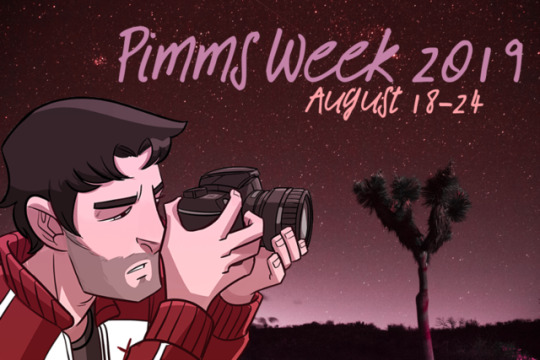

#pimms week 19

Photo

Pimms Week Starts Tomorrow!

Hey gang,

We’re so excited to bring you the 2nd year of Pimms fun and angst. Please remember that this is an event celebrating the chemistry and characters behind this incredible ship!

Our prompts can be found here, but really we accept all transformative works (whether finished or otherwise) that have to do with Pimms (so they can break up/not be together as long as they are the main focus of the work).

We’ll be following the tags “PIMMSWEEK” and “PIMMS WEEK” but tagging @pimmsweek is always easiest.

If you don’t see your post reblogged here within 24 hours, go ahead and give us a nudge! If you have any questions please feel free to reference the faq or send an ask.

This event will run from 08/18 until 08/24. HOWEVER, this blog will remain active until 09/01. So for anyone just finding out about this event and/or anyone who would like to participate, you still will have time to complete your works.

Thanks in advance and here’s to another great Pimms week!

10 notes

·

View notes

Photo

Nevermore stitched by Erin Pimm aka cup_of_floss. Pattern ($14) designed by Lila Umstead of Lila’s Studio.

“Another finish! Nevermore by Lila's Studio. I started this on my birthday this year (19 Feb). I absolutely love how intricate the patterns and motifs are. I have a couple of weeks off to recover from surgery I had two days ago. So that of course means lots of stitchy time! Stitched using all called for threads and fabric (40ct Picture This Plus linen, colour Feldspar), stitched 1 over 2.”

18 notes

·

View notes

Text

Christmas comes early as people rush to buy trees

Pete Hyde (r) says he is in a powerful place to fulfill hovering demand for bushes

Enterprise is booming for Pete Hyde, proprietor of Trinity Road Christmas Timber in Dorset.

Yearly he runs a pop-up website within the centre of Dorchester to promote the bushes he grows.

This yr, regardless of the necessity for social distancing and hand sanitiser, in addition to outlets being closed, he is already bought practically a 3rd extra bushes than regular for this level within the season.

And Christmas tree growers throughout the UK say they’re having a bumper yr.

“This yr all people is greater than ever decided to have a unbelievable Christmas,” says Pete. “Individuals are shopping for bushes earlier and individuals are prepared to push the boat out.”

“Quite a lot of prospects say that is the primary time they’ve had an actual tree.”

However just some weeks in the past Pete was “petrified” that prospects would purchase their bushes at a grocery store or backyard centre. As important retailers, they’ve been allowed to commerce throughout lockdown, whereas folks like him initially weren’t.

After lobbying from growers, the federal government relented and since then the spruces and firs have been flying off the farms.

Heather Parry from the British Christmas Tree Growers Affiliation (BCTGA) says a number of of her 320 members say it’s the busiest they’ve ever been.

UK farms normally promote about eight million bushes annually. This yr they predict it might attain as many as 10 million.

Growers say wholesale enterprise to retailers is already 24% greater than this time final yr.

It may very well be that some gross sales are coming earlier as folks search out a tree whereas they wait to be allowed to buy groceries once more.

York Christmas Timber have bought extra bushes than regular to each wholesale patrons and native prospects

Ms Parry thinks there are different causes too.

Fewer individuals are going overseas, and there are a lot of extra smaller gatherings happening as an alternative of enormous household get-togethers, requiring extra, smaller bushes, together with smaller turkeys.

And extra folks need the odor of the outside and the sense that they’re doing one thing “genuine” this yr. Some individuals are even shopping for an additional tree this yr, she says.

Story continues

“Your property is extra your fort this yr greater than ever earlier than,” she says. “And you have time to make paperchains, bake the salt dough decorations.”

York Christmas Timber, which has equipped this yr’s tree to 10 Downing Road, has been so busy “there’s been no time to breathe” says proprietor Olly Combe.

“My wholesale prospects are ringing again, wanting extra bushes, and I am getting enquiries from folks I’ve by no means bought to earlier than.”

“We lower bushes each week – we are able to management the speed they arrive out of the sector at. We will not management the speed prospects come down the drive at.”

It takes as much as 10 years to develop bushes from saplings, so he must be cautious not expend an excessive amount of of subsequent yr’s shares.

Tree being trimmed at Pimms Christmas tree farm in Matfield Kent

So may the availability of bushes run out?

Ms Parry says imports from Denmark have been negatively affected by a brand new pressure of Covid-19 discovered at mink farms in the identical area the bushes develop. On high of that, slower processing at UK ports, because of the virus, has brought about delays.

She thinks provides might get “tight” however everybody who desires a tree ought to have the ability to get one.

“So long as you continue to have growers who can harvest on demand, we’ll be OK to fulfill calls for of market,” says Pete Hyde in Dorset.

He nonetheless at the moment has the total vary on provide.

“If you would like a good-shaped tree with good needle retention, then go for a Nordmann fir – which might be 80% of the market, it is what everybody has.”

“If you would like a slimmer tree with a stunning odor, go for a Fraser fir or a silver fir,” he says.

And if you would like one thing with a extra tiered look? It is the noble fir – though most of us do not need to hear any extra about tiers, even on bushes.

Pete himself does not hassle deciding. He’ll have three bushes of three totally different varieties, dotted round his home. That’s, after all, assuming he is bought sufficient left.

from Growth News https://growthnews.in/christmas-comes-early-as-people-rush-to-buy-trees/

via https://growthnews.in

0 notes

Note

19. My favourite royal memory is…

Anyone who has followed me on here for the whole time would know for sure that my favourite memory was seeing the Cambridges in Canberra. Buuuut, I've blogged about that often enough already, so I won't repeat myself on that again. My other fond memories include the Cambridges too - the royal wedding, which for me in Australia was timed with the end of the work day, so my friends and I all gathered for a party, complete with Pimms, jam and scones and other royally appropriate or themed food that I'd trawled the supermarket for earlier. My friends who hosted the party had been in London the week before so we all had wedding hysteria! It was so fun. Other than that I guess it'd be when will & Kate presented George for the first time outside the hospital. I'd set my alarm for an early morning wake up and watched the walkout and interview with keen interest. I'm not as obsessed with the Cambridges these days, and I am of course also a huge fan of Mary...but I've never seen her live and really wasn't a huge royal follower when she got married. Her story still intrigues me though. Thank you so much for your question. I love getting mail!

1 note

·

View note

Photo

WANIMA, Wagakki Band, and Pimm's Perform on Buzz Rhythm 02 for January 19

This week’s guests were WANIMA, Wagakki Band, and Pimm’s. There was also a segment featuring talk segments with previous guests. WANIMA – Signal Wagakki Band – Yuki Kageboushi Pimm’s – Life is a Game SourceNext week: Golden Bomber Uchikubigokumon-Doukoukai Shota...

Read more on aramajapan.com

0 notes

Text

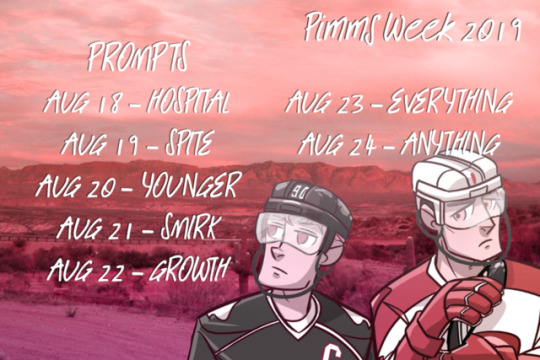

Pimms Week 2019 is right around the corner!

Thanks to everyone who showed interest in participating in Pimms Week again this year! We pushed back this event this year to allow our participants more time to rest and work on their pieces after participating in @kentparsonbirthdaybash . In case you don’t already know, one of our Pimms events, the 48th Draft Challenge, has migrated to the Birthday Bash team and will be hosted on their blog this weekend! You still have time to come up with angsty headcanons for this year’s challenge.

But back to the matter at hand: here are your prompts for this year’s Pimms Week! They’ve been hand chosen by our mod team to be broadly interpreted but also provide for maximum angst (which is something all Pimms shippers love).

August 18 - Hospital

August 19 - Spite

August 20 - Younger

August 21 - Smirk

August 22 - Growth

August 23 - Everything

August 24 - Anything (Free Day)

If you have any questions, feel free to drop a question in our inbox! We’re so excited to see what everyone comes up with this year.

11 notes

·

View notes

Text

Top stocks for February

We asked our writers to share their top stock picks for the month of February, and this is what they had to say:

Paul Summers: Cineworld

According to cinema operator Cineworld (LSE: CINE), more than 100 million people passed through its doors last year. Although its shares are up 20% over the last 12 months, I think there could be more upside ahead given the promising list of films due out in 2017, including Star Wars VIII, the Lego Batman Movie and Beauty and the Beast.

With excellent free cash flow, decent operating margins and an easily covered forecast yield of 3.4%, a P/E ratio of 16 for 2017 still looks reasonable. Assuming recent momentum hasn’t been lost, I suspect the shares will continue to rise before and after full-year results in early March.

Paul Summers has no position in Cineworld.

Harvey Jones: Diageo

Spirits are steadily rising at global drinks giant Diageo (LSE: DGE) after a dry few years. Last week’s half-year sales figures for the Guinness, Pimm’s and Smirnoff owner showed much-needed improvements, particularly in the key US spirits market, where it has disappointed lately. Organic growth picked up across all regions with a 4.4% increase in net sales, beating consensus of 3.1%.

Boss Ivan Menezes has faced struggles since taking the helm but can now talk confidently of “building a stronger, more consistent, better performing company”. As ever, the dividend looks low at 2.6% but policy remains progressive with a recent 5% hike. My only concern is the premium valuation of 25 times earnings, tempered by the fact that Diageo always trades on a high price/earnings ratio. Forecast earnings per share of 18% in the year to 30 June 2017, followed by another 9% in the year after, suggest more good cheer to come.

Harvey does not own shares in Diageo.

Peter Stephens: GlaxoSmithKline

Brexit negotiations are set to commence shortly and this may cause investor confidence in the UK’s economic outlook to come under pressure. As such, sterling could weaken in the coming months.

Therefore, GlaxoSmithKline (LSE: GSK) could be a beneficiary, since it reports in sterling but is a global business. The company’s diverse business model and strong, balanced pipeline of new treatments also enhance its defensive characteristics. At a time where the geopolitical outlook is fluid and unpredictable, defensive shares could become more popular.

Furthermore, a yield of 5.3% from a dividend covered 1.4 times by profit should retain investor interest as inflation gradually rises to a forecast 3% in 2017.

Peter Stephens owns shares in GlaxoSmithKline.

Rupert Hargreaves: KAZ Minerals

Shares in KAZ Minerals (LSE: KAZ) have staged a dramatic comeback this year. After falling 95% from their peak, the shares have added nearly 300% over the past 12 months thanks to improving sentiment towards the mining sector. I believe this rally can continue.

KAZ has also benefited from the rise in copper prices over the past 12months. Specifically, the price of one tonne of copper has risen from $4,500 in January 2016 to nearly $6,000 today. Off the back of this, analysts expect KAZ to report earnings per share growth of 185% for 2017 and 40% for 2018. Based on these forecasts, the shares are currently trading at a 2018 P/E of 6.2.

Rupert has no position in Kaz Minerals.

Edward Sheldon: Keller Group

Value has become harder to find recently; however, one company that has caught my eye is Keller Group (LSE: KLR).

Keller is the world’s largest independent ground engineering specialist, focusing on providing technically advanced and cost-effective foundation solutions. The foundation specialist is a key player in the US, generating 54% of sales from this region, and as such, the company looks well placed to benefit from Donald Trump’s infrastructure spending plans.

A slowdown in the Asia Pacific region resulted in Keller warning on near term profits in October but, for investors with a medium- to long-term time frame, I believe Keller looks good value on a forward looking P/E ratio of 10.7, falling to just 9.1 for 2018.

Edward Sheldon has no position in Keller Group.

Jack Tang: Provident Financial

Financial stocks have had a tough year in 2016, but I’m not shying away from the sector — I’ve picked Provident Financial (LSE: PFG) as my top stock for February.

While I acknowledge that slowing UK growth is a risk, and a key reason behind the stock’s weakness — default rates for sub-prime lenders tend to be more sensitive to economic conditions — I believe Provident is well cushioned by its robust margins and low operational gearing.

The lender has an enviable dividend track record, having raised its dividends by an average annual rate of 13.8% since 2011. The stock currently yields 4.5% and, looking forward, dividends are set to grow by roughly 9% in each of the next two years.

Jack Tang has no position in Provident Financial.

G A Chester: Sage Group

Sage Group (LSE: SGE) may not be the most glamorous technology stock — it provides accounting, payroll and payment systems — but it’s a FTSE 100 blue chip with millions of customers worldwide.

The company’s strategy to reinvigorate growth is working. Last year’s results came in ahead of City expectations and I think it could surprise on the upside this year, too. As such, I view it as good value on a (City consensus) P/E of 19 with a handy 2.6% dividend yield.

The CEO and chairman bought shares last week — their first purchases since 2015 and 2014 respectively.

G A Chester has no position in Sage.

Royston Wild: Taylor Wimpey

A steady flow of positive trading updates from London’s throng of listed housebuilders has seen the likes of Taylor Wimpey (LSE: TW) edge gradually away from the summer’s post-referendum lows.

Sure, this momentum may have moderated more recently, but I reckon another positive release from Taylor Wimpey — the firm’s full-year results are currently slated for February 28th — could prompt a fresh trek higher.

And fizzy statements from Barratt Developments and Persimmon in the days leading up to Taylor Wimpey’s update could facilitate extra share price gains across the entire sector.

Furthermore,Taylor Wimpey’s ultra-low valuations certainly leave scope for a fresh buying frenzy in the days ahead, the builder dealing on a P/E ratio of 9.1 times and carrying a dividend yield of 8.3%.

Royston Wild has no position in any shares mentioned.

Kevin Godbold: Utilitywise

UK-facing energy and water consultancy Utilitywise (UTW) operates as an intermediary between energy and utility suppliers and the commercial market. The firm has an impressive record of rising profits, and over a six-month view, the stock has momentum.

Percentages in double figures for return on capital and equity, and for the operating profit margin, bolster the case for quality. Last year’s result showed good support for profits from cash inflow, yet the stock looks cheap, with today’s share price around 178p throwing up a forward price-to-earnings rating just under nine for the year to July 2017. I think shares in Utilitywise look poised to perform well in February and during 2017.

Kevin Godbold has no position in Utilitywise.

Bilaal Mohamed: Vectura Group

My top stock for February is FTSE 250-listed pharmaceuticals business Vectura Group (LSE: VEC). The Chippenham-based drugmaker is an industry leader specialising in inhaled therapies for the treatment of respiratory diseases, with a current market value of around £900m. Vectura starts 2017 in a very strong position, with sustained growth in recurring revenues driven by seven recently launched inhaled products, and aided by last year’s acquisition of rival SkyePharma.

After a 20% share price slump in 2016, Vectura is trading on a very attractive valuation, with earnings expected to double over the next two years, bringing the P/E ratio down to just 10 by the end of 2018. I believe the group’s shares are significantly undervalued given its longer-term growth outlook.

Bilaal has no position in any shares mentioned.

Ian Pierce: Virgin Money

Shares of domestic retail banks are still trading well below pre-Brexit vote prices, including those of challenger bank Virgin Money (LSE: VM). However, with economic data post-Referendum showing the economy continues to hum along nicely, I think this was an overreaction from the market.

Shares of Virgin Money are priced at exactly book value, implying no growth is baked into share prices. But, fast growing mortgage and credit card operations and underlying return on equity of 12.2% makes Virgin a diamond in the rough. With higher growth potential and none of the high operating costs or legacy misconduct issues of larger rivals, Virgin Money is the only bank share I’m interested in.

Ian Pierce has no position in Virgin Money.

Roland Head: Wizz Air Holdings

Central and Eastern Europe-focused budget airline Wizz Air Holdings (LSE: WIZZ) reported a 17.4% increase in passenger numbers during the first half of last year. Pre-tax profits for the period rose by 39.1% to a new record of €253.3m.

The group’s shares have bounced back have bounced back from their post-referendum lows, but remain nearly 10% below their 52-week high of 2,021p. This has left the stock trading at a modest valuation discount to budget rivals such as easyJet and Ryanair.

Wizz Air’s third-quarter trading statement is due on 1 February. A strong performance could drive the shares higher ahead of the group’s full-year results.

Roland does not own shares of any company mentioned.

Are you prepared for Brexit?

Following Brexit, fear and indecision could hurt share prices in the coming months. That's why the analysts at The Motley Fool have written a free guide called Brexit: Your 5-Step Investor's Survival Guide. To get your copy of the guide without any obligations, click here now!

More reading

One growth stock I’d buy and one I’d sell in February

Can these homegrown tech companies become the new Apple?

Should you buy these 3 great dividend stocks in February?

With revenue up 211%, is this high-yielding small cap a better buy than Diageo plc?

These 3 income stocks could make you long-term rich

0 notes

Note

Hi, I'm new-ish to this fandom and haven't been around for one of these before so I was just wondering if this is an event with sign-ups or anything or if it's anyone can get involved if they want sort of thing? Thanks!

Hey! Thanks for asking! Pimms Week is an open-submission week event. We provide prompts for each day of the event that people are free to use/incorporate/take inspiration from in order to create great fanworks. Our only requirement is that the content be Pimms-centric. We love angst here so happy endings aren’t required! But the focus should be on Pimms. We also welcome polyamorous works that focus on Pimms.

Fanworks for Pimms Week can be posted with the tags “pimmsweek” or “pimms week” or by tagging our blog

@pimmsweek

or can be posted to our AO3 Collection

0 notes