#payouts api for paypal

Text

What are Wire Transfers?

Sending money from one person to another these days is easier than ever due to the availability of apps like CashApp and Venmo. In the past, however, transferring money from one bank account to another meant you either needed to write and mail a physical check or use a wire transfer. Although not used as often as in the past, wire transfers are still an important part of the global financial system.

A wire transfer is a direct transfer of funds electronically between financial institutions. They were more popular in the past because the Internet and debit cards didn’t exist at the time, so if you wanted to get money to someone’s bank account across the country, you had to send a wire transfer or write and mail a check from your bank account.

Sending Money Internationally

International wire transfers make up a big portion of today’s wire transfer activity. An international wire transfer needs to go through the Society for Worldwide Interbank Financial Telecommunications (SWIFT) system. When you send an international wire transfer, a record of the activity is recorded to ensure legal compliance, and this system uses special SWIFT codes.

Domestic transfers are usually completed within 24 hours, but international payments can take a few days to complete. Additionally, the cost to send international transfers by wire can be quite a bit higher compared to domestic transfers.

How to Send a Wire Transfer

To send a wire transfer, you will need to contact your financial institution. Although the process is fairly straightforward, each bank may have its own forms to fill out. You will need to have the bank details of the party to whom you’re sending a transfer to as well. The financial institution you send to must also be able to accept wire transfers.

As a side note, the SWIFT system may not allow all wire transfers to all places. If a country has been given restricted access to the SWIFT system due to international issues, you may be prohibited from transferring funds or may be limited in the amounts you can send to individuals and companies in certain countries.

Read a similar article about platform for payouts API here at this page.

0 notes

Text

#ecommerce#online#online store#paying#payment gateway#payment processing#payment systems#payments#payouts#small business#businesses#business#high risk merchant account#high risk payment gateway#paypal#payout#payout api#payment collection#payervault#payervault payment gateway

1 note

·

View note

Text

Fantasy Sports App Development Company: A Complete Guide for 2024

The world of fantasy sports has exploded in popularity, providing enthusiasts with an exciting way to engage with their favorite sports. As the demand for immersive and interactive fantasy sports experiences continues to grow, developing a robust and user-friendly fantasy sports app can be a lucrative venture. In this comprehensive guide, we'll delve into the essentials of fantasy sports app development in 2024, covering key features, technologies, market trends, and why partnering with DQOT Solutions can be your best move.

The Rise of Fantasy Sports Apps

Fantasy sports apps have revolutionized the way fans interact with sports, offering a blend of strategy, competition, and entertainment. These apps allow users to create virtual teams, compete against others, and earn rewards based on real-world sports performance. The appeal lies in the engagement and sense of community they foster among sports enthusiasts.

Key Features of a Fantasy Sports App

To ensure your fantasy sports app captivates and retains users, it should incorporate the following features:

User Registration and Profiles: Secure and seamless registration process with customizable user profiles.

Live Drafts: Real-time drafting capabilities for users to select their players.

League Management: Options for users to create, join, and manage leagues with friends or other users.

Player Statistics: Access to real-time player stats and performance data.

Scoring System: A transparent and customizable scoring system based on real-world performance.

In-App Chat: Communication tools for users to interact with league members.

Push Notifications: Timely alerts for game updates, player injuries, and other critical information.

Secure Payment Gateway: Safe and reliable payment processing for entry fees and payouts.

Social Media Integration: Easy sharing of achievements and league updates on social media platforms.

Admin Panel: A comprehensive backend for administrators to manage users, leagues, and content.

Technology Stack for Fantasy Sports App Development

Choosing the right technology stack is vital for the performance and scalability of your fantasy sports app. Here are some recommended technologies for 2024:

Frontend: React Native or Flutter for cross-platform development.

Backend: Node.js or Django for scalable server-side development.

Database: MongoDB or PostgreSQL for efficient data management.

Real-Time Data: WebSockets or Firebase for live data updates.

APIs: Integration with sports data providers like Sportradar, SportsDataIO, and FantasyData.

Payment Gateways: Integration with Stripe, PayPal, or Braintree for secure transactions.

Cloud Services: AWS, Google Cloud, or Azure for hosting and scalability.

Analytics: Mixpanel or Firebase for user behavior tracking and analytics.

Market Trends in 2024

Staying ahead of market trends can give your fantasy sports app a competitive edge. Here are some key trends to watch in 2024:

Esports Integration: Incorporating fantasy leagues for popular esports titles.

Blockchain and NFTs: Utilizing blockchain technology for transparent transactions and NFTs for unique player cards and rewards.

Enhanced Analytics: Providing users with advanced analytics and insights to make informed decisions.

Augmented Reality (AR): Enhancing user experience with AR features for live drafts and player interactions.

Localization: Catering to global audiences with multilingual support and region-specific leagues.

Why Choose DQOT Solutions for Your Fantasy Sports App Development?

At DQOT Solutions, we specialize in creating cutting-edge fantasy sports apps that deliver unparalleled user experiences. Our expertise in the sports industry, combined with our technical proficiency, ensures that your app stands out in a crowded market. Here's what we offer:

Custom App Development: Tailored solutions that align with your specific requirements and vision.

UI/UX Design: Intuitive and visually appealing designs that enhance user engagement and satisfaction.

API Integration: Seamless integration with leading sports data providers and third-party services.

Quality Assurance: Rigorous testing to ensure your app is reliable, secure, and bug-free.

Ongoing Support: Continuous support and maintenance to keep your app updated and performing optimally.

Conclusion

The fantasy sports market is poised for continued growth, making 2024 an ideal time to invest in a fantasy sports app. By incorporating essential features, leveraging the right technology stack, and staying attuned to market trends, you can create an app that captivates users and delivers significant value. Partnering with DQOT Solutions ensures that your app development journey is smooth and successful, providing you with the expertise and support needed to thrive in this dynamic industry.

Ready to bring your fantasy sports app idea to life? Contact DQOT Solutions today and let's create something extraordinary together!

0 notes

Text

Sports Betting Game Development Essentials Tools: Choosing the Best

Sports betting games have gained significant popularity in gaming, offering players an immersive and thrilling experience. Developing a successful sports betting game requires the right tools and technologies to ensure seamless gameplay, advanced features, and a captivating user experience. In this blog post, we'll explore the essential tools for sports betting game development and how blockchain game development tools are revolutionizing the process.

Sports Betting Game Development Essentials:

When embarking on sports betting game development, developers need various tools to bring their vision to life. Some essential tools include:

1. Game Engines:

Game engines serve as the foundation for sports betting game development, providing developers with the necessary tools and functionalities to create interactive gameplay, realistic graphics, and smooth animations. Popular game engines like Unity and Unreal Engine offer extensive features and support for sports betting game development.

2. Programming Languages:

Proficiency in programming languages is essential for building sports betting games. Developers often utilize languages such as JavaScript, C#, and Python to implement game logic, user interfaces, and backend functionality. Additionally, specialized frameworks and libraries tailored for game development, such as Phaser.js and Pixi.js, can streamline the development process.

3. Data APIs:

Access to real-time sports data is crucial for sports betting game development, enabling developers to provide accurate odds, scores, and statistics to players. Utilizing sports data APIs from reputable providers like Sportradar or STATS ensures reliable and up-to-date information for betting markets and in-game features.

4. Payment Gateways:

Integrating payment gateways is essential for facilitating deposits, withdrawals, and transactions within sports betting games. Developers can leverage payment processing APIs like Stripe or PayPal to securely handle financial transactions and support various payment methods, including credit cards, cryptocurrencies, and digital wallets.

Blockchain Game Development Tools:

In recent years, blockchain technology has revolutionized the gaming industry, offering decentralized solutions for enhanced security, transparency, and ownership of in-game assets. Blockchain game development tools play a pivotal role in integrating blockchain features into sports betting games. Some essential blockchain game development tools include:

1. Smart Contract Platforms:

Smart contracts serve as self-executing agreements written in code and deployed on blockchain networks. Platforms like Ethereum, Binance Smart Chain, and Solana provide a robust infrastructure for deploying smart contracts, enabling developers to implement features such as transparent betting rules, automated payouts, and provably fair gameplay.

2. Blockchain Development Frameworks:

Blockchain development frameworks offer libraries, templates, and tools for building decentralized applications (DApps) and integrating blockchain functionality into existing platforms. Frameworks like Truffle, Hardhat, and Remix provide developers with the necessary tools for smart contract development, testing, and deployment.

3. Decentralized Oracles:

Decentralized oracles act as bridges between blockchain networks and external data sources, providing secure and reliable access to off-chain information for smart contracts. Oracles such as Chainlink and Band Protocol enable sports betting games to fetch real-world sports data from trusted sources and incorporate them into blockchain-based betting markets.

Conclusion:

Sports betting game development requires a diverse set of tools and technologies to create engaging and immersive gaming experiences for players. From game engines and programming languages to data APIs and payment gateways, developers have a wide array of options to choose from. Additionally, blockchain game development services offer innovative solutions for integrating blockchain features into sports betting games, enhancing security, transparency, and user ownership. By leveraging the best tools available, developers can create successful sports betting games that captivate players and drive engagement in the competitive gaming market.

#blockchain game development#blockchain game development services#blockchain game development company

0 notes

Text

Enhancing the Checkout Experience: Cashfree Payments Partners with Shopify for Onsite Payments

In a significant development for India's burgeoning e-commerce sector, Cashfree Payments, a leading player in the payments and API banking landscape, has entered into a strategic partnership with Shopify, a global e-commerce platform. This collaboration aims to revolutionise online payments for Indian merchants by introducing onsite payments with cards, a game-changing feature that promises to enhance the customer shopping experience and boost revenue.

The introduction of onsite payments, made possible through the partnership between Cashfree Payments and Shopify, aims to address these issues head-on. With onsite payments, Indian merchants can collect payment information directly on their websites, eliminating the need for redirection to external payment gateways. This streamlined process ensures a seamless, swift, and controlled checkout experience for both customers and merchants, reducing cart abandonment rates and enhancing overall customer satisfaction.

One of the most noteworthy aspects of this collaboration is that it extends the functionality of onsite payments to Indian Shopify store owners. Initially, this feature was exclusive to Shopify stores in the United States. However, this partnership brings the benefits of onsite payments to the Indian e-commerce landscape, unlocking a world of potential for online businesses in the country.

At present, Indian customers can use credit and debit cards for onsite payments, and there are plans to introduce additional payment options in the future. This flexibility aligns with the diverse payment preferences of Indian consumers and further strengthens the appeal of onsite payments as a customer-centric solution.

Reeju Datta, one of the Co-Founders of Cashfree Payments, enthusiastically shared his thoughts on this collaboration, stating, "We are thrilled to join forces with Shopify to introduce the onsite payment solution in India. Our integration empowers Shopify merchants to provide customers with a frictionless checkout experience, leading to improved conversion rates and heightened customer satisfaction. The partnership between Cashfree Payments and Shopify demonstrates our mutual dedication to empowering India's burgeoning direct-to-consumer (D2C) and e-commerce ecosystem."

Bharati Balakrishnan, Country Head of Shopify for Southeast Asia and India, emphasized the importance of digital payments in the e-commerce experience, stating, "Digital payments are an integral part of the eCommerce experience, and we are pleased to partner with Cash Free Payments to enhance our payments offering and improve outcomes for our merchants in India."

Cashfree Payments is a dominant player in the Indian payment processing landscape, holding over 50% market share among payment processors. Known for its Payouts solution, the company has earned recognition as one of the leading online payment aggregators. Its strategic partnership with India's largest lender, SBI, underscores its pivotal role in building a robust payments ecosystem in the country.

Cashfree Payments collaborates closely with leading banks to develop the core payments and banking infrastructure that powers its products. Furthermore, it has integrated its solutions with major platforms such as Shopify, Wix, PayPal, Amazon Pay, Paytm, and Google Pay. Beyond India, Cashfree Payments' products are used in eight other countries, including the United States, Canada, and the United Arab Emirates.

Conclusion

The partnership between Cashfree Payments and Shopify marks a significant milestone in the evolution of India's e-commerce landscape. Onsite payments with cards promise to simplify and streamline the checkout process for Indian consumers while providing e-commerce merchants with the tools they need to boost sales and improve customer satisfaction. As the online shopping sector in India continues to expand, innovations like onsite payments are set to play a pivotal role in shaping the future of e-commerce in the country.

If you are looking for make your Shopify dream store visit :-Shopify Development Company in India, Apps Development Services

0 notes

Text

GET PAID DAILY BY JOINING OUR CPA LEAD NETWORK DAILY.

Install Mobile Apps and Get Paid

Get your friends, users, or visitors to install our iOS and Android apps and get paid per install. CPAlead provides daily payments to all publishers. This is how you know CPAlead is a direct source network for cost per install (CPI) offers.

Our CPI and CPA offer marketplace encourages advertisers to fight for your traffic by offering the highest payouts per install in the industry. The better their offers perform with your traffic, the more traffic they receive. Beyond our marketplace, we also offer robust tools such as Offer Walls, SDKs, APIs, native ads, and other monetization tools that will help you earn more.

https://tinyurl.com/mhmendfd

Click the above:

One-Click Sign Up

Sign Up With Google

By creating an account, you agree to our Terms and that you have read our Privacy Policy.

Or Email Sign Up

SIGN UP BELOW:

https://tinyurl.com/mhmendfd

First NameLast Name

Email AddressSkype Name (optional)

PasswordConfirm Password

By creating an account, you agree to our Terms and that you have read our Privacy Policy.

Submit Information

@ the link below:

https://tinyurl.com/mhmendfd

Why sign up?

A few reasons why...

$1 Minimum Daily Payments

Highest Payouts

Get Paid Per App Install

Direct CPI Offers

Membership is Always FREE

Get Paid Paypal, Payoneer & More

Virtual Currency

Offer Walls

Mobile App Ad Solutions

Achievements and Point Rewards

Get paid DAILY by joining the CPAlead network today.

Get in Touch

Recent Events

About CPAlead

Since 2006, CPAlead has paid out over $100,000,000 to mobile app and website developers in over 180 countries.

Our reputation as the #1 CPA and CPI marketplace is public and indisputable. Search TrustPilot, Facebook, Google Business, TopNetworks, or AffPaying for CPAlead and see for yourself what our publishers and advertisers say about us. Please don't take our word for it.

Register now:

https://tinyurl.com/mhmendfd

Advertising Resources

Buy iOS and Android App Installs

Mobile Pin Submits

Best CPI Offers

Click the link to register:

https://tinyurl.com/mhmendfd

Payment Options

Paypal, Payoneer, Wire, ACH, and Check.

1 note

·

View note

Text

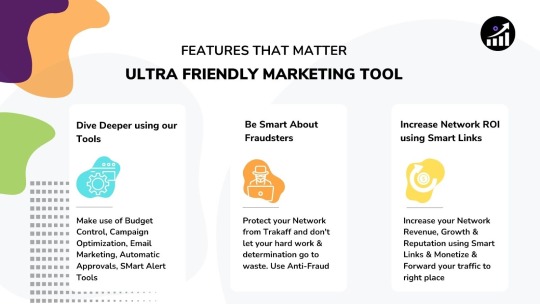

Trakaff.com : Powerful Affiliate Tracking Software

Trakaff is a Powerful & Trustworthy Affiliate Tracking Software that enables CPA Networks, Affiliate Networks & E-Commerce Companies to do advanced tracking and overall affiliate management.

Create your own affiliate network

Optimize your Campaigns Performance

Boost and Scale your CPA Network

Increase your ROI for your network

It’s not just about an efficient performance marketing tool for tracking clicks, conversions, sales, leads, app install, payouts, and revenue from affiliates who work with your network but also the User Interface (UI), Latest Technology, Automation and Affordability of Software. That’s why Trakaff is best to fill all these needs.

Service Type: Cloud-BasedTrial Period: 14-day without any cardBasic Plan Starts From: 59 USD/monthKnowledge Center: YesLanguage Support: EnglishCustomer Type: Small, Large Enterprise, Medium Business

Trakaff doesn’t end here, as it offers Smart-Links, Anti-Fraud Tool, 75+ Advanced Business Reports, Campaign Automation, Offer sync API, Smart Analytics, Multiple Themes for Affiliates, URL Builder tool and many more…

Get Your Free Trial Here.

Trakaff Pricing Model

Trakaff offers best-in industry pricing packages. To provide services to all cpa network & affiliate networks worldwide, Trakaff offers a 14-day Free Trial, with no credit/debit card required.

All the Features and Add-ons available in any plan can be customized according to affiliate network needs with most payment methods available like PayPal, Payoneer, MasterCard, Maestro, Visa Card, American Express Card, RazorPay, Webmoney and more. Our Direct Customer Service team can assist you with any payment method you require.

Individual Pricing Plans

Trakaff Key Benefits

Customizable Interface

Smart Links

Smart Caps

Real-Time Data

Advanced Tracking & Reporting

Pixel & Postback Integration

Campaign Automation

Powerful Fraud Detection Tool

Advance Targeting & Control

Scalable & Stable Service

Smart Optimization

Ad Networks Integration

Two-Way API

Bulk Upload Offline Campaigns

Offer Sync API

Link Builder Tool

Publisher Specific Payout Tool

GEO Specific Payout

Goals Tracking

TIER based & Group Based Payout for Publisher

Complete White Label Solution

Smart Links: Smart-link manage Your Traffic in a very smart way so you will get Max Revenue.Monetize and forward your traffic to the right place using our smart algorithms.

Fraud Detection: Anti-Fraud is a High-Security Tool that helps you Filter Unwanted Traffic to Your Network. Avoid Fraud Traffic like Fake Conversions, Fake Traffic Source, Fake Hits or Clicks. Alerts the user so that No Fraud Activity passes through Your Network.

Automation: Scale your network with automatic affiliate invoice creation, Smart Alert System that shows important changes in network instantly.

Advanced Targeting: Options like Geo based, Operating system base, Device based & Country Based which enables you to make use of your traffic well.

Offer Management: Get Offer Access control, Redirection Management System, Offer Approval System to highly Verified Trusted Publishers and many more…

Publisher Management: Use our smart communication & management tools, for publishers you can automate anything from Dynamic & Percentage based Payouts, Automated Emails, Multi Currency & Cap Limit Functions.

Reporting: Choose between 75+ comparison reports to gain a deeper understanding of your marketing efforts and develop strategies to drive growth. We got everything covered with Real Time Data in our affiliate marketing software.

24/7 Support: Trakaff support and your onboarding demo sessions are just one click away, if its on Skype, Chat, Email, Any Desk, Teamviewer or on call.

Even We have automated support like Chatbots & Enhanced Knowledge centre to help your CPA Marketing grow 24/7/365.

Overall Trakaff is the Ultimate Cloud Hosted Affiliate Tracking solution to Build, Grow & Scale your Performance Marketing to Next Level. It has helped Thousands of Affiliate Marketers and Networks to grow their Revenue around the Globe.

Further, You can Also Join Trakaff Referral Program, which has now Lifetime Commission on every referral and has zero threshold payment system. Register here.

Signup Today to Start Your Affiliate Network

1 note

·

View note

Text

Cashfree Payments launches ‘Co-lend’: India’s first fully automated escrow management solution for co-lending

Cashfree Payments launched ‘Co-lend’, India’s first fully automated escrow management solution for co-lending. ‘Co-lend’ has been developed in line with the digital lending guidelines announced by the Reserve Bank of India (RBI). It facilitates instant disbursal with auto reconciliation and a dashboard for managing multiple partnerships. Additionally, it requires no manual intervention, automatically notifies the loan management system, and eliminates reconciliation efforts.

Currently, in co-lending partnerships, the reconciliation of funding to the escrow accounts for disbursement and repayments is done manually, resulting in errors and delays. The lender and originator pool money into the Co-lend escrow, and then disbursals and collections happen from and into the escrow. In this process, the Loan Management System (LMS), the Loan Origination System (LOS), and the actual loan disbursal as well as repayment are disconnected, resulting in reporting delays and challenges in accounting and reconciliation for each player in the partnership. Cashfree Payments’ ‘Co-lend’ addresses all these challenges and makes the entire process automated, increasing efficiency and accuracy.

Cashfree Payments’ ‘Co-lend’ provides a robust platform for co-lending originators and lenders, especially the ones sanctioning high volumes of loans, where real-time disbursement, repayment and reconciliation are primary requirements. Cashfree Payments has also partnered with Loan Management Service and Loan Origination Service providers as well as banks to enable a plug-n-play offering for lenders to manage all their co-lending and add new partners with ease. The current set of banks that already support a Co-lend integration are ICICI Bank, Kotak Mahindra Bank, Yes Bank, IndusInd Bank, and Axis Bank.

Akash Sinha, Co-founder and CEO of Cashfree Payments, said, "With the exponential expansion in digital lending, there is a tremendous demand for compliant and scalable solutions. We are pleased to announce that Cashfree Payments now offers a co-lending platform to provide NBFCs and banks with a one-stop solution for escrow management, disbursal and repayment, with a focus on automating payments and complex reconciliation involved. As an innovator in the API banking and payments space, we have strived to deliver this solution at a vital juncture to assure continuity and development for our merchants while maintaining compliance at the forefront.”

With over 50% market share among payment processors, Cashfree Payments today leads the way in bulk disbursals in India with its product Payouts. Recently, India’s largest lender, SBI invested in Cashfree Payments, underscoring the company’s role in building a robust payments ecosystem. The company works closely with all leading banks to build the core payments and banking infrastructure that powers the company’s products and is also integrated with major platforms such as Shopify, Wix, Paypal, Amazon Pay, Paytm and Google Pay. Apart from India, Cashfree Payments’ products are used in eight other countries including the USA, Canada and UAE.

Read the full article

0 notes

Photo

Best Affiliate Manager Plugin for Wordpress

Afiliado:

Brought to you by Codex Infra, Afiliado is a full-featured affiliate WordPress plugin that’s ideal if you’re looking for an affiliate supervision system that works right out of the box. It gives many other affiliate WordPress plugins, with tools that are great for sellers, online stores and membership sites.

Let’s discover what the Afiliado WordPress plugin has to offer. To begin with, adding new affiliates is so easy, your affiliate program should make money within no time. And thanks to lots of integrations, you can hook this plugin to any wordpress and e-commerce platform that you have.

You’re allowed to track an unlimited number of affiliates, and traffic statistics allow you to put a finger on what’s working. Just like the affiliate WordPress plugins in this list, Afiliado is easy to setup and use.

Seeing as Afiliado is easy to customize and comes with an API, developers can bank on this plugin to build customized affiliate management programs, without any hassle. Can do, everything you need to run an affiliate program is already available in the plugin.

This awesome plugin does much more than that. Afiliado also includes options for manually adding affiliates and transformations.

If you opt for the premium add-on you can even add try affiliate referrals. You can setup transactions percentages, cookie length, affiliate pages and various other things easily. You can further integrate Afiliado with a group of awesome plugins such as Contact Form, WooCommerce, Easy Digital Downloads, MemberPress, PayPal Buttons, and so much more to push your affiliate program to greater extent.

Benefits of an Affiliate Marketing

· Affiliate Program can quickly increase scale of your traffic.

· Affiliate Program figures key relationships with high-volume affiliates.

· Improves engagement on-site which leads to higher revenue for the business.

· Affiliate Program generates more loyal customers.

What you get from Afiliado

· Easy set-up. Install and activate the plugin in word press or CMS website. Add some user settings and you are ready.

· Affiliate registration forms for users to list as them affiliates.

· Afiliado can create their own referral links from the Affiliate Area with the built-in referral link generator.

· Automatic and manual selections for affiliate approval

· No cap on affiliates everyone can join the program and promote.

· Full integration with popular WordPress and eCommerce platforms.

· Offer unlimited creatives like visual resources, links, etc. for better understanding.

· Accurate affiliate tracking, real-time broadcasting. Track affiliate-referred visits, referrals, earnings and affiliate registrations in real period of time.

· Pay affiliates directly to their bank using the plugin’s committed payouts.

· See your best earning affiliates, view affiliate reports, edit specific affiliate accounts, and modest affiliate registrations.

· A dashboard for your affiliates to track their presentation, view pays, retrieve their referral URL, find creatives, etc.

· You can Use coupon codes instead of affiliate links.

· Offer different pay rates to different users and also based on product.

· You can Control the duration of referral tracking cookies.

· Adjustable emails – They provide a variety emails for admin notification, affiliate registration, endorsement, rejection, earning reports, etc.

· Export data to excel file for predicting, accounting, and bookkeeping purposes.

· Complete log of every expenses sent to affiliates from the Payouts screen.

· Hooks and templates is to improve custom features and functionality.

· Users can generate, view, update, and delete the data using the WP-CLI commands from Afiliado. Also, perform CRUD operations using RestFul API.

· On the other hand, Affiliate For WooCommerce too full with features.

#web developing company#web development#wordpress#woocommerce#seo#digitalmarketing#make money online#affiliate-marketing-companies#affilate marketing

25 notes

·

View notes

Text

Guide on How to Use PayPal

PayPal is one of the world's most established and trusted online payment systems. It's been around since 1998 and is a go-to platform for businesses and individuals needing to send money. Everyday shoppers can use PayPal to pay for purchases on marketplace sites, e-commerce stores, etc. Meanwhile, companies can employ a PayPal integration API to pay employees, freelancers, international gig workers and more.

Here's how to get started with PayPal.

Creating Your Account

Creating your account is the first step to taking advantage of everything PayPal offers. This process is simple, and the PayPal website walks you through the information you need to provide.

Once you have your account, you can start sending or receiving money. The only information you need is the email address associated with your account and your PayPal password. If you're working with a company that uses a PayPal integration API, you only need to provide your email address to start receiving payments.

When you log into your account, you can see your balance.

That's also where you add a debit card, bank account or credit card to your PayPal digital wallet. These linked accounts will cover purchase amounts over your balance. You can also use them to withdraw funds from your PayPal accounts or add more.

Using PayPal to Make Purchases

One of the biggest benefits of having a PayPal account is that you don't need to provide sensitive financial information when you shop with retailers. You'll see a dedicated button during checkout when an online store or marketplace platform accepts PayPal.

Click on that button, and you'll connect to PayPal. Log in with your email address and password, and you're good to go. That's it! PayPal will use your available balance and/or linked accounts to cover the costs. Your information stays private, and you get added safety with PayPal's Buyer Protection Program.

The beauty of PayPal is that it's available on many devices. Download the PayPal app, and you can shop from your phone. No need to take out your card or worry about who you're giving your information to!

Read a similar article about digital wallet system here at this page.

0 notes

Text

GET PAID DAILY BY JOINING OUR CPA LEAD NETWORK DAILY.

Install Mobile Apps and Get Paid

Get your friends, users, or visitors to install our iOS and Android apps and get paid per install. CPAlead provides daily payments to all publishers. This is how you know CPAlead is a direct source network for cost per install (CPI) offers.

Our CPI and CPA offer marketplace encourages advertisers to fight for your traffic by offering the highest payouts per install in the industry. The better their offers perform with your traffic, the more traffic they receive. Beyond our marketplace, we also offer robust tools such as Offer Walls, SDKs, APIs, native ads, and other monetization tools that will help you earn more.

https://tinyurl.com/mhmendfd

Click the above:

One-Click Sign Up

Sign Up With Google

By creating an account, you agree to our Terms and that you have read our Privacy Policy.

Or Email Sign Up

SIGN UP BELOW:

https://tinyurl.com/mhmendfd

First NameLast Name

Email AddressSkype Name (optional)

PasswordConfirm Password

By creating an account, you agree to our Terms and that you have read our Privacy Policy.

Submit Information

@ the link below:

https://tinyurl.com/mhmendfd

Why sign up?

A few reasons why...

$1 Minimum Daily Payments

Highest Payouts

Get Paid Per App Install

Direct CPI Offers

Membership is Always FREE

Get Paid Paypal, Payoneer & More

Virtual Currency

Offer Walls

Mobile App Ad Solutions

Achievements and Point Rewards

Get paid DAILY by joining the CPAlead network today.

Get in Touch

Recent Events

About CPAlead

Since 2006, CPAlead has paid out over $100,000,000 to mobile app and website developers in over 180 countries.

Our reputation as the #1 CPA and CPI marketplace is public and indisputable. Search TrustPilot, Facebook, Google Business, TopNetworks, or AffPaying for CPAlead and see for yourself what our publishers and advertisers say about us. Please don't take our word for it.

Register now:

https://tinyurl.com/mhmendfd

Advertising Resources

Buy iOS and Android App Installs

Mobile Pin Submits

Best CPI Offers

Click the link to register:

https://tinyurl.com/mhmendfd

Payment Options

Paypal, Payoneer, Wire, ACH, and Check.

0 notes

Text

Flutterwave- A Potential Unicorn Payment Company in Africa.

Flutterwave was co-founded in year 2016 by Iyinoluwa Aboyeji and Olugbenga Agboola to solve the financial frictions of online payment process systems in Africa by making payment easy, fast, inclusive and secure with technology. They seem to be the 21st- century middle man type of the old trade by barter era where merchants trade what they have with something they need. Flutterwave serves as an online catalyst and gateway for users to achieve boundless payment needs either to make successful payments or cashouts, anywhere even in preferred local currency, creating a win-win butterfly moments for businesses and individuals in Africa.

Flutterwave have its headquarter in San Francisco Bay Area, West Coast Western US. Iyinoluwa Aboyeji one of the co-founders who is a 2016 Quartz African Innovator and also the Co-founder of Andela announced his exit as the CEO of Flutterwave after 2 years he co-founded the payment startup, similar to his exit from Andela a company he also co-founded, that trains developers locally and expose them to global opportunities. They have raised over $20.4m in 9 funding rounds funded by a total of 25 investors to include 4DX Ventures, FinTech Collective CRE Venture Capital, Plug and Play, Green Visor Capital, GreyCroft, Glynn Capital management, and HOF Capital and recently attracted investment from Raba Capital and Mastercard as an early-stage venture. They currently have a staff strength of over 50 direct employees, In the course of running their business, according to a report by Crunchbase, "Flutterwave actively use about 22 technology products and services such as Wordpress, Google Tag Manager and google analytics. The company's website actively uses over 82 technologies which include SSL by default, Android and iPhone mobile-enabled, they are ranked globally as 110,233 among active websites in the world with a traffic of over 447,023 monthly website visitors".

The fintech company is currently led by a team of 5 change agents comprising of 2 females and 3 males to include Olugbenga Agboola who is the CEO and Co-founder of the company, Bode Abifarin who serves as the Chief Operation Officer, Opeyemi Fowler- Head of Growth Nigeria, Usman Abiola-User Experience Designer and Ernest Terry Obi- Head of Global Sales. They also have board members and observers comprising of 4 foreign nationals namely; Will Szczerbiak, Ian Sigalow, Micheal Walsh and Joe Saunders. Flutterwave from inception to date has processed over $1.3 billion in over 10 million transactions helping big brands such as Uber, Facebook, Booking.com and Hotels.ng with payments to generate an estimated revenue of over $1 million annually and according to PrivCo “Flutterwave has a post-money valuation in the range of $10million to $50 million as July 31, 2017”. They compete with other companies in the fintech space such as PayPal, Interswitch, and VoguePay with presence in about 40 African countries.

Developer communities of young talents in Africa is growing as the internet and mobile penetration increases in a continent with the youngest workforce population in the world. Flutterwave is a big believer of African talents in the tech industry as they provide a global pedestal for local developers to put their skills to use to better their own lives and millions of other individuals in the global community through leading payment solutions.

They have 3 major categories of service which include developer APIs, Payment, and Software and also have 2 major products already in the market this includes Rave and Barter.

Rave is an easy way to make or receive payments from customers and merchants anywhere in the world through a simple payment link or integrated payout system to hundreds of individuals using mobile money, credit and debit cards, cash tokens. Unstructured Supplementary Service Data (USSD) and Automated Clearing House (ACH).

Barter helps individuals, businesses to manage finances with total control from peer to peer payment, data subscriptions, to send money, borrow money and other spending on bills and utilities to enable customers to focus on other pressing needs of life.

Pros-Some of the advantages of Flutterwave includes open market opportunities, growing developer community, easy and secured payment across borders, improving payment performance metrics, inspiring more profitable businesses in the 21st-century, saves time, hassle and unnecessary cost for individuals.

Cons- Poor password retrieval web interface system, poor work-life balance culture and focus on elite market segment only.

Conclusion

Flutterwave is a rave of change that has happened to the payment system majorly across Africa and the rest of the world as it is simplifying and securing ways payments are made or received by businesses and individuals around the world to promote digital economy. Looking ahead into the 21st-century Flutterwave seems to be the next Unicorn company rising from Africa to the world in the payment industry as the company in the past 3 years have shown growth potential in volume of transactions, engaged developer community and organic revenue boom.

1 note

·

View note

Text

PCI Compliance

Since customers are directed to the PayPal web site to consummate the transactions, the PCI compliance is taken care of – PCI stipulates the Payment Compliance trade security standards.

Contextual Checkout Buttons

Based on the customer’s profile, PayPal customizes the checkout buttons. as an example, Venmo users can have access to a Venmo checkout possibility. PayPal Credit (formerly “Bill American state later”) will be offered as associate possibility on relevant transactions. this is often primarily discourse commerce.

How to send money to Botswana from UK

Localized Payment strategies

PayPal is within the course of fixing place localized payment mechanisms for European customers. Besides the already-existing support for SEPA Direct Debit (Germany), PayPal is introducing support for iDEAL (the Netherlands), EPS (Austria), Giropay (Germany), MyBank (Italy), and Bancontact (Belgium).

Customizable Payment Buttons

According to PayPal, simply quarter-hour are needed to implement PayPal Payments customary, and it simply involves repeating and pasting. With the assistance of payment buttons, one will founded an internet store and sell as several things jointly needs.

PayPal’s button builder tools alter one to customise the looks of the buttons. this is often besides the pliability to customise the functioning of some aspects of the checkout method (whether you wish payment for associate item to be created forthwith or alter customers to accumulate things in an exceedingly cart). Non-profit organizations also can return up with donation buttons for one-time or continual donations.

POS System Integrations

One will mix PayPal with one in every of the company’s partner POS offerings. One has got to still give cash for the computer code subscription, however there are not any charges besides the dealings fees and hardware.

Online Invoicing

PayPal’s invoicing offerings will be utilized by consultants and contractors to invoice their purchasers at the identical rate as traditional on-line transactions. PayPal’s invoicing offerings are strong, sanctioning one to incorporate a tipping choice to the invoice. this is often besides the choice to line up instalments.

Pay flow Payment entry

The entry may be a default giving with PayPal’s on-line process tools. However, businesses employing a mastercard processor and not simply a entry will avail PayPal’s gateway as a standalone product.

Marketing Solutions

just in case majority of one’s customers use PayPal or one needs to boost the conversions on one’s website, one will undoubtedly take into account PayPal’s “Marketing Solutions”. The selling Solutions toolkit is accessible with all of the company’s on-line process choices, as well as Checkout. what is more, the feature is currently offered in countries besides the U.S..

Mass Payouts

If one needs to pay one’s men or contractors mistreatment PayPal, one will use the Mass Payout feature to transmit multiple payments at one shot rather than continual payments. This involves the use of either a programmer or the PayPal API. additionally,one will conserve cash as against PayPal’s customary rates.

1 note

·

View note

Text

Bulk Payment - Fast Money Transfer

Have you ever had to pay hundreds of vendors at the same time without making a mistake? It's a big undertaking, but firms must do it in order to continue running smoothly. When it comes to people's money, whether it's payroll, contractors, or commissions, you can't be late or make errors.

While it is simple to trade one-on-one, consistently paying a large volume necessitates the use of a mechanism known as bulk payouts (also called mass payments, payouts, and batch payments).

What is a Bulk Payment?

A bulk payment is a bank system that enables a payor to make repeated debit payments to a bulk list, such as a salary payment. A bulk list is a list of credit accounts or beneficiaries that you plan to pay from a single debit account. On your bank statement, the transaction appears as a single debit for the whole amount of the payment. To make a mass payment, transfer money in many methods, including:

Bank transfers (ACH)

Paypal or other financial institutions

Payments with credit and debit card (mainly for refunds)

bulk payouts processing results in speedier payouts and happy businesses. A bank wire transfer is the most typical method of sending a large payment in bulk.

This is known differently depending on where you are in the globe. Transfers are known as SEPA Credit Transfers in the Eurozone, ACH (Automated Clearing House) transactions in the United States, and Faster Payments or BACS in the United Kingdom. The benefit of current bank transfers is their rapidity. Payments are almost quick.

To begin a bulk payment transfer, you will need a technology that enables you to transmit a large number of payments at once. This is possible with tools such as an API, file importer, or File Exchange Gateway. Most banks provide these platforms, but access may be difficult to get and many tools have limits.

Another option is to collaborate with a firm that specializes in bulk payments. A PayPal account is a good place to start. They provide a bulk payment solution with their own API and file importer to make the procedure easier.

What Is the Difference Between a Bulk List and a Bulk Payment?

If your company processes a big number of "on account" or "lay-by" purchases, it is very hard to pay off each one individually. It takes up valuable time that might be spent on the company. bulk payouts enable you to execute several individual sales against a single entity in real-time. This allows businesses to pay off a customer's debt in bulk without having to go through each transaction individually.

Bulk payments cannot be made without first generating a bulk list. This is a pre-specified list of credit accounts or beneficiaries that you plan to pay from a single debit account. There are two kinds of bulk lists and bulk payouts:

Standard Domestic Bulk Payment

This sort of transaction enables a company to send a normal domestic transfer to several recipients from a single debit account. Standard domestic bulk payments are classified into many forms based on your needs:

Immediate Bulk Payments (IBULK)

Next-Day Bulk Payments (NBULK)

Future Dated Bulk Payments (FBULK)

The Future of Bulk Financial Services

Changes in the industry and technology are propelling this payment option to the forefront of the company. Marketplaces and comparable models (think Uber or Airbnb) have intricate payment requirements that need large sums of money being collected and sent. Every day, Airbnb, for example, gets money from thousands of visitors. They must then forward it to the hosts. Bulk payments are a payment method that addresses these concerns.

A vast number of individuals work as independent contractors, and this number is growing. The freelance economy necessitates more frequent payments. Furthermore, as technology progresses, money may be transmitted with considerably quicker payments (think instant SEPA in Europe or ACH in the US). Payees' expectations have shifted as a result. People want their money immediately. A company may deliver on time by accepting bulk payments.

1 note

·

View note

Photo

How to create a multivendor marketplace in WordPress

Would you like to create a multivendor marketplace in WordPress? WordPress makes it simple to make an online commercial center like Etsy, eBay, or Amazon. An online commercial center site additionally called a multi-seller site, permits clients to purchase and sell things by setting up their little stores inside your eCommerce stage.

Because of low overhead expenses, multi-merchant sites have become a well known online business thought.

In this article, we will tell you the best way to effortlessly make an online commercial center utilizing WordPress without burning through a huge number of dollars.

What Do You Need to Start an Online Marketplace utilizing WordPress?

To start with, you need to ensure that you are utilizing the correct site stage, and since you're perusing this article, you're in the perfect spot.

There are two sorts of WordPress accessible: WordPress.com versus WordPress.org. One is a restricted blog facilitating administration while the other is known as oneself facilitated WordPress which you've probably heard tons about. See the full examination between WordPress.com versus WordPress.org.

We suggest utilizing WordPress.org because it gives you the opportunity and admittance to all WordPress includes out of the crate.

You will require the accompanying things to fabricate an online commercial center site like Etsy or eBay.

A space name (For instance, wpbeginner.com)

Web facilitating account (This is the place where your site's documents are put away)

SSL Certificate (To safely acknowledge online installments)

WooCommerce (best WordPress eCommerce addon)

Online commercial center addon

The whole arrangement can require as long as 40 minutes, and we will walk you through each stage individually.

Let’s start with steps.

Stage 1. Setting up Your Ecommerce Platform

The initial step is to purchase an area name and a web facilitating account. You don't simply require a web facilitating, yet you will require assistance that works in WooCommerce facilitating because this is the product that we will use as our eCommerce stage.

Ordinarily, a space name costs $14.99/year, web facilitating 7.99/month, and SSL endorsement 69.99/year.

Presently, this appears as though a ton of cash if you are simply beginning.

Luckily, Bluehost an authoritatively suggested WordPress and WooCommerce facilitating supplier has consented to bring to the table our client's free space + SSL and markdown on their cloud WordPress facilitating.

Fundamentally, you can begin for $6.95/month.

Whenever you have bought facilitating, at that point follow our bit by bit instructional exercise on the most proficient method to begin an online store for complete arrangement directions.

You would now have a WordPress site with WooCommerce introduced on it.

In any case, as a matter of course WooCommerce expects that your site isn't a multi-merchant site, so it isn't workable for different clients to add their items and administrations to your site like you can on eBay or Etsy.

How about we change this.

Stage 2. Transform Your WooCommerce Site into an Online Marketplace

To start with, you need to introduce and initiate the Bazaarmodule. For additional subtleties, see our bit by bit control on the best way to introduce a WordPress module.

Bazaar is a commercial center answer for WooCommerce. It improves on building a commercial center site by transforming WooCommerce into a multi-seller site like eBay, Etsy, or Amazon.

Every merchant can sell their items while you keep full control of the site as the commercial center proprietor. You can pick your plan of action, installment techniques, item types, and then some.

Upon initiation, head over to Bazaar�� Settings page to arrange commercial center settings.

To start with, you will see the overall things. You need to ensure that the 'Seller Registration' box is checked to permit clients to join as Vendors on your site.

You can survey different things on the page and afterward click on the 'Save Changes' catch to store your settings.

Then, you need to tap on the 'Commission' tab to set a commission rate for sellers across your site. This is the sum you'll pay to the merchant for every deal.

Note: The worldwide commission rate can be superseded for singular merchants and items.

Then, you need to tap on the 'Abilities' tab to set sitewide rules for merchants. This piece of settings accompanies three areas.

The overall capacities incorporate permitting sellers to see and alter items and orders. The default choices would work for most destinations.

Then, change to the 'Items' segment and from here you can choose which sort of items merchants can add. For instance, you can restrict sellers to just add computerized downloads or an actual item.

You can likewise choose which information Vendors can see and use on the 'Add Products' page.

Finally, change to the 'Orders' area under 'Abilities' to choose what data sellers can see about the orders.

After setting up the capacities, the time has come to set up commercial center related pages on your site.

Change to the 'Show' tab under module settings to set up pages. You can just go to Pages » Add New to make another page for everything and add the shortcode showed in the settings to the page's substance territory.

After making all the pages and adding shortcodes to them, you can choose them here.

Underneath the pages, you will likewise discover 'Store settings' choice on the same wavelength. This where you can choose a prefix to use in Vendor shop URLs, permit them to set custom headers for their shop pages, and use HTML in shop depiction.

The subsequent stage is to set up installments for your sellers. Most commercial center sites set a base limit for their merchants and pay them on a month to month or week after week premise.

We prescribe utilizing manual installments to sellers as this gives clients sufficient opportunity to demand discounts or give input about the items.

Be that as it may, if you need to installment a withdrawal framework for merchants, at that point you can purchase premium additional items. Bazaar has additional items accessible for Stripe, MangoPay, Escrow, and Manual Payouts.

Contingent upon the installment passage you pick, you should set up an installment entryway by entering your API keys. Remember to tap on the 'Save Changes' catch to store your settings.

Since Bazaar is prepared, how about we set up WooCommerce for a multi-seller climate.

Stage 3. Empower Account Management in WooCommerce

First, you need to visit WooCommerce » Settings page and snap on the 'Records' tab. From here you need to check the cases close to client enrollment choice.

Remember to save your changes.

Stage 4. Setting up Navigation Menus

Presently that your multi-merchant commercial center arrangement is done. The time has come to make it simple for your clients to discover their way around your site.

To do that, go to the Appearance » Menus page. From here you need to add your client record and checkout pages to the route menu.

Remember to tap on the 'Save Menu' catch to store your changes. For more definite directions, see our guide on the most proficient method to add route menus in WordPress.

If you don't have a My Account page, at that point make another page in WordPress and add the accompanying shortcode in the post supervisor

.

[woocommerce_my_account]

Stage 5. Testing Your Marketplace Website

Your online commercial center site is presently prepared for testing. You can visit your site in another program window and make another record by tapping on the My Account interface at the top.

From here, the two clients and merchants can sign in to their records just as make another record.

When clients make another record, you will get an email warning. On the off chance that you can't get email notices, at that point investigate our guide on the best way to fix the WordPress not sending email issue.

You can likewise see new seller applications by visiting the Users » All Users page. You will see all new merchant demands as 'forthcoming seller', and you can favor or deny applications by tapping the connection under their username.

When affirmed, these sellers can sign in to their records and add their items by visiting their merchant dashboard. They can likewise see their orders and marketing numbers.

The main thing your sellers need to do is to set up their shop settings by tapping on the 'Store Settings' connection.

Contingent upon the installment techniques you set up, they should give their PayPal or Stripe email address to get installments. They can likewise give ledger data to coordinate manual installments.

When a seller adds another item, you will get a warning email and see a symbol close to the items menu. You would then be able to alter an item, favor it, or erase it.

Your shop page will show the items sold by the merchant's shop name.

Stage 6. Developing your Online Marketplace Website

To start with, you might need to pick a plan for your commercial center site. WordPress accompanies a great many free and paid subjects yet not every one of them is eCommerce prepared.

See our pick of the best WooCommerce subjects to locate an appropriate topic for your commercial center stage.

From that point onward, you would need to add new highlights to your site. For instance, making it a multi-merchant sell off-site or a participation local area.

You would need to follow which items are getting more traffic and which merchants are bringing more clients. For that, you should empower client following in WooCommerce on your site.

The greatest obstacle in becoming any eCommerce site is deserted truck deals. Figure out how to recuperate deserted truck deals like a professional to build your benefits.

Thanks for reading our blog, if you like our work please consider to pay a visit on our Facebook, Instagram and YouTube page. And if you are interested in reading more articles then you must see our latest blog post. There we have a detailed information about 5 Best Multivendor plugin for your start up in woocommerce marketplace.

#seo#wordpress#woocommerce#developer#development#webdesign#website#design#web development#digitalmarketing

2 notes

·

View notes