#seed fund startup india

Video

It could involve providing initial funding for startups or aiding small companies that want to grow but lack access to equity markets.

#venture capitalist india#investment in startup#seed investment#seed funding for startups#funding investors#invest in startups in india#jc team capital#seed capital#investors for startup#type of venture capital#seed fund startup india#funded startups in india

1 note

·

View note

Photo

(via Startup India Seed Fund Scheme (SISFS))

2 notes

·

View notes

Text

Funding Scheme 2023 | Seed Funding | Expertbells

The "Startup India Seed Fund Scheme (SISFS) 2024" is a cornerstone of the broader Startup India initiative, designed to empower early-stage startups by providing essential seed funding. Eligibility criteria for the scheme ensure inclusivity, allowing a diverse range of entrepreneurs to benefit. Under the Startup India Seed Fund Scheme, startups meeting specified criteria can access crucial financial support, fostering innovation and entrepreneurship across various sectors. The amount available through the scheme plays a pivotal role in catalyzing these early-stage ventures. By strategically injecting funds into promising startups, the initiative aims to propel technological advancements, job creation, and economic growth. The "Startup India Seed Fund Scheme 2024" reflects the government's commitment to nurturing a dynamic startup ecosystem in India, positioning the country as a global leader in entrepreneurship.

#startup india seed fund scheme eligibility#seed fund scheme startup india#startup india seed fund scheme amount#start up india seed fund scheme

0 notes

Text

Capital Venture Funds: Investing in Growth and Innovation for High Returns

Welcome to the world of capital venture funds! If you are looking to explore investment opportunities with high growth potential, capital venture funds can be an exciting avenue to consider. In this article, we will dive deep into the concept of capital venture funds, how they work, their benefits and risks, and provide valuable insights to help you make informed investment decisions.

What is a Capital Venture Fund?

A capital venture fund, also known as a venture capital fund, is a pool of money collected from various investors, such as individuals, institutions, or corporations, with the aim of investing in startups and early-stage companies. These funds are managed by professional venture capitalists who have expertise in identifying promising investment opportunities.

How Does a Capital Venture Fund Work?

Capital venture operate by raising capital from investors and using that money to provide funding to startups and emerging companies in exchange for equity stakes. The fund managers evaluate business proposals, conduct due diligence, and select ventures with significant growth potential. They offer financial and strategic support to these companies, with the ultimate goal of generating substantial returns on investment when the invested companies succeed.

Benefits of Investing in a Capital Venture Fund

Investing in a capital venture fund offers several benefits. Firstly, it provides access to high-growth opportunities that are typically unavailable in traditional investment options. Venture funds often invest in innovative and disruptive technologies, which have the potential to reshape industries and generate substantial returns. Additionally, investing in a capital venture fund allows diversification across a portfolio of startups, spreading the risk associated with investing in Truth Venture companies.

Risks Associated with Capital Venture Funds

While capital venture funds offer attractive prospects, it’s essential to consider the associated risks. Startups and early-stage companies are inherently risky investments, and not all ventures may succeed. The failure rate can be relatively high, and investors should be prepared for potential losses. Additionally, capital venture funds are illiquid investments, meaning that the invested capital may be tied up for a significant period before any returns can be realized.

How to Choose a Capital Venture Fund

When selecting a capital venture fund to invest in, thorough due diligence is crucial. Consider factors such as the fund’s track record, the expertise of its management team, the fund’s investment focus, and its alignment with your investment goals and risk appetite. Look for funds that have a diversified portfolio, an established network within the industry, and a robust investment strategy. Seeking advice from financial professionals can also provide valuable insights.

Top Capital Venture Funds in the Market

The capital venture fund landscape is diverse, with numerous reputable funds operating globally. Some of the top capital venture firms in the market include Sequoia Capital, Andreessen Horowitz, Accel Partners, and Benchmark Capital. These funds have a strong track record of successful investments and have been instrumental in supporting groundbreaking companies.

Steps to Invest in a Capital Venture Fund

Startup investing in a capital venture financing typically involves a structured process. Firstly, research various funds to identify the ones that align with your investment preferences. Contact the fund managers or reach out through a financial advisor to initiate the investment process. Complete the necessary paperwork, provide the required information, and transfer the investment amount as per the fund’s requirements. It’s important to review the terms and conditions of the fund carefully before committing your capital.

Tax Implications of Investing in a Capital Venture Fund

Tax implications of investing in capital venture funds vary depending on the jurisdiction and the specific regulations in place. In some cases, investments in venture capital funds may qualify for tax incentives or capital gains tax exemptions. However, it’s essential to consult with a tax professional or seek guidance from the fund managers to understand the specific tax implications and benefits associated with your investment.

Success Stories of Capital Venture Fund Investments

Capital venture funds have been behind some of the most successful and influential companies in the world. From early investments in companies like Google, Facebook, and Amazon, to the recent breakthroughs in innovative technologies, venture capital has played a crucial role in driving economic growth and fostering entrepreneurship. These success stories highlight the potential for substantial returns that can be achieved through astute venture capital investments.

Future Trends in Capital Venture Funding

The capital venture funding landscape is dynamic and constantly evolving. Several trends are shaping the future of venture capital, including the rise of impact investing, increased focus on diversity and inclusion, and the emergence of new industries and technologies. Artificial intelligence, blockchain, and clean energy are areas that are expected to attract significant venture capital investments in the coming years. Staying informed about these trends can help investors identify promising opportunities.

Conclusion

In conclusion, capital venture funds offer a unique investment avenue with the potential for high returns. While they carry inherent risks, the diversification, access to innovative companies, and strategic support provided by venture capital funds can outweigh the downsides for the right investors. Conducting thorough research, understanding the risks, and aligning your investment goals are key to making successful investments in capital venture funds.

FAQ

What is the minimum investment amount for a capital venture fund?

The minimum investment amount for capital venture funds varies depending on the fund. It can range from a few thousand dollars to several million.

How long does it typically take to realize returns from capital venture fund investments?

The timeframe for realizing returns from capital venture fund investments can vary widely. It can take several years, often around five to ten years, for startups to reach a stage where they generate significant returns or undergo an exit event.

Can individual investors invest in capital venture funds?

Yes, individual investors can invest in capital venture funds. However, some funds may have specific requirements or minimum investment thresholds for individual investors.

What is the difference between a capital venture fund and private equity?

While both capital venture funds and private equity funds invest in companies, the key difference lies in the stage of the companies they invest in. Venture capital funds primarily focus on early-stage companies and startups, while private equity funds typically invest in more mature companies with established operations.

Are capital venture funds suitable for risk-averse investors?

Capital venture funds are generally not suitable for risk-averse investors due to the higher level of risk associated with investing in startups and early-stage companies. Investors with a lower risk tolerance may prefer more conservative investment options.

Share this:

#Capital venture#Venture Capital#Capital venture fund#Seed funding#Seed capital#Venture capital firms#Startup funding#Venture capital fund#Venture capital financing#Seed funding for startups#truth ventures#Venture capital firms in US#Venture capital firms in UK#Capital venture India#Capital venture US#Capital venture UK#Venture Capital Ecosystem#Venture capital firms in india#Venture capital equity#Capital Venture Company#Capital venture funding#Stages of venture capital

0 notes

Text

How To Choose The Right Business Solutions For Investors And Entrepreneurs

To choose the right business solutions for investors and entrepreneurs, one needs to understand the elements: Identity and Analyzing the problem, search benefits, and finding opportunities.

#business solutions for investors and entrepreneurs#startup investments in India#Find a Growth Hacker for Your Startup#seed funding companies in gurgaon

0 notes

Text

What is Pre Seed Investors in India? JC Team Capital

Seed funding is an early stage of investment in a startup company, usually given in exchange for equity. It is the initial capital used to help a new business get off the ground and begin its operations. The purpose of seed funding is to help the company validate its business idea, build its initial product or service, and attract more investment to support its growth. Seed funding can come from a variety of sources, including angel investors, venture capitalists, and government grants. The amount of seed funding can vary greatly, but it typically ranges from a few tens of thousands of dollars to a few million dollars.

#seed funding In India#venture capital firm India#start up funding in india#funding for startups in india

1 note

·

View note

Text

Venture Catalysts is the #1 startup investor available in India.

Raising startup funding is one of the company's most exciting and challenging times. Venture catalysts have supported businesses in their early phases, especially when they are looking to acquire capital. Check out here to know more about them https://venturecatalysts.in/

#Angel Investors India#Early Stage Startup Funding#Seed Investors In Mumbai#Investors Platform#Raising Funds For Startups#Investors Company In India

0 notes

Text

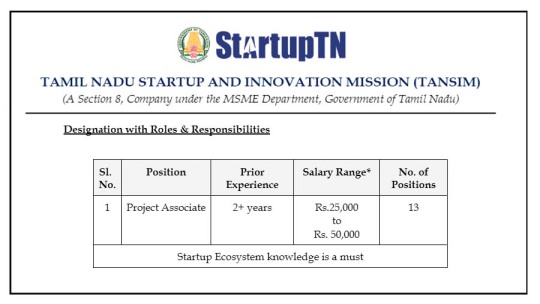

TANSIM Recruitment 2022 13 Project Associate Vacancy

TANSIM Recruitment 2022 13 Project Associate Vacancy

#govtjobs #upsc #ssc #currentaffairs #gk #ssccgl #ias #jobs #governmentjobs

TANSIM – Tamil Nadu Startup and Innovation Mission Recruitment 2022 Apply Project Associate Vacancies » Official Notification Released. Tamilnadu Government Official Release The Notification Interested & Eligible Candidate Please Must Check Full Notification Details , Education Details , Salary Details , Age Relaxation , Vacancies Details, Address Details Next Strat The Apply Process Eligible…

View On WordPress

#atal innovation mission#it startup tamil#startup#startup business ideas#startup company#startup india scheme tamil#startup stories tamil#startup tamil#startups#tamil nadu innovation grand challenge#tamil nadu startup and innovation mission#tamil nadu startup and innovation policy#tamil nadu startup seed grant fund#tamilnadu start up innovation mission ceo#tamilnadu start-up and innovation mission#tamilnadu startup and innovation mission new job recruitment#TANSIM Recruitment 2022 13 Project Associate Vacancy

1 note

·

View note

Text

What Is crowdfunding for startups?

crowdfunding is an easy way to raise fund for your startup through small contributions from a large number of people over the Internet. Through using power of internet you may reach your future investors to put seed finance in your startup. You can raise up to 1 Cr. in Seed funding.

#seed funding#seed capital#seed money#pre seed funding#seed investment#seed funding for startups#startup india seed fund#pre seed investment#seed finance

1 note

·

View note

Text

Startup Bull Run now faces reality

Startup Bull Run now faces reality

mini

Anecdotally, startup founders and management teams have reported that there is recurring – if not constant – pressure from their investors to “show them the money,” often ignoring ground realities in the process. Some startups delivered, and many others folded and closed shop.

The COVID-19 pandemic has been a destabilizing event globally. But not so much for the Indian startup ecosystem.…

View On WordPress

#boot returns#indian startups#new age companies#new registrations#seed funding#start#startups in india

0 notes

Text

#“pre seed startups#5 importance of entrepreneurship#pre seed funding amount#pre seed vc#pre seed vs seed#seed funding for startups india#what is pre seed funding

0 notes

Link

#startup#indian startups#Seed Fund Scheme#startup india seed fund scheme#sisfs#pm modi scheme#pm modi

0 notes

Text

Global Startup Accelerators & Corporate Innovation is provided by Accel Atoms.

The largest global network of accelerators with many corporate sponsors, Accel Atoms helps businesses grow abroad. To help them scale internationally, our companies have direct access to a worldwide network of the most appropriate mentors, partners, and investors in their industry.

#startup accelerator india#accelerator program#startup accelerator#seed accelerator india#startup accelerator program#startup funding india

0 notes

Text

If you ever had pastries at breakfast, drank soy milk, used soaps at home, or built yourself a nice flat-pack piece of furniture, you may have contributed to deforestation and climate change.

Every item has a price—but the cost isn’t felt only in our pockets. Hidden in that price is a complex chain of production, encompassing economic, social, and environmental relations that sustain livelihoods and, unfortunately, contribute to habitat destruction, deforestation, and the warming of our planet.

Approximately 4 billion hectares of forest around the world act as a carbon sink which, over the past two decades, has annually absorbed a net 7.6 billion metric tons of CO2. That’s the equivalent of 1.5 times the annual emissions of the US.

Conversely, a cleared forest becomes a carbon source. Many factors lead to forest clearing, but the root cause is economic. Farmers cut down the forest to expand their farms, support cattle grazing, harvest timber, mine minerals, and build infrastructure such as roads. Until that economic pressure goes away, the clearing may continue.

In 2024, however, we are going to see a big boost to global efforts to fight deforestation. New EU legislation will make it illegal to sell or export a range of commodities if they have been produced on deforested land. Sellers will need to identify exactly where their product originates, down to the geolocation of the plot. Penalties are harsh, including bans and fines of up to 4 percent of the offender's annual EU-wide turnover. As such, industry pushback has been strong, claiming that the costs are too high or the requirements are too onerous. Like many global frameworks, this initiative is being led by the EU, with other countries sure to follow, as the so-called Brussels Effect pressures ever more jurisdictions to adopt its methods.

The impact of these measures will only be as strong as the enforcement and, in 2024, we will see new ways of doing that digitally. At Farmerline (which I cofounded), for instance, we have been working on supply chain traceability for over a decade. We incentivize rule-following by making it beneficial.

When we digitize farmers and allow them and other stakeholders to track their products from soil to shelf, they also gain access to a suite of other products: the latest, most sustainable farming practices in their own language, access to flexible financing to fund climate-smart products such as drought-resistant seeds, solar irrigation systems and organic fertilizers, and the ability to earn more through international commodity markets.

Digitization helps build resilience and lasting wealth for the smallholders and helps save the environment. Another example is the World Economic Forum’s OneMap—an open-source privacy-preserving digital tool which helps governments use geospatial and farmer data to improve planning and decision making in agriculture and land. In India, the Data Empowerment Protection Architecture also provides a secure consent-based data-sharing framework to accelerate global financial inclusion.

In 2024 we will also see more food companies and food certification bodies leverage digital payment tools, like mobile money, to ensure farmers’ pay is not only direct and transparent, but also better if they comply with deforestation regulations.

The fight against deforestation will also be made easier by developments in hardware technology. New, lightweight drones from startups such as AirSeed can plant seeds, while further up, mini-satellites, such as those from Planet Labs, are taking millions of images per week, allowing governments and NGOs to track areas being deforested in near-real time. In Rwanda, researchers are using AI and the aerial footage captured by Planet Labs to calculate, monitor, and estimate the carbon stock of the entire country.

With these advances in software and hard-tech, in 2024, the global fight against deforestation will finally start to grow new shoots.

5 notes

·

View notes

Text

Business incubators and accelerators in India

We are business incubators and accelerators in India that provides support to early-stage startups and entrepreneurs. We provide a range of services such as mentorship, access to capital, networking opportunities, and other resources to help startups grow and succeed.

#Business incubators and accelerators in India#Find a Growth Hacker for Your Startup#Business Solutions for Investors & Entrepreneurs#seed funding companies in gurgaon

0 notes

Text

Demystifying Startup Investment in India: A Beginner's Guide

The Indian startup scene is a kaleidoscope of innovation, brimming with young ventures brimming with potential. As an investor, navigating this exciting yet complex landscape requires careful consideration. But where do you begin your journey to invest in startups India?

Growth91, a leading seed-stage investment platform, understands your questions. This guide unpacks the world of Indian startup investment, equipping you with the knowledge to make informed decisions.

Understanding the Startup Lifecycle:

Startups evolve through distinct stages, each with unique investment opportunities. Here's a simplified breakdown:

Seed Stage: This is where the magic starts. Passionate founders nurture a promising idea, often with a prototype and a clear vision. Seed-stage investors, like Growth91, play a crucial role by providing the initial funding needed to validate the concept and build a Minimum Viable Product (MVP).

Early Stage: With a validated concept and a growing customer base, the focus shifts towards scaling the business. Early-stage investors, like venture capitalists (VCs) and angel investors, provide capital to fuel growth initiatives like marketing and product development.

Growth Stage: The startup has achieved product-market fit and is scaling rapidly. Growth-stage investors, including VCs and private equity firms, provide larger funding rounds to accelerate expansion and market dominance.

Maturity Stage: The startup is a well-established, profitable business. Investment options at this stage include private equity or even an Initial Public Offering (IPO), allowing investors to potentially exit with significant returns.

Why Invest in Indian Startups?

India boasts a thriving entrepreneurial ecosystem, fueled by a young and tech-savvy population. This translates to a constant stream of innovative ideas tackling real-world problems. By investing in early-stage startups, you have the potential to:

Be an Early Mover: Gain exposure to high-growth ventures before they become mainstream.

Shape the Future: Support disruptive innovations that can transform industries and society.

Unlock High Returns: Seed-stage investments, while high-risk, offer the potential for exponential returns if the startup succeeds.

Growth91: Your Gateway to Promising Indian Startups

Growth91 simplifies your journey to invest in startups India. We offer a curated platform connecting you with high-potential seed-stage ventures across various sectors. Our rigorous due diligence process ensures you invest in promising ideas with strong founding teams.

Ready to join the Indian startup revolution? Explore investment opportunities on Growth91 and empower the next generation of Indian innovation.Demystifying Startup Investment in India: A Beginner's Guide

2 notes

·

View notes