#Capital venture UK

Text

Why do businesses fail even after good seed funding?

Most businesses fail even after receiving excellent seed funding because the management entirely misunderstands the demands and misallocates cash, losing the capital venture partner firm's trust in the process. Therefore, even if they must accept less startup funding, businesses must collaborate with venture capital firms that bring leadership and tested expertise. Truth Ventures is regarded as one of the best venture capital firms as they don't allow their partners to overspend or pay excessive attention to the current situation and only allocate cash by keeping long-term goals in mind.

#Truth vent#Truth ventures#truth venture#capital venture#capital venture fund#varun datta#varun datta ceo#seed funding#truth ventures#varun datta entrepreneur#varun datta founder#venture capital#seed capital#Capital venture India#Capital venture US#Capital venture UK#Venture Capital Ecosystem#Venture capital firms in india#Venture capital equity#Capital Venture Company#Capital venture funding#Stages of venture capital#Capital venture fund#venture capital in india#Types of venture capital#Investment Funding#Venture capital startup#Joint venture partner#Venture capital industry

3 notes

·

View notes

Text

Ben Stokes and bowler Stuart Broad launches new Venture Capital fund for early stage investments in four technology sectors.

#bowler#venture capital#venturecapitalist#funding#angel investment#startup#automation#technology#techjour#technology trends#investment#investnow#uk business#cricket#cricket news#trending2023#trendingnow

0 notes

Photo

Top Healthcare Venture Capital Firm - Zenith Partners

Are you looking for top healthcare venture capital firm UK ? Then you should get in touch with Zenith Partners. They provide most competitive bridge loan deals with a simple procedure only. To learn more, visit their website.

0 notes

Text

New post!

"Eddie Redmayne, star of the Fantastic Beasts series, enjoys a caffeine fix at a local speciality coffee shop".

By We love Budapest, January 30, 2024.

British actor Eddie Redmayne, currently shooting in Budapest, was spotted at a downtown speciality coffee shop. So, next time you are sipping on a flat white, keep an eye out – you might be sharing a coffee moment with the Oscar-winning star!

Redmayne, well known for his leading roles in the Fantastic Beasts series, The Danish Girl, and The Theory of Everything, has been in and out of Budapest since last summer. He is shooting ' The Day of the Jackal ', a thriller series based on Frederick Forsyth's novel, where he plays a professional assassin. Beyond the film set, he's been actively exploring the city, making appearances at a student protest and the Espresso Embassy, and now he ventured into another top-notch speciality café near the Parliament, where he posed for a photo.

The baristas at Madal said the actor had arrived solo and ordered a latte for himself and another to go. He was super friendly, greeting another guest with a 'Nice to meet you'.

As for the duration of his stay in the Hungarian capital, we have no information and the release date of the series also remains a mystery. But we do know that the filming locations span Budapest, Austria, Croatia, and the UK, and the cast includes Lashana Lynch, Adam James, Scott Alexander Young and Hans Peterson too. So some more celebrity spotting is definitely on the cards.

---

19 notes

·

View notes

Text

Next New Networks, Part 2

I’m going to try, in as few posts as possible, to create a coherent timeline of the short, eventful life of Next New Networks, an early, consequential moment in streaming video history.

From Part 1: There was almost no “professional” quality video on iTunes in November 2005. The result for us? 1 million downloads in the first 30 days! We had some hits!

Part 2: Early 2006

Wait! What? iTunes? What about YouTube?!

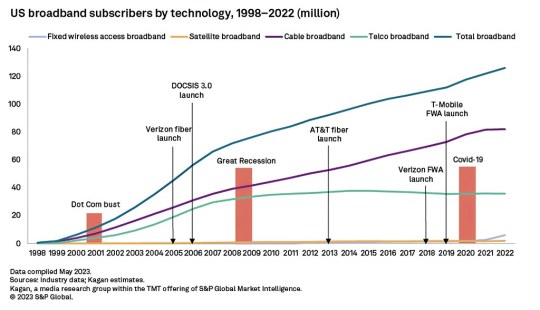

Let’s set the scene of online video in late 2005. The consumer internet is still coming into its own. Broadband connections, which will supercharge video consumption, have barely made themselves known. Vimeo is first, but starved by its corporate parent, YouTube is going to be the big thing, but it’s still independent, Google has launched its own (ultimately failed) competitor. No one understands who/what online video is for.

In our case, we announced Channel Frederator and VOD Cars as “video podcasts” and YouTube was wedding videos and baby’s birthday party. Apple iTunes was the place for podcasts, and Emil and David Karp were the only two people who’d pointed out to me that iTunes had recently been optimized to handle video, not just audio.

What did it all mean to me? Who the fuck knows? I had no particular plan, neither did Emil. Things just seemed cool, it was fun. I had a loose professional agenda, but it was a cartoon agenda, not particularly an online video strategy.

That said, as our numbers kept growing, and Steve Jobs used our logo in live presentations for the Video iPod, I said to Emil:

“You know, if we could launch 100 of these channels with this kind of performance, we could have our own media company!” Emil nodded, and we decided to register www.NextNewNetworks.com in January 2006. What the hey!

But still, no plan.

Jed Simmons @Next New Networks 2009

Until Jed Simmons started showing up.

Jed and I had been partners at Turner Broadcasting, the top two dogs running Hanna-Barbera Cartoons for Ted Turner until he sold his whole company to Time Warner (now WBD). He’d moved to the UK, got involved in venture, moved back to NewYork, I moved back to NY to run MTV’s online business for a minute, quit and opened Frederator/NY in addition to LA’s Frederator Studios. I suggested that he take a desk in our office and we could get into trouble together. The office was an open plan (I didn’t want to spend money to put up walls) so he could hear everything my big mouth spouted.

There might have been any plan, no strategy, but it sure was exciting. Thousands of views a day, hundreds of submissions of animated shorts –people still hadn’t realized that they could control the internet as well as well could– it was a brave new world. I would tell anyone who would listen how neat it all was.

Jed would ask me about what I was going to do with it all, I pushed him away. One day, he asked if I’d talked to any VCs. I didn’t know what he was talking about. He patiently explained and told me that a buddy we’d worked with at Turner was a venture capital guy now, Jed would invite him in. Sure.

Within a few days we were describing how we did what we did and why we thought it could be expanded. He blubbered about how YouTube would beat us, blah blah blah.

“YouTube is going to be our distributor,” Emil piped in. I’m not sure I understood what he meant. But, Emil was always right about these things, so I blah blah’d about it myself. Our friend wasn’t impressed (he rarely was when I had an idea at Turner either), and then he left. So be it.

A couple weeks later, he was back. But, this time he came with Santo Politi, one of his bosses, a founder and general partner at Spark Capital in Boston. We were at lunch downstairs in the French restaurant (owned by Anthony Bourdain’s partner and the ex-boyfriend of a former MTV colleague) and I went into what had become a 20 minute blah blah. In 10 minutes, Santo interrupted.

“OK, we’re in.”

What?

“We’re in. We’ll syndicate an $8 million, A Round.”

Emil, Jed and I looked at each other. What???

(More next time.) Part 1 here.

Next New Networks -by Tim Shey by Fred Seibert

#Next New Networks#Emil Rensing#Fred Seibert#Jed Simmons#Spark Capital#Boston#2006#2007#Channel Frederator#VOD Cars

2 notes

·

View notes

Text

To achieve net-zero carbon emissions by 2030, we have to increase the amount of capital invested in climate tech by 590 percent, says Daria Saharova, managing partner at VC World Fund, a European venture capital firm specializing in climate tech. While European funds, including the UK’s, have €19.6 trillion ($21.1 trillion) under management—and invested €19.6 billion in 2022—that’s not enough. We need to invest at least €1 trillion every year.

The good news? “Europe is leading the world in patent applications for climate technology,” she says. “Twenty-eight percent of all patents in this field originate in Europe, so almost one-third of the technology needed is created here.”

The problem, Saharova warns, is the misalignment between emissions and venture capital. Forty-eight percent of VC investment in 2022 was into mobility technology, such as e-scooters. Mobility accounts for only 15 percent of emissions, while more polluting industries like manufacturing, food and agriculture, and the built environment are underfunded. “Eighty-five percent of emissions receive only 52 percent of funding,” according to Saharova.

This matters, she explains, because personal behavior change will reduce only 4.3 percent of emissions. Technologies already in the market will account for 49.8 percent—meaning technologies under development and in need of investment will need to fill in the rest. “Forty-six percent of emissions will be reduced by technology that’s yet to be developed, and this is the tech we desperately need,” she says. “And we need venture capital.”

Venture capital has had its fingers burned in this area before, she points out. “Between 2008 and 2013 there was a lot of investment and a lot of failures. So right now, R&D accounts for 35 percent of investment, private equity 37 percent, and venture capital just 13 percent of climate tech funding.”

There’s a huge opportunity for VCs—as the fast rise of late-entrant private equity shows. The return on new investment in climate tech between 2015 and 2019 stands at almost 22 percent. But how do VCs pick the right investment areas when they often lack the skills?

“We need a crystal ball for a tech product’s sales, the target market, the tech’s influence on that market, its climate footprint, and interrelations with other solutions—in particular, some serious climate science,” she explains. “That’s a long list.”

World Fund has developed a benchmarking system called the Climate Performance Potential, or CPP, which is gradually filtering through to academia. It’s a blend of comparing the potential a startup has to avoid or reduce emissions, a willingness to ignore the startup’s own predictions, and its ability to look at the Total Addressable Market (TAM), which World Fund calls the Total Avoidable Emissions. This pairs a team’s ability to execute with an almost competitive product in a climate-effective technology bucket to understand the order of magnitude that your multiple can achieve.

“This model is focused on the technology rather than the company, so it can be applied to large organizations as well,” she explains. “It allows us to measure the carbon market for a technology compared to others by 2040. We need more private capital and public capital, and this model makes it easier for them to predict success.”

3 notes

·

View notes

Text

Want to Develop an Investment Website and App? Read Before Starting

The UK investment landscape is experiencing a digital surge. With over 8.6 million people actively investing in the UK (UK Finance, 2023), the demand for accessible and user-friendly investment platforms is booming. This presents a golden opportunity for entrepreneurs and established firms alike to capitalize on this trend by developing their own investment website and mobile app. However, venturing into the realm of financial technology (FinTech) requires careful planning and meticulous execution.

This blog post serves as your guide, navigating the key considerations, costs, features, and benefits associated with developing an investment website and app. Additionally, we'll explore the compelling reasons why partnering with a website development company in the UK can streamline your journey and maximize your success.

Why Build an Investment Website and App?

Before diving into the nitty-gritty, let's address the "why." Here are some compelling reasons to consider developing your own investment platform:

Reach a wider audience: A digital presence breaks down geographical barriers, allowing you to attract investors from across the UK and potentially even internationally.

Boost user engagement: A well-designed website and app provide a convenient and interactive platform for users to manage their investments, increasing engagement and loyalty.

Enhance brand image: A professional and user-friendly platform signifies credibility and builds trust with potential investors, solidifying your brand image in the competitive FinTech space.

Offer unique value proposition: By tailoring your platform's features and functionalities to a specific niche or investment strategy, you can stand out from the crowd and attract a targeted audience.

Increase operational efficiency: Streamlining investment processes through automation and online functionalities can significantly improve efficiency and reduce operational costs.

Planning Your Digital Investment Platform: Key Considerations

Target audience: Defining your ideal investor profile is crucial. Are you targeting seasoned investors, first-time buyers, or a specific demographic? Understanding their needs and expectations will guide your platform's design and functionalities.

Regulatory compliance: The financial services industry is heavily regulated, and your platform must adhere to strict compliance requirements. Partnering with a legal and financial expert is essential to navigate these complexities.

Security and data protection: Safeguarding user data and financial information is paramount. Invest in robust security measures and ensure compliance with data protection regulations.

Budget and timeline: Clearly define your budget and establish realistic timelines for development and launch. Be prepared for potential unforeseen costs and adjustments along the way.

Essential Features for Your Investment Platform

User-friendly interface: Both your website and app should be intuitive and easy to navigate, even for novice investors.

Comprehensive investment options: Offer a range of investment options aligned with your target audience, including stocks, bonds, ETFs, and potentially alternative investments.

Portfolio management tools: Provide investors with tools to track their performance, analyze holdings, and make informed investment decisions.

Secure transaction processing: Integrate secure payment gateways and ensure seamless transaction processing.

Educational resources: Offer educational resources, financial news, and market insights to empower investors and build trust.

Community features: Consider incorporating forums, chat rooms, or other community features to foster engagement and knowledge sharing among users.

The Benefits of Partnering with a Website Development Company

Developing a sophisticated investment platform can be a complex endeavor. Partnering with a reputable website development company can offer several advantages:

Expertise and experience: Agencies possess the technical expertise and experience to navigate the intricacies of FinTech development, ensuring compliance and best practices.

Project management and execution: They can manage the entire development process, from planning and design to development, testing, and launch.

Access to specialized resources: Agencies have access to specialized tools, technologies, and development teams tailored to FinTech projects.

Reduced risk and time to market: Partnering with an expert mitigates risks associated with in-house development and expedites the time to market.

Ongoing support and maintenance: Reputable agencies offer ongoing support and maintenance to ensure your platform's smooth operation and security.

Investment in Your Investment: Estimated Costs

The cost of developing your investment platform can vary significantly depending on several factors:

Complexity of features: The more sophisticated and diverse the features, the higher the development cost.

Platform design and development: Custom design and complex functionalities increase costs compared to using pre-built templates or frameworks.

Development team and timeline: The experience and size of the development team, as well as the project timeline, significantly impact the cost.

Ongoing maintenance and support: Factor in the cost of ongoing maintenance, security updates, and potential future enhancements.

While it's challenging to provide a definitive cost estimate without specific details, expect an investment ranging from tens of thousands to hundreds of thousands of pounds for a well-developed and secure investment platform.

By understanding the key considerations, essential features, and potential benefits, you can make informed decisions throughout the development process. However, the journey doesn't end there. Remember these crucial steps to ensure your platform takes flight:

Market research and validation: Conduct thorough market research to validate your platform's concept and identify any potential pitfalls. Gather feedback from potential users through surveys, focus groups, or beta testing to iterate and refine your offering.

Marketing and user acquisition: Develop a comprehensive marketing strategy to attract your target audience and drive user acquisition. Leverage social media, content marketing, and strategic partnerships to build brand awareness and generate interest.

Continuous improvement and innovation: The financial landscape is dynamic, so staying ahead of the curve is crucial. Continuously gather user feedback, monitor industry trends, and implement new features and functionalities to keep your platform competitive and relevant.

Building trust and transparency: In the financial world, trust is paramount. Ensure clear and transparent communication, provide comprehensive educational resources, and prioritize user security to foster trust and loyalty among your investor base.

Partnering for success: As mentioned earlier, collaborating with a website development company specializing in FinTech can be invaluable. Their expertise, resources, and ongoing support can significantly increase your chances of success.

By following these guidelines and leveraging the power of a trusted development partner, you can unlock the full potential of your investment platform and navigate the exciting world of FinTech with confidence. Remember, a well-developed and user-friendly platform can not only empower investors but also propel your business to new heights, solidifying your position in the ever-evolving digital investment landscape. Ready to embark on your investment platform development journey? Do your research, carefully consider your options, and seek guidance from the experts like Social Gamma the top website and App development and b2b digital marketing agency in London. With careful planning, strategic partnerships, and a commitment to user experience, you can build a platform that empowers investors and fuels your business growth.

2 notes

·

View notes

Photo

On 10th February 1972 the Island of Rockall, 250 miles west into the Atlantic formally became part of Scotland.

I say finally, but the arguments about this lump of granite are still going on. I particularly like the way the online magazine Hakai describes it and the goings on....

The Fight Over a Shitty Rock.

The tiny islet has been the source of an ownership dispute involving the Scotland, Ireland, Denmark and Iceland. The plateau on which it sits has caused the decades worth of tension.

While we might think we own it I agree with the United Nations definition in cases like this…

“rocks which cannot sustain human habitation”, there have been attempts to prove that Rockall is in fact an island and does not fall into that category.

Former SAS soldier Tom McClean spent 40 days on Rockall from from 26 May to 4 July 1985 in an attempt to validate it as an island and make it a British territory. Since then Greenpeace activists spent 42 days protesting against exploration. The activists landed on the island by helicopter to protest about potential oil exploration in the region.They spent 42 days on the rock, living in a solar-powered capsule.

Speaking at the time, one of the activists is quoted as saying: "The seas around Rockall, potentially rich in oil, are fought over by four nations - Britain, Denmark, Iceland and Ireland."By seizing Rockall, Greenpeace claims these seas for the planet and all its peoples."

They raised a new flag on the rock - the flag of the "Global State of Waveland" - establishing Rockall as the capital of an entirely new country.But they did not want to own Rockall - Greenpeace said it wanted to borrow it until it was "freed from the threat of development."It was a "virtual nation" in the early days of the internet with citizenship offered to anyone prepared to take a pledge to defend nature and act peacefully. Over the next few months, more than 15,000 applied for citizenship.

In 2014 Scottish explorer Nick Hancock occupied the rock for 45 days. Hancock, a surveyor from Edinburgh did this for charity raising money for Help for Heroes. The challenge was to land on Rockall and survive solo for 60 days. but but he had to cut his stay short after losing supplies in a storm.

For the moment, the status of the Shitty Rock remains that the UK claims is at part of its territory, more specifically, Scotland.

Read the Hakai article below, some of the article is wrong, like the Scottish Government saying the coast guard would board any Irish fishing boat venturing into a 19-kilometer zone around the islet of Rockall. While Scotgov work with the coastguard to some extent, Maritime and Coastguard Agency, is not devolved.

https://hakaimagazine.com/features/the-fight-over-a-shitty-rock/

17 notes

·

View notes

Text

Capital Venture Funds: Investing in Growth and Innovation for High Returns

Welcome to the world of capital venture funds! If you are looking to explore investment opportunities with high growth potential, capital venture funds can be an exciting avenue to consider. In this article, we will dive deep into the concept of capital venture funds, how they work, their benefits and risks, and provide valuable insights to help you make informed investment decisions.

What is a Capital Venture Fund?

A capital venture fund, also known as a venture capital fund, is a pool of money collected from various investors, such as individuals, institutions, or corporations, with the aim of investing in startups and early-stage companies. These funds are managed by professional venture capitalists who have expertise in identifying promising investment opportunities.

How Does a Capital Venture Fund Work?

Capital venture operate by raising capital from investors and using that money to provide funding to startups and emerging companies in exchange for equity stakes. The fund managers evaluate business proposals, conduct due diligence, and select ventures with significant growth potential. They offer financial and strategic support to these companies, with the ultimate goal of generating substantial returns on investment when the invested companies succeed.

Benefits of Investing in a Capital Venture Fund

Investing in a capital venture fund offers several benefits. Firstly, it provides access to high-growth opportunities that are typically unavailable in traditional investment options. Venture funds often invest in innovative and disruptive technologies, which have the potential to reshape industries and generate substantial returns. Additionally, investing in a capital venture fund allows diversification across a portfolio of startups, spreading the risk associated with investing in Truth Venture companies.

Risks Associated with Capital Venture Funds

While capital venture funds offer attractive prospects, it’s essential to consider the associated risks. Startups and early-stage companies are inherently risky investments, and not all ventures may succeed. The failure rate can be relatively high, and investors should be prepared for potential losses. Additionally, capital venture funds are illiquid investments, meaning that the invested capital may be tied up for a significant period before any returns can be realized.

How to Choose a Capital Venture Fund

When selecting a capital venture fund to invest in, thorough due diligence is crucial. Consider factors such as the fund’s track record, the expertise of its management team, the fund’s investment focus, and its alignment with your investment goals and risk appetite. Look for funds that have a diversified portfolio, an established network within the industry, and a robust investment strategy. Seeking advice from financial professionals can also provide valuable insights.

Top Capital Venture Funds in the Market

The capital venture fund landscape is diverse, with numerous reputable funds operating globally. Some of the top capital venture firms in the market include Sequoia Capital, Andreessen Horowitz, Accel Partners, and Benchmark Capital. These funds have a strong track record of successful investments and have been instrumental in supporting groundbreaking companies.

Steps to Invest in a Capital Venture Fund

Startup investing in a capital venture financing typically involves a structured process. Firstly, research various funds to identify the ones that align with your investment preferences. Contact the fund managers or reach out through a financial advisor to initiate the investment process. Complete the necessary paperwork, provide the required information, and transfer the investment amount as per the fund’s requirements. It’s important to review the terms and conditions of the fund carefully before committing your capital.

Tax Implications of Investing in a Capital Venture Fund

Tax implications of investing in capital venture funds vary depending on the jurisdiction and the specific regulations in place. In some cases, investments in venture capital funds may qualify for tax incentives or capital gains tax exemptions. However, it’s essential to consult with a tax professional or seek guidance from the fund managers to understand the specific tax implications and benefits associated with your investment.

Success Stories of Capital Venture Fund Investments

Capital venture funds have been behind some of the most successful and influential companies in the world. From early investments in companies like Google, Facebook, and Amazon, to the recent breakthroughs in innovative technologies, venture capital has played a crucial role in driving economic growth and fostering entrepreneurship. These success stories highlight the potential for substantial returns that can be achieved through astute venture capital investments.

Future Trends in Capital Venture Funding

The capital venture funding landscape is dynamic and constantly evolving. Several trends are shaping the future of venture capital, including the rise of impact investing, increased focus on diversity and inclusion, and the emergence of new industries and technologies. Artificial intelligence, blockchain, and clean energy are areas that are expected to attract significant venture capital investments in the coming years. Staying informed about these trends can help investors identify promising opportunities.

Conclusion

In conclusion, capital venture funds offer a unique investment avenue with the potential for high returns. While they carry inherent risks, the diversification, access to innovative companies, and strategic support provided by venture capital funds can outweigh the downsides for the right investors. Conducting thorough research, understanding the risks, and aligning your investment goals are key to making successful investments in capital venture funds.

FAQ

What is the minimum investment amount for a capital venture fund?

The minimum investment amount for capital venture funds varies depending on the fund. It can range from a few thousand dollars to several million.

How long does it typically take to realize returns from capital venture fund investments?

The timeframe for realizing returns from capital venture fund investments can vary widely. It can take several years, often around five to ten years, for startups to reach a stage where they generate significant returns or undergo an exit event.

Can individual investors invest in capital venture funds?

Yes, individual investors can invest in capital venture funds. However, some funds may have specific requirements or minimum investment thresholds for individual investors.

What is the difference between a capital venture fund and private equity?

While both capital venture funds and private equity funds invest in companies, the key difference lies in the stage of the companies they invest in. Venture capital funds primarily focus on early-stage companies and startups, while private equity funds typically invest in more mature companies with established operations.

Are capital venture funds suitable for risk-averse investors?

Capital venture funds are generally not suitable for risk-averse investors due to the higher level of risk associated with investing in startups and early-stage companies. Investors with a lower risk tolerance may prefer more conservative investment options.

Share this:

#Capital venture#Venture Capital#Capital venture fund#Seed funding#Seed capital#Venture capital firms#Startup funding#Venture capital fund#Venture capital financing#Seed funding for startups#truth ventures#Venture capital firms in US#Venture capital firms in UK#Capital venture India#Capital venture US#Capital venture UK#Venture Capital Ecosystem#Venture capital firms in india#Venture capital equity#Capital Venture Company#Capital venture funding#Stages of venture capital

0 notes

Text

2024 GLOBAL PREDICTIONS BY DR. DAVID ANIYIKAYE

1. The Nigerian Economy will be in a very delicate state due to inflation & scarcity of funds. I see a highly challenging year for the economy because it's still in a transitional stage. There is a desire to ditch an over-reliance on the dollar. (The Yuan & digital currency in view) but the cabals will resist the move fiercely.

2. Crime rate will be on the rise in Nigeria. The rate of prostitution & selling of hard drugs next year will be insane. I see busy timelines for law enforcement agents.

3. Speculative ventures & investment companies will flood the market space; where most of them will be positioned to rip people off based on "opportunities" for fast cash.

4. Politically, I see a lots of decampment in Africa! New allies or hybrid parties will be formed.

5. There will be economic recessions globally; a downturn for the USA as the dollar gets more weakened. Joe Biden will not win the election, & a woman or a Trump could replace him.

6. Russia & China will have the upper hand in the global power dynamics of 2024. Putin will be flexing his muscles but must be wary of the effects of wrong decisions on the economy of Russia. India will experience huge growth economically, while the UK will experience a highly challenging year.

7. Ukraine will be completely defeated by Russia in 2024 & will be taken over for a build.

8. Tensions will continue in the middle east in 2024 but there will be the appearance of some powerful figures for conflict resolutions to prevent WWIII. Tensions will exist strongly between the USA & Iran, while Russia sides with Iran. The role of China will be crucial to avoid escalations.

9. There will be massive spiritual awakening like never before, globally.

10. Big year of success for Davido & afrobeats in general. Wizkid will be moving smarter to regain lost grounds.

11. A year marked with conflicts, civil wars in many countries, heavy restrictions globally & financial losses for big companies.

12. A year of judgement for many evil people who pretend to be angels of light. It's also a year of fruition & rewards for the righteous.

13. A fortunate year for travel & hospitality industries. The desire for travel will be very high generally in 2024.

14. Huge progress in scientific discoveries, inventions & technological advancement. (Cure for an incurable disease).

15. A year of intense office politics & legal disputes. There will be intense discord among leaders due to differing opinions but I see hard settlements. World powers could resort to underhand tactics to gain control (e.g Major cyber attacks).

16. Nigerian actress Bimbo Akintola should lay low & be more mindful in 2024 to avoid a tragedy, bad health or huge loss.

17. Obtaining funding & raising capital will prove to be more challenging for many countries. It will require diligent efforts & valuable alliances to gather resources in 2024. Africa will come into huge focus because of her resources.

18. Some countries might offer to help Niger Republic (E.g China). The country is in need of a leader, & must be very careful in forming alliances. I see a major coup happening in another African country.

19. Pray against earthquakes, volcanic eruptions, flooding or other kind of disaster in places around California, Mexico, Italy, Japan, Turkey, Syria & Indonesia.

21. Some high profile men & women being brought down to earth in 2024. It's a year of karmic repercussions for past evil deeds. I see more unveiling of more scandals & atrocities.

22. People born in the year 1982, 1994, 1970 & 1958 with birth-month between March & December must be very careful of launching or starting anything new in the year 2024. They should avoid anything that has to do with some spotlight or risky moves. Prayers should be done against evil enchantments, the face of God should be sought like never before.

23. South Africa, France & India could form more economic alliance with Russia. India will be doing very well economically.

24. There will be significant climatic changes that are unfavourable globally. Sea levels will be rising exponentially. World governments will lay huge emphasis in the area.

25. Significant laws will be passed in relation to the use of AI as it gains more ground in the tech & media industry.

26. Dwayne Wade getting into some trouble legally. Gabrielle union could remarry or make a new relationship official & I foresee some sort of elevation of status for her.

27. Don Jazzy finally stepping down as the main boss of his label, to lead behind the scenes. He should be mindful of his health & not begin anything new for the spotlight to avoid a huge loss in 2024.

28. Fortunate year for Rihanna but artistes like Ty Dolla, Nicki Minaj, Lil' Uzi, Madonna, Lil' Baby, Lil' Wayne & Zlatan could be in the news for bad reasons. They should lay low in 2024 & be more prayerful.

#prophesy#predictions#new year 2024#seer#spirituality#astrology#clairvoyance#follow#i follow back#inspiration#inspiring quotes#instant folllow back#motivating quotes#the prophesies begin

3 notes

·

View notes

Text

“Last show of the year tonight, London!” Louis Tomlinson told a roaring sold-out crowd of 2,000 people at Shepherd’s Bush Empire last night. The show at the iconic venue in the UK’s capital was a special one-night-only gig to celebrate the release of his sophomore album, Faith In The Future. Released last month, it became Tomlinson’s first solo chart-topper in his home country.

After wrapping up his first 81-date world tour across five continents in September, last night’s setting was far more intimate than what the Doncaster-born star has been used to recently. Welcomed by a room full of screams and handmade signs, Tomlinson kicked off his 12-song set with “The Greatest,” a song he previously told EUPHORIA. he always envisioned as a show opener during the creative process of his record. Keeping with the high energy, Tomlinson dived straight into “Kill My Mind” before singing the Arctic Monkeys-infused “Written All Over Your Face,” an obvious career highlight and a smash hit waiting to happen. Out of all the One Direction songs Tomlinson could have sang, it was the heartfelt “Night Changes” he chose to put his own spin on. Vamped up with a full band production, his solo version was another reminder as to why “Night Changes” remains top tier. As the show continued, Tomlinson made sure to slow down the pace with the mellow “That’s the Way Love Goes” before closing with “Saturday.”

Venturing out on your own after being a member of one of the most famous pop groups of all time is not the easiest challenge to overcome. For Tomlinson, it appears his recent journey as a solo artist is on an all-time high and going just the way he hoped. With so much touring experience over the past 10 years, the 30-year-old is going down as a seasoned performer who keeps getting better and better. Never one to shy away from his admiration for his fans, the consistent crowd interaction in between each of the songs proved that performing on stage is where Tomlinson shines the most and what he enjoys doing more than anything else.

With numerous chants for “Angels Fly,” a song from the new record that has yet to be performed, that might be fans’ only critique of the special show. While they wait to witness it live with bated breath, there is always his 2023 arena tour for that song to get the justice it deserves. C’mon Louis!

Full set list:

“The Greatest”

“Kill My Mind”

“Written All Over Your Face”

“We Made It”

“Bigger Than Me”

“Night Changes”

“Copy of a Copy of a Copy”

“Out of My System”

16 notes

·

View notes

Text

Silicon Valley Bank failed this year because it bought too many Treasury bonds; surely it didn’t intend that to be a big risk. If you get rid of all the risk-takers at a bank, then there will be no one left who is good at taking risks, but the bank will still be taking risks. You have to strike the right balance.

and

But also it was just a big factual mistake! Crypto and DAOs and web3 were not a new way of organizing human economic behavior; they were an old way, the general partnership. They were a technological step backward: Ages ago, lawyers and financiers and governments figured out a new way to organize human behavior, the corporation, which allowed people to pool their capital in a new venture in ways that limited their risk and thus encouraged more and safer capital formation. And then crypto came along and people forgot.

— Money Stuff: Big Bonuses Are Back at UK Banks

1 note

·

View note

Text

Snider Card Info

“Antique Gun”

Soul Gun: Before All Else

Inflicts 3.6x (Max. 6x) damage to a single enemy.

Skill: Two-Part Fire

Inflicts 1.8x (Max. 3x) damage to a single enemy.

Trait 1: Battlefield Aptitude: UK

When the battlefield is in England, Attack increases by 11% (Max. 20%), and Defense increases by 11% (Max. 20%).

Trait 2: Hostility Sensing

Increases own Attack by 11% (Max. 20%) against enemies that have attacked self.

. . .

“Be Noble”

Soul Gun: Change, and Thus, Control

Inflicts 4.2x (Max. 6x) damage to a single enemy.

Skill: Buckshot Load

Inflicts 2.1x (Max. 3x) damage to a single enemy.

Trait 1: Battlefield Aptitude: UK

When the battlefield is in England, Attack increases by 11% (Max. 20%), and Defense increases by 11% (Max. 20%).

Trait 2: Overflowing Emotions

Soul Gun damage is increased by 27.5% (Max. 50%).

. . .

“Glare Lying Down”

Soul Gun: Change, and Thus, Control

Inflicts 4.8x (Max. 6x) damage to a single enemy.

Skill: Buckshot Load

Inflicts 2.2x (Max. 3x) damage to a single enemy.

Trait 1: Battlefield Aptitude: UK

When the battlefield is in England, Attack increases by 11% (Max. 20%), and Defense increases by 11% (Max. 20%).

Trait 2: Overflowing Emotions

Soul Gun damage is increased by 27.5% (Max. 50%).

Commentary

Card Commentary:

This is a fragment of a distant memory. A prequel to their story in England. The distorted brothers’ feelings accumulate in the hidden basement.

“Don’t be so arrogant. If you think I’ll be obedient forever, you’re making a huge mistake—”

Soul Gun Commentary:

Did you think you’d conquered me? Did you think I’d been broken? ...ha, what a joke. In the end, you’re in my grasp as well. Now, I’ll dye you my color.

. . .

“Ghost of Winsdam Castle”

Soul Gun: Before All Else

Inflicts 4.8x (Max. 6x) damage to a single enemy.

Skill: Two-Part Fire

Inflicts 2.4x (Max. 3x) damage to a single enemy.

Trait 1: Battlefield Aptitude: UK

When the battlefield is in England, Attack increases by 11% (Max. 20%), and Defense increases by 11% (Max. 20%).

Trait 2: Hostility Sensing

Increases own Attack by 11% (Max. 20%) against enemies that have attacked self.

Commentary

Card Commentary:

The mist-shrouded capital city and the Queen’s palace. A rumor lies here; never go out on a foggy night. If you ignore that warning and venture out—

“...looks like you wanted to catch my attention,” the violet-eyed apparition says with a silent smile.

Soul Gun Commentary:

He sought the power to overrun the enemies before him— and he gained it. That’s all there is to it. No explanation required, no words needed. Standing between violet darkness and golden light, he single-mindedly pursues dominion.

. . .

“Labyrinth -STRENGTH-”

Soul Gun: THE TOWER

Inflicts 4.8x (Max. 6x) damage to a single enemy, and increases own Attack by 10% (10 sec).

Skill: Strike Shot

Inflicts 2.4x (Max. 3x) to a single enemy.

Trait 1: Battlefield Superiority: UK

When the battlefield is in England, Attack increases by 22% (Max. 40%).

Trait 2: Stance Adjustment

Soul Gun damage increases by 2.7% (Max. 5%) for every Antique gun in the main or sub unit, and by 2.2% (Max. 4%) for every Modern gun.

Commentary

Card Commentary:

Whether you’re Noble or Ruthless, all that matters is slaughtering your enemies. However, if you leave your Nobility-obsessed brother to watch your back, you can fight however you please. With that in mind, he cast aside his own Nobility.

Soul Gun Commentary:

Fate points to the hand of Strength. I don’t know why. I have no need for your forgiveness; all I seek is power. Does the downpour of white blossoms mean hope, or death?

. . .

“Flowing Summer Stream”

Soul Gun: Before All Else: Impact

Inflicts 8x damage to a single enemy.

Skill: Buckshot Load: Domination

Inflicts 3x damage to a single enemy, and increases own Attack by 10% (10 sec).

Trait 1: Battlefield Superiority: UK

When the battlefield is in England, Attack increases by 22% (Max. 40%).

Trait 2: Violence Ahead

Skill gauge fills 50% faster, and Attack increases by 4% for each enemy defeated.

Commentary

Card Commentary:

Snider was suffering under the summer’s heat, and if “that” Snider is too bothered by the heat to go into battle, there’s no doubt that it’s an emergency. So... let’s all go somewhere to cool down!

Soul Gun Commentary:

I’m not concerned with the clothes. What I did just now was for my own benefit and nothing more— not “admirable conduct”, as my brother would put it. But... if you all are happier to be a bit cooler, that doesn’t bother me either.

. . .

“Mighty Raven”

Soul Gun: Raven • Bartitsu

Inflicts 5.6x damage to a single enemy, inflicts Taunt on self, and increases own defense by 10% (10 sec).

Skill: Fragment of a Demon Bird

Inflicts 2.4x damage to a single enemy, and increases own Defense by 20% (10 sec).

Trait 1: Battlefield Utilization: UK

When the battlefield is in England, Defence is increased by 22% (Max. 40%).

Trait 2: Defensive Mindset

Defense increases by 5.5% for each enemy on the battlefield, Max. 5 enemies.

Commentary

Card Commentary:

Passing through the mysterious door leads you to a bizarre world brimming with magic. However, not much changes for Snider. Magic is strength. Strength is good. And besides that, it feels good to fly.

Now, let’s enjoy this fairy tale of the dazzling witch!

Soul Gun Commentary:

Raven, the demon bird. Ravens have been a symbol of imminent demise since ancient times, and yet... well, there’s nothing else worth mentioning. Musketeers are guns. Guns bring death. ...see, nothing’s changed.

13 notes

·

View notes

Text

The tech world’s general fetishisation of West Coast culture is part of this story. An estimated 30 to 50 per cent of UK start-ups banked with SVB UK, with particular concentration at the top tier venture capital firms.

Heard some things about the UK branch but didn't know that they did that much.

3 notes

·

View notes

Text

Weekend Getaways from London

London is a one-stop destination offering endless things to experience, explore, and admire, but you might still require a break from the bustling city glamour. Well, the UK tourist visa not only offers you to explore the famous city but also has tons to venture outside the city. Within a few hours, you will have a plethora of weekend getaway options, whether you prefer a car, bike, or train.

With a perfect plan to enjoy the best weekend, we have picked the top places for weekend getaways from London.

Oxford

The city of dreaming spires, Oxford, is home to some of the world's most famous universities and a perfect weekend getaway destination from London, as you don’t just have to be a student to admire its charms. With every brick holding ancient history, the city is a wonderful cultural hub, giving you plenty of great places to go, eat, and drink.

No matter what age you are, it’s always worth exploring the history of Oxford University, including its colleges and other attractions such as the Ashmolean, the Pitt Rivers Museum, and the Bodleian Library, while wandering through the Port Meadow before stopping for some great burgers. Buy some great souvenirs and other items in the covered market, and if the weather is on your side, a picnic and punting excursion is a must.

The Cotswolds

The absolute definition of the English Countryside, The Cotswolds would pop up without any need for further thought. Ancient villages, shingle-roofed cottages, and miles of lush rolling grass where there is no shortage of sheep. The Cotswolds is a serene natural beauty to behold, making it one of the best weekend getaway locations from London.

With each region having its own charm, for a short weekend, head to Gloucestershire, packed with honey-coloured stone cottages and relaxing scenery. Enjoy the day at Westonbirt Arboretum, walk along the gazing cattle, take some snaps, or take clay pigeon shooting lessons at the Cotswolds Clay Club.

Brighton

This liveliest beachfront city on the southern coast of England is just an hour and 40 minutes from London. Brighton is a vibrant place to spend holidays, and as the unofficial LGBTQ capital of the United Kingdom, the city’s year-round festive vibes make it the perfect fit for fun day trips from London.

Explore the vintage stores and cute cafes of the Lanes, wander around the strolls and arty Boutiques, and in the evening, head over to Brighton’s most lively bars, pubs and clubs. Enjoy a relaxing walk along the Seven Sisters, a series of the famous Chalk Cliffs.

The Lake District

If outdoor adventure is your ultimate goal for this weekend, the Lake District is thriving with more than 900 miles of wilderness scattered with chocolate box villages. The site is perfect to visit at any given time, packed with a picturesque patchwork of lakes, woodlands, and lush valleys.

The Lake District is great for getting outdoors-hiking around the hills, paddling across the lakes, and exploring the country lanes. If the weather is great, hike up on Kendal Mint Cake and climb Scafell Pike-the highest peak in England. Visit the world of Beatrix Potter while you enjoy some yummy snacks in the Grasmere Gingerbread Shop.

Cornwall

The southern tip of England is one of the country’s most popular beach weekend trips from London. Cornwall is worth the hype to enjoy a weekend along the breathtaking coastlines along 300 miles of dunes.

The sea, sand, and sun are always at the top of the list, but adventure activities and history aren't far behind, with all of them venturing through cliffs, mediaeval harbours, and oak-forested creeks. Enjoy dipping with basking sharks and seals before walking down stepping-stone cliffs to experience tide pools, surfing, and body boarding.

From picturesque streets to seaside towns, London's outskirts have a lot more to offer. Pack your bags, pick a place, and get going for the best unwinding sessions.

5 notes

·

View notes

Text

One hour and three minutes before Silicon Valley Bank blocked all withdrawals, Pat Phelan got the last of his company's money out. Phelan's cosmetic medicine startup, Sisu Clinic, kept the majority of its reserves with the California-based bank. When he saw whispers of its problems spreading across the internet, he joined the digital bank run that ultimately pushed Silicon Valley Bank to collapse.

“I just messaged our chief financial officer and said, ‘Get the money out,’” Phelan says, adding he had to wait all night for the funds to arrive in his Bank of Ireland account. “It was an incredibly worrying 26 hours.”

After a tense weekend, regulators in the UK and US have stepped in to protect depositors, averting the most dramatic potential consequences of the largest US bank failure since the 2008 financial crisis.

But many in Europe’s tech industry warn of a slower-burn crisis to come. The reason that Silicon Valley Bank was so popular was because it filled a role that no one else would. It was part bank, part networking community, part venture capital firm. In some countries it was a major investor. In Ireland, the bank had planned to invest more than $500 million in technology and life science startups by 2024. In the Netherlands, the bank was in discussions about how to finance more local companies. Europe’s tech sector was already struggling with funding shortfalls, mounting losses, and widespread job cuts. The loss of Silicon Valley Bank only deepens the gloom.

“What happened during the last few days is once again there was a recognition that, especially when it comes to bigger [investment] rounds … there are not that many real big funds that can play a major role,” says Rinke Zonneveld, the CEO of Invest NL, a government-backed investment firm in the Netherlands. “We are dependent on US money.”

Silicon Valley Bank was embedded in Europe’s tech sector via a series of affiliated businesses and offices. Its Danish office, which didn’t have a banking license, focused on networking. The German branch did not offer a deposit business. But at the heart of that system was the bank’s London-based subsidiary, established in 2012, which helped startups across the EU with funding, loans, and accounts. On Friday, the Bank of England declared that Silicon Valley Bank was set to enter insolvency, before that arm of the business was acquired in a last-minute £1 rescue deal by HSBC bank.

But many of Silicon Valley Bank’s customers turned to the bank exactly because they felt that traditional lenders were not set up to cater to the technology industry’s specific demands.

The bank didn’t just enable tech companies with unusual financial structures to open accounts, says Check Warner, partner at London-based inclusive venture firm Ada Ventures. It also sponsored events and organizations trying to make the UK tech sector more diverse. “SVB was much more than just a bank,” she says. “I'd love it if a homegrown UK business was doing this role, but in the absence of that, Silicon Valley did it and did it really well.”

Silicon Valley Bank's struggles started with a bad bet on long-dated US bonds. Rising interest rates meant that the value of those bonds fell. As depositors started to worry about the bank's balance sheet, they pulled their money out. High interest rates have become a challenge across the industry, ending the cheap loans that tech companies got used to over the past decade and reducing available funding.

More than $400 billion in value was wiped from Europe’s tech industry in 2022, while some companies, like the buy-now, pay-later provider Klarna, watched their valuation plunge more than 85 percent. This year there’s been little reprieve, as layoffs continue within local startups as well as at Europe’s big tech outposts. At the end of February, Google confirmed it would cut 200 jobs from its business in Ireland.

“The whole tech industry is suffering,” Warner says. “Generally, in 2023 rounds are taking much longer; there's much less capital available.”

Against this backdrop it’s unclear whether any major European bank is able or willing to fill the niche that Silicon Valley Bank is leaving.

“Silicon Valley Bank is unique. There are not that many banks which provide startups loans,” says Reinhilde Veugelers, a senior fellow at economic think tank Bruegel and a professor at Belgian university KU Leuven. “Typically, European banks are not good alternatives, because they're way too risk-averse.”

And even if a bank wanted to take the risk, they'd likely struggle to replicate Silicon Valley Bank's deep knowledge of the startup ecosystem, Veugelers adds. “You need way more than deep pockets. You also need to be sufficiently close to the whole venture capital market and have the ability to do due diligence” she says. “If the bank had that capacity, it would have already been doing this.” HSBC did not immediately reply to WIRED’s request for comment.

Silicon Valley Bank was prepared to take risks that other banks wouldn't, says Frederik Schouboe, co-CEO and cofounder of the Danish cloud company KeepIt.

KeepIt secured a $22.5 million debt financing package—a way of raising money through borrowing—last year from Silicon Valley Bank’s UK business. Although the bank opened an office in Copenhagen in 2019, the branch did not have a banking license. Mainstream banks “are ultimately impossible to bank with if you are making a deficit in a subscription business,” Schouboe says. “The regulatory environment is too strict for them to actually help us.”

The way Silicon Valley Bank operated in Europe has earned its admirers. But now those people are worried the company’s collapse will warn other banks away from funding tech in the same way. It was SBV’s banking practices that failed, not the business model of funding the startup sector, says Berthold Baurek-Karlic, founder and managing partner of Vienna-based investment company Venionaire Capital. “What they did was they made big mistakes in risk management,” he adds. “If interest rates rise, this shouldn't make your bank go bust.”

Baurek-Karlic believes European startups were benefiting from the riskier bets that Silicon Valley Bank was taking, such as offering venture debt deals. The US and UK said Silicon Valley Bank is not system critical, arguing there was limited risk of contagion to other banks. That might be true in banking, he says. “But for the tech ecosystem, it was system critical.”

14 notes

·

View notes