#quickbooks export to excel without excel installed

Explore tagged Tumblr posts

Link

If you get stuck somewhere QuickBooks Won't Export to Excel Issue Export a report. In QuickBooks, go to the Reports menu Reports Centre.

So, if you are looking forward to proceeding with QuickBooks export to excel workbooks, this Here is how to export reports in Excel file format to QB online

#quickbooks export to excel not working#exporting from quickbooks to excel problems#quickbooks export transactions to excel#quickbooks export to excel without excel installed#how to export reports to excel in quickbooks desktop

1 note

·

View note

Text

Sage X3: Integrated Ecommerce, And Payments

Is a set of functions extending the attain of Sage ERP X3 to fulfill the operational wants of SMB Retail Market. It provides position based mostly consumer interfaces tailored to each pricing sage x3 facet of the enterprise. Regardless of perspective or operate; store clerk or manager, FusionRMS is built for velocity and ease of use and has served the SAGE channel for over fifteen years.

The highly effective course of automation and administration capabilities of Sage X3 adapt to your wants, making a natural circulate of labor both throughout the group and with companions. By connecting your business, you can manage its progress more successfully, management your bottom line, keep up with demand, get to market shortly and proceed to delight your clients. For most businesses, crucial information, insight, and indicators are scattered about–in spreadsheets, techniques, and databases. In some cases, staff themselves turn out to be gatekeepers of knowledge others want, which can cause bottlenecks. Without addressing all license mixtures and options a pattern 5-Full User Manufacturing bundle with subscription pricing begins at $24,000 yearly for on-premises installations plus RKL eSolutions providers to implement.

In this weblog, we would handle one common query we received from many customers of Sage 50. If you additionally wish to find out pricing sage x3 about it, we might request you to go through this weblog till the very finish. When you use QuickBooks Online, your knowledge is stored on our servers within the cloud.

You can run all of them as separate manufacturers with separate goals whereas also splitting inside dashboards from customer-facing sites. However, these websites can nonetheless share relevant data forwards and backwards — corresponding to customer, provider, and common ledger (G/L) information — for added analytics capabilities. Sage X3 has plentiful capabilities that speak to completely different sides of a enterprise and they're predominantly geared toward the organizations focused on distribution and provide chain administration.

From resetting your account to reinstalling the software program, we will cover every thing that you have to know to have the ability to get sage drive again up and operating. Imagine you’re an accountant working with purchasers overseas. You ship them stories in PDF format, they usually pricing sage x3 need to have the ability to open and use them in their very own software program. If you are having bother exporting a report from Sage to Excel, there are a quantity of things you can do to try to fix the problem.

… Video replay and shot tracer allow you to understand more about your golf swing and the way to fix it. … Performance-based practice builds confidence to make better scores. Welcome your family and friends in, and maintain your floors good and clear with a door mat in your entrance door.

0 notes

Text

When Does the QuickBooks Desktop Go Away?

When does the QuickBooks desktop go away? Many people have wondered when Intuit will stop supporting QuickBooks Desktop. The answer is 2023. Here's why. After all, the software is no longer needed by most people. Intuit will no longer support it. So what will happen to your business? Read on to find out. And if you're using the software, now's the time to update. If you haven't updated it yet, you're exposing yourself to data breaches.

QuickBooks Desktop has many benefits for both business owners and accountants. It comes in different versions, such as Pro, Premier, Enterprise, and Pro/Premier Accountant Edition. If you use QuickBooks Desktop on a regular basis, it's a good idea to upgrade every time a new service release is released. This way, you'll be able to keep all of the great features of your current version. You'll also receive automatic updates to your bank accounts, and you'll be able to access your financial data from any location.

If you are using QuickBooks Desktop, you can upgrade to the latest version for free. You can download the updated version in under an hour. The time it takes depends on the size of your company file. After installation, you'll need to activate your new version. This is a relatively simple process and will save you money over the long run. But be sure to back up all your data before making the switch. You won't regret it.

You may still have a few more options besides QuickBooks Desktop. For example, if you're looking to migrate from QuickBooks Desktop to another platform, you should consider Sage Accounting or Xero. Your accountant can help you decide which of the two is the best option for your company. You may also want to consider getting a merchant service to ensure that your business doesn't suffer in the process. This way, you can keep running smoothly without having to worry about losing any clients. Click here to understand a lot of details visit quickbooks desktop discontinued

The pricing structure of QuickBooks desktop will change in the near future. Enterprise and Pro subscriptions will remain unchanged, while Enhanced and Basic Payroll subscriptions will undergo price changes after Oct. 1. Subscribers with payroll and direct deposit fees will be moved to the new pricing structure, which doesn't charge per employee each month. Intuit will also continue to offer the Enterprise Gold and Platinum subscriptions, which don't require direct deposit fees. The changes will affect existing Payroll subscribers, but not those who haven't subscribed to the new pricing plan.

If you're using QuickBooks Desktop and want to access your bank accounts, the upgrade is an excellent option. It's a powerful program that gives you access to just about every type of account. It's the most popular accounting software and has a host of features for small businesses. You can import, export, and delete accounts in bulk, which is a huge benefit. QuickBooks can be error prone, so an error-free add-on will help you focus on your work and boost your productivity.

1 note

·

View note

Text

Quickbooks desktop payroll support 866-48I-OOI4

QuickBooks is a top-rated accounting system for small and medium-sized businesses. The software is smartly developed to organize sales by tracking expenses; organizing time-sheets, sales slips, and invoices; and maintaining tax information. You can choose the right QuickBooks version depending upon the requirement of your business. QuickBooks Desktop version is embedded with strong features that reflect the nature of the business. One more reason is the prompt QuickBooks Desktop Support that makes it the most preferable software.

Exclusive Features of QuickBooks Desktop (Pro, Premier, payroll, and Enterprise)

Sales Orders

Budget vs Actual for Jobs

Item Receipts

Balance Sheet by Class

QuickBooks Statement Writer

Inventory Assemblies

Progress Invoicing

Receiving Partial Purchase Orders

Main Features of the Payroll Software

Manage holidays easily, payroll deductions, and absences

Create pay slips and run payroll in just a few steps

Manage your accounts and run payroll from the same place

Access your payroll software whenever you need it

Email the pay slips or print them out and post them

Submit RTI data to HMRC and calculate tax and National Insurance

QuickBooks online version has been gathered much appreciation as it has simplified the life of accountants and bookkeepers across the globe by integrating the QuickBooks payroll within the online version itself. QuickBooks Payroll data is synced directly with other versions of this software such as QuickBooks Enterprise. Not only online payroll software accords support to QuickBooks users but also provide special assistance in terms of:

Along with QuickBooks Enterprise and the optional Advanced Inventory feature:

Multiple Warehouse Locations

Serial Number/Lot Number Tracking

QuickBooks software is available in many different versions. So many small businesses have been using QuickBooks Desktop for years and still, continue to use it. The enterprise owners also implement QuickBooks software because of its strong QuickBooks Enterprise Support. Currently, QuickBooks Desktop has more features and functionality than the other QB versions. To use the desktop version, however, you need to install software onto your computer. For a product-based business, QuickBooks Desktop is considered the best due to the features like multiple inventory tracking methods (the average cost of the FIFO method), batch invoicing capability, and the industry-specific features for businesses of different industries (General Business, Contractor, Manufacturing & Wholesale, Professional Services, Retail & Nonprofit.)

Main Benefits of QuickBooks Desktop

Prepare 1099s

Budget vs. accrual job costing

Auto-calculators of statement charges

Mileage tracking

Advanced Excel exports

The popularity of accounting software mainly depends on its components. There is no better software that is more beneficial to your business.

QuickBooks Desktop software offers several customized features. This version is remarkably superior with inventory tracking, time tracking, and budgeting. The software permits the user to locate the trivial expenses that can be cut-off easily. The desktop version can be an investment as it allows creating customized Excel reports after you have budgeted and tracked your expenses completely. QuickBooks Desktop version can be easily downloaded to your computer server and having an Internet connection is not mandatory. QuickBooks Desktop accords almost all the benefits of the QB online version by recording with budget and mileage to make better decisions. But you will be restricted to access your business finances from anywhere anytime without an Internet connection with the mobile version. QuickBooks Desktop is designed for stationery businesses.

Reasons to Consider QuickBooks Desktop is the Right Version for your Business

Introductory Fees: The QuickBooks Desktop version does not offer a trial version and requires the purchase of the software upfront with the fixed fees.

Monthly Calendar Fees: QuickBooks Pro Desktop 2015 version is one-time payment software or you can purchase QuickBooks Pro Plus for an annual payment.

Internet Connectivity: QuickBooks Desktop can be accessed from the personal computer in which it is installed on irrespective of Internet connection.

Automation Features: With QuickBooks Desktop, transactions (invoice, receipt, reports, etc.) must be processed manually as automation features are restricted to this version.

Remote Access: The QuickBooks Desktop version is linked to the computer it is installed on and therefore can only be accessed on-site. The user can not access the reports as it is not cloud-based.

Multiple Users: Simultaneous users are restricted in the QuickBooks Desktop version that keeps the data safe and secure.

Customized Features: The QuickBooks Desktop version has several customized features like the ability to prepare 1099s, track mileage, and budget and track expenses. The desktop version allows more flexibility to customize forms.

Technical Support: The basic QuickBooks Desktop version does not come with technical support although gets support for the Pro Plus edition only after making some specific payment.

Implement the Right Version

The above advantages of QuickBooks Desktop Version will help the business owners to make a decision about what is the right software for their business.

QuickBooks Desktop version is the best solution for businesses like:

Fixed office location

Software access is required by a small number of people

Businesses that exempts recurring monthly charge

Do not require online access to the books

Businesses that delve into customized features such as the ability to track budget etc.

Each version of QuickBooks accounting software has its own set of strengths and weaknesses. The business owners should carefully review and verify the differences in order to choose the best solution for their business.

If you have any query related to the QuickBooks Desktop version contact 99Accounting. It has been at the pinnacle of QuickBooks Consulting Services. Our in-house QB professionals, with the help of their experience, will suggest the right guidance that can be your route to business success.

1 note

·

View note

Text

Quickbooks desktop payroll support 866-48I-OOI4

QuickBooks is a top-rated accounting system for small and medium-sized businesses. The software is smartly developed to organize sales by tracking expenses; organizing time-sheets, sales slips, and invoices; and maintaining tax information. You can choose the right QuickBooks version depending upon the requirement of your business. QuickBooks Desktop version is embedded with strong features that reflect the nature of the business. One more reason is the prompt QuickBooks Desktop Support that makes it the most preferable software.

Exclusive Features of QuickBooks Desktop (Pro, Premier, payroll, and Enterprise)

Sales Orders

Budget vs Actual for Jobs

Item Receipts

Balance Sheet by Class

QuickBooks Statement Writer

Inventory Assemblies

Progress Invoicing

Receiving Partial Purchase Orders

Main Features of the Payroll Software

Manage holidays easily, payroll deductions, and absences

Create pay slips and run payroll in just a few steps

Manage your accounts and run payroll from the same place

Access your payroll software whenever you need it

Email the pay slips or print them out and post them

Submit RTI data to HMRC and calculate tax and National Insurance

QuickBooks online version has been gathered much appreciation as it has simplified the life of accountants and bookkeepers across the globe by integrating the QuickBooks payroll within the online version itself. QuickBooks Payroll data is synced directly with other versions of this software such as QuickBooks Enterprise. Not only online payroll software accords support to QuickBooks users but also provide special assistance in terms of:

Along with QuickBooks Enterprise and the optional Advanced Inventory feature:

Multiple Warehouse Locations

Serial Number/Lot Number Tracking

QuickBooks software is available in many different versions. So many small businesses have been using QuickBooks Desktop for years and still, continue to use it. The enterprise owners also implement QuickBooks software because of its strong QuickBooks Enterprise Support. Currently, QuickBooks Desktop has more features and functionality than the other QB versions. To use the desktop version, however, you need to install software onto your computer. For a product-based business, QuickBooks Desktop is considered the best due to the features like multiple inventory tracking methods (the average cost of the FIFO method), batch invoicing capability, and the industry-specific features for businesses of different industries (General Business, Contractor, Manufacturing & Wholesale, Professional Services, Retail & Nonprofit.)

Main Benefits of QuickBooks Desktop

Prepare 1099s

Budget vs. accrual job costing

Auto-calculators of statement charges

Mileage tracking

Advanced Excel exports

The popularity of accounting software mainly depends on its components. There is no better software that is more beneficial to your business.

QuickBooks Desktop software offers several customized features. This version is remarkably superior with inventory tracking, time tracking, and budgeting. The software permits the user to locate the trivial expenses that can be cut-off easily. The desktop version can be an investment as it allows creating customized Excel reports after you have budgeted and tracked your expenses completely. QuickBooks Desktop version can be easily downloaded to your computer server and having an Internet connection is not mandatory. QuickBooks Desktop accords almost all the benefits of the QB online version by recording with budget and mileage to make better decisions. But you will be restricted to access your business finances from anywhere anytime without an Internet connection with the mobile version. QuickBooks Desktop is designed for stationery businesses.

Reasons to Consider QuickBooks Desktop is the Right Version for your Business

Introductory Fees: The QuickBooks Desktop version does not offer a trial version and requires the purchase of the software upfront with the fixed fees.

Monthly Calendar Fees: QuickBooks Pro Desktop 2015 version is one-time payment software or you can purchase QuickBooks Pro Plus for an annual payment.

Internet Connectivity: QuickBooks Desktop can be accessed from the personal computer in which it is installed on irrespective of Internet connection.

Automation Features: With QuickBooks Desktop, transactions (invoice, receipt, reports, etc.) must be processed manually as automation features are restricted to this version.

Remote Access: The QuickBooks Desktop version is linked to the computer it is installed on and therefore can only be accessed on-site. The user can not access the reports as it is not cloud-based.

Multiple Users: Simultaneous users are restricted in the QuickBooks Desktop version that keeps the data safe and secure.

Customized Features: The QuickBooks Desktop version has several customized features like the ability to prepare 1099s, track mileage, and budget and track expenses. The desktop version allows more flexibility to customize forms.

Technical Support: The basic QuickBooks Desktop version does not come with technical support although gets support for the Pro Plus edition only after making some specific payment.

Implement the Right Version

The above advantages of QuickBooks Desktop Version will help the business owners to make a decision about what is the right software for their business.

QuickBooks Desktop version is the best solution for businesses like:

Fixed office location

Software access is required by a small number of people

Businesses that exempts recurring monthly charge

Do not require online access to the books

Businesses that delve into customized features such as the ability to track budget etc.

Each version of QuickBooks accounting software has its own set of strengths and weaknesses. The business owners should carefully review and verify the differences in order to choose the best solution for their business.

If you have any query related to the QuickBooks Desktop version contact 99Accounting. It has been at the pinnacle of QuickBooks Consulting Services. Our in-house QB professionals, with the help of their experience, will suggest the right guidance that can be your route to business success.

1 note

·

View note

Text

Quickbooks desktop payroll support 866-48I-OOI4

QuickBooks is a top-rated accounting system for small and medium-sized businesses. The software is smartly developed to organize sales by tracking expenses; organizing time-sheets, sales slips, and invoices; and maintaining tax information. You can choose the right QuickBooks version depending upon the requirement of your business. QuickBooks Desktop version is embedded with strong features that reflect the nature of the business. One more reason is the prompt QuickBooks Desktop Support that makes it the most preferable software.

Exclusive Features of QuickBooks Desktop (Pro, Premier, payroll, and Enterprise)

Sales Orders

Budget vs Actual for Jobs

Item Receipts

Balance Sheet by Class

QuickBooks Statement Writer

Inventory Assemblies

Progress Invoicing

Receiving Partial Purchase Orders

Main Features of the Payroll Software

Manage holidays easily, payroll deductions, and absences

Create pay slips and run payroll in just a few steps

Manage your accounts and run payroll from the same place

Access your payroll software whenever you need it

Email the pay slips or print them out and post them

Submit RTI data to HMRC and calculate tax and National Insurance

QuickBooks online version has been gathered much appreciation as it has simplified the life of accountants and bookkeepers across the globe by integrating the QuickBooks payroll within the online version itself. QuickBooks Payroll data is synced directly with other versions of this software such as QuickBooks Enterprise. Not only online payroll software accords support to QuickBooks users but also provide special assistance in terms of:

Along with QuickBooks Enterprise and the optional Advanced Inventory feature:

Multiple Warehouse Locations

Serial Number/Lot Number Tracking

QuickBooks software is available in many different versions. So many small businesses have been using QuickBooks Desktop for years and still, continue to use it. The enterprise owners also implement QuickBooks software because of its strong QuickBooks Enterprise Support. Currently, QuickBooks Desktop has more features and functionality than the other QB versions. To use the desktop version, however, you need to install software onto your computer. For a product-based business, QuickBooks Desktop is considered the best due to the features like multiple inventory tracking methods (the average cost of the FIFO method), batch invoicing capability, and the industry-specific features for businesses of different industries (General Business, Contractor, Manufacturing & Wholesale, Professional Services, Retail & Nonprofit.)

Main Benefits of QuickBooks Desktop

Prepare 1099s

Budget vs. accrual job costing

Auto-calculators of statement charges

Mileage tracking

Advanced Excel exports

The popularity of accounting software mainly depends on its components. There is no better software that is more beneficial to your business.

QuickBooks Desktop software offers several customized features. This version is remarkably superior with inventory tracking, time tracking, and budgeting. The software permits the user to locate the trivial expenses that can be cut-off easily. The desktop version can be an investment as it allows creating customized Excel reports after you have budgeted and tracked your expenses completely. QuickBooks Desktop version can be easily downloaded to your computer server and having an Internet connection is not mandatory. QuickBooks Desktop accords almost all the benefits of the QB online version by recording with budget and mileage to make better decisions. But you will be restricted to access your business finances from anywhere anytime without an Internet connection with the mobile version. QuickBooks Desktop is designed for stationery businesses.

Reasons to Consider QuickBooks Desktop is the Right Version for your Business

Introductory Fees: The QuickBooks Desktop version does not offer a trial version and requires the purchase of the software upfront with the fixed fees.

Monthly Calendar Fees: QuickBooks Pro Desktop 2015 version is one-time payment software or you can purchase QuickBooks Pro Plus for an annual payment.

Internet Connectivity: QuickBooks Desktop can be accessed from the personal computer in which it is installed on irrespective of Internet connection.

Automation Features: With QuickBooks Desktop, transactions (invoice, receipt, reports, etc.) must be processed manually as automation features are restricted to this version.

Remote Access: The QuickBooks Desktop version is linked to the computer it is installed on and therefore can only be accessed on-site. The user can not access the reports as it is not cloud-based.

Multiple Users: Simultaneous users are restricted in the QuickBooks Desktop version that keeps the data safe and secure.

Customized Features: The QuickBooks Desktop version has several customized features like the ability to prepare 1099s, track mileage, and budget and track expenses. The desktop version allows more flexibility to customize forms.

Technical Support: The basic QuickBooks Desktop version does not come with technical support although gets support for the Pro Plus edition only after making some specific payment.

Implement the Right Version

The above advantages of QuickBooks Desktop Version will help the business owners to make a decision about what is the right software for their business.

QuickBooks Desktop version is the best solution for businesses like:

Fixed office location

Software access is required by a small number of people

Businesses that exempts recurring monthly charge

Do not require online access to the books

Businesses that delve into customized features such as the ability to track budget etc.

Each version of QuickBooks accounting software has its own set of strengths and weaknesses. The business owners should carefully review and verify the differences in order to choose the best solution for their business.

If you have any query related to the QuickBooks Desktop version contact 99Accounting. It has been at the pinnacle of QuickBooks Consulting Services. Our in-house QB professionals, with the help of their experience, will suggest the right guidance that can be your route to business success.

1 note

·

View note

Text

QuickBooks Desktop Payroll Support +1-850-203-4454

QuickBooks is a top-rated accounting system for small and medium-sized businesses. The software is smartly developed to organize sales by tracking expenses; organizing time-sheets, sales slips, and invoices; and maintaining tax information. You can choose the right QuickBooks version depending upon the requirement of your business. QuickBooks Desktop version is embedded with strong features that reflect the nature of the business. One more reason is the prompt QuickBooks Desktop Support that makes it the most preferable software.

Exclusive Features of QuickBooks Desktop (Pro, Premier, payroll, and Enterprise)

Sales Orders

Budget vs Actual for Jobs

Item Receipts

Balance Sheet by Class

QuickBooks Statement Writer

Inventory Assemblies

Progress Invoicing

Receiving Partial Purchase Orders

Main Features of the Payroll Software

Manage holidays easily, payroll deductions, and absences

Create pay slips and run payroll in just a few steps

Manage your accounts and run payroll from the same place

Access your payroll software whenever you need it

Email the pay slips or print them out and post them

Submit RTI data to HMRC and calculate tax and National Insurance

QuickBooks online version has been gathered much appreciation as it has simplified the life of accountants and bookkeepers across the globe by integrating the QuickBooks payroll within the online version itself. QuickBooks Payroll data is synced directly with other versions of this software such as QuickBooks Enterprise. Not only online payroll software accords support to QuickBooks users but also provide special assistance in terms of:

Along with QuickBooks Enterprise and the optional Advanced Inventory feature:

Multiple Warehouse Locations

Serial Number/Lot Number Tracking

QuickBooks software is available in many different versions. So many small businesses have been using QuickBooks Desktop for years and still, continue to use it. The enterprise owners also implement QuickBooks software because of its strong QuickBooks Enterprise Support. Currently, QuickBooks Desktop has more features and functionality than the other QB versions. To use the desktop version, however, you need to install software onto your computer. For a product-based business, QuickBooks Desktop is considered the best due to the features like multiple inventory tracking methods (the average cost of the FIFO method), batch invoicing capability, and the industry-specific features for businesses of different industries (General Business, Contractor, Manufacturing & Wholesale, Professional Services, Retail & Nonprofit.)

Main Benefits of QuickBooks Desktop

Prepare 1099s

Budget vs. accrual job costing

Auto-calculators of statement charges

Mileage tracking

Advanced Excel exports

The popularity of accounting software mainly depends on its components. There is no better software that is more beneficial to your business.

QuickBooks Desktop software offers several customized features. This version is remarkably superior with inventory tracking, time tracking, and budgeting. The software permits the user to locate the trivial expenses that can be cut-off easily. The desktop version can be an investment as it allows creating customized Excel reports after you have budgeted and tracked your expenses completely. QuickBooks Desktop version can be easily downloaded to your computer server and having an Internet connection is not mandatory. QuickBooks Desktop accords almost all the benefits of the QB online version by recording with budget and mileage to make better decisions. But you will be restricted to access your business finances from anywhere anytime without an Internet connection with the mobile version. QuickBooks Desktop is designed for stationery businesses.

Reasons to Consider QuickBooks Desktop is the Right Version for your Business

Introductory Fees: The QuickBooks Desktop version does not offer a trial version and requires the purchase of the software upfront with the fixed fees.

Monthly Calendar Fees: QuickBooks Pro Desktop 2015 version is one-time payment software or you can purchase QuickBooks Pro Plus for an annual payment.

Internet Connectivity: QuickBooks Desktop can be accessed from the personal computer in which it is installed on irrespective of Internet connection.

Automation Features: With QuickBooks Desktop, transactions (invoice, receipt, reports, etc.) must be processed manually as automation features are restricted to this version.

Remote Access: The QuickBooks Desktop version is linked to the computer it is installed on and therefore can only be accessed on-site. The user can not access the reports as it is not cloud-based.

Multiple Users: Simultaneous users are restricted in the QuickBooks Desktop version that keeps the data safe and secure.

Customized Features: The QuickBooks Desktop version has several customized features like the ability to prepare 1099s, track mileage, and budget and track expenses. The desktop version allows more flexibility to customize forms.

Technical Support: The basic QuickBooks Desktop version does not come with technical support although gets support for the Pro Plus edition only after making some specific payment.

Implement the Right Version

The above advantages of QuickBooks Desktop Version will help the business owners to make a decision about what is the right software for their business.

QuickBooks Desktop version is the best solution for businesses like:

Fixed office location

Software access is required by a small number of people

Businesses that exempts recurring monthly charge

Do not require online access to the books

Businesses that delve into customized features such as the ability to track budget etc.

Each version of QuickBooks accounting software has its own set of strengths and weaknesses. The business owners should carefully review and verify the differences in order to choose the best solution for their business.

If you have any query related to the QuickBooks Desktop version contact 99Accounting. It has been at the pinnacle of QuickBooks Consulting Services. Our in-house QB professionals, with the help of their experience, will suggest the right guidance that can be your route to business success.

#quickbooksenterprisesupportphonenumber#contactnumberforquickbookspayroll#quickbookspayrollsupportnumber

0 notes

Text

Quickbooks payroll support number 8O8-9OO-3847

QuickBooks is a top-rated accounting system for small and medium-sized businesses. The software is smartly developed to organize sales by tracking expenses; organizing time-sheets, sales slips, and invoices; and maintaining tax information. You can choose the right QuickBooks version depending upon the requirement of your business. QuickBooks Desktop version is embedded with strong features that reflect the nature of the business. One more reason is the prompt QuickBooks Desktop Support that makes it the most preferable software.

Exclusive Features of QuickBooks Desktop (Pro, Premier, payroll, and Enterprise)

Sales Orders

Budget vs Actual for Jobs

Item Receipts

Balance Sheet by Class

QuickBooks Statement Writer

Inventory Assemblies

Progress Invoicing

Receiving Partial Purchase Orders

Main Features of the Payroll Software

Manage holidays easily, payroll deductions, and absences

Create payslips and run payroll in just a few steps

Manage your accounts and run payroll from the same place

Access your payroll software whenever you need it

Email the payslips or print them out and post them

Submit RTI data to HMRC and calculate tax and National Insurance

QuickBooks online version has been gathered much appreciation as it has simplified the life of accountants and bookkeepers across the globe by integrating the QuickBooks payroll within the online version itself. QuickBooks Payroll data is synced directly with other versions of this software such as QuickBooks Enterprise. Not only online payroll software accords support to QuickBooks users but also provide special assistance in terms of:

Along with QuickBooks Enterprise and the optional Advanced Inventory feature:

Multiple Warehouse Locations

Serial Number/Lot Number Tracking

QuickBooks software is available in many different versions. So many small businesses have been using QuickBooks Desktop for years and still, continue to use it. The enterprise owners also implement QuickBooks software because of its strong QuickBooks Enterprise Support. Currently, QuickBooks Desktop has more features and functionality than the other QB versions. To use the desktop version, however, you need to install software onto your computer. For a product-based business, QuickBooks Desktop is considered the best due to the features like multiple inventory tracking methods (the average cost of the FIFO method), batch invoicing capability, and the industry-specific features for businesses of different industries (General Business, Contractor, Manufacturing & Wholesale, Professional Services, Retail & Nonprofit.)

Main Benefits of QuickBooks Desktop

Prepare 1099s

Budget vs. accrual job costing

Auto-calculators of statement charges

Mileage tracking

Advanced Excel exports

The popularity of accounting software mainly depends on its components. There is no better software that is more beneficial to your business.

QuickBooks Desktop software offers several customized features. This version is remarkably superior with inventory tracking, time tracking, and budgeting. The software permits the user to locate the trivial expenses that can be cut-off easily. The desktop version can be an investment as it allows creating customized Excel reports after you have budgeted and tracked your expenses completely. QuickBooks Desktop version can be easily downloaded to your computer server and having an Internet connection is not mandatory. QuickBooks Desktop accords almost all the benefits of the QB online version by recording with budget and mileage to make better decisions. But you will be restricted to access your business finances from anywhere anytime without an Internet connection with the mobile version. QuickBooks Desktop is designed for stationery businesses.

Reasons to Consider QuickBooks Desktop is the Right Version for your Business

Introductory Fees: The QuickBooks Desktop version does not offer a trial version and requires the purchase of the software upfront with the fixed fees.

Monthly Calendar Fees: QuickBooks Pro Desktop 2015 version is one-time payment software or you can purchase QuickBooks Pro Plus for an annual payment.

Internet Connectivity: QuickBooks Desktop can be accessed from the personal computer in which it is installed on irrespective of Internet connection.

Automation Features: With QuickBooks Desktop, transactions (invoice, receipt, reports, etc.) must be processed manually as automation features are restricted to this version.

Remote Access: The QuickBooks Desktop version is linked to the computer it is installed on and therefore can only be accessed on-site. The user can not access the reports as it is not cloud-based.

Multiple Users: Simultaneous users are restricted in the QuickBooks Desktop version that keeps the data safe and secure.

Customized Features: The QuickBooks Desktop version has several customized features like the ability to prepare 1099s, track mileage, and budget and track expenses. The desktop version allows more flexibility to customize forms.

Technical Support: The basic QuickBooks Desktop version does not come with technical support although gets support for the Pro Plus edition only after making some specific payment.

Implement the Right Version

The above advantages of QuickBooks Desktop Version will help the business owners to make a decision about what is the right software for their business.

QuickBooks Desktop version is the best solution for businesses like:

Fixed office location

Software access is required by a small number of people

Businesses that exempts recurring monthly charge

Do not require online access to the books

Businesses that delve into customized features such as the ability to track budget etc.

Each version of QuickBooks accounting software has its own set of strengths and weaknesses. The business owners should carefully review and verify the differences in order to choose the best solution for their business.

If you have any query related to the QuickBooks Desktop version contact 99Accounting. It has been at the pinnacle of QuickBooks Consulting Services. Our in-house QB professionals, with the help of their experience, will suggest the right guidance that can be your route to business success.

#quickbooks enterprise support phone number#contact number for quickbooks payroll#quickbooks enhanced payroll support number

0 notes

Text

Quickbooks desktop payroll support 8O8-9OO-3847

QuickBooks is a top-rated accounting system for small and medium-sized businesses. The software is smartly developed to organize sales by tracking expenses; organizing time-sheets, sales slips, and invoices; and maintaining tax information. You can choose the right QuickBooks version depending upon the requirement of your business. QuickBooks Desktop version is embedded with strong features that reflect the nature of the business. One more reason is the prompt QuickBooks Desktop Support that makes it the most preferable software.

Exclusive Features of QuickBooks Desktop (Pro, Premier, payroll, and Enterprise)

Sales Orders

Budget vs Actual for Jobs

Item Receipts

Balance Sheet by Class

QuickBooks Statement Writer

Inventory Assemblies

Progress Invoicing

Receiving Partial Purchase Orders

Main Features of the Payroll Software

Manage holidays easily, payroll deductions, and absences

Create payslips and run payroll in just a few steps

Manage your accounts and run payroll from the same place

Access your payroll software whenever you need it

Email the payslips or print them out and post them

Submit RTI data to HMRC and calculate tax and National Insurance

QuickBooks online version has been gathered much appreciation as it has simplified the life of accountants and bookkeepers across the globe by integrating the QuickBooks payroll within the online version itself. QuickBooks Payroll data is synced directly with other versions of this software such as QuickBooks Enterprise. Not only online payroll software accords support to QuickBooks users but also provide special assistance in terms of:

Along with QuickBooks Enterprise and the optional Advanced Inventory feature:

Multiple Warehouse Locations

Serial Number/Lot Number Tracking

QuickBooks software is available in many different versions. So many small businesses have been using QuickBooks Desktop for years and still, continue to use it. The enterprise owners also implement QuickBooks software because of its strong QuickBooks Enterprise Support. Currently, QuickBooks Desktop has more features and functionality than the other QB versions. To use the desktop version, however, you need to install software onto your computer. For a product-based business, QuickBooks Desktop is considered the best due to the features like multiple inventory tracking methods (the average cost of the FIFO method), batch invoicing capability, and the industry-specific features for businesses of different industries (General Business, Contractor, Manufacturing & Wholesale, Professional Services, Retail & Nonprofit.)

Main Benefits of QuickBooks Desktop

Prepare 1099s

Budget vs. accrual job costing

Auto-calculators of statement charges

Mileage tracking

Advanced Excel exports

The popularity of accounting software mainly depends on its components. There is no better software that is more beneficial to your business.

QuickBooks Desktop software offers several customized features. This version is remarkably superior with inventory tracking, time tracking, and budgeting. The software permits the user to locate the trivial expenses that can be cut-off easily. The desktop version can be an investment as it allows creating customized Excel reports after you have budgeted and tracked your expenses completely. QuickBooks Desktop version can be easily downloaded to your computer server and having an Internet connection is not mandatory. QuickBooks Desktop accords almost all the benefits of the QB online version by recording with budget and mileage to make better decisions. But you will be restricted to access your business finances from anywhere anytime without an Internet connection with the mobile version. QuickBooks Desktop is designed for stationery businesses.

Reasons to Consider QuickBooks Desktop is the Right Version for your Business

Introductory Fees: The QuickBooks Desktop version does not offer a trial version and requires the purchase of the software upfront with the fixed fees.

Monthly Calendar Fees: QuickBooks Pro Desktop 2015 version is one-time payment software or you can purchase QuickBooks Pro Plus for an annual payment.

Internet Connectivity: QuickBooks Desktop can be accessed from the personal computer in which it is installed on irrespective of Internet connection.

Automation Features: With QuickBooks Desktop, transactions (invoice, receipt, reports, etc.) must be processed manually as automation features are restricted to this version.

Remote Access: The QuickBooks Desktop version is linked to the computer it is installed on and therefore can only be accessed on-site. The user can not access the reports as it is not cloud-based.

Multiple Users: Simultaneous users are restricted in the QuickBooks Desktop version that keeps the data safe and secure.

Customized Features: The QuickBooks Desktop version has several customized features like the ability to prepare 1099s, track mileage, and budget and track expenses. The desktop version allows more flexibility to customize forms.

Technical Support: The basic QuickBooks Desktop version does not come with technical support although gets support for the Pro Plus edition only after making some specific payment.

Implement the Right Version

The above advantages of QuickBooks Desktop Version will help the business owners to make a decision about what is the right software for their business.

QuickBooks Desktop version is the best solution for businesses like:

Fixed office location

Software access is required by a small number of people

Businesses that exempts recurring monthly charge

Do not require online access to the books

Businesses that delve into customized features such as the ability to track budget etc.

Each version of QuickBooks accounting software has its own set of strengths and weaknesses. The business owners should carefully review and verify the differences in order to choose the best solution for their business.

If you have any query related to the QuickBooks Desktop version contact 99Accounting. It has been at the pinnacle of QuickBooks Consulting Services. Our in-house QB professionals, with the help of their experience, will suggest the right guidance that can be your route to business success.

#quickbooks enterprise support phone number#contact number for quickbooks payroll#quickbooks enhanced payroll support number

0 notes

Text

An Biometric Time Attendance Terminal That Uses Multispectral Technology

For authentication, biometric identification systems use physical characteristics. The platform makes access to buildings more secure for employers and integrates employee time tracking.

Employees can ensure that they are not clocking in or out for each other by using a biometric time attendance terminal that reads fingerprints. An attendance system based on biometrics also helps to prevent unauthorized entry into secured areas.

Multiplespectrum time attendance terminal using biometrics

With biometric technology, it is easy to track employees. A Fingerprint time attendance device serves to identify employees as they leave and enter buildings.

Employees can access their historical work hours logged in the Terminal, as well as their balance of flex-time. Ethernet connections enable employers to communicate with all clocking systems of their organization. The Time Attendance terminal continues to function even when the connection is lost.

A web service enables global configuration from a central location. A single system for controlling clock data at multiple sites and remote sites. Managers can access employee data to run reports, schedule shifts, and keep track of employees’ arrivals and departures.

Installing and maintaining the Time Access Biometric Terminal is more straightforward than the former time and attendance terminal system. This biometric employee attendance machine includes new features while, still; ensuring compatibility with existing devices.

Linux and DOS are compatible with these terminal elements:

The employee message

Real-time flexibility

Cloud compatibility for web downloading

Improvements to employee downloads for web services

Function Zones

Controls for doors and barriers

The simulation of verifications

Graphical display

Online status indicator

Support for barcode, magstripe, and proximity readers

A biometric reader is available

Audio feedback

Feedback via visuals

The dynamic assignment of IP addresses

The first-generation biometric clock incorporates a fingerprint scanning device. Businesses no longer have to worry about buddy punching thefts. In addition to eliminating key, badge, and card tracking, this system makes security even more efficient.

By simply pressing their fingers on the scanner, employees can clock in and out quickly. The system scans fingerprints and identifies the employee’s location and assignment immediately. Access is permitted if the destination matches the pre-assigned place.

A database is available for storing the converted scans. A finger scan serves as the authentication at each entrance. In addition to supporting major payroll providers like QuickBooks, PeopleSoft, Paychex, and Oracle, this terminal uses first-generation technology.

You can view online, export, and manage payroll using the payroll system. The multispectral terminal can track time and attendance accurately and without errors using the latest fingerprint scanning technology.

Biometric time and attendance is beneficial to many industries

Organizations dealing with confidential client information should use a biometric time attendance system. Financial services are gathering personal information from their clients for banking, investments, or personal assets.

The health care industry protects medical records with law. For both companies, a fingerprint scanner might be the best option. It ensures accountability, efficiency, and productivity. Personnel are free to enter secure work areas, and they arrive on time.

It provides the following benefits:

Avoid early clock-ins, late clock-ins, and buddy punches

Better security for office buildings

Convenient fingerprint scanner

Quick and reliable

Flexible in every way

Payroll services from third parties

Accurately ensures data

Cost savings for organizations

The interface is user-friendly

Summary

Multispectral attendance terminal are an excellent way to eliminate buddy punching. Workers get paid for their wages, in addition to the hours they put in.

By integrating with leading payroll providers, organizations can manage payroll processes and file tax returns on time. Organizations can expand their workforces with this scalable system.

It comes with unlimited pay categories and a desktop biometric reader, ensuring high accuracy and efficiency.

Source:- https://time-access.store/an-biometric-time-attendance-terminal-that-uses-multispectral-technology/

#Time And Attendance Terminal System#Time Attendance Terminal#Biometric Time Attendance Terminal#Employee Attendance Machine

0 notes

Text

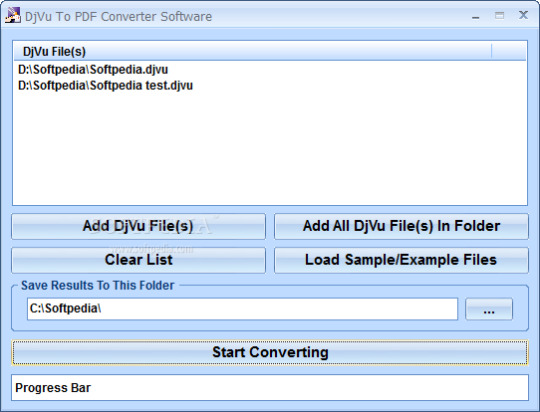

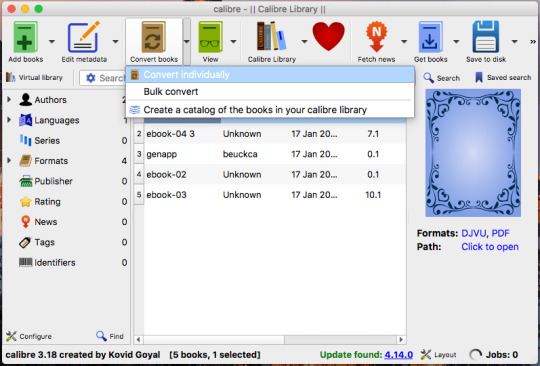

Djvu To Pdf Конвертер For Mac

Free DjVu-to-PDF converter: convert DjVu files to PDF format online, right in your browser.

Djvu To Pdf Converter Mac Free

Djvu To Pdf Converter Free Download For Mac

Djvu To Pdf Converter For Mac

Converting your file to pdf

在mac上djvu文件怎么打开呢? 使用 DjVu Reader Pro 可以打开DjVu格式的文件,进行阅读、翻页、搜索等操作。 DjVu Reader Pro 软件截图. 快速打开DjVu文件,即使是非常大的文件,也能顺利阅读。 在文档中搜索给定内容 导出为PDF、TXT等格式文档 快看支持 书签管理. Free DjVu to PDF is DjVu to PDF freeware designed for converting DjVu eBooks into frequently used PDF format in a batch. Here are some simple steps for smooth conversion of your files to PDF from DJVU: Go to our website; Click on DJVU to PDF conversion type; Upload the file you wish to convert in PDF from your local storage, or provide a link for downloading the file from the Internet, drag the. Download Djvu To Pdf Mac Software Advertisement EPub to PDF converter for Mac OS v.1.1.1 Digital Editions Converter that quickly and easily converted Digital Editions ePub ebook to PDF file formats. User can view PDF ebook on other computer, Kindle/Sony ereader or other devices, user also can print Digital Edition DRM protection ebook.

0 Here you go!

Your file is ready to download.

Djvu To Pdf Converter Mac Free

Invalid file extension

Please upload a file with the correct extension.

Server error

The server is busy now. Please try again later.

This file is password-protected

Please unlock the file and try again.

The file is too large

The maximum file size allowed is set to: 32Mb.

Your next free conversion will be available in one hour.

To convert more files, go to PDFChef Premium or wait until free conversions become available again.

Choose Your Plan

Online app

Unlimited number of task

https://loadcard201.tumblr.com/post/654757461674360832/core-keygen-for-mac. On OS X Yosemite running these applications is not a problem.How to install OS X Yosemite on MacOS Sierra.

19 converters

5 editing tools

Security guaranteed

$71.5 $19.95 billed annually

Online app

Unlimited number of task

19 converters

5 editing tools

Fusion provides a simple yet customizable way to install multiple operating systems on your Mac. New in Fusion is updated support for the Open Virtualization Format which includes an effortless installation walkthrough of the VMware vCenter Server Appliance OVA. VMware Fusion delivers the best way to run Windows on the Mac, and the ultimate development and testing tool for building apps to run on any platform. Ready for macOS 11.0 Big Sur, Fusion 12 supports macOS 10.15 Catalina and includes new features for developers, IT admins and everyday users. Vmware for mac os big sur crack. Download VMware Fusion 12 and let your Mac run Windows, Linux or Mac OS X Server. Run the most demanding Mac and Windows applications side-by-side at maximum speeds without rebooting.

Security guaranteed

$71.5 $19.95 billed annually

$29.95 billed annually

Desktop solution

Unlimited batch conversion

More conversion formats

More editing tools

Text editing

Electronic signatures

Fillable PDF forms

Security guaranteed

$29.95 billed annually

How to Convert DjVu to PDF Online:

Add your DjVu file using the Choose File button or by dragging and dropping it into the upload area

Wait for a few seconds

Click Download File

Free eBook Conversion Service

PDFChef is a service for e-book lovers that you can use for free once an hour. If you have a document in DjVu format and you don’t have software to read this format on your PC, try converting it with PDFChef! It will turn your DjVu file into a PDF that can be opened in any browser. Note, however, that the file size for the free service is limited to 32 MB.

Personal Data Privacy

We do not read or mine any data from your files. We do not copy or disclose the content of your files. All file processing is done automatically without human intervention. After converting your file from DjVu to PDF, all the processed files are deleted from our servers within 24 hours or less.

User-Friendly Interface

Our service gives you a very simple and intuitive interface, so you don't need to spend time figuring it out. Just drag and drop – and you are done!

Superfast DjVu-to-PDF Converter

When your files are processed on our powerful, ultra-fast web servers, you can change your DjVus to PDF files in less than a minute.

Djvu To Pdf Converter Free Download For Mac

More Features

📎 Office

🏝 Images

Djvu To Pdf Converter For Mac

🔮 Other

Need to do more?

Need to view or edit a PDF? Try our desktop version!

Advertisement

EPub to PDF converter for Mac OS v.1.1.1Digital Editions Converter that quickly and easily converted Digital Editions ePub ebook to PDF file formats. user can view PDF ebook on other computer, Kindle/Sony ereader or other devices, user also can print Digital Edition DRM protection ebook ..

Epubor Kindle to PDF Converter for Mac v.2.0.0.3The excellent Epubor Kindle to PDF Converter helps you convert Kindle books of MOBI,AZW, PRC format to PDF on Mac with just one click.The output PDF books (formerly Kindle books) are fairly high quality and suitable for being read on any PDF eReaders ..

HTML to PDF Converter for Mac v.2.0HTML to PDF Converter for Mac can be used to batch convert HTML files to PDF files on Mac system. HTML to PDF Converter for Mac is a smart and powerful tool specially designed for Mac OS X system. It can be used to convert .html, .htm, URL, etc. file ..

Euro Character Printing & Exporting to PDF updateEuro Character Printing & Exporting to PDF update is a product including an updated version of the PostScript procset applied by Adobe PageMaker. The updated version resolves a problem that customers encounter when printing the Euro currency ..

PD4ML. HTML to PDF converter for Java v.3.8.0PD4ML is a powerful PDF generating tool uses HTML and CSS as page layout and content definition format. Written in 100% pure Java, it allows users to easily add PDF generation functionality to end products. PD4ML is encapsulated in an easy-to-deploy ..

Softi ScanWiz V2 v.3.00ScanWiz is a scanner Software program for Microsoft Windows. it can create multi-page Pdf,s & tiff's even with a flatbed scanner. Its can Scan to PDF, Scan to Tiff and has automatic image processing functions www.softi.co.uk ..

GroupDocs.Conversion for Java v.1.0.0A universal document conversion Java library designed for easy integration into your own apps. Allows you to convert over 50 document types, including Microsoft Word, Excel, PowerPoint and Visio to PDF and raster image files.

QBO2PDF v.3.0.0.1QBO2PDF is an useful utility to convert your QBO (Quickbooks Web Connect) files to PDF format. Simply browse for your file, review transactions, select all or less and save it.

Bank2PDF for Mac v.3.2.5Finally the solution to convert your transaction files into a readable format ready to archive or print. Convert QFX/OFX/QBO/QIF to PDF and open in any PDF viewer. Review transactions in a readable view before converting.

QBO2PDF for Mac v.3.3.0Need to convert a transactions file to easy to access or archive format? Convert QBO to PDF and open in any PDF viewer. Review transactions in a readable view before converting. Free trial (up to 10 transactions per file converted) is available.

QFX2PDF for Mac v.3.3.0Need to convert a transactions file to easy to access or archive format? Convert QFX to PDF and open in any PDF viewer. Review transactions in a readable view before converting. Free trial (up to 10 transactions per file converted) is available.

PDF Bookmark v.1.11PDF Bookmark software automates the process of extracting bookmarks from existing pdf's, applying bookmarks to pdf's and updating/adding bookmarks to pdf's, it can also do list of files processing.

Silverlight .NET Image Viewer SDK v.1.65For .NET Developers who need to imaging SDK on Window and Mac. Display multi-page TIFF, BMP, GIF, JPEG, PNG, Barcode reader . Save as PDF, bmp, JPEG, PNG, multi-page TIFF. Fully-managed .NET library.

Epubor Mac eBook Converter v.2.0.0.3Epubor Mac eBook Converter enables you convert any ePUB, PDF, AZW, Mobi, PRC, HTMLZ, Topaz, etc. files on Mac, That means on Mac within minutes you can convert ePUB and PDF books to Mobi or AZW formats to be read them on diverse series Kindle devices ..

GroupDocs.Conversion for .NET v.1.8.0A lightweight .NET library that allows developers to convert back and forth between 50+ file formats, including PDF, Word, Excel, PowerPoint, Visio, CAD and raster images. The library is designed as a middleware for easy integration into .NET apps.

Epubor Ultimate for Mac v.3.0.9.331Epubor Ultimate eBook Converter for Mac has a powerful function enables you easily convert any ePUB, PDF, Mobi, AZW, Kindle eBooks to be read on any popular e-readers you'd like.

Cisdem Document Reader for Mac v.5.2.0Cisdem Document Reader for Mac enables you to read WPD, WPS, XPS, VISIO, DjVu, Winmail, PDF files on Mac with a fantastic reading experience. It also lets you easily print WPD, WPS, XPS, VISIO, PDF files and save it to PDF format on Mac.

WMF Converter Pro v.3.4.2The program allows you to render and convert single or multiple WMF, EMF files, preview them, change colors in vector based WMF files, and save either all of them, or selected ones as mac native images in one of 10 file formats ..

LeapDoc v.1.11Press print on your Mac or PC to automatically convert files to PDF & push them to your iDevice. Your iDevice is an amazing way to read documents. LeapDoc makes it much easier to get files such as iWork & MS Office documents to your iPhone, iPad or ..

Decipher TextMessage v.11.2.8Save iPhone text messages to computer to keep a running history of SMS, iMessage, and MMS messages on your Windows PC. Recover lost and deleted text messages. Print text messages or export to PDF.

Djvu To Pdf software by TitlePopularityFreewareLinuxMac

Today's Top Ten Downloads for Djvu To Pdf

Doxillion Document Converter Free Mac Doxillion Free Document and PDF Converter Software for Mac

Epubor Kindle to PDF Converter for Mac The excellent Epubor Kindle to PDF Converter helps you

PDF Imposition DE PDF Imposition DE software software automates the process

PDF Editor Mac PDF Editor Mac is a OS X free application that allows

WMF Converter Pro The program allows you to render and convert single or

RTF TO XML RTF TO XML converts RTF documents into well-formed XML, PDF

GroupDocs.Conversion for .NET A lightweight .NET library that allows developers to convert

PDF Bookmark PDF Bookmark software automates the process of

Cisdem PDF Converter OCR for Mac OCR PDF Converter comes with OCR technology to convert

Fopydo Image Scan for Mac OS X Fopydo Image Scan software was designed for creating PDF

Visit HotFiles@Winsite for more of the top downloads here at WinSite!

0 notes

Text

How To Get Validation Code For Quickbooks 2010

Sample Results From Member Downloads

How To Get Validation Code For Quickbooks 2010 Error

How To Get Validation Code For Quickbooks 2010 Download

QuickBooks Pro 2010 validation code free download. To activate QuickBooks. Open QuickBooks. If you have not yet registered QuickBooks, the Register. Quickbooks Validation Code. On Jul 8, 2014 at 13:31 UTC. Solved General Software. Next: Keepass 2 Sync on LAN. Get answers from your peers along with.

How To Get Validation Code For Quickbooks 2010 Error

Download NameDate AddedSpeedQuickbooks Pro Validation Code HDTV X26414-Jan-20212,582 KB/sQuickbooks Pro Validation Code Download14-Jan-20212,321 KB/sQuickbooks Pro Validation Code Crack13-Jan-20212,184 KB/sQuickbooks Pro Validation Code Unlock Code11-Jan-20212,085 KB/sQuickbooks.Pro.Validation.Code_09.Jan.2021.rar09-Jan-20212,723 KB/sQuickbooks Pro Validation Code (2021) Retail06-Jan-20212,811 KB/s

Showing 6 download results of 6 for Quickbooks Pro Validation Code

Welcome To DownloadKeeper.com

DownloadKeeper.com provides 24/7 fast download access to the most recent releases. We currently have 445,458 direct downloads including categories such as: software, movies, games, tv, adult movies, music, ebooks, apps and much more. Our members download database is updated on a daily basis. Take advantage of our limited time offer and gain access to unlimited downloads for FREE! That's how much we trust our unbeatable service. This special offer gives you full member access to our downloads. Take the DownloadKeeper.com tour today for more information and further details!

Quickbooks Pro Validation Code Information

Quickbooks Pro Validation Code was added to DownloadKeeper this week and last updated on 13-Jan-2021. New downloads are added to the member section daily and we now have 445,458 downloads for our members, including: TV, Movies, Software, Games, Music and More. It's best if you avoid using common keywords when searching for Quickbooks Pro Validation Code. Words like: crack, serial, keygen, free, full, version, hacked, torrent, cracked, mp4, etc. Simplifying your search will return more results from the database.

Copy & Paste Links

The word 'keygen' means a small program that can generate a cd key, activation number, license code, serial number, or registration number for a piece of software. Keygen is a shortcut word for Key Generator. A keygen is made available through crack groups free to download. When writing a keygen, the author will identify the algorithm used in creating a valid cd key. Once the algorithm is identified they can then incorporate this into the keygen. If you search a warez download site for 'quickbooks pro validation code keygen', this often means your download includes a keygen.

Popular Download Searches

Quickbooks Pro Validation Code | Quickbooks Pro Validation Code Crack | Avs Document Converter V2.2.4.210 | Rslogix 5000 V20.1 | Bubble Flytrix 1.10 For Palmos | Dap Latest | Winpatrol Plus V11.3.2007 Italian | Sony Sound Forge Audio Studio 9.0a | Sony Sound Forge 9.0e Build 441 | Megan Summers | Mac Os 9.2 | Clck RuSdhDh | Coin Organizer Deluxe 1.7 | Steinberg Lm | Allok Avi Mpeg Converter 4.4.0725 | Pgi Server V6.0.5 Linux | Tuneup Utilities 2010 9.0.4500.27 | The Devil In Miss Jones | Acd Tools | Argus One Dongle |

[ Home | Signup | Take A Tour | FAQ | Testimonials | Support | Terms & Conditions | Legal & Content Removal ] Design and Layout © 2021 DownloadKeeper. All rights reserved.

Quickbooks Data Recovery/ QBW File Repair / Quickbooks QBB Backup Recovery Quickbooks Data Recovery/ QBW File Repair / Quickbooks QBB Backup Recovery We offer the following services to users of QuickBooks: Data Recovery including damaged media (backups made on bad floppy disks) Password Recovery Conversion or update of QuickBooks files to later versions If you are having problems with your QuickBooks data, we can fix it. Guaranteed.

File Name:022-Quickbooks.asp#exp.zip

Author:File Repair Inc.

License:Shareware ($299.00)

File Size:5.08 Mb

Runs on:WinXP, WinME, Win98, Win95

dotConnect for QuickBooks is an ADO.NET provider for working with QuickBooks data through the standard ADO.NET or Entity Framework interfaces.

File Name:dcquickbooks.exe

Author:Devart

License:Shareware ($299.95)

File Size:44.83 Mb

Runs on:Win2000, WinXP, Win7 x32, Win7 x64, Windows 8, Windows 10, WinServer, WinOther, Windows2000, Windows2003, Windows Server 2000, Windows Server 2003, Windows Server 2008, Windows Server 2008r2, Windows Server 2012, Windows Tablet PC Edition 2005, Windows Media Center Edition 2005, WinVista, Windows Vista, WinVista x64

Quickbooks Data Recovery and damaged file repair for Quickbooks data file .QBW and Quickbooks backup file .QBB. Our goal is to help users of Quickbooks accounting software recover or repair valuable data files such as .QBW (QuickBooks Primary Data File) and .

File Name:submission_forms.zip

Author:Data Recovery USA Inc

License:Commercial ($)

File Size:6 Kb

Runs on:Win 3.1x, Win95, Win98, WinME, WinNT 3.x, WinNT 4.x, Windows2000, WinXP, Windows2003, Windows Vista

Create and print complete checks from VersaCheck Presto or directly from your QuickBooks, Quicken and Peachtree program using inexpensive blank check paper. Print from multiple bank accounts using one check stock. One time installation and setup of. ...

File Name:VersaCheck Presto

Author:VersaCheck

License:Freeware (Free)

File Size:89.49 Mb

Runs on:Windows2000, Windows2003, WinXP, Windows Vista, Windows 7

Backup your QuickBooks files with EZ Backup! EZ Backup QuickBooks Pro makes it easy to backup your QuickBooks data files to a local drive, network folder, CD/DVD and even to a remote FTP server. The application creates a self-restoring backup archive which includes a wizard interface that will guide you through restoring your data.

File Name:rezqbp6_29.exe

Author:RinjaniSoft

License:Shareware ($)

File Size:2.9 Mb

Runs on:WinXP, WinME, Win2003, Win2000, Win Vista, Win98, Win95, Windows 7, Windows 7 x64

NELiX TransaX QuickBooks Module allows acceptance of credit cards and ACH (E-check) transactions through NELiX TransaX within QuickBooks. Free Source code available to qualified partners. Batch processing also available.

File Name:NELiXTransaXQBModule.exe

Author:NELiX TransaX LLC

License:Freeware (Free)

File Size:10.87 Mb

Runs on:WinME, WinNT 4.x, WinXP, Windows2000, Windows2003, Windows Vista, Windows

Here is a simple, powerful client side JavaScript form validation script. You can just choose from a number of pre-built form validation routines. Using this code, you can do the common form validations in a snap!

File Name:javascript_form.zip

Author:JavaScript-Coder.com

License:Freeware (Free)

File Size:80 Kb

Runs on:Not Applicable

IBiz QuickBooks Integrator is a toolkit for QuickBooks™ developers that provides for quick and easy development of fully-integrated QuickBooks solutions. It eliminates much of the complexity of developing such solutions by providing easy to use. ...

File Name:setup.exe

Author:/n software inc.

License:Shareware ($399.00)

File Size:1.8 Mb

Runs on:Windows XP, 2000, 98, Me, NT

QODBC Driver for QuickBooks 8 brings you a convenient and useful software which makes the data in QuickBooks Pro Accounting Software easily available to most Windows applications.It allows you to easily link QuickBooks data into your Microsoft Excel. ...

File Name:QODBC Driver for QuickBooks

Author:FLEXquarters.com LLC

License:Trial ($149.00)

File Size:7 Mb

Runs on:Windows Vista, Windows Me, Windows XP, Window

The software allows you to import Easy Projects items such as time entries, customers, users, etc. into QuickBooks. QuickBooks Connector is an easy-to-use, yet robust application allowing you to export Time Entries and other items.

File Name:EPQBConnector_1.1.3.2229_Setup.exe

Author:Ahau Software

License:Shareware ($39.00)

File Size:13.55 Mb

Runs on:Win2000, Win7 x32, Win7 x64, Win98, WinOther, WinServer, WinVista, WinVista x64, WinXP, Other

The jsFromValidator is an easy-to-setup script for form validation which enables you to handle the whole form validation process without writing any JavaScript code.

File Name:js_afv_107.zip

Author:Professional JavaScripts

License:Shareware ($9.90)

File Size:41 Kb

Runs on:WinXP, Win7 x32, Win2000, Windows2000, Windows2003, Win98, Win95, Unix, Linux

Password recovery tool for QuickBooks documents (*. When you lose your password for a QuickBooks document and have to decrypt it, QuickBooks Password is the tool of choice. QuickBooks Password cracks lost or forgotten passwords to password-protected QuickBooks files (*.

File Name:quickbookspswdemo.zip

Author:LastBit Password Recovery

License:Demo ($45.00)

File Size:921 Kb

Runs on:Win95,Win98,WinME,WinXP,WinNT 4.x,Windows2000,Windows2003

Related:Quickbooks Validation Code - Zip Code Validation - Versacheck Validation Code - Address Validation Code - Fearcombat Validation Code

How To Get Validation Code For Quickbooks 2010 Download

Pages : <1 | 2 | 3

0 notes

Text

Program For Mac Free

Autocad Program Free For Mac

Kerbal Space Program For Mac Free

*Discount available for the monthly price of QuickBooks Online (“QBO”) is for the first 3 months of service, starting from the date of enrollment, followed by the then-current monthly price. Your account will automatically be charged on a monthly basis until you cancel. If you add or remove services, your service fees will be adjusted accordingly. Sales tax may be applied where applicable. To be eligible for this offer you must be a new QBO customer and sign up for the monthly plan using the “Buy Now” option. This offer can’t be combined with any other QuickBooks offers. Offer available for a limited time only. To cancel your subscription at any time go to Account & Settings in QBO and select “Cancel.” Your cancellation will become effective at the end of the monthly billing period. You will not receive a pro-rated refund; your access and subscription benefits will continue for the remainder of the billing period. Offer cannot be combined with any other Intuit offer.

The 2016 edition offers what Microsoft calls a 'simplified' Visual Basic Editor (VBE), which allows you to debug existing macros. For those who built macros in preceding Mac editions, this is a big loss. Bottom Line Excel 2016 is probably worth the upgrade just based on its ability to take advantage of OneDrive. But if you want to build new macros, you need to do that on the Windows side or use an earlier Mac version. Cons Macro limits: Prior to Office 2016, you could build macros in Excel for Mac. Excel type program for free.

HyperEngine-AV is a free video editing software for Mac used to capture, edit, organize process, and export video, audio, and text to create DVD quality movies and slide shows. It comes with twelve studio-quality effects from Arboretum's Hyperprism suite of audio processors. Download, Install, or Update the best Mac apps - MacUpdate.

Autocad Program Free For Mac

QuickBooks Online requires a computer with a supported Internet browser (see System Requirements for a list of supported browsers) and an Internet connection (a high-speed connection is recommended). The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Free flowchart program for mac. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks plan.

Kerbal Space Program For Mac Free

The QuickBooks Online mobile and QuickBooks Self-Employed mobile companion apps work with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Cancellation policy: There’s no contract or commitment. Music cutting program for mac. You’re free to switch plans or cancel any time.

The software also finds the duplicate or redundant files and enables deleting them Stellar Smart. It also synchronizes files between folders and shreds your unwanted files. Which program on my mac is best for duplicating cds. (stellar-info.com) 2 Smart Duplicate Finder - Accurately Finds & Removes Duplicate Files, Images/Photos/Pictures, Songs/MP3/Music Files and any other duplicates on your Computer and USB Drives. Size: 2.5 MB, Price: USD $29.95, License: Shareware, Author: Marvysoft (smartduplicatefinder.com) 3 -AVAILABLE AT MAS ONLY- Duplicate File Finder & Remover searches for duplicate files on Mac (internal and external drives), network and cloud storages. Size: 6.0 MB, Price: USD $9.95, License: Demo, Author: Stellar Information Technology Pvt.

Online services vary by participating financial institutions or other parties and may be subject to application approval, additional terms, conditions, and fees.

Claims

†5.6 million customers claim: Based on U.S. QuickBooks Online customer transaction data categorized from Jan-Apr 2016. QuickBooks Self-Employed customers are not included.

Terms, conditions, pricing, features, service and support are subject to change without notice.

0 notes

Text

300+ TOP FILEMAKER Interview Questions and Answers

FILEMAKER Interview Questions for freshers experienced :-