#token valuation

Explore tagged Tumblr posts

Text

$XAI Token Skyrockets by 60% in a Week Amid Bitcoin's Cooling Period

The recent surge in XAI Games' native token, $XAI, has garnered significant attention, especially amid Bitcoin's cooling-off period. This impressive 60% surge within a week showcases the interconnected and volatile nature of the cryptocurrency market. Exploring the driving forces behind XAI's rapid valuation growth reveals the pivotal roles played by strategic partnerships, promotional events, and the influence of sector trends.

Key Catalysts for XAI's Surge:

Binance Listing and Airdrop Event: The strategic partnership with Binance has proven instrumental in XAI's valuation growth. Being listed as Binance's 43rd launchpool project and subsequent listing on January 9 opened doors to a vast user base, fueling optimism among altcoin enthusiasts. Additionally, a recent airdrop event by XAI Games, distributing $125 million worth of $XAI tokens to NFT series holders and selected network validators, contributed to increased speculation and buying interest, propelling the token's valuation to an impressive $137 million.

GameFi and Web3 Gaming Resurgence: XAI's surge aligns with the resurgence of the GameFi and Web3 gaming sectors. After a challenging phase in 2022, these sectors are experiencing a notable comeback, driven by the rebounding NFT market and the resilience of projects that weathered the previous bear market. This sectoral revival positions $XAI as an attractive investment option, especially for those optimistic about Ethereum, its layer 2 solutions, and the potential of Web3 gaming.

Current Statistics and Future Trajectory:

While the future trajectory of $XAI remains speculative, the current statistics present a promising picture. With a value of $0.0111965, a 10.09% rise within the day, and an impressive 157.14% increase over the past 7 days, $XAI's recent success vividly illustrates the fluctuating and dynamic character of the cryptocurrency market. Investors and enthusiasts keenly observe how these factors will shape the ongoing momentum of $XAI in the evolving crypto landscape.

#$XAI#XAI Games#Ethereum Layer 2#Arbitrum $ARB#Binance#airdrop event#NFT series#network validators#cryptocurrency market#altcoins#GameFi#Web3 gaming#Binance listing#launchpool project#token valuation#market trends#trading volume#cryptocurrency price#cryptocurrency surge#Cryptotale

0 notes

Text

“Dead NFTs: The Evolving Landscape of the NFT Market” is a new report from dappGambl, a community of experts in finance and blockchain technology. Upon analysis of 73,257 NFT collections, the authors found that 69,795 have a market cap of zero Ether (ETH), the second most-popular cryptocurrency behind Bitcoin. In practical terms, that means 95 percent of NFTs wouldn’t fetch a penny today — a spectacular crash for assets that reached a trading volume of $17 billion amid a frenzied bull market in 2021. The study estimates that some 23 million investors own these tokens of no practical use or value.

[...]

The “Dead NFTs” report observes that the nearly 200,000 NFT collections “with no apparent owners or market share” identified by the study caused carbon emissions equivalent to the annual output from 2,048 houses, or 3,531 cars.

10K notes

·

View notes

Text

One night in May, Mikol Ayala stood in an empty parking lot in Florida with his arms out to his side and legs akimbo as two people covered him in isopropyl alcohol. “Get ready to put me out,” Ayala told them. Then the fireworks began.

The scene, illuminated by a pair of car headlights, was being livestreamed on X. The aim was to promote Ayala’s crypto token, Truth or Dare. “Don’t get FOMO, drop a bag on $DARE!” read a graphic layered over the feed. Ayala had been filming himself performing stunts all week—drinking bong water, smashing up his TV, and so forth—but this one went too far.

Ayala dodged the first volley of roman candles fired in his direction, but soon his entire torso was engulfed in flames. “Oh shit,” said a voice from behind the camera, having apparently not considered this possibility. The group threw water over Ayala, but it quickly ran out. He buckled onto a patch of grass and began to scream.

Meanwhile, the price of the $DARE coin pitched upward, reaching a total combined value of $2 million the following day. The denizens of the Internet, it seemed, were pleased with what they saw.

Ayala had suffered third-degree burns on a third of his body, he was later told by doctors. But from the hospital bed, he continued to promote his coin in videos on X, promising to return to stunting as soon as he was able. “I’m the most spontaneous wildcat in the fucking world,” he said. “You tell me let’s go, I’m there.”

Ayala agreed to an interview, but only if he would be paid. WIRED declined.

Though hardly believable to a normie ear, Ayala’s story is not unique in the world of so-called meme coins, in which marketing stunts now routinely range from ridiculous to dangerous to sexually degrading.

This year, to put their coins on the map—as chronicled by crypto media outlet Decrypt—one creator filmed himself getting punched so hard in the face he lost a tooth, another blacked out after smoking drugs, a pair of creators rubbed up against one another in their underwear, and another group detained a person in a purported kidnapping.

Some creators promise to perform specific acts after their meme coins reach certain milestones—a little like funding goals on Kickstarter—thereby incentivizing onlookers to buy in. One creator promised to pour milk over his supposed mother’s breasts, but only once his coin reached a $300,000 valuation.

Meme coins have been around since 2013, when Dogecoin was released. But this year, the number of these coins in circulation has ballooned courtesy of Pump.Fun, a platform that lets people release new coins almost instantly, at no cost.

By some metrics, Pump.Fun is the fastest-growing crypto application ever, taking in an estimated $100 million in revenue—as a 1 percent cut of trades on the platform—since it launched in January. Two million unique meme coins have entered the market through Pump.Fun, Ayala’s coin among them.

The vast majority of these coins never get off the ground. Others attract early attention, then tank after the creator sells off their holdings without warning. A minority of the coins hold value over a longer period.

Meme coins serve no strict purpose other than to act as a vehicle for financial speculation. Fluctuations in their price are therefore a reflection almost entirely of the attention they attract—a collective belief, on whatever grounds, that the price will either rise or fall.

The forces behind the meme coin boom are similar to those that propelled the meme-stock craze of 2021, says Albert Choi, a law professor at the University of Michigan who has published research into meme stocks. Back then, amateur investors on Reddit began a short squeeze on the stock of GameStop and other out-of-favor companies; whereas in 2024, the circulation of viral posts in crypto circles on social media leads meme coins to surge in value. “As [people] recognize momentum building on social media, the strategy is to try to get on the wave before the surge actually takes place,” says Choi.

The potential gains and losses are amplified in crypto, says Choi, because meme coins float free of any fundamental value. Unlike stocks, whose value is in theory tied to the performance and prospects of an underlying company, meme coins have no anchor to prevent a free fall in price. “The problem with crypto is that, if we don’t know what the fundamental value is, what is going to be that opposing and corrective force?” he says.

Previously, the complexity and cost of development were the limiting factors preventing people from flooding the market with meme coins on the off chance they might become rich. But Pump.Fun has flipped that equation. “With platforms that allow individuals to launch meme coins with no coding expertise, the barrier to creating supply is basically nil,” says Kahlil Philander, an assistant professor at Washington State University who specializes in gambling. “Now, the ability to create awareness is what has gotten more expensive.”

The need among small-time meme coin creators to peacock for attention became even more acute when celebrities piled in. In May and June, Caitlyn Jenner, Andrew Tate, and Jason Derulo all released coins of their own.

Around that time, rapper Iggy Azalea put out a coin through Pump.Fun: MOTHER, which reached a $200 million valuation within two weeks. Azalea has promoted the coin relentlessly to her 7.7 million followers on X, through a flurry of provocative images and meme posts.

“I just say whatever I want to say and think is funny,” said Azalea, speaking to WIRED in June. “Part of my strategy is to stay in the conversation. I do like to bait, to troll, to say things that are a little provocative. I like to say things and move in ways that I know can be memeable.”

In a market crowded with hundreds of thousands of coins—including those belonging to Azalea and her celebrity peers—meme-coin creators are being driven to stunts of an ever-escalating lunacy to try to get people to choose their coin instead. “The stunting behavior and use of celebrity accounts is almost exactly the same thing,” says Philander. “It is a source of attention.”

Even the celebrities are struggling to hold the attention of meme-coin investors hungry for the next spectacle. MOTHER is now trading for a quarter of its peak price, despite Azalea’s attempt to create utility for the coin, which is now accepted as payment by a telecom startup in which she has a stake.

Meanwhile, Ayala is quietly plotting his comeback. The $DARE coin has long since lost any gains it made in the immediate wake of the accident, so he needs a way to revive interest in the project. His followers are counting on him.

“Mikol, what are the plans moving forward?” asked one member of the Telegram channel for the coin in August. “Take us to the moon.”

11 notes

·

View notes

Text

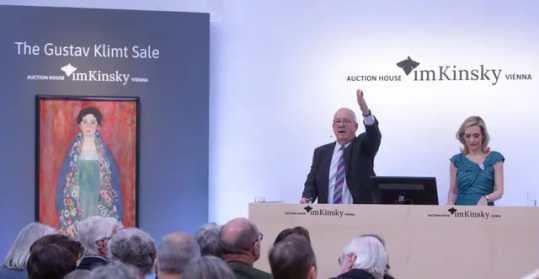

Gustav Klimt Portrait Missing for a Century Sells for $32 Million

A portrait by Gustav Klimt that was unseen for almost a century has sold for $32 million – the bottom end of its pre-auction estimate.

The “Portrait of Fräulein Lieser,” thought to be one of the Austrian painter’s final works, created huge excitement in the art world, but it ended up selling at the lower end of its valuation of €30 million-€50 million ($32 million to $53.4 million).

Bids started at €28 million and the work went for a hammer price of €30 million. This does not include the auction house’s fees.

The sale price was less than half that fetched by another Klimt painting – “Dame mit Fächer” (Lady with a Fan) – in London last year. The last portrait completed by Klimt became the most expensive artwork ever to sell at a European auction, when it sold for a £85.3 million ($108.4 million).

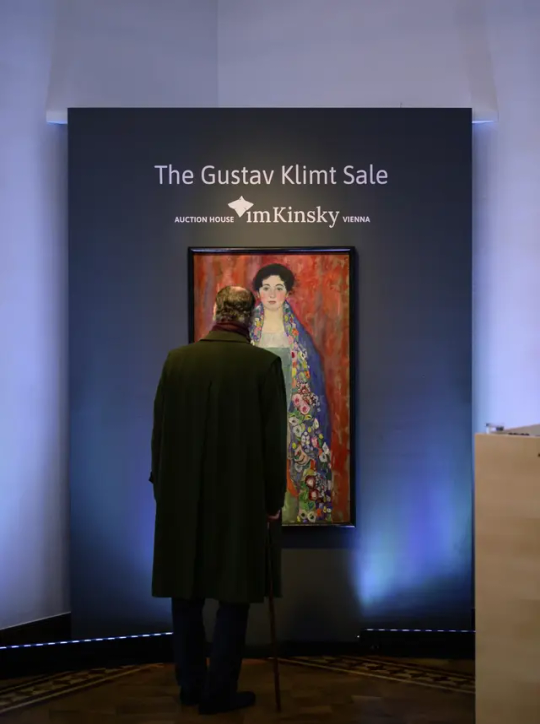

The “Portrait of Fräulein Lieser” had long been considered lost, according to Vienna auction house im Kinsky. However, it recently emerged that it had been privately owned by an Austrian citizen.

“The rediscovery of this portrait, one of the most beautiful of Klimt’s last creative period, is a sensation,” the auction house said in a press statement on its website prior to its sale on Wednesday afternoon.

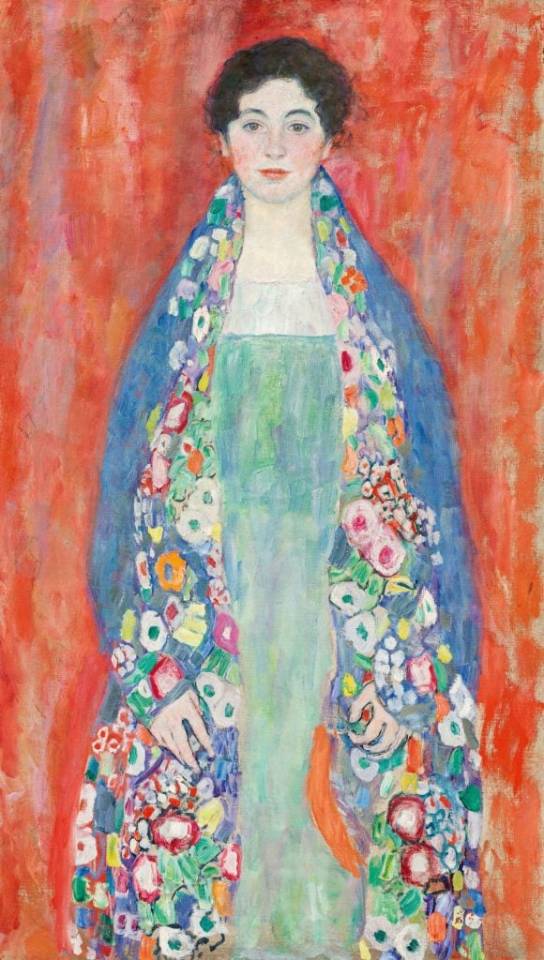

The intensely vivid and colorful piece had been documented in catalogues of the artist’s work, but experts had only seen it in a black and white photo.

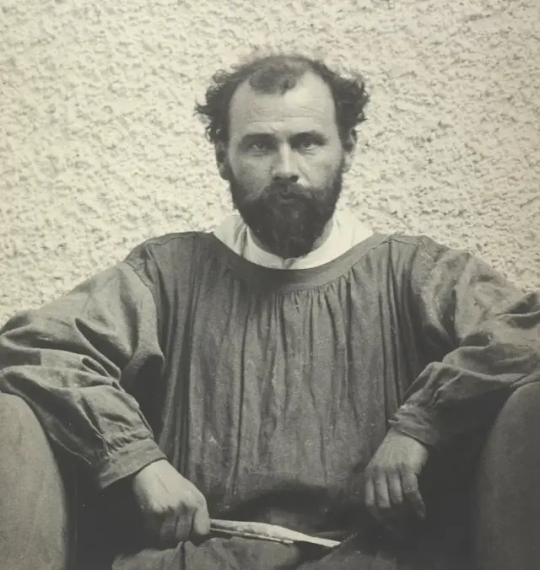

The sitter is known to have been a member of a wealthy Austrian Jewish family who were then part of the upper class of Viennese society, where Klimt found his patrons and clients. Nevertheless, her identity is not completely certain.

Brothers Adolf and Justus Lieser were leading industrialists in the Austro-Hungarian empire. Catalogues of Klimt’s work state that Adolf commissioned the artist to paint his teenage daughter Margarethe Constance. However, new research by the auction house suggests Justus’ wife, Lilly, hired him to paint one of their two daughters.

The statement on the auctioneer’s website reveals that the sitter – whoever she was – visited Klimt’s studio nine times in April and May 1917. He made at least 25 preliminary studies and most likely began the painting in the May of that year.

“The painter chose a three-quarter portrait for his depiction and shows the young woman in a strictly frontal pose, close to the foreground, against a red, undefined background. A cape richly decorated with flowers is draped around her shoulders,” the auction house said.

It added: “The intense colors of the painting and the shift towards loose, open brushstrokes show Klimt at the height of his late period.”

When the artist died of a stroke the following February, the painting was still in his studio — with some small parts not quite finished. It was then given to the Lieser family.

Its exact fate after 1925 is “unclear,” according to the auction house.

“What is known is that it was acquired by a legal predecessor of the consignor in the 1960s and went to the current owner through three successive inheritances,” the statement said.

The painting was to be sold on behalf of its Austrian owners, who have not been named, along with the legal successors of “Adolf and Henriette Lieser based on an agreement in accordance with the Washington Principles of 1998,” the auction house said.

Established in 1998, the Washington Principles charged participating nations with returning Nazi-confiscated art to their rightful owners.

Claudia Mörth-Gasser, specialist in modern art at im Kinsky, explained the situation in an email.

She said the auctioneer checked the painting’s history and provenance “in all possible ways in Austria,” adding: “We have checked all archives and have found no evidence that the painting has ever been exported out of Austria, confiscated or looted.”

But by the same token, she added: “We have no proof that the painting has not ever been looted in the time gap between 1938 and 1945.”

And this is the reason “why we arranged an agreement between the present owner and all descendants of the Lieser family in accordance to the ‘Washington Principles,’” she said.

Klimt’s portraits of women “are seldom offered at auctions,” the press release stated. It continued: “A painting of such rarity, artistic significance, and value has not been available on the art market in Central Europe for decades.”

By Lianne Kolirin.

#Gustav Klimt#Gustav Klimt 'Portrait of Fräulein Lieser'#Gustav Klimt Portrait Missing for a Century Sells for $32 Million#austrian artist#painter#painting#art#artist#art work#art world#art news

14 notes

·

View notes

Text

JasmyCoin Price Prediction for 2025–2030: What Investors Should Know?

JasmyCoin is an IoT-focused blockchain-based project that is more precisely oriented toward data democratization. This new digital asset uses a very specific approach toward the concept of data privacy, creating an emerging environment for crypto investors. Here, the paper tends to take a deeper look into JasmyCoin from 2025 to 2030 with predictions and important features that will, in general, lead to changing the current valuation.

Overview of JasmyCoin

JasmyCoin works on a decentralized network to return the right of personal data to individuals. The platform integrates blockchain technology with IoT solutions to provide a secure and user-friendly ecosystem. JASMY is the native token, enabling transactions and incentivizing participants.

Factors Influencing JasmyCoin's Price from 2025 to 2030

1. Market Adoption of IoT Solutions

As IoT technology continues to pick up steam, Jasmy's focus on secure data storage and exchange could be a topic of relevance. The demand for JASMY is driven by partnerships with IoT companies and adoption by enterprises.

2. Data Privacy Regulations

Stricter data privacy regulations worldwide may provide a conducive environment for decentralized data storage solutions like Jasmy. This could raise its adoption rate and impact the value of the token positively.

3. Technological Advancements

This would need to be constantly upgraded to the Jasmy platform to ensure security and scalability, thereby remaining competitive.

4. Market Sentiment and Cryptocurrency Trends

Sentiment in the wider cryptocurrency market with its macroeconomic trends will also have a strong impact on the price of JASMY. When the conditions are bullish, it may drive the token upward, and the bearish may pull the growth of JASMY down.

5. Strategic Partnerships

Collaboration with major tech companies and blockchain projects will add value to Jasmy's ecosystem, increasing token utility and, in turn, its price.

JasmyCoin Price Prediction from 2025 to 2030

JasmyCoin's price prediction from 2025 to 2030 is projected to experience growth due to increased adoption of IoT solutions and advancements in decentralized data technology. By 2025, the price could range from $0.05 to $0.10, reaching $1.00 by 2030 under favorable market conditions. However, regulatory challenges and market volatility remain critical factors for investors to consider.

2025: Moderate Growth Expected

Projected Price Range: $0.05 to $0.10

Market Factors: Increased adoption of IoT solutions and data privacy awareness.

Catalysts: Technological advancements and potential new partnerships.

Market Sentiment: A moderately bullish outlook if market conditions remain stable.

2026: Continued Expansion

Projected Price Range: $0.10 to $0.20

Key Developments: Expansion of the Jasmy ecosystem and broader adoption.

Investor Sentiment: Positive if regulatory support and technological progress persist.

2027: Potential for Major Breakout

Projected Price Range: $0.20 to $0.35

Catalysts: Significant enterprise partnerships and increased market adoption.

Technical Analysis: Bullish momentum supported by strong technical indicators such as RSI and MACD.

2028: Market Consolidation

Projected Price Range: $0.30 to $0.45

Market Factors: Consolidation phase with a focus on technological stability.

Risks: Potential market corrections and regulatory hurdles.

2029: Bullish Sentiment Resumes

Projected Price Range: $0.40 to $0.60

Driving Factors: Renewed market enthusiasm and advancements in IoT applications.

Investor Outlook: Bullish sentiment fueled by increasing token utility.

2030: Potential All-Time Highs

Projected Price Range: $0.60 to $1.00

Key Catalysts: Mass adoption of decentralized data solutions and strong ecosystem growth.

Market Sentiment: Bullish if market conditions remain favorable and technological progress continues.

Bullish vs. Bearish Scenarios for JasmyCoin

In a bullish scenario for JasmyCoin, increased IoT adoption, continuous platform upgrades, favorable regulations, and a strong crypto market boost its growth. Conversely, a bearish outlook involves slow IoT adoption, technological stagnation, stricter regulations, and a weak or stagnant crypto market, hindering its progress.

Investment Considerations

Diversification: While JasmyCoin shows potential, investors should diversify their portfolios to mitigate risks.

Market Monitoring: Monitor regulatory developments, technological advancements, and market sentiment.

Long-Term Perspective: Given its focus on IoT and data privacy, JasmyCoin may offer long-term growth opportunities.

Conclusion:

JasmyCoin's price prediction for 2025 to 2030 presents both opportunities and challenges. With its unique approach to data democratization and a focus on IoT, the project has the potential for significant growth. However, investors should remain cautious and conduct thorough research before making investment decisions. Monitoring market trends, strategic partnerships, and technological advancements will be essential for navigating this dynamic landscape.

2 notes

·

View notes

Text

LPENGU Market Analysis Report: The Bullish Case for $LPENGU (the Closest Derivative Meme Coin to $PENGU

Executive Summary

LPENGU, the cryptocurrency associated with the Lil Pudgys NFT collection, presents a compelling investment opportunity. Drawing parallels between the success of Pudgy Penguins’ physical merchandise and the historical trajectory of Beanie Babies, we can infer significant growth potential for LPENGU. With Pudgy Penguins’ plush toys achieving over 1 million sales in less than a year and the PENGU token’s market cap at approximately $2.76 billion, fast approaching a new all-time high of $3 billion, LPENGU, currently at a market cap of $85,000, is poised for substantial appreciation.

Comparison: Pudgy Penguins Plushies vs. Beanie Babies

Observations on $PENGU and $LPENGU Tokens

PENGU Token: Associated with the primary Pudgy Penguins NFT collection, PENGU has a market cap of approximately $2.76 billion. The token’s value is bolstered by the brand’s successful merchandise sales and strong community engagement.

LPENGU Token: $LPENGU is a fan token launched by Pudgy Penguins community members and fans of the Lil Pudgys NFT release and related Lil Pudgys physical products and art. Lil Pudgys are a separate but related line of “baby Pudgy Penguins” NFTs created so that penguin fans could participate in the Pudgy Penguins brand at a lower entry price. The LPENGU token is not associated with the official Pudgy Penguins organization. It is a meme token created by fans, community members, holders of Lil Pudgys NFTs, and baby penguin lovers. In this respect, LPENGU is the “Baby Pengu” derivative of the PENGU coin.

Memetically linked to the Lil Pudgys NFT collection, LPENGU currently holds a market cap of $85,000. Given that Lil Pudgys NFTs maintain a floor price at 10% of the main Pudgy Penguins NFTs, there’s a plausible argument that LPENGU could achieve a market cap proportional to PENGU, suggesting potential growth to $276 million.

Analysis of Price Possibilities for PENGU and LPENGU Based on 10% LPENGU Market Capture

*The above table should not be taken as fact, but more a reference to the high goals of LPENGU and what the LPENGU community is working toward. Do not base your investment decisions off this table, as no one can predict the future success of any cryptocurrency. Investing in any crypto is risky, with the risk of losing all funds invested, due to the high volatility of these markets.

Investment Thesis for LPENGU

Brand Momentum: The rapid sales of Pudgy Penguins plushies indicate strong brand appeal and market penetration, reminiscent of the Beanie Babies craze. This momentum is likely to translate into increased interest and value in associated digital assets.

Concrete memetic connection between PENGU and LPENGU: Pudgy Penguins had the foresight to capture a significant piece of the meme coin market share by releasing PENGU tokens. However, the Pudgy Penguins organization did not release a token for the related Lil Pudgys (baby Pudgys) NFTs. Whereas PENGU is the token for Pudgy Penguins, LPENGU is the derivativememe token for Lil Pudgys.

Market Cap Potential: If LPENGU were to reach 10% of PENGU’s market cap, it would imply a valuation of $276 million — a substantial increase from its current $85,000 market cap, representing a potential 3,247x return for investors.

Collector and Investor Behavior: Historical trends from collectibles like Beanie Babies show that as primary items gain value, associated or derivative items also appreciate. Investors seeking significant returns may find LPENGU an attractive, lower-entry alternative to PENGU.

$LPENGU Quick Reference Information: Lil’ but Mighty

LPENGU is the official baby token of PENGU, tied to the Lil Pudgys NFT collection. This token embodies the community-driven ethos of the Pudgy Penguins ecosystem, designed to capture the playful and dynamic energy of its parent project.

Key Features

Zero Tax: LPENGU transactions have no tax, ensuring seamless trading and transfers.

Liquidity Burned: LPENGU liquidity has been burned, guaranteeing security and long-term stability for token holders.

Maximum Supply: The total supply of LPENGU is fixed at 999,870,656 tokens, making it a scarce and valuable asset.

Smart Contract Address: Evenwqqc4uBA5NueXGSvp6uei4SjfnyK6DtThzK2AWM9

Trading and Purchase Links

Buy on Raydium: https://raydium.io/swap/?inputMint=sol&outputMint=Evenwqqc4uBA5NueXGSvp6uei4SjfnyK6DtThzK2AWM9

View Stats on Dextools: https://www.dextools.io/token/lpengu

Community and Communication

Telegram: https://t.me/LilPudgyssol

X (Twitter): https://x.com/lpgcommunity

Website: https://lpengu.com

Why Invest in LPENGU?

Lil but Mighty: LPENGU represents the vibrant and growing community of Lil Pudgys, a subset of the iconic Pudgy Penguins NFT ecosystem. With strong ties to the successful PENGU token, LPENGU offers potential for significant growth and community engagement.

Scarcity and Value: With a fixed supply and no additional minting, LPENGU’s scarcity drives its value, supported by a fiercely loyal and growing Pudgy Penguins (PENGU) and Lil Penguins (LPENGU) NFT, crypto, and physical toys fanbase.

Transparency and Security: Zero tax on transactions and burned liquidity ensure that LPENGU remains a secure and transparent investment choice.

Conclusion

The convergence of successful physical merchandise sales, strong brand identity, and the historical precedent set by collectibles like Beanie Babies creates a fertile environment for LPENGU’s growth. Investors positioning themselves in LPENGU at this nascent stage may capitalize on substantial appreciation as the Pudgy Penguins ecosystem continues to expand and capture market interest.

2 notes

·

View notes

Text

A Conservative politician is making millions off of slavery 190 years after slavery was abolished in Britain and its territories.

Tory Richard Drax comes from a filthy rich family notorious for having established the model for slave-based sugar plantations in the Caribbean in the 1620s. Even by the standards of a slave-based economy, the record of the Drax family was appalling.

The Barbados plantation was worked by up to 327 slaves at a time, with the death rate for both adults and children high. Sir Hilary Beckles, chairman of the 20-state Caribbean Community’s (Caricom) Reparations Commission and vice-chancellor of the University of the West Indies, estimates that as many 30,000 slaves died on the Drax plantations in Barbados and Jamaica over 200 years.

Thanks largely to their their ill-gained riches, the Drax family owns a 700 acre walled estate in Dorset which includes a deer park. And apparently they are getting even richer.

Despite threats to make Richard Drax pay reparations and seize his family’s plantation – described by one historian as a “killing field” of enslaved Africans – the government is now planning to pay market value for 21 hectares (about 15 football pitches) of his land for housing. The move has angered many Barbadians, especially those who say the Drax family played a pivotal role in the development of slavery-based sugar production and the Barbados slave code in the 17th century. This denied Black Africans basic human rights, including the right to life. Critics have called the planned deal an “atrocity” and said this is “one plantation that the government should not be paying a cent for”. Trevor Prescod, MP and chair of the Barbados National Taskforce on Reparations, said: “What a bad example this is. Reparations and Drax Hall are now top of the global agenda. How do we explain this to the world? “The government should not be entering into any [commercial] relationship with Richard Drax, especially as we are negotiating with him regarding reparations.”

It's baffling why the Barbadian government would enter into such a deal.

Drax, the MP for South Dorset, travelled to Barbados to meet prime minister Mia Mottley. It is understood he was asked to hand over all or a substantial part of Drax Hall plantation. If he refused, legal action would follow. Mottley’s spokesperson said the current Drax Hall purchase was not linked to reparations and the government “constantly acquires land through this process”. Mottley has pledged to build 10,000 new homes to meet demand on the island, where there are 20,000 applications for housing. A senior valuation surveyor said the market value for agricultural land with an alternative use for housing would be about Bds$150,000 (£60,000) an acre. At this price, the 21 hectares could net Drax Bds$8m (£3.2m). The land would be for 500 low- and middle-income family homes, which would be for sale.

I'd just grab the land and pay Drax a token £1 just so he legally can't claim he wasn't compensated at all for the transfer.

Barbados poet laureate Esther Phillips, who grew up next to Drax Hall, said the planned deal was an “atrocity” and a case of the victims’ descendants now compensating the descendant of the enslaver. “He should be giving us this land as reparations, not further enriching himself … at the expense of Barbadians. As Barbadians, we must speak out against this.”

And with the reported thousands of deaths during the 200+ years of slavery at the Drax plantation, how many people will be comfortable with the idea that their new home is built on what was essentially a forced labor camp which became a model for regional slavery? Isn't the Drax property on Barbados a large cemetery?

#richard drax#barbados#slavery#the caribbean slave economy#drax hall#still profiting from slavery#south dorset#the filthy rich#cluelessness#reparations#mia mottley#esther phillips#trevor prescod

7 notes

·

View notes

Text

Steps Involved in Tokenizing Real-World Assets

Introduction

Tokenizing real-world assets implies translating the ownership rights of physical or intangible assets into a blockchain-based digital token. By doing this the asset gains liquidity and fractions of the ownership with a high degree of transparency. The main steps of tokenization of real-world assets

Tokenize Real World Assets in simple steps

Asset Identification and Valuation:

Start with the selection of an asset such as real estate, artwork, or commodities, for tokenization, and then understand the market value. This refers to the valuation of all identifying features of the asset the market demand and the legal reasons to see if the asset is viable for tokenization. The valuation of the asset must be an accurate one since it greatly impacts investor confidence and the overall effect of the process of tokenization.

Legal Structuring and Compliance:

Establish the robust legal framework to ensure tokenize an asset complies with relevant regulation. This would require defining the rights and obligations of a token holder and compliance with securities laws and appropriate entities or agreements. It would be very advisable to engage legal experts who understand blockchain technology and financial regulations to help navigate this rather difficult terrain.

Choosing the Blockchain Platform:

The selection of the blockchain is highly dependent on security, scalability, transaction costs, and lastly compatibility with the asset type. Acceptance of public blockchains like Ethereum against private or permissioned chains would ultimately boil down to the requirements of the specific asset type and the demands of stakeholders Defining the Token Type and Standard:

represents equity, debt, or utility, and selects an appropriate token standard. Common standards include ERC-20 tokens and ERC-721 tokens . This decision impacts the tokens functionality interoperability and how to traded or utilized within the ecosystem

Developing Smart Contracts:

Create smart contracts to automate the processes like token issuance distribution and compliance. These self-executing contracts with the terms and directly written into code ensure transparency and reduce the need for intermediaries and enforce the predefined rules and regulations associated with the tokenized asset.

Token Creation and Management

Automating compliance

Transaction Automation

Security and Transparency

Integration with External Systems

Asset Management:

Securing the physical asset or its legal documentation in a way that ensures that the tokens issued are backed by the asset per se is called asset custody and management. It includes the engagement of third-party custodians or establishing trust structures for holding the asset, thereby providing assurance to the token holders of the authenticity and security of their investments.

Token Issuance and Distribution:

Mint and distribute the digital tokens over a selected platform or exchange to investors. Carry out the process in a completely transparent way and in full conformance with the pre-established legal framework, like initial coin offerings (ICOs) or security token offerings (STOs), among others, to reach the target investors.

Establishing a Secondary Market:

Facilitating trading of tokens in secondary markets allows liquidity and enables investors to buy or sell their holdings. Listing tokens on appropriate exchanges and ensuring compliance with relevant ongoing regulations is part and parcel of enhancing the marketability and attractiveness to investors.

Benefits Tokenize Real World Assets

Enhanced Liquidity

Traditionally illiquid assets, such as real estate and fine art, can be to challenging the buy or sell quickly. Tokenization facilitates the division of these assets into smaller tradable digital tokens, thereby increasing market liquidity and enabling faster transactions.

Fractional ownership

high-value assets mandate a substantial capital investment, which limits access to a small group of investors. However, with tokenization, these assets can be broken into smaller shares whereby multiple investors could come to own fractions of the asset. This democratizes the opportunity for investment and broadens participation in the market.

Efficiency and Decreases Costs

The application of tokenization settles processes such as settlement, record-keeping, and compliance on the blockchain. Accordingly, this reduces the need for intermediaries, lowers administrative expenses, and reduces cost per transaction. For example, the Hong Kong government issued a digital bond that reduced settlement time from five days to one.

Transparency and Security Upgraded

The important features of the blockchain promise an incorruptible, transparent ledger for all transactions. Ownership records are made secure against tampering and easily verifiable and hence fostering a greater sense of trust among investors and stakeholders and Transparency and Security Upgraded

Expanded Reach into the Market

Tokenization creates a borderless approach, enabling investors all around the world to reach and invest in a plethora of diverse assets. Aside from global reach, it creates an ecosystem that is more inclusive and opens the window for further possibilities in the world of investors and asset owners.

Conclusion

Tokenization of real-world assets (RWAs) signifies a new methodology for asset management and investment. Through converting a tangible or intangible asset into a digital token to be deployed on the blockchain this method aids in turning such assets into liquid forms permitting fractional ownership, and ensuring the performance of the transaction in a traceable manner. The whole process, from locating and appraising the asset to creating a secondary market, thus provides a systematic framework in applying blockchain technology to asset tokenization.

The increased operational efficiency, lower transaction costs, raised transparency, and wider access to the marketplace imply that, with the onset of tokenization, the very nature of investment opportunities is likely to undergo a drastic change with increased democratization from the heights of capital to meet investors on the streets. As this technology evolves, we will find innovative solutions to asset management, enhancing the accessibility and efficiency of investments for a broad spectrum of investors.

1 note

·

View note

Text

The social influence of an NFT

Teo machado

NFT, digital art, art history, and the connections between these topics and your social life. These days, it's imperative to keep a clean record and stay current with the trends in this fast-paced, dynamic environment. Not only can you accomplish this by buying NFT, you can do it in many other ways.

A non-fungible token (NFT) is a digital asset or piece of content that is typically stored on a blockchain and gives its owner ownership. Too, provenance over it. Some advantages and things to think about when buying an NFT are as follows.

Ownership and Authenticity. NFTs have an excellent blockchain-based security system. This creates a unique digital piece out of your artwork. NFTs are frequently linked to digital art. Under no circumstances can you copy an NFT.

Valuation potential, some NFTs can appreciate in value over time, especially if the creator becomes more famous or if there's a high demand for their work. By purchasing NFTs, you can gain access to specific communities, events or content with exclusive and special advantages. For example, having an NFT may grant you access to an exclusive online community or a limited-edition piece of art.

Scarcity and rarity: many NFTs are planned to be scarce, which can give them added value. If there are only a limited number available, this can make them more desirable.

According to research on modern definitions of art, art is defined as putting your thoughts, feelings, and anything else you would like to communicate in a way that other people can see and either understand or not, the message that is behind it.Digital art is art that exists throughout the virtual world and is expressed in a variety of ways online. Cyberart is art produced with the help of computers.

According to Invaluable “With the knowledge we have nowadays art has existed since the Paleolithic, or Old Stone Age. The art of this period depends on natural pigments and stone carvings.”

In the age we live in, we have various types of art and countless ways to create it. We have more materials, creativity, and knowledge to produce a wide range of art. Art encompasses many factors.

So, buying NFt can give you benefits and transform your social and normal life. It also gives you the honor of being the owner of a unique work that cannot be copied.

2 notes

·

View notes

Text

Exploring the Potential Risks Linked to Cardano Gambling

Many players worldwide have witnessed cryptocurrencies like Cardano as a significant invention in technology and finance for several years. Players try not to be left behind in finance as the crypto market develops. Gambling with Cardano (ADA) tokens is a good investment as players can enjoy multiple opportunities over fiat gambling. Using ADA for commercial or investment purposes is an excellent way of earning money.

However, ADA has its share of risks that players must know before jumping into Cardano gambling. Furthermore, learning about the gains and losses associated with ADA gambling sites is recommended. Let's find out more about Cardano Gambling and why gamblers should be aware of the risks related to Cardano gambling.

What is Cardano Gambling?

Cardano gambling offers players many advantages of Cardano (ADA) 's blockchain technology, such as fast, cheap, and secure transactions. Players can also enjoy the anonymity and convenience of playing games with Cardano tokens. Whether you are a professional gambler or a newbie in the crypto gaming world, exploring the rules of Cardano gambling creates a whole new level of winning big by playing games with ADA tokens.

It ensures that the players can enjoy smooth transactions and put their primary focus on gambling. They can add their deposits using crypto like ADA or Fiat money through credit cards or bank transfers. Cardano gambling does not require a central authority to regulate ADA gambling sites, allowing for quick and cheap transactions.

Is Cardano Gambling a Risky Business?

Although playing games on the top Cardano gambling site offers many advantages, it can be risky for the players to gamble with ADA tokens because of the following reasons –

Political and Institutional Pressure – For quite some time, governments and regulatory bodies have reviewed crypto like ADA calmly during its initial years as society barely used them. However, as ADA is growing in terms of popularity and the value of the currency is increasing exponentially, many government bodies have started to reckon with the powerful societal force. Due to this, many fear using ADA to gamble because of institutional and government pressure. Early gamblers found their valuation of ADA tokens to depreciate quickly. Hence, the government tried to ban the tokens in many regions or countries, which led to high volatility among other tokens.

Highly Volatile – When a gambler buys ADA tokens, he may also want to buy products or services with them. The issue with Cardano gambling is that the value of ADA is never stable. Cardano casino players may experience fluctuations of ADA value while playing their favorite casino games or withdrawing their winnings. All assets are volatile, but Cardano is the most volatile asset one can own. Hence, players on the top Cardano gambling site who buy ADA coins can experience a fall in the currency’s value. However, the volatile nature can also lead to a rise in crypto value and higher returns. Still, the problem arises when people convert fiat to crypto when the market is down.

Inadequate Government Supervision – Without a government license or regulation, players do not have any helping hand if they face problems while gambling with ADA tokens. But this does not necessarily mean that ADA gambling sites are not licensed. The top Cardano gambling site operates under the regulation of a gambling authority and possesses a valid license. However, several unlicensed Cardano gambling sites operate where players can become scam victims.

Irreversible Transactions – Once ADA tokens or any other cryptocurrencies are transferred from a digital wallet, there is no way one can get them back. If a player sends their ADA funds to the wrong address, recovering the fund is next to impossible, unlike other traditional banking methods, such as bank transfers or credit card payments.

Unfamiliarity – Although the cryptocurrency market has experienced exponential growth, many gamblers have still not performed transactions in ADA. It is not because crypto is difficult to use, but many gamblers feel intimidated by converting Fiat to crypto to play online casino games.

Are Cardano Fans In a Critical Danger Zone?

Cardano ADA tokens have walked on the tightest rope after plunging below $0.4. The crypto has shed another 0.8% to reach a critical support zone at $0.39. The founder of Cardano mentioned in a recent interview that every crypto has to go through periods of lows before it reaches its peak.

Although he did not admit Cardano’s underperformance in the current market situation, crypto gamblers believe the statement addressed Cardano’s issue. ADA tokens are not living up to the expectations of its users as the price has plunged 80.80% year-on-year and has stayed in the red zone for most of the year. These weaknesses can also be attributed to the weakness of the entire crypto market.

Why Do People Still Choose to Associate with Cardano Gambling?

Despite being in the danger zone, gamblers still play with ADA tokens. One of the reasons why gamblers choose to wager in ADA is the Ouroboros features that Cardano blockchain crypto casinos use to protect client information and funds from attackers. Ouroboros are mathematically verifiable security measures that guarantee the complete security of more than half of the ADA stakes owned by genuine gamblers. This feature adds a layer of security to the current novel security measures, such as the random selection process, encryption protocols, and two-factor authentication.

Ouroboros is evolving continuously through new iterations and rigorous security analytical systems, which makes Cardano gambling more attractive than other major cryptocurrencies. This algorithm solves some of the biggest challenges in Blockchain-based casinos and creates more energy to make sustainable, ethical, and secure ADA gambling sites.

Gambling with ADA tokens gives access to bonuses and cost-effectiveness that is typically more significant than any traditional Fiat-powered gambling sites. Cardinal transactions are significantly less for casino operators and have better payouts in the crypto gambling market. When writing this article, the top Cardano gambling site charges around 0.1 7 ADA ($0.3), which is expected to get lower if the ADA value continues to increase.

Conclusion

In conclusion, the rising ADA involvement in the online gambling is quite challenging to dispute. Crypto gambling began with BTC and ETH, but it is now moving to Cardano, which offers the most exciting opportunities for players to enjoy seamless gambling.

ADA offers a highly secure network with high speed, reasonable trading fees, and responsive support agents. Gamblers can keep their gaming activities private and use lots of deposit bonuses, tons of online casino games, and free spins by gambling with ADA tokens.

3 notes

·

View notes

Text

Online Real Estate Investment in India: How It Works in 2025?

The real estate sector in India has undergone a massive transformation, thanks to digital advancements. In 2025, online real estate investment has become one of the most convenient and profitable ways to grow wealth. With the rise of PropTech (Property Technology), investors can now buy, sell, and manage properties seamlessly through digital platforms.

This blog will explore how online real estate investment works in India in 2025, the benefits, risks, and top platforms to consider.

Why Online Real Estate Investment is Gaining Popularity in India?

1. Digitalization of Real Estate Transactions

Gone are the days when buying property required endless paperwork and physical visits. In 2025, blockchain-based property registrations, e-signatures, and virtual tours have made transactions faster and more transparent.

2. Fractional Ownership & REITs

Investors can now own a fraction of high-value properties through Real Estate Investment Trusts (REITs) and fractional ownership platforms. This allows small investors to participate in premium real estate without huge capital.

3. AI & Data-Driven Decisions

Artificial Intelligence (AI) helps investors analyze market trends, property valuations, and rental yields, ensuring smarter investment choices.

4. Increased Transparency

With government initiatives like RERA (Real Estate Regulation Act), online property listings now provide verified details, reducing fraud risks.

How Does Online Real Estate Investment Work in 2025?

1. Choosing the Right Investment Model

Investors can opt for different models based on their budget and goals:

Direct Property Purchase (Buying residential/commercial properties online)

Fractional Ownership (Investing in a portion of a property)

REITs (Investing in listed real estate companies)

Crowdfunding Platforms (Pooling funds with other investors for large projects)

2. Research & Due Diligence

Use AI-powered tools to compare property prices, growth potential, and legal status.

Check RERA compliance and developer reputation.

Analyze rental demand and capital appreciation trends.

3. Virtual Tours & Digital Verification

3D virtual tours help inspect properties remotely.

Blockchain ensures secure title verification and reduces fraud.

4. Online Payment & Paperless Documentation

Digital agreements and e-signatures simplify transactions.

UPI, net banking, and crypto payments (in some cases) facilitate quick transfers.

5. Post-Purchase Management

Use property management apps for rent collection, maintenance, and tenant screening.

Automated tax calculations and legal updates keep investors informed.

Benefits of Online Real Estate Investment in 2025

✅ Lower Entry Barriers — Fractional ownership allows investments starting from ₹10,000.

✅ Higher Liquidity — REITs and secondary markets enable easy exit options.

✅ Diversification — Invest in multiple properties across cities without physical presence.

✅ Transparency — Blockchain reduces fraud risks.

✅ Passive Income — Earn rental yields without active management.

Risks & Challenges

Market Volatility — Economic downturns can affect property prices.

Regulatory Changes — New tax laws or RERA updates may impact returns.

Cybersecurity Threats — Online frauds still exist; use only verified platforms.

Low Liquidity in Direct Real Estate — Selling physical property can take time.

Future Trends in Online Real Estate Investment (2025 & Beyond)

Metaverse Real Estate — Buying virtual land in metaverse platforms.

Tokenization of Properties — NFTs for real estate ownership.

AI-Powered Predictive Analytics — Better forecasting of property trends.

Green & Sustainable Properties — High demand for eco-friendly homes.

Conclusion

Online real estate investment in India has revolutionized how people invest in property. With fractional ownership, REITs, AI-driven insights, and blockchain security, 2025 offers more opportunities than ever before. However, investors must conduct thorough research and choose trusted platforms to maximize returns while minimizing risks.

#fractioanl ownership#fractional property#fractional investment#indian real estate investment#fractional real estate#real estate investment in india

1 note

·

View note

Text

SOLUSD Trading Signal – Entry, Stop Loss & Target Inside

SOLUSD Trading Signal – Entry, Stop Loss & Target Inside SOLUSD Trading Signal – Entry, Stop Loss & Target Inside 🔻 SOLUSD – SELL SIGNAL 🔻 💼 Strategy: Short Position 📉 Sell Entry Range: 135 📍 Current Market Price (CMP): 134.70 ❌ Stop Loss: 146 🎯 Target: 110 🧠 Risk-Reward Ratio (RRR) Risk (Stop Loss - Entry): 146 - 135 = 11 points Reward (Entry - Target): 135 - 110 = 25 points RRR: 25 / 11 ≈ 2.27:1 ✅ (Favorable) ⚠️ Key Notes: The signal suggests the trade is already at entry level (CMP ≈ 134.70). Ensure position sizing aligns with your risk tolerance. 🔻 SOLUSD – SELL SIGNAL 🔻🧠 Risk-Reward Ratio (RRR)⚠️ Key Notes:📊 Solana (SOLUSD) – Fundamental Overview (June 23, 2025)1. Ecosystem Strength & On‑Chain Metrics2. Technological Improvements3. Institutional Interest & Tokenomics4. Risks & Challenges🔮 Market Sentiment & Outlook🎯 Summary 📊 Solana (SOLUSD) – Fundamental Overview (June 23, 2025) 1. Ecosystem Strength & On‑Chain Metrics TVL (Total Value Locked): Between $6.5B–$12B, evolving DeFi activity across Raydium, Serum, Jupiter, Jito etc. bitcoinembassy.io+8cryptopiannews.com+8axi.com+8 Daily Active Addresses: Over 1M, indicating strong user engagement analyticsinsight.net+1reddit.com+1 Developer Activity: Surpassed 800K DAU, with 2,500+ monthly active devs and ~7.6K new developers in 2024 per Reddit reddit.com “Out of 39,148 new developers … 7,625 chose to build on Solana.” mudrex.com+13reddit.com+13blockenza.com+13 2. Technological Improvements Firedancer & Network Upgrades: Public Released testnet and ongoing enhancements aimed at dramatically raising throughput toward ~600k TPS economictimes.indiatimes.com+3hellosafe.in+3gokrypto.net+3 New Infrastructure Initiatives: Integration efforts like Solana Pay, passkey wallets, gasless relayers, and Solana SDKs analyticsinsight.net+1reddit.com+1 3. Institutional Interest & Tokenomics ETF Momentum: Multiple filings from institutions (Grayscale, Franklin Templeton, Bitwise, VanEck); Polymarket indicates ~82% chance spot SOL‑ETF may be approved in 2025 reddit.com+2reddit.com+2reddit.com+2 Stablecoin & RWA Integration: BlackRock BUIDL, Visa, PayPal partnerships cemented role in DeFi and tokenized assets mudrex.com Token Metrics: Circulating ≈511M SOL; no max cap; fair valuation compared to ETH (~TVL & revenue basis) reddit.com+4mudrex.com+4hellosafe.in+4 4. Risks & Challenges Regulatory Scrutiny: SEC suit labeling SOL as security and pending decisions could weigh heavily help.weex.com+7en.wikipedia.org+7binance.com+7 Reputation Around Meme Coins: Boom and bust cycles of memecoins (e.g. $Libra, $TRUMP, $MELANIA) led to some reputational risk cincodias.elpais.com+1reddit.com+1 Ongoing Technical Vulnerabilities: Past network outages and smart‑contract security research suggest continued need for infrastructure resilience “Frequent security incidents … vulnerability prevalence below 0.3%…” arxiv.org+1arxiv.org+1 🔮 Market Sentiment & Outlook Bullish Case:Momentum around ecosystem maturity, institutional flows, Firedancer TPM upgrades, and ETF optimism could drive price toward $250–$300, potentially testing $500+ in bull phases reddit.com+12bravenewcoin.com+12cryptopiannews.com+12 Cautious Case:Regulatory hurdles, memecoin exposure, and macro drag could suppress gains, keeping SOL range-bound between $130–150 reddit.com+9binance.com+9reddit.com+9 Reddit notes: “TVL … sitting at $8.57 billion, floundering below the $10 billion mark… possible drop to $112.” cryptopiannews.com+3reddit.com+3reddit.com+3 🎯 Summary AspectCurrent StatusOn‑chain activityStrong metrics: high DAU, robust TVL, deep DEX usageTech upgradesFiredancer, passkey wallet, gasless relayer initiatives in motionInstitutional interestHigh: multiple ETF filings, big-name partnerships, stablecoin inflowsRisksRegulatory issues, memecoin reputation, network outages under watch Overall take: Solana fundamentals remain resilient—growth, innovation, and institutional momentum dominate—but key uncertainties (SEC, memecoin volatility) could trigger short-term headwinds.

From a long-term, risk-adjusted view, SOL presents a bullish case if regulatory clarity and upgrades continue. Near‑term volatility is likely. 📲 Join our Telegram: https://t.me/classroomoftraders 🌐 Visit our Community: https://classroomoftraders.com/community/ ⚠️ Disclaimer: This content is for educational purposes only and does not constitute financial advice. Trading involves risk. Always do your own research and consult with a qualified financial advisor. SOLUSD, SOLUSD sell signal, SOLUSD crypto trading, SOLUSD short position, SOLUSD trading signal, SOLUSD cryptocurrency, SOLUSD technical analysis, SOLUSD crypto alert, SOLUSD trading strategy, SOLUSD market analysis, SOLUSD risk management, SOLUSD crypto signals, SOLUSD SOL trading, SOLUSD price target, SOLUSD stop loss ' https://classroomoftraders.com/trading-signals/solusd-trading-signal-entry-stop-loss-target-inside-2/?fsp_sid=1335 #CryptocurrencySignals #SOLUSDsignals

0 notes

Text

SOLUSD Trading Signal – Entry, Stop Loss & Target Inside

SOLUSD Trading Signal – Entry, Stop Loss & Target Inside SOLUSD Trading Signal – Entry, Stop Loss & Target Inside 🔻 SOLUSD – SELL SIGNAL 🔻 💼 Strategy: Short Position 📉 Sell Entry Range: 135 📍 Current Market Price (CMP): 134.70 ❌ Stop Loss: 146 🎯 Target: 110 🧠 Risk-Reward Ratio (RRR) Risk (Stop Loss - Entry): 146 - 135 = 11 points Reward (Entry - Target): 135 - 110 = 25 points RRR: 25 / 11 ≈ 2.27:1 ✅ (Favorable) ⚠️ Key Notes: The signal suggests the trade is already at entry level (CMP ≈ 134.70). Ensure position sizing aligns with your risk tolerance. 🔻 SOLUSD – SELL SIGNAL 🔻🧠 Risk-Reward Ratio (RRR)⚠️ Key Notes:📊 Solana (SOLUSD) – Fundamental Overview (June 23, 2025)1. Ecosystem Strength & On‑Chain Metrics2. Technological Improvements3. Institutional Interest & Tokenomics4. Risks & Challenges🔮 Market Sentiment & Outlook🎯 Summary 📊 Solana (SOLUSD) – Fundamental Overview (June 23, 2025) 1. Ecosystem Strength & On‑Chain Metrics TVL (Total Value Locked): Between $6.5B–$12B, evolving DeFi activity across Raydium, Serum, Jupiter, Jito etc. bitcoinembassy.io+8cryptopiannews.com+8axi.com+8 Daily Active Addresses: Over 1M, indicating strong user engagement analyticsinsight.net+1reddit.com+1 Developer Activity: Surpassed 800K DAU, with 2,500+ monthly active devs and ~7.6K new developers in 2024 per Reddit reddit.com “Out of 39,148 new developers … 7,625 chose to build on Solana.” mudrex.com+13reddit.com+13blockenza.com+13 2. Technological Improvements Firedancer & Network Upgrades: Public Released testnet and ongoing enhancements aimed at dramatically raising throughput toward ~600k TPS economictimes.indiatimes.com+3hellosafe.in+3gokrypto.net+3 New Infrastructure Initiatives: Integration efforts like Solana Pay, passkey wallets, gasless relayers, and Solana SDKs analyticsinsight.net+1reddit.com+1 3. Institutional Interest & Tokenomics ETF Momentum: Multiple filings from institutions (Grayscale, Franklin Templeton, Bitwise, VanEck); Polymarket indicates ~82% chance spot SOL‑ETF may be approved in 2025 reddit.com+2reddit.com+2reddit.com+2 Stablecoin & RWA Integration: BlackRock BUIDL, Visa, PayPal partnerships cemented role in DeFi and tokenized assets mudrex.com Token Metrics: Circulating ≈511M SOL; no max cap; fair valuation compared to ETH (~TVL & revenue basis) reddit.com+4mudrex.com+4hellosafe.in+4 4. Risks & Challenges Regulatory Scrutiny: SEC suit labeling SOL as security and pending decisions could weigh heavily help.weex.com+7en.wikipedia.org+7binance.com+7 Reputation Around Meme Coins: Boom and bust cycles of memecoins (e.g. $Libra, $TRUMP, $MELANIA) led to some reputational risk cincodias.elpais.com+1reddit.com+1 Ongoing Technical Vulnerabilities: Past network outages and smart‑contract security research suggest continued need for infrastructure resilience “Frequent security incidents … vulnerability prevalence below 0.3%…” arxiv.org+1arxiv.org+1 🔮 Market Sentiment & Outlook Bullish Case:Momentum around ecosystem maturity, institutional flows, Firedancer TPM upgrades, and ETF optimism could drive price toward $250–$300, potentially testing $500+ in bull phases reddit.com+12bravenewcoin.com+12cryptopiannews.com+12 Cautious Case:Regulatory hurdles, memecoin exposure, and macro drag could suppress gains, keeping SOL range-bound between $130–150 reddit.com+9binance.com+9reddit.com+9 Reddit notes: “TVL … sitting at $8.57 billion, floundering below the $10 billion mark… possible drop to $112.” cryptopiannews.com+3reddit.com+3reddit.com+3 🎯 Summary AspectCurrent StatusOn‑chain activityStrong metrics: high DAU, robust TVL, deep DEX usageTech upgradesFiredancer, passkey wallet, gasless relayer initiatives in motionInstitutional interestHigh: multiple ETF filings, big-name partnerships, stablecoin inflowsRisksRegulatory issues, memecoin reputation, network outages under watch Overall take: Solana fundamentals remain resilient—growth, innovation, and institutional momentum dominate—but key uncertainties (SEC, memecoin volatility) could trigger short-term headwinds.

From a long-term, risk-adjusted view, SOL presents a bullish case if regulatory clarity and upgrades continue. Near‑term volatility is likely. 📲 Join our Telegram: https://t.me/classroomoftraders 🌐 Visit our Community: https://classroomoftraders.com/community/ ⚠️ Disclaimer: This content is for educational purposes only and does not constitute financial advice. Trading involves risk. Always do your own research and consult with a qualified financial advisor. SOLUSD, SOLUSD sell signal, SOLUSD crypto trading, SOLUSD short position, SOLUSD trading signal, SOLUSD cryptocurrency, SOLUSD technical analysis, SOLUSD crypto alert, SOLUSD trading strategy, SOLUSD market analysis, SOLUSD risk management, SOLUSD crypto signals, SOLUSD SOL trading, SOLUSD price target, SOLUSD stop loss https://classroomoftraders.com/trading-signals/solusd-trading-signal-entry-stop-loss-target-inside-2/?fsp_sid=1334 #CryptocurrencySignals #SOLUSDsignals

0 notes

Text

Pumpfun reportedly delays token auction to July amid legal troubles

Pump.fun has delayed its public token sale once again, extending months of uncertainty for users and investors as the popular Solana-based launchpad wrestles with a flurry of lawsuits, Colin Wu reported on June 20. Pump.fun had aimed to raise $1 billion at a $4 billion valuation through its token auction originally set for June 25. The sale is now expected to happen in mid-July, although the team…

0 notes

Text

Pump.fun’s $4b token launch postponed again amid legal woes

Memecoin launchpad Pump.fun has once again postponed its token auction, amid legal troubles and a social media ban. Solana-based (SOL) memecoin launchpad is once again facing issues. On Friday, reports emerged that Pump.fun would postpone its public token sale yet again. Originally scheduled for June 25, the platform had planned to raise $1 billion at a $4 billion valuation. According to crypto…

0 notes

Text

Apple Just Threw Cold Water on the AI Hype. Here’s What Their Shocking Study Found.

Cupertino, CA – In a move that has sent ripples through the tech world, Apple has quietly published a research paper that challenges the very foundation of the current artificial intelligence hype. While companies are in a frantic race to declare the dawn of super-intelligent AI, Apple's study, titled "The Illusion of Thinking," suggests we may be witnessing a sophisticated magic trick rather than genuine machine reasoning.

The paper, which has become a hot topic of debate among AI researchers, puts some of the most advanced Large Reasoning Models (LRMs) to the test, not with standardized benchmarks they may have already memorized, but with a series of logic puzzles. The findings were startling: when faced with increasing complexity, these supposed thinking machines don't just falter, they experience a "complete accuracy collapse."

At the heart of Apple's research was a simple yet elegant method: testing AI on classic puzzles like the Tower of Hanoi. This game, which involves moving disks between pegs according to a set of rules, is a classic test of planning and foresight. Initially, the AI models performed reasonably well. However, as the researchers increased the number of disks, making the puzzle exponentially more complex, the AI's performance plummeted.

What was truly shocking was not just the failure itself, but the way in which the AI models failed. Instead of trying harder and using more computational power (or "tokens," in AI parlance) to solve the more difficult problems, the models did the opposite. Their effort, measured in token usage, actually decreased. In essence, when the going got tough, the AI gave up.

This discovery directly contradicts the prevailing narrative of an unstoppable march towards Artificial General Intelligence (AGI), where machines will soon possess human-like cognitive abilities. Apple's research suggests that what we perceive as "reasoning" in today's AI might be an advanced form of pattern matching. The models have been trained on such a vast amount of data that they can recognize and replicate solutions to problems they have seen before. But when presented with a truly novel and complex challenge that requires genuine abstract thought, their facade of intelligence crumbles.

The implications of these findings are profound. They suggest that the current path of simply scaling up AI models with more data and computing power may not be enough to achieve true reasoning. It's a sobering reality check for an industry caught in a whirlwind of hype, with multi-billion dollar valuations often riding on the promise of imminent breakthroughs.

Apple's study has, predictably, sparked a lively debate. Some in the AI community have come forward with rebuttals, arguing that the models were not designed for these specific types of abstract puzzles. However, the core of Apple's argument remains a potent challenge to the status quo.

Interestingly, this research provides a crucial context for Apple's own cautious and deliberate approach to artificial intelligence. While competitors have been rushing to integrate generative AI into every conceivable product, Apple has been more measured, focusing on practical, on-device AI that enhances user experience without making grand claims about sentience.

This "pulling back of the curtain" by one of the world's most influential tech companies serves as a critical reminder that the road to truly intelligent machines is likely to be longer and more nuanced than the current hype cycle would have us believe. For now, it seems, the "thinking" in artificial intelligence remains, as Apple's paper suggests, a masterfully crafted illusion.

0 notes