#tax compliance services

Text

Tax Compliance Services

We provide comprehensive tax compliance services, GST litigation, and Real Estate Regulation Act support across India. Our expert guidance ensures your business remains compliant with all regulations. Trust us to handle your tax needs efficiently, allowing you to focus on growing your business. Stay compliant and stress-free with our professional services.

1 note

·

View note

Text

Stay compliant and avoid penalties with our comprehensive guide to important tax forms. Learn about essential documents and tax compliance services to file your taxes correctly and efficiently.

0 notes

Text

Income Tax Return Filing for the Last 3 Years under Section 139(8A)

Setupfiling.in is an online leading platform that provide #Business Registration, #GST Registration, #Trademark Registration, #DPIIT Recognition, #Project report Preparation, #Income Tax Return Filing and Other #tax compliance services. At setupfiling.in, Entrepreneurs and their Families can avail all CA, CS and Legal work under one platform. Visit us www.setupfiling.in or Contact Us +91 9818209246

#Business Registration#GST Registration#Trademark Registration#DPIIT Recognition#Project report Preparation#Income Tax Return Filing and Other#tax compliance services

0 notes

Text

Discover essential tax compliance tips to streamline your financial responsibilities with our expert tax compliance services.

#tax compliance services#tax compliance solutions#business taxes compliance specialist#tax compliance service

0 notes

Text

Business Setup India | MyCA Cares

MyCA Cares is a Business Setup in India provides all kinds of Startup Registrations, Tax Registrations, Trade Mark Registrations, Legal Support and Accounting services. For More Information Visit Our Website

0 notes

Text

Streamlining UAE Tax Compliance: Saif Chartered Accountants as Your VAT Agent

A VAT Agent, registered with the FTA, assists taxable individuals in fulfilling their UAE tax obligations and rights. Saif Chartered Accountants, as your Tax Agent, offers expertise in Arabic records, compliance, updated tax laws, and effective tax planning, ensuring seamless representation and compliance with the Federal Tax Authority.

0 notes

Text

Business Advisory is a Tax and Compliance Report Management Company in Sydney. Our qualified team helps you stay compliant with all your tax obligations.

0 notes

Text

Tax Workout Group

50 N. Laura Street, Suite 2500, Jacksonville, FL 32202

(904) 544-3778

https://taxworkoutgroup.com/location/jacksonville

Tax Workout Group is a tax attorney firm in Jacksonville, FL, comprised of two main practice groups: Tax Controversy Group and Tax Bankruptcy Group. These two practice groups are comprised of IRS tax and tax bankruptcy attorneys, IRS tax auditors, IRS collection division personnel, Certified Public Accountants, and experienced paralegals and administrative support staff. For each engagement, we assign a highly qualified team of professionals headed by a tax attorney so that every client receives extraordinary senior-level attention throughout the handling of their case.

#Tax Attorney#Tax Lawyer#across the spiderverse#Tax Bankruptcy Lawyer#Tax Bankruptcy Attorney#Tax Controversy Attorney#Tax Compliance Services#Criminal Tax Defense Lawyer#Criminal Tax Defense Attorney

1 note

·

View note

Text

Tax Workout Group

121 S Orange Avenue, Suite 1500, Orlando, FL 32801

(321) 430-1045

https://taxworkoutgroup.com/location/orlando

Tax Workout Group is a tax attorney firm in Orlando, FL, comprised of two main practice groups: Tax Controversy Group and Tax Bankruptcy Group. These two practice groups are comprised of IRS tax and bankruptcy attorneys, IRS tax auditors, IRS collection division personnel, Certified Public Accountants, and experienced paralegals and administrative support staff. For each engagement, we assign a highly qualified team of professionals headed by a tax attorney so that every client receives extraordinary senior-level attention throughout the handling of their case.

#Tax Attorney#Tax Lawyer#Irs Lawyer#Tax Bankruptcy Lawyer#Tax Bankruptcy Attorney#Tax Controversy Attorney#Tax Controversy Lawyers#Tax Compliance Services#Criminal Tax Defense Lawyer#Criminal Tax Defense Attorney

1 note

·

View note

Text

Tax Workout Group

Tax Workout Group

2915 Biscayne Blvd.,Suite 300,Miami, FL 33137

(305) 203-1563

https://taxworkoutgroup.com/location/miami

Tax Workout Group is a tax attorney firm in Miami, FL, comprised of two main practice groups: Tax Controversy Group and Tax Bankruptcy Group. These two practice groups are comprised of IRS tax and tax bankruptcy attorneys, IRS tax auditors, IRS collection division personnel, Certified Public Accountants, and experienced paralegals and administrative support staff. For each engagement, we assign a highly qualified team of professionals headed by a tax attorney so that every client receives extraordinary senior-level attention throughout the handling of their case.

#Tax Attorney#Tax Lawyer#Irs Lawyer#Tax Bankruptcy Lawyer#Tax Bankruptcy Attorney#Tax Controversy Attorney#Tax Controversy Lawyers#Tax Compliance Services#Criminal Tax Defense Lawyer#Criminal Tax Defense Attorney

1 note

·

View note

Text

Regulatory Compliance & Outsourcing Tax Services | Kitescorporate

Looking for Taxation services? We offer a wide range of Tax Planning, Advisory and Regulatory services for businesses of all sizes. Our services include Direct Tax, Indirect Tax, International Taxation, and Tax Litigations matters, we can help you with all your taxation needs.

#Taxation Services#tax and regulatory services#tax compliance services#international taxation india#outsourcing tax services

0 notes

Text

Looking for best tax compliance services near you?

We can help you stay on top of all the required tax compliance forms and tasks. When you have access to everything through our easy-to-use platform, experience improved time and cost management – leaving you more time to focus on your business. https://gracelewiscpa.blogspot.com/2023/02/looking-for-best-tax-compliance.html

1 note

·

View note

Text

Setupfiling.in is an online leading platform that provide #Business Registration, #GST Registration, #Trademark Registration, #DPIIT Recognition, #Project report Preparation, #Income Tax Return Filing and Other #tax compliance services. At setupfiling.in, Entrepreneurs and their Families can avail all CA, CS and Legal work under one platform. Visit us www.setupfiling.in or Contact Us +91 9818209246

#GST Registration#Trademark Registration#DPIIT Recognition#Project report Preparation#Income Tax Return Filing and Other#tax compliance services

0 notes

Text

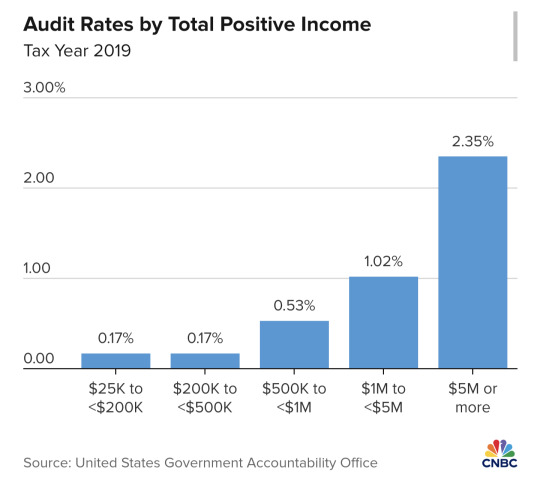

The nation’s millionaires and billionaires are evading more than $150 billion a year in taxes, adding to growing government deficits and creating a “lack of fairness” in the tax system, according to the head of the Internal Revenue Service.

The IRS, with billions of dollars in new funding from Congress, has launched a sweeping crackdown on wealthy individuals, partnerships and large companies. In an exclusive interview with CNBC, IRS Commissioner Danny Werfel said the agency has launched several programs targeting taxpayers with the most complex returns to root out tax evasion and make sure every taxpayer contributes their fair share.

Werfel said that a lack of funding at the IRS for years starved the agency of staff, technology and resources needed to fund audits — especially of the most complicated and sophisticated returns, which require more resources. Audits of taxpayers making more than $1 million a year fell by more than 80% over the last decade, while the number of taxpayers with income of $1 million jumped 50%, according to IRS statistics.

“When I look at what we call our tax gap, which is the amount of money owed versus what is paid for, millionaires and billionaires that either don’t file or [are] underreporting their income, that’s $150 billion of our tax gap,” Werfel said. “There is plenty of work to be done.”

“For complex filings, it became increasingly difficult for us to determine what the balance due was,” he said. “So to ensure fairness, we have to make investments to make sure that whether you’re a complicated filer who can afford to hire an army of lawyers and accountants, or a more simple filer who has one income and takes the standard deduction, the IRS is equally able to determine what’s owed. And to us, that’s a fairer system.”

Some Republicans in Congress have ramped up their criticism of the IRS and its expanded enforcement efforts. They say the wave of new audits will burden small businesses with unnecessary bureaucracy and years of fruitless investigations and won’t raise the promised revenue.

The Inflation Reduction Act gave the IRS an $80 billion infusion, yet congressional Republicans won a deal last year to take $20 billion of the funding back. Now they’re pressing for further cuts.

The Treasury Department said last week it estimates greater IRS enforcement will result in an additional $561 billion in tax revenue between 2024 and 2034 — a higher projection than it had initially stated. The IRS says that for every extra dollar spent on enforcement, the agency raises about $6 in revenue.

The IRS is touting its early success with a program to collect unpaid taxes from millionaires. The agency identified 1,600 millionaire taxpayers who have failed to pay at least $250,000 each in assessed taxes. So far, the IRS has collected more than $480 million from the group “and we are still going,” Werfel said.

On Wednesday, the agency announced a program to audit owners of private jets, who may be using their planes for personal travel and not accounting for their trips or taxes properly. Werfel said the agency has started using public databases of private-jet flights and analytics tools to better identify tax returns with the highest likelihood of evasion. It is launching dozens of audits on companies and partnerships that own jets, which could then lead to audits of wealthy individuals.

Werfel said that for some companies and owners, the tax deduction from corporate jets can amount to “tens of millions of dollars.”

Another area that is potentially rife with evasion is limited partnerships, Werfel said, adding that many wealthy individuals have been shifting their income to the business entities to avoid income taxes.

“What we started to see was that certain taxpayers were claiming limited partnerships when it wasn’t fair,” he said. “They were basically shielding their income under the guise of a limited partnership.”

The IRS has launched the Large Partnership Compliance program, examining some of the largest and most complicated partnership returns. Werfel said the IRS has already opened examinations of 76 partnerships — including hedge funds, real estate investment partnerships and large law firms.

Werfel said the agency is using artificial intelligence as part of the program and others to better identify returns most likely to contain evasion or errors. Not only does AI help find evasion, it also helps avoid audits of taxpayers who are following the rules.

“Imagine all the audits are laid out before us on a table,” he said. “What AI does is it allows us to put on night vision goggles. What those night vision goggles allow us to do is be more precise in figuring out where the high risk [of evasion] is and where the low risk is, and that benefits everyone.”

Correction: The IRS has collected $480 million from a group of millionaire taxpayers who had failed to pay. An earlier version misstated the amount collected.

#us politics#news#cnbc#2024#irs#internal revenue service#Danny Werfel#taxes#tax evasion#private jets#audits#Inflation Reduction Act#treasury department#Large Partnership Compliance#eat the rich#tax the rich#tax the 1%

15 notes

·

View notes

Text

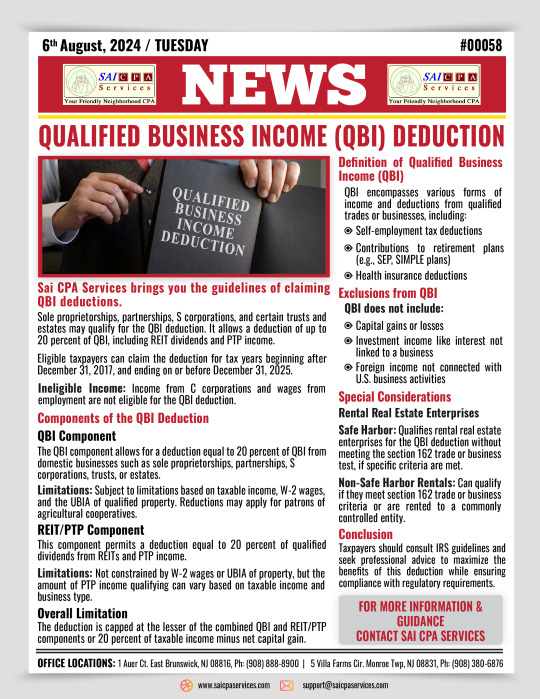

Connect Us: https://www.saicpaservices.com https://www.facebook.com/AjayKCPA https://www.instagram.com/sai_cpa_services/ https://twitter.com/SaiCPA https://www.linkedin.com/in/saicpaservices/ https://whatsapp.com/channel/0029Va9qWRI60eBg1dRfEa1I

908-380-6876

1 Auer Ct, 2nd Floor

East Brunswick, NJ 08816

#saicpaservices#financial services#irs#tax debt#audit#tax compliance#peace of mind#business growth#cpa#new jeresy#accounting#bookeeping#financial planning#BusinessForecasting#financial statements#strategic planning#representation#news#breaking news

2 notes

·

View notes