#profit from arbitrage

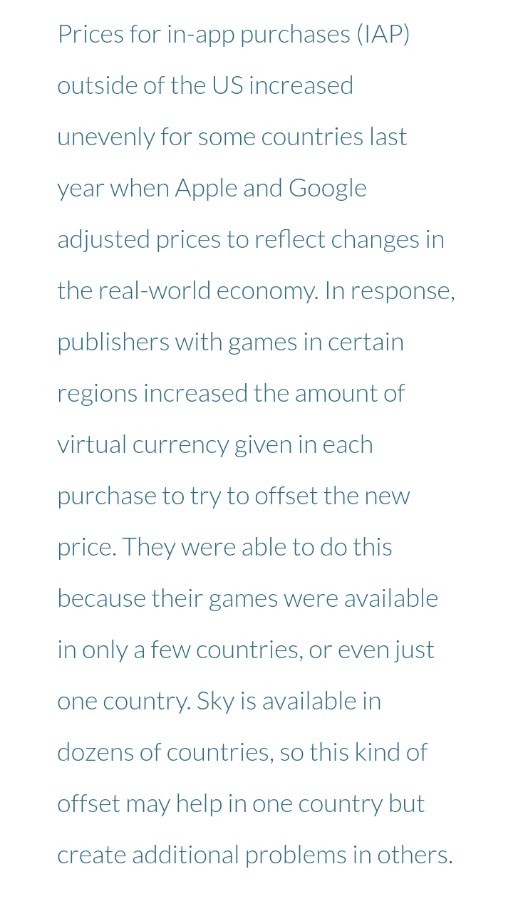

Text

youtube

BEST ARBITRAGE TO EARN DAILY 3% RISK FREE

This video is just to show you proof of withdrawal i made from Pantrage.com

I will be showing you guys my recent withdrawal of $20 made from my account and i received it instantly on my Binance wallet.

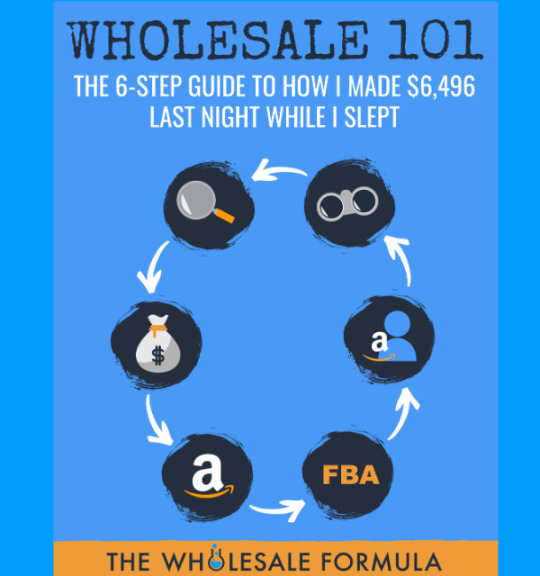

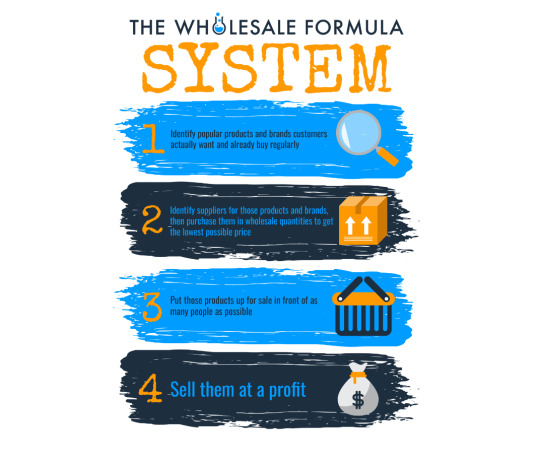

At Pantrage, their team of Crypto Experts uses Artificial Intelligence BOT to scan the top 10 Crypto Exchange Platforms and then Buy low at one Platform and sell high at another platform simultaneously.The entire process is carried out countless times a day by their team without you doing a single thing. Once the arbitrage transactions for the day have been completed, you will be paid your daily 3% earnings at the end of each trading day. Minimum deposit is $100.

You also earn $5 per each referral that joins through your referral link and you can withdraw your referral bonus once it get to the $20 minimum withdrawal amount without using it for the arbitrage. Deposit and withdrawal method is by USDT only. There is no risk involved here and your funds are 100% safe. This is pure arbitrage and not a Ponzi scheme or Trading. Join through my referral link below and start earning your daily profit as well.

NB:

My referral link

https://pantrage.com/my-account/?wwref=abbafrye

YouTube Video: https://youtu.be/5UHj3pxSF6g

#arbitrage#crypto arbitrage#latest arbitrage#2024 arbitrage#make money online#make money from crypto arbitrage#how to make money from arbitrage#risk free arbitrage#best arbitrage#profitable arbitrage#new arbitrage#arbitrage trading#free arbitrage bot#trade arbitrage#bot arbitrage#arbitrage US#US arbitrage#best worldwide arbitrage#profit from arbitrage#Youtube

0 notes

Text

Remember: always lowball. Every day, I hear hobbyists in every hobby complain about how expensive things have gotten. Those speculators have shown up, those businessmen, and they wish to extract every red cent out of your unhealthy love for this specific kind of blackboard chalk. They have decided to hoard, and they have decided to profiteer, and there is only one thing you can do: offer them a pitiful amount of money.

I was raised in the before-times, like a lot of you, and we were always taught to be fair and just in negotiations. That was because our folks were buying entire thirty-unit condominium buildings for $1000 and shaking at $950 seemed like a fair negotiation to both parties. Let me tell you this: those days are over. There's a guy on my local Kijiji trying to sell a single piece of firewood for eighty bucks.

Now, I hear a lot of you saying: just don't buy it, then. No. Not buying things just says "maybe nobody wants to buy it." Extreme lowballing says: "there's a lot of interest for it, at this insultingly-low price that makes me want to punch my grandma." And anyone who would punch their own grandmother really does not deserve to make a profit from modern-day retail arbitrage, do they? I certainly don't think so. Fuck 'em.

If there is a downside to be said for the modern lowballer, it's when your frantic efforts result in the total collapse of a market. One weekend of my passive-aggressive eBay "Make Offering" resulted, single-handedly, in significantly moving the price of Volare crossflow manifolds. Unfortunately, it also meant I was contractually obligated to buy all of them at that price. Of course, that means I now have cornered the market, and you're all gonna pay the price I'm asking for them. Time to get paid.

216 notes

·

View notes

Text

Croupier Comptable: Game Theory for The Venetian Macao, China (Trapping Aesthetic for Volleyball) 14K

BIO

My Name is Adrian Blake-Trotman. I am Indo-Mediterranean Caribbean Born in Toronto but From Barbados and Haiti. I am a Beta-arbitrage Mergers & Acquisitions Banker that Specializes in Commodities. I have Understanding Financial Markets by Université de Genève and Monetary Policy in the Asian-Pacific by Hong Kong University of Science and Technology with No Gr. 12 Math or Intro to Linear Algebra; I built a mathematical learning style by using Japanese Candlesticks Bullish Engulfing Discounted Cash Flow Charts for Poker. I Operate TAX AVOIDANCE through Freelance Mergers & Acquisitions through an Enterprise Foundation and Investment Trust. My background is Agriculture Working Class, I've worked in Kitchens and Grocery Stores. My goal is to connect the Democratic Republic of the Congo to two tax havens; Haiti & Seychelles to stabilize the Diamond Trade and more Important the Commodities Market. Through Mercantilism Agriculture Hedge Fund as a Central Bank, Options Volatility Exchange, Lab Grown Re-sale Market, Decentralized Currency and Fiat Money, Hospitality & Gaming. Also To form a Socioeconomic Status Agriculture Working Class; Blue, Pink, and White Collar Jobs. I am Modelling my Cartel off of Wall Street for De Beers but is owned and operated by the Société des Bains de Mer (SBM); The Casino de Monte-Carlo is owned and operated by the Société des Bains de Mer (SBM), a public company in which the government of Monaco and the ruling princely family have a majority interest. The company also owns the principal hotels, sports clubs, food service establishments, and nightclubs throughout the Principality. The Société des Bains de Mer operates in the accommodation, dining, entertainment, and gambling services. SBM manages and owns casinos, hotels, restaurants, bars, nightclubs, spas, beach clubs, and golf clubs. Fifty-two of their fifty-eight properties are located in Monaco. The concept of state-corporate crime refers to crimes that result from the relationship between the policies of the state and the policies and practices of commercially motivated corporations. The term was coined by Kramer and Michalowski in 1990.

THE ARNAULT MODEL: BALANCING FINANCIAL DISCIPLINE AND CREATIVITY

Over the next three decades, as he brought the best luxury brands in fashion, cosmetics, and beverages under the LVMH umbrella, Arnault proceeded to make “a series of brilliant business decisions” that “can only be called masterful.” Even his critics were impressed by “his ability to manage creativity for the sake of profit and growth.” Industry observers frequently credit his outstanding success in a highly competitive industry to the fact that—unlike other global CEOs—Arnault understands both the creative and the financial aspects of running a luxury business

Financed through Real Estate and Convertible Bonds

The Creation of Star Brands

In a 2001 Harvard Business Review interview, Arnault explained his famous business process, which—unlike the traditional fashion industry—requires financial discipline as well as creativity. The entire focus of Arnault's teams is the creation of “star brands” that must meet a high bar for four artistic and financial criteria: LVMH brands must be “timeless, modern, fast-growing, and highly profitable.” In practice, “profitable creativity” means that “star brands are born only when a company manages to make products that ‘speak to the ages’ but feel ‘intensely modern’ and ‘sell fast and furiously, all while raking in profits

Although the LVMH process begins with "radical innovation—an unpredictable, messy, highly emotional activity” on the creative end, as soon as “it comes to getting creativity onto shelves—chaos is banished,” and the company imposes "strict discipline on manufacturing processes, meticulously planning all 1,000 tasks in the construction of one purse.”

The genius of Arnault’s process is that, although the "front end of a star brand—the innovation…the creative process, the advertising—is very, very expensive,” the “back end of the process in the atelier (the factory)” is a place of "amazing discipline and rigor” that drives “high profitability behind the scenes.” Brands with “unbelievably high quality” require “unbelievably high productivity,” so “every single motion, every step of every process is carefully planned with the most modern and complete engineering technology.”

For example, when Arnault automated production at Vuitton, he drove that venerable old brand to the top spot on Fashionista’s list of the world's best-selling luxury brands in 2011, with a value of $24.3 billion—more than twice the amount of its nearest competitor.

As he spent “lavishly” on advertising, Arnault "rigorously" controlled costs by leveraging every possible synergy across the group: Kenzo manufactured a Christian Lacroix line; Givenchy manufactured a Kenzo perfume, and Guerlain created the first Vuitton perfume.

Creative Talent Management

As Arnault built LVMH into the world's largest luxury conglomerate, he hired new design talent for star brands that “speak to the ages” but “feel intensely modern”: from Céline, Kenzo, Guerlain, and Givenchy to Loewe, Thomas Pink, Fendi, and DKNY.

Because his model requires that “the counterbalance to creativity must be commerce,” Arnault “never hesitated to reign in, or outright terminate, creative executives who did not produce.” Since the early days at Dior, he has often replaced creative executives with non-traditional talent and then shuffled them across his brands to help him identify opportunities to drive profit—no matter how unpopular.

For example, at Givenchy in 1995, Arnault brought in a “fashion industry darling” and “notorious wild child,” British designer John Galliano, to replace Hubert de Givenchy, the industry icon “credited with defining simple elegance for an entire generation of women, (including) Audrey Hepburn, Jacqueline Kennedy, and the Duchess of Windsor.”

Within a year, Arnault moved Galliano, the first British designer in French haute couture, from Givenchy to Christian Dior to replace Gianfranco Ferré, the Italian couturier who had led Dior design since the late 1980s. Other non-traditional Arnault hires included installing 27-year-old Alexander McQueen (another British designer) at Givenchy and Marc Jacobs at Louis Vuitton, where he gave the American designer a mandate to challenge LVMH’s competitors, Prada and Gucci.

Although those iconoclastic designers later left LVMH, they had served Arnault’s purpose: interest in his traditional fashion houses had been jumpstarted by the early 21st century.

HOW TO STABILIZE THE DEMOCRATIC REPUBLIC OF THE CONGO, SEYCHELLOIS, AND HAITIAN CURRENCY (INDIAN PREMIER LEAGUE BUT FOR MMA & COMMODITIES NOT CRICKET & TECHNOLOGY MODEL)

Bioeconomy Agriculture Central Hedge Fund with Agriculture Bulge Brackets Oligopolistic System Hyper Inflation Vehicle Fiat Currency: Strict Negative Interest Rates for Investments; Debt/Equity Business Loan Period and Construction Loan/Tax Benefits Programs, Investment Trusts & Enterprise Foundations are Common Corporate Tax Avoidance Practices, and Raise Denominator of Currency & Print Currency for Insurance Companies for Building Process

Combat Sport as National Sport: Free Internet with Corporate Sponsor Purse Bid System Mixed Martial Arts Camps, Orphanages, Polytheist Churches, Gaming-Hospitality; and +EV Gambling

Mercantilism Fiat Currency Pegging: Foreign Exchange Rate to Diamond Peg Currency

Market Extension Vertical Integration Mergers Lottery

Industries: Mergers & Acquisitions Agriculture Industry, Decentralized Finance, Real Estate Finance and Economics, Capital Gains Tax Haven, Corporate Tax Haven, Inheritance Tax Haven, Art Ports, and Gaming-Hospitality

Blockchain Diamond-Metal Exchange Modelled Off of CBOE Volatility Index (VIX). Founded in 1973, the CBOE Options Exchange is the world's largest options exchange with contracts focusing on individual equities, indexes, and interest rates. Credit Spread Options and Blockchain the Commodities Market.

Business Capital is a Collaborative Environment through Generalized Education (STEM AND M & A)

Socioeconomic Status Agriculture Working Class Immigrants

XYY or Triple X Syndrome, ACTN3 Gene, MSTN Gene, and Mercury-Venus Births

A ROUND OF PAR GAME THEORY NETWORK

Beta Arbitrage with Convertible Bonds Compounding

Key Ingredients

Player's: Futures Exchange and Investor

Actions: Issue payments under any circumstances

Payoffs: Exchange - Larger Market Volume, Investor - Larger Assets Under Management or Profits

Representation

Extensive Form includes timing of moves. Player's move sequentially, represented as a tree (timing). Chess: the white player moves, then the black player can see White's move and react

Theory

There's a common expression of higher the risk, higher the reward; but in finance it should be higher reward, higher risk because people's savings are involved. This is why I created The Round of Par Games Theory Network where the intended score should always be 0. Nobody wins and nobody loses between investor and stock exchange, just a nice friendly draw. The Investors assets under management grows and the Exchange's Market Volume Grows.

Let's break down the Components:

Beta Arbitrage

Investor: Beta Arbitrage involves longing in one market and shorting in a DIFFERENT market. The example is longing Company A in the stock market but then going to Company A in the options market and placing a put/short option. Either way the Investor earns a profit.

Exchange: The Futures Exchange benefits because now not only is equity on the stock market is being bought but the options market has a larger volume.

Convertible Bond Compounding

Investor: By compounding through Convertible Bonds not only are you going to be paid back your money because creditors are first on the company's bankruptcy list unlike investors, but it's an easier way to buy more shares for growth investing while not diving head first.

Exchange: The Futures Exchange benefits because now not only is equity on the stock market is being bought, but the bond market has a larger volume.

LANGUAGES

Mandarin

Latin

INDUSTRY WORTH FOR COMMODITIES (AGRICULTURE WORKING CLASS)

In 2012, Forbes reported that $21 trillion was Off-Shored

In 2017 the equivalent of at least 10% of the world’s GDP is in offshore banks, and that number is probably higher due to the opaqueness of the world’s global tax havens, according to a research report release this month by the National Bureau of Economic Research.

The estimated amount of money laundered globally in one year is 2 - 5% of global GDP, or $800 billion - $2 trillion in current US dollars.

Taxes in the US – The federal government collected revenues of $3.5 trillion in 2019—equal to about 16.3 percent of gross domestic product (GDP) (figure 2). Over the past 50 years, federal revenue has averaged 17.4 percent of GDP, ranging from 20.0 percent (in 2000) to 14.6 percent (most recently in 2009 and 2010).

The foreign exchange or forex market is the largest financial market in the world – larger even than the stock market, with a daily volume of $6.6 trillion, according to the 2019 Triennial Central Bank Survey of FX and OTC derivatives markets.

In 2019, for example, the sales value of rough diamonds amounted to some 13.9 billion U.S. dollars worldwide. After polishing, the value increased by nearly double to 26.7 billion U.S. dollars. In 2019, the global diamond jewelry market value was approximately 79 billion U.S. dollars.

Global Cut Flowers Market to Reach $41. 1 Billion by 2027.

The global coffee market was valued at USD 102.02 billion in 2020,

Global Vanilla Market Is Expected to be worth Around USD 735 Million By 2026

According to the report published by Allied Market Research, the global cocoa market generated $12.8 billion in 2019, and is projected to reach $15.5 billion by 2027, witnessing a CAGR of 4.3% from 2021 to 2027

The global water and wastewater market was valued at 263.07 billion U.S. dollars in 2020. The market is projected to reach a value almost 500 billion U.S. dollars by 2028 at a CAGR of 7.3 percent in the 2021 to 2028 period.

The global tobacco market size was estimated at USD 932.11 billion in 2020 and is expected to reach USD 949.82 billion in 2021.

For the year 2020, Worldwide Cotton Market was US$ 38.54 Billion. Global Cotton Market is expected to reach US$ 46.56 Billion by 2027, with a CAGR of 2.74% from 2020 to 2027.

The global waste management market size was valued at $1,612.0 billion in 2020, and is expected to reach $2,483.0 billion by 2030, registering a CAGR of 3.4% from 2021 to 2030

According to Brandessence Market Research, the Energy Drink market size reached USD 61.23 billion in 2020 and expected to reach USD 99.62 Billion by 2027.

LEGAL DEFENSE

Smurfing: Reverse Onus, Challenge Mens Rea and Actus Rea, Press Malicious Prosecution Charges, Financial Settlement

RICO Legal Disputes Trademark (30 for 30 Court): Undisclosed Settlement; 1 large sum ($30 million) broken into a 3-part settlement, Not going to trial settlement (guaranteed payment for being brought into court), Case being unsealed settlement (if the case gets reopened), and Testimony settlement (in court testimony in reopened case). The non-disclosure agreement (NDA); Agreement to 10 years jail time for every broken NDA, NDA on Case, NDA on Testifying, and NDA on Settlement. Sealed Federal Cases: Have legal matters sealed by the court to prevent leaked information to media and Precedence for RICO

CRIME COLLAR

White-Blue collar crime is a subgroup of white-collar crime White Collar Crime, a term reportedly first coined in 1939, is synonymous with the full range of frauds committed by business and government professionals. Blue-collar crime is a term used to describe crimes that are committed primarily by people who are from a lower social class. This is in contrast to white-collar crime, which refers to crime that is usually committed by people from a higher social class.

SOCIOCULTURAL THEORY OF DEVELOPMENT

Agriculture Working Class Immigrants Socioeconomic Status Focused Key Players in Commodities Market*

Polytheism (Zeus, Poseidon, and Ogou-Athena)*

Births: Mercury-Venus, MSTN Gene, ACTN3 Gene, XYY Syndrome, or Triple X Syndrome

Māori All Blacks Sports Culture and Volleyball is National Sport*

Jumping for Cardio*

Poker Brain*

REITs/Real Estate ETF Investors with Index Credit or Debit Spreads Options Trading*

Mergers and Acquisitions Exploratory School System*

Sand-Based Calisthenics kallos sthenos (beautiful strength) Interval Training: Isometric-Plyometric, Circuit Training: Isometric-Isotonic, and Isometric-Mobility

Tofu is Protein of Choice

Fish/Seafood is Meat of Choice

Blueberry is consumed at every breakfast

Mineral Water instead of Spring Water

Coconut Syrup as Sugar Replacement

Business News is a part of The Cigar Culture

Sports Gambling for Extra Revenue Stream instead of Lottery Tickets when in Working Class

Hydrolyzed Collagen-Leucine is the Main Sports Medicine

Brokerage Accounts with First 10 Investments as Bond Funds and REITs

VAMMMBRGC LIFESTYLE BRAND RACKET

Volleyball (Trampoline)

Acting (Short Film Series: Aesthetic Taxi Game, Character: Expansive Mood Villain)

Modeling (Brand Activation Models)

Music (Psychedelic Festival Trap)

Martial Arts

Ballet (Females Only)

Rings Gymnastics (Males Only)

Graffiti (Art)

Cooking (Endorsements)

LVMH-Lacoste Collaboration Company For Tax Mergers Law; Market-extension merger: Two companies that sell the same products in different markets. 4.2.2 Corporate Taxation At the corporate level, the tax treatment of a merger or acquisition depends on whether the acquiring firm elects to treat the acquired firm as being absorbed into the parent with its tax attributes intact, or first being liquidated and then received in the form of its component assets.

What Is Vertical Integration? Vertical integration is a strategy that allows a company to streamline its operations by taking direct ownership of various stages of its production process rather than relying on external contractors or suppliers. A company may achieve vertical integration by acquiring or establishing its own suppliers, manufacturers, distributors, or retail locations rather than outsourcing them. However, vertical integration may be considered risky potential disadvantages due to the significant initial capital investment required.

Analysis Discounted Cash Flow (DCF): A key valuation tool in M&A, a discounted cash flow (DFC) analysis determines a company's current value, according to its estimated future cash flows. Forecasted free cash flows (net income + depreciation/amortization (capital expenditures) change in working capital) are discounted to a present value using the company's weighted average cost of capital (WACC). Admittedly, DCF is tricky to get right, but few tools can rival this valuation method.

VŒUX DE CHAMPAGNE SOGNI CAVIALI

Description: Beta-arbitrage Mergers & Acquisitions Cartel that commits Mediterranean-Caribbean and Afro-Mediterranean Socioeconomic Status Development Conflict Prevention and Reconstruction (CPR) Unit Charities, Protection Racket, Paramilitary Financing, Lobbyist-Investment Trust, Commodities Management, Gambling & Diamond Trafficking, Rolex Re-sale Market, Real Estate Brokerage, Graffiti Art Port, Smurfing, Nike Sports & Fashion Corporate Espionage and Larceny Business Model Reengineering, and VAMMMBRGC Contract Racketeering Through Enterprise Foundations

Activities: Executive Council for Mayor, Culinary Arts, Grey Market Fashion, Trap Shooting Gambling Tournaments, Volleyball Tournaments, Corporate Sponsor EdTech, Grocery Insurance & Electronic Financial Data Interchange, Diamond Encrusted Accessories Collaboration with LVMH, OTC Beta-arbitrage Branch Bracket, OTC Exchange (Commodities, Sports Betting Investment Trust, Real Estate Investment Trust, Cuisine Real Estate Investment Trust, Forex Pairs Contract for Difference, Retail/Hospitality Real Estate Investment Trust, Credit Swap Options Endorsement Index), VAMMMBRGC Youtube Distribution Channel (Gambling News Network, Noir Short Film Series [Shakespearean Crime], Cooking Channel, Sports Resort Real Estate, Sports/Modelling/Acting Business Case Study Video Essay, Brand Activation Modelling, Combat Sports, Calisthenics Workout Class, Sports Science Lessons, Graffiti Tourism, Music Videos, Natural Resources Documentaries, Hype Beast Re-Sale Market, Rolex Business Case Study Video Essays, Business Conferences).

DIAMOND TRAFFICKING

The WFDB Trade And Business Committee

The Trade and Business Committee makes recommendations to the Executive Committee concerning industry relations with financial institutions worldwide, lab-grown diamonds, Know Your Customer and the System of Warranties.

Idea 1: Luxury Goods Encrusted Items Investment Service and Auction. Example: Hermès Bag, Investment System: Masterworks, Auction System: Information Catwalks with models then bidding in a separate room with Video Replay for YouTube.

Idea 2: A sightholder is a company on the De Beers Global Sightholder Sales's (DBGSS) list of authorized bulk purchasers of rough diamonds. De Beers Group made this list, the second largest miner of diamonds. DBGSS was previously known as DTC (Diamond Trading Company). In May 2006, DTC released a list of the 93 sightholders on its website. High Fashion Accessories Aggregator Business Model with Auction and Re-sale.

Business Model

The London Metal Exchange (LME) which is based in Hong Kong is a commodities exchange that deals in metals futures and options. It is the largest exchange for options and futures contracts for base metals, which include aluminum, zinc, lead, copper, and nickel. The exchange also facilitates trading of precious metals like gold and silver.

Originally known as the Chicago Board Options Exchange (CBOE), the exchange changed its name in 2017 as part of a rebranding effort by its holding company, CBOE Global Markets. Traders refer to the exchange as the CBOE ("see-bo"). CBOE is also the originator of the CBOE Volatility Index (VIX), the most widely used and recognized proxy for market volatility.

ABC Exchange (Alumina, Beryllium, Carbon): There are four types of precious stones: diamonds, rubies, sapphires and emeralds. Each type has its own specific chemical and physical properties. Diamonds are made from carbon, rubies and sapphires from alumina and emeralds from beryllium.

Diamond Monopoly

What Is Vertical Integration? Vertical integration is a strategy that allows a company to streamline its operations by taking direct ownership of various stages of its production process rather than relying on external contractors or suppliers. A company may achieve vertical integration by acquiring or establishing its own suppliers, manufacturers, distributors, or retail locations rather than outsourcing them. However, vertical integration may be considered risky potential disadvantages due to the significant initial capital investment required.

My Vertical Integration Mergers: Company’s Diamond Mines, Merger Manufacturers, Company’s Distribution, and Merger Hospitality and Gaming Diamond Exchange

The Diamond Standard

Influence: Agricultural Bank of China is active in commercial banking, investment banking, and insurance services.

Mercantilism was a form of economic nationalism that sought to increase the prosperity and power of a nation through restrictive trade practices. Its goal was to increase the supply of a state's gold and silver with exports rather than to deplete it through imports. It also sought to support domestic employment.

The bio-economy is defined as the economic activity associated with the invention, development, production; and use of primarily bio-based products, bio-based production processes, and/or biotechnology-based intellectual property.

Industries Association; Hospitality and Gaming: Daily and Monthly Revenue Streams, Capital Gains Taxing: Create Offshore revenue through trading and Blockchain is a volatile market for good liquidity. FOREX Vehicle Currency: Low Interest Rates means currency will be traded against other currencies, Shorting own currency to get foreign currency and exchanging returns to domestic currency stabilize exchange rate and Currency Basket

Interest Rate Pegging: Environmental alternative to gold, Surplus item during Quantitative Easing, and Low Interest Rates lead to spending and loans for investment which means buying and trading diamonds will balloon

Mine Options: Credit spreads and debit spreads are different spread strategies that can be used when investing in options. Both are vertical spreads or positions that are made up entirely of calls or entirely of puts with long and short options at different strikes. They both require buying and selling options (with the same security) with the same expiration date but different strike prices.

Diamond Mine Investment Group: Mines can create private Investment Groups. Items within Group: diamond retail, diamond trading, industrial diamond manufacturing sectors

Lab-created diamonds are grown in controlled laboratory environments using advanced technology that replicates the conditions under which diamonds naturally develop beneath the Earth's crust. These lab-grown diamonds consist almost entirely of carbon atoms and are arranged in a diamond crystal structure.

DIAMOND ROLEX INVESTMENT TRUST (EXAMPLE)

Description

Watch Listing Through Discounted Cash Flow for Rolex Drop Culture or Re-Sale Market

Underwriting Products

$50,000 in value

Collector's Edition

Less than 20 models made

Masterwork Investing Platform (reference)

Masterworks is making the world of art a little less exclusive by offering everyday investors the chance to own a fraction of these high-priced investments with a much smaller amount of money.

Through the fine art investing platform, users can purchase (and trade) shares in what the company has defined as "blue-chip" art: masterpieces from artists like Pablo Picasso, Claude Monet, Andy Warhol, Banksy, Kaws, Jean-Michel Basquiat and more.

How Masterworks functions (reference)

Masterworks provides an affordable way to invest in art. What was once an option reserved exclusively for wealthy investors is now accessible to investors of all types. Here's how the platform works:

Masterworks will purchase a painting and file it with the SEC as a public offering, or IPO, similar to how a company goes public. Shares of the painting are then made available for purchase on the Masterworks website for as little as $20 per share. The company says it launches about one new painting every four to five days.

The platform stands out, especially for using propriety data to determine which artist markets have the most momentum, focusing on the very high-end segment of the art market that has predictable returns, the company says. Meanwhile, its research team works in the background to calculate appreciation rates, correlation, and loss rates.

Masterworks even recently added a secondary market, too, where investors can trade shares in paintings. Plus, Masterworks lets you invest your IRA earnings into their fine art through its partnership with Alto IRA, an alternative asset investing platform.

Industrial Embassy

Business Model: Insurance companies base their business models around assuming and diversifying risk. The essential insurance model involves pooling risk from individual payers and redistributing it across a larger portfolio. Most insurance companies generate revenue in two ways: Charging premiums in exchange for insurance coverage, then reinvesting those premiums into other interest-generating assets. Like all private businesses, insurance companies try to market effectively and minimize administrative costs. Types of Insurance: Mining, Manufacturing, Retail, Logistics

Financing is the process of providing funds for business activities, making purchases, or investing. Financial institutions, such as banks, are in the business of providing capital to businesses, consumers, and investors to help them achieve their goals. The use of financing is vital in any economic system, as it allows companies to purchase products out of their immediate reach. Equity financing is the process of raising capital through the sale of shares. Companies raise money because they might have a short-term need to pay bills or have a long-term goal and require funds to invest in their growth. By selling shares, a company is effectively selling ownership in their company in return for cash. Advantages of Equity Financing; Funding your business through investors has several advantages, including the following: The biggest advantage is that you do not have to pay back the money. If your business enters bankruptcy, your investor or investors are not creditors. They are part-owners in your company, and because of that, their money is lost along with your company. You do not have to make monthly payments, so there is often more cash on hand for operating expenses. Investors understand that it takes time to build a business. You will get the money you need without the pressure of having to see your product or business thriving within a short amount of time.

Planning Permission and Building Regulations Courses: Planning permission assesses whether the development fits in with local and national policies and whether it would cause unacceptable harm, for example, to neighbours' quality of life. Whereas building control covers the structural aspects of development and progress throughout the construction

AFRO-MEDITERRANEAN PARAMILITARY FINANCING

Military Payments

Sercurity Operations (SercOps) Payment: $150,000 yearly salary: Receives $100,000 salary; other $50,000 is used for branch-managed investment portfolio and investment trust

Discharge Payment: $75,000 yearly salary for Armoured Car Guard and Driver, Receives $50,000 salary; other $25,000 is used for branch-managed investment portfolio and investment trust

Military Funding: Central Hedge Fund Equity Given

Payment is in Fixed Currency

AFRO-MEDITERRANEAN SOCIOECONOMIC STATUS DEVELOPMENT CONFLICT PREVENTION AND RECONSTRUCTION (CPR) UNIT CENTERS

Corporate Sponsor: M & A Schools (Mergers and Acquisitions) & Retirement-preparatory School

Cross-Curriculum

STEM education is the cross-curricular study of science, technology, engineering, and mathematics, and the application of those subjects in real-world contexts.

Studying Style

I use Interleaving Studying for Generalist Kinaesthetic Learners.

Transition to Interleaving Studying: Online PowerPoint Presentation, Video Essays, Case Studies & Meta-analyses over Books to present Information as a country, Less Paper Use, Courses on Different PowerPoint Studying Styles, Make country a Business & Finance Culture and Technological Advanced, Overview at Beginning; Program Learning Concept Check During Quizzes at the End for Courses, Spaced Learning on concept checks before exiting the course.

A great example of when to use interleaving is sports, for instance, tennis. Instead of just practicing backhands in one session, you can interleave backhands, forehands, and volleys to get increased results. Another great example can be found in science classes, where interleaving math, physics, and chemistry, for example, can provide you with an advanced understanding of all 3 fields.

Spaced learning is a learning method in which highly condensed learning content is repeated three times, with two 10-minute breaks during which distractor activities such as physical activities are performed by the students. It is based on the temporal pattern of stimuli for creating long-term memories reported by R. Douglas Fields in Scientific American in 2005.

Spacing boosts learning by spreading lessons and retrieval opportunities out over time so learning is not crammed all at once. By returning to content every so often, students' knowledge has had time to rest and be refreshed.

The two concepts are similar but essentially spacing is revision throughout the course, whereas interleaving is switching between ideas while you study. Although interleaving and spacing are different interventions, the two are linked because interleaving inherently introduces spacing. These two concepts will create student-athletes

The best part about interleaving is that it is almost a universal aid in learning

Evidence suggests that spaced practice is more effective for long-term retrieval.

Interleaving Studying forces the brain to continually retrieve because each practice attempt is different from the last, so rote responses pulled from short-term memory won’t work.

Multiple choice test is an example of measuring retrieval by A. reconstruction. B. recognition.

Chess

Increasing Intelligence: Fluid and crystallized intelligence are constructs originally conceptualized by Raymond Cattell. The concepts of fluid and crystallized intelligence were further developed by Cattell and his former student John L. Horn. Crystallized intelligence. This refers to your vocabulary, knowledge, and skills. Crystallized intelligence typically increases as you get older. Fluid intelligence, also known as fluid reasoning, fluid intelligence is your ability to reason and think abstractly. Fluid intelligence refers to basic processes of reasoning and other mental activities that depend only minimally on prior learning (such as formal and informal education) and acculturation. Horn notes that it is formless, and can "flow into" a wide variety of cognitive activities Tasks measuring fluid reasoning require the ability to solve abstract reasoning problems. Examples of tasks that measure fluid intelligence include figure classifications, figural analyses, number and letter series, matrices, and paired associates. Crystallized intelligence refers to learned procedures and knowledge. It reflects the effects of experience and acculturation. Horn notes that crystallized ability is a "precipitate out of experience," resulting from the prior application of fluid ability that has been combined with the intelligence of culture. Examples of tasks that measure crystallized intelligence are vocabulary, general information, abstract word analogies, and the mechanics of language.

Bullet Chess: The rules for bullet chess aren't different from those of a regular chess game. Bullet chess refers to games played with time controls that are faster than 3 minutes per player. The most popular forms of bullet chess are 1|0 (one minute with no increment per player) or 2|1 (two minutes with a one-second increment per player). Increment (also known as bonus and Fischer since former World Chess Champion Bobby Fischer patented this timing method)—a specified amount of time is added to the players main time each move, unless the player's main time ran out before they completed their move.

Chess Benefits: It has been suggested by different scientists that chess involves, and possibly boosts, cognitive abilities such as working memory, fluid intelligence, and concentration capacity. Besides, chess may be beneficial for mathematical ability and, more widely, academic achievement by enhancing concentration and problem-solving skills.

Life-History Strategy

Life history theory posits that behavioral adaptation to various environmental (ecological and/or social) conditions encountered during childhood is regulated by a wide variety of different traits resulting in various behavioral strategies. Unpredictable and harsh conditions tend to produce fast life history strategies, characterized by early maturation, a higher number of sexual partners to whom one is less attached, and less parenting of offspring. Unpredictability and harshness not only affects dispositional social and emotional functioning, but may also promote the development of personality traits linked to higher rates of instability in social relationships or more self-interested behavior. Similarly, detrimental childhood experiences, such as poor parental care or high parent-child conflict, affect personality development and may create a more distrustful, malicious interpersonal style. The aim of this brief review is to survey and summarize findings on the impact of negative early-life experiences on the development of personality and fast life history strategies. By demonstrating that there are parallels in adaptations to adversity in these two domains, we hope to lend weight to current and future attempts to provide a comprehensive insight of personality traits and functions at the ultimate and proximate levels.

The Savant Skills Curriculum

Savant gifts, or splinter skills, may be exhibited in the following skill areas or domains: memory, hyperlexia (ie, the exceptional ability to read, spell and write), art, music, mechanical or spatial skill, calendar calculation, mathematical calculation, sensory sensitivity, athletic performance, and computer ability. These skills may be remarkable in contrast to the disability of autism, or may be in fact prodigious when viewed in relation to the non-disabled person.

Learning Centers

Enrichment centers require you to be aware of your students' learning styles (Kinesthetic) as well as their knowledge about a topic. The enrichment center can provide individual students with varied activities or combination of activities that differ from those pursued by other students. As such, the center becomes an individualized approach to the promotion of the topic.

Skill Centers Skill centers are typically used at the elementary level, more so than at the secondary level. Students may work on math facts, phonics elements, or other tasks requiring memorization and/or repetition.

Interest and Exploratory Centers: Interest and exploratory centers differ from enrichment and skill development centers in that they are designed to capitalize on the interests of students. They may not necessarily match the content of the textbook or the curriculum; instead they provide students with hands-on experiences they can pursue at their own pace and level of curiosity. These types of centers can be set up throughout the classroom, with students engaging in their own selection of activities during free time, upon arrival in the morning, as a “free-choice” activity during the day, or just prior to dismissal. These centers allow students to engage in meaningful discoveries that match their individual interests.

Programmed Learning

The way a teaching machine works is: It asks you a question. If you give the right answer, it goes on to the next question. If you give the wrong answer, it tells you why the answer is wrong and tells you to go back and try again. This is called "programmed learning".

Programmed learning, educational technique characterized by self-paced, self-administered instruction presented in logical sequence and with much repetition of concepts. Programmed learning received its major impetus from the work done in the mid-1950s by the American behavioral psychologist B.F.

Exploratory Learning (Singapore Field Trips)

The Choice Theory Culture:

Is an expected way of being or living

Encourages positive choices which lead to healthy relationships

Is relationship based and collaborative

Is not about controlling behavior, rather promoting personal responsibility

Carol Dweck's Growth Mindset Theory

Growth Mindset: “In a growth mindset, people believe that their most basic abilities can be developed through dedication and hard work—brains and talent are just the starting point. This view creates a love of learning and a resilience that is essential for great accomplishment. With a growth mindset, students continually work to improve their skills, leading to greater growth and ultimately, success. The key is to get students to tune into that growth mindset.

Dweck writes, “In the fixed mindset, everything is about the outcome. If you fail—or if you’re not the best—it’s all been wasted. The growth mindset allows people to value what they’re doing regardless of the outcome. They’re tackling problems, charting new courses, working on important issues. Maybe they haven’t found the cure for cancer, but the search was deeply meaningful,” (Dweck, 2015).

Poker as Intro to Portfolio Building

Famous Fund Managers who played Poker

Steven A. Cohen (born June 11, 1956) is an American hedge fund manager and owner of the New York Mets of Major League Baseball since September 14, 2020, owning roughly 97.2% of the team. He is the founder of hedge fund Point72 Asset Management and now-closed S.A.C. Capital Advisors, both based in Stamford, Connecticut. Cohen grew up in Great Neck, New York, where his father was a dress manufacturer in Manhattan's garment district, and his mother was a piano teacher. He is the third of seven brothers and sisters. He took a liking to poker as a high school student, often betting his own money in tournaments, and credits the game with teaching him "how to take risks." Cohen graduated from John L. Miller Great Neck North High School in 1974, where he played on the school's soccer team. Cohen received an economics degree from the Wharton School at the University of Pennsylvania in 1978. While in school, Cohen was initiated as a brother of Zeta Beta Tau fraternity's Theta chapter where he served as treasurer. While in school, a friend helped him open a brokerage account with $1,000 of his tuition money.

Carl Icahn is one of the most recognisable and successful investors in the world, having far outperformed the market on an annualised basis since 1968; at a rate which, by some measures, has him ahead of Warren Buffett. Carl Icahn was born on the 16th February 1936 in Queens, New York. It was a beach neighbourhood and a poor area. His mother was a pianist, but dropped her dreams of pursuing it as a career and instead chose a more stable job as a school teacher. His father also became a substitute teacher. As you may expect with both parents involved in education, Carl was extremely studious. At high school, he didn’t involve himself in many activities such as sports and clubs, instead he had set himself the big goal of making it to an Ivy League university; something most people in his area had no chance of doing. His teacher didn’t even think it was worth him applying, but this made him even more determined to be different. He had a mind-set that he wanted to be the best at everything. Icahn’s parents said they would only pay for university if he got into one of the top Ivy League universities. Although no one thought he stood a chance, he managed to enrol at Princeton University and studied philosophy as his major. His parents fulfilled their promise and paid for his Princeton fees but couldn’t stretch to anything else such as his accommodation or food. Instead, Carl got himself a summer job at a Cabana club in his neighbourhood to fund his living costs. It was at the Cabana club that he learnt how to play poker and joined in the games regularly. He says at the start he didn’t know how to play, but then he read 3 poker books in 2 weeks and became the best player there, taking home huge winning each summer. He says: “To me, it was a big game, big stakes. Every summer I won about $2,000, which was like $50,000 back in the ‘50s”

Brain Training: How Regular Poker Play Could Help Soccer Stars Succeed: An athlete’s brain is their most vital organ. It controls how the body functions, and it needs to be cultivated and disciplined just like the muscles do. Those in the industry are constantly searching for new ways to help soccer players get their heads in the game, and it turns out that poker can help immensely. By sharpening cognitive function, increasing social awareness, and improving mental endurance, poker enables athletes to rise to the occasion for peak performance on the field.

Conflict Prevention & Reconstruction Unit Psychology

Reintegration of child soldiers should emphasize three components: family reunification, psychosocial support and education, and economic opportunity. Family reunification—or, where that is not possible, foster placement or support for independent living—is crucial to successful reintegration.

Children are reintegrated into community life through the provision of psychosocial support, life skills classes and basic vocational training. At the end of the program, participants are provided with small grants to start businesses.

Post-traumatic growth (PTG) is a theory that explains this kind of transformation following trauma. It was developed by psychologists Richard Tedeschi, PhD, and Lawrence Calhoun, PhD, in the mid-1990s, and holds that people who endure psychological struggle following adversity can often see positive growth afterward. Post-traumatic growth often happens naturally, Tedeschi says, but it can be facilitated in five ways: through education (rethinking ourselves, our world, and our future), emotional regulation (managing our negative emotions and reflecting on successes and possibilities), disclosure (articulating what is happening and its effects), narrative development (shaping the story of a trauma and deriving hope from famous stories of crucible leadership), and service (finding work that benefits others).

People who have experienced posttraumatic growth report changes in the following 5 factors: Appreciation of life; Relating to others; Personal strength; New possibilities; and Spiritual, existential or philosophical changes

Although posttraumatic growth often happens naturally, without psychotherapy or other formal intervention, it can be facilitated in five ways: through education, emotional regulation, disclosure, narrative development, and service.

Forgeard found that the form of cognitive processing was critical in explaining growth after trauma. Intrusive forms of rumination caused a decline in multiple areas of growth, whereas deliberate rumination led to an increase in five domains of posttraumatic growth. Deliberate rumination involves perceiving multilateral sides of the stressful experience including value, meaning, and significance (Calhoun et al., 2000; Cann et al., 2011), and may also decrease the discrepancy between global and situational meanings, as it promote finding meaning. Trauma-focused cognitive behavioral therapy (TF-CBT) & Compassion-focused therapy (CFT) is a recommended psychotherapy

The two psychological traits which indicate a higher likelihood of experiencing post-traumatic growth are openness to experience and extraversion. Novelty seeking is positively associated with the Big Five personality trait of "extraversion," and to a lesser extent “openness to experience,” but is inversely associated with "conscientiousness." Online poker players are high sensation seekers who gamble to experience strong feelings and arousal, whereas impulsivity plays an important role in developing and maintaining pathological gambling.

CORPORATE SPONSOR: BETA-ARBITRAGE M & A EXAM

Poker Contest: Bankroll Budget*

Math Contest: Linear Algebra Contest, Probability and Ratios

Investment Management Contest: Decentralized Portfolio Building Simulation

Latin and Mandarin Technical Analysis Settings Fair: Year-Long Competition

Blues Ocean Strategy Game Theory Network Mergers & Acquisitions Contest: Macau Game Theory - The course includes modules in areas such as: Essentials of M&A, Due diligence training, Business valuation training, post-merger integration planning

Machine Learning Contest: Quantitative Aptitude

Winners Get a Full Ride to Internships (Licenes Courses I'm Gonna Make with Established Schools and Banks) Freshman Class is made of the contest winners: Mergers & Acquisitions Generalization with Corporate Sponsor; Understanding Capital Markets, Game Theory, Investment Model & Analysis, Quantitative Aptitude, Hedging Techniques, Foreign Language, Business Engineering, Business Models & Reengineering, Offshore Law, Blue Ocean Strategy, Investment Management with Python (Machine Learning)

Ages: 10, 12, 14, 17, 18, 20

SOCIOECONOMIC STATUS DEVELOPMENT CENTRES

Socioeconomic status is the social standing or class of an individual or group. It is often measured as a combination of education, income, and occupation.

EdTech

Business Model: Grants, corporate sponsorships, and recruiting business FutureLearn is another MOOC heavyweight with 210+ partners that include universities, humanitarian foundations, and large businesses. Some startups even rely on corporate sponsorship as their main business model

Generalist Education

VAMMMBRGC: Volleyball, Acting, Modelling, Music, Martial Arts, Ballet (Female), Rings Gymnastics (Male), Graffiti (Art), Cooking (Gastronomy)

STEM: Science, Technology, Engineering, Mathematics

M&A: Merger, Acquasitions

Welfare Investment Program

Fund through Rental Properties: Bond Funds, REITs

Credit Building Program: Line of Credit Deposit Program

Job Placement for Agriculture Working Class

Agricultural Industry means an industrial activity involving the processing, cleaning, packing or storage of the results from agricultural production. The working class (or labouring class) comprises those engaged in manual-labour occupations or industrial work, who are remunerated via waged or salaried contracts. Working-class occupations (see also "Designation of workers by collar colour") include blue-collar jobs, and most pink-collar jobs. Members of the working class rely exclusively upon earnings from wage labour; thus, according to more inclusive definitions, the category can include almost all of the working population of industrialized economies, as well as those employed in the urban areas (cities, towns, villages) of non-industrialized economies or in the rural workforce.

As with many terms describing social class, working class is defined and used in many different ways. The most general definition, used by many socialists, is that the working class includes all those who have nothing to sell but their labour. These people used to be referred to as the proletariat. In that sense, the working class today includes both white and blue-collar workers, manual and menial workers of all types, excluding only individuals who derive their livelihood from business ownership and the labour of others. The term, which is primarily used to evoke images of laborers suffering "class disadvantage in spite of their individual effort," can also have racial connotations. These racial connotations imply diverse themes of poverty that imply whether one is deserving of aid.

COMMODITIES REAL ESTATE

Insurance Premium, Financial Electronic Data Interchange, Royalties, Lease, & Gross Sale Payments for Restaurant Clientele Grocery Stores and Delivery Food Courts:

A lease payment is the equivalent of the monthly rent, which is formally dictated under a contract between two parties, granting one participant the legal right to use the other individual's real estate holdings, manufacturing equipment, computers, software, or other fixed assets, for a specified amount of time.

Gross sales refer to the grand total of all sales transactions over a given time period. This doesn't include the cost-of-sales or deductions (like returns or allowance). To calculate a company's gross sales, add up the total sales revenue for a specified period of time—monthly, quarterly, or annually.

A franchise (or franchising) is a method of distributing products or services involving a franchisor, who establishes the brand's trademark or trade name and a business system, and a franchisee, who pays a royalty and often an initial fee for the right to do business under the franchisor's name and system. Royalties is the amount someone pays you to use your property, after you subtract the expenses you have for the property.

CONFLUENCE FOREX & COMMODITIES BETA-ARBITRAGE FORMULA

Trading Psychology: Play Defense, Focus on preserving capital instead of gaining capital

Position Trading: Currency being used, Shorting Low-Interest Currency against High-Value Currency Or Currency Being used, Shorting Low Interest/High-Value Currency against High-Interest Currency. Examples: Carry-Roll Down Bonds, CFD Forex Gold

Swing Trading: Use mt4/mt5 With Heiken Ashi Charts, Setting at 14 or 21 Momentum Indicator above 0 as Divergence Oscillator and VSA as Reversal Oscillator and Trade when bullish candlesticks above 200 exponential moving average and/or 20 exponential moving average (EMA) on H1 (Hourly) Time Frame; use H4 (4 Hours) and D1 (1 Day) as reference. Works for Oil & Gold Commodities

Master Supply and Demand (S&D) Zones (banks use this)

Candlestick Patterns for Momentum: Bearish Engulfing, Hanging Man, Shooting Star Three Crows, Evening Star, (Short). Bullish Engulfing, The Bearish Inverted Hammer or Regular Hammer (Regardless of Colour), Morning Star, and Piercing Line (Long) are extremely Important

Candlestick Patterns for VSA When Volume Spikes Down and Price is Up Bearish: Shooting Star, Doji, Hanging Man, Doji-Star

Candlestick Patterns for VSA When Volume Spikes Up and Price is Down Bullish: Hammer, Inverted Hammer, Doji, Doji-Star

S&D Reversal Patterns: The Drop-Base-Rally is a bullish reversal pattern, The Rally-Base-Drop is a bearish reversal pattern

S&D Continuation patterns: The Rally-Base-Rally is a bullish continuation pattern, The Drop-Base-Rally is a bearish continuation pattern

Swing Trading Time Frame H1 (Hourly) Reference D1 and H4 to locate supply and demand zones Pivot Points and VSA

Heiken Ashi Candlesticks Much easier to read candlestick charts and analyze market trends

Using Pivot Points for Prediction A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames Works for commodities

Exponential Moving Average (EMA) 200 Day 20 Day

Momentum Indicator Settings 14 or 21

Volume Spread Analysis (VSA Trading) Entry 4 Steps: Identify the trend, Identify the sign of weakness in an existing uptrend, Wait to test the weakness for confirmation for the continuation of the uptrend, Look for any bullish reversal candlestick pattern for entry.

Relative Strength Index (RSI) Relative Strength Index (RSI) is a momentum indicator. It is a single line ranging from 0 to 100 which indicates when the stock is overbought or oversold in the market. If the reading is above 70, it indicates an overbought market and if the reading is below 30, it is an oversold market. RSI is also used to estimate the trend of the market, if RSI is above 50, the market is an uptrend and if the RSI is below 50, the market is a downtrend.

Commodity Channel Index Commodity Channel Index identifies new trends in the market. It has values of 0, +100, and -100. If the value is positive, it indicates uptrend, if the CCI is negative, it indicates that the market is in the downtrend. CCI is coupled with RSI to obtain information about overbought and oversold stocks.

What is Cash-and-Carry-Arbitrage? Cash-and-carry-arbitrage is a market-neutral strategy combining the purchase of a long position in an asset such as a stock or commodity, and the sale (short) of a position in a futures contract on that same underlying asset. A cash-secured put is an income options strategy that involves writing a put option on a stock or ETF and simultaneously putting aside the capital to buy the stock if you are assigned.

What are Gold CFD? A contract for difference (CFD) is a popular type of derivative that allows you to trade on margin, providing you with greater exposure to the gold market. Instead of purchasing gold itself, you buy or sell units for a given financial instrument depending on whether you think the underlying price will rise or fall.

What is Quanto Option? The Quanto option is a cash-settled, cross-currency derivative in which the underlying asset has a payoff in one country, but the payoff is converted to another currency in which the option is settled.

Hedging Strategies: Forex and Commodities CFD, Crude Oil Cash-secured Put Options (Binary Options)

TURF ACCOUNTANT

Beta-Arbitrage (PROFITS FOR BOOKMAKER)

+EV (Investment)

Live Betting (Balance Sheets)

BRANCH BRACKET DISCOUNTED CASH FLOW PORTFOLIO BET SLIP

+EV Round Robin instead of WACC Portfolio

$5 Units

GAME THEORY OPTIMAL POKER WITH LOOSE AGGRESSIVE & GROWTH INVESTING

Growth Investing Strategy & Game Theory

Japanese Candlestick Charts: Bullish Engulfing

Discounted Cash Flow Model: EV (Expected Value replaces WACC)

Mixed Strategy

Fold Equity

Community Cards

Companies Charts and Historical Financials

Royal Flush

Straight Flush

4 of a Kind

Full House

Flush

Hands

FCF of Companies

Strategy

Every chart starts with a green candlestick

Depending on your hand the second candlestick is either green or red

Green for the top 5 hands: Listed above

Red for the bottom 5 hands

If it's green invest by betting

If it's red fold

The third candlestick depends on the Flop

The fourth candlestick depends on The Turn

As more money gets betted the Green candlestick gets larger

After The Flop risk-assessment and probability needs to be accounted for

After The Flop, The Turn, and The River it is possible for a red candlestick to appear because of a fold or a better hand because you lost money. Judge how much money you lost by the size of the candlesticks growth

Tony Dunst Tips

Learn to think in Big Blinds, Opponents are Effective Big Blinds

Identify Player Types then Adjust

Study Big Blind Defense Frequency (Hand Ranges)

Work on Bubble and Final Table Play (Independent Chip Model)

Build 3 Betting Ranges

AFRO-MEDITERRANEAN SOCIOECONOMIC STATUS VOLLEYBALL SPORTS PERFORMANCE FOR KINAESTHETIC LEARNERS

Volleyball Physiological Age System for Both Genders: Plyometric High-Intensity Interval Training Through Cross Training, Wingspan Through Cross Training, Unstable Surface Muscle Recruitment Contrast Training, Isometric-Plyometric-Sprint-or-Vertical Jump Contrast Conditioning, Intermittent Hypoxic Training (IHT) Weighted Jump Rope Respiratory Conditioning, Functional Threshold Power (FTP) Cycling, Fascia and Central Pattern Generator Skill Development, Stretch-Reflex Elastic Strength Training, Running-Based Anaerobic Sprint Test (RAST), Stimulus-Fatigue-Recovery-Adaptation for Supercompensation, Autophagy Recovery, High Fat and High Carb with Lipolysis Supplement Nutrition: 3 Fuels of Energy in Oxygen, Fat, and Glucose, Convert Hybrid Muscle Fibers

Stretch Goal of Having a Physiological Age of 25

Volleyball is an aerobic sport with additional anaerobic demands. This will require volleyball players to work both energy systems, making cardiorespiratory conditioning very important. The aerobic, or lower intensity training, will help build a strong cardio base that is needed for a long match. A study done on college athletes showed that gymnasts and volleyball players had significantly higher bone mineral density than swimmers, which is considered a low-impact sport.

Collagen Athletes: Researchers found that a year of daily collagen peptides supplementation measurably increased bone mineral density in the lumbar spine and in the upper femur. The women also had higher levels of a blood biomarker that indicates bone formation. Collagen provides resistance to tension and stretch, which commonly occur in fascial tissues, such as ligaments, tendons, sheaths, muscular fascia and deeper fascial sub-layers. Julio Jones and Cam Newton do Fascia Beach Workouts https://www.youtube.com/watch?v=Unm5dvlcqL4

Offensive Systems 5-1 System Rotation 1: Setter Starts in Right Back, Rotation Offense to Middle Front, Run One Man or Two Man Routes, Call out Formations

Defensive Systems Middle Back Systems: The Set is important to determine if there’s enough time for one man, two man, or three man block. Shots to Plan for: Dink, Off-speed, and Angle. Setting Blocks: Mix Sequencing of Jump Two Man and Three Man Back

Anta Sports Fashion Collab Circuits (Graffiti Beachwear Fashion Week and Trade Show): Key City Tournaments

Planned Pregnancy: Mercury-Venus Cusp, MSTN Gene, ACTN3 Gene, and XYY Syndrome or Triple X Syndrome

CARTEL THEORY

HSBC Bank Holding Company Equity Financing

What Is a Bank Holding Company? A bank holding company is a corporation that owns a controlling interest in one or more banks but does not itself offer banking services. Holding companies do not run the day-to-day operations of the banks they own. However, they exercise control over management and company policies. They can hire and fire managers, set and evaluate strategies, and monitor the performance of subsidiaries’ businesses.

What Is Equity Financing? Equity financing is the process of raising capital through the sale of shares. Companies raise money because they might have a short-term need to pay bills or have a long-term goal and require funds to invest in their growth. By selling shares, a company is effectively selling ownership in their company in return for cash. Equity financing comes from many sources: for example, an entrepreneur's friends and family, investors, or an initial public offering (IPO). An IPO is a process that private companies undergo to offer shares of their business to the public in a new stock issuance. Public share issuance allows a company to raise capital from public investors.

Palmiers Noirs Rivals

United Kingdom

Jews

Luxembourg (EU Blacklist Creator)

Latin Kings

Sinaloa Cartel

Sonora Cartel

Colombian Cartels

Neymar

Banker Title

Croupier Comptable: An investment banker who has experienced decadence through Casino Capitalism

Palmiers Noirs Structure

Clandestine Cell System

A clandestine cell system is a method for organizing a group of people (such as resistance fighters, sleeper agents, mobsters, or terrorists) such that such people can more effectively resist penetration by an opposing organization (such as law enforcement or military units).

In a cell structure, each of the small group of people in the cell know the identities of the people only in their own cell. Thus any cell member who is apprehended and interrogated (or who is a mole) will not likely know the identities of the higher-ranking individuals in the organization.

The structure of a clandestine cell system can range from a strict hierarchy to an extremely distributed organization, depending on the group's ideology, its operational area, the communications technologies available, and the nature of the mission.

Criminal organizations, undercover operations, and unconventional warfare units led by special forces may also use this sort of organizational structure.

Infrastructure cells

Any clandestine or covert service, especially a non-national one, needs a variety of technical and administrative functions, such as: Recruitment/training, Forged documents/counterfeit currency, Finance/Fundraising, Communications, Transportation/Logistics, Safehouses, Reconnaissance/Counter-surveillance, Operational planning, Arms and ammunition, and Psychological operations

A national intelligence service has a support organization to deal with services like finance, logistics, facilities (e.g., safehouses), information technology, communications, training, weapons and explosives, medical services, etc. Transportation alone is a huge function, including the need to buy tickets without drawing suspicion, and, where appropriate, using private vehicles. Finance includes the need to transfer money without coming to the attention of financial security organizations.

Cartel Definition

Cartel is an ambiguous concept, which usually refers to a combination or agreement between rivals, but – derived from this – also designates organized crime. The main use of ‘cartel’ is that of an anticompetitive association in the economy.

Price cartels engage in price fixing, normally to raise prices for a commodity above the competitive price level.

Cartel Theory

Cartel theory is usually understood as the doctrine of economic cartels. However, since the concept of 'cartel' does not have to be limited to the field of the economy, doctrines on non-economic cartels are conceivable in principle. Such exist already in the form of the state cartel theory and the cartel party theory. For the pre-modern cartels, which existed as rules for tournaments, duels and court games or in the form of inter-state fairness agreements, there was no scientific theory. Such has developed since the 1880s for the scope of the economy, driven by the need to understand and classify the mass emergence of entrepreneurial cartels. Within the economic cartel theory, one can distinguish a classical and a modern phase. The break between the two was set through the enforcement of a general cartel ban after the Second World War by the US government.

Constituent characteristics and exclusion criteria for cartels

Constituent criteria for cartels would be the following: The members are, at the same time, partners as well as competitors (so do e.g. enterprises, states, parties, duelists, tournament knights). These members can be individual persons or organizations. The members of a cartel are independent of each other, negotiating their interests with each other and against each other. So there have to be at least two participants and they determine their interests autonomously. The members of a cartel know each other; they have a direct relationship, in particular they communicate with each other.

Exclusion criteria for cartels would be the following: There is a "hierarchical" or other strong "dependency relationship among the participants": a drug mafia that is organized hierarchically and managed by a single boss can't be a drug cartel in the sense of a real "cartel". KLikewise, a business corporation can't be a "cartel" due to its central management, which controls its subsidiaries. Furthermore, an OPEC, in which all adherents would be dependent on the largest member (since long: Saudi Arabia) would no longer be a "cartel". Similarly, colonial empires from a motherland and colonies do not constitute a "state cartel". The union of competitors, in their entirety or via important members of its association, is dependent on an outside power. A strict, state-mandated compulsory cartel without freedom of choice between the partners would not be a (real) cartel. A suitable example is the "Deutsche Wagenbau-Vereinigung" (German Railway Cars Association), which was organized in the 1920s by the "Deutsche Reichsbahn" (German Imperial Railways) – its "market opponent". The combination takes place between actors of different levels. Thus, the concerted actions of employers’ associations and trade unions in some industrialized countries was not a cartel, because the allies there were no homogenous competitors. The alleged members of a suspected cartel do not know each other, but only randomly show a parallel behavior: “Cartels of the godless”, “cartels of maintenance deniers” or “silent cartels” are therefore usually no real cartels, but pure verbal abuse formulas.

MACAU ECONOMICS

Science

Science of Aesthetics

Nutritional Biochemistry

Vertical-Rotational Force Kinetic Chain

Biomechanics

Sports Medicine

Technology

Biotechnology

FinTeach

RealTeach

Merger & Acquisition EdTech

Engineering

Business Engineering (Tribes Organism and Keynesian Macroeconomics)

Construction Management

Business Model Reengineering

Mathematics (Decentralized Central Banking)

Investment Management

Monetary Policy & Central Banking

Wolf Packs are Generalist

David Epstein examined the world’s most successful athletes, artists, musicians, inventors, forecasters and scientists. He discovered that in most fields—especially those that are complex and unpredictable—generalists, not specialists, are primed to excel. Generalists often find their path late, and they juggle many interests rather than focusing on one. They’re also more creative, more agile, and able to make connections their more specialized peers can’t see.

Wolves are habitat “generalists,” meaning they can adapt to living in many kinds of habitat. They basically need two things to thrive: abundant prey and human tolerance.

Trophic Cascade, an ecological phenomenon triggered by the addition or removal of top predators and involving reciprocal changes in the relative populations of predator and prey through a food chain, which often results in dramatic changes in ecosystem structure and nutrient cycling. (Trillwave in Macau)

A keystone species is an organism that helps define an entire ecosystem. Without its keystone species, the ecosystem would be dramatically different or cease to exist altogether. Keystone species have low functional redundancy. (Trillwave in Macau)

Unpredictable and harsh conditions tend to produce fast life history strategies, characterized by early maturation, a higher number of sexual partners to whom one is less attached, and less parenting of offspring.

BLUE OCEAN STRATEGY BY RENÉE MAUBORGNE AND W. CHAN KIM (COURTESY OF BLINKIST)

What’s in it for me? Conquer uncontested market space.

Every business asks themselves the same question: how can we beat out the competition? And almost every business comes up with the same answer: we need to become bigger, better, and faster to outperform our rivals.

But what if your business didn’t have to beat the competition because there wasn’t any? What if you could enjoy unlimited growth without worrying about limited demand? This isn’t some idle fantasy but a strategic approach that a handful of successful businesses have already made reality. How did they do it? And how can your business do the same? This short Blink will give you a taste.

Escape your competition by setting sail to a blue ocean.

When you establish a new business, competition can be brutal. Whether you’re selling wine, audio books, or life insurance, the market for a product can only get so big. So you’re left to fight with hundreds of other companies for your share of a limited demand. No surprise that America’s most popular business TV show is called Shark Tank! Markets today are like oceans, swarming with hungry companies ready to kill each other. There’s so much blood in the water, we can call these markets red oceans.

But every once in a while, a company emerges that seems to sail past all the competition. These are businesses that rise fast, grow uncontested, and seem to play by their own rules. What are they doing differently?

Well, instead of fighting over scraps in red oceans, these businesses navigate uncharted territory: blue oceans. You can think of blue oceans as all the markets we haven’t yet discovered, for products and services that don’t yet exist. Demand isn’t limited because demand isn’t there – it has to be created. But this isn’t a handicap, it’s an opportunity. Because if the size of your market isn’t limited, neither are your growth and profits.

In blue oceans, the water isn’t bloodied by cut-throat competition. It’s deep, clear, and full of undiscovered potential. The blue ocean strategy gives you the methodology and tools to conquer such uncontested markets. The basic tenet is this: It’s true that the space in a certain industry might be limited. But who’s to say that a business can’t create an entirely new industry?

Let’s look at an example of this in action: famous Canadian circus company Cirque du Soleil. With its extraordinary variety shows, Cirque du Soleil has entertained millions of people worldwide. On top of that, it’s made record profits. Not something you would expect from a circus company! How did the company do it?

Well, Cirque du Soleil did two interesting things. First, it got rid of the old circus staple of animal acts. Then, it supplemented its human acts with live music and compelling storylines. The first move reduced costs while the second introduced exciting new elements into the world of circus. In effect, Cirque du Soleil created a blue ocean: it carved out an entirely new market for artistic theater experiences. And people love it.

Lower your costs and differentiate yourself.

Perhaps you find the example of a circus company a bit too eclectic? No problem. There are thousands of other businesses that have successfully implemented a blue ocean strategy. Companies like Ford, Nintendo, Netflix, Nespresso, Yellow Tail, Southwest Airlines, and even The Body Shop. In this section, we’ll take a closer look at how they succeeded.

But first, a few more words about red oceans. In red oceans – industries that are already established – everyone plays by agreed rules. Not so long ago, these rules might have looked something like this: “Movies can be bought or rented.” “Wine needs to have an air of sophistication.” “Air travel is expensive.” But in blue oceans, none of these rules apply. Blue oceans are actively shaped by the actions of the industry players who create them.

Let’s be clear – you don’t need to reinvent the wheel to establish a blue ocean. Often, a few little tweaks are enough to set a product apart from its competitors and create a new market. It’s really quite simple: Take a close look at your industry as it is right now. Then think about which factors you can Raise, Eliminate, Reduce, and Create. Let’s go through these points step-by-step with examples.

Raise. Think about how you can elevate the product quality, price point, or service standards of your industry. Southwest Airlines did this when it became the first US airline to make domestic flights quick, easy, and affordable for everyone.

Eliminate. Consider which aspects of your product or service can be cut completely. Remember how Cirque du Soleil got rid of costly and unethical animal acts? Every industry has some outdated practice they’d be better off abandoning.

Reduce. Look at which production processes, product features or service offers you can reduce. Australian wine brand Yellow Tail, for instance, decided to reduce its focus on prestigious vineyards and the aging process in favor of affordable wines with broad appeal.

Create. Brainstorm what new features you can offer your customers. Netflix is a premium example of this that barely needs an explanation: it was the first company to offer on-demand streaming for movies and TV shows.

Ideally, considering these questions will help you do two things: lower your costs and differentiate your business from the competition. And that’s really all you need to create a blue ocean. Even more so, if your company keeps addressing these four factors – that’s raise, eliminate, reduce, and create –, it will stay one step ahead of the competition at all times.

Final summary

In this short Blink, you’ve learned about the difference between red and blue oceans. Rather than competing for limited market space, successful businesses often capture new markets with unlimited potential. They’re discovered by raising, eliminating, reducing, and creating industry factors in a way that lowers costs and sets your business apart from the competition.

RANGE BY DAVID EPSTEIN (COURTESY OF BLINKIST)

What’s in it for me? Learn why taking a wide-ranging approach to life will pay off.

In our complex and cutthroat world, there’s a lot of pressure to get a head start and specialize early. Many successful people, such as Tiger Woods, start to focus on one path early in life. But delve a little deeper, and it becomes clear that it’s generalists, not specialists, who are primed to excel.

Generalists may take a little longer to find their path in life, but they are more creative, can make connections between diverse fields that specialists cannot. This makes them more innovative and, ultimately, more impactful.

Drawing on examples from medicine to academia to sport, these blinks explore how breadth and range are far more powerful than specialized expertise. They also show that experts often judge their own fields more narrowly than open-minded, intellectually curious amateurs do.

In these blinks, you’ll learn; what comic books have to tell us about the ingredients of success, how the complexity of modern life has changed the way we think, and why you should be a Roger; not a Tiger.

Starting early and specializing is fashionable, but has dubious merit.