#top education loan provider

Text

Education loan to study abroad

Get the education loan you need to study abroad. Personalized service to help you reach your goals faster. With us by your side, you can focus on achieving academic excellence.

Get the financial aid you need to take your education abroad. We offer competitive rates and flexible repayment terms for all types of education loan options to help make your abroad studies a reality. Get started today and take the first step towards an Abroad study loan.

#Education loan to study abroad#Education loan for abroad studies#Student loan for studying abroad#Education loan for higher studies#Funds for higher education#Top education loan provider

0 notes

Text

Things Biden and the Democrats did, this week #9

March 9-15 2024

The IRS launched its direct file pilot program. Tax payers in 12 states, Florida, New Hampshire, Nevada, South Dakota, Tennessee, Texas, Washington, Wyoming, Arizona, Massachusetts, California and New York, can now file their federal income taxes for free on-line directly with the IRS. The IRS plans on taking direct file nation wide for next year's tax season. Tax Day is April 15th so if you're in one of those states you have a month to check it out.

The Department of Education’s Office of Civil Rights opened an investigation into the death of Nex Benedict. the OCR is investigating if Benedict's school district violated his civil rights by failing to protect him from bullying. President Biden expressed support for trans and non-binary youth in the aftermath of the ruling that Benedict's death was a suicide and encouraged people to seek help in crisis

Vice President Kamala Harris became the first sitting Vice-President (or President) to visit an abortion provider. Harris' historic visit was to a Planned Parenthood clinic in St. Paul Minnesota. This is the last stop on the Vice-President's Reproductive Rights Tour that has taken her across the country highlighting the need for reproductive health care.

President Biden announced 3.3 billion dollars worth of infrastructure projects across 40 states designed to reconnect communities divided by transportation infrastructure. Communities often split decades ago by highways build in the 1960s and 70s. These splits very often affect communities of color splitting them off from the wider cities and making daily life far more difficult. These reconnection projects will help remedy decades of economic racism.

The Biden-Harris administration is taking steps to eliminate junk fees for college students. These are hidden fees students pay to get loans or special fees banks charged to students with bank accounts. Also the administration plans to eliminate automatic billing for textbooks and ban schools from pocketing leftover money on student's meal plans.

The Department of Interior announced $120 million in investments to help boost Climate Resilience in Tribal Communities. The money will support 146 projects effecting over 100 tribes. This comes on top of $440 million already spent on tribal climate resilience by the administration so far

The Department of Energy announced $750 million dollars in investment in clean hydrogen power. This will go to 52 projects across 24 states. As part of the administration's climate goals the DoE plans to bring low to zero carbon hydrogen production to 10 million metric tons by 2030, and the cost of hydrogen to $1 per kilogram of hydrogen produced by 2031.

The Department of Energy has offered a 2.3 billion dollar loan to build a lithium processing plant in Nevada. Lithium is the key component in rechargeable batteries used it electric vehicles. Currently 95% of the world's lithium comes from just 4 countries, Australia, Chile, China and Argentina. Only about 1% of the US' lithium needs are met by domestic production. When completed the processing plant in Thacker Pass Nevada will produce enough lithium for 800,000 electric vehicle batteries a year.

The Department of Transportation is making available $1.2 billion in funds to reduce decrease pollution in transportation. Available in all 50 states, DC and Puerto Rico the funds will support projects by transportation authorities to lower their carbon emissions.

The Geothermal Energy Optimization Act was introduced in the US Senate. If passed the act will streamline the permitting process and help expand geothermal projects on public lands. This totally green energy currently accounts for just 0.4% of the US' engird usage but the Department of Energy estimates the potential geothermal energy supply is large enough to power the entire U.S. five times over.

The Justice for Breonna Taylor Act was introduced in the Senate banning No Knock Warrants nationwide

A bill was introduced in the House requiring the US Postal Service to cover the costs of any laid fees on bills the USPS failed to deliver on time

The Senate Confirmed 3 more Biden nominees to be life time federal Judges, Jasmine Yoon the first Asian-America federal judge in Virginia, Sunil Harjani in Illinois, and Melissa DuBose the first LGBTQ and first person of color to serve as a federal judge in Rhode Island. This brings the total number of Biden judges to 185

#Thanks Biden#Joe Biden#Democrats#politics#US politics#good news#nex benedict#abortion#taxes#climate change#climate action#tribal communities#lithium#electronic cars#trans rights#trans solidarity#judges

366 notes

·

View notes

Note

sorry if you've been asked this before but have you gone to college or are you interested? a lot of my fav writers went to pretty prestigious places and have masters or phds etc and i was the type of person who never thought i'd be able to go to school for writing (or anything really) but i'm gonna try this upcoming school year. would love any insight you have if any <3

my feelings on further education for writing are complicated, but to put it out there at the top: i did not go to college & do not consider it necessary to be published

i did not apply to college in high school, which was highly controversial according to teachers, who insisted i need to at least look. i had some poor grades (almost failed creative writing, almost failed sophomore english) & did not attend many after school programs. i skipped class, had a suspension on record for fighting, & i was deeply deeply clinically depressed. i was in therapy, on medication, & could not see that another few years of school would suit me, especially because i was trying to come out as trans in a small school & that exhausted & despaired me. i did not have savings, scholarship offers, & my parents had told me since childhood that any secondary education would be my responsibility

i would like to go to college now i think, or at least attend more workshops & small classes for poetry & fiction, but i still feel it is very unlikely. education costs are too high for me to consider it an agreeable sacrifice for those experiences & connections. if i had the chance to go somewhere for writing, it would have to be within a financial margin that seemingly does not exist for current college costs & i refuse to take out loans, especially when i would rather work a day job & further my transition

i think it is very possible to educate yourself. there are lots of online resources available that can provide you with lessons, prompts, readings, & "homework". one key element, that ive discussed with other published friends, is that doing it alone... means you are that: alone. there is a lot of value in being taught by someone or someones who can answer your questions & give you a uniquely human perspective. i have taught myself a lot privately, but it does come with a sometimes crushing distance that can feel downright alienating, if not discouraging. there is a thrill in discussing poetry in a group that cannot be replicated in solitude

on the other hand, i think experiences cannot be taught in a classroom. to write, you must live first. you have to have material & it is difficult to craft material when you are entirely occupied with study. heartbreak, loss, love, wonder, can all happen during college, & even college is its own experience, but i do think there is a lot of overlooked value in people who just do... people things without wondering if it'll make a good poem

when i went to a writing retreat last year, i was the only man to attend (or ever apply!) & the only person in the group to not have gone to, or actively be in, college. i was torn between thinking i was an outsider, because everyone around me was "better educated" & feeling like id accomplished something all on my own

so... at the end of the day, i think it is entirely personal whether someone goes to college for writing. i know people who have gone & loved it & others who did not find it useful. i think these depend upon yourself, the school, your style, what you're hoping to achieve, etc. i think most of all it's deeply important to learn with other people when you can, to talk to people about poetry, to go to readings & subscribe to journals & visit libraries & take notes. how that is done is up to you

144 notes

·

View notes

Text

Between 2000 and 2020, the total number of Americans owing federal student loans more than doubled from 21 million to 45 million, and the total amount they owed more than quadrupled from $387 billion to $1.8 trillion, growing much faster than any other form of household debt. Figure 1 shows the growth in student loan borrowers and balances

Prior to 2020, when payments were temporarily frozen, a million students defaulted each year, and millions more struggled with their loans and failed to make payments. As recently as 2018, the Congressional Budget Office expected taxpayers to earn a profit on federal student lending programs. It now expects new loans issued over the next decade will instead cost $393 billion—more than will be spent on Pell grants for low-income undergraduates (Congressional Budget Office 2024). Moreover, that prospective cost estimate excludes hundreds of billions of write-downs on existing loans expected because of new policies that will reduce borrowers’ payments and provide debt forgiveness. Compounding these financial costs, many students left college without a degree or with a degree of dubious value, having missed out on the opportunity to rise up the economic ladder. What went wrong?

Since federal student lending programs started in the 1950s, such programs have exhibited boom-and-bust credit cycles. Legislation expanding financial aid to increase educational opportunities led to increased enrollment but also to the proliferation and expansion of institutions providing low-quality education to riskier students. The subsequent deterioration of student outcomes—and reports of scandals—caused Congress to limit lending using so-called “accountability rules,” regulating how postsecondary institutions participate in federal lending programs. When these new rules constrained opportunities for some would-be students, Congress would then whittle away at the rules, allowing student loans to expand again, until a new range of concerns appeared.

After a previous student loan crisis in the 1980s was arrested by new accountability rules passed by Congress, those rules were gradually loosened in the late 1990s. Almost immediately, college enrollment and student borrowing accelerated, particularly among groups that had historically been underrepresented at traditional institutions—students who were lower-income; first-generation students; Black and Hispanic; older; enrolled less than full time; pursuing degrees other than a B.A.; and much more likely to rely on federal aid not just for tuition but also for other costs of attendance, like living expenses. Expanding educational opportunities for these groups is clearly desirable and a key purpose of financial aid programs. But from the perspective of student lending, these new borrowers were much riskier, partly because of their socioeconomic backgrounds and partly because of the institutions they attended.

The institutions that enrolled this new wave of borrowers were disproportionately not traditional four-year institutions with strong educational and economic outcomes. Starting around 2000, for-profit institutions tripled their enrollment and community college students tripled their rate of borrowing. In 2000, only one of the top ten schools in terms of aggregate student loan volume was for-profit. By 2014, for-profits accounted for eight of the ten schools whose students owed the most (Looney and Yannelis 2015). In general, the schools that enrolled the surge of new students were those with high default rates and low student loan repayment rates, where few students complete their intended degrees, or where graduates’ earnings are the lowest. This influx of disadvantaged borrowers to lower-quality schools was catastrophic for those students’ finances, aggregate student loan outcomes, and the federal student loan budget. Between 2000 and 2014, the student loan default rate rose by 75% (Looney and Yannelis 2015).

Today’s student loan crisis—and the fact that it is one of a series—highlights the challenges of using a student loan financial aid system to promote access to educational opportunities that vary enormously (but in opaque ways) in their quality, value, and student outcomes. Today, the student loan program is the most costly federal program for subsidizing higher education. In contrast to other federal aid to students, however, loan eligibility is not means tested, and few guardrails exist to prevent using loans to pursue low-quality or excessively costly programs. As a result, the program’s budget cost and its distributional effects are delegated to the program’s beneficiaries themselves—the institutions, which enroll students and set the cost of attendance, and the students, who decide where to enroll and how much to borrow. Schools’ payments are only very weakly linked to students’ outcomes. As a result of these misaligned incentives, students—particularly disadvantaged students and those historically underrepresented at universities—face high costs, variable quality, and inequity in who goes to college and graduate school.

6 notes

·

View notes

Text

Scott Galloway - NO MERCY / NO MALICE

Florida is now one of the most restrictive states in the country for abortion rights: The state’s supreme court reversed its own precedents on April 1 and upheld a ban on abortions after six weeks. Women in Florida, as in many states after the reversal of Roe v. Wade, now face harsh limits on their fundamental rights.

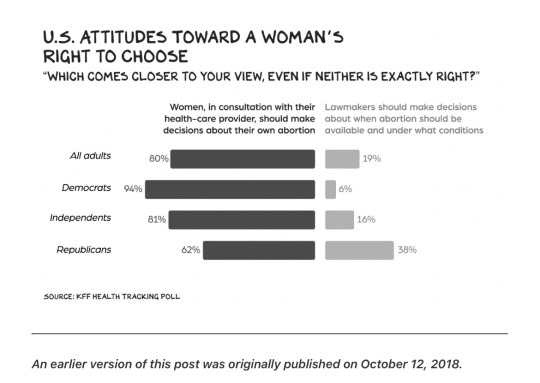

The same day, the court also allowed a proposal enshrining abortion rights in Florida’s constitution to appear on the ballot this November. There is a good chance it will pass, but it will be close — 60% will have to approve the amendment, and last fall, a poll found 62% of voters planned to vote for it. Nationwide, between 60% and 80% of Americans support a woman’s right to choose, depending on how the question is asked. The rest of the world is expanding the right of women to decide when and how they get pregnant and give birth. Yet in many states, a minority of Americans continue to impose their views on the rest of us. I say “us” because while this right is unique to women, it affects all of us. The right to terminate an unwanted pregnancy changed the course of my life, and my mother’s, even though I didn’t understand it at the time.

“D and What?”

On a late summer afternoon, between my junior and senior years of high school, I was in the passenger seat of my mom’s lime-green Opel Manta on the way home from work. Mom had secured me a job in the mailroom of her employer, the Southwestern School of Law, where she managed the secretarial pool, and we carpooled back and forth. Headed west on I-10 (the Santa Monica Freeway), between the La Brea and Fairfax exits, she told me about her plans for later in the week.

“I’m having a procedure called a D&C on Wednesday and won’t be home that night. Are you fine to stay alone?”

I was 16, and only really heard the part of her question suggesting I wasn’t old enough to spend the night solo in our condo. “Yeah, sure.” I didn’t ask what a D&C was, but I had the sense it had something to do with the great unknown, women’s health, and didn’t ask for details. My mom likely wanted to have a meaningful conversation with me, but that didn’t happen. Meaningful dialogue with teenage boys happens … just not when you expect. The question must have found some purchase in my consciousness, as I remember exactly what I was wearing: brown Levi’s corduroys, a Bruce Springsteen concert T-shirt, and top-siders. Not Sperry top-siders, but knockoffs. A pair of real Sperrys cost $32.

I was 16, my mom 46. I loved her because she loved me, completely. But that’s not what this post is about. I also loved the U.S. because it, too, loved us — me and my mom — completely. My mother was a single immigrant raising her son on a secretary’s salary. But this isn’t a sob story. We had good lives. Sure, money was definitely a thing, but we lived in a nice place and took vacations to Niagara Falls and San Francisco, ate at Junior’s Deli every Sunday night, and went some weekends to the beach in Santa Monica, where parking was $2 for the whole day, just behind lifeguard station No. 9.

Our nation welcomed my mother with open arms. Despite her having no education or money, we helped her out in between jobs and loaned her money so she could go to night school and become a stenographer. The state of California loved her son: The vision and generosity of the regents of UCLA and California’s taxpayers gave her unremarkable son (this isn’t a humblebrag, I was seriously unimpressive) a remarkable opportunity. I received a world-class education at little cost: UCLA (my B.A.) and UC Berkeley (an MBA) for a total cost (tuition) of $7,000 for all seven years.

More than just affordable, it was accessible: UCLA had a 76% admissions rate when I applied, and Berkeley’s Haas School of Business accepted me with an undergraduate GPA of (no joke) 2.27. America is about the opportunities it provides the unremarkable, not the manufacture of a superclass of billionaires from the pool of preordained remarkables.

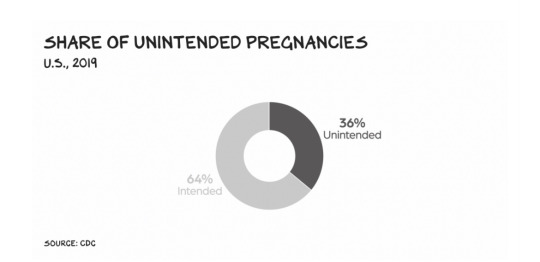

But the ultimate expression of our nation’s empathy and love for a single mother, in my view, was to grant, and protect, her domain over her reproductive system. In the U.S., 59% of women getting abortions are already moms. Twenty-four percent are Catholic, 17% mainline Protestant, 13% evangelical Protestant. Over a third of pregnancies in the U.S. are unintended.

Men and women create unwanted pregnancies. However, it’s often men’s lack of manhood that’s behind abortions. Half of women seeking an abortion cite the lack of a reliable partner as a reason for their choice. In many cases the partner is abusive. Among all abortion patients, 95% report that abortion was a good choice — they remain relieved several months after the procedure. Violence toward women declines precipitously after an abortion, because they can break ties with their abusers. The leading cause of death for women who are pregnant or have just given birth, by a factor of 2x, is homicide.

Alt Control

What is going on here? In my view, it has nothing to do with “life,” as the most staunch advocates of the “pro-life” movement are the first to advocate for cutting the child tax credit, executing criminals, or putting a pregnant woman in danger when a pregnancy becomes a health risk. Many argue that these folks are not obsessed with life, but birth. This also misses the mark — the same groups do not favor economic policies that would encourage people to have children. This is about control or, more specifically, retaking control and power back from women.

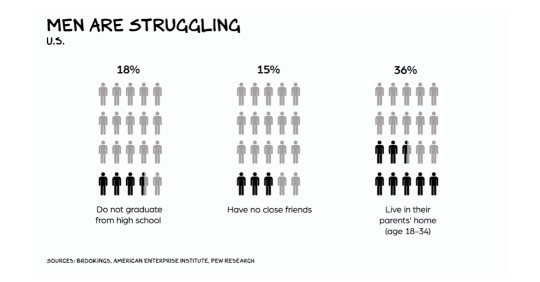

I write a lot about how far young men have fallen in America over the past several decades. Even more striking is the ascent of women, globally, over the same period. Women now outnumber men in tertiary education enrollment worldwide; and the number of women elected to parliamentary positions has doubled since 1990. Women’s wealth is growing faster than overall wealth. A static feature of a modern economy is women outpacing men in education and income growth.

However, this has stirred the ghoul that haunts the world … posing a greater threat to society than any autocrat or virus: extremism. The parabolic progress of women over the past several decades has inspired a gag reflex among the most conservative wings of many religions. The radical wings of Christian, Islamic, and Jewish sects have weaponized politics and blurred the lines between religion and legislation. In America, where there used to be a sharp distinction, as outlined in the Constitution, we’ve witnessed a first: the rollback of citizens’ rights with the overturn of Roe.

The backlash among Christian nationalists has been speedballed by the other great threat: loneliness. Two-thirds of women under the age of 30 have a romantic partner vs. just one-third of men the same age. Men have fewer friends than they once did. Unfortunately, men’s loneliness can turn toxic, as they have weaker social networks and consequent guardrails. Lonely young men are more prone to conspiracy theories, nationalism, and misogynistic content. In sum, they risk becoming shitty citizens. The most striking, and frightening, data re the abortion debate is the group that registers the least support for a women’s right to choose: Gen Z men (age 12 to 27). Do you think this reflects their love for the unborn, or resentment of the living (women) … who they feel shunned by? It’s simple: Radicalized and lonely American men want uppity women to sit down.

The weapon of choice among these groups is economic warfare. To deny someone bodily autonomy is analogous to defunding them; they lose power. The Turnaway Study followed 1,000 women who sought abortions (some successfully, some not), compiling over 8,000 interviews over five years. The women in the study who were denied an abortion on average had higher debt and a greater risk of bankruptcy, and they were more likely to be in poverty years after giving birth.

2nd Order

How did you get to where you are now? People tell themselves a story that credits their character and grit for success, while blaming outside forces for their failures. But small twists of fate, errant decisions, and sheer randomness put you in this place, at this moment. I’m in tech because I fell in love with a woman and followed her to the Haas School of Business — I’d initially enrolled at the University of Texas. It’s more likely, graduating in 1992 Austin, I would have ended up in the energy sector or back in banking vs. the clear and present choice of tech in (wait for it) Silicon Valley.

But going further back, if my mom, at 46, hadn’t had access to affordable family planning, our lives would have been changed dramatically. Not only did we lack the funds or connections to figure it out (a rich friend who knew a doctor or the resources to travel far and have the procedure), but we also didn’t have the confidence. Just as I didn’t apply to out-of-state colleges — only rich kids did that. A lower-middle-class household headed by a single parent, neither remarkable, puts both of you on your heels instead of your toes.

If Roe v. Wade hadn’t been the law of the land, things could have been much different for me and my mom. An unwanted child at 46 would have been financially ruinous for our household. There was no maternity leave for secretaries in the eighties. I likely would have done what my father and mother did when their families were in financial distress, and left school to help out. I wouldn’t have enrolled at UCLA. Instead, I would have stayed in the job my father had secured for me after high school, installing shelving at $18/hour — a lot of money for us at the time.

Without my mom having that choice, there would have been no UCLA, no Berkeley grad school, no tech startups, no tens of millions in taxes paid, and … fewer children. I have always been worried about money and did not especially want kids. There’s no way I’d have opted for kids, later in life, if financially strained. We see evidence of this today, as a younger generation is having fewer children because they can’t afford them. My mom’s right to choose not to have a child she couldn’t afford gave me the choice to have children I could. All unbeknownst to me, at 16 years of age.

America is a mix of opportunity and acceptance, each being a force multiplier for the other. The reversal of Roe is about extremists and people who feel shunned trying to recapture control from a group that’s increasingly less suppliant to religion or men. The result is a lack of prosperity and a dangerous regression in the U.S., which used to illuminate a path forward for other nations. The suppression of abortion rights is yet another transfer of wealth from the poor to the rich — no child of a private equity partner is going to lose her right to choose. The economic assault against women, specifically poor women and their families, cripples opportunity and acceptance. It is wrong and un-American.

Life is so rich,

Scott Galloway

#abortion#abortion rights#pregnancy#intended pregnancies#unintended pregnancies#education#religion#roe v wade#christian nationalist#Scott Galloway

6 notes

·

View notes

Text

Press Release

Harvard Art Museums’ Fall 2023 Exhibition Explores

Entwined Histories of the Opium Trade and the Chinese

Art Market

Opium pipe, China, Qing dynasty to Republican period, inscribed with cyclical date corresponding to 1868 or 1928. Water buffalo horn, metal, and ceramic. Harvard Art Museums/Arthur M. Sackler Museum, Bequest of Grenville L. Winthrop, 1943.55.6.

Cambridge, MA

This fall, the Harvard Art Museums present an exhibition that explores the entangled histories of the western sale of opium in China in the 19th century and the growing appetite for Chinese art in the United States at the beginning of the 20th century. Opium and Chinese art—acquired through both legal and illicit means—had profound effects on the global economy, cultural landscape, and education, and in the case of opium on public health and immigration, that still reverberate today. Objects of Addiction: Opium, Empire, and the Chinese Art Trade, on display September 15, 2023 through January 14, 2024 in the Special Exhibitions Gallery on Level 3 of the Harvard Art Museums, looks critically at the history of Massachusetts opium merchants and collectors of Chinese art, as well as the current opioid crisis.

A range of accompanying public programs will encourage community discussion around related topics, including the state of the opioid crisis in New England, the lingering political and economic effects of the Opium Wars, opium’s role in anti-Chinese U.S. immigration laws, and Chinese art collecting in Massachusetts. In addition, the artist collective 2nd Act will present a series of drama therapy workshops challenging ideas about addiction, and the Cambridge Public Health Department and Somerville Health and Human Services will host trainings on the use of naloxone (Narcan) to reverse opioid overdoses. In the early planning stages, Sarah Laursen, the Alan J. Dworsky Associate Curator of Chinese Art at the Harvard Art Museums, worked with Harvard students Emily Axelsen (Class of 2023), Allison Chang (Class of 2023), and Madison Stein (Class of 2024), who were instrumental in the development of the exhibition’s narrative and associated programming. Laursen also held a series of community feedback sessions to solicit reactions to the show’s content from Harvard students, faculty, and staff, as well as local experts and community members. Notably, the exhibition is opening during National Recovery Month, a national observance held each September to educate Americans about substance use disorder and the treatment options and services that can enable them to live healthy and rewarding lives.

“This exhibition is about the past and its impact on the present—but my hope it that it will also help us to think more productively about the future,” said Laursen.

“For example, the stigma around opium use initially resulted in the Qing government imposing harsh punishments for people experiencing addiction, rather than offering the empathy, treatment, and resources that people needed. Today, with overdose death rates in Massachusetts topping 2,300 individuals per year, we can learn from the past and choose to adopt harm reduction measures that will save lives.” On the collecting of Chinese art, Laursen notes, “By reexamining the formation of early 20th-century museum collections—as well as the underrecognized consequences of these initial acquisitions—we become better equipped to shape our policies for ethical collecting in the future.”

The exhibition comprises three thematic sections and presents more than 100 objects, including paintings, prints, Buddhist sculptures and murals, ceramics, jades, and bronzes, as well as historical materials including books, sale and exhibition catalogues, and magazine clippings from the collections of the Harvard Art Museums, with loans generously provided by the Peabody Museum of Archaeology and Ethnology, Fine Arts Library, Harvard-Yenching Library, Economic Botany Library of Oakes Ames, Houghton Library, and Baker Library (all at Harvard), as well as by the Forbes House Museum, the Ipswich Museum, and Mr. and Mrs. James E. Breece III.

Beginning with an examination of the origins of the opium trade, the first section includes a large comparative timeline that lays out events in China, Europe, and the United States in order to contextualize the complex histories of the opium and Chinese art trades. Britain began illegally selling Indian opium in China in the 18th century and increased its exports to counteract the demand for Chinese tea imports in Europe and the United States. In the 19th century, prominent Massachusett merchants such as members of the Perkins, Forbes, Heard, Cushing, Sturgis, Cabot, Delano, Weld, Peabody, and other elite local families were deeply involved in the lucrative Turkish opium trade as well. Conflicts between the Qing dynasty (1644–1911) and western powers over trading rights led to two Opium Wars (1839–42 and 1856–60), whose outcomes had far-reaching political and economic consequences.

In this first gallery, examples of typical Chinese export wares including tea wares, porcelains, and paintings that were popular in Europe and North America are presented alongside opium-related objects, including an opium pipe made of water buffalo horn and an opium account book for the year 1831 that lays bare the volume of the drug imported into the port of Guangzhou by just one firm, Russell & Co., run initially by members of Forbes family. A Qing dynasty painting of the Port of Shanghai (c. 1863–64), which became a commercial center after the first Opium War, shows a bustling harbor filled with boats and ships and reveals the location of the offices of prominent opium traders such as Russell & Co. and Augustine Heard & Co. Also visible is the headquarters of auctioneer Hiram Fogg, the brother of the China trader William Hayes Fogg, for whom Harvard’s Fogg Museum is named. Along with commerce, the first gallery also presents a range of documentary materials and ephemera that demonstrate the devastating impact of opium on Chinese society. Photographs and mass media illustrations critique the use and sale of opium. A slideshow, In Their Own Words, presents quotations from a diverse range of voices of individuals who were involved in or opposed the sale of opium and collecting of Chinese art. In many cases, these quotes flesh out the perspectives of historical figures who are named in labels throughout the galleries. Audio wands available in this space play excerpts from “Opium Talk,” an essay by Zhang Changjia (Shanghai, 1878) translated by Keith McMahon in The Fall of the God of Money: Opium Smoking in Nineteenth-Century China (Rowman & Littlefield, 2002).

The translations are read by Thomas Ho, a member of the local Chinese American community, and a transcript is available in the gallery, printed with permission from McMahon.

The second section highlights the history of imperial art collecting within China and demonstrates the growing appetite for Chinese art in Europe and the United States after the Opium Wars, especially after the looting of the Old Summer Palace in Beijing by British and French Troops in 1860 and in the wake of the Boxer Rebellion (1899–1901). Through the histories of merchants, collectors, dealers, museum directors, and professors, this section examines the early 20th-century formation of Chinese art collections in Massachusetts, including at the Fogg Museum. Chinese works from the collections of the Forbes House Museum and Ipswich Museum—once homes of opium traders of the Forbes and Heard families—show the taste at this time predominantly for functional or decorative objects such as export ceramics, lacquer furnishings, and other curiosities. However, the flood of newly available palace treasures and archaeological materials prompted the collecting of ancient bronzes and jades unearthed from tombs and Buddhist sculptures chiseled from cave temple walls.

Well-connected dealers in Asian art such as C. T. Loo (or Loo Ching-tsai) and Sadajirō Yamanaka 山中定次郎 acquired items from several sources—including from Chinese elites who fled the country after the fall of the Qing dynasty, imperial family members, and American collectors who lost their fortunes in the Depression—and sold those works to eager collectors around the world, such as Harvard alumnus Grenville L. Winthrop, who obtained 25 fragments from Buddhist cave temples in Tianlongshan, China.

The exhibition includes one work from this group, a sixth-century carved fragment depicting Bodhisattva Manjusri (Wenshu Pusa); to learn more about the Tianlongshan fragments now in the museums’ collections, visit hvrd.art/reframingtianlongshan. Others such as Langdon Warner, a Harvard alumnus and curator at the Fogg Museum, joined the First Fogg Expedition to China (1923–24) and personally removed works from the Mogao Caves in Dunhuang, leaving permanent scars on the archaeological landscape of China. Two wall painting fragments, among the best preserved of the twelve that Warner brought back to Harvard, are displayed alongside a large-sale photograph showing the present condition of the mural from which they were removed (Bust of an attendant bodhisattva and Bust of a bodhisattva surrounded by a monk and devas).

Exhibition curator Sarah Laursen added: “I am often asked, where did this object come from? How did it come to Harvard? In many cases, we do not know their precise sources nor the circumstances of their removal because in the past there was no demand for documentation. For most U.S. collections of Asian art it is rarely possible to reconstruct the complete chain of ownership. But there are some questions we can start to answer: How can we work with source countries to better document, care for, and understand these objects? How can we curtail the black market? What could ethical collecting or sharing of cultural property look like in the future?”

A third section, entitled Opioids Then and Now, investigates parallels between China’s opium crisis and the opioid epidemic in Massachusetts today. Materials here clarify how addiction affects the brain (an animated video, produced for a free online Harvard edX course, plays on a monitor) and offer potentially life-saving information about harm reduction and overdose prevention. Visitors are invited to share their thoughts and personal experiences on response cards in this space and can either post them publicly on a bulletin board in the gallery or deposit them in a private box to be preserved in the Harvard Art Museums Archives. Visitors will also be able to browse recent books about opioids and harm reduction.

A 24-page printed booklet available in the galleries draws together the exhibition’s extensive content in three thematic essays: Who has benefited from the opium trade? Who has been harmed by opium?

What is the legacy of the opium trade in U.S. museums?

None of the works in the exhibition or in the Harvard Art Museums collections as a whole were collected or gifted by Arthur M. Sackler, nor were they purchased using funds provided by him.

Online Resource

Exhibition webpage: harvardartmuseums.org/objectsofaddiction

Public Programming

A range of public programs held in conjunction with the exhibition Objects of Addiction will encourage community discussion around the opioid crisis, the effects of the Opium Wars on U.S.–China relations, the role of opium in Chinese exclusion in the United States, and art collecting practices. Unless noted, all events are held in-person at the Harvard Art Museums, 32 Quincy Street, Cambridge, MA 02138.

Admission to visit our galleries is free, but some programs have a fee (noted below). For updates, full details, and to register, please click the links below or see our calendar:

harvardartmuseums.org/calendar. Questions? Call 617-495-9400.

Lecture — Objects of Addiction: Opium, Empire, and the Chinese Art Trade

Thursday, September 14, 2023, 6–7:30pm

Join curator Sarah Laursen for a lecture on opium and Chinese art—two influential commodities traded in China, the British Empire, and Massachusetts between the 18th and early 20th centuries.

Free admission, but seating is limited and available on a first-come, first-served basis. Following the lecture, guests are invited to visit the exhibition on Level 3. This lecture will be recorded and made available for online viewing; check the link above after the event for the link to view.

Workshops — Rethinking Addiction: A Drama Therapy Workshop with 2nd Act Artist Collective

Saturday, September 16, 2023, 2–4pm

Sunday, October 22, 2023, 2–4pm

Saturday, November 11, 2023, 2–4pm

Drama therapists Ana Bess Moyer Bell and Amy Lazier of the artist collective 2nd Act will lead workshops designed to challenge participants’ ideas about addiction through a drama therapy model. By examining, embodying, and de-stigmatizing addiction and creating metaphorical objects of care, love, and support, participants will develop a shared understanding of addiction and how it affects daily life. $15 materials fee. Registration is required and space is limited. Minimum age of 14; no previous experience required.

Lecture — Objects of Addiction: Perspectives on the Opioid Crisis in New England

Sunday, September 24, 2023, 2–3:30pm

Specialists in addiction medicine, harm reduction, and public health policy will take part in a roundtable discussion about the current state of the opioid crisis in New England. Speakers:

Danielle McPeak, Prevention and Recovery Specialist, Cambridge Public Health Department; Leo Beletsky, Professor of Law and Health Sciences; Faculty Director, The Action Lab at the Center for Health Policy and Law, Northeastern University; Mark Joseph Albanese, Assistant Professor of Psychiatry, Harvard Medical School; Medical Director, Physician Health Programs; former Medical Director for Addictions, Cambridge Health Alliance; Bertha Madras, Professor of Psychobiology, Harvard Medical School; Director, Laboratory of Addiction Neurobiology, and Psychobiologist,

Division of Basic Neuroscience, McLean Hospital; Jay Garg ’24, Policy Chair for HCOPES

(Harvard College Overdose Prevention and Education Students); and Dennis Bailer, Overdose Prevention Program Director, Project Weber/RENEW. Free admission, but seating is limited and available on a first-come, first-served basis. Before and after the discussion, guests are invited to visit the exhibition on Level 3.

Gallery Talks — Objects of Addiction: Opium, Empire, and the Chinese Art Trade

Tuesday, October 3, 2023, 12:30–1pm

Wednesday, October 18, 2023, 12:30–1pm

Thursday, November 16, 2023, 12:30–1pm

Friday, December 1, 2023, 12:30–1pm

Wednesday, December 13, 2023, 12:30–1pm

Join curator Sarah Laursen for thematic 30-minute talks focused on select artworks in the exhibition. Free admission, but space is limited to 18 people and registration is required.

Narcan Trainings with the Cambridge Public Health Department and Somerville Health and Human Services

Tuesday, October 17, 2023, 5:30–6:30pm

Sunday, November 19, 2023, 2–3pm

Friday, December 1, 2023 (time TBA)

With an abundance of care for our community, the Harvard Art Museums are hosting one-hour on-site Narcan trainings, facilitated by the Cambridge Public Health Department and Somerville Health and Human Services. Their staff will also distribute the medicine for attendees to take home.

Naloxone (also known as Narcan) is a nasal spray that can rapidly reverse an opioid overdose by blocking opioids from attaching to receptors in the brain. Free admission, but space is limited and registration is required.

Exhibition Tours — Objects of Addiction: Opium, Empire, and the Chinese Art Trade

Thursday, October 26, 2023, 12–1pm

Tuesday, November 21, 2023, 12–1pm

Saturday, December 9, 2023, 12–1pm

Join curator Sarah Laursen for hourlong tours of the exhibition. Free admission, but space is limited to 18 people and registration is required.

Online Lecture — Objects of Addiction: A Conversation about Opium and Anti-Chinese Immigration

Laws in the United States

Saturday, October 28, 2023, 10–11am

Award-winning author and Harvard history professor Erika Lee will be in conversation with two Harvard students about the role of opium in the restrictions on Chinese immigration in the United States in the 19th and 20th centuries. Speakers: Erika Lee, Bae Family Professor of History, Harvard University; Jolin Chan ’25, Harvard University; Student Board Member, Harvard Art

Museums; Madison Stein ’24, Harvard University. This talk will take place online via Zoom. The event is free and open to all, but registration is required.

Lecture — Objects of Addiction: The Legacy of the Opium Wars

Wednesday, November 8, 2023, 6–7:30pm

Harvard faculty in Chinese history, business, politics, and law will take part in a roundtable discussion on the 19th-century Opium Wars and the legacy of the opium trade in U.S.–China relations. Speakers: Mark C. Elliott, Vice Provost for International Affairs; Mark Schwartz Professor of Chinese and Inner Asian History, Harvard University; William C. Kirby, T. M. Chang Professor of China Studies, Harvard University; Spangler Family Professor of Business Administration, Harvard Business School; Rana Mitter, S. T. Lee Professor of U.S.–Asia Relations, Harvard Kennedy School; Meg Rithmire, F. Warren McFarlan Associate Professor of Business Administration, Harvard Business School; Mark Wu, Director of the Fairbank Center for Chinese Studies, Harvard University; Henry L. Stimson Professor of Law, Harvard Law School. Free admission, but seating is limited and available on a first-come, first-served basis.

Lecture — Objects of Addiction: Collecting Chinese Art—Past, Present, and Future

Saturday, November 18, 2023, 2–3:30pm

Curators and specialists will explore early collecting of Chinese art in Massachusetts, historical interpretations of cultural heritage, and how contemporary museum collecting practices have changed and will continue to change in the future. Moderator: Soyoung Lee, Landon and Lavinia Clay Chief Curator, Harvard Art Museums. Speakers: Nancy Berliner, Wu Tung Senior Curator of Chinese Art, Museum of Fine Arts, Boston; Amy Brauer, Curator of the Collection, Division of Asian and Mediterranean Art, Harvard Art Museums; Sarah Laursen, Alan J. Dworsky Associate Curator of Chinese Art, Harvard Art Museums; Lisong Liu, Professor of History, Massachusetts College of Art and Design. Free admission, but seating is limited and available on a first-come, first- served basis. Before and after the lecture, guests are invited to visit the exhibition on Level 3.

Credits

Support for Objects of Addiction: Opium, Empire, and the Chinese Art Trade is provided by the

Alexander S., Robert L., and Bruce A. Beal Exhibition Fund; the Robert H. Ellsworth Bequest to the

Harvard Art Museums; the Harvard Art Museums’ Leopold (Harvard M.B.A. ’64) and Jane Swergold

Asian Art Exhibitions and Publications Fund and an additional gift from Leopold and Jane Swergold; the José Soriano Fund; the Anthony and Celeste Meier Exhibitions Fund; the Gurel Student Exhibition Fund; the Asian Art Discretionary Fund; the Chinese Art Discretionary Fund; and the Rabb Family Exhibitions Fund. Related programming is supported by the M. Victor Leventritt Lecture Series Endowment Fund. The accompanying booklet was made possible by generous support from Mr. and Mrs. James E. Breece III. Additional support for this project is provided by the Dunhuang Foundation.

About the Harvard Art Museums The Harvard Art Museums house one of the largest and most renowned art collections in the United States, comprising three museums (the Fogg, Busch-Reisinger, and Arthur M. Sackler Museums) and three research centers (the Straus Center for Conservation and Technical Studies, the Harvard Art Museums Archives, and the Archaeological Exploration of Sardis). The Fogg Museum includes Western art from the Middle Ages to the present; the Busch-Reisinger Museum, unique among North American museums, is dedicated to the study of all modes and periods of art from central and northern Europe, with an emphasis on German-speaking countries; and the Arthur M. Sackler Museum is focused on art from Asia, the Middle East, and the Mediterranean. Together, the collections include over 255,000 objects in all media. The Harvard Art Museums are distinguished by the range and depth of their collections, their groundbreaking exhibitions, and the original research of their staff. Integral to

Harvard University and the wider community, the museums and research centers serve as resources for students, scholars, and the public. For more than a century they have been the nation’s premier training ground for museum professionals and are renowned for their seminal role in developing the discipline of art history in the United States. The Harvard Art Museums have a rich tradition of considering the history of objects as an integral part of the teaching and study of art history, focusing on conservation and preservation concerns as well as technical studies. harvardartmuseums.org

The Harvard Art Museums receive support from the Massachusetts Cultural Council.

Hours and Admission

Open Tuesday–Sunday, 10am–5pm; closed Mondays and major holidays. Admission is free to all visitors. For further information about visiting, including general policies, see harvardartmuseums.org/visit.

For more information, please contact

Jennifer Aubin

Public Relations Manager

Harvard Art Museums

617-496-5331

6 notes

·

View notes

Text

By: Preston Cooper

Published: May 8, 2024

Key Points

This report estimates return on investment (ROI) — how much college increases lifetime earnings, minus the costs of college — for 53,000 different degree and certificate programs.

Bachelor’s degree programs have a median ROI of $160,000, but the payoff varies by field of study. Engineering, computer science, nursing, and economics degrees have the highest ROI.

Associate degree and certificate programs have variable ROI, depending on the field of study. Two-year degrees in liberal arts have no ROI, while certificates in the technical trades have a higher payoff than the typical bachelor’s degree.

Nearly half of master’s degree programs leave students financially worse off. However, professional degrees in law, medicine, and dentistry are extremely lucrative.

Around a third of federal Pell Grant and student loan funding pays for programs that do not provide students with a return on investment.

Executive Summary

In recent years, young Americans have expressed more skepticism about the financial value of higher education. While prospective students often ask themselves if college is worth it, this report shows the more important question is when college is worth it.

This report presents estimates of return on investment (ROI) for 53,000 degree and certificate programs ranging from trade schools to medical schools and everything in between. I define ROI as the increase in lifetime earnings that a student can expect when they enroll in a certain degree program, minus the costs of tuition and fees, books and supplies, and lost earnings while enrolled. My preferred measure of ROI accounts for the risk that some students will not finish their programs.

This report updates FREOPP’s previous research on ROI, utilizing new data from the U.S. Department of Education’s College Scorecard.

The findings show that college is worth it more often than not, but there are key exceptions. ROI for the median bachelor’s degree is $160,000, but that median belies a wide range of outcomes for individual programs. Bachelor’s degrees in engineering, computer science, nursing, and economics tend to have a payoff of $500,000 or more. Other majors, including fine arts, education, English, and psychology, usually have a smaller payoff — or none at all.

Alternatives to the traditional four-year degree produce varied results. Undergraduate certificates in the technical trades tend to have a stronger ROI than the median bachelor’s degree. However, many other subbaccalaureate credentials — including associate degrees in liberal arts or general education — have no payoff at all. Field of study is the paramount consideration at both the baccalaureate and subbaccalaureate levels.

The ROI of graduate school is also mixed. Professional degrees in law, medicine, and dentistry tend to have a strong payoff, often in excess of $1 million. However, nearly half of master’s degree programs have no ROI, thanks to their high costs and often-modest earnings benefits. Even the MBA, one of America’s most popular master’s degrees, frequently has a low or negative payoff.

The report introduces a new metric — the mobility index — to quantify the aggregate financial impact of each degree or certificate program. The mobility index multiplies each program’s ROI by the number of students it enrolls, thus rewarding programs for both financial value and inclusivity. Bachelor’s degrees in nursing and business administration dominate the top ranks of the mobility index.

Finally, the report estimates how much federal government funding flows to programs that leave students with no ROI. Around 29 percent of federal Pell Grant and student loan dollars over the last five years were used at programs that leave students with a negative ROI. The results point to a role for federal policymakers in improving the ROI of higher education.

While ROI should not be the only consideration for students approaching the college decision, the ROI estimates presented in this report can help students and their families make better choices regarding higher education. The estimates may also be of interest to other stakeholders, including policymakers, researchers, journalists, and institutions.

The full ROI estimates for undergraduate programs are available here. The full ROI estimates for graduate programs are available here.

[ Continued... ]

==

The article includes an interactive graph which allows you to choose from various majors and find the ROI. Some samples.

Controversial opinion: While there may be an argument to waiving or subsidizing college loans for courses that strongly benefit society, no program with a negative ROI should ever be given loan forgiveness or federal funding.

If you want to study Ancient Mesopotamian Interpretive Dance - or even more uselessly, Gender Studies - for your own pleasure and enjoyment, that's your business. And your financial responsibility; the bill for that resides with you. As far as society and our tax dollars are concerned, forgiving that loan or funding that course is just setting fire to money.

Reminder that you may be better off at a trade school. Courses are often shorter, more targeted and cheaper, so you end up working quicker, earning money more rapidly and have a lower debt that's paid off sooner.

#higher education#student loans#loan forgiveness#return on investment#college#college loans#academic merit#trade school#religion is a mental illness

3 notes

·

View notes

Text

From Debt to Prosperity: The Advantages of Debt Management in Cape Town

Debt is an issue that many individuals and households in Cape Town face, just like it is everywhere else in the world. Still, if you have the right plan and resources, you may turn things around and go from living with loans to being wealthy and stable. With several advantages that can help people regain control over their finances and create a more promising financial future, debt management Cape Town provides a way to make this change.

One of the main benefits of debt management in Cape Town is the ability to combine multiple debts into a single, affordable monthly instalment. This can lessen the chance of missing payments, which can result in extra fees and penalties while making it simpler to maintain on top of payments. Long-term cost savings can be achieved by consumers who consolidate their financial obligations by lowering their total interest rates.

One more benefit of debt management in Cape Town is the chance to collaborate with a qualified debt adviser or counsellor who can offer specialised advice and assistance. These specialists can assist clients in making a sensible spending plan, arranging a repayment schedule, and negotiating on their behalf with creditors. This can offer a clear route to financial freedom and help lessen the stress and anxiety associated with debt.

In Cape Town, financial counselling and schooling are additional benefits of debt management. Knowledge of finances can be enhanced, and better money management skills can be acquired by participants in many debt management programmes, which also offer educational materials and workshops. People will be better equipped to make wise financial decisions and stay out of debt going forward as a result.

Furthermore, debt management in Cape Town can assist people in raising their credit scores. Through a debt management programme, people can show creditors that they are creditworthy, which over time could improve their financial score. Acquiring loans, credit cards, and other financial products with better terms and lower interest rates may become simpler with a higher credit score.

In Cape Town, managing debt might enhance relationships. Although managing debt collectively can help couples and family members build stronger bonds and improve communication, financial stress is a common source of conflict in relationships. Programmes for managing debt frequently offer tools to enhance cooperation and money communication, which over time can strengthen bonds between people.

Moreover, debt management in Cape Town can provide people with a feeling of financial empowerment and under control. People may reclaim their sense of agency and confidence in the future of their finances by being initiative-taking in addressing their debt. This may increase general wellbeing and life quality.

Debt management in Cape Town can support an empowered and financially responsible culture. Through the provision of tools and resources, debt management programmes assist in the development of a financially responsible and literate culture. A more robust and prosperous society on all fronts may result from this.

Finally, debt management in Cape Town provides several advantages that can assist individuals with getting out of debt and securing a better financial future. For those seeking financial stability and prosperity, debt management programmes offer a wealth of resources and assistance. Education, debt consolidation for cheaper interest rates, and monetary independence are a few of these. People in Cape Town can take charge of their financial situation and create better futures for themselves and their families by using these programmes.

2 notes

·

View notes

Text

personal post about my ex so if you’re triggered by toxic relationships/emotional abuse/physical abuse/suicide, please don’t feel like you have to read anything below

I’m so just fucking fed up with him and this whole situation. Long story short, we moved in together in 2020 and he was just rude and disrespectful to my family and friends and isolated me from them to control me and keep me from running away (I was heavily abused as a child and tend to stay in bad situations because I’m terrified to leave) along with refusing to work and help me make my bills. I had to work full time in retail while doing my masters to make ends meet on top of relying on government assistance. Last year after my masters graduation, I found out that he had been cheating on me with someone that he met online and I ended our engagement, but allowed him to stay in the apartment because I felt guilty kicking him out and was suicidal at the time so I didn’t trust myself to be alone.

Well in the year that proceeded, he refused to get a job and all of the bills fell into my lap and became my responsibility on top of working full time at a job that refused to provide benefits (including sick time - if I got sick I had to take the day off with no pay) and payed well below the average for those in the field and with my educational background.

we were on the verge of being evicted because I wasn’t able to pay rent, buy groceries, or even feed my pets on top of him “needing” weed and his nicotine to function properly. Without them, he was incredibly abusive and would guilt me into buying them when we had nothing. I took out loans to make ends meet and it still wasn’t enough.

So I moved out of the apartment, payed off the rent I owed, and officially ended everything because I was tired of the abuse and feeling like I was worth nothing (mind you this happened the week of my eras tour show so I was exhausted and drained from that on top of all of that) to move in with my older brother who has let me live with him since so I can get back on my feet.

Thankfully I’ve repayed all of the loans I took out thanks to my new job which pays well and has benefits, and because I don’t have to spend at least $150 a week on his weed and nicotine (it used to be alcohol but I made him stop). It’s been five months since this all happened and he’s still bothering me to this day, to the point I’m debating changing my phone number so he and his family leave me alone.

I went to a few concerts recently and his aunt told him I was “cheating” on him - even though I ended things in July and was under the impression that he was moving on with his life - and he has been non stop messaging me since.

He even messaged me on discord on Christmas threatening to kill himself because I was “toying with him” and “leading him on”. I ignored his texts and went on and didn’t even check discord until today (the conversation was muted) because I flew to DC yesterday to visit my best friend for the first time in a year. I woke up to text coco and he had sent me over 100 messages calling me a whore, a liar, and then was telling me how much he loves me, how I’m “his ideal girl”, and that he wasn’t useless, amongst other things.

I know I can just block him, but it’s always been difficult for me to do something like that as I was taught by my grandmother and mom to love my abusers and to forgive them for what they’ve done - but my mom was also heavily abused by my dad and her family so it’s unintentional. I’m just so frustrated about the whole situation and I just want him to leave me alone but he just won’t.

My family and friends have been so incredibly supportive of me and doing everything in their power to keep me safe from him and I’m so grateful. I’m also so glad I’m in DC with my best friend because I feel safer than I have in quite a while (he knows where my family lives but doesn’t know where I live exactly). I haven’t felt this scared since I was stalked in college by someone who refused to take no as an answer and I got a restraining order and still felt unsafe.

I’m just lost and feeling like I can’t escape the guilt that I’m feeling, because I know that if he does commit suicide, his family will blame me for it. He’s always been this way and I just can’t do it anymore. I just want him to leave me alone.

I’m really sorry for the long rant and for talking about such sensitive topics, but I really needed to get it off my chest. It’s been lingering in my mind for so long and has been weighing heavily on me. He made me cry on Christmas and has made me feel like this is all my fault even though he put us both in the situation we were in.

If you read this, I’m doing okay physically and mentally and I’m in a safe place. I just needed to vent and get this off my chest, it’s been so hard for me to try and move past it….

#personal post#pls don’t read if abuse (emotional and physical) suicide or anything like that is triggering to you#also I’m so sorry to my moots who will read this bc I’ve never opened up about it before#and if you did read it#thank for you reading to my rant#and for being supportive#also this post is in no way related to Taylor so sorry for posting it on my main blog

6 notes

·

View notes

Text

Gin made with botanicals from the Palace of Holyroodhouse launched

The Royal Collection Trust has launched a dry gin using botanicals from the gardens of the Palace of Holyroodhouse 🏴

By Lauren Gilmour

A dry gin infused with botanicals grown in the gardens at the Palace of Holyroodhouse in Edinburgh has become the latest spirit to be launched by the Royal Collection Trust (Royal Collection Trust/His Majesty King Charles I|| 2024)

A dry gin infused with botanicals grown in the gardens at the Palace of Holyroodhouse in Edinburgh has become the latest spirit to be launched by the Royal Collection Trust.

Each gin is flavoured with ingredients sourced from the grounds of the Official Royal Residences.

The Palace of Holyroodhouse Dry Gin is infused with mint and lemon thyme hand-picked from the palace’s Physic Garden.

Inspired by the garden’s history of cultivating medicinal and culinary herbs, the botanicals – which are steeped for 24 hours before the distilling process begins – combine with juniper to create a delicately fragrant gin with a complex citrus top note.

The Physic Garden was opened adjacent to the palace in 2020 to recreate the earliest known gardens on the site.

It can be freely enjoyed year round by the people of Edinburgh and visitors to the Palace.

The Physic Garden on the grounds of the Palace of Holyroodhouse opened in 2020 (Royal Collection Trust/His Majesty King Charles 111 2024)

Originally founded in the grounds of the palace in 1670 by two Scottish physicians, Sir Robert Sibbald and Sir Andrew Balfour, it provided fresh ingredients for pharmacists and allowed students to learn the medicinal properties of plants.

It was the first garden of its kind in Scotland and was the forerunner of the Royal Botanic Garden Edinburgh.

Today, visitors to the Physic Garden will see plants such as fennel, lavender, and lemon balm growing as well as a meadow of wildflowers with healing properties.

The floral bottle design of the gin is inspired by the 17th century Scottish textiles seen on the bed in Mary, Queen of Scots’ bedchamber inside the palace.

The bottle design is inspired by the 17th-century Scottish textiles seen on the bed in Mary, Queen of Scots Bedchamber inside the Palace (Royal Collection Trust/His Majesty King Charles III 2024)

All profits from sales of the gin go towards the care of, and access to, the Royal Collection through the public opening of the Royal Residences, exhibitions, loans, and educational programmes managed by Royal Collection Trust, a registered charity.

@independent

PALACE OF HOLYROODHOUSE DRY GIN

New

£40.00

PALACE OF HOLYROODHOUSE DRY GIN is Cheaper than SH’s Sassenach Wild Scottish Gin and is crafted in the heart of Edinburgh 🏴

*Due to international shipping restrictions, this item is only available for delivery to addresses in the United Kingdom, Germany, New Zealand and Australia.

6 notes

·

View notes

Text

Tax Benefits on Education Loan

There are many tax benefits that come with taking out an education loan. The first is that the interest on your loan is tax-deductible. This means that you can deduct the interest you pay on your loan from your taxes, which can save you a significant amount of money. Additionally, if you are paying back your loan through an income-based repayment plan, the amount you pay each year is also tax-deductible.

Another great benefit of an education loan is that it can be deferred while you are in school. This means that you do not have to start making payments on your loan until after you graduate. This can give you a much-needed financial break during your studies.

Lastly, if you default on your education loan, the government will actually forgive the debt. This means that you will not have to pay back any of the money you borrowed for your education. While this may seem like a long shot, it is important to remember that the government wants to encourage people to get an education and they are willing to help out those who may struggle to repay their loans.

#Education loan to study abroad#Education loan for abroad studies#Student loan for studying abroad#Education loan for higher studies#Funds for higher education#Top education loan provider

0 notes

Text

Things Biden and the Democrats did, this week #22

June 7-14 2024

Vice-President Harris announced that the Consumer Financial Protection Bureau is moving to remove medical debt for people's credit score. This move will improve the credit rating of 15 million Americans. Millions of Americans struggling with debt from medical expenses can't get approved for a loan for a car, to start a small business or buy a home. The new rule will improve credit scores by an average of 20 points and lead to 22,000 additional mortgages being approved every year. This comes on top of efforts by the Biden Administration to buy up and forgive medical debt. Through money in the American Rescue Plan $7 billion dollars of medical debt will be forgiven by the end of 2026. To date state and local governments have used ARP funds to buy up and forgive the debt of 3 million Americans and counting.

The EPA, Department of Agriculture, and FDA announced a joint "National Strategy for Reducing Food Loss and Waste and Recycling Organics". The Strategy aimed to cut food waste by 50% by 2030. Currently 24% of municipal solid waste in landfills is food waste, and food waste accounts for 58% of methane emissions from landfills roughly the green house gas emissions of 60 coal-fired power plants every year. This connects to $200 million the EPA already has invested in recycling, the largest investment in recycling by the federal government in 30 years. The average American family loses $1,500 ever year in spoiled food, and the strategy through better labeling, packaging, and education hopes to save people money and reduce hunger as well as the environmental impact.

President Biden signed with Ukrainian President Zelenskyy a ten-year US-Ukraine Security Agreement. The Agreement is aimed at helping Ukraine win the war against Russia, as well as help Ukraine meet the standards it will have to be ready for EU and NATO memberships. President Biden also spearheaded efforts at the G7 meeting to secure $50 billion for Ukraine from the 7 top economic nations.

HHS announced $500 million for the development of new non-injection vaccines against Covid. The money is part of Project NextGen a $5 billion program to accelerate and streamline new Covid vaccines and treatments. The investment announced this week will support a clinical trial of 10,000 people testing a vaccine in pill form. It's also supporting two vaccines administered as nasal sprays that are in earlier stages of development. The government hopes that break throughs in non-needle based vaccines for Covid might be applied to other vaccinations thus making vaccines more widely available and more easily administered.

Secretary of State Antony Blinken announced $404 million in additional humanitarian assistance for Palestinians in Gaza, the West Bank and the region. This brings the total invested by the Biden administration in the Palestinians to $1.8 billion since taking office, over $600 million since the war started in October 2023. The money will focus on safe drinking water, health care, protection, education, shelter, and psychosocial support.

The Department of the Interior announced $142 million for drought resilience and boosting water supplies. The funding will provide about 40,000 acre-feet of annual recycled water, enough to support more than 160,000 people a year. It's funding water recycling programs in California, Hawaii, Kansas, Nevada and Texas. It's also supporting 4 water desalination projects in Southern California. Desalination is proving to be an important tool used by countries with limited freshwater.

President Biden took the lead at the G7 on the Partnership for Global Infrastructure and Investment. The PGI is a global program to connect the developing world to investment in its infrastructure from the G7 nations. So far the US has invested $40 billion into the program with a goal of $200 billion by 2027. The G7 overall plans on $600 billion by 2027. There has been heavy investment in the Lobito Corridor, an economic zone that runs from Angola, through the Democratic Republic of Congo, to Zambia, the PGI has helped connect the 3 nations by rail allowing land locked Zambia and largely landlocked DRC access Angolan ports. The PGI also is investing in a $900 million solar farm in Angola. The PGI got a $5 billion dollar investment from Microsoft aimed at expanding digital access in Kenya, Indonesia, and Malaysia. The PGI's bold vision is to connect Africa and the Indian Ocean region economically through rail and transportation link as well as boost greener economic growth in the developing world and bring developing nations on-line.

#Thanks Biden#Joe Biden#us politics#american politics#Medical debt#debt forgiveness#climate change#food waste#Covid#covid vaccine#Gaza#water resources#global development#Africa#developing countries

183 notes

·

View notes

Note

hey Kiran. um. not totally sure how to ask this. but i was hoping you could talk about some of your experiences with university as a disabled person of colour in Canada? bc i am those things as well (lol) and ive just about finished my first term and im thinking hard about whether or not i should continue despite the difficulty and youve spoken about some of that before. if you dont want to talk publicly i can come off anon

i'm okay with talking loosely about it publicly but if you want more precise/specific info talking privately would be better or if you want to know something that i don't mention in this answer. i also can't speak for experiences that i don't have, ie. my experience is my own and may or may not reflect yours or that of other disabled poc given the sheer diversity of people encompassed by that phrase. i'm just going to do bullet points here of stuff i think is most important off the top of my head:

- first of all, see if you qualify for the canada permanent disability student grant benefit if you aren't already receiving it. i'm familiar with OSAP but regardless of what province you're in, if you provide documentation that states you have a permanent disability to your province's student aid system and you show financial need you can receive up to $2000 per semester IN GRANTS (not loans) from the federal government as part of the canada permanent disability student benefit to help you with tuition and paying for other expenses, and even more if you do a spring/summer semester. again, it's paperwork and it's a drag, but that's a LOT of money that can make your life easier so you can focus on taking care of yourself and on your education. and again, i repeat, it's a GRANT not a loan, you don't have to pay it back.

- with that out of the way, i've found university exceptionally difficult and something i would only recommend if going to university is what is needed for the job you want to do or the field you want to be in. if you're unsure of what you want to do/what your goal is for university, or if what you want to do doesn't necessarily require a bachelor's degree, i don't think the pain is worth it. wait or do something else and then if you know for sure what you want and that you need a degree to get there, go ahead, and pace yourself. don't do a full course load, figure out what the sweet spot for you is and stick to that. my max course load is 3 classes per semester, less if i'm doing studio courses. if you have your disability status on file with your uni and with your provincial student aid system, you can take as little as 30-40% course load* (depends on the school and province) and you will still count as a full time student and reap the benefits of that.

- make sure that you have academic accommodations with your university's accessibility services, it can be a lot of work but it will save your life. having that & especially having accommodations that Require professors to give you extensions to assignments is so necessary and is the only reason i've gotten this far. the process for getting this & for getting permanent disability approved for student aid with the government various depending on your disabilities and can be exhausting and inaccessible, which is a problem in itself, but its completely necessary and something I personally would've been completely fucked without

- ive been in post secondary education for 6+ years now and i have never encountered a professor that refused to give me an extension on an assignment, including when I've submitted assignments late without mentioning it to them first, and outside of accommodations I put this largely on keeping an open and friendly communication with my profs. at the start of the semester I let them know that I have accommodations and will need extensions due to physical and mental health issues, and whenever i've had a flare up the first thing I did once I felt well enough to was to email them and let them know, and tell them that I am working on my assignments and will try my best to get them in as soon as I can. I have even submitted assignments weeks late, with an apology and amended with "I understand if this can't be marked/if it's too late, and I thank you for your patience with me regardless" and every single time they have marked my assignment without penalty. even if you have to suck up to them and apologize and do all of that shit, do it, because it'll save you. you don't need to elaborate and write your life story, just speak plainly and tell them you're having issues related to the reasons why you have accommodations and you're struggling but you're trying, and they will appreciate that. the vast majority of them want you to succeed and want to help you do that, you just have to try to meet them partway.

- if something fucked up is going on and you need help with a prof or some other kind of situation, contact your student union and ask them for help and they can either write on your behalf to wherever the complaint is best sent and follow up with it on your behalf OR point you in the right direction and offer support and resources. check if your student union has an accessibility rep and a rep for students of colour and contact them in particular, they are there to help you and they are your peers. they will also almost definitely have a food bank and can help you when it comes to your student medical insurance plan or any other concerns

- if you're on OSAP or other student aid and you need to drop a class, do it early, don't force yourself to suffer through it, because the longer you wait to drop it the higher chance you won't get a refund for the course, and if youre receiving grants that $ will be converted to loans if you don't get that refund. again, this is based on my experience with OSAP, but be aware of drop dates and plan accordingly. if something happens and you miss the drop date though, don't force yourself to suffer and stick through a course you know you cant finish. drop it before you get a 0 or failing mark on your file, because that can fuck you with the university admin side of things and get you on academic probation which can then effect your OSAP or whichever student aid service you have. based on experience I'd rather just get the $500 or however much tuition for that class cost me converted to a loan and deal with paying that back after I graduate, but of course it's entirely up to you.

25 notes

·

View notes

Text

WASHINGTON, D.C. – Today, the Consumer Financial Protection Bureau (CFPB) filed a proposed order against the student loan servicer Navient for its years of failures and lawbreaking. If entered by the court, the proposed order would permanently ban the company from servicing federal Direct Loans and would forbid the company from directly servicing or acquiring most loans under the Federal Family Education Loan Program.

These bans would largely remove Navient from a market where it, among other illegal actions, steered numerous student loan borrowers into costly repayment options. Navient also illegally deprived student borrowers of opportunities to enroll in more affordable income-driven repayment plans and forced them to pay much more than they should have. Under the terms of the order, Navient would have to pay a $20 million penalty and provide $100 million in redress for harmed borrowers.

“For years, Navient’s top executives profited handsomely by exploiting students and taxpayers,” said CFPB Director Rohit Chopra. “By banning the notorious student loan giant from federal student loan servicing and ensuring the winddown of these operations, the CFPB will finally put an end to the years of abuse.”