#stock market learning course

Text

they are many strategies that can be used for intraday trading. The best strategy for you will depend on your individual trading style and risk tolerance.

#intraday trading course#best trading course in india#share market basic knowledge#online share market classes#share market basics for beginners#stock market learning course

0 notes

Text

7 Golden Rules of Investing in Stock Market

You can put your money into a fixed deposit plan, mutual funds, provident funds, real estate, or seek wealth management services in India. However, there is one investing sector many people have found to be the most intriguing and appealing. Its appeal stems from the possibility of huge rewards that it provides. But, of course, we’re referring to the phenomena of the stock market investment.

Many people will agree that the stock market is a complicated subject. The stock market is affected by so many elements that it is hard to forecast how it will behave, whether the stock price will rise or fall. However, if one is not cautious, the allure of the stock market might result in significant losses.

Investing in the stock market needs a great deal of patience and discipline, as well as study, in-depth knowledge of the markets and economy, and a thorough awareness of market volatility. Of course, everyone knows you should buy cheap and sell high, but a few additional easy guidelines might help you win on the stock market.

There is no surefire method for stock market investment. However, there are several “golden guidelines” to remember besides seeking education from the 1 stock market training institute in India when investing in the stock market:

Here are the 7 Golden Rules for investing in the stock market:

1. Set Reasonable Goals

As a no 1 stock market trainer in India would tell you, if you make unreasonable assumptions and have exaggerated stock market expectations, you might be in huge trouble. While it is acknowledged that anticipating high returns on your investments is not a bad thing, expecting too much might lead to disaster. For example, several stocks have achieved more than 50% returns during a bullish trend in recent years, but this does not imply that you should invest all of your money in those particular stocks.

2. Prioritise the Long Term

Yes, we’ve all heard the adage about entering the market when it’s low and quitting when it’s high. Many people utilise this method to make a fast buck. However, such a strategy is difficult to adopt because it is hard to anticipate when the stock price will rise or whether its growth has reached its full potential. Even after one has sold a stock, it may rise higher. Therefore, think of the stock market as a long-term investment alternative rather than a short-term money-making instrument.

3. Never Succumb To Herd Mentality

The most crucial thing to remember when trading in the stock market is to avoid herd mentality. Do not just buy a stock because several influencers and experts have suggested it or because a buddy is doing so. Before investing in a certain company, it is critical to perform your research and fundamental and technical analysis. “Be frightened when others are greedy, and greedy when others are fearful,” Warren Buffet once advised. This guideline must always be observed.

4. Diversify

Portfolio diversification is an age-old stock market investment technique. Investing in a single firm or industry is never a smart idea since your investment may lose value if the company fails. As a result, investing in a varied portfolio is usually advantageous to balance your assets. Generally, investing in a mix of small, mid, and big-size equities is best. Small and mid-cap companies offer the greatest potential for growth and high profits, but they also carry significant dangers. And large-cap stocks are often steady and provide decent returns. A mix of all three would allow you to invest in stability and growth.

5. Complete Your Homework

Investing in the stock market without conducting appropriate research or having a basic grasp of economics is equivalent to shooting oneself in the foot. Before you invest your money in the stock market, spend some time and effort learning how it works. Learn about economic trends and the variables that influence the stock market. When investing in a certain firm, it is essential to research both the company’s historical success and prospects. The only approach is to examine the technical data about the company’s economic performance. Aside from that, it is critical to comprehend the worldwide influences on the stock market.

6. Constantly Monitor Your Portfolio

We live in rapidly changing times. Any significant event or occurrence, whether global or domestic, might impact the market. As a result, one must regularly analyze their portfolio and make modifications to the changing times. Suppose a person does not have the time to check or investigate their portfolio carefully. In that case, they should seek the assistance of a professional financial planner who can help them monitor their portfolio meticulously.

7. Do Not Allow Your Emotions to Take Control of You

It is critical to control your emotions when trading stocks. Emotions can obscure your judgement and lead to poor judgments. Several times, investors have panicked and liquidated their assets amid a negative trend, resulting in rock-bottom prices. Remember that patience is essential in the stock market, and you should never make judgments based only on your emotions.

The golden guidelines outlined above will undoubtedly assist you in understanding how to invest in the Indian stock market. Understanding the fundamentals of the stock market is critical. Alternatively, you can pursue stock market education from no 1 stock market trainer in the world.

Bharti Share Market’s highly educated faculty has over a decade of financial market experience. We have educated over 170,000 people through seminars and classroom programs. It grew from a single room in 2008 to 11 outlets in 9 locations to become the no 1 stock market training institute in Maharashtra.

These teaching characteristics and his experience make Bharti Share Market the number one stock market educator in Mumbai and Pune. Bharti sir provides an excellent platform for Technical Analysis Study through which you can research the stock market.

As the no 1 stock market training institute in Pune, Bharti Institute teaches everything from the fundamentals of the stock market to the A to Z foundations of technical analysis.

#stock market learning course#share market full course#stock market certification courses#stock market courses in india#share market free course#best share market course in india#best option trading course in india

1 note

·

View note

Text

yeah, there should be a course in high school on how to do taxes, apply to jobs and all that, etc. but you know what else there should be? a crash course on accessing healthcare

#i mean i did lowkey have a course that taught me how to apply for jobs etc#good ol planning 10. i hated that course#we didn't learn about taxes iirc but we DID learn about the stock market#i didnt even try in that module because i knew i wasn't going to be able to afford to invest in stocks#and i thought there were better things to invest my money in#but i have a wisdom tooth coming in and i know i should make an appointment with a dentist but uh#how do? how work???#dental isn't included in MSP here and i know i can get coverage through my uni#but i still dont know how THAT works either???#because despite paying $350 a year it's not guaranteed coverage???? apparently???????#i'm so lost and confused and i have to get a new form for fair pharmacare to even access it and i feel so defeated#i feel like people just Know what to do but there's so many moving parts and its confusing keeping track of everything

5 notes

·

View notes

Text

Online Share Market Courses

Whether you are looking to gain a basic understanding of stock market trading or want to deepen your knowledge and skills, the Goela School of Finance has the perfect course for you. With a focus on fundamental and technical analysis, the courses offered by the Goela School of Finance cover everything you need to know about the stock market.

The stock market fundamental analysis course covers the basics of stock market trading, including market trends, financial analysis, and risk management. The course is ideal for beginners who are new to stock market trading and want to gain a solid foundation of knowledge. The course covers the key concepts of fundamental analysis and helps students understand how to analyze the financial performance of companies and make informed investment decisions.

The stock market technical analysis course, on the other hand, focuses on the use of technical indicators and chart patterns to make informed investment decisions. This course is ideal for experienced traders who are looking to enhance their skills and make more accurate predictions about market trends and stock prices. The course covers advanced technical analysis concepts and provides students with hands-on training in using technical indicators and chart patterns to make informed investment decisions.

The Goela School of Finance also offers a complete stock market course, which covers both fundamental and technical analysis. This comprehensive course is ideal for individuals who are looking to become proficient in stock market trading and achieve their financial goals. With a focus on both theory and practice, the course provides students with a thorough understanding of the stock market and how it operates.

In conclusion, the Goela School of Finance is a leading provider of online share market courses in India. With a commitment to providing top-notch financial education, the courses offered by the Goela School of Finance are designed to help individuals achieve their financial goals. Whether you are a beginner or an experienced trader, the Goela School of Finance has the perfect course for you. Visit the website at goelasf.in to find out more and get started today.

#stock market fundamental analysis#stock analysis course free#share market learning course#complete stock market course#stock market course#stock market courses online free with certificate#stock market study course#stock market training course#online learning stocks#professional stock trading course#best stock market courses online

2 notes

·

View notes

Text

Options Trading Course Buying Setups & Strategies

Do you want to learn how to plan your trades or pick the right options? If yes, Join My Equity Guru’s options trading course buying setups & strategies. In this course you will learn about straddles and spreads including analyze market conditions, trading psychology and many more.

#Options Trading Classes#Options Trading Course Buying Setups & Strategies#Options Trading Course#Learn Options Trading#education#stock market

0 notes

Text

A professional stock trading course can make trading much easier for you. Professional traders share their thoughts, ideas, tips, and experiences with you and assist you in your journey to become a professional level trader by providing you with appropriate study materials and learning opportunities.

#Professional stock trading course#Trading classes for beginners#elearnmarkets#investing stocks#learn trading#stockstowatch#stock market#stock market courses#Stock trading courses#Learning how to invest in the stock market#Investment course for beginners free

0 notes

Text

Stock Market Foundation Course (Beginner) - My Academy

Learn how to trade in stock market and invest with StockGro academy. Explore StockGro’s Share market course and learn the fundamentals of stock market. https://www.stockgro.club/academy/courses/stock-market-foundation-course-beginner/

#stock-market-course#stock-trading-courses#learn-how-to-trade-stocks#stock-trading-courses-for-beginners#stock-market-courses-for-beginners#rading-courses-for-beginners

0 notes

Text

How To Learn Share Market

If you're wondering how to learn share market effectively, the journey begins with understanding the basics of stock market operations and investment strategies. Start by grasping fundamental concepts like stocks, shares, dividends, and market capitalization. It's essential to know the difference between the primary and secondary markets and the role of stock exchanges, such as NSE and BSE in India.

To deepen your knowledge, focus on two main methods of analysis: technical analysis, which involves studying charts and trends, and fundamental analysis, which assesses a company’s financial health through its balance sheet and income statements. Both are crucial when learning how to navigate the share market effectively.

Practical experience is another key aspect of learning the share market. Opening a demat and trading account allows you to apply your knowledge in real-time by investing in actual stocks. For beginners, virtual trading platforms can be a risk-free way to practice. These simulators replicate market conditions, providing a safe space to test your strategies.

Staying informed is equally important. Regularly follow financial news, market trends, and expert insights. This continuous learning will give you a better understanding of market dynamics and investment opportunities. Additionally, taking courses on how to learn share market from financial institutions or online platforms can provide structured education and expert guidance.

Building a diversified investment portfolio and understanding risk management are also essential steps when learning how to succeed in the share market. Start with stable investments like blue-chip stocks or mutual funds before exploring more volatile options. Diversification and risk management protect your investments and enhance long-term growth.

Ultimately, how to learn share market comes down to a combination of education, practical experience, and staying updated. By adopting a disciplined and patient approach, you can steadily build your expertise and confidence in the share market.

#How to learn share market#How to learn share market for beginners#How to learn share market in india#Stock market for beginners#How to learn share market online#How to learn trading for beginners#share market courses in delhi#share market classes in delh

0 notes

Text

What is Intraday Trading- Meaning and Basic of Day Trading

Intraday trading, also known as day trading, refers to the practice of buying and selling financial instruments, such as stocks, within the same trading day. This means that all positions are closed before the market closes, and no trades are held overnight. The primary goal of intraday trading is to capitalize on short-term price movements in the market.

Basic Concepts of Intraday Trading

1. Key Features

No Overnight Positions: Unlike long-term investors, intraday traders do not hold any positions overnight. They enter and exit trades within the same day to avoid the risk associated with overnight market movements.

High Frequency of Trades: Intraday trading often involves a high number of trades in a single day, as traders aim to take advantage of even small price movements.

Use of Leverage: Many intraday traders use leverage to increase their buying power. While this can amplify profits, it also increases the potential for losses.

2. Market Hours

Intraday trading is conducted during regular market hours, which typically run from 9:15 AM to 3:30 PM (IST) in India. The first hour and the last hour of the trading session are usually the most volatile and provide significant trading opportunities.

3. Tools and Techniques

Technical Analysis: Intraday traders heavily rely on technical analysis to make trading decisions. This involves analyzing price charts, patterns, and technical indicators to predict future price movements.

Price Patterns: Common patterns like head and shoulders, double tops/bottoms, and triangles are used to identify potential entry and exit points.

Volume Analysis: Volume is a crucial factor in intraday trading, as it helps confirm the strength of a price movement. High volume typically indicates strong market sentiment.

4. Types of Orders

Market Order: A market order is executed immediately at the current market price. It ensures that the trade is completed quickly but doesn’t guarantee the price at which the trade will be executed.

Limit Order: A limit order specifies the price at which you want to buy or sell a stock. The trade will only be executed if the market reaches your specified price.

Stop-Loss Order: A stop-loss order is used to limit potential losses by automatically selling a stock when it reaches a certain price.

5. Strategies in Intraday Trading

Scalping: This strategy involves making numerous trades to capture small price movements. Scalpers aim for small profits on each trade but make many trades throughout the day.

Momentum Trading: Traders buy stocks that are moving strongly in one direction, often due to news or strong market sentiment, and aim to sell them before the momentum fades.

Breakout Trading: This strategy focuses on stocks that break through significant price levels, such as support or resistance levels, with the expectation that the price will continue in that direction.

Advantages of Intraday Trading

Potential for Quick Profits: The high volatility and frequent price movements in intraday trading provide opportunities to make quick profits.

No Overnight Risk: By closing all positions before the market closes, intraday traders avoid the risk of adverse overnight news or events that could impact the market.

Disadvantages of Intraday Trading

High Risk: The potential for quick profits comes with high risk, especially when using leverage. Prices can move against you quickly, leading to significant losses.

Requires Constant Monitoring: Intraday trading requires constant attention and quick decision-making, which can be stressful and time-consuming.

Who Should Consider Intraday Trading?

Intraday trading is suitable for individuals who:

Have a deep understanding of the market and technical analysis.

Are comfortable with taking on higher risks for the potential of quick profits.

Can dedicate time to monitor the market throughout the trading day.

Possess the discipline to stick to a trading plan and manage emotions effectively.

Conclusion

Intraday trading can be a lucrative but challenging activity. It requires a solid understanding of market dynamics, share market technical analysis and strict risk management. While it offers the potential for quick profits, it also carries significant risks, making it essential for traders to approach it with caution and a well-thought-out strategy.

#stock trading courses#intraday trading course india#stock market courses#learn share market india#best stock market trainer#stock market institute#trading courses#trading institute in india#share market classes

0 notes

Text

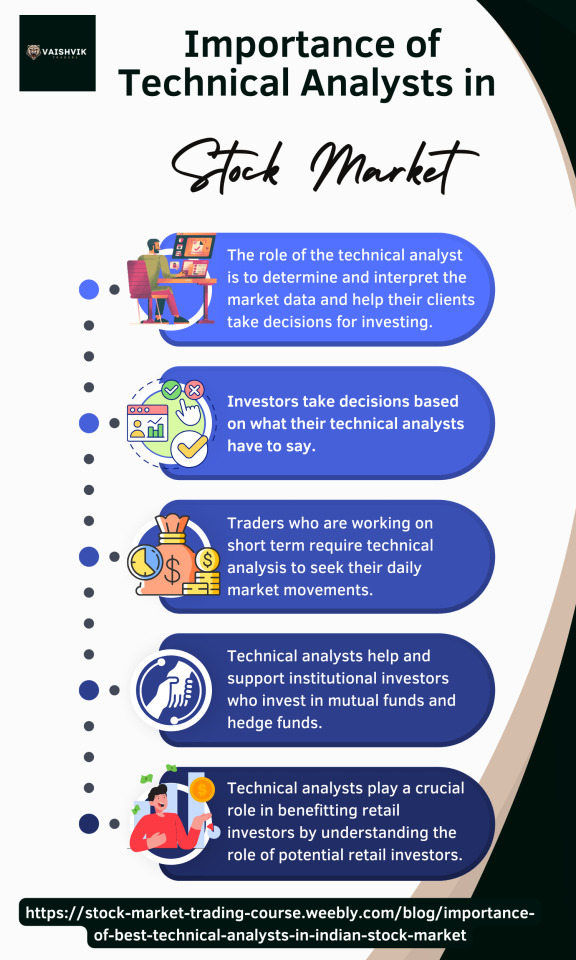

Importance of Best Technical Analysts in Indian Stock Market

The Indian stock market has a wide range of opportunities and challenges to be faced by investors. The role of a technical analysts for stock market is to take decisions and use their knowledge to predict the future price movements of the stocks. However, their role depends on different factors explained below.

#Nifty trading classes in jaipur#best stock market courses#technical analysts for stock market#trading learning program

1 note

·

View note

Text

Demystifying the Stock Market: A Comprehensive Guide for Beginners

The stock market, a conceptual behemoth in the investment world, often presents itself as an intricate maze for newcomers. With its fluctuating numbers, complex terminologies, and the oft-cited promise of financial growth, it's no wonder many individuals view this financial frontier as both fascinating and intimidating. However, when approached with a strong foundation and clear guidance, the stock market can be navigated with confidence and understanding.

It’s this very foundation that the "Beginners Guide to Stock Market" course by Finology Recipe aims to build. Designed with the beginner in mind, it’s the linchpin to unlocking clarity in what may initially appear to be a convoluted financial domain. Through this course, learners can strap in for an enlightening tour of the stock market, honing their knowledge from ground zero to insights that drive investment decisions.

Course Design: A Marathon for Mastery

True to its name, the "Beginners Guide to Stock Market" is a marathon—not a sprint. Over nine modules, learners embark on a comprehensive journey over two hours. This strategic design is augmented by the medium of instruction being English, catering to a wide audience with varying educational backgrounds.

Course Curriculum: In Pursuit of Financial Literacy

The course outline is systematic and inclusive, addressing key elements in a progressive manner. It includes:

Introduction to Stock Market: Setting the stage, this module invites participants to understand the stock market's purpose and functions.

Different Investment Instruments: Beyond stocks, there's a whole spectrum of investment avenues, from bonds to mutual funds, each with its own risks and rewards.

Regulators of Financial Markets: Transparent and fair markets are crucial. This section dives into the regulatory bodies that help maintain the integrity and efficiency of the markets.

Common Trading Terminologies: Jargon can be daunting. Terms like 'bear market,' 'bull market,' 'IPO,' and many more are demystified for easy digestion.

Philosophy Behind the Course

Acknowledging the anxiety that often accompanies financial decisions, the course creators have leveraged an educational philosophy centered on clarity and playfulness. The objective is not merely to impart knowledge, but to instill wisdom that dispels fears associated with market participation.

Course Components: A Rich Learning Experience

Factors that set this learning experience apart include:

PDFs: For those who appreciate the tangible handle on learning materials, downloadable PDFs provide the benefit of offline study and review.

Flashcards: Interactive learning is made more engaging with flashcards – an innovative method to remember complex concepts.

Assessments: Knowledge without measurement can be directionless; hence, assessments are integrated to mark progress.

Certificate: A certificate of completion not only marks an achievement but also reflects a commitment to understanding the intricacies of the stock market.

Starting Your Investment Journey

For those on the cusp of starting their investment journey, the "Beginners Guide to Stock Market" stands as an open door – an invitation to learn and grow within the exciting world of finance. The course promises not just theoretical knowledge, but also practical insights that can be foundational for making informed investment choices.

In essence, the course serves as an interpreter, translating the often-incomprehensible language of the stock market into digestible, learner-friendly concepts. The intention is to nurture and produce financially literate individuals equipped to engage with the market proactively.

Admittedly, participation in the stock market is no promise of immediate profit. It demands patience, resilience, and an informed perspective—qualities that this course strives to foster. For those who have eyed the market with trepidation or simple curiosity, a resource such as this might not just serve as an educational tool, but as a critical stepping stone towards personal financial empowerment.

0 notes

Text

Master Value Investing with 'My First Stock Market Course' | Finology Quest

Unlock the power of value investing with Finology Quest's flagship course - My First Stock Market Course. Learn financial statement analysis, ratio analysis, valuation techniques, and more to become a confident investor. Enroll now and get 50% off + 2 bonus courses!"

#stock market course#stock trading courses#learn how to trade stocks#stock market classes#online stock market courses#share market classes#share market courses online#stock exchange courses

0 notes

Text

#stock market classes in Mumbai#stock market classes#stock market classes Near Me#Stock market institute in Kalyan#Stock market institute near me#Share market courses in Kalyan#online share market classes#online share market course#online share market classes in Kalyan#online share market classes in Mumbai#online share market course in Kalyan#online share market course in Mumbai#Kalyan stock market training#Financial education in Kalyan#Equity market classes Kalyan#Investment training in Kalyan#Trading Classes near me#Kalyan investment workshops#Kalyan stock market learning centre#Local stock market education Kalyan#Kalyan financial market courses#Capital market classes in Kalyan#Stock Market Certification Courses Kalyan#Day trading workshops in Kalyan#Investment strategies seminars Kalyan#Stock Market Institute at Kalyan#Day Trading Strategy#Stock Market Certificate Course in Kalyan#Share Market Study Course in Kalyan#Trading courses Kalyan

0 notes

Text

Best Stock Trading Institute in Kerala | online stock trading course

Comprehensive Training Programs

Stock Market Kerala offers a wide array of courses catering to beginners and seasoned traders alike. From foundational lessons on understanding market dynamics to advanced strategies for portfolio management, their curriculum covers it all. Whether you prefer learning in a classroom setting or virtually, they have flexible options to suit your schedule.

Expert Trainers

What sets Stock Market Kerala apart is its team of experienced trainers. These professionals bring years of expertise and real-world trading insights to the table. Their approachable demeanor and willingness to help ensure that students get their doubts clarified promptly, fostering a conducive learning environment.

youtube

Online and Offline Learning

Recognizing the need for accessibility, Stock Market Kerala provides both online and offline classes. This flexibility enables students from various backgrounds and locations across Kerala to participate without constraints. The online sessions are interactive, ensuring an engaging learning experience similar to in-person classes.

youtube

Personalized Attention

Understanding the complexities of the stock market can be challenging. However, Stock Market Kerala believes in offering personalized attention to its students. The trainers are readily available to address queries and provide individual guidance, ensuring that no doubt goes unresolved.

Community Engagement

Beyond the classroom, Stock Market Kerala fosters a community of like-minded individuals passionate about trading. Networking events, discussion forums, and periodic meetups allow students to interact, share experiences, and broaden their perspectives.

Continuous Support

The learning experience doesn’t end with the course completion. Stock Market Kerala provides continuous support through post-training assistance, updates on market trends, and additional resources, ensuring that students stay informed and empowered.

youtube

Final Thoughts

Embarking on your stock market journey can be both thrilling and daunting. However, with the right guidance and training, navigating this financial landscape becomes more manageable. Stock Market Kerala stands as a beacon for aspiring traders, offering not just knowledge but also a supportive environment to nurture their skills.

Whether you’re a novice investor or seeking to refine your trading strategies, Stock Market Kerala’s comprehensive programs and experienced mentors might just be the catalyst for your success in the dynamic world of stock trading in Kerala.

JOIN NOW

#stock market#stock market classes#stock market courses#learn stock market#investing#best stock market courses#stock trading#Youtube

0 notes

Text

Stock Market Courses Online

Are you beginners and experienced traders looking to sharpen your stock market knowledge. Join My Equity Guru’s top rated stock market courses online, where you can learn expert insights, practical strategies and comprehensive learning materials.

#education#stock market#stock market learning app#stock market courses#stock market training#Stock Market Learning App

0 notes

Text

Investing is always a long-term wealth creation option. To accumulate wealth over a period of time, you may want to build a pool of assets that gives you a decent return to secure your future. So let's make your stocks investment easy.

#elearnmarkets#stock trading#stock market#investing stocks#Learning how to invest in the stock market#Investment course for beginners free

0 notes