#mortgage data entry process

Explore tagged Tumblr posts

Text

KYC Banking Form Filling Auto Typing Software | Auto Typing Software for KYC Banking Data Entry

KYC Banking Form Filling Auto Typing Software is a very helpful application which automates your whole process with 100% accuracy. In this KYC Banking Data entry work, company will provide encrypted images(which will be opened only in the data entry software). We will decrypt them and then convert into excel format. WORKING PROCESS:- Here KYC Banking data entry company will provide encrypted images which are opened only in the KYC Banking data entry software we will decrypted these images After that we have converted those decrypted images into excel format After that we will start auto typing process Opening KYC Banking form filling auto typing software selecting the KYC banking pattern and upload the converted excel file into the form filling auto typing software simply choose form number, click on begin and place the cursor in the first field of KYC Banking data entry software within 3 seconds automation process started

youtube

BPO Conversions Email:- [email protected] Contact No:- +91 96187 21254 Website: https://mortgageformfillingautotyper.com/ https://kycformfillingautotyper.com/ https://autoformfillersoftware.com/ https://autoformfillersoftware.com/health-insurance-form-filling-auto-typer-software https://autoformfillersoftware.com/kyc-auto-form-filler-software/ https://autoformfillersoftware.com/health-insurance-form-filling-auto-typer-software/ https://autoformfillersoftware.com/matrimonial-auto-form-fillup-software/ https://autoformfillersoftware.com/server-360-auto-form-filler-software/ https://autoformfillersoftware.com/financial-management-process-auto-form-filler-software/ https://autoformfillersoftware.com/cargo-auto-form-filler-software/ https://autoformfillersoftware.com/medical-insurance-auto-form-filler-software/ https://autoformfillersoftware.com/us-hospital-entry-auto-form-filler-software/ https://autoformfillersoftware.com/twinq-auto-form-filler-software/ https://autoformfillersoftware.com/mortgage-auto-form-filler-software/ Playlist:-https://www.youtube.com/watch?v=f66k1HUh3zY&list=PL0YD_PED4aqdrZtrnQr0e1gTN_KFmFarG&pp=gAQB

0 notes

Text

The Complete Guide to Mortgage Broker Outsourcing: What You Need to Know

Running a mortgage broking business can feel like a constant juggling act. Between handling client calls, submitting applications, following up with banks, and staying on top of compliance, it’s easy to get overwhelmed. This is where mortgage broker outsourcing becomes a game-changer. It’s not about giving away control, it’s about freeing up your time so you can focus on growth and client service. If you're considering outsourcing but not sure where to begin, this guide will walk you through what it means, what you can delegate, and how it helps increase mortgage broker efficiency without adding stress.

What Is Mortgage Broker Outsourcing?

In simple terms, it means hiring someone outside your business to take on specific tasks. Most often, this is a remote assistant or team that understands mortgage operations and industry tools. These are not general virtual assistants. Many providers specialize in broking support and know the process inside out — from submitting loans to handling CRM updates. You're not handing things off to a stranger; you’re adding skilled support where you need it most.

Why Are Brokers Turning to Outsourcing?

The short answer? Because time is limited. Even the most experienced brokers find themselves buried in repetitive admin work. That’s time you could be spending building client relationships or exploring new leads. Here’s what outsourcing can help you do: ● Save hours each week by removing manual tasks from your plate. ● Avoid hiring full-time staff when part-time or task-based help is enough. ● Reduce stress and improve workflow without overcomplicating operations. ● Scale up confidently when your support system is already in place. What Can You Outsource? You may be surprised how much you can delegate without losing control. Here are common tasks brokers outsource, along with how each one helps: ● Loan submissions and document preparation A remote expert can handle file lodgements, review documents for accuracy, and get your applications submitted faster. ● Application data entry Instead of re-entering client details into systems, let a trained assistant do it correctly the first time. ● Tracking loans and updating files Outsourced staff can follow up with lenders, check progress, and keep your CRM up to date so nothing slips through. ● Client follow-ups and reminders Whether it’s chasing ID documents or confirming appointments, these routine communications can be managed externally. ● Ordering credit reports and basic checks You can have someone pull reports and check key information so you’re ready to assess a file quickly. ● Compliance assistance Keep everything audit-ready with help managing checklists, notes, and document storage. Each of these helps you increase mortgage broker efficiency without adding complexity. The Tech Makes It Easy All thanks to cloud platforms, secure CRMs, and shared task tools, it’s never been easier to work with remote support. Most virtual assistants or service providers can plug directly into your workflow. You don’t need to change your systems. Just make sure your partner is comfortable working with the ones you already use. How to Start (Without Getting Overwhelmed) If you’re new to outsourcing, ease into it. Pick one task - like data entry or file tracking and try delegating that first. Here are a few simple tips: ● Choose someone with mortgage experience so they understand lender policies and documentation. ● Set clear instructions upfront so everyone’s on the same page. ● Make sure they use secure systems to protect your client data. ● Give it a couple of weeks to work through the learning curve. Start small, then expand once you feel confident in the partnership. Why It Works for Long-Term Once you’ve built a reliable outsourcing process, it becomes a natural part of how you operate. Files move faster. Clients get answers sooner. You get more time to focus on big-picture work. It’s not just about saving time today. It’s about building a business that can grow without burning you out. Final Thoughts. You don’t have to do everything yourself to run a successful brokerage. In fact, trying to do it all might be holding you back. With mortgage broker outsourcing, you gain a trusted support system that lets you work smarter, not harder. And when you remove the busywork, you’ll find it much easier to increase mortgage broker efficiency and stay focused on what matters most — your clients and your goals. If you’re ready to see how outsourcing can help your business, visit Loan Processor to learn more.

0 notes

Text

The Complete Guide to Mortgage Broker Outsourcing: What You Need to Know

Running a mortgage broking business can feel like a constant juggling act. Between handling client calls, submitting applications, following up with banks, and staying on top of compliance, it’s easy to get overwhelmed. This is where mortgage broker outsourcing becomes a game-changer. It’s not about giving away control, it’s about freeing up your time so you can focus on growth and client service. If you're considering outsourcing but not sure where to begin, this guide will walk you through what it means, what you can delegate, and how it helps increase mortgage broker efficiency without adding stress.

What Is Mortgage Broker Outsourcing?

In simple terms, it means hiring someone outside your business to take on specific tasks. Most often, this is a remote assistant or team that understands mortgage operations and industry tools. These are not general virtual assistants. Many providers specialize in broking support and know the process inside out — from submitting loans to handling CRM updates. You're not handing things off to a stranger; you’re adding skilled support where you need it most.

Why Are Brokers Turning to Outsourcing?

The short answer? Because time is limited. Even the most experienced brokers find themselves buried in repetitive admin work. That’s time you could be spending building client relationships or exploring new leads. Here’s what outsourcing can help you do: ● Save hours each week by removing manual tasks from your plate. ● Avoid hiring full-time staff when part-time or task-based help is enough. ● Reduce stress and improve workflow without overcomplicating operations. ● Scale up confidently when your support system is already in place. What Can You Outsource? You may be surprised how much you can delegate without losing control. Here are common tasks brokers outsource, along with how each one helps: ● Loan submissions and document preparation A remote expert can handle file lodgements, review documents for accuracy, and get your applications submitted faster. ● Application data entry Instead of re-entering client details into systems, let a trained assistant do it correctly the first time. ● Tracking loans and updating files Outsourced staff can follow up with lenders, check progress, and keep your CRM up to date so nothing slips through. ● Client follow-ups and reminders Whether it’s chasing ID documents or confirming appointments, these routine communications can be managed externally. ● Ordering credit reports and basic checks You can have someone pull reports and check key information so you’re ready to assess a file quickly. ● Compliance assistance Keep everything audit-ready with help managing checklists, notes, and document storage. Each of these helps you increase mortgage broker efficiency without adding complexity. The Tech Makes It Easy All thanks to cloud platforms, secure CRMs, and shared task tools, it’s never been easier to work with remote support. Most virtual assistants or service providers can plug directly into your workflow. You don’t need to change your systems. Just make sure your partner is comfortable working with the ones you already use. How to Start (Without Getting Overwhelmed) If you’re new to outsourcing, ease into it. Pick one task - like data entry or file tracking and try delegating that first. Here are a few simple tips: ● Choose someone with mortgage experience so they understand lender policies and documentation. ● Set clear instructions upfront so everyone’s on the same page. ● Make sure they use secure systems to protect your client data. ● Give it a couple of weeks to work through the learning curve. Start small, then expand once you feel confident in the partnership. Why It Works for Long-Term Once you’ve built a reliable outsourcing process, it becomes a natural part of how you operate. Files move faster. Clients get answers sooner. You get more time to focus on big-picture work. It’s not just about saving time today. It’s about building a business that can grow without burning you out. Final Thoughts. You don’t have to do everything yourself to run a successful brokerage. In fact, trying to do it all might be holding you back. With mortgage broker outsourcing, you gain a trusted support system that lets you work smarter, not harder. And when you remove the busywork, you’ll find it much easier to increase mortgage broker efficiency and stay focused on what matters most — your clients and your goals. If you’re ready to see how outsourcing can help your business, visit Loan Processor to learn more.

1 note

·

View note

Text

Why Becoming a Life Insurance Agent Is a Career with Purpose and Potential

In today’s world of uncertain financial and health risks, the role of a life insurance agent has never been more important. Life insurance is not just a policy—it’s a promise of protection, a financial safety net, and peace of mind for families. Behind every policy is a person who made that promise possible: a life insurance agent.

If you're considering a career that allows you to help others while achieving personal and professional success, becoming a life insurance agent could be the perfect path.

What Does a Life Insurance Agent Do?

A life insurance agent works with clients to assess their financial needs and recommend suitable life insurance plans. These agents serve as trusted advisors, helping individuals and families choose policies that will protect their loved ones in times of crisis.

Typical responsibilities include:

Consulting clients on coverage needs

Explaining policy options and benefits

Processing applications and policy servicing

Assisting with claims and updates

Building long-term client relationships

Why Choose a Career as a Life Insurance Agent?

1. Make a Meaningful Impact

You’re not just selling policies—you’re protecting families. Your work ensures that children continue their education, mortgages are paid, and loved ones are cared for even in the absence of the primary earner.

2. Financial Growth and Freedom

Most insurance companies and brokers offer performance-based compensation. This includes:

Commission on every policy sold

Renewal bonuses

Incentives, awards, and even travel opportunities

There’s no income cap—you earn in direct proportion to your efforts.

3. Flexible Work Schedule

Whether part-time or full-time, life insurance offers flexible working hours. Many agents appreciate the autonomy to manage their time and workload.

4. Career Progression

Start as a certified agent, then grow into leadership roles like team leader, branch manager, or even start your own agency.

5. Low Entry Barrier

To become a licensed life insurance agent in India:

You must complete 15 hours of training from an IRDAI-approved institute.

Pass the IRDAI licensing exam.

Join a registered insurer or broker as an agent or POSP (Point of Sale Person).

Who Can Become a Life Insurance Agent?

Anyone with strong communication skills, a passion for helping others, and a drive to succeed can become a successful life insurance agent. It’s a great career for:

Students looking to earn part-time

Homemakers wanting flexible income

Retirees or mid-career professionals seeking a meaningful second career

Entrepreneurs and financial advisors expanding their service portfolio

Technology Makes It Easier Than Ever

With digital platforms and mobile apps, agents can now:

Compare policies across insurers

Submit applications online

Track commissions and client data

Provide real-time support to customers

Firms like Square Insurance offer cutting-edge tools and extensive training to help agents succeed from day one.

Final Thoughts

Becoming a life insurance agent is more than a job—it’s a mission. It’s about empowering others while building a financially rewarding and flexible future for yourself. Whether you're just starting your career or looking to switch paths, this role offers unmatched personal satisfaction and long-term growth.

Interested in becoming a certified life insurance agent? Visit www.squareinsurance.in or contact your nearest branch to get started today!

0 notes

Text

Importance of Mumbai Property Card for Real Estate Buyers

In Mumbai's dynamic real estate market, ensuring the authenticity and legality of property transactions is paramount. One critical document that facilitates this is the Mumbai Property Card. This official record provides comprehensive details about a property, serving as a vital tool for buyers, sellers, and investors alike.

What Is a Mumbai Property Card?

A Mumbai Property Card is an official document issued by the local municipal authorities that details essential information about a specific property. It includes data such as the property's location, area, ownership details, and any encumbrances or legal disputes associated with it. This document is crucial for verifying the legitimacy of property transactions and ensuring transparency in the real estate market.

Why Is the Property Card Important for Buyers?

Proof of Ownership: The property card serves as legal evidence of ownership, confirming that the seller has the right to transfer the property.

Verification of Property Details: It provides accurate information about the property's dimensions, location, and boundaries, helping buyers make informed decisions.

Detection of Encumbrances: The card reveals any existing liens, mortgages, or legal disputes tied to the property, protecting buyers from unforeseen liabilities.

Facilitates Loan Approvals: Financial institutions often require a property card when processing home loan applications, as it substantiates the property's legitimacy.

Essential for Legal Transactions: Whether registering the property or transferring ownership, the property card is a mandatory document in legal proceedings.

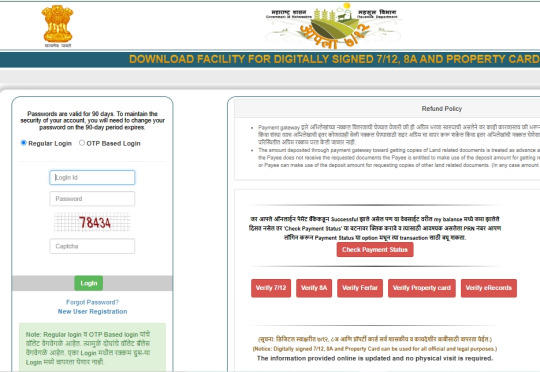

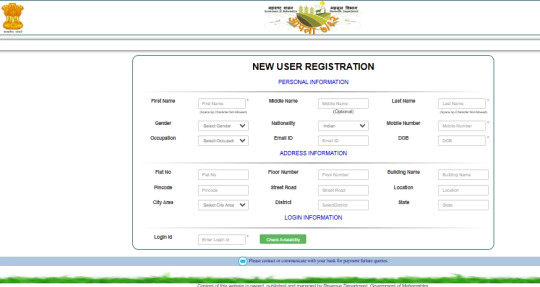

Applying for a Property Card Online

Online Method:

Access the Application Portal: Visit the Mumbai Suburban District’s official website

Navigate to Property Card Application: Look for the “Property Card Application” section.

You click the login box. Navigate to the next page.

Fill Out the Form: Complete the form with accurate details about the property and the applicant.

Submit the Application: Submit the filled application form along with the necessary documents to the designated office.

Offline Method:

Visit the local municipal office or the City Survey Office in Mumbai.

Fill out the application form for the property card.

Submit necessary documents, including proof of ownership and identification.

Pay the required fees.

Collect the property card upon notification.

Key Components of a Property Card

Survey Number: Unique identifier for the property.

Owner's Name: Details of the current registered owner.

Property Area: Exact measurements of the property.

Encumbrance Details: Information on any legal liabilities or disputes.

Mutation Entries: Records of ownership changes over time.

Conclusion

The Mumbai Property Card is more than just a document; it's a safeguard against potential legal and financial pitfalls in property transactions. For real estate buyers, ensuring the property's legitimacy through the property card is a step that cannot be overlooked. By understanding its importance and ensuring its verification, buyers can navigate Mumbai's real estate landscape with confidence and security.

1 note

·

View note

Text

Credit Application Automation: Save Time, Cut Costs, and Boost Accuracy

Banks spend millions processing loan applications the old-fashioned way. Loan officers manually review documents, calculate ratios, and make decisions one application at a time. This approach worked decades ago when volume was lower and expectations were different.

Today's customers expect instant responses. They apply for loans online and want answers within hours, not days. Meanwhile, banks struggle to keep up with application volume while maintaining accuracy and controlling costs.

Credit application automation offers a solution that addresses all three challenges simultaneously. Banks can process more applications faster, reduce operational costs, and make fewer mistakes.

The Cost of Manual Processing

Traditional loan processing requires significant human resources. A typical application takes 45 minutes to review when handled manually. During that time, a loan officer verifies income, checks credit history, calculates debt ratios, and evaluates collateral.

Banks pay loan officers well for their expertise. When these skilled professionals spend most of their time on routine data entry and calculations, the bank isn't getting full value from their salaries. The hourly cost of manual processing quickly adds up across thousands of applications.

Errors in manual processing create additional costs. Wrong calculations lead to poor lending decisions.

Approved loans that should have been declined often default, costing banks far more than the original loan amount. Rejected applications from qualified borrowers represent lost revenue opportunities.

Compliance costs also increase with manual processing. Banks must maintain detailed records for regulatory examinations. Paper files require physical storage space and are difficult to search when examiners need specific information. Staff time spent organizing and retrieving documents for compliance purposes adds to operational expenses.

How Automation Reduces Processing Time

Credit application automation transforms the review process from hours to minutes. Software reads digital applications instantly, extracts relevant data, and begins evaluation immediately.

No waiting for loan officers to become available or for documents to be manually entered into systems.

The technology performs multiple tasks simultaneously that humans must do sequentially.

While verifying employment through automated databases, the system also pulls credit reports, calculates financial ratios, and checks internal bank records. This parallel processing dramatically reduces total review time.

Routine applications that meet clear approval criteria can receive instant decisions. Customers submitting standard mortgage or auto loan applications often get preliminary approval before leaving the bank's website. This speed gives banks a competitive edge in markets where quick responses matter.

Complex applications still require human review, but automation handles the initial screening and data preparation.

Loan officers receive applications with calculations already completed and risk factors clearly identified. They can focus on making decisions rather than gathering information.

Cost Savings from Automated Processing

Labor represents the largest expense in traditional loan processing. Credit application automation reduces this cost significantly by handling routine tasks without human intervention. Banks can process more applications with existing staff or maintain current volume with fewer employees.

Technology costs money upfront, but operational savings develop quickly. Most banks recover their automation investment within 18 months through reduced processing costs. Larger institutions with high application volumes often see payback periods under one year.

Error-related costs drop substantially with automated processing. Mathematical mistakes become virtually impossible when computers handle calculations. Policy application becomes consistent across all applications, reducing the risk of compliance violations that result in regulatory fines.

Physical infrastructure costs decrease as banks rely less on paper documents. Storage space requirements shrink when records are kept electronically. Document retrieval costs disappear when files can be searched instantly using keywords or criteria.

Accuracy Improvements Through Automation

Human error rates in data entry typically range from 1% to 3% under normal conditions. During busy periods or when staff work overtime, error rates can climb much higher. Credit application automation eliminates these data entry mistakes entirely.

Mathematical calculations become perfectly accurate when handled by software. Debt-to-income ratios, loan-to-value calculations, and payment capacity assessments are performed consistently every time. Complex formulas that might confuse human reviewers are executed flawlessly.

Policy application improves with automation because software follows the same rules for every application.

Human reviewers sometimes interpret guidelines differently or make exceptions based on personal judgment. Automated systems apply criteria uniformly, ensuring consistent treatment for all applicants.

Document verification becomes more thorough with automation. The system can cross-reference information from multiple sources simultaneously. Income verification, employment confirmation, and asset validation happen instantly rather than taking days for manual verification.

Integration with External Data Sources

Modern credit application automation connects with numerous external databases to verify applicant information. Employment verification services, income databases, and asset verification systems provide instant confirmation of customer-provided data.

Credit bureau integration allows real-time access to updated credit scores and histories. The system can pull reports from multiple bureaus if needed and incorporate the most recent information into its decision-making process.

Bank account verification through third-party services confirms deposit accounts and transaction histories. This verification helps detect undisclosed debts or income sources that applicants might not have mentioned.

Risk Assessment Enhancement

Automated systems can analyze patterns in data that human reviewers might miss. The software examines relationships between different application elements and flags unusual combinations that warrant further review.

Fraud detection capabilities improve when automation processes applications. The system can quickly compare new applications against databases of known fraudulent submissions.

Suspicious patterns that develop gradually over time become visible when the software analyzes trends across many applications.

Credit scoring becomes more sophisticated with automation. The system can incorporate alternative data sources beyond traditional credit reports. Payment histories for utilities, rent, and other recurring expenses provide additional insight into applicant reliability.

Implementation Considerations

Banks need careful planning before implementing credit application automation. The system must integrate seamlessly with existing core banking platforms, loan origination systems, and customer relationship management tools. Poor integration can create bottlenecks that negate automation benefits.

Staff training requires attention during the transition period. Loan officers must learn how to work with automated systems and interpret machine-generated recommendations. Some employees may initially resist the change, preferring familiar manual processes.

Regulatory compliance becomes different, not necessarily easier, with automation. Banks must ensure their automated systems meet all applicable lending regulations. Decision logic must be transparent and explainable to regulators who examine the bank's processes.

System maintenance and updates require ongoing investment. Credit markets change, regulations evolve, and bank policies shift. The automation software must adapt to these changes through regular updates and refinements.

Measuring Success

Banks should establish clear metrics before implementing credit application automation. Processing time reductions, cost savings, and accuracy improvements all provide measurable benefits that justify the technology investment.

Customer satisfaction often improves with faster processing times. Survey scores typically increase when applicants receive quicker responses to their loan requests. This improvement can lead to increased customer retention and referrals.

Application volume capacity increases substantially with automation. Banks can handle seasonal spikes in loan demand without hiring temporary staff or asking existing employees to work excessive overtime.

Staff productivity metrics change when automation handles routine tasks. Loan officers can focus on relationship building, complex applications, and business development activities that generate more value for the bank.

Future Developments

Technology continues advancing in credit application automation. Machine learning capabilities allow systems to improve their decision-making over time by analyzing outcomes and adjusting criteria accordingly.

Integration with additional data sources will provide even more comprehensive applicant profiles. Social media information, spending patterns, and alternative credit data will help banks make more informed lending decisions.

Mobile applications are becoming more sophisticated, allowing customers to submit loan applications entirely through their smartphones. Document capture through mobile cameras eliminates the need for physical paperwork in many cases.

The Bottom Line

Credit application automation delivers measurable benefits across multiple dimensions. Time savings allow banks to respond faster to customer needs and handle higher application volumes. Cost reductions improve profitability while enabling competitive pricing. Accuracy improvements reduce risk and enhance compliance.

Banks that implement automation gain competitive advantages in the marketplace. They can offer faster service, maintain lower costs, and make better lending decisions. As customer expectations continue rising and competition intensifies, automation becomes less optional and more necessary for survival.

Success requires proper planning, adequate investment, and commitment to ongoing system improvement. Banks that approach automation thoughtfully and comprehensively position themselves well for future growth and profitability.

#credit application automation#automated loan processing#credit decision software#financial technology#fintech automation

0 notes

Text

Mortgage Custom Applications Development: Revolutionizing the Mortgage Industry

In a constantly changing mortgage environment, remaining competitive and cost-effective is imperative for mortgage lenders. One method of achieving this is by means of mortgage custom applications development. Custom applications are created to resolve the specific challenges of mortgage businesses, enabling them to streamline operations, lower costs, and provide an enhanced experience to their customers.

By developing customized solutions, mortgage professionals can automate processes, improve data accuracy, and facilitate efficient loan origination and processing. Following is an in-depth analysis of how mortgage custom applications development is revolutionizing the business.

What Is Mortgage Custom Applications Development? Mortgage custom application development consists of developing tailor-made software solutions to meet the precise operational needs of mortgage firms. These applications are not like off-the-shelf solutions but are specifically built from scratch, catering to the unique needs of the business, its operations, and customer demands.

The key purpose of custom application development is to streamline such processes as:

Loan Origination Automating the first-time loan application, document collection, and approval process.

Underwriting Streamlining the underwriting process through automated decision-making software and risk evaluation.

Document Management Electronic management of high volumes of loan documents, securely accessible by all parties involved.

Compliance Monitoring Compliance checks automation for verification that all requirements and rules are satisfied without human intervention.

Customer Relationship Management (CRM) Automated communications, notifications, and support facilities to enrich borrower interactions.

Why Mortgage Custom Applications Development Is Important Solutions Tailored for Specific Purposes Off-the-shelf software can provide general functions, but it doesn't necessarily cater to the specific processes, legislation, and challenges that mortgage companies are dealt. Custom applications are designed to fix a precise issue, allowing companies to develop systems that exactly fit their needs.

Increased Operational Efficiency By performing frequent operations such as data entry, document gathering, and credit inquiries, custom applications reduce errors and save time. This enables mortgage companies to automate their operations, remove bottlenecks, and facilitate closing loans in less time.

Regulatory Compliance The mortgage business is strictly regulated, with rules that change on a regular basis at the local, state, and federal levels. Custom applications for mortgages are designed with compliance as the focus, with all processes adhering to the most recent legal guidelines. For loan disclosures, fraud mitigation, or fair lending, custom solutions can be programmed to automatically verify and ensure compliance at each step.

Improved Customer Experience In a competitive marketplace, outstanding customer service is critical. Custom applications can provide functionality such as online tracking of loans, e-signature interfaces, and borrower portals to update borrowers and engage them in the process. Borrowers will be pleased with the convenience and visibility through real-time updates and effortless document upload.

Data Security Mortgage applications process sensitive borrower data, and hence, data security becomes a priority. Custom applications can include sophisticated security features like encryption, two-factor authentication, and role-based access controls to secure borrower data and company systems from cyber attacks.

Advantages of Mortgage Custom Applications Development Speedier Loan Processing Automation is the solution to accelerating the mortgage process. Custom applications minimize back-and-forth communications and manual entry by merging different tools and platforms. This enables quicker approvals, more effective underwriting, and faster closings.

Cost Savings With increased efficiency and less manual effort, custom applications can save mortgage companies substantial money. Moreover, automation minimizes the risk of expensive errors or compliance issues, further lowering operational costs.

Scalability As mortgage companies expand, their operations must expand with them. Custom applications are built to scale, meaning they can manage growing volumes of loans without diminishing performance. Whether it's adding additional loan officers, expanding loan processing capacity, or integrating new technology, custom solutions expand with the company.

Integration with Existing Systems Most mortgage firms already employ a range of software solutions to handle various parts of their business, including CRM systems, pricing engines, or document management systems. Custom applications can be developed to integrate with these existing systems seamlessly, allowing data to move between them without the need for manual intervention.

Data-Driven Insights Mortgage custom applications can be built with robust reporting and analytics capabilities. Integrating real-time data from multiple sources, these apps offer actionable information on loan performance, customer activity, and market trends. This enables businesses to make better-informed decisions that increase profitability and operational efficiency.

Typical Features of Mortgage Custom Applications Loan Application Management Custom applications tend to have simplified loan application forms, which can automatically gather borrower information. This results in quicker initiation of loans and a more hassle-free experience for borrowers.

Automated Underwriting Through the marriage of data analytics and artificial intelligence, custom mortgage applications can automate underwriting decisions. This minimizes human intervention and makes loan approvals quicker while maintaining consistent, fact-based decision-making.

e-Signature Integration Custom applications may also incorporate integration with e-signature solutions, enabling borrowers to sign documents electronically. This accelerates the loan closing process and enables a more efficient, secure transaction method.

Real-Time Loan Status Updates Customer portals within custom applications can be enabled where borrowers can view their loan status in real-time, monitor progress, and receive updates on necessary documents or next steps.

Mobile Optimization With increasing consumers using mobile devices, custom applications can be made mobile-friendly, allowing borrowers to access their loan details, upload documents, and sign documents on the move.

Selecting the Ideal Mortgage Custom Application Developer When hiring a developer of mortgage custom applications, it's important to select one with extensive experience in the mortgage sector and technology creation. The most important considerations include:

Industry Expertise: Select a developer familiar with the special requirements and rules of the mortgage business.

Customization: Make sure the solution is customizable enough to address your business's special needs.

Security Features: Information security should always be at the forefront, so make sure the application complies with current security practices.

Support and Maintenance: Regular support and maintenance are key to keeping the application running smoothly and in compliance. Mortgage custom application development is a game-changer for lenders who want to streamline their operations, enhance customer experiences, and remain competitive in an ever-changing market. By customizing software solutions to the business's unique requirements, mortgage companies can automate processes, maintain compliance, and offer a seamless borrowing experience.

As the mortgage market becomes more technologically advanced, investing in customized applications will not only make mortgage professionals more productive but will also place them in the position of leaders in an increasingly competitive environment.

#Encompass Consulting#Encompass Consultants#Mortgage Encompass Consulting#Mortgage Encompass Consultants#Mortgage Website Development#Encompass Development#Loan Origination Software Customization#Mortgage Centric Website#Mortgage Custom Applications Development#Mortgage Custom Applications#Mortgage Custom Integrations#Encompass Integrations#Encompass Software Support

0 notes

Text

BPO Projects

Ascent BPO is the most distinguished and reliable BPO outsourcing and offshoring that provides multiple services for data entry, call center BPO, and many other services. We have especially designed our BPO process outsourcing services that are enough for remove the barriers of geography, language, and time zones. Since its inception, we have been working with different industry verticals to help them in their business by providing value-added services and applications.

Are you looking for BPO Projects? If yes then you are at the right place as we help businesses, companies, and startups in making money by offering them reliable projects for BPO. With the constant support of our professionals, we can provide both offline and online BPO outsourcing services in the market. We ensure that the service we provide is as per our customers' exact requirements.

At Ascent BPO, we have varied BPO projects for startups that help a business achieve success. With us, you can save a lot of time in finding efficient and genuine resources for different projects. You can search for different projects for your outsourcing needs from our provided categories. Just go through our categories of online and offline project options to choose yours.

The latest ongoing BPO projects that we offer include

Form filling process: We can provide you with BPO projects from direct clients of any volume. You can get web searches, scanned images, manuscripts, and other related items. We assure the best to our customers in terms of pricing.

Medical Billing: With this project, we help your healthcare business to accelerate to increase efficiency and revenue generation. When you outsource this medical billing project to Ascent BPO, we ensure the highest quality and accuracy. Also, there will be no occurrences of any loss of data.

Mortgage Data Entry Project: If you want to know how to get bpo projects for data entry then all that you need to do is to connect with us. We provide this mortgage data entry project to vendors and other companies and make sure that they handle huge voluminous form-filling work while maintaining quality. The entire detail of the project will be explained by our trained workforce

Online Data Entry services: we have experience and domain expertise in offering customized Online Data Entry services to customers. Through these services, we aim to help our clients in gaining sustainable competitive benefits in the market. We have with us high-quality and affordable data entry solutions that can be availed online as well as offline as per the data entry requirements. If you are looking for these services of data outsourcing, then get connected without our enthusiastic data entry team.

Offline Data Entry: Many organizations have a huge amount of accumulated data. These data are mainly available in the forms of surveys, bills invoices, queries, etc. If you want to take care of the data processing and get domestic BPO projects with direct clients then you must visit us. We provide data entry projects that ensure high pay and a huge benefit. Our data entry team specializes in providing customized offline data entry services that deliver outputs in different formats. The format that a customer desires to get includes MS Excel or a customized database

Offline Medical Project: Under this project, we provide a high-quality service for medical offline form filling. It is done as per the formats of images and documents. The entire work of this project will be explained by our team of trainers to you. For the initial days, you will be provided with online and offline training. Apart from this, you will also get extra software for quality-checking purposes. We highly believe in offering outbound and inbound BPO projects so interested customers must contact us.

With Ascent BPO, you will get BPO projects without any limitations or restrictions. Right from locally to globally, we work effortlessly to provide projects to small vendors and startups.

Why Choose AscentBPO Projects?

AscentBPO has expertise in the execution of projects of data entry & management and BPO for startups to enable accurate output for different business verticals and industries. Let’s have a look at some of the pointers that will make you understand why chose our company for projects:

With us, there are no registration fees. You can get yourself register for free. Many entities in the market charge for registration also. You just need to pay for the projects that too at cost-effective pricing.

We have a wide range of BPO projects so that you can search for categories that suit your business requirements. Right from online & offline data entry to form filling, there are various options of projects to choose from.

The thing about the projects that you will avail from us will be directly from the clients. You can get in touch with the clients and get every minute detail from them regarding the project.

We ensure complete accuracy as without accuracy in data entry and processing there will be misleading in the outcomes may mislead. If this happens then it can create confusion among the data analysts.

Last but not least, we help you to get better and more effective data entry, form filling, medical billing, and call center projects for startups. With these projects, you will be able to expand your networks because of the local, national, and international clientele. This ultimately helps in generating good business options for the customers.

We serve different industries including real estate, healthcare, and IT. Our professionals have experience in handling the data with the efficiency of all the sectors. They also know the exact and in-depth data processing requirements of every industry. If you are looking for noted and authentic companies offering BPO projects then consider connecting with our data processing team. You can surely rely on our work as we work to ensure the efficiency and security of the data.

1 note

·

View note

Text

How to Download Mortgage Form Filling Auto Typer Software

Download mortgage form filling auto typer software from the website www.icrconversions.com, Firstly we will decript all mortgage images into normal images then all mortgage image files will convert into excel as based on instruction sheet, then that excel files we cannot copypaste on mortgage software, regarding that process we willl developed mortgage form filling auto typer software for mortgage data entry projects.

youtube

ICR Conversions Email id:- [email protected] Contact:-+91 95156 89468 Website:- http://www.icrconversions.com/ youtube channel:-https://youtube.com/@icrconversions4589?si=TYwIKF7uRaaMdHnq

1 note

·

View note

Text

WEEK 12- SAFADECO (SALVACION FARMERS DEVELOPMENT COOPERATIVE)

April 7 - 12, 2025

This week was quite eventful and productive, as it marked the final stretch of our internship at SAFADECO. It was a week full of tasks and responsibilities that highlighted not only the skills we’ve learned but also the trust given to us by the staff. At the beginning of the week, our first task was to organize the requirements needed for the members’ loan application forms. This included compiling the actual loan application form, insurance documents, and the credit investigation reports. These documents were important because they provided a comprehensive view of the members' financial status and their capacity to apply for and repay a loan. Following this, Ma'am Julie instructed us to print all the necessary documents that each member would need for their loan application. Once the printing was done, I was assigned to handle the Xerox copying of these requirements, particularly for one of the members under Sir Latuga, one of the Development Officers (DOs). This helped ensure that there were backup copies for both the office and the members' personal records.

On a different note, Ma'am Chloe gave us another task: to assist with her report. This involved checking each member’s profile in the Ekoop system to identify what type of loan they had availed of. It was detailed work that required accuracy and attention, especially because the report would be used for official documentation. After completing that, Ma'am Belle then assigned me to work on balancing the financial statements specifically for the Sorsogon branch. This was a bit more complex as it included various types of allowances such as RATA, Medical Allowance, Clothing Allowance, Communication Allowance, Hazard Pay, and more. Each entry had to be verified and totaled correctly to ensure that the financial records were accurate and up-to-date. We also participated in other important routine tasks such as filing. This meant finding the correct folders for each member and properly inserting their mortgage documents and loan application forms. In addition, I was tasked to write down the IDs of the co-makers, which is a vital part of the requirements in processing a loan application since the co-maker acts as a guarantor. Apart from our office duties, we also took part in a seminar titled "Vote Smart: A Guide to Being a Responsible Voter in 2025." This seminar was organized by NATCOO and was attended by both SAFADECO staff and us OJTs. It was an eye-opening event that emphasized the importance of responsible voting and active participation in the democratic process, especially in the upcoming elections.

Finally, I continued with one of my regular tasks, which was to input the collections made by the Development Officers. The process began with counting the actual cash collected, then inputting the data into the Ekoop system, and finally ensuring the records were balanced before handing them over to the teller for final verification.

As this week came to a close, I couldn’t help but feel a deep sense of gratitude and reflection. All these tasks—whether big or small—taught me how important accuracy, responsibility, and teamwork are in a professional setting. More than that, I came to a realization: internships are not just about learning how an organization works but engaging in different people to have a better communication.

0 notes

Text

How to Do Server 360 Form Fill Up Automatically | Step by Step Guide

Want to automate the Server 360 form fill-up process? In this video, we’ll show you how to fill Server 360 forms automatically using a reliable auto typer software. This step-by-step tutorial is perfect for beginners and professionals who are doing Server 360 data entry work and want to save time with automation. 🔍 Learn everything from: Downloading the auto form filler tool Setting it up for Server 360 forms How to use the automation step-by-step Tips to increase form filling speed Whether you're doing online Server 360 form filling, data entry automation, or looking for the best Server 360 auto typer software, this video covers it all.

youtube

BPO Conversions Email:- [email protected] Contact No:- +91 96187 21254 Website: https://mortgageformfillingautotyper.com/ https://kycformfillingautotyper.com/ https://autoformfillersoftware.com/ https://autoformfillersoftware.com/health-insurance-form-filling-auto-typer-software https://autoformfillersoftware.com/kyc-auto-form-filler-software/ https://autoformfillersoftware.com/health-insurance-form-filling-auto-typer-software/ https://autoformfillersoftware.com/matrimonial-auto-form-fillup-software/ https://autoformfillersoftware.com/server-360-auto-form-filler-software/ https://autoformfillersoftware.com/financial-management-process-auto-form-filler-software/ https://autoformfillersoftware.com/cargo-auto-form-filler-software/ https://autoformfillersoftware.com/medical-insurance-auto-form-filler-software/ https://autoformfillersoftware.com/us-hospital-entry-auto-form-filler-software/ https://autoformfillersoftware.com/twinq-auto-form-filler-software/ https://autoformfillersoftware.com/mortgage-auto-form-filler-software/ Playlist:-https://www.youtube.com/watch?v=f66k1HUh3zY&list=PL0YD_PED4aqdrZtrnQr0e1gTN_KFmFarG&pp=gAQB

0 notes

Text

Mortgage Brokers: Want to Write More Loans? Here’s How to Work More Efficiently

As a mortgage broker, your income and impact come down to one thing: how many loans you can settle each month. But with admin, follow-ups, compliance, and never-ending file updates, even top brokers struggle to find enough time to grow. The answer isn’t working more hours—it’s working more efficiently. Here’s how successful mortgage brokers are increasing their efficiency and consistently writing more loans without burning out.

The Problem: Time-Heavy Processes That Hold You Back Most brokers spend up to 70% of their day on tasks that don’t directly bring in revenue: ● Data entry ● Lender follow-ups ● Document collection ● CRM updates ● Compliance tasks All of these are important—but they can be delegated. The real value of a broker lies in building client relationships, structuring deals, and converting leads. Focus on What Matters: Income-Producing Activities If you want to write more loans, you need to shift your energy into: ● Meeting new clients ● Following up with warm leads ● Networking with referral partners ● Reviewing complex deals ● Educating clients on loan options By spending less time on backend admin and more time on these front-end activities, your settlements will grow.

How to Increase Efficiency Without Hiring Full-Time Staff Hiring full-time staff is one option, but it’s costly and time-consuming. A growing number of Australian mortgage brokers are opting to outsource their loan processing and admin instead. You can bring on a skilled virtual assistant or loan processor who works remotely but integrates seamlessly into your workflow. These professionals handle tasks like: ● Preparing files for submission ● Liaising with banks and lenders ● Tracking approvals and condition ● Managing compliance paperwork ● Sending updates to clients The result? Your business runs smoothly while you focus on writing more business. Proven Benefits of Delegating Admin Here’s what brokers are seeing when they outsource admin tasks: ✅ Higher client satisfaction (faster updates, fewer delays) ✅ More deals settled per month ✅ Improved work-life balance ✅ Reduced human error in loan packaging ✅ Better pipeline management Working efficiently doesn’t mean cutting corners—it means making smart decisions with your time. Choose a Support Team That Understands Mortgage Broking To truly increase efficiency, choose a support partner that knows the mortgage industry inside and out. At LoanProcessor.com.au, we specialise in supporting Australian brokers with end-to-end loan processing services. We use your existing tools and follow your workflow—no disruption, just results. To consistently write more loans, you don’t need to work harder—you need to work smarter. By outsourcing admin and increasing your day-to-day efficiency, you can double your output without doubling your hours. Want to unlock more time and scale your settlements? Connect with LoanProcessor.com.au and see how efficient your brokerage can become.

0 notes

Text

TurboTax 2025: The Easiest Way to File Your Taxes (Even If You’re Not a Math Whiz)

TurboTax, developed by Intuit, is a leading tax preparation software that simplifies the process of filing federal and state tax returns. It offers a range of services tailored to different tax situations, aiming to maximize refunds and ensure accurate filings.

We also provide information about

RTX Pro 6000 Blackwell: Does NVIDIA Even Know Who This GPU is For?

Key Features

User-Friendly Interface: TurboTax guides users through their tax returns with a step-by-step approach, making it accessible even for those with minimal tax knowledge.

Document Importing: The software allows users to import financial data directly from employers and financial institutions, streamlining the data entry process.

Expert Assistance: TurboTax provides access to tax experts for personalized guidance, ensuring users receive accurate answers to their tax-related questions.

Pricing and Versions

TurboTax offers various versions to cater to different tax needs:

Free Edition: Designed for simple tax situations, this version supports straightforward Form 1040 returns, including claiming credits like the Earned Income Tax Credit and Child Tax Credit.

Deluxe: Ideal for homeowners and those seeking to maximize deductions, this version assists with itemized deductions such as mortgage interest and charitable contributions.

Premier: Geared towards individuals with investments or rental property, offering features like investment property depreciation and guidance on investment income.

Self-Employed: Tailored for freelancers and small business owners, this version helps track expenses, maximize deductions, and estimate quarterly taxes.

TurboTax Live: Provides on-demand access to tax experts for real-time assistance and review, ensuring confidence in your tax filing.

Mobile Accessibility

TurboTax offers mobile applications for both iOS and Android devices, enabling users to file taxes on the go. The mobile app supports document scanning and importing, enhancing convenience for users.

AI Integration

In recent years, TurboTax has integrated artificial intelligence (AI) to assist users during tax season. AI-powered chatbots have evolved to provide more accurate and helpful responses, automating data entry and identifying potential deductions. However, experts advise caution, as AI tools may still be prone to errors, and it's essential to review all information carefully.

Customer Reviews

Users generally praise TurboTax for its ease of use and comprehensive support. Many appreciate the step-by-step guidance and the ability to import financial data directly from employers and financial institutions. However, some reviews suggest that the software can be expensive for more complex returns, and users should carefully select the appropriate version to avoid unnecessary costs.

Alternatives

While TurboTax is a popular choice, other tax preparation software options are available:

H&R Block: Offers both online and in-person assistance, suitable for complex tax situations.

TaxSlayer: Provides affordable solutions with added peace of mind through audit protection.

FreeTaxUSA: A budget-friendly option with free federal return filing and optional support features.

Each alternative has unique strengths, and the best choice depends on individual tax needs and preferences.

Read More :

RTX Pro 6000 Blackwell: Does NVIDIA Even Know Who This GPU is For?

Conclusion

TurboTax remains a strong option for individuals seeking a user-friendly and comprehensive tax preparation solution. Its range of versions caters to various tax situations, and its integration of AI tools demonstrates a commitment to leveraging technology for improved user experiences. However, it's essential to review all information carefully and consider alternative options to determine the best fit for your specific tax needs.

For more insights into the latest in technology and updates, visit TrueSides, your source for tech trends and innovations.

0 notes

Text

How a Bank Statement Analyser Helps in Fast-Tracking Loan Approvals

In today’s fast-paced financial ecosystem, speed and accuracy are critical to lending. Whether it's a personal loan, a business loan, or a mortgage, applicants expect a swift response from lenders. One of the biggest bottlenecks in the loan approval process has traditionally been the manual assessment of bank statements. Fortunately, with the emergence of the Bank Statement Analyser, this process has become faster, more accurate, and significantly more efficient.

What is a Bank Statement Analyser?

A Bank Statement Analyser is a digital tool or software that automatically extracts, categorizes, and interprets financial data from bank statements. These statements can be uploaded in various formats such as PDF, Excel, or directly fetched through APIs. Once processed, the tool generates insights into income patterns, expenses, EMIs, overdrafts, and cash flows—crucial for evaluating a borrower’s creditworthiness.

Instead of sifting through pages of bank transactions manually, underwriters and credit officers can access a clean, categorized report in seconds.

Why Speed Matters in Lending

Time is money, especially in lending. Customers expect real-time decisions, and financial institutions are under pressure to reduce turnaround time (TAT) for loan processing. Traditional methods involve manual data entry, validation, and risk evaluation, which can take several days. A Bank Statement Analyser compresses this timeline to just a few minutes, enabling near-instant decisions.

Fast loan approval not only improves customer experience but also increases the lender’s competitive advantage and loan conversion rates.

How a Bank Statement Analyser Accelerates Loan Approvals

1. Automated Data Extraction

The tool automatically reads and extracts data from uploaded statements, eliminating human error and manual entry delays. This includes parsing unstructured data like salary credits, NEFT/IMPS/RTGS transfers, utility payments, and more.

2. Income & Expense Categorization

A robust Bank Statement Analyser uses AI or rule-based logic to categorize transactions into buckets such as salary, rent, EMI payments, discretionary spending, and cash deposits. This financial profiling is key for assessing an applicant’s repayment ability.

3. Cash Flow Analysis

Understanding monthly cash inflows and outflows is crucial for risk assessment. The analyser identifies consistent patterns, flagging anomalies like sudden dips in income or frequent overdrafts, which may indicate financial stress.

4. Real-Time Risk Indicators

The analyser can instantly flag red flags such as bounced cheques, frequent minimum balance penalties, or excessive cash withdrawals. These indicators help lenders reject high-risk applications early in the process, saving time and resources.

5. Fraud Detection

Advanced tools come with built-in fraud detection algorithms that identify manipulated or tampered bank statements. By flagging inconsistencies, they protect lenders from processing fake or altered financial documents.

6. Customizable Reports for Underwriters

The output from a Bank Statement Analyser is typically available in customizable dashboards or downloadable reports. These insights empower credit teams to make informed decisions based on real-time data rather than intuition or guesswork.

Benefits for Lenders

Faster TAT: Reduce loan processing time from days to minutes.

Higher Accuracy: Minimize errors from manual review.

Better Risk Assessment: Granular financial profiling helps mitigate defaults.

Improved Scalability: Process thousands of applications simultaneously without hiring more staff.

Enhanced Customer Experience: Instant loan decisions improve satisfaction and retention.

Final Thoughts

In a digital-first lending environment, automating the review process is not just a luxury—it’s a necessity. A Bank Statement Analyser empowers lenders to accelerate loan approvals, reduce risk, and deliver a seamless borrower experience. As competition in the lending space heats up, adopting smart tools like these will be key to staying ahead of the curve.

Whether you're a bank, NBFC, or fintech startup, integrating a Bank Statement Analyser into your loan processing workflow is a step toward faster, smarter, and more secure lending.

0 notes

Text

Mastering Financial Reports with Accounting Software for Real Estate Investors

Financial reports play a crucial role in real estate investing. They help investors track income, expenses, and overall profitability. Without proper reporting, it’s easy to lose sight of financial health. Fortunately, accounting software for real estate investors simplifies this process, ensuring clarity and accuracy in financial management.

This guide explores essential financial reports, how to interpret them, and how accounting software makes it easier. Whether you're a beginner or an experienced investor, understanding these reports can improve decision-making and boost profits.

Why Financial Reports Matter in Real Estate Investing

Real estate investors deal with multiple transactions, including rent collection, property expenses, and taxes. Keeping track of everything manually can be overwhelming. That’s why financial reports are essential. They provide a clear overview of income and expenses, helping investors maximize their returns.

Some key benefits include:

Better financial planning – Know where your money is going.

Tax preparation – Avoid last-minute surprises.

Improved decision-making – Identify profitable properties.

Expense tracking – Cut unnecessary costs.

With the right accounting software, generating these reports becomes quick and effortless.

Key Financial Reports Every Real Estate Investor Should Know

1. Profit and Loss Statement (P&L)

This report summarizes revenue and expenses over a specific period. It shows whether a real estate investment is making money or operating at a loss.

What to look for:

Rental income

Maintenance and repair costs

Property management fees

Mortgage payments

By using accounting software for real estate investors, you can generate a P&L statement instantly, saving time and effort.

2. Cash Flow Statement

Cash flow tracks the movement of money entering and leaving a business. Positive cash flow means you're making money, while negative cash flow indicates a problem.

Key factors to track:

Rent received

Loan payments

Property maintenance costs

Utility bills

A good accounting tool automates cash flow tracking, ensuring accurate calculations.

3. Balance Sheet

The balance sheet provides a snapshot of an investor’s financial position. It lists assets, liabilities, and equity, helping you understand your net worth.

Components:

Assets – Properties owned, cash in bank, and accounts receivable.

Liabilities – Mortgages, property loans, and unpaid bills.

Equity – The investor’s total worth in the business.

Using accounting software for real estate investors makes it easy to keep an up-to-date balance sheet.

4. Rent Roll Report

A rent roll report tracks rental income for each property. It shows which tenants have paid and who owes rent.

Why it’s useful:

Helps monitor rental income trends

Identifies overdue payments

Aids in property valuation

5. Expense Reports

Keeping track of expenses is essential for tax deductions and financial planning.

Common expenses include:

Repairs and maintenance

Property management fees

Insurance

Advertising costs

Good accounting software categorizes expenses automatically, reducing the risk of missing tax deductions.

How Accounting Software Simplifies Financial Reporting

1. Automates Data Entry

Entering data by hand takes a lot of time and increases the chance of mistakes. Accounting software automates this process, pulling transactions directly from bank accounts and invoices.

2. Generates Reports Instantly

Instead of spending hours compiling data, accounting tools create financial reports with a single click. This saves time and improves accuracy.

3. Tracks Rental Income and Expenses

Many platforms allow users to categorize income and expenses, making tax preparation easier.

4. Provides Real-Time Insights

With cloud-based solutions, investors can access financial reports anytime, anywhere. This helps in making informed decisions on the go.

5. Reduces Human Errors

Mistakes in financial reporting can be costly. Automated software ensures accurate calculations, reducing risks associated with manual data entry.

Additional Benefits of Accounting Software

Beyond financial reporting, accounting software offers several other advantages that improve overall business efficiency.

1. Scalability for Growing Portfolios

As investors acquire more properties, managing finances manually becomes difficult. The right accounting software scales with your business, handling multiple properties effortlessly.

2. Streamlined Tax Filing

Tax season can be stressful for real estate investors. With integrated tax features, accounting software calculates deductions, organizes receipts, and even generates tax reports to simplify filings.

3. Integration with Other Tools

Modern accounting platforms integrate with bank accounts, property management software, and even payment processors. This streamlines transactions and eliminates duplicate data entry.

4. Customizable Financial Insights

Every investor has unique financial goals. Many accounting tools allow users to create customized reports, track specific metrics, and set up alerts for unusual spending patterns.

Choosing the Best Accounting Software for Real Estate Investors

When selecting software, consider the following features:

User-Friendly Experience

The software should be easy to navigate, allowing investors to manage finances without hassle. Complicated systems can be frustrating, especially for those without an accounting background. A clean dashboard helps users stay organized, while guided workflows for invoicing and expense tracking make setup simple.

Seamless Compatibility with Essential Tools

A reliable accounting solution should connect with banks, property management software, and payment platforms. Bank synchronization updates transactions automatically, ensuring accurate financial tracking. Compatibility with property management tools simplifies tenant payment tracking, while tax software integration streamlines tax preparation.

Automation to Reduce Manual Work

Manual bookkeeping is tedious and error-prone. The best accounting software automates key tasks like tracking rental payments, sending tenant reminders, and categorizing expenses for tax deductions. It also simplifies invoicing, ensuring accurate and timely payments while reducing administrative work.

Robust Reporting Capabilities

Investors need detailed, customizable reports to make informed decisions. A profit and loss statement tracks income and expenses, while a cash flow report highlights profitability. A balance sheet offers an overview of overall financial stability. One-click report generation and visual dashboards make financial analysis effortless.

Scalability and Cloud Access

As real estate portfolios grow, financial management becomes more complex. Scalable software supports multiple properties and offers cloud-based access for real-time financial monitoring. Multi-user access allows seamless collaboration, ensuring smooth operations across teams.

Many real estate investors rely on Rentastic for financial tracking and reporting. It provides powerful tools designed specifically for property management.

Final Thoughts

Understanding financial reports is key to real estate success. Whether tracking rental income, expenses, or overall profitability, having a clear picture of finances helps investors make better decisions. Using accounting software for real estate investors simplifies this process, ensuring accuracy and efficiency.

By leveraging the right tools, investors can save time, reduce errors, and focus on growing their portfolios. Want to take control of your real estate finances? Rentastic offers powerful financial tracking and reporting tools designed specifically for real estate investors. Explore top accounting software options today and optimize your investment!

0 notes

Text

LoanOptions.ai Unveils HAILO

Sydney, Feb 7: LoanOptions.ai, an award-winning loan matching technology provider, has launched its groundbreaking 5 Minute Home Loan Application, HAILO, aiming to transform the mortgage industry.Designed to streamline the home loan process, HAILO reduces application time to as little as five minutes and minimizes customer data entry by up to 80 per cent—without affecting credit scores. The…

0 notes