#invoice data entry in Excel

Explore tagged Tumblr posts

Text

Benefits Of Outsourcing Invoice And Bills Data Entry In 2024

Data entry services are changing at a greater pace in 2024! Today, businesses are focusing on core business operations, and instead of performing the data entry work internally, they are outsourcing such time-consuming operations as data entry, data verification, data validation, and payment processing to experts with highly qualified skills.

Invoice processing is the task of managing invoices and bills and processing the documents for daily business operations. Invoice and bill data entry is an essential task for performing daily accounting operations. It is advisable to process documents in-house and outsource the tedious work of data entry to an expert team of invoice and bill data entry service providers.

The invoice files can be shared with the data entry outsourcing service provider by various channels, such as email, shared cloud storage, or by using any data transfer software and tools. It is important to brief the outsourcing team on extracting only the relevant data from these invoices and bills. It is highly recommended to hire a data entry service provider that ensures accuracy and compliance by following the standard procedures.

List Of Benefits Of Outsourcing Invoice Data Entry In India

Being a business owner, you must be having plenty of work at hand and some of them are high priority tasks. In recent times, businesses are making smart choices for their business operations by filtering out the tasks that can be outsourced to professionals and focus on handling only the key elements of business.

Here is a detailed list of top 7 advantages you can achieve for your business by outsourcing invoice and bills data entry:

Save On Operational Costs: Outsourcing invoice data entry is the best solution for your business as compared to hiring additional staff for data entry in your company. Your business can save on overhead operational costs such as employee salaries, employee benefits, office work space and training expenses by outsourcing invoice data entry work to trusted partners.

Focus On Business Expansion: If your core team is stepping away from the crucial yet time-consuming data entry tasks, you can utilize your resources on future plans and strategies to grow your business and scale up to the next level.

Transparency Of Operations: Data entry service provider teams usually offer high transparency of work and regular updates of the work in progress; hence, you can be assured of the on-going process and stay ahead of the competition.

Data Security And Compliance: It is important to have a check of data security and safety standards with the invoice data entry service providers to ensure the data is in safe hands. Also, they are experts in staying compliant with standard procedures and protocols of data management as these teams have been working on data for many years.

Benefits Of Advanced Tools & Software: Invoice data entry results can be more accurate and efficient with the use of latest tools in the process and it can be achieved by using the technology of outsourcing partners. It is best to find an outsourcing partner that offers advanced tools and technology in the process to stay ahead of the competition in the invoice processing and bills data entry work.

High Quality Data Entry Results: It is seen that outsourcing invoice data entry tasks to professionals will improve the overall quality of your invoice processing result. You can check the testimonials of the service provider to make sure they offer top-notch quality.

Bulk Data Entry In Short Time: Getting data entry done by an outsourcing partner can help you scale your business operations. If you are having a small core-team and still have more work to do, the best way is to outsource invoice and bills data entry services at affordable costs to a trusted partner based in India.

Grab The Free Trial Offers!

Most of the outsourcing partners offer sample of their work to showcase the level of quality they offer, it can be the best opportunity to test the skills and quality of your partner company before handing over the complete responsibility of data entry work. Also, you can provide the time lines if you have short deadlines of your invoices.

How To Select The Best Invoice Data Entry Outsourcing Partner Online?

Choosing the best player in the market is a crucial task when you start to look for a data entry outsourcing partner. Data entry service providers must have a skilled and experienced team to meet your expected standards of result.

Quality of the delivered results will be your first priority as you are relying on your service provider for entering the data of important documents like invoices and bills.

You can look for the quick turnaround time as you do not want to keep your business lagging behind because of the delay in processes.

One of the most important factors is data safety and security standards as you do not want to be in a trouble by getting your data misused in theft or fraud.

Cost of the services needs to be considered by comparing it in-house operational costs as you must be saving on your budget by opting for outsourcing data entry services.

Strong communication between the service provider and your business as well as their internal team is very essential for a smooth functioning of your daily operations.

Use of advanced tools and technology including smart software and tools to have process automation. It will enhance the performance of your invoice data entry.

Customer Support team should be readily available to assist you with your queries around the clock, so that your business operations do not get affected in critical conditions.

In summary, your business can be beneficial in many ways once you choose to outsource invoice data entry services. It is high time to delegate the time taking operations to specialists offering the high-end quality results. Get ahead of your competitors by focusing more on future planning of your business and building strategies to expand your business. It is a Win Win situation for your business and core-team to utilize the skills in the most efficient direction that results in business growth.

Source Link: https://dataentrywiki.blogspot.com/2024/05/benefits-of-outsourcing-invoice-and-bills-data-entry-in-2024.html

#Invoice Data Entry#Invoice Data Entry Services#invoice data entry outsourcing#invoice data entry in Excel#Data Entry Invoices#Billing Data Entry

0 notes

Text

Financial accounting is the process of recording, summarizing, and reporting a company's financial transactions to external users. These users include investors, creditors, and other stakeholders who need to make informed decisions about the company. There are a number of basic financial accounting concepts that are essential for understanding how financial statements are prepared and interpreted. These concepts provide the foundation for financial reporting and help to ensure that financial statements are accurate and reliable.

#e invoice in tally#tally automation#accounting automation software#excel to tally import#auto entry in tally#data entry automation#automation for accountants#tally solutions#tally on cloud#automated bank statement processing

0 notes

Text

Front Office vs Back Office BPO: What’s the Difference?

If your company works with third-party vendors to handle specific tasks, you’re already familiar with Business Process Outsourcing (BPO). The BPO industry is booming, jumping from a market value of $92.5 billion in 2019 to $232.32 billion in 2020. In today’s gig economy, with remote work and hybrid setups becoming the norm, BPO is impossible to overlook. In fact, 80% of global executives plan to maintain or increase their outsourcing budgets. But what exactly are they outsourcing? The answer lies in two key categories: Front Office BPO and Back Office BPO. Let’s break down the differences between Front Office vs Back Office BPO.

What is Front Office BPO?

Imagine the face of your business—the part that interacts directly with customers. That’s what Front Office BPO is all about. According to Deloitte’s 2024 global outsourcing survey, 50% of executives outsource these customer-facing tasks. Think sales, marketing, customer service, or tech support—anything that involves direct contact with clients.

These front-office roles are critical because they shape your company’s reputation and drive revenue. To keep quality high while managing costs, many businesses turn to third-party vendors like marketing agencies, IT help desks, or customer support teams to handle these tasks.

What Does Front Office BPO Include?

Here’s a quick look at the types of tasks that fall under Front Office BPO:

Customer Service and Support: Fielding calls, emails, or texts from customers, answering their questions, resolving complaints, and solving problems.

Sales and Lead Generation: Reaching out to potential customers, nurturing leads, and turning them into loyal clients to boost revenue.

Technical Support and Helpdesk: Assisting customers with technical issues, like troubleshooting software or hardware problems.

Telemarketing and Telesales: Convincing customers over the phone to buy products or services and closing deals.

Live Chat and Social Media Management: Engaging with customers on social platforms, addressing concerns, and building relationships.

Skills Needed for Front Office BPO

To excel in Front Office BPO, vendors need:

Strong communication and people skills

Fluency in relevant languages and cultural sensitivity

Quick problem-solving abilities

Sales expertise

Emotional intelligence to handle customer interactions

What is Back Office BPO?

Now, shift your focus to the behind-the-scenes work that keeps a business running smoothly. That’s Back Office BPO. These are the internal, non-customer-facing tasks like accounting, HR, IT, or supply chain management.

This area is evolving, with specialized outsourcing in fields like legal services, IT support, or knowledge process outsourcing. Many companies, especially small businesses, outsource these tasks to cut costs and access expert skills without hiring full-time staff, as noted in Clutch’s 2023 report. While these processes don’t directly generate revenue, they’re essential for keeping operations efficient and understanding Front Office vs Back Office BPO.

What Does Back Office BPO Include?

Here’s what Back Office BPO typically covers:

Data Entry and Processing: Managing and updating company data, from financial records to customer details, ensuring accuracy and accessibility.

Accounting and Bookkeeping: Handling invoices, payments, and financial records to keep the books balanced.

Human Resources Management: Recruiting, onboarding, and supporting employees throughout their time with the company.

Research and Analytics: Analyzing market trends, competitors, or data to guide strategic decisions.

Quality Assurance and Compliance: Ensuring products and services meet high standards and follow regulations.

IT Support and Maintenance: Keeping technology running smoothly, from fixing software bugs to maintaining hardware.

Supply Chain Management: Coordinating the flow of goods, services, and information from suppliers to customers.

Skills Needed for Back Office BPO

To succeed in Back Office BPO, vendors need:

Technical expertise in specific fields

Keen attention to detail and accuracy

Process optimization know-how

Strong analytical thinking

Knowledge of compliance and regulations

Front Office vs Back Office BPO: Key Differences

So, what sets Front Office vs Back Office BPO apart? Let’s dive into the main distinctions:

1. Customer Interaction

The biggest difference is who they deal with. Front Office BPO is all about engaging directly with customers—think a customer service rep answering a client’s questions. Back Office BPO, on the other hand, operates in the background with little to no client contact. An accountant, for example, focuses on crunching numbers, not chatting with customers.

2. Revenue Impact

Front Office BPO has a direct effect on your bottom line. A marketing campaign or a skilled sales team can drive higher conversions and more revenue. Back Office BPO, while crucial, doesn’t immediately impact sales. IT support, for instance, ensures your systems run smoothly, enabling other teams to do their jobs effectively.

3. Time Sensitivity

Because Front Office BPO is customer-focused and tied to revenue, it’s often time-sensitive. Customer inquiries need quick responses, and sales teams must act fast to close deals. Back Office BPO tasks, like data entry or bookkeeping, follow more flexible timelines, prioritizing accuracy over speed.

4. Performance Metrics

Success in Front Office BPO is measured by customer satisfaction, response times, and conversion rates. For Back Office BPO, the focus is on accuracy, efficiency, and cost savings. For example, a data entry team’s performance might be judged by how error-free their work is, while a call center’s success hinges on happy customers.

Why Both Matter: The Bottom Line on Front Office vs Back Office BPO

Both Front Office BPO and Back Office BPO play vital roles in helping businesses save money while achieving top results. Front office outsourcing brings your brand to life through customer interactions, driving sales and building loyalty. Back office outsourcing keeps the gears turning with essential tasks like HR, IT, and accounting, allowing you to focus on growth.

The trick is figuring out which processes to outsource based on your current team’s strengths and your business goals. By understanding Front Office vs Back Office BPO, you can make smarter decisions to boost efficiency and profitability.

0 notes

Text

Why Rightpath Global Services Leads in AP Transformation

In the earlier parts of our Accounts Payable Services (AP) transformation series, we explored the structure of the P2P cycle, key AP milestones, and the operational groundwork behind invoice processing. In Part 5, we take a forward-looking approach: what happens when you evaluate your AP process critically and apply the right mix of intelligent automation?

Every organization, regardless of size or industry, encounters friction points in its AP process. Whether it’s delayed approvals, manual data entry, or inconsistent validations, these challenges are more common than you might think. That’s why a comprehensive process assessment is essential – it highlights inefficiencies at every milestone, paving the way for actionable improvements.

Tactical Automations: Building Efficiency with What You Already Have

Many AP teams still rely on spreadsheets and Access databases for tracking and reporting. While these tools are powerful, they often demand significant manual effort. Tactical automations can bridge this gap. Using macros and scripts in Microsoft Excel or Access, you can automate repetitive tasks like data consolidation, report generation, and reconciliation. These lightweight, cost-effective solutions bring immediate productivity boosts without the need for large-scale system changes.

Accounts Payable Services

Robotic Process Automation (RPA): Let Bots Handle the Repetition

When processes are rule-based and repeatable, Robotic Process Automation becomes a game changer. RPA can streamline invoice validation, duplicate checks, and even posting activities. The real flexibility comes in how bots are deployed.

In some cases, bots work side-by-side with AP personnel, handling tasks like invoice data entry while the human handles exceptions. In others, bots run entirely in the background, processing batches of invoices without any real-time oversight. There’s also a middle path – bots operate in the background but pause for human intervention when the logic detects anomalies or gaps. This hybrid approach balances speed with control, ensuring that human oversight is applied only when truly needed.

Accounts Payable Solutions

Artificial Intelligence: Smarter Systems for Smarter Decisions

While RPA is great for structured, rule-based processes, Artificial Intelligence (AI) is ideal for managing unstructured data and more dynamic workflows.

Generative AI creates intuitive interfaces between systems and humans. By using natural language processing, these tools allow users to interact with systems in everyday language – whether querying invoice status or uploading receipts. AI also shines in extracting insights from unstructured formats like emails or handwritten documents, further reducing manual effort.

Machine learning, a subset of AI, uses large volumes of historical data to identify patterns and optimize processes. For example, it can flag outlier invoices that may indicate fraud or errors, or categorize invoices automatically based on past behaviour.

Predictive analytics takes it a step further by forecasting trends. In the AP space, this might look like identifying vendors likely to submit late invoices, projecting future cash outflows based on historical payment cycles, or even prioritizing invoices that offer early payment discounts based on past behaviour.

Transforming AP with a Smarter, Scalable Foundation

When applied thoughtfully, automation and AI don’t replace people – they empower them. By freeing AP teams from mundane tasks, these technologies create space for more strategic work: analysing spend, managing supplier relationships, and driving financial insights.

At Right Path, we believe every AP transformation journey begins with clarity. Our Free Procure-to-Pay (P2P) Assessment helps you evaluate current processes, uncover automation opportunities, and design a smarter, scalable AP function tailored to your business.

Explore our website to learn more and claim your free assessment today. Let’s shift AP from reactive taskwork to proactive performance.

For more information click here: - https://rightpathgs.com/blogs/

0 notes

Text

Retail ERP Software That Grows with Your Business – Try It Now

In today’s fast-paced retail environment, businesses—both small and large—are under constant pressure to streamline operations, manage inventory efficiently, and deliver superior customer experiences. This is where the right ERP for retail industry can transform your operations and fuel long-term growth.

Whether you operate a single-store boutique or a multi-chain retail enterprise, choosing the right ERP partner like Nowara Infotech can mean the difference between chaos and control. This article explores the key skills business owners gain when adopting retail ERP solutions, drawing parallels with the strategic decision-making required in technical fields like online master’s in data science—which also teaches scalability, integration, and data insight.

Why Retailers Need ERP Now More Than Ever

Retailers today are grappling with multiple challenges: fragmented supply chains, rising customer expectations, and evolving sales channels (online, offline, mobile). Manual systems are no longer viable.

Here’s what a modern ERP software for retail industry addresses:

Real-time inventory management

POS (point of sale) synchronization

Multi-location tracking

Vendor and purchase management

Customer relationship optimization

According to a 2024 Statista report, over 67% of mid-sized retail businesses that adopted ERP saw improved operational efficiency and inventory accuracy within 6 months. This is why retail ERP solutions are no longer a luxury—they’re a necessity.

What You’ll Learn by Implementing ERP: Transferable Business Skills

Adopting ERP software for retail industry is like earning a degree in business efficiency. Similar to what students learn in a master’s in data science, you’ll gain the ability to:

1. Make Data-Driven Decisions

Just as data scientists leverage insights for strategic value, retailers using ERP can:

Track best-selling products in real time

Forecast stock demands during festivals

Understand peak shopping hours via dashboards

2. Automate Repetitive Tasks

Retail ERP solutions automate everything from:

Barcode-based inventory entry

GST-compliant invoicing

Supplier communication and reorders

This reduces human error and lets staff focus on customer engagement.

3. Improve Collaboration Across Departments

From inventory to sales to finance, ERP bridges internal silos. Everyone works from a single source of truth.

Top Features of Nowara Infotech’s ERP for Retail Industry

Nowara Infotech is known for providing scalable, affordable, and feature-rich ERP for retail business. Here’s what makes them stand out:

Omnichannel Capabilities

Whether you sell online, offline, or via social commerce, Nowara’s ERP unifies transactions, promotions, and inventory across all platforms.

GST & Compliance Ready

No more scrambling during audits. Everything is digitized, auto-updated, and compliant with Indian government standards.

Mobile POS & Reporting

Owners can view reports, monitor stock, and approve orders right from their phone. This is especially useful for small retailers with limited staff.

Multi-Store & Warehouse Integration

Ideal for larger businesses, Nowara’s ERP helps track stock across cities, schedule transfers, and detect shrinkage in real time.

User Journey: From Discovery to Implementation

Let’s walk through the stages retail businesses typically go through:

Awareness Stage:

You realize manual spreadsheets and cash registers are slowing you down. Mistakes happen. Stockouts are frequent. Sales data is a mess.

Keyword fit: Looking for “erp for retail industry” or “erp for retail business” that’s easy to use?

Consideration Stage:

You explore different retail ERP solutions, compare features, pricing, scalability, and industry specialization. You might Google “best ERP software for retail industry India.”

You find Nowara Infotech has excellent reviews, responsive support, and India-specific compliance built-in.

Decision Stage:

You book a free demo. After seeing the ease of use and ROI potential, you implement Nowara’s system and transform your business within weeks.

Case Study: A Small Retailer’s ERP Success Story

Consider Ritu’s Fashion Boutique, a small shop in Nagpur. Before Nowara’s ERP:

Inventory was manually tracked

Monthly losses occurred due to mismatched billing

Staff wasted time on reorder processes

After 3 months of ERP usage:

Inventory accuracy improved by 80%

Billing was automated and error-free

Sales increased by 35% due to faster checkout

Conclusion: Ready to Grow Your Retail Business?

If you’re serious about taking your business to the next level, it’s time to move beyond manual processes. Nowara Infotech’s ERP for retail industry adapts to your business size, goals, and challenges—offering a future-ready platform for sustainable success.

Ready to get started? Book your free ERP demo now and discover how seamless retail operations can be!

0 notes

Text

Building a Smarter Future with Franchise Management Platform

As education franchise chains expand, managing consistency, operations, and quality becomes increasingly challenging. From student admissions to staff coordination and fee tracking, traditional methods often fall short—leading to delays, miscommunication, and uneven performance across centers.

Our Franchise Management Platform (FMP) is built to solve these challenges. It centralizes operations, standardizes academic delivery, and gives franchisors full visibility into every branch—all through a single, powerful platform. The result? Smarter growth, stronger control, and a seamless experience for students and staff alike.

When Expansion Becomes a Burden

Education franchise chains often face fragmented operations—manual student data entries, inconsistent reporting, staff coordination issues, and decentralized communication. Franchise owners struggle with:

Disconnected systems for academic tracking

No centralized control over course content or scheduling

Delay in fee collection and payment tracking

Poor visibility into franchisee performance

Without a unified system, franchisees operate in silos—hindering scalability, brand consistency, and student satisfaction.

Enter FMP: A Smarter Framework for Franchise Excellence

Our Franchise Management Platform is built to tackle these pain points head-on. From centralized course management to real-time academic performance tracking, it brings every center under one smart umbrella. Key features include:

Unified Student & Staff Database: One platform to manage admissions, attendance, assignments, and payroll

Academic Content Control: Share updated syllabus, training modules, and exam schedules seamlessly across locations

Automated Fee Management: Simplified invoicing, reminders, and payment reconciliation

Performance Dashboard: Real-time visibility into each center’s KPIs, student outcomes, and revenue flow

The Transformation: What They Gained with Our FMP

Here’s how education franchises elevate their operations using our platform:

Consistency Across Branches: Uniform academic quality and branding, regardless of geography Faster Onboarding: New franchisees can be set up quickly with guided tools and ready-to-use templates Better Parent Communication: Automated updates on progress, payments, and announcements keep parents engaged Increased Revenue Control: Transparent tracking of income, expenses, and profitability for every location Operational Agility: Handle multiple centers with leaner teams and smarter tools

Conclusion

With our Franchise Management Platform, education chains unlock growth without chaos. They gain the confidence to expand, the tools to standardize, and the insights to improve. Whether it's a tutoring center, online academy, or hybrid learning chain—our platform makes franchise success scalable, sustainable, and smart.

Ready to transform your education franchise? Let’s talk.

0 notes

Text

Empowering Business Efficiency with Custom Software Solutions

Generic Software: A One-Size-Fits-All Approach That Doesn’t Fit All Most businesses begin their digital transformation journey using off-the-shelf software due to its ease of access and low initial cost. However, as operations become more complex, these solutions start to show their weaknesses. Limited customization, bloated features, and poor integration with other systems can lead to bottlenecks and inefficiencies. What initially seemed like a convenient tool often ends up hindering growth and innovation.

Custom Software: Designed for Specific Business Needs Unlike pre-built software, custom software is crafted to address the specific requirements of a business. Every feature, module, and user interface is developed with a clear understanding of the business model. Whether it's automating unique workflows, handling industry-specific data, or offering personalized dashboards, the customization makes all the difference. It becomes a reflection of how the company operates—precise, consistent, and effective.

Streamlining Operations Through Automation Custom software allows for powerful automation of routine tasks, significantly reducing manual errors and freeing up valuable time. Processes like inventory management, invoicing, data entry, or employee scheduling can be streamlined to operate more efficiently. Automation doesn’t just save time—it allows employees to focus on high-value tasks that contribute directly to business growth.

Enhancing Decision-Making with Real-Time Insights Having access to accurate, real-time data is critical in today’s fast-moving business environment. Custom software can be equipped with intelligent reporting features and analytics dashboards tailored to the KPIs that matter most. These tools empower leadership teams with actionable insights, allowing them to make informed decisions that are rooted in current, reliable data—not guesswork.

Improved Collaboration Across Teams One of the biggest challenges in growing organizations is maintaining seamless collaboration between departments. Custom software can unify different teams under a centralized digital ecosystem, improving communication, sharing of resources, and task coordination. Whether it’s syncing project updates or managing cross-departmental workflows, tailored software strengthens the internal structure of any organization.

Adaptability in a Changing Market Markets evolve, customer expectations change, and technologies continue to advance. With custom software, businesses have the flexibility to adapt to new requirements without overhauling their entire digital infrastructure. New features can be added, user interfaces can be modified, and scalability is always within reach. This adaptability ensures that businesses remain competitive and future-ready.

Investing in Long-Term Value Though developing custom software involves higher upfront investment, the long-term returns are significant. It reduces reliance on multiple disconnected tools, minimizes recurring licensing fees, and eliminates the hidden costs of inefficiency. More importantly, it provides a digital foundation that evolves with the company, supporting strategic goals and operational excellence.

Final Thought In today’s fast-paced digital economy, businesses must think beyond temporary fixes and invest in tailored technology that scales with them. By choosing to build personalized solutions that align with their vision, they unlock new levels of efficiency, clarity, and control. That’s the true advantage of embracing custom software development in USA.

0 notes

Text

Enhancing Enterprise Compliance and Effectiveness Through Exact Documentation Practices in IOR (IOR) Transport Procedures.

Introduction

In the short-paced global https://www.aerodoc.com/ior-eor/ of global logistics, documentation performs a pivotal role in making sure soft operations. Accurate documentation is above all valuable for Importer of Record (IOR) services, because it governs compliance with customs rules and mitigates dangers linked to penalties, delays, and competencies prison worries. This article delves deep into the significance of desirable documentation in IOR transport, emphasizing the varying parts concerned and premiere practices for good fortune.

The Importance of Accurate Documentation in IOR Shipping

Accurate documentation is the backbone of potent IOR delivery. It entails meticulous document-conserving that adheres to regulations set forth by customs authorities. Without distinct documentation, organisations face numerous challenges which will disrupt their grant chain and jeopardize their entry into foreign markets.

What is Importer of Record (IOR)?

The term "Importer of Record" refers to an character or entity responsible for ensuring that imported items adjust to nearby regulations and regulations. The IOR bears the duty for fee of duties and taxes whereas also making sure most excellent class and valuation of products.

Why is Documentation Critical in IOR Services?

Documentation serves dissimilar reasons inside IOR services:

Compliance: Ensures adherence to local customs legislation. Risk Management: Reduces the likelihood of mistakes which could lead to fines or confiscation. Efficiency: Streamlines logistics approaches, saving time and elements. Transparency: Provides a transparent trail for audits or investigations if wanted. Key Documents Required for IOR Shipping

Understanding the major information required for IOR transport is essential for any importer looking to navigate this troublesome panorama efficaciously.

Commercial Invoice: Details the transaction between customer and seller. Bill of Lading: Serves as a receipt and settlement among shipper and carrier. Packing List: Provides guidance about the contents of every package deal. Import Declaration Form: Required by customs experts detailing the cargo's specifics. Certificates of Origin: Verifies the place items were produced.

These archives need to be precise, comprehensive, and submitted on time to hinder problems for the period of clearance.

Common Challenges with Documentation in IOR Shipping

While effectual documentation is vital, various challenges can get up:

Complex Regulations: Varying law depending on us of a or product class can complicate compliance. Data Entry Errors: Mistakes when inputting facts can cause gigantic delays. Language Barriers: Miscommunication as a result of language alterations can reason inaccuracies.

Addressing these challenges because of thorough schooling and powerful systems can enrich accuracy severely.

Best Practices for Accurate Documentation in IOR Services

Implementing nice practices supp

youtube

0 notes

Text

Khaata Pro 🚀: How It Simplifies Your Billing

In today’s fast-paced business environment, managing finances manually or using outdated tools can slow down growth. That’s where Khaata Pro comes in, a next-generation billing and accounting software built specifically for small and medium-sized businesses in India. With its streamlined workflow, Khaata Pro empowers business owners to focus on scaling up rather than managing paperwork.

Let’s explore how Khaata Pro works step-by-step, from customer onboarding to real-time reporting.

🔁 Step-by-Step Workflow of Khaata Pro

1️⃣ Customer Onboarding

Start by adding your business details and GST information (if applicable).

Create multiple user roles (owner, accountant, staff) with access restrictions.

Add your company logo and choose from pre-built invoice templates.

✅ Why it matters: Sets up a secure, branded system for smooth daily operations.

2️⃣ Product & Inventory Setup

Enter your product catalog with SKU, pricing, and tax details.

Add stock levels, reorder thresholds, and supplier info.

Optionally use barcode generation and printing.

✅ Why it matters: Real-time stock tracking ensures better inventory management and order fulfillment.

3️⃣ Sales & Billing

Generate GST-compliant invoices (B2B, B2C, retail, or wholesale).

Choose the invoice template and customize terms.

Accept payments in cash, UPI, cheque, or digital wallets.

Share invoices via print, email, or WhatsApp.

✅ Why it matters: Enables quick and professional billing, boosting customer satisfaction.

4️⃣ Expense & Purchase Tracking

Record daily expenses (rent, utilities, vendor payments, etc.).

Upload and scan receipts for automated entry.

Generate and approve purchase orders for inventory restocking.

✅ Why it matters: Keeps your cash flow in check and helps forecast expenses.

5️⃣ Inventory Movement & POS

Use the Point of Sale (POS) module for walk-in customers.

Automatically update stock after each sale.

Get alerts for low-stock and out-of-stock items.

✅ Why it matters: Helps you maintain optimal inventory levels and avoid lost sales.

6️⃣ Payment Reminders & Collection

Track unpaid invoices and overdue payments.

Send automated WhatsApp/email reminders to clients.

Offer digital payment options linked with invoices.

✅ Why it matters: Improves payment cycles and reduces manual follow-up effort.

7️⃣ Reporting & Analytics

View dashboard summaries: revenue, profit, top-selling products, and more.

Generate GST reports (GSTR-1, GSTR-3B), sales summaries, and P&L statements.

Export reports in Excel or PDF formats.

✅ Why it matters: Makes it easy to stay compliant and make informed decisions.

8️⃣ Multi-Company & Multi-User Support

Manage multiple business branches under one account.

Give access to different users with assigned roles and permissions.

Switch between companies without logging out.

✅ Why it matters: Scales with your growing business structure and staff needs.

💡 Bonus Tools in the Workflow

Tool

Purpose

WhatsApp Integration

Send invoices and reminders instantly

Offline Billing

Continue operations without internet access

Rental Scheduling

Manage recurring billings like equipment rent

Cloud Backup

Secure your data with auto-sync and restore

✅ Real-Life Use Case

A retail shop owner can use Khaata Pro to:

Sell items using the POS module

Automatically reduce inventory

Generate GST bills for each customer

Receive payments via UPI or cash

Send follow-up messages on WhatsApp for unpaid bills

Download monthly reports and file taxes

All this in a matter of minutes without hiring a full-time accountant!

🎯 Final Thoughts

The beauty of Khaata Pro’s workflow lies in its simplicity. Each feature is built to reduce manual effort, save time, and make complex accounting easy for Indian business owners.

Whether you're a trader, wholesaler, freelancer, or service provider, this workflow ensures you're always in control of your finances and operations anywhere, anytime.

Coming Soon: Khaata Pro Launch on June 26, 2025 Stay tuned to experience the power of modern billing with Indian business needs at its heart.

0 notes

Text

Still Managing Operations with Excel? Discover What ERP Can Do in 2025

For decades, Excel has been the backbone of business operations—tracking inventory, forecasting demand, and even managing employee data. But in 2025, depending on spreadsheets alone is like using a compass in a world of GPS. As businesses scale, diversify, and face increasingly complex challenges, Excel simply can't keep up.

So, why are modern businesses rapidly replacing Excel with ERP systems? Let’s find out.

The Hidden Costs of Sticking with Excel

On the surface, Excel seems efficient—familiar, flexible, and low-cost. But beneath that simplicity lies a web of risks:

Data silos across departments mean no single version of truth.

Manual entry leads to frequent human errors and time-consuming corrections.

Real-time collaboration is nearly impossible—teams often work on outdated copies.

There’s no seamless connection between operations like procurement, production, sales, and accounts.

As your business grows, Excel files become harder to manage, slower to load, and more vulnerable to corruption or mismanagement.

These challenges don't just slow down your teams—they restrict your ability to scale, adapt, and compete.

What a Modern ERP Can Do in 2025

An ERP system like BETs ERP transforms how your entire business functions by integrating every department into a single, intelligent platform.

It connects your core operations—procurement, stores, production, sales, quality control, finance, HR, dispatch, and analytics—in real-time. That means no duplicate data, no disconnected systems, and no bottlenecks caused by manual tasks.

Imagine This Workflow

Your procurement team raises a purchase order digitally. The quality team gets notified as soon as raw material arrives, conducts inspection, and updates the result. Once approved, inventory automatically reflects the updated quantity in stores. Production planning begins based on real-time stock and sales orders. After production, finished goods are logged into inventory, ready for dispatch. Every movement is tracked, invoices are auto-generated, and accounting entries are created—without manual handovers or Excel sheets.

Core Capabilities of BETs ERP

Procurement Automation: Manage vendor quotes, approvals, and rate contracts.

Quality Control: Ensure consistent raw material and finished goods inspection.

Inventory Visibility: Track raw material, in-process goods, and finished stock across multiple locations.

Production Management: Plan batches, reduce wastage, and monitor real-time progress.

Sales Order Management: Process orders with inventory checks and delivery schedules.

Invoicing and Accounting: Generate GST-compliant invoices and auto-sync with accounts.

Dispatch & Logistics: Plan routes, schedule dispatches, and monitor vehicle movement.

Gate Operations: Log material and vehicle entries for secure, auditable records.

HR & Payroll: Manage attendance, payroll, training, and appraisals with ease.

Business Intelligence: Get real-time dashboards and reports across departments.

Why Businesses Are Choosing ERP Over Excel in 2025

ERP systems are not just about digitization—they’re about optimization and growth.

With ERP:

Data is live and accurate across all departments.

You reduce manual work, rework, and human error.

You can scale operations faster and manage multiple units easily.

Managers gain actionable insights, not just static reports.

Compliance, audits, and documentation become effortless.

You reduce dependency on individuals and ensure process continuity.

In contrast, Excel is limited to what a human can enter, update, and analyze manually.

Beyond Efficiency: Creating a Competitive Edge

Modern ERP platforms like BETs ERP don’t just solve problems—they enable possibilities.

You gain:

Faster time-to-market through automated processes.

Improved customer satisfaction with consistent order fulfillment.

Data-backed decisions with real-time insights.

Cost savings through reduced waste, better planning, and streamlined workflows.

Stronger supplier and employee relationships with transparent processes.

Conclusion: Excel Was a Tool. ERP Is a Strategy.

In 2025, businesses that continue to rely on spreadsheets for critical operations risk falling behind. The shift to ERP is not about replacing Excel—it’s about embracing a platform built for integration, intelligence, and innovation.

If your operations are still driven by manual entries, scattered data, and disconnected systems, it’s time to level up. BETs ERP offers the foundation for streamlined operations, strategic decision-making, and sustainable growth.

Don't let Excel limit your potential. Switch to ERP. Empower your business.

Contact us today for a personalized demo of BETs ERP.

To know more,

Visit Us : https://www.byteelephants.com/

0 notes

Text

Fintech is rapidly transforming the financial services industry, and the accounting profession is no exception. Accounting technology is automating tasks, improving efficiency, and providing accountants with new insights to help businesses make better decisions. The impact of fintech innovations on the accounting industry. We will discuss how technology is changing the roles of accountants and bookkeepers, and we will highlight five technologies that are transforming the accounting profession.

#accounting automation software#tally automation#tally solutions#automated bank statement processing#tally on cloud#e invoice in tally#excel to tally import#auto entry in tally#automation for accountants#data entry automation

1 note

·

View note

Text

How Can AI Software Development Services Boost Your Business?

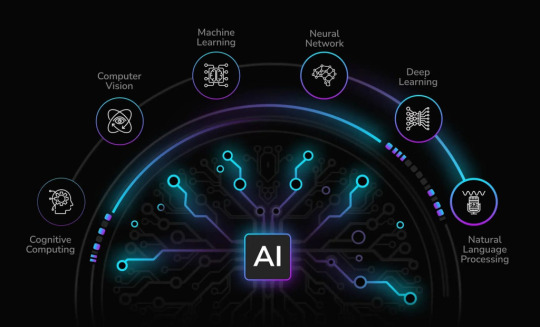

In today's rapidly evolving digital economy, staying competitive requires more than just adapting to technology—it demands innovation driven by intelligence. Artificial Intelligence (AI) is no longer a futuristic concept; it's a present-day force transforming industries across the globe. For businesses aiming to thrive in this landscape, AI software development services have emerged as a powerful catalyst for growth, efficiency, and innovation.

What Are AI Software Development Services?

AI software development services refer to the design, development, and deployment of AI-driven applications and systems tailored to specific business needs. These services often include machine learning (ML), natural language processing (NLP), computer vision, predictive analytics, and robotic process automation (RPA), among others. Leading AI development companies build intelligent systems that can learn from data, make decisions, and automate processes to drive value.

1. Streamlining Operations Through Automation

AI excels at automating repetitive and rule-based tasks. By integrating AI into core workflows, businesses can significantly reduce the need for manual intervention, minimize errors, and increase overall efficiency.

AI-powered bots can handle customer inquiries 24/7.

Intelligent automation tools can manage data entry, invoice processing, and inventory management.

Robotic Process Automation (RPA) can streamline back-office operations.

This results in cost savings, faster turnaround times, and more consistent outcomes.

2. Improving Decision-Making with Data Insights

Every business generates vast amounts of data, but only a few know how to utilize it effectively. AI software development services help transform raw data into actionable insights.

Predictive analytics models forecast trends and customer behavior.

AI algorithms identify patterns and anomalies in large datasets.

Real-time dashboards offer instant visibility into key performance metrics.

With AI, decision-makers can make more informed, data-driven choices that boost productivity and profitability.

3. Enhancing Customer Experience

Modern consumers expect personalized, seamless, and responsive interactions. AI enables businesses to deliver on these expectations:

AI chatbots offer instant customer support and query resolution.

Recommendation engines suggest products/services based on user behavior.

Sentiment analysis helps understand customer feedback in real time.

These solutions not only enhance user satisfaction but also foster customer loyalty and long-term engagement.

4. Enabling Scalable and Flexible Solutions

AI systems are inherently scalable. Whether you're a startup or an enterprise, AI solutions can grow with your business:

Cloud-based AI platforms offer flexibility and on-demand scaling.

Modular AI systems allow businesses to expand functionalities as needed.

Custom AI applications can be tailored for industry-specific use cases.

This adaptability ensures your business is always equipped to meet changing demands.

5. Strengthening Security and Compliance

Security threats and regulatory pressures continue to rise. AI can help organizations safeguard their data and ensure compliance:

AI-driven security systems detect unusual behavior and potential breaches.

Compliance automation tools help track and report regulatory adherence.

Machine learning models improve fraud detection in real-time.

These proactive security measures protect business integrity and customer trust.

6. Fostering Innovation and Competitive Advantage

AI empowers companies to innovate faster:

AI tools help in product development by analyzing user needs and testing variations.

Businesses can explore new markets with AI-powered market research.

AI accelerates R&D by simulating outcomes and optimizing processes.

Early adopters of AI not only keep up with competitors—they lead the market with smarter, faster innovations.

Conclusion

From operational efficiency and customer satisfaction to data-driven strategies and security, AI software development services offer immense value across every facet of a business. The integration of intelligent technology isn’t just a tech upgrade—it’s a strategic shift toward a more agile, innovative, and future-ready enterprise.

If you’re looking to unlock new growth opportunities, investing in AI software development services is one of the smartest business moves you can make today.

0 notes

Text

Front Office vs Back Office BPO: What’s the Difference?

If your company works with third-party vendors to handle specific tasks, you’re already familiar with Business Process Outsourcing (BPO). The BPO industry is booming, jumping from a market value of $92.5 billion in 2019 to $232.32 billion in 2020. In today’s gig economy, with remote work and hybrid setups becoming the norm, BPO is impossible to overlook. In fact, 80% of global executives plan to maintain or increase their outsourcing budgets. But what exactly are they outsourcing? The answer lies in two key categories: Front Office BPO and Back Office BPO. Let’s break down the differences between Front Office vs Back Office BPO.

What is Front Office BPO?

Imagine the face of your business—the part that interacts directly with customers. That’s what Front Office BPO is all about. According to Deloitte’s 2024 global outsourcing survey, 50% of executives outsource these customer-facing tasks. Think sales, marketing, customer service, or tech support—anything that involves direct contact with clients.

These front-office roles are critical because they shape your company’s reputation and drive revenue. To keep quality high while managing costs, many businesses turn to third-party vendors like marketing agencies, IT help desks, or customer support teams to handle these tasks.

What Does Front Office BPO Include?

Here’s a quick look at the types of tasks that fall under Front Office BPO:

Customer Service and Support: Fielding calls, emails, or texts from customers, answering their questions, resolving complaints, and solving problems.

Sales and Lead Generation: Reaching out to potential customers, nurturing leads, and turning them into loyal clients to boost revenue.

Technical Support and Helpdesk: Assisting customers with technical issues, like troubleshooting software or hardware problems.

Telemarketing and Telesales: Convincing customers over the phone to buy products or services and closing deals.

Live Chat and Social Media Management: Engaging with customers on social platforms, addressing concerns, and building relationships.

Skills Needed for Front Office BPO

To excel in Front Office BPO, vendors need:

Strong communication and people skills

Fluency in relevant languages and cultural sensitivity

Quick problem-solving abilities

Sales expertise

Emotional intelligence to handle customer interactions

What is Back Office BPO?

Now, shift your focus to the behind-the-scenes work that keeps a business running smoothly. That’s Back Office BPO. These are the internal, non-customer-facing tasks like accounting, HR, IT, or supply chain management.

This area is evolving, with specialized outsourcing in fields like legal services, IT support, or knowledge process outsourcing. Many companies, especially small businesses, outsource these tasks to cut costs and access expert skills without hiring full-time staff, as noted in Clutch’s 2023 report. While these processes don’t directly generate revenue, they’re essential for keeping operations efficient and understanding Front Office vs Back Office BPO.

What Does Back Office BPO Include?

Here’s what Back Office BPO typically covers:

Data Entry and Processing: Managing and updating company data, from financial records to customer details, ensuring accuracy and accessibility.

Accounting and Bookkeeping: Handling invoices, payments, and financial records to keep the books balanced.

Human Resources Management: Recruiting, onboarding, and supporting employees throughout their time with the company.

Research and Analytics: Analyzing market trends, competitors, or data to guide strategic decisions.

Quality Assurance and Compliance: Ensuring products and services meet high standards and follow regulations.

IT Support and Maintenance: Keeping technology running smoothly, from fixing software bugs to maintaining hardware.

Supply Chain Management: Coordinating the flow of goods, services, and information from suppliers to customers.

Skills Needed for Back Office BPO

To succeed in Back Office BPO, vendors need:

Technical expertise in specific fields

Keen attention to detail and accuracy

Process optimization know-how

Strong analytical thinking

Knowledge of compliance and regulations

Front Office vs Back Office BPO: Key Differences

So, what sets Front Office vs Back Office BPO apart? Let’s dive into the main distinctions:

1. Customer Interaction

The biggest difference is who they deal with. Front Office BPO is all about engaging directly with customers—think a customer service rep answering a client’s questions. Back Office BPO, on the other hand, operates in the background with little to no client contact. An accountant, for example, focuses on crunching numbers, not chatting with customers.

2. Revenue Impact

Front Office BPO has a direct effect on your bottom line. A marketing campaign or a skilled sales team can drive higher conversions and more revenue. Back Office BPO, while crucial, doesn’t immediately impact sales. IT support, for instance, ensures your systems run smoothly, enabling other teams to do their jobs effectively.

3. Time Sensitivity

Because Front Office BPO is customer-focused and tied to revenue, it’s often time-sensitive. Customer inquiries need quick responses, and sales teams must act fast to close deals. Back Office BPO tasks, like data entry or bookkeeping, follow more flexible timelines, prioritizing accuracy over speed.

4. Performance Metrics

Success in Front Office BPO is measured by customer satisfaction, response times, and conversion rates. For Back Office BPO, the focus is on accuracy, efficiency, and cost savings. For example, a data entry team’s performance might be judged by how error-free their work is, while a call center’s success hinges on happy customers.

Why Both Matter: The Bottom Line on Front Office vs Back Office BPO

Both Front Office BPO and Back Office BPO play vital roles in helping businesses save money while achieving top results. Front office outsourcing brings your brand to life through customer interactions, driving sales and building loyalty. Back office outsourcing keeps the gears turning with essential tasks like HR, IT, and accounting, allowing you to focus on growth.

The trick is figuring out which processes to outsource based on your current team’s strengths and your business goals. By understanding Front Office vs Back Office BPO, you can make smarter decisions to boost efficiency and profitability.

0 notes

Text

Rightpath GS: Your Partner in Financial Excellence

In the previous part of our blog series, we looked at how tactical automation, RPA, and AI can enhance the efficiency of Accounts Payable (AP) operations. But what if technology isn’t the only answer? Sometimes, the real transformation lies in how we approach process improvement itself. In Part 6 of our AP Transformation series, we turn to time-tested methodologies – Six Sigma and Lean – to explore non-technical ways of driving efficiency and reducing waste in the AP lifecycle.

Why Methodology Matters in Process Transformation

While automation offers significant advantages, many AP challenges stem from deeply embedded inefficiencies – such as unclear workflows, inconsistent task ownership, or redundant steps. Methodological approaches offer a structured way to analyse, question, and ultimately redesign processes. These techniques help organizations lay a strong foundation of operational discipline, making future automation efforts even more impactful.

Six Sigma: Reducing Defects, One Process at a Time

Six Sigma is a data-driven methodology focused on eliminating defects and minimizing variability in business processes. In the context of AP, this could mean fewer invoice mismatches, reduced payment delays, or more consistent posting accuracy.

For existing processes, the DMAIC framework – Define, Measure, Analyse, Improve, and Control – offers a clear roadmap. You begin by defining the problem or inefficiency, then measuring current performance and analysing the root causes. Once identified, targeted improvements are made, followed by ongoing control mechanisms to ensure the changes stick.

For processes being designed from scratch or undergoing a complete overhaul, the DMADV framework – Define, Measure, Analyse, Design, and Verify – comes into play. This helps ensure the new process is robust, scalable, and aligned with organizational goals before it’s rolled out.

Lean Thinking: Eliminating What Doesn’t Add Value

Lean methodology takes a different but complementary approach. It focuses on eliminating non-value-adding activities, commonly referred to as “waste.” In AP processes, this might include unnecessary approvals, manual hand-offs, duplicate entries, or waiting for data from other teams.

Lean categorizes waste into three broad forms: Muda, Mura, and Muri. Muda refers to activities that don’t add value. Mura represents inconsistencies that create bottlenecks or errors. Muri reflects overburdening employees due to inefficiencies in the workflow.

To make these actionable, Lean practitioners use the acronym TIMWOODS to identify eight specific types of waste: Transport, Inventory, Motion, Waiting, Overproduction,

Overprocessing, Defects, and Skills. Recognizing these waste types in your AP cycle – say, too many approval layers (waiting), manual keying of already available digital data (overprocessing), or underutilized staff expertise (skills) – can open the door to meaningful improvements.

Process Discipline is the Bedrock of Smart Transformation

Both Six Sigma and Lean encourage a culture of continuous improvement. They aren’t just toolkits but mindsets that enable organizations to be proactive rather than reactive. When AP teams embrace these principles, they move from firefighting individual errors to systematically eliminating the root causes of inefficiency.

At Right Path, we help businesses not only automate but also optimize. Our Free Procure-to Pay (P2P) Assessment looks beyond technology to uncover where process redesign can deliver lasting value. Whether you’re ready to implement Lean, launch a Six Sigma initiative, or simply looking for smarter ways to streamline AP, we’re here to guide your transformation journey.

Explore our website to learn more and claim your free assessment today. Let’s build processes that are not just faster, but fundamentally better. For more information click here: - https://rightpathgs.com/blogs/

0 notes

Text

Why Businesses Choose to Outsource Receivables for Financial Efficiency

Modern businesses are increasingly turning to finance and accounting outsourcing to streamline operations and cut costs. One of the most strategic areas in this shift is the decision to outsource receivables, a move that ensures better cash flow, reduced bad debt, and quicker collections. By outsourcing, companies gain access to specialized teams who manage invoicing, follow-ups, and client communication with precision and professionalism. This not only strengthens financial health but also frees up internal resources for growth-oriented tasks.

In addition to receivables, many organizations are also outsourcing General Ledger services to improve the accuracy and consistency of financial reporting. Managing the general ledger in-house can be time-consuming and prone to human error. With finance and accounting outsourcing, businesses benefit from expert reconciliation, journal entry management, and real-time financial visibility. These services provide clear insights into a company’s financial position while maintaining compliance and audit-readiness.

When companies outsource receivables and other financial functions, they gain more than just cost savings—they achieve operational excellence. The integration of General Ledger services with broader finance and accounting outsourcing strategies creates a streamlined, end-to-end financial system. This allows leadership to make informed decisions backed by reliable financial data. Whether you're a startup or an established enterprise, outsourcing these critical functions can give you the agility and insight needed to compete in today’s fast-paced market.

0 notes

Text

Overcoming Challenges with the Benefits of Process Automation in Business

As companies strive to stay ahead in an increasingly competitive global environment, integrating digital transformation tools becomes not just an option but a necessity. Among these tools, process automation stands out as a strategic lever that enables operational excellence, scalability, and smarter decision-making. From reducing human error to accelerating workflows and freeing up resources, the benefits of process automation in business are too significant to ignore.

What Is Process Automation in Business? Process automation involves using technology to perform repetitive tasks and streamline workflows that were previously handled manually. These tasks may include data entry, report generation, approvals, customer communications, and compliance monitoring. Automation software mimics human actions, reduces the need for constant supervision, and works round-the-clock without fatigue.

Why Automation Is a Competitive Advantage Businesses that adopt automation early enjoy a head start over competitors who rely on manual processes. Automation empowers them to respond quickly to market changes, enhance service delivery, and create an agile infrastructure that scales with demand. By minimizing downtime and human error, companies become more resilient and responsive.

Operational Benefits of Process Automation Process automation significantly improves workflow efficiency by ensuring consistent task execution, reducing bottlenecks, and minimizing manual intervention. It enhances transparency and compliance by automatically documenting every step of the process. This level of visibility is particularly beneficial for regulated industries where audit readiness is crucial.

How Automation Enhances Scalability and Agility As businesses grow, so do their operational complexities. Process automation allows systems to handle increased workloads without the need for additional human resources. It also facilitates quicker adaptations to new business models, product lines, or regulatory requirements by reconfiguring automated workflows rather than retraining staff.

Employee Productivity and Satisfaction By eliminating repetitive and low-value tasks, automation allows employees to focus on strategic, creative, and customer-focused responsibilities. This not only improves job satisfaction but also reduces burnout and employee turnover. Automation augments human intelligence, enabling smarter workflows rather than replacing human roles.

Cost Efficiency and Return on Investment Initial investments in automation often pay off through long-term cost savings. Businesses benefit from lower labor costs, reduced operational errors, improved throughput, and faster delivery times. These gains contribute to a higher return on investment, especially when automation is aligned with business goals and performance metrics.

Real-World Use Cases Across Industries In finance, automation handles invoice processing, compliance checks, and risk management. Retailers use it to manage inventory and customer service. In healthcare, automation supports patient records and appointment scheduling. Every industry finds its unique path to digital efficiency through automation.

Key Technologies Driving Automation Robotic Process Automation (RPA), Artificial Intelligence (AI), and Machine Learning (ML) are the core technologies enabling business process automation. They interpret data, make decisions, and learn from outcomes, making automation smarter over time. Integration with cloud platforms and APIs ensures seamless data flow across systems.

Challenges and Considerations Before Adoption While the benefits are immense, businesses must consider data security, integration complexity, employee training, and process suitability before automation. Not all processes should be automated; careful selection based on ROI and impact ensures long-term success. A clear change management strategy is also critical to avoid resistance.

For more info https://bi-journal.com/why-businesses-need-automation/

Conclusion Process automation is not a futuristic concept—it is a current-day necessity for businesses aiming for efficiency, growth, and competitive strength. It transforms how businesses operate by removing redundancy, speeding up operations, and allowing human resources to focus on innovation and value creation. As the digital economy evolves, the benefits of process automation in business will become the backbone of organizational success.

#Business Automation#Digital Transformation#Process Automation#BI Journal#BI Journal news#Business Insights articles

0 notes