#revenue recognition

Explore tagged Tumblr posts

Text

Nonprofit Revenue Recognition Simplified

Navigating Revenue Recognition Updates in Nonprofit Accounting

Keeping up with revenue recognition updates is essential for nonprofit finance teams, particularly with ASU 2018-08 and ASC 606. Understanding these changes ensures accurate financial reporting and compliance with evolving regulations. One critical aspect is determining whether government grants qualify as exchange transactions or contributions—a distinction that significantly impacts financial treatment.

Ensuring Compliance with ASC 606 and ASU 2018-08

ASC Topic 606 was introduced to align US GAAP with international standards, promoting global consistency in revenue recognition. Meanwhile, ASU 2018-08 refines guidance on contribution revenue, helping nonprofits navigate complex funding scenarios with clarity. Ensuring compliance with these standards is crucial, particularly when dealing with material deferred revenue at year-end.

Streamlining Financial Processes with the Right Tools

Adopting a structured approach to revenue recognition can simplify compliance and reduce manual effort. Many nonprofit organizations turn to specialized financial management solutions to automate and streamline their accounting processes, ensuring accuracy and efficiency in reporting. These tools not only help finance teams stay compliant but also improve transparency in financial decision-making.

Key Takeaways for Nonprofit Finance Leaders

A thorough understanding of updated revenue recognition standards is essential for making informed financial decisions.

Proper differentiation between exchange transactions and contributions ensures accurate reporting, particularly for government grants.

Aligning with ASC Topic 606 helps nonprofits maintain consistency in financial reporting on a global scale.

For finance teams looking to navigate these changes effectively, leveraging expert insights and best practices can provide a clear path forward. A comprehensive resource on simplifying nonprofit revenue recognition is available in this guide.

#nonprofit finance teams#financial management solutions#financial reporting#revenue recognition#financial treatment

0 notes

Text

Managerial Accounting vs Financial Accounting: Explained :

Managerial accounting, or management accounting, is a branch of accounting that focuses on internal financial processes and reporting to aid management in decision-making. Unlike financial accounting, which is primarily designed for external users, managerial accounting provides vital information that managers need to plan, control, and make strategic decisions regarding their operations. This field encompasses a wide range of activities, including budgeting, forecasting, variance analysis, and performance measurement, all geared towards improving the efficiency and effectiveness of an organization.

#Managerial Accounting#Financial Accounting#International Financial Reporting Standards#revenue recognition

0 notes

Text

Navigating Revenue Recognition Complexity

In the realm of revenue recognition, some transactions are straightforward, like retail sales where revenue is recognized upon immediate delivery. However, complexities arise when goods or services are delivered over time, such as subscriptions or bundled products, leading to challenges in determining when and how to recognize revenue.

Adherence to established industry standards, such as Generally Accepted Accounting Principles (GAAP), is crucial for businesses to ensure legal compliance and accurate financial reporting. Proper revenue recognition, guided by principles like ASC 606, not only reflects a company's performance accurately but also fosters transparency and comparability across industries.

Understanding Revenue Recognition: A Crucial Accounting Principle

Revenue recognition GAAP dictates the timing and method of recording revenue in financial statements, emphasizing recognition upon realization and earning, rather than when cash is received.

This principle serves several purposes: it enables CFOs and accounting teams to accurately depict financial performance, ensures transparency and accountability in reporting, fosters consistency and comparability among companies, and enhances trust in financial markets.

Evolution of Revenue Recognition Standards

Historically, revenue recognition standards varied across industries until the introduction of ASC 606 in 2014, which unified the process and shifted towards a more judgment-based approach. This evolution aimed to streamline revenue recognition and align it with GAAP, fostering clearer financial reporting.

Implications of Revenue Recognition on Financial Statements

The ASC 606 framework, in conjunction with GAAP, shapes a company's financial statements by dictating when revenue should be recognized—once performance obligations are met. Adhering to GAAP ensures accurate and consistent reporting, influencing a company's profitability, liquidity, and solvency, thus impacting its valuation and creditworthiness.

Strategic Implications of Revenue Recognition

GAAP's revenue recognition rules inform a company's strategic planning by providing objective performance assessments. Accurate revenue recognition enables informed decision-making in pricing, sales, and marketing strategies, enhancing credibility and reputation in the eyes of investors and creditors.

Core GAAP Principles Supporting Revenue Recognition

Several key GAAP principles underpin revenue recognition, including the realization principle, matching principle, and specific criteria outlined in ASC 606. These principles guide companies in recognizing revenue accurately and consistently, preventing misrepresentation and ensuring compliance.

Industry-Specific Revenue Recognition Guidelines

Revenue recognition practices vary across industries, necessitating tailored approaches. Software, construction, SaaS, eCommerce, and other sectors each have unique considerations for revenue recognition under GAAP, requiring careful assessment of contractual terms and performance obligations.

Navigating Common Revenue Recognition Challenges

Despite standardization efforts, revenue recognition can pose challenges such as timing issues, variable considerations, and complex contractual arrangements. Addressing these challenges requires a systematic approach, accurate estimation of variables, fair value measurements, and robust documentation and communication practices.

Harmonizing GAAP with Revenue Recognition Standards

GAAP complements revenue recognition standards like ASC 606 and IFRS 15, providing essential guidelines for accurate revenue reporting. Automating revenue recognition processes, through services like RightRev, can mitigate complexities and ensure compliance with GAAP, enhancing efficiency and accuracy in financial reporting.

#Revenue Recognition#GAAP (Generally Accepted Accounting Principles)#ASC 606#Financial Reporting#Accounting Standards#Financial Statements#Revenue Management#Revenue Accounting#Compliance#Industry Standards#Performance Obligations#Financial Performance#Revenue Forecasting#Revenue Automation#Strategic Planning#Contractual Obligations#Revenue Challenges#IFRS 15#Revenue Measurement#Financial Compliance

0 notes

Text

IFRS 15 Revenue Recognition Workshop: Navigating the Complexities

In the fast-paced world of business, staying abreast of evolving regulations and standards is crucial for any organization aiming to maintain its competitive edge. Shasat, a renowned name in professional training and development, has taken a bold step forward by launching its highly anticipated IFRS 15 Revenue Recognition Workshop. This intensive program is designed to provide professionals with the knowledge and skills needed to effectively navigate the complexities of the International Financial Reporting Standard (IFRS) 15, which came into effect on January 1st, 2018.

IFRS 15 is a standard that has left its mark on the global business landscape, particularly impacting companies engaged in long-term contracts with multiple elements. Industries such as telecommunications, software development, health sciences, and construction have found themselves grappling with the intricacies of this regulation. Shasat's workshop promises to be a beacon of guidance in this challenging terrain.

At the heart of this program lies a comprehensive exploration of the five-step model of IFRS 15. This model demands that organizations carefully distinguish between various elements within a contract and then recognize revenue for each element based on separate pricing structures. Additionally, participants will delve into the substantial demands imposed by the standard in terms of data collection and system capabilities, offering a practical and hands-on approach to compliance.

One of the standout features of the Shasat IFRS 15 Revenue Recognition Workshop is its holistic examination of the standard's implications. It shines a spotlight on critical areas such as the timing of revenue recognition and its far-reaching effects on aspects like bonuses, performance targets, key performance indicators (KPIs), corporate income tax, external relations, loan covenants, regulatory requirements, and other key areas. Even companies not typically engaged in long-term contracts will grapple with the standard's extensive disclosure requirements, adding to the urgency of understanding its nuances.

Participants in this workshop can anticipate gaining practical insights and skills to effectively navigate the new requirements imposed by IFRS 15. Furthermore, the program will provide attendees with insights into practical approaches for adapting their IT systems and underlying processes to align with the standard's demands. By the conclusion of the course, professionals will possess not only a deep understanding of IFRS 15 but also the confidence needed to ensure compliance with its requirements.

Shasat is proud to present this high-intensity 2-day course, led by expert trainers from the United Kingdom. These trainers bring a wealth of knowledge and experience to the table, offering practical insights and perspectives to help participants tackle the complexities of IFRS 15 head-on. Given the exclusivity of this learning opportunity, Shasat has made a limited number of seats available for the program.

Professionals across industries are encouraged not to miss out on this unique chance to deepen their understanding of IFRS 15 and position themselves for success in an evolving regulatory environment. To secure a spot in this program, individuals are urged to reach out to Shasat's training service team promptly.

Shasat's IFRS 15 Revenue Recognition workshop offers comprehensive coverage of essential areas, equipping participants to effectively navigate the latest regulatory mandates. Key learning features encompass identifying bundles of goods or services compared to distinct ones of substantial similarity, segregating combined contracts into distinct revenue components, determining transaction prices, allocating transaction values to contractual performance obligations, and employing various approaches, including the adjusted market assessment approach, expected cost plus margin approach, and the residual approach (under specific circumstances). Additionally, the workshop delves into recognizing revenue over time or at specific points, handling sales with return rights, addressing presentation and disclosure concerns, and highlighting critical distinctions between IFRS and US Generally Accepted Accounting Principles (GAAP). These topics represent vital knowledge for achieving compliance with the new regulations, and Shasat's expert trainers are dedicated to empowering participants with the requisite expertise and tools to excel in these domains.

Shasat's IFRS 15 Revenue Recognition Workshop will be held at various locations worldwide, ensuring accessibility to professionals from diverse regions. The upcoming program details are as follows:

IFRS 15 Revenue Recognition Workshop | GID 25002 | Zurich: November 6-7, 2023

IFRS 15 Revenue Recognition Workshop | GID 25004 | Singapore: October 26-27, 2023

IFRS 15 Revenue Recognition Workshop | GID 25005 | Toronto: December 8-9, 2023

IFRS 15 Revenue Recognition Workshop| GID 25007 | Cape Town: October 3-4, 2023

IFRS 15 Revenue Recognition Workshop | GID 25008 | Sydney: November 27-28, 2023

IFRS 15 Revenue Recognition Workshop | GID 25009 | Miami: December 19-20, 2023

For more details and to enrol in IFRS 15 Revenue Recognition Workshop, please visit:

https://shasat.co.uk/product-category/ifrs15-revenue-recognition-workshop-2-days/

This global reach ensures that professionals from various regions can access this valuable learning opportunity. To secure a place in the workshop, interested individuals are encouraged to contact Shasat's training service team promptly.

In a rapidly changing business landscape, knowledge is power. Shasat's IFRS 15 Revenue Recognition Workshop promises to be an indispensable resource for professionals seeking to navigate the complexities of this international accounting standard successfully. Don't miss this exclusive chance to enhance your skills and stay ahead in the ever-evolving regulatory landscape.

#IFRS#Financial Education#Accounting Standards#IFRS Training#Revenue Recognition#Financial Reporting#Professional Development#Accounting Courses#Regulatory Compliance#Business Training

0 notes

Text

Revenue Recognition: Understanding Principles and Guidelines

Revenue recognition is a fundamental concept in accounting that outlines the principles and guidelines for recognizing revenue in accordance with accounting standards. It is crucial for businesses to understand these principles to accurately report their financial performance. In this article, we will explore the step-by-step process of revenue recognition, providing detailed explanations and examples that are easily understandable, even for individuals with no accounting background.

What is Revenue Recognition?

Revenue recognition refers to the process of recording and reporting revenue in a company's financial statements. It involves determining when and how revenue should be recognized based on specific criteria outlined by accounting standards, such as the International Financial Reporting Standards (IFRS) or the Generally Accepted Accounting Principles (GAAP).

Step-by-Step Process of Revenue Recognition

Step 1: Identify the Contract

The first step in revenue recognition is to identify the contract between the company and its customer. A contract is an agreement that creates enforceable rights and obligations between the parties involved. It can be written, oral, or implied by customary business practices.

Step 2: Identify the Performance Obligations

Once a contract is identified, the next step is to determine the performance obligations within the contract. Performance obligations are promises to transfer goods or services to the customer. They can be explicitly stated in the contract or implied by customary business practices.

Step 3: Determine the Transaction Price

The transaction price is the amount of consideration that the company expects to receive in exchange for transferring goods or services to the customer. It may include fixed amounts, variable amounts, or both. The transaction price should be estimated at the beginning of the contract, considering any discounts, rebates, or incentives.

Step 4: Allocate the Transaction Price

If a contract includes multiple performance obligations, the transaction price needs to be allocated to each obligation based on their relative standalone selling prices. The standalone selling price is the price at which the company would sell the goods or services separately to a customer.

Step 5: Recognize Revenue as Performance Obligations are Satisfied

Revenue should be recognized when control of the goods or services is transferred to the customer. Control refers to the ability to direct the use of and obtain substantially all the remaining benefits from the goods or services. Revenue can be recognized over time or at a point in time, depending on the nature of the performance obligations.

Step 6: Measure and Recognize Revenue

The final step is to measure and recognize revenue based on the amount allocated to each performance obligation. Revenue should be recognized in the accounting period when the performance obligation is satisfied. This may require the use of estimates, such as the percentage of completion method for long-term projects.

Examples of Revenue Recognition

To illustrate the concepts discussed, let's consider a few examples:

1. Software Sales: A software company sells a license to a customer for $1,000. The company recognizes revenue at the point of sale when the customer obtains control of the software.

2. Subscription Services: A streaming platform offers monthly subscriptions for $10. The company recognizes revenue over time as the service is provided each month.

3. Construction Projects: A construction company enters into a contract to build a house for $200,000. The company uses the percentage of completion method to recognize revenue based on the progress of the project.

4. Product Bundling: A telecommunications company offers a package deal that includes internet, phone, and cable services for $100 per month. The company needs to allocate the transaction price to each service based on their standalone selling prices.

In summary, revenue recognition is a critical aspect of accounting that ensures accurate reporting of a company's financial performance. By following the step-by-step process of revenue recognition, businesses can adhere to accounting standards and provide transparent information to stakeholders. Understanding the principles and guidelines of revenue recognition allows companies to make informed decisions, assess their financial health, and maintain compliance with regulatory requirements.

Related Topics:

Financial Statement Analysis: Techniques and Applications

Financial Risk Management: Protecting the Organization's Financial Well-being

Financial Statement Fraud: Detecting and Preventing Common Types of Fraud

1 note

·

View note

Text

Multiple revenue recognition options/rules under one project in Dynamics 365 Project Operations Non-stocked/resource deployment

One of the common asks I hear from customers is the need to handle revenue recognition differently for different phases of a project. An example of this is “Contoso Electronics is working on a NextGen EV Electronics Design and Prototype build project for one of its customers. This is a fixed price contract/project that has 3 distinct phases. Design phase that runs for 3 months. This phase is…

View On WordPress

#Contract Line based revenue recognition#D365ProjectOperations#ProjOps Resource/Non-stocked#Revenue recognition

0 notes

Text

11th Accountancy - Conceptual Framework of Accounting Chapter 2

I. Multiple Choice Questions : Choose the Correct Answer Question 1: The business is liable to the proprietor of the business in respect of capital introduced by the person according to ……………… (a) Money measurement concept (b) Cost concept (c) Business entity concept (d) Dual aspect concept Answer: (c) Business entity concept Question 2: The concept which assumes that a business will…

View On WordPress

#Accounting period#Accounting standard#Bad debt#Depreciation#FYI#Institute of Chartered Accountants of India#Medium of exchange#Money measurement concept#Reserve Bank of India#Revenue recognition#Stock valuation#Supreme Court of India

0 notes

Text

Optimizing Payment and Revenue Recognition in Project Management

Optimizing payment and revenue recognition processes in project management is essential for financial stability, accurate reporting, and successful project execution. By streamlining payment workflows, implementing efficient revenue recognition practices, integrating with project management systems, and ensuring compliance, organizations can enhance cash flow, make informed financial decisions, and improve overall project performance. Embracing continuous improvement and staying abreast of industry trends will further contribute to the optimization of payment and revenue recognition processes, driving long-term success in project management.

In the realm of project management, efficient payment and revenue recognition play a crucial role in maintaining financial stability and ensuring project success. By optimizing these processes, organizations can streamline cash flow, accurately track revenue, and make informed financial decisions. In this blog post, we will explore the significance of payment and revenue recognition in project management and provide valuable insights into how to optimize these aspects for maximum efficiency.

1. The Importance of Payment and Revenue Recognition

Understanding the significance of timely payments and accurate revenue recognition.

The impact of optimized payment and revenue processes on project profitability and financial health.

Compliance with accounting standards and regulations in payment and revenue recognition.

2. Streamlining Payment Processes

Automating payment triggers and workflows to eliminate manual intervention and reduce delays.

Implementing effective payment tracking systems for enhanced visibility and control.

Ensuring prompt and accurate invoice generation and delivery to clients.

Utilizing electronic payment methods for faster and more secure transactions.

3. Efficient Revenue Recognition

Establishing revenue accounting conditions and principles for accurate recognition.

Implementing revenue recognition automation tools to eliminate errors and improve efficiency.

Properly accounting for project milestones, deliverables, and completion percentages.

Aligning revenue recognition practices with accounting standards (e.g., ASC 606, IFRS 15) to maintain compliance.

4. Integration with Project Management Systems:

Integrating payment and revenue recognition processes with project management software.

Leveraging project data to streamline payment and revenue workflows.

Generating real-time reports and analytics to monitor project financials and performance.

Facilitating seamless collaboration between finance and project teams for accurate revenue forecasting.

5. Mitigating Risks and Ensuring Compliance:

Identifying and mitigating potential risks associated with payment and revenue recognition.

Complying with legal and regulatory requirements to avoid penalties and legal issues.

Conducting regular audits and reviews to ensure accuracy and integrity in financial reporting.

6. Continuous Improvement and Optimization

Adopting a culture of continuous improvement in payment and revenue recognition processes.

Seeking feedback from stakeholders to identify areas for optimization.

Monitoring industry trends and best practices to stay updated and improve efficiency.

0 notes

Text

If you really want to understand how bloated blockbuster film budgets are today, and why it seems like every blockbuster film is treated like a failure if it doesnt make a billion dollars, consider Waterworld.

Waterworld came out in 1995, and was widely considered a failure, not because it flopped at the box office, it was in fact one of the top grossing films of that year, but because was so bloated that it was basically impossible to succeed. So how bad was this budget?

The answer is $175 million. Now that was in 1995, but it comes to about $300 million today.

If you are thinking, 'that sounds like the budget of most recent marvel movies' then you see the problem.

#Also waterworld is a fantastic movie that deserves more love and recognition#And this isnt even getting into how movie theater audiences are a lot smaller than in the past#Or how streaming offers much smaller revenues for studios

22 notes

·

View notes

Text

Navigating Revenue Recognition Complexities in Professional Services Firms

Revenue recognition is one of the most critical—and complicated—financial processes for professional services firms. Whether you’re running a consulting business, IT services company, or engineering firm, recognising revenue at the right time is essential for maintaining financial accuracy, ensuring compliance, and supporting business growth. But unlike product-based companies that follow a relatively straightforward sales model, professional services firms face unique complexities in revenue recognition.

Understanding the Core Challenge

Revenue recognition isn’t just about recording income—it’s about reflecting the economic reality of service delivery. The question is not “when did we send the invoice?” but rather “when have we earned the right to record revenue?” This distinction becomes tricky when service engagements span weeks or months, involve multiple milestones, or are billed based on time, deliverables, or outcomes.

As a result, navigating revenue recognition complexities in professional services firms requires a deep understanding of both accounting standards and project operations.

Common Revenue Recognition Scenarios in Services Firms

Time-and-Materials (T&M): Revenue is recognised as services are delivered. However, accurately tracking time spent and aligning it with billable rates is essential.

Fixed-Price Contracts: These can stretch over several months, requiring revenue to be recognised over time, often using percentage-of-completion methods. Delays or scope changes complicate the process.

Milestone-Based Billing: Revenue is recognised when specific deliverables or milestones are completed. But what happens when milestones are delayed or disputed?

Retainers and Subscriptions: Often paid upfront, these require revenue to be deferred and recognised evenly over the agreed service period.

Key Challenges That Make Revenue Recognition Complex

Lack of Integration between project teams and finance, leading to poor visibility of actual work progress.

Manual Tracking, often through spreadsheets, increasing risk of error and inefficiency.

Changing Scope or Timelines, which impacts billing cycles and disrupts planned revenue schedules.

Regulatory Pressures, such as adherence to IFRS 15 or ASC 606, which require clear mapping of performance obligations and matching them to revenue events.

Solutions for Simplifying Revenue Recognition

1. Establish Clear Revenue Recognition Policies

Set clear, organisation-wide policies based on contract types and align them with global accounting standards. Educate project and finance teams to ensure consistent application.

2. Leverage PSA Software

Adopting a Professional Services Automation (PSA) platform enables firms to automate revenue tracking based on real-time project progress, milestones, and actual time logs. This reduces reliance on manual inputs and ensures compliance.

3. Improve Collaboration Between Teams

Create a unified process where project managers, delivery leads, and finance teams work from the same data source. This ensures revenue is only recognised when work is completed as per the contract.

4. Enable Forecasting and Visibility

With better tools and data, firms can forecast revenue more accurately, manage cash flow efficiently, and quickly adapt to project changes.

Final Thoughts

Revenue recognition doesn’t need to be a bottleneck. With the right systems, structure, and collaboration in place, professional services firms can simplify this complex process, gain financial clarity, and scale confidently. By navigating revenue recognition complexities with a strategic and tech-enabled approach, firms turn compliance into a competitive advantage—delivering accurate, timely, and trusted financial reports.

0 notes

Text

Docyt Franchise Reporting Tool | AI Accounting Software

Gives real-time visibility, tracks KPIs & creates live reports instantly for all locations - Docyt is a game changer for franchise accounting. Learn more. For more info visit our website : https://docyt.com/use-case/franchise-reporting/

#expense reimbursement report#financial bookkeeping software#financial reporting services#financial reporting tools#franchise reporting#restaurant bookkeeping#restaurant bookkeeping services#retail bookkeeping#revenue recognition automation.

0 notes

Text

Advanced Accounting Training Online - Controller Academy

Controller Academy offers Advanced Accounting Training Online, equipping professionals with the expertise needed to excel in financial leadership roles. Our comprehensive courses cover GAAP principles, financial reporting, budgeting, internal controls, and corporate finance, ensuring you stay ahead in the industry. Designed for controllers, CFOs, and senior accountants, our training provides practical insights through interactive lessons, real-world case studies, and expert-led instruction. Whether you’re looking to enhance your skills, advance your career, or improve financial decision-making, Controller Academy delivers flexible, on-demand learning tailored to your needs.

0 notes

Text

Working with big orders comes with their own set of complexities from the accounting point of view. To be more specific, such large deals don’t always translate to on-the-spot cash realizations or sometimes the cash is realized in advance for services or goods that are yet to be delivered to the client. This leads to the question – when should the revenue recognized?

In this blog, we are going to discuss the concept of the revenue recognition method and how, as a small business owner, you can follow this principle.

0 notes

Text

Revolutionizing Revenue Recognition: The Power of Automation

The answer lies in automating the decision-making process itself.

Revenue accounting automation involves pre-defining rules based on policies and desired outcomes. These rules can then be applied directly to data sourced from sales contracts and various systems capturing orders, fulfillment, and billing. The result? Precise revenue calculations and forecast schedules over the contract term.

So, how does it actually work?

Imagine a revenue analyst reviewing a contract to identify critical components for revenue recognition. Similarly, automation software can be configured to identify these components through data mapping—things like contract number, customer name, contract term, deliverables, and pricing details.

Instead of relying on cumbersome spreadsheets, an automated revenue sub-ledger takes on the task of aggregating data, applying rules, and recognizing revenue based on predefined criteria.

Think of it as building a roadmap for revenue recognition—a set of rules and guidelines that automate the process from start to finish.

#Revenue Recognition#Automation#Accounting Automation#Revenue Accounting#Decision-Making Automation#Contract Management#Data Mapping#Forecasting#Rules-Based Automation#Financial Software

0 notes

Text

Identifying a Contract with a Customer (IFRS 15) in UAE

In today’s fast-changing business world, it’s essential for companies to report their earnings clearly and accurately. One key way to do this is by following IFRS 15: Revenue from Contracts with Customers, a global standard for recognizing revenue. IFRS 15 standard helps businesses know when and how to recognize the money they earn from contracts with their customers.

A big part of IFRS 15 is understanding contract identification, the first step in figuring out when a business should start recognizing revenue. For businesses in the UAE, knowing how to identify a contract correctly is essential for staying on the right side of the law and maintaining good financial practices. As companies in the UAE grow and expand, it’s increasingly important to follow IFRS 15 to avoid potential problems and keep financial records accurate.

#ifrs 15#Revenue from Contracts with Customers#ifrs 15 revenue recognition#ifrs revenue recognition#ifrs 15 revenue

0 notes

Text

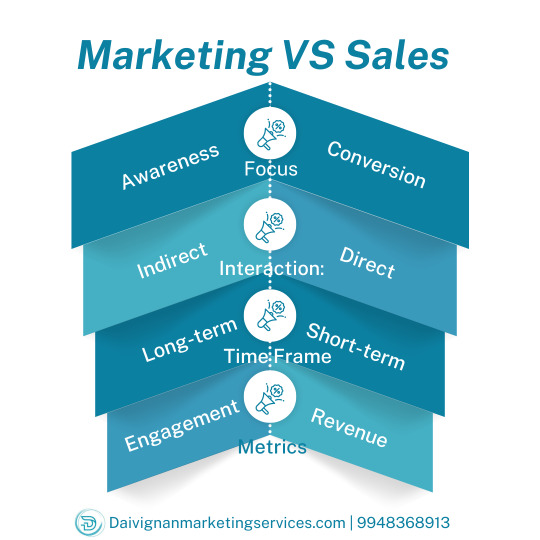

Marketing VS Sales

Here’s why understanding the crucial distinctions between marketing and sales can revolutionize your business strategy and skyrocket your success! Discover how Daivignan Marketing Services can transform your marketing efforts and drive unparalleled growth

Introduction Marketing and sales are crucial functions that work together to drive business growth and revenue. While they share the common goal of increasing success, they differ in approach, strategies, and responsibilities. Understanding these differences can help businesses leverage both functions more effectively. Marketing Definition and Focus Definition: Marketing is the process of…

View On WordPress

#Advertising Promotion#Brand Management#Brand Recognition#Business Growth#Campaign Performance#Content Creation#Content Marketing#content-marketing#Customer Behavior#Customer Experience#Customer Needs#Customer Satisfaction#Digital Marketing#digital-marketing#Email Marketing#Long-Term Brand Building#Market Research#Market Trends#marketing#PPC (Pay-Per-Click) Advertising#Revenue#Seamless Customer Journey#seo#SEO (Search Engine Optimization)#Short-Term Revenue Generation#Social Media Marketing#social-media-marketing#Strategy

0 notes