#pvt ltd registration

Text

0 notes

Text

One-Person Company Registration: Power to Solo Entrepreneurs

OPC in India opens huge avenues for individual entrepreneurs to hold a private limited company (PVT. LTD.,) where a person will have titles of owner, director, and shareholder all in his name. This efficient business structure melds the benefits of corporate distinctiveness together with the simplicity of sole proprietorship.

Now, the major advantages of OPC registration are:

●Easy formation with minimum documentation

●The limited liability protection for the owner.

●Related tax benefits

●Operational flexibility

The entire work of registration encompasses name approvals, getting DSC and DIN, incorporation certificate, and other important documents like Memorandum and Articles of Association. Other procedures include getting e-PAN, TAN, GST, and opening a bank account.

Though OPCs come with many advantages, they are only available to Indian citizens and a few NRIs. A foreign individual is not allowed to set up an OPC, and the minimum authorized capital mandated in an OPC is INR 1 lakh. OPC registration thus offers a wonderful platform for any venture in India’s emerging economy where aspiring entrepreneurs are looking for a formal business structure with personal control.

Aanoor Global: Your Partners in Trust for OPC Company Registration

Aanoor Global provides expert assistance to any entrepreneur who wishes to go through the OPC registration process without a single glitch. With a deep understanding of Indian corporate laws and their registration procedures, we can help entrepreneurs through each step of OPC formation while bringing compliance and efficiency on board. From name reservation to final incorporation, Aanoor Global will make the journey of establishing your one-person company very smooth.

Ready to start your business journey in Chennai? 🚀 Get done your company registration today and take the first step toward success!

Our team of experts will handle end to end support for paperwork, ensuring a smooth and hassle-free process.

For More details Call/WhatsApp +91–7401565656

#company registration#OPC registration#LLP registration#Pvt ltd Registration#partnership registration#Proprietorship Registration

1 note

·

View note

Text

Pros and Cons: The Downside of Registering a Private Limited Company in India

When we talk about the business structure for your new venture in India, a Private Limited Company comes as the most attractive option. A Privat Limited Registration is the most popular choice of entrepreneurs in India due to its numerous benefits. But as a coin has two sides, similarly along with benefits there are some drawbacks also. Here, in this article we will tell you about the disadvantages of a Pvt Ltd Registration.

Disadvantages of Private Limited Company Registration in India

High Compliance Costs: One of the primary limitations of Pvt Ltd Company registration in India is its high costs of compliances. The compliance cost of a Private limited company includes registration costs & cost of online compliance.

Restricted Share Transfer: The other major limitation of a Pvt Ltd Company registration in India is the restriction imposed on the transfer of shares. The members of a Private Limited Company neither transfer their shares freely to the general public nor sell them on the stock exchange of platforms.

Limited Access to Capital: A Private Limited Company cannot raise the capital from the general public as its members can’t sale their shares. A Pvt Ltd company can raise the funds only from smaller shareholders or private investors and not from the general public.

Complicated Dissolution Process: The complexity and legal formalities that have been associated with the process of dissolution of a Pvt Ltd Registration is a challenge and also create an additional burden for the directors and shareholders of the company.

Limited Number of Shareholders: As per the Companies Act 2013, a Pvt Ltd Registration can have a maximum number of 200 shareholders.

Complication in Expansion: Unlike other business structures, it can be complicated to expand a Private limited Company. If you want to expand your private company, it requires several regulatory approvals which can be more complex and time consuming.

Lack of Confidentiality and Privacy: As a registered entity, a private limited company has to disclose some crucial information to the regulatory authorities and has to make it available for the public inspection. Some important documents including annual return and financial statements can become accessible to the competitors, stakeholders and even general public

Strict Regulatory Requirements: It is compulsory for the Private Limited Company to stick to the regulatory requirements. There are mandatory filings including annual returns, financial statements, and director reports with ROC. For a Private limited registration, regular board meetings and AGMs are also compulsory.

Conclusion

As we told you earlier that just like a coin has two sides, a Private Limited Company Registration in India also has its own set of benefits & limitations. The above given disadvantages can impact your business operations and growth. So, you should remember that before deciding on this business structure in India, careful consideration and professional advice are crucial.

#register pvt ltd company online#Private Limited Registration#pvt ltd company registration in india#private limited company registration process#pvt ltd registration#pvt ltd company registration online#private limited company registration in india#pvt ltd company registration#private limited company registration

0 notes

Text

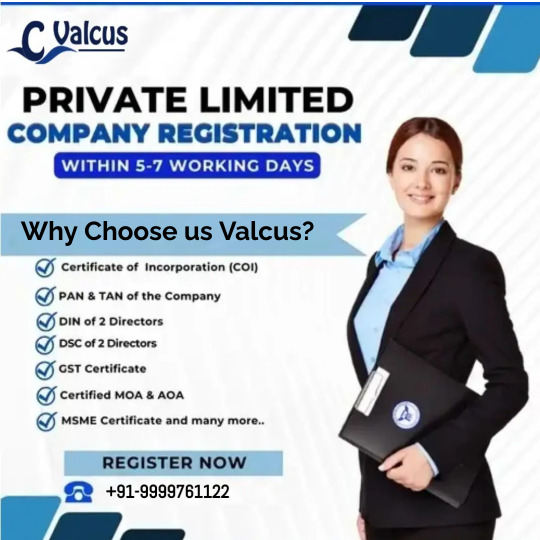

Starting a business is exciting, and picking the right structure is crucial. In Delhi, many business owners choose Private Limited Company registration (Pvt Ltd) for its credibility, limited liability, and growth potential. Let us break down the important steps and benefits of this process in simple terms. https://www.valcus.in/private-limited-company-registration.php

#ca services#gst registration#trust registration#ngo registration#ngo registration online#pvt ltd registration

1 note

·

View note

Text

Public or Private? Understanding the Dynamics of Company Registration

In the dynamic landscape of business, the choice between a Public Limited Company (PLC) and a Private Limited Company (Ltd) is a pivotal decision that significantly impacts a company’s structure, operations, and long-term goals. Understanding the dynamics involved in Public and Private Limited Company registration, assisting entrepreneurs in making informed choices for their business ventures.

Defining the Basics

In this section, we will delve into the fundamental differences between Public and Private Limited Companies. Exploring their definitions, structures, and key characteristics will set the stage for a deeper understanding of registration dynamics.

Ownership and Shareholding Structure

One of the primary distinctions lies in ownership and shareholding structures. We’ll discuss how Private Limited Companies have restrictions on the transfer of shares, fostering a more controlled ownership environment. In contrast, Public Limited Companies allow shares to be traded publicly, attracting a broader range of investors.

Capital Formation and Fundraising

Examining the dynamics of capital formation is crucial. We’ll explore how both Private and Public Limited Companies raise capital, with Private Limited Companies often relying on a smaller group of investors and Public Limited Companies having the ability to raise funds through public offerings.

Regulatory Compliance and Disclosure Requirements

Understanding the regulatory landscape is paramount for any company. We’ll delve into the compliance and disclosure requirements for both types of companies, shedding light on how Public Limited Companies face more stringent regulations due to their public nature.

Listing on Stock Exchanges

For Public Limited Companies, listing on stock exchanges is a significant step. We’ll explore the advantages and challenges associated with being publicly listed, including increased visibility, access to a larger pool of investors, and the regulatory obligations that come with it.

Decision-Making Processes

Moving into the internal dynamics, we’ll discuss the decision-making processes in Private and Public Limited Companies. Private Limited Companies often have a more streamlined decision-making structure, while Public Limited Companies may experience complexities due to the larger number of stakeholders.

Flexibility and Privacy

Flexibility and privacy considerations play a crucial role in choosing the right company structure. Private Limited Companies offer more flexibility in operations and decision-making, along with a higher level of privacy. We’ll examine how these factors can impact the day-to-day functioning of businesses.

Going Public: Transitioning from Private to Public Limited

For entrepreneurs considering the transition from a Private to a Public Limited Company, this section will provide insights into the process, challenges, and benefits. We’ll discuss the strategic considerations and preparations necessary for a successful shift to a public listing.

Case Studies and Real-Life Examples

To enhance practical understanding, we’ll explore case studies and real-life examples of successful Private and Public Limited Companies. This section aims to showcase how companies of varying sizes and industries have navigated the dynamics of their chosen registration status.

Conclusion

In conclusion, this blog has provided a detailed exploration of the dynamics involved in Private and Public Limited Company registration. Whether prioritizing control and privacy or aiming for broader capital access and visibility, entrepreneurs can now make informed choices that align with their business goals. Understanding these dynamics is crucial for laying the foundation of a resilient and successful company in today’s competitive business environment.

0 notes

Text

5 Reasons to Register a Company

Welcome to Vyaapar Seva Kendra, your trusted partner for all your business registration and compliance needs. In today's blog, we will explore the compelling reasons why registering a company is a smart decision for aspiring entrepreneurs and businesses of all sizes.

1. Legal Recognition and Protection

One of the foremost reasons to register a company is the legal recognition and protection it offers. When you register your company, it becomes a separate legal entity, distinct from its owners. This separation provides a shield that protects your personal assets from the company's liabilities. In other words, your personal assets, such as your home and savings, are not at risk if the company faces financial troubles.

2. Credibility and Trust

A registered company carries a higher level of credibility and trust in the eyes of customers, partners, and investors. It signifies a commitment to professionalism and adherence to legal standards. Many clients and businesses prefer to work with registered companies, enhancing your business opportunities and partnerships.

3. Access to Funding

If you plan to raise capital through investors or secure loans from financial institutions, registering your company is often a prerequisite. Investors and lenders are more likely to support a registered company as it signifies a higher level of commitment and accountability.

4. Brand Building and Intellectual Property Protection

Registering your company name not only establishes your brand but also provides protection against others using a similar name. This safeguards your brand identity and prevents potential confusion in the market. Additionally, registering trademarks and patents becomes easier for a registered company, further protecting your intellectual property.

5. Tax Benefits and Incentives

Depending on your country and business structure, registering a company can offer significant tax advantages. It allows you to take advantage of tax deductions, credits, and incentives that may not be available to sole proprietors or partnerships. Properly structured, your company can help you optimize your tax liabilities and improve your bottom line.

Conclusion

Registering a company is a strategic move that can provide a range of benefits, from legal protection to financial advantages. It enhances your business's credibility, opens doors to funding opportunities, and offers protection for your brand and intellectual property. Additionally, it can lead to substantial tax benefits, helping your business thrive.

At Vyaapar Seva Kendra, we understand the importance of company registration and are here to guide you through the process. Our expert team can assist you in navigating the complexities of registration, ensuring that your business enjoys all the advantages of legal recognition.

Don't miss out on the opportunities that come with registering your company. Visit our website here to learn more about our services and start your journey towards a successful and legally recognized business entity today. Register your company, and unlock the doors to growth and success!

2 notes

·

View notes

Text

Private Limited Company Registration

#privatelimited#privatelimitedcompany#private limited incorporation#pvt ltd company registration#pvt ltd

0 notes

Text

Setting up a private limited company Registration can be a complex process with various legal and financial challenges along the way. From choosing the proper business structure to navigating through the paperwork and regulations, there are several hurdles to overcome in the registration process. Understanding and addressing these common challenges is crucial for a successful registration. In this blog, we will explore the common challenges that arise during private limited company registration and provide valuable insights on how to overcome them effectively.

0 notes

Text

Proprietorship Firm Registration

Looking for Sole Proprietorship Registration? Now do a Proprietorship Firm Registration at the best price with the expert advice of Vedkee Associates. Contact Us for more details...Read more

#vedkee associates#gst consultant#company registration consultants#pvt ltd company registration in india

0 notes

Text

How to File Your Pvt Ltd Company Registration Online

Private Limited Company Registration: A Comprehensive Guide

A Private Limited Company (Pvt Ltd) is one of India's most popular business structures. It offers limited liability to its shareholders, restricts the number of shareholders, and prohibits public trading of shares. Registering a Private Limited Company involves several steps, legal formalities, and compliance requirements. This guide will walk you through India's Private Limited Company registration process.

Key Features of a Private Limited Company

Limited Liability: Shareholders' liability is limited to their shareholding.

Separate Legal Entity: The company is distinct from its owners.

Perpetual Succession: The private company continues to exist regardless of changes in ownership.

Minimum and Maximum Shareholders: Minimum of 2 and 200 shareholders.

Restrictions on Share Transfer: Shares can only be transferred with the consent of other shareholders.

Prerequisites for Registration

Directors: Minimum of 2 and a maximum of 15 directors.

Shareholders: Minimum of 2 and a maximum of 200 shareholders.

Registered Office Address: An address in India to receive official correspondence.

Capital Requirements: No minimum capital requirement exists, but the capital amount should be stated.

Digital Signature Certificate (DSC): All proposed directors and shareholders are required.

Director Identification Number (DIN): Required for all proposed directors.

Steps to Register a Private Limited Company

Obtain Digital Signature Certificate (DSC)

All proposed directors and shareholders must obtain DSCs. This ensures secure online filing of documents.

Apply for a Director Identification Number (DIN)

Directors must obtain DINs by submitting the required forms, proof of identity, and address.

Name Approval

Propose and reserve a unique company name through the MCA portal's RUN (Reserve Unique Name) web service. Ensure the name complies with the naming guidelines.

Prepare and File Incorporation Documents

Draft the Memorandum of Association (MOA) and Articles of Association (AOA).

File the SPICe+ (Simplified Proforma for Incorporating Private Company Electronically Plus) form along with the necessary documents:

MOA and AOA

Declaration by directors and shareholders

Proof of registered office address

Identity and address proof of directors and shareholders

Payment of Fees

Pay the prescribed government fees and stamp duty, which varies based on the state of incorporation and authorised capital.

Certificate of Incorporation

A Certificate of Incorporation is issued upon verification and approval by the Registrar of Companies (ROC). This certificate includes the Company Identification Number (CIN).

Apply for PAN and TAN

After incorporation, apply for the company's Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN).

Post-Incorporation Compliance

Bank Account: Open a current bank account in the company’s name.

Registered Office: Ensure the registered office is operational within 30 days of incorporation.

Commencement of Business: File a declaration for the commencement of business within 180 days of incorporation.

Statutory Registers: Maintain statutory registers and records.

Compliance Filings: Regularly file annual returns, financial statements, and other compliance documents with the ROC.

Benefits of Registering a Private Limited Company

Credibility and Trust: Enhances the company’s credibility and attracts investors.

Limited Liability Protection: Safeguards personal assets of shareholders.

Ease of Raising Capital: Raising funds from investors and financial institutions is more effortless.

Tax Benefits: Avail various tax deductions and benefits.

Perpetual Existence: Continues to exist irrespective of changes in ownership.

Conclusion

Private Limited Company Registration is a systematic process that offers numerous advantages regarding credibility, limited liability, and growth potential. Following the steps outlined in this guide, you can successfully establish your Private Limited Company and leverage its benefits for business success.

0 notes

Text

Unlock Business Potential with Expertpoint’s Private Limited Company Registration Services in Chennai

In Chennai's vibrant business landscape, establishing a Private Limited Company (PLC) offers numerous advantages, including limited liability, access to funding, and credibility among stakeholders. If you're looking to register a Private Limited Company in Chennai, Expertpoint provides comprehensive services designed to simplify the process and ensure compliance with regulatory requirements.

Understanding Private Limited Company Registration

A Private Limited Company is a popular corporate structure known for its separate legal entity status and limited liability protection for its shareholders. Registering a Private Limited Company in Chennai involves several steps regulated by the Ministry of Corporate Affairs (MCA), aimed at establishing legal recognition and operational legitimacy.

Expertpoint’s Private Limited Company Registration Services

Expertpoint specializes in providing efficient and reliable Private Limited Company registration services tailored to meet the specific needs of businesses in Chennai. Here’s how our services can benefit you:

1. Private Limited Company Registration in Chennai:

We facilitate Private Limited Company registration in Chennai, guiding you through the entire process from name reservation to obtaining the Certificate of Incorporation.

Our experts ensure compliance with all statutory requirements, making the registration process smooth and hassle-free.

2. Online Private Limited Company Registration in Chennai:

Embracing digital transformation, we offer online Private Limited Company registration services in Chennai for convenience and efficiency.

Our online platform allows you to initiate and track the progress of your application, providing real-time updates and ensuring transparency throughout the process.

3. Private Limited Company Registration Service in Chennai:

Expertpoint provides comprehensive Private Limited Company registration services in Chennai, including drafting and filing necessary documents such as Memorandum of Association (MoA) and Articles of Association (AoA).

We ensure that your application is accurate and complete, minimizing the risk of delays or rejections.

4. Private Limited Company Incorporation Service in Chennai:

As a trusted service provider, Expertpoint offers secure and user-friendly Private Limited Company incorporation services in Chennai.

Our team of experts assists you in understanding the legal requirements and implications of incorporating a Private Limited Company, ensuring compliance with MCA guidelines.

Why Choose Expertpoint?

Expertise and Experience:

With years of experience in corporate law and business registration, Expertpoint has helped numerous entrepreneurs and businesses establish their Private Limited Companies in Chennai. Our team of professionals is well-versed in the intricacies of Private Limited Company registration, ensuring thorough guidance and support throughout the process.

Personalized Service:

At Expertpoint, we understand that every business is unique. We provide personalized Private Limited Company registration services tailored to your specific requirements and business goals. Whether you're a startup or expanding your operations, our services are designed to meet your needs effectively.

Compliance Assurance:

Compliance with regulatory requirements is crucial when establishing a Private Limited Company. Expertpoint ensures that your registration adheres to all legal provisions and guidelines, minimizing the risk of errors or omissions.

Transparent Process:

Transparency is fundamental to our service approach at Expertpoint. We keep you informed at every stage of the Private Limited Company registration process, providing clarity and peace of mind. Our commitment to transparency fosters trust and confidence in our services.

Conclusion

Establishing a Private Limited Company offers significant advantages for entrepreneurs looking to scale their businesses while maintaining limited liability protection. With Expertpoint’s Private Limited Company registration services in Chennai, you can embark on your entrepreneurial journey with confidence and compliance.

Ensure legal recognition, operational legitimacy, and growth opportunities with Expertpoint’s Private Limited Company registration services in Chennai. Contact us today to learn more about how we can help you achieve your business goals efficiently and effectively. Visit : https://expertpoint.in/private-limited-company-registration/

0 notes

Text

#private limited company registration#private limited company registration in india#pvt ltd company registration online#pvt ltd registration#private limited company registration process#Private Limited Registration#register pvt ltd company online

0 notes

Text

0 notes

Text

Private Limited Company Registration in India | Effortless Process

Introduction to Private Limited Company Registration

Starting a business in India often begins with the process of registering a Private Limited Company, a popular choice among entrepreneurs due to its benefits. This chapter introduces the concept of a Private Limited Company, outlining its advantages and the importance of proper registration.

Understanding the Legal Framework

This section delves into the legal framework governing Private Limited Company registration in India. It covers the Companies Act, 2013, and other regulatory compliance requirements essential for registration. Understanding these legal aspects is crucial for aspiring business owners.

Step-by-Step Guide to Private Limited Company Registration

This comprehensive guide offers a detailed, step-by-step process for registering a Private Limited Company in India. From name reservation and obtaining Director Identification Numbers (DIN) to filing incorporation documents and obtaining the certificate of incorporation, this chapter simplifies the otherwise complex process.

Documentation and Requirements

Detailed information on the necessary documentation and specific requirements for Private Limited Company registration is provided here. This includes documents related to identity proofs, address proofs, and other essential paperwork mandated by the Registrar of Companies (ROC).

Benefits of Private Limited Company Registration

Enumerating the advantages of registering a Private Limited Company, this chapter discusses benefits such as limited liability protection, access to funding, credibility, and ease of ownership transfer. Understanding these benefits can influence entrepreneurs’ decisions regarding the type of business entity they choose to establish.

Compliance and Post-Registration Obligations

Post-registration obligations and compliance requirements are crucial for maintaining a Private Limited Company’s legal standing. This section highlights annual filing requirements, tax compliance, conducting board meetings, and maintaining statutory records.

Common Mistakes to Avoid

To prevent potential setbacks during the registration process, this chapter outlines common mistakes made by entrepreneurs when registering a Private Limited Company. Learning from these mistakes can save time, effort, and resources.

Conclusion — Making Company Registration Effortless

In conclusion, summarizing the key points discussed throughout the blog, emphasizing the importance of meticulous planning, adhering to legal requirements, and seeking professional guidance to make the Private Limited Company registration process as seamless as possible.

0 notes

Text

LLP vs Ltd: What’s the Difference?

When it comes to developing a firm entrepreneur usually find themselves at a crossroads attempting to identify one of the most efficient structure for their brand-new venture. Among one of the most usual kinds of company entities in numerous nations are the Limited Liability Partnership (LLP) together with the Private Limited Company (Ltd). Both have their particular benefits plus drawbacks as well as the option mainly depends upon the particular requirements plus objectives of business. This post will certainly look into the distinctions in between LLP coupled with Ltd concentrating on the company registration LLP process plus Pvt Ltd company registration process.

Understanding LLP (Limited Liability Partnership)

An LLP is a crossbreed business framework that includes aspects of both collaborations and also restricted responsibility firms. It supplies the adaptability of a collaboration while giving the minimal obligation defense of a firm.

Key Features of LLP

Limited Liability Protection: Partners in, an LLP are not straight responsible for the financial obligations of service. Their responsibility is restricted to the quantity they have actually bought the LLP.

Flexible Management Structure: Unlike a personal minimal firm an LLP does not call for an official framework with supervisors and also investors. Allies can handle business straight.

Taxation: LLPs typically gain from pass-through tax definition business itself is not strained. Rather earnings as well as losses are travelled through to the companions that report them on their specific income tax return.

Compliance and Regulatory Requirements: LLPs usually have less conformity needs contrasted to personal minimal firms. Yearly conformity as well as governing filings are less complex plus much less difficult.

Company Registration LLP Process:

Select a Unique Name: Ensure the name is special coupled with not currently being used by an additional entity.

Assign Partners: Identify at the very least 2 companions. These can be people or business entities.

Registered Office: Provide a signed up workplace address for the LLP.

Digital Signature Certificate (DSC): Obtain DSC for all assigned companions.

Supervisor Identification Number (DIN): Partners have to get a DIN.

Wealth Partnership Arrangement: Draft as well as send the LLP plan defining the lawful civil liberties plus responsibilities of the companions.

Send Incorporation Documents: Submit Form 2 (Incorporation Document plus Subscriber's Statement) with the Registrar of Companies.

Get Certificate of Incorporation: Once approved the Registrar will definitely provide a Certificate of Incorporation together with the LLP can start solution.

Understanding Ltd (Private Limited Company)

An Private Limited Company (Ltd) is a favored company structure for little to medium-sized companies. It offers restricted responsibility defense to its financiers as well as has an even more complex framework contrasted to an LLP.

Key Features of Pvt Ltd:

Limited Liability Protection: Shareholders are just liable for the amount they have actually bought the firm.

Different Legal Entity: An Ltd is thought about a different lawful entity from its proprietors indicating it can have building sustain financial debt, plus be demanded in its very own name.

Arranged Management: Requires an official framework with supervisors plus investors. Supervisors take care of the business while investors possess it.

Transferability of Shares: Shares can be moved easily based on the authorization of various other investors.

Tax obligation: Companies are strained at the company tax obligation price as well as returns paid to investors are additionally based on tax obligation.

Pvt Ltd Company Registration Process:

Select a Unique Name: Ensure the name follows the calling criteria along with is not currently taken.

Supervisors together with Shareholders: Identify a minimum of 2 supervisors as well as 2 investors. Supervisors have to have a DIN.

Signed Up Office: Provide a signed up workplace address for the firm.

Digital Trademark Certification (DSC): Acquire DSC for the recommended managers.

Supervisor Acknowledgment Number (FIGHT): All supervisors require to acquire a STRUGGLE.

Prepare Documents: Draft the Memorandum of Association (MOA) plus Articles of Association (AOA).

Send Incorporation Documents: Submit the combination documents having Form SPICe (Simplified Proforma for Incorporating Company Electronically) in addition to the MOA together with AOA to the Registrar of Companies.

Get Certificate of Incorporation: Once the papers are confirmed plus authorized the Registrar problems a Certificate of Incorporation coupled with the firm can start company.

Comparing LLP and Pvt Ltd

Responsibility:.

LLP: Partners have actually restricted obligation safeguarding individual properties.

Ltd: Shareholders have actually restricted obligation safeguarding individual possessions.

Tax obligation:.

LLP: Profits are strained just at the individual revenue degree of companions.

Ltd: Profits are exhausted at the company degree, coupled with returns are strained at the individual degree.

Conformity:.

LLP: Generally less conformity needs and also less complex regulative filings.

Ltd: More rigid conformity demands consisting of routine board conferences, declaring of yearly returns plus keeping legal signs up.

Monitoring Structure:.

LLP: Flexible administration framework without the requirement for a board of supervisors.

Ltd: Formal monitoring framework with a board of supervisors as well as investors.

Viability:.

LLP: Ideal for specialist solutions companies, such as law practice, bookkeeping companies, as well as professionals, where adaptable monitoring and also profit-sharing are essential.

Ltd: Suitable for companies seeking to increase resources increase procedures, plus possibly go public in the future.

Conclusion

Picking in between an LLP as well as a Pvt Ltd business relies on different elements consisting of the nature of business, administration choices, tax factors to consider plus conformity abilities. For business owners looking for a versatile administration framework with less conformity demands an LLP may be the perfect selection. On the various other hand those seeking an extra organized company with the capacity to elevate funding may favor a Pvt Ltd business.

Both frameworks supply substantial advantages as well as comprehending the distinctions is necessary for making an educated choice. No matter the option making certain appropriate firm enrollment is necessary for lawful acknowledgment plus defense of business. By extensively comprehending the firm enrollment LLP procedure as well as the Pvt Ltd company registration process business owners can establish a strong structure for their organization ventures.

0 notes

Text

#Private limited company registration in Chennai#Private limited company registration in Chennai online#Online Private limited company registration in Chennai#Private limited company registration#Private limited company registration online in Chennai#Pvt Ltd company registration in Chennai

0 notes