#offshore financial

Text

Considering outsourcing bookkeepers but unsure where to start? Our guide has you covered. Unlock the power of outsourcing your bookkeeping tasks!

0 notes

Text

How Does Offshore Accounting Influence Financial Reporting?

Offshore accounting significantly impacts financial reporting for multinational companies, presenting both challenges and opportunities. The practice involves recording financial transactions and maintaining accounts in jurisdictions outside the company's home country. This strategy is often utilized to optimize tax efficiency, access international markets, or streamline operational costs. However, offshore accounting practices can have notable implications on financial reporting.

One key influence of offshore accounting on financial reporting is the complexity it introduces into financial statements. Transactions conducted offshore may involve multiple currencies, differing tax regulations, and varying accounting standards, requiring meticulous reporting to ensure compliance and transparency. This complexity can affect the accuracy and reliability of financial reporting, potentially leading to challenges in auditing and regulatory compliance.

Offshore accounting can also impact the visibility of a company's financial performance. Certain transactions conducted offshore, such as intercompany transfers or the use of offshore entities for financing purposes, may obscure the true financial position of the company. This can create challenges in accurately assessing profitability, asset utilization, and overall financial health.

Furthermore, offshore accounting practices can raise concerns about transparency and ethical practices. The use of offshore jurisdictions for financial activities may be subject to scrutiny regarding tax avoidance or evasion. This can impact stakeholder perceptions and investor confidence, potentially affecting the company's reputation and market valuation.

In conclusion, the influence of offshore accounting on financial reporting underscores the importance of strategic management and professional guidance. Companies seeking to navigate the complexities of offshore transactions and ensure transparent financial reporting can benefit from consulting services offered by reputable firms like PKC Management Consulting. PKC specializes in international accounting and taxation, providing tailored solutions to address the challenges associated with offshore operations.

PKC Management Consulting assists companies in implementing robust accounting practices that align with international standards and regulatory requirements. By leveraging PKC's expertise, businesses can enhance their financial reporting processes, mitigate risks associated with offshore transactions, and uphold transparency and compliance. In today's globalized business environment, partnering with consulting firms like PKC Management Consulting is essential for optimizing offshore accounting practices and maintaining integrity in financial reporting.

Contact: +91 9176100095 ,

Email: [email protected]

Address: 27/7, Alagappa Rd ,Purasaiwakkam ,Chennai, Tamil Nadu 600084

Know more: https://pkcindia.com/

0 notes

Text

Navigating Offshore Financial Services: A Comparative Look at Vanuatu, Seychelles, and Cook Islands

In the diverse world of offshore financial services, selecting the right jurisdiction is crucial for the security, efficiency, and profitability of investments. Among the myriad options available, Vanuatu, Seychelles, and Cook Islands stand out as preferred destinations for offshore activities. This blog post provides a comparative analysis of these three jurisdictions to help investors make…

View On WordPress

0 notes

Text

Empower Your Business Ventures: O2 Group Dubai

Unlock growth opportunities and streamline your business operations with O2 Group Dubai. Our comprehensive range of services, from company formation to financial solutions, is designed to help businesses thrive in Dubai's dynamic business ecosystem. Trust O2 Group Dubai as your strategic partner for success in Dubai's vibrant business ecosystem.

#o2 group dubai#company formation in dubai#business setup in dubai#companyformation#dubairealestate#real estate companies in dubai#finance#dubairealestateinvestment#modern real estate#dubaiproperty#trade finance#offshore company formation#corporate finance#financial planning

0 notes

Text

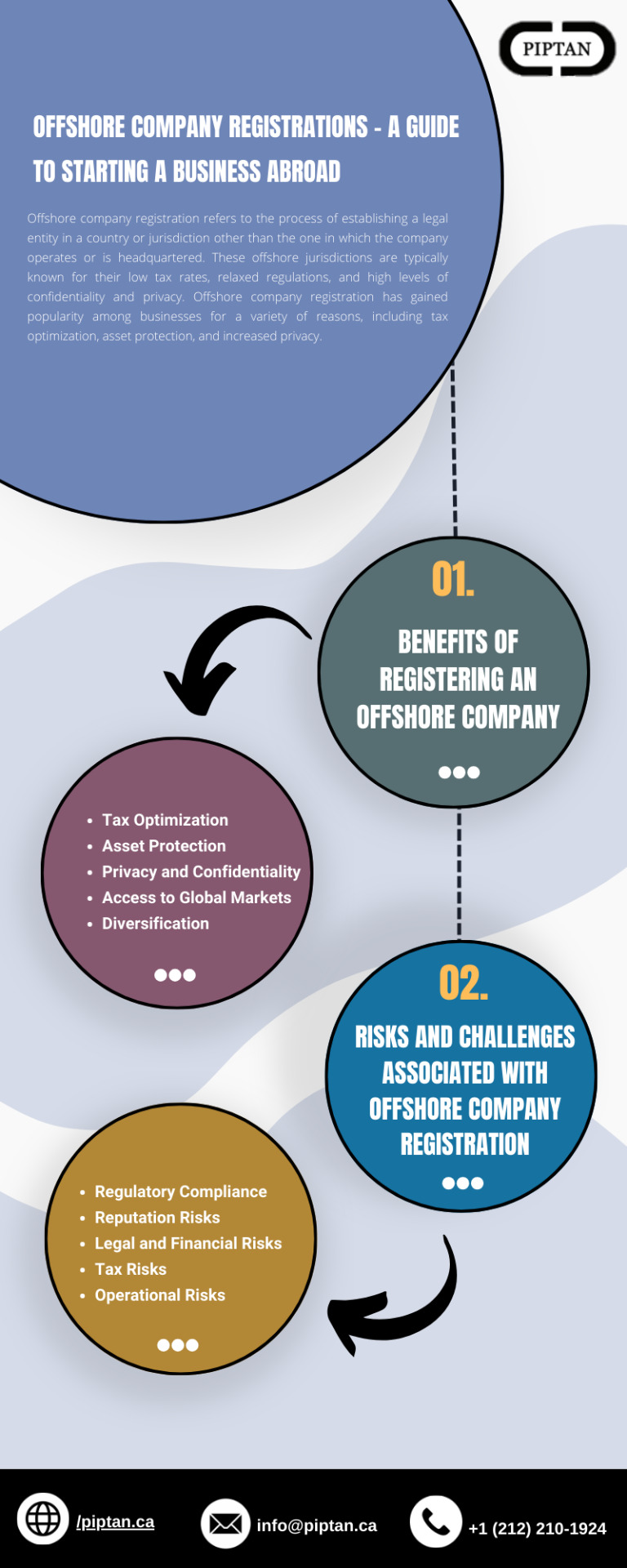

Offshore Company Registrations - A Guide to Starting a Business Abroad

Offshore company registration refers to the process of establishing a legal entity in a country or jurisdiction other than the one in which the company operates or is headquartered. These offshore jurisdictions are typically known for their low tax rates, relaxed regulations, and high levels of confidentiality and privacy. Offshore company registration has gained popularity among businesses for a variety of reasons, including tax optimization, asset protection, and increased privacy.

The process of registering an offshore company typically involves hiring a professional service provider, such as a law firm or corporate services provider, to assist with the incorporation process. The service provider will typically guide the client through the process of selecting the most appropriate offshore jurisdiction, based on the client's specific needs and objectives, and then assist with the necessary documentation and filings to establish the company.

1 note

·

View note

Text

Texas Consulting Firm Empowers Businesses with Advanced Offshore Financial Services

Texas Consulting Firm, a renowned leader in financial consulting, proudly announces the launch of its cutting-edge Offshore Financial Services, a strategic move aimed at empowering businesses to optimize their financial strategies in the global market.

In response to the evolving landscape of international business, Texas Consulting Firm has expanded its service portfolio to offer comprehensive Offshore Financial Services. These services are meticulously designed to provide businesses with unparalleled opportunities for growth, risk management, and financial efficiency.

Offshore Finance has become an increasingly vital component of global business operations, offering businesses the flexibility and advantages necessary for sustained success in a competitive marketplace. Texas Consulting Firm recognizes the unique challenges faced by businesses in navigating the complexities of international finance. With the introduction of advanced Offshore Financial Services, the firm aims to simplify and enhance the offshore financial landscape for its clients.

The key offerings of Texas Consulting Firm Offshore Financial Services include strategic tax planning, asset protection, and diversified investment solutions. The firm's team of seasoned financial experts leverages their deep industry knowledge to customize offshore finance strategies that align with the unique goals and needs of each client.

The Offshore Finance services provided by Texas Consulting Firm are not only geared towards large enterprises but are also tailored to meet the needs of small and medium-sized businesses seeking to expand their footprint globally. The firm believes that by offering advanced offshore financial solutions, businesses can optimize tax structures, protect assets, and explore new avenues for investment.

As part of the launch, Texas Consulting Firm will be hosting informational webinars and workshops to educate businesses on the benefits and intricacies of offshore finance. The firm encourages business leaders and decision-makers to explore the potential of Offshore Financial Services in achieving their financial objectives.

Texas Consulting Firm commitment to excellence, coupled with its forward-thinking approach, positions the firm as a trusted partner for businesses seeking to navigate the complexities of international finance. With the introduction of advanced Offshore Financial Services, Texas Consulting Firm continues to be at the forefront of empowering businesses for sustained success in the global marketplace.

About Texas Consulting Firm: Texas Consulting Firm is a leading financial consulting firm based in Houston, Texas. With a team of seasoned financial experts, the firm specializes in providing tailored financial solutions to businesses, optimizing their financial strategies for success in the global market. For more information, please visit [www.texasconsultingfirm.com].

For More inquiries, please contact:

Address: Houston, Texas

Contact: +17135130039

Email: [email protected]

#Offshore Finance#Offshore Financial Services#Finance Outsourcing#Finance Consulting Firms#Outsourcing

0 notes

Text

#Outsourced bookkeeping#accounting outsourcing#bookkeeping solutions#Offshore accounting services#Hire Expert bookkeepers#Outsourced financial reporting

0 notes

Text

Navigating Global Talent: Outsourcing vs. Offshoring

In the realm of business optimization, choosing between outsourcing and offshoring is pivotal. Outsourcing involves delegating tasks to external partners, while offshoring entails relocating operations to foreign shores. Make informed decisions to enhance efficiency and stay competitive in the global marketplace.

Get Free Quote!

#outsourced bookkeeping#outsourced accounting#financial analysis#Offshoring#Technology#RPA#Automation#Business

0 notes

Text

Top 10 Wealthiest Cities of the World in 2023

Introduction

As the world economy continues to expand, certain cities stand out as the

wealthiest in the world. The world's wealthiest cities are a testament to the

growing global economy and the increasing wealth of individuals and corporations.

These cities are centers of economic growth, innovation, and wealth. The most

affluent cities in the world are typically located in developed countries and are

home to some of the most successful businesses and industries.

The accumulation of wealth in these cities has been driven by various factors such

as technology, finance, natural resources, and skilled human capital. In this blog,

we will be looking at the wealthiest cities in the world in 2023.

Methodology

To determine the wealthiest cities in the world in 2023, the researchers and data

analysts at The Piptan Organization, analyzed data from various sources such as

the World Bank, International Monetary Fund, and other reputable institutions.

The data used in this analysis include GDP per capita, purchasing power parity

(PPP), and other economic indicators. We also considered factors such as

population size, economic diversification, and infrastructure development in our

analysis.

1) New York City, USA

New York City has always been a global economic hub, and it continues to remain

so in 2023. With a GDP of over $1.8 trillion, it is the wealthiest city in the world. The

city's financial sector is one of the biggest contributors to its economy, with Wall

Street being the financial capital of the world. Other industries such as technology,

healthcare, and media also contribute significantly to the city's economy.

New York City's infrastructure, world-class universities, and cultural diversity also

make it an attractive destination for businesses and individuals alike.

2) Tokyo, Japan

Tokyo is Japan's economic and cultural center, and it is the second wealthiest city

in the world with a GDP of over $1.6 trillion. The city's economy is diverse and

includes industries such as finance, technology, and manufacturing. Tokyo is home

to many of Japan's biggest companies and is a major financial hub in Asia.

The city's infrastructure, efficient public transportation, and highly educated

workforce also make it an attractive destination for businesses.

3) London, United Kingdom

London is the capital of the United Kingdom and one of the world's most prominent

financial centers. The city has a GDP of $731.2 billion and a per capita income of

$71,000. London's economy is primarily driven by finance, technology, and tourism.

London is home to many of the world's largest banks and financial institutions,

including the London Stock Exchange and the Bank of England. The city also

benefits from its diverse economy, with a thriving technology sector and a robust

tourism industry. London's strategic location in Europe also makes it an attractive

destination for businesses looking to expand their reach into the continent.

4) Singapore, The Republic of Singapore

Singapore is a small island nation in Southeast Asia known for its efficiency,

cleanliness, and high standard of living. In 2023, its GDP is projected to be around

$431 billion, making it one of the wealthiest cities in the world. Its economy is based

on finance, trade, and services and is one of the most innovative and dynamic in

Asia.

The average income in Singapore is around $75,000, which is one of the highest in

the world. The city's real estate prices are also among the highest, with the average

price per square meter at around SGD 14,000 ($10,000). However, Singapore offers

excellent healthcare, education, and infrastructure, making it a popular destination

for ex-pats and entrepreneurs.

5) Los Angeles, USA

Los Angeles is the second-largest city in the United States and is the fourth

wealthiest city in the world with a GDP of over $1 trillion. The city's economy is

diverse and includes industries such as entertainment, technology, and healthcare.

Los Angeles is home to Hollywood, the center of the global entertainment industry,

and is also a major hub for the aerospace industry.

The city's beautiful weather, cultural diversity, and world-class universities also

make it an attractive destination for businesses and individuals.

6) Hong Kong, China

Hong Kong is a special administrative region of China and one of the world's most

vibrant and prosperous cities. In 2023, its GDP is projected to be around $363

billion, making it one of the wealthiest cities in Asia. Its economy is based on

finance, trade, and services and is one of the world's most open and dynamic.

The average income in Hong Kong is around $46,000, which is higher than the

national average. The city's real estate prices are some of the highest in the world,

with the average price per square meter at around HKD 100,000 ($12,800). Despite

its high cost of living, Hong Kong offers an excellent quality of life, with world-class

healthcare, education, and infrastructure.

7) Beijing, China

Beijing is the capital city of China and has consistently been among the fastest growing cities in the world. The city's GDP is projected to reach $592.6 billion by

2023, making it one of the wealthiest cities in the world. Beijing is also home to

some of the biggest companies in China, such as Alibaba, Tencent, and Baidu.

These companies have driven Beijing's economic growth in recent years, and their

success is expected to continue. Additionally, the city has a high concentration of

millionaires and billionaires, making it a hub for luxury goods and services.

8) Shanghai, China

Shanghai is China's largest city and has long been a hub for international trade and

commerce. The city's GDP is expected to reach $634.8 billion by 2023, making it

one of the wealthiest cities in the world. Shanghai has a thriving financial sector,

with the Shanghai Stock Exchange being one of the largest in the world.

The city is also home to a large number of multinational corporations, such as CocaCola and Volkswagen. With a population of over 24 million people, Shanghai is a

hub for luxury goods and services, with many high-end shopping malls and luxury

hotels.

9) Sydney, Australia

Sydney is the largest city in Australia and is known for its stunning beaches, iconic

landmarks, and thriving business district. The city's GDP is projected to reach

$463.6 billion by 2023, making it one of the wealthiest cities in the world. Sydney's

economy is diverse, with strengths in finance, tourism, and technology.

The city is also home to many multinational corporations, including Google and

Microsoft. With a population of over 5 million people, Sydney has a high

concentration of millionaires and billionaires, making it a hub for luxury goods and

services.

10) Chicago, USA

Chicago is a city that has always been known for its economic strength and vitality.

In 2023, it is still one of the wealthiest cities in the world. The city is home to a

number of Fortune 500 companies, including Boeing, United Airlines, and

Caterpillar, among others. The city is also a major financial hub, with the Chicago

Mercantile Exchange and the Chicago Board of Trade both located there.

The city's economy is diverse, with strong sectors in finance, manufacturing, and

transportation. Chicago is also a major center for technology and innovation, with

many startups and established tech companies calling the city home. All of these

factors have contributed to Chicago's continued economic success.

What makes these cities the wealthiest?

The wealthiest cities in the world have a few common characteristics that have

contributed to their economic success. First and foremost, these cities have a highly

skilled and educated workforce that is able to adapt to the demands of a rapidly

changing economy.

Second, these cities have well-developed infrastructure and logistics networks that

make it easy for businesses to operate efficiently. Third, these cities have a diverse

and vibrant economy that includes a range of industries, from finance to

technology to manufacturing.

Finally, these cities have a favorable business environment, with supportive

government policies and comparatively, low tax rates that encourage investment

and entrepreneurship.

Conclusion

As we can see, the top 10 wealthiest cities mentioned in the list cities the ones that

have seen their economies grow and prosper in recent years. Each city has its own

unique strengths and sectors that have contributed to its economic success.

As we look ahead to the future, it will be interesting to see how these cities

continue to evolve and adapt to the changing economic landscape.

1 note

·

View note

Text

Caravel Global - International Financial Advisors in Zambia - Caravel Partners - Your International Investment Specialists in Zambia and Uganda

#ifa#ifa jobs#ifa recruitment#financial advisor#offshore#financial advisor jobs#wealth management#financial advisor careers#adviser jobs#dubai

0 notes

Text

youtube

Elevate Your Accounting Content Calendar with Chat GPT | Future proof accounts

Welcome to our channel, dedicated to empowering accountants and finance professionals with invaluable insights and strategies. 📊📚 In this video, we delve into the world of accounts management and financial reporting, covering topics ranging from future-proofing accounts to harnessing the capabilities of AI-driven tools like ChatGPT. Whether you're an accounting enthusiast or a seasoned professional, this content is tailored to help you navigate the complex landscape of financial data with confidence.

#DextPrecisionAccuracy#offshore#Accounts management#Future-proofing strategies#Quality account file checks#GST claiming process#Dext Precision training#Financial report analysis#Management report interpretation#AI tools in accounting#future proof accounts#how to check quality accounts file#dext percision#dext percision traning#accountting files#financial report#analyze financial report#using chat gpt in accounts#creating bar chart with ChatGPT#Youtube

0 notes

Text

What Accounting Functions Can Be Outsourced?

Outsourcing Accounting functions has become a popular strategy for businesses looking to streamline their operations, reduce costs, and focus on their core competencies. Many businesses find it challenging to manage their daily responsibilities along with Accounting, finance, and risk management. Among the most commonly outsourced tasks are bookkeeping, accounts payable, and accounts receivable, enabling businesses to achieve significant savings in both time and financial resources. By outsourcing these tasks businesses can save money and time. So, accounting outsourcing can be a better option for businesses to achieve efficiency in it. By entrusting these accounting tasks to external experts, companies can free up and can focus on their core competencies, and maintain compliance with financial regulations. In this article, we will explore the various accounting functions that can be outsourced.

Accounting Functions That Can Be Outsourced

Bookkeeping

Recording of financial transactions is bookkeeping. It can be time-consuming and unvarying. It is important for a business to keep records of its expenses and income. Outsourcing these tasks helps businesses save time and reduce the risk of errors. Bookkeeping requires attention to detail, and to maintain the privacy and accuracy of the information. Efficient bookkeeping and data entry are crucial for the organization's success. For an organization’s success bookkeeping is crucial.

Payroll Processing

Payroll processing involves calculating wages, taxes, and deductions for employees. This record shows the total salary paid and to be paid to employees for calculating payroll taxes. It's very important to follow all the rules and laws related to taxes and regulations. Outsourcing payroll processing to specialized firms has several benefits, including precise and timely payments, compliance with tax regulations, and secure handling of employee information.

Making Financial Reports

Financial reporting is essential for understanding a company's financial health, identifying trends, and making business decisions. Outsourcing this function to accounting professionals, ensures financial statements are prepared according to accounting standards and industry norms, and also businesses will receive high-quality reports which offer better insights into the business finances.

Filing sales tax and other types of taxes

Filing sales tax and other types of taxes involves the process of reporting and remitting financial obligations to the government. Outsourcing accounting firms can handle sales and other taxes, and improve tax-related aspects of the business making income tax filing easier. Sales tax is a tax on the sale of goods and services, usually collected by businesses from their customers and later paid to the state or local tax authorities. Filing taxes correctly and on time is important to follow tax laws to avoid penalties or legal consequences. Businesses often seek help from professionals or use tax software for accurate and efficient tax filing.

Auditing Services

Auditing services evaluate an organization's financial records, processes, and operations and help businesses and institutions build credibility, identify weaknesses, and promote transparency and accountability among stakeholders. Outsourcing auditing services can save money for large companies or those who need audited financial statements. External auditors bring a neutral perspective to the auditing process.

Accounts Payable & Accounts Receivable

Managing accounts payable and receivable is important to ensure proper cash flow. When outsourcing these will get to know that the accounting is done in a proper way. The records show the firm's liabilities, where the amount owed to the suppliers, cash discount, and payments due.

Maybe it's the ideal time for your business to outsource its accounting needs or other responsibilities. JAKs365 has emerged as a leading accounting outsourcing service, standing out as a preferred option for outsourced accounting firms due to its intense dedication to unique work. JAKs365 strives to understand each company's specific financial challenges and deliver efficient, cost-effective solutions. We will ease your task by handling your accounting tasks and responsibilities.

#accounting services#payroll services#financial consultation#offshoring accounting#training for accountants#payroll administration#Bookkeeping#bookkeeping services#Small business bookkeeping

0 notes

Text

Demystifying Offshore Finance: Understanding The Financial Secrecy Index

In the realm of international finance, the concept of financial secrecy often raises eyebrows and sparks curiosity. Understanding the dynamics of offshore finance requires delving into various metrics and indices, one of the most prominent being the Financial Secrecy Index (FSI). In this article, we aim to demystify the Financial Secrecy Index, its significance, and its implications for investors…

View On WordPress

1 note

·

View note

Text

Unveiling the Shadows: Safeguarding Financial Transparency in a Shifting World

In an interconnected global economy, financial transparency plays a critical role in maintaining the integrity and stability of the financial system. It serves as a cornerstone for trust, accountability, and informed decision-making. However, as the world continues to evolve and new challenges arise, it is imperative that we remain vigilant and proactive in identifying and addressing the emerging…

View On WordPress

#Cybersecurity#emerging challenges#financial transparency#global economy#offshore financial centers#regulatory oversight#Risks#tax havens#Technology

0 notes

Text

Offshore staffing for accounting firms involves hiring professionals from foreign countries to handle various accounting tasks remotely. It offers numerous benefits such as cost savings, access to a global talent pool, and increased productivity. By leveraging offshore resources, accounting firms can reduce overhead costs, scale their operations efficiently, and access specialized expertise. Offshore staffing also enables firms to provide round-the-clock service to clients in different time zones. However, it requires effective communication and management practices to ensure seamless collaboration. Overall, offshore staffing can be a strategic and beneficial approach for accounting firms to enhance their capabilities, improve efficiency, and remain competitive in a globalized business environment.

0 notes

Text

Best Countries for Offshore Company Formation in 2023

Offshore company registration refers to the process of establishing a legal entity in a country or jurisdiction other than the one in which the company operates or is headquartered.

These offshore jurisdictions are typically known for their low tax rates, relaxed regulations, and high levels of confidentiality and privacy. Offshore company registration has gained popularity among businesses for a variety of reasons, including tax optimization, asset protection, and increased privacy. In the second part of this blog, we will explore the best countries for offshore company formation in 2023.

Anguilla

When it comes to establishing an Best Offshore Company formation service, Anguilla has emerged as a highly desirable destination. This beautiful Caribbean island offers a range of benefits and advantages that make it an attractive option for individuals and businesses seeking to register an offshore company

Registering an offshore company in Anguilla can provide entrepreneurs with significant advantages, including tax benefits, asset protection, and privacy. Let’s delve into the numerous advantages of choosing Anguilla as the jurisdiction for your offshore company.

Best Country To Set Up An Offshore Company Register :

How to Register an Offshore Company in Anguilla?

Step 1: Choose a company nameThe first step in registering an offshore company in Anguilla is to choose a unique company name that is not already registered in the jurisdiction. The name should not be similar to any existing Anguillan company and should comply with the relevant regulations. It's advisable to conduct a name search to ensure availability.

Step 2: Engage a Registered AgentTo register an offshore company in Anguilla, it is mandatory to engage a registered agent licensed by the Anguillan Financial Services Commission (FSC). A registered agent will assist you in navigating the registration process, ensuring compliance with local regulations, and acting as a liaison between your company and the authorities.

Step 3: Determine the Company StructureAnguilla offers various company structures for offshore businesses, including companies limited by shares (Ltd.), companies limited by guarantee (Guarantee Ltd.), and limited duration companies (LLC). Choose the most suitable structure based on your specific needs, considering factors like liability protection, ownership, and operational flexibility.

Step 4: Prepare the Required DocumentationTo register an offshore company in Anguilla, you will need to gather and prepare the necessary documentation. This typically includes:

Articles of Incorporation:This document outlines the company's regulations and internal workings.

Memorandum of Association:It provides details about the company's purpose, structure, and activities.

Consent of Directors and Officers:The consent of all directors and officers should be obtained and documented.

Declaration of Compliance:This document certifies that the company meets all legal requirements.

Step 5: Submit the Application to the Registrar of CompaniesOnce you have prepared the required documentation, you will need to submit the application to the Registrar of Companies in Anguilla. Your registered agent will assist you in submitting the application along with the necessary fees.

Step 6: Pay the Required FeesAs part of the registration process, you will need to pay the requisite fees to the Anguillan authorities. The fees will vary based on the type of company and the services provided by your registered agent.

Step 7: Obtain a Certificate of IncorporationUpon successful completion of the registration process and payment of the fees, you will receive a Certificate of Incorporation from the Registrar of Companies. This document serves as legal proof of the existence of your offshore company in Anguilla.

Step 8: Fulfill Ongoing Compliance RequirementsAfter the registration process is complete, you must fulfill the ongoing compliance requirements for your Anguillan offshore company. This may include annual filings, maintaining proper accounting records, and adhering to any other obligations outlined by the Anguillan authorities.

In Conclusion, registering an Offshore company registration can provide entrepreneurs with significant advantages, including tax benefits, asset protection, and privacy. By following the step-by-step guide outlined above, you can successfully navigate the process of registering an offshore company in Anguilla. Remember to consult with a registered agent or legal professional to ensure compliance with all applicable laws and regulations. With the right guidance, you can establish a thriving offshore company in Anguilla and reap the benefits it offers.

Benefits of Registering an Offshore Company in Anguilla

Privacy and ConfidentialityAnguilla is renowned for its strong commitment to privacy and confidentiality. The jurisdiction has strict laws in place to protect the privacy of individuals and businesses. When you register an Offshore Company in Anguilla, you can enjoy enhanced privacy protection, ensuring that your personal and financial information remains secure and confidential.

Tax AdvantagesOne of the primary reasons individuals and businesses opt to register an offshore company is to enjoy tax advantages. Anguilla offers a favorable tax environment for offshore entities. There are no income taxes, capital gains taxes, inheritance taxes, or wealth taxes imposed on offshore companies registered in Anguilla. This allows you to retain a larger portion of your profits and optimize your tax planning strategies.

Easy Company FormationAnguilla boasts a streamlined and efficient company formation process. Setting up an offshore company in Anguilla is relatively straightforward and requires minimal bureaucracy. The jurisdiction offers user-friendly procedures and a supportive regulatory framework, making it hassle-free for individuals and businesses to establish their offshore entities.

Asset Protection:Asset protection is a crucial consideration for many individuals and businesses. Registering an offshore company in Anguilla provides a layer of protection for your assets. The jurisdiction's legislation is designed to safeguard your assets from potential legal threats, creditors, and lawsuits. By establishing an offshore company in Anguilla, you can mitigate risks and shield your assets effectively.

Flexibility and Operational Ease:Anguilla offers significant flexibility and operational ease for offshore companies. There are no requirements for minimum capitalization, and you have the freedom to structure your company according to your specific needs. Additionally, there is no mandatory requirement for annual general meetings or the disclosure of beneficial owners, further enhancing the operational ease and convenience of running an offshore entity in Anguilla.

Proximity to North America and Europe:Anguilla's strategic location in the Caribbean region provides easy access to both North American and European markets. This proximity makes it an ideal choice for businesses looking to expand globally and establish a presence in these lucrative markets. The well-developed infrastructure and connectivity of the island further facilitate trade and communication with international partners.

Professional Support and Services:Anguilla has a well-established network of professional service providers, including lawyers, accountants, and company formation agents, who specialize in assisting with the registration and ongoing management of offshore companies. These experienced professionals can provide expert guidance, ensuring compliance with local regulations and maximizing the benefits of your offshore company.

Panama

Panama is renowned for being a favorable jurisdiction for offshore company formation due to its strategic location, robust economy, and attractive tax regulations. Setting up an offshore company in Panama can offer numerous benefits, such as tax optimization, asset protection, and enhanced privacy.

Panama has gained a reputation as one of the most attractive jurisdictions in the world. Known for its business-friendly environment, and strategic location, Panama offers numerous benefits for individuals and businesses seeking to establish an offshore company. In this guide, we will walk you through the process of registering an offshore company in Panama.

How to Register an Offshore Company in Panama?

Step 1: Choose a company nameThe first step in registering an offshore company in Panama is selecting a unique company name that is not already registered. The chosen name should not be similar to any existing Panamanian company and must comply with the regulations set by the Public Registry of Panama.

Step 2: Engage a Registered AgentTo register an offshore company in Panama, it is mandatory to engage the services of a registered agent. A registered agent will facilitate the registration process, assist with the necessary documentation, and act as a liaison between your company and the Panamanian authorities.

Step 3: Determine the Company StructurePanama offers several company structures for offshore businesses, including Private Interest Foundations (PIFs) and International Business Corporations (IBCs). Consider the advantages and characteristics of each structure to determine the most suitable option based on your business objectives and needs.

Step 4: Prepare the Required DocumentationTo register an offshore company in Panama, you will need to gather and prepare the necessary documentation. The typical documentation includes:

Articles of Incorporation: This document outlines the company's purpose, share capital, and internal regulations.

Certificate of Good Standing: If incorporating a company that already exists, you may need to provide a certificate of good standing from the jurisdiction where the company is currently registered

Passport Copies and Proof of Address: Provide passport copies and proof of address for all directors, officers, and shareholders.

Notarized Power of Attorney: This document authorizes your registered agent to act on your behalf during the registration process.

Step 5: Submit the Application to the Public Registry of PanamaOnce you have prepared the necessary documentation, your registered agent will submit the application to the Public Registry of Panama. The application includes the company's Articles of Incorporation, along with the required fees and supporting documents.

Step 6: Pay the Required FeesAs part of the registration process, you will need to pay the applicable fees to the Public Registry of Panama. The fees vary depending on the type of company and the services provided by your registered agent.

Step 7: Obtain the Certificate of IncorporationUpon successful completion of the registration process and payment of the fees, you will receive a Certificate of Incorporation from the Public Registry of Panama. This certificate serves as legal proof of your offshore company's existence in Panama.

Step 8: Fulfill Ongoing Compliance RequirementsAfter registering your offshore company in Panama, it is crucial to comply with ongoing obligations and requirements. This includes maintaining proper accounting records, filing annual tax returns, and adhering to any other obligations outlined by the Panamanian authorities.

In Conclusion, registering an offshore company in Panama can provide entrepreneurs with significant advantages, including tax benefits, asset protection, and enhanced privacy. By following the step-by-step guide outlined above and working with a reputable registered agent, you can successfully navigate the process of registering an offshore company in Panama.

It is essential to consult with legal and tax professionals to ensure compliance with all applicable laws and regulations. With the right guidance, you can establish a successful offshore company in Panama and capitalize on the benefits it offers.

Benefits of Registering an Offshore Company in Panama

Favorable Tax EnvironmentOne of the key advantages of registering an offshore company in Panama is the favorable tax environment it offers. Panama operates on a territorial tax system, which means that offshore companies are only taxed on income derived from Panamanian sources. Income generated outside of Panama is exempt from local taxation, providing significant tax planning opportunities and potential tax savings for businesses.

Asset ProtectionPanama offers robust asset protection laws that make it an ideal jurisdiction for individuals seeking to safeguard their assets. By registering an offshore company in Panama, you can separate your personal assets from those of your company, reducing the risk of personal liability. The country's legal framework provides strong asset protection, making it more challenging for creditors or litigants to seize assets held within your offshore company.

Privacy and ConfidentialityPanama has strict laws and regulations in place to protect the privacy and confidentiality of individuals and businesses. The country's corporate laws ensure that the identities of beneficial owners, directors, and shareholders remain confidential and are not part of the public record. This level of privacy protection is highly sought after and provides individuals and businesses with peace of mind.

Simplified Company Formation ProcessSetting up an offshore company in Panama is relatively simple and straightforward. The process involves minimal bureaucracy and paperwork compared to other jurisdictions. The government has streamlined the company formation procedures, allowing for quick and efficient registration. This enables entrepreneurs and businesses to establish their offshore entities with ease and start operating swiftly.

Political and Economic StabilityPanama has long been regarded as a politically and economically stable country. It boasts a robust economy, a well-developed banking system, and a favorable business climate. The country's stable political environment ensures a secure and predictable investment climate, attracting businesses and entrepreneurs from around the world.

Strategic Geographical LocationSituated at the crossroads of the Americas, Panama enjoys a strategic geographical location. It serves as a vital international trade and logistics hub, connecting North and South America. This strategic position provides businesses with easy access to markets in both continents, making Panama an ideal base for expanding into the Americas.

International Banking and Financial ServicesPanama is home to a thriving banking and financial sector. The country has a well-established reputation as an international financial center, offering a wide range of banking services, including asset management, private banking, and offshore banking. Access to reputable and internationally recognized financial institutions can enhance the credibility and operational capabilities of your offshore company.

British Virgin Islands

The British Virgin Islands (BVI) has long been recognized as one of the premier offshore jurisdictions for company registration. Known for its favorable tax laws, robust legal framework, and business-friendly environment. The BVI offers numerous benefits for individuals and businesses seeking to establish an offshore company.

In this guide, we will delve into the advantages of choosing the British Virgin Islands as the jurisdiction for your offshore company.

How to Register an Offshore Company in the British Virgin Islands?

Step 1: Engage a Registered AgentTo register an offshore company in the BVI, it is mandatory to engage the services of a registered agent. A registered agent will guide you through the registration process, assist with the required documentation, and act as a liaison between your company and the BVI Financial Services Commission.

Step 2: Choose a Company NameThe next step is to select a unique company name that is not already in use. The chosen name should comply with the regulations set by the BVI Registrar of Corporate Affairs and should not be misleading or similar to existing companies in the jurisdiction.

Step 3: Determine the Company StructureThe BVI offers various company structures for offshore businesses, with the most common being the BVI Business Company (BVIBC). Consider the company structure that best suits your business objectives, taking into account factors such as liability protection, ownership flexibility, and ease of administration.

Step 4: Prepare the Required DocumentationTo register an offshore company in the BVI, you will need to gather and prepare the necessary documentation, including:

Memorandum and Articles of Association: These documents outline the company's purpose, activities, and internal regulations.

Consent Forms: Obtain consent forms from all directors, officers, and shareholders, confirming their agreement to act in their respective roles.

Registered Office Address: Provide a registered office address in the BVI where the company's official correspondence will be sent.

Identity Documents: Submit certified copies of passports or other identity documents for all directors, officers, and shareholders.

Step 5: Submit the Application to the BVI Financial Services CommissionOnce the required documentation is prepared, your registered agent will submit the application to the BVI Financial Services Commission. The application should include the necessary forms, fees, and supporting documents.

Step 6: Pay the Required FeesAs part of the registration process, you will need to pay the applicable fees to the BVI Financial Services Commission. The fees vary depending on the type of company and the services provided by your registered agent.

Step 7: Obtain the Certificate of IncorporationUpon successful completion of the registration process and payment of the fees, you will receive a Certificate of Incorporation from the BVI Financial Services Commission. This certificate serves as legal proof of your offshore company's existence in the British Virgin Islands.

Step 8: Fulfill Ongoing Compliance RequirementsAfter registering your offshore company in the BVI, it is important to fulfill the ongoing compliance requirements. This includes maintaining proper accounting records, filing annual returns, and adhering to any other obligations outlined by the BVI authorities.

In Conclusion, registering an offshore company in the British Virgin Islands can offer significant advantages for entrepreneurs, including tax benefits, asset protection, and confidentiality. By following the step-by-step guide outlined above and working with a reputable registered agent, you can successfully navigate the process of registering an offshore company in the BVI.

It is essential to seek advice from legal and tax professionals to ensure compliance with all applicable laws and regulations. With the right guidance, you can establish a successful offshore company in the British Virgin Islands and enjoy the benefits it offers.

Benefits of Registering an Offshore Company in the British Virgin Islands

Tax AdvantagesOne of the key benefits of registering an offshore company in the BVI is the favorable tax environment. The jurisdiction does not impose taxes on offshore companies' profits, capital gains, dividends, or inheritance. This means that your offshore company can benefit from significant tax savings and optimization of your global tax planning strategies.

Privacy and ConfidentialityThe British Virgin Islands places a strong emphasis on privacy and confidentiality. The jurisdiction has strict laws and regulations in place to protect the identities of company directors, shareholders, and beneficial owners. Registering an offshore company in the BVI allows you to maintain confidentiality, as these details are not available to the public.

Asset ProtectionThe BVI offers robust asset protection laws, making it an attractive destination for individuals seeking to safeguard their assets. By establishing an offshore company in the BVI, you can separate your personal assets from those held within the company. This separation reduces the risk of personal liability and provides a layer of protection against potential lawsuits or creditors.

Simple and Efficient Company FormationSetting up an offshore company in the BVI is a relatively straightforward process. The jurisdiction has a well-established company formation framework, with streamlined procedures and minimal bureaucracy. This allows for quick and efficient registration, enabling you to establish your offshore entity promptly and start conducting business.

Flexibility and Operational EaseThe BVI provides considerable flexibility and operational ease for offshore companies. There are no requirements for minimum capitalization, and you have the freedom to structure your company according to your specific needs. Additionally, the BVI allows for the appointment of corporate directors and offers simplified reporting requirements, making it convenient to run your offshore company.

International Recognition and CredibilityThe British Virgin Islands has gained international recognition as a reputable offshore jurisdiction. The jurisdiction's legal system is based on English common law, providing familiarity and credibility to international investors and business partners. This recognition enhances your offshore company's reputation and instills confidence in your stakeholders.

Professional Service ProvidersThe BVI has a well-developed network of professional service providers, including lawyers, accountants, and corporate service providers, who specialize in assisting with the registration and ongoing management of offshore companies. These experienced professionals can provide expert guidance, ensuring compliance with local regulations and optimizing the benefits of your offshore company.

Conclusion

In conclusion, Piptan offshore company registration can offer significant benefits to businesses seeking to optimize their tax liabilities, protect their assets, and increase their privacy. However, this process also carries several risks and challenges that businesses must carefully consider before pursuing offshore registration. Regulatory compliance, reputation risks, legal and financial risks, tax risks, and operational risks are among the most significant challenges associated with Best Offshore Company formation service. Businesses must ensure that they comply with all relevant laws and regulations, carefully manage their reputation, mitigate legal and financial risks, carefully evaluate tax implications, and effectively manage their offshore operations to successfully navigate these challenges. Despite these challenges, many businesses have successfully established offshore companies and taken advantage of the benefits associated with this process. However, businesses must carefully evaluate the potential benefits and challenges of offshore company registration and seek professional advice to ensure that they make informed decisions. Overall, Offshore Company Registration online can be a complex and challenging process, but with careful planning and execution, businesses can successfully navigate these challenges and reap the benefits of offshore company registration.

#Citizenship by Investment#Residency by Investment#Citizenship by Investment Program#Residency by Investment Programs#Offshore Company Registration#international business service#Citizenship programs#Residency Programs#Second Passport#Golden Visa#Economic Citizenship#Setting up a company in Singapore#offshore company formation#LLC Formation#Dual Citizenship#Offshore Banking#Pitan#Immigration by Investment#Golden Visa Program#Financial Advisory Firm#Offshore Company Incorporation Dubai#business setup consultants

0 notes