#tax return accountant texas

Text

Move To A Darker Place

This is a story of Man Vs. Machine.

---

Last March, my father attempted to file his Taxes.

My beloved father is a Boomer. Unlike most Boomers, my father is rather handy with technology because he was one of the people that had a not-insignificant hand in Developing a hell of a lot of it. He was studying Computer Science at Cal Poly before the computer science degree existed. I have many fond childhood memories of skipping through the aisles of various electronic and computer part warehouses while Dad described something that either terrified the staff or made them worship him as a God. He taught himself how to use his smartphone. Internationally.

So when he saw the option to file digitally with the IRS through the “ID.me” program, he leapt at the chance to celebrate the Federal Government finally entering the Digital Age.

It was all going swimmingly for about six hours, until he was ready to file and the system told him that it needed to verify his identity.

“Very Well.” said my father, a man unafraid of talking to himself and getting something out of the conversation. “It wouldn’t do for me to get someone else’s return.”

The System told him that it needed him to take a “Digital Image ID”.

a.k.a: A Selfie.

“A-ha!” Dad beams. Dad is very good at taking selfies. He immediately pulled out his phone, snapped one, and tried to upload it.

Please log into your Id.me Account and use the provided app to submit your Digital Image ID. The System clarified.

“Oh. You should have said so.” Dad pouted, but used his phone to log onto the ID.me account, do the six security verification steps and double-checked that the filing looked the same as it did on the desktop, gave the IRS like nine permissions on his phone, and held up the camera to take his Federal Privacy Invasion Selfie.

Please align your face to the indicated grid. Said The System, pulling up a futuristic green-web-of-polygons approximation.

“Ooh, very Star Trek. Gene Roddenberry would HATE this!” Dad said cheerfully, aligning his face to the grid. My father is a bit… cavalier, when it comes to matters of personal information and federal government, because he’s been on FBI watchlists since the late 60’s when he was protesting The Vietnam War and Ronald Regan before he’d broken containment.

Alas.

Anyway, there is very little information the federal government does not have on him already, but he’s as good at stalking the FBI as they are at stalking him, and had worked out a solution: He has something approaching a friendship with the local Federal Agent (Some guy named “Larry”. Allegedly), and got Larry hooked on Alternative Histories and Dad’s collection of carefully-researched “there is very likely buried treasure here” stories, and Larry is loath to bother his favorite Historical Fanfiction author too much.

But I digress.

After thinking for a minute, The System came back with an Error Message. Please remove glasses or other facial obstructions.

And here is where the real trouble began.

See, my father wears glasses that do substantially warp the appearance of his face, because he is so nearsighted that he is legally blind without them. His natural focal point is about 4 inches in front of his nose. While Dad can still take a selfie because he (approximately) knows where his phone is if it’s in his hand, he cannot see the alignment grid.

He should ask someone to take it for him! I hear the audience say. Yes, that would be the sane and reasonable thing to do, but Dad was attempting to do taxes at his residence in Fort Collins, while his immediate family was respectively in Denver, Texas and Canada. He tried calling our neighbors, who turned out to be in Uganda.

He looked down at the dog, Arwen, and her little criminal paws that can open doorknobs, but not operate cell phones.

She looked back at him, and farted.

“Well, I’ll give it a try, but if it gives me too much trouble, I’ll call Larry, and Larry can call the IRS about it.” Dad told her.

She continued to watch him. Arwen is an Australian Kelpie (a type of cattle-herding dog), going on 14 years old, deaf as a post and suffering from canine dementia now, but she still retains her natural instinct to Micromanage. She was also trained as a therapy dog, and even if she can’t hear my dad, still recognizes the body language of a man setting himself up for catastrophe.

So, squinting in the late afternoon light next to the back door, Dad attempted to line his face up with a grid he could only sort-of see, and took A Federal Selfie.

The System thought about it for a few moments.

Image Capture Failed: Insufficient Contrast. The System replied. Please move to a darker place.

“...Huh.” Dad frowned. “Alright.”

He moved to the middle of his office, away from the back door, lit only by the house lighting and indirect sunlight, and tried again.

Image Capture Failed. Please move to a darker place.

“What?” Dad asked the universe in general.

“Whuff.” Arwen warned him against sunk costs.

Dad ignored her and went into the bathroom, the natural habitat of the selfie. Surely, only being lit by a light fixture that hadn’t been changed since Dad was attempting to warn everyone about Regan would be suitably insufficient lighting for The System. It took some negotiating, because that bathroom is “Standing Room Only” not “Standing And Holding Your Arms Out In Front Of You Room”. He ended up taking the selfie in the shower stall.

As The System mulled over the latest attempt, Arwen shuffled over and kicked open the door to watch.

Image Capture Failed. Please Move to a Darker Place.

“Do you mean Spiritually?” Dad demanded.

“Whuff.” Arwen cautioned him again.

Determined to succeed, or at least get a different error message that may give him more information, Dad entered The Downstairs Guest Room. It is the darkest room in the house, as it is in the basement, and only has one legally-mandated-fire-escape window, which has blinds. Dad drew those blinds, turned off the lights and tried AGAIN.

Image Capture Failed. Please Move To A Darker Place.

“DO YOU WANT ME TO PHOTOGRAPH MYSELF INSIDE OF A CAVE??” Dad howled.

“WHUFF!” Arwen reprimanded him from under the pull-out bed in the room. It’s where she attempts to herd everyone when it’s thundering outside, so the space is called her ‘Safety Cave’.

Dad frowned at the large blurry shape that was The Safety Cave.

“Why not?” he asked, the prelude to many a Terrible Plan. With no small amount of spiteful and manic glee, Dad got down onto the floor, and army-crawled under the bed with Arwen to try One Last Time. Now in near-total darkness, he rolled on his side to be able to stretch his arms out, Arwen slobber-panting in his ear, and waited for the vague green blob of the Facial grid to appear.

This time, when he tapped the button, the flash cctivated.

“GOD DAMN IT!” Dad shouted, dropping the phone and rubbing his eyes and cursing to alleviate the pain of accidentally flash-banging himself. Arwen shuffled away from him under the bed, huffing sarcastically at him.

Image Capture Failed. Please move to a darker place.

“MOTHERFU- hang on.” Dad squinted. The System sounded strange. Distant and slightly muffled.

Dad squinted really hard, and saw the movement of Arwen crawling out from under the bed along the phone’s last known trajectory.

“ARWEN!” Dad shouted, awkwardly reverse-army crawling out from under the bed, using it to get to his feet and searching for his glasses, which had fallen out of his pocket under the bed, so by the time he was sighted again, Arwen had had ample time to remove The Offending Device.

He found her out in the middle of the back yard, the satisfied look of a Job Well Done on her face.

She did not have the phone.

“Arwen.” Dad glared. It’s a very good glare. Dad was a teacher for many years and used it to keep his class in order with sheer telepathically induced embarrassment, and his father once glared a peach tree into fecundity.

Arwen regarded him with the casual interest a hurricane might regard a sailboat tumbling out of its wake. She is a force of nature unto herself and not about to be intimidated by a half-blind house ape. She also has cataracts and might not be able to make out the glare.

“I GIVE UP!” Dad shouted, throwing his hands in the air and returning to the office to write to the IRS that their selfie software sucks ass. Pleased that she had gotten her desired result, Arwen followed him in.

To Dad’s immense surprise, the computer cheerfully informed him that his Federally Secure Selfie had been accepted, and that they had received and were now processing his return!

“What the FUCK?” Dad glared. “Oh well. If I’ve screwed it up, Larry can call me.”

---

I bring this up because recently, Dad received an interesting piece of mail.

It was a letter from the IRS, addressed to him, a nerve-wracking thing to recessive at the best of times. Instead of a complaint about Dad’s Selfie Skills, it was a letter congratulating him on using the new ID.me System. It thanked him for his help and expressed hopes he would use it again next year, and included the selfie that The System had finally decided to accept.

“You know, my dad used to complain about automation.” Dad sighed, staring at the image. “Incidentals my boy! My secretary saves the state of California millions of dollars a year catching small errors before they become massive ones! He’d say. Fought the human resources board about her pay every year. I used to think he was overestimating how bad machines were and underestimating human error, but you know? He was right.”

He handed me the image.

My father was, technically, in the image. A significant amount of the bottom right corner is taken up by the top of his forehead and silver hair.

Most of the image, the part with the facial-recognition markers on it, was composed of Arwen’s Alarmed and Disgusted Doggy face.

“Oh no!” I cackled. “Crap, does this mean you have to call the IRS and tell them you’re not a dog?”

“Probably.” Dad sighed. “I know who I’m gonna bother first though.” he said, taking out his phone (Dad did find his phone a few hours after Arwen absconded with it when mom called and the early spinach started ringing).

“Hey Larry!” Dad announced to the local federal agent. “You’re never gonna believe this. My dog filed my taxes!”

Larry considered this for a moment. “Is this the dog that stole my sandwich? Out of my locked car?” he asked suspiciously.

“The very same.” Dad grinned.

“Hm. Clever Girl.” Federal Agent Larry sighed. “I figured it was only a matter of time before she got into tax fraud.”

---

I'm a disabled artist making my living writing these stories. If you enjoy my stories, please consider supporting me on Ko-fi or Pre-ordering my Family Lore Book on Patreon. Thank you!

#Family Lore#Dogs#arwen#Arwen the Crime Dog#Taxes#Ronald Regan mention (derogatory)#long post under the cut#this one is funny this time#I could really use some extra tip money this month

9K notes

·

View notes

Text

A House committee on Friday made public six years of former President Donald Trump's tax returns, which showed he paid relatively little in taxes in the years before and during his presidency.

The House Ways and Means Committee had voted to make the thousands of pages of returns public in a party-line vote last week, but their release was delayed while staffers redacted sensitive personal information like Social Security numbers from the documents. Friday's release, the culmination of years of legal wrangling and speculation, included both personal and business records.

Trump on Friday blasted the release in a statement and on his Truth Social platform, saying “the Democrats should have never done it, the Supreme Court should have never approved it, and it’s going to lead to horrible things for so many people."

He also maintained the returns he fought to keep hidden — despite modern precedent that Presidents make their returns public — "show how proudly successful I have been and how I have been able to use depreciation and various other tax deductions as an incentive for creating thousands of jobs and magnificent structures and enterprises.”

The panel’s top Republican, Rep. Kevin Brady of Texas, called the release of the documents “unprecedented,” and said Democrats had unleashed “a dangerous new political weapon that reaches far beyond the former President, overturning decades of privacy protections for average Americans.”

“This is a regrettable stain on the Ways and Means Committee and Congress, and will make American politics even more divisive and disheartening. In the long run, Democrats will come to regret it,” Brady said.

The returns confirm much of what was contained in a 39-page report from the Joint Committee on Taxation released last week, including summaries from Trump’s personal tax forms and business entities.

For example, in 2020, Trump appeared to owe nothing in taxes, the report showed. That was thanks to Trump claiming $15 million in business losses, which resulted in him having negative $4 million in adjusted gross income. Trump then claimed a $5 million refund.

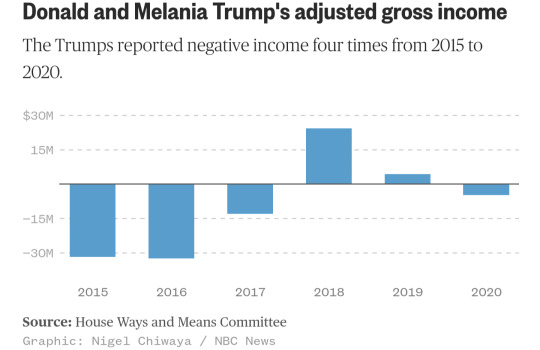

Trump reported millions in negative income in 2015, 2016, 2017 and 2020, and he paid only $750 in federal income taxes in 2016 and 2017.

In 2019, Trump and his wife, Melania, reported significant losses of more than $16.4 million but reported a total income of $4.4 million.

The returns also show Trump had numerous foreign bank accounts between 2015 and 2016, including in China, the United Kingdom, Ireland and St. Martin. The existence of the China account was first reported by the New York Times in 2020. Trump Organization lawyer Alan Garten told the paper then that the company had “opened an account with a Chinese bank having offices in the United States in order to pay the local taxes” after opening an office “to explore the potential for hotel deals in Asia.”

The other accounts were in countries where Trump had properties. His 2018 through 2020 returns only note having an account in the U.K. “I have many bank accounts and they’re all listed and they’re all over the place,” Trump said during an Oct. 2020 presidential debate. “I was a businessman doing business.”

The committee report also listed several overarching issues it believed the IRS should have investigated. For example, Trump claimed large cash donations to charities, but the report said the IRS did not verify them. The report also said that while Trump’s tax filings were large and complicated, the IRS does not appear to have assigned experts to work on them.

The Ways and Means Committee separately released a 29-page report summarizing its investigation into an IRS policy that mandates audits of returns filed by presidents and vice presidents. The committee found that the IRS had largely not followed its own internal requirements, beginning to examine Trump’s returns only after the House panel inquired about the process. Just one year of Trump’s returns was officially selected for the mandatory review while he was in office, and that audit of Trump's 2016 taxes was not complete by the time he left the White House, according to the report.

An audit of Trump's 2015 taxes was started shortly before the 2016 audit in 2019 — the same day the Ways and Means committee asked for information on the mandatory audits. Neither the 2015 audit nor audits of Trump's 2017-19 taxes that began after he left office were marked as being part of the audit program, and as of last month, none had been marked as completed either, the committee said.

The committee obtained Trump's tax returns in November, following a yearslong court fight for documents that other presidents have routinely made public since the 1970s.

The dispute ended up at the Supreme Court, which rejected Trump’s last-ditch plea to block the release of his tax records to House Democrats in a brief order handed down just before Thanksgiving.

Trump's refusal to release his returns led to a swirl of suspicions about what he might be trying to hide — foreign business dealings, a smaller fortune than he'd claimed publicly or paying less in taxes than the average American.

During the 2016 campaign, Trump maintained that he couldn't release his returns because they were under audit, and that he would make them public when it was completed — a vow he walked away from after he took office.

Information about his taxes has dripped out over the years.

In October 2016, The New York Times published some of Trump's 1995 state taxes and reported that he'd declared a $916 million loss that year. Three tax experts hired by the paper said the size of the loss and tax rules governing wealthy filers at the time could have allowed Trump to legally pay no federal income taxes for 18 years.

After Trump took office in 2017, reporter David Cay Johnston went on MSNBC's "The Rachel Maddow Show" with what he said were two pages of Trump's Form 1040 from 2005.

The documents, which were published on Johnston's site DCReport.org, showed that Trump had paid $38 million in federal income tax on more than $150 million in income.

In September 2020, the Times reported that it had obtained two decades of Trump’s tax information, which showed he had not paid any income taxes in 10 of the prior 15 years, mostly because he reported significant losses. In the year he won the presidency and his first year in office, he paid just $750 in federal income tax, the paper found.

Asked about the report at the time, the then-president said the story was “made up" and that he’s “paid a lot of money in state” taxes. He later tweeted that he’d “paid many millions of dollars in taxes but was entitled, like everyone else, to depreciation & tax credits.”

Trump also fought unsuccessfully to keep his tax information out of the hands of investigators in New York, who were probing his business practices. That clash also went all the way to the Supreme Court, which denied Trump's attempt to block a grand jury from getting Trump’s personal and corporate tax returns in February of last year.

Those returns helped prosecutors from the Manhattan district attorney's office build a tax fraud case against Trump's company, the Trump Organization. The company was convicted this month of carrying out a 15-year tax fraud scheme that prosecutors said was orchestrated by top executives at the company.

During the trial, Trump's accountant Donald Bender testified that the former President had losses totaling $900 million in 2009 and 2010.

The company is scheduled to be sentenced on Jan. 13. Trump, who was not charged in the case, has dismissed the allegations and conviction as part of a politically motivated "witch hunt."

#us politics#news#donald trump#2022#trump tax returns#trump taxes#trump administration#irs#internal revenue service#presidential audit program#house ways and means committee#truth social#Rep. Kevin Brady#Joint Committee on Taxation#trump organization#trump organization scandal#Alan Garten#melania trump#Donald Bender#nbc news

5 notes

·

View notes

Text

youtube

Business Name:

Sarah Jones CPA, LLC

Street Address 1:

1336 League Line Rd

Street Address 2:

Ste. 300

City:

Conroe

State:

Texas (TX)

Zip Code:

77304

Country:

USA

Business Phone Number:

(936) 228-2231

Business Email Address:

[email protected]

Website:

https://www.SarahJonesCPA.com/

Facebook:

https://www.facebook.com/SarahJonesCPALLC

Description:

We are a CPA Firm located in Conroe Texas, but are also licensed by the IRS in all 50 states. We are a boutique firm, specializing in advanced tax planning and providing massive value to our clients through our innovative strategies and services. We feel that each business owner should have a good CPA on their side. A CPA should not be seen as a "cost", but rather an investment in your tax planning and wealth management process. We offer a complimentary tax analysis to all potential and new clients. Tax planning is the foundation of all we do here at Sarah Jones CPA. Our Services Include: Accounting And Advisory Tax Preparation Tax Planning Business Consulting Wealth Advisory Services Insurance IRS Representation

Google My Business CID URL:

https://www.google.com/maps?cid=7120713542994838127

Business Hours:

Sunday Closed

Monday 9:00am-3:00pm

Tuesday 9:00am-3:00pm

Wednesday 9:00am-3:00pm

Thursday 9:00am-3:00pm

Friday 9:00am-3:00pm

Saturday Closed

Services:

Business consulting, Business tax planning, Business tax return preparation, Financial advising, General bookkeeping, Individual income tax return preparation, Individual tax planning, IRS representation & resolution, Payroll accounting, Accounts receivable, Bank reconciliations, Budgeting and forecasting, Business structure, Cfo services, Monthly reports, Prior year tax returns, Revenue growth, Financial planning , Tax planning, Estate planning, Wealth management

Keywords:

cpa conroe tx, tax preparation conroe tx, cpa near me, tax preparation near me, tax services conroe tx, bookkeeping services conroe tx, bookkeeping services near me

Business Slogan:

Build. Protect. Grow.

Owner Name, Email, and Contact Number:

Sarah Jones, [email protected], (936)228-2231

Location:

Service Areas:

2 notes

·

View notes

Text

Comprehensive Tax Services in Corpus Christi: Your Trusted CPA for IRS Relief, Financial Planning, and More

Introduction:

Managing your taxes efficiently is vital to maintaining financial health, both personally and for your business. Whether you're dealing with unfiled tax returns or looking for professional help with financial planning, finding the right Certified Public Accountant (CPA) can make all the difference. Hopkins CPA Firm, located in Corpus Christi, Texas, is your go-to partner for a range of financial services. With expertise in tax preparation, IRS Offer in Compromise, tax resolution, and more, our firm is dedicated to providing solutions that ease the burden of tax complexities.

This article delves into the core services offered by Hopkins CPA Firm, covering tax resolution services, IRS representation, and financial planning. Whether you're in Corpus Christi, Austin, Dallas, or anywhere in Texas, our experienced CPAs are equipped to help you tackle IRS problems, prepare your taxes, and plan for a secure financial future.

The Importance of a Local CPA in Corpus Christi

Corpus Christi has a unique blend of industries, including oil and gas, tourism, and agriculture, all of which have specific tax requirements. Having a CPA who understands these local nuances can make a big difference in how your taxes are handled. At Hopkins CPA Firm, we are deeply familiar with the tax laws and regulations that affect businesses and individuals in this area. From helping with unfiled tax returns to negotiating with the IRS, our team provides the personalized service that you need.

Local knowledge matters, especially when dealing with the IRS. Whether you are in Corpus Christi or another city like Austin or Dallas, understanding state and federal tax laws is essential. That’s why our team specializes in handling complex tax issues, whether for businesses or individuals, ensuring compliance and minimizing liabilities.

Unfiled Tax Returns Help: Get Back on Track

One of the most stressful issues taxpayers face is unfiled tax returns. The IRS takes this very seriously, and failure to file can result in severe penalties, wage garnishments, or even legal consequences. At Hopkins CPA Firm, we specialize in helping individuals and businesses who have fallen behind on their tax filings. Our team will work diligently to ensure all necessary paperwork is completed and filed, helping you avoid costly penalties.

Our firm not only assists in catching up on unfiled tax returns but also provides advice on how to stay compliant moving forward. We take a personalized approach, understanding your financial situation and offering solutions that fit your specific needs.

IRS Offer in Compromise: A Lifeline for Taxpayers

If you owe a significant amount of back taxes and are unable to pay the full amount, you may be eligible for an IRS Offer in Compromise (OIC). An OIC allows you to settle your tax debt for less than what you owe, provided you meet certain conditions. Hopkins CPA Firm has extensive experience in negotiating Offers in Compromise with the IRS, and we can guide you through the entire process.

Navigating the Offer in Compromise program can be complex. It requires a thorough understanding of your financial situation and the IRS's strict criteria. Our experienced CPAs will assess your eligibility, prepare the necessary paperwork, and negotiate with the IRS on your behalf. Our goal is to help you reduce your tax burden and give you a fresh start.

Tax Preparation for Individuals and Businesses

Tax preparation is not a one-size-fits-all process. Whether you’re an individual or a business owner, your tax situation is unique. Hopkins CPA Firm offers comprehensive tax preparation services tailored to meet your specific needs. We handle everything from basic tax returns to complex corporate filings, ensuring that every deduction and credit is claimed.

Our team stays updated on the latest tax laws to ensure compliance while maximizing your refund or minimizing your tax liability. By using a professional CPA firm like ours, you can be confident that your taxes are being prepared accurately and efficiently.

CPA Services in Austin and Dallas, Texas

Although our main office is located in Corpus Christi, we proudly extend our services to individuals and businesses in Austin and Dallas. These cities are home to growing industries and dynamic economies, each with its own unique tax challenges. Whether you are a tech entrepreneur in Austin or a corporate executive in Dallas, Hopkins CPA Firm is here to help you navigate the tax landscape.

Our CPAs understand the specific tax laws that affect businesses and individuals in Austin and Dallas. We offer the same level of personalized service to clients in these cities as we do in Corpus Christi, ensuring that your taxes are managed with the utmost care.

Financial Planning: Preparing for the Future

Financial planning is an essential aspect of managing both your personal and business finances. At Hopkins CPA Firm, we offer more than just tax services; we provide comprehensive financial planning solutions to help you achieve your long-term goals. Whether you are planning for retirement, saving for a child’s education, or managing your business's financial growth, our team has the expertise to guide you every step of the way.

Our financial planning services are tailored to your unique circumstances, helping you create a roadmap for your financial future. We offer investment advice, retirement planning, estate planning, and more, ensuring that your financial health is in good hands.

IRS Help: Resolving Tax Issues

Facing the IRS can be intimidating, especially if you owe back taxes or are dealing with penalties. At Hopkins CPA Firm, we provide professional IRS representation to help you resolve these issues. Whether you are facing wage garnishments, tax liens, or audits, our team has the experience to represent you effectively.

Our IRS resolution services include negotiating payment plans, requesting penalty abatement, and filing appeals when necessary. We work closely with the IRS to ensure that your tax issues are resolved in a timely and favorable manner.

Conclusion:

When it comes to managing your taxes and financial future, the right CPA can make all the difference. Hopkins CPA Firm in Corpus Christi is committed to providing comprehensive tax services, from unfiled tax return assistance to IRS Offer in Compromise, tax preparation, and financial planning. Whether you’re in Corpus Christi, Austin, or Dallas, our experienced team is ready to help you navigate the complexities of tax law and achieve financial success.

0 notes

Text

How to Budget Your First Home Purchase with a Local Real Estate Agent in Garden Ridge

Buying your first home is an exciting milestone, and with the right planning and guidance, it can also be a smooth and enjoyable process. If you are considering purchasing a home in Garden Ridge, Texas, working with a local real estate agent can be invaluable.

In this article, you can read in brief how to budget for your first home purchase, how to qualify for down payment assistance, debunk common misconceptions about these programs, and what to look for in a local real estate agent in Garden Ridge can help you navigate the process.

Budgeting is the foundation of a successful home purchase. Here’s a step-by-step guide to help you manage your finances effectively:

1. Assess Your Financial Situation

Start by evaluating your current financial status. Review your income, expenses, and any outstanding debts. Create a detailed budget to understand how much you can comfortably afford to spend on a home.

2. Determine Your Down Payment

Traditionally, a down payment of 20% of the home’s purchase price is recommended. However, many first-time buyers put down less. In Garden Ridge, with its diverse range of housing options, you might find that a lower down payment is feasible. Consider your savings and explore local down payment assistance programs to determine what’s best for you.

3. Calculate Monthly Mortgage Payments

Use online mortgage calculators to estimate your monthly payments based on different loan amounts, interest rates, and terms. Don’t forget to include property taxes, homeowners insurance, and potential HOA fees.

4. Consider Additional Costs

Beyond the down payment and monthly mortgage, factor in other expenses such as closing costs, moving costs, and any immediate home repairs or upgrades.

5. Plan for Future Expenses

Homeownership comes with ongoing costs, including maintenance, utilities, and repairs. Make sure your budget accounts for these future expenses to avoid financial strain.

How to Qualify for Down Payment Assistance

Down payment assistance programs can significantly ease the financial burden of buying a home. Here’s how to qualify:

Understand Program Requirements: Different programs have various eligibility criteria. Generally, you need to meet income limits, be a first-time homebuyer (or not have owned a home in the past three years), and buy a home within certain price limits. Research local programs in Garden Ridge to find one that fits your needs.

Check Your Credit Score: Many down payment assistance programs require a minimum credit score. Check your credit report and work on improving your score if necessary.

Complete Required Education: Some programs require homebuyer education courses. These courses provide valuable information about the home buying process and can be a great resource for first-time buyers.

Prepare Documentation: Gather necessary documentation, including proof of income, tax returns, and bank statements. Being organized will help streamline the application process.

Potential Types of Assistance – Down Payment Assistance Programs Garden Ridge

There are many DPA programs available for home buyers in Garden Ridge and in Texas. Here are some examples of potential types of assistance that you can explore:

Grants: This is one type of down payment assistance program available in Garden Ridge that is non-repayable. Funds are granted for down payments or closing costs

Loans: Repayable funds generally at a discounted rate, such as TDHCA’s loan for first-time buyers and NHSSA’s loan program.

Tax Credits: Offset tax liability, potentially boosting your monthly income for mortgage payments. TDHCA and TSAHC offer tax credit programs.

Discounts: Lower home or loan costs to minimize upfront or ongoing expenses.

Conclusion

Budgeting for your first home purchase in Garden Ridge involves careful planning and consideration. Working with a local real estate agent who understands the area and the nuances of down payment assistance can make the process much smoother. By budgeting wisely, qualifying for assistance, and choosing the right agent, you can navigate your first home purchase with confidence and ease.

Reach out to us!

0 notes

Text

Tips for Maximizing Retirement Savings with Planning

Planning for retirement is one of the most important financial steps you can take. With the right Retirement Planning strategies, you can maximize your retirement savings and ensure a comfortable future. Here are a few crucial pointers to get you going.

1. Start Early and Contribute Regularly

The more time you give your money to grow, the earlier you start saving for retirement. By making consistent contributions to your retirement accounts, you can benefit from compound interest. Over time, even modest, regular contributions can have a big impact.

2. Take Advantage of Employer-Sponsored Plans

If your employer offers a 401(k) or similar retirement plan, make sure to participate. Matching contributions, which are essentially free money, are offered by many employers. Make an effort to contribute enough to win the entire game.

3. Diversify Your Investments

The secret to minimizing risk and optimizing returns is diversification. Invest in a variety of asset classes, including bonds, equities, and real estate. This approach can help protect your portfolio from market volatility and provide more stable growth.

4. Maximize Tax-Advantaged Accounts

Utilize tax-advantaged retirement accounts like IRAs and Roth IRAs. These accounts have tax advantages that can improve the efficiency with which your funds grow. Understand the contribution limits and rules for each type of account to make the most of these benefits.

5. Plan for Healthcare Costs

Healthcare can be a significant expense in retirement. If you qualify, think about making investments in a Health Savings Account (HSA). HSAs provide three tax benefits: tax-deductible contributions, tax-free growth, and tax-free withdrawals for approved medical costs.

6. Review and Adjust Your Plan Regularly

Your retirement strategy need to change as your circumstances do. Regularly review your investments, contributions, and goals. Adjust your plan as needed to stay on track and ensure it aligns with your current financial situation and future aspirations.

7. Seek Professional Advice

Retirement planning can be complex, and professional guidance can make a big difference. At Expo Wealth, we specialize in providing tailored Retirement Planning, Philanthropy Services, and Estate Planning to help you achieve your financial goals. Our team of experts can help you create a comprehensive retirement strategy that maximizes your savings and ensures a secure future.

Conclusion

Maximizing your retirement savings requires careful planning and consistent effort. By starting early, taking advantage of employer-sponsored plans, diversifying your investments, utilizing tax-advantaged accounts, planning for healthcare costs, and regularly reviewing your plan, you can build a robust retirement fund. And remember, seeking professional advice can provide you with the confidence and expertise you need to succeed.

At Expo Wealth, we are committed to helping our clients in Texas achieve their financial goals through comprehensive Philanthropy Services, Retirement Planning and Estate Planning. Contact us today to learn more about how we can assist you on your retirement journey.

#Retirement Planning Services#Retirement Planning Strategies#Estate Planning#Retirement Planning#Investment Plans#Wealth Management

0 notes

Text

Discover Your Ideal Investment Property with LandSellersUSA com

Investing in real estate has long been a cornerstone of wealth creation, offering a tangible asset that can appreciate over time. However, finding the perfect investment property in the vast landscape of the United States can be daunting. Enter LandSellersUSA.com, your ultimate resource for locating prime investment properties for sale across the nation. With an extensive inventory and user-friendly interface, LandSellersUSA.com makes it easy to commence your investment journey immediately.

.

Why Invest in Real Estate?

Before diving into the features of Discounted residential lots for sale in Texas , it’s important to understand the benefits of investing in real estate:

Steady Cash Flow: Rental properties can provide a reliable source of monthly income.

Appreciation: Real estate often increases in value over time, providing a solid return on investment.

Tax Benefits: Real estate investors can take advantage of various tax deductions, including mortgage interest, property depreciation, and maintenance costs.

Diversification: Adding real estate to your investment portfolio helps diversify your assets, reducing risk.

Inflation Hedge: Real estate investments typically keep pace with inflation, preserving your purchasing power.

How LandSellersUSA.com Simplifies Your Search

LandSellersUSA.com is designed to streamline the property search process, making it easier for investors to find their ideal property. Here’s how:

Extensive Inventory

One of the standout features of LandSellersUSA.com is its extensive inventory of real estate listings. Whether you’re looking for residential properties, commercial spaces, agricultural land, or undeveloped plots, you’ll find a wide range of options to suit your investment goals. The platform aggregates listings from various sources, providing a comprehensive database that saves you time and effort.

User-Friendly Interface

Navigating the vast real estate market can be overwhelming, but LandSellersUSA.com’s user-friendly interface simplifies the process. The website is intuitively designed, allowing users to easily browse listings, apply filters, and compare properties. You can search by location, property type, price range, and other criteria to quickly find properties that meet your specific requirements.

Detailed Property Information

Making informed investment decisions requires access to detailed property information. LandSellersUSA.com provides comprehensive property descriptions, high-quality images, and essential details such as square footage, lot size, zoning information, and nearby amenities. This wealth of information empowers investors to evaluate properties thoroughly before making a purchase.

Market Insights and Trends

Staying informed about market trends is crucial for successful real estate investing. LandSellersUSA.com offers valuable insights and data on market conditions, helping investors make strategic decisions. From current property values and rental rates to neighborhood growth projections, the platform provides the information you need to identify lucrative investment opportunities.

Expert Support

For investors seeking additional guidance, LandSellersUSA.com offers access to a network of real estate professionals. Whether you need advice on financing options, property management, or legal considerations, the platform connects you with experts who can help you navigate the complexities of real estate investing.

Start Your Investment Journey Today

Embarking on your real estate investment journey has never been easier. With LandSellersUSA.com, you have a powerful tool at your fingertips to find and evaluate investment properties for sale across the United States. Here’s how to get started:

Visit LandSellersUSA.com: Head to the website to explore the extensive inventory of investment properties.

Create an Account: Sign up for a free account to save your favorite listings, receive notifications, and access additional features.

Search for Properties: Use the intuitive search tools to find properties that match your investment criteria.

Analyze Listings: Review detailed property information and market insights to make informed decisions.

Connect with Experts: Reach out to real estate professionals for advice and support.

LandSellersUSA.com is your gateway to discovering lucrative investment opportunities in the United States. Whether you’re a seasoned investor or just starting, the platform’s comprehensive resources and user-friendly design make it easier than ever to locate and invest in prime real estate. Start your investment journey today and unlock the potential of the U.S. real estate market with Investment Property for Sale USA

0 notes

Text

Trusted Financial Solutions with Hopkins CPA Firm in Corpus Christi

At Hopkins CPA Firm in Corpus Christi, we pride ourselves on delivering exceptional financial and tax services tailored to meet the unique needs of our clients. With a reputation for excellence and a commitment to providing top-notch advice and support, our firm is your go-to resource for all matters related to tax consulting, financial planning, and IRS assistance. Whether you require help with unfiled tax returns, tax preparation for your business, or navigating an IRS offer in compromise, our experienced team is here to provide expert guidance and solutions.

Premier CPA Services in Corpus Christi

As a leading CPA in Corpus Christi, Hopkins CPA Firm offers a comprehensive range of services designed to address various financial and tax-related needs. Our certified public accountants bring a wealth of knowledge and experience to the table, ensuring that all your financial matters are handled with precision and care. From individual tax returns to complex business tax filings, our team is equipped to handle it all. We understand the intricacies of tax laws and regulations and are dedicated to providing reliable and effective solutions to help you achieve your financial goals.

Expert Help with Unfiled Tax Returns

Dealing with unfiled tax returns can be stressful and overwhelming. At Hopkins CPA Firm, we specialize in providing professional unfiled tax returns help to assist you in getting back on track. Our team will work with you to gather necessary documentation, prepare and file your outstanding returns, and address any issues related to your past filings. We understand the potential consequences of unfiled returns and are committed to helping you navigate the process smoothly, ensuring that your tax obligations are met and any penalties or interest are managed effectively.

Professional Tax Preparation for Businesses

For business owners, accurate and timely tax preparation is crucial to maintaining compliance and optimizing financial performance. At Hopkins CPA Firm, we offer expert tax preparation business services tailored to meet the needs of companies of all sizes. Our team will work closely with you to understand your business’s unique financial situation and prepare your tax returns efficiently. We provide thorough and meticulous tax preparation services to help you minimize your tax liability and maximize your financial benefits, ensuring that you are well-prepared for tax season and beyond.

Navigating IRS Offers in Compromise

If you’re struggling with tax debt and looking for a resolution, an IRS offer in compromise may be a viable solution. At Hopkins CPA Firm, we provide comprehensive assistance with this process, helping you negotiate with the IRS to settle your tax debt for less than the full amount owed. Our experienced tax attorneys and consultants will evaluate your financial situation, prepare the necessary documentation, and advocate on your behalf to achieve a favorable outcome. We are dedicated to helping you find relief from tax burdens and offering a path to financial recovery.

CPA Services Across Texas

While our primary focus is on serving clients in Corpus Christi, Hopkins CPA Firm also provides expert services to clients in other major Texas cities, including CPA Austin Texas and CPA Dallas. Our extensive network of professionals ensures that clients across the state receive high-quality financial and tax services. Whether you’re based in Austin, Dallas, or another location, our team is ready to deliver the same level of expertise and commitment to excellence that defines our firm.

Comprehensive Financial Planning Services

Effective financial planning is key to achieving long-term financial success. At Hopkins CPA Firm, we offer a range of financial planning services designed to help you manage your finances, plan for the future, and reach your financial goals. Our team will work with you to create a customized financial plan that addresses your unique needs and objectives, from retirement planning and investment strategies to estate planning and risk management. We are dedicated to providing insightful and actionable advice to help you navigate your financial journey with confidence.

Contact Hopkins CPA Firm Today

If you’re looking for expert financial and tax services, look no further than Hopkins CPA Firm. Whether you need assistance with unfiled tax returns, professional tax preparation for your business, help with an IRS offer in compromise, or comprehensive financial planning, our team is here to provide the support and solutions you need. Contact us today to schedule a consultation or learn more about how we can assist with your financial and tax needs. Our dedicated professionals are ready to help you achieve your financial goals and find the relief you need.

In Conclusion

At Hopkins CPA Firm, we are committed to providing top-tier financial and tax services to clients in Corpus Christi and beyond. From expert CPA services in Corpus Christi to assistance with unfiled tax returns, professional tax preparation for businesses, and guidance on IRS offers in compromise, our firm is equipped to handle a wide range of financial challenges. Our focus on delivering high-quality, personalized service and effective solutions sets us apart as the trusted choice for all your financial needs. Reach out to us today and experience the difference that professional, dedicated service can make.

0 notes

Text

How Mobile Apps Are Enhancing Tax Refunds and Payments: Efficiency and Convenience

In the rapidly evolving world of finance and technology, mobile apps are transforming how we manage tax refunds and payments. The convenience and efficiency offered by these apps are revolutionizing the tax experience for both individuals and businesses. From simplifying the refund process to streamlining payment methods, mobile apps are making tax-related tasks more accessible and user-friendly. In this blog, we'll explore how mobile apps are enhancing tax refunds and payments and how leveraging mobile app development services in Texas can further optimize these processes.

Enhancing Tax Refunds with Mobile Apps

1. Faster Processing Times

Efficiency: Mobile apps accelerate the tax refund process by allowing users to submit their returns electronically. This speed reduces the time spent waiting for refunds compared to traditional paper filing methods.

Example: Users can file their taxes through a mobile app and receive notifications about their refund status in real-time. With electronic filing and direct deposit options, refunds are processed more quickly and efficiently.

2. Real-Time Refund Tracking

Convenience: Mobile apps provide users with real-time tracking of their tax refunds. This feature allows users to monitor the status of their refunds, ensuring they stay informed throughout the process.

Example: A mobile tax app can display updates on the status of your refund, including when it is being processed, approved, and when you can expect it to be deposited into your account.

3. Automated Refund Calculations

Efficiency: Many mobile tax apps come equipped with built-in calculators that automatically determine the amount of the refund based on the submitted data. This automation reduces manual errors and ensures accurate refund amounts.

Example: By inputting your financial information, the app calculates potential deductions and credits to provide an accurate estimate of your refund.

4. Streamlined Documentation

Convenience: Mobile apps simplify the process of submitting required documentation for tax refunds. Features like photo capture and document upload allow users to easily provide necessary documents without needing to visit a physical office.

Example: Users can take pictures of their W-2 forms or receipts and upload them directly to the app, speeding up the documentation process and reducing the chance of errors.

Streamlining Tax Payments with Mobile Apps

1. Secure Payment Options

Efficiency: Mobile tax apps offer secure payment options, such as credit/debit card payments and electronic transfers. These methods ensure that payments are processed quickly and securely.

Example: Users can pay their taxes directly through the app using a secure payment gateway, ensuring their payment information is protected and minimizing the risk of fraud.

2. Easy Payment Scheduling

Convenience: Mobile apps allow users to schedule tax payments in advance, helping them manage their finances more effectively and avoid last-minute payment rushes.

Example: A mobile app can enable users to set up automatic payments for estimated taxes or balance due, ensuring timely payments and reducing the risk of penalties.

3. Integrated Payment Reminders

Efficiency: Mobile apps can send reminders and notifications about upcoming tax payments and deadlines. This feature helps users stay on top of their payment schedules and avoid late fees.

Example: Users receive push notifications or email alerts about payment due dates, providing ample time to prepare and make the payment.

4. Detailed Payment Records

Convenience: Mobile apps provide users with detailed records of their tax payments. This feature helps users keep track of their payment history and simplifies the process of reconciling payments.

Example: Users can access a comprehensive history of their tax payments through the app, including dates, amounts, and transaction details, making it easier to manage and review their payment history.

Why Partner with Mobile App Development Services in Texas?

Integrating these features into a mobile tax app requires specialized expertise and technology. By partnering with professionals in mobile app development services in Texas, you can benefit from:

Custom Solutions: Tailored app development that meets your specific needs for tax refunds and payments.

Advanced Security: Implementation of robust security measures to protect sensitive financial data.

User-Friendly Design: Development of intuitive interfaces that enhance the user experience and simplify tax management.

Ongoing Support: Access to expert support and maintenance to ensure the app continues to perform efficiently and securely.

Conclusion

Mobile apps are revolutionizing the way we handle tax refunds and payments by offering enhanced efficiency and convenience. From faster processing times and real-time tracking to secure payment options and detailed records, these apps are transforming the tax experience. By partnering with mobile app development services in Texas, you can ensure that your mobile tax app leverages the latest technology and features to provide a seamless and efficient user experience.

Embrace the future of tax management with mobile apps and enjoy the benefits of improved efficiency and convenience in handling your tax refunds and payments.

0 notes

Text

Navigating the Complexities of Estate Planning: Essential Insights for Plano Residents

Estate planning is an essential aspect of ensuring your assets are managed and distributed according to your wishes. This comprehensive guide will delve into crucial topics such as trust administration, estate tax analysis, probate alternatives, and the role of a Plano probate lawyer, providing you with valuable information to navigate these processes effectively.

Expert Trust Administration Lawyers

Trust administration lawyers play a pivotal role in managing and distributing assets held in a trust. They ensure that the trust is administered according to the terms set forth in the trust document, providing legal guidance and support to trustees. Trust administration involves various tasks, including inventorying assets, filing necessary tax returns, and distributing assets to beneficiaries. Our team of skilled trust administration lawyers is adept at handling these responsibilities, ensuring that the trust administration process is smooth and compliant with legal requirements.

Comprehensive Estate Tax Analysis

Estate tax analysis is a critical component of estate planning, helping to minimize the tax burden on your estate. This analysis involves evaluating your estate's value, understanding applicable tax laws, and implementing strategies to reduce estate taxes. Our expertise in estate tax analysis enables us to identify potential tax liabilities and devise effective tax planning strategies. By doing so, we ensure that more of your estate is preserved for your beneficiaries, rather than being consumed by taxes.

Exploring Probate Alternatives

When planning your estate, it's important to consider probate alternatives to streamline the asset distribution process and avoid the lengthy and costly probate procedure. Some common probate alternatives include establishing living trusts, joint ownership of property, and designating beneficiaries on accounts and insurance policies. These alternatives can simplify the transfer of property upon death, providing a more efficient and private means of distributing your assets. Our experience in estate planning allows us to recommend the most suitable probate alternatives for your specific circumstances, ensuring your estate is managed according to your wishes.

Understanding the Trust Administration Process

The trust administration process encompasses a series of steps that must be followed to properly manage and distribute trust assets. These steps typically include:

Notification of Beneficiaries: Informing beneficiaries about the trust and their entitlement.

Inventory and Appraisal of Assets: Compiling a comprehensive list of trust assets and determining their value.

Payment of Debts and Taxes: Settling any outstanding debts and taxes owed by the trust.

Distribution of Assets: Distributing the remaining assets to beneficiaries according to the trust's terms.

Our thorough understanding of the trust administration process ensures that all legal requirements are met, and that the interests of the beneficiaries are protected.

Guidance from a Plano Probate Lawyer

A Plano probate lawyer is essential in guiding families through the probate process. Probate is the legal procedure for settling a deceased person's estate, including validating the will, inventorying assets, paying debts, and distributing the remaining assets to beneficiaries. Our team of experienced probate lawyers in Plano provides the necessary legal expertise and support to executors and administrators, ensuring that all aspects of the probate process are handled efficiently and in compliance with Texas probate laws. With our guidance, you can navigate the complexities of probate with confidence and peace of mind.

#trust administration lawyers#estate tax analysis#probate alternatives#trust administration process#plano probate lawyer

0 notes

Text

Onie Burnett Granville (June 28, 1916 - September 21, 1998) a Los Angeles Realtor, founded two Black-owned and operated state-chartered banks in the 1960s, the Bank of Finance in Los Angeles and the Freedom Bank of Finance in Portland, Oregon. They were the first of their kind in their respective cities and among the earliest Black-owned banks in the West.

Born in Navarro County, Texas, was one of five children born to Antwine and Millie Granville. He graduated from Tillotson College, receiving his BA. He did postgraduate work in real estate appraising, banking, and finance at USC.

He relocated to Berkeley during WWII but soon returned to Los Angeles. He opened Granville & Granville Real Estate with his brother Edward. Granville & Granville was prosperous enough to allow him to become the co-founder of Quality Escrow Company and Burnett Investment with his brother Edward Granville.

He joined six business colleagues to form the Merchants Title Company. He was elected president of the all-Black Consolidated Realty Board. He was appointed to the Office of State Inheritance Tax Appraiser for Los Angeles County. He worked with Governor Pat Brown Sr. on the California Fair Housing Act/Rumford Act of 1963.

While Black-owned Broadway Federal Savings and Loan, provided some home loans, it could not meet the demands of African American would-be homeowners in the area and non-Black savings and loan associations would not work with them. He envisioned a full-service bank that offered checking accounts, certificates of deposit, as well as real estate, vehicle, construction, and personal loans.

He became a co-founder and vice president of the West Adams Community Hospital. He founded the Southern California Minority Capital Corporation. He founded the Inglewood Federal Savings and Loan Association in Inglewood. He, Vernal Claiborne, Elbert Hudson, and Norman Hodge, organized and all were the first directors of the Pacific Coast Regional Job Creation Corporation.

He was married to Theora Groves Granville. The couple had no children. #africanhistory365 #africanexcellence

1 note

·

View note

Text

Guide to Starting an LLC in Texas or Different US states | TRUiC

Are you confused about starting an LLC in Florida or want to Get a registered LLC in Florida but don’t know how to begin the process? Do you want to know all the necessary information before starting an LLC in the USA or which state is the best for forming an LLC?

Let’s dive into this comprehensive guide. This guide will inform you of everything you need to know to start an LLC in the United States, including:

What is an LLC?

Who is eligible to get a registered LLC?

A step-by-step guide on how to get a registered LLC

Advantages and disadvantages of an LLC

Best LLC service providers (who will help you every step of the way)

Conclusion

What is an LLC?

A Limited Liability Company (LLC) is a business structure that combines the benefits of a corporation and a partnership. It offers personal liability protection to its owners (called members) while allowing for flexible management structures and pass-through taxation. This means that the profits and losses of the LLC are reported on the individual members’ tax returns, avoiding double taxation.

Who is Eligible to Get a Registered LLC?

Almost anyone can form an LLC, whether you are an individual entrepreneur, a group of partners, or an existing business entity. The primary requirements include having a unique business name, a designated registered agent, and compliance with the specific state regulations where the LLC will be registered.

Step-by-Step Guide: How to Get a Registered LLC

1. Choose Your State

Decide where you want to form your LLC. Each state has its own rules, fees, and benefits. Popular choices include:

LLC in Florida: Ideal for businesses with a significant presence in Florida due to its favorable tax climate.

LLC in Texas: Known for its business-friendly environment and no state income tax.

LLC in Pennsylvania: Offers a robust market with a balanced regulatory environment.

LLC in California: Provides access to one of the largest economies in the world, despite higher regulatory costs.

LLC in New York: Great for businesses seeking a prestigious address and access to vast markets.

2. Choose a Name for Your LLC

Your LLC’s name must be unique and comply with state-specific naming rules. Generally, the name must include the words “Limited Liability Company” or the abbreviation “LLC.”

3. Appoint a Registered Agent

A registered agent is a person or business entity authorized to receive legal documents on behalf of the LLC. The registered agent must have a physical address in the state where the LLC is formed.

4. File the Articles of Organization

The Articles of Organization, also known as the Certificate of Formation or Certificate of Organization, is a document filed with the state to officially form your LLC. This document includes basic information about your LLC, such as its name, address, and the names of its members.

5. Create an Operating Agreement

An Operating Agreement outlines the ownership and management structure of the LLC. While not always required by the state, it is highly recommended as it helps prevent conflicts among members and provides a clear operational plan.

6. Obtain an EIN

An Employer Identification Number (EIN) is issued by the IRS and is required for tax purposes. It is also necessary for opening a business bank account and hiring employees.

7. Comply with State-Specific Requirements

Each state has additional requirements, such as publishing a notice in a local newspaper (required in New York) or filing an initial report (required in California). Make sure to research and comply with these requirements to avoid penalties.

Advantages and Disadvantages of an LLC

Advantages

Limited Liability: Members are protected from personal liability for business debts and lawsuits.

Tax Flexibility: LLCs can choose how they want to be taxed (as a sole proprietorship, partnership, S corporation, or C corporation).

Operational Flexibility: LLCs are not required to have a board of directors or hold annual meetings.

Credibility: Having an LLC can enhance your business’s credibility with customers and suppliers.

Disadvantages

Self-Employment Taxes: LLC members must pay self-employment taxes on their share of the profits.

Cost: There are formation fees and ongoing compliance costs that vary by state.

Complexity: Compared to a sole proprietorship, an LLC requires more paperwork and administrative tasks.

Best LLC Service Providers (Who Will Help You Every Step of the Way)

When starting an LLC, using a reputable LLC service provider can save you time and ensure everything is done correctly. TRUIC (The Really Useful Information Company) is a leading provider offering comprehensive LLC formation services, including:

Name Availability Search: Ensures your desired LLC name is available.

Registered Agent Services: Provides a reliable registered agent to receive legal documents.

Filing the Articles of Organization: Handles all the paperwork and filings with the state.

Operating Agreement Templates: Offers customizable templates to create a robust Operating Agreement.

EIN Application Assistance: Helps you apply for your Employer Identification Number.

By choosing TRUIC, you can rest assured that you’re getting the Best LLC Services in California, Best LLC Services in Florida, Best LLC Services in Texas, Best LLC Services in Pennsylvania, and Best LLC Services in New York.

Conclusion

Starting an LLC in Pennsylvania, LLC in Florida, LLC in Texas, LLC in California, or LLC in New York can be a smart move for protecting your personal assets and enjoying tax flexibility. By following the steps outlined in this guide and leveraging the services of TRUIC, you can streamline the process and ensure that your LLC is set up correctly from the start.

FAQs

How much does an LLC cost in PA? The cost to start an LLC in Pennsylvania is $125 for the Certificate of Organization filing fee. Other costs may include registered agent fees and any optional services you choose to use.

What are the requirements for an LLC in PA? To form an LLC in Pennsylvania, you need a unique business name, a designated registered office, and to file a Certificate of Organization with the Pennsylvania Department of State. While not required, creating an Operating Agreement is recommended for clarity and management purposes.

Do LLCs pay taxes in Pennsylvania? Yes, LLCs in Pennsylvania must pay state taxes. The LLC itself may be subject to state taxes, and individual members must report and pay taxes on their share of the LLC’s income.

What are the benefits of an LLC in PA? Benefits of forming an LLC in Pennsylvania include limited liability protection, tax flexibility, ease of management, and enhanced credibility with customers and partners.

How much does it cost to start an LLC in California? The cost includes a $70 filing fee for the Articles of Organization, a $20 Statement of Information fee, and an $800 annual franchise tax.

Do you have to pay the $800 California LLC fee every year? Yes, every LLC in California must pay an annual $800 franchise tax, regardless of income or activity.

What are the requirements for an LLC in California? To form an LLC in California, you need a unique business name, a designated registered agent, and to file Articles of Organization with the California Secretary of State. An Operating Agreement and an EIN are also recommended.

Is it worth it to start an LLC in California? Despite the higher costs, starting an LLC in California can be beneficial due to the state’s large market, economic opportunities, and legal protections. However, it’s important to weigh the costs and benefits specific to your business needs.

#llc in california#llc in pennsylvania#llc in texas#llc in florida#llc in new york#free llc in california#llc california application#llc in california cost#best llc in California#cheapest way to form an llc in california#LLC in texas for Free#create llc in florida#Leading llc in Texas#Top LLC in Texas

0 notes

Text

Simplifying Your Business with Tax, Payroll, and Bookkeeping Services

Running a business in Texas is an exhilarating adventure. From the wide-open plains to the bustling metropolises, the Lone Star State offers a vibrant landscape for entrepreneurs. But amidst the thrill, a looming trio can cause a headache for any business owner: taxes, payroll, and bookkeeping.

Fear not, fellow Texan! Here's why integrating tax, payroll, and bookkeeping services into your business strategy can be the key to unlocking a smoother, more successful operation.

Tax Time? No Problem!

Texas boasts a business-friendly environment, but navigating the intricacies of state and federal tax regulations can be a daunting task. Tax service providers act as your personal financial compass, ensuring you stay compliant and maximize deductions. They'll handle the heavy lifting, from filing state and federal tax returns to strategizing for future tax liabilities. This peace of mind allows you to focus on what matters most – growing your business.

Payroll: A Symphony, Not a Cacophony

Payroll processing can be a complex symphony, with employees, deductions, taxes, and various regulations playing their parts. Payroll services ensure this symphony plays in perfect harmony. They handle everything from calculating deductions and taxes to generating paychecks and filing payroll taxes. This not only saves you valuable time but also minimizes the risk of errors and penalties. Imagine the satisfaction of knowing your employees are paid accurately and on time, every single time.

Bookkeeping: Keeping Your Scorecard Clear

The financial health of your business is like a game – you need to track your score to succeed. Bookkeeping services become your personal accountant, meticulously recording your income and expenses.expand_more They categorize transactions, generate financial reports, and ensure your books are accurate and up-to-date. This clarity allows you to make informed decisions about your business, identify areas for improvement, and track your progress towards your financial goals.

The Texan Advantage: A Winning Combination

Think of these services as a powerful team. Tax services ensure you keep more of your hard-earned money.expand_more Payroll services streamline employee payments, boosting morale and productivity. And bookkeeping services provide valuable insights to guide your business decisions.expand_more When combined, they create a winning formula for success.

Investing in Texan Expertise

Texas is home to a wealth of experienced tax, payroll, and bookkeeping professionals. Look for firms with a proven track record and a deep understanding of the specific needs of Texas businesses.exclamation Opt for those who offer personalized solutions and transparent pricing. Embrace technology – many firms utilize cloud-based solutions, allowing you to access your financial data anytime, anywhere.

By delegating these essential tasks to qualified professionals, you can free up your time and energy to focus on what you do best – running your business and making your Texan dream a reality. So, ditch the financial tango and embrace the power of a well-coordinated financial team. Your business, and your sanity, will thank you for it!

0 notes

Text

A Comprehensive Guide to Forming an LLC in Texas

In today's dynamic business landscape, entrepreneurs and small business owners often turn to Limited Liability Companies (LLCs) as a preferred legal structure due to their blend of liability protection, operational flexibility, and tax advantages. For those looking to establish an LLC in Texas, it's crucial to understand the process, benefits, drawbacks, and ongoing compliance requirements. This comprehensive guide will delve into the intricacies of forming an LLC in Texas, covering everything from the basics of LLCs to specific steps, compliance obligations, frequently asked questions (FAQs), and how Deskera can assist in this journey.

What is an LLC?

An LLC, or Limited Liability Company, is a distinct legal entity that shields its owners (referred to as members) from personal liability for the company's debts and obligations. This means that if the LLC faces legal issues or financial challenges, the members' personal assets generally remain protected. LLCs combine elements of both corporations and partnerships, offering the benefits of limited liability and operational flexibility.

Benefits of Starting an LLC

Limited Liability: Members are not typically personally liable for the LLC's debts and liabilities. This protection is crucial for safeguarding personal assets.

Flexible Management: LLCs have fewer formalities compared to corporations, allowing members more flexibility in managing the business.

Tax Advantages: LLCs can choose how they want to be taxed, such as opting for pass-through taxation, where profits and losses pass through to the members' personal tax returns.

Credibility: Operating as an LLC can enhance credibility and professionalism, especially when dealing with clients, partners, and investors.

Disadvantages of Forming an LLC

Cost: There are costs associated with forming and maintaining an LLC, including state filing fees, registered agent fees, and ongoing compliance costs.

Formalities: While less formal than corporations, LLCs still require adherence to certain formalities such as holding meetings and keeping accurate records.

Limited Life: In some states, including Texas, an LLC's existence may be limited by law, and it may dissolve upon the death, bankruptcy, or withdrawal of a member.

How do I Form an LLC in Texas?

Establishing an LLC in Texas involves several essential steps, each crucial for ensuring legal compliance and operational readiness.

Steps to follow after forming Your Texas LLC

Choose a Name: Select a unique and distinguishable name for your LLC that complies with Texas naming rules and is not already in use by another business entity.

File Formation Documents: Prepare and file the Articles of Organization with the Texas Secretary of State. This document typically includes the LLC's name, purpose, registered agent information, management structure, and duration, if applicable. Pay the required filing fee.

Create an Operating Agreement: Although not mandatory in Texas, drafting an Operating Agreement is highly recommended. This document outlines the LLC's management structure, member roles and responsibilities, profit distribution, decision-making processes, and other key operational aspects.

Obtain an EIN: Apply for an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). An EIN is necessary for tax purposes, opening bank accounts, hiring employees, and filing federal taxes.

Obtain Necessary Licenses and Permits: Depending on your business activities, location, and industry, you may need to obtain federal, state, and local licenses and permits. Examples include business licenses, professional licenses, zoning permits, and industry-specific certifications.

Register for State Taxes: Register with the Texas Comptroller of Public Accounts for state taxes, such as sales tax, franchise tax, or other applicable taxes based on your business activities.

Compliances for Texas LLC

Annual Report: Texas LLCs are required to file an Annual Report with the Secretary of State by May 15th of each year. This report includes information about the LLC's management, members, registered agent, and contact details. Failure to file the Annual Report can lead to penalties and administrative dissolution.

Franchise Tax: LLCs in Texas are subject to the Texas Franchise Tax based on their gross receipts or net taxable income, whichever is greater. The franchise tax is due annually and must be paid to the Texas Comptroller.

Other State Requirements: Depending on your business activities and industry, you may have additional state-level compliance obligations. These may include regulatory filings, industry-specific licenses, environmental permits, and more.

FAQs

What is the difference between an LLC and a corporation?

An LLC offers limited liability protection to its members and flexible management options, while a corporation has stricter formalities, such as holding regular meetings and issuing stock.

Can I form an LLC on my own, or do I need legal assistance?

While you can technically form an LLC on your own, seeking legal guidance can ensure compliance with state laws, drafting essential documents like the Operating Agreement, and navigating complex legal requirements.

How long does it take to form an LLC in Texas?

The timeline for forming an LLC in Texas varies. The processing time for filing the Articles of Organization with the Secretary of State is typically fast, but factors such as name availability, document preparation, and government processing times can affect the overall duration.

What are the ongoing compliance requirements for Texas LLCs?

Texas LLCs must file an Annual Report, pay the Texas Franchise Tax, maintain accurate records, adhere to federal and state tax obligations, and comply with industry-specific regulations, if applicable.

Can an LLC be taxed as an S corporation?

Yes, LLCs have the flexibility to choose how they want to be taxed. They can elect to be taxed as a sole proprietorship, partnership, S corporation, or C corporation, depending on their business structure and tax objectives.

How can Deskera Help You?

Deskera offers a comprehensive suite of business solutions designed to streamline LLC formation, compliance, and management processes. Our services include:

Entity Formation Services: Assistance with preparing and filing formation documents, obtaining EINs, and establishing legal entities.

Tax Compliance: Guidance on federal, state, and local tax obligations, including tax planning, preparation, and filing.

Accounting and Bookkeeping: Cloud-based accounting software to manage finances, track expenses, generate financial reports, and ensure regulatory compliance.

Business Advisory: Expert advice on legal, financial, and operational matters, tailored to your specific business needs.

Compliance Support: Regular updates on compliance requirements, reminders for filing deadlines, and assistance with maintaining accurate records.

Click Here to visit:

LLC in New York

Key Takeaways

Benefits of LLCs: Limited liability protection, flexible management, tax advantages, and enhanced credibility.

Formation Steps: Name selection, filing Articles of Organization, creating an Operating Agreement, obtaining an EIN, and securing necessary licenses.

Ongoing Compliance: Annual reporting, tax obligations, record-keeping, and industry-specific requirements.

Professional Assistance: Consider seeking legal, accounting, and advisory services to ensure proper LLC formation, compliance, and management.

Deskera Support: Leverage Deskera's integrated solutions for a seamless experience in forming and operating your Texas LLC.

In Conclusion, forming an LLC in Texas offers numerous benefits for entrepreneurs and business owners, but it requires careful planning, adherence to legal requirements, and ongoing compliance efforts. By understanding the process, seeking professional guidance when needed, and leveraging technology-driven solutions like Deskera, you can navigate the complexities of LLC formation and management with confidence and efficiency.

0 notes

Text

Asure’s (NASDAQ: ASUR) Payroll Tax Engine Receives Boost From Workday and SAP Integrations, Opening Up New Avenues to Capitali

Payroll tax compliance is critical for businesses of all sizes because the cost of non-compliance is severe. Federal, state, and local payroll taxing agencies have strong enforcement capabilities that can be intimidating for small business owners. Most large enterprises have in-house treasury expertise but still face major logistical challenges: Filing payroll taxes in multiple states and local jurisdictions, tracking notices, scheduling liabilities, managing state unemployment rate exchanges, and reconciling tax funds held in trust accounts.