#multifamily websites

Text

Before investing in any asset class, including real estate, it's important to be well-informed and prepared visit https://tridentmultifamily.com/

#multifamily investing oklahoma#real estate investing oklahoma#multifamily investment companies#multifamily investment firms#multifamily investment strategy#multi family real estate investing#multifamily websites#multifamily investment firm#multifamily investments#multifamily investor#multifamily real estate investing#real estate investment group#multifamily real estate investment company#multifamily real estate investment#multifamily investment company#multifamily real estate investing companies#multi-family real estate investment firm#investing in multifamily ebook

1 note

·

View note

Text

#multifamily investment strategy#investing in multifamily real estate syndications#multifamily equity partners#multifamily syndication website#multifamily real estate syndication#multifamily real estate investing

0 notes

Text

#multifamily offerings#multifamily syndication#passive real estate investing#apartment syndication investing#real estate passive investing#real estate investment disclaimer#multifamily real estate investing#multifamily real estate syndication#multifamily syndication website#multifamily equity partners#investing in multifamily real estate syndications#cash investors pembroke pines#multifamily real estate

0 notes

Text

Why you're coughing more today: Atlanta's high ozone alert

Atlanta has a "code orange" air quality alert today due to high ozone concentration, a chemical reaction between sunlight, oxygen, & pollution from cars, power plants, factories, etc.

(Sounds like car traffic makes it harder for pedestrians to breathe)

People in sensitive groups, such as asthma sufferers, may experience watering eyes, coughing, throat irritation, chest pain, and breathing difficulty. Try to limit your time outside, especially in the middle of the day.

Also, let's please stop polluting the air so much. How? From the EPA website:

"On Days when High Ozone Levels are Expected, Take these Extra Steps to Reduce Pollution:

> Choose a cleaner commute - share a ride to work or use public transportation.

> Combine errands and reduce trips. Walk to errands when possible.

> Avoid excessive idling of your automobile.

> Refuel your car in the evening when its cooler.

> Conserve electricity and set air conditioners no lower than 78 degrees.

> Defer lawn and gardening chores that use gasoline-powered equipment, or wait until evening."

Good tips. Notice that several of them revolve around cars.

Personally, I also recommend that the world focus on multifamily housing for the long run, which I'm committed to for several reasons, including the lessened burden on energy (shared walls = less AC/heating energy needed) and lessened burden from lawn-care pollution, and the way that density supports public transit.

[High horse dismounted. Good horse. Goooood horse.]

10 notes

·

View notes

Text

The Peebles Corporation

Website: https://peeblescorp.com/

Address: 1691 Michigan Avenue, Miami Beach, FL 33139

The Peebles Corporation is one of the largest hotel developers and land development companies. With a portfolio of over 10 million square feet and $8 billion in active and completed projects across major cities, their success through public and private partnerships is unmatched. As one of the largest multifamily developers, they prioritize construction excellence, sustainability, historic preservation, and innovative design for transformative outcomes. Recognized as one of the most acclaimed black-owned property management companies, The Peebles Corporation has become one of the largest multifamily developers in the US.

#Real Estate Development#hotel developers#hotel development#land development companies#property developer

LinkedIn: https://www.linkedin.com/company/the-peebles-corporation

#Real Estate Development#hotel developers#hotel development#land development companies#property developer

2 notes

·

View notes

Text

The Peebles Corporation

Website: https://peeblescorp.com/

Address: 1691 Michigan Avenue, Miami Beach, FL 33139

The Peebles Corporation is one of the largest hotel developers and land development companies. With a portfolio of over 10 million square feet and $8 billion in active and completed projects across major cities, their success through public and private partnerships is unmatched. As one of the largest multifamily developers, they prioritize construction excellence, sustainability, historic preservation, and innovative design for transformative outcomes. Recognized as one of the most acclaimed black-owned property management companies, The Peebles Corporation has become one of the largest multifamily developers in the US.

#Real Estate Development#hotel developers#hotel development#land development companies#property developer#commercial property development

LinkedIn: https://www.linkedin.com/company/the-peebles-corporation

#Real Estate Development#hotel developers#hotel development#land development companies#property developer#commercial property development

2 notes

·

View notes

Text

The Peebles Corporation

Website: https://peeblescorp.com/

Address: 1691 Michigan Avenue, Miami Beach, FL 33139

The Peebles Corporation is one of the largest multifamily developers with offices in New York City, Miami, and Washington D.C. With a portfolio of over 10 million square feet and $8 billion in active and completed projects across major cities, their success through public and private partnerships is unmatched. As one of the largest multifamily developers, they prioritize construction excellence, sustainability, historic preservation, and innovative design for transformative outcomes. Recognized as one of the most acclaimed black-owned property management companies, The Peebles Corporation has become one of the largest multifamily developers in the US.

#Real Estate Development#commercial property development#commercial real estate developers#commercial real estate development

LinkedIn: https://www.linkedin.com/company/the-peebles-corporation

#Real Estate Development#commercial property development#commercial real estate developers#commercial real estate development

2 notes

·

View notes

Text

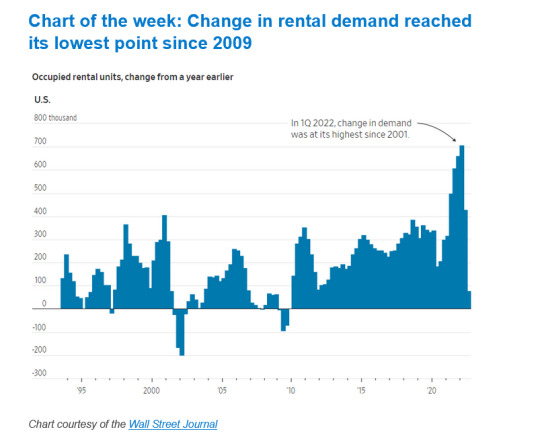

After a long stretch of record-high rents, Americans are renting fewer apartments as demand in the third quarter fell to its lowest level in 13 years.

Some renters are choosing to take on roommates, while others are boarding with family or friends. More people are opting to stay longer in their parents’ homes or moving back in, rather than pay steep rent increases, according to a recent UBS survey.

Apartment demand in the quarter, measured by the one-year change in the occupancy of units, was the lowest since 2009, when the U.S. was feeling the effects of the subprime crisis, according to rental software company RealPage. Measured quarterly, the drop in demand was the worst of any third quarter—normally prime leasing season—in the more than 30 years RealPage has compiled the data.

Meanwhile, the apartment-vacancy rate rose to 5.5% in the third quarter, up from 5.1% the quarter prior, according to property data firm CoStar.

Rents have risen 25% over the past two years, according to rental website Apartment List, pushing many renters beyond what they can now afford. Meanwhile, inflation on other essential goods, such as food and energy, is also eating into how much people have left to spend on housing.

“It’s a signal that rent can’t continue at the same level it has sustained over the last couple of years,” said Michael Goldsmith, an analyst at UBS. “We’ve reached a point where renters are maybe willing to pull out of the market.”

The apartment rental market looks to be cooling following a boom that started in early 2021. After the introduction of a Covid-19 vaccine, many people—especially younger people who had been living with their parents—rushed to rent in cities around the country. That boosted apartment demand and put upward pressure on rents. Some rental apartments were even subject to bidding wars.

Record high housing prices also played a role. They priced out many Americans who wanted to buy starter homes but instead have remained captives of the rental market. Home prices are now falling on a monthly basis, however, according to the latest S&P CoreLogic Case-Shiller National Home Price Index.

Rental prices have started to fall on a monthly basis for the first time in nearly two years, too, while other recent data points also show that renters are starting to push back.

Shonda Austin, a home healthcare worker, and her three children moved into her mother’s house in Flint, Mich., this month after facing a 24% rent increase in Las Vegas. She hopes to return to a home of her own by March to somewhere more affordable, such as Arkansas or North Carolina, where she could potentially buy.

“My goal is to just save as much as I can,” Ms. Austin said.

The supply of new apartments, which has grown this year in large markets such as Phoenix and Dallas, may be contributing to the drop in overall demand, because new projects add empty units to a slowing market. Economic uncertainty rooted in fears of a recession may also be contributing to lower apartment demand.

Leasing also typically eases during colder months, but analysts said the drop in demand that started earlier this year is now greater than what was expected.

“The spring and summer leasing season was a total bust,” said Jay Lybik, national director of multifamily research at CoStar.

Yet even with the recent decline in demand, asking rents have remained near record highs. Nationally, asking rents have started to drop only slightly month-to-month, and are still up by 6% or more when viewed annually, according to several data sources. In some hot markets, they are up much more than that. In Charleston, S.C., rent is 14% higher than it was a year ago, according to Apartment List.

To escape record high prices, more people are choosing to live rent free with friends or family, a September UBS survey found. Eighteen percent of U.S. adults surveyed said they had lived rent free with other people during the last six months, up from 11% at the same time one year ago. That was the highest share of adults living rent free with friends and family since UBS began asking the question in 2015.

Other renters are finding roommates or splitting rent with family members. In North Charleston, S.C., 27-year-old bartender Bailey Byrum said her younger sister moved in with her at her two-bedroom rental house. Ms. Byrum said her sister had trouble finding her own place and had recently been living with her parents.

“She has a good job… but places by yourself are like $500 to $600 out of her budget,” Ms. Byrum said.

Some landlords are encountering resistance to steeper rent increases. In downtown Birmingham, Ala., last year, Kim McCann and her husband leased a spacious loft apartment for $2,800, a rent that then already seemed overpriced, Ms. McCann said. This July the landlord texted Ms. McCann to say she would be raising the rent by an extra $900 a month because local real-estate demand had “exploded.”

Rather than pay $3,700 for the same apartment, Ms. McCann and her husband decided to move out in August. The loft sat on the market until at least this week, according to a listing on Zillow, and the asking price was cut twice.

“Fingers crossed other landlords come to their senses soon,” Ms. McCann said.

17 notes

·

View notes

Text

Mirka Investments

Mirka with its strategic partners develops and manages high quality, affordable multifamily rental housing communities.

Through innovative problem-solving financial structures and project designs that complement the needs of the community, we assist the underserved and diverse portions of the population including financially struggling families, veterans, seniors, formerly homeless, and developmentally disabled individuals.

Address: 600 B STREET, SUITE 300 SAN DIEGO, CA 92101, United States

Phone: +1 619 323 1447

Website: https://www.mirkainvest.com/

2 notes

·

View notes

Text

Regret Proof

Regret Proof

https://www.youtube.com/watch?v=xevGe6Ik1Do

Fear of regret is what drives me. Imagine meeting your 80-year-old self and having to apologize for not going after your dreams. I refuse to stay stuck in the same place. The time to go for it is NOW.

Please visit my website to get more information: https://ift.tt/1I9GmR2

🔔 Unlock multifamily real estate success! Subscribe for inspiring podcast insights on acquiring and developing multifamily properties, success stories, & growth strategies.

https://www.youtube.com/@JustinBrennan/?sub_confirmation=1

🔗 Stay Connected With Me.

👉 Facebook: https://ift.tt/BQw9Ruf

👉 Instagram: https://ift.tt/ya9c6Tq

👉 Linkedin: https://ift.tt/JhtNH58

👉 Watsapp: https://ift.tt/WYj25Cb

👉 Website: https://ift.tt/1I9GmR2

=============================

🎬 Recommended Playlists

👉 APARTMENT INVESTING

https://www.youtube.com/playlist?list=PLStA37XUJ_FH8nPpDK_bQksoz9F8G9-Fo

👉 A2G Short Clips

https://www.youtube.com/playlist?list=PLStA37XUJ_FGBgSZU_GQ_6KhXcTAxVG_B

🎬 WATCH MY OTHER VIDEOS:

👉 Buying A Multifamily In 90 Days For $18,000: Case Study With Justin Brennan

https://www.youtube.com/watch?v=AsPrXZi_LFI

👉 ADU's Flipping & Real Estate with Brian and Nick | Abundance2Give

https://www.youtube.com/watch?v=t_94wkQJwKc

👉 Las Vegas Mafia & Real Estate with Rob Brown | Justin Brennan | Abundance2Give

https://www.youtube.com/watch?v=p2ZM8ehsxG0

👉 How To Buy Multifamily Apartments In 90 Days | Multifamily Investing

https://www.youtube.com/watch?v=neG5DujMGfg

👉 The future of San Diego | Justin Brennan

https://www.youtube.com/watch?v=2xxR21SSRPc

=============================

✅ About Justin Brennan.

Welcome to Justin Brennan's channel! As CEO of The Brennan Pohle Group, I focus on acquiring and developing multifamily properties across the U.S. With over 500+ units and $157M in assets, my team and I aim for 10,000+ units and $4B in assets. Here, I share my journey and expertise in real estate, from title insurance to property management. Join me for insights on multifamily real estate, investment strategies, and personal growth. Subscribe for tips on achieving financial freedom and giving back.

🔹EXPERIENCE

• Licensed REALTOR ®DRE#01866398

• 15 years experience as a Realtor and Investor

• Former Asset Manager for Chase & Fannie Mae. (Handled thousands of distressed properties, short sales, and REOs throughout the USA.)

🔹EDUCATION:

• Degree in Finance & Marketing - Pepperdine University

• Masters Degree in Business - University of San Diego

• Masters Degree in Real Estate Development - University of San Diego Burnham Moores

• Certified Distressed Property Expert (CDPE)

• Certified Investor Agent Specialist CIAS)

🔔Ready to master the multifamily real estate game? Subscribe for expert insights & podcasts on multifamily investments, growth tactics, and industry expertise.

https://www.youtube.com/@JustinBrennan/?sub_confirmation=1

=================================

ADD HASHTAG HERE

Disclaimer: Any information or advice on this channel is for educational and general guidance only. Justin Brennan and his affiliates shall not be liable for any damages from using the content. Consult a financial advisor before making investments. All information is provided 'as is' without warranties. Links to other websites are for convenience; read their privacy statements. Comments are reviewed and may be deleted if inappropriate. Public comments do not reflect the views of Justin Brennan and his affiliates.

Copyright Notice: This video and my YouTube channel contain dialogue, music, and images that are the property of Justin Brennan. You are authorized to share the video link and channel and embed this video in your website or others as long as a link back to my YouTube channel is provided. Justin Brennan, JustinCBrennan.com, Multifamilyi.com, MultifamilySchooled.com, BrennanPohle.com. All Rights Reserved.

© Justin Brennan

via Justin Brennan https://www.youtube.com/channel/UCjR741czRkmAzoBKAlrPf6Q

September 21, 2024 at 03:18AM

#multifamilyinvesting#realestate#passiveincome#investment#realestatestrategy#entrepreneurs#luxuryliving#luxuryrealestate

0 notes

Text

What is Multi-Family Real Estate Investing?

Introduction

Multi-family real estate investing is a popular and lucrative strategy for building wealth and generating passive income. In this blog, we will delve into the concept of multi-family real estate investing, exploring its definition, advantages, key considerations, and how to get started in this exciting venture.

Understanding Multi-Family Real Estate Investing

Multi-family real estate investing involves the acquisition and ownership of properties that consist of multiple residential units. These units can range from duplexes and triplexes to larger apartment complexes. Unlike single-family homes, which are designed to accommodate only one family, multi-family properties offer the opportunity to house multiple tenants, increasing the potential for rental income.

The Advantages of Multi-Family Real Estate Investing

Investing in multi-family properties comes with several significant advantages:

1. Diversified Income

One of the most significant benefits of multi-family real estate investment is the ability to generate diversified income. With multiple units, you are not reliant on the income from a single tenant, reducing the risk of financial instability due to vacancies.

2. Economies of Scale

Managing multiple units in a single property allows for economies of scale. Operating and maintenance costs can be spread across the units, making it more cost-effective than owning multiple single-family properties.

3. Appreciation Potential

Multi-family properties tend to appreciate in value over time, which can lead to substantial long-term returns on investment.

4. Tax Benefits

Real estate investors enjoy various tax deductions and benefits, including deductions for property taxes, mortgage interest, and depreciation.

5. Professional Management

With multi-family properties, it becomes feasible to hire professional property management services, reducing the burden of day-to-day operations and tenant interactions.

6. Housing Demand

The demand for rental properties, especially multi-family units, remains consistent even in challenging economic times, making it a stable investment option.

7. Wealth Building

Investing in multi-family real estate provides an avenue for building long-term wealth through consistent rental income and property appreciation.

The related Multifamily investment strategy

Key Considerations for Multi-Family Real Estate Investing

Before diving into multi-family real estate investing, it's crucial to consider some essential factors:

1. Research and Due Diligence

Thoroughly research the real estate market in the area where you plan to invest. Look for neighborhoods with good growth potential and low vacancy rates.

2. Financing Options

Explore various financing options, including traditional mortgages, government-backed loans, and partnerships, to determine the most suitable funding method for your investment.

3. Property Condition

Inspect the property's condition before purchasing. Renovations and repairs can eat into your budget, so it's essential to assess the property's overall condition and estimate potential renovation costs.

4. Tenant Screening

Develop a robust tenant screening process to ensure you attract responsible tenants who pay rent on time and take care of the property.

5. Property Management

Decide whether you will manage the property yourself or hire a professional property management company to handle day-to-day operations.

6. Cash Flow Analysis

Perform a thorough cash flow analysis to determine the potential income and expenses associated with the property. Ensure that the rental income covers all costs and provides a positive cash flow.

#multifamily investing oklahoma#real estate investing oklahoma#multifamily investment companies#multifamily investment firms#multifamily investment strategy#multi family real estate investing#multifamily websites#multifamily investment firm#multifamily investments#multifamily investor#multifamily real estate investing#multifamily real estate investment company#multifamily real estate investment#multifamily investment company#multifamily real estate investing companies#multi-family real estate investment firm#investing in multifamily ebook

0 notes

Text

#multifamily offerings#multifamily syndication#cost segregation real estate#cost segregation depreciation guide#cost segregation commercial real estate#irs cost segregation guide#multifamily syndication website#apartment building sales drop#apartment syndication investing

0 notes

Text

#cost segregation guide#cost segregation depreciation guide#apartment building sales drop#cost segregation real estate#cost segregation commercial real estate#real estate tax benefits#tax benefits of multifamily investing#cash investors pembroke pines#investing in multifamily real estate syndications#multifamily equity partners#multifamily syndication website#multifamily real estate syndication#multifamily real estate investing#real estate investment disclaimer#irs cost segregation guide#irs cost segregation guide residential rental property#real estate passive investing#return metrics#Return Metrics For Real Estate Investors#apartment syndication investing#multifamily syndication#multifamily offerings

0 notes

Text

DSCR Loans in Los Angeles: A Guide for Real Estate Investors

DSCR Loans in Los Angeles is a common way for real estate buyers to get money. It stands for Debt Service Coverage Ratio. Instead of the borrower's credit score, this type of loan is based on how much money the property makes. As a result, investors who own rental homes or want to buy them are sure to like them.

What are DSCR Loans?

The property's yearly debt service to its net operating income (NOI) is used to decide if it meets the requirements for a DSCR loan. Most of the time, a DSCR of 1.25 or higher is thought to be better. The property's income is enough to pay off its bills and then some.

Benefits of DSCR Loans in Los Angeles

Most of the time, DSCR loans have less strict credit requirements than regular mortgages. This could be very helpful for buyers whose credit isn't perfect.

DSCR loans are based on how much money the property can make, not on how much money the client has. These bonds are perfect for investors who own or plan to own properties that bring in regular cash.

The loan-to-value (LTV) number for DSCR loans is usually higher than for regular mortgages. For buyers who need a bigger loan to cover the cost of the property, this could be helpful.

DSCR Loan Lenders in Los Angeles

There are many DSCR loan lenders in Los Angeles, and each one gives borrowers a variety of ways to pay back their loans. Before you decide, get quotes from a few different lenders and compare their terms, fees, and interest rates. There are a lot of different types of properties that lenders may specialize in, such as business real estate and multifamily homes.

Important information About How to Apply for a DSCR Loan

To get a DSCR loan, you need to know how much money the business makes in net operating income (NOI). Tax records and rent files, as well as other property revenue documents, must be easy to find.

The principal amount, the interest rate, and the length of time you have to pay back your loan are the three main things that decide how much you have to pay each year.

Credit doesn't matter much when it comes to standard mortgages, but it can still affect your interest rate and other loan terms.

For a DSCR loan to be approved, the condition of the land is one of several things that must be met. Lenders may ask for a review to find out how much the property is worth and what kind of shape it is in.

Conclusion

A DSCR loan in the Los Angeles area could be very helpful for real estate owners. If you want to make an informed choice about how to finance your next investment property, you need to read the terms of these loans very carefully.

Contact Us:

ACOM Capital

Website:- https://acom-capital.com

Email:- [email protected]

Contact:- +1 844-855-6267

0 notes

Text

Mike Morawski - Multifamily Underwriting 101

Key Takeaways

Multifamily investing requires a specialized vocabulary to navigate the industry effectively.

A rent roll is a critical document for understanding a property's income potential. Key items include tenant information, unit numbers, market rate rent, collected rent, lease terms, and unit mix.

Understanding operating expenses is crucial for profitability. Key categories include payroll, utilities, repairs and maintenance, insurance, taxes, and property management fees.

Understanding financial metrics like NOI, DSCR, and investor returns (ROI, IRR, cash-on-cash preferred returns) is essential for evaluating a property's performance.

Key terms like general partner (GP), limited partner (LP), share classes, waterfall returns, and sponsor fees are crucial for understanding deal structuring.

Thorough due diligence and underwriting are essential for evaluating a property's potential and risks.

Episode Timeline

[00:00:00] Mike introduces underwriting as a foundational tool for multifamily investing decisions.

[00:04:00] Analyzing income and expenses is crucial for assessing profitability and NOI.

[00:08:00] Capital expenditures significantly impact property value and investor returns.

[00:12:00] Evaluating rent growth and market conditions helps predict future income.

[00:16:00] LTV and LTC ratios determine debt capacity and equity safety.

[00:21:00] Interest rates, amortization, and DSCR are vital for securing financing.

[00:23:00] The GP team’s structure and roles ensure effective collaboration and management.

[00:28:00] Various sponsor fees compensate the GP team for their contributions.

Contact

Website: https://mikemorawski.com/

Email: [email protected]

Check out this Insider Secrets episode!

#multi-family#real estate event#investing#mike morawski#multi family global summit#my core intentions

0 notes

Text

Emerging Trends Shaping the Future of Commercial Real Estate Services Procurement

The commercial real estate services category is expected to grow at a CAGR of 5.1% from 2023 to 2030. The rising inflation Fed interest rate, and the post-pandemic situation have slowed down the commercial real estate sector across the globe. However, with the normalization of COVID-19, companies plan to increase their physical presence. On the other hand, multifamily, and industrial asset classes have performed well.

In 2023, the Industrial segment of the commercial real estate category has continued to showcase strength. The demand for warehouse and distribution space has been bolstered by increasing e-commerce sales and disruptions in the supply chain. According to the National Association of Realtors April 2023 report, the industrial vacancy rate stands at a low of 4.3%. Additionally, the industrial rent growth rate remains robust, reaching 10.3%. Warehouses have experienced an impressive 11.7% growth in rental prices.

Commercial real estate service providers are focusing on adopting technology to improve property management, smooth property dealing processes, and increase customer experience. To achieve this, service providers are adopting technologies such as virtual reality (VR), augmented reality (AR), big data and analytics, and artificial intelligence. Property buying and selling websites, real estate management software, virtual reality, drones, and other tech devices, real estate crowdfunding platforms, and marketing automation are some of the recent trends that depict the technological adoption in this category.

Order your copy of the Commercial Real Estate Services Procurement Intelligence Report, 2023 - 2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Companies are acquiring small players to increase their market penetration and global reach. For instance,

• In December 2022, CBRE Group acquired H2M Sverige AB a property management service company in Sweden. Post completion of the acquisition, H2M will operate as part of the CBRE Global Workplace Solutions (GWS) group and strengthens the presence of CBRE in the country.

• In October 2022, BBG, a commercial real estate service firm, acquired VSI Appraisal Group in Columbus. With this acquisition, BBG will enhance its presence in Columbus while adding affordable housing specialty to its portfolio of services.

Using drones to gather high-quality aerial images is a cutting-edge trend in the real estate industry. It offers a distinctive and influential viewpoint for property analysis. Drones are utilized across various real estate categories such as apartments, residential homes, vacant land, resorts, and commercial properties. With advanced in-drone camera technology, these unmanned aerial devices can capture videos, images, multiple overhead map images, and even 360-degree panoramas. This comprehensive approach provides additional information and transparency to prospective clients.

Commercial Real Estate Services Sourcing Intelligence Highlights

• Buyers in the commercial real estate category, such as businesses or investors, can exert significant bargaining power, particularly if there is a surplus of available properties. Buyers can negotiate favorable lease terms, request concessions, or shop around for alternative options. The level of buyer bargaining power depends on factors such as market conditions, demand and supply dynamics, and the availability of substitutes.

• Property management, common area management, utilities, security, and supply cost are some of the costs incurred in commercial real estate services.

• The average cost of appraising commercial buildings is USD 4,000 whereas big buildings may cost up to USD 15,000 or more.

• The category can be described as mature with several active property owners and buyers. Maintaining long-term broker relationships is recommended to get better property deals.

List of Key Suppliers

• CBRE

• Cushman & Wakefield

• Lee & Associates

• Savills

• Marcus & Millichap

• Colliers

• Avison Young

• Newmark Knight Frank

• TCN Worldwide

• RE/MAX, LLC

Browse through Grand View Research’s collection of procurement intelligence studies:

• Commercial Print Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

• Loyalty Programs Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

Commercial Real Estate Services Procurement Intelligence Report Scope

• Commercial Real Estate Services Category Growth Rate: CAGR of 5.1% from 2023 to 2030

• Pricing growth Outlook: 3% - 4% (Annually)

• Pricing Models: Full Service Outsource Pricing, Price for services offered, Competition based pricing

• Supplier Selection Scope: End-to-end service, cost and pricing, compliance, service reliability, and scalability

• Supplier Selection Criteria: Types of properties, quality, number of services offered, client relationship, track record and reputation, regulatory compliance, and others

• Report Coverage: Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

• Market Intelligence involving – market size and forecast, growth factors, and driving trends

• Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

• Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

• Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions

#Commercial Real Estate Services Procurement Intelligence#Commercial Real Estate Services Procurement#Procurement Intelligence

0 notes