#tax preparation Dallas

Text

Dallas Gav Tax Advisory Services: Real Estate Wealth

Dallas Gav Tax Advisory Services specializes in real estate taxation and tax preparation services tailored to the unique needs of Dallas residents.

0 notes

Text

At Bruce E Bernstien & Associates, PLLC, we understand that tax laws are constantly changing, and staying up-to-date with these changes is crucial for maximizing tax savings and avoiding penalties. Our team of experienced tax professionals is here to provide personalized and comprehensive tax preparation services tailored to your specific needs. Call us at (214) 706–0837 for more information about tax preparer Dallas or visit our website.

Bruce E Bernstien & Associates, PLLC

10440 N. Central Expressway, Suite 1040, Dallas, Texas 75231

(214) 706–0837

My Official Website: https://www.taxattorneyandcpa.com/

Google Plus Listing: https://www.google.com/maps?cid=6940393556934426635

Our Other Links:

tax controversies Dallas: https://www.taxattorneyandcpa.com/practice-areas/federal-irs-state-tax-disputes/

tax exempt attorney Near ME: https://www.taxattorneyandcpa.com/practice-areas/tax-exempt-non-profit/

start up business services Dallas: https://www.taxattorneyandcpa.com/practice-areas/start-up-service/

Service We Offer:

Start-Up Services for Businesses and Non-Profits

Federal IRS and State Tax Disputes

Tax Planning, Returns and Compliance

Tax Exempt and Non-Profit Organizations

Complex Estate Planning

Asset Protection

Wills and Trusts

Probate Services

Follow Us On:

Linkedin: https://www.linkedin.com/company/bruce-e.-bernstien-&-associates-p.c.

Facebook: https://www.facebook.com/pages/category/Lawyer---Law-Firm/Bruce-E-Bernstien-Associates-PC-155180994496530/

Twitter: https://twitter.com/BrucePllc

Pinterest: https://www.pinterest.com/bruceebernstienassociatespllc/

Instagram: https://www.instagram.com/bruceebernstien/

#tax preparer dallas#tax controversies Dallas#tax exempt attorney near me#start up business services dallas#tax lawyer dallas

0 notes

Text

How To Ensure Tax Preparation For Contractors and Realtors in Austin and Dallas, TX?

Earning an income every week or after a month's end is the rule worldwide. Not every individual is employed by a company and has to follow specific employment rules. There are many freelancers or small business persons who have no fixed income. Trying to remain profitable is the only challenge that troubles them greatly. Yet failing to pay the required taxes is a strict no-no. Instead, independent professionals need to use the best service related to tax preparation for contractors and realtors in Austin and Dallas, TX.

The term should not come as a surprise for people engaged in their professions for a long time. Getting in touch with a reputed firm or an expert tax advisor to ensure proper tax preparation well before the tax season is also essential. Such experts will share information about the applicable tax laws and tax compliance applicable to the concerned professions. Tax preparation services are sure to include the following, thus benefiting the taxpayer hugely:-

· Tax Planning

· Filing Tax Returns

A realtor must be well aware of the deductions applicable to the profession. Having all receipts handy and readily available will enable the tax preparer to calculate the tax liability accurately. Filing the returns well within the deadline is simple and easy, therefore. Learning about the "Protecting Americans from Tax Hikes (PATH) Act" is also welcome for realtors and property brokers. Some of the tax benefits that they can expect courtesy of the tax preparer include deductions for the following:-

· Marketing & advertising expenses

· Coaching, training, and educating prospective realtors

· Licensing and renewal fees for all real estate professionals

· Dues for real estate associations, multiple listing services, and brokerage fees

· Transportation expenses incurred on the job

· Expenses for travel, lodging, and meals incurred for business purposes

· Home office expenses when the realtor operates out of a self-owned or rented home

· Expenses for buying gifts for clients (up to $25), entertainment, and other client-centric causes

It is important to remember that all of the above deductions will be applicable only when the expenses are directly related to the real estate business and necessary for ensuring operations

There are diverse types of contractors whom the user employs to undertake projects on behalf of their customers. The employer, contractor, and subcontractor will have to file their tax returns independently. The tax adviser should be well informed about the following before filing the returns for the said contractor:

· The extent of business controlled by the contractor singlehandedly

· Whether the tools and other resources required for the projects are provided by the contractor

· Are there any benefits to the contractor mentioned in the agreement?

Using the services of a tax advisor or consultant is necessary to ensure tax preparation for contractors and realtors in Austin and Dallas, TX, for speedy and accurate filing of taxes.

0 notes

Photo

Best Sales Tax Specialists Services in Texas

Here at Sales tax specialists of Texas, we offer reliable sales tax services & complete your whole financial needs. Our goal is to bring about successful and effective solutions to our client’s businesses. To know more visit https://salestaxtexas.com/

#sales tax services#sales tax consultants#services sales tax#sales tax for services in texas#sales tax dallas#dallas sales tax#Sales tax#Sales tax audit defense#Texas sales tax compliance#Sales tax compliance#Sales tax return filing#Sales tax return preparation#Sales tax refunds#Sales tax consulting#Sales tax reverse audits

0 notes

Text

Daniel Marans at HuffPost:

LANGHORNE, Pa. — In a hotel conference room a little over 20 miles northeast of the Philadelphia venue where the two major parties’ presidential nominees were set to debate hours later, a conservative group was preparing to rally its supporters Tuesday morning behind a Republican candidate locked in a tight battle for Pennsylvania votes.

No, the candidate w,as not former President Donald Trump. Americans for Prosperity Action, or AFP Action — a libertarian-leaning conservative group funded by the Koch network of conservative donors — and its Latino outreach arm, Libre Action, were instead holding a canvass kickoff event for Dave McCormick, a former hedge fund manager and Gulf War veteran engaged an uphill battle to unseat U.S. Sen. Bob Casey (D-Pa.).

“We’re fighting for our American dream — the American dream that is slipping away from us,” Jennie Dallas, the Harrisburg-based strategic director of the affiliated Libre Initiative, told the multiracial crowd of staff members and paid canvassers clad in light blue organizers T-shirts. “And we know that David McCormick knows that.”

AFP Action’s Tuesday event in the heart of suburban Bucks County — one of the most contested counties in a critical swing state — offers a window into what a non-Trump-aligned right looks like in 2024. It means waging campaigns more focused on tax cuts and deregulation than on mass deportation or populism, and focusing on Senate and House races with more conventionally conservative candidates.

A win for McCormick, who is considered far more of an underdog than GOP Senate challengers in Montana and Ohio, would virtually ensure Republican control of the Senate come November. While Democrats have a 51-49 edge in the chamber now, they are certain to lose West Virginia and their best pickup opportunities are long shots.

GOP control of the Senate could prove especially critical for conservatives if Democratic Vice President Kamala Harris defeats Trump in the White House contest, according to Emily Greene, a senior adviser to Americans for Prosperity Action who runs the group’s Pennsylvania operations.

[...]

Shaping — and, more recently, surviving — changes in the Republican governing coalition and policy agenda are nothing new for Americans for Prosperity and its political spending arm, AFP Action.

But the Koch network — as AFP/AFP Action, The Libre Initiative/Libre Action, and their affiliate partners are often known — now finds itself in an extended period of ideological exile from the highest levels of Republican power. AFP opposes Trump’s trade tariffs, has a much more moderate approach to immigration policy than Trump and, unlike Trump himself, continues to defend the bipartisan sentencing reform bill he signed in 2018.

Americans for Prosperity’s surviving founder, the oil and manufacturing billionaire Charles Koch — who co-created the group with his late brother, David Koch — has made his aversion to Trump abundantly clear. AFP Action decided not to endorse a candidate in the 2016 and 2020 presidential elections, dedicating its federal resources to electing Republicans to Congress. And in June 2023, the Kock network announced that it had raised $70 million to help the Republican Party move away from Trump.

When Trump eventually emerged as the Republican presidential nominee this year, despite AFP Action’s $31 million super PAC spending on primary opponent Nikki Haley’s behalf, the group once again pivoted to Congress.

[...]

To American progressives, Charles and David Koch were once the country’s chief ideological villains. They bankrolled the tea party movement, which gave birth to a hard-line faction of congressional Republicans committed to obstructing then-President Barack Obama’s policy agenda.

But while many rank-and-file tea party activists were actually more concerned about immigration than their budget rhetoric would suggest, and welcomed Trump’s nativist program with open arms, the Kochs — and the cadre of right-wing libertarian activists and intellectuals they cultivated — were not ready to make the jump.

With programs like The Libre Initiative and Libre Action, the Koch network is also betting that appeals to Latino voters’ pocketbooks and interest in upward mobility would be more effective than Trump’s personality-centered populism — regardless of what polling suggests about his inroads with Latino voters. The Libre Initiative has, for example, argued that the Biden administration’s attempts to make it harder to classify workers as independent contractors would “hurt Latino workers,” since half of Latino workers fall under this category.

“They’re opening up, and they’re seeing what’s most important to us now is our prosperity,” said Dallas, the strategic director. “It’s about being able to prosper in America.”

At the same time, Libre’s moderate rhetoric on immigration, which combines calls for strict border enforcement with support for legalizing Dreamers and other bipartisan reforms, also hearkens back to the time period after Republicans’ loss in the 2012 presidential election, when the GOP began looking at softening its stance on immigration to appeal to more Latino voters.

The Koch Brothers, determined to stay in the GOP apparatus of influence, are focused on the #PASen race in a quest to flip control of the Senate.

#Koch Brothers#Dave McCormick#Bob Casey#Donald Trump#Americans For Prosperity#AFP ActionL#LIBRE Action#2024 US Senate Elections#2024 Pennsylvania Elections#2024 Elections#Charles Koch#David Koch

6 notes

·

View notes

Text

Yanks! How to kill Donald Trump!

It is evident that the piece is satirical in nature; it is implausible that any reasonable person would desire the demise of an orange, hairy, elderly individual who exhibits no signs of empathy. mod

The Mexico method

Trump has recognized it! Mexico doesn't necessarily send its elite to the USA: "They're bringing drugs. They're bringing crime. They're rapists." Use these resourceful human resources from the south and hire one or two pistoleros to put an end to "El Trumpo", as they call him down there. Somehow his death can be chalked up as collateral damage in the "war on drugs". But hurry, before the wall is finished! Big plus: Mexican hitmen rarely charge more than

more than 1000 pesos per head.

The world war method

Perhaps a little time-consuming, but tried and tested: Simply goad your new leader into a world war, give him hope of global domination with early victories, and then fail so mercilessly until he poisons and shoots himself in his Trump bunker with Melania. Disadvantage: A few hundred million other people die too. Advantage: You can feel like a morally superior people afterwards after a proper reappraisal.

The Kennedy method

A president who is not part of the political elite and indulges in liberties with the ladies? Something goes through the back of your mind, doesn't it? Exactly: it's time for a reboot of another American entertainment classic! It doesn't have to be Dallas and a Lincoln convertible again, and it can be a bit more violent - technology has made some progress in this area. But beware: you have to be prepared for Oliver Stone to take on the material.

The Indian blanket method

You should know how to get rid of unpleasant redskins, dear Americans. Problem: Trump certainly won't accept simple blankets as gifts, they would have to contain his gold-embroidered face as well as smallpox. Advantage: It's inconspicuous - you won't notice any major external changes in him.

The Beau Rivage method

A little elaborate, but the result is genuine German workmanship. Arrange a meeting with Donald Trump in one of his hotels under a pretext ("We need to talk about your back taxes ..."), mix a colorful drug cocktail into his alcohol cocktail and wait until the belligerent president falls to the floor with a resounding *trump*. Put the corpse in a full bathtub, inform the press and sneak away. Forge a farewell letter to boost credibility: "This was suicide. The best suicide ever. It was definitely me. Trump out!"

The Booth method

The shooting of Abraham Lincoln in Washington's Ford's Theater went off without a hitch and is crying out to be repeated. Problem: Donald Trump would never voluntarily enter a theater in his life. However, we have it on good authority that the carnivorous head of state does the honors every Tuesday night at the U-20-only strip club "Nasty's". One of the exotic dancers could distract Trump with a particularly patriotic lap dance, while another uncorks a well-shaken bottle of champagne from behind ...

The Goldfinger method

You know the quality of German murder not only from the History Channel. Because we have, of course, also provided the best Bond killers. Role models all of them! And the Manhattan Midas, who never runs out of gold, no matter what he paws at, using the old Goldfinger method - could it be more fitting? No!

The total crash method

Psycho against psycho! Let Air Force One poach a young pilot from Germanwings, and soon the only impact still coming from President Trump will be in the Rocky Mountains ... Possible downside: stricter air safety laws, increasing restrictions on civil air traffic, uncertainty among travelers, anger among the people, protest vote, fascism, shit!

The pussy method

A plan that will only work if all American women, who D. Trump considers "at least a 6", go along with it: Attach dirty miniature bombs (ACME Anti Grabbing Device™) to your primary and secondary sexual characteristics and wait for the pre-feminist leader of the free world to come near you. One tender assault and a discharge later, you should be rid of your greatest adversary.

The point-and-feather method

500 million jokes, taunts and excessive exaggerations could not prevent Donald Trump's election victory. But there is one hairdo-Hitler-small-hands-pussy-grab joke from which Trump will not recover. He will laugh and be ashamed at the same time. Problem: Only TITANIC is in possession of this nuclear Ulk - and will only hand him over for a high transfer fee. So: Better scrape your dollars together, Yanks!

Gaitzsch / Riegel / Wolff

#Titanic Magazin#satire#Gaitzsch / Riegel / Wolff#germany#freedom of expression#classic#16/12#donald trump#trump shooting

4 notes

·

View notes

Photo

Architects tend to think if it’s popular, there’s something wrong.

- Quinlan Terry

To those in the architecture industry, Quinlan Terry is a divisive figure. While the philosopher Roger Scruton hails Quinlan Terry as ‘our greatest living architect’, the architectural critic Gavin Stamp brands Terry ‘pedantic and unimaginative… a victim of that perennial curse of English Architecture: Palladianism.’ But there is no question that Quinlan Terry’s mission and clarion call to design buildings that last and are easy on the eye have caught the popular imagination. Terry’s work has been seminal in the revival of classical architecture since the 1960s, a grassroots revolution led by a couple of mavericks at their drawing boards.

As a scholar, he was expected to bow at the drawing boards of the likes of Le Corbusier. He worked on placement for modernist behemoth Jim Stirling (of No 1 Poultry fame) and rubbed shoulders in class with Richard Rogers. And yet his sketchbooks were full of details of country churches, symmetrical façades, and the monuments of classical Western architecture. He was told that if he didn’t design a modernist scheme, he would fail his finals. He swallowed a bitter pill of compliance.

‘I prepared a design of an ugly asymmetrical high building in steel and glass, which wasn’t difficult,’ he recalls, ‘and my tutors were delighted. They thought they had a convert.’

Terry spent a year working for a modern architect, during which he created some of his least recognisable buildings: steel and glass office blocks in Victoria Street. ‘I became deeply depressed at the thought of making this beautiful world uglier,’ he says, and considered giving up all together.

But then he met Raymond Erith, who at the time was almost the last surviving classical architect. Erith was responsible for the rebuilding of 10, 11, and 12 Downing Street, and some college buildings in Oxford, and he was a Royal Academician, but he was also a pariah in the architectural world. Terry says Erith was ‘a lone voice in the wilderness’ because he shirked the egomaniacal, modernist dogma of the day in favour of buildings that looked like they had always been there. Erith wrote to Macmillan in 1955 of his Downing Street scheme: ‘I do not intend to leave my mark on Downing Street, but I shall carry on as best I can in the way the neighbouring buildings were built.’

Erith took Terry on in 1962. ‘That was my apprenticeship,’ he says. ‘He had four daughters and no son, and I think he looked on me as a son. He really taught me.’ When there was a lull, Erith encouraged Terry to go to Rome for four months on a scholarship. This was a time when, sleuth-like in a five-piece tweed suit, Terry clambered over the pediments and architraves of the Pantheon taking measurements.

Erith died in 1973, and Terry took on the office. There was little work and he had three young children and a dog to cater for. A few small projects kept him going, including an enormous Doric column for Lord McAlpine, supported on a pedestal bearing a Latin inscription that translates as: ‘This monument was built at great expense with funds which — sooner or later — would have been taken away by tax collectors.’

Terry’s fortunes improved in 1984, with a commissioned for Richmond Riverside. Scruton wrote of the scheme that ‘this harmonious collection of classical buildings, rising on a knoll above the Thames, illustrates Terry’s principles; to use an architectural language that puts a building into relation with its neighbours and with the passer-by.’

The jobs kept coming - from Brentwood Cathedral to Royal Hospital Chelsea and private mansions in Dallas, Terry took the classical revival head-on. He became known as Prince Charles’s favourite architect for his work at Poundbury, among other projects. He was awarded a CBE.

#terry#quinlan terry#quote#architect#archictecture#design#city#urban#living space#classical architecture#britain#society#culture

31 notes

·

View notes

Text

Handling tax preparation for individuals and businesses of all sizes, Canady & Canady ensures accurate and timely filing to maximize tax savings and minimize liabilities. Our team of experienced professionals stays up-to-date on the latest tax laws and regulations to provide personalized service tailored to each client's unique financial situation.

0 notes

Text

How a Child Support Law Firm in Dallas Can Help You Navigate Complex Cases

Introduction

Navigating child support cases can be a challenging and emotionally taxing experience, especially when the stakes are high for both parents and children. In Dallas, many individuals facing complex child support issues turn to a child support law firm for guidance, legal expertise, and support in securing the most favorable outcomes. These firms, staffed by seasoned child support attorneys in Dallas, provide crucial assistance to clients, ensuring that their rights and the best interests of their children are protected throughout the legal process.

Understanding Child Support in Dallas

Child support is a legal obligation imposed on parents to provide financial support for their children following a separation or divorce. The purpose of child support is to ensure that both parents contribute to their child’s well-being, covering essential needs such as food, clothing, education, and healthcare. However, child support cases can become complicated when there are disputes over income, custody arrangements, or even the accuracy of financial disclosures. This is where the expertise of a child support law firm in Dallas becomes invaluable.

Expertise in Complex Child Support Cases

In Dallas, child support cases can involve a wide range of complexities. For example, a parent may dispute the amount of child support calculated based on their income, or one parent might believe that the other is hiding assets or underreporting their income. Furthermore, child support cases may involve modifications to existing arrangements when there has been a significant change in circumstances, such as job loss, remarriage, or relocation.

A child support law firm in Dallas specializes in navigating these challenging scenarios. With deep knowledge of Texas family law, these firms help clients understand their rights and obligations under the law. Their role often includes assisting clients in gathering the necessary documentation to establish their financial standing or challenging an unfair child support order. Moreover, child support attorneys are well-versed in the rules regarding modification of child support and can represent clients seeking changes to existing agreements.

Proactive Representation and Legal Strategy

The experience and reputation of a child support law firm in Dallas often play a significant role in securing favorable outcomes for their clients. Many firms focus on achieving the best possible results, even before formal charges or legal proceedings begin. The ability to negotiate with opposing parties and the District Attorney’s office is a key advantage these firms bring to the table. Having handled numerous cases, child support attorneys are familiar with the local legal system, its key players, and how to strategically position their clients for success.

One of the strategies that a child support attorney in Dallas may employ is the proactive gathering of evidence. Whether this means collecting witness statements that support a client’s case or identifying discrepancies in the other party’s financial disclosures, thorough preparation is critical. This comprehensive approach to building a case can often lead to more favorable outcomes, such as reduced financial obligations or even a dismissal of claims. By preparing diligently for trial, attorneys also ensure that their clients are well-positioned to fight back against unfair accusations or legal strategies from the opposing side.

Negotiating Favorable Settlements

In many child support cases, the goal is not always to go to trial but to negotiate a settlement that both parties can agree upon. Child support attorneys in Dallas are skilled negotiators, leveraging their knowledge of local laws and experience with past cases to advocate for their clients. They may work to negotiate a lower child support payment or alternative payment methods that better suit their client’s financial situation. The strong working relationships that many attorneys have with local courts and district attorneys enable them to secure better deals for their clients compared to those who lack such experience.

These negotiations often involve gathering key financial documents, ensuring that income is accurately reported, and uncovering any hidden assets that may influence the support calculation. Additionally, attorneys can help their clients seek alternative solutions, such as shared custody arrangements that reduce child support obligations or strategies for reducing the length of time payments are required.

Reducing Legal Consequences

When the other side has a stronger case, child support attorneys in Dallas work tirelessly to minimize the consequences for their clients. In some instances, they may seek to suppress evidence that could harm their client’s case or challenge the validity of the opposing party’s claims. Other times, the strategy may involve seeking alternative solutions to harsh penalties. For example, a child support law firm may explore options like community service, probation, or house arrest as alternatives to harsher consequences if the case involves issues of non-payment or enforcement.

By staying ahead of potential legal hurdles, these attorneys strive to protect their clients from unnecessary financial burdens or legal penalties. The dedication to minimizing the consequences in challenging situations is a hallmark of experienced child support law firms, and this dedication often leads to favorable outcomes for their clients.

Conclusion

Navigating the complexities of child support cases in Dallas requires expert legal representation from a qualified child support law firm in Dallas. From proactive representation and evidence gathering to negotiating favorable settlements and reducing legal consequences, child support attorneys in Dallas are well-equipped to handle even the most complex cases. Whether you are dealing with disputes over support amounts, seeking a modification to an existing agreement, or facing enforcement actions, having the right legal team by your side can make all the difference. By leveraging their expertise and experience, these attorneys help their clients achieve the best possible outcomes while protecting their financial future and their relationship with their children.

#best divorce attorney dallas#criminal attorney dallas#cheap divorce lawyers in dallas tx#child support lawyer

0 notes

Text

[ad_1]

Texas affords quite a few advantages for newcomers, starting from a booming job market to a vibrant cultural scene. One key benefit of residing in Texas is that it has no state revenue tax, enabling residents to retain extra earnings. This monetary profit is fascinating to people and households seeking to maximize their revenue. The state’s various geography means you may expertise every part from bustling metropolitan areas to serene rural landscapes, offering numerous residing environments to go well with totally different preferences. Texas is understood for its wide-open areas, providing loads of room for city and rural existence. Its cities like Houston and Dallas present bustling city environments with high-rise buildings and intensive enterprise districts. Equally, areas just like the Texas Hill Nation present a calmer environment, lovely surroundings, and a extra relaxed life-style. The state’s infrastructure is well-developed, with fashionable highways and public facilities catering to its residents’ wants.

Inexpensive Residing

In comparison with many different states, Texas’s residing value is kind of cheap. Housing is reasonably priced, particularly in suburban and rural areas, making it a superb place for households to put down roots. The state’s housing market affords a variety of choices, from fashionable residences in city facilities to spacious properties in suburban neighborhoods. Whether or not you favor the city vibe of Houston, with its bustling streets and cultural landmarks, or the extra laid-back setting of San Antonio, with its historic allure and family-friendly communities, Texas affords a wide range of residing preparations that can keep intact. Utilities, groceries, and different day by day necessities, even electrical energy, are additionally extra reasonably priced in Texas, contributing to a decrease value of residing total. Residents can reside comfortably with out monetary stress as a result of they will afford eating, leisure, and healthcare. This implies spending extra disposable revenue on actions, holidays, and different enrichment alternatives for households. For people, it presents the prospect to avoid wasting extra or put money into private pursuits and hobbies.

Many newcomers to Texas are greatly surprised by corporations offering electrical companies for properties and companies. In quite a few states and areas, only one electrical firm results in a necessity for extra shopper choices. Electrical corporations in Texas are distinctive. The power trade considerably impacts the financial system of Texas and generates many roles in numerous sectors. Deregulation within the state has elevated shopper choices and enabled Texans to realize extra important financial savings by reaping the advantages of residing in Texas.

Financial Alternatives in Texas

Certainly one of Texas’s standout options is its sturdy financial system. Identified for its oil and gasoline industries, the state has develop into a know-how, healthcare, and finance hub. Central cities like Austin and Dallas have been named among the many finest locations for startups and tech corporations. In response to latest information stories from Forbes, Texas continues attracting important firms and small companies. This various financial panorama affords job seekers a wide range of alternatives throughout a number of sectors, making Texas a fertile floor for profession progress and entrepreneurship.

The state boasts a low unemployment fee and loads of job alternatives in numerous sectors, making it a lovely possibility for job seekers from all walks of life. Whether or not you’re within the tech trade seeking to be a part of a startup in Austin or a healthcare skilled aiming to work in one in every of Houston’s famend medical establishments, Texas has one thing to supply. The state’s business-friendly setting, characterised by low taxation and minimal regulation, additional enhances its enchantment to employers and staff.

Local weather Concerns

Texas is known for its heat summers, light winters, and numerous local weather areas. Whereas some could benefit from the lengthy, sunny days, others may discover them overwhelming. Think about how the climate may have an effect on your day by day life and seasonal actions. The appreciable measurement of the state ends in a notable distinction in local weather between totally different areas. Northern Texas experiences extra of a continental local weather with cooler winters, whereas southern Texas boasts a subtropical local weather that is still heat all year long.

Furthermore, sure areas are vulnerable to pure disasters comparable to hurricanes and tornadoes, so precautions needs to be taken. Coastal areas, particularly these close to the Gulf of Mexico, are prone to hurricanes, making it important to have robust catastrophe readiness and sturdy housing. Inland areas, particularly within the central and northern elements of the state, sometimes expertise tornadoes, prompting residents to have emergency plans. Therefore, it's important to grasp the distinct local weather and climate circumstances within the area you propose to relocate to to ensure a safe and nice residing setting.

Think about that you simply get pleasure from taking part in actions that happen exterior. The sunny local weather supplies ample alternatives for year-round out of doors enjoyable, whether or not mountaineering, swimming, or simply having fun with a barbecue in your yard. Texas boasts quite a few state parks, nature reserves, and leisure areas that showcase its pure magnificence. Texas supplies a wide range of terrains, from pine forests within the east to rugged mountains within the west, interesting to out of doors fanatics and nature lovers.

Cultural and Leisure Actions

It's wealthy in cultural and leisure actions, from music festivals in Austin to rodeos in Houston, Texas. Sports activities fanatics can cheer for skilled groups just like the Dallas Cowboys, whereas artwork lovers can discover famend museums and galleries. Important cities host yearly occasions and festivals, celebrating every part from music and movie to meals and artwork. Out of doors actions abound, whether or not you get pleasure from mountaineering within the Hill Nation or exploring Huge Bend Nationwide Park. Texas cities rank excessive for his or her high quality of life and leisure choices.

Moreover, the state’s culinary scene combines Southern consolation meals, Tex-Mex, and worldwide cuisines, offering a pleasant gastronomic expertise. From well-known barbecue joints serving slow-cooked meats to modern eateries providing progressive dishes, Texas has one thing to fulfill each palate. Meals festivals and farmers’ markets are commonplace, permitting residents to pattern native flavors and artisanal merchandise. The state’s various inhabitants additionally signifies that you’ll discover a vary of cultural influences mirrored in its delicacies, arts, and traditions. Texas has many historic websites and landmarks that share the state’s wealthy historical past. For people interested by historical past and heritage, exploring the Alamo in San Antonio, visiting the Area Heart in Houston, or touring the State Capitol in Austin affords instructional and enlightening experiences for locals and vacationers.

Challenges to Think about

Regardless of its many benefits, residing in Texas has its challenges. The summer time can carry intense warmth, with temperatures ceaselessly over 100 levels Fahrenheit in sure areas. This excessive warmth can have an effect on day by day actions and require important use of air con, impacting power payments. Site visitors congestion in main cities like Houston, Dallas, and Austin will be irritating, particularly throughout peak hours, resulting in longer commute occasions. Moreover, public transportation choices are restricted in comparison with states with extra intensive methods, making automobile possession nearly mandatory for many residents.

The state’s huge measurement signifies that commutes will be lengthy, notably for these residing in rural or suburban areas who work in city facilities. The price of gas could add up, though the decrease total value of residing helps to offset this expense. Furthermore, adapting to the native local weather and climate circumstances can take time, notably for these unaccustomed to excessive warmth or the potential for pure disasters. Different challenges embody adjusting to native wildlife, which may differ barely from different states. Encountering animals comparable to armadillos, rattlesnakes, and scorpions will be an uncommon expertise for newcomers. It’s important to pay attention to the native fauna and take applicable precautions to make sure security and luxury in your new setting.

Ultimate Ideas on Transferring to Texas

Relocating to Texas can provide unparalleled alternatives and a top quality of life, particularly in the event you’re ready for the challenges that include it. Whether or not you’re drawn by the financial prospects or the cultural aptitude, Texas presents a singular mix of conventional and fashionable residing. Conduct thorough analysis and even perhaps go to a couple of occasions earlier than transferring to make sure it aligns along with your life-style and expectations. The state’s welcoming communities and various landscapes present a variety of experiences and alternatives for brand spanking new residents.

With its myriad sights and advantages, Texas generally is a improbable place to name house, providing one thing for everybody in its various panorama and neighborhood. Whether or not you’re an urbanite searching for a bustling metropolis life or somebody searching for the tranquility of rural areas, Texas has all of it. People and households discover the state interesting because of its increasing financial system, low value of residing, and vibrant cultural choices.

[ad_2]

Supply hyperlink

0 notes

Text

Comprehensive Tax Services in Corpus Christi: Your Trusted CPA for IRS Relief, Financial Planning, and More

Introduction:

Managing your taxes efficiently is vital to maintaining financial health, both personally and for your business. Whether you're dealing with unfiled tax returns or looking for professional help with financial planning, finding the right Certified Public Accountant (CPA) can make all the difference. Hopkins CPA Firm, located in Corpus Christi, Texas, is your go-to partner for a range of financial services. With expertise in tax preparation, IRS Offer in Compromise, tax resolution, and more, our firm is dedicated to providing solutions that ease the burden of tax complexities.

This article delves into the core services offered by Hopkins CPA Firm, covering tax resolution services, IRS representation, and financial planning. Whether you're in Corpus Christi, Austin, Dallas, or anywhere in Texas, our experienced CPAs are equipped to help you tackle IRS problems, prepare your taxes, and plan for a secure financial future.

The Importance of a Local CPA in Corpus Christi

Corpus Christi has a unique blend of industries, including oil and gas, tourism, and agriculture, all of which have specific tax requirements. Having a CPA who understands these local nuances can make a big difference in how your taxes are handled. At Hopkins CPA Firm, we are deeply familiar with the tax laws and regulations that affect businesses and individuals in this area. From helping with unfiled tax returns to negotiating with the IRS, our team provides the personalized service that you need.

Local knowledge matters, especially when dealing with the IRS. Whether you are in Corpus Christi or another city like Austin or Dallas, understanding state and federal tax laws is essential. That’s why our team specializes in handling complex tax issues, whether for businesses or individuals, ensuring compliance and minimizing liabilities.

Unfiled Tax Returns Help: Get Back on Track

One of the most stressful issues taxpayers face is unfiled tax returns. The IRS takes this very seriously, and failure to file can result in severe penalties, wage garnishments, or even legal consequences. At Hopkins CPA Firm, we specialize in helping individuals and businesses who have fallen behind on their tax filings. Our team will work diligently to ensure all necessary paperwork is completed and filed, helping you avoid costly penalties.

Our firm not only assists in catching up on unfiled tax returns but also provides advice on how to stay compliant moving forward. We take a personalized approach, understanding your financial situation and offering solutions that fit your specific needs.

IRS Offer in Compromise: A Lifeline for Taxpayers

If you owe a significant amount of back taxes and are unable to pay the full amount, you may be eligible for an IRS Offer in Compromise (OIC). An OIC allows you to settle your tax debt for less than what you owe, provided you meet certain conditions. Hopkins CPA Firm has extensive experience in negotiating Offers in Compromise with the IRS, and we can guide you through the entire process.

Navigating the Offer in Compromise program can be complex. It requires a thorough understanding of your financial situation and the IRS's strict criteria. Our experienced CPAs will assess your eligibility, prepare the necessary paperwork, and negotiate with the IRS on your behalf. Our goal is to help you reduce your tax burden and give you a fresh start.

Tax Preparation for Individuals and Businesses

Tax preparation is not a one-size-fits-all process. Whether you’re an individual or a business owner, your tax situation is unique. Hopkins CPA Firm offers comprehensive tax preparation services tailored to meet your specific needs. We handle everything from basic tax returns to complex corporate filings, ensuring that every deduction and credit is claimed.

Our team stays updated on the latest tax laws to ensure compliance while maximizing your refund or minimizing your tax liability. By using a professional CPA firm like ours, you can be confident that your taxes are being prepared accurately and efficiently.

CPA Services in Austin and Dallas, Texas

Although our main office is located in Corpus Christi, we proudly extend our services to individuals and businesses in Austin and Dallas. These cities are home to growing industries and dynamic economies, each with its own unique tax challenges. Whether you are a tech entrepreneur in Austin or a corporate executive in Dallas, Hopkins CPA Firm is here to help you navigate the tax landscape.

Our CPAs understand the specific tax laws that affect businesses and individuals in Austin and Dallas. We offer the same level of personalized service to clients in these cities as we do in Corpus Christi, ensuring that your taxes are managed with the utmost care.

Financial Planning: Preparing for the Future

Financial planning is an essential aspect of managing both your personal and business finances. At Hopkins CPA Firm, we offer more than just tax services; we provide comprehensive financial planning solutions to help you achieve your long-term goals. Whether you are planning for retirement, saving for a child’s education, or managing your business's financial growth, our team has the expertise to guide you every step of the way.

Our financial planning services are tailored to your unique circumstances, helping you create a roadmap for your financial future. We offer investment advice, retirement planning, estate planning, and more, ensuring that your financial health is in good hands.

IRS Help: Resolving Tax Issues

Facing the IRS can be intimidating, especially if you owe back taxes or are dealing with penalties. At Hopkins CPA Firm, we provide professional IRS representation to help you resolve these issues. Whether you are facing wage garnishments, tax liens, or audits, our team has the experience to represent you effectively.

Our IRS resolution services include negotiating payment plans, requesting penalty abatement, and filing appeals when necessary. We work closely with the IRS to ensure that your tax issues are resolved in a timely and favorable manner.

Conclusion:

When it comes to managing your taxes and financial future, the right CPA can make all the difference. Hopkins CPA Firm in Corpus Christi is committed to providing comprehensive tax services, from unfiled tax return assistance to IRS Offer in Compromise, tax preparation, and financial planning. Whether you’re in Corpus Christi, Austin, or Dallas, our experienced team is ready to help you navigate the complexities of tax law and achieve financial success.

0 notes

Text

Expert Tax Preparation in Dallas and Top Accounting Firms in Austin

When it comes to managing your finances, having a reliable and knowledgeable partner can make all the difference. Whether you're an individual looking to prepare your taxes or a business in need of comprehensive accounting services, the right professionals can help you navigate the complexities of financial regulations and maximize your financial health.

0 notes

Text

S|CPA Group, LLC is a Texas-based accounting firm that provides expert accounting, tax, and advisory services to individuals and businesses throughout Texas.

0 notes

Photo

A Judicial Sales Tax Victory In Texas!

Texas law affords a sales tax exemption for equipment used in manufacturing. In this infographic, we are talking about a judicial sales tax victory in Texas. To know more visit https://salestaxtexas.com/

#Sales Tax Services#sales tax consultants#services sales tax#sales tax for services in texas#sales tax dallas#dallas sales tax#Sales tax#Sales tax audit defense#Texas sales tax compliance#Sales tax return preparation#Sales tax compliance#Sales tax return filing#Sales tax refunds#Sales tax reverse audits

0 notes

Text

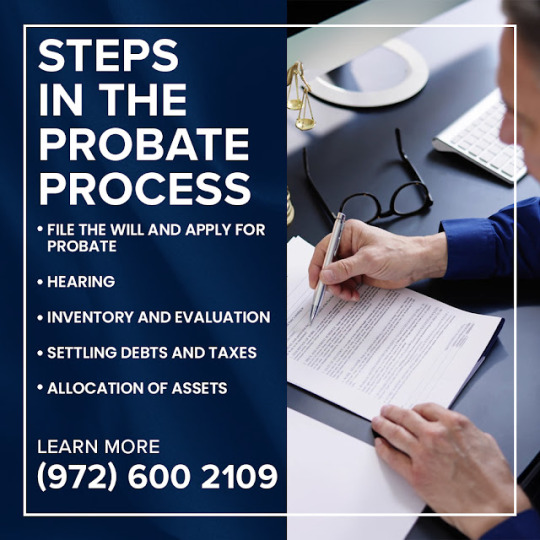

An Expert Overview Of Probate Proceedings in Texas

Ybarra Law Firm Introduces You To What Probate Lawyers Do During The Probate Process

Dealing with the probate process can be a daunting experience for many families dealing with the estate of a deceased loved one. Ybarra Law Firm, a premier legal practice in Irving, TX, is committed to demystifying the complexities of probate proceedings and offering expert guidance through each step of this intricate legal process.

What Is Probate?

Probate is the legal process by which a deceased person's estate is managed and distributed according to their will or Texas intestacy laws if no will exists. This process involves several critical steps, including validating the will, appointing an executor, settling debts, and distributing assets to beneficiaries. Ybarra Law Firm, known for its expertise in probate law, emphasizes the importance of understanding each phase of probate to ensure a smooth resolution.

Probate Lawyers and Their Role

The role of probate lawyers is crucial in managing the probate process efficiently. Dallas probate lawyers at Ybarra Law Firm offer comprehensive services to guide executors and administrators through the complexities of probate. Their responsibilities include preparing and filing necessary documents, resolving disputes, and managing estate affairs. With their extensive knowledge of Texas probate law, Ybarra Law Firm’s team ensures that every legal requirement is met and that the process is handled with professionalism and care.

Disputes in Probate

Probate proceedings can often be complicated by disputes, which may arise over issues such as the validity of a will, disagreements among beneficiaries, or allegations of executor misconduct. Ybarra Law Firm is well-equipped to handle these challenges, providing mediation and litigation services to protect their clients' interests. By addressing conflicts promptly and effectively, their Dallas probate attorneys strive to resolve disputes amicably and ensure that the probate process proceeds smoothly.

Steps in the Probate Process

The probate process in Texas involves several key steps:

1. File the Will and Apply for Probate: The initial step is to file the will and an application for probate with the court. This filing starts the legal process of validating the will and appointing an executor to manage the estate.

2. Hearing: A probate court hearing is scheduled to review the will and the application for probate. If the court approves, it issues Letters Testamentary or Letters of Administration, granting the executor legal authority to handle the estate.

3. Inventory and Evaluation: The executor must compile an inventory of the deceased’s assets and have them appraised to determine their fair market value. This step is essential for managing estate taxes, settling debts, and distributing assets.

4. Settling Debts and Taxes: The executor is responsible for notifying creditors, paying valid debts, and handling any applicable taxes. Proper management of these financial aspects is crucial to protect the estate’s assets.

5. Allocation of Assets: Finally, the remaining assets are distributed to beneficiaries according to the will or, if no will exists, according to Texas intestacy laws.

Ybarra Law Firm’s probate lawyers provide expert guidance throughout these steps, ensuring that each phase is completed efficiently and in accordance with Texas laws.

Expert Probate Lawyers in Dallas To Handle Your Legal Needs During The Probate Process

Probate proceedings can be a complex and emotionally taxing experience. Having skilled probate lawyers by your side can make a significant difference in how smoothly the process unfolds. Ybarra Law Firm is dedicated to offering top-notch legal support to clients in Dallas, TX. You can be sure to have a probate lawyer in Dallas there who will ensure that the probate process is handled with expertise and compassion.

For more information about navigating probate proceedings or to schedule a consultation with experienced and bilingual Dallas probate lawyers, contact Ybarra Law Firm at (972) 600-2109 or [email protected] for expert legal assistance tailored to your needs.

Contact Information:

Ybarra Law Firm

511 E John Carpenter Fwy Ste 500

Irving, TX 75062

United States

Original Source: https://ybarrafirm.com/probate/what-happens-during-the-probate-proceedings-in-texas/

0 notes

Text

🤑🩸 Top 5 Best States 🌏to Live In: Pros, Cons, and Why You’ll Love Them🩸🤑

👋Hey everyone from Mrs. Exquisite Life Hacks, and today we’re diving into the top states where you might just want to pack your bags and move! Get ready for the pros, the cons, and everything in between. Let’s get into it!

State 1: Florida]

• Visuals: Sun-drenched beaches, theme parks, and lively nightlife.

• Pros: “First up, Florida! Known for its sunshine and warm weather all year round. Great for those who love the beach and outdoor activities. No state income tax is a huge plus for your wallet!”

• Cons: “But, beware of those hurricane seasons and high humidity. And, if you’re not a fan of tourists, some areas can get pretty crowded.”

• Quick Facts: Average cost of living, average temperatures, and key cities highlighted with colorful graphics.

[State 2: Texas]

• Visuals: Expansive landscapes, diverse cities, and Tex-Mex cuisine.

• Pros: “Texas is booming with job opportunities and no state income tax. Plus, it’s got a rich cultural scene and affordable housing!”

• Cons: “On the flip side, the heat can be intense, and traffic in cities like Houston and Dallas can be a real headache.”

• Quick Facts: Key cities, average salaries, and housing market trends.

[State 3: Colorado]

• Visuals: Stunning mountain views, ski resorts, and vibrant city life.

• Pros: “Colorado offers a fantastic quality of life with beautiful landscapes, outdoor activities, and a strong economy. The air is clean, and the people are friendly!”

• Cons: “However, housing prices are rising, and the high altitude might be tough if you’re not used to it. Winter snow can also be a challenge for some.”

• Quick Facts: Cost of living, popular activities, and climate overview.

[State 4: North Carolina]

• Visuals: Scenic mountain ranges, charming cities, and beautiful coastlines.

• Pros: “North Carolina is known for its mild climate, affordable living, and diverse landscapes. It’s got a little bit of everything!”

• Cons: “The job market isn’t as strong in some areas, and you might have to deal with a bit of humidity in the summer.”

• Quick Facts: Highlights of major cities, average cost of living, and climate details.

[State 5: Washington]

• Visuals: Green forests, tech hubs, and vibrant urban scenes.

• Pros: “Washington offers stunning natural beauty and a strong job market, especially in tech. Plus, no state income tax!”

• Cons: “Be prepared for a lot of rain, especially in Seattle, and the cost of living can be quite high. Traffic congestion is another thing to consider.”

• Quick Facts: Major cities, average housing costs, and employment statistics.

[Conclusion]

• Visuals: Recap montage of all five states with vibrant transitions.

• Host Wrap-Up: “So there you have it—five amazing states with their own unique pros and cons. Whether you’re looking for sunshine, job opportunities, or natural beauty, there’s something for everyone. Huge thanks to Mrs. Exquisite Life Hacks for sponsoring this video! If you enjoyed this guide, don’t forget to like, subscribe, and hit that notification bell for more tips and life hacks. Catch you next time!” Signing off with love Mrs Exquisite! Muah 💋 🩸🤑

0 notes