#restore 1950s tax brackets

Text

#restore 1950s tax brackets#vote blue#vote biden#democrats#tax the rich#tax the 1%#tax the billionaires#billionaires should not exist#vote democrat#democracy#social democracy#vote blue to save democracy#vote blue 2024#democratic socialism#democrats now socialism later#vote biden/harris#biden/harris 2024

682 notes

·

View notes

Text

Article: In 41 States, Richest 1 Percent Pay Lowest Tax Rate of Any Group

In 41 States, Richest 1 Percent Pay Lowest Tax Rate of Any Group

The wealthy benefit the MOST off American infrastructure, highways, bridges, public schools & colleges.. police..& courts.. to protect their property .. All that costs OUR tax dollars.

Yet the filthy rich pay a LOWER PERCENTAGE. We pay 20% .. they pay far less. It hurts us middle class people. You can't buy products or take vacations with a 20% tax bill.

The rich CAN afford it, it doesn't hurt their lavish lifestyle. They have more than they can ever want or need.

It's just not fair.

Worse, this easy ability to keep profits because taxes are so low the rich can KEEP IT ALL is fueling greedflation and wildly unethical behavior.

This didn't happen in the early 60s when you couldn't keep nearly ALL your massive income.

In the 1960s any income over $2 million a year (not a bad salary) was taxed at 90%

High taxes then went far to stop greedy behavior because you couldn't turn millions into billions so easily as you can now.

Also...

Republicans claim to care about the national debt, but they keep making it worse by cutting taxes for the rich and yet still spending big on the Pentagon.

Tax the rich, or the American dollar will crumble eventually.

1 note

·

View note

Note

what was happening with deregulation in the US in the late 20th century? a lot of time I hear things in [blank] industry were okay and then Reagan/1980s happened.

Aha. Ahahhahaha. Ahahaha. HAH.

Basically: yes. Unbelievable as it may sound, the Republican party did once have a policy platform that consisted of more than "torment gay people, women, and people of color as much as possible while worshiping a deranged orange con man wannabe dictator." There are many trenchant analyses to be written on how they fell so far, though a large part of that must point out the abject white hysteria that resulted after Obama was elected in 2008, the institutional guardians of white supremacy realized that they hadn't done "well enough" at keeping a black man out of the White House, and two years later, we had the Tea Party. (Who, frankly, look almost cute and cuddly compared to the QAnon insurrectionist nutcases today.) However, I digress.

In the immediately post-World War II West, government spending was actually seen as a good thing, coming on the heels of Franklin D. Roosevelt's landmark New Deal that overhauled US social safety nets and public spending. The US-backed Marshall Plan was developed to restore Europe, and war hero general, the Republican Dwight D. Eisenhower, was elected president in 1953. During the two terms of his presidency (1953-61), the top marginal tax bracket was a whopping 91%. This itself was lower than the absolute maximum tax rate, which in 1944 rose to 94% of all income over $200,000 ($2.5 million in today's money). Not surprisingly, during Eisenhower's presidency, the US built the interstate system, developed the space program, and actually had money to fund public services and schools. This was the era when you could go to a public university for about fifty bucks a semester and buy a house on minimum wage, in your first job after you graduated. (Yes, I know this is enraging.) Not to paint too rosy a picture -- after all, this was the 1950s, with its violent Jim Crow laws, electroshock therapy as a common and accepted "remedy" for homosexuality, and attempts to force women back into the domestic sphere after their liberation during WWII -- but yes, it did relentlessly tax the wealthy and spend the profits on civic and public infrastructure. This all happened under Eisenhower, who was, again, a Republican.

High taxes on the wealthy remained a staple through the 1960s and 70s. In 1964, the topmost bracket was lowered to 77%, and in 1965, to 70%, where it remained until 1981. You may recognize this as Ronnie Raygun's first year in office. Then it was slashed to 50%, while Reagan hiked taxes on lower earners (despite his reputation as the Great Economizer, he raised taxes twelve different times during his eight years in office). By 1987, the highest marginal tax rate for an individual had plunged all the way to 28 percent (this down from the aforementioned high-nineties and middle seventies). Corporate and capital gains tax rates also took a dive, in the name of establishing what was forever after known as "Reagonomics," "supply-side economics," or "trickle-down economics." In short, in the thinking of the early 1980s Republican party, all this excessive taxation and government regulation was hindering the "pure" operation of the free market, and unfortunately, the market turmoil, gas shortages, and economic crashes of the 1970s made this a winning political platform. So cut the taxes, cut the rules, let the wealthy entrepreneurs do their thing, and they'll make so much money that they'll just benevolently hand it down to the lower classes!

That, again, might sound totally ludicrous, but it was the core of Reagonomics' magical thinking: enable the rich to make as much money as possible, and the rest of the economy will sort itself out. Well, as you may know, that, uh, did not happen. When you allow rich people to keep all the money they make, it turns out that they just hoard it, and don't actually altruistically pass it down to the lower classes. This slash in tax rates had to be accompanied, as mentioned, by removing all the bothersome rules and regulations that tried to ensure the ethical operation of the government and major companies. This was also a Reagan-specific innovation. Even Richard Goddamn Nixon (also a Republican) was fairly liberal on social programs and had created the Environmental Protection Agency and the Clean Water Act in 1972. The Reagan gang wanted that gutted, because it did annoying things like police the amount of toxic chemicals in groundwater, and that could interfere with making big-bucks profits. All those rules had to go, because again, they interfered with the so-called "Invisible Hand" of the market wherein it would, allegedly, automatically correct and police itself. Anything that made money for corporations was Good. Anything that didn't was Bad.

Reagan then joined this all-for-the-rich economic strategy with the other toxic element gaining power in American politics at this time: the religious right. Prior to the late 70s and early 80s, Christian conservatives had seen politics as something too grubby and of-this-world for true believers to concern themselves with; they only had to worry about heaven and the world to come. But with the rise of televangelists like Jerry Falwell, Pat Robertson, and the rest of the miserable crew, white evangelical Christians were mobilized to vote in large numbers -- and consistently -- for the first time. (Unfortunately for the rest of us, they have never stopped.) There was no chance of them joining the Democratic party, which had already horrified them with its acceptance of black people, the Voting Rights Act, the Civil Rights movement, and the federal push to desegregate schools and colleges (see especially the SCOTUS case Bob Jones University v. United States, 1983). So they found a welcoming home in the revamped Republican party, where economic and social conservatism made a happy marriage. Reagan was probably about as genuinely religious as Trump was (and as a former actor, he also came from an entertainment background), but he knew how to use the language and symbols of the religious right to cast himself as their shining moral hero (his campaign slogan in 1980 was, you guessed it, "Make America Great Again.") This, of course, played into Reagan's handling of the AIDS crisis, which was basically: just ignore it, it's God appropriately punishing those dirty homos.

Combined with his apocalyptic rhetoric about the Cold War, which drove the conflict to unsustainable levels before Reagan finally realized that maybe that wasn't a great idea, and his tendency to see the American president as an unaccountable monarch who didn't need to sully himself with asking Congress for approval (most notably exemplified in the Iran-Contra scandal of 1986, which almost brought down the administration), we can see all the ugly seeds of the lunatic far-right white-grievance cruelty machine that we're stuck with under the label of the Republican party today. This neoliberal economic policy was eagerly continued in the 90s under Bush Senior and Clinton: cut taxes, cut regulation, don't let anything get in the way of the Free Market. Which has led us to the wild income inequality we now have, the way billionaires and corporations have been largely able to completely shield their mega-profits from any taxation at all, and the resulting starvation of the middle and lower classes. What used to be automatically paid for, i.e. college, now has to be extensively loaned for, and that debt will usually never be fully paid off. There's no way a person can survive on one minimum-wage job, let alone buy a house.

We are only now talking about maybe, finally, imposing a 15% base rate for corporate taxation around the world. Fifteen percent. In America, it used to be as high as fifty-two percent (in the late 60s). Can you even imagine the abject screaming about socialism if that was proposed again today? Because yes, Reagan and the 1980s happened, and this is now what we're stuck with. Thanks for nothing, Gipper. Fuck you. Fuck you very much.

265 notes

·

View notes

Text

The Fabled 91% Tax Rate of Americas “Golden Years”

In light of the immense 70% tax rate Alexandria Ocasio-Cortez has introduced, which she has dubbed the ‘Green New Deal,’ it is necessary to discuss some of the claims she has referred to. In essence, she demands the wealthy pay a large portion of their income to subsidize government initiatives to combat environmental woes. Now I would hope we can all come into agreement that the environment is a vital factor that must be accounted for, after all, it is our home. Instead of discussing the varying approaches to its conservation and restoration, another conversation has been brought forth.

This is the notion that in the middle of the 20th century, the wealthy paid enormous taxes upwards of 91%. In regards to the marginal tax rate, Ms. Ocasio-Cortez is correct. However, we must dig into the nuances that are being conveniently ignored. This has created a much emphasized misconception floating around the minds of many Americans, particularly progressives, and it couldn’t be farther from the truth. To properly assess this, one must understand the history of tax laws in the United States, and their policy implications of today. Firstly, we must understand the purchasing power of money, PPM, has declined due to inflation. For example, $500,000 dollars in the 1950’s and 1960’s would equate to roughly $5 million dollars in today’s PPM. Obviously, this distorts statistics that are employed.

In the 50’s and 60’s, because there were a dramatically small number of individuals who were in that top tax bracket, and those who were did not pay anywhere near that fabled 91%. A study from the Congressional Research Service concluded that the effective tax rate for the 0.01 percent of earners paid only around 45% of their earnings. It also must be stressed, this 45% accounts for income, corporate, property, estate, and payroll taxes. This includes collections from federal, state, and local governments. In regards to income taxes exclusively, the wealthy paid an effective 16.9% in the 1950’s. How is this possible one was may ask? One observation is the mass amount of deductions and loopholes taxpayers could utilize, which were eventually disposed of in the Tax Reform Act of 1986. It has been stated by Lawrence Lindsey, the former governor at the Federal Reserve, that only eight Americans, yes only eight, paid the 91% tax rate.

Frankly, it is an erroneous belief that the “Golden Years” of mid 20th century America s was owed to the vast taxation of the wealthy. This claim is supported by the evidence that regardless of the tax rate, the government has only managed to collect roughly 20% of the Gross Domestic Product (GDP) in taxes since the 1950s, which is otherwise known as Hauser Law. Although many economists have their doubts about its validity, it has been consistent in the US economy. One can suggest this is due to a multitude of factors, namely individuals have an incentive to change their tendencies when adjusting for tax rates. One theory to this phenomenon, being a decrease in production and output due to escalated levels of taxation causing lesser tax revenues, is known as the Laffer Curve.

In conclusion, the claim that the rich are not paying their fair share and the vast amounts of financial growth in the 50s and 60s at the expense of the wealthy is a fabled myth. In fact, the top 3% of earners paid only 29% of all federal income taxes in the 1950s. In the recent decade, the wealthy contribute 51% of total federal income tax revenue, although data has shown they pay upwards of 70%. It is unfounded, and the claim has little to no evidence to support it. When will progressives, and even conservatives in regards to trade, learn that a market economy is not a zero-sum game? Just because one individual is better off, it does not make another poor. As history has shown, when wealthy entrepreneurs are engaged in large amounts of production and output, those who surround them are much better off. If we are to consider drastic policy, Ms. Cortez and her constituents should not be misleading in their observations.

The post The Fabled 91% Tax Rate of Americas “Golden Years” appeared first on Being Libertarian.

from WordPress http://bit.ly/2C9KA5f

via IFTTT

15 notes

·

View notes

Text

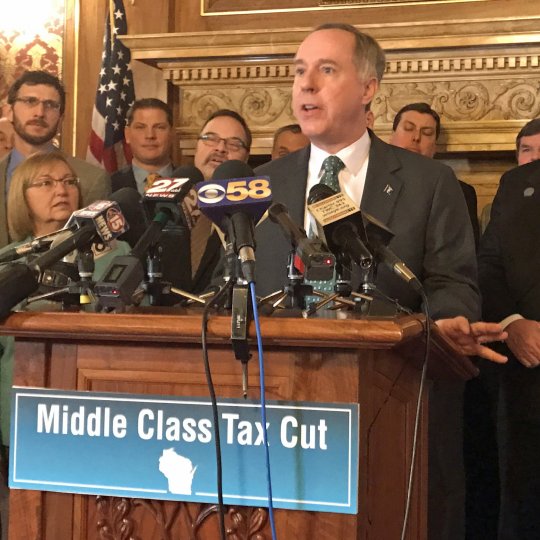

What Have Republicans Done For The Middle Class

New Post has been published on https://www.patriotsnet.com/what-have-republicans-done-for-the-middle-class/

What Have Republicans Done For The Middle Class

Tax Cuts For The Wealthy

Republican Tax Plan Worse Than We Thought For Middle Class Americans? | Velshi & Ruhle | MSNBC

The massive tax cuts that wealthy people get do not eliminate the naturally occurring expenses of our nation. The money has to be made up from somewhere, and whenever the elite class gets a tax cut, it ends up being the middle class that is forced to shoulder the burden.

If you look at the tax code from back in the decades when the United States was fiscally solvent, there were always massive taxes on extreme wealth. These taxes existed to provide incentive to major corporations to invest in their people and maintain a high standard of living for the middle class. This allowed those businesses to show a higher payroll expense and provided them with an obvious means of staying out of the high tax brackets.

Now that there are no longer any high tax brackets, those corporations just keep that money for themselves. Thats why the minimum wage has stagnated for decades and its no longer possible for families to support themselves on a single income.

Views On Cost Of Living Across Social Classes

Overall, 49% of the public says their familys income is falling behind the cost of living, while 42% say it is staying about even and just 7% say it is going up faster.

Across class lines, fully 66% of those who identify as lower class say they are falling behind the cost of living, compared with 29% who say they are staying about even and 4% who say their income is going up faster than the cost of living. Views are mixed among the middle class: 48% say their income is staying about even with the cost of living, but almost as many say it is falling behind; 6% say it is going up faster. Even among the upper class, about as many say their income is falling behind the cost of living as going up faster ; a 58% majority of upper-class adults say their income in staying about even with the cost of living.

Over the past two years, the overall share of the public saying they are falling behind the cost of living has declined as the share saying they are staying about even has increased.

Across the social classes, there has been a comparable uptick in the share saying they are keeping up with the cost of living among those who say they are upper class , middle class and lower class .

Life Satisfaction And Views Of Personal Finances Across Social Classes

Assessments of life satisfaction differ across self-identified social classes, with some of the widest differences seen between the views of the lower class and those of the upper and middle classes.

Majorities across groups say they are very satisfied with their family life. However, somewhat greater shares of those in the upper class and middle class say this than of those in the lower class .

About three-quarters of upper-class adults say they are very satisfied with their present housing situation; 68% of those in the middle class also say this. Among lower-class adults, far fewer say they are very satisfied with their current housing.

Similarly, most upper- and middle-class adults say they are very satisfied with their education, compared with 43% of lower-class adults.

Among those currently employed, 62% of upper-class adults say they are very satisfied with their current job, while about half of those in the middle class say they are very satisfied with their job. Among employed adults who describe themselves as lower class, 40% say they are very satisfied with their current job.

As the country has recovered from the Great Recession, assessments of personal finances have improved across most groups, particularly among those who describe themselves as middle class.

Among those who say they are middle class, positive personal financial ratings are up 12 points, from 43% who described their finances as excellent or good in 2011 to 55% in the current survey.

Recommended Reading: Have Democrats Tried To Impeach Every Republican President

The Middle Class Rises

The middle class, which Pew defines as two-thirds to two times the national median income for a given household size, began to grow after World War II due to a surge in economic growth and because President Franklin Delano Roosevelts New Deal gave workers more power. Before that, most Americans were poor or nearly so.

For example, legislation such as the Wagner Act established rights for workers, most critically for collective bargaining. The government also began new programs, such as Social Security and unemployment insurance, that helped older Americans avoid dying in poverty and supported families with children through tough times. The Home Owners Loan Corporation, set up in 1933, helped middle-class homeowners pay their mortgages and remain in their homes.

Together, these new policies helped fuel a strong postwar economic boom and ensured the gains were shared by a broad cross-section of society. This greatly expanded the U.S. middle class, which reached a peak of nearly 60 percent of the population in the late 70s. Americans increased optimism about their economic future prompted businesses to invest more, creating a virtuous cycle of growth.

Government spending programs were paid for largely with individual income tax rates of 70 percent on wealthy individuals and high taxes on corporate profits. Companies paid more than one-quarter of all federal government tax revenues in the 1950s . Today they contribute just 5 percent of government tax revenues.

Fouling Our Air And Drinking Water

Vote

EPA Greenhouse Gas Regulation : House Vote 249. Adopted 255172: Republicans 2360; Democrats 19172 on April 7, 2011

Purpose

This bill would prohibit the Environmental Protection Agency, or EPA, from regulating greenhouse gases in any effort to address climate change. It would amend the Clean Air Act to strike specific elements from the definition of an air pollutant unless regulation of those chemicals is not used in an attempt to address climate change. It also would clarify that the bill does not limit the authority of a state to regulate the emission of a greenhouse gas unless the regulation attempts to address climate change. This bill would harm all Americans. Greenhouse gases such as carbon dioxide and nitrous oxide are emitted from power plants, industrial facilities, and other sources, and released into the atmosphere. As these gases linger in the atmosphere, they trap heat radiating back from Earth, and the surface temperature of our planet rises. The rise in temperature causes rising sea levels, increased rainfall, floods, drought, wildfires, and severe storms, which not only harm our environment but also hurt our economy.

Vote

Commercial Boiler Emissions : House Vote 791. Adopted 275142: Republicans 2340; Democrats 41142 on October 13, 2011

Purpose

Vote

Water Pollution Regulatory AuthorityPassage : House Vote 573. Adopted 239184: Republicans 22313; Democrats 16171 on July 13, 2011

Purpose

Read Also: Kaine’s Lapel Pin

Republicans Are Protecting The Middle Class

H.R. 622, The State and Local Sales Tax Deduction Fairness Act, which makes the state and local sales tax deduction permanent, will bring much-needed tax fairness and certainty for hardworking taxpayers in states without a state income tax.

It will put more of the hard-earned money back into the pockets of people in states like Texas, Washington, Florida and Nevada that currently dont have the option.

It will allow families to keep more of their paycheck each year instead of feeding the corrupt IRS.

Middle class economics should be about helping families keep more of what they earn in sales tax states, and supporting family-owned farms and businesses rather than lining D.C.s pockets.

and the American Dream

For the first time in ten years the House will vote to repeal the estate tax through, H.R. 1105, The Death Tax Repeal Act, in an effort to bury the Estate Tax once and for all.

The Death Tax is an immoral tax and a calculated attack on the American Dream. It hurts our economy, punishes success and prevents family-owned businesses and farms from being passed down to the next generation. Over time it will steal the nest egg of minority and women-owned businesses, the fastest growing group of new start-ups in America who are building wealth for the very first time.

President Obama has been advised that if these bills hit his desk he should veto both of them. Why is the President turning his back on hardworking taxpayers? Why are we punishing success

How Democrats Became The Party Of The Upper Middle Class

Democrats may find it impossible to reclaim their historical identity.

When House Democrats introduced;what they call;the Heroes Act;this month, they described it as a bold and comprehensive coronavirus response bill that will meet the challenge this pandemic poses to our nation. Among;its provisions: restoring the full deductibility of state and local taxes, which the Republican tax legislation of 2017 had limited.

The issue doesnt have much to do with the coronavirus.;Theres only a loose relationship between the states hardest hit by it and the states whose residents have faced the most tax increases because of the deductibility limit. Liberal think tanks have criticized the idea of raising the cap,;noting;that 56% of its benefits would flow to the top 1% of households, and 80% would go to the top 5%.

Repealing the cap is nonetheless a party priority. After House Democrats impeached President Donald Trump on Dec.;18, it was the first order of business they took up. They passed full deductibility on Dec. 19.

As Democrats have kept raising the issue, Republicans have taken pleasure in pointing out that the politicians who usually decry budget-busting tax cuts for the rich were in this case demanding some.

Most nonwhite Americans vote for Democrats regardless of diploma . What underlies the new educational divide is a marked change in the preferences of white voters.

Also Check: Did Republicans And Democrats Switch Names

Scrapping Consumer Product Safety

Vote

Fiscal 2011 Continuing Appropriations, Consumer Product Safety Database : House Vote 137. Adopted in Committee of the Whole: 234187, Republicans 22710; Democrats 7177 on February 19, 2011

Purpose

This amendment would have barred the use of funds made available to implement the consumer product safety information database established under the Consumer Product Safety Act. In March 2011 the Consumer Product Safety Commission estab- lished the SaferProducts.gov database to provide all Americans with safety information on products they have bought or will consider buying. Rachel Weintraub, director of product safety for the Consumer Federation of America, argued Republicans were trying to pull the plug on a vital consumer resource.

Views On Government Help For Middle Class Wealthy And Poor

Where Are The Middle Class Tax Cuts President Donald Trump Promised? | Velshi & Ruhle | MSNBC

A clear majority of Americans say the federal government does not do enough to help the middle class, but the middle class is hardly alone on this list. Majorities also say the government doesnt do enough for older people, poor people or children.

Overall, 62% say the government doesnt do enough to help the middle class, while 29% say it does about the right amount and 6% say it does too much. Roughly the same share says the government does not do enough for poor people or for children , and 66% say the government doesnt do enough to help older people.

Wealthy people are the one group included in the survey for which the public thinks the government does too much: 61% say this, while 24% say the government does about the right amount and 9% say it does not do enough.

Republicans and Democrats differ significantly in views of how much help the government gives the wealthy and poor. But there is greater consensus across party lines when it comes to the middle class, with most in both parties saying the government does not do enough for this group.

Fully 77% of Democrats say the government does too much for wealthy people, while 12% say it does about the right amount and 9% say it doesnt do enough. Among Republicans, views are more mixed: 44% say the government does too much to help the wealthy, 39% say it does about the right amount and 9% say it does not do enough.

Read Also: Why Do Republicans Say Democrat Party

Perceptions Of The Parties

Judgments about Romney and Obama mirror the views of middle-class Americans toward the Republican and Democratic parties.

According to the survey, only about a quarter to a third of the middle class says that the Republicans or Democrats primarily favor middle-class interests over those of the rich or poor. Republicans are perceived as the party of the rich, while the middle class is divided over whether the Democratic Party is more concerned about their needs or those of the poor.

To examine the intersection of social class and politics, the Pew Research survey asked respondents if each of the two major political parties favors the rich, favors the middle class or favors the poor.

Overall, the middle class was somewhat more likely to say that the Democratic Party rather than the GOP favored its interests . 13 But about as many say the Democrats favor the poor , and 16% believe the party favors the rich.

At the same time about six-in-ten middle-class adults say the GOP favors the rich

roughly double the 26% who say the Republican Party primarily favors middle-class Americans.

The survey also found that the middle class is politically diverse: Roughly equal shares of middle-class adults identify with the Democratic Party or say they are independents , while somewhat fewer align with the Republican Party . As a group, middle-class adults are more likely to identify themselves as political conservatives than liberals . About a third say they are moderates.

The Philosophy Behind Republican Economic Policy

Republicans advocate supply-side economics that primarily benefits businesses and investors. This theory states that tax cuts on businesses allow them to hire more workers, in turn increasing demand and growth. In theory, the increased revenue from a stronger economy offsets the initial revenue loss over time.

Republicans advocate the right to pursue prosperity without government interference. They argue this is achieved by self-discipline, enterprise, saving, and investing.

Republicans business-friendly approach leads most people to believe that they are better for the economy. A closer look reveals that Democrats are, in many respects, actually better.

Don’t Miss: Why Are Republicans Siding With Trump

President Obama And Mitt Romney Both Say They Are Focused On Improving The Lives Of Middle

Just more than half — 52% — of middle-class adults said the president’s policies would benefit them should he win a second term. A lower number — 42% — of respondents said that Romney’s policies would help the middle class.

The new findings were published Wednesday by the Pew Research Center. The poll was conducted before Rep. Paul Ryan was added to the Republican ticket.

Part of a larger report on the middle class, the survey also indicates that Americans have some strong opinions about which groups would benefit from the candidates’ proposed policies.

A full 71% of respondents said that Romney’s policies would benefit the rich, while only 38% said the same of Obama’s plans.

The numbers flip when middle-class adults were asked about the poor. More than three-in-five — or 62% — said Obama’s policies would help the poor, while only one-in-three said Romney’s plans would help the group.

When asked to rate the parties rather than the candidates, respondents were even less likely to say politicians were looking out for their interests. Just 26% said that Republicans favor middle-class interests over those of the rich and poor. Only slightly more — 37% — said the same of Democrats.

Do Leaders In Congress Agree With The Rich Or The Middle Class

Three other papers similarly found that Democrats and Republicans differ strongly in how they represent different economic classes. But they complicate the story by showing that each partys behavior is influenced by interest groups, by what constituents of their own party say, and whether economic or social issues are at stake.

Matt Grossmann and William Isaac at Michigan State have put together a paper reaching similar conclusions. The authors looked specifically at the views of Democratic and Republican presidents and leaders in Congress and in the presidency, based on a data set covering 1,863 policy proposals the federal government considered from 1981 to 2002 and polling data on how the rich and middle class viewed these ideas.

That lets them see how much each party’s leaders agree with the middle class versus the rich as well as whose views are represented by interest groups like the ACLU, Sierra Club, American Conservative Union, or Americans for Tax Reform.

These interest groups, they find, tend to lean left overall even as some individual ones are conservative. They tend to support economic and social policies backed by the middle class, and oppose foreign policies backed by the wealthy. And Grossmann and Isaac found those groups representing certain subsets of the population were more influential than individual voters.

Read Also: Did Any Republicans Vote To Impeach

Repealing The Affordable Care Act

Vote

Repeal of the Affordable Care Act : House Vote 14. Adopted 245189: Republicans 2420; Democrats 3189 on January 19, 2011

Purpose

This bill called for repealing the Affordable Care Act, which ensures that 32 million people will gain insurance coverage, addresses rising health care costs, and includes important consumer protections against discriminatory insurance practices such as denying coverage to those with pre-existing conditions or charging higher rates based on a patients sex, race, or age. The proposed House bill would restore the provisions of the law amended or repealed by the Affordable Care Act and repeals certain provisions of the health care reconciliation law without offering an alternative to help the middle class cope with ever-rising health care costs. The Democratic Senate has vowed to protect the Affordable Care Act.

Vote

Repeal of Essential Health Care Benefits Section of the Affordable Care Act : House Vote 141. Adopted 239183: Republicans 2352; Democrats 4181 on February 19, 2011

Purpose

The categories are: ambulatory patient services; emergency services; hospitalization; maternity and newborn care; mental health and substance use disorder services, including behavioral health treatment; prescription drugs; rehabilitative and habilitative services and devices; laboratory services; preventive and wellness services, and chronic disease management; and pediatric services, including oral and vision care.

0 notes

Text

An Interview with John Staluppi, Owner of the Cars of Dreams Collection to be Sold at Barrett Jackson in April, 2018.

For nearly fifteen years, TV viewers of the popular Barrett-Jackson collector car auction have come to know John Staluppi for his solid taste in post-WWII American collector cars and his fierce ability to knock out virtually any opponent with a seven-figure bid. Though Barrett-Jackson bidders come in all shapes, sizes, and tax brackets, Staluppi made his mark thanks to a pint-sized lap dog named Dillinger.

A Maltese breed of canine, Dillinger was trained to bark on command. So before long the dog was placing the bids while poised in the arms of John, his wife Jeanette, or one of the Staluppi’s grandkids. Naturally, TV audiences ate it up and little Dillinger became “a thing” at Barrett-Jackson for many years.

With each winning “bark”, Staluppi accumulated another addition to his Cars of Dreams collection of more than 125 top-tier vehicles. Located in North Palm Beach, Florida, the Cars of Dreams collection is stored inside a former department store with more than 70,000 square-feet that’s been decorated with props and street scenes depicting New York City.

Only open four times a year, Staluppi’s private Cars of Dreams collection isn’t available for weddings or birthday parties. Rather, John works with charity organizations to help raise funding for law enforcement, children’s health programs, and heart disease and cancer-prevention research.

We recently visited with John Staluppi to learn more about his background, his plan to “shuffle the deck” by selling 125 cars at the upcoming Barrett-Jackson collector car event in West Palm Beach, Florida, and the plan to replace the sold cars with a whole new stash of classics.

Sadly, little Dillinger has gone to TV dog heaven to frolic with Rin Tin Tin and Scooby-Doo. But fear not, another Maltese pup, this one named Buddy, will take his place. Whether Buddy shares Dillinger’s passion for collector cars and being in the limelight remains to be seen. But either way, with Mr. Staluppi on the hunt for 125-plus new classic cars to replenish his Cars of Dreams collection during the next year, the story is far from over!

HRM) Where are you from?

JS) I was born in the Bensonhurst neighborhood of Brooklyn, New York. After a family move to Long Island, I then moved to Florida around 1977.

HRM) What was your first car memory?

JS) My father had a 1950 Nash four-door, one of those upside-down bathtub looking cars. It was a standard-shift car with the usual column-mounted gear lever, and Dad took the family to upstate New York for a vacation one time. Somehow I ended up alone in the car and was playing with the shift lever. When I got out of the car, I left it in Neutral. The next minute, the car comes rolling through the woods and my Dad was saying, “Whose driving through the woods?” Then he realized it was his car. I got in big trouble for that one. That Nash was one of the big ones with the fold-down seats you could camp in and a body that looked like a big beetle. The dash had this one central pod for the speedometer and gauges, they called it the “Uniscope.” It was a neat car.

HRM) At present I don’t see a Nash Ambassador in the Cars of Dreams collection, rather I see lots and lots of convertibles. What is your favorite car?

JS) I’d say my favorite car is the first Corvette I ever bought, a 1962 in Tuxedo Black. We didn’t have a lot of money, but my family helped me buy it by taking out a second mortgage on our home. It cost $3,100 back then and was a demonstrator model the dealership had for a discount ($4,038 was the base sticker price). I lived right around the corner from the Brooklyn-based Chevrolet dealer that had the car. But that was my first car that was mine. So to answer the question about what’s my favorite type of car, that’d be Corvettes at the core but followed closely by Chrysler 300 letter cars.

HRM) Wow, that’s the other end of the spectrum. Or is it?

JS) Those early 300’s could be very sporty cars. With their stiff suspensions, standard dual-quad induction, big tires, and upsized brakes, they handled better than you might expect. In a sense, a 300 convertible was like a four-seat Corvette. I had many jobs as a kid- I was a mechanic at the Chevy dealer I just mentioned, and a little later I worked as a lifeguard in upstate New York at a resort called Villa Maria. One of the head managers at the resort had a 1960 Chrysler 300F hardtop. It was blue and with the 413, and we used to go out and tear up the highway. It was an unbelievable car and started my love for 300 “letter cars.” It had the swiveling seats, the clear “Astra-Dome” bubble covering the instrument cluster, the massive Exner-era tail fins and being a 1960, was the first year for the ram induction setup (1955-1959 300’s had dual quads arranged inline atop a non-ram manifold). I remember everything about that car. It was a true bad boy and made the 1960 Chrysler 300F my absolute favorite car.

HRM) Your Cars of Dreams collection is known for being one of the few collections with such a wide variety of letter-series Chrysler 300’s. Tell us more.

JS) I have almost one of every letter-series Chrysler 300 here except for the 1959 300E. A total of only 690 1959 E’s were built, of them only 140 were convertibles. Finding a good survivor or even a solid restoration candidate is next to impossible. But that’s the fun of it. At present, I’m selling just about everything you see here in the Cars of Dreams collection. My plan is to fill this building one more time. This go-round, I’m aiming to have a truly complete collection of Chrysler 300 letter cars – including the elusive 1959 “E” – in both body types: hardtop and convertible. I’m a little bit on the fence with the 1962-1965 300s. First off, Chrysler abandoned the tail fins for 1962 but more seriously, Chrysler added a non-performance, non-letter 300 model that could be had with four doors. So to me, the 1962s aren’t as hard-core as the 1955-1961s. So I’m not sure I’ll expend as much effort acquiring 1962-up letter cars for this final go-round.

HRM) You’ve had some race cars, what was the first?

JS) That would be a 1955 Chevy. It was green, and I’m superstitious. Too many times to count, any green race car I’ve owned would blow up on me. It’d break a rear axle, transmission, or something else. We gave that ’55 the name “Mister Jinx.” Eventually we got all the bugs worked out of the car, and I ran it in C / Modified Production (C/MP). That was around the mid-1970s, and the track we used was Englishtown in New Jersey. Vinny Napp was the track manager, and we ran it often enough to hold the C/MP national championship title for a while. We also raced at Westhampton Dragstrip on Long Island and even as far away as Bristol, Tennessee’s so-called “Thunder Valley,” a great strip that’s still very active today. We had a lot of fun back then with Mister Jinx.

HRM) Did you do the driving?

JS) Oh yes! Modified Production allowed a fair amount of changes, so the original 265 V8 was replaced by a 327 with a Mickey Thompson cross-ram intake manifold. We had to remain naturally aspirated but worked in the usual modifications like high compression, a wild solid cam, hotter ignition, and, of course, a four-speed manual transmission. I ran a set of 5.38:1 rear axle gears and used to leave the line at over 6,000 rpm. It’d come out of the hole like a rocket ship.

HRM) Are you a stick man or do you prefer automatic transmissions?

JS) In the earlier days, I was a four-speed maniac. Three-speed on the tree is kind of sloppy- really antiquated. I do like the automatics of today, especially the types you can shift like a stick if you want to. They’re pretty much bullet proof. When you hit traffic, when you have to start shifting, that was fun when I was a kid. But now, at this point in life, I like to enjoy some comfort while I drive. Plus, most cars today only come with an automatic transmission, but again, the manual-shift mode does a pretty good job of simulating the old days – minus the left leg work.

HRM) You managed to locate – and buy – your first Corvette (the black 1962), so have you had any luck finding Mister Jinx, that 1955 Chevy drag car?

JS) Naah, that car is long gone. We sold it to a bunch of guys who continued racing it until it blew a tire and went off the track. I’m pretty sure the car was stripped to a shell then junked.

HRM) Beyond the Cars of Dreams collection, you’ve built and owned a series of 100-to-200-plus foot aluminum-hulled yachts and have a private jet. Success is obviously part of your life, how did it happen?

JS) I started as a mechanic in Brooklyn, then I opened up a gas station. Then a Honda motorcycle dealership franchise became available to me in Queens, on Queens Blvd. I was also a big motorcycle rider and we sold a lot of Honda ‘cycles in the mid-to-late 1960s. By the early 1970s, I was also selling the Honda 600 minicar in fair numbers. But it was the arrival of the larger Civic in 1973 that was really the beginning of true success. Sales were strong enough to allow the addition of more Honda dealerships, in Long Island and other locations. Those little Civics sold very well and I started making the real money. That allowed me to repay my debts to my parents, who funded my early efforts.

HRM) How many Honda dealerships did you grow to, and did you add other brands as well?

JS) In the 1970s, I had five Honda car dealerships and three Honda motorcycle dealerships, and then my first domestic brand was an Oldsmobile store. It was located in Brooklyn, and the success of that led to me getting some Chevrolet outlets. By the late 1980s, I had 42 car dealerships and was the largest privately-held car dealer in the world. Then interest went to 21 percent, and boy the debt load was heavy. I ended up selling off some of the good stores, and kept the bad stores, not that any were really that bad, but we turned them around and kept growing. Today, we’re the third largest privately held car sales company in the country. We do about 70,000 new cars per year, and about 30,000 used cars per year.

HRM) Who runs it all?

JS) It takes a great team, and my partner who helps keep the Long Island dealerships running is Michael Brown. My son John Jr. has stores in Las Vegas, and my son-in-law Scott has car dealerships in Queens, Great Neck, and Long Island. In fact, John Jr. is also a vintage car collector. He’s got about 35 or 40 classics out there in Las Vegas.

HRM) Are these many dealerships recognizable with names like “Staluppi Motors” or some name HOT ROD readers could seek out?

JS) They all carry the name “Atlantic”, “Advantage”, or “Millennium.” The Atlantic name stems from my first Oldsmobile (then later, Chevrolet) dealership, which was called Atlantic Oldsmobile.

HRM) Switching gears back to vintage and collectible cars, when you’re buying, what do you look for?

JS) I’m all about the hunt. I always buy cars I used to work on or knew about when I was a kid. Cars of the 1950s, 1960s, and 1970s were things I worked on, bought, sold, raced, and modified, when they were brand new. Not so much with the cars of the 1980s. By then, I had outgrown much of the hands-on, greasy fingers part of it. When I buy, I seek the finest looking examples and typically avoid unfinished projects. I prefer finished cars because it is all too easy to fall into the trap where you invest more than you’ll ever get back. Sure, if you can do the work on your own, and have the necessary skills to do good work, you can turn out a fine example. But when you add up the hours charged by any professional restoration business, a sure return on investment is rare. This is a labor of love. People who restore these cars spend thousands of hours on them, and finding missing parts is another side of it that can get costly, so I’m attracted to finished cars.

HRM) Are there any cars that you refuse to buy?

JS) I’m not a big fan of some of the more obscure vintage foreign cars. It’s about impossible to get restoration parts [for them]. I’m also not a huge Ferrari guy. Except for the pinnacle cars like the 250 GTO and such, I don’t really see the value.

HRM) No doubt it’s a lot of work to find, buy, and store so many cars. To some people, what you have here on display would be an acceptable life-long accomplishment. But you are about to sell 125 cars at the 2018 Barrett-Jackson West Palm Beach, FL collector car auction and start again. Why?

JS) I get bored. Again, with me it’s about the chase. My main business office is also contained within this structure (a former department store). When I need a break from the daily “brain damage” of keeping track of business, I’ll come out and restore my equilibrium with these wonderful vintage machines. It’s a lot of fun. I’m also a big fan of Lionel trains and have a large, running diorama in its own special room.

HRM) Anyone who has watched the televised Barrett-Jackson collector car auctions knows that you are known for buying the best examples available. Consignors also understand it’s a very good thing when you are bidding on their offerings because price is not an obstacle. Once these cars become part of your Cars of Dreams collection, are they treated differently versus other car collections?

JS) One thing that sets my collection apart from many, is the fact you can jump into any one of the cars on display, drive it out the door and go for a cruise. On the four-speed cars you don’t have to worry about it jumping out of gear because of bad synchros, the lights all work, they are all ready to go. I keep a staff of full-time mechanics led by Dave Crews, and there’s a multi-bay garage at the back of my display room to assure each car is road ready. If I buy a car and issues present themselves, we correct them. That way, when someone buys a car from my collection, they can buy it with good confidence. We exercise our cars, and that’s crucial in this day of reformulated gas that goes bad and gums up carburetors. By exercising the cars, the seals don’t get dried out and it makes a huge difference compared to cars that might sit idle for years at a time in other collections.

HRM) What’s more important to you, matching numbers, or a quality presentation?

JS) I like numbers-matching, but to me what’s more important than that would be the quality of the car, the quality of the restoration. Most of my high-end cars are numbers matching, but the plus to me is the way the car is restored- the quality of the chrome, the quality underneath the chassis, the nooks and crannies. Were the body mounts replaced? Are they detailed to the same degree as the grille? That’s where the value is. When you pull up to a car show, 90 percent of spectators don’t know what numbers matching means. But they do see a quality build, and that’s what I go after. The truth of the matter is, when I worked at Chevrolet, and we would get muscle cars with damaged engines, we simply changed short blocks and tossed the original “numbers matching” parts in the trash. Truth be told, after the repair, the engine was like new. The tiny stamped numbers on the block didn’t play into the equation whatsoever. On most pre-1968 cars, and the vast majority of 1950s cars, numbers-matching status isn’t as important because many cars simply lacked the numbers in the first place. So that’s where we turn our focus to the quality of the paint, chrome, interior, glass, and overall restoration.

HRM) How about resto-mods?

JS) That’s an area that I appreciate. Numbers-matching status has no bearing here, and that’s liberating. I have a number of resto-mods in this collection, and I bought them for the quality of execution. But again, in every case, you could take it out of my building and drive it to California. The air conditioning works, they handle well, the transmissions have overdrive, and they’re usually much faster than any original model. I think resto-mods and resto-rods are where the value is. I think resto-mods are worth a lot more money than a stock restoration. I understand the allure of original equipment, but in today’s world, a top tier resto-mod with good ingredients and craftsmanship is a better buy than a relic restored with original-type bias ply tires, a three-speed manual transmission, drum brakes, and king pin front suspension.

HRM) What are some cars that are under-valued in today’s marketplace?

JS) Big Cadillacs from the 1950s and 1960s. Cadillac is like a symbol, especially with the Eldorado and Eldorado Biarritz, those are real cars. You look at the bumpers, the stainless steel roof material, the interiors with golden threads, I think these cars are very much undervalued. I feel they will climb much higher as more people understand what they represented. Taking it further, I think all of the finned cars from the 1950’s are poised to appreciate. I’m also big on Chrysler finned cars of the Virgil Exner era. Not just the letter-series 300s we talked about already, but the Dodge D500s, Plymouth Furys and DeSoto Adventurers are really important cars that are blue chip investments.

HRM) Modern cars have to pass so many government crash, pedestrian safety and efficiency standards, their designers’ hands are tied. Its’ rumored that Dodge Challenger stylists intentionally gave up something like 1/2 of a mpg in 2008 to allow for the distinctive tunneled grille and “frowning brow” headlamps that give them so much identity. Do you think new cars will ever be distinctive again?

JS) I have a hard time looking at a Lexus or a Mercedes or a BMW, and I’m in the business as a dealer. Its’ hard to say make and model is which. Back then, you knew- that’s an Oldsmobile, that’s a Buick, that’s a Pontiac, that’s a Dodge, etc. You don’t see that now. I feel the carmakers need to add more visual variety and identity to their offerings.

HRM) Can you hint at what direction the next Cars of Dreams collection will take?

JS) This is something that’s a passion to me. Doing this one more time in my lifetime, my next collection of cars will be more of a variety. At present, Cars of Dreams celebrates the convertible body type. But for the next go around, I want more variety. Yes, there will be convertibles, but I also want to go after hardtops and even some wagons. Then I can take it in a different direction. At present, if you look around Cars of Dreams, the only reason you don’t see a convertible on display is when the factory didn’t offer it that way. An example would be the 1956-1957 Lincoln Continental MKII. Except for two factory prototype convertibles in 1957, the MKII is strictly a hardtop. If ever there was a car that deserved to be offered as a drop-top, the MKII is it. And know this, if one of those factory prototype convertibles surfaced, I’d pay the money for it! Another thing I want to point out is that there are two vintage fire trucks in the collection right now. They actually run, and I use them for parades. I had my shop install air conditioning inside one of them because it was so popular, we decided to make it more enjoyable here in the Florida heat. Commercial and emergency vehicles are interesting to me as well; I even have a Ford neighborhood ice cream truck I’ll be selling.

HRM) When you say the word “collection,” how many cars do you have?

JS) I keep about 130 cars here plus another 8 cars I keep at my home. Again, every one of them is ready for the road. Sometimes for fun, I’ll invite four or five buddies to come by then I’ll ask them which cars they want to drive, and we’ll gas them up and then attend a car show or cruise night.

HRM) Besides vintage cars and Lionel trains, you also enjoy ship building. Tell us about it.

JS) I’m building a new yacht now, which will be the ultimate, ultimate boat. I sold Diamonds Are Forever and Skyfall (Google them, dear reader, you’ll be amazed). This new one is a 230-foot boat that is going to be the ultimate yacht that’s ever been built by a person. We are hoping that for next year to have a party on it.

HRM) Back to the next collection, how does that get started?

JS) It isn’t about buying 130 cars, it’s about buying 130 great cars. In addition to having one of every 1955-1962 Chrysler 300 letter-series body type, I hope to focus on Oldsmobiles from 1950 through 1960. I want one of each model in each body configuration. More Corvettes will be added from each era, and I’m not against resto-mods representing specific years.

HRM) What does the future hold for the Cars of Dreams collection?

JS) After the next round of acquiring cars to replace the ones I’m selling at the April 2018 Barret-Jackson sale, I want to eventually pass it down to my son, John Jr. and my grandchildren. John Jr. lives in Las Vegas. He is mostly into Mopars and has about 35 cars there. As for the next round of purchases, I’ll open the door to a wider variety of cars. I’ll be at the auctions, buying and buying and buying. I’m excited to do this again.

HRM) What is it like when you are bidding on a car and suddenly there’s a TV camera pointed at your face?

JS) I gotta be honest- it’s fun. Sometimes when I’m bidding, it becomes like a war with me. Sometimes my wife Jeanette will be there with me while I’m bidding, and she’ll be asking, “are you crazy?” Then my cell phone will go off with calls from friends who see me on TV bidding who want to chime in on the action or they’re texting me “don’t lose that car, it’s a good one.” Meanwhile I’m thinking to the auctioneer “drop the hammer, drop the hammer!” The best is when my grandkids are there and they’re saying, “Poppie we’re not going to let that guy beat us? I say, ‘no way, no way’.” Sometimes it’ll cost me because the ego gets in front of the brain. One thing that used to happen to me at auction that I don’t let happen anymore is when a car shows up under the lights and I haven’t really checked into the underlying quality. When there’s a car on the docket list that catches my eye, now I make sure to get a close inspection in the days before it hits the block. That’s one of the reasons I like Barrett-Jackson, they stage the cars under the tents and in the lines for several days before they sell. This gives ample opportunity for close inspection. Once the car is on the block, there’s really no time to inspect it very closely, it becomes like a big race. But overall, I look forward to every Barrett-Jackson auction. I love it. It’s fun.

The post An Interview with John Staluppi, Owner of the Cars of Dreams Collection to be Sold at Barrett Jackson in April, 2018. appeared first on Hot Rod Network.

from Hot Rod Network http://www.hotrod.com/articles/interview-john-staluppi-owner-cars-dreams-collection-sold-barrett-jackson-april-2018/

via IFTTT

0 notes

Text

How is this real? We've been paying into social security with every paycheck and now orange blowhole thinks he's gonna cut our benefits? The fuck you say.

#restore 1950s tax brackets#tax the rich#tax the 1%#tax the billionaires#billionaires should not exist#vote democrat#vote blue#vote biden#democrats#democracy#social democracy#vote blue to save democracy#vote blue 2024#democratic socialism#democrats now socialism later#social security#biden/harris 2024

117 notes

·

View notes

Text

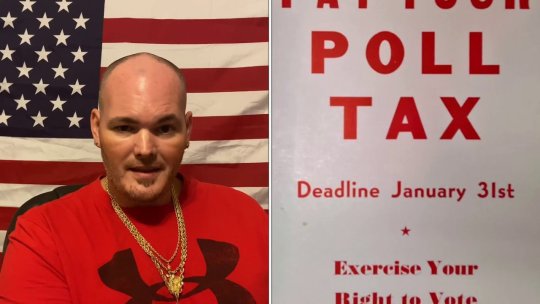

#restore 1950s tax brackets#tax the rich#vote blue#tax the 1%#vote biden#vote democrat#tax the billionaires#billionaires should not exist#democrats#democracy#social democracy#tax the rich!#vote blue to save democracy#vote blue 2024#democratic socialism#democrats now socialism later#biden/harris 2024#vote biden/harris

111 notes

·

View notes

Text

Many churches do charitable work. In my area, the homeless shelter could not operate without the support of local faith communities - including Jews and Muslims.

Fewer people participating in church means fewer people doing that charitable work. If the need is going to be served, more non-religious organizations will have to serve it.

I'm all for taxing churches. I'm also all for taxing the rich and investing that money in social programs that help those in need.

#tax the church#tax the rich#tax the 1%#tax the billionaires#billionaires should not exist#vote blue#vote biden#vote democrat#democracy#social democracy#democratic socialism#democrats now socialism later#restore 1950s tax brackets#vote blue 2024#vote blue to save democracy#vote biden/harris#biden/harris 2024#feed the hungry#love your neighbor#do unto others#judge not#blessed are the peacemakers

63 notes

·

View notes

Text

#restore 1950s tax brackets#tax the rich#tax the 1%#tax the billionaires#billionaires should not exist#vote blue#vote democrat#vote biden#democrats#democracy#social democracy#vote blue to save democracy#vote blue 2024#democratic socialism#democrats now socialism later#biden/harris 2024

76 notes

·

View notes

Text

#guillotine#it worked in france#tax the rich#restore 1950s tax brackets#vote blue#vote biden#vote democrat#democracy#social democracy#vote blue to save democracy#tax the 1%#vote blue 2024#tax the billionaires#billionaires should not exist#democratic socialism#democrats now socialism later

20 notes

·

View notes

Text

I don't understand how anyone thinks this is acceptable, but on the other hand, I own a machete and I am ready when y'all are.

#tax the billionaires#billionaires should not exist#tax the rich#tax the 1%#it worked in france#vote blue#vote democrat#vote biden#restore 1950s tax brackets#democrats#democracy#social democracy#democratic socialism#democrats now socialism later#vote blue to save democracy#vote blue 2024#biden/harris 2024#vote biden/harris#kill the rich#vote blue to save america#vote democratic

20 notes

·

View notes

Text

The rich are routinely given leniency by the courts, unlike the poor, who die in jail. Should surprise no one.

#tax the rich#vote blue#vote democrat#tax the billionaires#billionaires should not exist#vote biden#vote blue to save democracy#democracy#social democracy#tax the 1%#vote blue 2024#democratic socialism#democrats now socialism later#restore 1950s tax brackets#trump is a criminal

1 note

·

View note

Text

Article: New Report Reveals Big Oil’s Playbook to Silence Climate Protest

Billionaires have the power now to silence free speech and protests.

Solution:

1. Vote out Republicans.

2. Impeach corrupt Supreme Court members.

3. Reverse Citizens United.

4. Tax the shit out of MULTI millionaires and billionaires to discourage greed and pay for transitions to clean energy.

#restore 1950s tax brackets#impeach corrupt supreme court members#nationalize oil companies due to worldwild climate crisis

1 note

·

View note