#lcid

Explore tagged Tumblr posts

Text

0 notes

Text

Challenges ahead for Lucid Group Inc as financial performance worsens in latest report https://csimarket.com/stocks/news.php?code=LCID&date=2024-02-28145208&utm_source=dlvr.it&utm_medium=tumblr

0 notes

Text

LUCID vs TESLA - Strategic Alignment | ACCELERATE Strategy & Leadership

youtube

In this video, we're going to be comparing the two leading self-driving companies, LUCID and TESLA. We'll be looking at their strategic alignment, as well as their advantages and disadvantages. Ultimately, we want to help you decide which company is right for you. So be sure to watch this video to find out which one is the best fit for your needs! ✅✅✅✅✅ Get more Strategic Alignment podcast episodes & masterclasses in out SALT Shaker program https://acceleratestrategyleadership.training/salt1/ Watch More of My Videos And Don't forget to "Like & Subscribe" & Also please click on the 🔔 Bell Icon, so you never miss any updates! 💟 ⬇️ 🔹🔹🔹Please Subscribe to My Channel: 👉 https://www.youtube.com/@UCMsBDR7EodIwNmTAOVQE9qA Watch My popular Videos : Dr. Murray talking about DIMES for Implementing Strategy FAST! https://youtu.be/wp8S5N-tsrk?si=xE1I5VhWv2GE57Mu Igniting Transformation for Leaders & Managers | ACCELERATE Strategy & Leadership https://youtu.be/blvjKvF_J_A?si=VBuK4sX4FENOsJHR Dr. Murray speaking to leaders onVision, Mission and his RISE Framework https://youtu.be/4ZfEeQ7bMo4?si=MV7vshNZIhW-ey9t Closing Vision Gap & 5 Decision Costs https://youtu.be/iGEFlPIhpRc?si=GH4IXDQLOf-ChaRO Strategic Decisions Accelerate Vision https://youtu.be/TvWTU0Eon28?si=125g9a8qZpG4C0aS - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #To learn more about me, check out my Profile & CONNECT WITH ME 💟 ⬇️ #💠 Facebook: https://www.facebook.com/groups/genesisleadership #🔹 LinkedIn: https://www.linkedin.com/showcase/leadership-solutions-training #🔹 Instagram: https://www.instagram.com/genesisleadership #🔹 Website: leadershipsolutions.training - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

#LUCIDvsTESLAStrategicAlignment#ACCELERATEStrategy&Leadership#ACCELERATE_Strategy_u0026_Leadership#lucid_vs_tesla_strategic_alignment#accelerate_strategy_u0026_leadership#lucid_motors#tesla_stock#lcid_stock#lcid#lucid_motors_stock#lucid_stock#cciv_stock#lucid_motors_reveal#Strategic_Alignment#LUCID_vs_TESLA#lucid_motors_stock_news#peter_rawlinson#Youtube

0 notes

Text

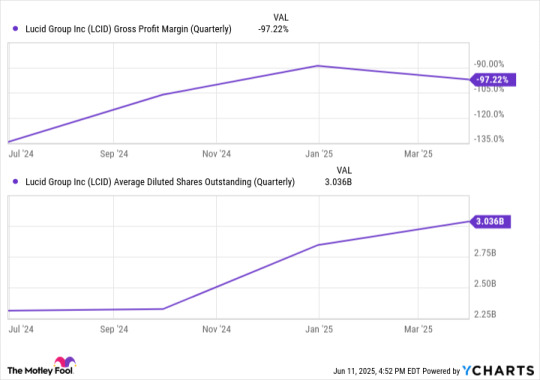

Every Lucid Group Investor Should Keep an Eye on These 2 Numbers

Lucid Group (LCID) is ready to ramp up sales aggressively over the next year or two. Following this year’s release of its Gravity SUV platform, analysts now expect sales to jump by 73% in 2025. Next year, analysts predict another 96% jump in sales. But it’s not just sales growth that investors should monitor. The two metrics below are equally important to track. Lucid investors should monitor…

View On WordPress

0 notes

Text

Could buying Lucid group stock today establish you for life?

Lucid makes a small amount of cars in relation to other automators. It is difficult to overlook that the company loses billions annually. Other key players compete in the same space. 10 stocks we like better than Lucid Group › Regardless of its status as an electric vehicle player (EV), Lucid group (NASDAQ: LCID) It's just car stock, and car stocks don't make investors. Testify Having been a…

0 notes

Text

Could buying Lucid group stock today establish you for life?

Lucid makes a small amount of cars in relation to other automators. It is difficult to overlook that the company loses billions annually. Other key players compete in the same space. 10 stocks we like better than Lucid Group › Regardless of its status as an electric vehicle player (EV), Lucid group (NASDAQ: LCID) It's just car stock, and car stocks don't make investors. Testify Having been a…

0 notes

Text

Benzinga: تقوم شركات صناديق التحوط في وول ستريت باختصار أسهم الولايات المتحدة وصناديق الاستثمار المتداولة ، مع إجمالي عدد قياسي في الحصول على الرافعة المالية | سلسلة أخبار Abmedia

صندوق التحوطتمت إضافة شورت شورت بقيم�� 25 مليار دولار في العقود المستقبلية للأوراق المالية (العقود الآجلة للأسهم القصيرة) ، وهي أكبر زيادة في ثلاثة أسابيع في أكثر من عقد من الزمان. كما ارتفعت المواقف القصيرة في صناديق الاستثمار المتداولة والأسهم الفردية ، بلغ إجمالي الرافعة المالية أعلى مستوى على الإطلاق. انتعشت S&P 500 بشكل حاد بنسبة 23 ٪ منذ أبريل ، لكن صناديق التحوط تكثف حاليًا رهاناتها الهبوطية على الأسهم ، مع مستويات قياسية حيث يتساءل المستثمرون عما إذا كانت الانتعاش من تعريفة الإغاثة ستستمر. في التزامات التجار الثلاثة الماضية ، أضافت صناديق التحوط 25 مليار دولار من التعرض لعقود الأسهم القصيرة ، وهي أكبر زيادة في ثلاثة أسابيع في عقد من الزمان. محلل وول ستريت: لا تزال فولكس واجن تشك في الانتعاش على المدى القصير لعقوبات التعريفة الجمركية وقال بن سنايدر ، محلل جولدمان ساكس ، إن الرافعة المالية الإجمالية ، بما في ذلك المراكز الطويلة والقصيرة ، ارتفعت إلى أعلى مستوى على الإطلاق. على الرغم من أن نسبة الرافعة المالية الصافية (Longs Minus Shorts) لا تزال أقل من مستوى فبراير ، إلا أن النمو المتسارع للمواقف القصيرة قد غير هيكل السوق. تؤكد هذه الزيادة الشكوك المتزايدة حول مرونة السوق في الانتعاش على شكل حرف V بعد عملية بيع التعريفة الجمركية. قال محلل أبحاث Steno Oskar Vårdal إن صناديق التحوط ومستشاري تجارة السلع (CTAs) يواصلون محاربة الدورة ، ومضاعفة رهاناتهم على السندات طويلة الأجل والمخاطر قصيرة الأجل مع بدء النمو الاقتصادي والتضخم في التسارع مرة أخرى. ما هي البائعين الذين يستهدفون صناديق التحوط؟ تشمل أهداف صناديق التحوط صناديق الصناديق الصناديق والأسهم الفردية. وفقًا لبيانات Goldman Sachs ، بلغت المواقف القصيرة لـ ETFs 218 مليار دولار في الربع الثاني ، ووصلت المراكز القصيرة لسهم واحد إلى 948 مليار دولار. أكبر نمو في المبيعات القصيرة لإنشاءات صناديق الاستثمار المتداولة الأمريكية في أبريل وحده. من بين ETFS المدرجة في الولايات المتحدة ، ارتفعت ETF المصرفية الإقليمية SPDR S&P 50 نقطة مئوية منذ منتصف شهر فبراير ، حيث تمثل 96 ٪ من الأسهم المتميزة ، وارتفعت ETF SPDR S&P Biotech ETF 27 نقطة إلى 111 ٪ ، وترتفع Ishares Russell 2000 ETF إلى 33 ٪. تشمل أعلى المواقف القصيرة في التاريخ صناديق مناجم Vaneck Gold ، التي تمثل 12 ٪ من الأسهم المتميزة ، وكانت أول مؤسسة ETF Trust NASDAQ-100 Tech 4 ٪ ، وكان Ishares Core S&P Mid-Cap ETF مليار دولار. اهتمام وول ستريت بالبيع على المكش��ف في أساسيات المستهلكين الجماهيريين تشمل اهتمامات وول ستريت المبيعات قصيرة المستهلك ضروريات المستهلكين ، والمرافق ، وصناعات الرعاية الصحية ، التي تمثل حاليًا المراكز الخمسة الأولى ، مع متوسط الممتلكات القصير في S&P 500 التي تمثل 2.3 ٪ من قيمتها السوقية ، واهتمامها القصير في صناعات التكنولوجيا المالية والمعلوماتية أقل من المتوسط طويل الأجل. أصبحت تلك الأسهم الأمريكية هي الأهداف مع الرهانات الأكثر هبوطًا؟ منذ ذروتها في فبراير ، تشمل الأسهم الأمريكية التي لديها أكبر نمو في المناصب القصيرة Somnigroup (NYSE Code SGI) ، Lucid Group Inc (NASDAQ Code LCID) ، Amer Sports Inc. (NYSE Code AS) ، First Solar Inc. (NASDAQ Code) مراقبة السوق الخالصة ، وليس أي نصيحة استثمارية. تحذير المخاطراستثمارات العملة المشفرة محفوفة بالمخاطر للغاية ، وقد تتقلب أسعارها بشكل كبير وقد تفقد كل مديرك. يرجى تقييم المخاطر بحذر.

0 notes

Text

Lucid irá adquirir instalações e ativos selecionados da Nikola com sede no Arizona — TradingView News

News https://portal.esgagenda.com/lucid-ira-adquirir-instalacoes-e-ativos-selecionados-da-nikola-com-sede-no-arizona-tradingview-news/

Lucid irá adquirir instalações e ativos selecionados da Nikola com sede no Arizona — TradingView News

O Lucid Group LCID disse na sexta-feira que irá adquirir instalações e ativos selecionados no Arizona, anteriormente pertencentes à falida fabricante de caminhões elétricos e movidos a hidrogênio Nikola Corp NKLAQ.

A transação não inclui a aquisição dos negócios, da base de clientes ou da tecnologia da Nikola relacionada aos caminhões elétricos movidos a célula de combustível de hidrogênio da Nikola, disse a fabricante de veículos elétricos em um comunicado.

0 notes

Text

Lucid (LCID) expects EV output to double in 2025 with its first SUV

0 notes

Text

1 No-Brainer Electric Vehicle Stock to Buy With $200 Right Now

Tesla, one of the largest companies in the world with a market cap above $1 trillion, still remains a viable investment opportunity. But investors who correctly identify the next Tesla could stand to make the greatest gains investing in electric vehicle (EV) stocks. Quite a few metrics suggest Lucid Group (NASDAQ: LCID) possibly being the diamond in the rough that you’re looking for, even if you…

0 notes

Text

$LCID: Lucid's Q4 production and delivery numbers boost stock by 8%, signaling strong growth potential with upcoming Gravity SUV.

0 notes

Text

Why Lucid Deserves a $250+ Valuation if Tesla Trades at $400+

Tesla (TSLA) has long been the golden child of the electric vehicle (EV) revolution, commanding significant market share and investor enthusiasm. However, with Lucid Group (LCID) emerging as a major contender, it’s worth re-evaluating market valuations. If TSLA is justified at $400 or more, LCID should be trading at $250 or higher. Here’s why.

Lucid Air vs. Tesla Model S: A Superiority in Luxury and Performance

The Lucid Air Grand Touring and the Tesla Model S are both flagship sedans designed to redefine luxury EVs. However, the Lucid Air pulls ahead in several key areas:

1. Range: The Lucid Air Grand Touring boasts an EPA-estimated range of up to 516 miles, compared to the Tesla Model S’s 405 miles. This distinction establishes Lucid’s dominance in efficiency and battery technology, making it a leader in addressing range anxiety—a top concern for EV buyers.

2. Charging Speeds: Lucid’s 900-volt architecture enables ultra-fast charging, delivering up to 300 miles of range in just 20 minutes. While Tesla’s Supercharger network is extensive, its charging speeds max out below Lucid’s capabilities.

3. Interior and Luxury: The Lucid Air outshines the Tesla Model S with a meticulously designed interior featuring premium materials, a spacious cabin, and advanced features like the Glass Canopy. Tesla’s minimalist design feels dated in comparison, particularly as consumers demand more refinement in the luxury EV segment.

4. Performance: The Lucid Air Grand Touring’s dual-motor configuration delivers up to 1,050 horsepower, rivaling Tesla’s Model S Plaid. While Tesla’s Plaid edition is slightly faster in 0-60 mph times, Lucid prioritizes a balance of luxury, power, and efficiency.

5. Fresh Design vs. Stagnation: Tesla’s designs, particularly the Model S, have remained largely unchanged for years, leading to a sense of stagnation in their aesthetics. In contrast, Lucid’s vehicles bring a fresh, innovative look to the EV market. The Lucid Air’s sleek, modern lines and sophisticated design language resonate with consumers seeking a cutting-edge luxury vehicle.

Lucid Gravity vs. Tesla Model X: The Future of EV SUVs

Lucid’s upcoming Gravity SUV is poised to disrupt the luxury EV SUV market, challenging the Tesla Model X head-on. Based on initial specifications and Lucid’s reputation for innovation, the Gravity is expected to outperform Tesla’s flagship SUV in several areas:

1. Space and Practicality: Lucid promises a more spacious interior with innovative seating configurations, making the Gravity more family-friendly and versatile than the Tesla Model X.

2. Range Leadership: Leveraging Lucid’s battery technology, the Gravity is likely to set new benchmarks for range in the SUV category, surpassing the Model X’s 348-mile EPA rating.

3. Design Excellence: While the Tesla Model X has become ubiquitous, the Gravity’s sleek design and futuristic aesthetics are likely to resonate with buyers seeking something fresh and exclusive.

4. Build Quality: Lucid’s commitment to craftsmanship ensures that the Gravity will outclass the Model X in material quality and attention to detail—areas where Tesla has faced criticism.

How a $250 Valuation Fuels Lucid’s Growth

Achieving a $250 valuation would not only validate Lucid’s current success but also provide the financial momentum needed to accelerate the development of new models. With increased capital, Lucid could explore innovative designs such as a Lucid Air Coupe or Convertible, further diversifying its product portfolio and appealing to new segments of luxury EV buyers.

Moreover, Lucid’s engineering excellence positions its vehicles as ideal candidates for specialized applications, such as police pursuit vehicles. The Lucid Air’s 516-mile range per charge could significantly reduce fuel costs for law enforcement agencies while ensuring extended operational readiness. This dual benefit of cost efficiency and sustainability highlights the practical applications of Lucid’s advanced technology.

Relativity to $1M Art Purchases: Sensible vs. Speculative

Consider the individual who paid over $1 million for a banana taped to a piece of drywall—an artwork that sparked global debate about value perception. When compared to such speculative purchases, investing in Lucid at $250 per share appears rooted in tangible innovation and growth potential. Lucid offers real-world technological advancements and a strong market position, making its valuation a much more sensible proposition for those seeking long-term returns.

Why LCID Deserves a $250+ Valuation

If Tesla can sustain a $400+ valuation based on its technological innovation and market dominance, Lucid’s superior products and growth potential justify a significant re-rating. Here are the key factors supporting a $250+ valuation for LCID:

Technological Leadership: Lucid’s advancements in range, charging, and energy efficiency are unmatched, even by Tesla. These innovations position Lucid as the premium choice in the EV market.

Luxury Market Focus: By targeting the high-end luxury segment, Lucid commands higher margins and appeals to discerning customers willing to pay a premium for quality and performance.

Expanding Product Portfolio: With the Lucid Air gaining momentum and the Gravity SUV set to launch, Lucid is building a diversified lineup to capture more market share.

Market Sentiment Shift: As the EV market matures, investors are looking beyond Tesla for opportunities. Lucid’s focus on excellence and innovation makes it a compelling alternative.

Conclusion

Lucid is not just an EV company; it’s a technology and luxury leader redefining the future of mobility. If Tesla can justify its lofty valuation, Lucid’s superior products and market strategy warrant a stock price of $250 or more. For investors, this represents a tremendous opportunity to capitalize on the next big name in electric vehicles.

0 notes

Text

Better Electric Vehicle (EV) Stock: Lucid Group vs. Rivian

Demand for electric vehicles is expected to surge over the next several decades. While much of this growth is expected globally, penetration for EVs is still expected to rise substantially in the U.S., the primary market for both Lucid Group (LCID -2.55%) and Rivian Automotive (RIVN -3.34%). If you’re looking to invest in a company with the potential to be the next Tesla, there are reasons to…

0 notes

Text

Week earnings ahead: AMD, PLT, F, DIS, trade, dkng, amc, lcid, gold, rivn, and more

Week earnings ahead: AMD, PLT, F, DIS, trade, dkng, amc, lcid, gold, rivn, and more Source link

0 notes

Text

Week earnings ahead: AMD, PLT, F, DIS, trade, dkng, amc, lcid, gold, rivn, and more

Week earnings ahead: AMD, PLT, F, DIS, trade, dkng, amc, lcid, gold, rivn, and more Source link

0 notes

Text

Stocks trend as Wall Street enters early 2025 with caution

January 04, 2025 12:09 PM ETAAPL, CEG, NVDAPLUG, ABEV, DEO, BF.B, X, TAP, SAM, BF.A, BUD, TSLA, NISTF, NPSCY, CVNA, CRNC, RIVN, U, SOFI, LCID, SOUN, RGTI, NMRAFrom: Preeti Singh, Editor of SA News at all The stock market started 2025 with a loss for the week. The S&P 500 fell 0.8% for the four-day trading week, closing three of those days in the red, extending a selloff for the first time since…

0 notes