#thermistor temperature sensor

Explore tagged Tumblr posts

Text

Battery Thermistor Bypass... #techmodifications #BatteryThermistorBypass #BypassingThermistors #gazetcare #DIYBypass #ElectronicsHacking #BatterySafety #mobilerepairing #mobilephonerepairing #repairingmobile #mobilesoftwarerepairing #mobilerepairingcourse #mobilerepairingtools #mobilerepairinginstitute

#thermistor#ptc thermistor#ntc thermistor#battery#how to bypass thermister and power up over load relay#thermister#how to bypass thermostat to run ac#what is thermistor#thermistors#bypass thermostat for ac#how to bypass thermostat#what is a thermistor#thermistor ntc#how to bypass a thermostat#thermistor temperature sensor#bead thermistor#tube thermistor#how to bypass ac thermostat#find power thermistor#thermisto#how to bypass the thermostat

0 notes

Text

Measuring Temperature through Electrical Properties

There are three common temperature sensors that rely on the electronic properties of materials to determine temperature.

The first are thermocouples. Thermocouples measure temperature based on the Seebeck effect. When a temperature difference exists between two connected and dissimilar (electrically conductive) metals, charge will flow from the warm end to the cool end, creating a voltage that is used to calculate the temperature. There are multiple types of thermocouples, including thermocouple probes and wires, and multiple materials that are used for these sensors. Commercial thermocouples are fairly inexpensive but may not be accurate to more than a degree or so.

The term thermistors, the second type of sensor, comes from thermal resistor. These are semiconducting resistors, whereas the resistance of the material is strongly dependent on temperature. There are two general types of thermistors, negative-temperature-coefficient (NTC) thermistors and positive-temperature-coefficient (PTC) thermistors, which have either less or more resistance at higher temperatures, respectively. These sensors are typically highly accurate, but have a limited range.

Finally, resistance temperature detectors (RTDs) also use electrical resistance to measure temperature, but whereas thermistors use semiconductors, RTDs use pure metals. Platinum, copper, and nickel wires are common choices and RTDs are typically produced in 2-, 3-, or 4-wire configurations, where the 4-wire varieties have the highest accuracy.

Sources/Further Reading: (Image source - MadgeTech) Thermocouples: (Omega, Wikipedia); Thermistors: (Omega, Wikipedia); RTDs: (Electrical4U, Wikipedia)

12 notes

·

View notes

Text

DHT11 Digital Temperature And Humidity Sensor is a basic and low-cost digital temperature and humidity sensor. This sensor is used for projects where accuracy and precision doesn't play big role. This comes in a blue perforated plastic enclosure. This has four pin. There is an upgraded version of the DHT11 temperature and humidity sensor available, which is DHT22 Sensor with higher sensing ranges.

The sensor uses a capacitive humidity sensor and a thermistor based temperature sensor to measure the ambient humidity and temperature. The humidity sensing ranges from 20% to 90% with ±5% accuracy and the temperature sensing ranges from 0 degrees to the 50 degrees Celsius with ±2°C accuracy. The sampling time of this sensor is 2 seconds almost. This Temperature and Humidity Sensor uses digital pins to communicate with the microcontroller unit and does not have any kind of analog pins.

2 notes

·

View notes

Text

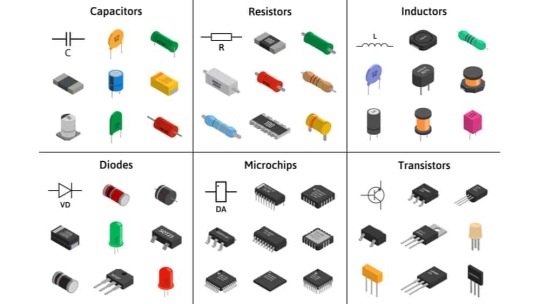

Electronics Components and Uses:

Here is a list of common electronics components and their uses:

Resistor:

Use: Limits or controls the flow of electric current in a circuit.

Capacitor:

Use: Stores and releases electrical energy; used for filtering, timing, and coupling in circuits.

Inductor:

Use: Stores energy in a magnetic field when current flows through it; used in filters, transformers, and oscillators.

Diode:

Use: Allows current to flow in one direction only; used for rectification, signal demodulation, and protection.

Transistor:

Use: Amplifies and switches electronic signals; fundamental building block of electronic circuits.

Integrated Circuit (IC):

Use: Contains multiple electronic components (transistors, resistors, capacitors) on a single chip; used for various functions like amplification, processing, and control.

Resistor Network:

Use: A combination of resistors in a single package; used in applications where multiple resistors are needed.

Potentiometer:

Use: Variable resistor that can be adjusted to control voltage in a circuit; used for volume controls, dimmer switches, etc.

Varistor:

Use: Protects electronic circuits from excessive voltage by acting as a voltage-dependent resistor.

Light-Emitting Diode (LED):

Use: Emits light when current flows through it; used for indicator lights, displays, and lighting.

Photodiode:

Use: Converts light into an electric current; used in light sensors and communication systems.

Zener Diode:

Use: Acts as a voltage regulator by maintaining a constant voltage across its terminals.

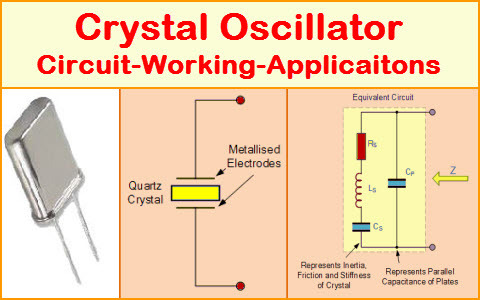

Crystal Oscillator:

Use: Generates a stable and precise frequency; used in clocks, microcontrollers, and communication devices.

Transformer:

Use: Transfers electrical energy between two or more coils through electromagnetic induction; used for voltage regulation and power distribution.

Capacitive Touch Sensor:

Use: Detects touch or proximity by changes in capacitance; used in touchscreens and proximity sensing applications.

Voltage Regulator:

Use: Maintains a constant output voltage regardless of changes in input voltage or load; used for stable power supply.

Relay:

Use: Electromagnetic switch that controls the flow of current in a circuit; used for remote switching and automation.

Fuse:

Use: Protects electronic circuits by breaking the circuit when current exceeds a certain value; prevents damage from overcurrent.

Thermistor:

Use: Resistor whose resistance changes with temperature; used for temperature sensing and compensation.

Microcontroller/Microprocessor:

Use: Processes and controls electronic signals; the brain of many electronic devices and systems.

fig:google-electronics

fig:google-electronics

fig:Crystal-Oscillator

This list covers some of the basic electronic components, and there are many more specialized components used for specific applications within the field of electronics.

#electronic#electricity#electric vehicles#electric cars#engineering#semiconductors#wireless#cables#electronics#smartphone#hardware

4 notes

·

View notes

Text

Yesterday, my brother came to me and asked if I could fix the AC window unit (which is the only AC we have in the house and it resides in his room) and I figured I would take a look.

The low voltage control circuits would power on, but the compressor and fan motor wouldn't and the temp sensor claimed a temperature of 49 degrees, when it very much was a muggy 80.

I took the covers off, looking for the temp sensor, but what I discovered was far more dramatic than a thermistor at the end of its life: three wires had burnt up. One spade terminal on the massive 35uF capacitor was blackened and another terminated to the end of a wire was practically melted. I measured the capacitance of the capacitors and they were fine. I had two theories for why this explosive event happened. The first was an over-current event caused by a short in the motor or compressor. The other was short caused by severe humidity or liquid water. There was a lot of water in the unit.

The motor spun just fine, so it wasn't seized. I figured I would cut and re-terminate the wires, connect everything, and try switching it on. And it worked! Some crimping, stripping, and soldering later, helped by a handy wiring diagram located inside the unit, and it ran. I jumped and laughed. My niece and nephew were hanging around with me in the garage, and they remarked that they hadn't heard me laugh in a long time, if at all.

I thought about this today and it was making me cry a bit. It had been so long since I had to solve a problem and fix it, physically. I need that in my life; it's my calling, and I've been deprived of it because no one will hire me for repair positions.

I went back to the college that brought me to this city in the first place and sat down with an advisor. I'm enrolling in the HVAC program and I begin in Autumn. Upon graduation, I become part of the HVAC union and they will get me a job. The mean rate is $27/hr.

I'm going to fix things again. I'm going to feel like a real person. The darkness that shrouded me during the pandemic will finally dissipate.

6 notes

·

View notes

Text

Glass-encapsulated NTC Thermistor Market: Forecasting Future Developments to 2025-2032

MARKET INSIGHTS

The global Glass-encapsulated NTC Thermistor Market size was valued at US$ 389.5 million in 2024 and is projected to reach US$ 678.9 million by 2032, at a CAGR of 8.34% during the forecast period 2025-2032. The U.S. market accounted for 28% of global revenue in 2024, while China’s market is expected to grow at a faster CAGR of 6.7% through 2032.

Glass-encapsulated NTC thermistors are precision temperature sensors featuring a negative temperature coefficient (NTC) element hermetically sealed in glass. This encapsulation provides superior environmental protection against moisture, chemicals, and mechanical stress compared to polymer-coated alternatives. These components are critical for temperature measurement and compensation in demanding applications across industries.

The market growth is driven by increasing adoption in medical devices, automotive systems, and industrial automation where reliability under harsh conditions is paramount. Recent advancements include miniaturized designs for wearable medical devices and high-temperature variants for electric vehicle battery management. Key players like Mitsubishi Materials and Vishay are expanding production capacities to meet rising demand, particularly in Asia-Pacific markets where electronics manufacturing is concentrated.

MARKET DYNAMICS

MARKET DRIVERS

Expanding Applications in Medical Devices to Accelerate Market Growth

The medical industry’s increasing adoption of glass-encapsulated NTC thermistors is creating significant growth opportunities. These components are critical in patient monitoring equipment, diagnostic devices, and therapeutic applications due to their high stability and accuracy. Over 65% of new medical devices requiring temperature sensing now incorporate glass-encapsulated variants rather than epoxy alternatives. The global medical sensors market, valued at over $25 billion in 2024, is projected to maintain a steady 7-9% CAGR through 2032, directly benefiting NTC thermistor manufacturers. Recent FDA approvals for smart medical implants with integrated temperature monitoring are further driving demand for reliable sensor solutions.

Automotive Electrification Trends to Fuel Demand

The automotive industry’s transition toward electric vehicles represents a major growth driver for glass-encapsulated NTC thermistors. These components are essential for battery thermal management systems in EVs, with each vehicle containing 15-25 thermistors on average. With global EV production expected to surpass 40 million units annually by 2030, demand for temperature sensors is projected to increase proportionally. Glass encapsulation provides the necessary durability against vibration and harsh under-hood conditions while maintaining measurement precision within ±0.5°C. Leading automakers are increasingly specifying glass-encapsulated versions for critical applications after demonstrating superior performance in accelerated life testing.

Industrial Automation Investments Driving Market Expansion

As Industry 4.0 initiatives gain momentum, glass-encapsulated NTC thermistors are becoming integral components in smart factories. Their ability to withstand industrial environments while providing reliable temperature data makes them ideal for predictive maintenance systems and process control applications. Manufacturing facilities are allocating over 30% of their sensor budgets to ruggedized temperature measurement solutions. The glass encapsulation provides chemical resistance critical for food processing, pharmaceutical production, and chemical manufacturing applications where epoxy alternatives would degrade. This sector alone accounts for nearly 40% of current glass-encapsulated NTC thermistor demand.

MARKET RESTRAINTS

Higher Production Costs Limiting Price-Sensitive Applications

While glass-encapsulated NTC thermistors offer superior performance, their manufacturing costs remain approximately 35-45% higher than standard epoxy-encapsulated alternatives. This price differential makes them less competitive in consumer electronics and other cost-sensitive markets where slight reductions in accuracy are tolerable. The specialized glass sealing process requires controlled atmosphere furnaces and precision handling equipment, contributing to elevated capital expenditures for manufacturers. In industries where hundreds of thousands of units are deployed annually, these cost considerations significantly impact purchasing decisions despite the technical advantages.

Complex Manufacturing Processes Affecting Supply Chain Dynamics

The production of glass-encapsulated NTC thermistors involves multiple precise steps including glass formulation, hermetic sealing, and rigorous testing. Each batch requires strict environmental controls throughout the manufacturing process. These complexities have resulted in longer supplier lead times averaging 12-16 weeks compared to 4-6 weeks for standard thermistors. The supply chain bottlenecks became particularly evident during recent semiconductor shortages, with some automotive manufacturers reporting 20-30% delays in sensor deliveries. This manufacturing intricacy also limits the number of qualified suppliers globally, reducing buyer flexibility.

MARKET CHALLENGES

Miniaturization Requirements Pushing Technical Boundaries

As end-use devices continue shrinking, thermistor manufacturers face mounting pressure to reduce package sizes while maintaining performance standards. Developing glass-encapsulated versions below 0.8mm diameter presents significant technical hurdles in hermetic sealing reliability. Current yields for sub-miniature glass packages remain below 60% in production environments compared to over 85% for standard sizes. This challenge is particularly acute in medical applications where device makers demand sensors smaller than 0.5mm for minimally invasive instruments. The industry must overcome material science limitations to achieve both miniaturization and durability targets.

Standardization Gaps Creating Interoperability Issues

The absence of universal standards for glass formulations and encapsulation methods is creating compatibility challenges across the supply chain. Different manufacturers utilize proprietary glass compositions with varying coefficients of thermal expansion, leading to performance inconsistencies in critical applications. These variations complicate system integration and require extensive requalification when changing suppliers. Industry groups are beginning to address these issues, but progress toward standardization has been slow despite growing recognition of the need.

MARKET OPPORTUNITIES

Emerging Battery Storage Applications Offering New Growth Prospects

The rapid expansion of grid-scale battery storage systems presents a significant opportunity for glass-encapsulated NTC thermistor suppliers. These installations require robust temperature monitoring solutions capable of withstanding 20+ year operational lifetimes in harsh environments. Recent pilot projects have demonstrated glass-encapsulated variants delivering 99.9% reliability over 5,000 thermal cycles—performance unmatched by alternative technologies. With global energy storage capacity projected to increase sixfold by 2030, this application could comprise 15-20% of total market demand within the next decade.

Advancements in Wireless Sensor Networks Creating Ecosystem Opportunities

The integration of glass-encapsulated NTC thermistors with energy-harvesting wireless nodes is enabling new monitoring applications in previously inaccessible environments. Recent developments in low-power sensor ICs allow operation for years without battery replacement when paired with these reliable temperature elements. Industrial facilities are deploying these solutions for equipment health monitoring, with adoption rates increasing approximately 40% annually. Suppliers offering pre-engineered wireless sensor modules are capturing significant market share by reducing implementation barriers for end-users.

GLASS-ENCAPSULATED NTC THERMISTOR MARKET TRENDS

Expanding Industrial Applications Drive Market Demand

The global glass-encapsulated NTC thermistor market is witnessing robust growth, primarily fueled by increasing adoption across industrial applications. These thermistors offer superior performance in harsh environments due to their hermetic glass encapsulation, which protects against moisture and chemical exposure. Industries such as automotive, aerospace, and manufacturing rely heavily on these components for precise temperature monitoring in critical systems. The automotive sector alone accounts for over 30% of global demand, with electric vehicle production accelerating adoption further. Additionally, glass-encapsulated thermistors are becoming indispensable in industrial automation, where sensor reliability directly impacts operational efficiency. With industrial IoT deployments growing at 15% annually, the need for durable, high-precision temperature sensors continues to rise.

Other Trends

Medical Technology Advancements

Medical applications are emerging as a significant growth segment for glass-encapsulated NTC thermistors. Their small form factor and biocompatibility make them ideal for invasive medical devices and diagnostic equipment. The global medical sensors market, valued at $16 billion in 2024, is projected to incorporate increasingly sophisticated temperature monitoring solutions. With minimally invasive surgeries growing by 8% annually, demand for tiny yet reliable thermistors in catheters and endoscopic tools is surging. Furthermore, wearable health monitors and implantable devices are adopting these sensors for continuous temperature tracking, creating new revenue streams for manufacturers.

Miniaturization and Material Innovations

Technological advancements in material science and manufacturing processes are enabling the production of smaller, more efficient glass-encapsulated NTC thermistors. The trend toward miniaturization is particularly evident in consumer electronics, where component space is at a premium. Smartphone manufacturers now incorporate these thermistors for battery temperature management in devices that generate significant heat during fast charging. Meanwhile, new glass compositions with enhanced thermal conductivity and durability are extending sensor lifespans in extreme conditions. These innovations are driving replacement cycles in industrial settings, where sensor failure can lead to costly downtime. With over 40% of industrial equipment failures relating to temperature issues, the reliability benefits of advanced glass-encapsulated thermistors justify their premium pricing in critical applications.

COMPETITIVE LANDSCAPE

Key Industry Players

Companies Invest in Innovation and Regional Expansion for Market Dominance

The global Glass-encapsulated NTC Thermistor market is moderately fragmented, with established manufacturers and emerging regional players competing for market share. WEILIAN leads the market with its comprehensive product range and strong foothold in Asia-Pacific, particularly in industrial applications where precision temperature sensing is critical. Their revenue share in 2024 reflects their technological edge in high-stability thermistor solutions.

Chinese manufacturers like Shenzhen Minchuang Electronics Co., Ltd. and Sinochip Electronics C0., LTD have gained significant traction, leveraging cost-effective production capabilities and rapid response to regional demand. These companies now collectively account for nearly 30% of the Asia-Pacific market, challenging traditional Western suppliers.

Meanwhile, Japanese firms such as Mitsubishi Materials Corporation and Shibaura maintain leadership in high-reliability applications through continuous R&D investment. Their dominance in medical-grade thermistors stems from stringent quality control and long-term stability certifications, making them preferred suppliers for critical healthcare equipment.

The competitive intensity is further heightened by European and American manufacturers focusing on niche applications. Companies like Vishay and Ametherm differentiate through specialized products for automotive and aerospace sectors, where glass encapsulation provides superior protection against harsh environments.

List of Key Glass-encapsulated NTC Thermistor Manufacturers

WEILIAN (China)

Shenzhen Minchuang Electronics Co., Ltd. (China)

HateSensor (South Korea)

Exsense Sensor Technology co. (China)

JPET INTERNATIONAL LIMITED (UK)

Sinochip Electronics C0., LTD (China)

KPD (South Korea)

Suzhou Dingshi Electronic Technology CO., LTD (China)

RTsensor (Germany)

SHIHENG ELECTRONICS (Taiwan)

Dongguan Jingpin Electronic Technology Co., Ltd (China)

Mitsubishi Materials Corporation (Japan)

Qawell Technology (China)

FENGHUA (HK) ELECTRONICS LTD. (Hong Kong)

Ametherm (USA)

Thinking Electronic (Taiwan)

Shibaura (Japan)

Semitec Corporation (Japan)

Vishay (USA)

Glass-encapsulated NTC Thermistor Market Segment Analysis

By Type

Single-ended Glass Sealed NTC Thermistor Leads Market Growth Due to Superior Stability in Harsh Environments

The market is segmented based on type into:

Single-ended Glass Sealed NTC Thermistor

Diode Type Glass Encapsulated NTC Thermistor

Others

By Application

Industrial Applications Dominate Market Share Due to Widespread Use in Temperature Monitoring Systems

The market is segmented based on application into:

Industrial

Medical

Automotive

Consumer Electronics

Others

By End User

Temperature Sensor Manufacturers Represent Key End Users Driving Market Expansion

The market is segmented based on end user into:

Temperature Sensor Manufacturers

Automotive Component Suppliers

Medical Equipment Producers

Industrial Automation Companies

Others

Regional Analysis: Glass-encapsulated NTC Thermistor Market

North America The North American region, particularly the United States, is a mature yet innovation-driven market for glass-encapsulated NTC thermistors. With a projected market size of $XX million in 2024, the growth is fueled by advancements in medical devices, automotive temperature monitoring, and industrial automation. The rise in demand for high-precision thermal sensors in electric vehicles (EVs) and renewable energy systems—particularly in solar panel temperature management—has significantly boosted adoption. Regulatory bodies such as the FDA encourage the use of reliable thermistors in medical equipment due to their stable performance and resistance to moisture ingress, making glass-encapsulated variants a preferred choice. However, the high cost of precision manufacturing and competition from alternative technologies pose challenges for market expansion.

Europe Europe is another key player, driven by strict quality and environmental standards under EU directives, particularly in the automotive (e.g., EV battery thermal management) and healthcare sectors. Germany and France lead in industrial applications, where sensors in HVAC systems and process control demand reliability in harsh environments. The region’s focus on green technology and Industry 4.0 is accelerating the shift toward glass-encapsulated NTC thermistors, which offer superior hermetic sealing compared to epoxy-coated alternatives. However, the market faces pricing pressures from Asian manufacturers, prompting European suppliers to emphasize customization and miniaturization to maintain competitiveness.

Asia-Pacific China, Japan, and South Korea dominate the APAC market, collectively accounting for over 50% of global production. China’s prominence is attributed to its electronics manufacturing ecosystem, with Shenzhen-based suppliers like Shenzhen Minchuang Electronics and SHIHENG ELECTRONICS catering to both domestic and export demands. The region’s rapid automotive electrification and consumer electronics boom (e.g., smartphones, wearables) drive volume growth, though price sensitivity limits premium product penetration. Japan remains a leader in high-accuracy thermistors for medical and industrial use, leveraging companies like Shibaura and Semitec Corporation. Meanwhile, India’s expanding telecom infrastructure and industrial automation sectors present long-term opportunities.

South America The South American market is nascent but growing, with Brazil and Argentina leading demand in automotive aftermarkets and HVAC systems. Economic instability and reliance on imports constrain local manufacturing, but increasing investments in renewable energy projects (e.g., wind turbines) are creating niche opportunities. The lack of stringent regulatory frameworks results in a preference for low-cost alternatives, though multinational firms are gradually introducing higher-performance glass-encapsulated solutions for specialized applications.

Middle East & Africa This region shows potential, particularly in oil & gas and telecommunications infrastructure, where temperature stability is critical. Saudi Arabia and the UAE are adopting these thermistors for industrial equipment monitoring, while Africa’s medical device market remains underserved due to funding gaps. The dependence on imports and limited technical expertise slows adoption, but partnerships with global players like Vishay and Ametherm could drive future growth as infrastructure projects expand.

Report Scope

This market research report provides a comprehensive analysis of the global and regional Glass-encapsulated NTC Thermistor markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The Global Glass-encapsulated NTC Thermistor market was valued at USD million in 2024 and is projected to reach USD million by 2032, at a CAGR of % during the forecast period.

Segmentation Analysis: Detailed breakdown by product type (Single-ended Glass Sealed NTC Thermistor, Diode Type Glass Encapsulated NTC Thermistor), application (Industrial, Medical, Others), and end-user industry to identify high-growth segments and investment opportunities.

Regional Outlook: Insights into market performance across North America (USD million estimated in 2024 for U.S.), Europe, Asia-Pacific (China projected to reach USD million), Latin America, and the Middle East & Africa, including country-level analysis.

Competitive Landscape: Profiles of leading market participants including WEILIAN, Shenzhen Minchuang Electronics Co., Ltd., HateSensor, Exsense Sensor Technology co., and JPET INTERNATIONAL LIMITED, among others. In 2024, the global top five players held approximately % market share.

Technology Trends & Innovation: Assessment of emerging technologies, precision temperature measurement advancements, and evolving industry standards for glass encapsulation techniques.

Market Drivers & Restraints: Evaluation of factors driving market growth such as increasing demand for reliable temperature sensors in medical applications, along with challenges like raw material price volatility and supply chain constraints.

Stakeholder Analysis: Insights for component suppliers, OEMs, system integrators, investors, and policymakers regarding the evolving ecosystem and strategic opportunities in the temperature sensor market.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/laser-diode-cover-glass-market-valued.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/q-switches-for-industrial-market-key.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/ntc-smd-thermistor-market-emerging_19.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/lightning-rod-for-building-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/cpe-chip-market-analysis-cagr-of-121.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/line-array-detector-market-key-players.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/tape-heaters-market-industry-size-share.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/wavelength-division-multiplexing-module.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/electronic-spacer-market-report.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/5g-iot-chip-market-technology-trends.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/polarization-beam-combiner-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/amorphous-selenium-detector-market-key.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/output-mode-cleaners-market-industry.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/digitally-controlled-attenuators-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/thin-double-sided-fpc-market-key.html

0 notes

Text

Why the Pt100 Temperature Sensor is Essential for Accurate Air Temperature Monitoring

In today’s industrial, HVAC, and environmental monitoring sectors, precise temperature measurement is more than just a requirement—it’s a necessity. Among the most trusted technologies for accurate readings is the Pt100 temperature sensor, known for its reliability, stability, and consistent performance across various applications.

At Shop.Testo, professionals can now access high-quality temperature sensor Pt100 solutions, including the advanced Pt100 air temperature sensor designed specifically for air temperature monitoring with digital precision.

What is a Pt100 Temperature Sensor?

The Pt100 sensor is a type of resistance temperature detector (RTD) that uses platinum (Pt) with a resistance of 100 ohms at 0°C—hence the name “Pt100.” It is renowned for its linear temperature-resistance relationship and high accuracy over a broad range of temperatures.

Compared to thermocouples or thermistors, the Pt100 temperature sensor offers excellent repeatability and stability, making it the preferred choice for many precision-based applications such as:

Laboratory experiments

HVAC system calibration

Industrial process monitoring

Environmental testing

Benefits of Using a Temperature Sensor Pt100

High Accuracy: Pt100 sensors can deliver temperature accuracy up to ±0.1°C, depending on the class and calibration.

Long-Term Stability: Platinum is chemically stable and maintains its performance over long durations, even in harsh environments.

Wide Temperature Range: Typically used between -200°C to +600°C, Pt100 sensors are ideal for both cold storage and high-temperature industrial settings.

Interchangeability: Standardized according to IEC 60751, Pt100 sensors are highly interchangeable, reducing the need for recalibration.

The Testo Pt100 Air Temperature Sensor: Designed for Precision

The Digital Air Temperature Pt100 Probe with TUC (Order No. 0618 0072) is available at Shop.Testo is a prime example of precision engineering. Designed specifically for air temperature measurement, this sensor is compatible with various Testo measuring instruments and features:

Quick response time for fast air temperature detection

Robust design suitable for demanding environments

Digital signal transmission, minimizing signal loss or noise

Pre-calibrated sensor for immediate use without setup hassles

This Pt100 air temperature sensor is ideal for professionals who require real-time and highly accurate air temperature readings, such as HVAC technicians, lab engineers, and industrial quality managers.

Applications of Pt100 Air Temperature Sensors

Whether you're monitoring airflows in a cleanroom, ensuring compliance in a food storage facility, or testing ventilation systems in industrial environments, a Pt100 air temperature sensor is an indispensable tool. Its accuracy and response time make it well-suited for:

Cleanroom environment monitoring

Industrial HVAC performance verification

Storage and transport of temperature-sensitive goods

Laboratory and R&D environments

Why Buy from Shop.Testo?

As the official Testo distributor in the UAE, Shop.Testo provides:

Genuine Testo instruments and probes

Local warranty and technical support

Fast delivery across the UAE

Competitive pricing on professional-grade tools

With over 60 years of experience in precision measurement technology, Testo remains a trusted name worldwide. Shop.Testo ensures that customers in the UAE have access to these cutting-edge instruments with local expertise and support.

Conclusion

Investing in a high-quality temperature sensor Pt100 is a smart move for any business or professional that values accuracy, durability, and performance. Whether you're fine-tuning an HVAC system or conducting laboratory-grade temperature testing, the Pt100 air temperature sensor from Shop.Testo is your reliable partner in precise thermal measurements.

Explore the full range of Testo sensors and probes today at Shop.Testo and elevate your measurement capabilities with confidence.

0 notes

Text

Temperature Sensor Market Size, Share, and Global Outlook

Devices called temperature sensors are employed in a variety of settings and applications to measure and track temperature. They detect changes in temperature and convert this data into readable signals for analysis or control. These sensors come in different types, including thermocouples, resistance temperature detectors (RTDs), thermistors, and infrared sensors, each suited for specific uses. Temperature sensors are widely used in industries such as manufacturing, automotive, healthcare, and consumer electronics to ensure optimal performance, safety, and efficiency. They play a critical role in processes that require precise thermal regulation, such as climate control systems, medical equipment, and industrial automation, ensuring accurate and reliable temperature monitoring.

According to SPER Market Research, states that Global Temperature Sensor Market is estimated to reach 13.09 USD billion by 2034 with a CAGR of 6.25%.

Drivers:

The need for precise, real-time temperature readings in a variety of sectors, including consumer electronics, manufacturing, automotive, and healthcare, is propelling the global market. Temperature sensors are essential for enhancing operating procedures and controlling energy efficiency. The market's expansion can be ascribed to the growing necessity for industrial automation, improvements in sensor technology, and the growing significance of preserving ideal temperature levels for a range of applications. For instance, Honeywell International has witnessed a significant increase in the use of its cutting-edge temperature sensors because of their potential to improve energy management and facilitate industrial Internet of things (IoT) applications. The need for accurate temperature monitoring is further fueled by the expanding trend of smart homes and connected gadgets.

Request a Free Sample Report: https://www.sperresearch.com/report-store/temperature-sensor-market.aspx?sample=1

Restraints:

The high initial cost of sophisticated sensors is one of the major market barriers, especially in sectors where price sensitivity is an issue. Despite the excellent precision and dependability of these sensors, their price may discourage smaller businesses or those in price-sensitive areas from implementing them. Costs may go up when including cutting edge features like wireless and Internet of Things connectivity. The expensive cost of modern temperature sensors, especially in small-scale operations, may hinder their adoption in some applications, such as pharmaceutical manufacture and food processing. These sectors might opt for less expensive, lower-quality, and less precise temperature sensors in an effort to reduce costs, which could significantly compromise the accuracy and reliability of temperature control. This compromise may lead to suboptimal performance in sensitive applications, potential safety risks, and a higher likelihood of system malfunctions or product defects due to improper thermal regulation.

United States of America held the biggest revenue share in the Global Temperature sensors Market. This dominance is attributed to high adoption rates in various industries like healthcare, aerospace, automotive, and food and beverage. Some of the key market players are STMicroelectronics. NXP Semiconductors, Omega Engineering Inc., Yokogawa Electric Corporation, Murata Manufacturing Co. Ltd., IFM Electronic GmbH and Dwyer Instruments

For More Information, refer to below link: –

Temperature Sensor Market Growth

Related Reports:

Global Retail Automation Market Growth

Global SCARA Robots Market Growth

Follow Us –

LinkedIn | Instagram | Facebook | Twitter

Contact Us:

Sara Lopes, Business Consultant — USA

SPER Market Research

+1–347–460–2899

#Temperature Sensor Market#Temperature Sensor Market Growth#Temperature Sensor Market Share#Temperature Sensor Market Size#Temperature Sensor Market Revenue#Temperature Sensor Market Demand#Temperature Sensor Market Analysis#Temperature Sensor Market Segmentation#Temperature Sensor Market Future Outlook#Temperature Sensor Market Scope#Temperature Sensor Market Challenges#Temperature Sensor Market Competition#Temperature Sensor Market forecast

0 notes

Text

0 notes

Text

Electronic Sensors – Techknow Engineering Enterprise

Electronic sensors are the core components of modern automation, control, and monitoring systems. At Techknow Engineering Enterprise, we offer a wide range of high-precision electronic sensors that deliver accurate data and ensure optimal performance for industrial and commercial applications. Whether you're working with hydraulic systems, automation equipment, or process control setups, our sensors provide reliable inputs to keep your operations running smoothly.

What Are Electronic Sensors?

Electronic sensors are devices that detect and respond to physical or environmental changes by converting them into electrical signals. These signals are then processed and used to monitor or control machines, systems, or processes.

Sensors play a key role in automation, predictive maintenance, safety systems, and efficiency improvements. From temperature and pressure sensing to position and level detection, these devices offer a gateway to intelligent operation.

Types of Electronic Sensors Offered by Techknow

At Techknow Engineering Enterprise, we supply a wide variety of electronic sensors suited for different environments and needs:

1. Pressure Sensors

Measure fluid or gas pressure in hydraulic and pneumatic systems

Ideal for monitoring system health and detecting leaks

Available in analog and digital outputs

2. Temperature Sensors

Detect temperature variations and relay accurate readings for process control

Used in HVAC systems, engines, manufacturing plants, and more

Options include thermocouples, RTDs, and thermistors

3. Level Sensors

Measure fluid levels in tanks, vessels, and pipelines

Available in ultrasonic, capacitive, and float-based versions

Suitable for water, oil, chemicals, and other media

4. Proximity Sensors

Detect the presence of nearby objects without physical contact

Common in automation, safety interlocks, and conveyor systems

Available in inductive, capacitive, and optical types

5. Position and Displacement Sensors

Track linear or rotary movement with high accuracy

Essential for automation, robotics, and industrial control systems

6. Flow Sensors

Monitor fluid flow rate in hydraulic, pneumatic, or water-based systems

Used in process industries, cooling systems, and more

Key Features of Our Electronic Sensors

✅ High accuracy and fast response times

✅ Wide range of sensing technologies and output types

✅ Durable design with IP-rated protection for harsh environments

✅ Compact and easy-to-install form factors

✅ Customizable configurations to meet unique application needs

Applications of Electronic Sensors

Our electronic sensors are widely used across industries, including:

🏭 Industrial Automation – Machine control, feedback systems, and predictive maintenance

🚜 Hydraulic Systems – Pressure, temperature, and fluid monitoring

🏗️ Construction Equipment – Positioning and load monitoring

🚛 Automotive Systems – Engine control, fluid levels, safety monitoring

🧪 Chemical & Pharmaceutical Plants – Accurate flow and temperature regulation

🌡️ HVAC Systems – Environmental control and temperature feedback

Why Choose Techknow Engineering Enterprise?

Techknow Engineering Enterprise is a trusted supplier of advanced electronic sensor technologies designed for precision, reliability, and long-term performance. Here’s why we’re the preferred choice:

🔍 Expert product knowledge and technical support

💡 Customized sensor solutions for OEMs and industry professionals

🏭 Partnership with top-tier sensor manufacturers

🚚 Fast delivery with ready stock for common sensor types

🧰 Wide selection of sensors for every sensing requirement

Get in Touch

If you’re looking for dependable electronic sensors for your industrial or commercial application, reach out to Techknow Engineering Enterprise. Our team is ready to help you select the best sensor solutions to enhance your system's performance and reliability.

0 notes

Text

Bimetal Thermometer vs Digital: What to Know

Temperature measurement is critical across industries—from food safety and HVAC systems to manufacturing and scientific research. Choosing the right thermometer type can impact accuracy, reliability, and convenience. Two common options are bimetal thermometers and digital thermometers. Each has its own working principles, benefits, and ideal use cases. This post explores how they compare, helping you make an informed decision.

Understanding Bimetal Thermometers

Bimetal thermometers & thermowell for thermometer operate using the principle of thermal expansion. Inside the thermometer, two different metals are bonded together into a coil or strip. These metals expand at different rates when exposed to temperature changes. As the temperature rises or falls, the coil bends, moving the pointer on a dial to indicate the temperature.

Key Features:

Mechanical Operation: Requires no power source.

Analog Display: Typically shows temperature on a dial.

Durability: Often used in rugged environments.

Temperature Range: Suitable for moderate to high temperatures.

Bimetal thermometers are commonly used in HVAC systems, ovens, and industrial applications where simplicity and reliability are essential. They are less prone to electrical interference and work well in environments where electronics might fail.

Understanding Digital Thermometers

Digital thermometers use electronic sensors, such as thermistors or resistance temperature detectors (RTDs), to measure temperature. These sensors convert temperature into an electrical signal, which is then displayed digitally.

Key Features:

Electronic Operation: Requires battery or external power.

Digital Display: Offers precise, easy-to-read results.

High Accuracy: Especially in controlled environments.

Additional Functions: May include memory storage, data logging, or alarms.

Digital thermometers are often used in laboratories, medical applications, food processing, and anywhere precision and data tracking are vital.

Comparing Bimetal and Digital Thermometers

Here’s a side-by-side comparison of the two types:

Feature

Bimetal Thermometer

Digital Thermometer

Power Requirement

None

Battery or power source needed

Display Type

Analog dial

Digital screen

Accuracy

Moderate

High

Response Time

Slower

Faster

Durability

Very durable

Can be fragile, depending on design

Maintenance

Minimal

May need calibration or battery changes

Cost

Generally lower

Can be higher, depending on features

Data Logging

Not available

Often available

Ideal Use Case

Harsh or remote environments

Precision-required applications

Pros and Cons

Bimetal Thermometers:

Pros:

No need for electricity or batteries

Simple design, easy to use

Withstands tough environments

Cost-effective

Cons:

Lower accuracy than digital types

Harder to read precisely

Slower response time

No advanced features like data logging

Digital Thermometers:

Pros:

High precision and resolution

Fast response

Easy-to-read display

Extra features like alarms or memory

Cons:

Requires power source

May need recalibration

More expensive

Not always suitable for extreme environments

Which One Should You Choose?

Consider a Bimetal Thermometer If:

You need a rugged, maintenance-free device.

Power availability is limited or non-existent.

You’re measuring steady-state temperatures where quick readings are not crucial.

Simplicity is more important than precision.

Consider a Digital Thermometer If:

Accuracy and fast response are critical.

You need to record or log data.

You’re working in a clean, controlled environment.

You want to avoid manual reading errors.

The best choice often depends on your specific application. For example, a food production facility might rely on digital thermometers for their accuracy and compliance with regulations. On the other hand, a mechanical workshop or outdoor boiler system might benefit more from the durability of a bimetal thermometer.

Hybrid Solutions

Some setups use both types of thermometers—bimetal for quick visual checks and digital for precise monitoring or automation. This approach offers redundancy and flexibility, particularly in complex systems.

Final Thoughts

Both bimetal thermometer and digital thermometers play vital roles in modern temperature monitoring. While digital models offer precision and advanced features, bimetal thermometers excel in durability and independence from power sources. Understanding the strengths and limitations of each helps ensure you select the right tool for your needs.

When choosing a thermometer, think about more than just price. Consider the environment, accuracy requirements, maintenance capabilities, and whether additional functions like logging or alarms are important. With the right choice, you’ll get reliable temperature data and avoid costly mistakes or failures.

Read Also: Precision, Durability, and Innovation by Shanghai Jun Ying Instruments

0 notes

Text

What Are Thermometers Used For and Why Are They Still So Important Today?

Thermometers are one of the most indispensable instruments in both everyday life and professional fields. These temperature-measuring devices are used across a wide spectrum of applications, from medical and laboratory use to industrial, HVAC, and culinary environments. Their function is simple but essential—accurately determining temperature for safe operations, health monitoring, process regulation, or product quality assurance.

As technology has evolved, so have thermometers. Traditional mercury-based tools have largely been replaced by more accurate, user-friendly alternatives such as digital thermometers, infrared thermometers, and probe-based devices. These modern versions provide better safety, higher precision, and easier usability.

How Do Thermometers Work?

Thermometers operate by measuring temperature through changes in physical properties. Each type relies on a specific principle:

Liquid thermometers detect expansion or contraction in mercury or alcohol.

Bimetallic thermometers use metal strips that expand at different rates.

Infrared thermometers measure the thermal radiation emitted by an object.

Digital thermometers use sensors such as thermistors or thermocouples to convert temperature into an electrical signal, displaying the result on a screen.

These different methods make each type suitable for specific use cases, offering varying levels of sensitivity, accuracy, and response time.

Why Should You Use Digital Thermometers?

Digital thermometers are now considered the go-to temperature-measuring tools across many sectors. Their growing popularity is due to several key advantages:

Fast and accurate readings

Easy-to-read digital displays

Safe and non-toxic compared to mercury types

Multiple formats, including probes, wearable sensors, and handheld devices

Integrated memory and data logging features in some models

Whether you're in healthcare, food safety, or industrial maintenance, digital thermometers offer an effective and reliable solution that enhances precision and decision-making.

What Types of Thermometers Are Commonly Used?

Various types of thermometers are available, each suited for different environments and applications. Understanding the unique characteristics of each helps in choosing the right tool.

Digital Thermometers

Offer fast response and high precision

Ideal for medical, laboratory, and home use

Often include features like memory storage, backlit displays, and flexible tips

Infrared Thermometers

Enable non-contact temperature measurements

Commonly used in food safety, HVAC, and manufacturing

Useful for taking readings from moving or inaccessible surfaces

Probe Thermometers

Feature stainless steel or thermocouple probes

Frequently used in cooking, food storage, and industrial processes

Allow deep penetration for internal temperature readings

Thermocouple Thermometers

Designed for high-temperature applications

Compatible with various sensor types

Offer fast response and durability in rugged environments

Liquid-in-Glass Thermometers

Traditional but less common today

Useful for controlled environments such as laboratories

Require careful handling due to risk of breakage

What Are the Key Features to Consider in Thermometers?

Before selecting a thermometer, it's important to identify the key attributes that align with your needs. Some of the most critical features include:

Measurement range that covers your intended application

Accuracy and resolution suitable for regulatory standards

Response time that ensures efficient workflow

Display readability for quick interpretation

Waterproof or rugged casing for field and industrial use

Battery life and power-saving modes in digital models

Data storage or connectivity options for tracking and logging

These features enhance functionality, improve efficiency, and promote safety and compliance.

Where Are Thermometers Commonly Applied?

Thermometers are used in a diverse range of industries and environments. Each sector has unique requirements that determine the type and design of thermometer needed.

Healthcare and Medical

Monitoring patient temperature during illness

Maintaining vaccine and sample storage conditions

Ensuring compliance with hygiene protocols

Food and Beverage

Measuring internal food temperatures during cooking

Verifying cold storage conditions for perishables

Complying with food safety regulations and HACCP standards

HVAC and Building Maintenance

Diagnosing system performance and airflow temperature

Monitoring ambient conditions in controlled environments

Preventing energy inefficiencies and system failures

Manufacturing and Industrial Processes

Monitoring equipment surface temperatures

Ensuring optimal process control and safety

Preventing overheating or machinery malfunction

Laboratory and Research

Maintaining precise environmental controls

Conducting chemical and biological experiments

Validating temperature-sensitive results

Agriculture and Horticulture

Measuring soil temperature for optimal planting

Monitoring greenhouse and livestock conditions

Managing climate for crop health and yield

What Makes a Thermometer Reliable in Professional Use?

Reliability in a thermometer is defined by its consistency, calibration capability, and durability. In professional settings, accuracy is non-negotiable, and tools must adhere to regulatory or industry standards.

Key traits of a reliable thermometer include:

Certification or calibration traceability

Minimal measurement deviation over time

User-friendly interfaces to reduce error

Robust design for field use or daily handling

Proper care, calibration, and periodic testing ensure your thermometer continues to deliver accurate and trustworthy data.

What Are the Benefits of Using Modern Thermometers?

Modern thermometers contribute significantly to improving operational efficiency and safety across sectors. Key benefits include:

Faster decision-making through instant results

Higher accuracy, reducing the risk of human error

Greater flexibility in measuring different materials and environments

Improved hygiene with contactless and waterproof options

Better compliance through digital logs and connectivity

These benefits make advanced thermometers an essential tool in maintaining health standards, product quality, and operational control.

How to Choose the Right Thermometer for Your Needs?

To select the best thermometer, consider your intended use, the required temperature range, environmental conditions, and compliance needs. Prioritize devices with features that support your workflow while ensuring long-term reliability.

Assess if contact or non-contact measurements are needed

Determine whether portability or fixed installation is ideal

Look for certifications for professional or regulated applications

Compare models based on accuracy, speed, and usability

Choosing wisely ensures consistent results and minimizes the risk of measurement errors in critical tasks.

0 notes

Text

DHT22 is a popular temperature and humidity based digital sensor. This is the upgraded version of the DHT11 temperature and humidity sensor. The sensor uses a capacitive humidity sensor and a thermistor based temperature sensor to measure the ambient humidity and temperature. The humidity sensing ranges from 0% to 100% with ±1% accuracy and the temperature sensing ranges from -40 degrees to the 80 degrees Celcius with ±0.5°C accuracy. The sampling time of this sensor is 2 seconds almost.

This Temperature and Humidity Sensor uses digital pins to communicate with the microcontroller unit and does not have any kind of analog pins. The module also has the inbuilt pull-up resistor and additional filter capacitor to support the DHT22 sensor. Thus the module is available in ready to go mode and can be directly connected with the microcontroller unit without using any kind of additional components.

2 notes

·

View notes

Text

Chill Out! Here’s Why Your Refrigerator Is Turning Into a Freezer

Ever opened your fridge expecting crisp lettuce and found frozen greens instead? If your milk has ice crystals or your fruits feel like popsicles, you’re not alone. Many people ask , why is my refrigerator freezing my food — a surprisingly common issue in households worldwide. Let’s dig into the reasons behind this chilly mystery and how you can restore your refrigerator to its ideal cooling mode.

1. Thermostat Settings: The First Suspect

One of the most common and often overlooked reasons is incorrect thermostat settings. Your refrigerator’s thermostat regulates the internal temperature, and setting it too low can lead to your food freezing.

Ideal Temperature Range: The USDA recommends keeping your fridge at or below 40°F (4°C), but not under 32°F (0°C) as this is the freezing point of water.

User Error: Sometimes the thermostat gets bumped when loading groceries, especially if it’s located on the back or sidewall.

Solution: Check your settings. A digital display should be around 37°F; for manual dials, medium settings work best.

2. Blocked Air Vents: Freezing Zone Creation

Refrigerators rely on air circulation to distribute cool air evenly. If vents inside the fridge get blocked by items or ice buildup, it can create cold spots that freeze items nearby.

Avoid Overpacking: An overloaded fridge prevents air from flowing freely.

Strategic Placement: Don’t place highly perishable or moisture-rich items directly in front of air vents.

3. Malfunctioning Thermostat or Sensor

Your refrigerator may freeze food due to faulty temperature sensors or a broken thermostat. These components regulate how often the compressor runs, and if they fail, the fridge might cool more than necessary.

Symptoms: If adjusting the thermostat doesn’t change the temperature or it fluctuates unpredictably, a malfunction is likely.

Fix: You might need to replace the thermostat or call a technician for a diagnostic check.

4. Damaged Door Seals

When fridge doors don’t seal properly, warm air sneaks in. The fridge compensates by running longer to maintain cool temperatures, which may lead to overcooling in some sections.

Test with a Dollar Bill: Close the door on a bill and try to pull it out. If it slides out easily, the seal might be weak.

Replace Seals: Door gasket replacements are affordable and easy to install.

5. Freezer Temperature Affecting Fridge

In most refrigerators, cold air from the freezer is circulated into the fridge compartment. If the freezer is too cold, it might send overly chilly air down below.

Check Freezer Settings: Keep it around 0°F (-18°C).

Inspect Damper Control: A stuck open damper will let too much cold air into the fridge.

6. Faulty Control Board or Thermistor

Modern fridges come with electronic control boards and thermistors that manage temperature precisely. A fault in these components can trick the system into thinking the fridge isn’t cold enough.

Diagnose Through Error Codes: Some models show error messages on the display.

Technical Help Required: This usually isn’t a DIY fix and will require professional assistance.

Midway Reminder: If you’re still dealing with refrigerator freezing food issues after checking these points, it’s best to consult a technician before it affects your food quality and energy bills.

7. Inconsistent Room Temperature

If your refrigerator is in a location with extreme temperatures, like a garage or porch, it might overcompensate by running longer than necessary. This could freeze the items inside, especially during winter.

Solution: Move the fridge to a climate-controlled environment or use a fridge model rated for garage use.

Conclusion: Don’t Let Your Fridge Freeze You Out

A refrigerator freezing your food is more than just an annoyance—it can spoil your meal plans, waste groceries, and hint at deeper mechanical issues. Start with simple fixes like adjusting the thermostat, checking airflow, and inspecting seals. If those don’t work, you might be dealing with sensor or board issues that require professional repair. Stay proactive and remember: the ideal fridge doesn’t freeze — it cools just right.

1 note

·

View note

Text

Bead Type Thermistors: The Tiny Component Making a Big Impact in Temperature Sensing

In the world of electronics, it's often the smallest components that play the biggest roles. One perfect example? Bead type thermistors—compact, highly sensitive devices that are revolutionizing temperature sensing in a wide range of applications.

Despite their small size, bead type thermistors are powerful performers. Their precision, responsiveness, and durability make them an essential component in everything from consumer gadgets to advanced industrial systems.

Let’s take a closer look at what makes these tiny thermistors such a big deal.

What Are Bead Type Thermistors?

Bead type thermistors are temperature-sensitive resistors with a bead-shaped ceramic element, typically encased in glass. Their resistance changes predictably with temperature, making them highly effective for:

Temperature measurement

Temperature compensation

Circuit protection

They are most commonly available in Negative Temperature Coefficient (NTC) versions, meaning resistance decreases as temperature increases.

Why Bead Type Thermistors Matter

1. Precision in a Small Package

Bead thermistors offer excellent accuracy and sensitivity, even with their miniature size. They can detect minute changes in temperature, making them ideal for precision applications like medical devices, scientific instruments, and consumer electronics.

2. Fast Thermal Response

Due to their small thermal mass, bead type thermistors respond quickly to temperature changes. This fast response time is crucial in real-time monitoring systems, such as digital thermometers, HVAC controls, and battery management systems.

3. Wide Operating Range

Bead thermistors can operate effectively over a broad temperature range, typically from -50°C to +150°C or more. This flexibility makes them suitable for everything from cold chain logistics to high-heat environments like engine bays or industrial equipment.

4. Durability and Stability

When sealed in glass, bead thermistors are highly resistant to moisture, corrosion, and mechanical stress. This durability makes them ideal for long-term use in harsh environments, ensuring stable performance over time.

5. Cost-Effective Solution

Bead thermistors offer high performance at a low cost, making them a budget-friendly choice for mass production. Their affordability, combined with their reliability, makes them a go-to component for engineers across industries.

Where You’ll Find Bead Type Thermistors

These tiny components are everywhere. Some of the most common applications include:

Medical devices: Digital thermometers, patient monitoring systems

Consumer electronics: Smartphones, wearables, battery packs

Automotive systems: Engine temperature sensors, climate control

Industrial controls: Thermal protection in motors and machinery

Home appliances: Ovens, refrigerators, and air conditioning systems

Final Thoughts

Bead type thermistors may be small, but their impact on temperature sensing technology is enormous. They deliver accuracy, speed, and reliability in a compact form, making them a crucial part of modern electronic systems.

As devices continue to get smarter and more compact, the role of tiny components like bead thermistors will only grow. Whether you're designing next-gen consumer electronics or mission-critical industrial equipment, these miniature sensors deserve a spot on your board.

So the next time you think about temperature sensing, remember: big things really do come in small packages.

1 note

·

View note

Text

NTC SMD Thermistor Market: Emerging Opportunities, Growth Drivers, and Forecast to 2025-2032

MARKET INSIGHTS

The global NTC SMD Thermistor market size was valued at US$ 1.34 billion in 2024 and is projected to reach US$ 2.16 billion by 2032, at a CAGR of 7.0% during the forecast period 2025-2032.

NTC SMD thermistors are miniature surface-mount devices that exhibit a negative temperature coefficient, meaning their resistance decreases as temperature rises. These compact components are widely used for temperature sensing, compensation, and protection in electronic circuits. Key product types include chip thermistors in bulk packaging and tape-and-reel formats, catering to various automated assembly processes.

The market growth is driven by increasing demand from consumer electronics, automotive electronics, and industrial automation sectors. Advancements in miniaturization and high-precision temperature measurement capabilities are expanding application areas. Leading manufacturers like TDK, Murata, and Vishay dominate the competitive landscape, collectively holding over 45% market share. Recent industry developments include the launch of ultra-thin 0402 package NTC thermistors by Mitsubishi Materials in Q1 2024, targeting space-constrained IoT applications.

MARKET DYNAMICS

MARKET DRIVERS

Expanding Applications in Consumer Electronics to Propel NTC SMD Thermistor Demand

The proliferation of smart devices and IoT applications is driving significant demand for NTC SMD thermistors, which provide precise temperature sensing capabilities in compact form factors. With smartphones incorporating up to 5-8 thermal sensors per device for battery management and performance optimization, component miniaturization trends directly benefit surface-mount thermistor adoption. The global smartphone market is projected to ship over 1.4 billion units annually, creating sustained demand for reliable temperature monitoring solutions. Furthermore, emerging wearable technologies require ever-smaller yet more accurate thermal protection components, with the wearable device market expected to grow at 14% CAGR through 2030.

Automotive Electrification Creating New Growth Opportunities

The automotive industry’s shift toward electrification represents a major growth vector for NTC SMD thermistors. Modern electric vehicles utilize approximately 300-400% more temperature sensors than conventional vehicles, with critical applications in battery management systems, power electronics, and motor controls. As global EV production is forecast to exceed 40 million units by 2030, thermistor manufacturers are developing specialized automotive-grade components with extended temperature ranges and improved vibration resistance. The recent introduction of AEC-Q200 qualified thermistors by leading suppliers demonstrates the industry’s response to this expanding application space.

Advancements in Medical Technology Driving Precision Requirements

Healthcare applications present substantial opportunities for high-accuracy NTC SMD thermistors. Portable medical devices and diagnostic equipment increasingly require miniature temperature sensors with ±0.1°C accuracy for critical patient monitoring and treatment applications. The global medical electronics market, valued at over $8 billion, continues to grow at 7% annually, creating demand for reliable thermal management solutions. Recent product developments include sterilizable thermistors for surgical equipment and ultra-miniature sensors for minimally invasive diagnostic tools.

MARKET RESTRAINTS

Raw Material Price Volatility Impacting Manufacturing Costs

The NTC SMD thermistor market faces significant margin pressures from fluctuating raw material costs. Critical materials including nickel, manganese, and cobalt have experienced price swings exceeding 50% in recent years, directly affecting production economics. Manufacturers must balance material substitutions against performance requirements, as alternative formulations often compromise key characteristics like thermal response time or stability. This challenge is particularly acute for cost-sensitive consumer electronics applications where component pricing remains under constant downward pressure.

Thermal Accuracy Challenges in Extreme Environments

While NTC thermistors offer excellent sensitivity, their performance limitations in extreme temperature ranges constrain certain industrial applications. Automotive underhood environments, for instance, require reliable operation from -40°C to +150°C, pushing the boundaries of conventional thermistor materials. Advanced packaging solutions and proprietary formulations help mitigate these issues but at significantly higher manufacturing costs. These technical limitations create opportunities for alternative sensing technologies in demanding applications.

MARKET CHALLENGES

Intense Price Competition from Alternative Technologies

The NTC SMD thermistor market faces growing competition from emerging sensing technologies. Silicon-based temperature ICs offer digital outputs and easier integration for certain applications, while RTDs provide superior stability in industrial environments. Although thermistors maintain cost advantages in many scenarios, continuous price erosion in the semiconductor industry makes alternative solutions increasingly attractive. This competitive pressure requires thermistor manufacturers to continually enhance performance characteristics while maintaining cost competitiveness.

Supply Chain Vulnerabilities in Critical Materials

Geopolitical factors and supply chain disruptions have exposed vulnerabilities in the thermistor manufacturing ecosystem. Certain rare earth oxides essential for high-performance formulations face concentrated production in limited geographic regions, creating potential bottlenecks. The industry is responding through strategic inventory management and dual-sourcing initiatives, but these measures add to operational complexity and cost structures. Recent trade policies and export controls have further complicated material procurement strategies for global manufacturers.

MARKET OPPORTUNITIES

5G Infrastructure Development Creating New Application Spaces

The global rollout of 5G networks presents substantial opportunities for NTC SMD thermistor adoption. Next-generation base stations and networking equipment require precise thermal management of power amplifiers and processors, with each unit potentially incorporating dozens of temperature sensors. The projected installation of over 7 million 5G base stations by 2025 creates significant demand for reliable, compact thermal monitoring solutions capable of withstanding harsh outdoor environments.

Energy Storage Systems Driving Specialty Component Demand

Grid-scale energy storage and residential battery systems represent a growing market for specialized thermistor solutions. These applications require sensors capable of precise temperature monitoring across large battery arrays while maintaining long-term reliability. The global energy storage market is projected to grow at 30% annually, with thermal management being critical for both safety and performance optimization. Custom thermistor configurations tailored for battery monitoring present opportunities for differentiation among component suppliers.

Industrial IoT Expansion Fueling Sensor Integration

The Industrial Internet of Things (IIoT) transformation is driving increased adoption of condition monitoring solutions across manufacturing facilities. Predictive maintenance systems often incorporate multiple temperature sensors to monitor equipment health, creating demand for robust, long-life NTC thermistors. With over 35 billion IIoT devices expected to be deployed by 2025, this application space offers significant growth potential for sensor manufacturers able to meet industrial reliability requirements.

NTC SMD THERMISTOR MARKET TRENDS

Miniaturization and High-Performance Demands Drive Adoption of NTC SMD Thermistors

The global NTC SMD thermistor market is experiencing significant growth due to the increasing demand for miniaturized and high-performance electronic components. Surface-mount device (SMD) thermistors offer compact designs with enhanced accuracy, making them indispensable in modern electronics. These components are widely used in applications such as LED control, temperature compensation, and power transistor stabilization. The market is expected to grow at a compound annual growth rate (CAGR) of % from 2024 to 2032, driven by advancements in semiconductor and sensor technologies. Rising demand for IoT-enabled smart devices and automotive electronics further fuels the adoption of NTC SMD thermistors, as they provide reliable temperature monitoring in constrained spaces.

Other Trends

Automotive Electronics and Electrification

The rapid electrification of vehicles is one of the most prominent trends shaping the NTC SMD thermistor market. With electric vehicles (EVs) and hybrid vehicles gaining traction globally, the need for efficient thermal management systems has surged. NTC thermistors play a crucial role in battery temperature monitoring, charging systems, and power electronics, ensuring safety and optimal performance. The automotive sector accounts for approximately 25% of the total demand for NTC thermistors, with China and the U.S. leading in adoption due to aggressive electrification policies. Additionally, the growing integration of advanced driver-assistance systems (ADAS) demands high-precision temperature sensors, further accelerating market growth.

Expansion of Consumer Electronics and Wearables

The consumer electronics sector continues to be a key driver for NTC SMD thermistors, particularly in smartphones, wearables, and smart home devices. Manufacturers are increasingly incorporating these thermistors for thermal management in high-performance processors, battery packs, and fast-charging circuits. The global wearables market, projected to grow at a CAGR of 14% over the next five years, is expected to boost demand for compact and highly responsive temperature sensors. Furthermore, the proliferation of 5G technology necessitates improved thermal regulation in network infrastructure and mobile devices, reinforcing the need for reliable SMD thermistor solutions. Leading suppliers such as TDK, Murata, and Vishay are investing in R&D to develop next-generation thermistors with enhanced sensitivity and durability.

NTC SMD Thermistor Market

COMPETITIVE LANDSCAPE

Key Industry Players

Leading Manufacturers Focus on Precision and Miniaturization to Capture Market Share

The NTC SMD Thermistor market exhibits a moderately fragmented competitive landscape, with established electronics component manufacturers competing alongside specialized sensor producers. In 2024, the top five companies collectively accounted for approximately 38% of global revenue, indicating room for mid-sized players to expand their footprint through technological differentiation.

TDK Corporation and Vishay Intertechnology currently lead the market through their diversified electronic component portfolios and strong distribution networks across Asia-Pacific and North America. These industry giants leverage their economies of scale to offer competitive pricing while investing heavily in miniaturization technologies for next-generation thermistor applications.

Meanwhile, Murata Manufacturing has been gaining significant traction through its proprietary ceramic semiconductor technology, which enables higher temperature stability in compact SMD packages. The company’s recent collaborations with automotive OEMs have positioned it strongly in the vehicle electrification segment, which represents one of the fastest-growing application areas for NTC thermistors.

Chinese manufacturers like Shenzhen Minchuang Electronics and WEILIAN are making strategic inroads through cost-competitive offerings tailored for consumer electronics and IoT devices. These companies are progressively enhancing their quality certifications and production capabilities to compete in higher-margin industrial segments.

Specialist firms such as Ametherm and Semitec Corporation are carving out niche positions through application-specific thermistor solutions. Their focused R&D investments in precision temperature measurement for medical devices and aerospace applications demonstrate how targeted innovation can succeed alongside large-scale manufacturers.

List of Key NTC SMD Thermistor Manufacturers

TDK Corporation (Japan)

Vishay Intertechnology (U.S.)

Murata Manufacturing (Japan)

WEILIAN (China)

Shenzhen Minchuang Electronics Co., Ltd. (China)

HateSensor (China)

Mitsubishi Materials Corporation (Japan)

Ametherm (U.S.)

Semitec Corporation (Japan)

Suzhou Dingshi Electronic Technology CO., LTD (China)

NTC SMD Thermistor Market

Segment Analysis:

By Type

Bulk Packaging Segment Leads Due to High Adoption in Industrial Applications

The market is segmented based on type into:

Bulk Packaging

Tape and Reel Packaging

By Application

Temperature Measurement and Control Dominates Owing to Increasing Demand in IoT and Smart Devices

The market is segmented based on application into:

LED Control

Temperature Compensation

Power Transistor Stabilization

Temperature Measurement and Control

Others

By End User

Consumer Electronics Segment Shows Strong Growth with Rising Smart Device Penetration

The market is segmented based on end user into:

Consumer Electronics

Automotive

Industrial

Medical

Aerospace and Defense

Regional Analysis: NTC SMD Thermistor Market