#payment systems

Explore tagged Tumblr posts

Text

"Mueller, She Wrote" has been around since -- well, since the whole failed Mueller/tRUmp impeachment folderol.

They know what they're talking about. 😔

51 notes

·

View notes

Text

Elon Musk DOGE exposed

youtube

Elon Musk does not want you to see this picture

Elon Musk melts down after his team of DOGE 'helpers,' who are all under 26 years old, that aided in infiltrating the Treasury Department, giving them access to sensitive personal information on Americans and to important payment systems are exposed on Musk's social media platform. John Iadarola and Adrienne Lawrence break it down on The Damage Report.

Elon Musk’s team of young DOGE disruptors have been unmasked, much to the ire of the billionaire and other MAGA figures.

One is a 19-year-old college freshman and heir to a popcorn fortune. Another was hosting Model UN sessions in 2019 and a third was given money by his parents to invest in stocks while at his high school in Silicon Valley.

The world’s richest man lashed out at an X account which suggested the six young men, who now have access the Treasury Department’s payment system, among other things, should be “paid a visit” by FBI agents.

“You have committed a crime,” Musk fired back at a comment from the account Monday, shortly before the post in question was removed for allegedly violating the platform’s rules."

Back to Contents

#Youtube#Trump#Trump unhinged#Donald Trump#Elon#Musk#Elon Musk#DOGE#Treasury Department#sensitive personal information#payment systems#John Iadarola#Adrienne Lawrence#The Damage Report#DOGE disruptors unmasked#MAGA#FBI#psychopath#psycopathy#psychopathic#mental illness#seek revenge#seeking revenge#oligarch#oligarchy#Musk unhinged

2 notes

·

View notes

Text

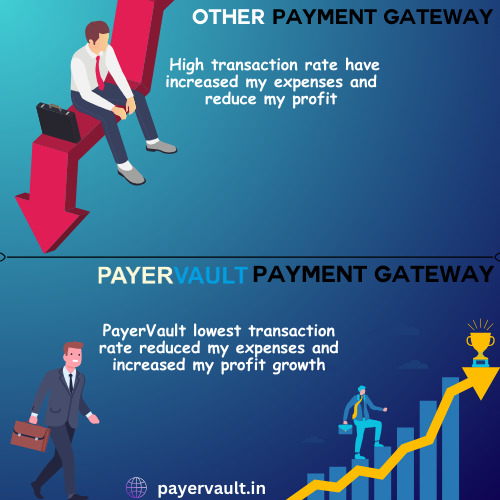

Ready to revolutionize your business's online transactions? Payervault offers seamless payment solutions at the lowest charges. Get started today! 💻💳 #Payervault #PaymentGateway #OnlineBusiness" Visit the website to learn more- https://payervault.in/

#finance#payments#payment solutions#business consulting#payment gateway#payment collection#paying#payouts#payment processing#payment services#payment systems#ecommerce#online#online shops offer#online store#online shopping#small business

3 notes

·

View notes

Text

What is tap to pay better than a credit card swipe?

Tap to Pay: The Future of Payments In today’s rapidly evolving digital world, the tap to pay method has gained significant traction, revolutionizing the way we make transactions. But what makes tap to pay better than the traditional credit card swipe? Convenience is undoubtedly one of the key advantages of tap to pay. Gone are the days of fumbling through your wallet, searching for the right…

View On WordPress

1 note

·

View note

Text

Conditioned Factors of Increase?

Why at the age of 52 would I suddenly be given financial increase? What did I ever do for the encouragements of networked society?

0 notes

Text

Say Goodbye to Quarters: Smarter Ways to Pay

Article by Automatic Laundry: Laundry systems and their technology are constantly changing. The days of fishing coins and bills out of a wallet have faded; instead, they’ve been replaced by payment options that work in new, innovative ways. Most laundry rooms and laundromats have already begun switching to touchless methods; according to an article on PYMNTS, contactless payment has more than…

0 notes

Text

Secure Healthcare Payments with Paynova | Fast & Compliant Payment Solutions

Secure healthcare payments made simple with Paynova by Helixbeat. Streamline transactions, reduce errors, and protect patient data using our reliable digital payment platform designed specifically for healthcare providers. Experience fast, safe, and compliant payment solutions today.

0 notes

Text

Is Your Electronic Payment System Eligible for R&D Tax Relief?

The time of cash is over thanks to electronic payment technology system advancements, but do HMRC recognise innovation in electronic payment systems as qualifying research and development?

We examine the world of financial technology, from the latest advancements to future innovation trends, to reveal the truth about whether your electronic payment system is eligible for the UK’s R&D tax relief.

As the world adopts a more digital way of living, the demand for electronic payment systems has been exceptionally high. This has led to fast paced innovation ranging from biometric security to voice commanded payments.

With businesses pouring time and money into improving electronic payment systems, we’re on a mission to help them receive a return on their investment with R&D tax relief — the innovation fund that supports advancement in science and technology.

So let’s determine whether your electronic payment system (EPS ) qualifies.

What is an Electronic Payment System?

An electronic payment system (EPS) is an alternative payment method to cash transactions, and operates by digitally transferring funds.

Although EPS technology was first introduced when Visa unveiled the first credit card terminal in 1979, it took a while for industry leaders to invest in innovative advancement in EPS’s.

Following the B2B boom in electronic transactions in the early 1980s, here is a brief timeline of EPS advancement:

1994: Launch of online payment capabilities Visa successfully make the first online payment, and First Virtual Holdings launches an online payment system for online credit card transactions

1999: Online transactions made more secure The launch of Paypal allowed consumers to make online purchases without sharing their credit card information with businesses

2007: Contactless transactions are introduced Near field communication technology set the stage for contactless payments, and Barclays released the first contactless card in the UK

2011: Mobile payments made possible With Quickpay and Google wallet launches, consumers are able to make wireless transactions via their mobile phones

2012: Launch of wearable payment technology Barclaycard releases the PayBand, a wristband that allows consumers to pay without the use of card, cash or phone, paving the way for further wearable technology integration

The fact that advancement in EPSs really started to make waves after 1999 is a testament to how the internet has influenced the way we pay.

Innovation in Electronic Payment Systems

Innovation in Electronic Payment Systems has driven significant advancements in digital transactions, enabling businesses and consumers to embrace cashless payments seamlessly. With constant developments in fintech innovation, these systems now cater to diverse needs, offering enhanced security, speed, and convenience. As organisations explore new ways to streamline processes, the adoption of advanced payment technologies has surged.

Back in 2020, a large portion of the world went cash free for the first time. With more people relying on EPSs than ever before and the limitations on contactless transactions removed, opportunities for further innovation were revealed.

Some of the current key areas of innovation for electronic payment systems include:

Enhanced security The development of fraud detection algorithms, encryption protocols and blockchain based solutions, aim to protect EPS users and their data

Improvements in user experience By frequently updating contactless payment solutions and incorporating them with seamless app development and technology integrations, EPSs are made more accessible

Speed and scalability

By developing new systems capable of handling high volumes of transactions with minimal speed, EPS transactions are made more efficient

With enhanced focus on these areas of innovation, the way we use EPSs has transformed over recent years.

Combining convenience with easy tracking, biometric authentication and automated transaction notifications have quickly become the key to managing our everyday expenditures — but this kind of advancement takes a lot of trial and error throughout significant research and development phases.

Introduction to R&D Tax Relief

The R&D tax relief (also known as R&D tax credits) is a government fund that incentivises businesses to invest in research and development.

Its aim?

To reduce the costs of scientific and technological innovation, and in turn, inspire an advancement in knowledge that helps to position the UK as a leader in innovation.

R&D Tax Relief Eligibility

As per HMRC’s guidelines, research and development is defined as a project that seeks to overcome a technical uncertainty in the field of science or technology, that a competent professional in the field could not solve. The project must also aim to produce a new or improved:

Product

Software

Service

Process

While the R&D tax relief provides qualifying projects with a quick return on investment, only a portion of the costs associated with research and development may qualify for the tax credits. Qualifying costs include:

Direct staff costs (including PAYE, NIC and pension contributions)

Software costs

Prototype development costs

Consumable items (including materials and some utilities)

As this is a form of tax relief, businesses looking to claim R&D tax credits must also be liable to corporation tax.

Benefits of R&D Tax Relief for the Payment Industry

On top of direct benefits for your business, your innovations strengthen the economy, and help to position the UK as a leader in financial technology (fintech). This efficient way of supporting businesses that take on challenging projects, while providing an economic boost, is why R&D tax relief is a reliable source of innovation funding.

Is Your Electronic Payment System Eligible for R&D Tax Relief?

Research and development projects that focus on producing or enhancing electronic payment systems typically fall under the category of technological innovation. By default, this means that you’re already half way to qualifying for R&D tax relief!

You next need to address the technical uncertainty that your EPS project aims to overcome, and what is required to solve the problem. You can do this by answering each of the following questions:

Is there a lack of solution or existing knowledge to the problem you’re aiming to solve with your project?

Is a competent professional in the field unable to solve the problem?

Is research and development necessary to solving the problem?

If you confidently said yes to each of these questions, then your project may be eligible for R&D tax credit relief.

Before you jump into making a claim, it is recommended that you consult with an R&D tax credit advisor, as they have a deeper understanding of the criteria that your project must meet in order to qualify.

How to Maximise R&D Tax Relief for Payment Systems

To maximise your R&D claim is to take a strategic approach to identifying qualifying activities and costs in order to make the most of the relief while maintaining compliance with tax regulations.

The best way to maximise your R&D tax relief requires following a simple plan that may also coincide with your project mapping phase. Your R&D tax relief plan should look like this:

Keep up to date with HMRC’s R&D policy Being aware of changes to policy or guidelines can help ensure your project remains eligible for the relief

Strategically allocate funding If you have additional research and development funding such as grants, allocating these finances to costs that aren’t eligible for R&D tax relief can help to reduce expenditure and increase tax credits

Document each stage of the project By keeping detailed documents of each stage (including challenges you face in the project), you’ll be able to identify qualifying activities

Categorise your costs Keeping your research and development costs separate from daily operations costs can make identifying your eligible expenditure easier, especially if you categorise each of the costs involved in the project

Work with R&D tax credit advisors People specialising in R&D tax relief have a working knowledge of R&D compliance, and are therefore able to assist in producing a well rounded claim that adheres to the latest tax regulations

How Alexander Clifford Can Help

At Alexander Clifford, we pride ourselves on being one of the UK’s leading R&D tax credit advisories. Our team has in depth insights into the latest R&D policies and legislation, ensuring you’re always in safe hands.

We’re meticulous when it comes to uncovering qualifying activities and eligible expenses that others might overlook, helping you receive the full potential of your R&D tax credit claims.

With over 2,400 successful claims and counting, our track record speaks for itself.

That’s why businesses trust Alexander Clifford to deliver expert advice and exceptional results when it comes to R&D tax credits.

Ready to experience our 5-star service? click here to book an appointment with one of our specialist advisors today!

Source: https://alexanderclifford.co.uk/blog/electronic-payment-system-rd-tax-relief/

0 notes

Text

𝟭𝟮 𝗘𝘀𝘀𝗲𝗻𝘁𝗶𝗮𝗹 𝗜𝗻𝘃𝗼𝗶𝗰𝗲 𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗧𝗲𝗿𝗺𝘀 𝗘𝘃𝗲𝗿𝘆 𝗕𝘂𝘀𝗶𝗻𝗲𝘀𝘀 𝗦𝗵𝗼𝘂𝗹𝗱 𝗞𝗻𝗼𝘄 Understanding invoice payment terms is crucial for smooth business operations and timely cash flow management. This article outlines 12 essential payment terms that every business owner and entrepreneur should be familiar with. From "Net 30" to "Payment in Advance," these terms help establish clear expectations between you and your clients, ensuring transparency and efficiency. Ready to streamline your invoicing process and avoid payment delays? Dive into the full guide here!

#entrepreneurship#finance#business#startup#invoice#free invoice software#invoice maker#invoice management system#invoxa#invoice generator#invoice template#payments#payment systems

1 note

·

View note

Text

Understanding Transaction Fees: A Guide for Consumers

In an increasingly cashless society, understanding transaction fees is essential for consumers looking to manage their financial activities effectively. From credit card purchases to online payments, transaction fees represent the hidden costs of convenience. For many, these fees remain obscure, creating confusion and sometimes frustration. However, gaining clarity on how these charges work can empower better financial decisions.

Eric Hannelius, an expert in the fintech and payment systems industries, emphasizes: “Transaction fees are often the price of digital convenience. While they might seem negligible individually, they can add up significantly over time, impacting both consumers and businesses.”

What Are Transaction Fees?

Transaction fees are charges imposed by financial institutions, payment processors, or merchants for facilitating electronic payments. These fees can apply to various payment types, including credit and debit card transactions, bank transfers, and digital wallet payments.

Common Types of Transaction Fees.

Merchant Fees: Businesses typically pay fees to payment processors or banks for accepting card payments. These fees, often expressed as a percentage of the transaction amount, vary depending on the card network (e.g., Visa, Mastercard) and the payment processor.

ATM Fees: When withdrawing money from an ATM outside your bank’s network, consumers often face surcharges imposed by both the ATM operator and their bank.

Foreign Transaction Fees: When making purchases in a foreign currency or through international merchants, consumers may incur a fee ranging from 1–3% of the transaction value.

Service Fees: Platforms like PayPal or Venmo may charge fees for expedited transfers or business transactions, separate from personal money transfers.

Subscription-Based Fees: Some payment platforms charge monthly or annual fees for enhanced features, such as faster processing times or advanced analytics.

Why Do Transaction Fees Exist?

Eric Hannelius explains: “Transaction fees cover the costs of processing payments, maintaining secure networks, and managing fraud prevention systems. They enable a seamless flow of digital payments while ensuring operational sustainability for financial institutions.”

Key drivers include:

Infrastructure Maintenance: Payment systems require investment in servers, software, and cybersecurity.

Interchange Costs: Card networks charge fees to facilitate transactions between banks and payment processors.

Risk Management: Payment systems often absorb risks like fraud and chargebacks, which contribute to fee structures.

For consumers, transaction fees may seem like minor inconveniences, but over time, they can become significant, especially for those frequently making cross-border payments or using credit cards extensively.

How to Minimize Transaction Fees?

Choose Fee-Free Accounts: Opt for banks and financial institutions offering accounts with no monthly maintenance or ATM withdrawal fees.

Leverage Cashback Programs: Some credit cards and apps provide cashback rewards that can offset transaction fees or provide additional savings.

Pay Attention to Terms: Eric Hannelius advises: “Understanding your card’s terms and conditions is essential. Consumers should know what triggers additional fees and plan their spending accordingly.”

Bundle Transactions: For international or large purchases, consider consolidating transactions to reduce multiple foreign exchange or service fees.

Seek Alternatives: Peer-to-peer platforms and direct debit options can sometimes offer cost-effective alternatives to traditional card payments.

What Lies Ahead for Transaction Fees?

The landscape of transaction fees is evolving with advancements in financial technology. Innovations like blockchain-based payments and real-time settlement systems promise to reduce costs associated with traditional payment networks. Additionally, increased competition among payment platforms is likely to bring fee structures under greater scrutiny. As Eric Hannelius observes: “The payment ecosystem is shifting toward transparency and efficiency. Consumers and businesses alike can expect new tools and systems aimed at minimizing costs without sacrificing convenience.”

Transaction fees are an inevitable part of modern finance, but they don’t have to be a burden. By understanding their nature and employing strategies to minimize costs, consumers can take greater control of their financial lives.

“Awareness is key,” says Eric Hannelius. “When consumers understand how transaction fees work, they’re better equipped to make informed decisions, whether it’s selecting a payment method or planning their spending habits.”

Educating oneself about these fees can transform a source of frustration into a manageable expense, reinforcing the importance of financial literacy in today’s digital economy.

0 notes

Text

How much time does it take to develop an app?

The time required to develop a mobile app is determined by its complexity, features, and platform (iOS, Android, or both). Typically, it can take between 3 and 9 months. The process starts with planning and research, which typically takes 2-4 weeks to determine the app's goal, target audience, and important features. The design phase (4-8 weeks) is the next step, during which wireframes and prototypes are used to create the user interface (UI) and user experience.

The development phase, which includes coding, takes the longest—ranging from 2 to 6 months or more, depending on whether the app is simple (e.g., a calculator) or complicated, with features such as real-time chat, payment systems, or AI. Testing and quality assurance take 2-6 weeks to correct errors, verify compatibility, and improve performance. Finally, the deployment phase takes approximately 1-2 weeks for app store submissions and approvals.

Third-party integrations, design revisions, and team skill can all influence the timeline. Working with an experienced app development team guarantees efficiency and quality. Whether you're creating a basic or complicated software, proper planning and teamwork can help to speed up the process.

#marketing#seo#branding#digital#content marketing#online marketing#digital marketing agency#digital marketing#email marketing#digital marketing in banglore#features#and platform (iOS#Android#or both). Typically#target audience#The development phase#which includes coding#a calculator) or complicated#with features such as real-time chat#payment systems#verify compatibility#and improve performance. Finally#Third-party integrations#design revisions

0 notes

Text

Unlocking the Secrets to Effortless Payments with AuxPay

Are you a business owner tired of the hassle of managing payments? Getting paid should be simple and stress-free, right? That's where AuxPay steps in, your dedicated payment solution designer. We're here to make your financial life smoother, your payment processing more efficient, and your choices more flexible.

The Power of Payment Customization

Managing your payments shouldn't be a complicated puzzle. At AuxPay, we understand that every business is unique. That's why we offer tailored payment solutions that cater to your specific needs. Say goodbye to the one-size-fits-all approach – with AuxPay, you're in control.

Simplifying Invoice Creation

Creating and sending invoices can be a tedious chore, but it doesn't have to be. AuxPay offers an intuitive app interface that simplifies invoicing. Whether you're dealing with clients, customers, or partners, generating invoices with AuxPay is a breeze. You can kiss those invoicing headaches goodbye.

Choose How You Want to Get Paid

At AuxPay, we believe that the power to choose should be in your hands. We support multiple payment methods, allowing you to select what works best for your business. Whether it's credit cards, bank transfers, or digital wallets, AuxPay has you covered. You decide – it's your money, your rules.

Real-Time Analytics for Smarter Decisions

To succeed in today's fast-paced business environment, you need insights at your fingertips. That's where our real-time analytics come in. With AuxPay, you can keep a pulse on your financial performance, track transactions, and gain a clear understanding of your business's financial health. Make informed decisions with the data you need, precisely when you need it.

Getting Started with AuxPay

Ready to simplify your payment processing and gain more control over your financial destiny? Getting started with AuxPay is easy. Visit our website at AuxPay.net and explore the array of features and benefits we offer.

Say goodbye to payment hassles and hello to financial freedom with AuxPay! Make life easier for your business today. Get started with AuxPay now and discover a new world of payment simplicity. Your business deserves it, and so do you.

Unleash the power of easy payments with AuxPay – the key to financial freedom. It's your financial life, simplified. 🚀💰

Discover the Power of Payment Customization

Are you tired of one-size-fits-all payment solutions that don't address your unique business needs? With AuxPay, you can customize your payment solutions for a more efficient and flexible financial life.

Simplify Your Invoicing Process

Creating and sending invoices shouldn't be a hassle. Learn how AuxPay's intuitive app interface simplifies invoicing, making it easier for you to manage your financial transactions.

Multiple Payment Methods for Your Convenience

Want to choose how you get paid? AuxPay supports various payment methods, allowing you to select the one that works best for your business. Gain control over your payments – it's your money, your rules.

Real-Time Analytics for Informed Decisions

To succeed in today's fast-paced business environment, you need real-time insights. Discover how AuxPay's real-time analytics empower you to make informed decisions and track your financial performance effectively.

#business#fintech#payment services#payments#payment gateway#payment systems#payment processing#payment solutions#apple pay#google pay#cash app#credit cards#debit card#credit report#artificial intelligence#financial freedom

3 notes

·

View notes

Text

Unlocking the Secrets to Effortless Payments with AuxPay

Are you a business owner tired of the hassle of managing payments? Getting paid should be simple and stress-free, right? That's where AuxPay steps in, your dedicated payment solution designer. We're here to make your financial life smoother, your payment processing more efficient, and your choices more flexible.

The Power of Payment Customization

Managing your payments shouldn't be a complicated puzzle. At AuxPay, we understand that every business is unique. That's why we offer tailored payment solutions that cater to your specific needs. Say goodbye to the one-size-fits-all approach – with AuxPay, you're in control.

Simplifying Invoice Creation

Creating and sending invoices can be a tedious chore, but it doesn't have to be. AuxPay offers an intuitive app interface that simplifies invoicing. Whether you're dealing with clients, customers, or partners, generating invoices with AuxPay is a breeze. You can kiss those invoicing headaches goodbye.

Choose How You Want to Get Paid

At AuxPay, we believe that the power to choose should be in your hands. We support multiple payment methods, allowing you to select what works best for your business. Whether it's credit cards, bank transfers, or digital wallets, AuxPay has you covered. You decide – it's your money, your rules.

Real-Time Analytics for Smarter Decisions

To succeed in today's fast-paced business environment, you need insights at your fingertips. That's where our real-time analytics come in. With AuxPay, you can keep a pulse on your financial performance, track transactions, and gain a clear understanding of your business's financial health. Make informed decisions with the data you need, precisely when you need it.

Getting Started with AuxPay

Ready to simplify your payment processing and gain more control over your financial destiny? Getting started with AuxPay is easy. Visit our website at AuxPay.net and explore the array of features and benefits we offer.

Say goodbye to payment hassles and hello to financial freedom with AuxPay! Make life easier for your business today. Get started with AuxPay now and discover a new world of payment simplicity. Your business deserves it, and so do you.

Unleash the power of easy payments with AuxPay – the key to financial freedom. It's your financial life, simplified. 🚀💰

Discover the Power of Payment Customization

Are you tired of one-size-fits-all payment solutions that don't address your unique business needs? With AuxPay, you can customize your payment solutions for a more efficient and flexible financial life.

Simplify Your Invoicing Process

Creating and sending invoices shouldn't be a hassle. Learn how AuxPay's intuitive app interface simplifies invoicing, making it easier for you to manage your financial transactions.

Multiple Payment Methods for Your Convenience

Want to choose how you get paid? AuxPay supports various payment methods, allowing you to select the one that works best for your business. Gain control over your payments – it's your money, your rules.

Real-Time Analytics for Informed Decisions

To succeed in today's fast-paced business environment, you need real-time insights. Discover how AuxPay's real-time analytics empower you to make informed decisions and track your financial performance effectively.

#business#payment solutions#fintech#business strategy#technology#payments#payment services#payment gateway#payment systems#payment processing#high risk merchant highriskpay.com#high risk merchant account#merchant services#google pay#apple pay#cashapp#point of sales#credit report#credit cards#debit card

2 notes

·

View notes

Text

Laundry Payment Trends to Watch

Article by A.L.L. Laundry Service: In the commercial laundry world, convenience is king, and the way customers pay is no exception. While credit cards have become the standard over the last decade, even they are beginning to feel outdated. As consumers embrace digital wallets, mobile apps, and tap-to-pay options in every part of their lives, they’re expecting the same from their laundry…

0 notes

Text

How to Create a Seamless Checkout Experience Using Modern Payment Systems

Introduction

A smooth and simple checkout process is important for any business. When customers find it easy to pay, they are more likely to complete their purchases and return for future shopping. Delays or complicated steps during checkout can make customers leave without buying anything.

One of the best ways to improve the checkout experience is by using payment systems that offer fast, secure, and flexible transaction options. The right payment system can make it easier for businesses to process payments while giving customers a hassle-free experience.

The Problems with a Complicated Checkout Process

Many businesses struggle with checkout issues that lead to lost sales. Some common problems include:

Too many steps – A long checkout process can frustrate customers, making them abandon their purchase.

Limited payment options – Not all customers use the same payment method. Offering only one or two choices can reduce sales.

Slow payment processing – Delays in confirming payments can make customers hesitate to buy again.

Security concerns – If customers feel their payment information is not safe, they may choose not to complete the transaction.

By addressing these problems, businesses can improve customer satisfaction and increase sales.

Steps to Create a Smooth Checkout Process

Offer Multiple Payment Methods

Customers have different preferences when it comes to paying for their purchases. Some use credit or debit cards, while others prefer mobile wallets, bank transfers, or even cash on delivery. Using payment systems that support multiple options allows customers to choose the method they find most convenient.

Simplify the Checkout Process

A long or confusing checkout process can drive customers away. Businesses should keep the number of steps to a minimum. Features like guest checkout, saved payment details, and autofill options help make transactions faster.

Use Fast and Secure Payment Processing

Speed matters when it comes to online payments. If transactions take too long to complete, customers may lose interest and cancel their purchase. Using payment systems with instant processing ensures that transactions go through quickly. Security features like encryption and fraud detection also help protect customer information.

Optimize for Mobile Payments

Many people shop using their smartphones. If a website or app does not support easy mobile payments, businesses could lose a large number of potential buyers. Mobile-friendly payment systems ensure that customers can pay conveniently from any device.

Display Clear Pricing and Fees

Unexpected costs during checkout can lead to abandoned carts. Businesses should make sure that all prices, taxes, and shipping fees are clearly displayed before the final payment step. This builds trust and reduces the chance of last-minute cancellations.

Provide Order Confirmation and Support

Once a payment is completed, customers should receive an instant confirmation message with their order details. If they face any issues, they should have access to quick customer support. A responsive support system improves trust and encourages repeat purchases.

Conclusion

A smooth checkout process is key to keeping customers happy and increasing sales. Businesses can improve the shopping experience by using payment systems that offer multiple options, fast transactions, and strong security measures. A well-designed checkout system reduces cart abandonment and ensures that customers complete their purchases without frustration.

If you want to improve your checkout process and provide a hassle-free experience for your customers, choose modern payment systems that simplify transactions and increase sales. Start making payments easier today!

0 notes

Text

UAE Central Bank Introduces Easy Cross-Border Payments

The Central Bank of the UAE has achieved a major milestone with the launch of the Minimum Viable Product (MVP) platform for the m-Bridge project. This platform, a first of its kind, promises to transform cross-border payments and settlements. Ready for early adopters, it's a game-changer in the world of wholesale transactions.

Teaming up with key institutions like the Bank for International Settlements Innovation Hub Hong Kong Centre, the Hong Kong Monetary Authority, the Bank of Thailand, and the Digital Currency Institute of the People’s Bank of China, the UAE Central Bank is leading the charge in digital currency innovation.

In January 2024, Sheikh Mansour Bin Zayed Al Nahyan initiated a historic cross-border payment of 'Digital Dirham' worth Dh50 million to China via the m-Bridge platform. This marked not only the platform's real-world readiness but also the first significant CBDC payment between a Mena country and a nation beyond the region.

The launch of the m-Bridge MVP platform signifies a monumental shift in global financial operations, promising enhanced efficiency, security, and transparency. With the UAE Central Bank at the forefront, the future of cross-border payments is brighter than ever.

#Cross-border payments#Digital currency#UAE Central Bank#m-Bridge project#Minimum Viable Product (MVP)#Wholesale transactions#Financial innovation#International collaborations#Digital Dirham#Central Bank Digital Currency (CBDC)#Global finance#Financial technology (FinTech)#Payment systems#Economic development#Financial transparency

0 notes