#udyam registration verification

Explore tagged Tumblr posts

Text

Apply for udyam registration

0 notes

Text

Your Guide to Getting the Udyam Annexure Certificate Online – Simple & Hassle-Free

The Udyam registration system has made it easy for small businesses in India to become officially recognized as Micro, Small, or Medium Enterprises (MSMEs). Once you register under Udyam, you receive a Udyam Certificate. But sometimes, you may also need an additional document called the Udyam Annexure Certificate. This certificate is especially useful for bank loans, tenders, government schemes, and other business needs.

In this easy-to-understand guide, we’ll explain everything you need to know about getting the Udyam Annexure Certificate online—step-by-step, without any confusion.

What is the Udyam Annexure Certificate?

The Udyam Annexure Certificate is a document that includes detailed information about your business that may not appear on the main Udyam Certificate. It includes data such as:

Type of organization

Date of commencement

Detailed address

Business activity (manufacturing/service)

Investment and turnover details

Social category of the entrepreneur

National Industry Classification (NIC) codes

Other relevant business data

This annexure is often requested by banks, government departments, or while applying for subsidies and tenders. It acts as supporting documentation to the main Udyam Certificate.

Why is the Udyam Annexure Certificate Important?

Many business owners ask why this certificate is even required. Here's why:

For Loan Applications – Banks may ask for this detailed annexure for MSME loan approvals.

For Subsidy Schemes – Government schemes sometimes need extra verification.

For Tenders – You may need to provide this document when bidding for government or private tenders.

For Verifying MSME Details – The annexure confirms all your Udyam registration information clearly and in full.

For Updating Business Records – It is helpful if you need a hard copy record of your updated Udyam details.

How to Download the Udyam Annexure Certificate Online?

Getting your Udyam Annexure Certificate online is simple. You just need your registered mobile number or Udyam Registration Number. Follow these steps:

Step 1: Visit the Official Udyam Portal

Go to the Udyam Registration Portal. This is the only official government website for MSME registration and related services.

Step 2: Click on “Print/Verify” Section

On the homepage, you’ll find an option like “Print/Verify Certificate”. Click on it.

Step 3: Enter Your Udyam Registration Details

You’ll need to enter one of the following:

Udyam Registration Number, or

Registered Mobile Number, or

Registered Email ID

Also, fill in the security captcha shown on the screen.

Step 4: Get OTP and Verify

You will receive a One-Time Password (OTP) on your registered mobile number or email. Enter this OTP to proceed.

Step 5: Download the Annexure Certificate

After OTP verification, your Udyam dashboard will open. From there:

Click on “Annexure Certificate”

Choose to Download or Print the PDF version

That’s it! Your Udyam Annexure Certificate is ready.

What Information is Shown on the Udyam Annexure Certificate?

The annexure certificate is quite detailed and contains the following:

Udyam Registration Number

Date of Registration

Business Name and Address

Type of Enterprise (Micro/Small/Medium)

Business Activity (Manufacturing or Services)

NIC Codes

Investment and Turnover Range

PAN and Aadhaar Details (Masked)

Date of Commencement

Owner’s Social Category and Gender

This document is a complete snapshot of your business identity under the MSME framework.

How to Update or Modify Annexure Certificate?

If your business details change (like turnover, investment, or activity), you can update your Udyam registration online. After the update:

The new Annexure Certificate will reflect the revised details.

Simply follow the same download process again.

Note: You must keep your details accurate and updated to avoid any delays in loan applications or government approvals.

Documents Not Required to Download Annexure Certificate

Good news! You don’t need to upload or submit any additional documents to download the certificate. Just make sure:

Your Aadhaar and PAN were verified during registration.

You have access to the registered mobile/email for OTP.

Who Should Use the Udyam Annexure Certificate?

This certificate is especially useful for:

Startup founders

Small manufacturers and service providers

Traders registered under MSME

Exporters and importers

Contractors and suppliers

Women and youth entrepreneurs applying for subsidies

Whether you're running a tailoring shop, small factory, IT consultancy, or grocery supply chain—this certificate strengthens your MSME credentials.

How Long Does it Take to Download?

The entire process takes less than 5 minutes if your mobile number/email is active and registered correctly. There's no fee and no need to visit any office. Everything is done online.

Final Tips for Business Owners

Keep a PDF copy saved on your phone or computer. Print a hard copy if required for bank or tender use.

Regularly check and update your business details on the Udyam portal.

Use the same certificate while applying for MSME loans, subsidies, and schemes.

Need Help?

If you face any issues while downloading the Udyam Annexure Certificate, you can:

Contact the Udyam Helpline: Available on the official portal

Visit your nearest MSME office

Take help from MSME consultants or online service providers

Conclusion

Getting the Udyam registration online is a simple but powerful step for every MSME in India. It strengthens your business identity, helps with financing, and ensures smooth participation in government and private opportunities.

With just a few clicks, you can access a document that brings big value to your small business. Don’t miss out—download your Udyam Annexure Certificate today!

#udyam registration#udyam registration online#print udyam certificate#apply udyam registartion#udyam registartion portal

0 notes

Text

Gridlines APIs: Powering Real-Time Verification and Smarter Compliance for the Digital Economy

In today’s high-speed digital economy, instant trust is currency. Whether it's a loan application, onboarding a business partner, or verifying a vehicle owner, digital platforms can't afford delays or compliance missteps. This is where Gridlines APIs step in as the silent engine powering smarter, faster, and more secure decision-making.

Gridlines, available at https://gridlines.io/, offers a powerful suite of APIs that enable fintechs, NBFCs, banks, and marketplaces to verify individuals and businesses in real-time, reduce risk, and stay compliant—all through a single, unified platform.

The Gridlines API Suite: Built for Fintechs, Designed for Scale

Gridlines’ ecosystem is built around modular and lightning-fast APIs, each serving a key function in the verification and fraud prevention lifecycle. Here's a snapshot of its major offerings:

1. MSME API

Instantly verifies a business's Udyam Registration Number, fetching data like business name, type, classification, and registration date. This is crucial for lenders evaluating loan eligibility or onboarding new vendors.

2. RC API (Registration Certificate)

With just a vehicle’s registration or chassis number, users can fetch accurate RC details to verify ownership, fitness validity, and insurance status—vital for vehicle financing, ride-sharing, or insurance underwriting.

3. KYB API (Know Your Business)

Go beyond individual KYC to verify businesses via GSTIN, PAN, and more. Ideal for platforms that deal with B2B partnerships, vendor onboarding, or SME underwriting.

4. Face Match API

Compare a selfie with the photo on an ID document to detect impersonation. Backed by liveness detection, this API adds a strong layer of security to remote onboarding.

Use Cases: Where Gridlines APIs Create Real Value

Lending Platforms use the MSME and KYB APIs to assess borrower eligibility and prevent shell company fraud.

Vehicle Financiers and insurers leverage the RC API to confirm ownership and vehicle compliance.

Gig Platforms can match faces with IDs to ensure only verified individuals are activated on their app.

Digital KYC Providers embed the Face Match API to detect deepfakes and spoofing attempts.

Advantages That Set Gridlines Apart

Real-Time Access: No delays—get verified results instantly.

Developer-Friendly: Easy integration with robust documentation.

Modular & Scalable: Pick and choose only what your use case demands.

Built for Compliance: Meet RBI, SEBI, and IRDAI norms with confidence.

Secure Infrastructure: Data is encrypted, compliant, and handled with care.

Conclusion: APIs That Empower Growth and Trust

Gridlines isn’t just another API provider—it’s a trust enabler. With Gridlines APIs, businesses can remove friction from onboarding, detect fraud early, and build compliance into their workflows. As India’s digital economy continues to accelerate, platforms that integrate smarter verification tools will lead the pack.

To explore how Gridlines can work for your use case, visit https://gridlines.io.Find us on Google: https://g.co/kgs/1Zp2QRj

#Gridlines APIs#MSME Verification#KYB#RC Status#Face Match#Fintech APIs#Fraud Prevention#API Integration#Digital Verification#Compliance Automation

0 notes

Text

Simplify Udyam and MSME Recognition for Credit Offers

Lend confidently to small businesses by verifying UDYAM registration details through the KYB Verification API. Get MSME recognition status, business size, and classification in seconds.

0 notes

Text

How to Find the Right NIC Code for Your Kirana Store?

Starting or registering at a Kirana Store and confused about the NIC Code? You’re not alone! Many small shop owners struggle with identifying the right business classification. But don’t worry — this guide will help you understand and find the correct NIC Code quickly and easily.

✅ What is NIC Code?

NIC (National Industrial Classification) Code is a number assigned by the Government of India to classify businesses based on their core activity.

It is essential for:

GST Registration

Udyam (MSME) Registration

Income tax filings

Licensing & schemes

If you run a Kirana Store, selecting the correct NIC Code helps the government identify the nature of your retail trade and offer the correct benefits.

📊 2-Digit NIC Code for Kirana Store

At the top level, businesses are categorized using 2-digit codes.

For Kirana Stores, the 2-digit NIC code is 47.

This code covers retail trade (excluding motor vehicles).

🔍 Breakdown of NIC Code for Grocery Shops

To be more specific, here is the full classification:

Level NIC Code Description

2-Digit Code 47 Retail trade, except of motor vehicles and motorcycles

4-Digit Code 4711 Retail sale in non-specialized stores with food, beverages, or tobacco

5-Digit Code 47110 Kirana Store sells everyday grocery items, snacks, packaged goods, etc.

So, if you’re running a Kirana Store, your most appropriate code is 47110.

📥 Where is NIC Code Required?

You’ll need to mention your NIC Code when registering for:

GSTIN

Udyam Aadhaar (for MSME benefits)

Shop & Establishment License

FSSAI Registration (if food products sold)

If you're operating a Kirana Store, make sure to use the correct code to avoid rejections or delays in government processes.

💡 Why It’s Important to Use the Right Code

Using the wrong NIC Code can lead to:

Rejection of your application

Missing out on subsidies or benefits

Incorrect tax treatment

Legal and compliance issues

For a Kirana Store, code 47110 ensures that you’re correctly classified under retail grocery business and eligible for related schemes and tax benefits.

Using these phrases in your application and website content helps improve search visibility and accuracy during verification.

📌 Pro Tips Before You Apply

✅ Always verify your business activity before selecting an NIC code.

🧾 Keep your product list ready — it helps during GST and MSME registration.

📄 Apply using government portals like udyamregistration.gov.in.

💬 If confused, consult a CA or registration expert to avoid errors.

🧾 Example Use Case

Ravi runs a Kirana Store in Lucknow. When registering for Udyam Aadhaar, he selected NIC Code 47110, which clearly defined his store as a retail grocery shop. As a result, he successfully availed MSME benefits, including zero-cost registration, loan eligibility, and government schemes.

📝 Summary

Choosing the right NIC Code for your Kirana Store is a simple but crucial step in your business journey. It helps you comply with government rules, access financial benefits, and classify your business properly.

✅ Final NIC Code for Kirana Store: 47110

(2-Digit Code: 47 → Retail Trade)

Want to know more about business registration for Kirana Stores or get help with GST? Drop your query in the comments or contact our experts!

#KiranaStore#NICCode#RetailBusinessIndia#MSMERegistration#UdyamAadhaar#GroceryStoreStartup#GSTRegistration#SmallBusinessTips#RetailShopOwner#BusinessRegistrationIndia

0 notes

Text

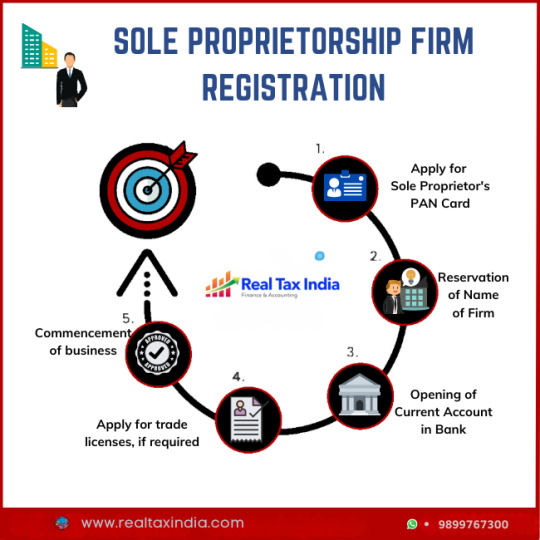

Sole Proprietorship Registration : A Step-by-Step Guide

How to Register a Sole Proprietorship in India Online — Process, Documents, Fees, and Expert Assistance

Are you a small business owner looking to start your entrepreneurial journey in India? Registering as a sole proprietorship is the simplest and most economical way to begin. With minimal compliance and straightforward registration, it’s ideal for individual entrepreneurs. In this blog, we’ll guide you through the sole proprietorship registration process, required documents, fees, and how to obtain a sole proprietorship certificate online in India. Whether you’re running a shop, offering freelance services, or operating a consultancy, registering your sole proprietorship is essential to legitimize your business.

And the best part? You don’t have to navigate the legalities alone. Real Tax India offers expert help for sole proprietorship registration, ensuring accuracy and timely compliance.

✅ What is a Sole Proprietorship?

A sole proprietorship is a type of business structure where a single individual owns and operates the business. It’s not considered a separate legal entity, meaning the owner is personally liable for business debts and obligations. Despite that, it remains the most popular and flexible choice for small businesses and startups in India.

📋 Why Register a Sole Proprietorship?

While a sole proprietorship can operate without formal registration, registering provides several benefits:

Business legitimacy and trust with clients or customers

Access to business bank accounts and UPI payments

Ability to apply for government tenders

Eligibility for GST registration

Smooth operations for e-commerce, supply chains, or vendor onboarding

Availing startup benefits and subsidies

🛠️ Sole Proprietorship Registration Process (Online)

You can easily register your sole proprietorship online in India with professional support. Here’s a simplified breakdown of the sole proprietorship online process:

Step 1: Choose a Business Name

Pick a unique business name that is not already in use or trademarked.

Step 2: Obtain Required Licenses & Registrations

Depending on your business type and turnover, you may need one or more of the following to establish proof of proprietorship:

GST Registration Mandatory if your turnover exceeds the threshold or you sell online.

Shop & Establishment Registration Required by most state governments for businesses with physical offices.

Udyam/MSME Registration Recommended for availing subsidies, loans, and MSME benefits.

Professional Tax Registration Applicable in select states like Maharashtra and Karnataka.

FSSAI Registration Required for food-related businesses.

Step 3: PAN Card & Aadhaar Card of Proprietor

You must have a valid PAN card and Aadhaar card for authentication and verification.

Step 4: Open a Business Bank Account

Once you obtain your sole proprietorship certificate or proof like GST or MSME registration, you can open a current account in your business name.

📁 Documents Required for Sole Proprietorship Registration

Here are the essential documents required for sole proprietorship online registration in India:

PAN card of the proprietor

Aadhaar card of the proprietor

Passport-size photo

Registered office proof — Rent agreement, utility bill, NOC from the owner

Bank account details (if applicable)

Business address proof

Email ID and mobile number for OTP verification

Depending on the registration type (GST, Udyam, etc.), Real Tax India will guide you through the precise list of documents required.

💰 Sole Proprietorship Registration Fees/Cost in India

The cost of registering a sole proprietorship can vary depending on the services opted and the state. However, with Real Tax India, the process is simplified and made affordable:

GST Registration — ₹500 to ₹1000 (one-time fee)

Udyam/MSME Registration — FREE or nominal fee

Shop & Establishment Registration — ₹1000 to ₹2000 (varies by state)

FSSAI Registration — ₹1000 to ₹2000 (basic license)

👉 For the most accurate and budget-friendly pricing, get in touch with Real Tax India for a customized quote based on your requirements.

📨 How to Apply for a Sole Proprietorship Certificate Online

The term sole proprietorship certificate usually refers to any document that proves your business’s legal existence — such as GST registration, MSME certificate, or Shop & Establishment certificate.

Here’s how to apply:

Visit the official registration portal or use a trusted service provider like Real Tax India

Submit your application form and upload documents

Complete OTP/email verification

Pay applicable government and service fees

Receive the certificate on your registered email ID

You can also apply for these certificates with the assistance of experts who will complete the end-to-end process for you.

🛡️ Why Choose Real Tax India for Sole Proprietorship Registration?

Registering your sole proprietorship correctly is crucial. Mistakes in application or document submission can delay your operations. Here’s why you should trust the experts at Real Tax India:

✅ Expert Guidance — Trained professionals will handle all legal formalities ✅ Affordable Pricing — No hidden fees ✅ Quick Turnaround — Get registered within days ✅ PAN-India Support — Available across India ✅ Free Consultation — Know what’s best for your business

📞 Get Started with Real Tax India Today!

Don’t let confusion delay your registration. Trust Real Tax India to register your startup on time and with 100% accuracy.

📞 Call: 9899767300 📧 Email: [email protected] 🌐 Website: https://realtaxindia.com

Whether you need help with a sole proprietorship certificate, understanding the online process, or estimating your registration cost, Real Tax India is your one-stop solution.

🏁 Final Thoughts

Starting a business as a sole proprietor in India is a smart and straightforward move. With low costs, minimal compliance, and complete control, it suits small traders, freelancers, and service providers. However, to operate professionally and avoid legal hassles, proper registration is essential. Let Real Tax India take care of it while you focus on growing your business.

1 note

·

View note

Text

How an MSME Verification API Simplifies Udyam Registration Checks Instantly

Instantly verify Udyam Registration details with Gridlines’ MSME verification API. Automate MSME onboarding, prevent fraud, and ensure KYB compliance at scale.

#MSMEVerification#UdyamRegistration#KYB#APIVerification#GridlinesAPI#FintechCompliance#BusinessVerification#FraudPrevention#DigitalOnboarding#MSMEIndia

0 notes

Text

How MSME and GST Registration Help You Secure Government Contracts and Tenders

Government contracts and public sector tenders represent some of the most reliable and lucrative opportunities for businesses in India. However, to participate in such procurement processes, businesses must meet specific legal and regulatory requirements. Two of the most essential prerequisites are MSME Registration and GST Registration. These registrations not only make your business eligible to apply but also offer special privileges and competitive advantages in the bidding process.

One of the most important steps is completing your online Udyam Udyog Aadhar MSME registration. Registered MSMEs enjoy exclusive benefits under government procurement policies, including a reservation quota, exemption from earnest money deposits (EMD), and price preference over non-registered entities. This dramatically improves your chances of winning tenders, especially as many government departments actively prioritize MSMEs to boost local entrepreneurship.

Alongside MSME certification, you must also complete online GST registration. A valid GSTIN is mandatory for businesses bidding on government tenders involving supply of goods or services. GST registration not only ensures compliance with Indian tax laws but also enables your business to issue tax-compliant invoices, claim input tax credit, and build trust with government departments looking for legitimate, well-documented suppliers.

Benefits of MSME Registration in Government Tenders

1. EMD and Fee Exemptions

Registered MSMEs are often exempt from paying Earnest Money Deposits (EMD) and tender application fees, reducing upfront costs and encouraging participation.

2. Tender Reservation Quota

The Indian government mandates that a minimum percentage of its annual procurement be sourced from registered MSMEs, ensuring better opportunities.

3. Price Preference Policy

Even if your bid is slightly higher than that of a large competitor, you may still win due to the price preference extended to MSMEs.

4. Faster Approval and Onboarding

Government portals and departments often fast-track the documentation and onboarding process for MSME-registered suppliers.

Importance of GST Registration in Public Contracts

1. Mandatory for Compliance

Most government departments require GST-compliant invoicing and payments. Without a GSTIN, your application may not be considered valid.

2. Credibility and Professionalism

GST registration enhances your business credibility, a factor that can influence evaluation criteria in tender processes.

3. Smooth Financial Transactions

With GST in place, payments and reimbursements from government clients become easier and more structured.

4. Input Tax Credit

GST-registered businesses can claim input tax credit on goods and services used, reducing costs and improving margins on public projects.

How to Get Started

To begin your journey into government contracting, it's essential to complete your business formalities. Register quickly and efficiently with the help of expert-backed platforms like Finodha. They guide you through document submission, eligibility verification, and compliance checks

0 notes

Text

Fueling Growth: Understanding MSME Loans in India

Micro, Small, and Medium Enterprises (MSMEs) are the backbone of the Indian economy, contributing significantly to employment generation, manufacturing output, and exports. However, one of the biggest challenges MSMEs face is access to timely and affordable credit. This is where MSME loans step in—tailored financial products that provide small businesses with the working capital and long-term funds they need to grow and compete.

What is an MSME Loan?

An MSME loan is a form of business financing provided to micro, small, and medium enterprises for various purposes, such as business expansion, purchasing machinery, working capital, or managing cash flow. These loans are offered by banks, Non-Banking Financial Companies (NBFCs), and fintech lenders, often under schemes supported by the Government of India, like CGTMSE (Credit Guarantee Fund Trust for Micro and Small Enterprises) and PMEGP (Prime Minister’s Employment Generation Programme).

Key Features of MSME Loans

Loan Amount: MSME loans can range from ₹50,000 to ₹2 crore or more, depending on the lender and the borrower’s profile.

Tenure: Usually between 12 months to 5 years, with flexible repayment schedules.

Collateral-Free: Many MSME loans are unsecured, especially those covered under government guarantee schemes.

Quick Disbursal: Some NBFCs and digital lenders offer instant approval and fund disbursal within 24–72 hours.

Competitive Interest Rates: Interest rates vary from 9% to 25%, depending on the lender, business health, and credit score.

Types of MSME Loans

Working Capital Loans: For day-to-day operational expenses like inventory, wages, and rent.

Term Loans: For long-term business investments like equipment purchase or infrastructure expansion.

Line of Credit (Overdraft): A revolving credit facility to manage irregular cash flow.

Equipment Financing: Specifically for purchasing new machinery or upgrading existing tools.

Government-Backed Loans: Under schemes like MUDRA, Stand-Up India, and PMEGP.

Eligibility Criteria

Though criteria vary slightly across lenders, the general requirements include:

Business should be classified as an MSME under the Udyam Registration.

Minimum 1 year of business vintage (some lenders require 3 years).

Valid business documents like GST registration, trade license, and bank statements.

Good credit history (CIBIL score of 650+ preferred).

MSME Loan Application Process

1. Assessment & Documentation

Start by evaluating your business needs and gathering documents such as:

Aadhaar, PAN card

Business registration proof

GST returns

Last 6–12 months of bank statements

2. Apply Online or Offline

You can apply through a bank, NBFC, or fintech platform. Many lenders offer a digital application process with minimal paperwork.

3. Verification and Approval

The lender assesses your creditworthiness and business performance. If approved, you receive a sanction letter.

4. Loan Disbursal

Funds are typically credited directly to your business bank account.

Final Thoughts

Access to finance is the lifeline for any growing enterprise. MSME loans empower small businesses to scale operations, embrace innovation, and compete globally. Whether you're a budding entrepreneur or an established small manufacturer, the right loan at the right time can transform your business journey.

With increasing digitalization and government support, securing an MSME loan today is simpler than ever—fueling not just businesses, but the future of India's economy.

0 notes

Text

5 Legal Benefits of a Virtual Office Address in Chennai

In the era of digital businesses, startups, and remote work, the traditional concept of a physical office is rapidly evolving. For entrepreneurs and professionals looking to establish a legitimate business presence without the financial burden of renting a full-fledged commercial space, virtual offices offer a practical and legally sound alternative.

Chennai, with its booming IT sector, robust infrastructure, and business-friendly ecosystem, is fast becoming a preferred destination for setting up new enterprises. In this article, we explore the five major legal benefits of using a virtual office address in Chennai, and how this smart solution can help your business maintain full compliance with minimal overhead.

1. Legally Valid for Business Registration

One of the primary legal advantages of using a virtual office address is that it qualifies as a legitimate registered business address. In India, the Ministry of Corporate Affairs (MCA) requires every business to declare a registered office address for incorporation. Similarly, if you're setting up a sole proprietorship or partnership firm, local authorities mandate an address for issuing licenses or trade permissions.

A professionally managed virtual office in a commercial zone meets all the documentation requirements:

No Objection Certificate (NOC) from the space provider

Rent Agreement between the virtual office provider and your business

Utility Bill (such as electricity or water bill) as proof of premises

These documents are essential when incorporating your company, obtaining a Shop & Establishment license, or applying for MSME/Udyam registration.

Why it matters legally: Using a residential address, or an address not authorized for commercial activity, can lead to rejection of your registration application or even penalties under the Companies Act. A virtual office eliminates this risk while keeping your compliance in check.

2. Supports GST Registration and Compliance

If your business is supplying taxable goods or services, it is mandatory to register for Goods and Services Tax (GST). GST registration requires the submission of valid address proof documents—something virtual office providers are well-equipped to deliver.

In Chennai, several virtual office services offer dedicated GST registration support by providing:

Latest utility bills

Legally stamped rent agreements

Signed NOCs from the owner

Additionally, many offer signage facilities or limited access to their premises, which becomes helpful if the GST officer conducts a physical verification.

Legal advantage: Attempting to register with an invalid address or incomplete documentation can delay your GST approval or result in legal complications, including notices under GST regulations. A compliant virtual office streamlines the entire process and gives your business a lawful GST presence.

3. Protects Privacy While Maintaining Legal Identity

A less obvious but crucial legal benefit is privacy protection. When registering your business, your registered office address becomes part of public records. For freelancers, consultants, or solopreneurs who work from home, using their residential address exposes personal information online.

A virtual office address solves this by offering a legally recognized commercial address that appears on:

ROC filings (Registrar of Companies)

Public business directories

Invoices and contracts

Legal and statutory correspondence

This setup ensures your home address remains confidential, yet your business retains a legitimate identity in the eyes of the law.

Why this is important: In today’s digital environment, protecting personal data is not only a matter of preference but often a legal requirement under data privacy regulations. Virtual offices offer a compliant alternative while shielding you from unwanted attention or data misuse.

4. Compliant with Licensing and Regulatory Approvals

Many industries in India require additional licenses or sector-specific approvals, depending on the nature of operations. Whether you're applying for an FSSAI license, Import Export Code (IEC), or a Shops & Establishments Certificate, a virtual office address can be used as the principal place of business—provided it is commercially zoned.

Chennai’s virtual office providers are often located in areas approved for commercial activity, such as:

Teynampet

Guindy

Anna Salai

Nungambakkam

OMR (Old Mahabalipuram Road)

This zoning compliance is critical because authorities may reject applications if the address is located in a residential area not sanctioned for business use.

Legal benefit: By using a compliant virtual address, your business avoids delays, rejections, or revocation of licenses. This is particularly useful when scaling into e-commerce, food delivery, import/export, or regulated services.

5. Accepted for Legal Notices and Government Communication

Another significant legal perk is that your virtual office address is recognized for receiving official legal correspondence, notices, and communication from government departments.

As per the Companies Act and other statutory laws, all communication—including legal notices, tax letters, and compliance audits—will be sent to the registered office address. A virtual office ensures:

Mail and courier handling with notification systems

Forwarding of official documents to your designated contact

In some plans, scanning and emailing of legal communication

This feature not only keeps you compliant but also ensures you never miss important updates from the Registrar of Companies, GST authorities, or municipal bodies.

Why this matters: Failing to receive or respond to legal notices can result in serious consequences—penalties, fines, or even cancellation of licenses. A virtual office provides a structured and professional solution to stay legally connected at all times.

Additional Legal Considerations When Using a Virtual Office

While virtual offices offer immense legal benefits, it’s important to understand certain boundaries and best practices to stay fully compliant:

1. Avoid Misrepresentation

You should clearly state your business type and location on official documents. Do not mislead customers or authorities by claiming the virtual office as your operational headquarters if you don't conduct operations there.

2. Use a Reputable Provider

Not all virtual offices are created equal. Ensure your provider offers legally valid documents and has a clean track record. Verify their registration and ask for sample agreements before committing.

3. Keep Records Updated

If you change your virtual office address, notify relevant authorities promptly—MCA, GST, banks, and licensing bodies. Keeping outdated records can lead to non-compliance issues.

Use Case: How a Freelancer Registered Legally Using a Virtual Office in Chennai

Ravi, a freelance UX designer, wanted to register as a sole proprietor and obtain a GST number to work with corporate clients. Renting a commercial space was out of his budget. Instead, he opted for a virtual office located in T Nagar.

With the virtual office provider’s help, he obtained:

A legally binding rent agreement

NOC from the property owner

Utility bill as address proof

He successfully registered his sole proprietorship with the Chennai municipal authorities, acquired GST registration, and even used the address on his website and invoices.

Today, Ravi operates remotely but maintains a legally recognized business presence, protecting his privacy and enhancing his credibility—all without stepping into a traditional office.

Final Thoughts

For remote-first entrepreneurs, freelancers, and startups in Chennai, the benefits of using a virtual office go beyond just cost savings or image enhancement. The legal advantages they offer are substantial and often critical to the success and sustainability of your business.

From enabling official company registration and GST compliance to protecting your privacy and ensuring you're reachable for legal correspondence, a virtual office lays the groundwork for a legally sound business operation.

With a virtual office in Chennai, you can confidently establish your legal footprint in one of India’s top business cities—without being tied to a traditional workspace.

0 notes

Text

How to Register on GeM Portal: A Step-by-Step Guide for Indian Businesses

If you're a business owner looking to sell to government departments, the Government e-Marketplace (GeM) is your gateway to a ₹3 lakh crore+ procurement ecosystem. But while the opportunity is huge, the registration and onboarding process can often be confusing, especially for first-time sellers.

In this blog, the experts at Bidz Professional, a trusted GeM Registration Consultant, break down the GeM Seller Registration process, documents required, and how you can get started with expert guidance.

What is GeM?

The Government e-Marketplace (GeM) is an online platform created by the Government of India to enable procurement of goods and services by various government departments, PSUs, and organizations. It ensures transparency, efficiency, and ease of doing business with the government.

As of 2025, GeM has:

Over 65,000+ buyer organizations

60 lakh+ registered sellers and service providers

Total order value crossing ₹3 lakh crore

Who Can Register on GeM?

You can register as a seller on GeM if you are:

An individual business owner

MSME/SME

Startup or DPIIT-recognized entity

OEM or authorized reseller

Service provider (e.g., cleaning, manpower, IT services)

GeM Registration Process (Step-by-Step)

Step 1: Prepare Documents

Make sure you have the following:

PAN Card

Aadhaar Card linked with mobile

Udyam (MSME) Registration or Company Incorporation Certificate

Bank Account details (with IFSC)

Active email ID and phone number

GST Registration (if applicable)

📌 Note: DPIIT-recognized startups can get exemptions on certain criteria.

Step 2: Visit the GeM Portal

Go to gem.gov.in, and click on “Sign Up” > “Seller”.

Step 3: Fill in Business Details

Organization type (Proprietor, Partnership, Pvt Ltd, etc.)

Legal Name (as per PAN)

Email and Mobile (linked with Aadhaar)

Office address

Step 4: Upload Documents & Verify

Submit PAN, Aadhaar, Udyam, and bank account info

Email/mobile verification via OTP

Upload a canceled cheque for bank verification

Step 5: Create Product Listings

Once registered, log in to your Seller Dashboard to:

Add products/services

Get OEM/brand approval if required

Set pricing, delivery terms, and warranty

Common Challenges Faced During Registration

Document mismatch errors

Aadhaar-linked mobile issues

Brand or OEM approval delays

GST verification failures

Incorrect category selection

This is where the team at Bidz Professional can make a difference.

Why Choose Bidz Professional as Your GeM Consultant?

Getting it right the first time ensures faster onboarding and quicker access to tenders. At Bidz Professional, we specialize in:

End-to-end support for seller registration

Documentation assistance

Brand and product listing

Bid participation help

Ongoing compliance & dashboard management

Over 100+ MSMEs and startups successfully onboarded on GeM with 100% satisfaction.

Our mission is to simplify public procurement access for every capable Indian business, one registration at a time.

Ready to Get Started?

Don’t miss out on government orders just because of paperwork. Let Bidz Professional help you register on GeM portal and start receiving procurement opportunities tailored to your business.

📲 Contact Bidz Professional for a Free Consultation

Have questions? Drop them in the comments or reach out—we’re happy to help!

0 notes

Text

Udyam Registration Verification: A Complete Guide

Get detailed information on Udyam Registration Verification in our informative blog. Learn the verification process, check your status, and ensure your MSME stays compliant. Take advantage of essential tips and guidance. Read more at Udyam Registration Verification.

0 notes

Text

Unlocking Growth: A Simple Path to Get Your Udyam Certificate Online

In today’s fast-paced digital world, starting and growing a small business has become easier than ever before. One of the key steps to build a strong foundation for any micro, small, or medium business in India is to get registered under the Udyam Registration system. This gives you an official Udyam Certificate, which brings many benefits and government support.

This guide will walk you through the process of getting your Udyam certificate online in the easiest and most understandable way.

What is the Udyam Certificate?

The Udyam Certificate is an official document provided by the Ministry of Micro, Small and Medium Enterprises (MSME), Government of India. It certifies that your business is registered as an MSME under the Udyam system.

With this certificate, your business is recognized by the government and becomes eligible for various schemes, subsidies, and support.

Why Should You Get a Udyam Certificate?

Getting a Udyam certificate is more than just registration – it is a gateway to growth opportunities. Here’s what it offers:

Access to government schemes and subsidies

Collateral-free loans from banks

Lower interest rates on business loans

Priority in government tenders

Tax benefits and exemptions

Ease of doing business with large companies

Helps in building trust and credibility.

Who Can Apply for the Udyam Certificate?

The following types of business owners are eligible:

Sole Proprietors

Partnership firms

Private Limited Companies

LLPs (Limited Liability Partnerships)

Hindu Undivided Families (HUFs)

Co-operative societies

Trusts

Any type of service or manufacturing business

Documents Required for Udyam Registration

The good news is: No documents or uploads are required during the Udyam registration process. The application is based on self-declaration.

But you’ll need the following basic details:

Aadhaar number of the business owner (mandatory)

PAN card of the enterprise (mandatory for companies and firms)

GST number (if applicable)

Bank details of the enterprise

Business address and activity details

How to Apply for Udyam Certificate Online (Step-by-Step)

You can apply online through the official Udyam portal. Here’s how:

Step 1: Visit the Official Portal

Go to the official Udyam Registration website

Step 2: Choose Type of Applicant

Click on “For New Entrepreneurs who are not Registered yet as MSME” if this is your first time.

Step 3: Enter Aadhaar Number

Enter your 12-digit Aadhaar number and the name of the business owner. You’ll get an OTP on your registered mobile number.

Step 4: PAN Verification

Enter your PAN details. The system will automatically fetch your information from the Income Tax portal.

Step 5: Fill in Business Details

Enter business name, address, bank account number, business activity (manufacturing/service), and investment details.

Step 6: Submit Application

Once you fill everything, submit the form. You will receive an instant acknowledgment and Udyam Registration Number.

Step 7: Download Udyam Certificate

You can download your Udyam certificate once it's generated – usually within minutes.

How to Download Udyam Certificate Later

If you didn’t download it after applying, don’t worry! You can easily download it later:

Visit the official portal.

Click on “Print/Verify Certificate”. Enter your Udyam number, mobile number, and OTP. Download or print the certificate.

Final Words: Why Every Small Business Should Register

Getting your Udyam Certificate online is a simple yet powerful step toward growing your business. It connects you with financial, legal, and commercial benefits that can make a huge difference in your journey. Whether you’re just starting or have been running your business for years, registering under Udyam is something you shouldn’t miss.

It’s quick, free, paperless — and most importantly, it opens new doors for your business success.

#udyam registration#udyam registration online#print udyam certificate#apply udyam registartion#udyam registartion portal

0 notes

Text

Powering Secure & Instant B2B Payments with Gridlines

In today’s fast-paced digital economy, instant, secure, and verified payments are no longer a luxury—they’re a necessity. For fintechs, NBFCs, marketplaces, and enterprises, the ability to automate business payouts without compromising on compliance or risk is crucial. That’s where Gridlines steps in—powering secure payment workflows through its advanced business verification and compliance APIs.

The Problem: Trust & Compliance Gaps in B2B Payments

B2B payment workflows often face significant hurdles—verifying the legitimacy of a vendor or seller, ensuring that payouts reach the correct bank accounts, and managing fraud risks during disbursal. Traditional KYC and KYB methods are slow, manual, and fragmented. For high-volume platforms like lending startups, gig marketplaces, or vendor-heavy enterprises, these inefficiencies are costly and dangerous.

Gridlines’ Solution: Real-Time Business Identity Verification

Gridlines offers a comprehensive API suite that enables platforms to build fully automated and compliant payment workflows. Whether you're sending payouts to vendors, disbursing loans, or onboarding new merchants, you need to verify who you're paying—instantly.

With Gridlines, you can:

Verify Udyam Registration Numbers to confirm MSME status

Cross-check PAN, GSTIN, and bank account ownership

Perform KYB (Know Your Business) checks in real-time

Ensure compliance with RBI and AML guidelines

All of this happens in seconds—giving you the confidence to release payments without manual intervention.

Key Benefits of Using Gridlines for Payments

Speed: Real-time APIs eliminate bottlenecks in disbursal.

Accuracy: Reduce payment errors and reversals with verified data.

Compliance: Stay audit-ready with in-built regulatory checks.

Scalability: Ideal for fintechs, gig platforms, and large enterprises handling bulk payouts.

Use Case Examples

NBFCs and Lending Startups: Automate business loan disbursals with verified KYB data.

Gig Marketplaces: Ensure the gig workers or vendors you pay are legitimate businesses.

E-commerce Platforms: Validate seller identity before enabling payouts.

Future-Proofing Your Payment Infrastructure

As regulatory norms tighten and fraud tactics evolve, having a future-proof and compliant payment infrastructure is a competitive advantage. Gridlines help you meet these demands while keeping the user experience frictionless.

By integrating Gridlines’ verification APIs, your platform ensures that every rupee disbursed is traceable, compliant, and secure—without slowing down operations.

Final Thoughts

Whether you're managing thousands of vendor payouts or offering instant working capital to SMEs, Gridlines is the API-first partner that enables safe, smart, and scalable payment operations. Get started with secure payment workflows that your business—and your regulators—can trust.

0 notes

Text

Streamline MSME Onboarding with KYB Verification

MSME identification and validation is now simple using our KYB Verification API. Pull UDYAM registration details to verify whether a business qualifies under the MSME category. Automate and scale your partner due diligence processes with confidence.

0 notes

Text

Step into Growth: A Complete Guide to Udyam Registration

Introduction

In the fast-paced business world, small and medium-sized enterprises (SMEs) often face the challenge of expanding their operations while navigating a maze of regulations and paperwork. Thankfully, the Government of India has introduced Udyam Registration, a simple yet powerful platform designed to make it easier for businesses to register, gain recognition, and access a wide range of benefits. Whether you are a new entrepreneur looking to start your business or an established SME aiming for growth, Udyam Registration can play a pivotal role in your business's journey.

What is Udyam Registration?

Udyam Registration is the official process through which small and medium-sized businesses in India can register under the Ministry of Micro, Small, and Medium Enterprises (MSME). It is a government-backed certification that acknowledges your business as a legitimate entity and makes it eligible for various benefits, including subsidies, loans, and government tenders. Previously, MSMEs were required to register under the Udyog Aadhaar system. However, the Udyam Registration platform is now the primary and streamlined method to register MSMEs in India. This new system is more user-friendly and has made the entire process digital, reducing paperwork and the need for physical visits.

Why Udyam Registration Is Important for Your Business

Government Benefits and Subsidies: Udyam Registration makes your business eligible for a wide array of benefits provided by the government, including access to low-interest loans, tax benefits, subsidies on technology upgrades, and special government schemes designed to support SMEs.

Access to Government Tenders: Many government contracts and tenders are only open to registered MSMEs. Udyam Registration allows your business to participate in these lucrative opportunities, enabling you to bid on government procurement and projects.

Priority Sector Lending: Registered MSMEs are given priority when applying for loans under the Priority Sector Lending scheme. This is especially useful for small businesses looking to scale and grow without the burden of high interest rates.

Legal Recognition: Udyam Registration provides legal recognition to your business, making it easier to build relationships with larger companies, access credit, and gain trust from customers, suppliers, and other stakeholders.

Enhanced Credibility: Being registered under Udyam adds credibility to your business. It acts as proof that your company meets all the legal requirements for operating as a small or medium-sized enterprise, which is often a factor when clients and partners are choosing vendors.

Subsidized Technology Upgrades: Udyam-registered businesses can avail of government schemes that provide subsidies for upgrading their technology, which can improve productivity, efficiency, and product quality.

How to Register for Udyam: Step-by-Step Process

1. Access the Udyam Registration Portal

Begin by navigating to the official Udyam Registration portal through your web browser.

2. Provide Business Information

Fill in essential details about your business, such as the business name, type, address, and bank account details. Double-check for accuracy before proceeding.

3. Review and Submit

Carefully review all the information you've entered to ensure its correctness. Once everything looks good, submit the application form.

4. Make Payment

Choose your preferred payment method and complete the registration fee payment.

5. OTP Verification

An OTP will be sent to the mobile number linked to your Aadhaar card for verification.

6. Enter OTP

Input the OTP you received on your mobile to authenticate your identity.

7. Finalize Registration

After verification, your registration process will be completed.

8. Receive Udyam Certificate

Once your registration is successfully validated, the Udyam Certificate will be sent to your email.

Important Tips for Udyam Registration

Provide Accurate Information

It’s crucial to ensure that all the details you enter are accurate, especially your bank account information. Any discrepancies can lead to delays in processing your registration, so double-check everything before submitting the form.

Prepare Required Documents

Although the registration process is primarily paperless, you may still need to upload certain documents, such as your PAN card, Aadhaar card, and GST number (if applicable). Having these documents ready will help you complete the registration smoothly.

Verify Your Business Category

When selecting your business category—whether micro, small, or medium—make sure to assess your investment and turnover carefully. This classification is important because it determines the benefits and schemes you will be eligible for. Accurate categorization ensures you receive the right support for your business needs.

Note: Now easily Print Udyog Certificate through the udyam portal.

Conclusion

Udyam Registration is a powerful tool for MSMEs looking to thrive in a competitive market. With government support, better access to finance, and an increased reputation, your business can make the most of the opportunities available. If you haven’t yet registered, now is the perfect time to take the first step toward growth and success. By completing the simple online registration process, you’ll be able to unlock a wide range of benefits and set your business on the path to sustained growth.

0 notes