#tax filing accountant texas

Text

Move To A Darker Place

This is a story of Man Vs. Machine.

---

Last March, my father attempted to file his Taxes.

My beloved father is a Boomer. Unlike most Boomers, my father is rather handy with technology because he was one of the people that had a not-insignificant hand in Developing a hell of a lot of it. He was studying Computer Science at Cal Poly before the computer science degree existed. I have many fond childhood memories of skipping through the aisles of various electronic and computer part warehouses while Dad described something that either terrified the staff or made them worship him as a God. He taught himself how to use his smartphone. Internationally.

So when he saw the option to file digitally with the IRS through the “ID.me” program, he leapt at the chance to celebrate the Federal Government finally entering the Digital Age.

It was all going swimmingly for about six hours, until he was ready to file and the system told him that it needed to verify his identity.

“Very Well.” said my father, a man unafraid of talking to himself and getting something out of the conversation. “It wouldn’t do for me to get someone else’s return.”

The System told him that it needed him to take a “Digital Image ID”.

a.k.a: A Selfie.

“A-ha!” Dad beams. Dad is very good at taking selfies. He immediately pulled out his phone, snapped one, and tried to upload it.

Please log into your Id.me Account and use the provided app to submit your Digital Image ID. The System clarified.

“Oh. You should have said so.” Dad pouted, but used his phone to log onto the ID.me account, do the six security verification steps and double-checked that the filing looked the same as it did on the desktop, gave the IRS like nine permissions on his phone, and held up the camera to take his Federal Privacy Invasion Selfie.

Please align your face to the indicated grid. Said The System, pulling up a futuristic green-web-of-polygons approximation.

“Ooh, very Star Trek. Gene Roddenberry would HATE this!” Dad said cheerfully, aligning his face to the grid. My father is a bit… cavalier, when it comes to matters of personal information and federal government, because he’s been on FBI watchlists since the late 60’s when he was protesting The Vietnam War and Ronald Regan before he’d broken containment.

Alas.

Anyway, there is very little information the federal government does not have on him already, but he’s as good at stalking the FBI as they are at stalking him, and had worked out a solution: He has something approaching a friendship with the local Federal Agent (Some guy named “Larry”. Allegedly), and got Larry hooked on Alternative Histories and Dad’s collection of carefully-researched “there is very likely buried treasure here” stories, and Larry is loath to bother his favorite Historical Fanfiction author too much.

But I digress.

After thinking for a minute, The System came back with an Error Message. Please remove glasses or other facial obstructions.

And here is where the real trouble began.

See, my father wears glasses that do substantially warp the appearance of his face, because he is so nearsighted that he is legally blind without them. His natural focal point is about 4 inches in front of his nose. While Dad can still take a selfie because he (approximately) knows where his phone is if it’s in his hand, he cannot see the alignment grid.

He should ask someone to take it for him! I hear the audience say. Yes, that would be the sane and reasonable thing to do, but Dad was attempting to do taxes at his residence in Fort Collins, while his immediate family was respectively in Denver, Texas and Canada. He tried calling our neighbors, who turned out to be in Uganda.

He looked down at the dog, Arwen, and her little criminal paws that can open doorknobs, but not operate cell phones.

She looked back at him, and farted.

“Well, I’ll give it a try, but if it gives me too much trouble, I’ll call Larry, and Larry can call the IRS about it.” Dad told her.

She continued to watch him. Arwen is an Australian Kelpie (a type of cattle-herding dog), going on 14 years old, deaf as a post and suffering from canine dementia now, but she still retains her natural instinct to Micromanage. She was also trained as a therapy dog, and even if she can’t hear my dad, still recognizes the body language of a man setting himself up for catastrophe.

So, squinting in the late afternoon light next to the back door, Dad attempted to line his face up with a grid he could only sort-of see, and took A Federal Selfie.

The System thought about it for a few moments.

Image Capture Failed: Insufficient Contrast. The System replied. Please move to a darker place.

“...Huh.” Dad frowned. “Alright.”

He moved to the middle of his office, away from the back door, lit only by the house lighting and indirect sunlight, and tried again.

Image Capture Failed. Please move to a darker place.

“What?” Dad asked the universe in general.

“Whuff.” Arwen warned him against sunk costs.

Dad ignored her and went into the bathroom, the natural habitat of the selfie. Surely, only being lit by a light fixture that hadn’t been changed since Dad was attempting to warn everyone about Regan would be suitably insufficient lighting for The System. It took some negotiating, because that bathroom is “Standing Room Only” not “Standing And Holding Your Arms Out In Front Of You Room”. He ended up taking the selfie in the shower stall.

As The System mulled over the latest attempt, Arwen shuffled over and kicked open the door to watch.

Image Capture Failed. Please Move to a Darker Place.

“Do you mean Spiritually?” Dad demanded.

“Whuff.” Arwen cautioned him again.

Determined to succeed, or at least get a different error message that may give him more information, Dad entered The Downstairs Guest Room. It is the darkest room in the house, as it is in the basement, and only has one legally-mandated-fire-escape window, which has blinds. Dad drew those blinds, turned off the lights and tried AGAIN.

Image Capture Failed. Please Move To A Darker Place.

“DO YOU WANT ME TO PHOTOGRAPH MYSELF INSIDE OF A CAVE??” Dad howled.

“WHUFF!” Arwen reprimanded him from under the pull-out bed in the room. It’s where she attempts to herd everyone when it’s thundering outside, so the space is called her ‘Safety Cave’.

Dad frowned at the large blurry shape that was The Safety Cave.

“Why not?” he asked, the prelude to many a Terrible Plan. With no small amount of spiteful and manic glee, Dad got down onto the floor, and army-crawled under the bed with Arwen to try One Last Time. Now in near-total darkness, he rolled on his side to be able to stretch his arms out, Arwen slobber-panting in his ear, and waited for the vague green blob of the Facial grid to appear.

This time, when he tapped the button, the flash cctivated.

“GOD DAMN IT!” Dad shouted, dropping the phone and rubbing his eyes and cursing to alleviate the pain of accidentally flash-banging himself. Arwen shuffled away from him under the bed, huffing sarcastically at him.

Image Capture Failed. Please move to a darker place.

“MOTHERFU- hang on.” Dad squinted. The System sounded strange. Distant and slightly muffled.

Dad squinted really hard, and saw the movement of Arwen crawling out from under the bed along the phone’s last known trajectory.

“ARWEN!” Dad shouted, awkwardly reverse-army crawling out from under the bed, using it to get to his feet and searching for his glasses, which had fallen out of his pocket under the bed, so by the time he was sighted again, Arwen had had ample time to remove The Offending Device.

He found her out in the middle of the back yard, the satisfied look of a Job Well Done on her face.

She did not have the phone.

“Arwen.” Dad glared. It’s a very good glare. Dad was a teacher for many years and used it to keep his class in order with sheer telepathically induced embarrassment, and his father once glared a peach tree into fecundity.

Arwen regarded him with the casual interest a hurricane might regard a sailboat tumbling out of its wake. She is a force of nature unto herself and not about to be intimidated by a half-blind house ape. She also has cataracts and might not be able to make out the glare.

“I GIVE UP!” Dad shouted, throwing his hands in the air and returning to the office to write to the IRS that their selfie software sucks ass. Pleased that she had gotten her desired result, Arwen followed him in.

To Dad’s immense surprise, the computer cheerfully informed him that his Federally Secure Selfie had been accepted, and that they had received and were now processing his return!

“What the FUCK?” Dad glared. “Oh well. If I’ve screwed it up, Larry can call me.”

---

I bring this up because recently, Dad received an interesting piece of mail.

It was a letter from the IRS, addressed to him, a nerve-wracking thing to recessive at the best of times. Instead of a complaint about Dad’s Selfie Skills, it was a letter congratulating him on using the new ID.me System. It thanked him for his help and expressed hopes he would use it again next year, and included the selfie that The System had finally decided to accept.

“You know, my dad used to complain about automation.” Dad sighed, staring at the image. “Incidentals my boy! My secretary saves the state of California millions of dollars a year catching small errors before they become massive ones! He’d say. Fought the human resources board about her pay every year. I used to think he was overestimating how bad machines were and underestimating human error, but you know? He was right.”

He handed me the image.

My father was, technically, in the image. A significant amount of the bottom right corner is taken up by the top of his forehead and silver hair.

Most of the image, the part with the facial-recognition markers on it, was composed of Arwen’s Alarmed and Disgusted Doggy face.

“Oh no!” I cackled. “Crap, does this mean you have to call the IRS and tell them you’re not a dog?”

“Probably.” Dad sighed. “I know who I’m gonna bother first though.” he said, taking out his phone (Dad did find his phone a few hours after Arwen absconded with it when mom called and the early spinach started ringing).

“Hey Larry!” Dad announced to the local federal agent. “You’re never gonna believe this. My dog filed my taxes!”

Larry considered this for a moment. “Is this the dog that stole my sandwich? Out of my locked car?” he asked suspiciously.

“The very same.” Dad grinned.

“Hm. Clever Girl.” Federal Agent Larry sighed. “I figured it was only a matter of time before she got into tax fraud.”

---

I'm a disabled artist making my living writing these stories. If you enjoy my stories, please consider supporting me on Ko-fi or Pre-ordering my Family Lore Book on Patreon. Thank you!

#Family Lore#Dogs#arwen#Arwen the Crime Dog#Taxes#Ronald Regan mention (derogatory)#long post under the cut#this one is funny this time#I could really use some extra tip money this month

9K notes

·

View notes

Text

Things Biden and the Democrats did, this week #9

March 9-15 2024

The IRS launched its direct file pilot program. Tax payers in 12 states, Florida, New Hampshire, Nevada, South Dakota, Tennessee, Texas, Washington, Wyoming, Arizona, Massachusetts, California and New York, can now file their federal income taxes for free on-line directly with the IRS. The IRS plans on taking direct file nation wide for next year's tax season. Tax Day is April 15th so if you're in one of those states you have a month to check it out.

The Department of Education’s Office of Civil Rights opened an investigation into the death of Nex Benedict. the OCR is investigating if Benedict's school district violated his civil rights by failing to protect him from bullying. President Biden expressed support for trans and non-binary youth in the aftermath of the ruling that Benedict's death was a suicide and encouraged people to seek help in crisis

Vice President Kamala Harris became the first sitting Vice-President (or President) to visit an abortion provider. Harris' historic visit was to a Planned Parenthood clinic in St. Paul Minnesota. This is the last stop on the Vice-President's Reproductive Rights Tour that has taken her across the country highlighting the need for reproductive health care.

President Biden announced 3.3 billion dollars worth of infrastructure projects across 40 states designed to reconnect communities divided by transportation infrastructure. Communities often split decades ago by highways build in the 1960s and 70s. These splits very often affect communities of color splitting them off from the wider cities and making daily life far more difficult. These reconnection projects will help remedy decades of economic racism.

The Biden-Harris administration is taking steps to eliminate junk fees for college students. These are hidden fees students pay to get loans or special fees banks charged to students with bank accounts. Also the administration plans to eliminate automatic billing for textbooks and ban schools from pocketing leftover money on student's meal plans.

The Department of Interior announced $120 million in investments to help boost Climate Resilience in Tribal Communities. The money will support 146 projects effecting over 100 tribes. This comes on top of $440 million already spent on tribal climate resilience by the administration so far

The Department of Energy announced $750 million dollars in investment in clean hydrogen power. This will go to 52 projects across 24 states. As part of the administration's climate goals the DoE plans to bring low to zero carbon hydrogen production to 10 million metric tons by 2030, and the cost of hydrogen to $1 per kilogram of hydrogen produced by 2031.

The Department of Energy has offered a 2.3 billion dollar loan to build a lithium processing plant in Nevada. Lithium is the key component in rechargeable batteries used it electric vehicles. Currently 95% of the world's lithium comes from just 4 countries, Australia, Chile, China and Argentina. Only about 1% of the US' lithium needs are met by domestic production. When completed the processing plant in Thacker Pass Nevada will produce enough lithium for 800,000 electric vehicle batteries a year.

The Department of Transportation is making available $1.2 billion in funds to reduce decrease pollution in transportation. Available in all 50 states, DC and Puerto Rico the funds will support projects by transportation authorities to lower their carbon emissions.

The Geothermal Energy Optimization Act was introduced in the US Senate. If passed the act will streamline the permitting process and help expand geothermal projects on public lands. This totally green energy currently accounts for just 0.4% of the US' engird usage but the Department of Energy estimates the potential geothermal energy supply is large enough to power the entire U.S. five times over.

The Justice for Breonna Taylor Act was introduced in the Senate banning No Knock Warrants nationwide

A bill was introduced in the House requiring the US Postal Service to cover the costs of any laid fees on bills the USPS failed to deliver on time

The Senate Confirmed 3 more Biden nominees to be life time federal Judges, Jasmine Yoon the first Asian-America federal judge in Virginia, Sunil Harjani in Illinois, and Melissa DuBose the first LGBTQ and first person of color to serve as a federal judge in Rhode Island. This brings the total number of Biden judges to 185

#Thanks Biden#Joe Biden#Democrats#politics#US politics#good news#nex benedict#abortion#taxes#climate change#climate action#tribal communities#lithium#electronic cars#trans rights#trans solidarity#judges

366 notes

·

View notes

Text

A doctors’ organization at the center of the ongoing legal fight over the abortion drug mifepristone has suffered a significant data breach. A link to an unsecured Google Drive published on the group’s website pointed users last week to a large cache of sensitive documents, including financial and tax records, membership rolls, and email exchanges spanning over a decade. The more than 10,000 documents lay bare the outsize influence of a small conservative organization working to lend a veneer of medical science to evangelical beliefs on parenting, sex, procreation, and gender.

The American College of Pediatricians, which has fought to deprive gay couples of their parental rights and encouraged public schools to treat LGBTQ youth as if they were mentally ill, is one of a handful of conservative think tanks leading the charge against abortion in the United States. A federal lawsuit filed by the College and its partners against the US Food and Drug Administration seeks to limit nationwide access to what is now the most common form of abortion. The case is now on a trajectory for the US Supreme Court, which not even a year ago declared abortion the purview of America’s elected state representatives.

The leaked records, first reported by WIRED, offer an unprecedented look at the groups and personnel central to that campaign. They also describe an organization that has benefited greatly by exaggerating its own power, even as it has struggled quietly for two decades to grow in size and gain respect. The records show how the College, which the Southern Poverty Law Center (SPLC) describes as a hate group, managed to introduce fringe beliefs into the mainstream simply by being, as the founder of Fox News once put it, “the loudest voice in the room.”

The Leak

A WIRED review of the exposed data found that the unsecured Google Drive stored nearly 10,000 files, some of which are compressed zip files containing additional documents. These records detail highly sensitive internal information about the College’s donors and taxes, social security numbers of board members, staff resignation letters, budgetary and fundraising concerns, and the usernames and passwords of more than 100 online accounts. The files include Powerpoint presentations, Quickbooks accounting documents, and at least 388 spreadsheets.

One spreadsheet appears to be an export of an internal database containing information on 1,200 past and current members. It contains intimate personal information about each member, including various contact details, as well as where they were educated, how they heard of the group, and when membership dues were paid. The records show past and current members are mostly male and, on average, over 50 years old. As of spring 2022, the College counted slightly more than 700 members, according to another document reviewed by WIRED.

The breach exposes some material dating back to the group’s origin. It includes mailing lists gathered by the group of thousands of “conservative physicians” across the country. (One document outlining recruitment efforts states in bold, red letters: “TARGET CHRISTIAN MDs.”) The ongoing recruitment of doctors and medical school students seen as holding Christian views has long been its top priority. The leaked records indicate that more than 10,000 mailers were sent to physicians between 2013 and 2017 alone.

While the group’s membership rolls are not public, the leak has outed most if not all of its members. A cursory review of the member lists surfaced one name of note: a recent commissioner of the Texas Department of State Health Services, who after joining in 2019 asked that his membership with the group remain a secret. (WIRED was unable to reach the official for comment in time for publication.)

The SPLC’s “hate group” designation, which the College forcefully disputes, haunted its fundraising efforts, records reveal. A barrage of emails in 2014 show that the label cost the group the chance to benefit from an Amazon program that would eventually distribute $450 million to charities across the globe. Amazon would deny the College’s application, stating that it relied on the SPLC to determine which charities fall into certain ineligible categories.

A strategy document would later refer to a “unified plan” among the College and its allies to “continue discrediting the SPLC,” which included a campaign aimed at lowering its rating at Charity Navigator, one of the web’s most influential nonprofit evaluators. One of the group’s admins noted that despite SPLC’s label, another charity monitor, GuideStar, listed the College as being in “good standing.”

The College’s GuideStar page no longer says this and appears to have been defaced. It now reads, “AMERICAN COLLEGE OF doodoo fartheads,” with a mission statement saying: “we are evil and hate gays :(((”

The Google Drive containing the documents was taken offline soon after WIRED contacted the American College of Pediatricians. The College did not respond to a request for comment.

The Talk

Leaked communications between members of the group and minutes taken at board meetings over the course of several years speak loudly about the challenges the group faced in pursuing its deeply unpopular agenda: returning America to a time when the laws and social mores around family squared neatly with evangelical Christian beliefs.

Many of the College’s most radical views target transgender people, and in particular, transgender youth. The leak, which had been indexed by Google, includes volumes of literature crafted specifically to influence relationships between practicing pediatricians, parents, and their children. It includes reams of marketing material the College aims to distribute widely among public school officials. This includes pushing schools to adopt junk science painting transgender youth as carriers of a pathological disorder, one that’s capable of spontaneously causing others–à la the dancing plague–to adopt similar thoughts and behaviors.

This is one of the group’s most dubious claims. While unsupported by medical science, it is routinely and incuriously propagated through literature targeted at schools and medical offices around the US. The primary source for this claim is a research paper drafted in 2017 by Lisa Littman, a Brown University scholar who, while a medical doctor, had not specialized in mental health. The goal of the paper was to introduce, conceptually, “rapid onset gender dysphoria”—a hypothetical disorder, as was later clarified by the journal that published it. Littman would also clarify personally that her research “does not validate the phenomenon” she’d hypothesized, since no clinicians, nor individuals identifying as trans, had participated in the study.

The paper explains that its subjects were instead all parents who had been recruited from a handful of websites known for opposing gender-affirmative care and “telling parents not to believe their child is transgender.” A review of one of the sites from the period shows parents congregating to foster paranoia about whether there’s a “conspiracy of silence” around “anime culture” that was brainwashing boys into behaving like girls; insights plucked in some cases straight from another, more notorious forum (widely known for reveling in the suicides of the people it has bullied).

A 2021 prospectus describing the group’s focus, ideology, and lobbying efforts encapsulates a wide range of “educational resources” destined for the inboxes of physicians and medical school students. The materials include links to a website instructing doctors on how to speak to children in a variety of scenarios about a multitude of topics surrounding sex, including in the absence of their parents. Practice scripts of conversations between doctors and patients advise, among other things, ways to elicit a child’s thoughts on sex with the help of an imaginative metaphor.

While the material is not expressly religious, it is clearly aimed at painting same-sex marriage as aberrant and immoral behavior. Physicians lobbied by the group are also told to urge patients to purchase Christian-based parenting guides, including one designed to help parents broach the topic of sex with their 11- and 12-year-old kids. The College suggests telling parents to plan a “special overnight trip,” a pretext for instilling in their children sexual norms in line with evangelical practice. The group suggests telling parents to buy a tool called a “getaway kit,” a series of workbooks that run around $54 online. The workbooks methodically walk the parents through the process of springing the topic, but only after a day-long charade of impromptu gift-giving and play.

These books are full of games and puzzles for the parent and child to cooperatively take on. Throughout the process, the child slowly digests a concept of “sexual purity,” lessons aided by oversimplified scripture and well-trodden Bible school parables.

Another document the group shared with its members contains a script for appointments with pregnant minors. Its purpose is made evidently clear: The advice is engineered specifically to reduce the odds of minors coming into contact with medical professionals not strictly opposed to abortion. A practice script recommends the doctor inform the minor that they “strongly recommend against” abortion, adding “the procedure not only kills the infant you carry, but is also a danger to you.” (Medically, the term “fetus” and “infant” are not interchangeable, the latter referring to a newborn baby less than one year old.)

The doctors are urged to recommend that the minor visit a website that, like the aforementioned website, is not expressly religious but will only direct visitors to Catholic-run “crisis pregnancy centers,” which strictly reject abortion. The same site is widely promoted by anti-abortion groups such as National Right to Life, which last year held that it should be illegal to terminate the pregnancy of a 10-year-old rape victim.

The Professionals

The effort to ban mifepristone, legislation the Supreme Court paused last month pending further review, faces significant legal hurdles but could ultimately benefit from the appellate court’s disproportionately conservative makeup. Most of the legal power in the fight was supplied by a much older and better funded group, the Alliance Defending Freedom, which has established ties with some of the country’s most elite political figures—former vice president Mike Pence and Supreme Court justice Amy Coney Barrett among them.

A contract in the leaked documents dated April 2021 shows the ADF agreeing to legally represent the College free of charge. It stipulates that ADF’s ability to subsidize expenses incurred during lawsuits would be limited by ethical guidelines; however, it could still forgive any lingering costs simply by declaring the College “indigent.”

In contrast to the College’s some 700 members, the American Academy of Pediatrics (AAP)–the organization from which the College’s founders split 20 years ago–has roughly 67,000. The rupture between the two groups was a direct result of a statement issued by the AAP in 2002. Modern research, the AAP said, had conclusively shown that the sexual orientation of parents had an imperceptible impact on the well-being of children, so long as they were raised in caring, supportive families.

The College would gain notoriety early on by assailing the positions of the AAP. In 2005, a Boston Globe reporter noted how common it had become for the American College of Pediatricians “to be quoted as a counterpoint” to anything said by the AAP. The institution, he wrote, had a rather “august-sounding name” for being run by a “single employee.”

Internal documents show that the group’s directors quickly encountered hurdles operating on the fringe of accepted science. Some claimed to be oppressed. Most of the College’s research had been “written by one person,” according to minutes from a 2006 meeting, which were included in the leak. The College was failing to make a splash. In the future, one director suggested, papers rejected by medical journals “should be published on the web.” The vote to do so was unanimous (though the board decided the term “not published” was nicer than “rejected”).

A second director put forth a motion to create a separate “scientific section” on the group’s website, strictly for linking to articles published in medical journals. The motion was quashed after it dawned on the board that they didn’t “have enough articles” to make the page “look professional.”

The College struggled to identify the root cause of its runtedness. “To get enough clout,” one director said, “it would take substantial numbers, maybe 10,000.” (The College’s recruitment efforts would yield fewer than 7 percent of this goal in the following 17 years.) Yet another said the marketing department advised that “the College needs to pick a fight with the AAP and get on Larry King Live.” Another, the notes say, felt the organization was too busy trying to “walk the fence” by neglecting to acknowledge that “we are conservative and religious.”

74 notes

·

View notes

Text

Okay I lied, I have more Lone Star thoughts. This is gonna make my blog theme so bad, oh god.

Carlos’ secret brings up so many plot holes like it just feels like… logistically and legally, things are missing, you know?

Carlos obviously has a will. TK saw him working on it, he is apparently in it (from Nancy’s joke about it). So the fact that Carlos is in fact legally married and doing a bunch of stuff like owning property with someone else, having a legal will, and who knows if TK and Carlos have any linked banked accounts… From a legal standpoint it just feels like this would’ve been something that was even alluded to earlier, if not on screen than at least by TK. Like “Oh you’re married, that explains that thing,” type of thing.

They also own the loft together, and I looked it up. This is what it says about owning property in Texas:

You’re telling me, that with all the paperwork it takes to buy a house (the loft counts as house property), the fact that Carlos is legally married never came up? Yes, I know Carlos technically bought it and put TK on the deed, but I’m pretty sure TK would have still had to sign the deed later on for security reasons in case of anything, since he is an equally party in the property. Not to mention the mortgage. All the paperwork with absolutely everything in their lives. Everything and there was never even a whiff of suspicion from TK? “Hey babe? Can I see the deed?” Hey babe, why is your martial status on this say you’re married? We’re only engaged, baby!” “Hey babe, sorry I’m totally reading your taxes over your shoulder, but I think the accountant messed this up. It says you filed your taxes separately, but you have a spouse and we’re not legally together.”

TK the boy who was cheated on is missing signs? I don’t think so.

Sorry, I don’t mean to put logic into the firefighter/paramedic/cop/freak natural disaster and newly founded white supremacist gang show… but as someone who is a screenwriter themself (hi, yes, me)… the bare minimum you can do is look up logical things.

#911 ls spoilers#911 ls s4#911 ls#911 lone star spoilers#911 lone star 4#911 lone star#the new hotness spoilers#Tarlos spoilers

10 notes

·

View notes

Text

Introductions

[First] [Previous] [Next]

Introductions

After Duck got off of Clementine, and the group of seven were sat in the living room, Kenny started to introduce himself and his family.

“I met Sarita a few weeks after moving to Texas.” Kenny gestured to her, his eyes kept going to Clementine, “Things were a bit… turbulent after…”

“Yeah, we, er, it’s in Clem’s file.” Said Alvin, scratching the back of his head.

“Oh, right…” Kenny trailed off, glancing at Clementine, “Sorry, it’s just been so long since we last saw Clem, how’s things been treating her?”

“I’ve gone through eleven families, ten since this is my second stint with Alvin and Rebecca.” Said Clementine, scratching her knee, “A few things happened.”

“Hmm.” Kenny frowned and looked at Clementine’s left hand, “What happened to your hand?”

Clementine immediately covered her left hand with her right, “It’s a long story.”

“When we last saw Clementine, she was with Omid and Christa.” Said Duck, getting a flinch from Clementine.

“Y-yeah.” Clementine looked at the floor, “They, er, they gave me back.”

“They what?” Demanded Kenny, looking furious, “They promised Lee they’d look out for you!”

“T-they were going to have a baby and-” Kenny cut Clementine off.

“Clem, they promised Lee and Carley, a later me, that they’d keep you safe, fed and watered,” Interjected Kenny, “They were being given money to help!”

“Wait, what do you mean ‘they were being given money’?” Asked Rebecca, frowning.

“Clementine’s Lee and Carley’s sole beneficiary,” Explained Kenny, “Since Lee’s folks and brother were killed in that drug store fire in Macon and Carley wasn’t on speaking terms with hers, they left everything they had to Clementine.”

“What?”

Kenny looked at Clementine, startled, before scowling, “Of course, they didn’t bother to explain it to you.”

“I’m sorry, but Lee and Carley?” Asked Alvin, “As in her first set of foster parents?”

“And in my opinion, they should’ve been her only set of foster parents, no disrespect to y’all.” Said Kenny, “That sick bastard didn’t deserve to live after what he did.”

“W-what do you mean everything?” Asked Clementine, getting Kenny’s attention.

“Well, there’s the pharmacy, now it’s back up a running, their belongings, or at least the bits that haven’t been sold, and all of their money, plus whatever was made from the selling of their belongings.” Explained Kenny, “After the oh so wonderful invention of taxes, I’d say you’d have at least a couple hundred thousand dollars.”

Rebecca frowned, “I hope it’s in a secure account, so she can access it when she’s older.”

“Yeah, but the only ones with the details are Omid and Christa.” Grumbled Kenny, “I used to have the details, but I destroyed my copies after my, er, incident.”

“Dad had a mental breakdown after mom died.” Said Duck, cheerfully.

“Duck!” Scolded Sarita, as Kenny facepalmed.

“Sorry, I derailed this whole conversation.” Apologised Kenny, looking over at them.

“It’s fine,” Rebecca waved him off, “Clem actually came back to us at the end of August, she’s been with us ever since. She’s actually made a couple of friends.”

“Really?” Asked Kenny, looking at Clementine, who was still looking at her knees, “What’re their names, Clem?”

“W-well, there’s Sarah, she kind of like Duck, but she quieter, and smart,” Duck pulled a face, “There’s Becca, she used to be a bully, and then there’s Gill, he was just there.”

“What do you mean ‘he was just there’?” Asked Kenny, frowning.

“We met him while we were doing detention.” Answered Clementine, “Other than that, we’d never met him before.”

“How’d you meet the other two?” Asked Sarita, finally fixing her hand.

“I met Sarah before school started,” Said Clementine, pausing for a moment, “and I met Becca after I beat her up for bullying Sarah.”

Kenny and Sarita stared at Clementine, slack jawed.

“…I apologised?”

“Is, is there anything else that might surprise us?” Asked Kenny, in disbelief.

“I saw a guy get his skull caved in?”

“What?!”

I

Clementine winced as Duck talked at a mile a minute, she guided him through the packed school corridors, glaring at everyone in front of her. A plus, she supposed, of beating someone up on the first day of term. No one wanted to cross her.

“Hey, Clem.” Greeted Gill, before spotting Duck, “Who’s that?”

“This is Duck, his real name’s Kenneth, he’s moved in next door.” Said Clementine, as Duck looked around, “He also knew me a few years ago.”

“So, he’s a ‘level four friend’?” Asked Gill, as Becca joined them.

“Who’s the cunt?”

“…I see you’re all caught up with Game of Thrones.” Said Gill, as Clementine sighed.

“I’m going to wait for Sarah to get here, before repeating myself.” Grumbled Clementine, dropping into a chair.

“Ooh.” Said Duck, getting their attention. They saw Duck pressed against the glass of a fish tank, staring at the fish. Becca slowly turned and looked at Clementine, “I think Sarah’s going to be a while.”

Sarah walked in, her head buried in her book, Clementine noticed it was a different to the one she was reading the day before.

“Did your dad not like Storm of Swords?” Asked Clementine, finally catching the books title, “What makes him think The Hobbit is any better?”

“There isn’t any swearing in it.” Answered Sarah, looking up from the book’s pages.

“How do you walk with your face in that thing?” Asked Gill, taking his eyes off Duck.

“I shuffle.” Sarah spotted Duck, “Who’s that?”

The four looked over at Duck.

“An old friend from a few years ago, he’s moved in next door to Alvin and Rebecca.” Clementine watched Duck tap on the glass, “He’s about a smart as a bag of hammers.”

“A bag of hammer can’t talk.” Interjected Duck, looking away from the fish tank, “None of those fish are real.”

The leant to look behind Duck, and stared at the plastic fish wiggling in the water.

“I’ve been putting fish food in that thing.” Stated Clementine, outraged, “For three months!”

“You know, that explains a few things.” Said Gill, still watching the plastic fish.

I

Clementine grunted as she, Becca, Sarah and Gill tried to move a car stuck in some mud. Luke and Pete had made another appearance, while Daryl quietly watching the two and the children. Nick dropped his head against the steering wheel.

“Okay, stop!” Called Nick, shoving the car door open, “It’s not going anywhere.”

“We could try and tow it out.” Suggested Gill, panting as he leant against the car.

“The tractor is back at the school, and that’s if the school lets us borrow it.” Responded Daryl, running a hand down his face.

“What if we pulled from the front?” Asked Clementine, shivering from the cold.

“That just runs the risk of one or all of you getting hit by a car.” Dismissed Luke, looking at the wheels, “We could try the wood again.”

“Nah, it’d just slide right on under and shoot out the other side.” Refuted Daryl, glaring at the vehicle, “We might have to leave it for tonight.”

“That’s alright,” Snarked Becca, “I’m sure none of us mind freezing our tits off.”

“Or, in your case,” Responded Gill, “your nubs.”

“We could move it, if the three adults actually help.” Stated Clementine, throwing a glare at Daryl, Pete and Luke.

“Fair point.” Conceded Daryl, jerking his head and motioning for Pete and Luke to help.

Nick got back int the car and the group of seven all shoved the car. A couple moments passed, before the car suddenly shot forwards out of the mud. That left Clementine, Sarah, Becca and Gill to fall, face first, into the mud, with three grown men dropping on top of them.

“Well,” Said Luke, getting to his feet and helping Pete up, “That was fun.”

Daryl scoffed, before helping the kid up, “We’re done for today, go clean yourselves up and get home.”

Becca spat some mud out of her mouth, while Sarah wiped mud off her glasses.

“Well,” Said Gill, after getting the mud out of his eyes, “At least it wasn’t manure.”

“Still smells bad.” Muttered Clementine, as they headed back to the school building, “The showers should still be open.”

I

“You know, I just realised something.” Said Becca, making Sarah and Clementine jump, “That was our last detention.”

“Yay,” Muttered Clementine, “you guys still free this weekend?”

“My dad’s going to be working, so I shouldn’t be doing anything.” Replied Sarah, as Clementine popped her back.

“Same, more or less, why?” Said Becca, as she washed the mud of her face.

“There’s that movie, you know, the horror movie of the century.” Answered Clementine, “I was thinking on going and seeing it.”

“Is Duck going to be there?” Asked Becca, turning the shower off.

“I don’t know yet.” Said Clementine, “I haven’t asked him.”

“What’s up with Duck, anyway?” Asked Sarah, stepping out of the shower.

“He and I were friends a few years ago, we, er, we saw his mom kill herself.” Said Clementine, “Duck, for the most part, shut down. The last time I saw him, it was like he was a ghost. I was actually surprised to see him smiling.”

“I can’t believe I’m saying this,” Said Becca, “but, I think he should come with us.”

“The anti-social member of our group, who doesn’t like new people, is suggesting we invite someone new to a gathering?” Snarked Clementine, towelling herself dry.

“He’s new to us, not you.” Retorted Becca, pulling her shirt of her head, “I thought it might be nice if you had someone with something in common to talk to.”

“That and the movies has a deal for free food for a group of five.” Stated Sarah, pulling her jeans on, “But, other than that, I think Becca’s right.”

“…Thanks.”

“Is your dad picking us up?” Asked Sarah, looking at Clementine, “His car is really warm.”

I

“There’s three hours we’re never going to get back.”

Clementine hummed, agreeing with Becca.

“The scariest part was the opening credits, and that was because it was in 3D!” Grumbled Sarah, as Duck looked at the poster for the movie.

“Maybe it was mis-listed.” Suggested Duck, getting everyone’s attention, “The actors are all some form of comedian.”

Everyone stared at Duck, before looking at the poster.

“That would explain the sex scene.” Stated Gill, frowning.

I

“You know,” Said Becca, looking around Alvin and Rebecca’s living room, “This place is bigger than I expected.”

“It’s the front,” Said Duck, getting comfortable in an armchair, “It’s kinda narrow, but it’s long.”

Becca hummed, as the dvd Clem put on started. Clementine dropped down next to Sarah, as Gill sat in the other armchair. Becca dropped herself down on the other side of Sarah. They made idle conversation, while the movie played.

“If you were to have any limb amputated, which one would it be?” Asked Becca, getting disturbed looks from everyone.

“Weird question,” Said Duck, “I don’t think I’d lose a limb.”

“Me neither.” Agreed Sarah, looking at Sarah.

“Any limb?” Asked Gill, frowning, “What constitutes as a limb?”

“I think she means an arm or a leg, Gill.” Responded Clementine, “I’d lose one of my legs.”

“I’d lose a finger.”

“Becca, I’m not sure that’s a limb.” Said Duck, as Clementine adjusted herself on the sofa.

“It’s part of your body, it’s a limb.”

Clementine snorted, glancing at them, “Then I should’ve been exempt from this.”

“Oh, yeah.” Muttered Becca, as Clementine wiggled her half-finger at her.

I

“I thought this was supposed to be a short-cut.” Huffed Duck, as Clementine walked a couple feet a head.

They were walking through a forest, heading back to a cabin Alvin had rented near the school. Luke, Pete and Nick had offered to take Clementine and her friend hunting and, while Rebecca didn’t like the idea of teaching the children how to handle a gun, Clementine’s foster parents agreed. The trio were on their way back from a riverbank not far from the cabin.

“I said it was a detour, not a short cut.” Stated Becca, stopping to let Duck catch up.

“What do you think Gill and Sarah are doing?” Asked Duck, making Clementine glance back at him and Becca.

“Sarah’s probably going through that first aid course and Gill’s spending time with his parents.” Shrugged Clementine, absently rubbing her arm, “I can still feel that coyote.”

“I can still see it.” Muttered Becca, as Duck tripped over a root, “For fucks sake, Duck.”

“Sorry.”

“That’s what, the twentieth time?” Asked Clementine, before someone bumped into her.

“Oh, jeez, sorry kid.”

Clementine froze at the voice, before she slowly turned and looked at the voice’s owner.

“Clementine?” Asked Jane, glancing around the group, “Who’re these guys?”

“Wouldn’t you like to know.” Grumbled Clementine, “What are you doing here?”

“I was out for a walk.” Answered Jane, jogging to keep up.

“Okay, fuck off.”

Jane froze, allowing Clementine and her friends to put a little bit of distance between them and Jane.

“So,” Asked Becca, “Who’s that?”

“Foster parent number eleven, I think.” Answered Clementine, looking at Becca, “She’s the one I was with when Sam, that dog I told you about, bit me and tore a chunk out of my arm. She took one look at me and ran off, leaving me with a mangled arm and a dog trying to kill me.”

“W-what happened to the dog?” Asked Duck, swallowing.

“I, I had to kill it.” Responded Clementine, “Jane took me camping, and one of the tents had a branch land on it, breaking it,” Clementine wiped her eyes to get rid of the burning feeling, “I kicked him onto some spikes while I was trying to get him off me. It would’ve been cruel to let him suffer like that. But, afterwards, I had to scavenge what first aid I could and stitched my arm up. I don’t remember much else, but I know I passed out and, when I woke up, I was in a hospital bed. I remember seeing Bonnie and meeting someone called Jean or something. I, apparently, came really close to dying.”

“Whoa.” Whispered Becca, getting a snort from Clementine.

“You want to know the funny part?”

“What?” Asked Duck, swallowing thickly.

“I was disappointed.” Stated Clementine, hollowly, “I was the happiest I’d ever been, when I was dying. It was so peaceful…”

“And then you woke up.” Finished Becca, getting a scoff from Clementine.

“Yeah, then I was dragged back into the fucked-up reality of my life.”

Becca glanced behind her, quietly noting that Jane had a guilty look on her face.

They spotted the cabin and Clementine power walked over to it and tore the door open. She rushed up the stairs and into the room she was sharing with Becca for the trip. Rebecca and Alvin looked after her, stunned at the silent fury the girl was emanating, before looking back at the door as Becca and Duck walked in.

“Is everything okay?” Asked Alvin, as Rebecca got up and went up to the room Clementine was in.

“Clem, she, uh,” Duck looked at the floor, “she ran into someone from her past and things kinda ended up spilling out.”

Alvin sighed, before glancing up at the door to the room Clementine was in. He noted that Rebecca wasn’t by in, so he assumed she was in the room with Clementine.

Up in the room, Rebecca held Clementine, as she finished telling her what she told Becca and Duck, as she started to bawl. Clementine buried her face in Rebecca’s shoulder, her tears wetting the fabric.

“Why?” Sobbed Clementine, making Rebecca freeze.

“Why what, Clem?” Asked Rebecca, gently, as Clementine hiccupped.

“Why does everyone leave me?!” Wailed Clementine, her voice slightly muffled by Rebecca’s shoulder, “Why doesn’t anyone want me?”

“That’s not true,” Murmured Rebecca, “Alvin and I want you; we’re not going to leave you. Not again.”

“T-that’s w-what L-L-Lee a-and C-Carley said!” Cried Clementine, as Rebecca tightened the grip on Clementine.

Rebecca sighed through her nose and looked up at the ceiling, holding onto Clementine as she cried.

I

“Hey, Clem,” Said Sarah, sitting across from Clementine in the school cafeteria, “When’s your birthday?”

“October 26th.” Answered Clementine, not looking up from her book.

“Wait, what?!” Exclaimed Becca, jumping up, “We passed over your birthday and you didn’t say anything?!”

“It’s not a big deal.” Shrugged Clementine, looking up, “That last birthday I celebrated was my seventh birthday and that ended with my first set of foster parents being murdered.”

Duck flinched and winced, “Oh, yeah. I guess that put a dampener on things.”

Clementine snorted, “You could say that.”

“So, you’re, what, thirteen now?” Asked Gill, making Clementine look at him.

“I think so.”

“Do you celebrate Christmas?” asked Becca, making Clementine look at her.

“Yeah, I celebrate Christmas, it’s the only holiday that I can remember having a fixed date.” Stated Clementine, digging her phone out of her pocket. The battered brick looked tiny when she put it on the table, Clementine picked the phone back up and then struck the table with it. The phone turned on, making Clementine put it back on the table.

“That’s starting to become annoying.” Said Gill, as Clementine started checking her texts.

“Trust me, you don’t want this as an alarm clock.” Muttered Clementine, as the phone died on her, “Shit.”

“Where’d Alvin and Rebecca get that?” Asked Sarah, looking down at the phone, “And why didn’t they get you one that worked?”

“It worked when I got it.” Muttered Clementine, scowling at the phone, “Then I dropped it in a river…and forgot to take it out of my pocket when I put them out for the wash.”

The group stared at Clementine, who shifted in her seat, “I’ve got a lot going on.”

I

“You remember Chuck?” Asked Duck, making Clementine jump.

“Yeah, what about him?”

“Do you think he’s still alive?” Murmured Duck, talking quietly so he didn’t wake the rest of their friends. Sarah had invited them all to a sleep over, with the three girls joking about putting make up on the boys.

“I like to think he’s got his guitar and he’s travelling across the country, exploring everything he can find.” Whispered Clementine, smiling gently, “I bet he’s dragging Ben and Molly all over, drinking everything they can find.”

“I miss them.” Sighed Duck, “I miss how simple things were then.”

“Yeah.”

“I can still see it, sometimes,” Whispered Duck, making Clementine look at him, “I see Mom sitting us down, telling us to keep looking at her-”

Duck’s voice cracked, before he swallowed and continued, “Telling us to keep looking at her, a-and then she got that fucking gun.”

Clementine swallowed thickly, her gaze returning to the ceiling, “What happened after, after Kenny placed me with Omid and Christa?”

“He had a breakdown, started drinking,” Answered Duck, “He nearly crashed into a lake, he was driving drunk. After that, I was placed with my aunt. Dad went to rehab, he and I have been only been back together for about a year.”

“Well,” Said Clementine, looking over at Duck, “not to sound unsympathetic, but at least your dad came back for you.”

Duck winced, looking back at Clementine, “I guess I was lucky, I thought that he wasn’t for a while. I hated him for ages, I guess I still do at times, for ages I thought I lost my parents and my sister in the span of three weeks.”

“Ha.” Laughed Clementine, “I managed to get handed back to social services in that time.”

Duck snorted, “I thought I had it bad, but hearing the stuff you went through, I don’t think I’d be here today, if it happened to me.”

Clementine snorted quietly, “We’re so fucked up.”

“Yeah.” Agreed Duck, before slowly falling back asleep, with Clementine not far behind him.

I

Clementine looked around the Ski lodge that had been rented by the large group she was in. Sarita and Sarah were decorating a giant Christmas tree, while Becca helped Shel and Gill’s dad, Randy, shift some tables. Alvin and Kenny sorting through the Christmas light, with Alvin finding a laser pointer. Rebecca was sitting off to the side with AJ, while Duck, Gill and Carlos shifted some of the furniture.

“And, done!” Said Patricia, making Clementine look up at her.

“It feels kinda weird.” Admitted Clementine, nervously fiddling with the necklace Sarah had given her as a late birthday present.

“You’ll get used to it, there’ll be a day when you’re not wearing it and it’ll feel wrong.” Assured Patricia, looking over the group, “I hope you don’t mind, but Gill told me about that dog attack you suffered from.”

“I’ve told a few people, so don’t worry about it.” Responded Clementine, looking around.

“If it helps, I’m a professional counsellor,” Said Patricia, “I can speak with one of my colleagues about arranging some session with you.”

Clementine looked at her feet, “Can, can I think about it?”

“Take all the time you need.” Patricia reassured her.

“Hey, Clem,” Said Becca, getting Clementine’s attention, “I’ve been meaning to ask, how come you never take that hat off?”

Clementine stiffened slightly, before answering, “It was one of the last things Lee gave me.”

“So, it has sentimental value.” Grunted Becca, shoving the table, “I still don’t get, how you seem to keep having accidents, I mean you’re not clumsy, but you keep getting bruises all over the place.”

“I’ll tell you, but only if you never tell anyone else.” Said Clementine, leaning forwards.

“Sure, we won’t tell a soul.” Said Becca, making Clementine lean back.

“I kept losing a fight against a tree.”

Everyone stopped and looked at Clementine, there was a moment of silence, before Duck started laughing.

“A tree broke your arm!”

Within moments, everyone was laughing, Clementine cracking a smile as Duck slipped and crowned himself on the sofa.

#the walking dead game#twdg clementine#twdg becca#twdg sarah#twdg gill#twdg duck#twdg alvin#twdg aj#twdg rebecca#twdg kenny#twdg sarita#twdg family au#delta writes#twdg luke#twdg nick#twdg pete#peter joseph randall#daryl dixon#twdg jane#twdg randy#twdg patricia#twdg shel#twdg carlos

10 notes

·

View notes

Text

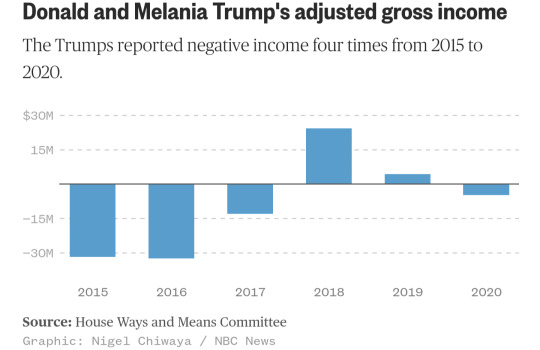

A House committee on Friday made public six years of former President Donald Trump's tax returns, which showed he paid relatively little in taxes in the years before and during his presidency.

The House Ways and Means Committee had voted to make the thousands of pages of returns public in a party-line vote last week, but their release was delayed while staffers redacted sensitive personal information like Social Security numbers from the documents. Friday's release, the culmination of years of legal wrangling and speculation, included both personal and business records.

Trump on Friday blasted the release in a statement and on his Truth Social platform, saying “the Democrats should have never done it, the Supreme Court should have never approved it, and it’s going to lead to horrible things for so many people."

He also maintained the returns he fought to keep hidden — despite modern precedent that Presidents make their returns public — "show how proudly successful I have been and how I have been able to use depreciation and various other tax deductions as an incentive for creating thousands of jobs and magnificent structures and enterprises.”

The panel’s top Republican, Rep. Kevin Brady of Texas, called the release of the documents “unprecedented,” and said Democrats had unleashed “a dangerous new political weapon that reaches far beyond the former President, overturning decades of privacy protections for average Americans.”

“This is a regrettable stain on the Ways and Means Committee and Congress, and will make American politics even more divisive and disheartening. In the long run, Democrats will come to regret it,” Brady said.

The returns confirm much of what was contained in a 39-page report from the Joint Committee on Taxation released last week, including summaries from Trump’s personal tax forms and business entities.

For example, in 2020, Trump appeared to owe nothing in taxes, the report showed. That was thanks to Trump claiming $15 million in business losses, which resulted in him having negative $4 million in adjusted gross income. Trump then claimed a $5 million refund.

Trump reported millions in negative income in 2015, 2016, 2017 and 2020, and he paid only $750 in federal income taxes in 2016 and 2017.

In 2019, Trump and his wife, Melania, reported significant losses of more than $16.4 million but reported a total income of $4.4 million.

The returns also show Trump had numerous foreign bank accounts between 2015 and 2016, including in China, the United Kingdom, Ireland and St. Martin. The existence of the China account was first reported by the New York Times in 2020. Trump Organization lawyer Alan Garten told the paper then that the company had “opened an account with a Chinese bank having offices in the United States in order to pay the local taxes” after opening an office “to explore the potential for hotel deals in Asia.”

The other accounts were in countries where Trump had properties. His 2018 through 2020 returns only note having an account in the U.K. “I have many bank accounts and they’re all listed and they’re all over the place,” Trump said during an Oct. 2020 presidential debate. “I was a businessman doing business.”

The committee report also listed several overarching issues it believed the IRS should have investigated. For example, Trump claimed large cash donations to charities, but the report said the IRS did not verify them. The report also said that while Trump’s tax filings were large and complicated, the IRS does not appear to have assigned experts to work on them.

The Ways and Means Committee separately released a 29-page report summarizing its investigation into an IRS policy that mandates audits of returns filed by presidents and vice presidents. The committee found that the IRS had largely not followed its own internal requirements, beginning to examine Trump’s returns only after the House panel inquired about the process. Just one year of Trump’s returns was officially selected for the mandatory review while he was in office, and that audit of Trump's 2016 taxes was not complete by the time he left the White House, according to the report.

An audit of Trump's 2015 taxes was started shortly before the 2016 audit in 2019 — the same day the Ways and Means committee asked for information on the mandatory audits. Neither the 2015 audit nor audits of Trump's 2017-19 taxes that began after he left office were marked as being part of the audit program, and as of last month, none had been marked as completed either, the committee said.

The committee obtained Trump's tax returns in November, following a yearslong court fight for documents that other presidents have routinely made public since the 1970s.

The dispute ended up at the Supreme Court, which rejected Trump’s last-ditch plea to block the release of his tax records to House Democrats in a brief order handed down just before Thanksgiving.

Trump's refusal to release his returns led to a swirl of suspicions about what he might be trying to hide — foreign business dealings, a smaller fortune than he'd claimed publicly or paying less in taxes than the average American.

During the 2016 campaign, Trump maintained that he couldn't release his returns because they were under audit, and that he would make them public when it was completed — a vow he walked away from after he took office.

Information about his taxes has dripped out over the years.

In October 2016, The New York Times published some of Trump's 1995 state taxes and reported that he'd declared a $916 million loss that year. Three tax experts hired by the paper said the size of the loss and tax rules governing wealthy filers at the time could have allowed Trump to legally pay no federal income taxes for 18 years.

After Trump took office in 2017, reporter David Cay Johnston went on MSNBC's "The Rachel Maddow Show" with what he said were two pages of Trump's Form 1040 from 2005.

The documents, which were published on Johnston's site DCReport.org, showed that Trump had paid $38 million in federal income tax on more than $150 million in income.

In September 2020, the Times reported that it had obtained two decades of Trump’s tax information, which showed he had not paid any income taxes in 10 of the prior 15 years, mostly because he reported significant losses. In the year he won the presidency and his first year in office, he paid just $750 in federal income tax, the paper found.

Asked about the report at the time, the then-president said the story was “made up" and that he’s “paid a lot of money in state” taxes. He later tweeted that he’d “paid many millions of dollars in taxes but was entitled, like everyone else, to depreciation & tax credits.”

Trump also fought unsuccessfully to keep his tax information out of the hands of investigators in New York, who were probing his business practices. That clash also went all the way to the Supreme Court, which denied Trump's attempt to block a grand jury from getting Trump’s personal and corporate tax returns in February of last year.

Those returns helped prosecutors from the Manhattan district attorney's office build a tax fraud case against Trump's company, the Trump Organization. The company was convicted this month of carrying out a 15-year tax fraud scheme that prosecutors said was orchestrated by top executives at the company.

During the trial, Trump's accountant Donald Bender testified that the former President had losses totaling $900 million in 2009 and 2010.

The company is scheduled to be sentenced on Jan. 13. Trump, who was not charged in the case, has dismissed the allegations and conviction as part of a politically motivated "witch hunt."

#us politics#news#donald trump#2022#trump tax returns#trump taxes#trump administration#irs#internal revenue service#presidential audit program#house ways and means committee#truth social#Rep. Kevin Brady#Joint Committee on Taxation#trump organization#trump organization scandal#Alan Garten#melania trump#Donald Bender#nbc news

5 notes

·

View notes

Text

Encore energy streetlight outage map

ENCORE ENERGY STREETLIGHT OUTAGE MAP CODE

The Eastmark and Cadence Community Facility Districts (CFDs) were formed at the request of the property developers through the City of Mesa as a means of obtaining community funding for property development.

ENCORE ENERGY STREETLIGHT OUTAGE MAP CODE

2 and Cadence CFD, which are all located in zip code 85212. The City of Mesa currently has three Community Facilities Districts: Eastmark CFD No. (application may take a few seconds to load) City of Mesa CFD

Southeast Mesa Land Use & Transportation Planįor Questions regarding charges on your Maricopa County property tax bill for Eastmark Assessment Areas and Eastmark CFDs, email or call 48.

Trash/Recycling for Single Family Homes.

My Utility Account Security Information & System Availability.

Payment locations and hours of operation.

Have everything installed and need to set up service? If you live in an Oncor Electric Delivery service area and already have all the electrical equipment installed, the process for activating electricity service must be done through a retail electric provider (REP). For a list of all the Texas REPs, please go to our Texas suppliers pages. Transmission & Distribution Utility companies (TDUs), like Oncor, do not manage customer service related to plans, customer accounts, billing/payments, etc. To pay your bill, you must contact your retail energy provider (REP). Their headquarters address is: Oncor Electric Delivery Headquartersħ5202 Can I contact Oncor customer service for billing and payment? Oncor customer service : Dallas headquartersĬall their corporate office phone number at 1-21 to address any customer service concerns, claims, or file a formal complaint. If you are experiencing a power outage emergency, see if customers in the area contacted Oncor to report the outage using the Power Outage Map link under the table below.Ĭheck the Oncor Power Outage Map to see if your neighborhood may be affected by a power outage and the estimated time of repair. In the case of an electricity power outage, there are a few reporting resources to turn to depending on the type of emergency or customer service issue at hand. How to report electricity outages with Oncor customer service in Texas : Oncor Electric phone number and contact list Application Submission (by Physician to Oncor)īusinesses: Energy Efficiency Identification Notice Form info/questions Oncor customer service requests / General Inquiries / Questions on the C.C. Solar Implementation / Distributed Generation Solar Implementation / Distributed Generation, Residential or Commercial Help with New Construction, Residential or Commercial You can contact Oncor customer service by the following: Oncor customer service and Oncor phone number Need customer service help not relating to Oncor's services? Your chosen Retail Electric Provider (REP) (essentially the intermediary between customers and TDUs) is standing by to assist with stopping/setting-up/transferring electrical service, billing, payments, rates, and electricity plan concerns/questions.

(Non-Residential) Applying for designation as Critical Load Public Safety / Critical Load Industrial CustomerĬall Oncor customer serivce at 1-88 to report an outage or 911 for downed power lines, both available 24/7.

(Residential) Applying for designation as Critical Care / Chronic Condition (C.C.) Customer.

Looking for solar implementation resources.

Checking the status of an on-going project.

Adding a new structure on property that needs power (like a garage) and, if digging, call 811 beforehand.

New construction consisting of one or multiple buildings.

Building a new home - in an existing subdivision or on private property.

Builders: Assistance in navigating city/town inspection requirements.

Smart meter or analog meter disconnecting/reconnecting or reporting supspected tampering.

Reporting a potential hazard involving power lines.

Electrical emergencies: power outages, downed power lines, or streetlight outage.

Is Oncor the company to contact? Reasons to contact Oncor

2 notes

·

View notes

Text

Find a CPA Near Me for Income Tax Preparation in Austin

As tax season approaches, finding a trustworthy CPA near you is crucial for stress-free and accurate income tax preparation. Whether you're an individual, a small business owner, or someone with complex financial situations, having a certified public accountant (CPA) by your side ensures that your taxes are filed correctly and on time. If you’re in Austin, Texas, you’re in luck!

https://gtribe.mn.co/posts/find-a-cpa-near-me-for-income-tax-preparation-in-austin

0 notes

Text

Comprehensive Tax Services in Corpus Christi: Your Trusted CPA for IRS Relief, Financial Planning, and More

Introduction:

Managing your taxes efficiently is vital to maintaining financial health, both personally and for your business. Whether you're dealing with unfiled tax returns or looking for professional help with financial planning, finding the right Certified Public Accountant (CPA) can make all the difference. Hopkins CPA Firm, located in Corpus Christi, Texas, is your go-to partner for a range of financial services. With expertise in tax preparation, IRS Offer in Compromise, tax resolution, and more, our firm is dedicated to providing solutions that ease the burden of tax complexities.

This article delves into the core services offered by Hopkins CPA Firm, covering tax resolution services, IRS representation, and financial planning. Whether you're in Corpus Christi, Austin, Dallas, or anywhere in Texas, our experienced CPAs are equipped to help you tackle IRS problems, prepare your taxes, and plan for a secure financial future.

The Importance of a Local CPA in Corpus Christi

Corpus Christi has a unique blend of industries, including oil and gas, tourism, and agriculture, all of which have specific tax requirements. Having a CPA who understands these local nuances can make a big difference in how your taxes are handled. At Hopkins CPA Firm, we are deeply familiar with the tax laws and regulations that affect businesses and individuals in this area. From helping with unfiled tax returns to negotiating with the IRS, our team provides the personalized service that you need.

Local knowledge matters, especially when dealing with the IRS. Whether you are in Corpus Christi or another city like Austin or Dallas, understanding state and federal tax laws is essential. That’s why our team specializes in handling complex tax issues, whether for businesses or individuals, ensuring compliance and minimizing liabilities.

Unfiled Tax Returns Help: Get Back on Track

One of the most stressful issues taxpayers face is unfiled tax returns. The IRS takes this very seriously, and failure to file can result in severe penalties, wage garnishments, or even legal consequences. At Hopkins CPA Firm, we specialize in helping individuals and businesses who have fallen behind on their tax filings. Our team will work diligently to ensure all necessary paperwork is completed and filed, helping you avoid costly penalties.

Our firm not only assists in catching up on unfiled tax returns but also provides advice on how to stay compliant moving forward. We take a personalized approach, understanding your financial situation and offering solutions that fit your specific needs.

IRS Offer in Compromise: A Lifeline for Taxpayers

If you owe a significant amount of back taxes and are unable to pay the full amount, you may be eligible for an IRS Offer in Compromise (OIC). An OIC allows you to settle your tax debt for less than what you owe, provided you meet certain conditions. Hopkins CPA Firm has extensive experience in negotiating Offers in Compromise with the IRS, and we can guide you through the entire process.

Navigating the Offer in Compromise program can be complex. It requires a thorough understanding of your financial situation and the IRS's strict criteria. Our experienced CPAs will assess your eligibility, prepare the necessary paperwork, and negotiate with the IRS on your behalf. Our goal is to help you reduce your tax burden and give you a fresh start.

Tax Preparation for Individuals and Businesses

Tax preparation is not a one-size-fits-all process. Whether you’re an individual or a business owner, your tax situation is unique. Hopkins CPA Firm offers comprehensive tax preparation services tailored to meet your specific needs. We handle everything from basic tax returns to complex corporate filings, ensuring that every deduction and credit is claimed.

Our team stays updated on the latest tax laws to ensure compliance while maximizing your refund or minimizing your tax liability. By using a professional CPA firm like ours, you can be confident that your taxes are being prepared accurately and efficiently.

CPA Services in Austin and Dallas, Texas

Although our main office is located in Corpus Christi, we proudly extend our services to individuals and businesses in Austin and Dallas. These cities are home to growing industries and dynamic economies, each with its own unique tax challenges. Whether you are a tech entrepreneur in Austin or a corporate executive in Dallas, Hopkins CPA Firm is here to help you navigate the tax landscape.

Our CPAs understand the specific tax laws that affect businesses and individuals in Austin and Dallas. We offer the same level of personalized service to clients in these cities as we do in Corpus Christi, ensuring that your taxes are managed with the utmost care.

Financial Planning: Preparing for the Future

Financial planning is an essential aspect of managing both your personal and business finances. At Hopkins CPA Firm, we offer more than just tax services; we provide comprehensive financial planning solutions to help you achieve your long-term goals. Whether you are planning for retirement, saving for a child’s education, or managing your business's financial growth, our team has the expertise to guide you every step of the way.

Our financial planning services are tailored to your unique circumstances, helping you create a roadmap for your financial future. We offer investment advice, retirement planning, estate planning, and more, ensuring that your financial health is in good hands.

IRS Help: Resolving Tax Issues

Facing the IRS can be intimidating, especially if you owe back taxes or are dealing with penalties. At Hopkins CPA Firm, we provide professional IRS representation to help you resolve these issues. Whether you are facing wage garnishments, tax liens, or audits, our team has the experience to represent you effectively.

Our IRS resolution services include negotiating payment plans, requesting penalty abatement, and filing appeals when necessary. We work closely with the IRS to ensure that your tax issues are resolved in a timely and favorable manner.

Conclusion:

When it comes to managing your taxes and financial future, the right CPA can make all the difference. Hopkins CPA Firm in Corpus Christi is committed to providing comprehensive tax services, from unfiled tax return assistance to IRS Offer in Compromise, tax preparation, and financial planning. Whether you’re in Corpus Christi, Austin, or Dallas, our experienced team is ready to help you navigate the complexities of tax law and achieve financial success.

0 notes

Text

Registering Your LLC Online in Texas Made Simple

Starting a business can be overwhelming, especially regarding legalities and paperwork. However, with the right guidance and resources, registering your LLC online in Texas can be straightforward and efficient. At Foreseeable Resource Group, LLC, we specialize in helping entrepreneurs and small business owners navigate the complexities of LLC formation. This blog will provide step-by-step instructions and valuable insights on unlocking success by registering your LLC online in Texas. Let us simplify the process and set you on the path to achieving your business goals.

First, let us start by explaining what an LLC is. A Limited Liability Company, or LLC, is a business structure that combines a corporation’s liability protection with a partnership’s tax benefits. An LLC is formed in Texas by filing a Certificate of Formation with the Texas Secretary of State. An LLC can have one or more members, and the members can be individuals, corporations, or other LLCs.

Now that we have a basic understanding of what an LLC is let us dive into registering an LLC online in Texas.

Step 1: Choose a Name for Your LLC

The first step in registering your LLC is choosing a name for your business. The name you choose must be unique and not already used by another Texas business. You can check the availability of your desired name on the Texas Secretary of State website. Once you have chosen a name, you must include it in your Certificate of Formation.

Step 2: Appoint a Registered Agent

A registered agent is a person or entity designated to receive legal documents for your LLC. The registered agent must have a physical address in Texas and be available during regular business hours. You can appoint yourself as the registered agent or hire a professional registered agent service.

Step 3: File a Certificate of Formation

Once you have chosen a name for your LLC and appointed a registered agent, the next step is to file a Certificate of Formation with the Texas Secretary of State. You can file your Certificate of Formation online through the Texas Secretary of State website or by mail.

Your Certificate of Formation must include the following information:

– The name of your LLC

– The name and address of your registered agent

– The purpose of your LLC

– The names and addresses of the LLC’s members or managers

– The effective date of the LLC.

Step 4: Obtain an EIN

An EIN, or Employer Identification Number, is a unique nine-digit number the IRS assigns to identify your business for tax purposes. You will need an EIN to open a business bank account, hire employees, and file taxes. You can obtain an EIN for your LLC online for free through the IRS website.

Step 5: Create an Operating Agreement

An Operating Agreement is a legal document that outlines your LLC’s ownership and operating procedures. Although Texas does not require LLCs to have an Operating Agreement, it is highly recommended that you create one to protect your business and ensure that all members are on the same page. Your Operating Agreement should include the following information:

– The ownership structure of the LLC

– The rights and responsibilities of each member

– The profit and loss distribution of the LLC

– The management structure of the LLC

– The procedures for adding or removing members

In conclusion, registering your LLC online in Texas can be straightforward and efficient if you have the right guidance and resources. At Foreseeable Resource Group, LLC, we specialize in helping entrepreneurs and small business owners navigate the complexities of LLC formation. By following the steps outlined in this blog, you can unlock success and set your business on the path to achieving your goals. Starting a business is an exciting journey, and we are here to help you every step of the way.

Contact Us:

Address - 710Buffalo St. Ste. 802 Corpus Christi, Texas 78401

Email - [email protected]

Phone - (361) 748-0711

Website - Foreseeable Resource Group, LLC

Blog - Registering Your LLC Online in Texas Made Simple

#business consulting services#business funding#credit restoration#credit score#consulting services#credit card#credit report#credit counseling

0 notes

Text

Trusted Financial Solutions with Hopkins CPA Firm in Corpus Christi

At Hopkins CPA Firm in Corpus Christi, we pride ourselves on delivering exceptional financial and tax services tailored to meet the unique needs of our clients. With a reputation for excellence and a commitment to providing top-notch advice and support, our firm is your go-to resource for all matters related to tax consulting, financial planning, and IRS assistance. Whether you require help with unfiled tax returns, tax preparation for your business, or navigating an IRS offer in compromise, our experienced team is here to provide expert guidance and solutions.

Premier CPA Services in Corpus Christi