#master data management solution for private equity

Explore tagged Tumblr posts

Text

Brownloop’s private equity data platform delivers intelligent Master Data Management, solving challenges like scattered data, poor quality, and lack of standardization. Brownloop helps firms optimize data architecture and elevate data integrity to unlock reliable insights and drive smarter decisions.

#private equity data platform#mdm for private equity#master data management solution for private equity

1 note

·

View note

Text

Siddhant Masson, CEO and Co-Founder of Wokelo – Interview Series

New Post has been published on https://thedigitalinsider.com/siddhant-masson-ceo-and-co-founder-of-wokelo-interview-series/

Siddhant Masson, CEO and Co-Founder of Wokelo – Interview Series

Sid Masson is the Co-Founder and CEO of Wokelo. With a background spanning strategy, product development, and data analytics at organizations like the Tata Group, Government of India, and Deloitte, Masson brings deep expertise in applying emerging technologies to real-world business challenges. At Wokelo, he is leading the company’s mission to transform how knowledge workers conduct due diligence, sector analysis, and portfolio monitoring through agentic AI frameworks.

Wokelo is a generative AI-powered investment research platform designed to automate complex research workflows, including due diligence, sector analysis, and portfolio monitoring. Using proprietary large language model (LLM)-based agents, the platform facilitates the curation, synthesis, and triangulation of data to generate structured, decision-ready outputs.

Wokelo is used by a range of organizations, including private equity firms, investment banks, consulting companies, and corporate teams, to support data-informed decision-making.

What inspired you to create Wokelo AI, and how did you identify the need for an AI-driven research assistant that could streamline due diligence, investment analysis, and corporate strategy?

Wokelo AI was born out of firsthand experience. Having spent years in management consulting at Deloitte and corporate development at Tata Group, I encountered the same challenges over and over – manual, repetitive research, data scarcity in private markets, and the sheer grunt work that slows down analysts and decision-makers.

The turning point came during my second master’s in AI at the University of Washington, where my thesis focused on Natural Language Processing. While freelancing as a consultant to pay my way through school, I built a prototype using early versions of GPT and saw firsthand how AI could turn weeks of work into days and hours – without compromising quality. That was the lightbulb moment.

Realizing this technology could revolutionize investment research, I decided to go all in. Wokelo AI isn’t just another research tool – we were some of the first people pioneering AI agents two years ago. It’s the solution I wish I had during my years in due diligence and investment analysis.

How did your experience at Deloitte, Tata, and the Government of India shape your approach to building Wokelo?

At Deloitte, as a management consultant, I worked on a variety of complex projects, dealing with research, analysis, and due diligence on a daily basis. The work was intensive, involving a lot of manual, repetitive tasks and desk research that frequently slowed down progress and increased costs. I became all too familiar with the pain points of gathering data, especially when it came to private companies, and the challenges that came with using traditional tools that weren’t built for efficiency or scalability.

Then, at Tata Group, where I worked on M&A and corporate development, I continued to face the same issues — data scarcity, slow research, and the challenge of turning raw information into actionable insights for large-scale decisions. The frustration of not having effective tools to support decision-making, particularly when dealing with private companies, further fueled my desire to find a solution.

Additionally, my work with the Government of India on the IoT solution for a water infrastructure project, further refined my understanding of how product innovation could address real-world problems on a large scale, and it gave me the confidence to apply the same approach to solving the research and analysis challenges in the consulting and investment space.

So, my professional background and my firsthand exposure to the struggles of research, analysis, and data collection in consulting and corporate development directly influenced how I approached Wokelo. I knew from experience the roadblocks that professionals face, so I focused on building a solution that not only automates grunt work but also allows users to focus on high-impact, strategic tasks, ultimately making them more productive and efficient.

Wokelo leverages GenAI for research and intelligence. What differentiates your AI approach from other summarization tools in the market?

While most competitors offer chatbot-style Q&A interfaces – essentially repackaged versions of ChatGPT with a finance-focused UI – Wokelo AI takes a completely different approach. We built an AI agent specifically designed for investment research and financial services – not just a chatbot but a full-fledged workflow automation tool.

Unlike simple summarization tools, Wokelo handles end-to-end research deliverables, performing 300-400 analyst tasks that would typically take a week. Our system autonomously identifies requirements, breaks them into subtasks, and executes everything from data extraction and synthesis to triangulation and report generation. As a result, our clients get deep, comprehensive, and highly nuanced insights – a real analysis, not just surface-level answers.

Another key differentiator is accuracy and reliability of the intel. Wokelo doesn’t make up insights, it doesn’t hallucinate – it provides fully referenced, fact-checked outputs with citations, eliminating the trust issues that many GenAI tools have. As a cherry on top, our platform users also get exportable reports in various formats typically used by analysts, making it a seamless replacement for traditional research platforms like PitchBook or Crunchbase, but with far richer intelligence on M&A activity, funding rounds, partnerships, and market trends.

Wokelo is more than just an LLM with a UI wrapper. Can you explain the deeper AI capabilities behind your platform?

Wokelo is purpose-built for investment research, combining cutting-edge AI, exclusive financial datasets, and a research-centric workflow – offering capabilities that extend far beyond a simple LLM with a UI wrapper. At its core, Wokelo leverages a Mixture of Experts (MoE) approach, integrating proprietary large language models (LLMs) pre-trained on tier-1 investment data, ensuring highly precise, domain-specific insights for investment professionals.

Designed for seamless workflow integration, Wokelo features a collaborative, notebook-style editor, allowing users to create, refine, and export well-structured, templatized outputs in PPT, PDF, and DOCX formats—streamlining research documentation and presentation. Its multi-agent orchestrator and prompt management system ensures dynamic model adaptability, while robust admin controls facilitate query log reviews and compliance rule enforcement.

By merging advanced AI capabilities with deep financial intelligence and intuitive research tools, Wokelo delivers an end-to-end investment research solution that goes far beyond a standard LLM.

How does Wokelo ensure fact-based analysis and prevent AI hallucinations when synthesizing insights?

As we serve highly reputable clients whose every decision must be backed by precise data, accuracy and credibility are at the core of our AI-driven insights. Unlike general-purpose AI platforms that may produce speculative or unverified information, Wokelo ensures fact-based analysis through a robust, citation-backed approach, eliminating AI hallucinations.

Every trend, analysis, market signal, case study, M&A activity, partnership update, or funding round insight generated by Wokelo is grounded in real, verifiable sources. Our platform does not “make up” information – each insight is accompanied by references and citations from premium data sources, trusted market intelligence platforms, tier-one news providers, and verified industry databases. Users can access these sources at any time, ensuring full transparency and confidence in the data. Wokelo has an internal fact check agent using an independent LLM to ensure every fact or data point is mentioned in the underlying source.

Additionally, Wokelo integrates with customers’ internal data repositories, unlocking valuable insights that might otherwise remain scattered or underutilized. This ensures that our AI-driven analysis is tailored, comprehensive, and aligned with specific investment-related queries.

Designed for high-stakes business decision-making, Wokelo’s AI is trained to synthesize insights, not speculate—pulling exclusively from factual datasets rather than generating assumptions. This makes Wokelo a more credible and reliable alternative to general-purpose AI tools, empowering businesses to make informed, data-driven decisions with confidence.

How does Wokelo’s AI handle real-time data aggregation across multiple sources like filings, patents, and alternative data?

Wokelo’s AI excels at real-time data aggregation by tapping into over 20 premium financial services datasets, including key sources like S&P CapIQ, Crunchbase, LinkedIn, SimilarWeb, YouTube, and many others. These datasets provide rich, reliable information that serves as the foundation for Wokelo’s analytical capabilities. In addition to these financial datasets, Wokelo integrates data from a variety of top-tier publishers, including news articles, academic journals, podcast transcripts, patents, and other alternative data sources.

By synthesizing insights from these diverse and continuously updated data streams, Wokelo ensures that users have access to the most comprehensive, real-time intelligence available. This powerful aggregation of structured and unstructured data allows Wokelo to provide a holistic view of the market, offering up-to-the-minute insights that are crucial for investment research.

Wokelo is already being used by firms like KPMG, Berkshire, EY, and Google. What has been the key to driving adoption among these high-profile clients?

Wokelo’s success among industry leaders like KPMG, Berkshire, EY, and Google stems from its ability to deliver measurable, transformative impact while seamlessly integrating with professional workflows. Unlike generic AI solutions, Wokelo is purpose-built for investment research, ensuring that its algorithms not only meet but exceed the high standards expected in this sector.

A key driver of adoption has been Wokelo’s close collaboration with leadership teams, allowing firms to embed their hard-won expertise into proprietary AI workflows. This deep customization ensures that Wokelo aligns with the nuanced decision-making processes of top investment professionals, providing best-in-class reliability and earning the trust of elite clients. These firms choose Wokelo over other tools in the market for its depth of analysis, fidelity, and accuracy.

Beyond its precision and adaptability, Wokelo delivers tangible efficiency gains. By reducing due diligence timelines from 21 to just 10 days and automating core research tasks, it significantly cuts manpower costs while freeing senior professionals from hours of manual work. With the ability to screen 5–10X more deals per month, firms using Wokelo gain a competitive edge, accelerating decision-making without compromising on depth or accuracy.

By combining cutting-edge AI, deep customization, and real-world impact, Wokelo has established itself as an indispensable tool for top-tier investment and advisory firms looking to scale their operations without missing critical details.

How does Wokelo integrate into the existing workflows of investment professionals, and what feedback have you received from users?

Wokelo integrates seamlessly into investment workflows by automating the entire deal lifecycle—from evaluating sector attractiveness to identifying high-potential companies in a global database of over 30 million firms. It offers in-depth company analysis, competitive benchmarking, and data room automation, eliminating tedious file reviews and quickly generating actionable insights. Wokelo also supports portfolio monitoring, peer analysis, and provides easy-to-export PPTs with client branding, streamlining client presentations and meeting prep.

Users report significant efficiency gains, reducing due diligence timelines from 20 days to just one week and increasing deal evaluation capacity from 100 to 500 per month—boosting deal coverage by tenfold.

How do you see AI transforming the investment research landscape in the next five years?

We’re only scratching the surface of what’s possible. AI will enable end-to-end research in a fraction of the time. With high-fidelity “super agents” capable of handling everything from deep market research and expert calls to data analysis and drafting a well-formatted 100-page deck, tasks that would traditionally require a team of five consultants working 6–8 weeks can now be accomplished much faster. This leap in speed and breadth of output will unlock new levels of productivity, allowing human experts to focus on high-level strategy and judgment.

AI will enable 50–100x more deals in the pipeline. By automating large parts of due diligence and analysis, AI-driven solutions can help investment managers expand their deal-screening capacity exponentially, uncovering more opportunities and diversifying portfolios in ways that were previously unfeasible.

The most pivotal element will be the amplified human-AI synergy. As these “super agents” take on the heavy lifting, collaboration between AI tools and human decision-makers becomes crucial. While AI will expedite processes and surface insights at scale, human expertise will remain essential for fine-tuning strategies, interpreting nuanced findings, and making confident investment decisions. This synergy will drive enhanced returns and innovation across the investment research landscape in the next five years.

As AI tools become more prevalent, how do you see human analysts and AI collaborating in the future?

As AI tools become more prevalent, the future of human analysts will revolve around collaboration rather than competition with AI. Rather than replacing analysts, AI will act as a powerful augmentation tool, automating repetitive tasks and enabling analysts to focus on higher-value, strategic work. The most successful analysts will be those who learn to integrate AI into their workflows, using it to enhance productivity, refine insights, and drive innovation. Rather than fearing AI, analysts should view it as a game-changing tool that amplifies their skills and allows them to add greater value to their organizations.

Ultimately, AI won’t replace human analysts—but analysts who embrace AI will replace those who don’t.

Thank you for the great interview, readers who wish to learn more should visit Wokelo.

#ADD#admin#adoption#agent#Agentic AI#agents#ai#ai agent#AI AGENTS#AI hallucinations#AI platforms#ai tools#AI-powered#Algorithms#amp#Analysis#Analytics#approach#Articles#automation#background#banks#benchmarking#Born#Branding#Building#Business#Case Study#CEO#challenge

0 notes

Text

MBA Business

The Master of Business Administration (MBA) is designed to equip students with the knowledge and skills necessary to drive social and business innovation within global communities. Often a two-year, one-year, or part-time choice, an online MBA allows students to attend school remotely. It is highly likely that most MBA candidates will be able to find an educational solution that works with their schedule, interests, and time commitment restraints. The MBA degree is the most common route into certain fields, including strategic planning and private equity. Other financial services fields, however, may no longer consider an MBA an entry-level degree - mba admission consultants.

Learners complete a capstone course that incorporates a real-world project. Through the application of various management and leadership principles, graduates develop the ability to lead stakeholders in creating impactful, ethical enterprises. The program explores business theories, applying systems thinking to evaluate complex business conditions and develop strategic responses. Collaboration is emphasized, with a focus on building partnerships across diverse and virtual environments - mba admission consultants in Delhi.

Without the ability to strike up a casual conversation with the classmate in the next seat, online learners often need to put a little more creative effort into making professional connections. The curriculum includes electives in corporate finance, information technology strategy and data-driven marketing management. If you're considering a business master’s degree, determine your goals and find a program that aligns with your objectives.

Often, a complete MBA application packet includes a resume, statement of purpose or essays, recommendation letters, and GMAT or GRE test scores. Some admissions departments invite applicants for an interview, but not in all cases. If you're considering whether an MBA degree is right for you, this guide is here to help with resources, tips, and answers to frequently asked questions about this graduate business degree. At the very least, make sure you can complete coursework in your desired focus area. The good news is that the best online M.B.A. schools create venues for remote learners to network, such as virtual or local events, in-person immersions, student associations and on-campus orientations. For more information, please visit our site https://www.goalisb.com/

0 notes

Text

The Future of Investment Banking in India: Trends and Innovations to Watch in 2025

Investment banking is evolving rapidly in India, driven by technological advancements, regulatory changes, and shifting market dynamics. For finance professionals aiming to break into this sector, staying ahead of these trends is essential. Pursuing an Online Investment Banking Course can provide the competitive edge needed to succeed in this dynamic landscape.

Key Trends Shaping the Future of Investment Banking in India

1. Digital Transformation and Fintech Integration

Indian investment banks are embracing fintech solutions to streamline operations and enhance client experiences. From AI-driven trading algorithms to blockchain-powered settlements, technology is reshaping traditional banking services. Professionals with expertise in digital finance, gained through an Online Investment Banking Course, will be in high demand.

2. Rise of ESG (Environmental, Social, and Governance) Investing

Sustainability has become a key factor in investment decisions. Asset managers are increasingly aligning portfolios with ESG principles. Understanding ESG analysis and reporting frameworks through a CFA program can open lucrative opportunities in sustainable finance roles.

3. Increased Mergers and Acquisitions (M&A) Activity

India’s growing startup ecosystem and corporate consolidation efforts are driving a surge in M&A deals. Investment bankers play a pivotal role in deal structuring, due diligence, and valuation. An Online Investment Banking Course offers practical insights into M&A processes, enhancing career prospects.

4. Regulatory and Compliance Changes

With the Securities and Exchange Board of India (SEBI) introducing stricter regulations, compliance has become more complex. CFA-certified professionals, equipped with knowledge of financial regulations, are valuable assets to firms ensuring compliance and risk management.

5. Private Equity and Venture Capital Growth

India’s booming startup sector has fueled the growth of private equity and venture capital investments. Investment bankers with expertise in financial modeling and valuation are critical to these transactions. Completing an Online Investment Banking Course provides hands-on experience in financial analysis.

Why CFA is Crucial for Investment Banking Careers

The CFA credential is one of the most respected certifications in the finance industry. It covers key areas like investment management, financial analysis, and ethics, making it ideal for aspiring investment bankers.

Comprehensive Financial Knowledge: The CFA curriculum ensures proficiency in areas like equity investments, fixed income, derivatives, and alternative investments.

Global Recognition: Recognized across over 165 countries, a CFA designation opens international career opportunities.

Ethics and Professionalism: CFA emphasizes ethical decision-making, a crucial aspect of investment banking.

Pursuing a CFA alongside an Online Investment Banking Course can provide practical knowledge, networking opportunities, and hands-on experience in the field.

Skills Required for Future Investment Bankers

To excel in the evolving landscape of investment banking, professionals need to develop the following skills:

Financial Modeling and Valuation: Mastering these skills through online courses enhances deal structuring capabilities.

Analytical Thinking: CFA training hones analytical skills crucial for evaluating complex financial data.

Negotiation and Communication: Investment bankers lead negotiations and communicate with stakeholders, making these soft skills invaluable.

Technological Proficiency: Familiarity with financial technologies like AI and blockchain is becoming increasingly essential.

Conclusion

The future of investment banking in India is full of opportunities for professionals who adapt to changing trends and develop the right skill set. Earning an Online Investment Banking Course can accelerate career growth by providing practical knowledge, industry insights, and professional credibility. With the right qualifications, you can be at the forefront of the next wave of financial innovation.

0 notes

Text

Decoding Excellence: Private Equity Portfolio Management Unveiled

Have you ever pondered over the invisible forces steering the success of financial giants in the private equity domain? The answer lies in the sophisticated world of private equity portfolio management software – a powerhouse that seamlessly integrates real-time data analytics, performance tracking, and risk management. Join us on a journey as we demystify this technological wizardry, revealing the strategic capabilities shaping the triumphs of established private equity and venture capital businesses.

The Core of Excellence:

Within the intricate tapestry of managing portfolio investments, private equity management software stands as a pinnacle of excellence. This advanced toolset empowers portfolio managers with an array of features tailored to navigate and dominate the complexities of market dynamics.

Real-time Data Analytics:

Imagine possessing a tool that serves as a dynamic lens into the heart of the market, providing an instantaneous, real-time view of each investment within your portfolio. Private equity portfolio monitoring software enables swift responses to market shifts, offering precise information and extensive analysis that transforms decision-making into a strategic art form.

Performance Tracking:

Moving beyond conventional numerical assessments, performance tracking becomes a detailed exploration of investment trajectories. This feature unveils patterns and insights, transforming every market fluctuation into a strategic brushstroke on the canvas of your portfolio, crafting a masterpiece of financial brilliance.

Risk Management:

No comprehensive strategy is complete without robust risk management capabilities. Private equity portfolio management software equips portfolio managers with powerful tools to identify, assess, and mitigate potential threats. It acts as an anticipatory shield, ensuring the portfolio sails through turbulent times unscathed.

The Impact of Strategic Mastery:

As the curtains rise on the capabilities of private equity portfolio monitoring software, the impact becomes clear. Picture a portfolio that is not merely surviving storms but emerging more robust and resilient. This tool transcends the realm of investment management, sculpting a legacy of financial success through strategic mastery.

Navigating the Landscape:

While exploring the capabilities of private equity portfolio monitoring software, the critical question arises – how do you choose the right tool for your financial realm? In this expansive landscape of potential vendors, seek a solution that seamlessly aligns with the unique needs of established private equity and venture capital businesses. Look for a tool offering a harmonious blend of simplicity and power tailored to your specific demands.

Conclusion:

In the world of professional private equity portfolio management, excellence reigns supreme over unnecessary complexity. This software isn't merely a tool; it's the key to mastering financial success. As you explore its potential, remember that true empowerment comes from exceeding the expectations of your financial goals. The journey to unlocking this excellence is just beginning, with boundless possibilities awaiting your command.

1 note

·

View note

Text

Review OBORTECH (OBOT)

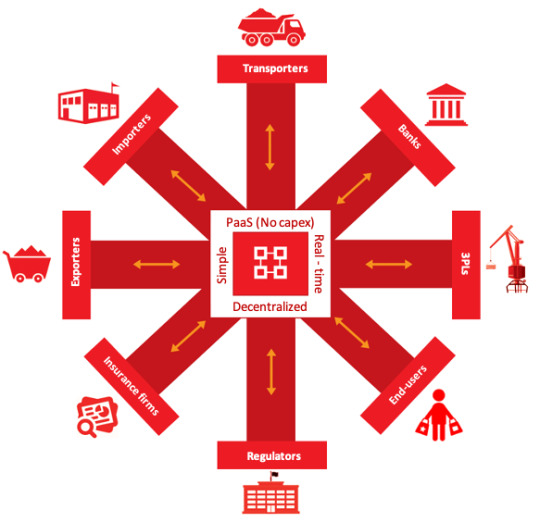

OBORTECH - Smart logistics hub

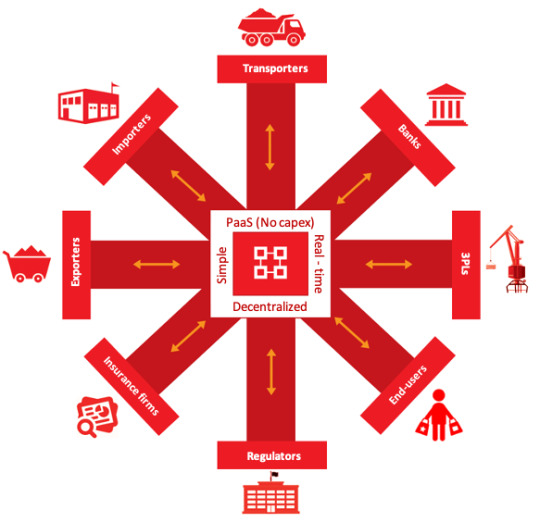

A FULLY DIGITAL ECOSYSTEM FOR YOUR SUPPLY CHAIN

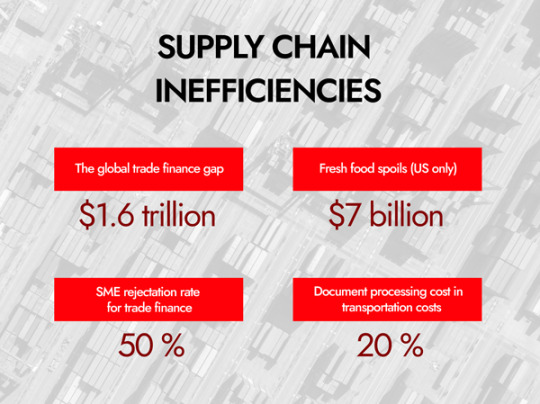

OBORTECH aims to increase the performance and efficiency of current logistics services with the power of Blockchain and IoT. OBOT token serves as a bridge between DeFi and digital supply chain solution offered by OBORTECH called Smart Hub.

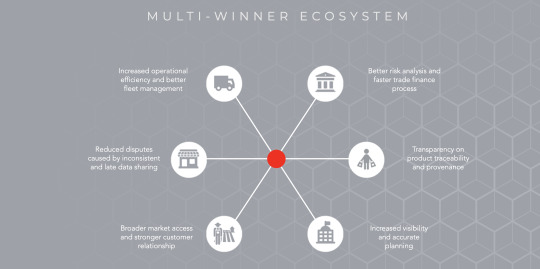

MULTI-WINNER ECOSYSTEM

Better risk analysis and faster trade finance process

Increased operational efficiency and better fleet management

Reduced disputes caused by inconsistent and late data sharing

Transparency on product traceability and provenance

Broader market access and stronger customer relationship

Increased visibility and accurate planning

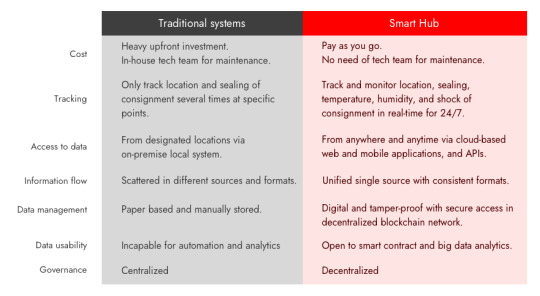

OBORTECH's Smart Hub VS Traditional systems

THE SMART HUB OFFERS

Blockchain and cloud powered communication hub

Accessible via easy to use web and mobile user interfaces, and an open API, the Smart Hub brings together supply chain actors, and enable their supply chains to share information, collaborate, conduct data analysis, and validate product traceability in real-time on a trusted platform.

Tamper-proof, unified and online document exchange

The Smart Hub allows secure sharing and exchange of documents with supply chain partners using blockchain powered version control. Authorized parties to any shipment can immediately see when changes have been made, and by whom, along a shipment journey.

IoT based real-time visibility and tracking

IoT sensors are installed on containers/trucks and transmit data to the Smart Hub dashboard to track valuable shipments, monitor their key physical measurements, and protect high-value products against theft. A client gets positioning data for shipment in real-time, irrespective of the shipping carrier they choose.

Open and decentralized networking marketplace

Based on the blockchain based trusted network established among the Smart Hub participants, the marketplace ecosystem will enable verification and scoring of stakeholders in supply chain without the need for third-party credentials. Moreover, the marketplace is a blockchain based decentralized ecosystem that enables buying, selling and exchanging of services without the need of intermediaries among the users.

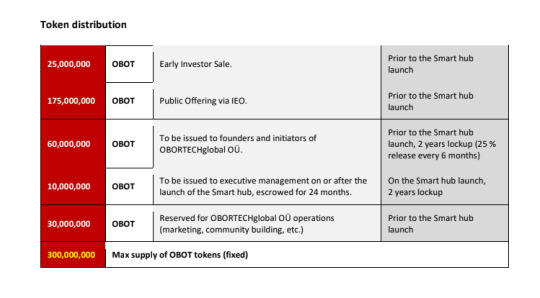

OBOT DEFI

FOR DIGITAL SUPPLY CHAIN

Smart Hub transaction fee

OBOT token will be used for paying Transaction fee of bundled services offered by the Smart Hub. Every transaction revenue received by OBOT is split in the following way: 5% for token burns, 20% for marketing & community building, 5% for Non-Profit activities, and 70% for Network Admin fee.

Contract bonus

OBOT token can be used for promoting contract performances between the Smart Hub users. Users collaborating via the Smart Hub can convert some portion of their contract funding into OBOT tokens and allocate them in Escrow Contract as a bonus payment.

Crowdfunding

Members of the Smart Hub can launch crowdfunding activities to OBOT token holders in the Smart Hub Marketplace. It will be done either by lending with algorithmic interest rate protocol based on calculation of member score/rating or by pledging (similar to Kickstarter) between creators and backers based on Escrow Contract and performance tracking in the Smart Hub’s blockchain network.

Exchanging services

OBOT token will be used in the Smart Hub Marketplace when its users exchange services among them. The Smart Hub Marketplace is a blockchain based decentralized ecosystem that enables buying, selling and exchanging of services without the need of intermediaries among the Smart Hub users.

Member rewarding

The Smart Hub members will be rewarded by OBOT tokens based on their score/rating in the Marketplace. Members will be scored/rated by various ways based on blockchain data and performance histories in the Smart Hub network.

Governance

OBOT token allows holders to participate in Governance decisions of the Smart Hub Marketplace. They can exercise voting rights on policies of member enrollment, service exchanges, and crowdfunding activities of the Marketplace.

With OBOT tokens, the Smart Hub users can enjoy rewards like express delivery and extra care of products during shipments via the Smart Hub network. Get your OBOT tokens today by participating in our IEO

The manual and paper based processes often used in Supply Chain Industries are time consuming and also result in a lot of extra maintenance costs.

IEO starts on Probit from 10th March 2021

Starting price: ETH 0.000015

Invest upto 1 ETH, get 50% more bonus OBOT tokens

Invest between 1ETH - 2 ETH, get 100% more bonus OBOT token

Invest more than 2 ETH, get 200% more bonus OBOT tokens

ROAD MAP

TEAM

Tamir Baasanjav: CEO and Founder

He is specialized in project management and strategic communication. He had worked in managerial and expert positions of prestigious international development, government and business organizations such as an agency funded by Government of the United States for transportation and energy efficiency fields, Knowledge Hub project of Swiss Agency for Development and Cooperation on sustainable mining, and the biggest corporate bank of Mongolia. He also has 10 years of experience in UX and product designs. He won the global product design contest held by Adidas.

He designed the Smart Hub concept and its business strategy. He manages the project and leads the product design and marketing/communication.

Enkhbat Dorjsuren: Logistics Lead and Co-founder

He has 20 years of experience in logistics and transportation sector. He is a CEO of Mongolian Express LLC, one of the largest inland transport and logistic companies in Mongolia. He has extensive network in Mongolian transportation and logistics sector.

He established the project’s partnerships in the transportation sector and leads partnership development in Mongolia and Euro-Asia

Tungalag Sukhbat: CFO

She is a finance and investment professional more than 20 years of experience. She has worked in different domains including strategic and financial consulting, central banking, corporate banking, asset management, and multilateral development programs in managerial and expert positions. She achieved CFA Charter in the UK and is a member of the CFA Institute. Moreover, she is a Certified Business Appraiser of Mongolia.

She developed the business plan as well as financial modelling and analysis of the project. She leads financial management and analysis of the project.

Zoljargal Dashnyam: Chief Counsel

She has extensive experience in corporate law and private equity. Her portfolio of clients includes investment banks, multinationals, mining companies, and investment funds. She graduated Harvard Law School in Master of Laws. She was ranked as a top-tier lawyer in Mongolia for 9 years. She is a Senior Partner of the leading law firm in Mongolia, DB>S.

She is in charge of the governance model development of the Smart Hub and legal activities of the project.

Alok Gupta: Blockchain Architect

He is a certified blockchain developer with over 12 years of experience in application development and deep knowledge of Hyperledger Fabric architecture and functionalities. He was in top 5% of Blockchain Architecture Design course conducted by IBM and IIT, a top technology institute in India. He developed various blockchain projects and applications in supply chain, real estate registry, health insurance, etc.

He developed the blockchain architecture and application of the prototype system. He leads the blockchain (Hyperledger) architecture and application development of the project.

Maxim Prishchepo: Blockchain Architect

He is a blockchain architect with more than 6 years of experience in blockchain development and 20 years of experience in architecture designs of complex financial IT systems. He is a qualified analyst in crypto banking & finance. He worked as a core blockchain developer and architect for Energi, 0chain, and Wagerr projects. His main areas of specialization are Bitcoin, Ethereum, PIVX, ZCash and other open-source based blockchain solutions.

He developed the Ethereum smart contract of the project. He leads the token payment system and Ethereum blockchain development of the project.

Mauro Andriotto: Adviser

He is internationally recognized as one of the leaders in blockchain and Security Token Offering (STO). He is a professor of Corporate Finance and University of Geneve – UBIS. He is an Independent Expert at the European Commission for Horizon 2020 where he approves public grants for startups. He is also the former quantitative leader at EY for the South Europe area.

He advises the project on European market and fundraising

Garry Pinder: Adviser

He is a Managing Director of Intermodal Solutions Group (ISG). ISG is a global company supplying container rotation systems for the mining, grain and ship loading industries. It operates in 12 countries and wide network of client base in South American region.

He advises the project on South American market of containerized transportation of agricultural and mining products.

Ulf Henning Richter: Adviser

He specialized in logistics and infrastructure technologies of Europe, China, and Africa regions. He is a member of China Highway & Transportation Society. He is also a Chairman of LUKOIL, Hong Kong branch.

He advises the project in partnership development in China.

For more information, please follow the links below:

Website: https://www.obortech.io/

WHITEPAPER: https://drive.google.com/file/d/1a9vax2925irEnR5yUVx8ZAGo84ISLEre/view

Telegram: https://t.me/OBORTECH

Twitter: https://twitter.com/OBORTECHhub

Facebook: https://www.facebook.com/OBORTECH

Linkedin: https://www.linkedin.com/company/obortech

Medium: https://blog.obortech.io/

Youtube: https://www.youtube.com/channel/UCQxPIavuaCHfdpGsT8_hFkw

AUTHOR:

Bitcointalk Username: Manuel Akanji

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=2954998

Telegram Username: @Manuelakanji777

ETH Address: 0x176a48a2Eb8FF8dfa46e58741E4A7b642C90F512

1 note

·

View note

Text

“Female Workforce” in Economy: Participation and Segregation

Author: Ashima Singh

Masters of Arts (M.A) in Public Policy

Jindal School of Government and Public Policy (JSGP)

OP Jindal Global University, Sonipat, Haryana

Contents

1. Introduction

2. Women’s Economic Contribution: A Historical View

3. Women’s Economic Contribution: In Present Century

4. Economic Freedom: Still a Dream?

Occupational Segregation

Part-time work

Wage – gap

5. Women and Economy : Vision India

6. Impact of Globalization

7. NSSO vs. ILO : Fact Findings

8. Economic Autonomy

9. Challenges and Solutions

Social Security Illiteracy Employment Access Gender Wage Gap Effect of Household Income Concentration in Low Paid The gap between Provider and Seeker Domestic Division of Labour Automation of Work

10. Conclusion

11. Abbreviation

12. Reference

Introduction

‘Women’ and ‘work’ is an inseparable amalgamation since the birth of human civilization. In pre – industrial society women were an indispensible entity in the economic contribution. Those days’ home and workplace was often the same or very close because craftsmanship and agriculture used to be the main economic activities. Both men and women were sharing the task and had equal influence on the economic contribution.

Gradually, due to the industrialization of the world, the distance between home and workplace rose because now the factories were the workplace. Also, factories needed few individual with specialized knowledge about the work, to be done by machine. This ‘industrial era’ associated women with domestic and caring services like the maid, nurses, domestic servants, etc. women participation in the paid labor force rose more or less continuously over the 20th century. Labor shortage during 1st world war became vital in the women’s entry into the labor force. After the Second World War gender gap started narrowing continuously at the economic front, though the female workforce was mostly engaged in lower – paid, part-time work.

Further, the Women’s Movement of the 1960s and 1970s for dismantling workplace inequality enabled them to gain legal equality with men. Then onward many women explored and attained a dizzying height in their career to realise the gender equality in the true sense. But the bigger question – Is gender equality attained? It’s a vexed question because occupational segregation, part – time work and the wage gap are the inequalities still existing in society throughout the world. The biggest barrier in attaining the equality is said to be ‘the domestic division of labor’. According to a UK survey of the 21st century, Women still spend nearly 3hrs a day on house work (excluding shopping and childcare) whereas men spend approximately 1hr 40min only (ONS 2003).

Presently women make up a little over half the world’s population but their contribution to measured economic activity, growth and development is far below its potential. They also face significant wage differential as compared to their male counterparts (IMF, SDN, Sep 2013).

In India, the economy has been growing rapidly since last three decades but its female workforce participation rates have declined. What may be the reason? Social and political structure of our country? According to the report of ILO (2014), this decline is actually a shift of women from recognize work to unpaid work due to family and social reasons. Also, women are mostly preferred in agricultural and non – agricultural sector for unskilled work with a lower wage. Earning differentials results in differences in skill acquisition, education and training which creates a vicious cycle of poor participation of the female workforce in the country’s economy.

Inspite of so many women empowerment programmes, Government’s 5 year plan and Women Movements the goal of ‘women emancipation’ is yet to be achieved. Making plans or donating fund for ‘women cause’ will never fetch the desired goal. The Women empowerment programme has to be implemented in the correct perspective. The age old myopic visioned policies have to be redrafted to remove the constraints, preventing women from developing their full economic potential. The re – drafted policy must re – orient the woman to access the opportunity of economic participation with insight and proficiency at par with man.

Women’s Economic Contribution: A Historical View -

In pre – industrial society, productive and household activities were not separate. Craftsmanship and agriculture being the main productive activities, people use to carry out this work with all members (male and female) of the family in and around their houses. As a result, women had the equal influence on the economic front and were having the full charge of family and income.

With the onset of industrialization, the distance between home and workplace increased. This change brought the change in the family’s economic participation. Men folk with more technical prowess and lesser domestic responsibility walked away from home to work in factories and women being more associated with domestic work took charge of children, home management and cooking. Later due to poor economic condition few women got employed as a maid, nurses and domestic servant in more affluent families. This gave rise to paid labor force continuously over the 20th century until the Second World War. Though it resulted in narrowing the gender gap at the economic front but increased the number of lower – paid, part time job.

Women’s Economic Contribution – In Present Century –

In the present century average age of marriage and childbirth has increased the opportunity to work for women. Also, small family configuration and the mechanization of many domestic works has also enabled the women to work outside and contribute to the economy. The women movement of the 1960s and 1970s has encouraged many women throughout the world to enter the labor market for personal fulfillment, economic freedom and to gain legal equality with men. Contemporary women’s prerequisite is ‘economic independence’.

Economic Freedom: Still a Dream?

Does a woman enjoying an economic freedom in the true sense? It’s still a question which often remains unanswered because while choosing and performing ‘economic activity’ gender inequality at work often comes as an unpalatable reality. Women still experience a number of inequalities in the labor market.

These inequalities can be mainly categorize in the following three types –

· Occupational Segregation – women are often considered for subordinate jobs and poorly paid jobs like secretarial jobs, social work, child care, teaching, etc. Even if they get selected for higher jobs like Doctor, Engineer, Professor, etc their promotional aspects becomes a challenge at times due to the gender bias mindset of the system. Women in a system always gets jobs with little authority while men occupy the top most position.

· Part – time work – due to flexibility in working hours many women choose part – time jobs. This facility is widespread in many fields like IT, teaching, etc. It provides economic independence to women along with permitting supervision of home and children. But this limit their career growth and job surety.

· Wage – gap – in many private institutions like schools, colleges, hospitals, etc it has been seen that women and men are being paid different salaries. Even in real estate women labor are paid a lesser amount than men employed for the same job as them. The pay gap differs by sector, with the widest gap – 55% in the financial sector (Fawcett Society, 2011).

Women’s contribution to the world’s population is about 50% but their contribution in economic activities is far too less. Labor market across the world remains divided along gender lines and gender equality seems to be suggested but unaccepted reality. What is the reason? ‘Skill’ is said to be the main reason behind this gender inequality in the workplace. This is indeed a complex issue because as a feminist researcher has argued, what is called ‘skill’ is a socially constructed and subject to change (Steinberg 1990).

Many feminist have discarded this plea of segregation due to ‘skilled’ and ‘unskilled’ minds. In the Millennium Declaration ILO (International Labor Organization) gave the phrase ‘decent and productive work’ which has been described as – equal opportunities for men and women to obtain decent and productive employment in conditions of freedom, equity, security and human dignity (ILO, Decent Work Country Programmes Guidebook). Ensuring equal rights, equal power and equal voice in decision making policies is a challenging task and discrepancies between the policies for women at workplace and its proper implementation at ground zero is one of the main reasons of economic disparity worldwide.

Women and Economy: Vision India

In India, women remained an integral part of economic activities since human civilization but unfortunately, our female fraternity was stamped as ‘caring industry’ that ought to take care of family members. This prejudice has pruned the women’s right to equality at all levels. Inspite of feminist movements, women’s movement and National Commission for Women (NCW) which came into being in January 1992, achievement of ‘goal of equality’ at socio – economical and political front is still a challenge for the country. The main reason behind this short – coming is – intention to bring about the change in social structure gets defeated due to socio – political supremacy of male counterparts. Data available with ILO highlights the existence of age old norms of ‘male dominated society’, where females are discouraged to seek a job outside their homes. According to ILO’s data, between 2004 to 2011, when the Indian economy grew at a healthy average of about 7%, there was a decline in female participation in the country’s labor force from over 35% to 25%. Surprisingly, access to education for Indian Women is inversely proportional to their enrolment for employment. (Hindustan Times, March 8, 2016). Such kinds of facts hints towards the lacunae, inadequacies, or shortcomings in our legislative measures on the planning.

Impact of Globalization

Globalization has certainly increased the opportunity for women with increased interdependence, interconnectedness and cross – cultural exchange but this has benefited only to urban and educated women and marginalized the rural workforce. On one hand, globalization has extended the economical horizon of women but at the same time, it has eroded the spirit of rural and informal sectors like farmers, artisans etc. However, globalization has led to the improvement of wages of laborers, and great feminization of the workforce but its impact is yet to be ascertained, specially on the rural socio – economical structure.

The effect of globalization and modernization can be seen in India’s present economic structure where female participation in financial, social, judiciary, academics and defense services is quite encouraging but these achievements are restricted to the small and mainly urban selection of women.

NSSO VS ILO: Fact Findings

According to NSSO (National Sample Survey Office) in 1999 – 2000, 35% of rural women and 17% girls (over 15 yrs old) were working as regular or casual wage workers, self – employed or unpaid helpers in family enterprises. By 2011 – 12, after a period of rapid economic growth, this has declined to 25% in rural areas and remained at the same low rate in urban areas. However, this figure excluded some of the works which contribute to the economy but does not get recognition as ‘economic activity’. According to ILO’s (International Labor Organization) new definition of work adopted in 2014, Women Workforce Participation rate in 1999 – 2000 increases to a whopping 89% in rural areas and only declines to 85% in 2011 – 12 (due to more enrolment in education among 15 – 24 age group). In Urban areas, the participation rate increases to 81% in the year 2011 – 12 ILO research further suggests that the above gradual decline in later years (2011 – 2012) is not actually a decline but a shift from paid to unpaid work due to loss of agency or family and societal constraints (The Guardian, July 16, 2016)

Economic Autonomy –

If we look at the social status of the women with special reference to her economical autonomy, surely their position has improved drastically from the mid – nineteenth century women of present day’s society (especially urban society) have harnessed the power of “self governance”. Though in rural areas the situation is still not appreciable because in villages and smaller cities governing power is still in the hands of men even if their women have included in economic activities. The women’s movement and globalization has changed the socio – political environment of women in India. Wider acceptance of women’s rights, gender equality etc. has been seen in present India, still, the change is at a gradual pace and limited to benefit the upper, middle and lower middle class women in society. SEWA (Self Employed Women’s Association) and some other women union are trying hard to extend the limit of opportunities to rural areas also so that the rural women workforce can also be roped in women empowerment programmes by providing them private space of earning and spending. Under SEWA 60,000 poor women could be employed to contribute to the Indian economy.

According to the IMF report on women workers in India, female labor force participation rates vary between urban and rural areas. It has been mentioned in the report that women working force participation is more in rural areas as compared to urban areas. The reason given is with very high education but the percentage of women workforce in those jobs is minimal as compared to the population of women in India.

Source: NSS Employment and Unemployment Surveys and IMF staff calculations.

There is also growing the gap in participation between male and female labor force in India. These gender gaps in participation are more in urban areas, which is 45% approximately. The reason given behind it is when the wage increases in male’s salary the participation rate of female decreases in the family. (IMF/ Working Paper/Asia Pacific Department, March, 2015).

Challenges and solutions –

The journey of civilization has travelled from pre – industrial area and after passing through the industrial area now it has reached to the information age where the economy is also known as ‘knowledge economy’ where the workforce is needed for marketing, sales, designs apart from physical production and distribution of goods. Ironically India inspite of having 15% of global population and 48.5% women population (as compared to men population of India) its economy is still having a 6th ranking at the global level. One of the main reasons of it is undoubtedly ‘gender inequality’ in all economic sectors. Much has been done at all levels to bridge the gender gaps but inequalities in life start with the socio – economic condition and mindset of people and society. In other words, inequality begins at home with discrimination between female and male child). So the government must ensure ‘education and awareness’ programmes for the people of the nation, irrespective of the proximity of the area. A paradigm shift at socio – political level is needed to develop more relevant economic policies to generate equal opportunities for the female fraternity. The challenge to meet does not lie in the quantum of expenditure but the position of policy.

Social Security -

Crime against women is not new. The latest statistics are released by National Crime Records Bureau (NCRB) show that nationwide crimes against women in our country have increased by 7.1% since 2010 (Times of India, Aug 27, 2013). Social insecurity is the major deterrent of women independence and participation in economic activities especially outside the home.

Illiteracy

The problem of illiteracy among women in our country is worse though sex differentials have narrowed down. The absolute number of female illiterate has gone down during 2010 – 2011 but is still high as compared other countries. Inspite of constitutional commitment of right to education and so many educational schemes implemented by our government (National Adult Educational Programme, Rural Functional Literacy Programme etc), the aim of education for women is yet to be realising in its correct perspective.

Employment Access -

Government has launched many urban and rural development schemes like Mission Antyodaya, MGNREGA, SWAYAM, SANKALP, National Skill Development Mission but the lack of information deprives the aspirants from the access to opportunity of availing such facilities to empower themselves.

Gender Wage Gap –

Though the gender wage gap is shrinking in India but still in the unorganized or organized market, women earn much less (upto 56% less) than the same colleagues performing the same work.

Effects of Household income –

Women’s economic independence often gets curbed due to average household income because as the family income increases women’s participation in the labor market tends to decrease (specially in the rural area).

Concentration in low paid – Undervalued Job –

Women are preferred in cleaning, catering, caring and clerical work which neither gives them recognition nor the economic independence.

Gap between Providers and Seeker –

In present information age it is just an unfortunate reality that Government on its part has launched many schemes to provide economic independence to women through SIDO, DIC, SIDBI, commercial banks, NABARD and cooperative societies which are meant to provide financial support for entrepreneurship but due to lack of information about these welfare schemes most of the section of women remain deprived of all these opportunities. Also due to the complicated procedure and dearth of credits in these financial institutions transactions becomes almost impossible.

India became the fastest major economy in the world in 2015 – 2016 and registered a growth rate of 7.6% (the first advance estimates of GDP released by CSO. If India could increase women labour force participation by resolving the gender issue of its male chauvinistic society, then it can increase women labor force participation by 10% (68 million) more women by 2025 and that could increase its GDP by 16% (Catalyst, Nov 15, 2015).

The pre – requisite for economic empowerment of women in an accessible comprehensive policy which can encourage the women of all sections of society to come forward to the labor market and contribute to the economy and attain their birth right of economic independence which is the other name of women empowerment in the true sense.

Domestic Division of Labor

Though the society all over the world has moved towards more egalitarian relationships major part of the society of India is still having a patriarchal society where all power of independence is with men fraternity. In such a societal structure economic independence of women remains ‘dependent’ on men. However, a change is being felt in the urban sociological structure where traditional family patterns are being renegotiated but its pace is too slow and restricted upto urban boundaries only.

Automation of Work

Due to the installation of automated or programmable machineries in most of the industries and other workplaces, the need for human workforce has been reduced. This further hampered the women employment because such works demand fewer and skilled workforce hence men are preferred over women for such jobs. In a survey done by ‘Catalyst’ it is found that overall labor force participation rate for women in India is falling from 37 percent in 2004 – 05 to 29 percent in 2009 – 10 (Catalyst, Nov 17, 2015).

Conclusion

India, in spite of being emerging as a fast growing economy on the global map, is still facing void due to unequal participation of male and female citizens of the country in its economic contribution. India is keeping an appreciable pace with globalization also through its socio – economic contributions. The only untenable fact is that in spite of the plethora of opportunities, availabilities and talents, India’s women workforce is still struggling hard to attain economic independence. There is no dearth of ideas or statistical analysis of gender inequality at the economic front but the need of the hour is to find effective solutions through a proactive approach and user friendly policies. The policy is needed to encourage the women fraternity to overcome the stereotype mindset of our socio - economic system and reorient their minds to fetch the equal share of ‘economic independence’.

Abbreviation

IMF – International Monetary Fund

SDN – Software Defined Networking

ILO – International Labour Organization

NCW – National Commission for Women

NSSO – National Sample Survey Office

SEWA – Self Employed Women’s Association

NCRB – National Crime Record Bureau

MGNREGA – Mahatma Gandhi National Rural Employment Guarantee Act

SWAYAM – Study Webs of Active Learning for Young Aspiring Minds

SANKALP – Skill Acquisition and Knowledge Awareness for Livelihood Promotion Programme

SIDO – Small Industries Development Organization

DIC – Deposit Insurance Corporation

SIDBI – Small Industries Development Bank of India

NABARD – National Bank for Agriculture and Rural Development

GDP – Gross Domestic Product

CSO – Central Statistics Office

ONS – Office of National Statistics

Reference

“Decent Work Country Programme Guidebook”, International Labour Organization, ILO, 1996 – 2016.

Giddens Anthony and Griffiths Simon, Sociology, Polity, cop. 2006.

UK Standard Industrial Classification of Economic Activities, ONS, 2003.

“World of Work Report 2014”, International Labour Organization, ILO, 1996 – 2017.

Das Sonali, Chandra – Jain Sonali, Kochhar Kalpana and Kumar Naresh, “Women Workers in India: Why So Few Among So Many?” IMF Working Paper, International Monetary Fund, 2015.

“Women in Leadership”, Catalyst – Changing Workplace. Changing Lives, Nov 17, 2015.

1 note

·

View note

Text

FinTech: Is This Set To Poise As A Neo-Banking Or Is Only The Noise?

Guess everyone knows by now – what is FinTech?

FinTech is a buzzword that has been constantly making the right noise in technology, investments and start-up circles since last two decades. Investors across the globe are following it close on their heels. We have extreme views of experts believing that this would put an end to the traditional banking on one hand to forming a new tech bubble on the other! However, given the adoption of FinTech services globally and the investments being pumped up by global firms, instil a huge confidence in the potential prospect of this industry & its applications. FinTech has given rise to a start-up scene of over 4,000 firms with business models that span across lending, payments, personal finance, remittance, investments, securities trading and savings. Its importance was reinforced during the global financial crisis of 2008 that highlighted the inefficiencies in the banking system and prodded the tech industry to understand and take advantage of the numerous opportunities presented by the financial world. FinTech has helped digitize the financial sector, reshaping businesses and transforming the way consumers use and manage money. Prominent FinTech brands in the industry include Bitcoin, LendingCLub, PayPal, Tencent, Check, OnDeck, Future Advisor, FundBox and Kreditech, among others.

What is the investment outlook by 2020? Currently, who are the leading investors?

According to Goldman Sachs, the FinTech sector promises a pot of revenues to the tune of US$4.7 tn that investors across the globe are hitting on. Investors are pouring in billions of dollars into financial start-ups across the globe and have in fact quintupled their investments, from US$4 bn in 2013 to US$20 bn in 2015; and are expected to grow to US$46 bn by 2020, on the back of further advancements in technology and innovative financial products. Investor groups, across segments, have exhibited interest in the sector, with venture capital firms contributing 24% to the total investments, private equity firms 15%, angel investors 12% and corporate & other investors 49%. Few investors (and their investments) that have hit the spotlight include SoftBank (SoFi), Baseline ventures (Millenial Personal Finance), Alibaba (PayTm), General Atlantic (Avant), Google (Symphony), Intel (IntelSee), Salesforce (SalesForce Financial Services Cloud), JP Morgan Chase (Bunker), Master Card (Pinpoint-loyalty provider) and Pingan (Lufax). The frontrunners in attracting these investments, as of Jan 2016, were payments/loyalty/Ecommerce firms (51%), followed by Banking/Lending firms (41%). The remaining share of investments (8%) has been made in securities/capital markets, wealth management, financial BPOs, financial management, insurance technology, and FinHCIT companies.

But what has convinced so many investors for betting their money in FinTech firms?

The emergence of new technologies such as Blockchain (public ledger account for Bitcoin transactions), Internet of Things (IoT), machine learning or artificial intelligence (AI), cloud-based solutions, Big-data and the increased coverage expansion of mobile apps has turned the traditional model of financing on the head and is driving financial innovation. It has eased monetary transactions, ensured faster processing, reduced documentation requirements, improved risk management, made investments easier and reduced the cost of financial services. The internet savvy young population has supported greater usage of card payment methods, higher smartphone penetration, online payments and at the Point of sale terminals transactions. Such a change in consumer behaviour is driving a myriad of advancements in FinTech.

Another key driver for FinTech start-ups is the rise of Small & Medium Enterprises (SMEs), which are constantly in search for adequate low-cost funds and need customized solutions for processing merchant card payments, supply chain financing, and credit & expense management. The lower interest rates charged by the online lending platforms such as Peer to Peer lending and CrowdFunding, has made it attractive for SMEs to borrow money from these platforms. The lower cost and higher returns offered by FinTech services is due to absence of significant hurdles and overhead costs that traditional banks are subject to. For instance, Prosper, a P2P lending platform offers average returns of ~7%, while it is only ~1-2% for deposit holders in a traditional US bank.

Each of the sub-segments of FinTech has shown exponential growth in the past few years. According to a global survey conducted by Business.com in 2015, nearly 30% individuals with smartphones prefer using mobile payment services over cash or card transactions. Bitcoin, another major sub-segment of FinTech is changing the way we use currency. As of 2015, nearly 6 million people across the globe used Bitcoin for various transactions for its faster processing and higher security associated with its usage. Similarly, other segments like payments, money lending, roboadvisors etc. offer unmatched opportunity for investors. We will be discussing more on each of these sub-segments in this blog series. We leave you with a quick list of services or sub-segments of FinTech. Watch out for our next post!

Source: ValueAdd

This article is authored by Girish Bhise (Founder & CEO of ValueAdd) About The Author: Girish has over 15 years of research experience across investment banking, equity research, fixed income and credit research, and business strategy research for large global clients including asset management firms, investment banks, brokerage firms, corporations, private equity & venture capital firms. Has extensive experience in successfully managing large-scale research right-shoring transitions across multiple regions. Is a thought-leader in the global research & technology industry. He is an MBA with specialization in Finance from the University of Pune, and Bachelor in Commerce from the University of Mumbai.

Please share your feedback/comments/thoughts on [email protected]. Thank you for time.

", "wordcount": "919", "publisher": { "@type": "Organization", "name": "ValueAdd Research and Analytics Solutions ", "logo": { "@type": "ImageObject", "url": "https://www.valueadd-research.com/wp-content/uploads/2016/04/FinTech.png", "width": 600, "height": 60 } }, "url": "https://www.valueadd-research.com/fintech-set-poise-neo-banking-noise/", "datePublished": "2016-04-23", "dateCreated": "2016-04-23", "dateModified": "2016-04-23", "articleBody": " Guess everyone knows by now – what is FinTech?

FinTech is a buzzword that has been constantly making the right noise in technology, investments and start-up circles since last two decades. Investors across the globe are following it close on their heels. We have extreme views of experts believing that this would put an end to the traditional banking on one hand to forming a new tech bubble on the other! However, given the adoption of FinTech services globally and the investments being pumped up by global firms, instil a huge confidence in the potential prospect of this industry & its applications. FinTech has given rise to a start-up scene of over 4,000 firms with business models that span across lending, payments, personal finance, remittance, investments, securities trading and savings. Its importance was reinforced during the global financial crisis of 2008 that highlighted the inefficiencies in the banking system and prodded the tech industry to understand and take advantage of the numerous opportunities presented by the financial world. FinTech has helped digitize the financial sector, reshaping businesses and transforming the way consumers use and manage money. Prominent FinTech brands in the industry include Bitcoin, LendingCLub, PayPal, Tencent, Check, OnDeck, Future Advisor, FundBox and Kreditech, among others.

What is the investment outlook by 2020? Currently, who are the leading investors?

According to Goldman Sachs, the FinTech sector promises a pot of revenues to the tune of US$4.7 tn that investors across the globe are hitting on. Investors are pouring in billions of dollars into financial start-ups across the globe and have in fact quintupled their investments, from US$4 bn in 2013 to US$20 bn in 2015; and are expected to grow to US$46 bn by 2020, on the back of further advancements in technology and innovative financial products. Investor groups, across segments, have exhibited interest in the sector, with venture capital firms contributing 24% to the total investments, private equity firms 15%, angel investors 12% and corporate & other investors 49%. Few investors (and their investments) that have hit the spotlight include SoftBank (SoFi), Baseline ventures (Millenial Personal Finance), Alibaba (PayTm), General Atlantic (Avant), Google (Symphony), Intel (IntelSee), Salesforce (SalesForce Financial Services Cloud), JP Morgan Chase (Bunker), Master Card (Pinpoint-loyalty provider) and Pingan (Lufax). The frontrunners in attracting these investments, as of Jan 2016, were payments/loyalty/Ecommerce firms (51%), followed by Banking/Lending firms (41%). The remaining share of investments (8%) has been made in securities/capital markets, wealth management, financial BPOs, financial management, insurance technology, and FinHCIT companies.

FinTech Chart

But what has convinced so many investors for betting their money in FinTech firms?

The emergence of new technologies such as Blockchain (public ledger account for Bitcoin transactions), Internet of Things (IoT), machine learning or artificial intelligence (AI), cloud-based solutions, Big-data and the increased coverage expansion of mobile apps has turned the traditional model of financing on the head and is driving financial innovation. It has eased monetary transactions, ensured faster processing, reduced documentation requirements, improved risk management, made investments easier and reduced the cost of financial services. The internet savvy young population has supported greater usage of card payment methods, higher smartphone penetration, online payments and at the Point of sale terminals transactions. Such a change in consumer behaviour is driving a myriad of advancements in FinTech.

Another key driver for FinTech start-ups is the rise of Small & Medium Enterprises (SMEs), which are constantly in search for adequate low-cost funds and need customized solutions for processing merchant card payments, supply chain financing, and credit & expense management. The lower interest rates charged by the online lending platforms such as Peer to Peer lending and CrowdFunding, has made it attractive for SMEs to borrow money from these platforms. The lower cost and higher returns offered by FinTech services is due to absence of significant hurdles and overhead costs that traditional banks are subject to. For instance, Prosper, a P2P lending platform offers average returns of ~7%, while it is only ~1-2% for deposit holders in a traditional US bank.

Each of the sub-segments of FinTech has shown exponential growth in the past few years. According to a global survey conducted by Business.com in 2015, nearly 30% individuals with smartphones prefer using mobile payment services over cash or card transactions. Bitcoin, another major sub-segment of FinTech is changing the way we use currency. As of 2015, nearly 6 million people across the globe used Bitcoin for various transactions for its faster processing and higher security associated with its usage. Similarly, other segments like payments, money lending, roboadvisors etc. offer unmatched opportunity for investors. We will be discussing more on each of these sub-segments in this blog series. We leave you with a quick list of services or sub-segments of FinTech. Watch out for our next post!

Fintech Subseg new (3) Source: ValueAdd

This article is authored by Girish Bhise (Founder & CEO of ValueAdd) About The Author: Girish has over 15 years of research experience across investment banking, equity research, fixed income and credit research, and business strategy research for large global clients including asset management firms, investment banks, brokerage firms, corporations, private equity & venture capital firms. Has extensive experience in successfully managing large-scale research right-shoring transitions across multiple regions. Is a thought-leader in the global research & technology industry. He is an MBA with specialization in Finance from the University of Pune, and Bachelor in Commerce from the University of Mumbai.

Please share your feedback/comments/thoughts on [email protected]. Thank you for time.

", "author": { "@type": "Person", "name": "ValueAdd Research and Analytics Solutions Editorial team" } }

0 notes

Text

Scope of Management and Career Opportunities

Every company or organisation wishes to profit from the operations they carry out. Companies require skilled professionals in order to run their businesses successfully and profitably. These professionals, also known as managers, supervise the entire department they are in charge of and ensure the smooth operation of the department’s overall infrastructure. They work to achieve the best results and profits for the company, as well as to provide the best solutions to any problems that arise. Because management is at the heart of all businesses, a career in management is highly desirable for young graduates in the country and a popular choice among them.

The future scope of management is expanding all the time

The management sector is divided into several departments, each of which is equally important. Any of these sectors can be chosen to have a rewarding and fulfilling career in management. These industries are as follows:

Marketing Management– Masters degree in marketing management field is concerned with advertising and developing strategies to increase the company’s public reach.

Finance Management– Finance management is concerned with the management of the company’s financial assets. It also focuses on increasing revenue for the company in order to achieve better results.

Production Management– This department, also known as Production and Operation Management, is in charge of industrial processes, planning, and control. This ensures that the transaction runs smoothly at all levels.

Human Resource Management- Human Resource Management (HRM) is a comprehensive and strategic approach to managing the workplace environment, culture, and people.

Personnel Management– This type of management is concerned with hiring, utilising, developing, and retaining employees in order for them to become increasingly valuable to the company. It aids in the retention of a satisfied workforce.

Office Management– Office management is in charge of all of the tasks and operations that go into running a business. In other words, it is concerned with administrative management.

Inventory Management– The primary focus of Inventory Management is the maintenance, management, and stocking of goods for the inventory.

Banking Management– This management field is concerned with the company’s commerce. The management section includes investment, taxation, seed funding, and fund management.

Management Career Opportunities

There are multiple career options in the management sector offers after you complete an MBA. An MBA is without a doubt one of the best degrees for increasing your chances of landing a high-level management position in a reputable company. It boosts and advances your career like no other postgraduate degree, and it helps you broaden your job opportunities in fields such as finance, operations, human resources, marketing, and many more.

Because there are many sectors in the management domain, and each sector offers a plethora of job opportunities, here is a list of jobs you can pursue after graduation if you want to advance your career in management.

Marketing Manager Management Consultant Investment Banker Business Analyst Financial Advisor Administrative Manager Human Resource Manager Product Manager Operations Manager IT Manager You may be interested in the following MBA management specialisations:

An MBA in finance will prepare you to work in asset management, treasury, corporate finance, credit risk management, private equity, corporate banking, hedge fund management, credit risk management, sales and trading, and other areas.

MBA in Business Analytics will open doors to positions such as data scientist, business analyst, IT analyst, healthcare analyst, computer systems analyst, and market research analyst. It will train you to be an expert in E-commerce, financial institutions, and information technology. A master’s degree in human resource management opens the door to senior positions such as staffing director, compensation manager, placement manager, technical recruiter, HR generalist, and employee relations manager.

An MBA in marketing will prepare you to be a product and brand management expert, as well as a retailing and advertising management expert. It will provide employment opportunities in competitive marketing, analytical marketing, customer relations marketing, online marketing, and business marketing.

An MBA in Information Technology will provide a lucrative management career with positions such as business analyst, project manager, system manager, analytics manager, marketing manager, data processing manager, and business development executive or manager.

Because management positions and responsibilities frequently overlap, you’ll need to pursue an MBA that takes a flexible approach and covers almost all topics so that you can master multiple management domains. Britts Imperial in Management MBA courses can prepare you for a career boost in any direction you desire.

The future scope of management appears to be very promising. With management being one of the most in-demand career paths in the decade, it is critical to sharpen one’s skills and keep up with modern developments and advancements in the field.

Pursuing an MBA programme, such as the PG Progam in Management, can lead to a variety of job opportunities and a significant salary increase. While deciding on a post-graduate programme can be difficult, an MBA is a safety net on which you can always rely. An MBA graduate is preferred over all other graduates for managerial positions because they add significant value to any organisation.

Britts Imperial University College

N Block, Sharjah Publishing City Free Zone, Sharjah, UAE

971(06)7675511

0 notes

Text

Matthew Kissner, President & CEO of Wiley – Interview Series

New Post has been published on https://thedigitalinsider.com/matthew-kissner-president-ceo-of-wiley-interview-series/

Matthew Kissner, President & CEO of Wiley – Interview Series

Matthew Kissner is Wiley’s 15th President and CEO, a role he’s held since July 2024. He has been with Wiley in a leadership, board, or consulting role for over 20 years, including as Group Executive and Board Chair. He also served previously as Interim CEO in 2017 and 2023-2024.

His extensive experience includes leadership positions with Pitney Bowes, Bankers Trust, Citibank and Morgan Stanley, and he has been a private equity operating partner focusing on business, financial and healthcare services.

Matt is also a member of the Board Executive Committee of the Regional Plan Association, a non-profit urban research and advocacy organization. Matt earned both a Bachelor of Science in Education and Master of Business Administration from New York University.

Wiley, founded in 1807, is a global leader in research and education, providing innovative solutions and services that help individuals tackle the world’s most pressing challenges. With a rich history spanning over two centuries, Wiley produces books, journals, and encyclopedias in both print and electronic formats, alongside a wide range of online products, services, training materials, and educational resources for undergraduate, graduate, and continuing education students.