#loan officers

Text

Unlock your dream home with confidence using our home loan eligibility calculator. Determine your borrowing capacity, assess eligibility criteria, and streamline your home buying process effortlessly.

0 notes

Text

I’d like to thank the government for this banger focaccia I’m making

#actually I don’t thank the government you all have been having so many issues with my loans#I’ve had to go to so many offices and phone calls. NO thank you to the government. For this focaccia#it’s garlic butter onion bacon blue cheese BY THE WAY!!!!#little bit of hot honey drizzle#the og from the restaurant I had this at was a flatbread and it had tomatoes#but I don’t like tomatoes and I want to make focaccia#kipspeak#it’s still rising. I made garlic too early so now I have to start over w that bc it’s not even enough garlic#but whateva. Wish me luck on caramelizing these onions

46 notes

·

View notes

Text

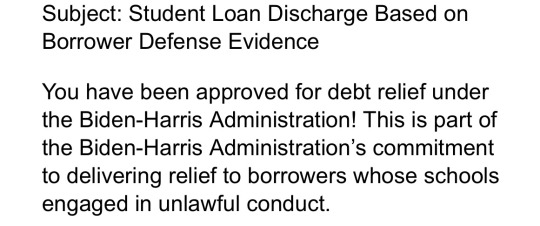

A CHRISTMAS MIRACLE HAS OCCURED 🎉🎉🎉🎉🎉

#i’m no longer a girl with 60k in student loan debt for an art degree#I CANT EVEN WRAP MY HEAD AROUND IT#i’ve been checking online to make sure it’s the offical studentaid email#i still have like 6k from beauty school but!!!

80 notes

·

View notes

Text

Donald Trump slammed President Joe Biden’s plans to cancel student loan debt as “vile” and suggested that the program will be “rebuked” if he is elected.

The Biden administration has canceled loan balances for nearly 4.8 million people by relying on a mix of existing programs and new policies after the Supreme Court struck down his campaign-trail promise for sweeping relief last year.

In a rambling campaign rally speech in Racine, Wisconsin, on Tuesday, Trump compared debt relief to what he said is “illegal amnesty” for immigrants married to American citizens.

“He did that with the tuition and that didn’t work out too well, he got rebuked, and then he did it again, it’s going to get rebuked again, even more so, it’s an even more vile attack, but he did that with tuition just to get publicity with the election,” he said.

Twenty minutes later, he blamed student loan relief for a climbing federal budget deficit.

“Because he’s throwing money out the window,” Trump said. “This student loan program, which is not even legal, it’s not even legal, and the students aren’t buying it, by the way. His polls are down. I’m leading in young people by numbers that nobody has ever seen.”

Last year, the Supreme Court blocked Biden’s plans for student debt relief after a pair of lawsuits from Republican attorneys general and conservative legal groups.

At a campaign event that same day, Trump hailed the decision and called Biden’s plans “very unfair to the millions and millions of people who paid their debt through hard work and diligence.”

Project 2025, a right-wing special interest-backed plan for Trump’s return to the White House, has also called for reversing student debt cancellation and eliminating the Office of Federal Student Aid.

Earlier this year, more than a dozen GOP-led states launched another federal court battle to challenge Biden’s latest debt relief plans. Biden is “unilaterally trying to impose an extraordinarily expensive and controversial policy that he could not get through Congress,” according a lawsuit led by Missouri’s Republican attorney general.

Before Biden’s plan was struck down, millions of people who took out federally backed student loans were eligible for up to $20,000 in relief.

Borrowers earning up to $125,000, or $250,000 for married couples, would be eligible for up to $10,000 of their federal student loans to be wiped out. Those borrowers would be eligible to receive up to $20,000 in relief if they received Pell grants.

Roughly 43 million federal student loan borrowers were eligible for that relief, including 20 million people who could have had their debts entirely wiped out, according to the White House. 16 million people had already submitted their applications and received approval for debt cancellation prior to the court’s ruling.

Still, the administration has been able to speed relief for nearly 5 million Americans by leaning on programs that have existed for years, including during Trump’s administration.

Last month, the administration aided $7.7 billion in relief, including wiping out debts for nearly 67,000 public servants enrolled in the Public Service Loan Forgiveness program, according to the Education Department.

Another 54,000 borrowers had their balances cleared under a new repayment plan that promises to cancel debts from loans of less than $12,000 if they had made their payments over 10 years. Another 39,000 borrowers who have been in repayment for more than 20 to 25 years as part of an income-driven repayment plan also had their balances cleared.

The administration’s student loan plans are also fuelling a federal budget deficit, which will hit $1.9 trillion this fiscal year, according to the Congressional Budget Office.

That includes a projected $145 billion spike from changes to the student loan forgiveness plan, including a proposal to waive interest for millions of borrowers.

The amount of debt taken out to support student loans for higher education costs has exploded within the last decade, alongside surging tuition costs, private university enrollment growth, stagnant wages and a lack of investments in higher education and student aid, which puts the burden of college costs largely on students and their families.

Many borrowers also have been trapped by predatory lending schemes with for-profit institutions and sky-high interest rates that have made it impossible for many borrowers to make any progress toward paying off their debt, with interest adding to balances that have exceeded the original loans.

#us politics#news#republicans#conservatives#donald trump#gop#2024#2024 elections#biden administration#president joe biden#department of education#student loan forgiveness#Office of Federal Student Aid#us supreme court#Public Service Loan Forgiveness#congressional budget office

6 notes

·

View notes

Text

I saw this post floating around where ppl were trying to derail "don't work for a US defense contractor" with like "these other jobs are also shitty or predatory!!"

And I didn't wanna address it directly. But.

1. Those other jobs can be highly variable in their shittiness to other people. Some of them are better than others. Sometimes it changes from company to company. Some of those jobs named were actually whole fields where there are vastly different players out there.

2. Those other jobs were all industries that are highly government regulated & with lots of federal regulations to protect consumers/customers. It's not a perfect system, but it does like, exist. Huge ass lawsuits get won over violations all the time.

3. None of those jobs are focused on trying to kill people at any point in time from process to product or service. They may not be trying to keep people living easy, but they also aren't actually supplying weapons of war for murder purposes so like....

Still.....not comparable??? Defense contractors are included in acab lol.

#an irs agent and a payday loan guy are both technically collectors of debt but those things arent the same lol#not all irs agents obviously. officers? whatever.#...maybe i should work for the irs make that govt $$$#anyways

9 notes

·

View notes

Text

AHHHHHH

#this post brought to you by: me#i. applied for a preapproval letter for a mortgage yesterday. and spoke to a realtor to start finding me houses#i want to move several states away which further complicated things. but the houses there are CHEAP#like under 100k for a 2 bedroom move in ready#anyways i got approved for 80k with a 20k down payment. and im FREAKING THE FUCK OUT#and because i got that pre app letter i have a loan officer calling me today to talk#and we literally work at the same bank so i can SEE that hes active and hasnt read my message#even though its been 45 minutes. KEVIN MESSAGE ME BACK. IM NOT GONNA BE ABLE TO FOCUS UNTIL I DO THIS CALL#AHHHHHHH S C R E A M. it might happening!!!! i might be finally.mov8ng out in a few months!!!#i mgiht be a HOMEOWNER by the end of the year#i have been saving money for this since i was. 16? 17?#ive had a good well paying job since i was 18.#AHHHHHHHHHHHHHHHHHHHHHHHH#once i have a house then i start job searching in that area. and start getting really serious about LEAVING my very good job#which is soooo scary. this job was supposed to be my lifelong career. but then everyone fucking moved to other states and left me behind#so theres no point staying here.#i might never have this kind of job security again.#but also my realtor said that theres a lot of bank jobs in that area so maybe itll be easy to find something#on the fence on if i tell my parents that im Making Moves right now#on one hand its hard to not talk about it becuae im STRESSED TF OUT#but on the other hand when i tentatively mentioned the state i want to move to#richard started yelling and swearing el oh el#might be better to wait and avoid the tension as long as possible?#but also i dont know how they can stay angry when its literally my best option#the other places where my friends live either have 0 opportunity and high housing prices. or are even moe liberal than where im going#idk. why do half of my problems come down to “my parents will be mad” like im a 12 year old or something. shit fucking sucks#this is why i want to get out of here#also it feels weird and bad to talk to my friends about how stressed i am about buying a house when all of them are stressed about#not being able to make rent or something. my problems feel like a brag in a really odd and shitty way. but hey!#if this works out maybe ill start being stressed about how im going to make my mortgage payments! :') yay!

9 notes

·

View notes

Text

Zombie Loan offical art

20 notes

·

View notes

Text

I decided to quit while I'm ahead and graduate early instead of finishing my Master's and I got a decent grade and can move on or whatever but. already it is hitting me how much more I am enjoying and interested in maths, now that I'm not studying it. I have literally been off my course for 2 days and already found the motivation and interest to look up multiple details and ideas for my own interest and how I'm so looking forward to some of the further (independant) study I'll be doing in the next year and just. It's crazy how poor teaching, an exclusively results-based focus, an awfully designed set of modules with poorly chosen content, a set of modules I hated and which I was ill-prepared for, a lack of almost any support from lecturers, no proper tutorials or any seminars for 3 years, and a deeply isolationist learning culture turned out to not be a very conducive learning environment to my AuDHD. who would have thought.

#note that I was doing an integrated Master's which is a UK thing#where you do a regular undergrad and a much smaller Master's in your 4th year without having graduated yet#so you're still eligible for undergrad grants & student loan#but because they're rushed the Master's are considered a bit. well useless#Also we only had max 16 contact hours but usually this was in fact 8 because they just put the other 8 as office hours#which you could only go to for specific queries for max 10 mins#in fairness some of this was due to chronic illness and working a lot (in a job I enjoyed far more than my degree) & Covid & my issues#but also. fuck that uni#mathblr#academia

4 notes

·

View notes

Text

Weren't allowed stuffies.

Mom called the psych unit AHEAD of time

#spirits pointed out the initiated one.#he told us to PLEASE not throw up in the communal area#our bad.#ceci#(grandmas nicknames) mima#izzy educated everyone on narcissists and the type of abuse they can conjure up in the right positions#i educated about the system#jessie bitched about the rules#bren sang#dont forgot all of us loudly calming down our little and educational discussions about bowl movements while in actuve trauma responses.#*active#circle :)#we have epileptic seizures and non epileptic seizures#educational#apollo#even told the doctor who negotiated our release from not only the pen but the psych ward that she filed a restraining order#we got more drugs because we COMMUNICATED.#walked us out of the building:] daddy called the sherrifs office to get our dog and the important stuff#safely at Daddys grandmas house where she will be helping us get a propper home using her husband's 401k (loan and cash up front)

2 notes

·

View notes

Text

Maximizing Efficiency: Why Realtors and Loan Officers Rely on Mortgage Calculators?

In the fast-paced realms of real estate and finance, efficiency reigns supreme. Realtors and loan officers navigate intricate transactions daily, demanding precision and speed in their decision-making processes. To meet these demands, professionals rely on technology, particularly mortgage calculators, to streamline operations. Among the array of tools available, the best apps for loan officers, offering comprehensive solutions to optimize workflows and ensure accuracy in financial computations.

Precision at Your Fingertips:

Complex Algorithms Simplified: Mortgage calculations involve intricate algorithms, including loan amounts, interest rates, terms, and more.

Eliminating Guesswork: Mortgage calculators ensure accuracy, providing precise estimates of monthly payments, total interest, and critical metrics.

Confidence and Informed Decision-Making: Accurate calculations instill confidence in clients and facilitate informed decision-making throughout transactions.

Time-Saving Powerhouses:

Streamlining Operations: Manual calculations are prone to errors and time-consuming, while mortgage calculator apps offer swift and accurate results.

Advanced Features for Efficiency: The best apps for loan officers integrate preloaded formulas and real-time updates, expediting decision-making processes.

Instant Accessibility: With just a few taps, professionals access vital financial information, responding promptly to client inquiries and maximizing productivity.

Enhanced Client Communication:

Facilitating Meaningful Discussions: Mortgage calculators enable clear visualization of loan scenarios, promoting meaningful client interactions.

Empowering Informed Decisions: Clients gain a comprehensive understanding of their financial obligations, fostering trust and credibility.

Building Lasting Relationships: Transparent communication cultivates mutual respect, laying the foundation for long-term client relationships.

Conclusion:

In conclusion, mortgage calculators are indispensable tools for realtors and loan officers striving to maximize efficiency. Leveraging technology allows professionals to access accurate calculations, streamline workflows, and enhance client engagement. Among the myriad options, the best finance calculator apps offer tailored solutions for industry needs. Embracing these tools is not just an option but a necessity in today's competitive landscape. For those seeking ultimate efficiency in financial computations and transactions, the Mortgage Calculator for Realtors stands out as the key to success.

Note: Always consult with your loan officer to get current and accurate information & calculations.

#Loan calculator#Motgage calculator#home loan#mortgage broker#realtors#loan officers#Florida#orlando#USA#Brokers in Florida

0 notes

Text

Enrolled in the payment plan for school and it posted my payment plan three times for the full semester amount instead of the like broken up payment amounts? now its saying each payment is like 2000 instead of a third of that and of course i cant do anything about it till monday when the first third of the payment is due

#im assuming its a glitch#cause ive had major glitches happen to me already like it said i accepted a loan and my fasfa got cut in half for no reason#but like if this doesnt fucking fix itself by monday#im gonna go fucking insane#i guess im gonna send an email#but like ill prolly have to be in the bursar office at 8am monday morning

2 notes

·

View notes

Text

I’m really frustrated my card got locked on Friday - I’ve been going through donating $5 to roughly 12-14 campaigns for weeks now but this week it gets flagged as potential fraud? Not only that the company is closed on the weekends so I have to wait until Monday to unlock my card (if I was still living alone and had to buy my own groceries/pay for gas I would be in trouble).

#ra speaks#personal#me: *living at home again* okay my cost of living has decreased by $50-$75 bucks a week let’s donate it all every week -#the credit card company who I’ve never once wronged: FUCK YOU STOP SPENDING YOUR OWN MONEY LIKE THAT ITS SCARING THE FRAUD SYSTEM#last time my card got locked (sending money to a group doing a bus ride to dc for Palestine protesting) I didn’t get a notification/case no#and I remember that being a problem so then this time I call and the 1800 person asks for my case no. and it’s like.#¯\ _(ツ)_/¯ fuck me I guess#I’ll ask abt it when I call the local office on monday cause like I think they could unlock my card if I had the damn case no.#but I’ve literally never been contacted. which is weird bc they 100% have my phone/email on file#like I get emails abt my loans through them and when I make a payment and shit. why not emails abt locked card? who knows

4 notes

·

View notes

Text

If God had wanted ME to live he would not have created ME

#gopher rambles#vent ish#god fucking damn it all#my college bill is higher than it was estimated to be and i dont have the money to pay it off#so im going to have to call the financial aid office#i really dont want to have to take out a loan but i might have to#if they say im not graduating this semester i might just drop out

2 notes

·

View notes

Text

I have paid off about $18,000 of student loans (like just did the pay off early amount rather than waiting 10+ years to pay almost double because of interest) and I still have almost 100k left...

#I paid off the ones that don't qualify for loan forgiveness#Also other than a part time job before joining the Air Force#I haven't used my degree for anything#I didn't join as an officer#and my current job doesn't require a degree#(in fact most people I've worked with look down on education as a whole so that's cool)

3 notes

·

View notes

Text

I love that nobody is allowed to have a bad day except my mother

#i submitted a form to see if there are any FHA loans I would qualify for to make a down payment on a fucking $25000 trailer home#and they said ‘sorry you don’t qualify for anything we have right now’#and I might need to take a Xanax and force myself to fall asleep because if I stay conscious much longer#I don’t trust myself not to do something drastic#because this week has fucking sucked#a new piece of shit thrown at me every fucking day#and I have no fucking money and have to spend 2 hours in the fucking car each day#to go work a job where I don’t get a shred of respect from anyone outside my office#I’m fucking losing it#I really don’t want to leave this job but the cost both financially and mentally is actually going to kill me#I’m trying to apply for a first time homebuyer loan but I have to take a 6 hour course#and it’s been rescheduled twice#and there’s only so much funding for the program#and based on the FHA rejection I think I make just enough money to not be a priority for that funding#but 50% of my monthly fucking income goes to loans and bills

3 notes

·

View notes

Text

youtube

Every time I do my taxes I think of this video

#SICK JAN we don't have to claim a home office#IF IT MEANS we'll both GO TO JAIL#chris fleming#also i think i may have fucked up on my taxes. student loans also. i love usamerica#Youtube

3 notes

·

View notes