly dashboards > Payment gateway integration They make processes easier and help the company succeed in the future.

Is it possible for software providers in Patna to handle larger, national or international MLM groups? Yes, Many companies in Patna supply scalable MLM software for both domestic and international business operations. They allow users to customize, work with many languages and connect to payment networks worldwide to appeal to a global market.

Why should I go with Camwel Solutions instead of a big software firm? Working with local partners like Camwel we find support teams are available faster and offer packaged pricing for nearby businesses. On top of that, they are familiar with local requirements and the latest market trends, so they’re a good choice for MLM businesses in Patna.

0 notes

Text

Embedded Finance: The Future of Seamless Financial Integration

In an era where convenience is king and user experience defines competitive advantage, embedded finance is reshaping the future of financial services. It marks a pivotal shift from traditional, siloed banking models to a world where financial services are seamlessly integrated into non-financial platforms—turning every company into a potential fintech company.

What Is Embedded Finance?

Embedded finance refers to the integration of financial services—such as payments, lending, insurance, and investment—into the digital experiences of non-financial platforms. Rather than redirecting users to banks or third-party providers, embedded finance allows companies to offer these services directly within their ecosystems.

For example:

E-commerce platforms offering “Buy Now, Pay Later” (BNPL) options at checkout.

Rideshare apps providing in-app wallets or instant driver payouts.

Freelance platforms offering integrated invoice financing or insurance.

By embedding financial capabilities, businesses can streamline user journeys, enhance customer loyalty, and unlock new revenue streams.

Why Embedded Finance Matters

1. Improved User Experience

Customers no longer need to switch between multiple platforms. Financial tasks become a native part of their digital experiences—making it faster, easier, and more intuitive to complete transactions.

2. New Revenue Opportunities

Non-financial companies can monetize financial services through referral fees, interest income, or subscription models. This turns previously untapped financial interactions into profitable business units.

3. Financial Inclusion

Embedded finance democratizes access to banking. Small businesses, gig workers, and underbanked populations gain access to tools and services they might have otherwise been excluded from.

4. Data-Driven Insights

Companies already possess rich customer data. When combined with financial data, it enables better credit risk assessment, personalized offers, and predictive analytics that enhance both service and safety.

Key Components of Embedded Finance

Embedded Payments: Allow users to pay within a platform without being redirected. Think Uber’s one-tap ride payments or Amazon’s seamless checkout.

Embedded Lending: Platforms offer credit at the point of need, such as BNPL services or working capital loans for small sellers.

Embedded Insurance: Offers microinsurance policies—e.g., travel insurance booked along with a flight ticket.

Embedded Investment & Banking: Apps enabling users to open accounts, invest, or save directly within non-banking platforms.

Technology Enablers

APIs (Application Programming Interfaces): APIs allow financial services to be "plugged into" other platforms securely and efficiently.

Banking-as-a-Service (BaaS): BaaS providers offer modular banking functions that companies can embed, such as account creation or KYC compliance.

RegTech: Regulatory technology ensures compliance with financial regulations, making it easier and safer to offer embedded services.

Challenges and Considerations

Despite its promise, embedded finance faces several hurdles:

Regulatory Complexity: Navigating financial regulations across regions requires careful oversight and partner selection.

Data Security and Privacy: Handling sensitive financial data requires robust security frameworks and transparency.

Trust and Liability: When financial services go wrong, it can damage a brand’s reputation—even if they’re not the financial provider themselves.

The Future Outlook

Embedded finance is not a passing trend—it’s a fundamental shift in how financial services are delivered and consumed. As APIs become more sophisticated, and fintech partnerships more common, expect an explosion of innovation in sectors like retail, healthcare, logistics, and real estate.

According to a report by Bain & Company, embedded finance is expected to reach $7 trillion in transaction volume by 2030, transforming everything from how we shop to how we get paid.

Conclusion

Embedded finance is redefining the boundaries between financial and non-financial sectors. By seamlessly integrating financial services into everyday platforms, it empowers businesses to deliver greater value, personalization, and convenience to their customers. For companies willing to embrace this future, the rewards are not just financial—they're foundational to building lasting, tech-forward customer relationships.

#branding#financial services#investment#finance#financial advisor#financial planning#financial wellness#financial freedom#investment planning#Embedded finance

0 notes

Text

Happy Vasant Panchami From Waayupay

0 notes

Text

UPI Payout API

Rainet Technology has introduced an innovative service known as the UPI Payout API Service, revolutionising how businesses handle transactions in India. The UPI Payout service leverages the Unified Payments Interface (UPI) system, which is renowned for its seamless, real-time payment capabilities. This service is designed to facilitate bulk disbursements, making it an ideal solution for businesses that need to manage mass payouts efficiently.

The UPI Payout API enables companies to integrate this powerful payment solution directly into their existing systems, allowing for the automated processing of transactions. This integration significantly reduces the time and effort required to manage large-scale payments, whether for vendor payments, employee salaries, or customer refunds. By using the UPI Payout API, businesses can ensure that their transactions are secure, fast, and reliable, thus enhancing their operational efficiency and customer satisfaction.

Rainet Technology's UPI Payout API service stands out due to its robustness and ease of integration. The API is designed to be user-friendly, providing comprehensive documentation and support to assist businesses in the integration process. Moreover, it supports various types of transactions, ensuring flexibility and adaptability to different business needs. With the UPI Payout API, businesses can benefit from the extensive reach of UPI, which is widely accepted across India, ensuring that transactions can be made to virtually any bank account in the country.

In summary, the UPI Payout API service by Rainet Technology offers a cutting-edge solution for businesses looking to streamline their payment processes. By integrating the UPI Payout API, companies can automate and expedite their financial transactions, leading to improved efficiency and customer experience. This service not only underscores Rainet Technology's commitment to innovation but also highlights the transformative potential of UPI in the digital payment landscape.

Visit Website: https://rainet.co.in/payin-and-payout.php

#payin#payin api#payout#payout account#cashfree payout#payouts api#payouts#instant payout#instant withdrawal#pay in pay out#bbps api provider#bbps login#paytm upi integration api#upi integration api#upi integration#upi api integration#bbps#education portal development company#upi payment gateway#upi payment gateway integration

0 notes

Text

UPI Payout API

Are you tired of the hassle and delays that come with traditional payment methods? Picture this: you own a thriving online business, and your hard work is finally paying off. Your customers love your products and services, but when it comes to paying you, they have to navigate a labyrinth of slow bank transfers and hefty transaction fees. Frustrating, right? Well, fret no more! Introducing the UPI Payout API by Rainet Technology. With this innovative solution, you can bid farewell to these pain points and streamline your payment processes like never before. In this blog, we will dive deep into the world of UPI payout API – uncovering its features, benefits, and step-by-step implementation. Join us as we explore how this powerful tool can revolutionize the way you receive payments, supercharging your business and making transactions faster, smoother, and more secure.

Short Summmery

The UPI Payout API by Rainet Technology offers a solution to the hassle and delays of traditional payment methods.This innovative tool streamlines payment processes, making transactions faster, smoother, and more secure.The blog will cover the benefits, working mechanism, use cases, best practices, integration steps, and challenges/solutions of implementing the UPI Payout API.By implementing the UPI Payout API, businesses can revolutionize the way they receive payments, leading to increased efficiency and customer satisfaction.

Introduction

# Introduction

Welcome to our comprehensive guide on UPI Payout API. In this section, we will introduce you to the concept of UPI Payout API and its significance in modern businesses.

What is UPI Payout API?

UPI (Unified Payments Interface) Payout API is a powerful tool that allows businesses to transfer funds seamlessly using the UPI platform. It enables quick and secure transactions among businesses, individuals, and platforms. With UPI Payout API, businesses can automate payouts to multiple beneficiaries with a single API integration.

The Rise of UPI Payout API

In recent years, UPI has emerged as a popular and game-changing payment system in India. With its ease of use, fast transactions, and wide acceptance, UPI has revolutionized the way money is transferred. As a result, businesses are leveraging UPI Payout API to streamline their payout processes and provide a seamless payment experience to their customers.

Benefits of UPI Payout API

Implementing UPI Payout API offers several advantages for businesses. Here are some key benefits:

1. Efficiency: UPI Payout API enables automated and faster fund transfers, eliminating the need for manual intervention. This results in improved efficiency and reduced processing time for businesses.

2. Cost-effective: By automating payouts through UPI, businesses can significantly reduce administrative costs, such as printing checks or processing manual transfers.

3. Enhanced customer experience: With UPI Payout API, businesses can offer their customers instant settlements, improving overall satisfaction and loyalty.

4. Security: UPI Payout API adheres to robust security measures, ensuring the safety of transactions and protecting sensitive customer data.

How UPI Payout API Works

To understand how UPI Payout API works, let's break it down into a few simple steps:

1. Integration: Businesses integrate their systems with UPI Payout API, connecting their platform to the UPI infrastructure.

2. Beneficiary Verification: The API verifies the beneficiary's UPI ID or Virtual Payment Address (VPA) to ensure accuracy and prevent fraudulent activities.

3. Transaction Initiation: Businesses initiate funds transfer requests through the API, specifying the amount, beneficiary details, and other relevant information.

4. Authentication: The customer's approval is obtained through a secure UPI interface, ensuring authorized transactions.

5. Transaction Confirmation: Once the transaction is successfully processed, businesses receive real-time confirmation, enabling them to updat

Benefits of UPI Payout API

Benefits of UPI Payout API

The use of UPI (Unified Payments Interface) Payout API provides numerous benefits to businesses and developers. Let's explore some of the key advantages below:

1. Seamless Transaction Processing:

- With UPI Payout API, businesses can facilitate seamless transaction processing, allowing them to disburse funds to multiple beneficiaries effortlessly.

- The API streamlines the payment process, eliminating the need for traditional methods such as checks or manual bank transfers.

2. Instant and Real-time Payments:

- UPI Payout API enables businesses to make instant and real-time payments to recipients.

- Beneficiaries receive funds directly into their bank accounts, ensuring quick access to funds without any delays.

3. Cost-effective Solution:

- Implementing UPI Payout API eliminates the need for multiple intermediaries involved in traditional payment methods.

- As a result, businesses can save costs on commissions, processing fees, and other charges associated with conventional payment approaches.

4. Enhanced Security:

- UPI Payout API adheres to robust security protocols and encryption standards, ensuring secure and reliable fund transfers.

- The API employs multi-factor authentication, keeping sensitive information and transactions protected from potential threats.

5. Scalability and Flexibility:

- The UPI Payout API offers scalability and flexibility, enabling businesses to handle varying transaction volumes effortlessly.

- Whether processing a few transactions or large-scale payouts, the API can accommodate the needs of businesses of all sizes.

6. Efficient Tracking and Reporting:

- UPI Payout API provides businesses with comprehensive tracking and reporting capabilities.

- It allows businesses to monitor the status of transactions, generate reports, and reconcile payments, ensuring transparency and efficient financial management.

7. Integration with Existing Systems:

- The UPI Payout API seamlessly integrates with existing business systems and applications.

- This integration facilitates a smooth transfer of funds within the organization's ecosystem, enabling efficient management of finances.

8. Improved Customer Experience:

- The quick and hassle-free payment experience offered by UPI Payout API enhances customer satisfaction and loyalty.

- Beneficiaries appreciate the convenience of receiving payments directly into their bank accounts, resulting in a positive user experience.

💡 key Takeaway: The UPI Payout API offers businesses and developers several benefits, including seamless transaction processing, instant payments, cost-effectiveness, enhanced security, scalability, efficient tracking, and improved customer experience.

How UPI Payout API Works

How UPI Payout API Works

The UPI Payout API is a powerful tool that allows businesses to easily transfer funds to individuals or other businesses using the Unified Payments Interface (UPI) system. This section will provide an in-depth explanation of how the UPI Payout API works and how businesses can leverage its capabilities.

Understanding UPI

Before diving into how the UPI Payout API works, it is crucial to understand the basics of the Unified Payments Interface. UPI is a real-time payment system developed by the National Payments Corporation of India (NPCI) that enables users to make instant money transfers between bank accounts. It provides a seamless, secure, and convenient way to send and receive funds.

Initiating a Payout

To initiate a payout using the UPI Payout API, businesses need to follow a series of steps. Here's a breakdown of the process:

1. Registration: First, businesses need to register with a UPI service provider and obtain the necessary credentials to access the UPI Payout API. This typically involves creating an account and obtaining an API key or access token.

2. Authentication: Once registered, businesses need to authenticate their requests by providing the required identification and authorization details. This step ensures the security and integrity of the transaction.

3. Preparing the Payout: Businesses need to gather all the necessary information to process the payout, such as the recipient's UPI ID, amount to be transferred, and any additional instructions or references.

4. Integration: The next step is integrating the UPI Payout API into the business's existing systems or applications. This can be done using programming languages like Python, Java, or PHP, depending on the business's requirements and capabilities.

5. Requesting the Payout: After integration, businesses can send a payout request to the API endpoint, passing the required parameters and authentication details. The API processes the request and initiates the fund transfer to the recipient's UPI ID.

Verification and Confirmation

Once the payout request is made, the UPI Payout API initiates the transfer process. During this phase, several steps are taken to ensure the accuracy and security of the transaction:

- Verification: The API verifies the validity of the payout request, including checking the availability of sufficient funds and verifying the recipient's UPI ID.

- Validation: The API validates the transaction data, ensuring that all the necessary details are correct and complete.

- Confirmation: Onc

Use Cases of UPI Payout API

Use Cases of UPI Payout API

1. E-Commerce Platforms

E-commerce platforms can greatly benefit from integrating the UPI Payout API into their systems. With this API, these platforms can seamlessly process payments and disburse funds to their sellers, vendors, or service providers. By leveraging the UPI infrastructure, e-commerce platforms can offer an efficient and secure way for their users to receive payments directly into their UPI-linked bank accounts. This not only enhances the user experience but also streamlines the payment process for sellers, enabling faster access to funds.

2. Gig Economy and Freelancing Platforms

In the rapidly growing gig economy, freelancers and independent contractors often face challenges when it comes to receiving timely payments for their services. UPI Payout API presents a perfect solution for gig economy and freelancing platforms to overcome these hurdles. By implementing this API, these platforms can enable seamless and instant fund transfers from clients to freelancers. This ensures that freelancers receive their payments quickly, helping them maintain a steady cash flow and enhancing their overall experience on the platform.

3. Peer-to-Peer (P2P) Lending Platforms

UPI Payout API offers a valuable use case for peer-to-peer lending platforms. These platforms connect borrowers with lenders in a streamlined and efficient manner. By integrating the UPI Payout API, these platforms can disburse loan amounts directly into borrowers' bank accounts, eliminating the need for complex and time-consuming manual processes. The API ensures secure and instant fund transfers, making the lending experience seamless for both borrowers and lenders.

4. Online Marketplaces

Online marketplaces that facilitate services like rentals, car-sharing, or home-sharing can leverage the power of UPI Payout API to enable hassle-free payments to their users. By integrating this API, these marketplaces can ensure secure and quick disbursement of earnings to their sellers or providers. This enhances trust and reliability, encouraging users to continue using the platform and facilitating seamless transactions within the marketplace ecosystem.

5. Insurance and Claims Disbursement

Insurance companies often need to process claims and disburse funds to the insured party quickly. UPI Payout API can streamline this process, allowing insurance companies to transfer claim amounts directly into the policyholder's bank account. By integrating this API, insurers can provide a seamless and convenient experience for their customers, reducing paperwork and delays associated with traditional payment methods.

Best Practices for Implementing UPI Payout API

Best Practices for Implementing UPI Payout API

Implementing the UPI Payout API requires careful planning and adherence to certain best practices. By following these guidelines, you can ensure a seamless integration and optimize the performance of your UPI payout system. Let's explore some key best practices:

1. Understand the UPI Guidelines

Before you start implementing the UPI Payout API, it's crucial to thoroughly understand the UPI guidelines provided by the National Payments Corporation of India (NPCI). Familiarize yourself with the technical specifications, transaction limits, security requirements, and any other regulations imposed by the governing body. This will ensure that your implementation aligns with the defined standards and avoids any compliance issues.

2. Design a User-Friendly Interface

When integrating the UPI Payout API into your system, prioritize user experience. Design a clean and intuitive interface that allows users to easily initiate and track payout transactions. Provide clear instructions and error messages to guide users through the process. A user-friendly interface not only enhances customer satisfaction but also reduces the chances of errors during transactions.

3. Validate User Input

To prevent erroneous or fraudulent transactions, implement robust input validation mechanisms. Validate user inputs such as mobile numbers, UPI IDs, and transaction amounts to ensure they adhere to the required format and meet the necessary criteria. Applying these validations at the entry point will reduce the risk of errors and improve the overall reliability of your payout system.

4. Implement Strong Security Measures

Security should be a top priority when implementing the UPI Payout API. Implement secure coding practices to safeguard sensitive user information and transactions. Utilize encryption techniques such as SSL/TLS to protect data transmission. Additionally, regularly update your system's software and security patches to address any vulnerabilities. By incorporating strong security measures, you build trust with your users and mitigate the risk of data breaches or unauthorized access.

5. Monitor and Analyze Transactions

Once your UPI Payout API is up and running, it's crucial to monitor and analyze transaction data. By tracking transaction success rates, response times, and error logs, you can identify patterns or issues that may arise during payouts. Implement automated monitoring systems that notify you of any failed transactions or abnormalities, allowing you to take immediate action and provide a seamless experience for your users.

6. Plan for Scalability

As your business grows, your payout system should be able to handle increasing transaction volumes. Ensure that your syste

Integration Steps for UPI Payout API

Integration Steps for UPI Payout API

Implementing the UPI Payout API into your business processes requires careful planning and execution. Follow these integration steps to ensure a smooth and successful implementation:

1. Understand UPI Payout API Documentation: Begin by thoroughly studying the documentation provided by Rainet Technology for their UPI Payout API. Familiarize yourself with the API endpoints, request payloads, response formats, and security protocols.

2. Assess System Requirements: Determine if your current system meets the technical requirements for integrating the UPI Payout API. Ensure that your infrastructure, servers, and programming languages are compatible with the API specifications.

3. Obtain API Credentials: Contact Rainet Technology to obtain the necessary API credentials, such as the API key and secret. These credentials are essential for authenticating your requests to their UPI Payout API.

4. Develop a Test Environment: Set up a separate testing environment to perform integration tests before deploying the UPI Payout API in your production environment. This allows you to identify and resolve any issues or inconsistencies before going live.

5. Perform API Integration: Utilize your preferred programming language or SDK (Software Development Kit) to integrate the UPI Payout API into your existing systems. Make sure to handle response codes and error scenarios properly to provide a seamless user experience.

6. Implement Error Handling: Incorporate robust error handling mechanisms to gracefully handle any errors that may occur during API interactions. This includes validating inputs, handling authentication failures, and handling HTTP status codes appropriately.

7. Test and Debug: Conduct thorough testing of the integrated UPI Payout API. Validate different scenarios, such as successful payouts, failed transactions, and edge cases, to ensure the system functions as expected. Use debugging tools and log analysis to troubleshoot and resolve any issues.

8. Secure the Integration: Implement stringent security measures to protect sensitive data during API communication. Adhere to best practices for secure data transmission, such as utilizing secure sockets layer (SSL) encryption and implementing proper access control mechanisms.

9. Monitor and Maintain: Regularly monitor the UPI Payout API integration for performance, reliability, and security. Maintain an efficient logging and monitoring system to detect anomalies, track usage, and ensure compliance with regulatory requirements.

10. Stay Updated: Keep up with Rainet Technology's updates and announcements regarding their UPI Payout API. Stay informed about any changes, enhancements, or bug fixes that ma

Challenges and Solutions for UPI Payout API Implementation

Challenges and Solutions for UPI Payout API Implementation

Implementing a UPI Payout API can come with its fair share of challenges. However, with careful planning and execution, these challenges can be overcome to create a seamless payment experience for your business. In this section, we will explore some of the common challenges faced during UPI Payout API implementation and provide practical solutions to address them.

1. Compliance and Security Challenges

One of the primary concerns when implementing any payment system is ensuring compliance with regulatory requirements and maintaining a high level of security. In the case of UPI Payout API, it is crucial to adhere to the guidelines set by the regulatory authorities and to safeguard sensitive user information.

Solution: To address compliance and security challenges, it is recommended to work closely with legal and security experts. They can provide guidance on implementing robust security measures, such as encryption protocols, secure data storage, and two-factor authentication. Regular audits and vulnerability assessments should also be conducted to ensure ongoing compliance and to identify and fix any security loopholes.

2. Integration Complexity

Integrating the UPI Payout API into your existing system can be a complex task, especially if you have a large and intricate architecture. Compatibility issues, data mapping, and API version updates are some of the potential hurdles that may arise during the integration process.

Solution: To simplify the integration process, it is advisable to seek the assistance of experienced developers and ensure clear communication between your development team and the API provider. It is essential to thoroughly understand the API documentation, follow the best practices provided, and leverage any available libraries or SDKs for smoother integration. Regularly updating the API version to stay in sync with the latest developments is also crucial.

3. Scalability and Performance Optimization

As your business grows, it is essential to ensure that the UPI Payout API can handle increased transaction volumes and maintain optimal performance levels. Failure to address scalability and performance challenges can lead to delays in payouts and a subpar user experience.

Solution: To ensure scalability, it is recommended to architect your system using scalable infrastructure and employ load balancing techniques. Regularly monitoring API performance and conducting performance tests under different load conditions can help identify and address any bottlenecks. Utilizing caching mechanisms and optimizing database queries can also enhance the overall performance.

4. Error Handling and Exception Management

During the UPI Payout API implementation, there is always a possibility of encountering errors or exceptions. I

Conclusion

Conclusion

In conclusion, the UPI Payout API is a powerful tool for businesses looking to streamline their payment processes and enhance customer experiences. By leveraging the benefits of this API, businesses can achieve faster and more secure transactions while reducing manual efforts and costs.

To recap, the UPI Payout API offers several advantages. First, it provides a seamless and efficient way to transfer funds in real-time using the Unified Payments Interface (UPI) platform. Businesses can leverage this API to automate payment disbursements to customers, employees, or vendors.

Implementing the UPI Payout API comes with a variety of benefits. It enables businesses to offer a range of payment options to their customers, fostering convenience and satisfaction. Moreover, by automating the payout process, businesses can save time and resources, allowing for seamless scalability as the business grows.

To successfully implement the UPI Payout API, businesses should follow some best practices. They should ensure that the API integration is aligned with their business goals and objectives. This involves understanding their specific payment requirements, assessing the security measures in place, and optimizing the user experience.

Integration steps for the UPI Payout API involve collaboration between the business and payment service provider. The business needs to gather the necessary documentation and credentials, set up a developer account, and integrate the API into their existing systems or applications. Thorough testing is crucial to ensure seamless functionality and error-free transactions.

While implementing the UPI Payout API offers tremendous benefits, there can be challenges along the way. Businesses may face issues related to technical complexities, compliance requirements, or even network connectivity. However, these challenges can be overcome with careful planning, thorough testing, and ongoing support from the payment service provider.

By embracing the UPI Payout API, businesses can unlock opportunities for growth and enhance their payment capabilities. It is a versatile solution that caters to various use cases, from e-commerce platforms to marketplaces, gig economy platforms, and more.

In summary, the UPI Payout API empowers businesses with a reliable, secure, and cost-effective means to disburse payments seamlessly. By leveraging this API, businesses can automate their payout processes, improve efficiency, and enhance the overall customer experience.

💡 key Takeaway: The UPI Payout API is a powerful tool for businesses to automate payment disbursements and enhance customer experiences, offering benefits such as faster transactions, convenience, and scalability. By following best practices and integrating the API effectively, businesses can overcome challenges and unlock new growth opportunities,

FAQ

What are the conclusions of this article?

Rainet Technology provides a upi payout api that helps businesses process payments quickly and easily.

What are the use cases for the UPI Payout API?

The UPI Payout API can be used by businesses to pay their employees, vendors, and other creditors. Additionally, the API can be used to send payments to mobile and online shoppers in real-time.

What are the challenges and solutions for implementing the UPI Payout API?

There are a few key challenges to implementing a UPI payout API. The first is ensuring that the system is able to handle large volumes of transactions quickly and efficiently. Additionally, it is important to ensure that the API is user-friendly and easy to use so that it can be integrated into customer applications quickly. Finally, it is important to keep data security and privacy in mind, as any sensitive information should be handled securely.

Conclusion

Thank you for reading my blog post. If you have any questions or would like help with your eCommerce SEO, please don’t hesitate to contact me. I would be happy to help.

Visit Website: https://rainet.co.in/payin-and-payout.php

#payin#payin api#payout#payout account#cashfree payout#payouts api#payouts#instant payout#instant withdrawal#pay in pay out

1 note

·

View note

Text

Startup-Ready APIs for Instant Financial Integration

Startups can’t waste time on complex banking integrations. SprintNXT delivers ready-to-deploy APIs for verification, collections, and payouts. Build faster, launch sooner, and scale without limits.

0 notes

Text

What is a Payout API? – Everything You Need to Know

In the age of instant digital transactions, businesses are constantly looking for ways to streamline payments to employees, vendors, partners, and customers. Whether it's processing salaries, issuing refunds, paying gig workers, or distributing incentives — managing payouts efficiently is essential.

That’s where a Payout API comes into play.

🧾 What is a Payout API?

A Payout API (Application Programming Interface) is a software interface that allows businesses to automate and manage bulk or individual payments directly from their system to the recipient’s bank account, UPI ID, wallet, or card — without manual intervention.

It connects your backend systems (like your CRM, ERP, or app) to a payment provider’s infrastructure to execute payouts in real-time or scheduled batches.

⚙️ How Does a Payout API Work?

Integration: The business integrates the payout API with its platform.

Authentication: API uses secure tokens/keys for verified access.

Payment Request: The system sends a request to transfer funds with recipient details and amount.

Processing: The API processes the transaction through the banking network.

Response: The system receives confirmation with a success or failure message.

✅ Key Benefits of Using a Payout API

🔹 Instant Transfers Send payments in real-time to any bank account, UPI, wallet, or card.

🔹 Bulk Payout Capability Execute thousands of payments at once with minimal effort.

🔹 Automated Reconciliation Auto-track the status of every transaction—no manual tracking required.

🔹 24/7 Availability Unlike traditional banking, Payout APIs work round-the-clock.

🔹 Secure & Compliant Fully encrypted data transfer with compliance to financial regulations.

🔹 Customizable Workflows Integrate with your system for payouts triggered by specific events like refunds, deliveries, or user actions.

🏢 Who Can Use a Payout API?

Payout APIs are useful for a wide range of industries:

E-commerce: Vendor payments & customer refunds

Fintech & NBFCs: Loan disbursements, commissions

Gig Economy Platforms: Pay freelancers or delivery partners

Marketplaces: Seller settlements

Gaming & Reward Apps: Distribute winnings & incentives

HR & Payroll: Employee salary disbursals

🚀 Why Businesses are Adopting Payout APIs

Manual bank transfers are slow, error-prone, and not scalable. A Payout API eliminates the inefficiencies by automating the entire process, improving cash flow management, reducing operational costs, and enhancing user experience.

🔐 Security Considerations

Look for a payout API provider that offers:

Bank-grade encryption

Role-based access controls

Two-factor authentication (2FA)

Real-time monitoring & alerts

Compliance with regulatory norms (like RBI guidelines in India)

Final Thoughts

A Payout API is a powerful tool that empowers businesses to scale fast and pay smart. With automation, speed, and security at its core, it has become an essential asset for any organization dealing with high-volume or recurring payments.

If you're looking to enhance your payout process, integrating a reliable payout API can bring both efficiency and competitive edge.

#PayoutAPI #FintechSolutions #DigitalPayments #BusinessAutomation #BulkPayouts #InstantTransfers #APIBasedPayments #SmartBusinessTools #NifiPayments #FinancialTechnology

0 notes