#per capita global food waste

Text

Stop food loos and waste for the people and the planet.

Cutting back on food loss and waste is also stated in the 2030 Agenda for Sustainable Development, and specifically Target 12.3, which calls for halving the per capita global food waste at the retail and consumer levels, as well as reducing food losses along production and supply chains.

0 notes

Text

Dairy Herd Management Market Trends: Leveraging Technology for Sustainable Farming Practices

The global dairy herd management market size is expected to reach USD 5.35 billion by 2030, registering a CAGR of 7.1% during the forecast period, according to a new report by Grand View Research, Inc. Rising awareness among dairy farm owners toward improvement and optimization of production methods to decrease operational cost is anticipated to drive the market. Increasing global population and changing dietary habits are increasing demand for milk and milk products. The per capita income of individuals is increasing and as a result, they are spending more on foods that are rich in proteins, carbohydrates, and other vital nutrients. Milk and milk products being a major source of protein, their demand is expected to rise in the upcoming years. In order to cater to this increasing demand, farmers are upgrading manual operations to automated ones, such as waste and environment management, and increasing usage of mobile apps for managing cattle and dairy production.

Dairy Herd Management Market Report Highlights

The global market is anticipated to exhibit a CAGR of 7.1% over the forecast period, on account of growing emphasis of end users on improvement and optimization of dairy operations

By product, milk management systems are anticipated to exhibit steady growth through 2030 thanks to increasing adoption and deployment in dairy farms

On the basis of end user, large-scale farms will register higher growth compared to cooperative, small, and medium scale ones owing to associated cost of installation of such solutions

Asia Pacific is anticipated to exhibit lucrative growth over the forecast period owing to changing preference of dairy farm owners toward automation in the industry. Moreover, favorable government initiatives to increase production in countries such as China and India are expected to boost the market.

For More Details or Sample Copy please visit link @: Dairy Herd Management Market Report

The dairy industry has been lagging behind, as compared to other industrial sectors, in the adoption of robots. This can be attributed to limited knowledge about the technology and low per capita income of dairy farm owners. However, there is a wide range of potential applications of robotics in this industry. Milking robots or automatic milking systems are one of the effective and successful applications of robotics in this space. Robotic milking refers to extraction of milk from dairy animals without human labor. The implementation of automated systems in this industry is expected to boost the market.

Advanced software and hardware components such as temperature controllers and behavior monitoring cameras and sensors used in dairy herd management have minimal error probability. Use of these components in combination with integrated historical database helps in improving production output. Advantages of dairy herd management during calving and pregnancy, such as health and behavior monitoring and medication tracking, are also expected to support market growth in the upcoming years.

However, manufacturers have struggled to integrate these health-related operational improvements into mainstream dairy farming practices. While attempts were made in the past to introduce new these technologies, small-scale farmers have been skeptical to use new technologies and have rejected the same. This arises from an orthodox mindset or focus on buying new livestock to increase production rather than investing in new technology.

The large-scale end-user segment has been dominating the market and is expected to retain its dominance over the forecast period on account of higher rate of adoption. Moreover, increasing awareness regarding its cost benefits over traditional management techniques, coupled with rising labor cost, is expected to boost the market in the upcoming years. Growing competition trends have also led farm owners globally to install innovative solutions that help them attain operational efficiency. However, high initial investments inclusive of expensive consulting fees, major infrastructural developments, and advanced controllers and equipment, combined with low awareness among end users are expected to restrain the market growth.

#DairyHerdManagement#LivestockManagement#AgriculturalTechnology#FarmManagement#AnimalHealth#DairyFarming#HerdHealth#DairyIndustry#FarmTech#Agribusiness#AnimalWelfare#HerdManagement#PrecisionFarming#AgriTech#LivestockHealth#FarmAutomation#DairyEconomics

0 notes

Text

Plastic pollution in the ocean

Although plastic waste accumulation on land is certainly a pressing issue, a significant portion of unrecycled, incinerated (resulting in pollutant emissions), or landfilled plastic eventually makes its way into the oceans, exacerbating the magnitude of the problem. Plastic pollution in marine environments not only directly harms some species but also leads to fatal consequences as it is frequently mistaken for food by others. For instance, in 2019, a young Cuvier's beaked whale was discovered stranded in the Philippines and subsequently perished. A post-mortem examination revealed its stomach was obstructed by over 88 pounds (40 kg) of plastic debris. A similar tragic incident occurred in Greece in 2021.

While affluent nations often produce substantial amounts of plastic waste per capita, they generally possess more effective waste management systems, unlike middle-income and low-income countries still in the developmental phase of their infrastructure, which tend to exhibit higher rates of mismanaged plastic waste. Consequently, such mismanaged waste is more prone to seep into the ocean from land.

Research indicates that between 4.8 and 12.7 million metric tons of plastic find their way into the ocean annually. However, a 2017 study highlighted that 80% of mismanaged plastic in the ocean originated from just five Asian countries: China, Thailand, Vietnam, Indonesia, and the Philippines. A subsequent study released in 2021 yielded similar findings.

Per country profiles in plastic pollution

China

- In 2010, China led in plastic production, generating 59.08 million tons of plastic waste, surpassing the United States, which produced 37.83 million tons.

- China initiated substantial measures to mitigate plastic waste, committing to banning single-use, non-degradable bags in major cities by the end of 2020 and extending the ban to all cities and towns by 2022. Additionally, single-use plastic straws were prohibited by the end of 2020.

- By 2016, China's plastic waste production dropped significantly to 21.60 million tons, marking a reduction of nearly 28 million tons. In contrast, the United States experienced a much smaller decrease of less than 4 tons during the same period.

- Despite being among the top plastic waste producers globally, China exhibited one of the lowest per capita rates of plastic waste production in 2016, with only 15.6 kilograms per person annually.

United States

- In 2016, the United States held the title of the world's largest plastic waste producer, with a staggering output of 34.02 million tons.

- The United States has a concerning waste management practice, burning approximately six times more plastic waste than it recycles. This incineration process frequently releases harmful chemicals into the atmosphere, contributing to increased greenhouse gas emissions.

- Alongside countries like Canada and the U.K., the United States engages in the practice of exporting collected plastic waste to Asian nations, where it undergoes recycling or disposal, often inadequately. This practice can distort the perception of actual waste generation levels in both the exporting and importing countries.

Germany

- In 2010, Germany generated 14.48 million tons of plastic waste, with 31,239 tons categorized as plastic litter susceptible to entering waterways.

- Germany exhibited one of the highest daily per capita rates of plastic waste in the world at .46 kilograms.

- By 2016, Germany's plastic waste production decreased significantly to 6.68 million tons.

- In 2018, Germany's Environment Ministry introduced a comprehensive five-point plan to further decrease the nation's plastic waste output.

Brazil

- Brazil, ranked as the fifth-largest country globally, holds the position of the fourth-largest producer of plastic waste.

- Annually, Brazil generates approximately 10.68 million tons of plastic waste.

- A mere 1.28% of Brazil's total plastic waste is estimated to be recycled, leaving the vast majority to be either incinerated, deposited in landfills, or causing pollution on land and in the oceans.

Japan

- In 2016, Japan produced an estimated 4.88 million tons of plastic waste.

- Japan boasts over 18,000 miles of coastline, highlighting its extensive marine environment.

- Criticism arises due to Japan's cultural emphasis on hygiene, leading to excessive plastic packaging, with foods often being wrapped, rewrapped, and bagged in multiple layers of plastic.

- The Japanese government has set a target of reducing plastic usage by 25% by the year 2030 as part of its efforts to address environmental concerns.

Pakistan

- In 2010, Pakistan produced approximately 6.41 million tons of plastic waste, ranking as the sixth-largest plastic waste producer globally.

- By 2016, Pakistan's position dropped to 16th, with a reduced total of 2.73 million tons of plastic waste generated.

- Pakistan, the fifth most populous country globally as of 2022, is estimated to utilize around 55 million plastic bags each year.

- In August 2019, the Plastic-Bag Free Initiative was introduced in Pakistan, aiming to prohibit the manufacturing, sale, and purchase of plastic bags.

Russia

- Russia's plastic waste production escalated from approximately 5.84 million tons in 2010 to nearly 8.47 million tons in 2016, distinguishing it as one of the few nations experiencing an increase rather than a decrease in plastic waste output.

- Research indicates that the Baltic Sea beaches in the Kaliningrad region harbor up to 36.3 pieces of microplastic per kilogram of dry sediment, underscoring the severity of plastic pollution in the area.

- Local and volunteer-driven initiatives have emerged in Russia to combat plastic pollution, yet the vast scale of the country's size and population necessitates these efforts to be significantly expanded to achieve substantial effectiveness.

Turkey

- In 2010, Turkey produced an estimated 5.6 billion tons of plastic waste.

- The average individual in Turkey utilizes around 440 plastic bags annually.

- Beginning January 1, 2019, Turkey implemented a ban on single-use plastic bags, promoting the adoption of reusable and paper alternatives to mitigate plastic pollution.

- Presently, plastic bags are priced at 0.25 Turkish liras (equivalent to 0.036 U.S. dollars) as part of the initiative to discourage their usage.

Egypt

- In 2010, Egypt ranked as the tenth-largest contributor to global plastic waste, generating approximately 5.46 million tons.

- Egypt held the distinction of being the primary producer of plastic waste within the Arab world.

- Additionally, Egypt was identified as the largest contributor to plastic pollution within the Mediterranean Sea.

0 notes

Text

Yeast Industry to Witness Revolutionary Growth

The yeast market has been experiencing steady growth driven by various factors such as increased demand for convenience foods, rising consumption of bakery products, and expanding application scope in the pharmaceutical and animal feed industries. Yeast is a versatile ingredient used in baking, brewing, winemaking, and as a flavor enhancer in savory dishes.

The global yeast market size is on a trajectory of significant expansion, projected to reach USD 8.5 billion by 2029 from the 2024 valuation of USD 5.5 billion, displaying a promising CAGR of 8.9%. The growth of the yeast market is expected to be driven by factors such as the awareness of the health advantages linked with yeast ingredients and products, particularly in food and feed applications. Increasing demand from the baking and brewing sectors, along with shifting consumer preferences towards yeast-based food and beverages globally, further contributes to this growth. Moreover, the rising preference for natural and clean-label ingredients in food and beverage products has further propelled the yeast market forward. As consumer preferences continue to evolve towards healthier and sustainable options, the yeast market is expected to witness sustained growth, with innovations likely to drive further diversification in applications and product offerings.

Key trends in the yeast market include:

Growing Demand for Bakery Products: Yeast is a crucial ingredient in breadmaking, and with the increasing consumption of bakery products globally, the demand for yeast has been on the rise.

Expanding Application in the Food and Beverage Industry: Yeast finds applications beyond baking, including brewing, winemaking, and the production of various fermented foods and beverages. As consumer preferences for these products evolve, so does the demand for yeast.

Health and Wellness Trends: There's a rising interest in healthier and natural ingredients among consumers. Yeast, particularly nutritional yeast, is gaining popularity as a source of vitamins, minerals, and protein, especially among vegan and vegetarian populations.

Technological Advancements: Advances in biotechnology and fermentation processes have led to the development of improved yeast strains with enhanced functionalities, such as increased tolerance to stress conditions, improved flavor profiles, and higher nutritional content.

Regional Market Dynamics: The yeast market's growth varies by region, influenced by factors such as economic development, population growth, dietary preferences, and the presence of key players in the market.

Sustainability Initiatives: With increasing environmental concerns, there's a growing emphasis on sustainable production practices in the yeast industry. This includes efforts to reduce energy consumption, optimize resource utilization, and minimize waste generation.

To know more get PDF Copy: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=268

By type, the baker’s yeast segment is projected to account for the largest share of the yeast market.

During the forecast period, the baker's segment is expected to lead the market in terms of type, primarily due to the cost-effectiveness and extensive applications of baker's yeast across various industries, including food and feed. The expansion of the baker's yeast market correlates directly with the growing consumption of bakery products, especially bread, particularly in developed regions.

Notably, the All India Bread Manufacturer's Association (AIBMA) reports that India's per capita consumption of bread is estimated to be around 1.5 kg to 1.75 kg. This surge in bakery product consumption, particularly bread, is a significant driver behind the anticipated growth of the baker's yeast segment in the market throughout the forecast period. Additionally, advancements in baking technology and the increasing popularity of artisanal bread are expected to further fuel the demand for baker's yeast in the global market.

In North America, the US dominates the yeast market due to rising trade opportunities.

The rise in trade opportunities has positioned the United States as a dominant force in the Yeast market within North America. With a notable export volume of USD 147 million in 2022, the United States emerged as the sixth-largest exporter of Yeast globally, showcasing its significant presence in the international market. Notably, the main destinations for US Yeast exports include Canada, Mexico, and Japan, indicating a diverse reach across different regions. Moreover, the fastest-growing export markets for US Yeast, such as Canada, Italy, and Japan, highlight the country's ability to capitalize on expanding trade avenues. Additionally, while the United States imports substantial amounts of Yeast, totaling USD 439 million in 2022, its status as the largest importer globally provides leverage in negotiating favorable trade terms and strengthening its position as a dominant player in the North American yeast market. This robust trade activity underscores the United States' growing influence and competitiveness in the global Yeast trade landscape, particularly within the US region.

Book a meeting with our experts to discuss your business needs:

Prominent firms featured

The key players in this market include ADM (US), Associated British Foods plc (UK), Alltech (US), AngelYeast Co., Ltd (China), Lallemand Inc. (Canada), ICC (Brazil), Leiber (Germany), Lesaffre (France).

0 notes

Text

Tracking progress to have global food waste.

To catalyse essential action towards reducing food waste and achieving SDG 12.3, it's imperative to grasp the extent of food waste. Measuring food waste allows countries to comprehend the magnitude of the issue, thereby revealing the size of the opportunity, while establishing a baseline for tracking progress.

The Food Waste Index Report 2021 marked a pivotal moment in understanding global food waste across retail, food service, and household sectors. It unveiled a greater availability of food waste data than anticipated, particularly at the household level, and revealed that per capita household food waste generation was more consistent worldwide than previously thought.

The Food Waste Index Report 2024 builds upon its predecessor in three key ways: Firstly, it incorporates vastly expanded data points from around the world, providing a significantly more robust global and national estimates, detailed in Chapter 2 of the main report. Secondly, it expands on the SDG 12.3 food waste measurement methodology introduced in the 2021 report, offering enhanced guidance on measurement across retail, food service, and household sectors. This additional guidance delves into various methodologies, their strengths and limitations, and strategies for prioritising sub-sectors for measurement, as explored in Chapter 3. Lastly, the report transitions from focusing solely on food waste measurement to exploring solutions for food waste reduction. The chapter examines effective approaches to reducing food waste globally, with a spotlight on public-private partnerships in this 2024 report.

Explore the Food Waste Index Report 2024!

youtube

#solutions for food waste reduction#Think.Eat.Save#united nations environment programme#household food waste#sdg 12.3 food waste indicator#food waste#food waste reduction#food waste index report#Youtube

0 notes

Text

Sustainable Solutions: Addressing E-Waste Pollution and Ensuring Food Security

Abstract

Electronic waste is currently the largest growing waste stream in the world. It is hazardous, complex and expensive to treat in an environmentally sound manner. Unsustainable electronic waste management of has led to pollution of rivers, which has negatively affected the environment, agriculture activities and food security. The research sought to investigate the waste management of electronic waste, its impact on environment, agriculture and food security in the rural communities. To recommend sustainable waste management strategy for the country and reduce the adverse effects on environment and agriculture to enhance food security. Zimbabwe has become an electronic waste hazard as waste pile up at backyard and in houses. A research survey was conducted in Mutare urban and peri-urban rural communities involving a sample of 1250 participants revealed that 29% of waste was electronic effluent, 29% of waste in backyard, 22% of waste in storerooms. The peri-urban rural communities are heavily affected downstream as the Sakubva River and its streams are polluted, either poisoned or drying up. Methods of disposal were landfilling, burning, backyard and storeroom storage. Food security as a state where the availability, accessibility, utilization and stability of food are ensured and food production is enough to cover the food demand of the people has been heavily affected as water for gardening and field crop irrigation is polluted. It was revealed that in some areas farmers have totally stopped gardening as the source of water has dried up due to both soil and water pollution.

Introduction

The United Nations (2008) defines food security as a state where the availability, accessibility, utilization and stability of food are ensured and food production is enough to cover the food demand of the people. FAO (2010) reviewed that despite the fact that more than enough food was being produced per capita to adequately feed the global population, about 925 million people remained food insecure in 2010. Abalansa et al. (2021) indicated that electronic waste is a rapidly developing environmental problem particularly for the most developed countries that has negatively affected the sustainable agriculture practices for food security. Electronic waste are various forms of electric and electronic equipment that have ceased to be of value to their users or no longer satisfy their original purpose (Gill, 2021). The electronic waste products have exhausted their utility value through either redundancy, replacement, or breakage and this include both “white goods” such as refrigerators, washing machines, and microwaves and “brown goods” such as televisions, radios, computers, and cell phones (Gill, 2021). Electronic waste is considered the "fastest-growing waste stream in the world” (WEF, 2019) with 44.7 million tonnes generated in 2016- equivalent to 4500 Eiffel towers Balde et al. (2017). In 2018, an estimated 50 million tonnes of electronic waste was reported, thus the name ‘tsunami of electronic waste’ given by the United Nations (WEF, 2019). Its value is at least $62.5 billion annually (WEF, 2019).

The world currently has a variety of environmental problems resulting from manufacturing activities, including plastic pollution and electronic waste. Plastic pollution can be traced back to the beginning of the commercial production of plastics in the 1950s (Barnes et al., 2009), but more recently, electronic waste is considered an emerging environmental problem (Saldana-Duran et al., 2020). The sources of the majority of these can be traced to major developed countries, although there is an increasing contribution from rapidly developing countries like China and India. The Basel Convention was formulated to ensure that environmental problems are not exported across boundaries (Choksi, 2001; Ogunseitan, 2013; Kummer, 1992). Developed countries have state-of-the-art facilities, finances and technology to handle waste (Forti et al., 2020). However, much of the electronic waste is not recycled but exported to developing countries (Illes and Geeraerts, 2016), which are already struggling with economic problems such as poverty. Many factors contribute to this surge in electronic waste. These include the short lifecycle of equipment, low recycling (Rabani and Thakur, 2020), and the continuous upgrading of electronic equipment (Wang et al., 2019) as affluent societies demand the latest technology. Electronic waste has been described as one of most difficult classes of waste to manage due to a constant change in its features and specificities (Borthakur and Singh, 2020). Recently, Zimbabwe has also been become an electronic waste hazard as electronic equipment are piling up very fast in company offices and in houses. Electronic scrap components, such as central processing units, contain potentially harmful materials such as lead, cadmium, beryllium, or brominated flame-retardants. Recycling and disposal of electronic waste may involve significant risk to health of workers and their communities (Sakar, 2016). According to the Basel Convention (1989) on the Control of Transboundary Movements of Hazardous Wastes and Their Disposal of 1989, Art. 2(1), "'Wastes' are substance or objects, which are disposed of or are intended to be disposed of or are required to be disposed of by the provisions of national law" (Basel Convention, 1989). Under the Waste Framework Directive 2008/98/EC, Art. 3(1), the European Union defines waste as "an object the holder discards, intends to discard or is required to discard."(EPC, 2008).

In 2000, Zimbabwe moved a gear up to introduce use of high electronic technology mainly computers. The country received several donations of digital electronic equipment including computers, printers and digital instruments. However, as the old type writers, calculators and till machines and banking machine were replaced with the new electronic equipment, waste management became a challenge. Electronic waste was created as the old electronic products were discarded along the years, as it was believed that they had attained end of their useful life. The rapid expansion of technology and the consumption driven society results in the creation of a very large amount of electronic waste in the back yard, storerooms and in the spare rooms at homes. There are several pieces of legislation in place pertaining to litter and waste management. Electronic waste management in Zimbabwe is guided by the EMA, Chapter 20:27. Section 70 (1) of the EMA Act which stipulates that ‘No person shall discharge or dispose any waste in a manner that causes environmental pollution or ill health to any person’ (EMA, 2002). Thus, it follows that according to the EMA Act, any person whose activities generate waste is mandated to use measures to minimise the waste through treatment, reclamation and recycling, among others. Mihaela (2014) revealed that there is an interdependence, between sustainable agriculture practice concepts and food security. The downstream communities in the peri urban of Muatre require water for agricultural activities, which has been heavily affected by pollution upstream, hence, food security is also heavily affected downstream. Hamid, (2019) indicated that the main outcome of sustainable agriculture practices is food security.

Nevertheless, about half of the global population is affected by food insecurity and malnutrition, a symptom of the dysfunctions of the current food system (Hamid, 2019) as the land, soil, water and air are polluted by waste. Therefore, since Zimbabwe moved a gear up to introduce use of high electronic technology mainly computers. The improper management and disposal of the electronic waste from the old electronic products along the years as resulted into pollution of the dumping sites, rivers and streams. The pollution has heavily affected the agriculture activities and the communities downstream is now food insecure. The research sought to investigate the waste management of electronic waste, the impact of the electronic pollution on agriculture and food security in the study area. This was done to recommend sustainable waste management strategy for the country and reduce the effects of pollution on environment and agriculture in order to enhance food security.

Source : Need for sustainable solution: Environment, rural agriculture and food security affected by electronic waste pollution of streams and Sakubva River

1 note

·

View note

Text

Global Fermented Food and Ingredient Market Report |BIS Research

Major ingredient types of fermented ingredients include amino acid, organic acid, and industrial enzyme, among others. Amino acid represents the most significant ingredient in the market for fermented food and ingredients. During the forecast period, ingredient areas, such as industrial enzyme, and organic acid are expected to display the maximum growth, owing to the high possibilities of value addition in these ingredient areas. Fermented food ingredients help in enhancing the quality, texture and flavor of food products. These help in making food products healthier and better in taste. These ingredients are formed using the process of fermentation and are further used in different food products. These ingredients are used to add flavor and to enhance the properties of food products or can also be used in supplements.

The fermented food and ingredient market is projected to grow from $512.19 billion in the year 2018 to $689.34 billion by 2023, growing at a CAGR of 6.12% from 2018 to 2023. The demand for fermented food and ingredients is driven by increasing population, rising per capita income and increasing awareness about health among the consumers.

Understanding Fermentation:

Fermentation is a natural process where microorganisms such as bacteria, yeast, and molds break down food components, leading to the transformation of flavors, textures, and nutritional profiles. This ancient practice not only enhances the shelf life of foods but also contributes to the development of complex and appealing taste profiles.

Market Dynamics:

Health and Wellness Trends:

Consumers are increasingly seeking functional foods that offer health benefits beyond basic nutrition. Fermented foods are rich in probiotics, which are known to promote gut health and support the immune system. As awareness of the gut-brain connection grows, fermented foods are gaining popularity as a part of a holistic approach to well-being.

Culinary Diversity:

The global culinary landscape is witnessing a surge in demand for diverse and exotic flavors. Fermentation adds depth and complexity to dishes, making them more appealing to adventurous eaters. As consumers become more open to trying new and unique flavors, fermented foods and ingredients find their way into mainstream diets.

Download the sample to know more @ Global Fermented Food and Ingredient Market

Sustainability and Waste Reduction:

Fermentation is a sustainable food preservation method that reduces the need for artificial additives and extends the shelf life of perishable foods. Additionally, it provides an opportunity to repurpose food by-products, contributing to a more sustainable food industry.

Technological Advancements:

Advances in food technology and biotechnology have facilitated the production of fermented foods on an industrial scale. From controlled fermentation processes to the development of specialized strains of microorganisms, these innovations have streamlined production and expanded the variety of fermented products available in the market.

Key Players and Products:

Yogurt and Dairy Products:

The yogurt market remains a major player in the fermented food sector, with new variations such as Greek yogurt and probiotic-enriched options gaining popularity.

Kimchi and Fermented Vegetables:

Asian fermented vegetables, including kimchi and pickles, are capturing the global palate, offering a spicy and tangy twist to traditional salads and side dishes.

Kombucha:

The kombucha market has experienced explosive growth, driven by the rising demand for probiotic-rich beverages. Its unique combination of tea, sugar, and fermented cultures has become a favorite among health-conscious consumers.

Sourdough and Fermented Grains:

Artisanal bread and fermented grains, such as sourdough, appeal to those seeking alternatives to conventional baked goods. The slow fermentation process contributes to the distinct texture and flavor of these products.

Challenges and Future Prospects:

While the fermented food market is thriving, it is not without challenges. Issues related to standardization, regulatory compliance, and consumer education need to be addressed. However, the future looks promising as researchers delve deeper into the potential health benefits of specific fermented foods and as chefs and food scientists continue to experiment with innovative combinations.

Conclusion:

The global fermented food and ingredient market is experiencing a renaissance, driven by a perfect blend of tradition, health consciousness, and culinary innovation. As consumers continue to explore diverse flavors and prioritize holistic well-being, fermented foods are likely to remain a staple in diets worldwide. The journey into this flavorful world of fermentation is only just beginning, promising a future where our plates are not just filled with nourishment but also with the rich, complex tastes of cultures and traditions from around the globe.

0 notes

Text

Cubitainer Industry and the Rise of Food Delivery Services

The Cubitainer Industry is on an upward trajectory, with projections indicating a steady growth trend. Over the period of 2022 to 2032, the demand for cubitainers is expected to exhibit a notable compound annual growth rate (CAGR) of 4.4%. In 2022, the Cubitainer Industry is anticipated to be valued at US$ 98.2 million, and this figure is projected to experience substantial revenue growth, reaching US$ 151.1 million by 2032.

This growth is primarily attributed to various factors, including the rise in per capita income and the increasing disposable income of the middle-class population. As individuals have more financial resources at their disposal, there is a heightened inclination to invest in alcoholic and energy drinks, propelling the sales of cubitainers. This highlights the interplay of economic factors in driving the demand for cubitainers within the market.

Buy this Exclusive Report: https://www.futuremarketinsights.com/reports/sample/rep-gb-4948

The cubitainer industry plays a pivotal role in the packaging sector, offering innovative and versatile packaging solutions. Here is an analysis of the cubitainer industry, focusing on its key aspects:

Market Overview: The cubitainer, a combination of a flexible bag and rigid outer container, provides a unique packaging solution for a wide range of liquid products. These containers are particularly popular in industries where the safe storage and transportation of liquids are essential.

Key Drivers:

Versatility: Cubitainers are known for their versatility, making them suitable for various industries such as chemicals, pharmaceuticals, food and beverages, and agriculture.

Lightweight Design: The lightweight design of cubitainers offers advantages in terms of reduced shipping costs and improved handling efficiency.

Environmental Considerations: Cubitainers are often chosen due to their eco-friendly attributes, as they are recyclable and reduce plastic waste.

Product Protection: The dual-layered structure of cubitainers provides excellent protection against contaminants and tampering, making them suitable for sensitive liquids.

Challenges:

Competition: The cubitainer industry faces competition from traditional rigid containers, as well as other flexible packaging options like pouches and bags.

Regulatory Compliance: Meeting industry-specific regulations, particularly in sectors like pharmaceuticals and chemicals, can be challenging.

Market Fragmentation: The Cubitainer Industry is fragmented, with many manufacturers offering similar products, creating pricing pressures.

Trends:

Customization: Manufacturers are offering customizable cubitainer solutions to cater to specific industry needs, such as barrier properties, sizes, and closures.

Sustainability Focus: The industry is increasingly focusing on sustainable practices, including using recyclable materials and reducing packaging waste.

Innovative Closure Systems: Advanced closure systems are being developed to enhance the resealability and tamper-evident features of cubitainers.

Global Market: The Cubitainer Industry is a global one, with key players located in various regions, including North America, Europe, and Asia. It serves diverse industries that require liquid storage and transportation solutions.

Outlook: The cubitainer industry is expected to maintain steady growth, primarily driven by its versatility, lightweight design, and sustainability aspects. As industries continue to seek cost-effective and eco-friendly packaging solutions, cubitainers are well-positioned to meet these evolving demands. However, addressing competition, meeting regulatory compliance, and offering innovative customization options are key challenges to address for industry players.

Top of Form

read more info: https://www.futuremarketinsights.com/reports/cubitainer-market

0 notes

Text

International Food Loss and Waste Awareness Day has been celebrated annually on September 29, since 2019. It aims to raise awareness among people to avoid food waste.

This day is an opportunity to draw the attention of both the public sector (national or local authorities) and the private sector (companies and individuals), to implement measures and actions to reduce food waste, in order to restore and rebuild better and more resistant.

The European Commission joins the Food and Agriculture Organization of the United Nations (FAO), the United Nations Environment Program and other relevant organizations in the global call for action against food loss and waste. Reducing food losses and waste is an integral part of the European Union's "EU Farm to Fork Strategy" for a fair, healthy and environmentally friendly food system.

To accelerate the EU's progress towards this objective, the Commission proposed that, by 2030, Member States reduce food waste by 10% in processing and manufacturing, and by 30% per capita in retail and consumption (restaurants, food services and households).

This Day was proclaimed in Resolution 74/209, adopted at the UN General Assembly on December 19, 2019.

instagram

0 notes

Text

FOOD WASTAGE REDUCTION IN THE RETAIL INDUSTRY BY DIFFERENT COUNTRIES

Written By: Gargi Sarma

Food is lost either during or right after harvest, costing an estimated $600 billion. Can producers and retailers take any action? 33 to 40 percent of the food produced worldwide is lost or squandered annually, which is a terrible statistic. Even if this fact was catastrophic in less dire times, it is even more urgent given the impending global food catastrophe brought on by the Ukraine War, COVID-19, and climate change. More than 800 million people worldwide—or one in nine individuals—cannot eat enough to stay healthy. Food loss and waste will have harsher effects over time.

The food and beverage business is facing a rising problem with food waste. Many organisations are seeking ways to reduce their waste as sustainability has elevated in importance for CPG companies and the customers who buy their products. The new coalition would encourage businesses to be open and honest about how much they are really wasting before collaborating to develop novel ways to cut it.

The freshness clock starts ticking whenever the food moves from the farm to the back of the store. Grocery stores put a lot of effort into finding high-quality produce goods for their consumers, but the process of getting those things to the shelf can have an impact on both quality and shelf life. Suppliers concentrate on moving their products quickly and carefully through the rigorous supply chain to the shop. The baton is then handed off to the retailer, who must carefully unload the merchandise and display it to clients to sell every lot well before its expiration or sell-by date. This is done to guarantee that the amount of time spent in the client's home is sufficient to guarantee a wonderful dining experience. Farm-to-fork food waste is a problem with opportunities at every link in the supply chain, but for this article, we'll concentrate on the area that the grocery business is in charge of.

It appears challenging to reduce waste given the complexity of the weather, geopolitical difficulties, distribution, sales unpredictability, pricing, promotions, and inventory management. Fortunately, cloud-based data analytics and machine learning are effective tools in the war against food waste.

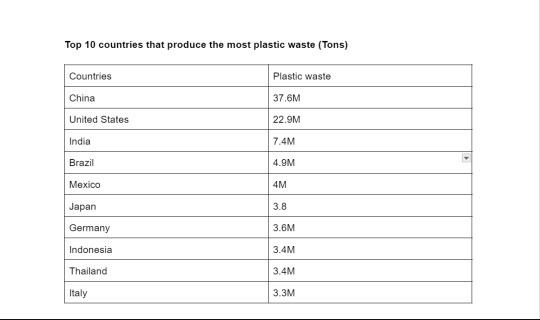

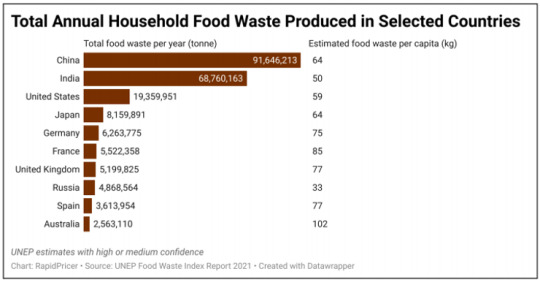

Figure:1

Food waste on a worldwide scale is on its way to becoming a billion-tonne disaster. The globe produces 931 million tonnes of food waste annually, of which 569 tonnes originate from households, according to the UNEP's 2021 food waste index. The food service (244 million tonnes) and retail (118 million tonnes) industries are responsible for the remaining portion. The typical home globally produces 74 kg of food waste per capita each year, and this number is largely comparable across countries and income classes, suggesting that significant progress is required to address the issue.

According to the index, if food loss and waste were a nation, it would produce the third-highest amount of greenhouse gas emissions worldwide. So how wasteful are different nations in terms of food? It should come as no surprise that the two countries with populations greater than a billion people had the highest absolute food waste rates. India throws out 68.8 million tonnes of food annually, whereas China reportedly wastes 91.6 million tonnes. With 19.4 million tonnes of food waste yearly, the US is slightly further down the list than Europe's leading producers, France and Germany, which each produce between 5 and 6 million tonnes.

When it comes to the amount of waste created per person, things seem to be rather different. For instance, the average Indian household throws out 50 kg of food annually, compared to 59 kg in the United States. Despite having 2.6 million tonnes of total food waste annually, Australia has a high amount of per capita waste, with 102 kg of trash produced by each family annually, according to the index. Russian household garbage is only 33 kg per person, with an estimated 4.9 million tonnes of rubbish produced there annually.

5 Countries Leading the Fight Against Food Waste:

There are regional solutions to the global issue of food waste. It follows that distinct geographical regions will always have various cultures, infrastructures, difficulties, and opportunities. As a result, each area's approach to combating food waste needs to be customised to what will work best for them. We can solve this issue if every nation, state, city, and household does their share to decrease trash.

We can learn a lot from the very efficient strategies that many nations are using to reduce food waste and, hopefully, adapt them to our own needs.

France

Food waste in supermarket stores was virtually outlawed in France in 2016. France passed a regulation requiring grocery retailers to donate edible food instead of throwing it out in response to an increase in demand at food banks and other charities (spurred by an increase in unemployment and homelessness).

In order to prevent 'dumpster diving', food that is approaching or past its best-before date but is still acceptable to eat was previously dumped in the trash and frequently purposefully ruined with bleach or other chemicals.

Food waste has significantly decreased as a result of the heavy fines and even jail time that grocery store managers who break the law now face.

Additionally, the nation is spending a lot of money and time encouraging reforestation and sustainable agriculture throughout the world.

Norway

A deal to reduce food waste by half by 2030 has been inked by the Norwegian government and the food sector in the nation.

Together, they are altering how consumers interpret "use by" and "best before" dates as well as how supermarkets handle food that is getting close to these dates. Foods like these are now more frequently donated and discounted at grocery stores (instead of being thrown out), and because of marketing initiatives and consumer education, customers are now more likely to take advantage of these deals.

Even a grocery store in the nation sells only food that is about to expire or has already done so.

Additionally, a number of apps and technologies are emerging to assist grocery retailers, consumers, and nonprofit organizations in ensuring food is used effectively rather than going to waste.

Denmark

In just 5 years, Denmark decreased food waste nationwide by 25%!

Stop Spild Af Mad, a nonprofit organization that means "stop food waste" in English, has been raising awareness, developing powerful campaigns, and promoting radical change at every link in the food waste chain.

Denmark currently has the most food waste initiatives of any European nation, and the data shows how effective they are.

Japan

Japan has a significant issue with food waste, just like many wealthy nations. Additionally, the number of people in need is growing. They lack a lot of space for farming and landfills, too. That results in a very unsustainable food culture, which may be the reason the nation takes food waste so seriously.

There have been numerous initiatives to address the issue since the early 2000s. As an illustration, the nation currently has a national food bank organization called Second Harvest that is committed to removing edible food from supermarkets and other shops and swiftly redistributing it to people in need. Additionally, there are programmes that give extra store points for buying food that is close to its best-before date, and a new law called the Food Recycling Act tries to reroute food waste to facilities that turn it into compost, animal feed, and electricity.

The government is putting a lot of emphasis on education, from primary school through university, in an effort to alter the way the country views the issue and prepare the next generation to do even better at decreasing food waste.

South Korea

The capital of South Korea saw a 10% reduction in food waste, or 300 tonnes per day, in just 4 years! Why did they succeed? As a first step, they demanded payment.

Seoul adopted a law in 2016 requiring residents to pay a recycling charge based on the amount of food trash they generate. This law has been so effective that it has inspired similar legislation in numerous other towns and provinces across the nation.

The way it operates is that food waste is measured and recorded in special bins placed across the city. The waste is just dumped in, and then the bill is issued. The trash is subsequently transformed into energy or animal feed. Residents can either take food waste to one of the many compost bins, which also demand a modest price, or dispose of it in the trash if they buy specific garbage bags.

It should come as no surprise that when waste is paid for, people are far more driven to reduce their waste!

We are all impacted by the problem of food waste. Even if boundaries and distance may separate us, we are all inhabitants of the same planet. a nonreplaceable world for which we have not been caring. Let's make a commitment to helping one another improve and learn from one another. We can change this if we all do our part.

Food Waste in Retail Stores

It is believed that 5-7% of perishables are lost due to inadequate management, with the perishable category accounting for between 50 and 60 percent of sales in a supermarket. Accordingly, food waste and shrinkage can cost businesses up to 4% of their total sales. Retailers provide products at a discount and sell them to customers before they expire and need to be thrown away in order to reduce food waste. The discounting of food, however, only makes up 0.75% of the 4% income loss.

Retail food waste is a bigger issue in developed markets than it is in emerging ones. In mature markets, growing food waste is a result of consumers' demands for complete variety and consistent availability in retail stores. The moral and social debate between consumers who demand choice and businesses who provide it is complex, yet the impact on the environment and economy is much easier to measure.

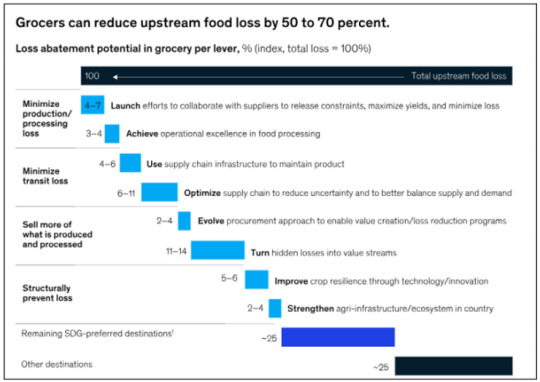

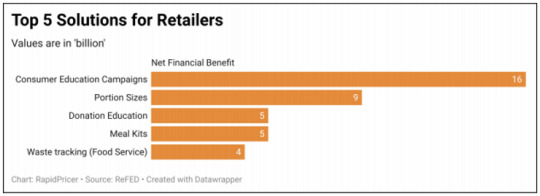

Figure:2

Technologies that are helping reduce food waste in different countries

Food waste and climate change mitigation have greatly benefited from the digital transition. Additionally, by focusing on their corporate social responsibility while increasing their revenue, these tactics support firms.

Figure:3

With IoT and blockchain technology, the supply chain will be shorter:

Businesses can follow the path of their food from the harvesting stage to the warehouse thanks to technology. An estimated 14% of the food produced and consumed worldwide is lost during the harvest, food preparation, and retail processes.

Businesses may use IoT and blockchain technology to find supply chain vulnerabilities. The Internet of Things consists of a variety of online-connected gadgets.

Retailers can track every product and make timely judgements regarding the entire food supply chain by utilising IoT technology. IoT technology also assists them in locating resources and reducing downtime. Similarly to this, blockchain technology gives retailers safe, long-lasting, and date-and-time-stamped records of food production and transactions. With the use of blockchain technology, you can quickly assess the lifecycle of your product and decide how to improve it. Simply put, a digital blockchain system can reduce waste dramatically, improve food safety, change food production, and make it simpler to trace food from the farm to the table.

A small business called Ripe.io, situated in San Francisco, uses the blockchain to connect its growers, processors, distributors, merchants, and digital customers. This helps businesses acquire information about the beginning to end of the food supply chain.

IoT devices are also being utilised to track the entire process, from food manufacturing and transport through harvest. The supply chain is transparent and trackable because the entire procedure is carried out in real-time. With the aid of real-time insights, monitoring sensors on refrigerators and bins assist experts in identifying performance variations.

Overstocks are prevented via automated replenishment based on precise forecasts:

Major retail companies have successfully reduced overstock over the past few years by automating replenishment based on software that can anticipate sales at the item level. Although this technology is quite effective for ambient ranges, it is challenging to implement in product categories with a limited shelf life, such as fresh vegetables. However, merchants are always researching this issue and attempting to enhance their fresh item forecasting strategies.

In April 2011, the Swiss grocery chain Coop started automating the ordering process for its selection of fresh vegetables. Coop began employing forecasting tools to manage the ordering process for its ambient range as early as 2005. With this, the Swiss retailer was able to enhance on-shelf availability while also reducing inventory in its locations by 8%. Due to this achievement, Coop made the decision to implement automated forecasting for its fresh produce division as well. In April 2010, the retailer began to roll out the solution to the rest of the dairy category, as well as meat, convenience goods, fruit and vegetables, fresh baked goods, and plants. This was followed by a test with 30 dairy products. A retailer must have reliable inventory data in order to automate restocking. Coop eliminated the multiplication key at its checkouts as a result. The purpose of this is to prevent situations like booking many chocolate tastes under the same GTIN (Global Trade Identification Number, formerly known as an EAN code). Currently, Coop's scanning precision is 99.85%.

Real-time stock levels that are accurate:

With the use of technologies that can anticipate sales by item, retailers have improved their order volumes significantly during the past ten years. The precision of stock levels in the systems is one requirement for the accomplishment of replenishment automation. Now, some retailers are taking things a step further by keeping track of the stock levels of individual items in their assortment throughout the day, ideally in real-time.

The in-store manufacturing of pastries, grilled chicken, or any other delicacies sold at a service counter is one sector that could undoubtedly benefit from real-time inventory management. There is no need to make extra muffins or breads in the backroom if a merchant is aware that particular varieties aren't selling as well as anticipated.

Dynamic pricing enables price adjustments based on available inventory and sales projections:

Retailers can only go so far with automated replenishment in terms of decreasing food waste and losses from unsold perishables. Even if they can manage their inventory with the help of this technology to better meet their sales projections, there will always be some excess supply in the fresh produce section. For instance, strawberries are especially challenging for retailers to handle because it is difficult to predict how they will sell. They won't sell well if they are too green when they get to the store. If they are overly ripe, the same would apply. From a forecasting viewpoint, apples can also be challenging. Although they have a long shelf life, it might be challenging to predict when they should be marked down.

This is where dynamic pricing and real-time inventory management come into play and assist retailers in further lowering write-offs in the fresh food section. Retailers can at least lock in a percentage of their initially anticipated sales if the products are already on the shelf and in danger of going bad by lowering prices. In the Netherlands, Albert Heijn has put this to the test.

Smartphones and ESL transmit price changes:

According to the concept research from SAP and SAF, a number of in-store technologies allow the retailer to keep track of fresh produce sales throughout the day and mark down prices appropriately if sales are lower than expected. In Regensdorf, close to Zürich, SAP's Future Retail Centre is actively testing the technology.

It compares actual sales throughout the course of the day at the product level with a continuously updated prediction using an automated forecasting and ordering system, and it identifies material variances. When a product is overstocked or out of stock at the end of the day, the system notifies the store. Then, employees on the shop floor can implement the necessary steps, like applying price reductions or automatic price reductions at the register.

Customers' mobile devices present potential for upselling:

The system presented in Regensdorf, Switzerland, already sends price notifications and exclusive discounts to customers' smartphones. Retailers can take it a step further and run cross-selling campaigns on customers' mobile devices. With the latter, businesses can boost full-priced product sales to make up for decreasing sales from marked-down goods.

To achieve this level of contact, shops must also provide customers with the option of self-scanning using their cell phones or other mobile devices. If this is the case, merchants may ask customers who choose to purchase reduced tomatoes and self-scan them, "Would you like to buy some spaghetti as well?"

For instance, if a consumer has specified in their profile that they are vegetarian or vegan or that they prefer certain goods, they will be notified right away if their preferred veggie burger or vegetable is on sale.

GS1 Databar makes automated markdowns at the register possible:

Following up on its abandoned effort with price displays, Albert Heijn has been experimenting with a different strategy to address the issue of food waste since October 2010. With the use of the GS1 Databar, the merchant automatically lowers the cost of game and poultry goods in one store in Zaandam. The store's checkouts automatically deduct 35% from these items' regular prices on the day they expire. This works because the GS1 Databar can contain data like serial numbers, lot numbers, and expiration dates in addition to the Global Trade Item Number (GTIN), which it carries on its barcode. The standard pricing of game and poultry products is advertised in-store, and markdown prices are also advertised on the day of expiration.

The issue of how to announce price changes in-store will remain, even if all shops are able to read the GS1 Databar. Before proceeding to checkout, customers will want to know which items are on sale.

Overall, the GS1 Databar method of marking down perishables is undoubtedly a more economical option. However, it only reduces rates on the day of expiration and does not provide the same options as more all-encompassing strategies, such as the one delivered to customers' smartphones.

Extended shelf life to maintain the freshness of the food:

According to the UN, over half of the fruits and vegetables grown worldwide are lost or discarded each year. Businesses are now utilizing technology to make informed decisions in order to deal with this enormous food waste.

Lineage Logistics, a well-known U.S. logistics company, uses AI, blockchain, machine learning, and IoT technology to keep food fresh during the entire journey. Additionally, this improves public health. IoT temperature and vibration sensors are used by Lineage Logistics to notify the company of any rise or fall in warehouse temperatures. This prolongs the food's shelf life and maintains the food at the ideal temperature.

AI can be used by retail businesses to collect client data and pass it on to their manufacturers. The producers then create the appropriate quantity of food while avoiding surplus production. To estimate the remaining shelf life of their products, many businesses employ biosensors. Scientists in Singapore have recently been working on developing an "electronic nose" that can predict when meat will start to decompose. The apparatus is still undergoing testing, though.

Sensors in packaging that determine freshness:

The IoT sensors used in the packaging process provide information about the product's freshness and shelf life. Distributors can use this information to better plan their distribution strategy and cut waste on foods with lower shelf lives.

Time-temperature sensors are used by Russian retailer X5 Retail Group to indicate when a product is going to expire by changing color. By doing so, the business may effectively manage food waste while simultaneously looking out for the general public's health.

Food redistribution

Additionally, technology promotes the distribution of food to prevent food waste. One well-known instance is Copia, which analyzes and informs businesses about their waste and the causes behind it using software for managing food waste.

About 5 million pounds of fresh food have been salvaged by Copia from landfills and given to those in need.

The surplus food is gathered from farmers and distributed by the Dutch company Instock. In this manner, food waste is prevented. Instead, it will help those who are hungry.

Establishing a network for food donations:

Together, Walmart and the Walmart Foundation are creating a sustainable food system. All people should find it more accessible, secure, and healthy.

They have given more than 5 billion pounds of food to non-profit food donation organizations in North America during the last 15 years. Additionally, they contributed more than $145 million in grants to advance the goals of Feeding America and its regional food banks.

These retail contribution programs store goods at food banks as opposed to throwing them away. To ensure that no food is wasted, retailers and grocery stores can collaborate with their local food banks.

Retailers can help those in need by collaborating with a charitable food distribution programme. These products are typically collected from the stores by food bank trucks, who then distribute them to the poor.

You can give out-of-production items, consumable perishables, and product samples to food banks as a retailer. But you might need to properly train your staff in order to carry out the storage and transportation of these things.

Conclusion:

Food waste isn't good for the environment, particularly with rising global hunger. When food is fresh, it can be conveniently donated to people in need. We need resilient food systems across a variety of businesses to make sure of that.

In order to improve food security, blockchain, IoT, and machine learning technologies have discovered successful food waste solutions. We may aspire for a better future as long as companies keep using them to decrease food waste.

Going forward, technology solutions that assist shops in preventing food waste will become more and more crucial. Simply put, every chance to cut waste would assist merchants financially at a time when their already precarious margins are under increasing pressure.

It is believed that 5-7% of perishables are lost due to inadequate management, with the perishable category accounting for between 50 and 60 percent of sales in a supermarket. Only a small amount of this waste, which could account for up to 4% of total sales, will be recovered through markdowns. Grocery merchants should give the problem of waste top consideration as consolidation and rivalry within the industry heat up and profits come under persistent downward pressure.

Sources:

About RapidPricer

RapidPricer helps automate pricing, promotions and assortment for retailers. The company has capabilities in retail pricing, artificial intelligence and deep learning to compute merchandising actions for real-time execution in a retail environment.

Contact info:

Website: https://www.rapidpricer.com/

LinkedIn: https://www.linkedin.com/company/rapidpricer/

Email: [email protected]

0 notes

Text

Hominy Feed Market Is Estimated To Witness High Growth Owing To Increasing Demand for Animal Feed

The global Hominy Feed Market is estimated to be valued at US$ 1.25 billion in 2023 and is expected to exhibit a CAGR of 6.8% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights. Market Overview: Hominy feed is a byproduct of corn milling that is used as animal feed. It is rich in essential nutrients and serves as a cost-effective feed option for livestock. Hominy feed provides various advantages such as improved digestion, increased milk production, and enhanced growth in animals. The growing demand for animal feed, specifically in the livestock industry, is driving the market growth. The need for high-quality feed options that promote animal health and performance is boosting the demand for hominy feed. Market Key Trends: One key trend in the hominy feed market is the increasing adoption of sustainable farming practices. As consumers become more conscious about the environmental impact of food production, there is a growing demand for sustainable and eco-friendly animal feed options. Hominy feed, being a byproduct of corn milling, reduces food waste and promotes a circular economy. This trend is expected to drive the market growth, as farmers and feed manufacturers seek more sustainable alternatives. Furthermore, the market is witnessing an increasing focus on product innovation and development. Companies in the hominy feed market are investing in research and development to enhance the nutritional content of their products and cater to the specific dietary requirements of different animal species. This trend is driving the introduction of new and improved hominy feed formulations, expanding the market potential. In conclusion, the hominy feed market is expected to experience high growth due to the increasing demand for animal feed and the adoption of sustainable farming practices. The market is also witnessing a trend of product innovation and development to cater to evolving consumer needs. PEST Analysis: Political: The political factors influencing the hominy feed market include government regulations and policies related to agriculture, trade agreements, and food safety standards. Governments play a crucial role in setting policies that can affect the production, import, and export of hominy feed. Economic: The economic factors affecting the market include GDP growth, disposable income, and consumer spending patterns. The increasing per capita income and changing dietary habits of consumers are driving the demand for hominy feed, as it is viewed as a cost-effective and nutritious ingredient. Social: The social factors influencing the market include changing lifestyles, dietary preferences, and cultural influences. The growing awareness about the benefits of hominy feed in terms of its nutritional value and versatility has led to an increasing adoption of hominy feed in various food preparations. Technological: Technological factors impacting the market include advances in food processing techniques, automation, and packaging innovations. Technological advancements have led to improved production efficiency and quality control, ensuring the safety and consistency of hominy feed products. Key Takeaways: The global Hominy Feed Market Share is expected to witness high growth, exhibiting a CAGR of 6.8% over the forecast period. This growth can be attributed to the increasing demand for nutritious and cost-effective food ingredients in various culinary applications.

0 notes

Text

Why is reducing food loss and waste important in contributing to agrifood systems transformation?

Between 691 and 783 million people faced hunger in 2022, with a mid-range of 735 million (FAO, 2023). While hunger and food security continue, an estimated 13 percent of the world’s food is lost in the supply chain from post-harvest prior to retail (FAO, 2022); a further 17 percent of food is wasted in households, food services and in retail (UNEP, 2021).

Currently, many of the world’s agrifood systems are unsustainable, as they degrade agricultural land, contribute to greenhouse gas emissions and loss of biodiversity and consume groundwater. Food systems are also vulnerable to external climate and other shocks, partly because of the impact on the environment.

Reducing food loss and waste can play a key role in the transformation of agrifood systems by increasing the availability of food, contributing to food security, healthy diets, and building resilience. Food loss and food waste reduction also serves as a key climate strategy by reducing greenhouse gas emissions (GHGs). It can therefore help countries and businesses to raise climate ambition, while conserving and protecting our ecosystems and natural resources upon which the future of food depends.

The 2030 Agenda for Sustainable Development – specifically SDG 12, target 12.3 – calls for halving per-capita global food waste at the retail and consumer levels and reducing food losses along production and supply chains. Target 16 of the Kunming-Montreal Global Biodiversity Framework (GBF) among other issues, also calls for “halving global food waste by 2030.”

Accelerating the pace of actions to reduce FLW toward meeting the SDG 12.3 target, and the target set by the GBF for food waste reduction is a dire necessity to positively impact the pace of agrifood system transformation – with tangible benefits for people and planet.

#food waste reduction#international day of awareness on food loss and waste reduction#agri food systems#agriculture sustainability#food security#united nations environment programme#Food and Agricultural Organization of the United Nations

0 notes

Text

Global U.S. Bottled Water Market Is Estimated To Witness High Growth Owing To Increasing Consumer Preference for Healthy and Convenient Beverages

The global U.S. Bottled Water Market is estimated to be valued at USD 22,175.71 million in 2021 and is expected to exhibit a CAGR of 8.42% over the forecast period 2022-2030, as highlighted in a new report published by Coherent Market Insights.

A) Market Overview

The U.S. Bottled Water Market offers consumers a convenient and healthy hydration option. With concerns about tap water quality and increasing consciousness about health and wellness, consumers are increasingly opting for bottled water. Bottled water provides a safe, portable, and readily available drinking water solution, making it a preferred choice for individuals on the go. The need for safe drinking water is becoming more prevalent due to the rising instances of water contamination and the spread of waterborne diseases. Furthermore, the convenience offered by bottled water in terms of packaging formats, such as single-serve bottles, large bottles, and even flavored and enhanced options, caters to the diverse preferences of consumers.

B) Market Key Trends

One key trend in the U.S. Bottled Water Market is the growing demand for flavored and functional bottled water. Consumers are increasingly seeking enhanced water options that offer additional health benefits or appeal to their taste preferences. This trend is driven by the rising focus on health and wellness and the desire for more exciting and flavorful beverage options. For example, companies like Nestle Waters and The Coca-Cola Company have introduced flavored bottled water products with natural flavors and no added sugars, targeting health-conscious consumers. These flavored options not only provide hydration but also offer subtle hints of fruit flavors or herbal infusions, making them a popular choice among consumers.

C) PEST Analysis

Political: The bottled water industry in the U.S. operates within a regulated framework imposed by various authorities at the federal, state, and local levels. Regulations focus on maintaining water quality, labeling requirements, and environmental concerns related to packaging and waste management.

Economic: The U.S. Bottled Water Market is influenced by economic factors such as disposable income levels, consumer spending patterns, and distribution channels. Economic stability and increasing disposable incomes positively impact the demand for bottled water products.

Social: Shifting consumer preferences towards healthier beverage options and increasing awareness about the importance of hydration drive the demand for bottled water. Social factors such as changing lifestyles and a growing preference for on-the-go convenience also contribute to market growth.

Technological: Technological advancements in water purification processes and packaging materials play a crucial role in the bottled water industry. Innovations in filtration techniques, bottling technologies, labeling, and packaging help maintain product quality and safety.

D) Key Takeaways

Market Size: The global U.S. Bottled Water Market is expected to witness high growth, exhibiting a CAGR of 8.42% over the forecast period. This growth is primarily driven by increasing consumer demand for healthy and convenient beverage options.

Regional Analysis: North America dominates the U.S. Bottled Water Market, accounting for the largest market share. The region's high per capita consumption of bottled water, coupled with the presence of key market players like Nestle Waters and PepsiCo, contributes to its significant market share.

Key Players: Key players operating in the global U.S. Bottled Water Market include Nestle Waters, PepsiCo, Inc., The Coca-Cola Company, Groupe Danone, Suntory Beverage & Food Ltd, Mountain Valley Spring Company, LLC, and CG Roxane, LLC. These players focus on product innovation, expansion strategies, and sustainability initiatives to maintain their market presence.

In conclusion, the U.S. Bottled Water Market is expected to witness significant growth due to increasing consumer preference for healthy and convenient beverage options. Flavored and functional bottled water products are gaining popularity, and market players are focusing on innovation to meet consumer demands. The market is regulated by political policies, influenced by economic factors, driven by social preferences, and supported by technological advancements. North America leads the market, and key players play a crucial role in shaping the industry landscape.

#Coherent Market Insights#US Bottled Water Market#Food and Beverages#Beverages#Hydration#Drinking Water#Public Health

0 notes

Text

The Business Case for Investing in Food Waste Management ESG

Environmental, Social and Governance (ESG) strategies have become paramount to steer positive change for the planet, people, communities and other stakeholders. Sustainability has garnered headlines with measures for waste reduction, carbon emissions and higher raw material costs. The global push to boost ESG performance has compelled brands to emphasize recycling and waste management.

Notably, the adoption of the Sustainable Development Goals suggests countries’ commitment to helping halve per capita food waste at the consumer and retail levels and minimize food losses by 2030. Amidst efforts to bolster food accessibility, around 687 million people go hungry each day, according to a report cited by the World Bank. In essence, the organization notes that 1.3 billion tons of food are wasted by consumers and retailers or lost along the supply chain.

Investors, shareholders and other stakeholders are emphasizing the reduction of environmental footprint. Government agencies and organizations are responding to demands for ESG reporting. The emergence and implementation of policies have made a profound difference in the industry. In August 2022, U.S. President Joe Biden inked an Inflation Reduction Act, alluding to the injection of USD 369 billion into energy and climate projects in the next 10 years. Several provisions of the Act aim to minimize greenhouse gas emissions by a billion metric tons by 2030.

Key Companies in Food Waste Management Industry

• Veoli

• Suez

• Waste Management, Inc.

• Republic Services, Inc.

• Covanta Ltd.

• Stericycle, Inc.

Discover more regarding the practices and strategies being implemented by industry participants in the Food Waste Management Industry ESG Thematic Report, 2023, published by Astra ESG Solutions

Environmental Perspective

Food waste management companies have exhibited bullish traction for ESG as they augment greenhouse gas emission- and food waste- reduction targets. Boosting sustainable practices to motivate vendor partners, stakeholders and communities can solidify the company’s position in the global ecosystem. To illustrate, Albertsons Companies mentioned in its report the commitment to zero food waste going to landfills by 2030.

The American grocery company is vying to propel the reusability, recyclability and compostability of Own Brands packaging by 2025. Furthermore, it is gearing to achieve net zero emissions in its operations by 2040 and 47% carbon reduction from its operation by 2030. Prominently, the company suggested it diverted over 215 million pounds of food from landfill with the help of anaerobic digestion. Industry partners and leaders are expected to be inclined towards creating a sustainable food system, eradicating hunger and undergirding food security.

Is your business one of the participants in the Food Waste Management Industry? Contact us for focused consultation around ESG Investing, and help you build sustainable business practices

Social Perspective

Amidst the prevalence of food insecurity, an emphasis on customers’ and employees’ well-being has prompted industry leaders to bank on the social pillar. In doing so, stakeholders have upped their efforts on diversity, equity and inclusion to foster community engagement, augment the pool of diverse candidates, expand training and promote racial equity and social justice. For instance, in 2021, Kellogg’s included Potential Severe Injury Fatality cases and rolled out EHS Insight Dashboards to offer better trends analysis of EHS data. The company claims to have no fatalities in 2021, with a global total Kellogg total reportable incident rate of 0.42.

The food company has furthered its efforts on diversity globally. For instance, as of December 2022, 25% of the 3,000 employees in Kellogg India are women. Women of Kellogg + (WOK+) has become pivotal in empowering women and advocating gender equity in the workplace. The American food manufacturing company is committed to Human Rights Campaigns Best Place to Work for LGBTQ Equality and Diversity Best Practices Index, among others. Companies are expected to embrace the commitment to diversity, equity and inclusion to deliver upsides to the communities, people and the environment.

Governance Perspective

Food waste management companies are counting on corporate governance, transparency, board diversity, corporate behavior and ethics to stay ahead of the curve. Diversity of experience, skills, backgrounds, qualifications, expertise and age will hold the key to selecting board members. Notably, in Veolia, seven out of ten directors on the Board of Directors of Environment are independent. The BoD is responsible for drafting the agenda of the annual shareholders meeting and appointing the chairman and the financial statements. The company has four committees: Research, Innovation and Sustainable Development Committee, accounts and audit committee, nominations committee and compensation committee.

Brands, such as Veolia, have made a giant stride in gender diversity to bolster their position in ESG performance. Prominently, the company has 33% women on the Executive committee and is gearing up for 25% women among Group executives by 2023. With gender diversity and professional equity gaining ground, companies are poised to create meaningful change through investments in governance.

The competitive landscape alludes to an emphasis on organic and inorganic strategies to tap into the global landscape. To put things in perspective, commitment to environmentally friendly food practices using state-of-the-art technologies may become pronounced in the ensuing period. The use of machine learning and AI could become the next big thing to reduce waste and propel sales through inventory management. Amazon asserts the Amazon Forecast has helped its customers in Greater China minimize product waste by 37%, leading to 22% cost savings across three merchandise categories and 168 stores.

About Astra – ESG Solutions by Grand View Research