#best online loan app

Text

#Stashfin#loan#instant loan#personal loan app#loan app#personal loan#best online loan app#best personal loan app

2 notes

·

View notes

Text

Rupee112 is a leading financial institution committed to empowering individuals in their financial journey. As a trusted lender, Rupee112 specializes in providing Instant Personal Loans to individuals facing various financial needs and challenges.

Reference Link:-https://in.pinterest.com/pin/1118089044977730177/

#Payday Loans for Salaried Employees faridabad#emergency personal loan app Ahmedabad#Urgent Personal Loans Ghaziabad#emergency personal loan approval gurgaon#urgent payday loans Kolkata#best instant personal loan app Ahmedabad#Short Term Loan Services faridabad#instant personal loan low cibil chennai#Immediate personal loans faridabad#Online personal loans faridabad#Salary-Based Loans Mumbai#instant payday loans Bengaluru#instant personal loan for salaried gurgaon#best instant loan app kolkata#instant loan for salaried employee Hyderabad

2 notes

·

View notes

Text

Online Loan Cash | Stashfin

Unexpected expenses can hit anytime. Stashfin is here to help! Get the cash you need quickly and easily with our online loan cash application. We offer:

Instant decisions: Apply in minutes and know your approval status right away.

Flexible amounts: Borrow what you need, from ₹1,000 to ₹5 lakh.

Fast funding: Get the approved cash in your account within hours.

Simple application: No complex paperwork, just a quick online process.

Repayment options: Choose a repayment plan that fits your budget, with terms from 3 to 36 months.

Don't let financial surprises slow you down. Stashfin is your one-stop shop for online cash loans. Get started today!

1 note

·

View note

Text

CHIME BANK: Experience the Future of Banking with the CHIME Online Checking Account!

youtube

Are you tired of long lines at the bank and hefty fees that eat into your hard-earned money? Welcome to the CHIME Bank - Online Checking Account, designed for the digital age!

#chime bank account#chime bank#chime banking app#no credit check loans online instant approval#chime banking#best online checking account#online banking#chime account#best online bank account#no credit check checking account#how to get a bank account without a credit check#banks for broke people#Youtube#debit card

0 notes

Text

The Future Scope of an MBA in Finance

The Future Scope of an MBA in Finance

The Future Scope of an MBA in Finance

Are you considering pursuing an MBA in finance? If so, you may be wondering about the future scope of this degree. In today’s rapidly evolving business landscape, it’s essential to understand how this qualification can benefit you in the long run.

The Growing Demand for Finance Professionals

Finance is a critical…

View On WordPress

#best loan app#finance professionals#future scope#instant loan#instant loan app#instant loan app without income proof#instant personal loan#instant personal loan app#instant personal loan online without income proof#loan#loan app#MBA in finance#new loan app#The Future Scope of an MBA in Finance

0 notes

Text

Personal Loan App | Stashfin

The Stashfin Personal Loan app is your gateway to effortless and swift financial assistance. This user-friendly mobile application provides access to personal loans ranging from INR 1,000 to INR 5,00,000. With minimal documentation and a hassle-free online application process, you can secure funds for various purposes, including emergencies, travel, education, or debt consolidation. Stashfin offers competitive interest rates and flexible repayment options, tailored to your financial needs. The app ensures quick approvals and disburses funds directly to your bank account, making it a reliable and convenient solution for your financial requirements. Say goodbye to lengthy paperwork and experience financial freedom with the Stashfin Personal Loan app.

#personal loan#personal loan app#loan app#loan apps#loans app#instant loan#online personal loan#loan#all loan app#loan application#instant loan app#best loan app#best instant loan app#credit line app

1 note

·

View note

Text

Download LokSuvidha Finance's Personal Loan App to get an instant credit up to Rs. 1 lakh with 100% paperless process with quick approval & disbursal.

Click here to download app: shorturl.at/lJPT2

For more details, you can visit us on: https://loksuvidha.com/personal-loan/

#personal loan app#personal loans#instant personal loan#LokSuvidha Finance#LokSuvidha App#online personal loan#Quick Personal Loan App#Best Personal Loan Apps'#online loans

1 note

·

View note

Text

In the realm of modern finance, the concept of instant personal loans has revolutionized the way individuals access much-needed funds. This paradigm shift is attributed to the seamless online application process, which allows borrowers to submit their loan requests from the comfort of their homes. Gone are the days of tedious paperwork and long waiting times.

#quick loan service#best instant loan#genuine personal loan app#need personal loan urgent#emergency personal loan online#cheapest personal loan

0 notes

Text

FlexPay Instant Cash Loans: Apply Online for Emergencies & More

Let's say you're a salaried individual who has just received an unexpected bill for a car repair. You can't afford to pay out of your regular monthly budget. This is where the FlexPay instant credit app comes into play, which you can use to pay for the car repair.

With this instant cash loan online, you have the flexibility to repay the credit over time rather than all at once.

Instant Cash Loans

Instant cash loans are a popular way to access money quickly and easily, especially when unexpected expenses arise. Applying for instant cash loans online has made the process even more convenient, with borrowers able to complete the entire process from the comfort of their own homes. One such service that offers instant cash loans online is FlexPay. Let’s explore the benefits of using this instant cash loan.

What is FlexPay?

We are an instant credit line app that offers instant cash loans online. It allows you to apply for loans quickly and easily, without the need for extensive paperwork or waiting in long lines. The service is available 24/7, so you can apply and get an instant cash loan in 5 minutes whenever you need one. It offers a range of loan options.

How can I use It for Emergencies?

This best online instant loan app can be used for many emergencies that require immediate funding. Here are some examples of emergencies that a borrower can use this line of credit for:

1. Medical Expenses: If you have an unexpected medical emergency, such as a hospital visit or surgery, we can help you cover the costs of medical bills, prescription medication, and other related expenses.

2. Car Repairs: If your car breaks down unexpectedly, we can help you cover the cost of repairs or purchasing a new car.

3. Home Repairs: If your home requires urgent repairs, such as a leaky roof, broken plumbing, or a faulty electrical system, we can help you pay for the necessary repairs.

4. Emergency Travel: If you need to travel urgently, for example, to attend a family member's funeral or to visit a sick relative, we can help you cover the costs of travel and accommodation.

5. Unexpected Expenses: Sometimes unexpected expenses can occur, such as a home appliance breakdown or a sudden job loss, which can impact on your financial situation. This line of credit can provide you with the funds you need to cover these expenses until you are back on your feet.

Advantages of Applying for Instant Cash Loans Online

One of the biggest advantages of using our cash app is the convenience factor. Borrowers can apply for a loan from anywhere, at any time, using their computer or mobile device. The application process is quick and easy, with most borrowers receiving a decision within minutes. Another advantage is the ability to withdraw cash whenever you want. We offer a scan now and pay later feature that lets you pay anywhere in India.

Other Ways to Use This Instant Credit App

Our revolving credit app can be used for various purposes, including travel, credit card debts, and education. Here's how:

Travel: This line of credit can be used to fund travel expenses such as flight tickets, hotels, rental cars, and activities. This can be helpful if you need to travel for work or leisure and don't have the funds available to pay for everything upfront.

Credit Card Debts: If you have high-interest credit card debts that are difficult to manage, we can help you consolidate your debts and pay them. This can potentially save you money in the long run and make it easier to manage your finances.

Education: If you're looking to further your education, whether it's to pursue a degree or to take a course, we will help you cover the costs. This can be particularly useful if you don't qualify for traditional student loans or need to cover the costs of education while you work.

What’s the Eligibility?

To be eligible for an instant cash loan with FlexPay, you must meet certain criteria, including:

Having a minimum regular source of income (INR 8,000)

A valid bank account.

A citizen of India.

Be 18 years of age and above.

How do I Apply?

To apply for a line of credit:

Download the app.

Create an account.

Complete your profile and apply for credit.

We will review your information and provide you with a credit limit if approved. It's important to read and understand the terms and conditions before accepting the credit.

Conclusion

We are the best online instant loan app that provides a flexible and convenient way to fund travel, consolidate credit card debts, and pay for education. However, as with any form of credit, it's important to use it responsibly and to make sure that you can afford to repay any credit that you take on.

0 notes

Text

Quick Personal Loan Same Day | Solve Your Money Problems

That’s where an emergency personal loan online comes into play. Before diving deep into the discussion, let us first find out what an emergency loan is. These specially designed instruments can aid when you need funds on short notice. Visit the blog to read more.

Visit- https://medium.com/@rupe3693/quick-personal-loan-same-day-solve-your-money-problems-0745fa58eae6

#instant personal loan for low cibil score noida#instant payday loan gurgaon#Personal Loan for Salaried Employee Faridabad#urgent payday loans Kolkata#emergency personal loan app Ahmedabad#instant personal loan for salaried gurgaon#immediate loan#Same day approval loans delhi#Payday Loans for Salaried Employees faridabad#Best instant personal loan app Gurgaon#emergency personal loan approval gurgaon#best instant personal loan app Ahmedabad#Short Term Loan Services faridabad#best instant loan app kolkata#Loan for salaried employees delhi#Online emergency loan instant approval noida

0 notes

Video

youtube

TrueBalance App - ప్రతిఒక్కరి భాగస్వామి | Personal loan | Online Loan App

Taking a personal loan may have multiple reasons like starting a small home-based business or paying your child’s school fees, funding for holiday trips, home renovation, or even in medical emergencies. Instant loan is one of the best financial solutions when anyone is in need or is in search of immediate cash! And here, The TrueBalance, online loan app can be your best financial support, which not only makes it more effortless to realize dreams but also fund emergencies on time.

0 notes

Text

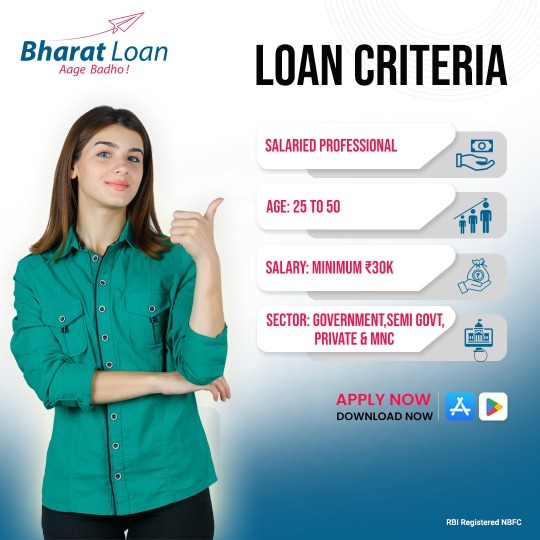

Redefining Financial Solution - Personal loan in Faridabad

Everyone is in the pursuit of achieving more; it can be getting a new car, a salary hike, a new job that pays more, starting a business, etc. While making sure every need and want is fulfilled, what if financial emergencies arise and you are left with nothing? When such situations arise, anyone, especially salaried employees, can access support from Bharat Loan, offering short-term loans ranging from ₹5k to ₹1Lakh. Visit the blog to read more.

Visit- Redefining Financial Solution - Personal loan in Faridabad

#Apply Online For Emergency Loan Ghaziabad#Salaried Loan Providers Ghaziabad#Best Instant Personal Loan App Ghaziabad#Instant Emergency Loan Ghaziabad#Best Instant Personal Loan App Ahmedabad#Payday Loans For Salaried Employees Faridabad#Urgent Personal Loans Ghaziabad#Emergency Personal Loans Delhi#Instant Personal Loan App Ahmedabad

0 notes

Text

Personal loan apps have become increasingly popular in recent years, offering a convenient way to borrow money quickly and easily. These apps allow you to apply for a loan, check your loan status, and manage your payments all from the comfort of your smartphone.

However, before using a personal loan app, it's important to understand how they work and what to look for. Some things to consider include the app's reputation, interest rates and fees, loan terms, and eligibility requirements.

0 notes

Text

Travel loans: Everything you should know about it - Travellers of India

Planning to get a travel loan for a vacation? Here's everything that you need to know before applying for one.

0 notes

Text

Tips to Stop Living Paycheck to Paycheck

Did you know that, as of 2022, more than 60 percent of Americans live paycheck to paycheck? It's a grim figure that can make anyone worry about the future. When you live this way, you have very little wiggle room for emergency expenses. That means that an accident or unplanned fee can lead to financial turmoil.

Getting out of this cycle isn't easy, but these tips will put you well on your way.

Create a Realistic Budget You Can Follow

Start your journey to better financial security by setting a budget. The best personal finance app can help you better understand how you spend. See where your money goes now to identify areas where you can improve.

Then, set a budget for every significant category. For example, set limits on how much you can spend on groceries, rent, utilities, etc. Focus on the essentials and see how much you have left over. The goal is to increase that excess amount as much as possible.

Make Some Sacrifices

When you set a budget, you'll probably realize that you must make some sacrifices. That's a normal part of getting out of this paycheck-to-paycheck cycle. You can't afford to overspend on luxuries or eat out every day.

It's a bummer, but your sacrifices can pay off tenfold in the future. Prioritize the most necessary expenses and cut back on discretionary spending.

Pay Off Debts as Quickly as Possible

The best personal finance app can help you maximize extra money between paychecks. But what do you do with it? The best course of action is to use it to pay off debt.

Lower credit card balances, pay off student loans and take care of any debts that hang over you. Doing so will help you shrink your debt-to-income ratio. That will lead to fewer bills and more discretionary income between paychecks.

Put Money Into Savings

Don't stop at paying off your debts. Put extra money into savings. A padded savings account will cover you in the event of an emergency. Even if you have limited funds between paychecks, a well-funded savings account will ensure that unexpected expenses don't lead to financial ruin.

Read a similar article about pay allstate bill online here at this page.

#labcorp online bill payment#carmax bill payment online#pay quest diagnostics online#cash advance loans#online software for bill payments#best budget app#best personal finance app

0 notes

Text

Personal loan refinancing is a financial strategy where individuals replace an existing personal loan with a new loan, usually from a different lender, at more favorable terms. When individuals initially take out a personal loan, they agree to certain interest rates and loan terms. However, as financial circumstances change, the terms of the original loan may not be the most beneficial.

#personal loan details#personal loans with low interest rate#online bank loan apply#online loan approval instant#best way for personal loan#online loan app instant#private finance for personal loan#apply for personal bank loan#private company loan#instant digital personal loan#low rates for personal loans

0 notes