#personal liability insurance

Photo

Cheap Cars on Insurance

Car insurance offers protection against financial losses arising from thefts and accidents we providers will also verify the insurance buyer’s car for correct repair and best protection on road.

0 notes

Text

submitted my paperwork for my licensing today and i spent TWO HOURS debating Dr. C or Dr. M because i don’t want anyone to refer to me as my full name i want all the power of just one letter and my last name.

#also WHAT i am literally THAT close to being a clinician#just liability insurance and ONE exam to determine the rest of my career :)#well and two years of surgery/clinical rotations but i need the lisence and liability to do that#meg gets personal

4 notes

·

View notes

Text

i hate handling things actually nvm

#i know being frustrated at an insurance agent is a normal human experience but i am not having a good time#like brain fuzz for the entire week but now im not even confused/upset im just. trying to get on with things#like ive called everyone i needed to call and theyre all great but the one person they need to sign off on car rental/repairs/whatev.....#isnt calling me back#like fuck i need my car back and i found out they havent even CALLED the lot it was towed to yet#what is the point of having insurance if i am still at the mercy of the other driver's insurance#and i know theyre gonna drag this investigation out cause they dont want to accept liability when it was an unbelievably clear cut accident#sorry the investigation that hasnt even started yet. good god.#i have work to do! i have meetings i need to be in person for like girl come on#and my beloved honda civic. my folks were like you should sue for PI but in reality its the emotional damage of being w/o my car#its gonna need at least two weeks of repairs i know this the tow guy TOLD me this so would love to get started i hate this

2 notes

·

View notes

Text

Mesa Arizona Insurance - Home, Auto, Boat, RV Insurance, Business Professional Liability Insurance, Commercial Trucking Oil & Gas, Business Workers Comp Insurance

Arizona Insurance is a leader in Mesa, Arizona insurance services. We provide personal insurance, homeowners, auto, boat, RV, motorcycle and life insurance coverage. We also provide commercial business insurance, general business insurance, professional liability insurance, workers comp insurance, and commercial trucking and transportation insurance, including oil and gas trucking insurance. Call Arizona insurance if you are looking for insurance in Mesa, Arizona.

youtube

Contact Arizona Insurance for all your personal and business insurance needs in Mesa, Arizona and Maricopa County, AZ.

#Mesa#Arizona#Insurance#Personal#Business#auto#home#homeowners#trucking#commercial#liability#workers comp#services#Youtube

1 note

·

View note

Text

General Liability Insurance in Coral Springs, FL

For all of your insurance needs in West Palm Beach, including Palm Beach, Delray Beach, Lake Worth, Boca Raton, and the surrounding areas, Innovative Insurance is your one-stop shop. General Liability Coverage is one of the many business insurance products that our full-service firm specializes in. For your company, we provide the best rates on general liability insurance together with unmatched service. You can always rely on Innovative Insurance's skilled and courteous agents to give you the individual attention you require.

After being called in, all certificates are issued within minutes, and all calls are answered quickly. It makes sense why we are routinely included among the top 5 producers for our main insurance providers! We are also honored to be a member of FCCI Insurance Company's Presidents Club and to have been awarded the esteemed Gold Medallion Agent award by Zurich Insurance Company for exceptional performance.

0 notes

Text

Making a successful public liability claim requires proof that you were injured in a public place and that someone else breached their duty of care. Learn how it works.

You can make a public liability claim in Queensland when you are injured in a public or private place, and someone else is to blame. Even if you are partly at fault, you could still receive a public liability compensation payout.

Our public liability claims guide explains the claims process, barriers to success, and how to win when you have a valid claim.

#public liability insurance#public liability claims#accidents#injury claims#accident claims#compensation#personal injury law

0 notes

Text

Safeguarding Consumers: Unraveling the Complexities of Product Liability and Consumer Protection Laws

Introduction

In the intricate web of commerce, two stalwarts—Product Liability and Consumer Protection Laws—stand guard, ensuring consumer rights and corporate accountability. Product Liability Law stands as a shield, holding accountable those behind defective products causing harm. It covers design flaws, manufacturing defects, and inadequate warnings, all aimed at shielding consumers from unsafe goods. Meanwhile, Consumer Protection Law acts as a barrier against unfair business practices, emphasizing honesty and transparency in the relationship between businesses and consumers.

Why Understanding the Differences Matters

This comprehensive legal framework encompasses issues like design flaws, manufacturing defects, and insufficient warnings, providing consumers with protection from unsafe goods.

On a parallel track, Consumer Protection Law acts as a bulwark against unfair and deceitful business practices. It regulates the interaction between businesses and consumers, prioritizing transparency, honesty, and fairness. Within this legal sphere lie various regulations, including those governing false advertising, fraud, and product labeling, all geared towards empowering consumers with accurate information and the confidence to make informed decisions.

Importance of Distinguishing Between the Two

Navigating the intersection of Product Liability and Consumer Protection Laws holds utmost significance for both businesses and consumers. While Product Liability specifically targets holding entities accountable for physical harm stemming from faulty products, Consumer Protection Law casts a broader net, ensuring ethical business behavior and truthful product representation. The distinction between the two is pivotal: it aids businesses in meeting compliance standards and empowers consumers by providing a comprehensive understanding of their rights. This blog will delve into these intricacies, guiding readers through the legal complexities governing product safety and consumer welfare.

Understanding Product Liability

Definition and Extent

Product Liability encompasses the legal framework that holds manufacturers, distributors, and sellers accountable for their product's safety and quality. It includes situations where a product causes harm due to defects, inadequacies, or lack of warnings.

Types of Product Defects

Manufacturing Defects: These arise during production, making a specific product deviate from its intended design, potentially turning an otherwise safe item into a hazard.

Design Defects: Inherent flaws in a product's concept, making an entire product line potentially dangerous, regardless of individual item quality.

Warning Defects: Insufficient or misleading warnings about proper product use or potential risks, leading to hazards due to unclear instructions or labeling.

Burden of Proof in Product Liability Cases

In such cases, the plaintiff typically bears the burden of proof, needing to show the product's defect and its direct link to their injury or damages. This standard often demands establishing a clear cause-and-effect relationship between the defect and harm suffered.

Key Players: Manufacturers, Distributors, and Retailers

While manufacturers primarily ensure product safety, distributors and retailers also hold significant roles in the supply chain. Identifying the responsible party is crucial, given each entity's unique obligations and liabilities. Understanding their interactions is pivotal in navigating product liability scenarios effectively.

Unveiling Consumer Protection Law

This segment peels back the layers of Consumer Protection Law, diving into the privileges it bestows upon consumers, the forbidden maneuvers it guards against, the vigilant overseers ensuring adherence, and the legal pathways available to those affected. Mastering these dimensions equips both consumers and businesses with the know-how to navigate the intricate landscape of consumer protection.

Overview of Consumer Rights

Consumer Protection Law stands as the sentinel of consumer rights, striving to guarantee equitable, transparent, and principled dealings between businesses and consumers. At its core, it endows consumers with rights to precise information, equitable treatment, and the capacity to make informed choices.

Forbidden Practices under Consumer Protection Laws

False Advertising: These laws adamantly prohibit misleading or false advertising. Businesses must uphold truth in their marketing materials to prevent consumers from being misled about a product or service's quality, attributes, or advantages.

Unfair Business Practices: This encompasses a broad spectrum of misleading maneuvers that may harm consumers. Such practices range from bait-and-switch tactics to exploitative pricing strategies, all forbidden under consumer protection regulations.

Deceptive Marketing: Consumer Protection Laws take aim at deceptive marketing ploys, which involve creating a false impression about a product or service through misleading language, visuals, or any means that might confuse or deceive consumers.

Regulatory Authorities Overseeing Consumer Protection

Numerous regulatory bodies are tasked with monitoring and enforcing consumer protection laws. These agencies, like the Federal Trade Commission (FTC) in the United States, play a pivotal role in investigating grievances, taking legal action against offenders, and advocating for fair business practices.

Legal Recourses for Consumers

Consumer Protection Laws offer a spectrum of legal recourses to consumers who have fallen victim to unfair or deceptive business practices. These remedies could involve reparations for damages, product replacements, or even injunctions to halt the continuation of harmful practices. The legal framework ensures consumers have channels to seek justice when their rights are violated.

Comparing Product Liability and Consumer Protection Law

This segment dives into the complexities of accountability, legal benchmarks, and potential intersections between Product Liability and Consumer Protection Laws. Understanding the intertwined yet distinct roles of these legal frameworks is essential for businesses and consumers as they navigate the intricate legal terrain surrounding product safety and ethical trade practices.

Focus on Accountability

Product Liability: Manufacturers' Responsibility for Product Flaws

Product Liability Law centers on accountability in the manufacturing sphere. It holds manufacturers, distributors, and retailers accountable for ensuring their products meet safety standards. When a product defect leads to harm, manufacturers become the primary targets for legal action, emphasizing the need for stringent safety measures and quality control during production.

Consumer Protection Law: Addressing Unfair Trade Practices and Deception

In contrast, Consumer Protection Law widens its purview to cover all interactions between consumers and businesses. Its objective is to ensure fairness and transparency, holding businesses accountable for any deceptive tactics, false advertising, or unjust treatment of consumers. This extends beyond the product itself, encompassing the overall conduct of businesses in the market.

Legal Standards and Requirements

Product Liability hinges on demonstrating that a product's flaw directly caused harm to the consumer. The burden of proof lies with the injured party to establish a clear link between the product's defect and the resulting damages. Conversely, Consumer Protection Laws often revolve around proving unfair or deceptive practices without necessarily requiring a direct connection between the deceptive act and the consumer's harm.

Overlapping Scenarios: Instances Where Both Laws May Apply

Certain situations witness the convergence of Product Liability and Consumer Protection Laws. For example, a product with a design defect might not only trigger a product liability claim but also fall under scrutiny concerning Consumer Protection Laws if its marketing or labeling was misleading. These instances highlight the intricate nature of these legal realms, emphasizing the importance of a comprehensive understanding of both to navigate the complexities of consumer safety and corporate responsibility.

Insights from Notable Legal Battles : Exploring Case Studies

Prominent Product Liability Cases

General Motors Co.: Vehicle Components

In March 2008, General Motors (GM) faced a substantial product liability lawsuit regarding its Dex-Cool coolant. Allegations arose about the use of a harmful chemical leading to leaks and engine damage. A class-action lawsuit representing around 35 million GM customers sought approximately $150 million in restitution. Eventually, individual payments ranged from $50 to $800 for involved customers.

Philip Morris: Tobacco Products

In 2002, Philip Morris (now Altria Group Inc.) encountered legal action from a lung cancer patient attributing her illness to smoking cigarettes. The claim highlighted the tobacco company's alleged failure to adequately warn about associated risks. Initially, the court imposed a staggering $28 billion in punitive damages and $850,000 in compensatory damages. After a nine-year legal battle, this amount was significantly reduced to $28 million. This case underscores the evolving nature of product liability claims, particularly in industries like tobacco, where product use implications significantly impact health.

Prominent Consumer Protection Cases

Susan Davis v. Charles G. McCarthy, Jr.

Susan Davis filed a lawsuit against Charles G. McCarthy, Jr., accusing him of abusive debt collection practices related to her daughter's furniture financing. McCarthy, employed at a debt collection agency, was accused of persistently contacting Davis's cell phone to recover the debt. The jury ultimately ruled against Davis, dismissing her claim and denying her damages, while McCarthy was granted costs.

Process Controls International v. Emerson Process Management et al

A convoluted legal battle unfolded among Process Controls International (Automation Service), Emerson Process Management, and insurers, involving the original equipment manufacturer (OEM), Fisher Controls International. Automation Service sued Emerson, claiming interference with its sale of remanufactured industrial parts. Fisher counterclaimed, alleging breach of a 2007 settlement agreement, unfair competition, false advertising, and trade secret misappropriation. The jury sided with Fisher, awarding $5,445,901, dismissing Automation Service's claims against other parties. This case highlights the complexities within the realm of consumer protection legal disputes.

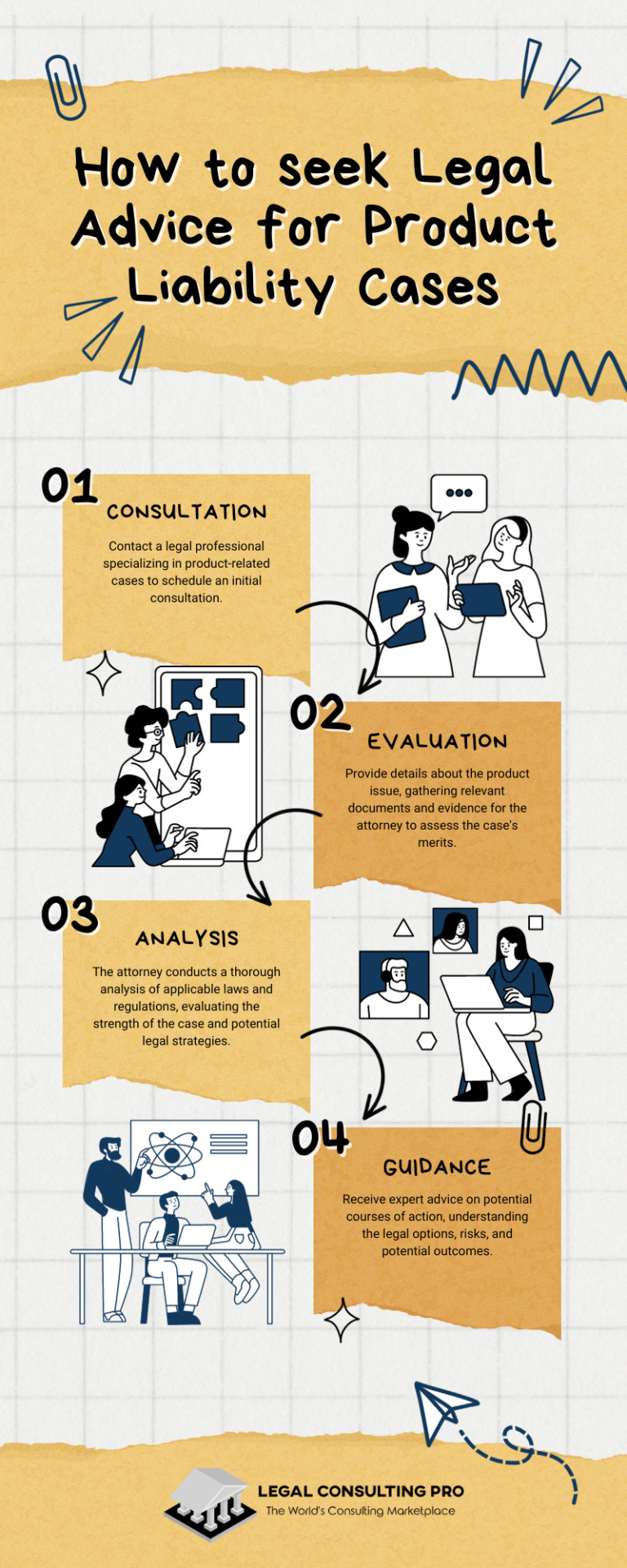

Importance of Legal Consultation

Within the intricate maze of product liability and consumer protection, the necessity of seeking professional guidance cannot be emphasized enough. Legal professionals, especially those supported by specialized services like Legal Consulting Pro, stand as crucial allies. They help navigate the complexities of the legal landscape, ensuring both businesses and consumers walk confidently towards justice and resolution.

The Role of Legal Professionals in Navigating Complex Cases

In the labyrinthine realm of product liability and consumer protection laws, the expertise of legal professionals is indispensable. Attorneys specializing in these areas play a pivotal role in decoding complex cases, ensuring clients comprehend their rights, and guiding them through intricate legal procedures. Beyond courtroom advocacy, they act as strategic guides, charting the best course to secure favorable outcomes for all involved parties.

Benefits of Seeking Legal Advice Early

Early involvement of legal experts can significantly impact a case. Consulting an attorney at the outset of a product liability or consumer protection issue helps avert potential pitfalls and establishes a sturdy legal strategy. From evaluating case merits to advising on vital evidence collection, early legal counsel ensures clients are well-equipped to handle any legal hurdles. Timely advice isn't merely reactive; it's a proactive step towards protecting interests and minimizing risks.

Introduction to Legal Consulting Pro's Expertise

In this landscape teeming with legal intricacies, Legal Consulting Pro stands out as a reliable support system. Specializing in legal process outsourcing, their forte lies notably in product liability and consumer protection cases. They excel in services like deposition summarization, a critical facet of case preparation. Their knack for distilling complex depositions into concise, informative summaries empowers legal teams with a strategic edge. By harnessing their expertise, attorneys can streamline case preparation, bolster courtroom performance, and ultimately drive more favorable outcomes for their clients.

Conclusion

Deciphering the Interplay of Product Liability and Consumer Protection Laws

As we wrap up our exploration into the intersection of Product Liability and Consumer Protection Laws, it's crucial to recap the key insights gained. Product Liability Law places the responsibility on manufacturers for flawed products, covering manufacturing defects, design flaws, and inadequate warnings. Conversely, Consumer Protection Laws safeguard consumers from unfair business practices, misleading advertising, and deceptive marketing. Understanding these distinctions is vital for both businesses and consumers to navigate the intricate legal terrain surrounding product safety and consumer rights.

Encouraging Legal Consultation

When confronting product-related disputes, seeking legal advice is of paramount importance. Legal professionals specialized in product liability and consumer protection bring valuable expertise and experience. Early consultation empowers individuals and businesses to make informed decisions, evaluate the strength of their case, and take strategic actions to protect their rights. Seeking guidance from legal experts isn't just a necessity but a proactive step toward achieving a fair and equitable resolution.

Final Thoughts on the Evolving Legal Framework

The legal framework governing product liability and consumer protection remains in a constant state of evolution. With technological advancements and market changes, these laws adapt to address emerging challenges. Staying updated about these transformations is crucial for both businesses and consumers. It showcases the dynamic nature of the legal system that governs the products we use daily and the rights we hold as consumers. In navigating the complex crossroads of product liability and consumer protection, remember that knowledge is power. Whether you're a business striving for compliance or a consumer seeking fairness, the law, when employed with expertise, can ensure justice and resolution. Armed with this understanding, move forward confidently in product-related legal matters, aiming for a marketplace that is equitable and just for everyone involved.

#legal#legal service#personal injury lawyer#deposition#product liability lawyer#product liability insurance#consumer protection#legal industry#legal consultancy services#know your rights#case studies#legal advice#product safety#consumer rights

0 notes

Text

Personal Liability Insurance

General liability insurance is an essential type of commercial coverage for most businesses it can help to protect you from claims arising from bodily injury, property damage, or advertising injury so Personal Liability Insurance covers claims arising from operations conducted by a business entity this coverage can be customized to meet the needs of your business there are a number of ways to find the best general liability insurance for your business the first step is to identify the risks associated with your business operations and decide what coverage you need and once you understand your general liability coverage, you can better equip your business to respond to risk.

0 notes

Text

The Importance of Public Liability

Public liability Sydney protects individuals and businesses from financial losses resulting from property damage or personal injury. This type of insurance covers a wide range of incidents, including slips and falls.

There is a huge range of businesses that require public liability, from sole trader cleaners to large national companies. Many are required by government contracts to have cover. To know more about Public Liability, visit the Arc Insurance Brokers website or call 0468848642.

Many tradesmen work on site at client locations, which puts them at risk of property damage and personal injury. While not mandatory in Australia, it is wise for tradies to take out public liability insurance to cover their business against the risks of an incident.

It covers any damages your business is liable for caused by your business activities, such as third-party property damage, personal injury and accidental damage to goods. Without public liability, a single incident could bankrupt your business.

The cost of public and product liability will vary between insurers. It will also depend on your occupation and how much of the risk is carried by your business. For example, electricians will pay higher premiums than plumbers due to the more hazardous nature of their jobs. Other factors that will affect the price include your turnover and the number of people in your business. Some insurers may measure these by revenue, while others use staff numbers.

Whether you operate as an independent contractor or work for a company, public liability and workers compensation are important requirements to meet. Failure to have the required insurance policies can result in hefty fines from the NSW government and a loss of reputation.

Subcontractors are usually specialists hired by a principal contractor to carry out a particular task or function on a jobsite. While this is a common practice in many industries, it’s vital that businesses ensure their subcontractors have the right insurance coverage in place before accepting their services.

If damage or injury is caused by a subcontractor, the injured person or business will likely sue everyone involved. This includes the principle contractor, the head contractor and any other subcontractors or employees. This is why it’s vital for subcontractors to have their own public liability policy. They should also request a copy of the policy from any principal contractors they work with to ensure their policy is current.

Australian law deems importers as manufacturers of the goods they bring in, meaning if these imported goods cause injury or damage to someone then you may be held liable. This can be a substantial claim as insurance policies typically cover compensation payable to the injured party, and also your defence costs.

Whether you’re a graphic designer in Burwood or a hair and beauty salon in Thredbo public liability is something every NSW small business should consider. As a professional it’s likely you interact with your clients in many different ways from visiting their workplace to meeting them at their home, work or at third party locations.

All of these scenarios are a potential risk for your business as it’s not always possible to be with your clients and control their actions at all times. That’s why it’s important to be covered with a comprehensive Public Liability policy.

As a small business owner in NSW, you have plenty on your plate. There are marketing campaigns to manage, staff salaries to pay and Zoom calls to make. But don’t underestimate the importance of securing public liability insurance.

Just one claim could be financially crippling and destroy your reputation. That’s why public liability is a must for any business that interacts with customers, clients or the general public.

Whether it’s a child injures themselves at your children’s play centre, or your employee damages customer property at their workplace, public liability covers compensation claims and reasonable legal fees incurred to defend the claim. It also includes a range of other expenses, like cleaning costs and repairs to third party property. This type of cover is not mandatory, but many organisations you work with may ask that you carry a certain level of public liability cover. If you’re unsure about what cover you need, talk to a licenced insurance broker or business adviser. To know more about Public Liability, visit the Arc Insurance Brokers website or call 0468848642.

#personal insurance#insurance brokers australia#personal insurance kellyville bridge#personal insurance sydney#insurance brokers sydney#business insurance kellyville ridge#insurance brokers#Sydney Insurance Broker#Insurance Brokers Australia#Business Insurance Australia#public liability#public liability insurance#public liability insurance for business#public liability insurance price#public liability insurance cost

0 notes

Video

youtube

Pure Risks Unveiled: The Hidden Truth Affecting Every Single One of Us!

0 notes

Text

Splatt Lawyers Townsville

Splatt Lawyers Townsville is a local law firm in Townsville offering comprehensive legal services to people in need. Our team of experienced and skilled personal injury lawyers is committed to providing expert legal advice and representation for car accident claims, work injury compensation, slip and fall claims, product injuries, and public liability claims.At Splatt Lawyers Townsville, we understand the challenges people face when claiming a personal injury. Our dedicated team works diligently to ensure our clients receive the compensation they deserve. With our extensive knowledge of personal injury law and a track record of successful outcomes, you can trust us to handle your case with the utmost professionalism and care.Whether you have been involved in a car accident, suffered a work-related injury, experienced a slip and fall incident, encountered product-related injuries, or need assistance with public liability claims, we are here to help. Our lawyers have the expertise and skills to navigate the complex legal landscape and advocate for your rights.Our local Townsville lawyers provide personalised attention and tailored legal solutions. We prioritise communication and transparency, keeping you informed throughout the legal process. Our friendly team will guide you every step of the way, providing support and advice to help you make well-informed decisions.

Address: 161 Bundock St Belgian Gardens QLD 4810, Australia

Phone: +61 1800 700 125

Website: https://splattlawyers.com.au/personal-injury-compensation-lawyers-townsville/

#personal injury lawyers#car accident lawyers#insurance claim lawyers#no win no fee lawyers#car accident claims#work injury claims#product liability claims#public liability claims

1 note

·

View note

Text

#California#Insurance#Personal#Business#Auto#Home#Motorcycle#Homeowners#Commercial#Trucking#OilandGas#Workers Comp#WorkersCompensation#Liability#Los Angeles#San Francisco#San Diego#Santa Monica#OrangeCounty#CA

0 notes

Text

Insurance and Understanding 6 Different Types of Insurance

Insurance is an important aspect of risk management and protecting yourself from unforeseen events. It provides a safety net that helps us recover financially when things go wrong. However, navigating the world of insurance can be confusing due to the many types of insurance available. In this article, we will explore the basic concepts of insurance and learn about the different types of insurance policies that individuals should be aware of.

Understanding Insurance:

Insurance is a contractual agreement between an individual or entity (the policyholder) and an insurance company (the insurer). The policyholder pays a premium in return for financial protection against specific risks. In the event of a covered loss, the insurer compensates the policyholder as per the terms mentioned in the insurance policy.

Types of Insurance:

To know more click here:

#insurance#lifeinsurance#health insurance#vehicleinsurance#personal finance#investment#liability insurance#homeinsurance#property insurance

0 notes

Text

Pregnancy Personal Injury Attorney: Seeking Compensation and Justice

Understanding Pregnancy Personal Injuries

Pregnancy personal injuries refer to any harm or damage suffered by an expectant mother during her pregnancy. These injuries can occur due to various reasons, such as medical negligence, accidents, or hazardous working conditions. While pregnancy should ideally be a time of joy and anticipation, personal injuries can significantly impact the well-being…

View On WordPress

#accident#Appeals#Determining Liability#Documenting Injuries#Filing a Lawsuit#insurance#investigation#legal process in personal injury cases#personal injury attorney#pregnancy personal injury attorney#Statute of Limitations#statute of limitations in personal injury cases

0 notes

Text

Why College Students Shouldn't Overlook Renters Insurance

Are you a college student renting off-campus accommodation? While juggling classes, exams, and social activities, it's easy to overlook the importance of protecting your personal belongings. That's where renters insurance comes in. In this article, we'll explore why renters insurance is a smart choice for college students and how it can provide the financial security you need.

1: The Value of Renters Insurance for College Students Protect Your Valuables with Renters Insurance Content: Renters insurance is more than just another expense; it's a safety net for your belongings. As a college student, you may not think you own much of value, but when you consider your laptop, smartphone, textbooks, and other personal items, the cost of replacing them can quickly add up. Renters insurance provides coverage against theft, fire, vandalism, and other covered perils, ensuring that you won't have to bear the burden of replacing your belongings on your own.

Liability Coverage for Peace of Mind Content: Renters insurance not only protects your personal property but also includes liability coverage. As a college student, accidents can happen, and you could be held responsible for any damages or injuries that occur in your rented space. With renters insurance, you'll have liability coverage that can help cover legal expenses and potential medical bills, giving you peace of mind.

2: Customizing Renters Insurance to Fit Your Needs Affordable Coverage Tailored for Students Content: Contrary to popular belief, renters insurance is often affordable for college students. Insurance providers understand the unique needs of students and offer policies that fit within a student's budget. By customizing your coverage limits and deductibles, you can find a policy that aligns with your financial situation. Additionally, some insurance companies even offer discounts for students with good grades or for those who install safety features like smoke detectors or security systems.

3: Steps to Secure Renters Insurance How to Get Renters Insurance Content: Getting renters insurance is a straightforward process. Start by researching reputable insurance companies that offer renters insurance in your area. Compare quotes and coverage options to find the policy that best suits your needs. Once you've selected an insurer, reach out to them via their website or call their customer service to initiate the application process. Be prepared to provide information about your rental property, the value of your belongings, and any additional coverage you may need.

Renters insurance is a crucial investment for college students. It protects your personal property, provides liability coverage, and offers peace of mind during your college years. Don't underestimate the value of this coverage, as it can save you from unexpected financial burdens. Get in touch with a reliable insurance provider today and secure the renters insurance you need to safeguard your belongings. Visit our website at www.superior-ins.com today.

0 notes

Text

Esthetician Liability Insurance | Insurance for Estheticians

Esthetician insurance coverage is crucial for your business's survival. At 2autoinsurance, we specialize in providing insurance solutions for estheticians. Our comprehensive policies, tailored to your unique needs, have helped over 100,000 entrepreneurs safeguard their businesses. From personal liability insurance to coverage for treatment-related injuries, we've got you covered. Discover the basics of insurance for estheticians and ensure the protection of your valuable services.

At 2autoinsurance, we understand your unique needs. With over fifty partners and customized policies, we've helped 100,000 entrepreneurs protect their businesses. Our mission is to make esthetician insurance coverage accessible. Let us guide you through the basics of insurance for estheticians.

Visit here : 2autoinsurance.com/esthetician-insurance/

#estheticians insurance#does insurance cover esthetician#personal liability insurance for estheticians#esthetician liability insurance#esthetician insurance coverage#insurance for estheticians#2autoinsurance

1 note

·

View note