#sushiswap binance smart chain

Text

#Giant GoldenTree#sushiswap#sushiswap crypto#sushiswap price prediction#sushiswap tutorial#sushiswap analysis#sushiswap vs uniswap#sushiswap dex#sushiswap liquidity pool#sushiswap eth usdt#sushiswap liquidity#sushiswap coin bureau#sushiswap vs pancakeswap#sushiswap price analysis#sushiswap coinbase wallet#sushiswap liquidity mining#sushiswap technical analysis#sushiswap binance smart chain#sushiswap vs pancakeswap vs uniswap#sushiswap coin#sushiswap 2022

0 notes

Text

What is Bullion Coin (BLO)?

Bullion is a cutting-edge DeFi platform that is designed and introduced to help you grow your cryptocurrencies effortlessly. With Bullion, you can earn passive income like never before. Our innovative protocols provide opportunities for yield farming, staking, and liquidity provision, all while ensuring the utmost security and transparency.

Be a Bullioniare!

Introducing you to the all-new Bullion Coin (BLO asset) which is a powerful standard multi-chain cryptocurrency backed by bullion assets such as gold, silver, and platinum for you to boost your earnings up to 100X. This asset is issued by Bullion Defi — a decentralised finance platform for you to lend, borrow, and earn interest in order to stake bullion assets.

BLO coin was developed and introduced to offer a secure, transparent, and scalable platform to imply bullion trading and get better investment options. The asset denotes the value of its decentralized application and serves as a mechanism in terms of utility in the ecosystem. This asset is planned to be released in different standard blockchains including BEP20, ERC20, SOL51, POLYGON, etc.

Some of the functionalities, opportunities, and benefits of Bullion Coin BLO are as follows:

- It is pegged to the value of bullion assets that gets stored in safe vaults and audited on serial regular basis.

- It has low volatility giving a user high liquidity due to the easy exchange of bullion assets or any other cryptocurrencies.

- It provides high returns for staking where you can earn much interest/rewards by locking your owned/held BLO coins in smart contracts.

- It allows you to access the global market and wide opportunities for bullion trading and investment where you can feasibly interact with other participants on the blockchain network.

- It supports the development and exploration of the bullion industry while leveraging the adoption of blockchain technology as well as great innovation in the sector.

Bullion DeFi project is on the verge of building, innovating, and exploring one of the biggest and strongest communities that will believe in the core intention, and potential of the project. The team and project consider the community not to be only the holder of the BLO assets but also to hold the right to share technical/promotional suggestions getting all involved in the decision-making activities and betterment of the project.

This project intends to develop, initiate, and promote the BLO ecosystem to eventually dedicate its resources to research, development, and governance. Bullion Coin is a utility token which is not supposed to hold any value outside the BLO ecosystem.

Total Supply: 20 million (20,000,000 BLO)

· Seed Sale: 6%

· Presale: 4%

· Staking: 36%

· Scheduled minting: 30%

· Marketing: 5%

· Development: 5%

· Team Reserve: 3%

· Initial Developers reserve: 1%

· Contract Royalty: 10%

To buy Bullion Coin BLO, follow the below-mentioned steps:

Step 1: Apply and get a compatible wallet to store BLO coins. You have the option to download the official Bullion Defi wallet from the official website or apply to any other wallet supporting ERC-20 tokens.

Step 2: Hold some cryptocurrency in your wallet, as BLO coins are deployed and support the Ether blockchain protocols. So, you hold some cryptocurrency exchange from Coinbase or Binance.

Step 3: Swap your Ethereum assets for BLO coins on a decentralized exchange that lists BLO coins like Uniswap or say SushiSwap. Check out the contract address and the token symbol of BLO coins from the Bullion Defi official portal.

Step 4: Finally, confirm the transaction and wait for the time period to get processed by the blockchain network. Once approved, you get the amount of BLO coins in your wallet balance.

If you are interested and want to learn more about Bullion Coin (BLO) and the Bullion Defi project, you can visit the official website or read out the whitepaper. You can also follow the team on social media channels like Twitter and Telegram.

website: https://www.bulliondefi.com/

Twitter: https://twitter.com/bulliondefi

Facebook: https://www.facebook.com/BullionDefi

Telegram: https://t.me/bulliondefi

Reddit: https://www.reddit.com/user/bulliondefi

#Bullion Defi#Bullion Coins#Defi#Blo#blockchain#Blo Tokenomics#Bullion#Bullion Defi Swap#Bullion Dex#Defi Earning

2 notes

·

View notes

Text

Behind the Scenes: Crafting a Successful Flash Loan Arbitrage Bot

The world of Decentralized Finance (DeFi) has brought about revolutionary ways to trade, invest, and make profits, with flash loans standing at the forefront of this evolution. One of the most lucrative methods for tapping into DeFi’s potential is through arbitrage, particularly using flash loans. If you’re considering Flash Loan Arbitrage Bot Development, this blog will take you behind the scenes to understand the critical aspects of building a successful flash loan arbitrage bot.

What Is Flash Loan Arbitrage?

Flash loan arbitrage is a trading strategy that capitalizes on the price differences of assets across multiple decentralized exchanges (DEXs). A flash loan allows traders to borrow large sums of cryptocurrency without collateral, but with the caveat that the loan must be repaid within a single blockchain transaction. This allows traders to quickly execute profitable trades across different exchanges.

A flash loan arbitrage bot is an automated tool designed to identify arbitrage opportunities and execute trades in real time. With the fast pace of DeFi, automation is crucial to ensure trades happen in fractions of seconds, maximizing profit potential.

Key Components of a Successful Flash Loan Arbitrage Bot

1. Automated Flash Loan Execution

The core feature of any flash loan arbitrage bot is its ability to automate the borrowing and repayment of flash loans. The bot must interact seamlessly with DeFi platforms like Aave, dYdX, or Uniswap to ensure that the loan is repaid within the same transaction, minimizing risks for the trader.

- Why it matters: Without automation, it would be impossible to execute a flash loan arbitrage opportunity within the tight time constraints of a single transaction.

2. Real-Time Price Tracking Across DEXs

For a flash loan arbitrage bot to be effective, it must constantly monitor price discrepancies across various DEXs. Platforms like Uniswap, SushiSwap, PancakeSwap, and others present frequent arbitrage opportunities, and the bot needs to scan real-time data feeds and APIs to find these opportunities instantly.

- Why it matters: Even a minor delay in detecting price discrepancies can result in missed profit opportunities, especially in the fast-moving world of DeFi.

3. Smart Contract Integration

Smart contracts are at the heart of DeFi, and your flash loan arbitrage bot must be built with robust smart contract integration. These contracts manage the borrowing, trading, and repayment of flash loans, ensuring everything happens within one seamless transaction.

- Why it matters: Smart contracts enable trustless, secure transactions. If a flash loan arbitrage opportunity is not profitable or the conditions aren't met, the transaction is automatically canceled.

4. Gas Fee Optimization

One of the most overlooked but vital aspects of Flash Loan Arbitrage Bot Development is gas fee optimization. On networks like Ethereum, high gas fees can significantly cut into your profits. Your bot should include techniques to minimize these costs, such as bundling transactions or executing trades during periods of lower network congestion.

- Why it matters: High gas fees can quickly turn a profitable arbitrage trade into a loss. Optimizing these fees is crucial for maintaining profitability.

5. Risk Management Protocols

Risk management is another key component. Arbitrage opportunities can be highly profitable, but they also carry risks such as slippage (price movement during the trade) and failed transactions. Your bot should be designed to handle these risks by setting slippage limits and aborting trades that fall below a certain profitability threshold.

- Why it matters: Effective risk management ensures that your bot only engages in trades where the likelihood of profit outweighs potential losses.

6. Cross-Chain Compatibility

As DeFi expands across multiple blockchain ecosystems such as Ethereum, Binance Smart Chain, and Polygon, your flash loan arbitrage bot should be able to function on various chains. Cross-chain compatibility widens the range of arbitrage opportunities and increases the bot’s profitability by allowing it to take advantage of different market conditions.

- Why it matters: Multi-chain compatibility enables your bot to operate in more diverse markets, increasing the likelihood of finding profitable arbitrage opportunities.

Development Challenges and Solutions

Security Risks

DeFi is a high-stakes environment, and your flash loan arbitrage bot is only as good as its security. Since flash loans involve high-value, instant transactions, your bot must be thoroughly tested for vulnerabilities, such as reentrancy attacks or bugs that could expose funds to hackers.

- Solution: Comprehensive audits of the bot’s code and smart contracts and continuous monitoring can mitigate security risks.

Network Latency

Speed is crucial for successful arbitrage. Any delay in data processing or transaction execution can mean missing out on profitable opportunities. Your bot needs to be optimized for low latency and high-speed transaction execution.

- Solution: Use optimized coding practices, low-latency servers, and efficient communication with blockchain nodes to ensure your bot performs at optimal speeds.

Profitability Monitoring

Your bot mustn’t engage in unprofitable trades. A built-in profitability monitoring system will evaluate potential trades by factoring in gas fees, slippage, and other transaction costs before executing them.

- Solution: Set a threshold for minimum profits and only allow the bot to proceed with trades that meet this criterion.

Conclusion

Building a successful flash loan arbitrage bot requires careful planning, technical expertise, and a deep understanding of market dynamics. With features like automated execution, cross-exchange price monitoring, smart contract integration, and gas optimization, your bot can effectively capitalize on arbitrage opportunities. As Flash Loan Arbitrage Bot Development continues to evolve alongside the growth of DeFi, it remains a profitable venture for developers and traders alike.

By focusing on security, speed, and profitability, you can craft a bot that not only survives but thrives in the highly competitive DeFi ecosystem.

#flash loan arbitrage bot#flash loan arbitrage bot development#flash loan arbitrage bot development company

0 notes

Text

List of 15 Best DeFi Yield Farming Platforms

In the rapidly evolving landscape of cryptocurrency, yield farming has emerged as a popular method for crypto holders to earn passive income. Leveraging decentralized finance (DeFi) protocols, investors can stake or lend their assets to earn rewards in the form of additional tokens. Here’s a curated list of 15 prominent yield farming crypto platforms that stand out in the market today:

Compound Finance

Known for its robust lending and borrowing features.

Offers competitive interest rates on deposited assets.

Aave

Allows users to earn interest on deposits and borrow assets.

Known for its innovative flash loan feature.

Yearn Finance (YFI)

Aggregates yields from various DeFi platforms to optimize returns.

Features automated yield farming strategies.

Uniswap

Popular decentralized exchange (DEX) that facilitates liquidity provision.

Users can earn trading fees by providing liquidity to the platform.

SushiSwap

Forked from Uniswap, offering additional features and incentives.

Rewards liquidity providers with SUSHI tokens.

Balancer

Enables users to create liquidity pools with customizable asset ratios.

Rewards liquidity providers with trading fees and BAL tokens.

Curve Finance

Optimized for stablecoin trading and low slippage.

Rewards liquidity providers with trading fees and CRV tokens.

Synthetix

Focuses on synthetic assets and trading.

Users can stake SNX tokens to earn rewards.

MakerDAO

Known for its stablecoin DAI, backed by collateralized debt positions (CDPs).

Users can earn fees through the stability fee mechanism.

PantherSwap

Offers yield farming opportunities with high APRs.

Incentivizes liquidity providers with PANTHER tokens.

Cream Finance

Provides lending, borrowing, and yield farming services.

Users can earn by supplying liquidity to various pools.

Harvest Finance

Automates yield farming strategies to maximize returns.

Integrates with various DeFi protocols for optimized farming.

Bancor

Offers automated market maker (AMM) functionality.

Users can earn trading fees and BNT tokens by providing liquidity.

QuickSwap

Built on the Polygon network for low-cost transactions.

Rewards liquidity providers with QUICK tokens.

PancakeSwap

Popular AMM on the Binance Smart Chain.

Users can farm CAKE tokens by providing liquidity.

Conclusion

The ICO development services sector continues to evolve alongside the growth of DeFi. As yield farming gains popularity, investors are increasingly seeking reliable platforms to maximize their crypto assets. Whether you're a newcomer exploring these opportunities or an experienced investor diversifying your portfolio, these 15 platforms offer a spectrum of options to consider. By staying informed and adapting to market trends, investors can harness the potential of DeFi yield farming to generate sustainable returns.

In the realm of DeFi yield farming, the landscape is vast and ever-changing, with these platforms leading the charge in innovation and user rewards. Whether you're looking for liquidity provision, automated strategies, or simply exploring new avenues for passive income, these platforms offer diverse opportunities to engage with the evolving world of decentralized finance.

0 notes

Text

What crypto exchange is decentralized?

Understanding Decentralized Crypto Exchanges

In the ever-changing world of cryptocurrencies, decentralized exchanges (DEX) have emerged as a game changer. What does it mean for a cryptocurrency exchange to be decentralized?

Breaking Down Decentralization in Crypto Exchanges

Decentralization in cryptocurrency exchanges refers to the lack of a central authority overseeing the platform's functioning. Decentralized exchanges operate on a peer-to-peer network, as opposed to traditional exchanges, which are controlled by a central institution that conducts trade.

Key Characteristics of Decentralized Crypto Exchanges

Peer-to-Peer Transactions: DEX enables direct transactions between users, eliminating the need for intermediaries.

Non-Custodial: Users keep control of their funds throughout the trading process, lowering the danger of hacking or fraud that comes with centralized exchanges.

Transparency: DEX transactions are recorded on a public blockchain, which ensures their transparency and immutability.

Resistance to Censorship: Because there is no central authority to shut down, decentralized exchanges are less vulnerable to censorship and regulatory meddling.

Popular Decentralized Crypto Exchanges

Uniswap: Founded in 2018, Uniswap is a major decentralized exchange based on the Ethereum blockchain. It enables users to exchange ERC-20 tokens without the requirement for a middleman.

SushiSwap: Forked from Uniswap, SushiSwap adds features like yield farming and staking, drawing a big user base in the DeFi community.

Balancer: Balancer is a decentralized asset management platform that allows users to design and maintain automated portfolio strategies.

PancakeSwap: Built on the Binance Smart Chain, PancakeSwap became famous because of its low transaction costs and fast trading.

Advantages of Decentralized Crypto Exchanges

Security: Users have complete control over their funds, which reduces the likelihood of theft or hacking.

Privacy: Because users are not required to register accounts or give personal information, DEX provides a higher level of privacy.

Global Accessibility: Anyone with an internet connection can use decentralized exchanges, regardless of geographical location or financial standing.

Lower Fees: DEX often charge lower fees than centralized exchanges, making them more affordable for traders.

Challenges and Limitations

Liquidity: Decentralized exchanges often struggle with liquidity issues, which can lead to slippage and higher trading costs for users.

User Experience: While the user interface of DEX has improved over time, it still faces challenges in terms of usability and accessibility for novice traders.

Regulatory Uncertainty: The regulatory landscape surrounding decentralized exchanges is still evolving, posing potential risks for users and developers.

Conclusion

Decentralized cryptotokens exchanges mark a crucial step toward a more transparent, safe, and inclusive financial system. While they provide their own set of issues, the advantages they provide in terms of security, anonymity, and accessibility make them an appealing alternative for crypto traders worldwide. As the crypto sector evolves, decentralized exchanges will play an important role in influencing the future of finance.

Check our latest blog - How to Launch a Crypto Token and Get It Listed

#new crypto token#crypto currency#upcoming crypto tokens#decentralized#crypto#finance#blockchain#buy crypto currency#multichain#tokenization

0 notes

Text

Top 5 Crypto Swap Sites: A Comprehensive Review

Introduction

In the rapidly evolving world of cryptocurrencies, the ability to seamlessly exchange one digital asset for another has become increasingly important. Crypto swap sites offer users a convenient way to trade between different tokens and coins without the need for centralized exchanges. Among these platforms, Spider Swap has emerged as a notable player, providing users with a range of features and benefits. In this comprehensive review, we'll explore the top 5 crypto swap sites, with a particular focus on Spider Swap.

Spider Swap

Spider Swap is a crypto swap and stake platform based on Solana Blockchain. It offers users a fast, secure, and cost-effective way to swap between a wide variety of Solana based tokens. One of the standout features of Spider Swap is its low transaction fees, thanks to the efficiency of their platform. Additionally, Spider Swap boasts a user-friendly interface, making it accessible to both novice and experienced traders alike. With its focus on security and transparency, Spider Swap has quickly gained popularity within the crypto community.

PancakeSwap

PancakeSwap is another decentralized exchange operating on the Binance Smart Chain. It allows users to swap BEP-20 tokens, provide liquidity for trading pairs, and earn rewards through yield farming. PancakeSwap is known for its intuitive interface and robust features, including decentralized governance through its native token, CAKE. While PancakeSwap offers a wide range of tokens for trading, it faces competition from other platforms like SpiderSwap in terms of transaction fees and user experience.

Uniswap

Uniswap is one of the most popular decentralized exchanges in the cryptocurrency space, operating on the Ethereum blockchain. It pioneered the concept of automated market makers (AMM), allowing users to swap ERC-20 tokens without the need for order books. Despite its popularity, Uniswap has faced criticism for high gas fees and slower transaction times during periods of network congestion. However, its role in facilitating decentralized trading cannot be understated, and it continues to be a dominant force in the DeFi ecosystem.

SushiSwap

SushiSwap is a decentralized exchange forked from Uniswap that operates on multiple blockchains, including Ethereum and Binance Smart Chain. It offers similar features to Uniswap, such as AMM trading and liquidity provision, but with added incentives for users through its native token, SUSHI. SushiSwap has gained traction as an alternative to Uniswap, particularly among users looking to minimize transaction fees and maximize yield through staking and other DeFi opportunities.

Balancer

Balancer is a decentralized exchange and automated portfolio manager that operates on Ethereum. It allows users to create custom liquidity pools with multiple tokens and different weightings, enabling more flexible trading strategies. Balancer's unique approach to liquidity provision appeals to sophisticated traders and investors seeking greater control over their portfolios. However, like other Ethereum-based platforms, Balancer is susceptible to high gas fees and scalability issues.

In conclusion, crypto swap sites play a vital role in facilitating the exchange of digital assets in a decentralized manner. While each platform offers its own set of features and benefits, SpiderSwap stands out for its efficiency, low fees, and user-friendly interface on the Binance Smart Chain. However, users should consider their specific needs and preferences when choosing a crypto swap site, taking into account factors such as supported tokens, transaction fees, and security features. Whether you're a seasoned trader or new to the world of cryptocurrencies, there's a swap site out there to suit your needs.

0 notes

Text

PancakeSwap token DeFi dünyasında parlıyor! Yükseliş hangi seviyede son bulacak?

Kripto Para Haber – SushiSwap ve Uniswap’ın muadili olan PancakeSwap, DeFi platformu olan Binance Smart Chain (BSC) üzerinde çalışan bir merkezi olmayan borsa ve likidite protokolüdür. PancakeSwap, kullanıcıların kripto varlıklarını takas etmelerine, likidite sağlamalarına ve kazanç elde etmelerine olanak tanır. CAKE coin, PancakeSwap’ın yerel token’ıdır. Kullanıcılar bu token’ı kullanarak…

View On WordPress

0 notes

Text

Sàn DEX là gì? Các đặc điểm của sàn giao dịch phi tập trung

Sàn DEX là gì? Sàn DEX là viết tắt của Decentralized Exchange, tạm dịch là sàn giao dịch phi tập trung. Trong forex, sàn DEX là một nền tảng cho phép người dùng giao dịch tiền tệ fiat và tiền điện tử mà không cần thông qua một bên thứ ba, như ngân hàng hoặc sàn giao dịch tập trung (CEX).

Sàn DEX hoạt động trên nền tảng blockchain, sử dụng các smart contract để thực hiện các giao dịch. Điều này giúp đảm bảo tính minh bạch và an toàn của các giao dịch.

Trong forex, sàn DEX có một số ưu điểm so với CEX, bao gồm:

Tính phi tập trung: Người dùng có toàn quyền kiểm soát tài sản của mình và không phụ thuộc vào bất kỳ bên thứ ba nào.

Mức độ bảo mật cao: Các giao dịch trên sàn DEX được thực hiện thông qua các smart contract, giúp giảm thiểu rủi ro bị hack.

Tính thanh khoản cao: Các sàn DEX thường có tính thanh khoản cao hơn các CEX, đặc biệt là đối với các loại tiền điện tử mới.

Tuy nhiên, sàn DEX cũng có một số nhược điểm, bao gồm:

Hạn chế về các loại tài sản giao dịch: Hiện tại, các sàn DEX chủ yếu chỉ hỗ trợ giao dịch tiền điện tử.

Khó sử dụng: Các sàn DEX thường có giao diện phức tạp hơn so với các CEX.

Phí giao dịch cao: Phí giao dịch trên các sàn DEX thường cao hơn so với các CEX.

Một số sàn DEX phổ biến trong forex:

Uniswap: Sàn DEX lớn nhất hiện nay, hỗ trợ giao dịch hơn 2.000 loại tiền điện tử.

Pancakeswap: Sàn DEX phổ biến trên mạng lưới Binance Smart Chain.

SushiSwap: Sàn DEX sử dụng mô hình AMM để tạo thanh khoản.

dYdX: Sàn DEX hỗ trợ giao dịch phái sinh.

Curve Finance: Sàn DEX chuyên về giao dịch stablecoin.

Lời kết:

Sàn DEX là một lựa chọn thay thế cho CEX trong forex. Với những ưu điểm về tính phi tập trung, bảo mật và thanh khoản, sàn DEX đang ngày càng trở nên phổ biến. Tuy nhiên, người dùng cần cân nhắc kỹ những nhược điểm của sàn DEX trước khi sử dụng.

0 notes

Text

The Ethereum blockchain is notable for its smart contract functionality and various other things. However, many might not be conversant with the challenges the network encounters. In a recent interview, Ethereum’s founder, Vitalik Buterin, revealed the biggest of them all.

Ethereum’s Biggest Challenge

Speaking with CNBC, Buterin mentioned that the biggest challenge that the “Ethereum ecosystem” faces is ensuring that it builds products that provide value to its users. According to him, the last decade was test-running, but now Ethereum needs to provide utility.

Ethereum is known to host some of the biggest decentralized applications (dApps), including prominent decentralized exchanges (DEXs) like Uniswap, Curve Finance, and Sushiswap. The network has also grown massively to the extent that several Ethereum layer-2 networks have sprung up in a bid to scale the network.

Despite this, it seems that Buterin believes that there is more to be done, even as Ethereum has asserted itself as the go-to network for dApps and other decentralized solutions. Meanwhile, ETH, its native token, is the second-largest cryptocurrency by market cap.

Buterin also spoke about how cryptocurrencies enjoy greater use in less-developed countries as people use crypto tokens to make payments and for savings.

Cryptocurrencies have long been touted as a hedge against inflation, and it would seem that crypto is being put to use where it is needed most. A recent report by Chainalysis showed that the highest-ranked countries for crypto adoption are being plagued with a devaluing fiat currency.

The Ethereum founder also stated that centralized entities like Binance need to take a back seat for crypto adoption to move forward. While he appreciates these entities’ role in growing the crypto industry, he believes crypto needs to become more decentralized.

His reason for saying this isn’t far-fetched as he noted that these entities are vulnerable to “both pressure from the outside and to themselves being corrupted.” Truly, centralized entities have taken many hits this past year, which has had far-reaching consequences on the industry.

Last year, one of the biggest crypto exchanges, FTX, collapsed, which had several ripple effects on the crypto industry and market. Meanwhile, the two largest crypto exchanges by trading volume, Binance, and Coinbase, are currently embroiled in legal battles against the SEC.

ETH price sits at $1,578 | Source: ETHUSD on Tradingview.com

The Future Of Ethereum

Last year, Ethereum transitioned from a proof-of-work consensus mechanism to proof-of-stake following the Merge. Buterin stated this move has made the network more decentralized as it is “harder to shut down” than a proof-of-work network.

He also banished the idea that the network was heavily reliant on him, which many had identified as a weakness as the government could easily go after him to clamp down on the network.

Related Reading: What The Drop In Spot And Derivatives Volumes Means For The Price Of Bitcoin

According to him, Ethereum has grown to become independent of him and the Ethereum Foundation. He points out how several independent applications on the blockchain have taken the workload off him and made the network more autonomous.

As to Ethereum’s future plans and projects, he said that the network is focused on privacy and scaling with the help of zero-knowledge (ZK) rollups. ZK rollups are layer-2 scaling solutions that help scale the Ethereum network by moving computation off-chain, thereby reducing the computing workload on the network. It also promotes privacy, as one can verify transactions without knowing what it is about.

Source

0 notes

Text

Autobahn Network Nedir?

Autobahn Network'ün bugünkü canlı fiyatı 0,014788$ ve 24 saatlik işlem fiyatı 5.064,46$. TXL fiyatlarımızı USD cinsinden gerçek zamanlı olarak güncelliyoruz. Autobahn Network son 24 saatte %1,10 düştü. CoinMarketCap'in şu anki sıralaması 1344 ve canlı piyasa değeri 991.875$. internet üzerinden. 67 070 793 TXL madeni para ve maks. 600.000.000 TXL adet tedariği.

Autobahn Network'ü güncel oranda nereden satın alacağınızı öğrenmek istiyorsanız, Autobahn Network hisselerinin ticareti için en iyi kripto para borsaları PancakeSwap (V2), ProBit Global, SushiSwap, PancakeSwap ve ApeSwap (BSC). Kripto değişim sayfamızda listelenen diğerlerini bulabilirsiniz.

Otoyol Ağı (TXL) nedir?

Autobahn ağı, BNB Smart Chain (eski adıyla Binance Smart Chain) için ilk yükseliş seviyesi 2 rallisi. Maliyetleri düşürürken ve temeldeki BNB akıllı zincirine gömülürken bir yazma işlevi gerçekleştirmek üzere tasarlanmıştır. Optimism'in açık kaynak kodunu kullanan Autobahn, kullanımı ve maliyeti azaltmak için işlemleri toplu olarak işlemek üzere tasarlanmış bir koleksiyon olarak BNB Akıllı Zincir katmanı üzerine inşa edildi.

Autobahn ağını benzersiz kılan nedir?

Optimistic ve Zero-Knowledge Rollups gibi proaktif çözümler, işlem hacmini artırmak, işlem süresini kısaltmak ve gaz maliyetlerini azaltmak için tasarlanmıştır. Ancak bu yaratıcı çözümler Ethereum madenciliğine odaklanıyor. Autobahn Network'ün geliştiricileri, diğer EVM zincirlerinin aynı duruma düşmesini önlemek için bir izleme aracına sahip olma ihtiyacını gördüler, dolayısıyla Autobahn Network oluşturuldu.

Autobahn Network, BNB Smart Chain (BSC) ve topluluğuna hizmet etmek için tasarlanmıştır. BSC, blok zinciri ekosistemi üzerine inşa edilen hacim ve yeni hizmetler açısından en Kademe 1 operatörlerinden biri olduğunu kanıtladı. Bu büyümeyi teşvik etmek ve hizmetlerin yavaş ve pahalı bir katman tarafından engellenmemesini sağlamak için, BNB ağı giderek daha pahalı hale gelmeden önce yol ağı oluşturuluyor. Bugün bile, ortalama BSC işleminin maliyeti yaklaşık 0,35 ABD dolarıdır (Kaynak: YCharts). Bu maliyet, çoğu NFT projesi ve sınırlı ticaret kapasitesine sahip oyunlar için uygun değildir. Autobahn Network Optimistic Rollup'ta ticaretin yaklaşık 0,0175 $ ve daha az maliyetli olması bekleniyor.

TXL'in faydaları nelerdir?

TXL = Eskiden "Tixl" olarak bilinen iş alanı. TXL belirtecinin sabit bir üst sınırı vardır ve tüm işlemlerden, staking ve yönetişim ücretlerinden yararlanır: - TXL, işlem ödemeleri ve yol ağları açısından bir gaz kaynağı olarak çalışır. - Yol ağı alanında PoS staking: Düğüm ana bilgisayarları, yol ağında yapılan her işlem için BNB alacaktır. - Trafik ağı yönetimi: Düğümün ana bilgisayarı, trafik ağının yöneticisi olacaktır.

Read the full article

0 notes

Text

Top DeFi Protocols to Watch Out for in 2023

Introduction:

The world of decentralized finance (DeFi) continues to evolve at a rapid pace, revolutionizing traditional financial systems and offering users greater control over their financial assets. As we step into 2023, the DeFi landscape is poised for even more innovation and growth. In this article, we will explore some of the top DeFi protocols to keep an eye on throughout the year.

Uniswap V3: Uniswap, one of the pioneering decentralized exchanges (DEX), released its third version, Uniswap V3, with improved features to enhance user experience and capital efficiency. With concentrated liquidity and multiple fee tiers, Uniswap V3 aims to further optimize trading strategies and provide users with enhanced control over their trading parameters.

Aave: Aave remains a significant player in the DeFi lending and borrowing sector. Known for its flash loans and innovative interest rate models, Aave continues to attract users seeking efficient ways to earn interest on their cryptocurrencies and access instant loans without intermediaries.

SushiSwap: SushiSwap has gained substantial traction as a prominent decentralized exchange and automated market maker (AMM). With features like yield farming, staking, and its own governance token, SUSHI, the protocol aims to provide users with new opportunities to generate returns on their crypto holdings.

MakerDAO: As a pioneer in the world of decentralized stablecoins, MakerDAO's Dai continues to be a cornerstone in the DeFi ecosystem. Its collateral-backed model, driven by the MKR token, ensures stability and decentralization in the issuance of stablecoins.

Compound: Compound is another major player in the lending and borrowing space. Its algorithmic interest rate determination and governance structure have garnered attention from both users and developers. As it continues to innovate, Compound remains a key platform for users looking to lend or borrow various cryptocurrencies.

Curve Finance: Curve Finance stands out as a specialized AMM optimized for stablecoin trading. Its low slippage and low fee structure make it an attractive choice for users looking to trade stablecoins with minimal cost.

Synthetix: Synthetix focuses on creating synthetic assets, allowing users to gain exposure to real-world assets without holding the underlying assets themselves. With an expanding list of synthetic assets and a governance token, SNX, Synthetix is pushing the boundaries of what's possible in the DeFi space.

Yearn Finance: Yearn Finance operates as a yield aggregator, automatically moving user funds between various lending protocols to optimize returns. Its suite of products simplifies yield farming for users, making it an appealing option for those seeking passive income opportunities.

PancakeSwap: For those operating on the Binance Smart Chain (BSC), PancakeSwap offers a DeFi platform similar to Uniswap. With lower transaction fees compared to the Ethereum network, PancakeSwap has become a popular choice for users looking to access DeFi on BSC.

Terra: Terra stands out for its stablecoin, TerraUSD (UST), which is algorithmically stabilized by a combination of collateral and algorithmic mechanisms. With a focus on stability and usability, Terra is making strides in bridging traditional finance with the DeFi world.

Conclusion: The DeFi landscape in 2023 continues to offer diverse protocols and platforms, each with its unique value proposition and features. Whether you're interested in lending, borrowing, trading, or yield farming, there are ample opportunities to explore and engage with decentralized finance. Keep an eye on these top DeFi protocols as they drive innovation and reshape the future of finance. Remember, while the potential for high rewards exists, the DeFi space also carries risks, so always do your own research and consider your risk tolerance before participating.

0 notes

Text

The Best Yield Farming Platforms for 2023

Yield farming is a hot trend in the cryptocurrency world, and for good reason. It's a way to earn passive income on your crypto assets, and the potential returns can be very high.

But with so many yield farming platforms out there, it can be tough to know which ones are the best. That's why I'm here to share my personal experience with some of the top platforms in 2023.

Acet.finance

Acet.finance is my top choice for yield farming in 2023. It offers a wide variety of features that make it a great platform for earning passive income, including:

High APYs: Acet.finance offers some of the highest APYs in the industry, with many pools offering returns of over 100%.

Multiple asset types: You can yield farm with a wide variety of assets on Acet.finance, including stablecoins, tokens, and even NFTs.

Liquidity pools: Acet.finance offers a variety of liquidity pools, so you can find one that's a good fit for your risk tolerance and investment goals.

Staking: You can also stake your tokens on Acet.finance to earn rewards.

I've been yield farming on Acet.finance for a few months now, and I've been very happy with the results. I've earned a significant amount of passive income, and I've been impressed with the security and stability of the platform.

Other great yield farming platforms

In addition to Acet.finance, here are a few other great yield farming platforms to consider in 2023:

Yearn.finance: Yearn.finance is a popular yield aggregator that automatically finds the best yield opportunities for your assets.

Aave: Aave is a decentralized lending platform that allows you to earn interest on your crypto assets.

PancakeSwap: PancakeSwap is a decentralized exchange on the Binance Smart Chain that offers yield farming opportunities.

SushiSwap: SushiSwap is another popular decentralized exchange that offers yield farming opportunities.

Choosing the right yield farming platform

When choosing a yield farming platform, there are a few factors you'll want to consider, including:

The APYs offered: The higher the APY, the more passive income you'll earn. However, it's important to do your research and make sure the platform is legitimate.

The types of assets supported: Some platforms only support certain types of assets, so make sure the platform supports the assets you want to yield farm.

The fees associated with yield farming: Some platforms charge fees for yield farming, so make sure you understand the fees before you start.

The security of the platform: It's important to choose a platform that's secure and has a good track record.

Conclusion

Yield farming is a great way to earn passive income on your crypto assets. With so many great platforms to choose from, you're sure to find one that's a good fit for you.

I hope this article has helped you choose the best yield farming platform for you. If you have any questions, please feel free to leave a comment below.

P.S. If you're new to yield farming, I recommend starting with a small amount of money. This will help you learn the ropes and minimize your risk.thumb_upthumb_downtuneshareGoogle it

0 notes

Text

BETTER TRADING OPERATION APESWAP & ECOSYSTEM LOTTERY

APESWAP UNIQUEThis platform is unlike any other platform you are familiar with. It is very easy to use, it fully covers all aspects of trading and Investing on the basis of Auto market builder and works on the same principles as platforms like sushiswap and PancakeSwap. Through this platform, all tokens that conform to the BEP-20 class can be exchanged and staked. Getting to know other AMM protocol platforms means that you only need to learn how to use the new features added in these platforms. This platform has evolved beyond the traditional platform and can stand alone. It offers a token called $ BANANA which is very attractive. On the platform, tokens will be the only way users can make the most of the platform and make use of the new features.

The cryptocurrency money space is planned so that when you offer monetary help to others through cultivating, you get remunerated.

How does this cultivating work?

This works like seed and reap time: you loan your tokens to individuals on the stage for a specific period, and you are remunerated with tokens thereafter.

There are a few ranch/blending choices accessible on the Apeswap stage:

BANANA/BNB

BNB/USD

ETH/BNB

BTC/BNB

BANANA/BUSD

Homestead sets are not unchangeable. You can make your own pair on the stage. Everything relies upon what you need!

The APESWAP team is doing a wonderful job!

There are some excellent features: Have you been looking for a place to bet, farm, sell NFTs and exchange tokens?

These are some of the amazing features that Apeswap has to offer.

You can easily do all the things mentioned above on the APESWAP platform.

APESWAP TOKEN

The team at APESWAP decided to go the Ape route by naming their token $ BANANA.

Sounds pretty interesting, right?

Well, you can exchange and farm for Banana tokens on the platform. And you have several exchange options available.

Whether it's BNB or USDT, you can easily exchange and stake your $ BANANA and earn rewards.

And oh, there is also a lottery feature that you can win.

AMAZING FEATURES OF APESWAP

Now, let's dive right into the awesome features APESWAP has available for you.

APESWAP is on the blockchain today and is supported by the Binance Smart Chain. Its sole purpose is to help users generate profits and to help them achieve those who already provide $ BANANA features and tokens for their daily transactions. In this way, users will have a high level of control and can take advantage of existing finances. There is so much more available to users than they can even realize on ethereum, taking them to the top as they become free to trade and use the newly provided information. What you should look forward to in this platform is how to use the $ BANANA token, how to use agriculture and how to take part in an Initial Apes Offering. The Defi platform is growing steadily and will continue to do so on the Binance Smart Chain.

APESWAP LOTTERY FINANCE:

When you hear the lottery, what comes to your mind?

Free! Free stuff! Chance to win!

The same goes for the Apeswap Financial Lottery: You can win a lot of $ BANANA if you play the lottery.

How do I play the lottery, you ask?

Simple!

You buy an APESWAP lottery ticket.

Yes, the same way you buy a lottery ticket, get a unique lottery code, it's the same way the APESWAP lottery works.

There is a four digit code on the ticket you get.

Tickets sell for $ 10 BANANA.

One ticket goes for 10 $ BANANA.

When the four numbers on your ticket match the four winning lottery numbers, you win.

For people whose four numbers don't match the four lottery numbers, there are still wins for them, but not as many as those who have all four winning lottery numbers.

Winning the lottery is simple: the order of your ticket numbers must match the winning numbers of the lottery.

POOL AND EXCHANGE: In cryptocurrency, pool is when people get together, and then lend people out of that pool of money.

The advantage of the pool is that people get rewarded for pooling their money to help others.

With APESWAP pools, you can create your own, and other people will join you.

Some of the popular pools on this platform are:

Banana Pool

JDI Pool

Lyptus Pool

Exchange on APESWAP is fast and secure. And the exchange fee is as low as 0.3%.

Exchange fees are used to keep the platform running well.

NFA Auction: You can create and auction Non-Fungible Apes on APESWAP.

Yes, NFA is Apeswap's substitution for NFT.

The world is going crazy about NFT, Apeswap has created the NFA, the digitally created Kera art. This monkey is available for auction and has changed hands of late.

So if you're looking to step into the exciting new world of the NFA, this is your chance!

CONCLUSION

You will definitely want to make purchases and transact tokens or even exchange, tokens will allow you and with that, it will be easy to access Defi and also grow your finances. You will not be in a position to compromise when you use this platform as it offers the best security and will always put all its users ahead of the crypto market. Everyone needs to understand this and then move on with this platform at once.

The multitude of opportunities available on the platform makes it the perfect platform for those starting cryptocurrency trading, staking, farming and selling NFTs. Follow APESWAP! Get your $ BANANA!

LINKS YOU MAY NEED:

Website: https://apeswap.finance/

Twitter: https://twitter.com/ape_swap

Telegram Group: https://t.me/ape_swap

Telegram Channel: https://t.me/ape_swap_news

Medium: https: //ape-swap.medium.com/

Github: https://github.com/ApeSwapFinance

AUTHOR DETAILS

Bitcointalk Username: Gedang_goreng

Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=3243664

BSC Address: 0x36cf2Fdf76E1CEFE2357a9bba779F0F7c363d735

3 notes

·

View notes

Text

MEXC Global Research: Market Investment Research Analysis of the Base Layer Expansion Scheme, Polygon (MATIC)

In 2021, the projects at the forefront of the base layer blockchain race is not Binance Smart Chain, Polygon, and Solana. However, the latter two are likely to have late development advantages.

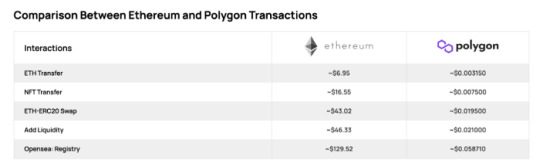

Polygon uses an Ethereum sidechain that focuses on high performance and scalability issues. Unfortunately, every user who uses Ethereum for transactions suffers from high gas fees and transaction congestion. The following data in the picture can fully summarize the problems to be solved by Polygon.

We can look at Polygon’s situation from the following aspects.

1. Polygon network DeFi TVL

At present, the TVL of the Ethereum network is $88.52 billion USD, and the TVL on Binance Smart Chain is $24.77 billion USD, the TVL on the Polygon Network is $3.6 billion USD.

Compared with this set of data, the current Polygon DeFi ecosystem may be far inferior to the Ethereum network or the Binance Smart Chain. However, another set of data shows that in the second quarter of this year, the number of Polygon’s daily active wallet addresses once surpassed Ethereum to 73,000, with an year-on-year increase of 13000%. So far, the number of Polygon wallet addresses is 660,000 +.

About the situation of the Polygon network’s native asset MATIC (based on the data retrieved on September 3): The asset price is 1.5USDT/token, the market value is $9.754 billion USD, and the market value ranks 19; The total value of online staking is U$1.832 billion USD.

At present, Polygon is in a multi-chain-driven mode. Its ecosystem leaders are AAVE, Sushi, Aavegotchi, and other games. Dapp also decided to expand its functions to Polygon·

According to a report by Dappradar in July, since its expansion to Polygon, AAVE’s TVL on the sidechain has reached $2.11 billion USD. Considering Ethereum, this number accounts for 22.56% of the total TVL. A similar situation occurred in SushiSwap. Its TVL in Polygon accounts for 20.4% of the total TVL of SushiSwap.

Therefore, based on the data, at present, the TVL contribution value of Polygon mainly comes from AAVE and Sushiswap.

2. Polygon (MATIC) Tokenomics

MATIC has a total distribution of 10 billion tokens, including:

The distribution proportion of private sales and Launchpad sales is 3.8% and 19%, respectively;

The allocation proportion of team and advisors is 16% and 4%, respectively;

The distribution proportion of foundation, network operation, and the ecosystem is 12%, 21.86%, and 23.33%, respectively.

According to public disclosure, MATIC’s private sales price is 0.00079USDT/token and 0.00263USDT/token respectively. The partial private sale has been unlocked in 2019, and the partial network operation has also been unlocked; The team will unlock 1/5 every half a year from April 2020; The foundation will unlock 1/8 every half a year from April 2019; The ecosystem part will be unlocked every half a year from April 2019. In other words, before all these MATICs are unlocked, they will face certain selling pressure in April and October every year.

3. Polygon’s Security Situation

Polygon mainly combines the features of sovereign blocks (sovereignty, scalability, and flexibility) and Ethereum (security, interoperability, and developer experience), which is compatible with existing Ethereum tools (such as MetaMask, MyCrypto, Remix, etc.), and can exchange messages between them and with Ethereum.

Polygon’s technology implements the Polygon framework and the Polygon protocol through two main components.

The “Polygon framework” allows developers to deploy Ethereum compatible preset blockchains with one click and provides a set of customized modules for building blockchains, including pluggable consensus, staking, governance, Ethereum virtual machine EVM/Ewasm, execution environment, and dispute resolving procedures.

The “Polygon Protocol” can transmit information between Polygon chains or between Polygon chains and Ethereum and rely on the security as a service of the Ethereum network.

There are two ways for Polygon to realize the capacity expansion path. One is the path that depends on Ethereum network security, namely “Secured Chains”. This method does not establish its own verifier pool, but is directly provided by Ethereum or professional verifiers.

Under this method, in addition to the current implementation of Matic Plasma, Polygon will also support other major extension solutions, such as zkRollups, Optimal Rollups, Validium, and other various schemes.

The other is Stand-alone Chains, which has its own verifier pool, is fully responsible for its security, and has the advantages of independence and flexibility. Examples include the Matic PoS chain, sidechain, and enterprise chain. However, because of this, many projects cannot share security, which may impact them when becoming a part of the Polygon ecosystem.

Polygon provides various solutions in Ethereum’s capacity expansion, including the core Polygon PoS chain, two mature solutions Polygon SDK and Polygon Plasma, and trying to build a dedicated data availability layer Polygon Avail.

In August, Polygon acquired Hermez with $250 million USD, thus complementing the capacity expansion technology based on zero-knowledge proof (ZK), which is the most difficult at present, so that Polygon can further complement the Rollup scheme.

4. Polygon’s Ecosystem Situation

At present, Polygon’s Layer2 chain has been widely used, with more than 520 DApps, more than 400 million on-chain transactions, and more than 17 million independent address users, including DeFi, NFT, and games. At present, there are more than 520 ecosystem projects deployed on Polygon with apparent official cooperation, including many blockchain ecosystems such as DeFi, NFT, GameFi, and tools.

In addition to the leading projects Aave, Sushi and Aavegotchi, AirNFTs, Quickswap and Decentral Games Polygon has formed a primary ecosystem dominated by DEX, insurance, lending, NFT and GameFi.

Recently, polygon held a hackathon for the first time in the theme directed towards Fastest way to build Polygon dApps with Moralis, Building an NFT marketplace on Polygon, Polygon DeFi Panel, etc. to provide professional ecosystem construction and post-investment services for innovative ecosystem projects.

MEXC Global will participate in the project as a global market partner. In addition, MEXC Global and Polygon will jointly set up a global ecosystem fund to invest in Polygon’s innovative ecosystem projects.

Note: This article is only for information sharing and does not constitute any investment suggestions.

1 note

·

View note

Text

Summarizer is an artificial intelligence newspaper.

There are so many things happening in the world, of course, you cannot know about everything that happened. But it is, of course, important to be at least aware of the most important events. A fully automated newspaper – AI News Summarizer – will help you with this.

Summarizer aims to make your daily news shorter through the use of AI. Its bots scan the Internet for news, summarize them, and then sort them into categories. You just need to go to the website https://summarizer.co/. The main page contains the most important, interesting and extraordinary news that happened recently. Also filter news by category: cryptocurrency, finance, technology, sports, etc.

After selecting the news of interest, you can see the date of the news, the percentage of compression (bots look for news in different sources, and compress them, keeping the main idea) using the TextRank function with the optimization of the similarity function to summarize the text. This news can be easily shared with other people through your social networks.

Soon, in order to be able to read the newspaper and use all the functions, you will need to buy and hold $ SMR tokens in your wallet. By doing this, you support the project. At any time, if you decide to stop reading Summarizer, you can simply sell your $ SMR back to the market.

The main advantages of Summarizer.

Since the newspaper is fully automated, it needs constant control, the bot is also involved in the control. The newspaper has many bots that are responsible for their function. There is a crawler bot, a summa bot, an editor bot, a delivery bot, an optimizer bot, a repair bot, etc. no problem with this newspaper.

As I already said, the TextRank function operates, which shortens the news, thereby giving you the opportunity to study more news in the same period of time. Of course, you can read the entire article at any time, without any compression.

The site itself is very easy to use. You can choose the night mode (it helps your eyes a lot, read in the dark). The site is optimized for speed. Summarizer articles usually load in less than 1 second.

Summarizer is available on Google News and Telegram. You can now receive the latest AI summary news on your favorite platform.

Most importantly CONFIDENTIALITY. Unlike almost any other news site, this newspaper does not have a code to track your personality and behavior.

Tokenomics.

The distribution of the SMR token will take place in 3 stages.

Private sale at $ 0.008 per SMR.

Join the whitelist to participate in the private sale!

The public sale will take place after the private sale at the rate of USD 0.01 per SMR.

Launch on PancakeSwap, planned after private and public sales. Starting price: $ 0.012 per SMR.

The project allocation is shown in the screenshot.

Allocation

The token is deployed to itself Binance Smart Chain and we integrate the token with Summarizer via Web3. Our SMR token has passed the TechRate audit. Its source code has also been published and tested by BSCScan.

Road map.

The creators of the project have colossal plans. At this point in time, only a small part of the set goals has been achieved.

The launch of an application for Android and IOS is planned. Soon, the platform token will be displayed on the most famous crypto-currency monitoring platforms, these are CoinGecko and CoinMarketCap. The token will be traded not only on the PancakeSwap exchange. Listing on many top DEX and CEX exchanges is planned.

The development of the newspaper itself is also in the plans. This is the creation of Open Summarizer technology for other news publishers. Which will allow news publishers to easily create summaries for their articles in large numbers, deliver these summaries to their readers through newsletters and news feeds.

They can even create their own version of the Summarizer website with just a few clicks. The profits generated from this activity will be used to buy back and burn the SMR.

Connecting SMR to Other Chains with Anyswap

Using Anyswap, admins will connect SMR to the Ethereum, Polygon and Harmony blockchains. This will increase the availability of Summarizer to users of other networks. And by making SMR available across multiple chains, it will create more trading pairs and trading volume for SMR on DEXs like Uniswap and SushiSwap.

Don’t forget to subscribe to the social networks of the project. They will definitely help you and answer all your questions.

The official website of the newspaper – https://summarizer.co/

Tokenomics website – https://token.summarizer.co/

Telegram – https://t.me/SummarizerOfficial

Twitter – https://twitter.com/SummarizerC

Medium – https://medium.com/@summarizer

Reddit – https://www.reddit.com/user/Summarizer_Official

author

Bitcointalk username: Abung

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=2662588

Bsc wallet address:0x3F69b5C3e1C7163ebd3B232b9Ca1e18d3aCb1E98

1 note

·

View note

Text

#sushiswap#sushiswap crypto#sushiswap price prediction#sushiswap tutorial#sushiswap analysis#sushiswap dex#sushiswap liquidity pool#sushiswap vs uniswap#sushiswap eth usdt#sushiswap liquidity#sushiswap coin bureau#sushiswap vs pancakeswap#sushiswap price analysis#sushiswap coinbase wallet#sushiswap liquidity mining#sushiswap technical analysis#sushiswap binance smart chain#sushiswap vs pancakeswap vs uniswap#sushiswap explained#sushiswap coin

0 notes