#online document verification Software

Explore tagged Tumblr posts

Text

Trusted Document Verification software| Zionitai

Zioshield is an advanced online document verification software that ensures the authenticity of identity documents like Aadhar, PAN, and passports.

online document verification Software

document verification company in india

Document Security Solutions

Identity Verfication AI

document verification service

id document verification

#online document verification Software#document verification company in india#Document Security Solutions#Identity Verfication AI#document verification service#id document verification

0 notes

Text

How Canadian Licensing Systems Protect Against Identity Fraud

Identity fraud is a growing concern worldwide, and Canada is no exception. As licenses increasingly serve as key forms of identification for banking, travel, and government services, Canadian licensing systems have had to evolve with robust security measures to protect against identity fraud. Whether you are applying for your first license or renewing an existing one, it’s important to understand how these systems work to safeguard your personal information.

1. Advanced Physical Security Features

Modern Canadian driver’s licenses are embedded with multiple physical security features designed to make them extremely difficult to forge or tamper with. These include:

Holographic overlays: Special images that appear when the license is tilted, making duplication extremely difficult.

Microprinting: Very tiny text that is not visible to the naked eye but detectable under magnification, preventing easy reproduction.

Ghost images: A faint second image of the license holder that helps prevent photo swapping.

Raised lettering: Some jurisdictions use raised text that you can feel, adding another layer of protection against fakes.

These built-in technologies make it easy for authorities and businesses to quickly spot a fraudulent license during routine checks.

2. Digital Data Encryption

Canadian licensing systems now store driver data in encrypted databases, making unauthorized access to personal information extremely difficult. When information is transferred — such as when police scan your license or when you renew online — the data is encrypted both in transit and at rest. This ensures that even if someone intercepts the data, it remains useless without the decryption keys.

3. Stringent Identity Verification at Issuance

Before issuing a license, provincial and territorial licensing authorities conduct rigorous identity verification checks. Applicants must present multiple pieces of identification, including:

Proof of legal status in Canada (passport, PR card, visa).

Proof of residency within the province.

Secondary documents such as a birth certificate, citizenship card, or utility bill.

In many cases, cross-checks with federal databases (like immigration records or citizenship status) ensure that the applicant is who they claim to be. Newcomers may also face additional document checks to confirm their eligibility before a license is issued.

4. Real-Time Photo Comparison and Biometrics

When you renew your license or apply for a new one, your photograph is compared with existing photos on record using facial recognition software. This system helps detect cases where someone might be trying to fraudulently assume another person’s identity. In the future, more provinces are planning to expand the use of biometrics, such as fingerprints or iris scans, to further strengthen identification measures.

5. Ongoing Monitoring and Alerts

Canadian licensing systems do not just verify identities at the point of issuance — they continue monitoring afterward. If a license is reported stolen, lost, or involved in suspicious activity, it can be flagged in the system. Law enforcement agencies and border officials have real-time access to these databases, making it harder for stolen or fraudulent licenses to be used undetected.

Additionally, provinces encourage drivers to immediately report lost or stolen licenses to prevent identity theft and ensure the system remains secure.

Canadian licensing authorities are committed to staying ahead of fraudsters by continually updating security features and identity verification processes. Thanks to multi-layered protection — from physical security measures to real-time monitoring — Canadians can trust that their licenses remain a strong line of defense against identity fraud.

For step-by-step guidance on obtaining your driver’s license safely and staying informed about new ID requirements, visit LicensePrep.ca. Their resources make navigating the licensing process simple and secure!

#IdentityFraud#CanadianDriversLicense#LicenseSecurity#IDVerification#LicensePrepCanada#FraudPrevention#DrivingInCanada#Secure

4 notes

·

View notes

Text

Jups.io Slot Games: Exciting Gameplay and Trusted Transactions

In the dynamic world of online gaming, Jups.io stands out as a premier crypto casino, offering an exhilarating selection of slot games that captivate players worldwide. As a leading no KYC crypto casino, Jups.io combines thrilling gameplay with seamless investment and withdrawal processes, ensuring a trustworthy and user-friendly experience. This article delves into the allure of Jups.io’s slot games, highlights the platform’s reliability, and underscores why it’s a top choice for crypto casino enthusiasts. Visit Jups.io to explore this exciting gaming hub.

Slot Games: A World of Spins and Wins

Slot games are the heartbeat of any crypto casino, and Jups.io delivers an impressive array of options to suit every player’s taste. These games feature vibrant graphics, engaging themes, and rewarding mechanics, making them a favorite among casual and seasoned gamblers alike. Popular titles include classic three-reel slots, modern video slots with immersive storylines, and progressive jackpot slots offering life-changing payouts. Each slot game operates on a Random Number Generator (RNG), ensuring fair and unpredictable outcomes, a hallmark of Jups.io’s commitment to transparency in its no KYC crypto casino environment.

Playing slots on Jups.io is straightforward yet thrilling. Players select their bet size, spin the reels, and aim to align symbols across paylines to win. Bonus features like free spins, wild symbols, and multipliers enhance the excitement, increasing the potential for big wins. Whether you’re chasing a jackpot or enjoying a quick spin, Jups.io’s slot games deliver endless entertainment. The platform’s intuitive interface ensures easy navigation, allowing players to dive into the action without delay, a key advantage of this crypto casino.

Why Jups.io is a Trusted Crypto Casino

Jups.io’s reputation as a reliable no KYC crypto casino stems from its commitment to player satisfaction and operational excellence. Unlike traditional online casinos, Jups.io eliminates the need for lengthy Know Your Customer (KYC) verification, allowing players to register and play with just an email address. This privacy-focused approach appeals to crypto enthusiasts who value anonymity, making Jups.io a standout in the crypto casino space. The platform’s use of blockchain technology ensures secure transactions, protecting players’ funds and data.

Jups.io’s reliability is further evidenced by its robust game offerings and partnerships with top-tier software providers. These collaborations guarantee high-quality, provably fair games, reinforcing trust among players. The no KYC crypto casino model also aligns with the ethos of decentralization, offering a seamless gaming experience without bureaucratic hurdles. Players can focus on enjoying their favorite slots, confident in the platform’s integrity.

Seamless Investment and Withdrawal Processes

One of Jups.io’s strongest attributes is its flawless investment and withdrawal system, a critical factor for any crypto casino. The platform supports a wide range of cryptocurrencies, including Bitcoin, Ethereum, and Tether, enabling instant deposits with no fees. Players can fund their accounts in seconds, ensuring uninterrupted gameplay. This efficiency is a testament to Jups.io’s status as a leading no KYC crypto casino, prioritizing speed and convenience.

Withdrawals are equally seamless, with Jups.io processing payouts rapidly, often within minutes. Unlike some platforms that impose delays or hidden fees, Jups.io ensures players receive their winnings promptly, reinforcing its reliability. The absence of KYC requirements streamlines the withdrawal process, allowing players to access funds without submitting personal documents. This player-centric approach makes Jups.io a trusted choice for crypto casino enthusiasts seeking hassle-free transactions.

Conclusion: Spin with Confidence at Jups.io

Jups.io’s slot games offer a thrilling blend of entertainment and opportunity, making it a go-to destination for crypto casino fans. As a no KYC crypto casino, it prioritizes privacy, security, and ease of use, delivering a gaming experience that’s both exciting and trustworthy. With seamless investment and withdrawal processes, Jups.io ensures players can focus on the fun without worrying about delays or complications. Whether you’re a slot enthusiast or new to crypto gaming, Jups.io provides a reliable and rewarding platform to spin and win. Join today at Jups.io and discover the future of online gaming.

2 notes

·

View notes

Text

Navy Recruitment Result: Everything You Need to Know

Joining the military is a dream for many people searching for to serve their united states, gain valuable skills, and enjoy a disciplined and adventurous way of life. The recruitment system is rigorous and includes multiple levels, which includes written tests, bodily exams, clinical examinations, and interviews. Once those stages are completed, candidates eagerly await their military recruitment consequences. In this newsletter, we will discover the navy recruitment end result procedure, how to test outcomes, elements affecting selection, and what comes subsequent for a success applicants.

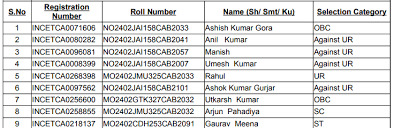

Official website for Navy recruitment result download

Understanding the Navy Recruitment Process

The army recruitment manner is designed to choose the most capable applicants. It involves several tiers:

Notification and Application

The military releases legitimate recruitment notifications detailing eligibility standards, utility dates, and choice approaches.

Candidates submit their packages online or offline in the designated time-frame.

Written Examination

Most military recruitment drives encompass a written exam protecting subjects like Mathematics, General Knowledge, Science, and English.

The examination assesses a candidate’s aptitude and information applicable to naval service.

Physical Fitness Test (PFT)

Candidates who skip the written examination ought to undergo a physical health check.

The check typically includes strolling, push-ups, sit-ups, and different endurance sporting activities to determine bodily fitness ranges.

Medical Examination

A thorough clinical take a look at-up is performed to ensure applicants meet the desired scientific standards.

Any medical conditions that would intervene with naval obligations may additionally cause disqualification.

Interview and Document Verification

Candidates who clean the preceding degrees are called for an interview.

Documents together with academic certificates, identification proofs, and caste certificates (if relevant) are demonstrated.

Final Merit List and Training

Based on usual overall performance, a final advantage listing is prepared.

Selected candidates are sent to naval training academies to start their adventure in the military.

How to Check Navy Recruitment Results

Once all stages are finished, the navy recruitment result is released via diverse official channels. Here’s how applicants can test their consequences:

Official Website

The number one supply for recruitment results is the professional army recruitment website.

Candidates ought to log in with their registration info to access their results.

Email and SMS Notifications

Some recruitment our bodies send end result notifications thru electronic mail or SMS to applicants.

It is essential to provide correct contact information all through the software manner.

Employment News and Newspapers

Results will also be posted in main employment newspapers and regional courses.

Recruitment Offices and Help Desks

Candidates can go to the closest army recruitment office to inquire about their effects.

Factors Affecting Selection in Navy Recruitment

Not all applicants who follow are selected. Several elements affect the selection system:

Performance in Written Examination

Scoring high marks within the written test will increase the probabilities of selection.

Physical Fitness Levels

Candidates should meet the desired health standards.

Poor bodily performance may cause disqualification.

Medical Standards Compliance

Candidates have to be in accurate health with none scientific conditions that restrict naval service.

Availability of Vacancies

The variety of available positions plays a position in figuring out how many applicants are selected.

Background Verification and Discipline

A smooth historical past and disciplined behavior are critical for choice.

What Comes Next for Selected Candidates?

If a candidate’s name appears within the final merit listing, they ought to prepare for the following steps:

Joining Letter and Training Instructions

Selected candidates acquire a joining letter with details in their schooling agenda and reporting date.

Reporting at Training Center

Candidates need to file to their assigned training center on the desired date.

Induction and Orientation

New recruits go through orientation packages to familiarize them with naval lifestyles.

Basic Training

Training consists of bodily conditioning, naval drills, swimming, technical training, and educational guides.

Specialization Training

After primary training, recruits may additionally undergo specialised education based totally on their roles within the army.

2 notes

·

View notes

Text

Thousands of law enforcement officials and people applying to be police officers in India have had their personal information leaked online—including fingerprints, facial scan images, signatures, and details of tattoos and scars on their bodies. If that wasn’t alarming enough, at around the same time, cybercriminals have started to advertise the sale of similar biometric police data from India on messaging app Telegram.

Last month, security researcher Jeremiah Fowler spotted the sensitive files on an exposed web server linked to ThoughtGreen Technologies, an IT development and outsourcing firm with offices in India, Australia, and the US. Within a total of almost 500 gigabytes of data spanning 1.6 million documents, dated from 2021 until when Fowler discovered them in early April, was a mine of sensitive personal information about teachers, railway workers, and law enforcement officials. Birth certificates, diplomas, education certificates, and job applications were all included.

Fowler, who shared his findings exclusively with WIRED, says within the heaps of information, the most concerning were those that appeared to be verification documents linked to Indian law enforcement or military personnel. While the misconfigured server has now been closed off, the incident highlights the risks of companies collecting and storing biometric data, such as fingerprints and facial images, and how they could be misused if the data is accidentally leaked.

“You can change your name, you can change your bank information, but you can't change your actual biometrics,” Fowler says. The researcher, who also published the findings on behalf of Website Planet, says this kind of data could be used by cybercriminals or fraudsters to target people in the future, a risk that’s increased for sensitive law enforcement positions.

Within the database Fowler examined were several mobile applications and installation files. One was titled “facial software installation,” and a separate folder contained 8 GB of facial data. Photographs of people’s faces included computer-generated rectangles that are often used for measuring the distance between points of the face in face recognition systems.

There were 284,535 documents labeled as Physical Efficiency Tests that related to police staff, Fowler says. Other files included job application forms for law enforcement officials, profile photos, and identification documents with details such as “mole at nose” and “cut on chin.” At least one image shows a person holding a document with a corresponding photo of them included on it. “The first thing I saw was thousands and thousands of fingerprints,” Fowler says.

Prateek Waghre, executive director of Indian digital rights organization Internet Freedom Foundation, says there is “vast” biometric data collection happening across India, but there are added security risks for people involved in law enforcement. “A lot of times, the verification that government employees or officers use also relies on biometric systems,” Waghre says. “If you have that potentially compromised, you are in a position for someone to be able to misuse and then gain access to information that they shouldn’t.”

It appears that some biometric information about law enforcement officials may already be shared online. Fowler says after the exposed database was closed down he also discovered a Telegram channel, containing a few hundred members, which was claiming to sell Indian police data, including of specific individuals. “The structure, the screenshots, and a couple of the folder names matched what I saw,” says Fowler, who for ethical reasons did not purchase the data being sold by the criminals so could not fully verify it was exactly the same data.

“We take data security very seriously, have taken immediate steps to secure the exposed data,” a member of ThoughtGreen Technologies wrote in an email to WIRED. “Due to the sensitivity of data, we cannot comment on specifics in an email. However, we can assure you that we are investigating this matter thoroughly to ensure such an incident does not occur again.”

In follow-up messages, the staff member said the company had “raised a complaint” with law enforcement in India about the incident, but did not specify which organization they had contacted. When shown a screenshot of the Telegram post claiming to sell Indian police biometric data, the ThoughtGreen Technologies staff member said it is “not our data.” Telegram did not respond to a request for comment.

Shivangi Narayan, an independent researcher in India, says the country’s data protection law needs to be made more robust, and companies and organizations need to take greater care with how they handle people’s data. “A lot of data is collected in India, but nobody's really bothered about how to store it properly,” Narayan says. Data breaches are happening so regularly that people have “lost that surprise shock factor,” Narayan says. In early May, one cybersecurity company said it had seen a face-recognition data breach connected to one Indian police force, including police and suspect information.

The issues are wider, though. As governments, companies, and other organizations around the world increasingly rely on collecting people’s biometric data for proving their identity or as part of surveillance technologies, there’s an increased risk of the information leaking online and being abused. In Australia, for instance, a recent face recognition leak impacting up to a million people led to a person being charged with blackmail.

“So many other countries are looking at biometric verification for identities, and all of that information has to be stored somewhere,” Fowler says. “If you farm it out to a third-party company, or a private company, you lose control of that data. When a data breach happens, you’re in deep shit, for lack of a better term.”

9 notes

·

View notes

Text

Free Paycheck Stub Creator: Create Professional Pay Stubs in Minutes Online

Workers and employers need fast, affordable solutions to document income in today's digital economy. Whether you're self-employed, part of the gig economy, or managing a small team, having access to accurate pay stubs is crucial for financial stability, compliance, and trust.

With FreePaycheckCreator.com, you can access a free paycheck stub creator to generate clean, compliant, and downloadable stubs in minutes—no need for expensive software or complex payroll systems—just a simple tool designed for real-world needs.

What Is a Paycheck Stub Creator?

A paycheck stub creator is an online tool that allows individuals or businesses to input basic income information—like hours worked, salary amount, and tax deductions—and generate a professionally formatted pay stub. It’s ideal for anyone who needs to:

Show proof of income

Maintain financial records

Provide stubs for employees or contractors

Apply for loans, rentals, or other verifications

The stub includes details such as gross pay, taxes, deductions, net income, and the payment period—mirroring what traditional employers issue.

Who Needs a Free Paycheck Stub Creator?

A free paycheck stub creator isn’t just for business owners—it’s designed for anyone who earns income but doesn’t receive traditional pay statements.

✔ Freelancers & Contractors

Independent workers often don’t get pay stubs. A stub creator helps validate income for taxes, loans, or housing.

✔ Gig Economy Workers

Rideshare drivers, food delivery workers, and digital freelancers can use paycheck stubs as formal documentation of earnings.

✔ Small Business Employers

Business owners with a few employees can use this tool to issue pay stubs without subscribing to expensive payroll systems.

✔ Job or Loan Applicants

Applicants often need to present proof of income. Generated stubs are acceptable for most financial and rental applications.

Why Choose FreePaycheckCreator.com?

FreePaycheckCreator.com simplifies the paycheck stub creation process while keeping it entirely free.

No cost: Use all features without paying a dime.

No registration: Start creating stubs immediately—no account or login required.

Fast results: Generate stubs in under 5 minutes.

Customizable fields: Input exact pay rates, hours worked, tax deductions, and payment periods.

Professional format: Download a clean, printer-ready PDF you can use anytime.

Data security: No personal information is stored. Your data remains yours.

How to Use the Free Paycheck Stub Creator

Using the tool at FreePaycheckCreator.com is simple and fast:

Visit the Website

Open https://freepaycheckcreator.com on your preferred device.

Enter Employer & Employee Details

Fill in the employer and employee's names, addresses, and contact details.

Input Income & Deductions

Choose between hourly or salaried pay. Add in the rate, hours worked, or salary, and list deductions (taxes, insurance, etc.).

Review and Download

Preview your stub for accuracy, then download it as a PDF.

You can create as many stubs as needed, completely free of charge.

Legal Validity and Use Cases

Pay stubs are often required for legal, financial, and tax purposes. According to the U.S. Department of Labor, wage records are essential for compliance, especially when audited or applying for government benefits.

Generated stubs from FreePaycheckCreator.com can be used for:

Personal income verification

Loan or mortgage applications

Rental agreements

Employment onboarding

Tax filing records

Just ensure the information entered is accurate and truthful.

Advantages Over Payroll Software

Traditional payroll services can be expensive and time-consuming, especially for freelancers and small businesses. Here's why FreePaycheckCreator.com is a better option:

Affordability: No subscription fees or hidden costs

Speed: You don’t need to install or configure anything—enter, preview, and download

Simplicity: No need for accounting knowledge or payroll experience

Flexibility: Create stubs on demand for different clients, employees, or roles

Privacy: No stored data or third-party access

This tool is ideal for those who need quick, hassle-free solutions without sacrificing professionalism.

Real-Life Use Examples

✔ A Freelancer Renting a Home

Landlords typically ask for three months of pay stubs. Using the free stub creator, a freelancer can quickly produce verified income documents.

✔ A Café Owner Paying Staff

Instead of investing in a full payroll suite, the owner uses the tool to generate weekly pay stubs for part-time workers.

✔ A Gig Worker Applying for a Loan

Banks request payment documentation before approving personal loans. Stubs created with this tool serve as valid proof of earnings.

Best Practices When Using a Stub Creator

Always input truthful, accurate data.

Fake or misleading information may lead to rejection of your application or legal issues.

Retain copies

Keep digital or printed stubs organized for tax filing or audits.

Update your tax knowledge.

Ensure you’re applying the correct rates and deductions, especially if you work in different states or have different tax brackets.

Use for official purposes only.

Don’t generate stubs for someone else or provide false data for verification.

Frequently Asked Questions (FAQ)

Q1: Is FreePaycheckCreator.com free?

Yes. You can create and download unlimited pay stubs with no hidden costs or subscription requirements.

Q2: Are these stubs legally valid?

Yes, if filled out accurately, they can be used for tax filing, loan applications, housing, and other verification processes.

Q3: Do I need to create an account?

No account or registration is needed. Visit the site and begin creating your stub.

Q4: Can I use the tool for my employees?

Yes. Small business owners can use it to generate stubs for hourly or salaried workers.

Q5: Is my data stored?

No. FreePaycheckCreator.com does not retain your information, ensuring complete privacy and control over your documents.

Final Thoughts

Whether you're managing your business or simply working independently, reliable income documentation is no longer optional—it’s essential. A free paycheck stub creator like FreePaycheckCreator.com allows you to create accurate, compliant, professional stubs without spending a single penny.

Forget complicated payroll systems or costly templates. With this tool, all you need is your pay information—and five minutes of your time.

#free check stub creator#free paycheck stub creator#paycheck stub maker free#paycheck template free#free paycheck creator

0 notes

Text

Top 8 Features of Urgent Care Software Every Clinic Should Know

Urgent care centers have become essential healthcare hubs, offering immediate treatment for non-life-threatening conditions. As patient expectations for speed and quality increase, clinics must adopt technologies that streamline operations and deliver timely care. The top 8 features of urgent care software are designed to meet these needs by optimizing workflows, reducing administrative burden, and improving patient outcomes.

In this article, we’ll break down the top 8 features of urgent care software that are crucial for modern urgent care centers.

1. Real-Time Patient Registration and Intake

One of the most critical features is real-time patient intake. Modern urgent care software allows patients to complete registration forms digitally, either before arrival or upon entering the facility. This minimizes wait times and helps staff quickly triage cases.

Benefits:

Reduced paperwork

Faster check-ins

Improved data accuracy

By automating this process, clinics can manage high patient volumes without sacrificing service quality.

2. Electronic Health Record (EHR) Integration

EHR integration is at the core of any efficient urgent care platform. This feature enables providers to access patient histories, lab results, allergies, prescriptions, and previous visits in real-time.

Benefits:

Seamless patient data flow

Enhanced clinical decision-making

Reduced duplication of tests and treatments

Among the Top 8 Features of Urgent Care Software, EHR integration ensures continuity of care and boosts collaboration between providers.

3. Automated Insurance Verification

Time-consuming manual eligibility checks can slow down operations. With built-in insurance verification tools, urgent care software can instantly verify coverage, co-pays, and deductibles before treatment.

Benefits:

Faster check-in process

Fewer billing errors

Improved patient transparency

Automated eligibility checks are now a must-have feature, particularly for clinics handling high patient turnover.

4. Telemedicine Capabilities

Telemedicine is no longer just a trend—it’s a necessity. The ability to offer virtual consultations directly through urgent care software has transformed how clinics operate.

Benefits:

Expanded reach to remote patients

Reduced in-clinic congestion

Continuity of care during off-hours

Of the Top 8 Features of Urgent Care Software, telehealth functionality ensures clinics stay competitive and accessible in a digital-first world.

5. Queue Management and Appointment Scheduling

Efficient queue management is vital for urgent care. Software with smart scheduling tools allows patients to book appointments online, join virtual waitlists, or receive updates on wait times via SMS.

Benefits:

Improved patient satisfaction

Better resource allocation

Minimized lobby congestion

Advanced scheduling tools help manage peak hours and ensure that care is delivered smoothly.

6. Clinical Documentation Templates

To speed up charting, urgent care software should offer customizable templates tailored to common conditions like flu, sprains, minor burns, and infections.

Benefits:

Faster documentation

Consistent charting

Easier compliance with regulations

Templates reduce the time spent on repetitive documentation, allowing providers to focus more on patient care.

7. Integrated Billing and Coding Tools

Efficient billing is the backbone of healthcare RCM services. Software that includes built-in CPT, ICD-10, and HCPCS coding ensures accurate and compliant billing.

Benefits:

Faster reimbursements

Reduced claim denials

Streamlined billing process

Out of the Top 8 Features of Urgent Care Software, billing integration directly impacts a clinic’s financial performance.

8. Reporting and Analytics Dashboard

The final key feature is a powerful analytics dashboard. These tools provide actionable insights into patient flow, revenue trends, staff productivity, and clinical outcomes.

Benefits:

Data-driven decision-making

Performance tracking

Enhanced operational efficiency

Analytics tools empower urgent care administrators to refine operations and grow strategically.

Why These Features Matter

Choosing software without these core functionalities can lead to inefficiencies, missed revenue, and poor patient experiences. The Top 8 Features of Urgent Care Software discussed here are not just conveniences—they are critical components that define how well a clinic performs in today’s competitive environment.

Urgent care clinics operate in fast-paced, high-volume settings. From front desk check-in to claims processing, every touchpoint needs to be seamless. By integrating technology that automates, informs, and connects, clinics can deliver high-quality, cost-effective care while maintaining a positive bottom line.

Final Thoughts

Investing in urgent care software is more than a tech upgrade—it's a strategic move. The Top 8 Features of Urgent Care Software help address the unique challenges of walk-in clinics, from fluctuating patient volumes to the need for rapid decision-making. Whether you are launching a new clinic or looking to enhance an existing one, choosing software with these features is essential for long-term success.

Make sure your urgent care center is equipped with the tools that matter most. From telemedicine to real-time reporting, these features collectively improve patient satisfaction, staff productivity, and financial health.

0 notes

Text

Real Estate Revolution: 7 Powerful Ways AI Transforms the Industry!

From Guesswork to Intelligence: A Realtor’s Journey with AI in Real Estate

It was a humid Monday morning when Meera, a 32-year-old real estate agent in Kochi, stared at her spreadsheet of unsold properties. Despite her relentless effort — calls, site visits, newspaper listings — something felt outdated. Clients wanted more than square footage and location; they wanted personalization, insights, speed.

That’s when Meera decided to give Artificial Intelligence a shot.

The First Spark: Smarter Listings Her journey began with AI-enabled property portals. Instead of static listings, these platforms learned about the buyer. One client who initially searched for 2BHK apartments near schools was also shown gated villas near tech parks — because the AI recognized his browsing habits and income patterns. He booked a site visit the same day.

For the first time, Meera saw how AI could understand buyers better than they understood themselves — a game-changer in real estate.

Numbers That Spoke Volumes A week later, Meera used an AI-based pricing tool. She uploaded photos, property age, area, nearby amenities — and out came an estimated market value, rental potential, and price flexibility range. She was stunned.

Earlier, price negotiation felt like a gamble. Now, with machine learning models tracking market behavior, seasonality, and neighborhood demand, she could speak numbers with confidence. The AI wasn’t just helping her sell — it was helping her sell smart.

A Tireless Assistant Her next discovery was an AI-powered chatbot on her agency’s website. This digital assistant could answer 80% of the queries — location, EMI estimates, floor plans, virtual tours — while Meera focused on high-value clients.

When she closed her first deal fully online through that assistant, she didn’t feel replaced — she felt relieved.

It was clear: in the modern world of real estate, AI wasn’t about automation — it was about augmentation.

Beyond Sales: Helping Builders and Developers Meera soon found herself working with a local builder. “Where should we build next?” he asked. She turned to AI’s predictive analytics.

The software processed traffic trends, land prices, school zones, office expansion zones, and even social media buzz. Within days, it suggested three micro-locations ripe for growth.

For Meera, this wasn’t just a sale. It was real estate strategy at a whole new level.

Paperwork? Streamlined. Another problem: paperwork. KYC, lease drafts, buyer IDs — all of it piled up. AI document verification tools began scanning, flagging inconsistencies, and storing them securely. No more late-night proofreading or legal hiccups.

In real estate, where legal missteps can mean massive losses, this felt like having a lawyer and a filing clerk rolled into one.

Trust Built on AI What about fraud? Meera had lost a client two months back to a fake listing on a rival site. Now, AI fraud detection scanned listings for duplicate images, inconsistent metadata, and red flags in seller profiles. It brought a new sense of security — for both agents and clients.

In a field like real estate, trust is everything. And AI helped her build it.

The Bigger Picture Soon, Meera was onboarding NRI clients — people who couldn’t visit properties but wanted real estate investments in Kerala. AI tools helped her translate trends, localize insights, and provide virtual walkthroughs. Geography no longer limited her sales.

For deeper insight into how AI is transforming the future, click the link below:

Conclusion: A New Era Begins Today, Meera doesn’t chase leads with flyers or wait endlessly for callbacks. She lets Teemify’s intelligent agent handle the patterns — automating follow-ups, sorting qualified leads, and even scheduling property walkthroughs — while she focuses on building real relationships. Her revenue is up. Her hours are better. And her clients? More satisfied than ever.

AI didn’t change what she did in real estate. Teemify changed how she did it — intelligently, efficiently, and effortlessly.

#realestateinnovation#aiinrealestate#proptech#artificialintelligence#futureofrealestate#intelligentrealestate#realestatetech#smartrealestate#realestatedigitaltransformation

1 note

·

View note

Text

Top Medical Billing Practices to Boost Revenue & Ensure Compliance in Healthcare

Top Medical Billing Practices to Boost Revenue & Ensure Compliance in Healthcare

Introduction

in the ever-evolving landscape of healthcare, a robust medical billing process is vital for ensuring financial stability, maximizing revenue, and maintaining regulatory compliance. Proper medical billing practices not only streamline cash flow but also help avoid costly audits and penalties. Whether you’re a healthcare provider, billing specialist, or practise manager, understanding the top strategies for effective medical billing is essential. This comprehensive guide explores proven practices, practical tips, ���benefits, real-world case studies, and expert insights to help you optimize your billing workflow and achieve enduring growth.

why Effective Medical Billing Practices Matter

Efficient medical billing is the backbone of a profitable healthcare practice. It directly impacts revenue cycle management,patient satisfaction,and compliance with federal and state regulations. Poor billing practices can result in delayed payments, denied claims, revenue loss, and legal complications. Thus, adopting best practices is crucial for fiscal health and operational excellence.

Key Medical billing Practices to Boost Revenue & Ensure Compliance

1. Accurate Data Entry & Documentation

One of the most foundational aspects of successful medical billing is ensuring accuracy in patient data and documentation. Mistakes in demographic info, insurance details, or clinical documentation can lead to claim rejections.

Double-check patient information during registration

Ensure thorough and precise clinical documentation

use integrated electronic health records (EHR) systems for automatic data syncing

2. Staying Updated with Coding & Regulations

Medical coding standards-such as ICD-10, CPT, and HCPCS-stand at the core of insurance reimbursements. Outdated or incorrect codes can cause claim denials or audits.

Regularly train billing staff on coding updates

Utilize coding software with built-in guidelines

stay informed about healthcare billing regulations like HIPAA and Medicare policies

3. Robust Claim Submission & Follow-up Process

Automating claim submission and implementing diligent follow-up procedures enhance the chances of timely reimbursement. Use electronic claim submission (EDI) systems to reduce errors and accelerate processing.

Step

Action

Benefits

1

Automatic claim submission via EHR

Faster processing

2

Regular claim status review

Early detection of issues

3

Prompt appeal of denied claims

Increased revenue recovery

4. Effective Denial Management

Handling claim denials proactively can save considerable revenue and prevent cash flow disruptions.Establish a denial management team or process for rapid resolution.

Analyze denial reasons systematically

Correct errors promptly and resubmit claims

Implement denial tracking tools for continuous enhancement

5. Regular Staff Training & Education

Healthcare billing regulations and coding standards evolve frequently. Continuous education ensures your team remains compliant and efficient.

Schedule quarterly training sessions

Leverage online courses and certifications

Promote a culture of compliance and accuracy

6. Integrate Revenue cycle Management (RCM) Technology

Investing in comprehensive RCM software can automate many billing tasks, from patient registration to collections. This integration leads to reduced errors and faster reimbursements.

Popular tools include:

Automated claim scrubbing

Real-time eligibility verification

Advanced analytics dashboards

Benefits of Implementing Top Medical Billing Practices

Benefit

Description

Increased Revenue

Faster and accurate reimbursements boost your practice’s cash flow.

Improved Compliance

Minimize legal risks by adhering to regulations and standards.

Reduced Claim Denials

Efficient processes lead to fewer rejected claims, saving time and resources.

Enhanced Patient Satisfaction

Clear billing processes and obvious interaction improve patient trust.

Operational Efficiency

Automation and staff training streamline workflows for better productivity.

Practical Tips for Optimizing Your Medical Billing Process

Use Technology: Invest in reliable billing and practice management software that integrates with EHR systems.

Monitor KPIs: Track metrics such as days in accounts receivable, claim rejection rate, and denial reasons for continuous improvement.

Establish Clear policies: Develop standardized procedures for billing,denials,and collections to ensure consistency.

Maintain Open Communication: Foster collaboration between clinical, administrative, and billing teams for seamless workflows.

Perform Regular Audits: Conduct periodic audits to identify vulnerabilities and rectify inconsistencies early.

Case Study: Transforming Billing Efficiency at HealthyCare Clinic

Background: HealthyCare Clinic faced recurring claim rejections and delayed reimbursements, impacting their revenue cycle. They decided to overhaul their billing practices.

Approach: By implementing automated billing software, retraining staff, and establishing a denial management team, HealthyCare substantially enhanced their billing operations.

Aspect

Before

After

Claim Rejection Rate

15%

4%

Average Days in Accounts Receivable

45 days

25 days

Revenue Growth

Flat

15% increase annually

Result: Streamlined billing led to faster collections, fewer rejected claims, and increased revenue-highlighting the power of adopting top medical billing practices.

First-Hand Experience: My Recommendations

Having worked with various healthcare providers, I recommend prioritizing technological integration and staff training. Align billing practices with evolving regulations to stay compliant and optimize revenue. Consistent review and improvement ensure your practice remains resilient against common billing pitfalls.

Conclusion

Implementing top medical billing practices is key to boosting revenue,ensuring compliance,and fostering a smooth healthcare operation. From accurate documentation and staying current with coding standards to leveraging automation and continuous staff education, these strategies can transform your billing process into a powerful tool for growth.Remember, proactive denial management and regular audits are essential for maintaining financial health. By adopting these proven practices, healthcare providers can achieve operational excellence, enhance patient satisfaction, and secure long-term success.

Ready to revolutionize your medical billing? Contact us today for expert guidance and tailored solutions to maximize your healthcare practice’s revenue and compliance!

https://medicalbillingcodingcourses.net/top-medical-billing-practices-to-boost-revenue-ensure-compliance-in-healthcare/

0 notes

Text

The Welcome Wagon, Digitized: Crafting Seamless Digital Onboarding Journeys

The first few days, weeks, and even months of a new employee's tenure are pivotal. This "onboarding journey" sets the tone for their entire experience with an organization, profoundly impacting their productivity, engagement, and long-term retention. In today's dynamic work environment, characterized by remote teams, hybrid models, and a digitally native workforce, the traditional paper-heavy, disjointed onboarding process is no longer sufficient. Enter the digital onboarding journey – a strategic, technology-driven approach designed to create a seamless, engaging, and efficient welcome for every new hire.

Digital onboarding is far more than just signing documents online. It's a holistic experience that leverages HR technology to integrate new employees into the company culture, equip them with necessary tools and knowledge, and make them feel connected and valued from the moment they accept the offer. It transforms a logistical hurdle into a strategic opportunity.

Let's explore five key components of crafting an impactful digital onboarding journey:

1. Pre-boarding Engagement: Building Excitement Before Day One

The onboarding journey truly begins the moment a candidate accepts the offer. Digital pre-boarding leverages this crucial period to build excitement, reduce anxiety, and ensure a smooth transition.

Personalized Welcome Kits: Sending digital welcome emails, videos from leadership, or even virtual tours of the office (if applicable).

Essential Information Delivery: Providing access to company handbooks, organizational charts, and a FAQ section digitally.

Early Paperwork Completion: Enabling new hires to complete necessary HR forms (tax documents, direct deposit, benefits enrollment) securely online before their official start date, freeing up Day One for more meaningful interactions.

Team Introductions: Facilitating virtual introductions to their manager, team members, and key stakeholders, perhaps through shared collaboration platforms or short video messages.

This pre-boarding phase helps new hires feel integrated and prepared, turning pre-start jitters into anticipation.

2. Streamlined Paperwork and Compliance

One of the most immediate and appreciated benefits of digital onboarding is the dramatic reduction in administrative burden and the assurance of compliance.

Automated Form Completion: Digital platforms can pre-populate forms with existing candidate data, minimizing repetitive entry.

E-Signatures and Workflow Automation: Documents can be signed digitally, and automated workflows ensure forms are routed to the correct departments (IT, Payroll, Benefits) instantly for processing.

Compliance Checks: Automated prompts and checks ensure all necessary regulatory documents (e.g., I-9 verification, background checks) are completed accurately and on time, reducing legal risks.

Centralized Document Storage: All completed paperwork is securely stored in a centralized digital repository, easily accessible for HR and auditing purposes.

This efficiency frees up HR professionals and new hires alike from tedious administrative tasks, allowing them to focus on substantive integration.

3. Personalized Learning and Development Pathways

Digital onboarding extends beyond initial paperwork to provide tailored learning and development opportunities that accelerate a new hire's proficiency and cultural assimilation.

Role-Specific Training Modules: Delivering essential training (e.g., product knowledge, company processes, software usage) through online modules, videos, and interactive simulations that new hires can complete at their own pace.

Access to Knowledge Bases: Providing immediate digital access to internal wikis, training libraries, and team resources.

Customized Learning Paths: Utilizing AI or rule-based systems to recommend relevant courses or resources based on the new hire's role, skills gap, and career aspirations.

Virtual Orientation: Hosting live or pre-recorded virtual orientation sessions that introduce company history, values, and key departments.

By digitizing and personalizing learning, organizations ensure new hires are equipped with the right skills and information precisely when they need it, accelerating their time to productivity.

4. Fostering Connection and Culture in a Virtual World

Especially crucial for remote and hybrid teams, digital onboarding plays a vital role in building connection and integrating new hires into the company culture.

Virtual Meet-and-Greets: Facilitating virtual coffee chats with team members, cross-functional colleagues, and even senior leaders.

Buddy/Mentor Programs: Digitally pairing new hires with experienced colleagues who can provide guidance, answer informal questions, and help them navigate the organizational landscape.

Access to Communication Channels: Integrating new hires into relevant Slack channels, Microsoft Teams groups, or internal social platforms where they can engage with colleagues.

Cultural Content: Providing digital access to stories, videos, and resources that articulate company values, mission, and unique cultural aspects.

Virtual Social Events: Organizing online team-building activities, happy hours, or games to encourage informal interaction.

These digital touchpoints are essential for making new hires feel a sense of belonging, even when physical presence isn't constant.

5. Analytics and Continuous Improvement

A significant advantage of digital onboarding platforms is their ability to collect valuable data, enabling HR to continuously analyze and optimize the new hire experience.

Completion Rates: Tracking which forms are completed, and which training modules are accessed, providing insights into engagement and potential bottlenecks.

New Hire Surveys: Collecting automated feedback at various stages (e.g., 30, 60, 90 days) to gauge satisfaction, identify pain points, and understand overall experience.

Time-to-Productivity Metrics: Analyzing how quickly new hires become fully productive, linking it back to the effectiveness of the onboarding journey.

Retention Data: Correlating onboarding effectiveness with long-term retention rates to prove ROI.

This data-driven approach allows HR teams to move beyond anecdotal evidence, iteratively refining their digital onboarding processes to ensure maximum impact and an exceptional experience for every new employee.

In conclusion, digital onboarding journeys are no longer a luxury but a strategic imperative for modern businesses. By embracing technology to streamline administrative tasks, personalize learning, foster connection, and gain valuable insights, organizations can transform the new hire experience from mundane to magical. A well-executed digital onboarding journey not only boosts efficiency and ensures compliance but, most importantly, cultivates engaged, productive, and loyal employees who feel truly welcomed from day one.

To learn more, visit HR Tech Pub.

0 notes

Text

Trusted Document Verification software| Zionitai

Zioshield is an advanced online document verification software that ensures the authenticity of identity documents like Aadhar, PAN, and passports.

online document verification Software

document verification company in india

Document Security Solutions

Identity Verfication AI

document verification service

id document verification

#online document verification Software#document verification company in india#Document Security Solutions#Identity Verfication AI#document verification service#id document verification

0 notes

Text

How to Reconcile Balance Sheet with Advanced Reconciliation Tools

Balance sheet reconciliation checks if account balances in the balance sheet match the general ledger and supporting documents. It finds any differences. Tools that do this automatically make it more accurate and faster.

With automated software, finance teams can make their financial close process smoother. This leads to better financial health and smarter choices.

Key Takeaways

Balance sheet reconciliation is vital for accurate financial statements.

Advanced tools make the reconciliation process simpler.

Automated software cuts down on manual mistakes.

Streamlined financial close processes boost financial integrity.

Improved accuracy helps in making better financial decisions.

Understanding Balance Sheet Reconciliation

Keeping financial records accurate is key. Balance sheet reconciliation helps ensure this. It checks if account balances are right and complete.

What Is Balance Sheet Reconciliation?

It's about matching account balances with documents and outside sources. This makes sure financial reports show a company's true financial state.

The steps in this process are:

Checking account balances against bank statements and other sources

Finding and fixing any differences

Keeping records of the whole process and its results

Key Accounts Requiring Regular Reconciliation

Some accounts need regular checks because they're very important. These include:

Cash and cash equivalents

Accounts receivable and payable

Inventory and other current assets

Checking these accounts often helps avoid mistakes, spots fraud, and meets financial rules.

Consequences of Inaccurate Balance Sheets

Wrong balance sheets can lead to big problems. These include fines, losing investor trust, and bad financial choices. The effects of wrong financial reports can harm the company and its people.

Some possible issues are:

Regulatory fines and penalties

Loss of credibility with investors and lenders

Poor financial planning and decision-making

Challenges of Traditional Reconciliation Methods

The old ways of doing reconciliation are full of problems. They make it slow and prone to mistakes for those in finance. These methods need a lot of manual work, which takes a lot of time and effort.

Manual Processes and Time Consumption

Doing reconciliation by hand means a lot of typing, checking, and matching. It can make people tired and more likely to make mistakes. This slows down the process and takes away from more important financial tasks.

Extensive manual data entry

Time-consuming verification processes

Increased likelihood of human error

Error Rates and Detection Difficulties

Old methods of reconciliation are more likely to have mistakes because they're done by hand. Finding and fixing these errors can be hard. This can lead to wrong financial reports and trouble with rules.

Compliance and Audit Trail Weaknesses

Traditional methods often don't have strong compliance and audit trail features. This makes it hard to show you're following the rules. It can lead to more risk during audits and fines.

Knowing these problems, finance experts can see why using automation for reconciliation is a good idea. These new tools can make the process faster, reduce mistakes, and improve following rules and audits.

Modern Reconciliation Tools and Their Capabilities

The world of reconciliation has changed a lot with new tools. These tools make financial checks more efficient and accurate.

Cloud-Based vs. On-Premise Solutions

Today, you can find reconciliation tools online or on your own servers. Online tools are flexible and save money on hardware. But, server-based options give you more control over your data.

It's important to think about what you need before choosing. This will help you pick the right tool for your business.

AI-Powered Matching Algorithms

Advanced tools use AI to match transactions automatically. This cuts down on manual work and boosts accuracy. They learn from your data to get better over time.

Workflow Automation Features

These tools also automate workflows. This means you can set up your own steps for financial checks. It makes sure everything is done right and on time.

Automation also helps avoid mistakes. It lets your team focus on important tasks.

Integration with ERP and Accounting Systems

Good reconciliation tools work well with your current systems. They make it easy to keep all your data in sync. This is key for accurate financial reports.

It helps keep your financial management smooth and reliable.

Step-by-Step Guide to Balance Sheet Reconciliation Using Software

Reconciling a balance sheet is key and can be made easier with advanced software. This process has several steps to ensure everything is accurate and up to date.

Initial Data Import and System Configuration

The first step is to import data into the software. This includes general ledger accounts and bank statements. The system is then set up to meet the organization's needs.

Import general ledger accounts and bank statements.

Configure the software to match the organization's reconciliation needs.

Set up user roles and permissions to ensure secure access.

Creating Custom Matching Rules

Advanced software lets you create custom matching rules. These rules help match transactions automatically based on set criteria.

Define the matching criteria, such as date, amount, and description.

Configure the software to automatically match transactions.

Review and refine the matching rules to ensure accuracy.

Identifying and Resolving Exceptions

The software finds exceptions that need manual review. This includes transactions that don't match or are outside set limits.

Review exceptions to determine the cause of the discrepancy.

Take corrective action to resolve the exception.

Document the resolution for audit purposes.

Documentation and Approval Workflows

Lastly, the software helps with documentation and approval. It generates reports and keeps an audit trail.

Generate reconciliation reports for review and approval.

Maintain an audit trail of all reconciliation activities.

Obtain approval from authorized personnel.

By following these steps, organizations can use software to make reconciliation easier. This improves accuracy and reduces errors.

Best Practices for Implementing Reconciliation Automation

To get the most out of reconciliation automation tools, organizations must follow best practices during implementation. This involves several key steps that ensure a smooth transition to automated reconciliation processes.

Assessing Reconciliation Requirements

Before selecting a reconciliation automation tool, it's essential to assess your organization's reconciliation requirements. This includes identifying the types of accounts to be reconciled, the frequency of reconciliations, and any specific regulatory or compliance needs.

Identify the scope of reconciliation activities

Determine the frequency of reconciliations

Assess specific compliance or regulatory requirements

Selecting the Right Solution

Choosing the appropriate reconciliation automation solution is critical. Factors to consider include the tool's ability to integrate with existing systems, its scalability, and its ability to meet specific reconciliation needs.

Evaluate integration capabilities with existing financial systems

Consider the scalability of the solution

Assess the tool's ability to handle complex reconciliation tasks

Training Staff and Managing Change

Effective training and change management are critical for the successful adoption of reconciliation automation tools. This involves educating staff on the new system's capabilities and ensuring they are comfortable using it.

Develop a detailed training program for staff

Establish clear communication channels for support

Monitor adoption rates and address any issues promptly

Establishing Reconciliation Schedules and Responsibilities

To ensure the ongoing effectiveness of reconciliation automation, it's necessary to establish clear schedules and responsibilities. This includes defining who is responsible for reconciliations, the frequency of these tasks, and the deadlines for completion.

Define clear roles and responsibilities for reconciliation tasks

Establish a schedule for reconciliations that meets business needs

Set deadlines for completion and review of reconciliations

By following these best practices, organizations can maximize the benefits of reconciliation automation. This improves financial accuracy and reduces the risk of errors.

youtube

Measuring the ROI of Advanced Reconciliation Tools

Advanced reconciliation tools can bring big financial gains to companies. They offer a significant advantage through different ways.

It's key to look at several areas where these tools help a lot.

Quantifying Time and Labor Savings

Automated reconciliation software cuts down on manual work needed for reconciliations.

Automated data import and matching cut down on manual data entry.

Streamlined workflows let staff focus on more important tasks.

Quicker reconciliation cycles mean faster close processes.

By measuring these time savings, companies can see clear cost cuts from using these tools.

Calculating Error Reduction Benefits

Reconciliation software for banks greatly lowers the chance of mistakes in financial reconciliations.

Automated matching algorithms ensure accurate transaction matching.

Real-time exception reporting helps solve issues quickly.

Consistent reconciliation processes boost overall financial accuracy.

By cutting down on errors, companies avoid costly rework, fines, and damage to their reputation.

Compliance Cost Reductions

The use of bank reconciliation software also leads to big savings in compliance costs.

Automated audit trails make regulatory compliance easier.

Standardized reconciliation processes lower the risk of non-compliance.

Efficient documentation and approval workflows cut down on admin work.

These savings not only cut costs but also improve the company's compliance stance.

Case Studies: Real-World Implementation Results

Many companies have seen great results from using advanced reconciliation tools, showing big ROI.

A financial institution using automated reconciliation software cut its reconciliation time by 40% and error rates by 25% in six months.

These examples show the real benefits of using these tools. They lead to better financial accuracy and lower costs.

Conclusion: Elevating Financial Accuracy Through Technology

Advanced reconciliation tools have changed the game for financial accuracy. They make the process more accurate, efficient, and compliant. With a strong reconciliation solution, companies can automate their work, cutting down on mistakes and improving reports.

Automated account reconciliation lets finance teams do more strategic work. They no longer spend hours on manual data entry. This also makes it easier to follow rules and avoid legal issues.

As tech gets better, so will the role of reconciliation software in finance. Companies using automation will see big wins. They'll get better financial data, save money, and make smarter choices.

By using a top-notch reconciliation solution, finance pros can make their work more accurate and reliable. This leads to business growth and success.

Also Read: Best Balance Sheet Reconciliation Software for Small Businesses

#reconciliation#automated reconciliation#recon#finance solutions#bank reconciliation#automation#finance management#Youtube

0 notes

Text

Private Limited Company Registration in India: Why Bizsimpl is the Preferred Choice for Startups

India’s startup ecosystem is booming, with thousands of new businesses being launched every year. However, turning a brilliant idea into a structured, legally compliant business requires more than passion—it needs the right foundation. That’s where Private Limited Company Registration comes in. This business structure not only provides legitimacy and credibility but also unlocks long-term benefits for entrepreneurs and investors alike.

In this blog, we’ll explore how Bizsimpl makes Private Limited Company Registration smarter, faster, and future-proof for aspiring founders—without overwhelming them with legal jargon or red tape.

What Makes a Private Limited Company Ideal for Modern Entrepreneurs?

Choosing the right structure can significantly impact your business’s credibility, operational flexibility, and ability to scale. A Private Limited Company offers the perfect balance between control and compliance.

Key Reasons to Register as a Private Limited Company:

Scalable Structure: Enables rapid expansion with minimal legal restructuring.

Ownership Control: Allows founders to retain majority control while bringing in investors.

Corporate Identity: Adds credibility and professionalism in the eyes of customers and partners.

Attractive to Investors: A structured shareholding system makes equity investments seamless.

Structured Governance: Encourages better recordkeeping, financial planning, and accountability.

At Bizsimpl, we understand how important it is to not only register your company but also to align your legal structure with your growth ambitions.

When is the Right Time for Private Limited Company Registration?

Founders often ask: Should I register my company early or wait until we generate revenue?

Here’s when you should seriously consider Private Limited Company Registration:

When you're building a tech or SaaS product and want to onboard early users or investors.

When you want to issue shares to co-founders, employees, or advisors.

When banks or marketplaces ask for a registered corporate entity to onboard you.

When you’re applying for grants, tenders, or accelerator programs.

When you're formalizing your venture to protect your brand legally.

Delaying incorporation can result in missed opportunities. Bizsimpl ensures your business becomes official before the next big opportunity knocks.

Private Limited Company Registration for Founders Working Remotely

Post-2020, many entrepreneurs operate from multiple locations or work fully remote. This has raised new questions about address requirements, digital filing, and compliance ease.

The good news? You can complete your Private Limited Company Registration 100% online with Bizsimpl—no matter where you're located in India.

Bizsimpl enables:

Remote document submissions

Digital verification of identity and address

eFiling of incorporation forms

Real-time tracking and updates

Whether you’re based in Bangalore, Delhi, Hyderabad, or a tier-2 city, you can register your Pvt Ltd company without stepping out of your home.

Choosing the Right Company Name: Branding + Compliance

One of the most crucial aspects of Private Limited Company Registration is name approval. Your brand name should be catchy, compliant, and available.

Bizsimpl helps you:

Check name availability across MCA records

Avoid restricted or similar-sounding names

Reserve your preferred name via the RUN or SPICe+ route

We even help with strategies to choose names that are brand-friendly and domain-available for your website. After all, your company name is the first impression in the digital world.

Private Limited Company Registration for Tech Startups

India’s startup revolution is being led by tech founders solving real-world problems. If you’re building a SaaS product, mobile app, fintech tool, or any software-driven business, Private Limited Company Registration is a must.

Why?

Investors prefer companies with structured equity

It allows issuance of Employee Stock Options (ESOPs)

Intellectual Property (IP) can be owned by the company

It provides clear revenue tracking and fund management

Bizsimpl works closely with founders in the tech ecosystem, offering efficient company formation tailored to digital-first businesses.

Simplified Compliance Tools with Bizsimpl

Many founders hesitate to register a company because of compliance worries. Bizsimpl removes that anxiety.

We provide:

Automated reminders for filing deadlines

User-friendly dashboards for document access

Post-incorporation checklists specific to Pvt Ltd entities

Guidance on board meetings, annual returns, and director responsibilities

With Bizsimpl, Private Limited Company Registration isn’t the end—it’s the beginning of a well-managed company journey.

Mistakes to Avoid During Private Limited Company Registration

A small mistake during registration can lead to rejection or delays. Some common errors include:

Submitting outdated or blurred documents

Choosing an invalid or misleading company name

Not aligning the business objective with MoA clauses

Listing incorrect shareholding patterns

With Bizsimpl, your application is reviewed thoroughly before submission, reducing the risk of rejections and speeding up the process.

How Bizsimpl Supports First-Time Entrepreneurs

If you're a first-time founder, you're probably juggling a product, a team, and a vision—while figuring out legal structures. Bizsimpl offers:

Dedicated guidance tailored for beginners

Easy explanations for every step of the registration process

Timely follow-ups to prevent missed deadlines

Transparent pricing with no hidden fees

Thousands of first-time founders have completed their Private Limited Company Registration with confidence using Bizsimpl’s streamlined process.

Conclusion: Get Started with Bizsimpl Today

Incorporating your business shouldn’t be complicated, expensive, or time-consuming. With the right partner like Bizsimpl, you can complete your Private Limited Company Registration seamlessly—without any guesswork.

By choosing Bizsimpl, you’re choosing:

Expert guidance

Transparent timelines

Affordable packages

Hassle-free incorporation

Don’t wait for the “perfect time.” Make your business official today with the support of India’s trusted startup registration partner—Bizsimpl.

#PrivateLimitedCompanyRegistration#CompanyRegistrationIndia#Bizsimpl#StartupInIndia#CompanyIncorporation#PvtLtdIndia#IncorporationWithBizsimpl#StartSmartWithBizsimpl

0 notes

Text

How to Integrate Aadhaar eSign APIs in Indian Business Workflows?

In today’s fast-changing world, businesses in India are becoming smarter and faster with the help of digital tools. One of the best tools available is the Aadhaar eSign solution. It is a simple and legal way for people so they can sign documents by using their Aadhaar number. If your business still relies on paper documents, printers, or couriers to get signatures, it’s time to consider a better way.

In this guest blog, we will explain what Aadhaar eSign is and how you can easily use it in your everyday business activities.

What is Aadhaar Based eSign?

Aadhaar-based eSign is a government-approved method of signing documents electronically. Instead of printing and physically signing papers, a person can sign them online using their Aadhaar number and a one-time password (OTP) sent to their Aadhaar-linked mobile number.

The best part of eSign is that it is completely legal, secure and accepted all over India. In fact, recently, the High Court of Kerala has allowed signing affidavits and vakalats to be digitally signed by using Aadhaar-based signatures.

Why Should You Use Aadhaar eSign in Your Business?

Let’s be honest — printing, signing, scanning, and sending documents can be a real hassle. However, by using eSign Aadhaar, businesses can skip all this hassle. Here’s how it helps your business:

You can sign documents in just a few minutes to save time

Busienses can cut dowon on printing and courrier charges.

Aadhaar Signature Verification Online uses OTP verification to confirm the identity of the person signing. So you can ensure the integrity of the document.

Aadhaar-based eSign is legally recognised by Indian law under the IT Act.

People can sign from anywhere — at home, in the office, or on the move.

Where Can You Use Aadhaar eSign?

You can use Aadhaar-based eSign for all kinds of documents, such as:

Offer letters and joining forms

Rental agreements and contracts

Customer agreements in banking and finance

Loan forms and insurance documents

Purchase orders and vendor agreements

NDAs and legal paperwork

Whether you are in HR, legal, finance, real estate, or tech, eSign India can make things easier for both you and your customers.

How to Start Using Aadhaar eSign in Your Business?

Here’s the good news: You don’t need to be a tech expert or a developer to use Aadhaar eSign in your business. You just need to follow a few easy steps.

Step 1: Choose a Trusted eSign Partner

There are companies in India that are officially allowed to offer Aadhaar-based eSign services, including Meon Technologies, Sign Desk and others. These are called eSign

Service Providers (ESPs).

You can look for a partner who:

It is approved by the government

Offers easy-to-use tools

Has good customer support

Understands your business needs

Step 2: Tell Them What You Need

Once you choose an eSign Aadhaar provider, you should clearly discuss your requirements with them. For example:

What kind of documents do you want to sign?

Who will be signing — employees, clients, or vendors?

Do you want a simple web-based system or something that works with your current software?

Step 3: Send Documents for eSign

After setup, you can upload a document (like a contract or form), enter the details of the person who needs to sign, and send them a secure link.

The signer simply:

1. Clicks the Aadhaar eSign link

2. Enters their Aadhaar number

3. Receives an OTP on their Aadhaar-linked phone

4. Enters the OTP and signs the document

It’s really that easy!

Step 4: Get the Signed Document

Once signed, you can then download and share the signed document. It includes a time stamp and other proof that the document was signed correctly. You can also receive alerts when documents are signed.

Final Thoughts

Aadhaar eSign is one of the easiest and safest ways to sign documents in India today. It’s fast, legal, secure, and helps businesses so they can save time and money. Whether you are a startup, a small business, or a large enterprise, by integrating eSign Aadhaar, you can make a smart move in this digital world.

So if you’re still stuck with printers, paper, or long email threads just to get one signature, now is the perfect time to switch.

0 notes

Text

Mastering Optometry Medical Billing: Tips to Maximize Revenue and Ensure Accurate Reimbursements

Mastering Optometry Medical Billing: Tips to Maximize Revenue and Ensure Accurate reimbursements

In today’s competitive healthcare landscape, efficient and accurate medical billing is crucial for the success of your optometry practise. Proper billing processes not only ensure you receive timely reimbursements but also help maximize your revenue streams. Whether you’re new to optometry billing or looking to refine your current practices, this comprehensive guide offers valuable insights and practical tips to master optometry medical billing.

Understanding the Importance of accurate Optometry Medical Billing

Optometry practices, like all healthcare providers, rely heavily on robust billing procedures to maintain financial health.Accurate billing ensures that:

Reimbursements are correct and timely

Denials and rejections are minimized

Patient accounts remain accurate

Compliance with healthcare regulations is maintained

The practice’s revenue is maximized without legal risks

Effective optometry medical billing involves understanding coding standards,maintaining organized documentation,and implementing streamlined processes. Now, let’s explore how you can optimize your billing practices.

Key Components of Effective Optometry Medical Billing

1. Accurate Coding and Documentation

Correct coding is essential for reimbursement success.For optometry-specific services, familiarize yourself with the latest CPT and ICD-10 codes. Proper documentation of services ensures that claims are supported and reduces chances of denials.

2. using up-to-date Practice Management Software

Invest in a reliable optometry billing software that integrates seamlessly with your patient management system. Automated coding, billing, and claims processing can improve accuracy and efficiency.

3. Regularly Monitoring Claim Status

Track submitted claims regularly to identify delays or issues early. This proactive approach helps in fast resolution of rejected or denied claims, ensuring smoother cash flow.

4. Staff Training and Ongoing Education

Ensure your team understands the latest coding updates, payer policies, and compliance requirements.Regular training minimizes errors and enhances overall billing accuracy.

Practical Tips to Maximize Revenue in Optometry Medical Billing

Tip 1: Verify Patient Insurance Info

Accurate insurance verification before services are rendered reduces claim rejections due to incorrect or outdated coverage data.

Tip 2: Implement Fee Schedules and Collections Policies