#Accounting Automation

Explore tagged Tumblr posts

Text

Simplify Client Verification and Onboarding with Automation

Tired of chasing documents and managing manual identity checks? With NexBot, client verification and onboarding become faster, smarter, and fully compliant. Our automation securely collects client data, verifies IDs in real-time, and syncs everything directly into your workflow, saving hours of admin time. Whether you're an accounting firm or financial service provider, NexBot's solution ensures a seamless onboarding experience while maintaining top-tier compliance standards.

✅ Boost productivity ✅ Reduce drop-offs ✅ Impress clients from day one

👉 Book your free demo at www.nexbot.com.au and discover how to onboard clients the smart way.

#accountants melbourne#tax accountant#accounting automation#professional accountants#xero ai#accountant#accounting ai#bot

0 notes

Text

Why Accountants Should Care About AI Today

AI isn’t just the future—it’s already changing the work style for accountants! 🧮✨ Here’s why you should start paying attention:

1️⃣ Efficiency Boost 🚀

Imagine automating time-consuming tasks like data entry and reconciliations. AI tools save hours of work, letting you focus on what really matters—your clients!

2️⃣ Error-Free Accounting ✅

Even the best of us make mistakes, but AI doesn’t! From flagging anomalies to ensuring compliance, AI handles accuracy like a pro, helping you avoid costly errors.

3️⃣ Stay Ahead of the Curve 📈

The industry is evolving, and tech-savvy accountants are winning the game. Clients want faster results and better insights—AI makes sure you deliver both effortlessly.

Still worried about AI replacing you? 🤖 Don’t be! AI isn’t here to take your job; it’s here to make your life easier.

Think of it as your super-efficient assistant!

👉 Ready to learn how AI can transform your accounting practice?

Read the full blog here:

3 Compelling Reasons Why Accountants Should Care About and Adopt AI Today

#Accountants & AI#Artificial Intelligence in Accounting#Accounting Automation#Benefits of AI for Accountants#Future of Accounting

0 notes

Text

Revolutionising the Ledger: Embracing Accounting Automation, Outsourcing, and the Productivity Revolution

The role of accountants has transformed significantly with the relentless march of digitalization. According to a study by Forrester and Basware, 84% of finance leaders consider automating accounts payable a key element in their digital transformation strategies. This blog explores how technology, specifically accounting automation, is reshaping the way accountants operate, leading to increased efficiency, enhanced analytical capabilities, and strategic roles in the business world.

Power of Accounting Automation Tools

Accounting automation marks a pivotal shift in how financial operations are managed within firms. It streamlines and optimises financial processes, reducing manual input and minimizing errors. This transition from traditional, paper-based methods to automated systems is driven by the need for increased efficiency, accuracy, and the ability to handle complex financial tasks with precision.

The significance of accounting automation cannot be overstated. By embracing automation, accountants enhance the accuracy of financial data, eliminating the potential for human error in manual data entry. It catalyses the speeding up of routine tasks, allowing accountants to focus more on intricate, strategic activities contributing directly to the overall success and growth of the organisation.

From Data Entry to Strategic Analysis: Redefining the Accountant’s Role

Automation liberates accountants from routine data entry, enabling them to engage in value-added activities beyond traditional responsibilities. For instance:

Financial Planning and Analysis (FP&A):

Accountants delve into financial planning and analysis, analysing trends, forecasting future scenarios, and contributing to robust strategies.

Risk Management:

Accountants identify potential financial risks, assess their impact, and collaborate with other departments to develop mitigation strategies.

Advisory Services:

Accountants transition into advisory roles, advising on investment decisions, cost-saving initiatives, or opportunities for revenue growth.

Enhanced Analytical Capabilities of Accountants

Beyond liberating accountants from mundane tasks, automation catalyses enhanced analytical capabilities. With routine data entry and processing automated, accountants can focus on more complex and strategic aspects of financial analysis.

Accounting automation tools provideaccountants with access to vast datasets and real-time financial information which can empower professionals to conduct more thorough and insightful financial analyses. Rather than being confined to basic number-crunching, accountants can:

Conduct In-Depth Financial Analysis:

With the ability to quickly analyse large datasets, accountants can uncover patterns, trends, and anomalies that may have previously gone unnoticed. This depth of analysis contributes to a more comprehensive understanding of the financial health of the organization.

Scenario Planning:

Accountants can engage in scenario planning, utilizing their enhanced analytical skills to model various financial scenarios. This proactive approach allows businesses to prepare for different outcomes and make informed decisions in the face of uncertainty.

Strategic Decision Support:

Armed with enhanced analytical capabilities, accountants become invaluable assets in providing decision support to the management team. They can present data-driven insights that aid in strategic decision-making, ultimately steering the organization toward sustainable growth.

Overcoming Challenges: Adapting to the Accounting Automation Landscape

Addressing Concerns About Job Displacement

Adding automation to accounting doesn’t take away jobs; it reshapes them. Accountants now focus on important, strategic tasks, becoming partners in the success of the organisation. Automation helps them avoid repetitive jobs, allowing them to use their skills to understand tricky financial data, advise on decisions, and handle fast business changes.

Training and Upskilling for Accountants in the Era of Automation

Thriving in accounting automation requires continuous training and upskilling. While traditional accounting skills are crucial, proficiency in data analysis, system optimization, and technology utilisation is equally vital. This proactive approach future-proofs their careers, making them valuable contributors in a technology-driven era.

Accounting Outsourcing: A Strategic Move

In addition to automation, strategic accounting outsourcing has also gained prominence in the accounting landscape. Outsourcing routine tasks to specialised firms allows accountants to focus on high-value activities, contributing to organisational growth. Whether it’s bookkeeping, year end accounts preparation, tax preparation or payroll processing, outsourcing can enhance efficiency and reduce operational costs.

Navigating the Cultural Shift Within Accounting Firms

Implementing accounting automation or accounting outsourcing requires a cultural shift in accounting firms. Leadership plays a crucial role in communicating the strategic vision, aligning it with organisational goals, and addressing workforce concerns transparently.

Cultivating a culture of continuous learning and adaptability empowers employees to explore new technologies, fostering collaboration and innovation. The focus is on viewing automation and outsourcing as enablers, augmenting human capabilities rather than threatening job roles. Nurturing this culture ensures a workforce that is agile, innovative, and ready for the evolving landscape, driving sustained success.

Embracing the Productivity Revolution in Accounting

Accounting automation, coupled with strategic accounting outsourcing, transforms the accountant’s role, enhancing productivity and enabling the handling of complex tasks. Embracing this revolution involves leveraging tools, proactive upskilling, fostering innovation, and strategic outsourcing. Accountants can thrive in the automated landscape, ensuring continued success in the evolving world of accountancy. For all your outsourcing needs, you can consider partnering with Integra Global Solutions, UK’s premier accounting outsourcing and automation provider for accounting firms.

#accounting automation#accounting outsourcing#accounting solutions#outsourced accounting#UK accounting#accounting firms

0 notes

Text

The AI Revolution in Accounting: Bridging the Talent Gap and Driving Efficiency

The accounting world is undergoing a transformative shift driven by a talent shortage crisis in accounting roles. Recent research conducted by Avalara, reveals that 84% of CFOs in the United States and the United Kingdom are grappling with a significant talent shortage within their accounting and finance teams. This shortage is more pronounced in the UK, where a staggering 92% of CFOs struggle to recruit essential finance talent. As this challenge looms over financial departments, CFOs are turning to artificial intelligence (AI) to streamline processes, reduce burnout, and bridge the talent gap. In this blog, we explore how AI adoption is changing the financial landscape and helping CFOs navigate these turbulent waters.

The Talent Shortage Dilemma:

A staggering 81% of CFOs report a talent shortage in accounting roles, sparking concerns about the future of accounting departments. This shortage extends beyond traditional accounting roles, with 49% of CFOs highlighting the need for Financial Planning and Analysis (FP&A) expertise within their organizations. The primary reasons for this talent deficit are diverse.

Lack of Experienced Talent:

According to 63% of CFOs, a lack of experienced talent contributes to the shortage. This view is reinforced by 54% of respondents who believe that today's shortage is a result of fewer individuals majoring in finance functions. The accounting sector's changing landscape demands expertise that many aspiring professionals may not have pursued, leaving a void in experienced talent.

Employee Burnout and Career Changes:

A significant portion (47%) of CFOs attribute the diminishing talent pool to employee burnout due to long hours and repetitive tasks. Many accounting and finance professionals are also considering career changes, further exacerbating the problem. The accounting industry's traditionally demanding work environment has taken a toll on professionals, pushing them to seek more fulfilling careers elsewhere.

Evolving Demands of Accounting Roles:

The role of accounting professionals has evolved over the years. They are no longer confined to traditional bookkeeping and number-crunching tasks. Modern accounting teams are expected to provide strategic insights and play a more advisory role. This shift in responsibilities demands a different skill set, contributing to the talent shortage as accounting professionals adapt to these new demands.

AI Adoption: A Solution to the Talent Shortage:

Recognizing the need for innovative solutions, CFOs are evolving their staffing approaches by investing in AI. An overwhelming 92% of CFOs in the US and UK believe that AI tools can help businesses find efficiencies, drive productivity, and increase profitability. Their commitment to this belief is evident, with 89% planning to invest in AI to streamline their finance functions, and nearly half (44%) set to adopt AI by the end of 2023.

Key AI Adoption Trends:

Vendor Cooperation: Most CFOs (56%) are seeking vendor cooperation to integrate AI solutions into their accounting departments. This underscores the importance of third-party vendors in the AI adoption process. These vendors bring specialized expertise and technology that can expedite the implementation of AI in accounting.

Outsourcing AI Expertise:

About 22% of CFOs plan to rely on offshore service providers to implement AI solutions, while only 21% wish to build in-house AI capabilities. Outsourcing AI expertise allows firms to tap into the knowledge of experts who have successfully implemented AI in similar contexts. It can also be a cost-effective option, as building in-house AI capabilities requires significant resources and time.

Empowering Accounting Professionals:

AI's transformative potential lies in its ability to augment the work of finance professionals. By automating mundane tasks, AI allows teams to focus on higher-value activities like client-facing advisory and forward planning, ultimately alleviating the global talent shortage in accounting. With AI, finance professionals can have data-driven conversations and leverage AI as a research and data analyst, significantly boosting productivity.

AI and the Future of Accounting:

As AI becomes an integral part of finance and accounting operations, it promises to revolutionize how accounting professionals interact with data. With AI, they have data-driven conversations and leverage AI as a research and data analyst, significantly boosting productivity.

Streamlining Repetitive Tasks:

One of the immediate benefits of AI in finance is the automation of routine and time-consuming tasks. AI-powered software can handle transaction entry, reconciliation, and report generation with speed and accuracy that human counterparts find challenging to match. This not only frees up valuable time but also reduces the risk of errors that can occur in manual processes.

Enhanced Decision Support:

AI can analyze vast amounts of data in real-time, providing valuable insights to aid decision-making. Whether it's predicting market trends, identifying cost-saving opportunities, or assessing investment risks, AI can provide CFOs and finance professionals with the information they need to make informed decisions swiftly.

Improved Compliance and Risk Management:

The accounting industry is highly regulated, with stringent compliance requirements. AI can play a crucial role in ensuring compliance by continuously monitoring transactions and flagging potential issues. Additionally, AI can help identify and mitigate financial risks by analyzing historical data and identifying patterns that may indicate impending problems.

Personalized Customer Experiences:

AI can also be used to enhance customer interactions in accounting. Chatbots and virtual assistants powered by AI can provide personalized customer support, answer inquiries, and assist with account management. Not only does this increase client happiness, but it also frees up human resources for more complex responsibilities.

Cost Savings and Efficiency Gains:

By automating routine tasks and optimizing processes, AI can lead to significant cost savings in the long run. It reduces the need for manual labor, minimizes errors, and improves overall efficiency, making financial operations more cost-effective.

Conclusion:

The accounting industry is at a crossroads, with a talent shortage crisis threatening the stability and growth of accounting departments. AI adoption is emerging as a lifeline, enabling CFOs to streamline operations, reduce burnout, and bridge the talent gap. By automating routine tasks, AI empowers finance teams to focus on strategic initiatives and client-facing activities.

The future of accounting is increasingly intertwined with artificial intelligence, as companies that embrace AI now stand to reap substantial benefits and stay ahead of the curve. As we navigate uncertain economic waters, AI is proving to be a beacon of innovation and efficiency for finance leaders worldwide. As the accounting landscape evolves, the integration of AI will be pivotal in ensuring not only the survival but also the thriving of accounting departments in an ever-changing world.

In this era of AI transformation, one solution that stands out is Integra Balance—an AI-Powered Robotic Process Automation (RPA) solution designed specifically for accounting firms. Integra Balance combines cutting-edge AI algorithms with robotic automation to optimize financial processes, enhance accuracy, and improve overall efficiency in accounting operations. With Integra Balance, accounting firms can effortlessly integrate AI into their workflow, allowing them to tackle the talent shortage crisis head-on and position themselves for a prosperous future. Don't wait to embrace the power of AI in accounting. Take action today by exploring how Integra Balance can revolutionize your accounting processes and help your firm thrive in this rapidly changing landscape.

#accounting#aiaccountingsoftware#aibookkeepingsoftware#AIbookkeeping#aiautomationinaccounting#aiaccounting#AIaccountingsolution#aifinance#accounting software#accounting services#accounting automation#AIpoweredaccounting

0 notes

Text

INTERAC Applications for Public Accounting | Intersoft Systems Inc

The INTERAC core accounting applications are easily tailored to accommodate the needs of a variety of businesses. Intersoft Systems, Inc. offers NTERAC Client Accounting, Payroll, Time and Billing, Practice Management Software Solutions.

#INTERAC Applications#Public Accounting#Accounting Software#Financial Management#Accountancy Tools#CPA Software#Financial Reporting#Tax Preparation#Audit Solutions#Accounting Automation

0 notes

Text

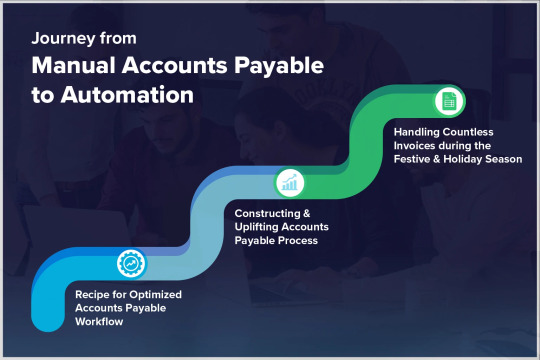

Journey from Manual Accounts Payable to Automation

73% of Accounts Payable Professionals Relying on Manual Process Face Slow Processing & Late Payment – Source

The accounts payable process across industries is still manual, paper-based. As a result, businesses are prone to missing invoices, delay in vendor reconciliation, vendor management, maintaining records, late payments, fraud, duplications, and more.

Let’s have a deeper understanding of how the accounts payable workflow would be when done manually.

It’s a reality. Let’s face it. Accounts Payables continue to be manual, tedious, and mundane for most businesses across diverse industries. However, accounts payable automation is the key to optimizing the complete accounts payable workflow and stay on top of the game.

Transformation from manual to automated accounts payable is no longer a “nice to have” strategic move, rather, it’s a “must have” for all future-focused firms. The Accounts Payable automation market is expected to reach up to USD 2 billion by 2029. Mention not, the need of transformation from manual accounts payable process to automation is different across industries. And guess what?

Here, you have the opportunity to dive deep into accounts payable automation journey of businesses across industries. So, keep scrolling to find out more about some real case studies.

for more information visit us at - https://pathquest.com/knowledge-center/blogs/journey-to-accounts-payable-automation/

#accounts payable automation software#accounting automation#accounts payable automation solutions#automated accounts payable#ap automation software

0 notes

Text

0 notes

Text

Revolutionizing Revenue Recognition: The Power of Automation

The answer lies in automating the decision-making process itself.

Revenue accounting automation involves pre-defining rules based on policies and desired outcomes. These rules can then be applied directly to data sourced from sales contracts and various systems capturing orders, fulfillment, and billing. The result? Precise revenue calculations and forecast schedules over the contract term.

So, how does it actually work?

Imagine a revenue analyst reviewing a contract to identify critical components for revenue recognition. Similarly, automation software can be configured to identify these components through data mapping—things like contract number, customer name, contract term, deliverables, and pricing details.

Instead of relying on cumbersome spreadsheets, an automated revenue sub-ledger takes on the task of aggregating data, applying rules, and recognizing revenue based on predefined criteria.

Think of it as building a roadmap for revenue recognition—a set of rules and guidelines that automate the process from start to finish.

#Revenue Recognition#Automation#Accounting Automation#Revenue Accounting#Decision-Making Automation#Contract Management#Data Mapping#Forecasting#Rules-Based Automation#Financial Software

0 notes

Text

Streamlining Your Processes with Onboardible Workflow Automation Software

Onboardible workflow automation software is a one-stop-solution that streamline and automate the process of creating, managing, and executing workflows, such as those used in business processes, software development, and IT operations. Workflow automation software can be used to automate manual tasks, such as data entry, document management, and customer service. Automation can help reduce errors and improve accuracy. It provides assistance with compliance and reporting. Automation controls costs and improve customer service, with forecasting and budgeting. Automation also has ability to help with data analysis and provide insights into financial performance.

Key Features:

Easy team handling: Onboardible can help teams handle their tasks more easily by automating processes and streamlining communication. This type of software can help teams stay organized and on track by providing tools for task management, project tracking, and collaboration.

Assign tasks with minimal clicks: Onboardible Workflow automation software can be used to assign tasks with minimal clicks. The software can be used to create a workflow that automates the process of assigning tasks. The workflow can be configured to assign tasks to specific users or groups of users based on certain criteria. The workflow can also be configured to send notifications to users when tasks are assigned to them. This allows users to quickly and easily access the tasks they need to complete.

Share Word and Docs with clients over chats: Word and Docs files can be shared with the clients over chats. This eliminates the use of another application.

Monitor progress: This software can be used to monitor the progress through a workflow. It can also be used to generate reports that provide an overview of the improvement or progress of the workflow.

#Accounting workflow automation#accounting automation#workflow software#workflow management#remote tax preparation

1 note

·

View note

Text

AI can’t do your job

I'm on a 20+ city book tour for my new novel PICKS AND SHOVELS. Catch me in SAN DIEGO at MYSTERIOUS GALAXY on Mar 24, and in CHICAGO with PETER SAGAL on Apr 2. More tour dates here.

AI can't do your job, but an AI salesman (Elon Musk) can convince your boss (the USA) to fire you and replace you (a federal worker) with a chatbot that can't do your job:

https://www.pcmag.com/news/amid-job-cuts-doge-accelerates-rollout-of-ai-tool-to-automate-government

If you pay attention to the hype, you'd think that all the action on "AI" (an incoherent grab-bag of only marginally related technologies) was in generating text and images. Man, is that ever wrong. The AI hype machine could put every commercial illustrator alive on the breadline and the savings wouldn't pay the kombucha budget for the million-dollar-a-year techies who oversaw Dall-E's training run. The commercial market for automated email summaries is likewise infinitesimal.

The fact that CEOs overestimate the size of this market is easy to understand, since "CEO" is the most laptop job of all laptop jobs. Having a chatbot summarize the boss's email is the 2025 equivalent of the 2000s gag about the boss whose secretary printed out the boss's email and put it in his in-tray so he could go over it with a red pen and then dictate his reply.

The smart AI money is long on "decision support," whereby a statistical inference engine suggests to a human being what decision they should make. There's bots that are supposed to diagnose tumors, bots that are supposed to make neutral bail and parole decisions, bots that are supposed to evaluate student essays, resumes and loan applications.

The narrative around these bots is that they are there to help humans. In this story, the hospital buys a radiology bot that offers a second opinion to the human radiologist. If they disagree, the human radiologist takes another look. In this tale, AI is a way for hospitals to make fewer mistakes by spending more money. An AI assisted radiologist is less productive (because they re-run some x-rays to resolve disagreements with the bot) but more accurate.

In automation theory jargon, this radiologist is a "centaur" – a human head grafted onto the tireless, ever-vigilant body of a robot

Of course, no one who invests in an AI company expects this to happen. Instead, they want reverse-centaurs: a human who acts as an assistant to a robot. The real pitch to hospital is, "Fire all but one of your radiologists and then put that poor bastard to work reviewing the judgments our robot makes at machine scale."

No one seriously thinks that the reverse-centaur radiologist will be able to maintain perfect vigilance over long shifts of supervising automated process that rarely go wrong, but when they do, the error must be caught:

https://pluralistic.net/2024/04/01/human-in-the-loop/#monkey-in-the-middle

The role of this "human in the loop" isn't to prevent errors. That human's is there to be blamed for errors:

https://pluralistic.net/2024/10/30/a-neck-in-a-noose/#is-also-a-human-in-the-loop

The human is there to be a "moral crumple zone":

https://estsjournal.org/index.php/ests/article/view/260

The human is there to be an "accountability sink":

https://profilebooks.com/work/the-unaccountability-machine/

But they're not there to be radiologists.

This is bad enough when we're talking about radiology, but it's even worse in government contexts, where the bots are deciding who gets Medicare, who gets food stamps, who gets VA benefits, who gets a visa, who gets indicted, who gets bail, and who gets parole.

That's because statistical inference is intrinsically conservative: an AI predicts the future by looking at its data about the past, and when that prediction is also an automated decision, fed to a Chaplinesque reverse-centaur trying to keep pace with a torrent of machine judgments, the prediction becomes a directive, and thus a self-fulfilling prophecy:

https://pluralistic.net/2023/03/09/autocomplete-worshippers/#the-real-ai-was-the-corporations-that-we-fought-along-the-way

AIs want the future to be like the past, and AIs make the future like the past. If the training data is full of human bias, then the predictions will also be full of human bias, and then the outcomes will be full of human bias, and when those outcomes are copraphagically fed back into the training data, you get new, highly concentrated human/machine bias:

https://pluralistic.net/2024/03/14/inhuman-centipede/#enshittibottification

By firing skilled human workers and replacing them with spicy autocomplete, Musk is assuming his final form as both the kind of boss who can be conned into replacing you with a defective chatbot and as the fast-talking sales rep who cons your boss. Musk is transforming key government functions into high-speed error-generating machines whose human minders are only the payroll to take the fall for the coming tsunami of robot fuckups.

This is the equivalent to filling the American government's walls with asbestos, turning agencies into hazmat zones that we can't touch without causing thousands to sicken and die:

https://pluralistic.net/2021/08/19/failure-cascades/#dirty-data

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2025/03/18/asbestos-in-the-walls/#government-by-spicy-autocomplete

Image: Krd (modified) https://commons.wikimedia.org/wiki/File:DASA_01.jpg

CC BY-SA 3.0 https://creativecommons.org/licenses/by-sa/3.0/deed.en

--

Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#reverse centaurs#automation#decision support systems#automation blindness#humans in the loop#doge#ai#elon musk#asbestos in the walls#gsai#moral crumple zones#accountability sinks

277 notes

·

View notes

Text

How Xero AI and Accounting AI Improve Efficiency

Accounting has evolved far beyond spreadsheets and data entry. With the rise of Xero AI and accounting AI, firms now have access to tools that streamline workflows, improve compliance, and drastically reduce manual effort.

In Australia, small to mid-sized accounting practices are quickly adopting artificial intelligence to stay competitive. The shift isn’t just about technology — it’s about working smarter, not harder.

What Is Xero AI?

Xero AI refers to intelligent features built into the Xero platform, designed to automate repetitive tasks. It can categorize transactions, suggest account matches, and highlight anomalies — all based on how you work.

By learning from historical data it improves over time, allowing accountants to complete tasks faster with greater accuracy.

How Accounting AI Supports Practice Growth

While Xero AI handles core bookkeeping tasks, broader accounting AI platforms take it further — automating invoice matching, reconciliations, and even client reporting. The result?

✅ Less time spent on admin

✅ Fewer manual errors

✅ Increased time for client advisory

✅ Real-time insights across all financial activities

This is where NexBot steps in — adding a powerful layer of automation on top of your existing systems.

Why NexBot Is the Perfect AI Partner

NexBot enhances what Xero AI offers by integrating with your cloud tools and automating tasks outside the platform. Whether it’s downloading ATO documents, auto-generating workpapers, or onboarding clients, NexBot handles the background work, so your team can focus on growth.

Plus, NexBot is built by accountants, for accountants. That means it understands the workflow, language, and compliance standards unique to the Australian accounting industry.

🚀 Ready to Automate Your Accounting Workflow?

If you're already using Xero AI, take the next step with NexBot. Our bots run 24/7, learn your processes, and save you hours every week.

👉 Book your free demo at www.nexbot.com.au and see how AI can transform your practice from the inside out.

#Xero AI#bot automation#accountants melbourne#professional accountants#bookkeeping bot for accountants#accounting automation#accounting ai

0 notes

Text

3 Ways Suvit Simplifies Rotating Accounting Duties Among Your Team

Keeping accounting tasks fresh and evenly distributed doesn’t have to be a headache!

With Suvit, rotating duties within your team become easy, efficient, and transparent.

Here’s how Suvit helps:

1️⃣ Custom Role Management: Assign tasks like GST reconciliation or report generation with tailor-made roles. Edit and adapt roles as your team rotates responsibilities! 🛠️

2️⃣ Detailed User Reports: Get a clear picture of who’s doing what with module-wise insights. Perfect for tracking performance and balancing workloads! 📊

3️⃣ Activity Logs for Accountability: Keep an eye on actions taken by each user. Transparency and trust? Check! ✅

Suvit takes the guesswork out of task rotations, ensuring smooth transitions and a well-balanced workflow for your accounting team.

Want to dive deeper into these features?

👉 Read the full blog here.

Transform the way your team collaborates with Suvit! 🚀

#accounting duties#accounting tasks#accounting software#accounting automation#accounting problems#accounting team#team management

0 notes

Text

Got hit with three of those damn ask spams this morning, so unfortunately the askbox is closed for a little bit.

#ffs#hope staff gets a handle on this soon#and no one gives them shit for filtering this as the spam it's become#there is no way any of this is legitimate#it's always an account follows you and then immediately invades your askbox#this is absolutely some automated scam bullshit

13 notes

·

View notes

Text

Several years later, Facebook has been overrun by AI-generated spam and outright scams. Many of the “people” engaging with this content are bots who themselves spam the platform. Porn and nonconsensual imagery is easy to find on Facebook and Instagram. We have reported endlessly on the proliferation of paid advertisements for drugs, stolen credit cards, hacked accounts, and ads for electricians and roofers who appear to be soliciting potential customers with sex work. Its own verified influencers have their bodies regularly stolen by “AI influencers” in the service of promoting OnlyFans pages also full of stolen content. …

Experts I spoke to who once had great insight into how Facebook makes its decisions say that they no longer know what is happening at the platform … “I believe we're in a time of experimentation where platforms are willing to gamble and roll the dice and say, ‘How little content moderation can we get away with?,'” Sarah T. Roberts, a UCLA professor and author of Behind the Screen: Content Moderation in the Shadows of Social Media, told me.

Very good and troubling article. If Meta - one of the richest companies in the world - is giving up on moderation, what does it mean for the dying, cash-strapped website we’re all on?

#The automated spam filter right now is overtuned and seems to ban most people who’ve made new Tumblr accounts#And they'll unban you the moment you email Tumblr support about it#faster than a human could manage - it's pretty clearly also a robot unbanning people#I suspect Tumblr has automated the majority of its moderation#And I think the situation with trans women being banned is likely a function of that being a group of people subject to malicious reports#combined with that automation

19 notes

·

View notes

Text

i was so mad and i continue to be mad when the muskrat rolled out his utterly pointless and counterproductive 'anti-bot measures' on twitter bc it killed the account i was following that would just post a different wolf picture every hour. the people DESERVE their hourly wolf !!!!!

20 notes

·

View notes

Text

A Complete Guide to Optimize Accounts Payable Automation

The primary focus of small and medium business owners is to sustain, grow, and thrive. Unfortunately, when it comes to manual accounts payable process, there are many bottlenecks that result in delayed payments and impede vendor relationships. This guide aims to eliminate that.

Single or multi location business owners that I count rely on manual accounts payable processes. I’ve identified that they are prone to missing invoices, delay in vendor reconciliation, vendor management, and maintaining records, low visibility, slow approval, late payments, fraud, duplications, tedious escalations, and more. As these issues come up repeatedly in the workflow, I’ve written this guide to help SMB owners like you to streamline and automate complete Accounts Payable workflow.

for more information visit us at - https://pathquest.com/knowledge-center/blogs/journey-to-accounts-payable-automation/

#accounts payable automation software#accounting automation#accounts payable automation solutions#automated accounts payable

0 notes