#stockmarketforbeginners

Text

#stock market#StockMarketTraining#AhmedabadInstitute#TradingStrategies#FinancialEducation#LearnTrading#InvestmentTraining#StockMarketForBeginners#TradingCourses#ExpertGuidance#StockMarketEducation#ProfessionalTradingInstitute#share trading#tradingclasses#trading courses online#stock market courses#stock market classes#stocks#stockmarketcourses#tradingtips#trading workshops

0 notes

Text

Feeling unsure about entering the stock market? 🌐📈 No worries. At Taking Forward is here.

.

🌐 Visit Now: (https://www.takingforward.com/)

📍 Address: 207, Hari Kripa Complex, MP Nagar Zone 2, Madhya Pradesh, Bhopal

📞 Contact No.: +918225022022

#TakingForward#StockMarketForBeginners#InvestingMadeSimple#FinancialConfidence#StockMarketEducation#NewInvestorTip

0 notes

Link

#11stockmarketsectors#allsectorsinstockmarket#differentsectorsinstockmarket#marketsectors#sectorrotationinstockmarket#sectorsinstockmarketindia#stockmarket#stockmarketanalysis#stockmarketforbeginners#StockMarketSectors#stockmarketsectorsexplained#stockmarketsectorslist#stockmarkettoday#stocksectors#stocksectorschart#stocks#whatarethe11sectorsofthestockmarket

0 notes

Text

Make Money Free World Home Office

#makemoneyonline#earnmoneyonline#makemoneywriting#makemoneywithnfts#makemoneyonline2023#earnmoney#earnmoneywriting#gcashgamesearnmoney2023#philippinestockmarket#rategloeeview#stockmarketdaytradingstrategies#stockmarketdividendsphilippines#investinginstockmarket#rateglolegitornot#stockmarketforbeginners#philippines#rateglo#stockmarketanalysis#rategloapp#stockmarketphilippines#earn money online#Earn make from

0 notes

Text

What are the advantages of Investing in stocks?

Investing in stocks offers numerous advantages that can help individuals grow their wealth over time. We understand the potential risks involved in stock investments, but we also recognize the immense benefits that come with informed and strategic investing. In this comprehensive guide, we will explore the advantages of investing in stocks and provide valuable insights to help you make informed decisions.

Potential for High Returns

One of the primary advantages of investing in stocks is the potential for high returns. Unlike other types of investments, such as bonds or savings accounts, stocks have the ability to generate significant profits. By purchasing stocks, you become a shareholder in a company, and as the company performs well, the value of its stock is likely to increase. With careful research and analysis, you can identify promising stocks that have the potential to deliver substantial returns.

Diversification for Risk Mitigation

Diversification is a crucial strategy in investing, and stocks provide an excellent opportunity to achieve it. By investing in a variety of stocks across different sectors and industries, you can spread your risk and avoid putting all your eggs in one basket. In other words, if one company or sector experiences a downturn, your overall portfolio will be less affected. Diversification helps minimize the impact of individual stock performance and provides stability in the face of market fluctuations.

Liquidity for Easy Access

Stocks offer liquidity, which means they can be easily bought or sold on the stock market. Unlike certain investments like real estate or private businesses, stocks provide a high level of flexibility. If you need cash or want to capitalize on an investment opportunity, you can readily sell your stocks. This liquidity ensures that your funds are easily accessible when you need them.

Tax Benefits for Enhanced Returns

Investing in stocks can also bring about tax benefits. Dividends received from stocks are often taxed at a lower rate than ordinary income, providing an advantage for stock investors. By maximizing these tax benefits, you can enhance your overall returns and keep more of your hard-earned money.

While investing in stocks presents a multitude of advantages, it is important to be aware of the potential risks involved.

Volatility: Navigating Market Fluctuations

The stock market is inherently volatile, with prices experiencing frequent and sometimes sharp fluctuations. This volatility can make it challenging to predict investment outcomes accurately. It is crucial to have a long-term perspective and be prepared for short-term fluctuations in stock prices.

Potential Losses: Mitigating Investment Risks

As with any investment, there is always the possibility of losses when investing in stocks. The value of a stock can decline due to various factors, including market conditions, company performance, or unforeseen events. It is essential to conduct thorough research and carefully assess the potential risks associated with any investment before committing funds.

Guarding Against Fraud

Fraudulent activities can pose a risk to investors in the stock market. It is essential to exercise caution and conduct due diligence before investing in any company. Researching the company's financials, reputation, and management team can help you make informed decisions and mitigate the risk of falling victim to fraudulent schemes.

To optimize your stock investment strategy and increase your chances of success, consider the following additional tips:

Start Small and Learn

If you are new to investing, it is advisable to start with small investments. This approach allows you to gain experience, familiarize yourself with the market, and learn from your investment decisions. As you become more confident and knowledgeable, you can gradually increase your investment amounts.

Conduct Thorough Research

Before investing in any stock, conduct thorough research on the company, its financials, competitive landscape, and industry trends. Analyze historical data, evaluate the company's growth potential, and consider expert opinions. Informed research serves as a foundation for making sound investment choices.

Embrace Portfolio Diversification

Diversifying your investment portfolio is a fundamental strategy to manage risk effectively. Allocate your funds across different asset classes, such as stocks, bonds, and real estate. Within the stock portion of your portfolio, diversify across various industries and market sectors. This diversification helps protect your investments from the impact of any single stock or industry underperforming.

Regularly Rebalance Your Portfolio

As your investment portfolio evolves, it is crucial to periodically rebalance it. Rebalancing ensures that your portfolio aligns with your investment goals and risk tolerance. By selling overperforming assets and reinvesting in underperforming ones, you maintain a balanced and optimized portfolio.

Adopt a Long-Term Perspective

Successful stock investing often requires a long-term approach. While short-term market fluctuations are inevitable, the stock market has historically shown an upward trend over the long term. By maintaining a patient and disciplined approach, you are more likely to experience positive returns.

At , we recognize the importance of providing reliable and accurate information to help investors make informed decisions. By understanding the advantages and risks of investing in stocks, you can develop a well-rounded investment strategy that aligns with your financial goals.

Overall, investing in stocks can be a powerful tool for growing wealth over time. The potential for high returns, portfolio diversification, liquidity, and tax benefits make stocks an attractive investment option. However, it is crucial to navigate the inherent risks, including market volatility, potential losses, and fraudulent activities. By implementing a strategic approach, conducting thorough research, and following best practices, you can position yourself for investment success in the stock market.

Read the full article

#Businessgrowth#Dividendstocks#High-growthstocks#Howtobuildwealthwithstocks#Howtoinvestinstocks#Investinginstocksforbeginners#Low-riskstocks#stockmarket#Stockmarketforbeginners#Stockmarketstrategies#Stockmarkettips#UK#unitedkingdom#unitedstates#USeconomy#USA#whatarethebenefitsofinvestinginstocks#whataretheprosandconsofinvestinginstocks

0 notes

Text

Market prediction knowledge

Want to updated with the market. know the market prediction today and for stock market prediction tomorrow and be updated with the data click on the link and be updated on daily basis.

#tomorrow#market#stock#nifty#stockmarket#predictions#prediction#stockmarketforbeginners#stocksmarket#readyfortomorrow#Created by Inflact Hashtags Generator

1 note

·

View note

Text

youtube

Are you a beginner looking to dive into the exciting world of stock market trading? Look no further! In this comprehensive video, we provide you with all the essential knowledge and practical tips you need to start buying and selling stocks confidently.

#StockMarketForBeginners#StockTradingForBeginners#LearnStockMarketTrading#StockMarketCoursesForBeginners#BuyingStocksForBeginners#Youtube

0 notes

Photo

Insiders Online Stocks Trading Tips And Tricks

https://ebook-2.com/ebooks/insiders-online-stocks-trading-tips-and-tricks

Attention: We Are Not To Be Held Responsible If Your Online Trading Profits Start To Skyrocket…!

Always Been Interested In Online Trading? But Super-Confused And Not Sure Where To Even Start? Fret Not! Learning It Is A Cakewalk, Only If You Have The Right Guidance...!

Finally! You Can Now Discover Some Of The Most Effective And Little Known Insider Secrets, That Will Let You Master The Art Of Online Trading, And Save A Lot Of Time, Money, And Other Hassles In Direct Transactions…! Fame Is Beckoning You…Just Grab It!

#stocks #stocktrading #stockmarketforbeginners #stockmarket #daytrading #tradingstocks #livestocktrading #howtoinvestinstocks #bakrostore #ebook2 #downloadsebook2 #onedollarbook

stocks,stock market for beginners,stock market,day trading,stock trading,live stock trading,trading stocks,day trading stocks,trading live,day trading live,stocks trading,live trading,day trading penny stocks,day trading for beginners,stock trading for beginners,stocks to buy,stock market trading,trading stock market,how to invest in stocks,trading,stock market trading for beginners,day trading stock charts,live day trading

#stocks#stocktrading#stockmarketforbeginners#stockmarket#daytrading#tradingstocks#livestocktrading#howtoinvestinstocks#bakrostore#ebook2#downloadsebook2#onedollarbook

1 note

·

View note

Text

How To Invest In Stock Market For Beginner by Traders Training Academy.

"Looking for the best stock market academy in Bangalore? Look no further! Traders Training Academy offers top-notch training and education on the stock market"

Investing in the stock market can seem intimidating for beginners, but it can be a great way to grow your wealth over time. Here are some steps to follow when investing in the stock market as a beginner:

Educate yourself: Learn the basics of the stock market, including how it works, how to buy and sell stocks, and how to read stock charts. You can start by reading books, online resources, and watching educational videos.

Set investment goals: Determine why you want to invest in the stock market, your investment horizon, and your risk tolerance. This will help you choose the right stocks to invest in and create a diversified portfolio.

Open a brokerage account: Choose a reputable brokerage firm that offers low fees and easy-to-use trading platforms. You'll need to provide personal and financial information to open an account.

Start with a small amount: As a beginner, it's best to start with a small amount of money and gradually increase your investments as you gain experience and confidence. Don't invest money you can't afford to lose.

Diversify your portfolio: Don't put all your money into one stock or industry. Diversify your portfolio by investing in a mix of stocks, bonds, and other securities.

Monitor your investments: Keep an eye on your investments regularly, but avoid making frequent trades based on short-term market fluctuations. Remember that investing in the stock market is a long-term game.

Learn from your mistakes: Expect to make mistakes as a beginner. Use your mistakes as learning opportunities and adjust your investment strategy accordingly.

Remember that investing in the stock market involves risk, and there are no guarantees of profits. Be patient, do your research, and invest wisely.

#StockMarketForBeginners#InvestingForBeginners#StockMarketBasics#StockMarket101#BeginnerInvestor#StockMarketEducation#StockTradingForBeginners#LearnToInvest#InvestingTips#StockMarketAdvice#NewToInvesting#BeginnerTrader#StockMarketGuide#InvestmentEducation#FinancialLiteracy#Apple#Tesla#Microsoft

0 notes

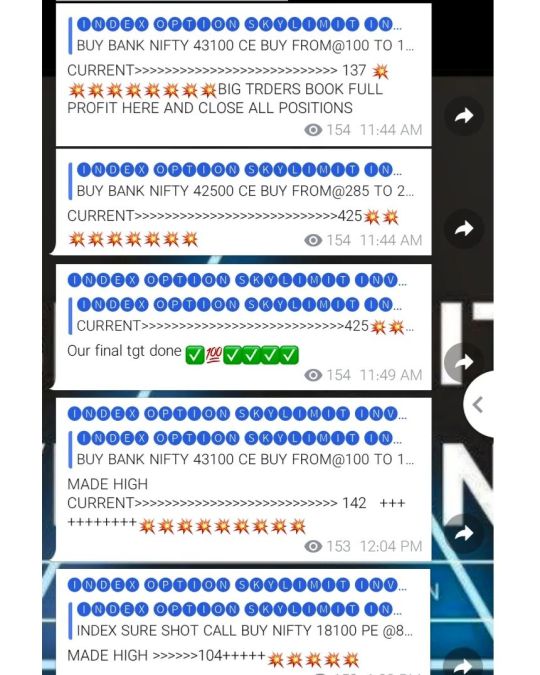

Photo

#bankniftyoptions #nifty50 #sharemarkettimes #investing101 #stockmarketforbeginners #financialfreedomstartshere #financialeducation #wealthmanagement #daytradingacademy #stockstrader #tradingplaces #financetips https://www.instagram.com/p/CnNM0euh_4v/?igshid=NGJjMDIxMWI=

#bankniftyoptions#nifty50#sharemarkettimes#investing101#stockmarketforbeginners#financialfreedomstartshere#financialeducation#wealthmanagement#daytradingacademy#stockstrader#tradingplaces#financetips

0 notes

Video

youtube

1075 PROFIT | Daily 2000 Profit Series | Day #14 | Trading in Telugu |

Day 13: ₹1992 Profit – Almost Hit the Daily 2000 Target! | Telugu Trader AJ

Hello, traders! Welcome back to Day 13 of the ₹2000 Daily Profit Series on Telugu Trader AJ! Today’s trading session brought us a solid profit of ₹1992—just shy of the ₹2000 target, but still a successful day in the market. As always, the trades were executed on the Zerodha platform, and I’ll walk you through the key strategies and trades that helped me stay consistent with profits.

Full Video:

Watch it here

What You’ll Learn in Today’s Video:

Live Trade Analysis: I’ll break down the exact trades that brought in ₹1992 today. Watch as I explain my thought process behind each entry and exit, and how I managed to make nearly ₹2000 despite some tricky market conditions.

Risk Management: One of the most important aspects of trading is managing your risk effectively. In this session, I’ll show you how to minimize losses and protect your capital while working towards your profit target.

Zerodha Platform Tips: As usual, today’s trading was done on Zerodha, and I’ll share some useful tips on how to navigate the platform for faster, more efficient trading.

Why You Should Watch:

Consistency is key in trading, and even when the market doesn’t give you big gains, it’s important to stay disciplined and stick to your strategy. In today’s video, you’ll see how I handled challenging market movements and still walked away with a decent profit. Whether you’re new to trading or have been in the game for a while, this video will provide insights into how to stay calm and focused even when things don’t go exactly as planned.

If you’re new to the series, the ₹2000 Daily Profit Series is all about making consistent daily profits in intraday trading using simple and effective strategies. Every day, I share my live trades, break down my decisions, and help you learn how to apply these techniques in your own trading journey.

Join the Community

Make sure to subscribe to my channel, Telugu Trader AJ, for more daily updates, live trades, and valuable trading tips. Hit the notification bell so you never miss a video, and join the conversation in the comments section—share your thoughts, ask questions, or let me know what you’d like to see in future videos.

Hashtags:

#Day13 #Daily2000Profit #TeluguTraderAJ #Zerodha #IntradayTrading #DayTrader #TeluguTrading #StockMarket

Stay focused, traders! Let’s keep learning and growing together on the road to consistent profits.

Watch Today’s Full Video: Click here

#trading #daily2000 #telugutraderfun #zerodha @TELUGU_TRADER_AJ

#intraday #trading #daytrader #telugu #zerodha #ajtrading

#TeluguTrader, #TeluguStockMarket, #TeluguInvesting, #TeluguFinance, #StockMarketTelugu, #TeluguTradingTips, #TeluguStocks, #StockMarketForBeginners, #DayTradingTelugu, #SwingTradingTelugu, #StockMarketUpdatesTelugu, #OptionsTradingTelugu, #IntradayTradingTelugu, #FinanceTelugu, #StockMarketTips, #InvestmentTelugu, #TradingStrategies, #PassiveIncomeTelugu, #WealthCreationTelugu, #MoneyManagement, #TradingMotivation, #FinancialFreedom, #YouTubeShorts, #ShortsTelugu, #ShortsForYou, #ViralShorts

0 notes

Text

Price Earnings Ratios Made Easy for Investors

Understanding the Basics of Price Earnings Ratios Price Earning Ratios (PE Ratios) serve as a fundamental tool in the realm of investment analysis, offering valuable insights into stock valuations and market expectations. Understanding these ratios is crucial for both novice and seasoned investors alike, as they provide a snapshot of a company's earnings relative to its stock price. This article delves deep into the basics of PE Ratios, explores their various types, interprets their significance, and offers strategies for effective utilization in investment decisions.

Understanding the Basics of Price Earning Ratios

What is a Price Earning Ratio?

Price Earning Ratios (PE Ratios) serve as a fundamental tool in the realm of investment analysis, offering valuable insights into stock valuations and market expectations. Understanding these ratios is crucial for both novice and seasoned investors alike, as they provide a snapshot of a company's earnings relative to its stock price. This article delves deep into the basics of PE Ratios, explores their various types, interprets their significance, and offers strategies for effective utilization in investment decisions.

Understanding the Basics of Price Earning Ratios

What is a Price Earning Ratio?

A Price Earning Ratio, often abbreviated as PE Ratio, is a financial metric used to assess the relative valuation of a company's stock. It compares the current market price of a share to the earnings per share (EPS) generated by the company over a specific period, typically the last twelve months (Trailing PE Ratio) or the expected earnings over the next twelve months (Forward PE Ratio).

Definition and Formula Explained

The formula for calculating PE Ratio is straightforward: divide the current market price of a stock by its EPS. For example, if a company's stock is trading at $50 per share and its EPS is $5, the PE Ratio would be 10 ($50 / $5).

Importance of PE Ratios in Investment Analysis

PE Ratios are pivotal in investment analysis because they provide a quick assessment of how much investors are willing to pay per dollar of earnings. A high PE Ratio may indicate that investors expect higher growth in the future, while a low PE Ratio could suggest undervaluation or slower growth prospects.

Key Components of Price Earning Ratios

Breaking Down Price and Earnings Components

The "price" in PE Ratio refers to the market price of the stock, which reflects the collective sentiment and expectations of investors regarding the company's future performance. The "earnings" component represents the company's profitability, measured by EPS, which indicates how much profit is generated per outstanding share of stock.

How Market Price Influences PE Ratios

Fluctuations in market price directly impact PE Ratios. If the market price rises without a corresponding increase in earnings, the PE Ratio increases, potentially signaling overvaluation. Conversely, a decline in market price relative to earnings can lead to a lower PE Ratio, possibly indicating undervaluation.

Types of Price Earning Ratios

Forward PE Ratio: Predicting Future Performance

The Forward PE Ratio uses projected earnings to estimate future profitability. Investors use this ratio to gauge whether a stock is priced reasonably based on expected future earnings growth. A lower Forward PE Ratio relative to the current PE Ratio might suggest that analysts anticipate increased earnings in the upcoming year.

Trailing PE Ratio: Analyzing Past Performance

The Trailing PE Ratio reflects historical earnings over the past twelve months. It provides insights into how the market has historically valued a company's stock relative to its actual earnings. Investors use this ratio to assess whether a stock is currently overvalued or undervalued based on recent financial performance.

Interpreting Price Earning Ratios

Benchmarking PE Ratios Across Industries

Comparing PE Ratios across industries helps investors understand how different sectors are valued in the market. Industries with high growth potential, such as technology or biotechnology, typically have higher PE Ratios due to anticipated future earnings growth. Conversely, stable industries like utilities or consumer staples may have lower PE Ratios.

What High and Low PE Ratios Indicate

A high PE Ratio may suggest that investors expect substantial future growth and are willing to pay a premium for anticipated earnings. However, it could also indicate overvaluation if earnings growth does not meet expectations. Conversely, a low PE Ratio may signal that a stock is undervalued relative to its earnings potential, presenting a buying opportunity.

Factors Influencing Price Earning Ratios

Economic Conditions and PE Ratios

PE Ratios are influenced by broader economic conditions, such as interest rates, inflation, and GDP growth. During periods of economic expansion, investors may be more optimistic about future earnings, leading to higher PE Ratios. Conversely, economic downturns or recessions may dampen earnings expectations, resulting in lower PE Ratios.

Impact of Growth Rates on PE Ratios

The growth rate of a company's earnings plays a crucial role in determining its PE Ratio. Companies with higher projected earnings growth rates often command higher PE Ratios, reflecting investor confidence in their ability to deliver strong financial performance in the future. Conversely, stagnant or declining growth rates may lead to lower PE Ratios.

Advantages of Using PE Ratios in Investment Decisions

Identifying Undervalued and Overvalued Stocks

PE Ratios help investors identify stocks that may be undervalued or overvalued compared to their earnings potential. By comparing a company's PE Ratio to its historical averages, industry peers, and the broader market, investors can make more informed decisions about buying, selling, or holding stocks.

PE Ratios as a Comparative Tool

PE Ratios enable investors to compare the valuations of multiple stocks within the same industry or across different sectors. This comparative analysis helps investors identify stocks that offer better value relative to their earnings and growth prospects, facilitating diversified investment strategies.

Limitations and Risks of Price Earning Ratios

Misinterpretations and Pitfalls to Avoid

While PE Ratios provide valuable insights into stock valuations, they can be misleading if not interpreted in context. A high PE Ratio may be justified by strong earnings growth expectations, or it could indicate market exuberance and potential overvaluation. Similarly, a low PE Ratio may signal undervaluation or reflect fundamental weaknesses in a company's financial health.

When PE Ratios Can Be Misleading

PE Ratios may fail to capture certain nuances of a company's financial health, such as one-time events, changes in accounting practices, or extraordinary expenses. Investors should supplement PE Ratio analysis with comprehensive due diligence, including examining a company's competitive position, management quality, and long-term growth prospects.

Strategies for Using Price Earning Ratios Effectively

Combining PE Ratios with Other Financial Metrics

To gain a more comprehensive view of a company's valuation, investors should consider combining PE Ratios with other financial metrics, such as Price-to-Book Ratio, Dividend Yield, and Earnings Growth Rate. This multidimensional analysis helps mitigate the limitations of any single ratio and provides a holistic perspective on investment opportunities.

Long-term vs. Short-term Investment Strategies

Investors should align their use of PE Ratios with their investment objectives and time horizons. Long-term investors may focus on companies with sustainable earnings growth and reasonable valuations, using PE Ratios as a guide for identifying quality stocks. In contrast, short-term traders may leverage fluctuations in PE Ratios to capitalize on market inefficiencies and short-term price movements.

Case Studies and Examples

Analyzing Real-world Applications of PE Ratios

By examining case studies of companies with varying PE Ratios, investors can gain practical insights into how these ratios influence investment decisions and stock performance. Case studies illustrate the dynamic relationship between earnings expectations, market sentiment, and stock valuations across different industries and economic environments.

Successful Use of PE Ratios in Investment Strategies

Successful investors share their strategies for effectively utilizing PE Ratios to identify investment opportunities, mitigate risks, and achieve long-term financial goals. Real-life examples demonstrate how disciplined analysis of PE Ratios, combined with qualitative research and market insights, can lead to informed investment decisions and portfolio outperformance.

Frequently questions (FAQs)

1. What is the ideal PE Ratio for investing?

The ideal PE Ratio varies depending on factors such as industry norms, growth expectations, and economic cycles. Generally, a lower PE Ratio may indicate a potential bargain, but it's essential to consider the company's growth prospects and overall market conditions.

2. How often should I reassess PE Ratios in my portfolio?

It's advisable to reassess PE Ratios periodically, especially when there are significant market shifts or changes in a company's financial performance. Regular monitoring helps investors stay informed about potential changes in stock valuations.

3. Can PE Ratios be used to predict stock market trends?

PE Ratios provide insights into individual stock valuations rather than broader market trends. While they can indicate whether a stock is overvalued or undervalued relative to its earnings, other factors like macroeconomic indicators and investor sentiment also influence market trends.

4. What are the limitations of relying solely on PE Ratios?

PE Ratios do not consider qualitative factors such as management quality, competitive advantages, or industry trends. Relying solely on PE Ratios may overlook important aspects of a company's financial health and growth potential.

5. How can investors mitigate risks associated with PE Ratios?

Investors can mitigate risks by diversifying their portfolios, conducting thorough research beyond PE Ratios, and considering a company's long-term growth prospects and competitive positioning. Combining PE Ratios with other financial metrics provides a more comprehensive view of investment opportunities.

Key Takeaways

Bottom LineUnderstanding PE Ratios: PE Ratios (Price Earning Ratios) are crucial for assessing how much investors are willing to pay per dollar of earnings and evaluating stock valuations.

Types of PE Ratios: There are two main types of PE Ratios—Forward PE (predicting future performance) and Trailing PE (analyzing past performance)—each offering unique insights into stock valuation.

Interpreting PE Ratios: Investors can benchmark PE Ratios across industries to gauge relative valuations and understand what high or low ratios signify about a stock's potential.

Factors Influencing PE Ratios: Economic conditions, growth rates, and market sentiment significantly impact PE Ratios, influencing investor perceptions of stock value.

Advantages: PE Ratios help in identifying undervalued or overvalued stocks and serve as a comparative tool for making informed investment decisions.

Limitations and Risks: Misinterpretations of PE Ratios can occur if not considered alongside other financial metrics or during periods of market volatility.

Strategies for Use: Combining PE Ratios with comprehensive analysis of a company's financial health and long-term prospects enhances decision-making accuracy.

Case Studies: Real-world examples illustrate successful applications of PE Ratios in identifying investment opportunities and managing portfolio risks effectively.

Conclusion: Mastering PE Ratios empowers investors to navigate financial markets with confidence, leveraging insights into stock valuations to optimize investment strategies and achieve long-term financial goals.

Bottom Line

Mastering Price Earning Ratios empowers investors with a valuable tool for evaluating stock valuations, assessing growth prospects, and making informed investment decisions. By understanding the basics of PE Ratios, interpreting their significance in different contexts, and applying strategic analysis techniques, investors can navigate the complexities of financial markets with confidence. Incorporating PE Ratios into a comprehensive investment strategy enhances financial literacy, fosters disciplined decision-making, and maximizes the potential for long-term portfolio growth.

Read the full article

#earnings#Invest#investingforbeginners#Investmen#MakeyMoney#p/eratio#peratio#peratioexplained#peratiofordummies#peratioinstockmarket#priceearningratio#priceearningsratio#pricetobookratio#pricetoearnings#pricetoearningsratio#pricetoearningsratioexplained#SaveMoney#Saveing#stockmarketforbeginners#whatisperatio

1 note

·

View note

Text

0 notes

Video

Jim Cramer buffoon entertainer or adviser. He is making money on suckers with impunity. He can safely say the same bull shit that they all do, with words like: Maybe, probably, IF, it should, it MAY, depends, etc...why are you even there? OH so the network can charge for commercials, they get richer and pay you a ton of money, GOT IT!

I know they cover their asses with the "entertainment" disclosure. But I still think there should be some accountability for the "cast & visitors" of Making Money with Charles Payne, Squawk box & on the street, Liz Clamon, Fast Money on CNBC, etc. If what they say doesn't happen they uses excuses.

If they are getting paid for their time and if CNBC is making money from commercials etc, than they should be held liable for what they say.

There are many people that listen to every word they say, until they get scorched. Unfortunately there is always a new wave of viewers that have no idea what they are listening to and trust these PAID entertainers.

AI satire loves making fun of these easy money bad actors

#fastmoney #squawkonthestreet #squawk #stockmarket #stockmarketnews #stockmarketforbeginners #stockmarketlive #stockmarketlivenews #stockmarketlivestream #stockmarketlivetrading #stocks #stockstobuy #stockstobuynow #stockstowatch #squawkbox #charlespayne #makingmoneycharlespayne @charlespayne6709

@JimCramerMadMoney #madmoney #jimcramer #cnbc @CNBC @FoxBusiness #foxbusiness #bloomberg

0 notes

Video

youtube

0 notes

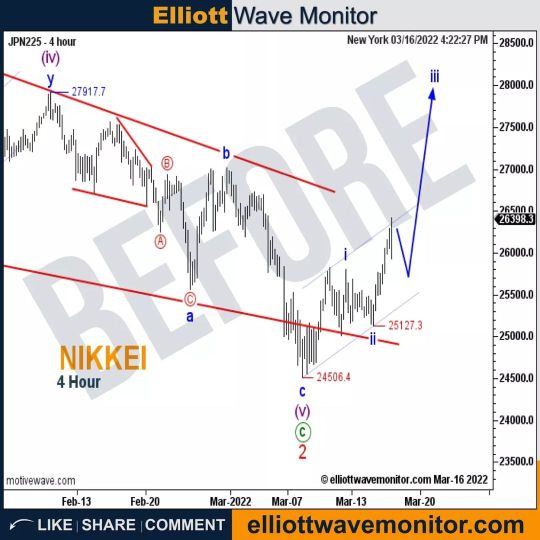

Photo

That's Why You Should Visit elliottwavemonitor.com Daily . . . #stockmarket #stocks #stockmarketindia #stockmarketnews #stockmarketinvesting #stockmarkets #stockmarketeducation #stockmarkettips #stockmarketmemes #stockmarketquotes #stockmarketanalysis #stockmarkettrader #stockmarketcrash #stockmarketupdate #stockmarketbasics #stockmarketlab #stockmarketsimplified #stockmarketinvestor #stockmarketforbeginners #stockmarkettrading #stockmarketcourse #stockmarketing #stockmarketmindgames #stockmarket101 #stockmarkettraining #stockmarketindiatips #stockmarketlearning #stockmarketfacts #stockmarketadvisory #stockmarketgame (at USA) https://www.instagram.com/p/Cbim3Hpg4NR/?utm_medium=tumblr

#stockmarket#stocks#stockmarketindia#stockmarketnews#stockmarketinvesting#stockmarkets#stockmarketeducation#stockmarkettips#stockmarketmemes#stockmarketquotes#stockmarketanalysis#stockmarkettrader#stockmarketcrash#stockmarketupdate#stockmarketbasics#stockmarketlab#stockmarketsimplified#stockmarketinvestor#stockmarketforbeginners#stockmarkettrading#stockmarketcourse#stockmarketing#stockmarketmindgames#stockmarket101#stockmarkettraining#stockmarketindiatips#stockmarketlearning#stockmarketfacts#stockmarketadvisory#stockmarketgame

1 note

·

View note