#online personal loan app loans personal loan

Text

Best Loan App in India | TrueBalance

TrueBalance is a best loan app in India that provides loans faster. Loans applied through apps are approved quickly in contrast to traditional loans.TrueBalnce is one of the best loan apps available on the Google Play store that offer quick personal loans for both salaried and self-employed! Hurry Up! Your dreams are just to get fulfilled with just a few clicks.

0 notes

Text

Rupee112 is a leading financial institution committed to empowering individuals in their financial journey. As a trusted lender, Rupee112 specializes in providing Instant Personal Loans to individuals facing various financial needs and challenges.

Reference Link:-https://in.pinterest.com/pin/1118089044977730177/

#Payday Loans for Salaried Employees faridabad#emergency personal loan app Ahmedabad#Urgent Personal Loans Ghaziabad#emergency personal loan approval gurgaon#urgent payday loans Kolkata#best instant personal loan app Ahmedabad#Short Term Loan Services faridabad#instant personal loan low cibil chennai#Immediate personal loans faridabad#Online personal loans faridabad#Salary-Based Loans Mumbai#instant payday loans Bengaluru#instant personal loan for salaried gurgaon#best instant loan app kolkata#instant loan for salaried employee Hyderabad

2 notes

·

View notes

Text

Should I Get Personal Loan During A Period With High Inflation Rate ?

Long-term inflation hikes can be concerning for an individual, and with good reason, even though price increases are partially a reflection of generally positive economic progress. Your personal finances are directly impacted by inflation, which sets spending and budgetary restrictions. However, in the event that you require additional funds, is it prudent to obtain a personal loan at a time of elevated inflation rates?

This blog provides all the information you need to take out a personal loan during a period of high inflation, including how much it will cost, if it makes sense, what the advantages are, and what to watch out for.

Do you need a personal loan?

You should think about whether a loan is the right choice for you and your circumstances before taking out a personal loan. When used wisely, personal loans may be a dependable and practical financial instrument. You should consider how you will repay the loan balance because missing loan payments can negatively impact your credit score and financial stability, making it more difficult for you to obtain financing in the future, should you want to do so.

Even if personal loans are fantastic, you should consider your options carefully before selecting the best course of action in light of rising inflation rates. This includes utilizing a credit card or personal lines of credit, checking your personal savings, and taking out secured loans.

What impact does inflation have on loan rates?

Fixed interest rates are affected by inflation indirectly, and the two are associated even though they don't directly affect each other. The main instrument that central banks use to control inflation is inflation, which explains why. Authorities may increase interest rates in order to discourage borrowing and promote saving if inflation is out of control. The government will, on the other hand, cut interest rates if the economy needs a boost, which will encourage people to borrow more money and increase their spending capacity.

What is the cost of inflation on personal loans?

The interest rate for personal loans is often fixed, meaning that it stays the same over the term of the loan. Your interest rates on personal loans that you took out prior to inflation will remain stable, so inflation won't affect them. But if you're a first-time borrower taking out a loan during inflation, you might have to pay more interest because lending rates are likely to rise.

How do inflation rates benefit borrowers?

Money loses value with time, and as they say, "now is better than later." This is a fundamental principle of inflation. Thus, as a borrower, you will be able to repay lenders with money that is worth less than what you borrowed in the first place if inflation increases.

Should you take out a personal loan during an inflation increase?

It all comes down to your requirements in the end. Food, goods, and other basics of life could cost more than you can afford when inflation strikes. A personal loan might assist you pay for any unforeseen costs that may develop in this situation and solve your cash flow issues. Although you should take into account how long it will take, it is likely that your finances will start to improve and you will be able to pay back the personal loan.

As lending is typically done at a fixed rate, the inflation rate is typically appropriately factored into the loan cost. Your credit score and ability to repay the loan are other elements that affect the cost of the personal loan. Banks will charge you a low interest rate if they believe you have a solid capacity for payback. On the other hand, a high interest rate will apply if your credit score is outstanding. Applications for personal loans may occasionally be denied to borrowers with extremely low credit scores and inadequate ability to repay the loans. That way, when you search for a personal loan, these factors are taken into consideration.

When taking out a personal loan, it's important to consider your needs, your ability to repay the loan, and your other choices.

2 notes

·

View notes

Text

#Stashfin#loan#instant loan#personal loan app#loan app#personal loan#best online loan app#best personal loan app

2 notes

·

View notes

Text

Achieve financial peace of mind with our fast loan application process. Choose hassle-free loans for a brighter future!

0 notes

Text

What is the difference between Traditional and Digital Lending?

Imagine yourself living in your old good days. Your father is heading to a local bank with a pile of papers, praying for the Instant Approval of the loan. Do you know for what purpose? Of course, to borrow some cash for the next BIG THING.

Fast-forward to 2024. You are sitting at your home, and with a few taps and swipes, you're applying for a loan and getting one, too. Do you know how? Of course, Digitally.

The financial sector has undergone significant changes in the past few decades. Hereby, Digital Lending Companies like Chinmay Finlease Limited welcome you to the world of Digital Lending Services, where the only paperwork you might encounter is the receipt of your prepaid phone bills. Let’s explore what has caused the difference in the past decades and how people have turned their tables towards digital lending systems.

Traditional Lending: The Old Classical Approach

Traditional lending was the rock and will always be the bedrock of finances. It is synonymous with a well-established financial institution like a bank. The traditional model comprises in-person interactions, paper-based processes, and relatively extended decision periods. The core image is of a borrower walking into a bank branch, filling out lengthy forms, providing collateral, having long conversations with the bank manager, and waiting days or weeks for the loan to be approved.

WHEREAS

Digital Lending: The New Classic Approach

Digital lending is born from the digital revolution. It is the modern way of lending digital loans. It uses digital platforms like websites and mobile apps that integrate AI technology throughout lending. Moreover, this model is successfully driven by a Fintech Company like Chinmay Finlease Limited, which provides personalised financial services to its customers.

–wrapping up!

The lending landscape is rich and varied, offering options from traditional finance to digital platforms. Wholly and solely, the choice between traditional lending and digital lending depends on the borrower's preferences, needs, and circumstances.

Chinmay Finlease Limited is among the best digital lenders and a premier choice for those seeking financial solutions. We provide quick online Personal Loans, Consumer Durable loans, and Emergency Loans with minimal paperwork. With us, you're not just obtaining a loan but partnering with a trusted and dedicated company to help you achieve financial success.

Source Link: Difference Between Traditional and Digital Lending

#loan app#personal loan app#perosnal loan#instant loan#loan#instant loan app#online loan#quick loan#emergency loan

0 notes

Text

https://www.gopaisa.com/referral-signup-bonus-code-coupons-offers/banksathi-referral-code-refer-earn

Are you looking for a way to build a rock-solid passive income source with zero investment? Try the BankSathi app! Become a financial advisor using the BankSathi Referral Code (2013012617) and start earning over Rs. 1 Lakh per month by recommending financial products to your friends and family. Click to read full post.

#banksathi#banksathi app#referral code#referral link#referral offer#referral marketing#referral#promo code#finance#money#credit cards#demat accounts#personal loan#earn money#passive income#earn money online

0 notes

Text

#car loan#fast cash loans online#home loan#instant loan#loan#loan against property#loan apps#msme loan#personal loans#same day payday loans

0 notes

Text

Online Loan Cash | Stashfin

Unexpected expenses can hit anytime. Stashfin is here to help! Get the cash you need quickly and easily with our online loan cash application. We offer:

Instant decisions: Apply in minutes and know your approval status right away.

Flexible amounts: Borrow what you need, from ₹1,000 to ₹5 lakh.

Fast funding: Get the approved cash in your account within hours.

Simple application: No complex paperwork, just a quick online process.

Repayment options: Choose a repayment plan that fits your budget, with terms from 3 to 36 months.

Don't let financial surprises slow you down. Stashfin is your one-stop shop for online cash loans. Get started today!

1 note

·

View note

Text

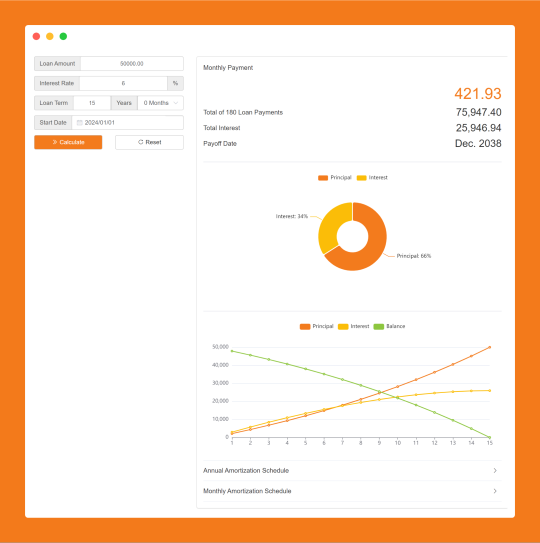

Personal Loan Calculator is an online finance calculate tool that can help you to estimate your monthly payments, total interest, true loan cost, and annual percentage rate (APR) after factoring the fees, insurance to plan your finances wisely.

#Online Web Tools#Web Tools#Free Web Tools#Online Tools#Free Online Tools#A.Tools#Web Apps#Online Calculator#Personal Loan Calculator#Loan Calculator

0 notes

Link

TrueBalance Instant personal Loan app is always ready to help you with your financial needs. It is one of the best loan apps available on the Google Play store that offer quick personal loans for both salaried and self-employed! The process is very simple. once you get the approval on your loan, your approved loan amount is directly credited into your bank account. So, worry not and fulfill last-minute urgent cash needs without any stress only with the TrueBalance app. The instant loan is only provided through the RBI licensed NBFC, so it is 100% Safe. Loan features are subject to change from time to time at the sole discretion of the company. Please refer to the T&C for current applicable features.

0 notes

Text

Best Instant Emergency Loan App Online

The Rupee112 medical loan solution: Why it services in times of an emergency.Instant personal loan up to Rs 1,00,000. Checked your exclusive credit limit on the Rupee112. It is a very easy service provided by our customers.

More information visit our site. https://play.google.com/store/apps/details?id=com.vrindafinlease.rupee112

#instant emergency loan#apply online for emergency loan#Apply instant emergency loan#emergency loan online#instant personal loan online gurgaon#instant emergency loan app#emergency loan app download

0 notes

Text

Personal Loan

Unlock Your Dreams with a Personal Loan! 🌟

Are you looking to fund your dreams or tackle unexpected expenses? A personal loan could be your ideal solution! Whether it's for home renovations, medical emergencies, or a much-needed vacation, a personal loan offers the flexibility you need.

Why Choose a Personal Loan?

Flexibility: Use it for various purposes—debt consolidation, weddings, and more!

Quick Approval: Get fast access to funds when you need them most.

Fixed Payments: Enjoy the certainty of fixed monthly payments.

How to Apply:

Check Your Credit Score: A good score can help secure better rates.

Compare Lenders: Research to find the best terms and rates.

Gather Documents: Have your ID, proof of income, and other necessary documents ready.

Submit Your Application: Apply online or in person for quick approval.

#fincrif #PersonalLoan #Finance #Dreams #Loans #apply online

Considerations:

Interest Rates: Understand how they affect your total repayment.

Fees: Be aware of any processing or hidden fees.

Repayment Terms: Choose what fits your budget.

A personal loan can be a powerful tool to achieve your goals! If you’re ready to explore your options, comment below or send us a message for personalized assistance. Don’t let financial constraints hold you back—let a personal loan pave the way to your future! 💰✨

0 notes

Text

Revolutionizing Financial Wellness: ATD-Money's Approach to Quick Loans and Advance Salary Solutions in India

In the world of digitalization and modern financing systems, access to quick and reliable loan solutions is crucial. ATD-Money emerges as a game-changer in the industry, offering innovative products and services to address the diverse financial needs of every individual across India. Let's explore how ATD-Money is revolutionizing the financial ecosystem with its unique approach to quick loans, instant cash disbursement, and advance salary solutions. Gone are the days of lengthy loan applications and waiting weeks to get approval. ATD-Money is redefining the borrowing experience with its digital, seamless, efficient process. Whether you need an instant loan, advance salary loan, or cash infusion to tide you over until payday, ATD-Money has you covered all across. Let's delve into the key features and benefits of ATD-Money's cutting-edge financial solutions.

Quick Loans for Instant Financial Relief:

Life is unpredictable and financial emergencies can strike when no one expected. ATD-Money understands the urgency of such situations and offers quick loans solutions as per your need to provide instant financial relief. With our easy application process and swift approval mechanism, you can access the funds you need in no time. Whether it's covering medical expenses or unexpected bills, our quick loans ensure that you're never caught off guard.

Advance Salary Loans:

Waiting for your next salary to cover the urgent expenses can be stressful. ATD-Money offers advance salary solutions to bridge the gap between paydays. Our advance salary loans allow you to access a portion of your upcoming salary in advance, providing much-needed financial flexibility when you need it the most. Say goodbye to financial worries and hello to peace of mind with ATD-Money's advance salary loans.

Instant Cash Disbursement:

When time is of the essence, waiting for funds to arrive can be frustrating for anyone. ATD-Money's instant cash disbursement feature ensures that you get access to your loan amount without any delay. Whether you're facing a medical emergency or any other unexpected expense, our instant cash disbursement ensures that you have the funds, when you need them the most.

Easy Application Process:

We understand that navigating through the loan application process can be daunting. That's why ATD-Money offers an easy and hassle-free application process. With just a few simple steps, you can complete your loan application online and get one step closer to financial freedom. Our user-friendly interface and dedicated customer support team are always there to guide you every step of the way.

Conclusion:

ATD-Money is not just a lender; it is a financial partner committed to helping you achieve your emergency requirements and overcome financial challenges. With our quick loans, advance salary solutions, and instant cash disbursement, we are revolutionizing the way people access financial assistance in India. Experience the convenience, speed, and reliability of ATD-Money's financial solutions and take control of your financial future today with a smile.

#quick cash loans#payday loans#personal loans#instant loan#cash loans#loan app in india#advance salary loan#fast cash loans online#loan apps

0 notes

Text

Achieve financial peace of mind with our fast loan application process. Choose hassle-free loans for a brighter future!

0 notes

Text

Download Instant Personal Loan App

Chinmay Finlease Limited is a rapidly growing Instant Personal Loan App trusted by 7 Lakh+ salaried young professionals in India. As an RBI-registered NBFC, we're dedicated to empowering young Indians financially. We provide quick, paperless personal loans directly to your bank account. Download the Chinmay app and get instant personal loans online with quick approvals and flexible repayment options.

#perosnal loan#personal loan app#loan app#online loan app#instant loan#instant loan app#loan#instant personal loan#quick loan app

0 notes