#itr verification

Explore tagged Tumblr posts

Text

No Salary Slip? No Problem! Apply for Instant Loan Online Without Documents in 2025

Struggling to get a loan due to low income, no salary slip, or poor credit score? You’re not alone.

In today’s fast-paced world, financial emergencies don’t wait. Whether it's a medical bill, urgent travel, or rent payment, people often need instant cash loans in 1 hour in India without the hassle of paperwork. However, traditional banks demand documents, proof of income, and a good CIBIL score.

What if we told you that in 2025, there are real solutions to get instant approval loans online without any salary slips, CIBIL checks, or even detailed income proofs?

Let’s explore India’s best no-verification loan apps that are helping thousands of users like you get money in minutes – stress-free.

Why Do People Look for Instant Loans Without Documents?

Many salaried individuals, freelancers, or small business owners often face these challenges:

No salary slip or bank statement

Low or no credit score (CIBIL)

No ITR or formal income proof

Need for urgent funds (within 1 hour)

That’s where instant loans without a salary slip and no-proof personal loan apps step in.

These apps leverage AI-powered credit engines, alternative data, and KYC to offer instant loan disbursal in minutes – even to first-time borrowers with no formal documents.

Who Can Apply?

You can apply personal loan online instantly if you meet the following:

Age: 18+ years

Basic KYC: PAN + Aadhaar

Bank account for loan disbursal

Mobile number linked to Aadhaar

Basic repayment capacity (even gig work/freelancing)

Top No-Verification Loan Apps in India (2025)

Here’s a list of trusted apps where you can get an instant loan without documents or a CIBIL check:

Most of these apps offer quick cash loans without income proof, helping even those with bad credit get personal loan approval.

How to Apply for a Loan Without Income Proof or CIBIL Check?

Here’s a step-by-step guide for an easy personal loan application online in India:

Download the App (Investkraft, KreditBee, CASHe, etc.)

Complete eKYC – Aadhaar + PAN verification

Enter Basic Details – Employment type, monthly income (self-declared)

Bank Account Link – To receive disbursal

Loan Offer & Approval – Instant approval in most cases

Get Funds – Loan disbursal in minutes to your bank or wallet

That’s it! No need to upload salary slips, bank statements, or wait for long approvals.

Real-Life Scenario: How Ramesh Got ₹20,000 in 15 Minutes

I work part-time and earn ₹12,000 monthly. No ITR, no salary slip. I had a sudden health expense and tried KreditBee. I just uploaded my Aadhaar, PAN, and filled in basic info. ₹20,000 was credited to my account in under 15 minutes. Zero paperwork, no credit check!

— Ramesh, 21, Delhi

Is It Safe to Borrow from No-Proof Loan Apps?

Yes, but choose only RBI-registered NBFC-backed apps. Read reviews, verify data encryption policies, and ensure they don’t ask for unnecessary permissions.

Avoid shady apps that:

Demand advance payments

Call your contacts

Threaten legal action

Stick to reputed names like KreditBee, CASHe, and PaySense for a trusted instant loan without a credit score check in India.

Common Myths Busted

Top 5 FAQs – Instant Personal Loans Without Documents in India

1. Can I get a loan without a CIBIL or a salary slip?

Yes. Many apps allow a loan without a salary slip or a bank statement using KYC and alternate data.

2. How fast can I get the loan amount?

You can receive funds within 5 to 30 minutes, depending on the app and verification speed.

3. Is my low CIBIL score a problem?

No. Several platforms specialize in offering loans without a credit score check in India or to low-CIBIL borrowers.

4. Which is the best app for quick cash without income proof?

KreditBee and TrueBalance are top-rated for quick cash loans without income proof.

5. Do I need a job to get a personal loan?

Not always. Some apps offer loans to freelancers, students, and self-declared income earners.

Final Thoughts – Raise Instant Funds Without Hassle in 2025

In 2025, getting instant personal loans without income proof, CIBIL score, or documents is no longer be a dream. With the rise of AI-driven loan platforms, users across India can now meet urgent needs without fear of rejection.

Whether you're looking to apply personal loan online instantly, get an instant cash loan in 1 hour in India, or use a no proof personal loan app, the options are many – and very real.

Choose your app wisely. Stick to trusted names. Borrow only what you need. And enjoy the freedom of instant funds without paperwork.

#Get instant approval loan online#apply personal loan online instantly#instant cash loan in 1 hour in India#insta loan app without salary slip#bad credit personal loan approval guaranteed#loan without salary slip or bank statement#easy personal loan apply online India#instant loan disbursal in minutes#get instant loan without documents#quick cash loan without income proof#no proof personal loan apps#loan without credit score check in India

2 notes

·

View notes

Text

Understanding Tax Refunds: JJ Tax made it easy

Handling tax refunds can seem overwhelming, but having a clear grasp of the process can make it straightforward. This newsletter aims to demystify tax refunds by covering key aspects: eligibility criteria, claiming procedures and tracking your refund status.

What is a Tax Refund?

A tax refund represents the amount returned to taxpayers who have overpaid their taxes over the fiscal year. This situation arises when the total tax deducted or paid exceeds the actual tax liability determined based on their income.

In India, tax payments are made through TDS (Tax Deducted at Source), advance tax, or self-assessment tax. When the total tax paid or deducted surpasses your tax liability as calculated in your Income Tax Return (ITR), the excess amount is refunded. This mechanism ensures taxpayers are reimbursed for any overpayments.

Who is Eligible for a Tax Refund?

Eligibility for a tax refund depends on various factors:

Excess Tax Payments If your TDS or advance tax payments exceed your tax liability, you’re eligible for a refund. This often applies to salaried employees, freelancers, and individuals with taxable investment income.

Claiming Deductions If you claim deductions under sections like 80C, 80D, etc., and these deductions lower your tax liability below the total tax paid, a refund may be due.

Filing an Income Tax Return Only those who file their Income Tax Return can claim a refund. The return must accurately reflect your income, deductions, and tax payments to establish if a refund is warranted.

Losses to Set Off If you have losses from previous years or the current year that can be carried forward and set off against current year income, you might be eligible for a refund if these losses reduce your tax liability.

Who is Not Eligible for a Tax Refund?

Certain situations or individuals may not qualify for a tax refund:

Income Below Taxable Threshold If your total income is below the taxable limit, a refund may not be applicable.

Salary Below Government Criteria Individuals earning below the minimum threshold specified by the Government of India may not qualify for a refund.

No Overpayment If your tax payments match your tax liability or you haven’t overpaid, a refund will not be available.

Non-Filers or Incorrect Filers Those who fail to file their Income Tax Return or file it incorrectly will not be eligible for a refund. Proper filing is essential for initiating the refund process.

Invalid Deductions Claims for deductions that do not meet tax regulations or lack valid documentation may result in a refund rejection.

Incorrect Bank Details If the bank account information provided in your ITR is incorrect or incomplete, the refund may not be processed.

How to Claim Your Tax Refund

Here’s a step-by-step guide to claiming your tax refund:

File Your Income Tax Return (ITR) Access the Income Tax Department’s e-filing portal. Choose the correct ITR form based on your income sources and eligibility. Accurately complete all required details, including income, deductions, and tax payments.

Verify Your ITR Verify your ITR using Aadhaar OTP, net banking, or by sending a signed ITR-V to the Centralised Processing Centre (CPC). Verification must be completed within 120 days of filing your ITR.

ITR Processing The Income Tax Department will process your return, assess your tax liability, and determine the refund amount. This process can take a few weeks to several months.

Refund Issuance After processing, the refund will be credited directly to your bank account. Ensure your bank details are accurate and up-to-date in your ITR.

Update Bank Account Details (if needed) If your bank details change after filing your ITR, promptly update them on the e-filing portal to ensure correct refund crediting.

How to Check Your ITR Refund Status for FY 2024-2025

To check your refund status, follow these steps:

Visit the Income Tax E-Filing Portal Go to the official Income Tax Department e-filing website.

Access the 'Refund Status' Section Navigate to the ‘Refund Status’ page, typically under the ‘Services’ tab or a similar heading.

Enter Required Details Input your PAN (Permanent Account Number) and the assessment year for your filed return.

Review the Status The portal will show the status of your refund, including whether it has been processed, approved, or if further action is needed.

Track Refund Processing Keep an eye on any updates or notifications from the Income Tax Department regarding your refund.

Understanding the tax refund process can simplify the experience. By following these steps and staying informed about your eligibility, you can make sure that you have a smooth process and quickly receipt of any excess tax payments. For expert guidance and personalized assistance, consult with JJ Tax. Visit our website or contact us today to get the support you need for all your tax-related queries.

JJ Tax

2 notes

·

View notes

Text

How to Schedule and Prepare for VFS Appointments for Business Visas

Professional advice on booking, documentation, and attending VFS appointments confidently

Introduction

For most Indian professionals applying for business visas to countries like the UK, Canada, Schengen nations, or Australia, scheduling a VFS (Visa Facilitation Services) appointment is a critical step. While the process may seem technical, with the right preparation, you can move through it smoothly and confidently. This guide explains how to schedule your VFS appointment, what documents to prepare, and how to present yourself during the visit.

Step 1: Understand Why VFS Is Important

VFS Global acts as a bridge between visa applicants and the respective embassies or consulates. For business visa applications, VFS handles:

Appointment booking

Document collection and verification

Biometrics (fingerprints and photo)

Passport submission and return tracking

Missing your appointment or submitting incomplete paperwork can delay your travel or result in rejection.

Step 2: Booking Your VFS Appointment

✔️ Visit the Official VFS Website

Go to the official VFS Global site for your destination country. Do not use third-party portals or agents unless officially registered.

✔️ Choose the Right Visa Type

Select “Business Visa” as the category. You will be asked to provide basic personal information, your passport number, and intended travel dates.

✔️ Select a Convenient Time and Center

Pick a time slot at a nearby VFS center. Early morning slots are usually less crowded. Book at least 15–20 days in advance to avoid last-minute rushes.

Step 3: Prepare Your Documents for Submission

Business visa applications must be supported with both originals and copies of critical documents. Common requirements include:

Printed appointment confirmation letter

Passport (original + photocopies)

Business Cover Letter from your employer

Invitation Letter from the overseas organization

Bank statements, ITRs, and financial proofs

Photographs (as per country specifications)

Completed visa application form (printed and signed)

Organize documents neatly in order. Use labeled folders or transparent files for a clean, professional presentation.

Step 4: What to Expect at the VFS Center

On the day of the appointment:

Arrive 15–30 minutes early

Dress professionally

Carry a government-issued ID (for verification)

Security checks are mandatory at entry

Submit your documents in the designated order

Biometrics (photo and fingerprints) will be captured

A receipt will be provided for tracking your application

Note: Some centers offer premium services like document scanning, SMS tracking, and courier return—use them if you're short on time.

Step 5: After the Appointment

You can track your application online using your receipt number. The passport is usually returned in 5 to 15 working days, depending on the destination and season.

Tips for a Smooth VFS Experience

Double-check your documents before the visit

Be polite and cooperative with VFS staff

Don't staple or clip papers; use paperclips if needed

Carry extra passport-size photos, just in case

Avoid applying close to weekends or holidays

Conclusion

VFS appointments are a key part of your business visa journey. By preparing thoroughly and understanding the process, you increase your chances of a smooth submission and timely approval. With organized documents and confident presence, your business travel plans will stay firmly on track.

Click Here

1 note

·

View note

Text

Angel One Demat Account Opening Process: Step-by-Step Guide

Angel One Demat Account Opening Process: Complete 7-Step Guide

Opening a demat account is the essential first step in your investment journey. If you’ve been researching online, chances are you’ve come across Angel One, one of India’s most trusted and user-friendly stockbroking platforms. This article will walk you through the Angel One demat account opening process, giving you everything you need to get started quickly, securely, and completely online.

Whether you’re a beginner or a seasoned trader, understanding the Angel One demat account opening process ensures that you can start investing without confusion or delays. So let’s break down each step and get you started on your path to financial growth.

Why Choose Angel One?

Before diving into the actual process, it’s important to understand why Angel One stands out. With zero brokerage on equity delivery and flat ₹20 per order for intraday and F&O trades, it offers one of the most cost-effective solutions in the market. Additionally, features like real-time portfolio tracking, ARQ Prime (AI-based advisory), and access to U.S. stocks make it a powerful tool for investors.

Most importantly, the Angel One account opening process is fast, digital, and designed for convenience. With the right documents, your account could be live in just 1–3 working days.

Documents Required for Angel One Demat Account

To avoid delays during the Angel One demat account opening process, make sure you have the following documents ready in PDF or JPEG format:

PAN Card (mandatory for KYC)

Aadhaar Card (linked to your mobile for e-signature)

Bank Proof – Cancelled cheque or latest bank statement

Signature on white paper

Live Selfie (captured during registration)

If you're planning to trade in Futures & Options (F&O), also prepare:

Income Proof – Latest salary slip, 6-month bank statement, or ITR

Additional Address Proof (only if requested)

Angel One Demat Account Opening Process – Step-by-Step

Now that your documents are in order, let’s walk through the Angel One demat account opening process. The entire registration can be completed in under 30 minutes.

1. Verify Your Mobile Number

Visit the official Angel One website or download the mobile app. Enter your mobile number and verify it using the OTP sent to your phone.

2. Enter Personal Details

Next, provide your full name and email ID. You’ll receive a second OTP on your email for verification.

3. Complete KYC Verification

This is a critical step in the Angel One demat account opening process. You’ll need to link your Aadhaar using DigiLocker and enter your PAN details to proceed.

4. Link Your Bank Account

Upload a cancelled cheque or a recent bank statement. You can also verify your account via UPI. This step enables secure fund transfers.

5. Upload Selfie and Signature

Take a live selfie using your webcam or phone camera and upload your scanned signature. These help confirm your identity.

6. Add Nominee and Income Details

Although optional, adding a nominee provides extra security. If you’re going to trade in F&O, this is where you’ll upload income proof.

7. E-sign the Application

To complete the Angel One account opening process, e-sign your application using your Aadhaar credentials. After submitting, your application enters review.

What Happens After You Submit?

Once you complete the steps, Angel One typically verifies and activates your account within 1–3 business days. After activation, you can begin trading and investing in:

Equity (delivery and intraday)

Mutual Funds

IPOs

F&O

Commodities

U.S. Stocks

Thanks to a user-friendly dashboard, navigating through these options becomes seamless.

Benefits After Completing the Angel One Demat Account Opening Process

Upon successful account activation, you unlock a host of features that enhance your investing experience:

Real-time portfolio monitoring

NSDL Speed-e integration

Tax-ready e-statements

One-click demat/remat services

24x7 customer support and advanced research tools

These features ensure that the Angel One demat account opening process is not just about setting up an account—but about building a complete investment ecosystem.

Final Thoughts

In conclusion, the Angel One demat account opening process is streamlined, efficient, and beginner-friendly. From verifying your mobile number to uploading essential documents and completing Aadhaar e-signing, each step is designed to simplify onboarding.

With just a few clicks and minimal documentation, the Angel One account opening process enables you to access a wide range of investment options. If you’re ready to take control of your financial future, prepare your documents and follow this guide to open your account with ease.

0 notes

Text

No Excuses, Just Money: Get Your Instant Cash Loan in Guwahati Within 1 Hour

Emergencies don’t knock. They crash through the door—and when they do, you can’t wait for bank queues, clueless agents, or endless verification calls. Whether it’s a medical emergency, education fee, business shortfall, or a travel plan—instant cash loan Guwahati is your fastest way to financial rescue.

At FinCrif, we cut through the noise. You apply, we verify, and your money lands in your account in as little as 1 hour. That's right—your personal loan Guwahati 1 hour delivery promise is real.

Why Instant Cash Loans in Guwahati Make More Sense Now Than Ever

Living in a fast-moving city like Guwahati means you can’t afford slow decisions. Here's why people are ditching traditional banks and opting for Guwahati instant loan options:

🔹 No collateral – Just your income and KYC docs

🔹 Instant approval and disbursal

🔹 Fully online Guwahati loan application

🔹 Loan amount from ₹10,000 to ₹5,00,000

🔹 Tenures up to 60 months

🔹 Minimal documentation

The old banking model is broken. Waiting 5 days for loan approval doesn’t work when your problem needs solving in 5 minutes.

Who Qualifies for a Personal Loan in Guwahati?

Not everyone gets a loan. But if you’re earning and responsible, your Guwahati loan application can get greenlit fast.

For Salaried Applicants:

Monthly salary: ₹15,000+

Age: 21–58 years

Minimum 6 months in current job

Stable salary credit in bank account

Valid address in Guwahati

For Self-Employed:

Age: 25–60 years

2+ years of business proof

Regular income through ITR or GST filings

Business location in Guwahati or nearby areas

Whether you’re in Beltola, Dispur, Paltan Bazaar, or Maligaon—FinCrif offers instant cash loan Guwahati with city-specific convenience.

It’s quick, simple, and safe. No drama. Just decisions.

How to Apply: Guwahati Loan Application in 5 Easy Steps

Gone are the days of branch visits and manual forms. With FinCrif, your Guwahati loan application goes like this:

Visit FinCrif’s online platform

Select “Instant Loan Guwahati”

Enter personal, employment, and income details

Upload required documents

Get approval in minutes & funds in 1 hour

If you have your PAN, Aadhaar, salary slip, and bank statement handy—you’re halfway done already.

Required Documents for Instant Loan Guwahati

To get a Guwahati instant loan, make sure you’ve got the following ready (preferably scanned in PDF or JPEG):

Aadhaar Card

PAN Card

Latest 3-month salary slips or ITR

Bank statements (3–6 months)

Recent passport-size photograpAddress proof (utility bill, rental agreement)

The cleaner and clearer your documents, the faster the process.

Why Guwahati Residents Are Choosing FinCrif

From students in RG Baruah to traders in Fancy Bazar and teachers in Pan Bazaar, Guwahatians are switching to FinCrif’s instant cash loan Guwahati services for three powerful reasons:

Time is everything – And we don’t waste yours.

We get local – Our approval algorithm understands Guwahati’s employment and income trends.

We are 100% transparent – No hidden fees, no last-minute surprises.

Bonus tip: If you include extra income sources like incentives or rent, your eligibility shoots up.

How to Boost Your Approval Rate Instantly

Want a personal loan Guwahati 1 hour approval rate close to 100%? Follow these 5 hacks:

Keep your CIBIL score above 700

Avoid recent EMI bounces

Disclose all income sources

Use one application portal (FinCrif) to avoid rejection risk

Choose the right tenure for affordability

Remember, lenders don’t reject people—they reject incomplete or weak profiles.

Common Mistakes That Delay Loan Approval

Avoid these if you want that instant cash loan Guwahati in 1 hour:

Submitting blurred documents

Giving inconsistent address/employment info

Having recent personal loan defaults

Applying with too many lenders at once

Ignoring calls or emails for verification

Don’t shoot yourself in the foot. Play it smart, and get approved in record time.

Who’s Taking Instant Loans in Guwahati?

Our recent data shows that applicants fall under these five buckets:

✅ Office professionals needing short-term liquidity

✅ Business owners closing vendor payments

✅ Students covering college or entrance exam fees

✅ Home-based entrepreneurs buying tools or equipment

✅ Women managing wedding, child birth, or health expenses

Guwahati instant loan services aren’t just a backup plan—they’re becoming a smart tool in city life.

Final Word: Don’t Wait, Accelerate

Life doesn’t pause when your wallet’s empty. Whether you're planning ahead or fighting fires, instant cash loan Guwahati through FinCrif gives you the edge.

No games. No gimmicks. Just fast money with zero excuses.

If you need up to ₹5 lakh today, and can pay it back like a pro, your personal loan Guwahati 1 hour is ready. We’ll handle the approvals, the documents, and the disbursal. You handle your life—with confidence.

👉 Start your Guwahati loan application now. Get funded in 1 hour. The rest? That’s up to you.

0 notes

Text

Australia Business Visa Processing Time for Indians in 2025: Complete Guide

With its strong economy, innovation-driven industries, and thriving startup ecosystem, Australia has become one of the top destinations for Indian entrepreneurs and professionals. Whether you’re attending a business conference in Sydney or exploring investment opportunities in Melbourne, a valid business visa is essential. Understanding the Australia business visa processing time helps ensure timely travel and smoother planning.

Why Australia is a Prime Business Destination?

Australia ranks consistently among the top 15 global economies and offers:

High ease-of-doing-business ratings

Transparent regulations

Government incentives for foreign investors

Access to markets across Asia-Pacific

📊 Stat Check: According to Austrade, India is now Australia’s sixth-largest trading partner, with two-way trade reaching AUD 46 billion in 2024. As a result, the number of business visa applications from India rose by 21% in the past year alone.

Types of Business Visas to Australia

There are two main visa categories for business travelers:

1. Visitor Visa – Subclass 600 (Business Stream)

This is suitable for short-term business visits like meetings, seminars, or exploratory visits.

Validity: Up to 3 months

Entries: Single or multiple

2. Business Innovation and Investment Visa – Subclass 188

This is a long-term provisional visa for those seeking to start or invest in a business in Australia.

Validity: Up to 4 years

Pathway: Leads to permanent residency (Subclass 888)

Australia Business Visa Processing Time (2025)

The processing time for an Australia business visa depends on the visa type and individual application:Visa TypeProcessing TimeSubclass 600 (Business Stream)10 to 20 working daysSubclass 188 (Business Innovation)6 to 11 months (varies by stream)

🕒 Note: Delays may occur due to incomplete documents, verification requirements, or changes in immigration policies.

Documents Required for Business Visa

To ensure faster processing, prepare these essential documents:

Valid passport (minimum 6 months validity)

Recent passport-sized photographs

Invitation letter from Australian business entity

Cover letter explaining business purpose

Financial documents (bank statements, ITR)

Proof of ties to India (employment or business proof)

Travel itinerary and hotel bookings

Providing complete and verifiable documents significantly reduces delays in the Australia business visa processing time.

Why Seek Professional Visa Guidance?

With fluctuating timelines and immigration updates, many applicants rely on visa consultants for:

Accurate document preparation

Application tracking

Faster approvals

Avoiding common errors that lead to rejection or delay

Visa experts streamline the process, giving you confidence and clarity throughout your journey.

Conclusion

Understanding the Australia business visa processing time is key to planning a successful business trip from India. Whether you’re looking to explore short-term opportunities or lay the foundation for a long-term investment, Australia offers the right ecosystem for growth.

Apply early, stay prepared, and let professionals guide you through a smooth application process—because in business, timing is everything.

FAQs: Australia Business Visa Processing Time

Q1: How long does the Australia business visa take to process? A: The Subclass 600 typically takes 10–20 working days, while Subclass 188 can take 6–11 months.

Q2: Can I expedite my visa application? A: While there's no official fast-track for all cases, submitting accurate documents can speed up approvals.

Q3: Is an invitation letter mandatory? A: Yes, it strengthens your application and is generally required for Subclass 600.

Q4: Can I work on a business visa in Australia? A: No, the business visa allows non-remunerative activities like meetings or trade visits only.

Q5: Is the Australia business visa extendable? A: Subclass 600 may be extended under special conditions, but new applications are often required.

0 notes

Text

Income Tax Return Filing in Dwarka by Vatspk – Simplify Your Tax Filing Today

Income Tax Return Filing in Dwarka by Vatspk

Filing your Income Tax Return (ITR) on time is more than a legal obligation—it’s a crucial step toward responsible financial planning. If you're located in Dwarka and seeking expert assistance, Vatspk is your go-to solution for Income Tax Return Filing in Dwarka.

With years of experience, a team of certified tax professionals, and a client-centric approach, Vatspk ensures that your ITR filing is hassle-free, accurate, and compliant with the latest government regulations.

Why Income Tax Return Filing is Important

Income Tax Return filing offers several benefits beyond avoiding penalties:

Claiming tax refunds for excess deductions

Proof of income for loans and visa applications

Carrying forward losses to future years

Establishing financial credibility

Who Needs to File an Income Tax Return?

You must file your ITR if:

Your gross income exceeds the exemption limit (₹2.5 lakh for individuals under 60)

You earned foreign income

You have investments in foreign assets

You want to claim a refund

You're a company, LLP, or partnership firm, regardless of income level

Why Choose Vatspk for ITR Filing in Dwarka?

At Vatspk, we understand that tax compliance can be overwhelming. Our expert team streamlines the process with:

✅ Personalized Tax Planning ✅ Quick e-Filing with Acknowledgment ✅ Affordable Pricing Packages ✅ Assistance with Notices and Rectifications ✅ PAN-Aadhaar Linking, TDS Queries, and More

Whether you're a salaried employee, a freelancer, or a business owner in Dwarka, Vatspk tailors ITR filing services to suit your needs.

Documents Required for ITR Filing

To file your ITR through Vatspk, you'll need:

PAN Card & Aadhaar Card

Form 16 (for salaried individuals)

Bank Statements & Interest Certificates

Investment Proofs (LIC, PPF, ELSS, etc.)

Rental Income or Property Details

Capital Gains Details (if any)

TDS Certificates

Our ITR Filing Process at Vatspk

Initial Consultation – We understand your income sources and tax profile

Document Collection – Easy upload via email or secure portal

Computation & Verification – We calculate your taxes and get your approval

Online Filing & Acknowledgment – Return is filed and confirmation sent

Post-filing Support – Assistance with refund tracking or corrections

Affordable Pricing Plans

We offer transparent pricing starting from as low as ₹499/- for salaried individuals. Custom packages available for businesses, NRIs, and freelancers.

Frequently Asked Questions (FAQs)

Q1. Why should I file my Income Tax Return through Vatspk in Dwarka?

Ans: Vatspk offers expert tax advisory, fast filing, and complete compliance support. Our Dwarka-based experts make sure your return is filed accurately with zero stress.

Q2. Can Vatspk help me file past-year or belated returns?

Ans: Yes. Vatspk can help you file belated returns, revise returns, or respond to IT department notices effectively.

Q3. What if I miss the ITR filing deadline?

Ans: Missing the deadline attracts a late fee under Section 234F and may result in loss of refund claims or inability to carry forward capital losses.

Q4. Is physical presence required to file ITR with Vatspk?

Ans: No. Vatspk offers 100% online ITR filing. You can share documents digitally, and our team will manage everything remotely.

Q5. Do you also assist with business or GST returns?

Ans: Absolutely. Vatspk provides GST filing, TDS returns, business tax compliance, and accounting services in addition to ITR filing.

Contact Vatspk Today!

Make your Income Tax Return Filing in Dwarka fast, secure, and simple. Contact Vatspk today and leave your tax worries to us!

#gst consultant in dwarka#income tax consultant in delhi#accounting#ca in delhi#chartered accountant in delhi#gst consultant in delhi#income tax consultant in dwarka#sections#tds#vatspk

1 note

·

View note

Text

Your Essential Guide: Documents Checklist for a Canada Business Visa from India

For Indian entrepreneurs and professionals eyeing expansion into Canada's thriving market, a meticulously prepared visa application is the first crucial step. While the process can seem intricate, having a clear "documents checklist" is your best ally. This guide will detail every essential paper you need to secure your Canada Business Visitor Visa, ensuring a smooth journey towards your global aspirations.

Understanding the Business Visitor Definition

Before we dive into the checklist, remember what a "business visitor" means to Canadian immigration. You are entering Canada temporarily to engage in international business activities, not to enter the Canadian job market or receive a salary from a Canadian entity. Your primary source of income and profits must remain outside Canada. Activities typically include attending conferences, meetings, trade shows, negotiating contracts, or exploring investment opportunities.

The Comprehensive Documents Checklist for Your Canada Business Visa

Accuracy and completeness are paramount. Gather these documents carefully:

I. Personal & Travel Documents:

Valid Indian Passport:

Original passport.

Must be valid for at least six months beyond your intended stay in Canada.

Should have at least two blank pages for visa stamping.

Any old passports with previous travel history/visas (especially to Canada, USA, UK, Schengen) are highly beneficial.

Recent Passport-sized Photographs:

Two recent photos (taken within the last six months).

Must meet Canadian visa photo specifications (typically 35mm x 45mm, white background, 80% face visible).

Completed Online Application Forms:

IMM 5257 (Application for a Temporary Resident Visa): This is the main application form.

IMM 5645 (Family Information Form): Details about your family members.

Any other forms requested by the IRCC portal based on your specific answers.

Travel Itinerary:

Confirmed round-trip flight bookings.

Confirmed hotel reservations or proof of accommodation for your entire stay.

II. Financial Documents (Proof of Funds):

This demonstrates your ability to support yourself during your stay without becoming a public charge.

Bank Statements: Original bank statements for the last 6 months (savings and current accounts), duly stamped and signed by the bank.

Income Tax Returns (ITR): Copies of your personal Income Tax Acknowledgement (ITR-V) for the last 2-3 years.

Salary Slips: If employed, original salary slips for the last 3-6 months.

Proof of Other Income/Assets: Documents for Fixed Deposits, property ownership, mutual funds, or other investments that demonstrate financial solvency.

III. Purpose of Visit & Business Ties:

This section is crucial to prove your genuine business intent and your strong ties to India, ensuring your return.

Invitation Letter from Canadian Host:

On the Canadian company's official letterhead.

Clearly stating the purpose and duration of your visit.

Details of the business activities you will undertake (e.g., meeting schedule, conference agenda).

Confirmation of who will cover your expenses (e.g., accommodation, travel) if applicable.

Full contact information of the inviting person/company.

Cover Letter from Your Indian Company / Self-Declaration (if Self-Employed):

On your Indian company's letterhead (if applicable), signed and stamped.

Explaining the purpose of your trip, your role in the company, and the expected benefits of the visit.

Confirming your employment details, approved leave, and commitment to return to India.

If self-employed, a detailed letter on your business letterhead explaining your business, the purpose of your visit, and your intent to return.

Proof of Business/Employment in India:

For Employed Individuals: Employment verification letter from your current employer, stating your position, date of joining, salary, and approval for your leave.

For Self-Employed/Business Owners:

Company registration documents (e.g., Certificate of Incorporation, Partnership Deed, Shop & Establishment license).

Memorandum of Association (MOA) / Articles of Association (AOA).

Proof of active business operations (e.g., recent invoices, contracts, business bank statements).

Chamber of Commerce membership (if any).

Evidence of Ties to India:

Property ownership documents (if applicable).

Marriage certificate (if married).

Birth certificates of dependent children in India.

Any other documents that demonstrate compelling reasons for you to return to your home country.

IV. Additional Documents (If Applicable):

Medical Examination: May be required if you've recently traveled to certain countries or for longer stays. You'll be informed if this is needed.

Police Clearance Certificate (PCC): May be requested in some cases if there are concerns about your criminal history.

Previous Visa Copies: Copies of any previous Canadian visas, or visas to other major countries (USA, UK, Schengen).

Application Process: Key Steps

Online Application: Fill out all forms and upload documents via the IRCC portal.

Pay Fees: Pay the visa fee (CAD 100) and biometric fee (CAD 85) online.

Biometrics: Schedule and attend an appointment at a VFS Global Visa Application Centre (VAC) in India for fingerprint and photo submission. VFS Global VACs in major Indian cities (e.g., Mumbai, Delhi, Bangalore, Pune) generally operate Monday to Friday, from 09:00 to 17:00, though Pune opens earlier at 08:00.

Passport Submission: If your application is approved, you'll receive a request to submit your passport to the VAC for visa stamping.

Quick Stats on Canada Business Visas for Indians

Processing Time: While official IRCC times vary, general visitor visa processing for online applications can range from 50-55 days, and for paper applications, 60-65 days. However, specific processing times for business visitor visas can vary significantly. Always check the official IRCC website for the most current processing times.

Visa Validity: A Canada business visitor visa can be granted for up to 10 years or until your passport expires, whichever comes first, allowing for multiple entries. The typical stay duration per visit is up to 6 months.

Fees (Approximate INR equivalents as of June 2025):

Visa Application Fee: CAD 100 (approx. ₹6,100 - ₹6,300)

Biometrics Fee: CAD 85 (approx. ₹5,200 - ₹5,400)

Frequently Asked Questions (FAQs)

Q1: Is an invitation letter mandatory for a Canada business visa?

A1: Yes, a clear and detailed invitation letter from your Canadian business host is a crucial document and is almost always required.

Q2: How much bank balance do I need for a Canadian business visa?

A2: There's no fixed amount, but you must demonstrate sufficient funds to cover all your expenses (accommodation, food, local travel, personal) for the entire duration of your planned stay, plus your return airfare. A general guideline is at least CAD 1,000 per month of stay.

Q3: Can I apply for a Canada business visa if I have a valid US visa?

A3: Having a valid US visa (especially a B1/B2) can sometimes strengthen your application, as it indicates a history of compliance with another major Western nation's immigration rules. However, it does not guarantee approval for a Canadian visa.

Q4: Can I travel to Canada before my planned business trip date?

A4: You should plan to enter Canada on or close to your intended travel date as stated in your application. While a visa allows entry, the border services officer at the port of entry will make the final decision on your admission and length of stay.

Q5: What is VFS Global's role in the Canada visa application process?

A5: VFS Global operates the Visa Application Centres (VACs) on behalf of the Canadian government in India. They handle biometric collection (fingerprints and photo) and passport submission/collection after a visa decision is made. They do not decide on the visa outcome.

0 notes

Text

ITR 2 e-Filing Expert in Mumbai

ITR 2 e-Filing Expert in Mumbai: Trusted Solutions for High-Income Taxpayers

If you're a salaried individual with capital gains, owning multiple assets, or earning from foreign sources, filing ITR 2 is not just an annual compliance ritual—it’s a strategic financial move. But let's be honest: navigating the complexities of ITR 2 e-filing can be overwhelming without expert assistance. That’s why more and more taxpayers in Mumbai, India’s financial hub, are turning to professional ITR 2 consultants for error-free, timely, and optimized tax filing.

Welcome to the ultimate guide for finding the best ITR 2 e-Filing Expert in Mumbai—your partner in achieving tax efficiency, compliance, and peace of mind.

Why You Need an ITR 2 e-Filing Expert in Mumbai

Mumbai, home to lakhs of professionals, NRIs, stock market investors, and property owners, sees a growing demand for tailored income tax filing services—especially for those who fall under Income Tax Return Form 2 (ITR-2). Here's why:

1. Complex Income Structures

If you’re earning from multiple sources like:

Capital gains (stocks, mutual funds, or property),

Foreign income or assets,

More than one residential property, or

Director in a company not owning unlisted shares,

...then ITR 2 is mandatory. An expert ensures your reporting is accurate and tax-saving opportunities are not missed.

2. Error-Free Filing with Real-Time Compliance

E-filing ITR 2 isn’t just data entry—it requires in-depth knowledge of tax laws, interpretation of income types, and experience with advanced utility forms provided by the Income Tax Department. An experienced consultant helps avoid:

Mistakes leading to notices

Mismatch of Form 26AS and AIS

Incorrect disclosure of foreign assets

3. Maximum Deductions & Legal Tax Optimization

Only a professional understands how to legally optimize tax under sections like 80C, 80G, 24(b) (home loan interest), and more. If you’re a high net-worth individual or NRI, this guidance is priceless.

Key Features of a Top ITR 2 Consultant in Mumbai

When selecting the right expert, ensure they offer:

One-on-One Consultation

Secure document handling

Experience with capital gains taxation

Specialized knowledge in NRI taxation

Online and offline support

TDS reconciliation from AIS/26AS

Post-filing assistance for refunds or scrutiny notices

A true ITR 2 expert in Mumbai doesn’t just file—they strategize.

Top Trending Services by ITR 2 Filing Experts in Mumbai

Today’s top firms offer:

E-filing for Capital Gains (STCG, LTCG)

Foreign Income & Foreign Asset Disclosure

Crypto & Digital Asset Income Tax Filing

Rental Income from Multiple Properties

Consultation on Presumptive Taxation & Advance Tax

DSC (Digital Signature Certificate) based e-verification

PAN-Aadhaar Linking & Tax Planning Advisory

Who Should File ITR 2?

You should opt for ITR 2 filing if:

You are a salaried individual with income from capital gains or foreign assets

You earn rental income from more than one house

You're an NRI or Resident but Ordinarily Not Resident (RNOR)

You’re a director in a listed company (but not holding unlisted shares)

If these apply to you, DIY tax portals aren’t enough. Get professional help to stay 100% compliant and maximize your tax benefits.

Why Choose a Local ITR 2 Expert in Mumbai?

While online options are everywhere, a local tax consultant in Mumbai brings specific advantages:

Familiarity with regional tax nuances

Access to offline verification centers if needed

Face-to-face consultation in real time

Faster turnaround for city-based documentation

Whether you reside in Andheri, Bandra, Lower Parel, Powai, or Navi Mumbai, having a trusted tax expert nearby is a strategic asset.

FAQs: ITR 2 e-Filing in Mumbai

Q. Is ITR 2 only for high-income earners?

No. It applies based on income type, not just amount. Even salaried people with capital gains must file ITR 2.

Q. What documents are required for ITR 2 filing?

You’ll need:

Form 16 & 26AS

Capital gains statements

Property documents (if applicable)

Bank statements

Foreign asset declarations (if any)

Q. Can I file ITR 2 myself?

Yes, but given its complexity, even the IT department recommends professional assistance for ITR 2.

Your Trusted ITR 2 Partner is Just a Click Away

Don’t let tax season stress you out. Trust a certified ITR 2 e-Filing Expert in Mumbai to manage your returns with accuracy, efficiency, and confidentiality. With increasing scrutiny by the tax department, especially for capital gains and foreign assets, professional help is no longer optional—it’s essential.

0 notes

Text

NRI Advisory Services: Empowering Global Indians with Expert Guidance

In today’s globally connected world, millions of Indians reside abroad for employment, business, or personal reasons. While their lives may be based overseas, their ties to India—whether emotional, financial, or legal—remain strong. Managing these ties efficiently, however, requires expert assistance. This is where NRI advisory services come into play, offering strategic guidance to help Non-Resident Indians (NRIs) navigate the complex legal, financial, and regulatory landscape of India.

What Are NRI Advisory Services?

The NRI advisory services are professional services designed to assist NRIs in handling their India-related affairs, including taxation, real estate, legal documentation, inheritance, banking, and investments. These services offer tailored advice and execution support to help NRIs make informed decisions while staying compliant with Indian regulations such as FEMA, RBI, and Income Tax Act provisions.

Why Are NRI Advisory Services Important?

India has specific rules and regulations that apply exclusively to NRIs. These can be confusing and difficult to manage from abroad. Missteps can result in legal complications, tax penalties, or financial losses. NRI advisory firms act as your local representative, ensuring your interests are protected and your decisions are backed by professional advice.

Key Areas Covered by NRI Advisory Services

1. Tax Planning and Compliance

Indian taxation rules differ significantly for NRIs. Advisory services provide:

Guidance on residential status and applicable tax rules

Assistance with filing Income Tax Returns (ITRs)

Tax deduction at source (TDS) management for property sales

Support with Double Taxation Avoidance Agreements (DTAA)

Strategic planning to reduce tax liabilities

2. Investment and Financial Advisory

NRIs often look for safe and profitable investment opportunities in India. Advisors offer:

Portfolio management and wealth advisory

Recommendations on NRI-compliant mutual funds, bonds, and stocks

Support in opening and managing NRE/NRO accounts

FEMA-compliant investment planning

3. Property and Real Estate Services

Whether buying, selling, or renting property, NRIs need trusted advice. Services include:

End-to-end assistance with property purchase and sale

Legal verification of documents

Tenant management and rental income monitoring

Repatriation of sale proceeds with RBI clearance

4. Legal and Succession Advisory

Legal documentation and inheritance matters can be difficult to manage from overseas. Advisors help with:

Drafting and registering Power of Attorney (PoA)

Creating wills and succession plans

Probate, legal heir, and succession certificate support

Assistance in family property settlements

5. Repatriation and Banking Advisory

Transferring funds from India to your resident country requires careful compliance. Advisors assist with:

RBI and FEMA compliance for repatriation

Guidance on remittance limits

Preparation of Form 15CA and 15CB

Liaising with banks for documentation

6. OCI and Citizenship Services

Many NRIs hold or apply for Overseas Citizenship of India (OCI). Advisory services provide:

Assistance with OCI applications and renewals

PIO to OCI conversion

OCI card documentation and legal compliance

Advantages of Using Professional NRI Advisory Services

Expert Knowledge: Professionals stay updated on changing Indian laws and tax rules.

Time-Saving: Avoid unnecessary travel or long wait times by getting remote assistance.

Custom Solutions: Services are tailored based on your financial goals and personal situation.

Trusted Network: Access to certified chartered accountants, legal experts, and property consultants.

Compliance Assurance: Stay fully compliant with Indian laws to avoid legal or tax trouble.

Common Challenges NRIs Face Without Advisory Support

Paying higher TDS due to improper capital gains planning

Facing legal issues in property transfer or inheritance

Non-compliance with FEMA regulations during fund repatriation

Incomplete or incorrect tax filings

Loss of investment opportunities due to lack of market insights

An expert NRI advisor helps you avoid these pitfalls by providing comprehensive guidance and execution support.

Conclusion

Non-Resident Indians face unique challenges when managing their affairs in India. From taxes to investments, property to legal matters, every decision must align with the country’s regulatory framework. NRI advisory services simplify this complexity, offering a single-window solution to meet all your cross-border needs. With the right guidance, NRIs can safeguard their wealth, maintain legal compliance, and achieve financial peace of mind—no matter where they are in the world.

0 notes

Text

Best SBI Credit Card Options Without a Salary Slip

Here are a few cards you can consider if you're applying without a salary slip:

1. SBI Unnati Credit Card

Issued against a fixed deposit (minimum ₹25,000)

No income documents required

Great for building credit history

2. SBI SimplySAVE Credit Card

Available for self-employed with bank statements or ITR

Earn rewards on daily spending like groceries, dining, movies

3. SBI Student Plus Advantage Card

Designed for students

Requires an FD as collateral

Ideal for first-time credit users

Documents You Can Use Instead of a Salary Slip

To complete the SBI Credit Card application without a salary slip, you can provide:

PAN card and Aadhaar card (for identity verification)

Latest 6-month bank statement showing regular credits

ITR for last 1 or 2 financial years

Proof of fixed deposit (for secured credit cards)

Utility bills or rental agreement (for address proof)

How to Apply for an SBI Credit Card Without a Salary Slip

Follow these simple steps:

Visit the official SBI Card website – www.sbicard.com

Select the card you want and click ‘Apply Now’

Fill in your personal details like name, PAN, mobile number

Choose Self-Employed, Student, or Other in occupation type

Upload alternate income proof like ITR or FD details

Complete e-KYC and submit

Once your documents are verified, you may receive instant approval and digital access to your new SBI Credit Card.

Tips to Improve Approval Chances

Maintain a good credit score (700+)

Show consistent bank deposits or savings

Choose a secured card backed by an FD if unsure

Apply for entry-level cards with low eligibility requirements

Remember, your credit history and financial behavior matter more than just a payslip.

Final Thoughts

Applying for an SBI Credit Card without a salary slip is very much possible. SBI offers flexible eligibility criteria, allowing self-employed individuals, freelancers, and students to enjoy the benefits of a credit card. With the right documents and responsible usage, you can start building your credit profile and access rewards, cashback, and financial freedom.

So don’t wait—explore your options and apply today, even without a salary slip!

0 notes

Text

How to File Income Tax Return Online in India (2025 Guide)

Filing your Income Tax Return (ITR) is an annual financial responsibility for all earning individuals and businesses in India. With advancements in digital infrastructure, the Government of India has made the process of filing an ITR more streamlined and user-friendly. In 2025, e-filing continues to be the most efficient method to report your income, claim deductions, and pay any outstanding taxes.

This comprehensive guide will walk you through the process of filing your Income Tax Return online in India, making tax season less daunting and more manageable.

📋 What is an Income Tax Return?

An Income Tax Return is a form used to declare your income, expenses, exemptions, and tax liabilities to the Income Tax Department of India. Every individual or entity earning income during a financial year is required to file an ITR, depending on their total income and category.

Filing your ITR on time ensures you remain compliant with the law, avoid penalties, and are eligible to claim tax refunds, if applicable.

🧾 Documents Required for ITR Filing

Before you begin filing your Income Tax Return, gather the following documents:

PAN Card

Aadhaar Card

Form 16 from your employer (for salaried individuals)

Form 26AS (Tax Credit Statement)

Bank account details

Investment proof for deductions under sections like 80C, 80D, etc.

Details of capital gains, rental income, and business income if applicable

🖥️ Step-by-Step Process to File ITR Online in 2025

Step 1: Register/Login to the Income Tax e-Filing Portal

Visit the official portal: https://www.incometax.gov.in Use your PAN as your User ID to log in. First-time users will need to register.

Step 2: Choose the Right ITR Form

The ITR form you select depends on your income sources. Here are common ones:

ITR-1 (Sahaj) – For salaried individuals with income up to ₹50 lakh

ITR-2 – For individuals with capital gains or foreign assets

ITR-3 – For professionals or those with business income

ITR-4 (Sugam) – For presumptive income under sections 44AD/ADA

Step 3: Prefill and Verify Details

After selecting the form, most of your data (PAN, salary, TDS, bank details) will be auto-filled. Cross-check every detail carefully to avoid errors.

Step 4: Declare Income and Claim Deductions

Add any additional income (interest, rental, freelance work, etc.) and claim deductions under various sections such as:

80C – Investments in PPF, ELSS, LIC, etc.

80D – Health insurance premiums

80E – Interest on education loan

80G – Donations to charities

Step 5: Calculate Tax Liability

Once all income and deductions are filled, the system auto-calculates your tax liability. If you owe taxes, pay them using the “e-Pay Tax” facility.

Step 6: Submit and E-Verify Your Return

After final review, submit your Income Tax Return. Then complete e-verification using one of the following methods:

Aadhaar OTP

Net banking

Bank account EVC

Demat account verification

E-verification is mandatory for your ITR to be processed.

⏰ Important Deadlines for FY 2024-25

Due Date for Individuals: July 31, 2025

With Audit (Businesses/Professionals): October 31, 2025

Filing after the due date attracts late fees and interest.

✅ Benefits of Filing Income Tax Return

Claim refunds on excess TDS paid

Serve as proof of income for loans or visa applications

Avoid penalties for non-compliance

Carry forward capital losses

Build a clean financial record

🔚 Conclusion

Filing your Income Tax Return online in India has become a fast, paperless process thanks to government digital initiatives. By following the right steps and ensuring accurate declarations, you can file your ITR with ease and on time. Whether you're a salaried employee, freelancer, or business owner, staying tax-compliant not only saves you from penalties but also unlocks a host of financial advantages.

Start early, verify all details, and file your Income Tax Return before the deadline to enjoy a stress-free tax season in 2025.

0 notes

Text

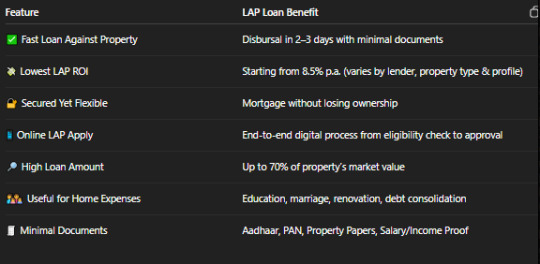

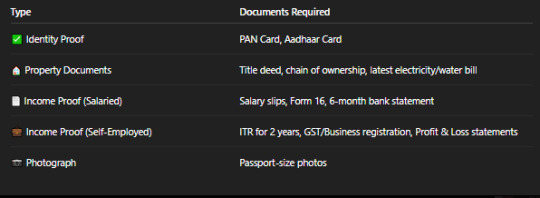

LAP Loan 2025: Get Instant Loan Against Property Online Without Income Proof

Starting Fresh: Turning Your Property Into Instant Funds in 2025

In today’s rapidly growing economy, many salaried and self-employed individuals are asset-rich but cash-strapped. Whether it’s funding your child’s education, handling medical emergencies, expanding your business, or managing wedding costs, the solution might be lying under your roof, literally. Welcome to the world of LAP Loans (Loan Against Property) — one of the fastest-growing funding solutions in India.

Let’s break it down step-by-step in simple language, solve your common doubts, and help you apply online without the stress of paperwork or hidden costs.

What is a LAP Loan?

LAP Loan stands for Loan Against Property, a secured loan where you mortgage your owned property — residential or commercial — to a bank or NBFC and receive a loan amount against it.

This means, instead of selling your house or land, you keep it as collateral and still retain ownership while raising funds.

LAP Full Form: Loan Against Property

Type: Secured Loan

Usage: Personal, business, education, wedding, debt consolidation, emergency

Ownership: Retained by the borrower

Approval Speed: Within 48–72 hours (online)

Who Can Apply for a LAP Loan in 2025?

Anyone who owns an immovable property — salaried or self-employed — can avail of a LAP loan. Here’s how it breaks down:

For Salaried Individuals:

Should be employed with a stable income

Have a clear property title

Minimum age: 21 years; Max: 60 years

Salaried LAP meaning: A property-backed loan provided to salaried people for personal or home-related expenses

For Self-Employed Individuals:

Must own a registered business or practice

Income proofs or ITRs might be required

Flexible repayment tenures up to 15 years

Why Choose LAP Loan in 2025?

Here's why LAP is trending among Indians this year:

LAP Loan Eligibility Criteria in India (Salaried & Self-Employed)

For Salaried Individuals:

Minimum ₹25,000 salary/month

At least 1-year job stability

Clear credit history (CIBIL score 650+ preferred)

Property should be in urban/semi-urban areas

Co-applicant allowed (spouse/parent)

For Self-Employed:

Minimum 2 years of business continuity

Income proof (ITRs or bank statements)

Office or house property can be mortgaged

LAP Loan Documents Required

Make sure you have the following documents ready when you apply:

LAP Loan Process – Step-by-Step

Applying for a Loan Against Property in 2025 has become easier than ever:

Visit your lender’s website or a loan marketplace

Select “Apply for LAP Loan Online.”

Enter details – name, mobile, income, property info

Upload soft copies of the required documents

Await tele-verification and property inspection

Get approval within 24–72 hours

Receive funds directly into your account

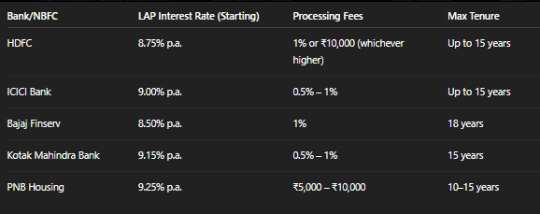

Tip: You can also compare LAP ROI (rate of interest) across banks like HDFC, ICICI, Bajaj Finserv, and Kotak to find the lowest one.

LAP ROI (Rate of Interest) Comparison 2025

Note: Rates vary by city, profile, and property type. Always check the latest offers.

Common Use Cases – Why People Take LAP Loans in India

Child’s higher education (domestic & abroad)

Marriage expenses

Renovating or building a home

Business working capital

Consolidating high-interest debts

Emergency medical needs

Who Can Avail a Loan Against Property in India?

Salaried employees (Govt/Private)

Doctors, lawyers, CA professionals

Business owners, shopkeepers

Retirees with property income

NRIs (in selected banks)

Even if you have a low salary or no ITR, private loan against property options exist, but ROI will be slightly higher.

FAQ – Frequently Asked Questions

Q1. What is a LAP loan, and how is it different from a personal loan?

Ans: LAP is a secured loan where you mortgage property, while a personal loan is unsecured. LAP offers higher amounts and lower interest rates.

Q2. Can I get a loan against property without income proof?

Yes, some NBFCs and private lenders offer LAP without a salary slip, based on property value and alternate income sources.

Q3. What kind of property can be used for LAP?

You can mortgage residential, commercial, or rented property (owned) — but it must have a clear legal title.

Q4. How fast can I get an immediate loan against property?

With pre-approved documents and an online application, you can get funds within 2–3 working days.

Q5. Are there fees and charges on the LAP loan for salaried individuals?

Yes. Banks may charge processing fees (0.5–1%), legal charges, valuation fees, foreclosure charges (if applicable), and GST.

Final Words: Should You Apply for a LAP Loan in 2025?

If you're looking for a fast, flexible, and low-interest loan, then a Loan Against Property (LAP) is one of the best options in 2025. Whether you are salaried or self-employed, you can apply for a LAP loan online and unlock the power of your own property, without selling it.

Before choosing a lender, compare LAP rates, check eligibility, and always read the fine print on charges.

Call to Action

Apply for LAP Loan Online Today – Get Fast Funds Against Property with Lowest ROI in 2025.

Want help comparing top LAP offers? Message us, and we’ll guide you 1-on-1!

#lap loan#lap loan against property#loan against property for salaried person#what is lap loan#lap roi#salaried lap meaning#loan against property lap#fast loan against property#lap eligibility#apply for loan against property online#lap loan apply online#lap in loan#how to raise loan against property#lap loan full form#loan against property for salaried individuals#loan against residential property#lap loan documents required#loan against property fees and charges for salaried individuals#how to apply for loan against property for salaried individuals#loan against property for salaried individuals for home expenses#bank gives loan against property#lap loan legal associate#private loan against property#loan against immovable property#interest on lap#loan against property features for salaried individuals#loan against property mortgage#how to apply for loan against property for self employed individuals#loan against property features for self employed individuals#who can avail a loan against property

0 notes

Text

How to Open Angel One Account Online: Step-by-Step Demat Guide

How to Open Angel One Account Online – Full Digital Guide

If you're ready to start investing in the stock market, knowing how to open Angel One account online is a smart first step. Angel One is a leading stockbroker in India, offering a seamless and fully digital experience. With zero paperwork and fast verification, opening a demat account has never been easier. This guide will walk you through the Angel One demat account opening process step by step, helping you get started within minutes.

Why Choose Angel One for Your Investments?

Before diving into the signup process, it’s important to understand what makes Angel One a preferred broker for lakhs of investors:

Zero brokerage on equity delivery (up to ₹500/month)

Flat ₹20/order on intraday and derivatives

Smart investing with AI-based tools like ARQ Prime

Easy access through mobile, web, and desktop platforms

Fully digital KYC process for faster verification

Because of these features, many new and experienced investors choose Angel One as their trading partner.

Step-by-Step Guide: How to Open Angel One Account Online

The process to open your account is completely online and typically takes just 10–15 minutes. Make sure you have your essential documents handy, and let’s get started.

Step 1: Visit the Official Website

First, go to the Angel One website and click on the “Open Demat Account” button. This action takes you to a secure page to begin registration.

Step 2: Enter Basic Personal Details

Fill in your name, email ID, and mobile number. You’ll then receive OTPs on your phone and email, which you must verify before moving ahead.

Step 3: Complete e-KYC Using Aadhaar

Next, input your PAN card number and verify your identity using DigiLocker, which links to your Aadhaar. This step is vital in the Angel One demat account opening process, as it ensures your details are legally authenticated.

Step 4: Link Your Bank Account

Now, enter your bank account details. You can either upload a cancelled cheque or use UPI for verification. This account will be used for all your future trading transactions.

Step 5: Upload Your Signature and Live Selfie

Here, you’ll be asked to upload your signature on white paper. Additionally, use your phone or webcam to capture a live selfie for identity confirmation.

Step 6: Nominee & Income Details (Optional)

Though optional, adding a nominee is recommended for account safety. If you’re planning to trade in derivatives like F&O, then upload income proof such as a salary slip or ITR as per SEBI guidelines.

Step 7: Review and E-Sign Your Application

Lastly, double-check all the provided information. Then, e-sign your application using Aadhaar OTP. Within 1–3 business days, your account will be active and ready for use.

Angel One Account Opening Documents Checklist

To ensure a smooth experience, prepare the following before starting the process:

Mandatory Documents:

PAN Card

Aadhaar Card (linked with mobile number)

Bank proof (cancelled cheque or passbook/statement)

Signature on white paper

Live selfie

Optional (For F&O or Margin Trading):

Income proof (ITR, payslip, or bank statement)

Additional address proof if requested

What to Do After Your Account Is Active

Once your account is live, you gain access to a range of investment services directly through Angel One’s platforms. You can:

Buy/sell stocks, IPOs, mutual funds, and ETFs

Trade in Futures and Options with leverage

Explore global investments, including US stocks

Invest in bonds and fixed income products

Track corporate actions and receive dividends

Apply for loans against securities if needed

All of this is available via Angel One’s intuitive mobile app and website.

Final Thoughts

To summarize, understanding how to open Angel One account online empowers you to begin your investment journey effortlessly. Thanks to a completely paperless system and a simplified Angel One demat account opening process, you can be market-ready in no time.

Start by keeping your documents ready, follow the 7 easy steps, and you'll soon be trading from the comfort of your home. If you need help picking a plan or uploading your documents, just ask—we’re here to guide you through.

0 notes

Text

Low CIBIL Score? Here’s How You Can Still Get the Loan You Deserve

Let’s be real: banks don’t care about your emergencies when your CIBIL score is in the gutter. You’re judged by a number—and if that number is below 650, you’re instantly blacklisted. But here’s the good news: CIBIL defaulters loan options are real, and they’re growing fast in India’s evolving digital finance world.

If you’ve been rejected multiple times and are tired of hearing “NO,” this guide is for you. Let’s break down how to secure a loan for CIBIL defaulters, why FinCrif is a game-changer, and how to apply for loan with low CIBIL score without wasting time, dignity, or hope.

What Is a CIBIL Defaulter?

CIBIL (Credit Information Bureau of India Limited) tracks your financial behaviour, especially loan repayments. A score below 650 or consistent payment defaults puts you in the “defaulter�� category.

But guess what? One bad financial phase shouldn’t define your future. That’s where CIBIL defaulters loan solutions come in—to give you a second chance.

Why Do Banks Refuse Loans for CIBIL Defaulters?

Traditional banks are extremely risk-averse. If your credit score is low, you’re labeled as “unreliable,” even if the default happened years ago or due to circumstances beyond your control (job loss, medical emergency, etc.).

Banks don’t look beyond the score. But FinCrif does.

With FinCrif, you can apply for loan with low CIBIL score by providing alternative verifications—like income stability, updated KYC, and current repayment capacity.

Can CIBIL Defaulters Really Get a Loan? Yes—Here’s How

Don’t fall for fake promises or illegal lending apps. Getting a loan for CIBIL defaulters is 100% possible through regulated NBFCs and digital lending platforms like FinCrif.

Here’s what you need:

Stable Monthly Income – Salaried or self-employed with income proof.

Updated Documents – PAN, Aadhaar, Bank Statement.

Honest Disclosure – Be upfront about your defaults.

Willingness to Pay Higher Interest – It’s the tradeoff for low score risk.

Once verified, your CIBIL defaulters loan gets approved based on today’s financial behaviour—not your past mistakes.

How to Apply for Loan with Low CIBIL Score: Step-by-Step

At FinCrif, the process is designed to be transparent, fast, and inclusive. Here’s how to apply:

Visit FinCrif’s Website Go to www.fincrif.com and select “Loan for CIBIL Defaulters.”

Enter Your Basic Details Name, mobile, income, and PAN/Aadhaar.

Upload Key Documents Bank statement, salary slips (or ITR), and ID proof.

Custom Credit Assessment FinCrif uses a dynamic risk profile—not just CIBIL. So you get a fair shot.

Loan Disbursal If approved, your CIBIL default loan is credited within hours.

Done. No humiliating interviews. No rejections based purely on a score.

Types of Loans for CIBIL Defaulters Available

FinCrif and similar platforms offer various CIBIL defaulters loan options:

Personal Loans – Up to ₹2 Lakhs for urgent needs.

Secured Loans – Backed by gold, FD, or insurance.

Business Loans – For self-employed individuals with consistent cash flow.

Payday Loans – Small-ticket, short-term loans to cover immediate gaps.

All these are designed to help you rebuild—not punish you.

Why FinCrif Is a Better Choice for CIBIL Default Loans

FinCrif isn’t just another digital loan app. It’s built to serve people who’ve been rejected by the system. Here's why it's the best platform for a loan for CIBIL defaulters:

✅ Credit Score Isn’t Everything – Other financial behaviors matter too.

✅ No Predatory Rates – Transparent and fair interest, even for high-risk borrowers.

✅ Fast Processing – Get approval and money in hours, not weeks.

✅ Easy Repayment Options – EMI plans that don’t choke your wallet.

FinCrif believes you are more than a credit score—and your future shouldn’t be judged by your past.

Real Talk: The Cost of a CIBIL Defaulters Loan

Let’s not sugarcoat it—CIBIL default loan options often come at a higher interest rate. Why? Because you’re a higher risk. But if you choose the right platform (like FinCrif), the terms are still manageable and fair.

Remember, the goal isn’t just to get a loan—it’s to rebuild your credit score. Timely repayments on these loans can help you climb back up.

How to Improve Loan Approval Chances

Want to increase your odds of getting approved for a loan for CIBIL defaulters? Follow these tips:

Clear Any Small Outstanding Dues Even settling small credit card bills can lift your score.

Apply for Lower Amounts First Start small. Prove your repayment capacity.

Avoid Multiple Applications Too many rejections can damage your score further.

Be Honest on Application Lenders hate hidden defaults. Honesty builds trust.

Submit Consistent Bank Statements Show stable income flow—even if you’re self-employed.

FAQs on CIBIL Defaulters Loan

Q. Can I get a loan if my CIBIL score is below 550? Yes, with FinCrif’s alternative credit profiling, approval is still possible.

Q. Do I need to submit collateral? No, unsecured loans are available. But secured options have better terms.

Q. Will this improve my CIBIL score? Absolutely—if you repay on time.

Q. Is FinCrif a bank? No, it’s a digital lending platform that works with RBI-registered NBFCs.

Final Words: It’s Time to Rewrite Your Financial Story

A bad credit score isn’t a life sentence. You deserve financial dignity, even if you've slipped up in the past. FinCrif makes it possible to apply for loan with low CIBIL score and move toward a stable, secure future.

Whether it’s an emergency, a dream, or just getting your financial confidence back—CIBIL defaulters loan options are your shot at redemption.

So stop waiting. Stop begging. Start taking control.

Visit www.fincrif.com and apply for your CIBIL default loan now.

0 notes