#types of blockchain

Explore tagged Tumblr posts

Text

WHAT ARE THE DIFFERENT TYPES OF BLOCKCHAIN TECHNOLOGIES?

Blockchain technology explained As an innovative technology, Blockchain is a distributed database that facilitates secure information sharing in orders called “blocks.” Blockchain technology’s major features that increase its adoption are its immutable, transparent, and decentralized nature. Blockchain technology was first developed for cryptocurrencies, but it has found its use case in different…

View On WordPress

0 notes

Text

At work they really want us to try and use AI to optimize workflow or something but when asked about it I just honestly said "I'm not sure this will actually make anything faster for me..."

#i wish people would stop trying to put it into applications where it doesn't really have a good use case....#i hesitate to make the comparison since unlike the blockchain i think there *are* practical applications of genAI however#right now it feels like when certain types wanted to use the blockchain for whatever despite it not being practical#(or necessarily even *possible*)#just cuz it was the hot new buzzword

6 notes

·

View notes

Text

That's terrifying

spam emails are horrifying on an entirely different level once you actually begin to grapple with the material reality of ‘cyberspace’. how many servers were involved in dumping this message into my trash folder, where are they located, how much water goes into cooling them every day? where did the metals come from to build these facilities, who maintains them, how much labour and suffering and exploitation is required to bombard me with 50 messages a day i don’t even look at for products i will never buy? not just useless or a nuisance, but actively harming the earth & its people, and for what. zero social value, zero human communication, just capital trying to metastasise

#modern technology#scams and fraud#remember how during the chip shortage of the early pandemic when pc gamers couldn't acquire GPUs because of crypto bros#who were buying them up to build bitcoin farms?#I remember seeing this picture of a fucking huge farm that was basically a bunch of storage storage-type buildings#all full of rows upon rows of bitcoin blockchain calculating setups#guzzling more electricity than some micronations#anyway#this reminds me of that

46K notes

·

View notes

Text

Data Tokenization in 2025: A Comprehensive Guide

By 2025, is concerned about privacy and data security have reached levels that have never been seen before. Because of new privacy laws, more people using the cloud, and constant cyber threats, data tokenization has become a vital resource in this day and age. The remainder of this piece will talk about how data tokenization has changed over time, as well as its main uses, pros, and cons in the year 2025.

What is Data Tokenization?

It is possible for "tokenize" data, which means to replace sensitive information like credit card numbers, PII, or medical records with a non-sensitive version of that information. You can't use the token and figure out what it means without the data and the process of tokenization. It helps keep private data safe, which lowers the possibility of data breaches.

Key Components of Data Tokenization in 2025

a. Advanced Tokenization Algorithms

By 2025, the tokenization algorithms have advanced a great deal and are also more efficient. Nowadays, real-time data tokenization can be performed with modern algorithms on large amounts of information without considerable latency. Such algorithms are designed to maintain the usability of the original data as much as possible in the course of its maximum protection.

b. Tokenization in a Multicloud Environment

As enterprises are moving to multicloud architectures, tokenization systems today can allow integration on different clouds. Being able to tokenize and detokenize data within various environments enables organizations to secure their data and use different cloud providers for their elasticity and scalability.

c. Privacy-Enhanced Computation

proactively stay till 2025, tokenization will also use computation methods that protect privacy, like safe multiparty computation and homomorphic encryption. These methods make it possible to process private data in a cleaned-up or tokenized form that doesn't reveal the actual data. This makes it possible to share and analyze the data safely without compromising privacy.

How Tokenization Works in 2025

Step 1: Data Identification and Classification

Prior to any tokenization process, businesses first need to locate and categorize the confidential data within their systems. Due to emerging capabilities in machine learning and artificial intelligence, such data discovery systems are capable of detecting and classifying sensitive content present in both structured and unstructured databases without any human intervention.

Step 2: Tokenization Process

Following data has been classified, the private information is transformed to an unique resource which is generated by the tokenization system.like the credit card number "4111 1111 1111 1111" could be changed into a symbol like "ABCD1234XYZ5678." The original sensitive data is kept safely in a token vault that only those with permission can get to.During data usage, the tokenized format is employed, allowing operations to continue without exposing the original information. This ensures both the confidentiality of the data and its safe handling throughout the process.

Step 4: Detokenization (if needed)

There are a variety of applications where the tokenized data could be used, for instance, e-commerce, CRM systems, business intelligence tools, etc. Because these tokens do not carry sensitive information, the chances of data compromise, while the information is being processed or stored, is significantly mitigated for the organizations.

Benefits of Data Tokenization in 2025

a. Enhanced Data Privacy

The GDPR ( General Data Protection Regulation)in Europe and CCPA the California Consumer Privacy Act are just two examples of rules and guidelines that require organizations to protect personal data. Other data protection policies are also on the way all over the world. In order to follow the rules, tokenization encrypts private data and lowers the chance that any personal identification information (PII) will be Shared.

b. Reduced Data Breach Risk

So when it comes to data theft, in most cases if not all of them the data that has been tokenized is of no value thus minimizes the risk or the effect of the outside threats. In most cases where an attacker possesses system information with a tokenized piece of data, the attacker cannot be able to disassemble or work out the data without the token storage.

c. Secure Data Analytics

In 2025, owing to the development of tokenization, businesses can now utilize and analyze sensitive information without venturing into privacy concerns. Take the case of the medical or financial industries; data tokenization allows predictive analytics and machine learning to be performed on sensitive data without breaking any data privacy laws.

d. Scalable Across Environments

Organizations can now execute tokenization within on-premises, hybrid, and multi-cloud environments. This flexibility extends even more for organizations migrating toward the cloud or extending their digital infrastructure as data protection becomes paramount.

Secure Your Data with Tokenization – Get Started Today with real world asset tokenization solutions

Use Cases for Tokenization in 2025

a. Financial Services

Tokenization has been usually employed by financial institutions to protect P-C-I and account numbers for years. More so, in 2025, the usage of banks, DeFi and cryptocurrencies propelled this entirely into a new dimension. Aids such as tokenization of identity and transaction provides a layer of security even for purpose of use wallets making it easier to operate under strict financial regulations.

b. Healthcare

The healthcare industry which handles very delicate patient information has embraced tokenization to safeguard medical records, insurance details, and billing information. Tokenization is used by healthcare institutions in the year 2025 for sharing anonymized medical data for the sake of research and collaboration without compromising on patient privacy.

c. E-commerce and Retail

Tokenization is a technique that e-commerce platforms have consistently employed to ensure the safety of customer financial data. In the year 2025, tokenization has been implemented to protect other forms of customer information such as loyalty schemes, delivery addresses, and purchase patterns. Retailers also embrace the use of tokenization to avoid breaching the GDPR and CCPA regulations when conducting worldwide business transactions.

d. IoT and Smart Devices

The Internet of Things (IoT) gets more popular. Tokenization saves the huge amounts of data that smart devices generate. By 2025, tokenization will make it impossible to get to private data like fingerprint data from smartwatches and even geographic information from autonomous vehicles.

Future Trends in Data Tokenization

a. Zero-Knowledge Proofs and Blockchain Integration

Tokenization is talked about more when talking about blockchain applications in 2025, especially when talking about decentralized banking and supply chain. With zero knowledge proofs (ZKP), users can show that a transaction or piece of data is real without giving away the private data itself. This way of doing things is a completely new way to keep info safe and private.

b. Quantum-Resistant Tokenization

Due to the possible advent of quantum computing, which has the capacity to cathartic current encryption protocols, quantum secure tokenization methods are in the process of being constructed. These methods make sure that the tokenized data will be safe even in the post-quantum world.

c. AI-Driven Tokenization

AI is fundamentally important in providing an automated approach to the tokenization process. By 2025, AI technologies will be able to operate in real time to locate sensitive information and campaign for its tokenization while adjusting itself to variations in the flow of information. This lightens the burden placed on humans and enhances the effectiveness of the mechanisms put in place to safeguard data integrity.

Conclusion

By the year 2025, data tokenization is no longer an emerging trend, but a holy grail in the modern strategies of securing data. As the cloud computing technologies, AI, and quantum resistant techniques improve, the tokenization technology today is not only more advanced but also secure and scalable to businesses. Regardless of the industry – be it finance, healthcare, retail, the Internet of Things, or others – organizations are utilizing tokenization to secure data, adhere to international laws, and minimize the chances of data losses.

With advancements in technology, whereby every day, new products and services reach the target market, it can be expected that even in 2025 and beyond, the practice of tokenization will be one of the foremost tools in the enhancement of privacy, security, and trust in this age that is highly reliant on data.

0 notes

Text

Unlocking the Future: Exploring the Different Types of Real Estate Tokenization

The property market is being transformed by real estate tokenization where assets can be divided into digital tokens representing ownership or shares in a property. A blockchain is used to record these tokens and this makes sure that there is transparency, security and liquidity. Tokenization helps in reducing the high capital associated with real estate investment thus making it possible for more people to invest in this type of business. In this article, we shall identify the different types of real estate tokenization looking into their distinctive characteristics as well as advantages and disadvantages.

1. Equity Tokenization

In the world of real estate tokenization, equity tokenization is one of the most popular methods. With this approach, the tokens stand for shares of ownership that are linked to a piece of land or an organization operating within the real estate sector. By buying these tokens, investors turn themselves into shareholders who possess similar entitlements as traditional equity investors. Such rights may involve earning dividends from rents collected, joining forces for property value increase and enjoying a voice in some issues related to the management.try your own Equity Tokenization with the help of Real estate tokenization development.

Advantages of Equity Tokenization

Fractional Ownership - Tokenization of equity allows for fractioned ownership providing the possibility for investors to purchase part of a property instead of its whole asset. This consequently lowers the point of entry and opens real estate investment to a larger group.

Liquidity - Real estate that has been tokenized can be traded on other markets making it liquid which is rarely seen in conventional real property investment. In this scenario, investors are able to buy or sell their tokens quite easily depending on market situation.

Transparency: Because of the blockchain technology, which guarantees that all transactions are recorded indefinitely, it means that investors can see everything. As a result, there is less chance of getting conned and more faith is given towards investments.

2. Debt Tokenization

Tokens representing shares in a real estate loan or mortgage are generally referred to as debt tokens. Those investors who purchase such tokens essentially extend their loans to the owner or developer of properties, with the assurance that they will receive interest payments at certain intervals. This model appeals more to investors who prefer fixed income streams rather than those obtained from equity transactions.

Advantages of Debt Tokenization

Sustainable Revenue: Normally, debt tokenization presents a constant interest rate which makes it possible for investors to anticipate their profits and have a stable cash inflow.

Reduced Risk: As a result of the collateral backing them, debt tokens are usually considered less risky than shares or equities as such‐an action can be taken if there is no other option available for meeting obligation.

Diversification: By featuring a variety of real estate loans in their portfolio, investors may earn varying interests or returns from one investment to another depending on type of house.

3. Hybrid Tokenization

Hybrid tokenization integrates components of debt and equity tokenization. In this structure, any token can indicate a right of ownership in relation to an asset as well as a part of its attached liability. With such balanced investments, one may enjoy both potential higher returns on capital and constant income streams.

Advantages of Hybrid Tokenization

Risk and return are allocated proportionally: The hybrid tokenization combines both equity and debt to produce an even risk-return profile which interests more investors.

Flexibility: Investors can partake in various aspects of real estate through equity or debt or even both depending on their preference for liquidity and capital goals.

Enhanced ability to provide cash: The two-fold character in which hybrid assets exist may make them more recognizable to many investors which leads to an increase in liquidity within this market for those who wish or have experienced it before.

4. Income-Generating Tokenization

It is a process of income generating tokenizing that focuses on assets that generate periodic rental income such as commercial buildings, residential estates or tourist resorts. Every person who buys such tokens will be entitled to a portion of the rent proceeds according to the size of share owned.

Advantages of Income-Generating Tokenization

Continuous cash flow is vital for investors; hence, it becomes a better option for those in need of current income instead of future growth in value.

The other advantage is that the income streams remain relatively stable as they are long term contracts with tenants which helps reduce the effects of market changes.

Diversifying: By enabling income-generating tokenization, investors are able to diversify their real estate portfolios over various kinds of properties and sites.

5. Real Estate Investment Trust (REIT) Tokenization

Tokenizing a REIT means transforming parts of it into tokens that can be used in digital form. The kind of business entity called a REIT deals with the ownership, management or funding of properties that generate income. In this way, more liquidity and accessibility can be offered to those investors who were unable to engage in traditional real estate investment activities since they had to meet high minimum capital demands.

Advantages of REIT Tokenization

Diversification: Usually, REITs comprise of widely ranged class of properties consequently lessening risks related to investing on one property.

Liquidity: Tokenized REITs can be traded on secondary markets, which makes it easy for investors to convert their investments into cash as compared to traditional ones.

Tokenization reduces the lowest amount of money that needs to be invested so as to make REITs available to a larger group of investors.

Check out our : Real estate tokenization guide

6. Utility Tokenization

The application of utility tokenization for real estate is an uncommon model which is on the rise. Ownership is not represented by utility tokens but rather they offer entry to property related services or perks. To illustrate this, one could have a utility token that allows them to occupy a holiday renting house for a particular number of days every year.

Advantages of Utility Tokenization

Only for the selected, the following was prepared: Benefits which are only given to you as a holder of utility tokens (discounted rates, priority access, special services etc.).

Adaptability: Utility tokens are adjustable to provide different kinds of rewards for the property owners and managers hence they become a multi-purpose instrument for builders of estates.

Meaning, they can be bought at lower prices by investors or users interested in particular advantages aligned with their needs without any need for heavy investments like purchasing shares on stock exchange.

Conclusion

Tokenizing the real estate provides several openings for investors, property owners as well as developers. Starting from equity and debt tokenization to hybrid models and utility tokens, these different types come with different merits and demerits. The possibilities for real estate tokenization democratizing access to property investment and improving market liquidity will only increase as the technology and regulatory environment continue evolving. For one to take part in this quickly advancing area, one needs to think about their own objectives, risk appetite, and particularities of each model of tokenization.

#Tokenizing the real estate#types of real estate tokenization#real estate tokenization#blockchain technology

0 notes

Text

Discovering Crypto Airdrops: A Step-by-Step Guide

Envision stumbling upon a hidden gem that adds significant value to your collection. In the world of cryptocurrencies, this is akin to participating in a crypto airdrop, where you can receive free tokens and potentially enhance your digital asset portfolio.

Crypto airdrops are an innovative promotional strategy employed by blockchain projects to distribute free tokens among community members. These tokens are often given in exchange for completing tasks, demonstrating loyalty, or simply being part of the project’s ecosystem. Airdrops aim to boost awareness, reward loyal supporters, and increase token circulation. However, participants must remain vigilant to avoid scams and privacy breaches associated with these giveaways.

To partake in airdrops, stay informed about upcoming events, ensure your wallet is compatible, and meet the specified criteria. While the prospect of free tokens and financial gains is enticing, it’s crucial to understand the associated risks and tax implications. For those keen on optimizing their participation in airdrops, Intelisync offers specialized services in creating and managing airdrop campaigns, providing you with the expertise needed to successfully navigate and benefit from this dynamic aspect of the crypto world.

While the excitement of receiving free tokens is undeniable, participants should always exercise caution and stay informed to avoid potential pitfalls. If you’re interested in expanding your crypto portfolio through well-designed airdrop campaigns, Intelisync offers expert services to guide you through the process. Contact Intelisync today to learn how we can help you achieve your blockchain goals and maximize your Learn more....

#Are crypto airdrops safe?#Benefits of Crypto Airdrops Bounty#Airdrops Can I sell airdropped tokens?#Exclusive Airdrops#Holder Airdrops#How Can Airdrops Help Me Get Free Cryptocurrency?#How can Intelisync help with creating airdrops?#How Do Crypto Airdrops Work?#How do I participate in a crypto airdrop?#How to Participate in a Crypto Airdrop Pros and Cons of Crypto Airdrops#Raffle Airdrops#Risks and Considerations of Airdrops#Standard Airdrop#Types of Crypto Airdrops#What Is a Cryptocurrency Airdrop?#Why Do Companies Do Airdrops?#Why Do Companies Do Crypto Airdrops?#Intelisync Blockchain solution#Intelisync crypto development#Intelisync Metaverse development service.

0 notes

Text

#Europe Insurtech Market Report by Type (Auto#Business#Health#Home#Specialty#Travel#and Others)#Service (Consulting#Support and Maintenance#Managed Services)#Technology (Blockchain#Cloud Computing#IoT#Machine Learning#Robo Advisory#and Country 2024-2032

0 notes

Text

What Are the Main Types of Crypto Wallets?

When your assets leave your hands, it is important to have a safe and reliable way to store your assets. A crypto wallet serves this purpose, allowing users to store, manage, and trade their cryptocurrency assets securely. Moreover, crypto wallets enable users to interact with decentralized finance (DeFi) applications and trade non-fungible tokens (NFT). This blog will examine the main types of crypto wallets, their functions, and how to choose the best one for your needs.

What is a Crypto Wallet?

To conduct transactions on any blockchain network, you need your private key, which is kept in a digital wallet. Contrary to popular belief, the wallet does not store the cryptocurrency itself. Instead, it holds the private key that unlocks your blockchain address, where the cryptocurrency is stored. This distinction is important as your private key's security directly correlates with your crypto assets' security.

Public and Private Keys in Cryptocurrency Wallets

Before exploring the different types of cryptocurrency wallets, it is essential to understand what ‘public’ and ‘private’ keys are:

Public Key: Similar to your bank account number is this. Money can be shared with other people to get money.

Secret Key: This is similar to a password or PIN. Since it lets you access and control your cryptocurrency, it needs to be kept a secret.

Types of Crypto Wallets

Paper Wallets

How They Work: You generate a wallet using a paper wallet generator and print out the private and public keys. The keys remain offline, reducing the risk of hacking.

Benefits: Completely offline, reducing the risk of hacking.

Drawbacks: Helpless to physical damage (e.g.: water, fire), tedious to use for transactions, and easily lost.

Best For Users who infrequently plan on interacting with their cryptocurrencies and prioritize offline security.

Hardware Wallets

How They Work: These devices store your private key in a secure hardware device. To make a transaction, you connect the hardware wallet to a computer or mobile device, ensuring that the private key never leaves the device.

Advantages: Combines the security of offline storage with the convenience of signing transactions when connected to a computer. Popular brands include Ledger and Trezor.

Disadvantages: It can be costly and still require careful handling to prevent physical damage or loss.

Best For Users who value high security and are willing to invest in a powerful storage solution.

Software Wallets

How They Work: These wallets are always connected to the internet, providing seamless access to your cryptocurrencies and enabling quick transactions and interactions with DeFi applications.

Edges: Highly convenient for frequent transactions, DeFi interactions, and trading. Always connected to the internet, making it easy to use.

Impediments: Higher risk of hacking due to constant online connectivity. Additionally, if the device is lost or swiped, the wallet can be accessed if not properly secured.

Best For Users who frequently transact and interact with DeFi applications and prioritize convenience.

Hot Wallet VS Cold Wallet

Hot Wallet

Definition: Always connected to the internet, making it easy to transact but also powerless to cyber threats.

Examples: Most software wallets fall under this category.

The best option for Frequent traders and users who need quick and easy access to their crypto assets.

Cold Wallet

Definition: Not connected to the internet, providing higher security against hacks.

Examples: Paper and hardware wallets when not plugged into an internet-connected device.

Best For Long-term holders who prioritize security over convenience.

Frequency of Working with Blockchain Technology

Infrequent Use: If you want to purchase popular cryptocurrencies like BTC or ETH to hold over a long duration, a cold storage wallet solution may be best for you. A USB flash drive would be an illustration of cold storage. These kinds of gadgets are great for storing cryptocurrency since they keep your wallet off the internet and out of hackers' hands.

Regular Utilization: A software wallet might be your best bet if you intend to trade cryptocurrency regularly and engage with decentralized finance applications. The highest level of protection is provided by desktop and mobile wallet apps among these varieties.

Bringing It All Together

Selecting the correct cryptocurrency wallet is critical for protecting your digital assets. Paper wallets offer offline security but need careful storage. Hardware wallets connect offline security with transaction convenience, though they are more expensive. Software wallets provide the most convenience for frequent transactions and DeFi interactions but are more subject to hacking. Deciding between a hot wallet and a cold wallet depends on your specific needs and how often you interact with your cryptocurrencies. Whether you are a long-term holder or an active trader, there is a suitable crypto wallet for you.

Conclusion

Understanding the different types of crypto wallets and their specific use cases is essential for securely managing your cryptocurrency assets. Whether you opt for the simplicity and offline security of a paper wallet, the protection of a hardware wallet, or the convenience of a software wallet, your choice should align with your transaction frequency and security preferences. By selecting the right wallet, you can ensure your crypto assets are safely stored and easily accessible when needed.

0 notes

Text

What Are the Different Types of Outsourcing?

The use of cloud technology is increasing, with remote working leading the way. Every business, whether old or new, embraces cloud computing to create a virtual presence. Artificial intelligence (AI) and machine learning are both catalysts for growth. Outsourcing to an expert with working knowledge and prior experience in emerging technologies is the best way to take advantage of these changing dynamics.

Visit us:

#Different Types of Outsourcing#blockchain application development#ios app development#website development company

0 notes

Text

Types Of Crypto Wallets

What is a Blockchain Wallet?

First of all, you need to keep in mind that ownership of cryptocurrency is different from ownership of the traditional currency. Cryptocurrency is not available in the physical form and is considered a group of codes.

In reality, crypto wallets don’t store the currency but act as a tool of interaction with blockchain, i.e., generating the necessary information to receive and send money via blockchain transactions.

A blockchain wallet is a cryptocurrency wallet that allows users to manage different kinds of cryptocurrencies—for example, Bitcoin or Ethereum. A blockchain wallet helps someone exchange funds easily. Transactions are secure, as they are cryptographically signed. The wallet is accessible from web devices, including mobile ones, and the privacy and identity of the user are maintained.

How Do Blockchain Wallets Work?

A crypto wallet is used to interact with a blockchain network. With a wallet, a user is able to view and manage their cryptocurrency, as well as initiate transactions. They exist in many forms, from easy-to-use online web wallets offered by leading crypto exchanges to more technically complex and secure offline, hardware-based wallets.

What all wallets have in common are keys, which are needed to access a user’s crypto assets. When a wallet is created, a pair of keys are generated, one public and one private. These lengthy alphanumeric sequences may appear similar, but their functions are drastically different.

A public key works like a bank account number; it can be shared with anybody who wants to send you cryptocurrency, much like how an account number appears at the bottom of a paper check. A private key, on the other hand, can be thought of as your bank account’s PIN code and should be carefully safeguarded. Anyone who has access to that private key will have complete control over your crypto holdings.

When a user wants to send cryptocurrency, they input the receiver wallet’s public key and the amount of crypto they want to send. The process is reversed when a user wants to receive crypto. Anytime cryptocurrency moves out of a wallet, the transaction must be “signed” using the private key. How that crucial step happens depends on the type of wallet you use.

Cold Wallets vs Hot Wallets

Internet connectivity defines a wallet in terms of hot or cold. Hot wallets are connected to the Internet and thus are less secure and pose more risks but are user-friendly. Cold wallets, on the other hand, are stored offline and don’t require internet connectivity.

A hot wallet simply means any crypto wallet that is connected to the internet. They’re easy to use, so most types of crypto wallets are of the “hot” variety. But they are more vulnerable to hackers. Because of this, it is not recommended to keep large amounts of cryptocurrency in a hot wallet.

Cold wallets are the type of wallet that is offline, or not connected to the internet. Since the only way to interact with the blockchain is through the internet, cold wallets are considered highly secure and virtually impervious to hacking. Cold wallets tend to require a bit more technical know-how, so they’re typically suited for more experienced users or those with large amounts of assets.

Types of hot wallets

Hot wallets are basically the wallets that connect to the internet and generally offer lesser security. Hot wallets offer better accessibility due to their connection to the internet. They are highly user-friendly. There are several different types of hot wallets available, each with potential benefits and drawbacks depending on needs.

Desktop wallets

These are installable software packs available for operating systems. Desktop wallets utilize encryption to keep a user’s private keys securely stored on their computer hard drive.

Web wallets

These wallets are accessed by internet browsers. Web wallets are wallets provided by a third party, typically a crypto exchange, which offer seamless access to a user’s holdings using a web browser.

Mobile wallets

Mobile wallets allow users to quickly and securely send or receive cryptocurrency with their phone and an active internet connection.

Types of cold wallets

The two most popular types of cold wallets are hardware and paper. Both are considered a highly secure way of securing your crypto.

Paper wallets

It is a physically printed QR-coded form of wallet. As the name suggests, a paper wallet is an offline wallet solution where private keys are written down or printed and securely stored.

Hardware wallets

Hardware wallets are hardware devices that individually handle public addresses and keys. It cost up to 70-150 dollars, but it is worth it. It is a battery-less device and can be connected to a PC and accessed by native desktop apps. The most popular hardware wallets are Ledger Nano S and Trezor.

Most Famous Crypto Wallets in 2024

MetaMask

MetaMask is the most popular wallet currently used in Web3. With an active base of approx. 21 million monthly active users, its user-friendly interface enables the ability to interact with the blockchain.

Coinbase Wallet

The Coinbase Wallet app allows users to explore the decentralised web with a dApp browser. You do not need a Coinbase account to use the Coinbase Wallet app.

Trust Wallet

A non-custodial mobile wallet that stores your private key locally with an additional layer of security.

Zerion

Zerion is an investing app that enables anyone, anywhere in the world, to access a suite of new financial products and services built on the backbone of decentralized finance (DeFi). Zerion is an intuitive mobile-first web3 social wallet and investing tool that enables anyone to manage their DeFi and NFT portfolios.

Argent

Argent is a relatively new addition to the extensive set of Web3 wallets on the market. Argent caters to Ethereum users as it is only compatible with Ethereum tokens. Moreover, the wallet focuses on supplying a user-friendly customer experience when it comes to using dApps and DeFi

Rainbow

Rainbow is a non-custodial wallet that supports the Ethereum network. Moreover, Rainbow has native support for dApps of the Ethereum network.

Trezor Model T

The Trezor Model T is an advanced cryptocurrency hardware wallet. Store Bitcoin, passwords, tokens and other keys with confidence.

Ledger Nano

The Ledger Nano also referred to as the Ledger wallet, is a hardware cryptocurrency wallet that allows you to safely store your cryptocurrencies. Not only that, but it allows you to send and receive lots of different cryptocurrencies too.

Exodus

Exodus is a software-based hot wallet that has a few distinct features, like having a built-in exchange. You can buy and sell assets straight from your wallet without transferring funds to an exchange or brokerage.

Phantom

Phantom is a popular non-custodial crypto wallet designed for Solana that lets you do more than just deposit and send cryptocurrency.

Glow

Glow is a fast, easy-to-use wallet for Solana. The wallet currently does not serve as a web wallet or desktop wallet.

0 notes

Text

#blockchain app development solutions#Cryptocurrency App Development#Different Types of Cryptocurrencies

0 notes

Text

Unique digital assets known as NFTs are stored on a blockchain network. This provides a safe means of purchasing, selling, and trading these digital assets for buyers, sellers, and traders. As a result, NFT marketplaces are becoming a well-liked venue for investors, collectors, and artists to purchase and sell NFTs.

0 notes

Text

What is the best way to start investing? - Investment

#investment#stock investments#investments#types of investments#business investments#blockchain#crypto

0 notes

Text

Focus.xyz – Redefining the Creator Economy with Web3

Welcome to the future of social media. Focus.xyz isn’t just another platform—it’s a revolution. Built on the powerful DeSo blockchain, Focus empowers creators to monetize directly, build communities freely, and own their content without middlemen or platform fees. 🔥 Why Creators Are Switching to Focus.xyz

1. 100% Creator Revenue: No Cuts, No Catch. Say goodbye to heavy platform fees. With Focus, creators keep 100% of their earnings, from tips and subscriptions to premium content unlocks and even custom token launches.

2. Post-to-Earn Model : Every post can earn you real crypto rewards. Focus incentivizes quality engagement—your content isn’t just liked, it’s valued. Some posts have earned up to $1,000.

3. Complete Content Ownership : p Your followers, your content, your rules. Built on a decentralized blockchain, Focus gives creators full control and ensures censorship resistance and permanence.

4. Private & Secure by Design Focus enables anonymous posting, end-to-end encrypted messaging, and decentralized identity. Engage with your audience without ever compromising your privacy.

💡 Perfect for: Influencers tired of being demonetized. Educators and experts are monetizing premium knowledge. Communities and DAOs are looking for secure social engagement. Web3-native creators wanting real crypto-native monetization.

📈 Built for Viral Growth Referral Rewards: Invite others and earn from their activity—perfect for community builders. Engagement Bounties: Discover top content creators and get rewarded. Early Mover Advantage: With $75M in early backing from names like Coinbase, Sequoia, and a16z, now’s the time to grow with Focus.

⚡ Focus.xyz vs Traditional Platforms Feature Focus.xyz Twitter / Instagram / Patreon Platform Fees 0% 10–40% Content Ownership Yes (on-chain) No Anonymity & Privacy Full Limited Native Crypto Payments Instant Often restricted Creator Token Support Yes No 🎯 Join the Creator-Led Movement Don’t just build an audience—build your own economy.

👉 Start today: https://focus.xyz

👉 Follow and earn: Post. Engage. Get rewarded.

#Focus.xyz#crypto social network#decentralized social media#DeSo blockchain#Web3 social platform#creator economy#SocialFi#blockchain-based social network#crypto content monetization#censorship-resistant social media

310 notes

·

View notes

Text

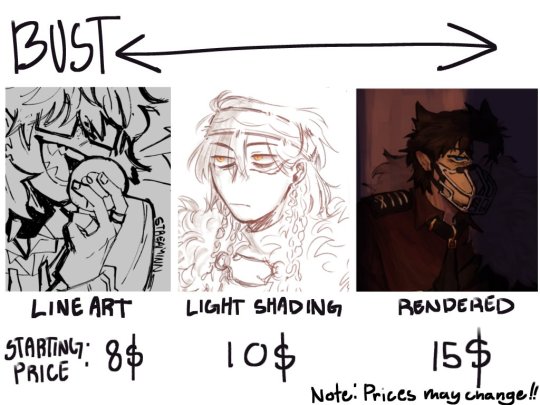

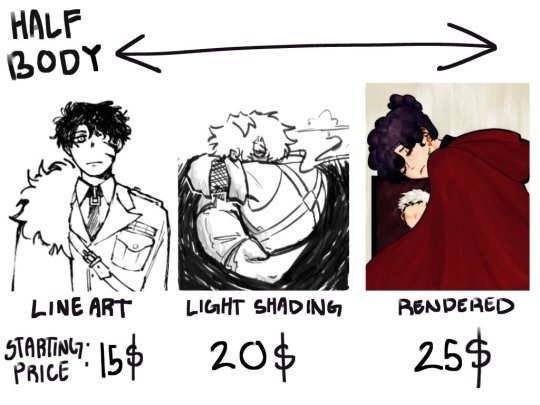

Quick sale till... march? Maybe? Who knows, i'm trying to get verified in Vgen so i'll keep the sale going until i reach that or if there's too many orders

If you'd like more examples of my works, feel free to check the tags commission work, rendered, my art or ask for more in DM’s!

You can either commission me through Vgen or here. I'd appreciate it if its through vgen so i can get verified but if you don't feel like it, shoot me a DM and we can talk there.

Now, read everything below first before commissioning me.

🗐 COMMERCIAL RIGHTS

⚲ IMPORTANT!

Upon commissioning the artist, the client automatically agrees to the terms of service provided, as it is assumed they have read them. If there are any questions or concerns, feel free to reach out through DMs or my other socials.

No additional payments are required for the following, as long as credit is given with my handle "@streamdotpng" whenever used:

✔ Icons, Banners, Thumbnails, and Posts used for streaming or other content purposes.

If the art is used for commercial purposes, with the artist’s consent, the artist will receive an agreed-upon percentage of the sales profits.

✒ GENERAL

The Artist has the right to refuse a commission if they are not comfortable or confident about the request.

The client is allowed to ask for progress updates every 2-4 days and are freely given. If it is a rushed commission, feel free to ask for more frequent updates.

By commissioning the artist, the client acknowledges that the artist is a student and this is not the artist’s full-time job. The client should not expect the artist to treat it as such.

Communications will generally be done in Vgen Chats (Please check your emails for chat notifications). Unless you prefer to communicate in other applications, that is also allowed as long as you let me know. Scroll down to see the end of my Terms of Service for my contacts or check the links in my profile.

Under any circumstances, Clients are not permitted to use any part of the commissioned artwork for non-fungible tokens (NFTs), blockchain, cryptocurrency platforms or AI Training. Such usage is strictly prohibited and may result in legal action taken.

✎ᝰ. CAN, MIGHT & WON’T DRAW!

╰┈➤ CAN DRAW !

Fanart

Shipping [GL, BL, Straight, Yumeship]

Original Characters

PNGtuber Models (e.g Blinking, Speaking)

Character sheets

╰┈➤ MIGHT DRAW ! (We’ll need to talk more about these requests)

Anthropomorphic animals

Heavy Armor

Excessive Gore

Comics

Complicated backgrounds (e.g. Detailed interior, buildings etc)

Honestly, if it isn’t in the "Can Draw" list, let’s talk about it!

╰┈➤✖ WILL NOT DRAW !

Depiction of suicide and self harm

Depiction of any type of hateful/political art

Anything that crosses my personal boundaries

⏱ TIMELINE & WORK PROCESS

Work completion will take at least 1-2 weeks minimum, depending on the amount of commissions worked on.

My work process simplified: Draft and Line Art ➤ Colouring ➤ Final Touches.

My work process expanded on: Draft ➤ Line Art ➤ Flat Colours ➤ Shading ➤ Final Work.

After completing each stage, I will contact you for either payment or revisions and thoughts.

$ PRICING & PAYMENT

Prices vary depending on the commission. I’m flexible, but here are some base prices:

$5-10 USD depending on the background

$10-15 USD per person added

Note: There can be additional charges due to PayPal fees.

Half the payment is expected to be paid upfront Post-Draft or Post-Line Art. The rest of the payment will be paid fully after the Flat Colours are seen and approved. If payment hasn't been received, the Artist will not continue until then.

The option to fully pay upfront is allowed but must be talked about before sending over the money.

No refunds are allowed after the draft has been sent.

You can pay through PAYPAL, KOFI or VGEN

↺ REVISION POLICIES

Once the coloring stage begins, the only major revisions permitted are details that the artist may have missed and was specified by the client while the commission was still in the sketching/lineart stage (e.g. a missing tattoo that’s essential to the character’s design).

If the client is unsatisfied with the commission Post-Line Art, the artist is willing to discuss and make minor edits as stated prior (e.g. adjusting colors). However, the artist will not redraw the piece and expects full payment, as the client should have specified in the sketch stage the changes they wanted to be made.

The client may not hire another artist to adjust the image without the artist’s consent.

The artist is willing to edit the image post commission for the commissioner, but may charge a small fee depending on what is being asked of them

🛈 RUSHED COMMISSIONS

Rush Fees apply. Contact me first to discuss how much you’re willing to pay for the rush fee.

The fastest turnaround time is 1-2 days (maximum 4 days) with the same quality as my usual work.

For short deadlines, you must be responsive when it comes to communication. It'd save us both the headache and worry.

▸ DISCLAIMER!

Breaking or disrespecting the rules of the Terms of Service will lead to a permanent ban and you will be blacklisted. It means, users who break the Terms of Service will lose the rights to commission me.

However, I may allow second chances. Blacklisted users can contact me with proof of improved behavior to request removal.

---

…and that’s about it? Just don’t expect me to be obligated to draw something and we’ll figure something out. Not to mention that depending on how much commissions i’m getting and how busy i am, the art will take atleast a few days to a week!

If you got references, provide them! It’ll help alot. You can also ask for progress updates, just don’t mind me accidentally not seeing the message bc this is tumblr and I don’t get notifs for some reason.

That’s about it, thanks for seeing this yall. Again, If you want to see more examples, simply look at my art tags in my account or send a DM and i'll send some over there.

149 notes

·

View notes

Text

The Ultimate Beginner's Guide to Stablecoins

Stablecoins represent a revolutionary development in the cryptocurrency landscape, providing a stable alternative to the highly volatile nature of traditional digital assets like Bitcoin. By pegging their value to fiat currencies, commodities, or other assets, stablecoins offer a reliable means of transaction and investment within the crypto ecosystem. Fiat-backed stablecoins such as Tether (USDT) and USD Coin (USDC) are supported by real-world reserves, ensuring their stability. Meanwhile, crypto-collateralized stablecoins like DAI are backed by other cryptocurrencies, offering greater decentralization and transparency. Despite their benefits, stablecoins are subject to regulatory scrutiny and technological risks, as demonstrated by past incidents like the Terra UST collapse.

Stablecoins bridge the gap between cryptocurrencies and traditional finance by providing a stable and liquid asset that can be used for trading, payments, and as a buffer against market volatility. They are integral to the functioning of decentralized finance (DeFi) platforms, enabling activities such as lending, borrowing, and yield farming. However, the success and reliability of stablecoins depend on robust regulatory frameworks, security measures, and technological advancements. As these aspects continue to evolve, stablecoins are expected to play an increasingly important role in the global financial system.

Intelisync is at the forefront of this financial innovation, offering services to help you navigate and leverage stablecoin technology effectively. Whether you are an investor, builder, or consumer, we can assist you in understanding Learn more....

#Algorithmic Stablecoins#Benefits of stablecoin#Can stablecoins lose their value#Challenges and Risks Crypto-collateralized stablecoins#FIAT-backed Vs Algorithmic Stablecoins#Fiat-Collateralized Stablecoinsn#How to Store Stablecoins Safely#How to Use Stablecoins in DeFi Platforms#Popular Stablecoins in the Market#The future of stablecoins#Types of Stablecoins#What is a Stablecoin A Complete Guide for Beginner#What is a stablecoin#What is the difference between Stablecoins vs. Central Bank Digital Currencies (CBDCs)?#Why Are Stablecoins So Important Intelisync blockchain development intelisync web3 agency

0 notes