Don't wanna be here? Send us removal request.

Text

Public Cloud Market Report 2023: Global Trends, Growth, and Opportunities

The public cloud industry has experienced explosive growth in recent years, revolutionizing the way businesses operate and deliver services. In 2023, the global public cloud market reached new heights, with an increasing number of companies adopting cloud-based solutions to drive innovation, improve efficiency, and enhance their competitive edge.

The Public Cloud Global Market Report 2023 provides a comprehensive overview of the key trends, challenges, and opportunities that have shaped the industry's growth and evolution.

I. Overview of the Public Cloud Market:

Definition and Scope:

The public cloud refers to a cloud computing model where resources, such as storage, computing power, and applications, are delivered over the internet by third-party providers. These services are available to the general public on a pay-as-you-go basis, offering unparalleled scalability, flexibility, and cost-effectiveness compared to traditional on-premises solutions.

Market Size and Growth:

According to the Global Market Report 2023, the public cloud market has witnessed remarkable growth, with a CAGR of over 20% from 2018 to 2023. The market's value has surged to several hundred billion dollars, showcasing the increasing adoption of cloud services across various industries.

II. Key Factors Driving Market Growth:

Digital Transformation Initiatives:

Enterprises worldwide are embracing digital transformation to remain competitive and meet evolving customer demands. The public cloud has emerged as a critical enabler of this transformation, providing access to advanced technologies such as AI, big data analytics, and IoT, allowing companies to develop innovative products and services.

Cost Savings and Scalability:

Public cloud services eliminate the need for significant upfront infrastructure investments, as companies can scale their resources up or down based on demand. This agility not only saves costs but also reduces time-to-market for new offerings, giving businesses a competitive advantage.

Remote Workforce:

The COVID-19 pandemic accelerated the adoption of remote work, making cloud-based collaboration tools and virtual workspaces essential for business continuity. As companies embraced remote work models, cloud services facilitated seamless collaboration and secure access to company data from anywhere.

Cloud Security Advancements:

Public cloud providers have heavily invested in enhancing security features and compliance certifications, alleviating concerns related to data breaches and cyber threats. As a result, many organizations now trust cloud solutions with sensitive data and critical workloads.

III. Key Challenges and Considerations:

Data Privacy and Compliance:

As more data is stored and processed in the cloud, ensuring compliance with regional data privacy laws and industry regulations becomes critical. Businesses must carefully choose cloud providers that align with their compliance requirements.

Vendor Lock-in:

While cloud migration brings numerous benefits, the risk of vendor lock-in remains a concern. Companies should design their applications and systems with portability in mind to avoid difficulties in switching cloud providers in the future.

Performance and Downtime:

Reliance on internet connectivity can introduce latency issues and downtime, which may impact business operations. It is essential to select a reputable cloud provider with robust redundancy and disaster recovery capabilities.

IV. Regional Market Insights:

North America:

North America has dominated the public cloud market, driven by tech-savvy enterprises, substantial IT spending, and a high level of cloud adoption in diverse sectors, including finance, healthcare, and manufacturing.

Europe:

European countries have been witnessing significant growth in public cloud adoption, with the EU's General Data Protection Regulation (GDPR) playing a key role in shaping data protection practices.

Asia Pacific:

The Asia Pacific region has emerged as a hotbed of cloud adoption, fueled by the region's burgeoning startup ecosystem and the proliferation of internet-enabled devices. Overall, the Public Cloud Global Market Report 2023 reflects the continued ascendance of cloud computing as a transformative force in the business landscape. With digital transformation becoming a top priority for organizations worldwide, the public cloud's flexibility, scalability, and cost-effectiveness are driving unprecedented growth and innovation. Despite challenges related to data privacy and vendor lock-in, the benefits of cloud adoption far outweigh the risks, ensuring that the public cloud market will remain on a growth trajectory in the coming years. Businesses that embrace cloud-first strategies and focus on selecting reliable cloud partners are poised to thrive in this dynamic and fast-evolving landscape. Read the full article

#BenefitsofPublicCloudServices#CloudSecurityandCompliance2023#Cost-effectiveCloudServices2023#DigitalTransformationwithPublicCloud#GlobalPublicCloudMarket2023#PublicCloudAdoptionTrends2023#PublicCloudvs.On-PremisesSolutions#ScalabilityinPublicCloudSolutions#SecureCloudSolutionsforBusinesses#stockmarket#TopCloudProvidersfor2023#UK#unitedkingdom#unitedstates#USeconomy#USA

0 notes

Text

Nasdaq, S&P 500, and CAC40: Impact of US Debt Downgrade

The recent US debt downgrade has sent shockwaves through the global stock market, leading to a sharp decline in major indices. Among them, the Nasdaq 100, S&P 500, and CAC40 have all experienced significant losses. In this in-depth analysis, we will explore the impact of the downgrade on these indices, examine the technical factors influencing their movements, and assess the potential outlook for investors.

The Nasdaq 100: Testing Uptrend Amidst a Pullback

The Nasdaq 100, known for its focus on technology and growth-oriented companies, has been a standout performer this year, rallying an impressive 40%. However, this substantial growth has led many experts to anticipate a significant pullback. As predicted, the US debt downgrade acted as a catalyst for a sell-off, driving the Nasdaq 100 to its lowest level in three weeks. Nevertheless, the uptrend remains intact, leaving investors questioning the depth of the pullback required to dent this upward trajectory. Currently, the index is targeting the rising trendline support from the April lows, and a breach of this level could trigger additional declines. Below this, the 50-day Simple Moving Average (SMA) at 15,076 is the next critical support level to watch. If the selling pressure persists, short-term support may be found at 14,920, and further down at 14,688. To significantly impact the uptrend, a much more substantial downward move, likely below 14,000, would be necessary. However, investors must remain vigilant as the market's sentiment can shift quickly, potentially leading to a more prolonged correction.

S&P 500: Aiming to Stay Above Key Support Levels

Similar to the Nasdaq 100, the S&P 500 has also faced significant selling pressure since the US debt downgrade. The index has plunged to a level not seen since early July, raising concerns among investors. The 50-day SMA has emerged as a critical support level, and its ability to hold could dictate the index's short-term trajectory. A break below this level might lead to more downside potential, with investors closely monitoring the 4392 area, which previously served as strong support in July. As of now, there are few signs of a recovery. However, if the index manages to reclaim the 4550 level, it would signal a resurgence of buyer confidence. A move above this level could indicate that the worst of the sell-off is over, potentially leading to a broader market rebound.

CAC40: European Markets Suffer the Impact

European markets, particularly the CAC40, have borne the brunt of the US debt downgrade's impact more severely than their Wall Street counterparts. The CAC40 saw its gains from late July evaporate when it struggled to sustain a breakout above trendline resistance. The index's losses are now pushing it towards the 200-day SMA, currently around 7096. A breach of this level could bring the index back to the early July lows, adding to the pessimism surrounding European equities. However, a move back above the 7350 mark might indicate that a low is in place, providing some respite for investors. Such a development could put the CAC40 on course to target the 7500 level once again, offering a glimmer of hope amidst the prevailing market uncertainty.

Technical Analysis and Future Prospects

While the US debt downgrade played a significant role in triggering the current market turmoil, it is essential to consider the broader technical factors influencing these indices. The declining trendline, 50-day SMA, and critical support levels have become vital reference points for investors seeking potential entry or exit points. In a market where uncertainty prevails, investors must exercise caution and consider the significance of the technical indicators before making investment decisions. A well-informed approach, coupled with a diversified portfolio, can help navigate turbulent times and minimize potential losses.

The Road Ahead: Considerations for Investors

As we move forward, the outlook for global markets remains uncertain. The aftermath of the US debt downgrade will continue to influence investor sentiment and market movements. Several factors will come into play, including geopolitical developments, monetary policy decisions, and corporate earnings reports. For investors, adopting a cautious and patient approach is crucial. While the recent sell-off has raised concerns, it is essential to remember that markets tend to experience cycles of growth and correction. Staying informed, seeking professional advice, and adhering to a long-term investment strategy are prudent steps to weather the storm. The US debt downgrade has unleashed market turmoil, impacting major indices worldwide. The Nasdaq 100, S&P 500, and CAC40 have all experienced significant declines, prompting investors to reassess their positions. Technical analysis reveals key support levels and critical SMA points, serving as reference markers for potential market movements. The current pullback, while severe, has not yet disrupted the uptrend entirely, but investors must remain cautious. Read the full article

#CAC40Europeanmarketdownturn#CAC40MarketDownturn#Globalstockmarketturmoil#GlobalMarketTurmoil#HighVolumeTags#InvestorsentimentafterUSdebtdowngrade#InvestorSentiment#LowCompetitionKeywords#Marketcorrectionoutlook#MarketCorrection#MarketSellOff#Nasdaq100technicalanalysis#Nasdaq100Analysis#Risingtrendlinesupportanalysis#S&P500supportlevels#SP500Support#stockmarket#Techstockmarketsell-off#TechStocks#TrendlineSupport#unitedkingdom#unitedstates#USdebtdowngradecatalyst#USdebtdowngradeimpact#USDebtDowngrade

0 notes

Text

Electrify America: The Game-Changer in EV Charging Networks

In an exciting development for the electric vehicle (EV) industry, seven major automakers, including Ford, BMW, and Volkswagen, have recently unveiled their plans to establish a groundbreaking electric vehicle charging network named Electrify America.

This ambitious initiative aims to compete head-on with Tesla's Supercharger network and address one of the most significant hurdles in the widespread adoption of EVs: the lack of charging infrastructure. In this article, we will delve into the details of the Electrify America network, its potential impact on the EV market, and explore how businesses and individuals can plan their own EV charging stations to be part of this transformative movement.

The Electrify America Network

The Electrify America network is poised to revolutionize the EV charging landscape in the United States. With an initial plan to deploy 2,000 fast-charging stations across the nation, it promises to offer an extensive and convenient charging network for all EV drivers, not just owners of specific brands like Tesla. This inclusivity is expected to accelerate the transition to electric vehicles, as it removes a major barrier for potential buyers worried about charging accessibility. Seven multinational automakers — BMW (BMWYY), GM (GM), Honda, (HMC), Hyundai (HYMTF), Kia, Mercedes-Benz Group (MBGAF), and Stellantis (STLA) — announced on Wednesday that they will form a new charging network that they say will "significantly expand access to high-powered charging" in North America. The funding for the Electrify America network comes from a monumental $2 billion settlement paid by Volkswagen following its diesel emissions scandal. The network's establishment is projected to be fully operational by 2025, which is a significant milestone for the EV industry and a clear signal of the automakers' commitment to sustainable transportation.

Driving the EV Revolution Forward

The announcement of Electrify America and the collective efforts of the seven major automakers represent a significant stride toward shaping the future of transportation. The demand for EVs in the United States has been skyrocketing, with a remarkable 87% increase in EV sales in 2022 alone. This growth trend is anticipated to continue as more consumers become environmentally conscious and seek alternatives to traditional internal combustion engine vehicles. With the proliferation of the Electrify America charging network, the convenience and accessibility of EV charging will be unparalleled. As a result, we can anticipate a surge in EV adoption rates, further fueling the industry's momentum and driving the transition towards sustainable transportation solutions.

Planning Your EV Charging Station

As the EV revolution gains momentum, many businesses and individuals are considering installing their EV charging stations. Doing so not only demonstrates a commitment to sustainability but also opens up new revenue streams and attracts eco-conscious customers. Here's a step-by-step guide to help you plan your EV charging station effectively: 1. Choose the Type of Charging Station The first step is to decide on the type of EV charging station you want to install. There are two main options to consider: Level 2 chargers and DC fast chargers. Level 2 chargers are slower but less expensive, making them an excellent choice for businesses and locations where cars are parked for an extended period. On the other hand, DC fast chargers are faster and ideal for high-traffic areas where quick charging is crucial. 2. Find the Perfect Location The success of your EV charging station depends significantly on its location. It should be easily accessible to EV drivers and strategically placed to attract potential customers. High-traffic areas such as shopping centers, restaurants, and public parking lots are excellent choices. Additionally, consider proximity to major highways and popular destinations to cater to long-distance travelers. 3. Ensure Access to Sufficient Power An EV charging station requires a stable and ample power supply to deliver an optimal charging experience. Work with a qualified electrician to ensure that your chosen location can handle the electricity demands of the charging station. Investing in a robust power infrastructure will help you avoid potential issues and provide a reliable service to your customers. 4. Obtain the Necessary Permits and Approvals Before installing your EV charging station, you must obtain the required permits and approvals from local authorities and regulatory bodies. Permitting requirements may vary from state to state, so it's essential to research and comply with all relevant regulations. This step is crucial to ensure a smooth and lawful operation of your charging station.

The Future of EV Charging Stations

The future of EV charging stations is undeniably promising. With the EV market projected to grow exponentially, the demand for charging infrastructure will follow suit. Industry experts predict that the United States will boast over 500,000 charging stations by 2030, making electric vehicles even more viable and convenient for the masses. Furthermore, advancements in EV technologies will play a pivotal role in shaping the future of charging stations. As EVs continue to evolve, offering longer driving ranges on a single charge, the need for high-powered DC fast chargers may decrease. This trend will lead to more widespread adoption of Level 2 chargers, catering to a broader spectrum of EV owners. This way, the announcement of the Electrify America network by seven major automakers marks a defining moment in the evolution of the EV industry. This initiative promises to rival Tesla's Supercharger network and pave the way for widespread EV adoption across the United States. As individuals and businesses plan their own EV charging stations, they contribute to the growth of a sustainable transportation ecosystem and support the vision of a cleaner, greener future. Read the full article

#(HMC)#andStellantis(STLA)#BMW#BMW(BMWYY)#ElectrifyAmericachargingnetwork#EVchargingstationsguide#Ford#FutureofEVcharginginfrastructure#GM(GM)#Honda#Hyundai(HYMTF)#Kia#MajorautomakersEVcharging#Mercedes-BenzGroup(MBGAF)#PlanningEVchargingstation#UK#unitedkingdom#unitedstates#Volkswagen

1 note

·

View note

Text

Navigating the Forex Market: Unraveling the Fed's Influence

The Federal Reserve Bank (Fed), as the central bank of the United States, plays a crucial role in shaping the country's economic landscape. Its decisions have far-reaching effects on the forex market, influencing interest rates, inflation, and overall economic growth. As forex traders, understanding the Fed's impact on the market is paramount to making informed and profitable decisions.

Interest Rates: A Catalyst for Market Movements

One of the most significant levers at the Fed's disposal is its target interest rate, which serves as the benchmark for the entire US economy. When the Fed decides to raise interest rates, it effectively increases the cost of borrowing for businesses and consumers alike. As a result, businesses may reduce investments, and consumers may tighten their purse strings, leading to a potential slowdown in economic growth. On the other hand, when the Fed lowers interest rates, it becomes cheaper for businesses and individuals to borrow money, leading to increased spending and potential economic expansion. As a forex trader, it's crucial to pay close attention to any hints or indications of potential interest rate changes from the Fed. This information can serve as a compass, guiding your trading decisions and helping you anticipate market movements.

Inflation: Striking the Balance

The Fed's primary goal is to maintain inflation at a moderate and stable level. When inflation is too high, it erodes the purchasing power of consumers and businesses, leading to economic instability. Conversely, when inflation is too low, it can lead to economic stagnation and reduced consumer spending. Keeping track of inflation indicators and the Fed's stance on inflation is vital for forex traders. Understanding the central bank's outlook on inflation can provide valuable insights into the potential shifts in monetary policy and the overall health of the economy.

Fostering Economic Growth

Promoting sustainable economic growth is another crucial aspect of the Fed's responsibilities. When the economy is thriving, it creates opportunities for businesses to expand and hire more workers, leading to increased consumer spending and market confidence. Conversely, during economic downturns, job losses and reduced spending can result in challenging trading conditions. As a forex trader, being aware of the Fed's commitment to fostering economic growth can help you gauge the overall sentiment of the market. Positive economic indicators and the Fed's strategies to stimulate growth can present attractive trading opportunities.

Unveiling the Fed's Monetary Policy

Apart from monitoring interest rates, inflation, and economic growth, forex traders should keep a close eye on the Fed's monetary policy statements and press releases. These communications offer valuable insights into the central bank's outlook on the economy, its assessment of current conditions, and potential future actions. As the central bank's stance on monetary policy shifts, the forex market may experience fluctuations and increased volatility. Staying well-informed about the Fed's thinking and potential policy adjustments empowers traders to make timely and well-calculated decisions.

The Intersection of the Fed and the Forex Market

The decisions made by the Federal Reserve Bank reverberate across the globe, influencing not only the US economy but also the entire forex market. As a forex trader, it is essential to have a clear understanding of how these decisions impact currency pairs and various financial assets. When major announcements or policy changes are on the horizon, forex traders should brace themselves for potential market turbulence. Volatility may increase significantly, creating both opportunities and risks. By thoroughly analyzing the Fed's actions and statements, traders can position themselves advantageously.

Anticipating the Fed's Moves

Accurately predicting the Fed's decisions is no easy feat, as they depend on a myriad of economic indicators and data. However, keeping abreast of economic reports, labor market trends, and inflation figures can provide valuable clues about the direction the central bank may take. Additionally, monitoring the speeches and interviews of key Fed officials can shed light on their individual perspectives and potential leanings. Such insights can further inform your trading strategies and risk management techniques.

Staying Informed: A Key to Success

In the ever-changing landscape of the forex market, knowledge is power. Forex traders who wish to outperform the competition and make informed decisions must stay informed on the latest economic developments and Fed-related news. Continuous learning and adaptation to new market conditions are vital for success. Overall, The Federal Reserve Bank's influence on the forex market cannot be overstated. As the central bank of the United States, its decisions on interest rates, inflation, and economic growth can create ripples across the global financial system. As a forex trader, being vigilant about the Fed's actions, closely monitoring economic indicators, and staying informed on monetary policy statements are essential to navigating the market successfully. Read the full article

#Businessgrowth#FederalReserveForexAnalysis#FedsMonetaryPolicyandForex#FedsRoleinForexTrading#ForexForecast:FedsDecisions#ForexMarketandFederalReserveNews#ForexMarketImpactoftheFed#ForexTradersGuidetoFederalReserve#ForexTradingwiththeFederalReserve#RiskManagement#TradingStrategiesduringFedAnnouncements#UnderstandingFedsForexInfluence#unitedkingdom#unitedstates#USA

0 notes

Text

JPMorgan Chase & Co-A Global Financial Titan

In the illustrious tapestry of American financial history, one name shines brighter than most - J. Pierpont Morgan, the visionary founder of J.P. Morgan & Co. Established in the year 1871, this iconic financial institution stands as a testament to the extraordinary ingenuity and influence of one of the most revered financiers in American history. Let us see captivating journey through the life and times of J. Pierpont Morgan, a mastermind of mergers and acquisitions.

The Maestro of Mergers and Acquisitions

J. Pierpont Morgan, with his astute financial acumen, earned the title of "The Maestro of Mergers and Acquisitions." He possessed an unparalleled ability to identify potential synergies between companies and strategically engineered mergers that would redefine the economic landscape. These strategic partnerships facilitated the creation of formidable business entities that became the cornerstones of American industry.

Forging Giants: General Electric, US Steel, and AT&T

Among his most remarkable achievements were the roles he played in the establishment of General Electric, US Steel, and AT&T. By fostering alliances and consolidating resources, Morgan orchestrated the creation of these monumental corporations, each of which left an indelible mark on its respective industry. General Electric's innovative prowess, US Steel's industrial might, and AT&T's communication supremacy are testaments to Morgan's remarkable vision and foresight.

JPMorgan Chase & Co.: Carrying the Torch of Financial Eminence

Fast forward to the present day, and the legacy of J. Pierpont Morgan thrives through the enduring success of JPMorgan Chase & Co. As a prominent entity listed on the New York Stock Exchange (NYSE) under the ticker symbol "JPM," the company stands tall as a financial titan. The year 2023 saw the company's stock trading at an impressive $110 per share, commanding a staggering market capitalization of over $400 billion. This accolade solidified JPMorgan Chase as not only the largest bank in the United States but also the world's preeminent bank by market capitalization.

J.P. Morgan's Access: A Tale of Vision and Influence

J.P. Morgan, founded by the legendary J. Pierpont Morgan in 1871, stands as a testament to visionary financial access. With expertise in mergers and acquisitions, Morgan created some of the largest and most successful companies in the United States, including General Electric, US Steel, and AT&T. Today, as JPMorgan Chase & Co., it holds a position of prominence on the New York Stock Exchange (NYSE) under the ticker symbol "JPM," with a market capitalization of over $400 billion. With a global presence and a significant impact on the financial markets, JPMorgan Chase employs over 250,000 people in more than 100 countries. Its commitment to corporate responsibility ensures ethical and responsible management practices. The enduring legacy of J.P. Morgan's financial access continues to shape the modern financial landscape, leaving an indelible mark on the world of finance.

A Global Force: Impact on the Financial Markets

JPMorgan Chase's sphere of influence transcends borders, as it operates in over 100 countries, with a massive workforce exceeding 250,000 employees. This global footprint has earned the company the status of a major player in the global economy. Its far-reaching activities sway financial markets, influence investment trends, and shape economic policies worldwide. Few financial institutions can rival the breadth and depth of JPMorgan Chase's impact on the global financial landscape.

Driving Economic Growth through Empowerment

Beyond its financial prowess, JPMorgan Chase assumes the mantle of a substantial employer. Its extensive activities and vast employee base contribute significantly to driving economic growth, bolstering communities, and fortifying economies. As a harbinger of economic empowerment, the company's contributions to job creation and economic development remain unparalleled.

The Pillars of Corporate Responsibility

At the heart of JPMorgan Chase's resounding success lies a deep-rooted commitment to corporate responsibility. The company has meticulously crafted and implemented a myriad of policies and procedures to ensure ethical, transparent, and responsible management practices. This unwavering dedication to ethical conduct not only ensures the company's enduring success but also serves as a beacon for other corporations striving to uphold high standards of integrity. Overall, J. Pierpont Morgan's founding of J.P. Morgan & Co. in 1871 marked the beginning of a legendary journey in the world of finance. His brilliance in orchestrating mergers and acquisitions laid the groundwork for the creation of iconic companies like General Electric, US Steel, and AT&T, whose legacies persist to this day. JPMorgan Chase & Co., the torchbearer of his vision, has emerged as an unrivaled financial juggernaut, commanding the global stage with its influential presence. As it continues to influence financial markets, drive economic growth, and embody corporate responsibility, JPMorgan Chase stands as a testament to the enduring impact of visionary leadership and ethical business practices. Read the full article

#J.PierpontMorganmergersandacquisitions#J.P.Morganfinancialhistory#J.P.Morganlegacyofinfluence#J.P.Morganvisionaryfounder#jpmorganaccess#JPMorganChasecorporateresponsibility#JPMorganChaseeconomicgrowth#JPMorganChasefinancialtitan#JPMorganChaseglobalimpact#JPMorganChasemarketcapitalization#JPMorganChasestockmarketposition#stockmarket#unitedkingdom#unitedstates

0 notes

Text

Dow Jones Futures Surge-Microsoft & Alphabet Results Awaited!

In this article, we bring you the latest updates on Dow Jones futures and how they are set to rise ahead of crucial earnings reports from tech giants Microsoft and Alphabet.

Dow Jones Futures Surge as Microsoft and Alphabet Gear Up to Report Earnings

The excitement in the financial world is palpable as Dow Jones futures witness a significant surge on the evening of July 22, 2023. Investors eagerly await the key earnings reports from two tech behemoths - Microsoft and Alphabet. The Dow futures contract for September delivery shows a notable increase of 100 points, or 0.3%, resting at 31,240. Simultaneously, the S&P 500 futures contract for September delivery is also on the rise, up by 12.5 points, or 0.3%, reaching 3,875. The Nasdaq 100 futures contract for September delivery follows suit, ascending by 25 points, or 0.2%, now standing at 11,550. Microsoft Earnings Report Projections The spotlight is on Microsoft as it prepares to disclose its earnings after the bell on Friday. Market analysts have their expectations set at earnings of $2.48 per share on revenue of $51.7 billion. Such favorable numbers could instill confidence among investors and potentially lead to a rally in the stock market. Alphabet Earnings Report Projections Alphabet, the parent company of Google, is scheduled to unveil its earnings on Monday. Analysts predict earnings of $10.68 per share on revenue of $68.04 billion. A positive earnings report from Alphabet could further buoy market sentiment, contributing to the overall market's upswing. Other Noteworthy Earnings Reports Aside from Microsoft and Alphabet, several other prominent companies are slated to release their earnings reports on Friday. These include Johnson & Johnson, Travelers, and Goldman Sachs. These reports could also exert considerable influence on market trends, depending on whether they exceed or fall short of expectations.

Assessing the Stock Market's Volatility

The stock market has experienced its share of volatility in recent weeks. Investors find themselves grappling with the delicate balance between potential economic growth and the looming risk of a recession. Notably, the S&P 500 has witnessed an 18% decline year-to-date, leaving many investors on edge. Optimism for the Second Half of the Year Despite the uncertainty, some analysts hold an optimistic view for the second half of the year. A key factor in this positive outlook is the Federal Reserve's likely decision to raise interest rates at a more gradual pace than previously anticipated. Such a strategy is aimed at bolstering economic growth and could potentially set the stage for a market rebound.

Factors Influencing the Stock Market on Friday

As we navigate through this critical period, several factors could sway the stock market's trajectory on Friday. It is crucial for investors and market participants to stay vigilant and keep an eye on these determinants: 1. Earnings Reports The earnings reports of Microsoft and Alphabet will undoubtedly be the driving force behind Friday's market movements. Positive earnings surprises from these tech giants could instill investor confidence and lead to a bullish trend. Conversely, disappointing reports may exert downward pressure on the market. 2. Economic Data The release of key economic data, such as the jobs report, is closely monitored by investors. Favorable economic indicators that reflect a healthy pace of growth may inspire optimism and drive market gains. Conversely, signs of a slowdown could dampen market sentiment. 3. Geopolitical Risks Geopolitical events have the potential to disrupt the markets. Ongoing conflicts, such as the war in Ukraine, pose geopolitical risks that could trigger market volatility. Any escalation of these tensions may lead to cautious investor behavior.

Navigating the Near-Term Volatility

As we navigate the near-term volatility, it is essential to recognize that the market remains dynamic and subject to swift changes. The delicate interplay between economic indicators, corporate earnings, and geopolitical events can cause sudden fluctuations.

Final Thoughts

In conclusion, Dow Jones futures are witnessing a rise ahead of key earnings reports from Microsoft and Alphabet. The stock market's performance on Friday is contingent upon a host of factors, including the earnings reports, economic data, and geopolitical risks. While the market remains volatile, there is optimism for a potential rebound in the second half of the year. Read the full article

#DowJonesfutures#EarningsReports#EconomicDataAnalysis#GeopoliticalRisksandMarketImpact#investorconfidence#MarketVolatility#MicrosoftandAlphabetEarnings#Near-TermMarketForecast#SecondHalfoftheYearOutlook#stockmarket#Stockmarkettrends#UK#unitedkingdom#unitedstates#USeconomy

0 notes

Text

Seven Leading AI Companies Embrace Ethical Safeguards

In a landmark announcement, seven leading artificial intelligence (AI) companies have come together to implement a set of voluntary safeguards aimed at enhancing the safety and responsibility of AI technology. With giants like Amazon, Google, Meta, Microsoft, Anthropic, Inflection, and OpenAI at the forefront, this collective effort signifies a significant step towards building a safer future for AI applications.

The announcement was made public by none other than President Joe Biden himself, further cementing the importance of these measures in the world of AI development.

The Vital Safeguards

These crucial safeguards encompass a range of initiatives aimed at mitigating potential risks and ensuring ethical practices in AI development and utilization. Let's take a closer look at each of them: 1. Testing the Security of AI Systems Recognizing the potential vulnerabilities in AI systems, the participating companies have agreed to subject their technologies to rigorous independent testing. By allowing external experts to assess their AI systems for security flaws, these companies demonstrate a commitment to transparency and public safety. Moreover, they will make the results of these tests accessible to the public, fostering an environment of openness and accountability. 2. Watermarking AI-Generated Content The rapid advancement of AI has enabled the generation of sophisticated content, including text, images, and videos. To ensure users can identify and verify AI-generated content, the companies have pledged to incorporate watermarks on such materials. This measure will help curb the spread of misinformation and disinformation, providing users with a reliable means of distinguishing between AI-generated and human-generated content. 3. Investing in Cybersecurity With the growing prevalence of cyber threats, securing AI systems has become paramount. The seven AI companies have committed to investing in robust cybersecurity measures to safeguard their technologies from potential attacks. This proactive approach aims to protect not only the interests of the companies but also the safety and privacy of the users who interact with their AI products. 4. Flagging Societal Risks The ethical implications of AI have been a subject of widespread concern. Acknowledging this, the companies have undertaken to flag potential societal risks associated with their AI systems. These risks include biases, discrimination, and misuse, which could arise due to the deployment of AI in various domains. By doing so, the companies are taking a proactive stance towards addressing social issues and fostering inclusivity. 5. Sharing Trust and Safety Information To foster a collaborative and responsible AI ecosystem, the companies will actively share information about trust and safety with each other and the government. This collective sharing of knowledge will facilitate the identification and resolution of potential issues, allowing for continuous improvements in AI development and application. It will also aid in the establishment of industry-wide best practices.

The Path Forward for AI

The introduction of these voluntary safeguards marks a momentous milestone in the journey towards a safer and more responsible AI landscape. By setting a precedent for transparency, accountability, and collaboration, these measures demonstrate the industry's dedication to addressing the challenges posed by AI. However, it's essential to recognize that these safeguards are only the beginning of a broader movement. While they provide a solid foundation, continued efforts are imperative to ensure AI's safe and ethical growth. It is crucial for the participating companies to adhere to their commitments, incorporating them into their core business strategies.

Implementation and Monitoring

The success of these safeguards hinges on effective implementation and monitoring. Each company must develop concrete plans outlining how they intend to comply with the agreed-upon measures. Simultaneously, the government must play an active role in overseeing the enforcement of these safeguards, ensuring they deliver the intended outcomes. Furthermore, ongoing research is vital to explore the ever-evolving risks associated with AI technology. By staying ahead of potential challenges, the industry can proactively develop mitigation strategies and update the safeguards accordingly. This will ultimately fortify the integrity of AI systems and bolster public trust in the technology.

Educating the Public

An essential aspect of a responsible AI ecosystem is educating the public about AI's potential risks and benefits. The participating companies can play a pivotal role in disseminating information and increasing awareness about AI's impact on society. Educated users are more likely to use AI responsibly and hold companies accountable for their actions. Overall, the agreement among seven leading AI companies to implement voluntary safeguards represents a crucial turning point in the development and application of AI technology. These safeguards signal a commitment to prioritize safety, ethics, and societal impact, which is essential for building a sustainable AI future. While these measures are commendable, it's essential to remember that the journey towards responsible AI is an ongoing process. As technology evolves, so will the potential risks and challenges. By collaborating, investing in research, and fostering transparency, the industry can pave the way for an AI landscape that benefits humanity as a whole. Read the full article

#AdvancingResponsibleAI#AIIndustryCollaboration#AISafetyMeasures#AISecurityTesting#AITechnologySafeguards#Amazon#Anthropic#BuildingaSaferAILandscape#CybersecurityforAISystems#EnsuringEthicalAIUse#EthicalAIDevelopment#FlaggingAIRisks#FutureofAISafeguards#Google#Inflection#Meta#Microsoft#MonitoringAISafeguards#openAI#ProactiveAIRiskMitigation#PromotingAIAccountability#PublicAwarenessofAIRisks#ResponsibleAIPractices#SharingTrustInformationinAI#stockmarket#SustainableAIGrowth#TransparencyinAI#UK#unitedkingdom#unitedstates

0 notes

Text

Stock Market Struggles to Stay Ahead, Dow Keeps Rally Going

In this article, lets delve into the recent developments in the stock market, with a specific focus on the struggles and triumphs of major indices and individual stocks. We provide you a comprehensive analysis of the market's performance on a recent Monday, shedding light on the factors that influenced the fluctuations in stock prices.

S&P 500 and Nasdaq Composite Retreat While Dow Sets New Record High

On a recent trading day, the S&P 500 and Nasdaq Composite indices encountered challenges, leading to a decline in their values by the end of the trading session. In contrast, the Dow Jones Industrial Average showcased its resilience by holding on to its gains and even achieving a new record high. The stock market's mixed performance on this day indicates the presence of various driving forces that impacted investor sentiment and influenced market movements.

Factors Affecting the Stock Market Performance

Several factors contributed to the volatility and uncertainty observed in the stock market. Rising inflation emerged as a key concern for investors, as it can potentially erode the purchasing power of consumers and put pressure on corporate profits. Additionally, the ongoing war in Ukraine added geopolitical tensions to the mix, further impacting investor confidence. Amidst these external challenges, some investors capitalized on the recent rally in stocks, deciding to take profits and secure gains. Such profit-taking activities added to the market's downward pressure, creating a pullback in stock prices.

Copart (CPRT) Soars with Strong Earnings, Setting New Highs

Notwithstanding the overall sell-off, one standout performer in the market was auto parts retailer Copart (CPRT). The company reported robust earnings results, propelling its stock price to reach a new 52-week high. The impressive surge of more than 10% in CPRT stock on that day underscored the company's strong fundamentals and investor confidence in its growth prospects.

Home Depot (HD) Faces Headwinds Due to Weak Guidance

In contrast to Copart's success, home improvement retailer Home Depot (HD) encountered headwinds on the same trading day. The company's stock price experienced a significant decline, amounting to over 4%, after issuing weak guidance for the current quarter. This guidance prompted concerns among investors about Home Depot's near-term performance and potential challenges it might face in the market.

Key Takeaways from the Market's Performance

To summarize the market's performance on this particular Monday: S&P 500 and Nasdaq Composite relinquished their early gains and closed lower, highlighting the vulnerability of these indices to prevailing economic and geopolitical uncertainties. Dow Jones Industrial Average displayed remarkable strength, holding on to its gains and reaching a new record high, a testament to its stability amidst volatile market conditions. Inflation and Geopolitical Tensions served as significant factors that influenced investor sentiment and contributed to the market sell-off. Profit-taking Activities were observed, indicating that some investors opted to secure their gains following a recent rally in stocks. Copart's Impressive Performance stood out as the company's strong earnings drove its stock price to achieve new highs, signifying its potential for further growth. Home Depot's Challenges were evident with its stock price decline, attributed to weak guidance for the current quarter, raising concerns among investors.

Navigating the Future: Opportunities Amidst Volatility

Looking ahead, the stock market is expected to remain volatile, given the ongoing economic and geopolitical uncertainties. As investors, it is crucial to stay informed and vigilant in assessing the risks to the global economy. However, amidst the challenges lie opportunities for astute investors to identify undervalued stocks with growth potential. Overall, the stock market's recent performance showcased a blend of struggles and triumphs, with the Dow Jones Industrial Average standing strong while the S&P 500 and Nasdaq Composite faced downward pressure. Rising inflation and geopolitical tensions added complexity to the market dynamics, prompting some investors to book profits from recent gains. Nonetheless, amidst the challenges, individual stocks like Copart demonstrated exceptional growth potential, while others, such as Home Depot, faced short-term headwinds. The key takeaway is that navigating the stock market requires vigilance, insight, and a well-informed approach to identifying opportunities. Read the full article

#AstuteInvestorStrategies#CopartEarningsSurge#DowJonesRally#ExpertStockMarketAnalysis#FinancialMarketResilience#GeopoliticalTensionsImpact#GrowthPotentialinStocks#HomeDepotGuidance#interestrates#InvestmentDecisionInsights#InvestorSentimentAnalysis#Long-termInvestmentOutlook#MarketDynamicsOverview#MarketTrendsMonitoring#MarketVolatility#NasdaqCompositeFluctuations#Profit-takingStrategies#RisingInflationConcerns#S&P500MarketAnalysis#stockmarket#Stockmarketperformance#UndervaluedStocksOpportunities#unitedkingdom#unitedstates#USeconomy#USA

0 notes

Text

Weaker USD, Rising Inflation Expectations Boost Gold, EUR, S&P 500

Weaker USD, Rising Inflation Expectations Boost Gold, EUR, S&P 500The US dollar (USD) is under pressure as investors assess the latest economic data and the Federal Reserve's (Fed) monetary policy outlook.The US dollar (USD) is under pressure as investors assess the latest economic data and the Federal Reserve's (Fed) monetary policy outlook.Gold (XAU/USD) is trading near its highest level in over a year, supported by the weaker USD and rising inflation expectations.Gold (XAU/USD) is trading near its highest level in over a year, supported by the weaker USD and rising inflation expectations.The euro (EUR/USD) is also on the rise, benefiting from the weaker USD and the prospect of higher European Central Bank (ECB) interest rates.The euro (EUR/USD) is also on the rise, benefiting from the weaker USD and the prospect of higher European Central Bank (ECB) interest rates.The S&P 500 (SPX) index has broken out to a new all-time high, as investors remain optimistic about the US economic recovery.The S&P 500 (SPX) index has broken out to a new all-time high, as investors remain optimistic about the US economic recovery.Tesla (TSLA) earnings are due out on Wednesday, July 20. The electric car maker is expected to report strong results, which could boost the broader stock market.Tesla (TSLA) earnings are due out on Wednesday, July 20. The electric car maker is expected to report strong results, which could boost the broader stock market.The NFP report, which is due out on Friday, July 22, is the most important economic data release of the week. The report is expected to show that US job growth slowed in July, but that the unemployment rate remained unchanged.The NFP report, which is due out on Friday, July 22, is the most important economic data release of the week. The report is expected to show that US job growth slowed in July, but that the unemployment rate remained unchanged.The Fed is scheduled to hold its next monetary policy meeting on July 26-27. The central bank is widely expected to keep interest rates unchanged, but it could provide more details about its plans to taper its asset purchases.The Fed is scheduled to hold its next monetary policy meeting on July 26-27. The central bank is widely expected to keep interest rates unchanged, but it could provide more details about its plans to taper its asset purchases.The US-China trade war is still a major risk factor for the global economy. The two sides are scheduled to hold their next round of trade talks in early August.The US-China trade war is still a major risk factor for the global economy. The two sides are scheduled to hold their next round of trade talks in early August.The Brexit deadline is fast approaching. The UK is due to leave the European Union on October 31, 2023.The Brexit deadline is fast approaching. The UK is due to leave the European Union on October 31, 2023.The global economy is facing a number of headwinds, including rising inflation, slowing global growth, and trade tensions.The global economy is facing a number of headwinds, including rising inflation, slowing global growth, and trade tensions. Read the full article

0 notes

Text

What are the advantages of Investing in stocks?

Investing in stocks offers numerous advantages that can help individuals grow their wealth over time. We understand the potential risks involved in stock investments, but we also recognize the immense benefits that come with informed and strategic investing. In this comprehensive guide, we will explore the advantages of investing in stocks and provide valuable insights to help you make informed decisions.

Potential for High Returns

One of the primary advantages of investing in stocks is the potential for high returns. Unlike other types of investments, such as bonds or savings accounts, stocks have the ability to generate significant profits. By purchasing stocks, you become a shareholder in a company, and as the company performs well, the value of its stock is likely to increase. With careful research and analysis, you can identify promising stocks that have the potential to deliver substantial returns.

Diversification for Risk Mitigation

Diversification is a crucial strategy in investing, and stocks provide an excellent opportunity to achieve it. By investing in a variety of stocks across different sectors and industries, you can spread your risk and avoid putting all your eggs in one basket. In other words, if one company or sector experiences a downturn, your overall portfolio will be less affected. Diversification helps minimize the impact of individual stock performance and provides stability in the face of market fluctuations.

Liquidity for Easy Access

Stocks offer liquidity, which means they can be easily bought or sold on the stock market. Unlike certain investments like real estate or private businesses, stocks provide a high level of flexibility. If you need cash or want to capitalize on an investment opportunity, you can readily sell your stocks. This liquidity ensures that your funds are easily accessible when you need them.

Tax Benefits for Enhanced Returns

Investing in stocks can also bring about tax benefits. Dividends received from stocks are often taxed at a lower rate than ordinary income, providing an advantage for stock investors. By maximizing these tax benefits, you can enhance your overall returns and keep more of your hard-earned money. While investing in stocks presents a multitude of advantages, it is important to be aware of the potential risks involved.

Volatility: Navigating Market Fluctuations

The stock market is inherently volatile, with prices experiencing frequent and sometimes sharp fluctuations. This volatility can make it challenging to predict investment outcomes accurately. It is crucial to have a long-term perspective and be prepared for short-term fluctuations in stock prices.

Potential Losses: Mitigating Investment Risks

As with any investment, there is always the possibility of losses when investing in stocks. The value of a stock can decline due to various factors, including market conditions, company performance, or unforeseen events. It is essential to conduct thorough research and carefully assess the potential risks associated with any investment before committing funds.

Guarding Against Fraud

Fraudulent activities can pose a risk to investors in the stock market. It is essential to exercise caution and conduct due diligence before investing in any company. Researching the company's financials, reputation, and management team can help you make informed decisions and mitigate the risk of falling victim to fraudulent schemes. To optimize your stock investment strategy and increase your chances of success, consider the following additional tips:

Start Small and Learn

If you are new to investing, it is advisable to start with small investments. This approach allows you to gain experience, familiarize yourself with the market, and learn from your investment decisions. As you become more confident and knowledgeable, you can gradually increase your investment amounts.

Conduct Thorough Research

Before investing in any stock, conduct thorough research on the company, its financials, competitive landscape, and industry trends. Analyze historical data, evaluate the company's growth potential, and consider expert opinions. Informed research serves as a foundation for making sound investment choices.

Embrace Portfolio Diversification

Diversifying your investment portfolio is a fundamental strategy to manage risk effectively. Allocate your funds across different asset classes, such as stocks, bonds, and real estate. Within the stock portion of your portfolio, diversify across various industries and market sectors. This diversification helps protect your investments from the impact of any single stock or industry underperforming.

Regularly Rebalance Your Portfolio

As your investment portfolio evolves, it is crucial to periodically rebalance it. Rebalancing ensures that your portfolio aligns with your investment goals and risk tolerance. By selling overperforming assets and reinvesting in underperforming ones, you maintain a balanced and optimized portfolio.

Adopt a Long-Term Perspective

Successful stock investing often requires a long-term approach. While short-term market fluctuations are inevitable, the stock market has historically shown an upward trend over the long term. By maintaining a patient and disciplined approach, you are more likely to experience positive returns. At , we recognize the importance of providing reliable and accurate information to help investors make informed decisions. By understanding the advantages and risks of investing in stocks, you can develop a well-rounded investment strategy that aligns with your financial goals. Overall, investing in stocks can be a powerful tool for growing wealth over time. The potential for high returns, portfolio diversification, liquidity, and tax benefits make stocks an attractive investment option. However, it is crucial to navigate the inherent risks, including market volatility, potential losses, and fraudulent activities. By implementing a strategic approach, conducting thorough research, and following best practices, you can position yourself for investment success in the stock market. Read the full article

#Businessgrowth#Dividendstocks#High-growthstocks#Howtobuildwealthwithstocks#Howtoinvestinstocks#Investinginstocksforbeginners#Low-riskstocks#stockmarket#Stockmarketforbeginners#Stockmarketstrategies#Stockmarkettips#UK#unitedkingdom#unitedstates#USeconomy#USA#whatarethebenefitsofinvestinginstocks#whataretheprosandconsofinvestinginstocks

0 notes

Text

Understanding the Connection Between a Credit Report and a Credit Score

When it comes to assessing your creditworthiness, two essential tools that lenders use are your credit report and your credit score. Although distinct, these tools are interconnected, providing valuable insights into your borrowing and repayment history.

Let's delve deeper into the connection between a credit report and a credit score to help you navigate the world of credit with confidence. The Role of a Credit Report A credit report serves as a comprehensive record of your borrowing and repayment activities. It includes details such as your credit accounts, payment history, outstanding debts, and any public records associated with your credit. Lenders rely on credit reports to evaluate your financial responsibility, reliability, and risk as a borrower. Unveiling the Credit Score A credit score, on the other hand, represents a numerical summary of the information present in your credit report. It condenses your credit history into a single number, providing lenders with a quick snapshot of your creditworthiness. Commonly used credit scoring models include FICO scores, developed by the Fair Isaac Corporation, and VantageScores, created by VantageScore Solutions. Factors Influencing Your Credit Score Numerous factors come into play when calculating your credit score. Understanding these elements can empower you to make informed financial decisions and improve your creditworthiness. Let's explore some key factors that influence your credit score: 1. Payment History Arguably the most critical factor, your payment history showcases your track record of timely payments. Lenders want to see a consistent pattern of meeting your financial obligations promptly, as it demonstrates your ability to manage credit responsibly. 2. Debt-to-Credit Ratio The amount of debt you carry in relation to your available credit, often referred to as the debt-to-credit ratio or credit utilization ratio, plays a significant role in your credit score. Maintaining a low ratio demonstrates responsible credit management and can positively impact your creditworthiness. 3. Length of Credit History The length of your credit history is an essential consideration for lenders. A longer credit history provides a more substantial foundation for evaluating your financial behavior and helps lenders assess your creditworthiness more accurately. 4. Credit Account Diversity Lenders prefer to see a healthy mix of credit types in your portfolio. Having a combination of installment loans, such as mortgages or car loans, and revolving credit accounts, like credit cards, demonstrates your ability to manage different credit obligations and can positively influence your credit score. 5. Credit Inquiries Every time you apply for new credit, a hard inquiry is generated on your credit report. Multiple hard inquiries within a short period can raise concerns for lenders, potentially lowering your credit score. It's advisable to limit the number of credit inquiries you make, particularly within a compressed timeframe. The Significance of a Credit Score Your credit score acts as a crucial determinant for lenders when assessing your creditworthiness. Typically ranging from 300 to 850, a higher credit score indicates lower credit risk. With an impressive credit score, you become more eligible for favorable terms, including lower interest rates on loans and credit cards. The Vitality of Regular Credit Report Checks Maintaining accuracy in your credit report is paramount. By monitoring your credit report on a regular basis, you can identify and rectify any inaccuracies that may arise. It's recommended to obtain a free copy of your credit report annually from each of the three major credit bureaus through AnnualCreditReport.com. If you happen to discover any errors or discrepancies on your credit report, it's essential to take immediate action. Initiate a dispute with the relevant credit bureau, providing supporting documentation to substantiate your claim. The credit bureau is then obligated to investigate the matter within 30 days. If the disputed information is found to be inaccurate, the credit bureau must remove it from your credit report. Credit Score vs. Credit Report: Which Takes Precedence? While both your credit score and credit report play integral roles in assessing your creditworthiness, your credit score holds more weight in the eyes of lenders. It serves as a concise representation of your credit history and is primarily used to determine your eligibility for loans and credit cards. However, it's crucial to recognize that your credit report forms the foundation for calculating your credit score. Any errors or discrepancies in your credit report can potentially lower your credit score and hinder your chances of securing favorable credit terms. Empowering Yourself for Financial Success To achieve the best possible terms on loans and credit cards, it's essential to understand the connection between your credit report and credit score fully. By diligently managing your credit, making timely payments, maintaining a healthy credit utilization ratio, and diversifying your credit portfolio, you can steadily improve your creditworthiness over time. Remember, knowledge is power. Stay vigilant by regularly monitoring your credit report for inaccuracies, and take immediate action to dispute any errors. With a strong credit score and an accurate credit report, you'll be well-positioned to seize financial opportunities and pave the way for a brighter financial future. Read the full article

#Benefitsofregularcreditreportchecks#Creditreportandcreditscoreexplained#creditscore#creditscorecom#Creditworthinessanditsrelationshipwithcreditreportandcreditscore#Debt-to-creditratioandcreditscoreimpact#Disputingerrorsonyourcreditreport#Diversifyingcreditaccountsforabettercreditscore#experianbusinesscredit#experiancredit#Factorsinfluencingyourcreditscore#freecredit#hardinquiry#Howcreditscoreaffectsloaneligibility#Impactofcreditinquiriesonyourcreditscore#Importanceofcreditreportandcreditscore#Lengthofcredithistoryandcreditworthiness#Managingcredit:creditreportandcreditscore#multiplecreditinquirieswithin30days#Theroleofpaymenthistoryincreditscoring#Tipstoimproveyourcreditscore#Understandingtheconnectionbetweencreditreportandcreditscore#unfreezeexperiancredit

0 notes

Text

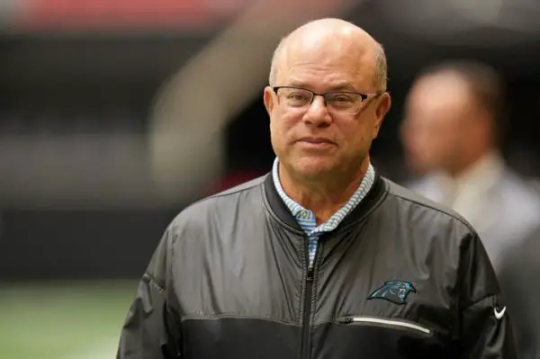

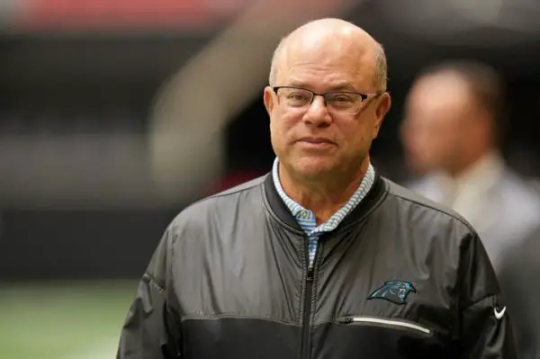

David Tepper: The Philanthropist Who Gave Back to His Community

David Tepper, an exceptional American billionaire hedge fund manager, has not only made a name for himself in the financial industry but has also gained recognition as the proud owner of the Carolina Panthers, a renowned team in the National Football League (NFL).

As the founder and president of Appaloosa Management, a global hedge fund based in Miami Beach, Florida, Tepper has demonstrated remarkable expertise in investment strategies and has achieved remarkable success throughout his career. Early Life and Education: A Foundation for Success David Tepper, who was born in Pittsburgh, Pennsylvania, on September 11, 1957, was raised by a Jewish family in the East End area of Stanton Heights. His parents, Harry and Roberta, gave him a supportive environment in which he was encouraged to follow his passions and hone his skills. Tepper showed an early interest in sports, especially football, and early evidence of his remarkable memory when he recalled baseball statistics from cards his grandfather had given him. Tepper was a National Merit Scholar while he was a student at Pittsburgh's Peabody High School, where he excelled academically. He began his academic career at the University of Pittsburgh after graduating from high school, where he eventually earned a bachelor's degree in economics in 1978. Tepper went on to earn an MBA from Carnegie Mellon University in 1982 after realizing the value of continuing his education. This enhanced his understanding and proficiency in the field of finance. Family and Personal Life While David Tepper's professional endeavors have garnered significant attention, he remains a private individual who prefers to keep his personal life out of the public eye. Tepper is happily married to Nicole Tepper, and together, they have three children named Brian, Casey, and Randi. Despite his reserved nature, Tepper's impact on the financial world and his dedication to philanthropy speak volumes about his character and commitment to making a difference. Building a Strong Foundation After earning his MBA from Carnegie Mellon and gaining a solid understanding of economics, David Tepper started his career as a credit analyst at Equibank. He joined Republic Steel's finance department in 1984, where he developed crucial knowledge in distressed investing. Tepper joined Goldman Sachs's newly established junk bond department in 1985, though, and his career really took off after that. He rose quickly to a key position inside the company. The Rise of a Hedge Fund Powerhouse David Tepper decided to leave Goldman Sachs in 1993 to start his own hedge fund, Appaloosa Management, as a result of his unmatched competence and entrepreneurial zeal. The fund flourished and quickly acquired prominence under his skilled supervision. By the turn of the 2000, Appaloosa Management had over $1 billion in assets under management, solidifying its position as a major player in the financial sector. Tepper's investment approach focused on distressed debt, and he had a remarkable aptitude for spotting undervalued assets during difficult economic times and frequently capitalizing on them to make substantial returns. Tepper successfully navigated market volatility by savvy decision-making and rigorous analysis, earning his reputation as one of the most knowledgeable investors of his generation. Wealth and Philanthropy: David Tepper net worth David Tepper's wealth has increased significantly over time; in 2023, it is predicted that he would have a net worth of over $18 billion. Due to his extraordinary success, Tepper has developed into a well-known philanthropist who donates millions of dollars to numerous charity organizations. Tepper's philanthropy has allowed institutions like Carnegie Mellon University, the University of Pittsburgh, and the Robin Hood Foundation to expand their goals and have a good influence on communities. Diversifying and Expanding Horizons Beyond his imposing position in the hedge fund sector, David Tepper has started a number of businesses that have increased his power and widened his reach. Notably, he has made investments in well-known sports organizations like the New York Mets, Charlotte FC, and the Carolina Panthers. Tepper also owns a large portion of the renowned Heinz Ketchup Company, demonstrating his breadth of economic interests and his aptitude for spotting lucrative investment opportunities. Investments: A Bold and Calculated Approach David Tepper is known for his fearlessness and willingness to take calculated risks when investing. He has made a number of significant and wise investment choices over his career that have generated sizable profits. His huge wager against the subprime mortgage market in 2008, which turned out to be quite profitable, is a prime example. Tepper has constantly stood out among his colleagues due to his aptitude for analyzing market trends and spotting lucrative possibilities. A Visionary Leader and Philanthropist David Tepper's impact on the financial industry, coupled with his remarkable success as a hedge fund manager and business leader, is undeniable. His entrepreneurial spirit, strategic decision-making, and exceptional investment acumen have catapulted him to the pinnacle of the financial world. Moreover, his commitment to philanthropy and generosity in giving back to society highlight his character and commitment to making a positive difference in the lives of others. Read the full article

#2008financialcrisis#AppaloosaManagement#Billionairehedgefundmanager#CarnegieMellonUniversity#CarolinaPanthersowner#DavidTepper#davidteppernetworth#Distresseddebtinvestor#Heinzketchup#howdiddavidteppermakehismoney#NewYorkMets#philanthropist#stockmarket#Subprimemortgagemarket#UK#unitedkingdom#unitedstates#UniversityofPittsburgh

1 note

·

View note

Text

How Elon Musk's XAI Will Use Public Tweets to Train AI Models

How Elon Musk's XAI Will Use Public Tweets to Train AI ModelsElon Musk has announced that his new artificial intelligence (AI) company, XAI, will use public tweets to train its AI models.Elon Musk has announced that his new artificial intelligence (AI) company, XAI, will use public tweets to train its AI models.Musk believes that public tweets can provide a valuable source of data for AI training, as they can reflect real-time human thoughts and opinions.Musk believes that public tweets can provide a valuable source of data for AI training, as they can reflect real-time human thoughts and opinions.XAI is still in its early stages of development, but Musk has said that he eventually wants it to be able to "examine the universe" and "solve some of the world's most pressing problems."XAI is still in its early stages of development, but Musk has said that he eventually wants it to be able to "examine the universe" and "solve some of the world's most pressing problems."XAI will also be used to improve the performance of Tesla's self-driving cars.XAI will also be used to improve the performance of Tesla's self-driving cars.Musk has said that he is "very excited" about the potential of XAI, and believes that it could "change the world."Musk has said that he is "very excited" about the potential of XAI, and believes that it could "change the world."However, some experts have warned that there are risks associated with using public tweets to train AI models, such as the potential for bias and privacy violations.However, some experts have warned that there are risks associated with using public tweets to train AI models, such as the potential for bias and privacy violations.Musk has said that XAI will be designed to be "fair" and "respectful" of privacy, but it remains to be seen how the company will address these concerns.Musk has said that XAI will be designed to be "fair" and "respectful" of privacy, but it remains to be seen how the company will address these concerns.The announcement of XAI comes at a time when there is growing concern about the potential for AI to be used for malicious purposes.The announcement of XAI comes at a time when there is growing concern about the potential for AI to be used for malicious purposes.However, Musk has said that he believes that AI can be a force for good in the world, and that XAI will be used to "benefit humanity."However, Musk has said that he believes that AI can be a force for good in the world, and that XAI will be used to "benefit humanity."The launch of XAI is a significant development in the field of AI, and it will be interesting to see how the company's work progresses in the years to come.The launch of XAI is a significant development in the field of AI, and it will be interesting to see how the company's work progresses in the years to come. Read the full article

0 notes

Text

Fed to Hike Rates Even as Inflation Cools

Fed to Hike Rates Even as Inflation Cools Inflation has finally dropped to target territory, but the Fed is still likely to hike rates this month. Inflation has finally dropped to target territory, but the Fed is still likely to hike rates this month.The Fed is likely to continue hiking rates in the coming months, even if inflation continues to decline.The Fed is likely to continue hiking rates in the coming months, even if inflation continues to decline.The Fed is concerned that inflation could spiral out of control if it does not act aggressively to cool it down.The Fed is concerned that inflation could spiral out of control if it does not act aggressively to cool it down.The Fed's rate hikes are likely to slow economic growth, but they are seen as necessary to bring inflation under control.The Fed's rate hikes are likely to slow economic growth, but they are seen as necessary to bring inflation under control.The Fed is walking a tightrope, trying to avoid a recession while also bringing inflation down.The Fed is walking a tightrope, trying to avoid a recession while also bringing inflation down.The global economy is facing headwinds, including the war in Ukraine and rising interest rates.The global economy is facing headwinds, including the war in Ukraine and rising interest rates. A recession is a possibility in 2023, but it is not inevitable. A recession is a possibility in 2023, but it is not inevitable. Investors should be prepared for volatility in the markets in the coming months. Investors should be prepared for volatility in the markets in the coming months.The Fed's actions will have a significant impact on the global economy.The Fed's actions will have a significant impact on the global economy.The next few months will be critical for the global economy.The next few months will be critical for the global economy. Read the full article

0 notes

Text

Ripple Wins SEC Case: What Does This Mean for Bitcoin and Ethereum?

Ripple Wins SEC Case: What Does This Mean for Bitcoin and Ethereum?On July 13, 2023, a US judge ruled that Ripple Labs Inc did not violate federal securities law by selling its XRP token on public exchanges.On July 13, 2023, a US judge ruled that Ripple Labs Inc did not violate federal securities law by selling its XRP token on public exchanges.The ruling was a partial victory for Ripple, as the judge found that some of Ripple's XRP sales to institutional investors did violate securities laws.The ruling was a partial victory for Ripple, as the judge found that some of Ripple's XRP sales to institutional investors did violate securities laws.However, the ruling was a major win for the cryptocurrency industry as a whole, as it clarified the legal status of XRP and other cryptocurrencies.However, the ruling was a major win for the cryptocurrency industry as a whole, as it clarified the legal status of XRP and other cryptocurrencies.The ruling also sent a positive signal to other cryptocurrency companies that are facing regulatory scrutiny from the SEC.The ruling also sent a positive signal to other cryptocurrency companies that are facing regulatory scrutiny from the SEC. In the wake of the ruling, Bitcoin and Ethereum prices surged, with Bitcoin briefly breaking above the $31,000 level. In the wake of the ruling, Bitcoin and Ethereum prices surged, with Bitcoin briefly breaking above the $31,000 level.Other cryptocurrencies also saw gains, with XRP leading the way with a 70% increase.Other cryptocurrencies also saw gains, with XRP leading the way with a 70% increase.The ruling is likely to have a positive impact on the overall cryptocurrency market, as it could lead to increased institutional investment.The ruling is likely to have a positive impact on the overall cryptocurrency market, as it could lead to increased institutional investment.It could also lead to more regulatory clarity for the industry, which could help to attract new users.It could also lead to more regulatory clarity for the industry, which could help to attract new users.However, it is important to note that the ruling is not final, and the SEC could still appeal the decision.However, it is important to note that the ruling is not final, and the SEC could still appeal the decision.Overall, the ruling is a positive development for the cryptocurrency industry, and it could lead to further gains in the months ahead.Overall, the ruling is a positive development for the cryptocurrency industry, and it could lead to further gains in the months ahead. Read the full article

0 notes

Text

PPI Declines for 12th Straight Month, Core PPI Still Above Fed's Target

PPI Declines for 12th Straight Month, Core PPI Still Above Fed's TargetThe Producer Price Index (PPI) rose by just 0.1% for the 12 months ended in June.This is the lowest annual increase in PPI since August 2020.This is the lowest annual increase in PPI since August 2020.Economists were expecting an annual increase of 0.4%.Economists were expecting an annual increase of 0.4%.Core PPI, which excludes food and energy, rose 2.4% for the 12 months ended in June.Core PPI, which excludes food and energy, rose 2.4% for the 12 months ended in June. This is a step down from the 2.6% increase seen in May. This is a step down from the 2.6% increase seen in May. Core PPI also increased 0.1% month on month. Core PPI also increased 0.1% month on month.The slowdown in PPI is a sign that inflation is starting to cool.The slowdown in PPI is a sign that inflation is starting to cool.However, inflation is still well above the Federal Reserve's target of 2%.However, inflation is still well above the Federal Reserve's target of 2%.The Fed is expected to continue raising interest rates in an effort to bring inflation down.The Fed is expected to continue raising interest rates in an effort to bring inflation down.The slowdown in PPI could help to ease some of the concerns about inflation.The slowdown in PPI could help to ease some of the concerns about inflation. Read the full article

0 notes

Text

How to Start an Online Business with No Money?

In today's digital age, starting an online business has become a popular endeavor for aspiring entrepreneurs. The allure of the internet offers countless opportunities to build a successful business, even if you have limited financial resources. In this guide, we will explore actionable strategies and innovative approaches to help you launch your online venture without requiring substantial upfront capital.

Leveraging Your Skills and Expertise

1. Identify Your Niche The first step in starting an online business with no money is to identify your niche. By focusing on your passions, interests, or areas of expertise, you can carve out a unique space in the digital marketplace. Conduct thorough research to determine the demand for your chosen niche and the potential competition you may face. 2. Showcase Your Knowledge through Content Creation Content creation is an invaluable tool for establishing your online presence and attracting an audience. Leverage your skills and expertise to create compelling and informative content that resonates with your target market. Start a blog, produce engaging videos, or launch a podcast to showcase your knowledge and build credibility within your niche.

Harnessing the Power of Social Media

1. Build a Strong Social Media Presence In today's interconnected world, social media platforms have become indispensable for business growth. Leverage the power of social media to reach a wider audience and connect with potential customers. Create business accounts on platforms such as Facebook, Instagram, Twitter, and LinkedIn. Consistently engage with your audience by sharing valuable content, responding to comments, and participating in relevant conversations. 2. Collaborate with Influencers Collaborating with influencers can significantly amplify your online business's visibility. Identify influential individuals within your niche who have a substantial following and align with your brand values. Reach out to them, propose collaboration opportunities, and leverage their audience to increase brand awareness and attract potential customers.

Embracing Cost-Effective Marketing Strategies