#public limited company registration online

Text

#Public limited Company registration in Bangalore#Public limited Company registration in Bangalore online#Online Public limited Company registration in Bangalore#Public limited Company registration#Public limited Company registration in Karnataka#Public limited Company registration in India#Public limited Company registration online in Bangalore

0 notes

Text

Farmer Producer Organization (FPO Registration) - Process, Fees, Documents Required

The Indian economy is an agricultural-centric economy. Agriculture in India is the livelihood for a majority of the population as it employs more than 50% of the Indian workforce. But the sad part is producers and farmers are deprived of the agricultural process. They don’t have access to technology, knowledge, and funds. To address this issue, the concept of Producer Company was introduced in 2002, to help improve the lives of farmers and producers.

What is a Producer Company?

Producer company is a corporate body of producers, farmers and agriculturists with the objective of procurement, production, harvesting, grading, pooling, handling, marketing, selling or export of the members or import of goods and services for themselves. In simple words, this type of company is formed with the aim to improve the lives of people associated with the agriculture industry by providing them access to technology, market, credit, etc.

*Process of:

Step 1. Application for Digital Signature Certificate (DSC)

Step 2. Application for the Name Approval

Step 3. Filing of SPICe Form (INC-32): Details of the company, Details of members and subscribers, Application for Director Identification Number (DIN), Application for PAN and TAN, Declaration by directors and subscribers, Declaration & certification by professional

Step 4. Filing of e-MoA (INC-33) and e-AoA (INC-34)

Step 5. Issuance of PAN, TAN, and Incorporation Certificate

Read more about documents, fees, and benefits of Farmer Producer Organization

#business#india#business growth#manage business#nidhi company registration#private limited company registration in bangalore#public limited company registration#public records#farming#agriculture#public company#digital signature certificate#digital signature online

0 notes

Text

Are you confused about which company type suits your business plan the most? Here’s a complete guide to Company registration.

Reach us for Company Registration Online in India, We'll be more than happy to help you !

Auriga Accounting pvt.ltd

Auriga accounting always help for all type of business

Kindly Contact On +91-7982044611/+91-8700412557, [email protected] Or Visit Our Website :WWW.AURIGAACCOUNTING.IN

Company Registration

Nidhi Company Registration

Proprietorship Firm Registration

Partnership Registration

One Person Company ( OPC) Registration

Private Limited Registration

LLP Registration

Public Limited Registration

Section 8 Company Registration(NGO)

Producer Company Registration

Common Services

Shop Act Registration

Udyog Adhar ( MSME) Registration

Food License Registration

Income Tax Return ( Business )

Income Tax Return ( Salary)

GST Registration

ISO Certificate

Trademark Registration

Digital Signiture

ESI & PF Registration

12A & 80G Registration

Import Export Code Registration

Professional Tax Registration

Income Tax , GST Consultant , TDS And TCS Work, Import Export Consultant, Tax Audit, Company Registration, ROC Filing & Others Services.

#aurigaaccounting#auriga_accounting#companysecretary #registration #pvtltdcompany #entrepreneur #mca #trademark #trademarkedsetups #trademarks #importexport #company #corporate #incorporation #companyregistration #startup #startupindia #startupindiastandupindia #startups #startupindiahub #india #business

#Are you confused about which company type suits your business plan the most? Here’s a complete guide to Company registration.#Reach us for Company Registration Online in India#We'll be more than happy to help you !#Auriga Accounting pvt.ltd#Auriga accounting always help for all type of business#Kindly Contact On +91-7982044611/+91-8700412557#[email protected] Or Visit Our Website :WWW.AURIGAACCOUNTING.IN#Company Registration#Nidhi Company Registration#Proprietorship Firm Registration#Partnership Registration#One Person Company ( OPC) Registration#Private Limited Registration#LLP Registration#Public Limited Registration#Section 8 Company Registration(NGO)#Producer Company Registration#Common Services#Shop Act Registration#Udyog Adhar ( MSME) Registration#Food License Registration#Income Tax Return ( Business )#Income Tax Return ( Salary)#GST Registration#ISO Certificate#Trademark Registration#Digital Signiture#ESI & PF Registration#12A & 80G Registration#Import Export Code Registration

0 notes

Text

Subsidiary Company Registration in India: A Comprehensive Guide by Masllp

Setting up a subsidiary company in India has become an increasingly attractive option for foreign businesses seeking to expand into one of the world's fastest-growing economies. Whether you're a multinational corporation or a small business looking to tap into the Indian market, registering a subsidiary company in India offers numerous benefits. In this guide, we'll explore the process, benefits, and key considerations for subsidiary company registration in India, with expert insights from Masllp.

Why Register a Subsidiary Company in India?

India's booming economy, large consumer base, and favorable business environment make it an ideal location for foreign businesses to establish a subsidiary. Here are some compelling reasons to consider subsidiary company registration in India:

Access to a Growing Market: India is one of the largest markets in the world, with a population exceeding 1.4 billion. This vast consumer base offers tremendous opportunities for growth and expansion.

Favorable Investment Policies: The Indian government has implemented several reforms to attract foreign direct investment (FDI). These policies provide various incentives, including tax benefits and easier regulatory procedures.

Limited Liability Protection: A subsidiary company in India operates as a separate legal entity, offering limited liability protection to the parent company. This means that the parent company's assets are protected in the event of any liabilities incurred by the subsidiary.

Operational Flexibility: A subsidiary in India can operate independently, allowing the parent company to maintain control while benefiting from local expertise and resources.

The Process of Subsidiary Company Registration in India

The process of registering a subsidiary company in India involves several steps. While it may seem complex, partnering with experts like Masllp can streamline the process and ensure compliance with all legal requirements.

Choosing the Right Business Structure: The first step is to decide on the type of subsidiary company you wish to establish. The most common types are:

Private Limited Company: The most preferred structure for foreign businesses, offering limited liability and ease of management.

Public Limited Company: Suitable for larger businesses planning to raise capital through public offerings.

Branch Office: An extension of the parent company, suitable for companies looking to explore the market without establishing a separate legal entity.

Obtaining Digital Signatures (DSC) and Director Identification Numbers (DIN): The directors of the subsidiary must obtain DSC and DIN, which are essential for filing online documents with the Registrar of Companies (ROC).

Name Approval: The next step is to reserve a unique name for the subsidiary company. This is done by submitting an application to the Ministry of Corporate Affairs (MCA).

Drafting Memorandum of Association (MOA) and Articles of Association (AOA): These documents outline the objectives, rules, and regulations of the subsidiary company. They must be drafted and submitted along with the registration application.

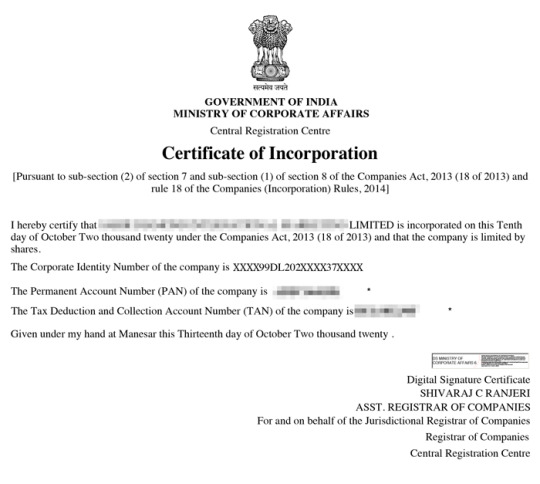

Filing the Registration Application: The final step involves submitting the registration application to the ROC, along with the necessary documents and fees. Once approved, the ROC issues a Certificate of Incorporation, officially recognizing the subsidiary company.

Key Considerations for Subsidiary Company Registration in India

Before proceeding with subsidiary company registration, there are a few critical factors to keep in mind:

Compliance Requirements: Subsidiary companies in India must adhere to various compliance requirements, including annual filings, tax obligations, and audits. Partnering with experts like Masllp ensures that your subsidiary remains compliant with all legal requirements.

Taxation: Understanding the tax implications of operating a subsidiary in India is crucial. Subsidiaries are subject to corporate tax, GST, and other local taxes. Masllp can provide guidance on tax planning and optimization strategies.

Local Partnerships: Establishing partnerships with local businesses or consultants can provide valuable insights into the Indian market and help navigate regulatory challenges.

Cultural and Language Differences: Understanding the cultural and linguistic nuances of the Indian market is essential for successful business operations. Investing in local talent and resources can bridge these gaps.

How Masllp Can Help with Subsidiary Company Registration in India

Navigating the complex process of subsidiary company registration in India requires expertise and local knowledge. Masllp offers comprehensive services to guide foreign businesses through every step of the process, ensuring a smooth and hassle-free experience. Our services include:

Legal Consultation: Expert advice on choosing the right business structure and complying with Indian regulations.

Documentation and Filing: Assistance with drafting and submitting all necessary documents, including MOA, AOA, and registration applications.

Tax Planning: Guidance on optimizing your tax strategy to minimize liabilities and maximize profits.

Ongoing Compliance Support: Ensuring your subsidiary remains compliant with all legal requirements, including annual filings and audits.

Conclusion

Registering a subsidiary company in India is a strategic move that can open doors to one of the most dynamic markets in the world. With the right guidance and support from Masllp, you can navigate the registration process with ease and set your business up for success in India.

For more information or to start the process of subsidiary company registration in India, contact Masllp today. Our team of experts is here to help you every step of the way.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ajsh#ap management services

4 notes

·

View notes

Text

How to Set Up an LLC in Pennsylvania: Step-by-Step Guide by TRUIC

Establishing a Limited Liability Company (LLC) varies across states, and Pennsylvania has its own specific process. New business owners can find the process confusing, but this comprehensive guide by TRUIC will remove the guesswork. Continue reading to find out how to create an LLC in Pennsylvania.

Types of LLCs in Pennsylvania USA

Pennsylvania offers various LLC types to suit different business needs:

Single-member LLC: Consists of one owner (member) who holds all ownership rights.

Member-managed LLC: A multi-member LLC where all owners (members) have a say in decision-making and manage the business.

Manager-managed LLC: A multi-member LLC where members appoint a manager to handle daily operations, suitable for larger LLCs.

Restricted LLC: For professional services like medicine, dentistry, law, etc., requiring registration as a restricted professional company.

Benefit LLC: Formed to create a general public benefit, impacting society and the environment positively.

Domestic LLC: An LLC formed within Pennsylvania.

3 Steps to Setup LLC in Pennsylvania USA

Setting up an LLC in Pennsylvania involves filing several documents with the Department of State and can be done online or by mail.

Step 1: Select a Distinct Name for Your LLC

Ensure your chosen LLC name is unique by using Pennsylvania’s business entity search tool. If the name is available, but you're not ready to register, you can reserve it for 120 days.

Naming Rules:

Must include "company," "limited," "limited liability company," or their abbreviations.

Must not include words like "corporation" or "incorporated."

Step 2: Choose a CROP, or Registered Office

You need to provide a physical address in Pennsylvania for your LLC, or enter into an agreement with a Commercial Registered Office Provider (CROP) to provide this address.

Step 3: Put Your LLC Documents in Order

Submit a Certificate of Organization and a docketing statement to the Pennsylvania Department of State. Veterans may apply for a fee waiver. For LLCs formed elsewhere, file a Foreign Registration Statement.

Register an LLC online in Pennsylvania

Filing online is efficient and straightforward. Visit the Pennsylvania Department of State's website to access the online filing portal, complete the necessary forms, and pay the filing fee.

What does it take to start an LLC in PA?

While it's challenging to avoid all costs, you can minimize expenses by handling the filing yourself and serving as your own registered agent. Utilize free resources for creating your operating agreement.

Creating an LLC with Just One Member in Pennsylvania

Similar steps apply to LLCs with many members. Single-member LLCs benefit from simplified management and flexible taxation, often being treated as a disregarded entity for tax purposes.

Lets Find: Is PA a good state for an LLC?

Advantages of a PA LLC

Limited Liability Protection: Personal assets are protected from business liabilities.

Tax Flexibility: Choose from various tax structures to optimize tax obligations.

Simplified Compliance: Fewer formalities than corporations.

Enhanced Credibility: Boosts business trust and legitimacy.

How much does it cost to start an LLC in Pennsylvania: know more

Primary costs include the filing fee for the Certificate of Organization, registered agent fees (if applicable), and publication costs (if needed). Additional costs might include legal assistance for drafting documents.

Processing Fee: $125

State Filing Fee: $125, payable to Pennsylvania's Commonwealth; nonrefundable

Mailing Address:

Pennsylvania Department of State

Bureau of Corporations and Charitable Organizations

P.O. Box 8722

Harrisburg, PA 17105

A Docketing Statement must be sent with your Certificate of Organization if you file it by mail.

Check out our Pennsylvania Certificate of Organization tutorial for assistance in filling out the form.

How Long Does It Take to Get an LLC in PA?

Online Filing: Typically processed within 5-10 business days.

Mail Filing: Can take several weeks due to processing times.

Crucial Actions Following LLC Formation

Obtain an Employer Identification Number (EIN)

necessary if your LLC employs a large number of people. Get a free EIN from the IRS website.

Create an Operating Contract

While not required, an operating agreement is crucial for outlining management structure, ownership, and operational procedures, helping to prevent disputes.

Keep Your Personal and Business Assets Apart

Open a business bank account and keep business transactions separate from personal ones to maintain liability protection.

Submit Your Decennial Report

Pennsylvania requires a decennial report every 10 years to update business information. The next filing period is in 2031.

Also Evaluate LLCs in Florida, California, and New York USA

LLC in New York

Includes filing fees, a publication requirement, and biennial statements. The publication requirement can be costly due to the need to publish in newspapers For all information go and visit LLC in New York.

LLC in California

Involves filing fees and an annual franchise tax. Requires biennial Statement of Information filings but no publication requirement and Visit for further details click to LLC in California.

LLC in Florida

Requires filing Articles of Organization with a filing fee. No publication requirement and straightforward annual report filings. For more comprehensive details, please visit LLC in Florida.

Conclusion

Setting up an LLC in Pennsylvania is a strategic move for many entrepreneurs. Follow this step-by-step guide by TRUIC to navigate the process confidently. Whether forming a single-member or multi-member LLC, Pennsylvania provides a supportive business environment.

Ready to form your LLC? Visit TRUIC for user-friendly resources and start your LLC formation journey today. Together, let's make your company's vision a reality.

2 notes

·

View notes

Text

Public Limited Company Registration in Gurgaon

Enjoy a quick & seamless online Public Limited Company Registration process in Gurgaon. Kickstart your Company in Gurgaon with the expert assistance of RegisterKaro.

Step 1: Connect with our experts.

Step 2: Our experts will guide and prepare all the documents for Incorporation.

Step 3: Get your Company Incorporation Certificate in Gurgaon.

An Overview of Public Limited Company Registration in Gurgaon

In India, Gurgaon is one of the fastest growing cities and it’s an IT hub and it provides advantages to various companies. One of the main benefits of a Company registered in Gurgaon is the availability of a highly-skilled workforce composed mostly of technologically inclined professionals. Cutting edge infrastructure & favorable business laws in Gurgaon form a sustainable economic framework for start-ups. Further, its home to world-class tech companies luring fresh talent across the nation & a well-known startup epicenter. There is a huge scope for new Company Registration in Gurgaon.

At RegisterKaro, our experts help many clients every day for Company Registration in Gurgaon. Our experts will help you in the process of Company Registration in Gurgaon in a very small time frame subject to complete and proper documentation required for Online Company Registration in Gurgaon.

What are the Benefits of Public Limited Company Registration in Gurgaon?

With a strong infrastructure, flourishing IT Sector & a pro-business administration, Gurgaon provides a conducive environment for companies to grow & thrive. Gurgaon offers many benefits that can help your companies to succeed, including:

1. Secured assets;

2. Strong infrastructure;

3. Access to a large customer base;

4. Limited Liability Protection;

5. Easy access to Government Services;

6. Steadier contribution of capital & stability;

7. Business-friendly environment;

8. Exponential growth & expansion opportunities;

9. Access to capital.

Eligibility Criteria for Public Limited Company Registration in Gurgaon

Following is the eligibility criteria for Public Limited Company Registration in Gurgaon:

1. A minimum of 2 Shareholders & 2 Directors are required for Public Limited Company Registration and both the Directors & Shareholders can be the same people;

2. All businesses must have a registered office address from where they will conduct their business;

3. DSC (Digital Signature Certificate) and DIN (Director Identification Number) for all the Directors are also required;

4. The owners of the business will have to draft the required legal documents such as MoA, AoA & Shareholders Agreement;

5. At least one of the Directors must be an Indian Resident i.e., he or she must have stayed in India for at least 182 days in the last year.

For More info Click here :

#public limited company registration#Register Karo#company registration#Public Limited Company registration in Gurugram

2 notes

·

View notes

Text

Navigating the Digital Divide: China’s New Restrictions on Online Gaming and the Implications for Surveillance

Introduction

Critics argue that China’s recent move to restrict online gaming for minors has sparked global discussion about the potential consequences of such measures. While the intentions behind the regulations may be commendable, the implementation and potential outcomes raise concerns about individual privacy and the expansion of surveillance. This blog delves into the intricacies of China’s new gaming restrictions, exploring the potential consequences and their implications for surveillance.

China’s Online Gaming Restrictions: A Closer Look

According to (World Economic Forum 2021), in August 2021, China’s National Press and Publication Administration (NPPA) issued a notice imposing new restrictions on online gaming for minors. The regulations stipulate that minors are prohibited from playing online games during the weekdays, with a maximum of three hours of playtime permitted on weekends and holidays. Additionally, gaming companies are mandated to implement strict identification verification procedures and adopt real-name registration systems to ensure compliance. It was mentioned by (Inocencio 2021), that only on Fridays, Saturdays, Sundays, and national holidays - from 8pm to 9pm were kids allowed to play video games. On top of that real-name verification and log-in systems are now necessary for access to online games and gaming businesses are only able to provide three hours of service to young gamers during those short windows of time (Inocencio 2021).

Potential Consequences of the Restrictions

The implementation of these restrictions has the potential to impact various aspects of Chinese society, particularly among the young generation. One significant consequence is the potential for increased surveillance. To enforce the gaming restrictions, gaming companions may need to implement more stringent monitoring mechanisms, such as tracking playtime, game content, and user interactions. This increase in data collection could re=aise concerns about privacy and the potential for misuse of potential information (Xiao 2022). Restricting gaming for those under the age of eighteen can prevent addictions from forming, which some experts believe has serious ramification for the gaming business (Brooke 2021). Due to what research showed that gaming habits frequently develop in children, this may have an effect on China’s tech companies’ future earnings (Brooke 2021).

Impact on Individual Privacy

The expanded surveillance measures associated with the gaming restrictions could have a chilling effect on individual privacy. The constant monitoring of online activities could lead to self-censorship and a reluctance to engage in open and unfettered online interactions. This could potentially hinder the free flow of information and ideas, particularly among younger generations (Yaqoub, Jingwu & Ambekar 2023). This would ultimately be the same technological framework that shields kids from danger, restricts speech on the internet, and gathers a ton of personal information (Yang 2023).

Implications for Social Cohesion

The restrictions could also have implications for social cohesion. By limiting minors’ access to online gaming, which has become a significant social platform for rmany young people, the regulations could potentially fragment social connections and hinder the formation of online communities. This could lead to a sense of isolation and disconnection among younger generations (Yue, Teresiene & Ullah 2021). This would in turn make children become socially apprehensive and find it difficult to communicate with adults or their classmates (Shoppe 2021). It is also mentioned by (Shoppe 2021) that because humans are social beings that share knowledge with one another, social isolation can impede social and emotional development in addition to slowing intellectual progress.

Alternative Approaches

Instead of imposing strict restrictions, amore balanced approach could involve promoting healthier gaming habits and encouraging parental involvement in monitoring their children’s online activities. Educational programs could be implemented to teach minors about responsible gaming, cyberbullying prevention, and online safety. Additionally, promoting alternative leisure activities and encouraging physical and social interactions could help reduce excessive gaming among minors. One of the methods include to set a limit to one self. For example, setting timers for how long one plays a certain game and become conscious to the amount of time spent playing in a day even if one does not stop immediately after the timer goes off, awareness is still essential (Allan 2017).

Conclusion

China's new restrictions on online gaming for minors raise concerns about individual privacy, surveillance, and the potential impact on social cohesion. While the intentions behind the regulations may be to promote healthy habits and protect minors, the implementation could have unintended consequences that require careful consideration. A more balanced approach that focuses on education, parental involvement, and alternative leisure activities could be more effective in addressing the underlying concerns while minimizing potential negative impacts.

List of References

Allan, P 2017, ‘How to cut back on playing video games’, Lifehacker, 22 June, viewed 23 November 2023, <https://lifehacker.com/how-i-cut-back-on-playing-video-games-1796340031>.

Inocencio, R 2021, ‘What’s behind China’s new online gaming restrictions for kids?’, CBS News, 2 September, viewed 23 November 2023, <https://www.cbsnews.com/news/china-gaming-restrictions-online-crackdown-digital-technology/>.

Shoppe, S 2021, ‘Effects of social isolation on children’, Soul Shoppe, 5 October, viewed 23 November 2023, <https://soulshoppe.org/blog/2021/10/05/effects-of-social-isolation-on-children/#:~:text=It%20can%20make%20children%20anxious,hinder%20social%20and%20emotional%20growth.>.

World Econmic Forum 2021, What’s behind China’s video game restrictions, Media, Entertainment and Sport, viewed 22 November 2023, <https://www.weforum.org/agenda/2021/09/what-s-behind-china-s-video-game-restrictions/>..

Xiao, L 2022, ‘Reserve your judgement on “Draconian” Chinese video gaming restrictions on children’, Journal of Behaviroal Addictions, vol. 11, no. 2, viewed 22 November 2023, <https://www.ncbi.nlm.nih.gov/pmc/articles/PMC9295219/>.

Yang, Z 2023, ‘China is escalating its war on kids’ screen time’, MIT Technology Review, 9 August, viewed 23 November 2023, <https://www.technologyreview.com/2023/08/09/1077567/china-children-screen-time-regulation/>.

Yaqoub, M, Jingwu, Z & Ambekar, SS 2023, ‘Pandemic impacts on cinema industry and over-the-top platforms in China’, Media International Australia, 3 January, viewed 22 November 2023, <https://www.ncbi.nlm.nih.gov/pmc/articles/PMC9816632/>.

Yue, X, Teresiene, D & Ullah, I 2021, ‘How COVID-19 pandemic affect film and drama industry in China an evidence of nonlinear empirical analysis’, Economic Research-Ekonomska Istrazivanja, vol. 35, no. 1, viewed 22 November 2023, <https://www.tandfonline.com/doi/full/10.1080/1331677X.2021.1937262>.

3 notes

·

View notes

Text

Online Company Registration in India – Bright Legal Registration Services

Starting a business in India has become more accessible than ever, thanks to streamlined processes for online company registration in India. Whether you're setting up a small enterprise or a large-scale business, registering your company is a crucial first step. With the help of professional services like Bright Legal Registration Services, the entire process is simplified, ensuring that your business is legally compliant from the very start.

Why Online Company Registration is Important

Registering your business legally provides a number of advantages. First and foremost, it gives your business a formal structure and identity, which helps in building trust with clients, investors, and stakeholders. Secondly, online company registration in India offers tax benefits, protection from personal liability, and access to business loans or government grants.

Bright Legal Registration Services specializes in offering hassle-free online company registration in India, helping entrepreneurs navigate through legal formalities quickly and efficiently.

Types of Companies You Can Register Online in India

Before proceeding with Online Company Registration in India , it’s essential to understand the various types of companies you can register, depending on your business needs:

Private Limited Company: One of the most popular choices, a private limited company limits the liability of its shareholders and ensures a seamless transfer of shares.

Limited Liability Partnership (LLP): Ideal for businesses where the owners wish to share limited liability while maintaining flexibility in management.

One Person Company (OPC): A perfect solution for solo entrepreneurs, an OPC allows individuals to operate their business as a company while enjoying limited liability.

Public Limited Company: For large-scale businesses planning to raise capital from the public, this type of company structure is best suited.

Each of these structures requires specific documentation and follows particular guidelines for online company registration in India. Bright Legal Registration Services ensures that the entire registration process for any company type is quick, transparent, and compliant with the latest laws.

Key Steps for Online Company Registration in India

Registering a company online might sound complex, but with the right guidance from Bright Legal Registration Services, you can complete it with ease. Here's a simplified version of the steps involved in online company registration in India:

Obtain a Digital Signature Certificate (DSC): The DSC is essential for filing online forms for company registration. Each director must have a DSC to authenticate documents electronically.

Get a Director Identification Number (DIN): A DIN is assigned to each director, which is required to form a company in India. This is done through an application on the Ministry of Corporate Affairs (MCA) portal.

Name Approval: You will need to select and reserve a unique name for your company. The name should comply with the guidelines set by the Registrar of Companies (ROC).

Filing the Incorporation Forms: The next step in the Online company registration in India is filing the incorporation forms with the ROC, along with the Memorandum of Association (MOA) and Articles of Association (AOA).

Certificate of Incorporation: Once all the forms are submitted and verified, the ROC issues a Certificate of Incorporation, making your business officially registered.

Throughout the process, Bright Legal Registration Services offers complete support, making online company registration in India a stress-free experience.

Benefits of Choosing Bright Legal Registration Services for Online Company Registration

When it comes to online company registration in India, working with experts like Bright Legal Registration Services can save you time, effort, and even costs. Here are some reasons why they are the best choice:

Expert Guidance: With years of experience in company registration, Bright Legal Registration Services understands the legal requirements, ensuring that your business is set up without any delays.

Time-Efficient Process: They handle all the paperwork, document submission, and coordination with government authorities, making the process of online company registration in India faster and more efficient.

Transparent Pricing: No hidden costs, just transparent pricing with clear breakdowns for every step of the registration process.

Post-Registration Support: Bright Legal Registration Services also provides ongoing support for compliance, filing annual returns, and other legal formalities to ensure your business remains compliant after registration.

Why Online Company Registration in India is the Future

The shift toward online company registration in India has revolutionized the way businesses are formed. By leveraging online platforms, the Indian government has reduced paperwork, improved efficiency, and made it easier for entrepreneurs to register their businesses from any part of the country.

Services like Bright Legal Registration Services further simplify the process by offering end-to-end solutions for business incorporation, ensuring compliance with the Companies Act, 2013. Whether you're a first-time entrepreneur or an experienced business owner, the online registration process offers a cost-effective and time-efficient way to get your business up and running.

Conclusion

For entrepreneurs looking to establish their business in India, choosing Online Company Registration in India is a practical and efficient approach. With professional support from Bright Legal Registration Services, the entire process becomes streamlined, allowing you to focus on building your business while they take care of the legal formalities.

If you're ready to take the first step toward forming your company, let Bright Legal Registration Services be your trusted partner in online company registration in India. Their expertise, transparent pricing, and efficient process ensure a smooth registration experience, allowing you to launch your business with confidence.

#Online Company Registration in India#Bright Legal Registration Services#Best Online Registration in India

0 notes

Text

#Public limited Company registration in Bangalore#Public limited Company registration in Bangalore online#Online Public limited Company registration in Bangalore#Public limited Company registration in Karnataka#Public limited Company registration online in Bangalore

0 notes

Text

Public Ltd Company Registration in India - Online Process, Documents Required, Fees

A Public Limited Company is a type of business entity which has limited liability features and offers shares to the general public for raising equity capital. It is governed by the Companies Act, 2013 and registered under the Ministry of Corporate Affairs. It can be incorporated with a minimum number of seven members and at least three members must be the directors of the company.

A Public Limited Company has the benefits of limited liabilities and it can sell its shares to the general public for raising capital. It is suitable for large businesses that require huge capital and are registered under the Companies Act, 2013.

Advantages of Public Limited Company registration:

Limited Liability

Separate Legal Entity

Raise Capital

Credibility and Attention

Free Transferability of Shares

Minimum requirements for Public Limited Company registration:

Minimum of seven members is required

Minimum of 5 lakh rupees is required for share capital

At least three members must be the directors of the company

Public Limited Company Registration Fees:

The total cost of Public Limited Company registration in India, including government and professional fees, starts from ₹11,999 and takes around 14-21 working days.

To know more (click here)

#public limited company registration#business#india#startup#business growth#manage business#nidhi company registration#partnership firm registration#private limited company registration in bangalore#private limited company registration in chennai#private limited company registration online#indian business

0 notes

Text

How to Register a Company in Daman: A Step by Step Guide

Why Register a Business in Daman?

Daman offers several advantages for businesses. Its location provides easy access to major cities like Mumbai and Surat. Additionally, the region has tax incentives and relaxed regulatory frameworks that help reduce the overall cost of doing business. Entrepreneurs also benefit from lower operating costs compared to neighboring regions. Moreover, registering a company in Daman is relatively straightforward, making it an ideal choice for both startups and established businesses.

Types of Companies You Can Register

Before delving into the registration process, it’s essential to understand the different types of companies you can register in Daman:

Private Limited Company (Pvt Ltd): Suitable for businesses looking to raise capital, Daman register this structure limits liability to shareholders’ investments and is often preferred by startups.

Limited Liability Partnership (LLP): An LLP combines the benefits of a company and partnership. Partners are only liable for their capital investment, making it a safer choice for small businesses.

One Person Company (OPC): Ideal for solo entrepreneurs who wish to retain full control of their business while limiting personal liability.

Sole Proprietorship: The simplest form of business structure, Daman game login a sole proprietorship involves minimal compliance but offers no protection of personal assets.

Public Limited Company: This structure is ideal for large enterprises that plan to raise capital from the public. However, it comes with more stringent regulatory requirements.

Steps to Register a Company in Daman

Choose a Company Name

The first step is to choose a unique name for your company. The name should not infringe on any existing trademarks or resemble the names of already registered companies. You can check the availability of your desired name on the Ministry of Corporate Affairs (MCA) portal.

Obtain a Digital Signature Certificate (DSC)

To proceed with online registration, Daman login you’ll need a Digital Signature Certificate (DSC). This is mandatory for signing electronic documents during the registration process. You can obtain a DSC from any government-authorized agency.

Apply for Director Identification Number (DIN)

Each company director must obtain a Director Identification Number (DIN). You can apply for a DIN through the MCA portal by submitting proof of identity and address.

Prepare the Required Documents

You will need the following documents for company registration:

Proof of identity (PAN card, Aadhaar card) of directors.

Proof of address (utility bill, rent agreement) of directors and the registered office.

Memorandum of Association (MoA) and Articles of Association (AoA).

Passport-sized photographs of the directors.

File for Incorporation

Once all documents are ready, Daman game download file an online application for incorporation through the MCA portal. You will be required to submit the MoA, AoA, and other relevant documents during this stage. The system will also prompt you to pay the necessary registration fees.

Obtain the Certificate of Incorporation

After the application is reviewed and approved by the Registrar of Companies (ROC), you will receive a Certificate of Incorporation. This certificate signifies that your company is legally registered and can commence business operations.

Post-Registration Compliance

After successfully registering your company, you need to comply with certain post-registration requirements:

GST Registration: If your company’s turnover exceeds a specific threshold or if you are engaged in inter-state trade, you will need to register for Goods and Services Tax (GST).

Tax Registration: You must register for applicable taxes such as corporate income tax, professional tax, and others based on your business activity.

Trademark Registration: If you wish to protect your brand, consider registering your trademark.

Opening a Bank Account: You’ll need to open a corporate bank account in the name of your company for financial transactions.

0 notes

Text

Company formation in UK

Conquering the Kingdom: A Guide to Company Formation in UK

So, you've dreamt of venturing across the pond and planting your entrepreneurial flag in the fertile soil of the UK? Fantastic! But before you unleash your business prowess upon the land, there's a crucial task at hand: Company Formation in UK. Fear not, brave adventurer, for this guide will equip you with the knowledge and tools to navigate the process with confidence.

Step 1: Choosing Your Company Structure

First things first, decide what kind of kingdom you wish to build. The most popular choice is the limited company, offering personal liability protection and distinct legal identity from yourself. Consider other options like partnerships or sole traders, but weigh their limitations against your ambitions.

Step 2: Naming Your Noble Steed

Craft a company name that resonates with your brand and is available for registration with Companies House. Aim for something catchy, memorable, and reflective of your business. Remember, this is your banner in the marketplace, so choose wisely!

Step 3: Gathering Your Loyal Subjects

Assemble your founding team - directors and shareholders who will steer the company ship. Each member needs to provide personal details like addresses and shareholdings. If privacy is a concern, consider using nominee directors and shareholders, but be aware of the legalities involved.

Step 4: Establishing Your Royal Address

Every company needs a registered office address within the UK. This will be your official postal and public record location. Opt for a reliable provider who can offer virtual office services if a physical space isn't your immediate need.

Step 5: Registering with Companies House

This is where your company officially enters the realm of existence. You can register online through Companies House or utilize formation agents to ease the process. Be prepared to pay a registration fee and provide your chosen name, structure, and director/shareholder details.

Step 6: Taxing Matters and More

Once registered, you'll need to set up tax affairs with HMRC, including registering for Corporation Tax and PAYE if you plan to employ staff. Additional legal and administrative tasks may arise depending on your specific business nature.

Bonus Tip: Seek Guidance from Wise Counsel

While DIY formation is possible, navigating the nuances of UK company law can be tricky. Consider seeking expert advice from accountants, lawyers, or formation agents for a smoother journey.

Remember, dear entrepreneur, with careful planning and this guide as your compass, forming your company in the UK can be a thrilling adventure. Go forth, conquer the market, and establish your business kingdom with pride!

Masllp your way to success!

This blog post offers a lighthearted and informative approach to company formation in UK. You can tailor it further by:

Including specific information about Masllp and its services related to Company formation in UK.

Adding personal anecdotes or experiences to make the content more relatable.

Highlighting unique aspects of the UK business landscape that appeal to international entrepreneurs.

Providing links to useful resources and further information for readers.

With a bit of creativity and Masllp-specific details, you can turn this guide into a valuable resource for your target audience and establish yourself as an expert in the field.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services

3 notes

·

View notes

Text

Private Limited Company Registration In India

Your dream to start a business in India can't come to realization if you don't have a proper business entity to support it. A private limited company is India's most prominent form of business entity. From veterans to novices, from budding start-ups to established entrepreneurs, and from north India to south India, it is considered the best business entity.

In order to start your business with such an entity, you must go through four simple steps. The first step is to obtain the DSC signature, and the second is to apply for the Director Identification Number. Third, get name approval and fill SPICe+ form and lastly obtain PAN and TAN number.

One Person Company Registration

An OPC or One Person Company is a business format where a single person owns the company. There is no more than a single director or more than a single member. Being a single-handled company, an OPC is easy to manage. If you are an entrepreneur who seeks singular success, you can register as an OPC in India.

The definition of a One Person Company is explained in Sub Section 62 of Section 3 of the Companies Act, 2013, which states: “One Person Company means a company which features only one Member.” Therefore, unlike a Private Limited Company, this single company registration of a single owner doesn’t need a minimum of two directors. However, like a private limited company, the online One Person Company Registration in India does provide you with Limited Liability.

The process of company registration in India is simple and includes fewer steps. Apply for DSC and DIN, then send the name of the company for approval, collect all the documents, and file the form on the MCA website if the authority found the application and documents correct, then it provides you a status of One Person Company.

Nidhi Company Registration In India

Nidhi Company is a business entity in India governed under the Companies Act 2013. Its sole objective is to engage with thrift and savings among its members. A Nidhi Company is a Non-Banking Financial Institute that exclusively provides services like lending and deposits to its members. Therefore, it can be said a Nidhi Company in India only consists of funding from its members and shareholders.

Starting a Nidhi Company in India means starting a Non-Banking Financial Companies class. They are governed by the Reserve Bank of India. This body tells the registered Nidhi Company guidelines about lending and depositing activities. However, Nidhi Companies can only deal with their members. Therefore outside members are not allowed.

Startup Registration In India

In the initial days of the company, it is called a Startup. By starting a company in India, you take your first step in the business world. After setting up a company it comes under the category of startup for 10 years. To get the recognition, you must complete the startup registration.

In the process of registration, the government of India is helping businesses to grow. These schemes have many benefits and to take these benefits, the startup needs to register under the Department of Industrial Policy and Promotion (DPIIT). The startup businesses must fulfil the eligibility to obtain the certificate of a startup business.

Public Limited Company Registration In India

A Public Limited Company should be the preferred business choice in India if you plan to raise funds from the general public through Initial Public Offering (“IPO”) because public limited companies have been privileged under Securities Laws to access the capital market.

Sole Proprietorship Registration, Eligibility And Process

A sole proprietorship in India is the most popular form of business structure for micro and small businesses operating in the unorganized sectors due to its simplicity, ease of information access, and nominal cost. Because of these factors, single owners are going for sole proprietorship registration in India.

The sole owners are liable for all the business debts and have unlimited liability. So, their business and personal assets are at risk. getting a certificate of incorporation for sole Proprietorship is a good idea. However, obtaining a certificate of sole Proprietorship is generally unsuitable for medium and large-scale businesses due to the array of disadvantages like unlimited liability, no separate legal entity, non-transferability, and limited company life.

Company Partnership Registration In India

Partnership registration in India involves the legal process of establishing a partnership firm under the Indian Partnership Act, 1932. This process ensures that the partnership is legally recognized and the partners' rights and obligations are clearly defined. A partnership firm is a business entity where two or more individuals agree to operate a business together, sharing profits and losses according to the terms of their partnership agreement.

To register a partnership, the partners must prepare a partnership deed, which outlines the terms of the partnership, including the name of the firm, the nature of the business, the rights and duties of the partners, and the profit-sharing ratio. The partnership deed must be signed by all partners and should be registered with the Registrar of Firms to gain legal validity. Registration provides the partnership with a legal status and enhances its credibility, facilitating better access to financial and legal benefits.

Our Assistance In Company Registration In India

At GLOBAL TAXMAN INDIA Ltd, we provide end-to-end solutions for Company Registration. Our services.

GLOBAL TAXMAN INDIA Ltd is a leading legal consultancy firm, offering comprehensive services related to Company Registration in India.

Contact us .

Tel : +91-9811099550

Mail - [email protected]

Visit - www.globaltaxmanindia.com

0 notes

Text

Stepwise Process for Incorporating a Business in Hong Kong

Hong Kong is not just a city; it’s a thriving global business center. Its strategic location, strong legal system, and pro-business environment make it an ideal hub for entrepreneurs and companies looking to expand internationally. Whether you're a startup or an established business, understanding how to incorporate a company in Hong Kong is vital. This guide will walk you through the essential steps, from navigating the company registry to utilizing professional incorporation services.

Why Incorporate in Hong Kong?

Hong Kong provides significant advantages for businesses. With a free-market economy, low taxes, limited government intervention, and a legal system based on English common law, it’s one of the top choices globally for starting a business. Ranked 3rd worldwide in the World Bank's "Doing Business Report 2023," Hong Kong’s location also offers unmatched access to mainland China and the wider Asia-Pacific region.

Steps to Incorporate a Business in Hong Kong

Incorporating a company in Hong Kong is a straightforward process. Here's what you need to do:

Select a Company Name: Make sure your chosen name is unique by checking its availability on the Hong Kong company registry’s online tool.

Prepare Required Documents: These include the Articles of Association, Incorporation Form (NNC1 for private companies or NNC1G for public companies), and the Notice to Business Registration Office (Form IRBR1).

Submit Your Application: File your documents either online through the e-Registry or in person at the Companies Registry.

Obtain a Business Registration Certificate: After incorporation, apply for this certificate, which must be renewed annually.

Open a Corporate Bank Account: Choose a trusted bank in Hong Kong to handle your business finances.

Maintain Ongoing Compliance: Ensure you meet your statutory obligations, including annual returns, financial reports, and tax filings.

Why Use Professional Incorporation Services?

While incorporating in Hong Kong is relatively easy, professional services offer several benefits:

Expert Advice: Specialists with detailed knowledge of local regulations.

Time Savings: Speed up the incorporation process.

Compliance Support: Ensure you meet all legal requirements.

Additional Services: Providers often offer services like virtual offices, accounting, and secretarial assistance.

Key Regulatory Authorities

Understanding the regulatory bodies in Hong Kong is critical for smooth operations:

Companies Registry: Oversees company registration and ensures statutory compliance.

Inland Revenue Department (IRD): Manages tax matters and issues Business Registration Certificates.

Overcoming Common Challenges

Though the incorporation process is streamlined, there are a few challenges:

Complex Documentation: Preparing documents accurately can be challenging; professional assistance can simplify the process.

Opening a Bank Account: Hong Kong banks may have strict requirements; expert advice can be crucial.

Ongoing Compliance: Using a corporate secretarial service helps ensure your business remains compliant.

Conclusion

Incorporating a company in Hong Kong offers significant benefits, from its strategic location to a business-friendly climate. But what comes next? What challenges and insider tips could affect your success? There’s more to discover about setting up business in Hong Kong, and we can provide the insights you need.

#consulting#business consulting#business incorporation#hong kong business#business incorporation services#setting up business in Hong Kong#incorporating a business in Hong Kong

1 note

·

View note

Text

Getting to and from Luton Airport: A Guide to Luton Airport Taxis

Located just 28 miles north of Central London, Luton Airport is one of the UK's busiest airports, catering to millions of passengers annually. For travelers seeking a convenient and stress-free way to get to or from Luton Airport, taxis offer a reliable solution. Whether you're a business traveler needing a quick commute or a tourist exploring London, using a Luton Airport taxi service can make your journey smoother and more enjoyable. Here's everything you need to know about using taxis at Luton Airport.

1. Why Choose Luton Airport Taxis?

Taxis are a popular mode of transportation for several reasons. They offer the convenience of door-to-door service, which is particularly helpful if you're traveling with heavy luggage or in a group. Unlike public transportation, which may involve multiple changes and crowded conditions, taxis provide a direct route to your destination. Taxis can also save you time, especially if you're running on a tight schedule or arriving late at night when public transport options are limited.

2. How to Book a Luton Airport Taxi

Booking a taxi to or from Luton Airport is straightforward. There are various options available:

Pre-booking Online: Many taxi companies allow you to book a ride online in advance. This is a great option if you want to ensure availability and avoid waiting. Online booking platforms often allow you to compare prices, choose vehicle types (standard, executive, luxury), and provide flight details to track arrival times.

Phone Booking: You can also book a taxi by calling one of the many taxi services that operate in the area. They often provide 24/7 service, making them a reliable option for early morning or late-night flights.

Walk-Up Services: If you haven't pre-booked, you can find taxis waiting outside the arrivals terminal at Luton Airport. While this may sometimes lead to a longer wait during peak times, it’s a convenient option for last-minute travel.

3. Types of Taxi Services Available

Standard Taxis: These are regular taxis that provide comfortable and reliable transportation. They are suitable for solo travelers or small groups with minimal luggage.

Executive Taxis: For those looking for a more luxurious experience, executive taxis offer high-end vehicles such as Mercedes-Benz or BMW. These are ideal for business travelers who need a comfortable and professional mode of transport.

Minibuses: If you're traveling with a larger group or have lots of luggage, minibus services are available. They can accommodate up to eight passengers, making them a cost-effective option for families or groups.

4. Cost of Luton Airport Taxis

The cost of a taxi ride from Luton Airport to Central London typically ranges from £80 to £100, depending on the type of vehicle and the time of day. Fares are usually higher during peak hours or at night. Pre-booking can sometimes offer discounts or fixed rates, which can be more economical than metered taxis. It's advisable to check with the taxi company for an estimated fare before booking.

5. Benefits of Pre-Booking a Taxi

Guaranteed Availability: By pre-booking, you ensure that a taxi will be waiting for you when you arrive, which is especially important during peak travel seasons or late-night flights.

Flight Tracking: Many taxi services offer flight tracking, which means your driver will be aware of any delays and adjust the pickup time accordingly.

Fixed Rates: Pre-booking often provides fixed rates, which can be cheaper and avoids the uncertainty of metered fares.

6. Tips for a Smooth Taxi Experience

Confirm Your Booking: Always confirm your taxi booking a day before your travel to avoid any last-minute issues.

Know Your Driver: Some services send driver details, including their name and car registration number, for security and peace of mind.

Check for Extra Charges: Ask if there are additional fees for luggage, waiting time, or late-night trips, so you are not caught off guard.

Conclusion

Luton Airport taxis provide a convenient, comfortable, and reliable way to travel to and from the airport. Whether you're a solo traveler, business executive, or part of a large group, there is a taxi service to meet your needs. By considering your options and booking in advance, you can ensure a smooth and stress-free journey. Safe travels!

0 notes

Text

Mastering Melbourne Short Rental Management for Maximum Success

The short-term rental market in Melbourne is booming, with property owners seizing the opportunity to earn income from tourists and short-term visitors. However, managing a short-term rental effectively can be challenging without the right strategies in place. Whether you’re a new host or a seasoned property owner, understanding how to navigate Melbourne's short rental management landscape is crucial for maximizing your success.

In this guide, we’ll cover everything from setting up your property to choosing the right management company, ensuring your short-term rental thrives in Melbourne's competitive market.

The Essentials of Melbourne Short Rental Management for New Hosts

Understanding Melbourne’s Short-Term Rental Regulations

Before diving into short-term rentals, it’s essential to understand the legal framework in Melbourne. Melbourne's short-term rental regulations are designed to maintain harmony in residential areas while fostering tourism. Hosts must comply with these requirements to avoid penalties.

Key Legal Requirements and Compliance

Short-term rental properties in Melbourne must adhere to local regulations, including occupancy limits, noise restrictions, and guest behavior policies. Depending on your property’s location, specific zoning rules may apply, restricting short-term rentals in certain areas.

Licensing and Registration Procedures

In some cases, registering your property with the local council may be required. Additionally, ensuring your property meets Melbourne's fire safety and building standards is crucial for guest safety and compliance.

Local Zoning and Safety Standards

Zoning laws vary by suburb, so it’s important to understand how they impact short-term rental operations. Safety features such as smoke alarms, fire extinguishers, and emergency exit plans should also be in place to protect your guests and meet regulations.

Setting Up Your Property for Short-Term Rentals

Once the legal aspects are covered, it’s time to focus on preparing your property for guests. Melbourne’s travelers expect comfort, style, and convenience, so your rental should cater to these needs.

Essential Amenities and Furnishings

A well-furnished rental can significantly enhance the guest experience. Essentials like high-quality bedding, Wi-Fi, kitchen appliances, and toiletries are must-haves. Offering extras such as Netflix, board games, and local travel guides can set your property apart from competitors.

Designing for Guest Comfort and Appeal

Creating an inviting space is key to securing bookings. Consider a stylish yet practical interior design that appeals to both leisure and business travelers. Melbourne is known for its chic, modern aesthetic, so aligning your decor with local trends can help attract more guests.

Creating an Inviting and Functional Space

Think about how you can make the space as functional as possible. From storage solutions to a well-equipped kitchen, making the space user-friendly ensures guests feel at home, increasing the likelihood of positive reviews and repeat bookings.

Optimizing Your Listing for Melbourne Short-Term Rentals

Once your property is ready, crafting an appealing online listing is the next step in attracting guests.

Crafting an Engaging Property Description

Your property description should highlight the unique features of your rental while also appealing to potential guests' needs. Include details about your location, nearby attractions, and what makes your property stand out in Melbourne's short-term rental market.

Taking Professional Quality Photos

High-quality photos are one of the most effective ways to increase your listing’s visibility. Consider hiring a professional photographer to showcase your property in its best light, capturing key features such as open spaces, natural lighting, and luxurious touches.

Highlighting Unique Features and Benefits

Does your property have a stunning view, proximity to public transport, or unique architectural design? Be sure to emphasize these points. Highlighting what makes your rental special can help draw in more bookings.

How Melbourne Short Rental Management Experts Can Boost Your Revenue

Partnering with a Melbourne short rental management company can elevate your property’s performance, especially when it comes to maximizing revenue.

Dynamic Pricing Strategies by Melbourne Short Rental Managers

Professional management companies use sophisticated tools to adjust rental prices based on market demand, ensuring you never miss out on potential income.

Understanding Market Demand and Trends

Melbourne's rental market fluctuates with the seasons, events, and local tourism trends. A short-term rental manager can analyze these factors and adjust pricing to reflect peak and off-peak periods.

Tools for Automated Pricing Adjustments

Dynamic pricing tools allow management companies to automatically update your rental prices based on demand. These tools ensure you stay competitive while optimizing your revenue.

Seasonal and Event-Based Pricing Tips

Melbourne hosts numerous events, from the Australian Open to the Melbourne International Comedy Festival. Taking advantage of these events by adjusting your pricing accordingly can significantly boost your earnings.

Marketing Your Short-Term Rental Effectively

In a competitive market like Melbourne, effective marketing is essential to attract guests and maintain high occupancy rates.

Leveraging Popular Booking Platforms

Melbourne short rental managers are experts at listing properties on top booking platforms like Airbnb, Booking.com, and Expedia. They optimize your listings to ensure they are highly visible to potential guests.

Utilizing Social Media and Online Advertising

Social media is a powerful tool for reaching a broader audience. Short rental managers can create targeted advertising campaigns on platforms like Instagram and Facebook to promote your property.

Building a Strong Online Presence and Reputation

A management company can help build your rental’s reputation by encouraging guests to leave reviews, engaging with customers online, and responding to inquiries promptly.

Enhancing Guest Experience to Increase Reviews

Providing a memorable guest experience leads to positive reviews, which are crucial for maintaining a high ranking on booking platforms.

Providing Exceptional Customer Service

Excellent guest service is the cornerstone of a successful rental. Melbourne short rental managers ensure smooth communication and timely responses, which enhances the overall guest experience.

Creating Personalized Guest Welcome Packs

Offering personalized touches such as a welcome pack with local snacks, drinks, and maps of Melbourne’s best attractions can make a lasting impression on guests.

Implementing Guest Feedback for Continuous Improvement

Actively seeking and implementing guest feedback ensures that your property is always improving. Addressing any issues guests have mentioned in reviews can boost future guest satisfaction.

Streamlining Operations with Melbourne Short Rental Management Services

Managing day-to-day operations can be overwhelming, especially if you own multiple properties. Melbourne short rental management companies can take over these tasks, ensuring smooth operations.

Day-to-Day Operations and Maintenance

Managing Cleaning and Turnover Schedules

Ensuring your property is spotless between guest stays is critical. Professional cleaning teams can handle quick turnovers, leaving your rental ready for the next guest.

Handling Repairs and Upkeep Efficiently

From minor repairs to regular maintenance, a management company ensures that your property remains in top condition, minimizing the risk of guest complaints.

Coordinating with Service Providers

Whether it's managing gardeners, electricians, or plumbers, rental management companies coordinate all service providers to keep your property running smoothly.

Guest Communication and Support

Handling Inquiries and Booking Requests

Promptly responding to inquiries and managing bookings is essential for securing guests. A management company handles all guest communication, ensuring nothing slips through the cracks.

Managing Check-Ins and Check-Outs Smoothly

From arranging key handovers to ensuring a smooth check-out process, professional property managers ensure a hassle-free experience for both you and your guests.

Resolving Issues and Complaints Promptly

Handling guest complaints quickly and effectively is key to maintaining a positive reputation. Management companies ensure that any issues are dealt with promptly and professionally.

Financial Management and Reporting

Tracking Income and Expenses

A short-term rental manager tracks all income and expenses, providing you with a clear picture of your property’s financial performance.

Generating Financial Reports and Statements

Monthly financial reports allow you to monitor the success of your property and make informed decisions for future investments.

Understanding Tax Implications and Deductions

Short-term rental managers also help with understanding tax deductions and implications, ensuring you are maximizing your financial returns.

Choosing the Right Melbourne Short Rental Management Company

Selecting the right short rental management company is critical to your property’s success.

Evaluating the Services Offered

Comprehensive Management vs. A La Carte Services

Some companies offer full-service management, while others allow you to choose specific services. Decide which option works best for your needs.

Comparing Service Packages and Costs

Compare service packages and pricing structures to find the best fit for your property. Consider the services that will offer the most value.

Checking for Additional Support and Perks

Some companies may offer additional perks such as interior design consultation, professional photography, or concierge services for guests.

Assessing the Experience and Reputation of Management Companies

Reviewing Client Testimonials and Case Studies

Check reviews and case studies from previous clients to gauge the company’s performance and reputation.

Industry Certifications and Professional Associations

Industry certifications and professional affiliations are a good indicator of a management company’s credibility.

Success Stories and Track Record

Look for a company with a proven track record of success, particularly in Melbourne’s competitive short-term rental market.

Understanding the Contract Terms and Conditions

What to Look for in Management Agreements

Read the contract carefully to understand the terms, including service fees, cancellation policies, and management responsibilities.

Negotiating Fees and Service Levels

Don’t be afraid to negotiate the terms and fees to suit your needs and ensure you’re getting the best possible service.

Ensuring Transparent and Fair Terms

Ensure the contract is transparent, with no hidden fees or vague terms that could lead to misunderstandings down the line.

Conclusion

Managing a short-term rental in Melbourne requires a mix of strategic planning, market knowledge, and exceptional guest service. Whether you choose to manage your property yourself or work with a professional Melbourne short rental management company, the key to success lies in preparation, pricing, and guest satisfaction.

By following the insights shared in this guide, you’ll be well on your way to maximizing your property’s potential and achieving long-term success in Melbourne’s short-term rental market.

0 notes