#tally billing software

Explore tagged Tumblr posts

Text

Whats New In TallyPrime 5.1

Tally Prime 5.1 introduces several enhancements designed to streamline business operations and ensure compliance.

1. Enhanced GST Management:

Simplified GST Conflict Resolution: Quickly identify and resolve discrepancies in GST details across transactions and masters, reducing errors and ensuring compliance.

Bulk B2B to B2C Conversion: Efficiently convert multiple transactions from Business-to-Business (B2B) to Business-to-Consumer (B2C), particularly useful when dealing with inactive GSTINs.

Consolidated GSTR-1 Exports: Export GSTR-1 returns for multiple periods into a single Excel file, saving time for businesses with multiple GST registrations.

2. Streamlined Payroll Compliance:

Integration with FVU Tool Version 8.6: Seamlessly export payroll data for accurate tax filing.

Enhanced Support for New Tax Regime: Excludes unnecessary deductions for employees under the new tax regime, ensuring accurate payroll calculations.

3. Flexible Voucher Numbering:

Retain existing voucher numbering systems or customize them for specific voucher types, providing greater control over financial records.

4. Enhanced e-Way Bill Generation:

Automatic Distance Calculation: Tally Prime 5.1 automates the calculation of distances based on PIN codes, eliminating manual input and reducing errors in e-Way Bill generation.

Support for Material In and Out Transactions: Generate e-Way Bills for internal transactions such as material transfers during production, enhancing compliance.

Improved Export Invoice Handling: Accurately generate e-Way Bills for export invoices by ensuring valid port PIN codes are included.

5. Localized Language Support:

View and print amounts in words in Arabic, enhancing usability for Arabic-speaking users.

6. Improved User Experience:

Simplified Stock Descriptions: View stock item descriptions in a single line for better clarity in invoices.

Accurate GST Calculations for Services: Fixes previous errors, ensuring compliance and precision.

Flexible Advance Receipt Adjustments: Adjust payments and receipts with no time restrictions, offering greater flexibility.

These updates in Tally Prime 5.1 aim to enhance efficiency, accuracy, and compliance, making it a valuable upgrade for businesses seeking to optimize their accounting and financial processes.

#tallyprime#accountingsoftware#cloud accounting software#tally on cloud#gst reconciliation#gst registration#tallysoftware#tally customization#tallyaccountingsoftware#chartered accountant#small business#entrepreneur#finance#startup#strategies#branding#gst services#gst billing software#gst compliance#gst

1 note

·

View note

Text

#Tally ERP-9#GST accounting software#Tally GST module#GST compliance#Tally ERP-9 features#GST invoicing#Tally GST integration#Tally GST implementation#Tally ERP-9 for GST returns#GST billing in Tally

0 notes

Text

Tally Training in Chandigarh: Build a Successful Accounting Career

In today’s fast-paced digital economy, proficiency in accounting software like Tally is no longer optional — it’s a necessity. Whether you’re a student, a working professional, or someone planning a career shift into finance, Tally training in Chandigarh offers a golden opportunity to build a solid foundation in business accounting. With growing business activity in the region, mastering Tally can set you apart in the competitive job market.

Introduction to Tally and Its Relevance

Tally is one of the most widely used business accounting software in India. It simplifies complex financial operations such as invoicing, inventory management, taxation, payroll processing, and financial reporting. Tally ERP 9, the earlier version, was known for its robust features, while Tally Prime — the latest iteration — offers an intuitive interface and smarter navigation for enhanced productivity.

In a country where small and medium enterprises form the economic backbone, Tally plays a critical role in helping businesses maintain compliance and streamline operations. From automating GST filings to tracking stock levels in real time, Tally’s capabilities are deeply aligned with the needs of modern Indian enterprises.

Why Choose Tally Training in Chandigarh?

Chandigarh has steadily grown into a major educational and business center in North India. With its well-connected infrastructure and proximity to Punjab, Haryana, and Himachal Pradesh, it attracts students and professionals from across the region.

The city boasts several reputed training institutes that specialize in job-oriented programs, including Tally training in Chandigarh. These institutes not only provide structured learning but also offer real-world exposure through internships and industry interactions. The business-friendly environment of Tricity — comprising Chandigarh, Mohali, and Panchkula — further enhances placement opportunities for Tally-trained individuals.

Key Features of a Good Tally Training Institute

Selecting the right institute can make a big difference in how effectively you master Tally. Look for the following features when choosing your Tally course:

Certified and experienced trainers ensure you’re learning from professionals who understand both the software and its industry applications. Practical exposure through case studies and real-time projects helps you gain confidence in using Tally in real-world scenarios.

Modern Tally courses now include essential modules like GST compliance, inventory control, payroll processing, MIS report generation, and taxation management. Institutes that regularly update their syllabus in sync with government norms and business trends are more valuable.

Personalized mentorship, flexible batch timings (weekend/evening), and career support services like resume building and mock interviews can significantly enhance your learning experience.

Career Scope After Tally Training

Completing a certified Tally course can unlock a variety of career paths. Common roles include:

Accountant

GST Consultant

Billing Executive

Finance Executive

Audit Assistant

Tally skills are especially in demand in sectors like retail, manufacturing, logistics, healthcare, and professional services. Small and mid-sized businesses across the Tricity area consistently hire Tally-certified professionals for daily bookkeeping, tax filing, and reporting.

The average starting salary for a fresher with Tally training ranges from ₹15,000 to ₹25,000 per month, with rapid growth potential as you gain experience and industry exposure.

Tally ERP 9 vs Tally Prime: What You’ll Learn

A well-rounded Tally training program in Chandigarh covers both Tally ERP 9 and the newer Tally Prime. While ERP 9 remains in use across many companies, Tally Prime introduces improved usability with a simplified menu structure, enhanced multi-tasking, and better data tracking.

Key modules you’ll explore include:

Financial Accounting and Ledger Management

Inventory Management and Stock Control

Payroll Setup and Salary Processing

GST and TDS Return Filing

MIS Reports and Business Intelligence

Data Backup and Security Features

You’ll also learn how to use Tally as a business management tool that integrates seamlessly with compliance and audit requirements.

Best Tally Training Institutes in Chandigarh

When choosing an institute, reputation matters. The best Tally training institutes in Chandigarh offer practical curriculum, certified trainers, placement assistance, and flexible learning schedules.

Bright Career Solutions Mohali stands out as a highly rated institute offering in-depth Tally training with practical exposure. With expert faculty, dedicated career support, and strong student feedback, BCS Mohali has become a trusted name in Tally education in the region.

Students regularly highlight the institute’s hands-on training approach, one-on-one mentorship, and successful placement records across local businesses and startups.

FAQs About Tally Courses in Chandigarh

Q. Is Tally useful for non-commerce students? Ans. Yes. Tally is designed to be user-friendly and can be learned by students from non-commerce backgrounds. Institutes usually begin with accounting basics before diving into software-specific training.

Q. What is the typical duration and cost of Tally training? Ans. The duration can range from 1 to 3 months depending on the course level (basic to advanced). Fees generally range from ₹5,000 to ₹15,000. Institutes like BCS Mohali also offer installment plans.

Q. Is a Tally certification necessary to get a job? Ans. While not mandatory, a certification adds credibility to your resume and significantly boosts your chances during hiring. Certified professionals are often preferred for finance and accounts roles.

Conclusion

Tally training in Chandigarh is more than just a short-term course — it’s a launchpad for a rewarding career in finance and accounting. With businesses increasingly relying on Tally for daily operations and compliance, skilled professionals are in high demand.

Whether you’re a student, job seeker, or professional looking to upgrade your skills, enrolling in a Tally course from a reputed institute like Bright Career Solutions Mohali can help you take a decisive step toward career success. The right training, combined with dedication and practice, can turn you into a valuable asset for any business.

2 notes

·

View notes

Text

🧾 GST Billing & Invoicing Software – The Ultimate Solution for Small Businesses in India

In today’s fast-paced business world, managing GST invoices, stock, and accounts manually is not only time-consuming but prone to errors. This is where a smart GST Billing & Invoicing Software comes to your rescue.

Whether you run an optical store, retail shop, or small business — using automated GST software can save hours and boost productivity.

✅ Why You Need GST Billing Software

1. 100% GST Compliant Invoices - Create professional invoices with your GSTIN, HSN/SAC codes, and automated tax calculations — in seconds.

2. E-Invoice Generation - Connect directly with the GSTN portal for seamless e-invoicing and avoid penalties.

3. Integrated Stock & Inventory Management - Track your real-time stock levels, product batches, expiry dates, and low stock alerts — all from your billing screen.

4. Sales, Purchase, & Return Management - Handle sales orders, purchase orders, quotations, and returns with one-click conversion to invoices.

5. Tally Integration & Accounting - Export reports directly to Tally ERP and simplify your accounting process.

🔍 Top Features of GST Billing & Invoicing Software

📦 Inventory & Stock Control

💳 POS System for Fast Billing

🧾 GST Reports: GSTR-1, GSTR-3B, GSTR-9

📈 100+ Business Reports (Profit & Loss, Stock, Sales)

🧑💼 Multi-user Access with Role Permissions

☁️ Cloud Backup & Data Security

📱 Mobile & Desktop Compatible

👨💻 Who Is It For?

This software is ideal for:

🕶️ Optical Shops

🛍️ Retail Stores

🏥 Pharmacies

🧰 Hardware Shops

📚 Book Stores

🏬 Small & Medium Enterprises (SMEs)

🚀 Boost Business Efficiency Today!

Switching to a Partum GST billing software is not just about compliance — it’s about scaling your business smartly. With built-in automation, detailed reports, and error-free invoicing, your daily operations become faster and smoother.

📞 Book your FREE demo now! ✅ No credit card needed ✅ 17+ Software packages ✅ Trusted by 5,000+ businesses

youtube

#gst billing software#InvoicingSoftwareIndia#BillingAndInventory#RetailBilling#EInvoiceIndia#TallyIntegration#Youtube

2 notes

·

View notes

Text

"DCA"(DIPLOMA IN COMPUTER APPLICATION)

The best career beginning course....

Golden institute is ISO 9001-2015 certified institute. Here you can get all types of computer courses such as DCA, CFA , Python, Digital marketing, and Tally prime . Diploma in Computer Applications (DCA) is a 1 year "Diploma Course" in the field of Computer Applications which provides specialization in various fields such as Fundamentals & Office Productivity tools, Graphic Design & Multimedia, Programming and Functional application Software.

A few of the popular DCA study subjects are listed below

Basic internet concepts Computer Fundamentals Introduction to programming Programming in C RDBMS & Data Management Multimedia Corel draw Tally ERP 9.0 Photoshop

Benefits of Diploma in Computer Application (DCA)

After completion of the DCA course student will able to join any computer jobs with private and government sectors. The certification of this course is fully valid for any government and private deportment worldwide. DCA is the only best option for the student to learn computer skills with affordable fees.

DCA Computer course : Eligibilities are here... Students aspiring to pursue Diploma in Computer Applications (DCA) course must have completed their higher school/ 10 + 2 from a recognized board. Choosing Computers as their main or optional subject after class 10 will give students an additional edge over others. Apart from this no other eligibility criteria is set for aspirants. No minimum cutoff is required.

"TALLY"

A Tally is accounting software. To pursue Tally Course (Certificate and Diploma) you must have certain educational qualifications to thrive and prosper. The eligibility criteria for the tally course is given below along with all significant details on how to approach learning Tally, and how you can successfully complete the course. Generally, the duration of a Tally course is 6 month to 1 year ,but it varies depending on the tally institution you want to join. Likewise, tally course fees are Rs. 10000-20000 on average but it also varies depending on what type of tally course or college you opt for. accounting – Accounting plays a pivotal role in Tally

Key Benefits of the Course:

Effective lessons (topics are explained through a step-by-step process in a very simple language) The course offers videos and e-books (we have two options Video tutorials in Hindi2. e-book course material in English) It offers a planned curriculum (the entire tally online course is designed to meet the requirements of the industry.) After the completion of the course, they offer certificates to the learners.

Tally Course Syllabus – Subjects To Learn Accounting Payroll Taxation Billing Banking Inventory

Tally Course

Eligibility criteria: 10+2 in commerce stream Educational level: Certificate or Diploma Course fee: INR 2200-5000 Skills required: Accounting, Finance, Taxation, Interpersonal Skills Scope after the course: Accountant, Finance Manager, Chartered Accountant, Executive Assistant, Operations Manager Average salary: INR 5,00,000 – 10,00,000

"In this Python course"

Rapidly develop feature-rich applications using Python's built-in statements, functions, and collection types. Structure code with classes, modules, and packages that leverage object-oriented features. Create multiple data accessors to manage various data storage formats. Access additional features with library modules and packages.

Python for Web Development – Flask Flask is a popular Python API that allows experts to build web applications. Python 2.6 and higher variants must install Flask, and you can import Flask on any Python IDE from the Flask package. This section of the course will help you install Flask and learn how to use the Python Flask Framework.

Subjects covered in Python for Web development using Flask:

Introduction to Python Web Framework Flask Installing Flask Working on GET, POST, PUT, METHODS using the Python Flask Framework Working on Templates, render template function

Python course fees and duration

A Python course costs around ₹2200-5000.This course fees can vary depending on multiple factors. For example, a self-paced online course will cost you less than a live interactive online classroom session, and offline training sessions are usually expensive ones. This is mainly because of the trainers’ costs, lab assistance, and other facilities.

Some other factors that affect the cost of a Python course are its duration, course syllabus, number of practical sessions, institute reputation and location, trainers’ expertise, etc. What is the duration of a Python course? The duration of a basic Python course is generally between 3 month to 6 months, and advanced courses can be 1 year . However, some courses extend up to 1 year and more when they combine multiple other courses or include internship programs.

Advantages of Python Python is easy to learn and put into practice. … Functions are defined. … Python allows for quick coding. … Python is versatile. … Python understands compound data types. … Libraries in data science have Python interfaces. … Python is widely supported.

"GRAPHIC DESIGN"

Graphic design, in simple words, is a means that professional individuals use to communicate their ideas and messages. They make this communication possible through the means of visual media.

A graphic designing course helps aspiring individuals to become professional designers and create visual content for top institutions around the world. These courses are specialized to accommodate the needs and requirements of different people. The course is so popular that one does not even need to do a lot of research to choose their preferred colleges, institutes, or academies for their degrees, as they are almost mainstream now.

A graphic design course have objectives:

To train aspirants to become more creative with their visual approach. To train aspirants to be more efficient with the technical aspects of graphics-related tasks and also to acquaint them with relevant aspects of a computer. To train individuals about the various aspects of 2-D and 3-D graphics. To prepare aspirants to become fit for a professional graphic designing profession.

Which course is best for graphic design? Best graphic design courses after 12th - Graphic … Certificate Courses in Graphic Design: Adobe Photoshop. CorelDraw. InDesign. Illustrator. Sketchbook. Figma, etc.

It is possible to become an amateur Graphic Designer who is well on the road to becoming a professional Graphic Designer in about three months. In short, three months is what it will take to receive the professional training required to start building a set of competitive professional job materials.

THE BEST COMPUTER INSTITUTE GOLDEN EDUCATION,ROPNAGAR "PUNJAB"

The best mega DISCOUNT here for your best course in golden education institute in this year.

HURRY UP! GUYS TO JOIN US...

Don't miss the chance

You should go to our institute website

WWW.GOLDEN EDUCATION

CONTACT US: 98151-63600

VISIT IT:

#GOLDEN EDUCATION#INSTITUTE#COURSE#career#best courses#tallyprime#DCA#GRAPHICAL#python#ALL COURSE#ROOPAR

2 notes

·

View notes

Text

NYPD officers in riot gear march onto Columbia’s campus on April 30, 2024, in NYC. Photo: Kena Betancur/AFP via Getty Images

How Much Money Did The NYPD Waste Quashing Student Protests? We Tallied It Up.

The last big protests cost $150 million in NYPD overtime — with tens of millions more in lawsuit settlements.

— Bryce Covert | May 7 2024

IN THE EARLY hours of April 30, Columbia University President Minouche Shafik announced that negotiations with student protesters had failed. She ordered the students, who were demanding that the school divest from Israel, to disband their encampments and end their protests.

Instead, students occupied Hamilton Hall. They renamed the building — which has a long history of occupations — Hind’s Hall in honor of Hind Rajab, a 6-year-old Palestinian girl who was killed in the Gaza Strip by Israeli forces after calling for help in January.

“Every dollar that we spend on policing, especially policing that is suppressing our constitutional rights in a democracy, is an affront.”

That evening, at Shafik’s request, the New York City Police Department stormed the campus for the second time in two weeks. Hundreds of officers in riot gear showed up around 8 p.m., violently mass arresting students, and stayed until at least midnight, when the university said the area had been cleared.

Mayor Eric Adams has called for Columbia to foot some of the bill, but New York City residents are, for now, the ones paying for that violent evening. Based on estimates of the size of the police force and the cost per officer, New York spent at least $200,000 on overtime alone for the four-hour raid to clear Hamilton Hall, according to an analysis by The Intercept.

“Every dollar that we spend on policing, especially policing that is suppressing our constitutional rights in a democracy, is an affront against so many New Yorkers who are in desperate need for economic and social support,” said Jawanza Williams, director of organizing at VOCAL-NY, a community activist group. “The administration has a totally flipped, upside-down perspective when it comes to what should be a priority in the city’s spending and the city’s budget.”

Two hundred thousand dollars may not sound like much, but Williams pointed out that it could, for example, be used staff up the city’s housing discrimination office or even help families stay housed themselves.

The cost of the crackdown — part of a wider NYPD dragnet against Gaza protests — is likely to increase exponentially, especially as protests continue to grow. Large numbers of police can now be seen at most of the daily protests popping up around the city. (The NYPD did not respond to a request for comment.)

Based on past protests, the fiscal toll of the NYPD’s response could easily reach nine figures. Policing of the 2020 George Floyd protests in New York ended up costing the city nearly $150 million in overtime alone — with tens of millions, and counting, in additional settlement payouts in police abuse lawsuits.

Overtime in Overdrive

To make its estimate for the cost of the size of the police force bearing down on Columbia’s campus, The Intercept used public eyewitness accounts, publicly available photo evidence, and software tools for estimating crowd size.

Carla Mende, a graduate student who filmed what happened with a documentary team and recounted her experience to the Columbia Spectator, counted about 500 officers rushing by her. A crowd estimation tool counts nearly 200 officers in two Getty photos of helmeted police swarming the campus. At least 90 officers can be seen in footage of police climbing an armored police vehicle with a ramp on top to enter Hamilton Hall.

The cost of paying NYPD overtime, on average, is $100 per hour per officer, according to an estimate given to The Intercept by the New York City Comptroller’s Office. That means the hundreds of police who showed up at Columbia that night cost New York City hundreds of thousands of dollars in overtime.

Just going by the Mende’s estimate of 500 officers, the city spent $200,000 to clear Hamilton Hall — and that doesn’t count the officers who stayed around after Columbia declared the campus cleared, the use of military-style equipment, or other costs for the massive police mobilization.

Shafik requested that NYPD officers stay on campus from April 30 through May 17.

One student who was arrested that night told student-run radio station WKCR that police taunted the student protesters by telling them about all the overtime they were making.

Millions in Payouts

The April 30 raid on Columbia was just one of a series of recent crackdowns in which police stormed onto New York City college campuses. That same evening, according to Hell Gate, “hundreds” of officers flooded onto the City College of New York’s campus and violently disbanded its encampment. “Well over” 100 cops showed up to disband an encampment at the New School in the early hours of May 3, according to the university’s Students for Justice in Palestine chapter.

In total, the NYPD has arrested nearly 500 people at Columbia, CCNY, Fordham University, the New School, and New York University so far.

The cost of sending NYPD streaming onto college campuses will have to be absorbed by a city budget already under harsh austerity measures imposed by Adams. In September, he told all city agencies to absorb a 15 percent cut after imposing multiple rounds of cuts in 2022.

Public libraries have already eliminated Sunday service, and they’ve warned they’ll soon be forced to cut Saturday service as well. Schools that lost enrollment in the pandemic are at risk of losing funding. The city’s free preschool program for 3-year-olds is getting hollowed out. The city’s drop-off compost sites are permanently closing this month. In his April budget, Adams restored some of the slashed funding, but not all. Among the big-ticket items that the mayor reinstated funding for was money for new classes of police.

Meanwhile, the cost of the current crackdown is only going to grow. The last large-scale NYPD protest crackdown cost the city 1,000 times more than what The Intercept estimates police spent raiding colleges on April 30.

In 2020, when protests over the killings of George Floyd and Breonna Taylor erupted over the summer, huge police forces violently suppressed them. It cost the city $145.7 million in overtime, pushing total NYPD overtime costs to $721 million in 2020, up from $600 million the year before. The figure was the highest number Comptroller Brad Lander’s office documented between 2013 and 2022.

The cost of police overtime also doesn’t account for what the city will have to pay out when protesters sue over mistreatment, as they are likely to do.

The NYPD’s response to the 2020 protests resulted in a $13.7 million settlement for attacking protesters and a $7 million settlement for kettling them. Individual lawsuits added another $12 million in costs as of last summer.

Other large protests, even one-offs, have led to massive legal settlements. The police response to the 2004 Republican National Convention in Manhattan resulted in a $10.3 million settlement paid to protesters and $7.6 million spent on lawyers’ fees.

The city has paid more than $500 million in misconduct settlements over the last six years.

#The Intercept#Money 💰#Millions in Payouts#NYPD | Squashing | Students | Protests#Overtime | Overdrive

2 notes

·

View notes

Note

Congratulations on finishing the David video ! I hope that my well wishes helped you through the process ...Now how long is that therapy bill--

Well thank you! Indeed, those well wishes and those of everyone else sure did help.

Oh, so you wanna know the therapy bill? As in, everything that drove me insane while making it? Here you go!

CW this may come off as a bit of a vent post at times but it’s not actually serious. I’m perfectly fine. I’m perfectly fine. I’m perfectly-

>David as a character being really complicated. This son of a bitch has been my main source of stress over the course of- how long have I been working on this again? I don’t even want to think about it.

>I thank the gods I already had some editing experience because it would have been hell to edit this otherwise. It was still hell, but at least I knew my way around it a bit.

>However, I was rusty at the start, so the editing style fluctuates somewhat noticeably through the video. This isn’t really bothersome for viewers I think, but it annoys me conceptually.

>The audio at the start of the video is bad and I am not fixing it at this point, you all are just gonna have to deal with it. It isn’t unbearable, and it gets way better, but y’know.

>Also I had to get over some performance anxiety that I just don’t like my voice too much if you can just imagine Min’s voice instead of mine that’d be great-

>Ehem-

>Numerals, footnotes, tally 5, all the things that drove me insane before I started making the video.

>Altdrdt was also a small heart attack because what if something about it changes something about the MV- Thankfully nothing can really be connected, so we’re fine.

>Speaking of small heart attacks, the editing software I used (Lightworks free edition) occasionally crashes for no apparent reason, and while I always knew it wasn’t a problem, I did always worry I would lose a lot of progress whenever it happened, so you know, stress.

>Footnote 11. Fuck that one in particular.

>Footnote 8’s non-existence too. At this point I really hope it just doesn’t exist so I don’t have to adjust the explanation I gave for it.

>The world of abnormal sentiment dances. Why is that code so fucking unsolvable tally 5 got solved in like 48 hours-

>”Original”. I don’t feel like color-coding it here, but you know what I’m talking about probably.

>Actually color theory in general. It’s a really good theory, but I have to mention it literally all the time and it drove me insane.

>Language theory too. Why does this MV require knowledge in Japanese I am so done.

>The pronoun “wagahai.” Between this and the Milgram Mikoto “boku/ore” thing I am going to become an expert in Japanese first person pronouns.

>The nursery rhyme “Goodbye triangle, come again square,” and how it’s changed for LGI. I didn’t read into it took much, but just finding it was enough of a headache.

>The line where Xander says David is “just as human as the rest of us.” And y’know, “No Longer Human” and all that. Stop trying to get me to ship Xanvid because it’s gonna work eventually. (It already is).

>Everything is a fucking Hamlet reference. There are eight in total. Sometimes you’ll see a line that’s literally a sentence long, you google it and oops! It’s fucking Hamlet again! “I did love you once, you should not have believed me”, “call the noblest to the audience”, “the purpose of playing is as twere to hold a mirror up to nature,” etc. In fact, there’s a chance you don’t even know what that last one is, because it’s almost fucking translucent in the “clown clown let’s go off and engage in self-delusion” scene.

>Speaking of difficult-to-notice things, the arrow pointing at the Mai portrait in like one frame of the “God is dead” thing. It was pointed out to me after I edited the explanation of that numeral, which is just hilarious, isn’t it?

>I accidentally fell down the LGI rabbit hole while researching too. I ended up falling in love with the character, Ayaka Tsujima, mostly out of Stockholm syndrome, and all the songs are extreme bangers. None of them are on Spotify and I want to cry.

>”Even if you cry, make noise, …” First chorus.

“Even if you cry, make noise, …” Second chorus.

“Even if we cry, make noise, …” Third chorus.

Why is it different? I have an answer in the video, but it sure dealt 12d4 psychic damage when I realized that!

(Is that how psychic damage works? I don’t know I’ve never really been into tabletop RPG.)

>Could J and Whit stop making themselves look like the masterminds please? Veronika too but I don’t think that can really be stopped.

>Xander’s missing eyepatch in the one scene, and the theories which came from it.

>All the lyrics and all the background text augh. It’s so much.

>Why is Min only mentioned like once and very briefly I wanted to gush about her for at least half the video but I could only talk about her for like a minute at most I am so mad.

>The tunnel scene, the tunnel scene. There are so many literary references and none of them really seem related and I don’t think anyone understands my struggle.

>Fucking “””Diana””” in that one scene. How is a character we have three frames of driving me so insane?

>Did you know Socrates, the philosopher, was very Shidou Kirisaki-coded? I learnt that while researching for this video!

… I don’t know how we got there, but it is referenced in a visual gag in the video.

>The David MV was sorta my gateway into Milgram, so you can probably count that as part of the brainrot it inflicted on me as well.

>The amount of times I would google some author or book and the first search result was fucking Bungou Stray Dogs. It wasn’t a big deal but it always amused me.

I could probably continue, but that’s enough for now. Yeah I’m about to single-handedly make a therapist’s entire career.

Anyways, take care! Because I sure need to!

4 notes

·

View notes

Text

Simplifying Tax Filing: The Best Accounting Software Solutions for Indian Companies

Tax filing can be a complex and time-consuming process for Indian companies. However, with the right accounting software, this task can be simplified and streamlined. In this article, we will explore the best accounting software solutions for Indian companies that can assist in simplifying tax filing.

1. Tally ERP 9: Tally ERP 9 is a leading accounting software widely used in India. It offers comprehensive features for managing financial transactions, generating accurate financial reports, and ensuring GST compliance. With built-in tax filing capabilities, Tally ERP 9 simplifies the process of tax computation and e-filing, saving time and reducing errors.

2. QuickBooks: QuickBooks is a popular accounting software that caters to small and medium-sized businesses in India. It provides features like expense tracking, invoicing, and financial reporting. QuickBooks simplifies tax filing by automatically categorizing transactions, generating GST-compliant reports, and facilitating seamless integration with tax filing portals.

3. Zoho Books: Zoho Books is a cloud-based accounting software that offers Indian businesses an efficient way to manage their finances. It provides GST-compliant invoicing, expense tracking, and bank reconciliation features. Zoho Books streamlines tax filing by generating accurate tax reports, providing support for e-way bill generation, and enabling integration with GSTN for seamless filing.

By leveraging these top accounting software solutions, Indian companies can simplify tax filing processes and ensure compliance with GST regulations. These software options automate various aspects of tax computation, generate GST-compliant reports, and facilitate easy e-filing. They minimize manual effort, reduce the chances of errors, and provide businesses with a clear overview of their tax obligations.

In conclusion, choosing the right accounting software is essential for Indian companies looking to simplify tax filing. Tally ERP 9, QuickBooks, and Zoho Books are among the top accounting software solutions that can streamline the tax filing process, saving businesses valuable time and effort while ensuring accuracy and compliance.

2 notes

·

View notes

Text

The Small Business Owner's Guide to Software: Demystifying Tech for Growth in Patna, Bihar

In the heart of Bihar, Patna is witnessing a digital shift in how small businesses function. With growing competition and increasing customer expectations, embracing the right software solutions is no longer a luxury—it's a necessity. At Sanity Softwares, we are committed to helping small businesses in Patna bridge the gap between traditional business models and modern technological solutions.

Why Small Businesses in Patna Must Embrace Software Solutions

Small businesses often face challenges such as manual errors, inefficient workflows, inventory mismanagement, and delayed customer service. The right software tools can automate tasks, streamline operations, and boost overall productivity, enabling businesses to compete effectively and grow sustainably.

Top Business Areas Where Software Can Make a Big Difference

Accounting and Finance Management

Managing accounts manually can be time-consuming and prone to human error. Accounting software like Tally, Zoho Books, and QuickBooks can:

Automate invoice generation

Track expenses and payments

Generate financial reports in real-time

Ensure GST compliance

We, at Sanity Softwares, provide customized accounting solutions tailored for local businesses, helping them stay compliant and organized.

Customer Relationship Management (CRM)

Maintaining customer relationships is vital for repeat business. CRM software helps:

Track interactions

Manage leads and follow-ups

Send automated reminders and emails

Understand customer buying behavior

Local retailers, real estate firms, and service providers in Patna are increasingly adopting CRM tools to strengthen their customer engagement strategies.

Inventory and Billing Software

Running a Kirana shop, pharmacy, or wholesale business? Inventory mismanagement can lead to overstocking or stockouts. Our inventory solutions:

Track stock in real-time

Generate auto-alerts on low inventory

Simplify billing with barcode integration

Offer mobile-based sales reporting

Sanity Softwares specializes in deploying GST-ready inventory and billing software designed specifically for small-scale businesses in Bihar.

HR and Payroll Management Software

Even small businesses with 5–50 employees need an efficient way to manage attendance, salaries, and statutory deductions.

Benefits include:

Automated salary calculation

PF, ESI, and TDS compliance

Biometric attendance tracking

Leave and holiday management

We offer cloud-based payroll solutions with easy-to-use dashboards and local language support for Patna-based companies.

POS Systems for Retailers

Retailers in Patna's Boring Road, Kankarbagh, or even rural outskirts can benefit from Point-of-Sale (POS) systems that:

Process transactions quickly

Accept multiple payment modes

Maintain real-time sales records

Integrate with inventory systems

Our POS solutions are scalable and affordable for startups and growing shops alike.

Why Sanity Softwares is the Go-To Partner for Small Businesses in Patna

Founded with a vision to digitize Bihar's business ecosystem, Sanity Softwares brings:

Local expertise with a deep understanding of regional market needs

Customized software solutions for retail, distribution, education, and service sectors

Dedicated support team to assist with installation, training, and after-sales

Affordable pricing models to ensure even micro-enterprises can digitize affordably

Whether you're an electronics wholesaler in Ashok Rajpath or a boutique in Patliputra Colony, we ensure your transition to software is smooth, supported, and successful.

How to Choose the Right Software for Your Business in Patna

1. Identify Your Business Needs

Start by listing down the processes that consume the most time or are error-prone.

2. Evaluate Features and Scalability

Choose software that grows with your business and includes features you'll need tomorrow, not just today.

3. Ask for a Demo

Before buying, request a live demo. At Sanity Softwares, we offer free trials and demos to help you make an informed decision.

4. Check for Support and Updates

Choose software that offers regular updates, data security, and a responsive customer support team.

Real-Life Success Stories from Patna

Retail Chain in Bazar Samiti

Implemented billing and CRM software from Sanity Softwares. Saw a 40% increase in repeat customers and reduced billing time by 60%.

Tutoring Institute in Rajendra Nagar

Adopted a student management system. Now manages fees, attendance, and exam results digitally with zero paperwork.

Benefits of Going Digital with Sanity Softwares

Boost operational efficiency

Reduce manpower cost

Enhance customer satisfaction

Improve business insights through reports and analytics

We don’t just sell software—we partner with businesses to help them thrive in the digital age.

Frequently Asked Questions

1. I have a very small team. Do I still need business software?

Yes! Even solo entrepreneurs can benefit from automation tools that save time and eliminate manual errors.

2. Do I need to be tech-savvy to use your software?

No. Our solutions are designed for simplicity, and we provide hands-on training and local language support.

3. What kind of support do you offer?

From installation to troubleshooting, our Patna-based support team is always a call away.

4. Can your software handle Bihar’s GST rules?

Absolutely. All our software is 100% GST-compliant and regularly updated as per government mandates.

5. How do I get started?

Just visit sanitysoftwares.com or call us for a free consultation and demo.

Patna’s small businesses are entering a new era. Don’t let outdated methods hold you back. Let Sanity Softwares help you transform, grow, and succeed.

0 notes

Text

BUSY Accounting Software Training | Learn GST Billing & Financial Management

Introduction

In a world where financial accuracy and regulatory compliance are essential for every business, accounting software plays a vital role. One of the standout tools gaining popularity across industries is BUSY Accounting Software. Known for its versatility, BUSY offers a robust solution for managing accounting, inventory, billing, and taxation—all in one platform. For students, job seekers, and professionals, understanding how to navigate such software can significantly elevate their career trajectory. Especially in India’s rapidly growing commercial landscape, learning to use tools like BUSY has become a cornerstone in modern accounting education.

Why BUSY Accounting Software Matters Today

BUSY is more than just a tool for tallying numbers. It allows businesses to track inventory, manage ledgers, generate GST reports, and monitor financial health with accuracy. Its user-friendly interface, along with comprehensive features like multi-location inventory and configurable invoices, makes it suitable for both small enterprises and large corporations.

As companies transition from manual bookkeeping to digital systems, there’s a rising demand for professionals who can operate software like BUSY effectively. This is where structured learning comes into play—building a strong foundation in accounting concepts while also mastering tools that are relevant in today’s job market.

Building the Foundation: Learning the Basics

For anyone beginning their journey in finance, enrolling in a basic accounting course in yamuna vihar can be the first step. These programs usually start with core concepts such as journal entries, ledgers, and trial balances before introducing software tools. By pairing these concepts with practical exposure to BUSY, learners can build a strong base for future specialization.

Some students choose to enhance their understanding through basic accounting classes in yamuna vihar, which often include practical sessions focused on using accounting software. These classes enable learners to see how theoretical knowledge translates into real-time data entry and reporting within platforms like BUSY.

Professional Training and Certification

As one progresses, more intensive learning through an accounting course in yamuna vihar or accounting training in yamuna vihar becomes valuable. These structured programs provide deep dives into tax compliance, inventory control, invoice generation, and financial reporting within BUSY. They also often simulate business transactions so learners can experience real-world applications.

Many opt for accounting certification courses in yamuna vihar to add credibility to their skills. These certifications help learners validate their proficiency with software and increase their employability in sectors such as retail, logistics, and consulting.

Advanced Modules and Business Applications

For those who are more career-focused, business accounting classes in yamuna vihar are particularly useful. These classes focus not only on mastering BUSY but also on understanding its role in business decision-making. Learners explore cash flow analysis, vendor management, and statutory reports—critical for business performance evaluation.

Similarly, a business accounting course in yamuna vihar introduces scenarios like budgeting, sales forecasting, and GST reconciliation. These courses help students grasp how financial software contributes to strategic planning and compliance.

Expanding Opportunities Beyond the Basics

As digital finance becomes the new norm, accounting training in uttam nagar has seen a significant rise in demand. Many learners enroll in an accounting course in uttam nagar to bridge their skill gaps and stay competitive in the job market. These courses often blend theoretical accounting frameworks with live projects in BUSY, giving learners an edge over traditional methods.

To complement these programs, institutions also offer accounting training courses in uttam nagar that focus on automation, audit trails, and payroll processing using BUSY. Such practical exposure helps students gain confidence in working with real data and understand how businesses use software for daily financial operations.

Certifications and Career Growth

Many institutions now offer accounting certification courses in uttam nagar to validate the skills gained through training. These certifications can enhance a resume, giving candidates a better chance at roles like junior accountant, financial analyst, or accounts executive.

To begin at a fundamental level, some students opt for a basic accounting course in uttam nagar followed by basic accounting classes in uttam nagar. These programs typically cover the essentials before transitioning to BUSY, ensuring that students have a well-rounded skill set.

Focusing on Business Accounting

As learners grow more confident, many shift toward business accounting classes in uttam nagar. These classes are designed to align with corporate standards and often include detailed modules on budgeting, internal auditing, and report customization within BUSY. A well-structured business accounting course in uttam nagar usually ends with a capstone project, where students simulate running an entire company’s books using the software.

This practical approach ensures that learners are not only software-savvy but also capable of making informed financial decisions—a quality highly sought after in today’s workforce.

Conclusion

Mastering BUSY accounting software is more than a technical skill—it's a career catalyst in the evolving financial landscape. Whether you're just starting with a basic accounting course or diving into complex business modules, combining accounting education with BUSY proficiency opens up diverse career paths.

The structured approach of blending theory with practical applications—offered through various accounting training courses and certifications—ensures that learners are well-equipped for the real world. From journal entries to tax filings, BUSY simplifies every process, allowing professionals to focus on strategy rather than paperwork.

With the right training and commitment, any student or professional can leverage BUSY to contribute effectively to their organization’s financial health, and in doing so, secure a strong position in today’s digital-first business world.

#BUSY Accounting Software#BUSY Software Training#BUSY Accounting Course#BUSY Software Basics#Learn BUSY Software#BUSY Software for Beginners#Accounting with BUSY Software

0 notes

Text

"Take your business on the go with Hawks Software!

DS SOFTWARE & WEB SOLUTIONS recommends Hawks Software for seamless accounting and business management on your mobile device.

- Access financial reports and statements anywhere, anytime

- Manage inventory and track orders with ease

- Stay connected with your team and clients on-the-go

With Hawks Software, you can:

- Scan invoices and receipts using your device's camera

- Track expenses and manage cash flow

- Generate invoices and quotes on-the-go

Empower your business with mobile accessibility and stay ahead of the curve. Contact DS SOFTWARE & WEB SOLUTIONS to learn more and get started with Hawks Software today!"

#tallyprime#tallysoftware#tallyaccountingsoftware#tally customization#cloud accounting software#billing software

0 notes

Text

Unlock Career Opportunities by Joining the Best GST Course in Noida at GVT Academy

Looking to kickstart or upskill your career in taxation? At GVT Academy, our Best GST Course in Noida is designed with real industry challenges in mind, ensuring practical and job-ready training. This course is perfect for students, professionals, and business owners who want to gain hands-on knowledge of Goods and Services Tax and become job-ready.

Why Choose GVT Academy?

✅ Comprehensive Curriculum – Learn everything from GST Basics, ITC, Registration, Returns, and E-Way Bill to advanced concepts like Audit, Refunds, TDS, and E-commerce taxation. ✅ Real-time Practical Training – File real client data on GST Portal, Tally, and BUSY software with expert guidance. ✅ Includes Income Tax & TDS Modules – Understand personal taxation, ITR filing, TDS returns, exemptions, and much more. ✅ Exclusive Tally + BUSY Training – Learn to generate GSTR reports, TDS returns, and balance sheets directly in accounting software. ✅ Finalization & Banking Module – Gain advanced skills in balance sheet creation, CMA data, project reports, and tax planning.

Learn from experienced faculty and get certified training that enhances your resume and boosts your career growth!

Flexible Timings: 📌 Weekday and Weekend Batches Available 📌 Morning and Afternoon Slots

Join GVT Academy today and become a certified GST expert! Limited Seats – Book Your Spot Now!

1. Google My Business: http://g.co/kgs/v3LrzxE

2. Website: https://gvtacademy.com

3. LinkedIn: www.linkedin.com/in/gvt-academy-48b916164

4. Facebook: https://www.facebook.com/gvtacademy

5. Instagram: https://www.instagram.com/gvtacademy/

6. X: https://x.com/GVTAcademy

7. Pinterest: https://in.pinterest.com/gvtacademy

8. Medium: https://medium.com/@gvtacademy

#gvt academy#gst course#e accounting#data analytics#advanced excel training#data science#python#sql course#advanced excel training institute in noida#best powerbi course#power bi#advanced excel

0 notes

Text

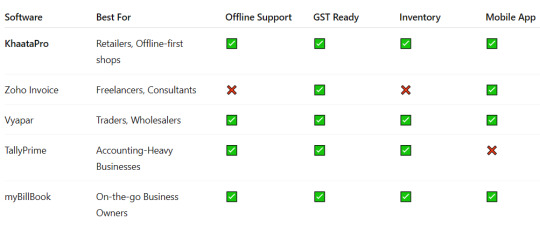

5 Best Billing Software for Small Businesses in 2025

Efficient billing is the backbone of any successful small business. Whether you run a retail shop, offer professional services, or operate a small manufacturing unit, accurate and streamlined invoicing ensures steady cash flow, organized accounts, and simplified tax filing. Thankfully, modern billing software has made it easier than ever to manage business finances.

In this blog, we explore the 5 best billing software ideal for small businesses in 2025 with a spotlight on the rising favorite, KhaataPro.

1. KhaataPro – Smart Billing, Simple Business

Khaata Pro is a powerful and easy-to-use billing software designed specifically for small and medium-sized businesses in India. Launching in 2025, Khaata Pro is poised to become a game-changer for retailers, wholesalers, and service providers who want digital billing without the tech headache.

Key Features:

Offline & Online Billing Modes

GST-Compliant Invoicing

Expense and Stock Management

Customer Credit Tracking

Multi-Language Interface (including English, Hindi, Marathi)

Mobile-Friendly Dashboard for Shopkeepers

Why Choose KhaataPro? With its user-friendly interface, regional language support, and offline functionality, KhaataPro is perfect for shop owners and local businesses that need digital solutions without constant internet access.

2. Zoho Invoice – Ideal for Service Providers

Zoho Invoice is a cloud-based billing solution tailored for freelancers, consultants, and small service-based businesses. It allows users to create professional invoices, automate payment reminders, and track time-based billing.

Highlights:

Customizable Invoice Templates

Client Portals

Online Payment Integrations

Time Tracking & Project Billing

Best For: Freelancers, consultants, and agencies looking for project-based billing with detailed time logs.

3. Vyapar – Designed for Indian Small Businesses

Vyapar is a popular GST billing software used widely in India, especially among traders and local retailers. It offers mobile and desktop support and includes features that go beyond billing, such as accounting, inventory, and order management.

Highlights:

Barcode Scanning & Inventory

Bill-wise Payment Tracking

GST Reports and Filing Assistance

Delivery Challans & Quotations

Best For: Indian shopkeepers and wholesalers who need both inventory and billing in one place.

4. TallyPrime – Trusted Accounting with Invoicing

While Tally is traditionally known for accounting, TallyPrime brings in simplified billing features with a deep focus on compliance and scalability. It suits businesses that need invoicing tied closely with accounting, inventory, and statutory reports.

Highlights:

Invoicing with Inventory Integration

GST and Multi-Tax Invoicing

Bank Reconciliation

Customizable Reports

Best For: Small to medium-sized enterprises that want billing + full-fledged accounting in one package.

5. myBillBook – Mobile-First Billing Software

myBillBook is a modern GST billing app that offers quick invoicing, real-time inventory updates, and analytics. Its mobile-first approach is great for businesses that are always on the move.

Highlights:

Create Bills in Seconds via Mobile

Digital Catalog & Stock Alerts

E-Way Bill Generation

Automatic Payment Reminders

Best For: Mobile-savvy small businesses that want flexibility and accessibility.

Final Thoughts

0 notes

Text

ERP Dubai: The Smart Way to Streamline Your Business in 2025

Introduction: The Digital Shift in Dubai's Business Landscape

Dubai is a global business powerhouse with thriving sectors like retail, logistics, real estate, construction, and manufacturing. As businesses strive to operate faster and smarter, the demand for ERP in Dubai is rapidly increasing. ERP (Enterprise Resource Planning) software helps unify and automate key operations, making it a strategic necessity for forward-thinking businesses in the UAE.

What Is ERP and Why Is It Crucial?

ERP software integrates your business functions—such as accounting, HR, sales, inventory, and procurement—into a centralized platform. This gives businesses real-time insights, reduces manual work, and increases operational efficiency.

Key Benefits of ERP in Dubai:

VAT-compliant accounting and finance management

Automated inventory and supply chain processes

Seamless HR and payroll handling

Real-time dashboards and reports

Multi-currency and multi-language support (including Arabic)

Why ERP Is Gaining Momentum in Dubai

Dubai’s competitive, fast-moving market makes operational efficiency a top priority. With rapid expansion and regulatory compliance requirements, businesses are choosing ERP Dubai solutions for:

📊 Data-driven decision-making

🕒 Faster processes and reduced turnaround time

📈 Scalable solutions for growing companies

✅ Local support and customization for UAE businesses

Top Industries Leveraging ERP in Dubai

Retail & E-commerce: POS, customer data, loyalty programs

Manufacturing: Production, material planning, quality control

Logistics: Warehouse management, fleet tracking, shipping

Construction: Budget control, project scheduling, vendor tracking

Healthcare: Patient records, billing, and compliance management

Best ERP Providers in Dubai

If you’re planning to implement ERP in your business, here are some trusted ERP companies in Dubai:

1. Banibro IT Solutions

Banibro is a reliable Odoo ERP partner in Dubai, offering tailored ERP solutions for SMEs and large enterprises. Their expert implementation services include module customization, integration, training, and support.

2. Focus Softnet

A cloud-based ERP provider with AI-driven features suitable for multiple industries.

3. Sage Middle East

Offers scalable ERP software for finance, HR, and operations, with strong UAE compliance features.

4. Tally UAE Edition

A leading choice for finance-focused ERP needs, especially among small businesses.

Why Choose Banibro for ERP in Dubai?

Banibro IT Solutions stands out for delivering end-to-end ERP Dubai services with flexible deployment, fast implementation, and excellent post-launch support. Whether you're in retail, logistics, or construction, Banibro builds ERP systems that fit your business like a glove.

✅ Ready to Optimize Your Business in Dubai?

Transform your operations with Banibro IT Solutions – your trusted partner for ERP Dubai solutions.

👉 Book Your Free ERP Consultation and take the first step toward streamlined success!

0 notes

Text

Boost Your Accounting Career with Practical e-Accounting

INTRODUCTION

In today’s digitally driven financial world, e-Accounting has become an essential skill for anyone looking to build a stable and rewarding career in the accounting and finance sector. From small businesses to large enterprises, companies are shifting towards digital platforms for managing accounts, taxes, payroll, and financial reports. As a result, practical e-Accounting training is now more valuable than ever—especially for students and beginners looking to enter this dynamic field.

If you’re aspiring to work in accounts, taxation, or finance, enrolling in a Complete e-Accounting Training in Yamuna Vihar or Uttam Nagar can be the smartest step towards building a strong foundation.

What is e-Accounting?

e-Accounting refers to the use of electronic tools and accounting software like Tally, BUSY, and Excel to manage financial data, taxation, GST, TDS, payroll, and other business processes. It’s not just about recording transactions—it’s about understanding how finances flow within an organization using technology. That’s why courses like e-Accounting with Practical Software Training in Uttam Nagar are in high demand.

Why Students Should Learn Practical e-Accounting

For students, especially from commerce backgrounds, practical e-Accounting knowledge opens doors to real-time accounting jobs. The theoretical knowledge from textbooks is useful, but what companies really look for is hands-on experience with real software and business scenarios.

By enrolling in Beginner to Advanced e-Accounting Classes in Yamuna Vihar, students gain valuable exposure to:

Tally ERP for GST and financial accounting

Payroll management systems

Income Tax and TDS calculations

Excel-based financial reporting

Invoice and billing software

Banking and reconciliation practices

The focus is not just on concepts but on practical tasks that accountants handle every day in real organizations.

Key Modules That Shape Your Future

Most well-structured courses such as the e-Accounting and Taxation Course in Uttam Nagar cover a blend of accounting fundamentals and modern software tools. These modules typically include:

Basics of accounting and journal entries

Tally ERP with GST and TDS setup

Payroll & salary structure creation

Taxation basics (GST, TDS, ITR filing)

Bank reconciliation

Excel-based MIS reporting

Business-oriented projects for real-world application

This kind of comprehensive curriculum is also offered under the Advanced e-Accounting with Payroll & GST in Yamuna Vihar, which prepares you for entry-level to intermediate roles in the accounting field.

Certification That Makes You Job-Ready

When you complete training from a Certified e-Accounting Institute in Uttam Nagar, you don’t just gain knowledge—you receive certification that adds real weight to your resume. Employers value certified candidates, especially those trained in software like Tally, Excel, and BUSY, along with knowledge of GST, TDS, and payroll compliance.

Being certified from the Top e-Accounting Institute for Beginners in Yamuna Vihar also helps you stand out during interviews and internship applications.

Real-Time Learning with Practical Software

What makes e-Accounting with Financial Reporting Course in Yamuna Vihar truly impactful is the use of real-time software. You don’t just learn theory; you work on projects using actual accounting tools. This prepares you to step into job roles such as:

Junior Accountant

Accounts Executive

GST & TDS Assistant

Payroll Operator

Data Entry Operator with Finance Skills

Moreover, the e-Accounting with GST and TDS Training in Uttam Nagar ensures that you’re updated with current tax rules and compliance practices, making you immediately useful in any financial organization.

Final Thoughts

In a competitive job market, basic knowledge isn’t enough. Students must be job-ready from day one, and practical e-Accounting training provides just that. Whether you choose to study through e-Accounting Classes for Beginners in Uttam Nagar, the focus should be on gaining real, actionable skills that can help you secure stable employment in finance, taxation, or business accounting.So if you're planning to enter the finance world, now is the perfect time to get certified in e-Accounting—and future-proof your career with practical, hands-on knowledge.

Suggested Links:

TallyPrime With GST

BUSY Accounting Software

e Accounting

GST Course with e-Filing

0 notes

Text

⛽ Petrol Pump Accounting Software – Smart Automation for Fuel Stations in India

Running a petrol pump isn’t just about selling fuel — it’s about managing high-volume transactions, inventory, credit accounts, and daily cash flow with precision. A dedicated Petrol Pump Accounting Software makes all of this seamless, saving time and reducing human errors.

If you're still using spreadsheets or manual ledgers, it's time to switch to a smart, GST-ready accounting system tailored for fuel stations.

✅ Why Petrol Pump Businesses Need Specialized Software

1. Daily Sales & Cash Register - Record diesel, petrol, and lubricant sales per nozzle, meter reading, and shift — with auto calculations of credit and cash flow.

2. Accurate Stock & Tank Management - Monitor tank-wise fuel stock, dip readings, evaporation loss, and fuel receipts from suppliers with real-time tracking.

3. Credit & Party Ledger Management - Manage bulk customers, transporters, and corporate credit accounts with full ledger reports, payment status, and auto-reminders.

4. GST-Compliant Invoicing & Reporting - Generate GST-ready invoices with HSN codes, integrate e-invoicing, and auto-generate GSTR-1, GSTR-3B, and more.

5. Tally & Bank Integration - Easily sync accounting data with Tally ERP and manage receipts, payments, and bank reconciliation directly within the software.

🔍 Top Features of Petrol Pump Accounting Software

🧾 Shift-wise Billing & Cash Collection

⛽ Fuel Stock, Tank & Nozzle Reading Reports

📅 Daily Sales Summary

👨💼 Party-wise Ledger & Payment Tracking

📈 Profit/Loss, Credit Sales, and Tax Reports

🔄 Tally, E-Invoice & Excel Integration

☁️ Cloud Backup + Multi-Location Support

🚀 Automate Your Petrol Pump Today!

Manual errors, missing stock, delayed payments — these are problems of the past. With our Partum Petrol Pump Accounting Software, you get complete control, real-time reports, and error-free operations every day.

📞 Book Your FREE Demo Now! ✅ 10 Days Free Trial | ✅ GST Compliant | ✅ 25 Years Experience

youtube

#PetrolPumpSoftware#FuelStationAccounting#BillingSoftwareIndia#PumpBillingSolution#GSTFuelStation#NozzleReading#PumpLedgerSoftware#FuelManagementSystem#OilBusinessSoftware#AccountingAutomation#Youtube

1 note

·

View note