#unharvested Wealth

Text

Fields of Gold

October 12 2023

Bean fields are plentiful throughout the Midwest. Just yesterday, the unharvested fields of gold were lined with delivery trucks awaiting their payload as the combine gathered the crop that pays for the farmer to live throughout the winter.

Here in Laporte County, not to be confused with the city of Laporte, we are accustomed to pulling to the side of the road as the 14 foot…

View On WordPress

#farming#fields of Gold#harvest#Indiana photo#Indiana photography#la Porte county indiana#LaPorte Indiana#Midwest#photo of the day#photography#photography farm and country#soybean fields#unharvested Wealth

0 notes

Text

There are multiple problems with Voxette’s take (if I remembered it correctly - they have me blocked) that the future will be significantly wealthier and therefore climate change management should be left to them instead of us taking it on.

1. It’s much cheaper to burn hydrocarbons for power than it is to unburn them. This is, in fact, the entire reason we burn hydrocarbons for power. Any technology getting around this would not be changing the thermodynamics, but collecting more energy some other way, like engineered algae blooms that collect currently unharvested sunlight in the open ocean.

This is part of the general case that it’s usually (though not always) more expensive to fix something than it is to not-break it.

2. There is more than one kind of wealth. The future might have fancy cybernetic augmentations and virtual reality while at the same time undergoing ecological collapse, having smog problems worthy of a y2k Chinese manufacturing hub, spending 10% of its GDP on ecological remediation, and so on.

These kinds of wealth interact in ways more complicated than just summing them up.

3. Civilization is about the intergenerational accumulation of wealth in general. The way climate is going, it’s the intergenerational accumulation of debt.

Voxette should be less individualist - not anti-individualist, but rather acknowledge that the political and social support of the structures that make individualism feasible as a practical matter is contingent on various factors, including the peak stress suffered by these institutions, and that for individual freedom to exist these institutions (or ones like them) must be propagated and renewed intergenerationally.

I’m not saying we can’t leave some of the job to the future, but that doesn’t mean it wouldn’t be prudent to start some of the work now. Balancing collective needs for what is necessarily a collective environment with individual freedoms and limitations on state power is a challenging endeavor! The more time available to do so, the better.

13 notes

·

View notes

Text

The People of the Sea

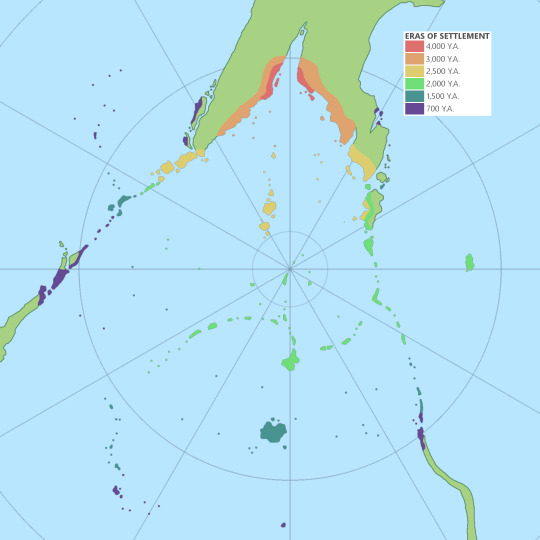

The Circumpolar Languages are a major family of languages spread across the shallow seas of Sogant Raha’s southern pole. Their origin is in coastal Vinsamaren, and they spread south over a period of about 4,000 local years; due to multiple waves of migration, conquest, and back-migration, and the displacement of Circumpolar-speaking peoples from their original coastal regions, the later distribution of languages is rather different from the original division of dialects, but still reflects a rough chronological division as one moves over the pole.

The geography of the southern seas is dominated by numerous chains of hundreds or thousands of small islands, the result of vigorous volcanic and tectonic activity across the fractured small plates. rift zones, and mostly-submerged continental landmasses in the region. The Gull Islands, which divide the Great Northern Sea and the Sea of Birds at Morning, represent the southern uplands of what, during Sogant Raha’s past ice ages, was Vinsamaren’s low-lying southern plain. The Smoky Islands, the Islands of Pigs and Islands of Rats, and the Windbreak Islands all are the result of volcanic activity along large subduction zones; while the Isles of Swift Fish and the Seven Brothers are the result of hotspot activity.

The combination of open sea and Kiata’s warm climate means that polar winters are relatively mild, and the water is ice-free year-round. Warm currents from the flanking oceans makes the weather of the outer archipelagos particularly mild, though they also annually drive powerful extratropical cyclones southward, sometimes breaching the straits and remaining over the cold southern seas for weeks at a time.

(map enlarged; scale is in km)

While occasional archipelagic empires have arisen in the southern seas, these have proved transient in the face of the large distances and frequent dangers of travel in the region. Most political units are island-scale principalities and commonwealths, and while some more northerly islands have acquired wealth through facilitating transcontinental trade, for the most part these cultures can be rather inward-looking. Nonetheless, they are all possessed of a similarly intrepid spirit, being the most accomplished and daring sailors on the planet, in this or any other era. Though there are a few scattered traces of ancient human habitation in the archipelagoes, in the past even much more technologically sophisticated cultures have tended to avoid the southern isles. Not so the People of the Sea, who have proven to be dauntless even in the face of fire and storms.

Proto-Circumpolar is the reconstructed common ancestor of the Circumpolar languages. Like almost all later circumpolar languages, Proto-Circumpolar has a complex morphology centered around biliteral (mostly, but not exclusively, consonantal) roots, tripartite morphosyntactic alignment, a large set of noun classes, and strong active/stative and transitive/intransitive distinctions in verbal morphology. In line with the most archaizing of its daughter languages, Proto-Circumpolar is also reconstructed as using extensive noun incorporation, which can result in sentences comprised essentially of a single very complex verb.

The vowels of Proto-Circumpolar are [a e i o u]; realized in short, closed syllables as [æ ɛ ɪ ʌ ʊ]; however, only the vowels [a i u] can appear as components of roots. The consonant system is as follows:

Stops: p t k : [ʔ] b d g

Nasals: m n ng [ŋ]

Fricatives: f s sh h v z zh

Semivowels: w j gh [ʁ~ʀ]

Taps, trills: r l b [ɾ ɺ ʙ]

Roots are primarily biliteral; triliteral roots exist, but are treated as a special examples of the regular types of biliteral root. Roots typically have an inherently or originally nominal or verbal meaning, e.g., P-H, “dwell, inhabit, fish along the shore of,” a verb, and D-SH-G, “outrigger canoe,” a noun, but can in principle be inflected for any nominal or verbal category. Nominal roots further exhibit a three-way noun-class distinction which is generally described as “old,” “young and small,” or “young and large;” but these classes are arbitrary outside of living things (people, plants, animals), and in some noun classes (e.g., units of time and supernatural entities) inflect only for the “old” class.

(timeline map enlarged)

The nineteen noun forms are as follows: 1. people (including professions, kinship terms, etc.), 2. islands (the word “island,” words for various types of island, and proper names of islands), 3. places on islands (any natural geographical feature that isn’t part of the sea), 4. made things (boats, houses, tables, cooked food, and the flesh of domesticated animals), 5. harvested things (fruits, grain, and the flesh of wild animals), 6. natural things and unharvested fruits (rocks, rivers, trees), 7. weather terms except wind and kinds of winds, 8. units of time, 9. wild land animals, 10. domesticated land animals, 11. things pertaining to the sea and wind (including currents, tides, reefs, shoals, bays, and inlets), 12. domesticated plants, 13. inedible plants, 14. poisonous plants, 15. edible sea life, 16. inedible sea life, 17. poisonous or venomous sea life, 18. the supernatural (ghosts, spirits, gods), and 19. anything sacred or taboo (fanes, shrines, death, the plague, injury by fire, harvest sacrifices, drowned corpses). Nouns have single, plural or collective, partial (i.e., inherently possessed), and uncountable forms, and seven cases: agentive, patientive, subject, instrumental, accusative (used only for direct objects), dative (used only for indirect objects), and vocative. While this means that any given noun root can have in theory many hundreds of forms, almost no root in practice has a form for each noun form, and class and case endings tend to be similar across many or all classes. The difference in how each declension handles endings tends to arise from the phonological structure of the root itself rather than being arbitrary; for instance, all roots whose second element is -A belong to the same declension.

Verbs have seven major conjugations: stative, intransitive imperfective, transitive imperfective, ditransitive imperfective, intransitive perfective, transitive perfective, and ditransitive perfective. The distinctions between conjugations are more semantic than strictly aspectual, e.g., P-H in the 3rd conjugation means “settle, colonize,” but in the sixth “visit, camp at”, and both verbs can be conjugated in, say, a habitual or progressive tense. There are thirteen tense/aspect/mood combinations (indicative, imperative, future imperative, jussive, past, past perfect, past subjunctive, future subjunctive, present habitual, past habitual, present progressive, past progressive, and non-future conditional) and three persons; but as with the noun, save phonologically triggered differences, these affixes tend to be the same across each conjugation.

Proto-Circumpolar regularly incorporated the patient or agent into the verb as an affix; it could also sometimes incorporate the instrument or subject. Word order was probably free, with a weak tendency toward SOV.

(subfamilies enlarged)

Along with shared vocabulary around sailing, geography, methods of fishing and agriculture, and weaponry and political terminology, which all point to ancient cultural commonalities between even the most far-flung Circumpolar languages, the Circumpolar peoples all share a common vocabulary of local wights and supernatural intercessors. Different islands now emphasize different spirits in their local pantheons, but all share a concept of the “Parliament of All Seas,” at which island-guardians or kingdom-patrons decide the fate of the world, and a common ritual law which forbids under terrible penalties contact with the polluted or profane, and permits contact with the sacred only after extensive rituals of charity and purification.

3 notes

·

View notes

Text

Yield Alert: Buy This 7.1% Dividend Before it’s Too Late

Yield Alert: Buy This 7.1% Dividend Before it’s Too Late:

Canadian companies offer some of the juiciest dividends on the market. One such company just hit a 7.1% yield.

While a 7.1% dividend yield may seem lofty, keep in mind that this firm has consistently maintained an impressive payout. Over the last five years, the dividend has ranged between 5.2% and 9.1%. The current payout is well within its historical norm.

The latest bump in the dividend has come from a temporary pullback in the share price. Opportunistic investors can now achieve a market-leading income with plenty of upside potential.

Short-term pain

Rogers Sugar (TSX:RSI) has been a high-dividend payer for decades. In fact, it was originally set up purely as an income vehicle to redistribute profits from its sugar plantations.

If you look at the historical stock price, you’ll quickly realize that this is a pure-play income stock. The stock price today is in the same range shares traded at in 2011. Investors haven’t received big capital gains but rather consistent dividends.

Volatility has still presented itself from time to time. Fluctuations have caused the dividend to expand and compress regularly. In 2019, the stock price dipped from $6 to $5, pushing the yield up to 7.1%. The reasons behind the drop are clear, and most likely, they’re temporary, allowing new investors to snap up shares at a discount.

Long-term gain

Last quarter, management revealed “severe snow and frost damage has resulted in an inability to store or process the unharvested damaged sugar beet crop.” Upcoming financials should reflect this challenge, pressuring revenue and profits. The stock price decline coincided perfectly with this revelation, so it’s likely to be the impetus.

Luckily, the winter damage isn’t permanent. All indications suggest it will only impact the financials for a quarter or two. Afterwards, it’ll be back to business as usual.

When conditions normalize, expect the share price to rebound. Investing now lets you lock in the 7.1% dividend.

The rebound could also be sharper than past instances. That’s because Rogers has been investing in verticals like maple syrup, which have improved economics and higher profit margins.

These new initiatives haven’t boosted cash flow yet given there’s upfront investment needed, but in the coming years, they should provide a diversified source of profits for the company. “We remain confident in our long-term strategy and are well-positioned for the future,” executives noted on the most recent conference call.

Despite a difficult fourth quarter, Rogers still generated $31 million in free cash flow in 2019. That’s more than enough to service its debt, invest in new products, and support its 7.1% dividend payout.

5 TSX Stocks for Building Wealth After 50

BRAND NEW! For a limited time, The Motley Fool Canada is giving away an urgent new investment report outlining our 5 favourite stocks for investors over 50.

So if you’re looking to get your finances on track and you’re in or near retirement – we’ve got you covered!

You’re invited. Simply click the link below to discover all 5 shares we’re expressly recommending for INVESTORS 50 and OVER. To scoop up your FREE copy, simply click the link below right now. But you will want to hurry – this free report is available for a brief time only.

Click Here For Your Free Report!

Fool contributor Ryan Vanzo has no position in any stocks mentioned.

0 notes

Link

Canadian companies offer some of the juiciest dividends on the market. One such company just hit a 7.1% yield.

While a 7.1% dividend yield may seem lofty, keep in mind that this firm has consistently maintained an impressive payout. Over the last five years, the dividend has ranged between 5.2% and 9.1%. The current payout is well within its historical norm.

The latest bump in the dividend has come from a temporary pullback in the share price. Opportunistic investors can now achieve a market-leading income with plenty of upside potential.

Short-term pain

Rogers Sugar (TSX:RSI) has been a high-dividend payer for decades. In fact, it was originally set up purely as an income vehicle to redistribute profits from its sugar plantations.

If you look at the historical stock price, you’ll quickly realize that this is a pure-play income stock. The stock price today is in the same range shares traded at in 2011. Investors haven’t received big capital gains but rather consistent dividends.

Volatility has still presented itself from time to time. Fluctuations have caused the dividend to expand and compress regularly. In 2019, the stock price dipped from $6 to $5, pushing the yield up to 7.1%. The reasons behind the drop are clear, and most likely, they’re temporary, allowing new investors to snap up shares at a discount.

Long-term gain

Last quarter, management revealed “severe snow and frost damage has resulted in an inability to store or process the unharvested damaged sugar beet crop.” Upcoming financials should reflect this challenge, pressuring revenue and profits. The stock price decline coincided perfectly with this revelation, so it’s likely to be the impetus.

Luckily, the winter damage isn’t permanent. All indications suggest it will only impact the financials for a quarter or two. Afterwards, it’ll be back to business as usual.

When conditions normalize, expect the share price to rebound. Investing now lets you lock in the 7.1% dividend.

The rebound could also be sharper than past instances. That’s because Rogers has been investing in verticals like maple syrup, which have improved economics and higher profit margins.

These new initiatives haven’t boosted cash flow yet given there’s upfront investment needed, but in the coming years, they should provide a diversified source of profits for the company. “We remain confident in our long-term strategy and are well-positioned for the future,” executives noted on the most recent conference call.

Despite a difficult fourth quarter, Rogers still generated $31 million in free cash flow in 2019. That’s more than enough to service its debt, invest in new products, and support its 7.1% dividend payout.

5 TSX Stocks for Building Wealth After 50

BRAND NEW! For a limited time, The Motley Fool Canada is giving away an urgent new investment report outlining our 5 favourite stocks for investors over 50.

So if you’re looking to get your finances on track and you’re in or near retirement – we’ve got you covered!

You’re invited. Simply click the link below to discover all 5 shares we’re expressly recommending for INVESTORS 50 and OVER. To scoop up your FREE copy, simply click the link below right now. But you will want to hurry – this free report is available for a brief time only.

Click Here For Your Free Report!

Fool contributor Ryan Vanzo has no position in any stocks mentioned.

0 notes