#transactional SMS gateway

Explore tagged Tumblr posts

Text

#bulk sms gateway#bulk sms gateway provider#bulk sms gateway hardware#best international sms gateway#bsnl sms gateway#bulk sms api gateway#bulk sms gateway software#bulk sms service gateway#bulk sms gateway free#transactional sms gateway#bulk sms gateway api#cheap international sms gateway#bulk sms international gateway#best sms gateway api#bulk sms gateway price#sms gateway reseller

0 notes

Text

BOOST YOUR BUSINESS WITH BULK MESSAGING

WHAT IS BULK MESSAGING AND WHY DOES IT MATTER?

With a world moving at high speed digitally, companies require instant, trustworthy, and economical means of communications. BULK MESSAGING is the answer to all their requirements, and they can send numerous text messages in seconds to customers, employees, or subscribers. For promotions, transactional notifications, or customer care, SMS MESSAGING helps in direct and instant communication with high response rates.

BENEFITS OF BULK MESSAGING FOR BUSINESSES

Unlike emails that often go unread, BULK MESSAGING has a significantly higher open rate, with over 90% of text messages read within minutes. It ensures instant delivery with no delays, enabling businesses to reach their audience in real-time. With simple API integration, companies can automate SMS MESSAGING for seamless customer interaction. Cost-effectiveness makes bulk messaging an affordable option for startups and large enterprises alike. Most importantly, it helps build customer trust through personalized, interactive messaging.

HOW TO CHOOSE THE BEST BULK SMS COMPANY?

Selecting the right BULK SMS COMPANY is critical for businesses looking for high deliverability, reliability, and advanced automation. Key factors to consider include:

Delivery Rate: Ensure the provider offers high message deliverability with direct carrier routes.

Pricing Transparency: Look for providers with no hidden charges and competitive pricing.

API and Integration: Seamless integration with CRM, e-commerce, and marketing tools.

Scalability: Ability to handle thousands of messages per second without delays.

24/7 Support: Reliable customer service for troubleshooting and campaign management.

USING PROMOTION TEXT MESSAGE IN EGYPT FOR BUSINESS GROWTH

Businesses in Egypt can maximize their marketing efforts with PROMOTION TEXT MESSAGE IN EGYPT, allowing them to send exclusive deals, limited-time offers, and brand updates directly to customers' mobile devices. This strategy ensures better response rates compared to traditional advertising. Some key benefits include:

Localized Marketing: Reach the right audience in Egypt with targeted campaigns.

Immediate Customer Engagement: Prompt responses to promotions and offers.

Higher ROI: Lower costs and higher conversion rates than email or display ads.

Personalized Messaging: Tailor messages based on customer preferences and purchase behavior.

HOW BULK SMS IN EGYPT HELPS COMPANIES CONNECT WITH CUSTOMERS?

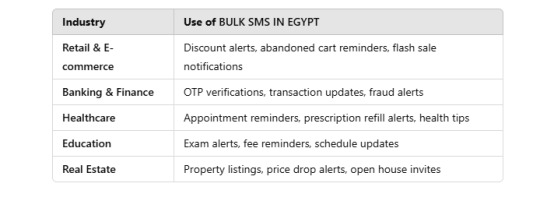

Taking advantage of��BULK SMS IN EGYPT enables companies to promote customer relationships and enhance retention levels. From appointment reminders, transactional alerts, to promotional news, SMS marketing in Egypt is now a key communication tool. Some of the uses are:

HOW TO RUN A SUCCESSFUL BULK MESSAGING CAMPAIGN?

To achieve maximum results, businesses need to focus on:

Audience Segmentation: Target the right customers for higher engagement.

Clear Call-to-Action (CTA): Messages should be concise with a compelling CTA.

Optimal Timing: Send messages at peak hours when users are most active.

Personalization: Address recipients by name and customize offers.

Performance Tracking: Monitor delivery, open rates, and conversion rates to optimize future campaigns.

FINAL THOUGHTS: WHY BULK MESSAGING IS THE FUTURE OF BUSINESS COMMUNICATION

In a competitive market, businesses need instant, scalable, and cost-effective communication strategies. BULK MESSAGING ensures businesses stay connected with their customers, drive higher engagement, and boost sales. Whether you are looking for a trusted BULK SMS COMPANY, planning a PROMOTION TEXT MESSAGE IN EGYPT, or optimizing your outreach with BULK SMS IN EGYPT, investing in SMS marketing is a game-changer. Start leveraging bulk messaging today and take your business communication to the next level!

#Bulk SMS Company#bulk messaging#sms messaging#Bulk SMS In Egypt#SMS Gateway SMPP In Egypt#Promotion Text Message In Egypt#Transactional Alerts

0 notes

Text

SMS Gateway SMPP in Egypt – Reliable Enterprise Messaging

Looking for a trusted SMS Gateway SMPP in Egypt? Telkosh provides a cutting-edge messaging platform that ensures high-speed SMS delivery for businesses. Our robust infrastructure allows direct telecom operator connections, reducing latency and increasing efficiency. With advanced security protocols, real-time analytics, and easy integration, Telkosh delivers an optimized SMS Gateway SMPP in Egypt for all industries.

#Bulk SMS Gateway#Bulk SMS Gateway In Egypt#Transactional Alerts#Transactional SMS In Egypt#SMS Gateway SMPP#SMS Gateway SMPP In Egypt

0 notes

Text

Unlock Seamless Messaging with the Unofficial WhatsApp API

In today’s fast-paced digital world, businesses rely on WhatsApp for customer communication, marketing, and transactional messaging. While the Official WhatsApp API requires approvals and has strict guidelines, many businesses explore the Unofficial WhatsApp API for faster and more flexible integration. In this blog, we’ll explore what the Unofficial WhatsApp API is, its benefits, risks, and how Quick Message can help you make the most of it.

What is the Unofficial WhatsApp API?

The Unofficial WhatsApp API is a third-party solution that allows businesses to send and receive WhatsApp messages without going through Meta’s official approval process. Unlike the Official WhatsApp API, which requires verification through a Business Solution Provider, the Unofficial API offers direct access to WhatsApp’s messaging features, providing businesses with a quick and easy way to integrate.

Benefits of Using the Unofficial WhatsApp API

Many businesses choose the Unofficial WhatsApp API because of its flexibility and cost-effectiveness. Here’s why:

Instant Setup – Unlike the Official API, which requires business verification and approval, the Unofficial API allows immediate integration.

More Control & Flexibility– Businesses can customize their messaging solutions without the restrictions imposed by Meta.

Cost-Effective– Without intermediaries, businesses can save on messaging costs, making it a budget-friendly option for startups and small businesses.

No Dependency– Direct integration means no reliance on third-party Business Solution Providers, which often have additional charges and limitations.

Risks and Challenges

While the Unofficial WhatsApp API offers many advantages, it also comes with significant risks:

Account Bans & Compliance Issues– Meta actively monitors unauthorized usage, and businesses using the Unofficial API risk having their numbers permanently banned.

Security & Data Privacy Risks– Since the API is not officially supported, data security and encryption may not meet WhatsApp’s standards, leading to potential vulnerabilities.

No Official Support– Without Meta’s backing, businesses using the Unofficial API may face technical issues with no guaranteed support or resolution.

How Quick Message Enhances Your Experience

At Quick Message, we understand the need for businesses to have a seamless WhatsApp messaging solution. Whether you choose the Official API for compliance or the Unofficial API for flexibility, we provide:

Optimized and Secure Integration – Helping businesses reduce risks while maximizing efficiency.

Custom Messaging Solutions – Tailored to your business needs, ensuring smooth customer interactions.

Scalable Options – Whether you’re a startup or an enterprise, we offer solutions that grow with your business.

Conclusion

The Unofficial WhatsApp API offers businesses a quick and flexible messaging solution, but it comes with risks. Understanding the trade-offs between official and unofficial APIs is crucial. Quick Message helps businesses choose the best API option to ensure secure, scalable, and cost-effective WhatsApp communication. Ready to integrate WhatsApp into your business? Contact Quick Message today!

#transactional sms api#Transactional SMS API integration#SMS gateway for transactions#API for transactional message#Transactional SMS services#Unofficial WhatsApp API#WhatsApp Unofficial API

1 note

·

View note

Text

Quick Message: Simplify Communication with Business Bulk SMS

Effective communication forms the foundation of any successful business. Today, instant delivery of messages to many recipients can be either your trump card or lead to disaster in marketing, customer service, and internal communication. Quick Message, a leading business bulk SMS platform, is poised to take the way business communicators connect on a different level.

What are Business Bulk Text Messages?

Business bulk text messaging is an effective communication tool that lets companies send text messages to a large group of recipients at once. It's a versatile solution for the effective reach of customers, employees, and stakeholders.

Bulk Text Messaging Key Features:

Mass Messaging: Send personalized texts to hundreds or thousands of people at once.

Scheduling: Automate your campaigns to ensure timely delivery.

Two-Way Messaging: Engage in real-time conversations when needed.

Benefits for Businesses of all sizes:

Reach your audience no matter where they are.

High Open Rates: Text messages have an astonishing 98% open rate, which is way beyond email.

Instant Delivery: Ensure that critical updates are sent instantly.

Why Quick Message is the best choice for Bulk text messaging?

Quick Message is the choice of businesses of all sizes because of its advanced features and user-friendly nature.

User-Friendly Interface: Designed for ease of use, even for beginners.

Reliable and Secure: Our platform ensures your data and messages are protected.

Affordable Pricing: Tailored plans to suit businesses, whether small startups or large enterprises.

Advanced Analytics: Gain insights into campaign performance with detailed reports.

Benefits of Using Quick Message’s Bulk Text Messaging

1. Instant Communication

Reach customers and employees in real-time, whether for promotions, reminders, or updates.

2. High Engagement

The response rate of text messages is unparalleled; they keep your audience engaged.

3. Low-Cost Marketing

Avoid the expenses of traditional marketing while gaining better results.

4. Automation to Save Time

Automate tasks and free up time for more strategic business activities.

Business Uses for Bulk Text Messaging

Bulk texting can be applied to various scenarios:

Customer Promotions: Exclusive deals and discounts can be sent directly to your audience.

Appointment Reminders: Avoid no-shows by sending reminders on time.

Internal Communication: Inform your team about schedules, meetings, and announcements.

Event Notifications: Notify customers of new product launches, webinars, or surveys.

Getting Started with Quick Message

Step 1: Sign Up and Onboard

Signing up with Quick Message is easy. Sign up, and our team will walk you through the onboarding process.

Step 2: Launch Your First Campaign

Quickly create and schedule your first bulk text messaging campaign in just minutes.

Step 3: Write Effective Messages

Use clear, concise, and engaging language to maximize impact.

Best Practices for Bulk Text Messaging

To ensure that your campaigns are successful, here are some best practices:

Personalize Messages: Tailor messages to resonate with your audience.

Consider Timing: Schedule messages during optimal times for your recipients.

Stay Compliant: Always adhere to regulations, including opt-in and opt-out requirements.

Customer Success Stories

Quick Message has helped thousands of businesses enhance communication and boost results.

Testimonial from Local Retailer: "Quick Message helped us get 20% sales growth through our promotional campaigns."

Tech Startup Case Study: "Their automation tools would save us hours of work per week and greatly help improve internal communication."

Conclusion

Quick Message is the best simplifier and amplifier of business communications using innovative bulk text messaging. Some benefits are unparalleled instant communication, high engagement with a cost-effectiveness for businesses to thrive at large.

#business bulk text messaging#sms promotional messages#sms gateway integration#best transactional sms service provider in india#sms gateway whatsapp#bulk sms service near me#transactional sms provider#promotional and transactional sms#bulk sms api provider#transactional sms messages#business sms api#best sms gateway provider#Unofficial WhatsApp API#WhatsApp Unofficial API#best WhatsApp unofficial API in Delhi#Transactional SMS services#API for transactional message#SMS gateway for transactions#Transactional SMS API integration#transactional sms api#Unofficial WhatsApp#otp sms service provider#Business WhatsApp API

1 note

·

View note

Text

SMS Transactional Messaging: Benefits of SMS for Transactions

Benefits of SMS for Transactions:

Instant Communication: SMS ensures quick delivery, making it ideal for delivering time-sensitive information.

High Open Rates: People tend to read SMS messages promptly, leading to higher open rates compared to other communication channels.

Reliability: Transactional SMS is considered high-priority, ensuring reliable and timely delivery of critical information.

Customization: Businesses can customize sender IDs, enhancing brand recognition and trust.

Types of Transactional SMS:

Order Confirmations: Notify customers about successful transactions or purchases.

Account Alerts: Send updates about account activities, password changes, or security alerts.

Delivery Status: Provide real-time updates on the status of deliveries or services.

Appointment Reminders: Send reminders for appointments, reservations, or scheduled services.

How to Send SMS Messages for Transactions:

Integrate with Systems: Use APIs to integrate transactional SMS with existing systems for seamless automation.

Customizable Templates: Create templates for consistency and compliance with regulations.

Opt-In Management: Efficiently manage opt-ins to ensure compliance with regional regulations.

Transactional SMS Examples:

"Your order #12345 has been confirmed. Expected delivery date: [Date]."

"Hi [Customer Name], your account password was changed on [Date]. If not you, please contact support."

"Appointment reminder: You have a scheduled meeting with [Service/Person] on [Date] at [Time]."

Difference between Transactional and Promotional SMS Service:

Purpose:

Transactional SMS: Conveys critical information related to a user's transaction or service.

Promotional SMS: Used for marketing and promotional activities.

Content:

Transactional SMS: Informational and time-sensitive content.

Promotional SMS: Marketing content, offers, and promotions.

Delivery Priority:

Transactional SMS: High priority for immediate delivery.

Promotional SMS: May have lower delivery priority.

Difference between SMS and SMTP:

Purpose:

SMS (Short Message Service): Mobile messaging for short text messages.

SMTP (Simple Mail Transfer Protocol): Protocol for sending and receiving emails.

Medium:

SMS: Mobile network infrastructure.

SMTP: Operates over the Internet for email communication.

Opt-In and Legality of Sending Text Messages:

OPT (One-Time Password): Often used in transactional SMS for authentication, not a standalone category.

Legality: Compliance with regional regulations is essential. Many regions require opt-in consent for marketing messages.

Texting as Transactional Communication:

Yes, texting can be considered transactional communication when conveying critical and time-sensitive information related to a transaction or service.

Remember to stay informed about local regulations and industry best practices to ensure compliance and build positive customer relationships through transactional SMS.

#transaction#transactional sms#sms marketing#bulk sms api#sms gateway#transactional sms service provider

1 note

·

View note

Text

How Can Bulk SMS Services Increase Your Business Revenue?

With the help of Bulk SMS, you can reach an infinite number of target groups at once and interact with your customers in a more efficient and personalized manner.

What is Bulk SMS Marketing? How Can This Help Your Company?

The bulk SMS service is very simple to use because you can send information about your product to any contacts you may have of customers or visitors. It has a high conversion rate because people who know you well will be more likely to trust you and make a purchase if you deliver quality services.

It's time to show off if you want to stand out in the online market. However, don't forget to guide them through the process and address any questions or doubts from clients. If you don't, your competitors' products will appear more appealing than yours.

Every city, state, and nation can receive bulk SMS services from our organization, Shree Tripada. The primary benefit is that he is always available to respond to your inquiries. Since achieving client satisfaction is essential to always pushing oneself to new heights, our mission is to ensure that our relationships with clients are straightforward and honest.

If you have set your mind to start this new trending and effective bulk SMS marketing strategy, then look no further as, Shree Tripada Infomedia is the most trusted bulk SMS service provider since 12+ years of expertise.

Why to Choose Shree Tripada?

Shree Tripada provides bulk SMS software that aids in OTP security for account login and ensures 100% data privacy. We can send out more than 20 crore SMS messages every month. With more than 12+ years of experience in the bulk SMS sector, we are better able to understand the demands of our clients.

Our Services:

Shree Tripada Infomedia offers an extensive array of reasonably priced bulk SMS services that are customized to meet the unique requirements of Pune-based businesses. Among their offerings are:

1. Promotional SMS: Shree Tripada Infomedia uses customized promotional SMS campaigns to assist businesses advertise their goods, services, deals, and discounts. Businesses may effectively increase customer engagement and drive sales thanks to their proficiency in creating appealing marketing messages and their capacity to reach a wide audience.

Related Article: Top 10 Bulk SMS Marketing Trends for 2023 - Bulk SMS Solution

2. Transactional SMS: The company provides transactional SMS services that let companies notify, alert, and provide vital information to their clientele. Shree Tripada Infomedia makes sure that transactional messages are delivered promptly and reliably, whether they are order confirmations, appointment reminders, or critical updates.

3. OTP Bulk SMS: Use an OTP bulk SMS service from a reputable supplier to safeguard your online transactions. For your company, get dependable and affordable OTP SMS solutions. Reach out to us right now!

What do you get after partnering with Shree Tripada?

Shree Tripada provides advanced technology and quick communication solutions to help you engage with your most important clients and broaden the reach of your marketing initiatives.

Live Reports

Unicode & Schedule

24*7 FREE DLT Support

Own Infrastructure

2-3 Sec Delivery

Premium Gateways

100% Server Uptime & Robust API

Platinum Telecom Partner

It's time to upgrade your business with the most trending and effective bulk SMS marketing. Shree Tripada is a dependable resource for the best bulk SMS gateway and a safe way to send SMS messages. We provide a wide range of SMS communication tools in addition to affordable bulk SMS services, allowing our users to receive all the SMS solutions they require in one location.

Must Read:

Importance of Transactional SMS in Every BusinessWhat is DLT Registration and How to register on DLT platform

#bulksms#bulksmsservice#promotional bulk sms#transactional sms service#otp bulk sms#bulk api#bulk sms gateway#bulksmsmarketing#bulk sms marketing

0 notes

Text

#bulk sms dehradun#bulk sms provider in dehradun#bulk sms service provider in dehradun#bulk sms service in dehradun#bulk sms services in dehradun#bulk sms marketing in dehradun#bulk sms company in dehradun#bulk sms reseller in dehradun#bulk sms in dehradun#bulk sms gateway in dehradun#pomotional bulk sms service in dehradun#transactional bulk sms service in dehradun#bulk sms#bulk sms gateway#free bulk sms service#sms marketing companies#bulk sms service provider near me#best bulk sms provider#bulk sms near me#bulk sms agency#bulk sms service

0 notes

Text

Secure your banking communication with SMS Gateway Center!

🏦 Engage customers instantly with Bulk SMS and WhatsApp Business API—ideal for transaction alerts, OTPs, and account updates. Trust us to keep your clients connected!

👉 https://www.smsgatewaycenter.com/bulk-sms-whatsapp-banks/

#SMSGatewayCenter#BulkSMS#WhatsAppBanking#BankingSolutions#FinancialServices#CustomerCommunication#SMSMarketing#WhatsAppBusinessAPI#SecureMessaging#BankingTech

2 notes

·

View notes

Text

Payments and Withdrawals: Knowing What to Expect.

Another area where scams often trip people up is the money. I've seen fake apps that ask users to deposit using suspicious wallets or gateways they don't know. In contrast, 11xplay pro supports established payment methods and usually confirms transactions with an SMS or email. Although withdrawals are not always instantaneous, they can be traced and predicted. When I withdrew my first 1,000 INR, it took about 48 hours, but I got constant updates.

0 notes

Text

Transactional SMS In Kenya – Trusted Business Communication

Telkosh provides Transactional SMS In Kenya for businesses needing reliable messaging solutions. Our platform enables instant delivery of OTPs, alerts, and verification codes, ensuring high security and efficiency. Whether in finance, healthcare, or retail, Transactional SMS In Kenya from Telkosh helps businesses maintain seamless communication with customers. With advanced API integration and high delivery rates, we empower enterprises with a trusted and scalable messaging solution.

#Bulk SMS Service#Bulk SMS Service In Kenya#Transactional SMS#Transactional SMS In Kenya#SMPP SMS Gateway#SMPP SMS Gateway in Kenya

0 notes

Text

What are the must-have features in a fintech app?

In the modern financial landscape, fintech apps have become a cornerstone of convenience, accessibility, and innovation. As more users shift toward digital platforms for their financial needs, the demand for robust and user-friendly fintech software continues to rise. Whether you're developing a mobile banking app, a payment gateway, a budgeting tool, or a lending platform, there are essential features every fintech app must include to succeed in a highly competitive market.

These features are not only critical for user experience but also play a significant role in security, scalability, and customer trust. Let's explore the must-have features that define a powerful and effective fintech app.

1. Secure Onboarding and User Authentication

User onboarding is the first interaction customers have with a fintech app. A smooth, intuitive, and secure onboarding process builds trust from the start. This includes:

Simple registration with minimal steps

Secure identity verification (e.g., document upload, selfie verification)

Integration with KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols

Multi-factor authentication (MFA)

Biometric login using fingerprint or facial recognition

These features ensure that the app complies with financial regulations while offering a frictionless experience for legitimate users.

2. Intuitive and Responsive User Interface (UI/UX)

Design is a critical factor in the success of any fintech software. A clean, user-friendly interface improves navigation, reduces user frustration, and increases engagement. The app should support both dark and light themes, have clear menu structures, and ensure all actions are easily accessible.

Responsiveness is also crucial — users expect the app to load quickly and function seamlessly across devices, from smartphones to tablets.

3. Real-Time Notifications and Alerts

Timely communication is vital for keeping users informed about their financial activities. Push notifications, SMS alerts, and in-app messages can be used to:

Notify users about successful transactions

Alert them of suspicious activity

Remind them about upcoming bill payments or due dates

Provide promotional offers or updates

Real-time alerts contribute to transparency and help users maintain control over their finances.

4. Transaction History and Statements

A fintech app must provide users with easy access to their transaction history. This includes:

Filters by date, category, or transaction type

Downloadable PDF or Excel statements

Search functionality

Categorization of income and expenses

Offering this transparency builds trust and helps users better manage their money.

5. Seamless Payment Integration

One of the core functions of any fintech app is enabling users to send and receive money. Seamless integration with payment gateways, UPI, mobile wallets, and traditional banking systems is a must. Key features include:

Peer-to-peer (P2P) transfers

Bill payments and mobile recharges

Scheduled or recurring payments

QR code-based payments

The process should be fast, reliable, and secure.

6. Personalized Financial Insights

Data-driven fintech services offer personalized experiences that help users make smarter financial decisions. Incorporating AI and machine learning enables the app to:

Offer spending insights

Track budgets and set financial goals

Recommend financial products

Predict cash flow or upcoming expenses

This personalization adds value and keeps users engaged with the app on a regular basis.

7. Robust Security Features

Security is non-negotiable in the world of fintech. To ensure the safety of user data and funds, a fintech app must include:

End-to-end data encryption

Tokenization of payment details

Role-based access controls

Secure API integration

Real-time fraud detection systems

These measures not only protect user data but also reinforce regulatory compliance and platform credibility.

8. Chatbot or Customer Support Integration

Even the most well-designed fintech apps will encounter users who need help. Including a chatbot or live customer support integration provides quick answers to FAQs and complex issues alike. Features such as:

24/7 live chat

AI-powered virtual assistants

Ticketing system for complex queries

help boost user satisfaction and reduce churn.

9. Multi-Currency and Localization Support

If the fintech app is targeting a global or diverse user base, it should offer multi-currency support, localized languages, and region-specific regulations. This includes:

Displaying balances in local currencies

Currency conversion features

Compliance with local tax and regulatory policies

It makes the platform more inclusive and adaptable to different markets.

10. Analytics Dashboard for Admins

Behind the scenes, administrators need real-time dashboards to monitor performance, transactions, user behavior, and compliance. A comprehensive admin panel should include:

KPIs and financial metrics

Fraud and risk alerts

User activity logs

API monitoring and audit trails

These analytics ensure smooth operations and informed business decisions.

Conclusion

The success of a fintech app hinges on the combination of user convenience, security, functionality, and innovation. Including these must-have features ensures the app can stand up to user expectations while staying compliant with financial regulations.

Modern fintech software is evolving rapidly, and staying ahead means continuously integrating features that meet both market demands and regulatory standards. From biometric authentication to personalized insights and AI-driven chatbots, every feature contributes to a better and more secure financial experience.

Companies like Xettle Technologies are at the forefront of this transformation, developing innovative fintech solutions that blend technology with user-centric design. By integrating essential features and staying committed to quality and compliance, Xettle Technologies exemplifies the best practices in building robust fintech platforms.

As digital finance continues to grow, having a feature-rich fintech app is no longer optional — it's essential for staying relevant and competitive in a fast-paced world.

0 notes

Text

10 Must-Have Payment Gateway Features to Increase sales

The best payment gateway is often the final and most critical touchpoint between your customer and your revenue. A seamless, secure checkout experience doesn’t just complete an online payment—it builds trust, enhances your brand reputation, and increases the chance of repeat business. As digital transactions rapidly become the norm, businesses must invest in payment gateway integrations that go beyond basic processing.

Today’s customers expect multiple payment options, including credit/debit cards, digital wallets, UPI, and even Buy Now Pay Later, all accessible through mobile-friendly payment systems. To stay ahead, your business needs a gateway that delivers speed, secure online payments, and user convenience—because in a competitive market, your online payment experience can be the reason someone chooses you over the rest.

Why are payment gateway features important for sales ?

When it comes to online shopping, the payment process can make or break the sale. A secure payment gateway with features like fast checkout, saved cards, and mobile payment support creates a smooth experience that encourages customers to complete their purchase. On the other hand, a complicated or slow process can lead to abandoned carts—even if the product is perfect. Features like multiple payment options, digital wallets, and credit cards give users the freedom to choose how they pay, which builds trust and increases the chance of successful transactions.

The right payment gateway features directly impact sales growth by improving user experience and reducing friction. Think of it like this—if a customer can pay in one click, they’re more likely to come back. Features like real-time payment tracking, one-tap mobile checkout, and smart error handling reduce frustration and build confidence. Across the world—and especially in dynamic markets like the UAE—businesses are seeing higher conversions simply by offering fast, secure, and flexible online payment solutions. The best payment gateways today are those that support global scalability while catering to local preferences, helping businesses grow smarter in every country they serve.

According to recent studies, nearly 69.57% of online carts are abandoned, and one of the biggest reasons is a poor or complicated payment process. The moment customers face friction—whether it's limited payment options, slow loading, or security concerns—they hesitate, and that hesitation costs sales. It shows that 18% of users abandon purchases due to long or confusing checkout steps. But when businesses use features like one-click checkout, multiple payment methods, and mobile responsiveness, the conversion rate can increase by up to 35%. It’s not just about accepting payments anymore—it’s about creating a moment that feels smooth, safe, and fast.

In this blog, we cover the top 10 features your payment gateway should have to drive higher conversions and sustainable sales growth.

1. Scalable as You Grow

Today, you may have 100 orders a month. Tomorrow, it could be 10,000. Your gateway should grow with you—supporting high volumes, new markets, and global currencies.

Why it matters: You won’t need to switch providers later and disrupt your flow.

2. Saved Cards for Returning Customers

Make it easier for repeat customers by letting them save their card details securely (with tokenization). No need to enter the same info again.

Why it matters: Faster repeat purchases = more loyal customers = higher lifetime value.

3. Custom Branding on Checkout Page

Your checkout page shouldn’t look like it belongs to someone else. Use your logo, colors, and even a custom thank-you message.

Why it matters: Branded checkout builds customer confidence and trust in your business.

4. One-Tap Pay Links

Let users pay without even visiting your website. Share a direct pay link via WhatsApp, SMS, or email.

Why it matters: The easier it is to pay, the faster they buy.

5. Multi-Currency Checkout for International Buyers

If you ship globally, let customers pay in their own currency and see prices in real time based on exchange rates.

Why it matters: Less confusion = more global customers converting.

6. Instant Settlement for Businesses

You shouldn’t have to wait days to receive your money. A good gateway offers quick settlement cycles—sometimes even the same day.

Why it matters: Faster cash flow helps you restock, invest, and grow your business faster.

7. Integrated Tax & VAT Calculations

In UAE, VAT is a must. Your gateway should automatically calculate and display VAT/GST to keep things transparent.

Why it matters: No surprises for customers, and smooth reporting for your business.

8. Plug-and-Play for Marketplaces

If you run a marketplace, your gateway should allow split payments between you and your sellers instantly.

Why it matters: Smooth seller payouts increase platform trust and attract more vendors.

9. API for Custom Features

Want to build something unique? A flexible gateway should offer developer-friendly APIs to create custom workflows.

Why it matters: You don’t need to compromise on what your business needs.

10. Voice-Enabled Checkout (for Mobile Users)

Allow users to say card details or OTP with voice if they're hands-free

Why it matters: Adds accessibility and is perfect for on-the-go shoppers.

Conclusion:

A great product deserves a great payment experience. By including these 10 powerful features in your payment gateway, you’ll not only build trust and simplify payments, but also turn more visitors into paying customers.

Whether it's offering multiple payment options, ensuring top-notch security, or giving instant confirmations—each feature works together to make your checkout process a revenue booster.

If you're looking for a reliable and feature-rich gateway that’s made to increase sales, Foloosi brings it all in one smart solution. With a seamless user experience and tools built for businesses in the UAE and beyond, Foloosi helps you get paid faster and smarter.

Visit to know more - https://foloosi.com/payment-gateway-in-uae

0 notes

Text

Real-Time API Monitoring: The Key to Building Reliable, High-Performing Web Applications

today’s fast-paced digital world, Application Programming Interfaces (APIs) are the backbone of every modern web or mobile application. Whether it’s a weather app fetching real-time data or an e-commerce site processing payments via Stripe, APIs power almost everything behind the scenes.

But what happens when an API silently fails? Your app becomes sluggish—or worse—completely unusable. That’s where real-time API monitoring comes in.

What Is API Monitoring? API monitoring refers to the process of automatically testing and tracking the availability, performance, and response of APIs over time. Think of it as a health check system that watches your APIs 24/7, ensuring they’re up, fast, and doing exactly what they’re supposed to do.

Real-time API monitoring takes it a step further—you’re alerted the moment something breaks.

Why API Monitoring Matters Your application may look fine on the surface, but behind every button click, data request, or user login, there's often one or more APIs at work. If any of them fail:

Users get error messages

Transactions fail to process

Performance slows down

Trust, traffic, and revenue are lost

Real-time monitoring ensures you catch these issues before your users do.

What Does Real-Time API Monitoring Track? Availability (Uptime): Is the API online and accessible?

Response Time: How long does it take to get a response?

Correctness: Are the responses accurate and as expected?

Rate Limiting: Are you close to hitting API usage limits?

Authentication Issues: Is your token or API key expired or invalid?

Use Case: WebStatus247 API Monitoring in Action Let’s say you’re using WebStatus247 to monitor your app’s integration with a payment gateway like Razorpay or Stripe.

Here’s what happens:

You set up real-time monitoring for the endpoint /api/payment/status.

Every few minutes, WebStatus247 sends a request to test the API.

If the status code isn’t 200 OK, or the response time spikes, you receive instant alerts via email or SMS.

You check the logs, identify the issue, and take corrective action—often before users even notice a problem.

Real-Time Alerts: Your First Line of Defense The core advantage of real-time monitoring is instant awareness. With platforms like WebStatus247, you can:

Set custom alert thresholds (e.g., response time over 800ms)

Receive notifications via email, Slack, SMS, or webhook

Access logs and trend data for root-cause analysis

No more guesswork. No more blind spots.

Benefits of Real-Time API Monitoring

Improved Reliability Downtime is expensive. Monitoring helps you stay ahead of outages, ensuring high availability for your services.

Faster Incident Response The faster you know about a problem, the faster you can fix it. Real-time alerts reduce mean time to resolution (MTTR) significantly.

Better User Experience Users do not tolerate broken features. Monitoring ensures that critical functionality—such as login, search, or checkout—remains operational.

Developer Efficiency Developers and DevOps teams can focus on building instead of reacting. With confidence in system health, teams can innovate more freely.

Real Metrics Drive Better Decisions API monitoring is more than just failure prevention. It helps teams:

Optimize performance by identifying slow endpoints

Detect traffic patterns and usage peaks

Justify infrastructure investments with performance data

Improve API documentation and reliability over time

Monitoring Helps Security, Too Real-time monitoring can alert you to signs of potential security issues, such as:

Unauthorized access attempts

Token expiration or failures

Unexpected status codes or response anomalies

In a world where data breaches are costly, proactive monitoring adds a layer of protection.

Synthetic Monitoring vs Real User Monitoring Real-time API monitoring is a form of synthetic monitoring—it simulates user behavior by sending requests to your APIs at regular intervals. This is proactive, meaning it catches problems before users encounter them.

In contrast, Real User Monitoring (RUM) collects data from actual user interactions. Both have value, but synthetic monitoring is essential for early detection.

Best Practices for Effective API Monitoring Monitor All Business-Critical Endpoints: Especially those that affect user sign-in, checkout, and real-time data delivery.

Set Thresholds Carefully: Avoid alert fatigue by defining meaningful conditions.

Automate Token Checks: Monitor for token expiry or authentication errors.

Use Multiple Locations: Test from different regions to catch geo-specific outages.

Review and Analyze Logs: Use dashboards to understand trends and identify root causes.

Global Monitoring = Global Reliability For applications with a global audience, testing from a single server is not sufficient. API responses can vary by location due to server load, latency, or network issues.

WebStatus247 allows you to simulate user requests from multiple global locations. This helps ensure consistent performance and availability across regions.

Conclusion: Visibility Builds Confidence APIs are mission-critical. They power everything from user authentication to content delivery. Yet, because they’re invisible to the end user, their failure can go unnoticed—until the damage is done.

Real-time API monitoring helps teams stay ahead. It empowers you to identify issues early, act quickly, and ensure your application remains fast, stable, and trustworthy.

For any serious development or DevOps team, this is no longer optional. It is essential.

Start Monitoring Today Ready to ensure your APIs are fast, reliable, and always online? Visit WebStatus247 and start monitoring in minutes. Gain full visibility, prevent costly downtime, and improve user satisfaction with every request.

0 notes

Text

How to Secure Your IndusInd Bank Credit Card for Safe Transactions

Our smartphones have become gateways to convenience—and that includes banking. From checking balances to paying bills and making investments, everything is now possible at the tap of a button. But with convenience comes the need for heightened security, especially when it comes to secure credit card transactions.

If you’re an IndusInd Bank customer, you have access to one of the most advanced and user-friendly tools to manage your credit card securely: the IndusInd Mobile app for android. This app isn’t just about managing money—it’s designed with robust safety features that ensure every transaction you make is protected.

In this blog, we’ll walk you through practical security tips, the built-in benefits of using the IndusInd Bank app for credit card management, and how you can make every swipe, tap, or online payment safe.

Security Tips: Using the IndusInd Bank App to Safeguard Your Credit Card

1. Enable Instant Card Controls

The IndusInd Bank Mobile Banking app empowers users with real-time control over their credit card usage. You can enable or disable international usage, set daily transaction limits, or even temporarily lock the card if it’s misplaced—all in just a few taps.

Tip: Make it a habit to turn off card usage for channels you don’t frequently use (e.g., international transactions or contactless payments).

2. Set Up App Lock and Biometric Authentication

The app allows users to enable biometric login using Face ID or fingerprint recognition. Adding a PIN or biometric authentication ensures that only you can access your banking details—even if your phone is stolen.

Tip: Always enable two-factor authentication and avoid using easily guessable passwords or patterns.

3. Track Real-Time Alerts

Every time your IndusInd Bank credit card is used, you receive a real-time SMS and push notification alert via the app. This lets you monitor your card activity 24x7, helping you catch any unauthorized use instantly.

Tip: Regularly review your transaction history on the app. If you spot anything unusual, you can immediately block the card through the app and report it.

4. Manage Your Virtual Card Securely

The IndusInd Bank app also provides access to your virtual credit card, which can be used for online purchases. Virtual cards add an extra layer of protection by masking your actual credit card number.

Tip: Use your virtual card for online transactions and limit its usage via app settings for enhanced security.

5. Update Contact Information Regularly

Keeping your mobile number and email address updated ensures you never miss any transaction alerts or bank communications. The app makes it easy to update contact details directly.

Tip: Avoid sharing OTPs or card details, even if the request seems to come from someone claiming to be from the bank. IndusInd Bank never asks for such sensitive information.

Benefits of Secure Transactions via the IndusInd Bank Mobile App

Total Control in Your Hands

The app puts complete control of your credit card usage in your hands. Whether it’s enabling/disabling online transactions, blocking a lost card, or generating a new PIN instantly, you’re never dependent on branch visits or customer care calls.

Advanced Encryption and Data Protection

IndusInd Bank uses state-of-the-art encryption protocols and multiple layers of authentication to keep your data safe. Every transaction is processed through a secure server, minimizing the risk of cyber fraud.

Instant Blocking and Reissuance

Lost your credit card? No worries. Through the app, you can block the card instantly and request a new one with zero delay. This quick action can save you from potential fraud or misuse.

Seamless Integration Across Services

The app integrates your credit card management with your savings account, loans, investments, and fixed deposits. This unified view ensures you don’t miss any payment due dates or security updates.

Exclusive In-App Offers and Rewards Tracking

Beyond security, the app enhances your credit card experience with easy access to personalized offers, rewards balance tracking, and EMI conversion options—all securely available within the app interface.

To Sum Up

Managing and safeguarding your credit card doesn’t have to be stressful. With the IndusInd Bank Mobile Banking app, you get a powerful, secure, and intuitive platform that lets you control every aspect of your credit card usage—right from your smartphone.

By following best practices like enabling real-time alerts, activating biometric authentication, and using virtual cards for online transactions, you can enjoy peace of mind with every swipe. So, download the IndusInd Mobile app for iOS today and take control of your credit card security like never before.

0 notes

Text

#bulk sms dehradun#bulk sms provider in dehradun#bulk sms service provider in dehradun#bulk sms service in dehradun#bulk sms services in dehradun#bulk sms marketing in dehradun#bulk sms company in dehradun#bulk sms reseller in dehradun#bulk sms in dehradun#bulk sms gateway in dehradun#pomotional bulk sms service in dehradun#transactional bulk sms service in dehradun#bulk sms#bulk sms gateway#free bulk sms service#sms marketing companies#bulk sms service provider near me#best bulk sms provider#bulk sms near me#bulk sms agency#bulk sms service

0 notes