#universal life insurance vs whole life

Text

Comparing Options: Universal Life Insurance Versus Whole Life

Universal life insurance vs whole life insurance are two popular types of permanent life insurance, each offering unique features and benefits. While both provide lifelong coverage and accumulate cash value over time, there are significant differences between the two that can impact their suitability for different individuals. In this comprehensive comparison, we'll explore the key distinctions between universal life insurance and whole life insurance, helping you understand their similarities, differences, and considerations for choosing between them.

Understanding Universal Life Insurance

Universal life insurance is a type of permanent life insurance that offers flexibility in premium payments, death benefits, and cash value accumulation. With universal life insurance, policyholders have the flexibility to adjust premium payments and coverage amounts to suit their changing needs and financial circumstances. Additionally, cash value accumulation within universal life insurance policies grows on a tax-deferred basis, providing potential tax advantages for policyholders.

Understanding Whole Life Insurance

Whole life insurance is another type of permanent life insurance that provides coverage for the entire life of the insured, as long as premiums are paid. Unlike universal life insurance, whole life insurance features level premiums, guaranteed death benefits, and a fixed cash value component. Premiums remain fixed throughout the life of the policy, offering predictability and stability for policyholders. The cash value component of whole life insurance grows at a guaranteed rate of return, providing stable and predictable growth over time.

Comparing Features: Universal Life Insurance vs. Whole Life Insurance

While universal life insurance and whole life insurance share some similarities as permanent life insurance options, they also have distinct differences that set them apart:

Premiums: One of the primary differences between universal life insurance and whole life insurance is the structure of premiums. Universal life insurance typically offers flexibility in premium payments, allowing policyholders to adjust the amount and frequency of payments within certain limits. In contrast, whole life insurance features level premiums, meaning the premium amount remains fixed throughout the life of the policy.

Cash Value Growth: Another key distinction is how cash value accumulates within the policy. In universal life insurance, cash value accumulation is based on interest rates and market performance, providing the potential for higher returns but also greater risk and volatility. In contrast, whole life insurance guarantees a minimum rate of return on cash value accumulation, offering stable and predictable growth over time.

Policy Flexibility: Universal life insurance offers greater flexibility in policy management compared to whole life insurance. Policyholders can adjust premium payments, coverage amounts, and investment options to suit their changing needs and financial goals. Whole life insurance, on the other hand, is more rigid in its structure, offering less flexibility for policy adjustments once the policy is in place.

Death Benefit and Cash Value Relationship: In universal life insurance, the death benefit and cash value are separate, allowing policyholders to see a clearer breakdown of how their premiums are allocated between the two components. In whole life insurance, the death benefit and cash value are integrated, meaning the cash value contributes to the overall death benefit.

Costs and Affordability: The cost of universal life insurance and whole life insurance can vary depending on factors such as age, health, coverage amount, and policy features. Generally, whole life insurance tends to have higher premiums compared to universal life insurance, reflecting the guaranteed death benefit and cash value accumulation features.

Benefits of Universal Life Insurance

Universal life insurance offers several benefits, including:

Flexibility: Universal life insurance policies offer flexibility in premium payments, coverage amounts, and investment options, allowing policyholders to tailor their policies to suit their individual needs and financial goals.

Cash Value Accumulation: Cash value within universal life insurance policies grows on a tax-deferred basis, providing potential tax advantages and allowing policyholders to accumulate savings over time.

Death Benefit Protection: Universal life insurance policies provide a death benefit to beneficiaries upon the insured's death, offering financial protection and security to loved ones.

Policy Management: Universal life insurance policies allow policyholders to adjust premium payments, coverage amounts, and investment options to adapt to changing financial circumstances and objectives.

Benefits of Whole Life Insurance

Whole life insurance offers several benefits, including:

Guaranteed Death Benefit: The death benefit of whole life insurance is guaranteed, providing policyholders and their beneficiaries with peace of mind knowing that a benefit will be paid out upon the insured's death.

Stable Premiums: Whole life insurance features level premiums that remain fixed throughout the life of the policy, offering predictability and stability for policyholders.

Cash Value Growth: The cash value component of whole life insurance grows at a guaranteed rate of return, providing stable and predictable growth over time.

Policyholder Dividends: Some whole life insurance policies may pay dividends to policyholders, which can be used to increase cash value, reduce premiums, or purchase additional coverage.

Drawbacks of Universal Life Insurance

Despite its benefits, universal life insurance also has some drawbacks that should be considered:

Market Risk: Universal life insurance exposes policyholders to market risk and volatility, as cash value accumulation is based on interest rates and market performance.

Complexity: Universal life insurance policies can be complex and difficult to understand, particularly for individuals who are not familiar with insurance and investment concepts.

Costs and Fees: Universal life insurance policies may come with higher costs and fees compared to other insurance products, potentially impacting overall affordability and policy performance.

Drawbacks of Whole Life Insurance

Similarly, whole life insurance has its drawbacks, including:

Higher Premiums: Whole life insurance premiums are typically higher than those of term life insurance or universal life insurance, reflecting the guaranteed death benefit and cash value accumulation features.

Limited Flexibility: Whole life insurance policies are less flexible than universal life insurance policies, making it challenging for policyholders to adjust premiums, coverage amounts, or policy terms once the policy is in place.

Slow Cash Value Growth: The cash value component of whole life insurance policies may take time to accumulate significant savings, particularly in the early years of the policy when a significant portion of premiums goes towards administrative fees and commissions.

Suitability of Universal Life Insurance vs. Whole Life Insurance

The suitability of universal life insurance vs. whole life insurance depends on individual circumstances, financial goals, and risk tolerance. Universal life insurance may be suitable for individuals seeking flexibility in premium payments, cash value accumulation, and policy management. It can be particularly attractive for individuals with fluctuating income or evolving financial needs.

On the other hand, whole life insurance may be suitable for individuals seeking guaranteed death benefits, stable premiums, and predictable cash value accumulation. It can be a valuable tool for individuals looking for long-term financial security and estate planning purposes.

Conclusion

Universal life insurance and whole life insurance are both popular options for individuals seeking permanent life insurance coverage. While they share some similarities, such as lifelong coverage and cash value accumulation, they also have distinct differences in terms of premiums, policy flexibility, cash value growth, and transparency. Understanding these differences is essential for making an informed decision about which type of policy is most suitable for your needs and financial goals. Consulting with a financial advisor can help you evaluate your options and choose the life insurance policy that best meets your individual circumstances and objectives.

0 notes

Text

10 Reasons Why You Need the Best Life Insurance Policy Today

Are you wondering why you need the best life insurance policy today? Life is full of uncertainties, and having the right coverage in place is essential to protect your loved ones financially.

In this blog post, we will explore 10 compelling reasons why you should prioritize getting the best life insurance policy without delay.

Reason 1: Financial Security for Your Loved Ones

The primary…

View On WordPress

#best life insurance#best life insurance policy#cash value life insurance#insurance#insurance agent#insurance sales#life insurance#life insurance 101#life insurance agent#life insurance dave ramsey#life insurance explained#life insurance sales#term insurance#term life insurance#term vs whole life insurance#universal life insurance#what is life insurance#whole life insurance#whole life insurance explained

0 notes

Text

#best whole life insurance#whole life insurance cash value#is whole life insurance worth it#term vs whole life insurance calculator#term life vs whole life vs universal life

1 note

·

View note

Text

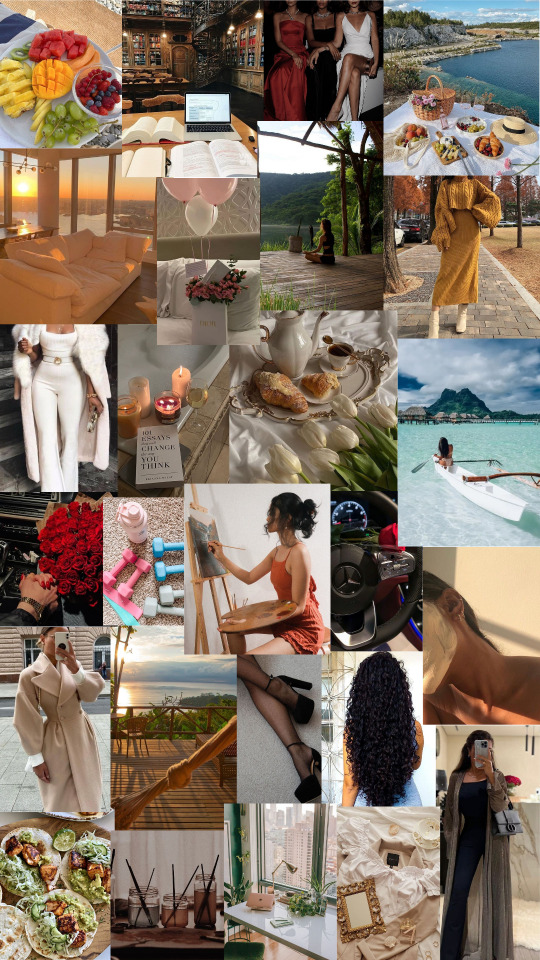

Jan. 1st 2022: Goals & Vision board

Fitness: Strong & healthy

Daily movement (yoga/dance) 20 min

Walk 1hr 5x / week

Resistance training 3x / week

Nutrition: Listen to what my body needs

More whole & anti-inflammatory foods

Weekly meal prepping

Veggies & protein with each meal

Self-care: Pampering the self

Skincare (consistent with morning and night routines)

Haircare (style curls weekly,

Spa nights every 2 weeks (nails, baths, scrubs, waxing, masks, trim hair, etc)

Aesthetics: more bold, more creative, more Me.

New hairstyle 2x / month

Same clothes, new outfits 2x / month

Step up eyebrow & lip game

Financial: Money is a tool, not the goal

Finish e-com modules by March 1

Remote part-time through Act

Learn to invest with TFSA

Academics: I am smart. Now I gotta be disciplined.

11.0 CGPA in all classes

Study 2hr/day Monday-Friday (not including watching lectures)

Complete assignments & papers in advance

Personal Enrichment: Stimulate the mind

Read 1 book / month (any genre)

Study Italian

Research topic of interest & record thoughts monthly

Wellness & Creativity: For the Soul

Journaling 10min / night

Morning meditation 10min / day

Canva or watercolour 1hr / week

Social media: Connection vs Disconnection

Limit unnecessary screen time 2hr / day

Use apps more intentionally

Unfollow / unfriend accounts, pages & people that no longer align with me

Adult things : Miscellaneous

Move back near university

Take driving exam

Get new passport

Get life insurance

Relationships :

Maintain firm boundaries

Invest in healthy, respectful, balanced connections

Release those (family, friends, etc.) that do disturb my peace

21 notes

·

View notes

Text

this isn't a fully fleshed out thought so don't aim for the jugular or anything. but I feel like there's an intersection btwn shit like Pink Sauce (and other failed startups/online businesses, even ones run by celebrities) and the lack of education about what a business actually takes, vs the constant barrage of individualist, capitalist messaging that encourages anyone and everyone to monetize their free time, capitalize on their heartfelt hobbies and skills, and Start Your Own Small Business Anyone Can Do It Get A Side Hustle It'll Be So Easy-- and specifically the way this message is accelerated and spread thru modes like TikTok.

Like I have been, so far, unable to STOP the constant rapid fire of everyone I've ever met oh so helpfully suggesting I start selling shit online to make a little extra cash. I'm sure many of you have, too. Ever since ebay and paid online surveys became a thing I have not heard the end of this shit. And I don't even use TikTok.

A lot of us already have a loose grasp on the lack of education (esp in America) vs "TikTok spreading information as reliably as a playground game of telephone," but plenty of people still don't?? Especially people who rely on apps like that as their main source of online socialization/news.

I'm not saying the onus wasn't on Pink Sauce Gal to figure that stuff out. I'm not absolving her of responsibility. I'm just saying I can absolutely see a generous read of this situation. I can absolutely see how one smalltime chef who has worked so hard for years just got seduced by this fake American Dream promise of "sell your product, anyone can do it, ALL you have to do is TRY real hard!!" not realizing what she was up against because she had no way to know, no one showing her where to start, no frame of reference for everything she even needed to know later. Just thousands and thousands of people asking to try her sauce.

Truly, getting in over your head is something which anyone can, in fact, do, and very easily. Idk about starting a whole business. But I don't think I know ANYONE who would be able to resist that many people screaming "TAKE MY MONEY" after going viral.

I finally caved and started trying to sell my art on Etsy as a a proper "small business" last year, after decades of people pushing me to do that for all of the above listed reasons. And I got relatively lucky. I had lots of friends avidly supporting me and I made several hundred dollars right away which is pretty cool.

And despite the fact I had help and was fairly successful, despite the fact that art is fairly straightforward and I didn't even necessarily have to look into legalities, there were TONS of other things I was NOT prepared for and which were NOT, in fact, "just monetizing my free time so easy omg." It turns out running a small business IS STILL RUNNING A BUSINESS and there are dozens upon dozens of things you simply can't foresee if you're not, y'know, a business owner already.

But there is no guidebook for the new, average seller, no neat how-to, no clean checklist to run down of topics you need to be well versed in before you start; unless you can afford to go to university for business, small business folks are often kinda just handling these things as they come up. You see a lot of this in art spaces which are a lot more forgiving in terms of figuring out your weird safety issues, packaging, insurance and shipping, how to handle returns and fussy customers and broken pieces.

Food safety is not nearly so forgiving. But that still hasnt stopped everyone and their fucking cousin, my whole LIFE, from suggesting that I Just Open A Bakery Or Sell My Pretty Pastries OnLine after seeing me stand near a stove for 5 minutes. "People would love it you'd make so much money!!!!" Not one of those people ever stops and asks about food safety and inspections and shit. They're just so chock full of good ideas, though. Hm.

After trying my hand at art sales and realizing even That was beyond my ken, I kindly say, Fuck Off About How Anyone Can Do This, actually. That's a lie just as much as the overarching image of pulling yourself up by your bootstraps. Not everyone is cut out for every type of work and that's just the fucking way it is.

If family wants to buy cookies from me or commission art from me Ill gladly accept a tip, but I don't do that stuff to make a quick buck, AND everything everyone ever told me about selling art was also misleading bc, shockingly, none of the people suggesting it to me had ever tried it.

Well, I have now, and it's not actually so easy that just anyone can do it.

I'm just anyone and I couldnt do it.

I also totally and completely understand why anyone, in THIS economy, might be compelled beyond their abilities by some of those same messages. I can understand how a woman with a solid capability to cook might think "Im so good at the rest, surely I can handle the business side of this, too."

But there are REASONS why management, quality control, salespeople and chefs all become separate jobs when a business grows. Again I'm not saying Pink Sauce is fine or whatever, like sorry babe but I wouldn't try that crap if you paid me ("honestly it has its own taste"? Ok uh. bye).

But I do sympathize with the speed at which it became a meme, and how she couldn't learn fast enough to keep up with what was, seemingly, a business opportunity-- one the likes of which EVERYONE IS CONSTANTLY TALKING ABOUT. Like basically the whole country was telling her that's what it was and not everyone is OSHA-minded like me and my friends here on Tungler dot com.

I mean I think there's also ABSOLUTELY something to be said about this whole tangle of issues, and how very relatedly to all of it, rage bait and misinformation is actually MORE PROFITABLE than a genuine product in many cases because of the engagement it generates (ie. Every person who can't stand to let someone be wrong online and who has to comment every single thing wrong with this video. You, yes you. You're actually helping the content creators you hate so much w that shit. Don't engage. Don't use the dislike button. The worst disdain in this day and age is No Engagement Whatsoever). But arguably that is just as viable of a "business opportunity" as sales in this day and age.

Anyway I suppose you could read Pink Sauce as something meant to generate fame and discussion this way also, but I don't really know and I'm not making a sweeping statement either way. In either case I can see how someone would be enticed by the siren song of internet virality providing income. I don't know this lady, I don't use TikTok, I just see these wider patterns and how individuals fall prey to their machinations and I think, "is that something?" And then I think, "maybe we should stop encouraging everyone to constantly monetize everything they do every waking minute of the day all the time? Cus sometimes it doesn't work out? And look, it's ok for people to have different interests and means of income? And also it's ok for some people to just have hobbies w/o making it a whole thing?" But I am no scholar, merely a guy

1 note

·

View note

Text

Navigating Life Insurance: Finding the Best Policy for Your Needs

In today's uncertain world, having the right life insurance policy is paramount for securing the financial future of your loved ones. With countless options available, finding the best life insurance policy can seem daunting. However, armed with the right knowledge, you can make an informed decision that provides peace of mind and protection. In this article, we'll explore the key factors to consider when searching for the best life insurance policy tailored to your unique needs.

Understanding Your Needs: Before delving into the myriad of life insurance options, it's crucial to assess your financial situation and long-term goals. Consider factors such as your age, income, debts, dependents, and future expenses. Are you looking for coverage to replace lost income, cover mortgage payments, or fund your children's education? Understanding your needs is the cornerstone of selecting the right policy.

Term vs. Permanent Insurance: One of the first decisions you'll encounter is choosing between term and permanent life insurance. Term life insurance offers coverage for a specific period, typically 10, 20, or 30 years, providing a death benefit if you pass away during the term. It's an excellent option for those seeking affordable coverage for a set duration. On the other hand, permanent life insurance, such as whole life or universal life, provides coverage for your entire life and includes a cash value component that grows over time. While it tends to have higher premiums, permanent insurance offers lifelong protection and can serve as a valuable investment tool.

Comparing Policies: With a clear understanding of your needs and the types of insurance available, it's time to compare policies from different providers. Look beyond the premiums and delve into the policy features, riders, and benefits offered by each insurer. Consider factors such as the insurer's financial strength, customer service reputation, and claims-paying ability. Additionally, pay attention to any exclusions or limitations that may impact your coverage.

Seeking Professional Guidance: Navigating the complexities of life insurance can be overwhelming, especially for those unfamiliar with the industry. Consider seeking guidance from a licensed insurance agent or financial advisor who can provide personalized recommendations based on your unique circumstances. An experienced professional can help you evaluate your options, understand the fine print, and make an informed decision.

Conclusion: Choosing the best life insurance policy requires careful consideration of your financial situation, goals, and preferences. By understanding your needs, comparing policies, and seeking professional guidance, you can find a policy that offers the right balance of coverage and affordability. Remember, life insurance is not one-size-fits-all, so take the time to explore your options and make a decision that provides security and peace of mind for you and your loved ones.

0 notes

Text

Group life insurance vs. individual life insurance; what is the difference?

A life insurance policy is a contract between an individual (the policyholder) and life insurance companies in Sri Lanka. In exchange for regular premium payments, the insurance company agrees to provide a specified amount of money to the designated beneficiaries upon the death of the insured person. This pay out, known as the death benefit, is intended to provide financial support to the beneficiaries, helping them cover various expenses such as funeral costs, mortgage payments, debts, and living expenses. Hence it is important that you choose the best life insurance company in Sri Lanka, when looking to get one of these policies.

Life insurance policies come in various forms, but the two main types are:

Term Life Insurance: This type provides coverage for a specified term, such as 10, 20, or 30 years. If the insured person dies during the term, the beneficiaries receive the death benefit. If the policyholder survives the term, there is no pay out, and the coverage typically needs to be renewed at a higher premium.

Permanent Life Insurance: This type provides coverage for the entire lifetime of the insured person. It also includes a cash value component that grows over time and can be accessed by the policyholder. Permanent life insurance includes whole life, universal life, and variable life insurance.

The importance of having a life insurance in Sri Lanka can be understood from various perspectives:

Financial Protection: Life insurance provides financial protection to your loved ones in the event of your death. The death benefit can help replace lost income, cover outstanding debts, and maintain the financial well-being of your family.

Estate Planning: Life insurance can play a crucial role in estate planning, helping to ensure that your assets are distributed according to your wishes. It can provide liquidity to cover estate taxes and other expenses.

Debt Repayment: If you have outstanding debts, such as a mortgage or loans, a life insurance policy can be used to pay off these debts, preventing them from becoming a burden on your family.

Funeral Expenses: Funerals can be expensive, and a life insurance pay out can help cover the costs associated with a funeral and related arrangements.

Legacy Planning: Life insurance allows you to leave a financial legacy for your loved ones, ensuring that they have the resources they need to maintain their quality of life.

While not everyone may need life insurance, it can be particularly important for individuals with dependents, such as spouses, children, or ageing parents. It is essential to carefully assess your financial situation and needs to determine the appropriate type and amount of coverage for your specific circumstances.

What is the difference between group life insurance and individual life insurance?

Group life insurance and individual life insurance are two distinct types of life insurance policies that differ in their structure, purpose, and how they are obtained. Here are the key differences between the two:

Group Life Insurance:

Coverage for a Group: Group life insurance is typically offered by employers or organisations to a large group of individuals, such as employees or members of an association. It is a form of coverage that extends to multiple people under a single policy.

Simplified Underwriting: Group life insurance often involves simplified underwriting processes, meaning that individual members of the group may not need to undergo a detailed medical examination or provide extensive health information. The coverage is usually available to all members of the group, regardless of their individual health conditions.

Employer-Sponsored: In many cases, group life insurance is offered as part of an employee benefits package. Employers may pay for a basic level of coverage, and employees may have the option to purchase additional coverage at group rates.

Lower Premiums: Group life insurance policies typically have lower premiums compared to individual policies because the risk is spread across a large group of people. However, the coverage may be more limited and may not be customised to individual needs.

Portability: In some cases, group life insurance coverage may be portable, allowing individuals to retain coverage if they leave the group (e.g., employment) by converting the group policy to an individual policy or through other options provided by the insurer.

Individual Life Insurance:

Personalised Coverage: Individual life insurance is a policy purchased by an individual for their own benefit or for the benefit of their chosen beneficiaries. It is tailored to the specific needs and circumstances of the policyholder.

Comprehensive Underwriting: Individual life insurance policies often involve a more detailed underwriting process, which may include a medical examination and a thorough review of the applicant's health history, lifestyle, and other factors. The premium is determined based on the individual's risk profile.

Ownership and Control: The policyholder has full ownership and control over an individual life insurance policy. They can choose the coverage amount, beneficiaries, and policy features based on their personal preferences and financial goals.

Flexibility: Individual life insurance policies offer more flexibility in terms of coverage options. Policyholders can choose from various types of policies, such as term life, whole life, universal life, and variable life insurance, each with its own features and benefits.

Cost: While individual life insurance may have higher premiums compared to group life insurance, it provides more comprehensive and customisable coverage tailored to the individual's needs.

Group life insurance is often provided by employers or organisations to cover a group of individuals, with simplified underwriting and lower premiums, while individual life insurance is personally owned, involves more detailed underwriting, and offers greater customisation and flexibility. Both types of insurance aim to provide financial protection to beneficiaries in the event of the policyholder's death.

0 notes

Text

What is a Corridor in Relation to a Universal Life Insurance Policy

Corridor in Relation to a Universal Life Insurance Policy

Introduction to Universal Life Insurance

Universal life insurance is a versatile financial tool that provides coverage for individuals while offering flexibility in premium payments and potential cash value accumulation. Understanding the components of a universal life insurance policy is crucial for maximizing its benefits and making informed decisions.

Understanding Life Insurance Policy Components

Before delving into the concept of a corridor in universal life insurance, it's essential to grasp the basics of life insurance policies. There are various types of life insurance, including term life, whole life, and universal life. Universal life insurance stands out for its flexibility and customizable features.

What is a Corridor in Universal Life Insurance?

In the realm of universal life insurance, a corridor refers to the gap between the policy's cash value and the death benefit. This corridor plays a significant role in how the policy operates and determines the level of coverage provided.

How Corridor Works in Universal Life Insurance Policies

The corridor in a universal life insurance policy affects several aspects of the policy's functionality, including premium payments, cash value accumulation, and death benefit payouts. Understanding how the corridor works is essential for policyholders to make informed decisions regarding their coverage.

Advantages of Corridor in Universal Life Insurance

One of the primary advantages of the corridor in universal life insurance is the flexibility it offers in premium payments. Policyholders can adjust their premiums within certain limits, allowing them to tailor their coverage to their changing financial circumstances.

Additionally, the corridor provides an opportunity for cash value growth within the policy. As premiums are paid and interest is credited to the cash value, the corridor allows for the potential accumulation of funds that can be accessed by the policyholder during their lifetime.

Furthermore, the corridor enables policyholders to customize their coverage by adjusting the death benefit amount. This flexibility ensures that the policy meets the evolving needs of the insured and their beneficiaries.

Challenges Associated with Corridor in Universal Life Insurance

While the corridor offers flexibility and customization options, it also presents challenges for policyholders. Managing the policy effectively requires regular review and monitoring to ensure that it continues to meet the insured's financial objectives.

Market conditions can also impact the performance of a universal life insurance policy with a corridor. Fluctuations in interest rates and investment returns can affect the cash value growth and overall stability of the policy.

Corridor Management Strategies

To navigate the complexities associated with the corridor in universal life insurance, policyholders can employ various management strategies. Regularly reviewing the policy, adjusting premiums and benefits as needed, and monitoring cash value growth are essential steps to ensure that the policy remains on track to meet the insured's goals.

Corridor vs. Non-Corridor Universal Life Insurance

It's essential to differentiate between corridor and non-corridor universal life insurance policies. Non-corridor policies typically have a smaller gap between cash value and death benefit, which may impact premium payments and policy performance.

Importance of Understanding Corridor for Policyholders

Understanding the concept of a corridor is crucial for universal life insurance policyholders. By gaining insight into how the corridor affects premium payments, cash value accumulation, and death benefit payouts, policyholders can make informed decisions that maximize the benefits of their coverage.

Conclusion

In conclusion, the corridor is a fundamental concept in universal life insurance that influences various aspects of policy performance and functionality. By understanding how the corridor works and implementing effective management strategies, policyholders can optimize their coverage to meet their financial objectives and provide security for their loved ones.

FAQs

1. What is the primary function of a corridor in universal life insurance? The corridor in universal life insurance determines the gap between the policy's cash value and death benefit, impacting premium payments and policy performance.2. How can policyholders manage the challenges associated with the corridor?Policyholders can employ management strategies such as regular policy review, adjusting premiums and benefits, and monitoring cash value growth to effectively manage the challenges associated with the corridor.3. What distinguishes corridor from non-corridor universal life insurance policies?Corridor policies have a larger gap between cash value and death benefit compared to non-corridor policies, which may impact premium payments and policy performance.4. Why is it essential for policyholders to understand the concept of a corridor?Understanding the corridor is crucial for policyholders to make informed decisions regarding their coverage, ensuring that it aligns with their financial objectives and provides security for their beneficiaries.5. How can policyholders access the potential cash value growth within a universal life insurance policy?Policyholders can access the potential cash value growth within a universal life insurance policy by withdrawing funds or taking out policy loans, depending on the terms of the policy.

Read the full article

0 notes

Text

Life Insurance vs Health Insurance: Key Differences for Informed Choices

Planning for the future is a cornerstone of responsible living, and if you're a forward-thinker, considering Life and Health Insurance policies should be your next strategic move. Let's embark on a journey to comprehend the nuances of these policies, exploring the key differences that set Life Insurance and Health Insurance apart.

Understanding the Contrast of Life Insurance vs Health Insurance

Life insurance and health insurance serve disparate purposes, acting as financial safeguards in distinct scenarios. Here's a detailed breakdown of the differences:

FeaturesLife InsuranceHealth InsuranceCoverage TypeComprehensive, lifelong coverage, pays at policyholder's deathPrimarily covers medical expenses, health needsPremiumsFixed and flexible premiums, investment plans availableOnly fixed premiums, no investment, prioritizes medical needsDurationLong-term plan with fixed tenureShort-term plan, typically renewed annuallyTerminationUsually ends with policy expirationRenewed annually to ensure continuous health coverageBenefitsProvides financial protection to family upon policyholder's demiseCovers medical expenses and hospitalization during the policy termSurvival BenefitsOffers both survival and death benefits at the end of the insurance termNo survival benefits, focuses on addressing medical needs

Unveiling Life Insurance

Life insurance is essentially a contractual agreement between a policyholder and an insurance company, promising to provide the insured amount to the bereaved family after the policyholder's demise. This coverage serves as a pillar of financial stability for the entire family and supports future plans or investments.

Types of Life Insurance

- Whole Life Insurance: Featuring fixed premium payouts and tax-free, fixed sum assured, it is a cost-effective option with a lower risk profile.

- Universal Life Insurance: Blending investment and death benefits, this option offers flexible premiums and higher returns, albeit with increased risk.

Advantages and Disadvantages of Life Insurance

Pros - Cost-Effective: Less expensive than permanent policies.

Affordable Large Death Benefit: Provides substantial coverage at a reasonable cost.

Online Accessibility: Easy quotes and application process available online.

Convertible Policies: Some can convert to permanent policies without new medical exams.

Health-Based Premiums: Future premiums based on current health for convertible policies.

- Temporary Coverage: Ends once the term expires.

Cost Increase at Renewal: Buying a new policy at term end can be expensive.

Limited Options After Term: Difficulty securing new coverage if health declines.

No Cash Value: Lacks a cash value accessible during the policyholder's lifetime.

Decoding Health Insurance

Health insurance steps into action when health issues arise, requiring medical attention and hospitalization. Policyholders pay fixed premiums for health protection, and the coverage varies based on the chosen health insurance plan.

Types of Health Insurance

- Individual Health Insurance: Tailored for individual needs, covering medical expenses, illnesses, accidents, and emergencies.

- Family Floater Health Insurance: An umbrella coverage for all household members under one premium, addressing various medical expenses.

- Senior Citizens Health Insurance: Customized for those aged 60 and above, accounting for specific needs like domiciliary care and critical illnesses.

Advantages and Disadvantages of Health Insurance

Pros - Financial Security in Critical Illness

Cashless Hospitalization

Network Hospitals for Cashless Services

No Claim Bonus for Increased Sum Insured

Add-ons or Riders for Customization

Financial Protection in Case of Death or Disability

Peace of Mind and Focus on Quality Healthcare

Affordable Healthcare with Comprehensive Coverage

- High Costs, Especially for the Self-Employed

Pre-Existing Conditions Have Waiting Periods

Waiting Periods for Certain Benefits

Age-Dependent Increase in Premiums

Co-Pay Requirements for Insured Customers

Complexity in Comparing Coverage and Premiums

Life Insurance vs. Health Insurance

The decision to invest in life or health insurance hinges on individual needs. While life insurance ensures family financial security in the event of the policyholder's death, health insurance addresses medical expenses during the policyholder's lifetime.

Key Distinctions

- Why Invest?

- Life Insurance: Ensures family financial security in case of sudden death.

- Health Insurance: Shields against rising medical expenses, eliminating out-of-pocket costs.

- Core Benefit:

- Life Insurance: Pays the promised sum to the beneficiary.

- Health Insurance: Covers treatment expenses, subject to conditions.

- Additional Benefits:

- Life Insurance: Various add-ons like maturity benefits, surrender benefits, and loyalty additions.

- Health Insurance: Some policies provide free health check-ups, and no claim bonuses may apply.

- Types of Covers:

- Life Insurance: Individual and group covers, with plans like term, savings, child-related, and retirement.

- Health Insurance: Individual, family, and group coverage, including comprehensive plans and critical illness cover.

- Tax Benefits:

- Life Insurance: Under Section 80C and Section 10(10D) of the Income Tax Act.

- Health Insurance: Under Section 80D of the Income Tax Act.

In your financial portfolio, Life Insurance and Health Insurance play distinct roles. Making an informed decision based on your unique requirements will unlock the full potential of each.

The Benefits Unveiled

Benefits of Life Insurance Plans

- Financial security and protection.

- Tax-free payouts.

- Guaranteed death benefit.

- Tax benefits as per prevailing tax laws.

Both Life Insurance and Health Insurance are indispensable for those concerned about the future, family, and well-being. Health insurance safeguards your medical affairs, while life insurance ensures your family's security in your absence.

In the uncertain journey of life, it's prudent to protect yourself and your loved ones before it's too late. Both these insurance policies are crucial, and the choice between them is now a personal one. Consider your needs, weigh the options, and secure a better future for yourself and your family.

Read the full article

0 notes

Link

0 notes

Text

Whole Life vs Universal Life: Which Insurance Policy Is Right for You

Introduction

When it comes to life insurance, two of the most common options are whole life vs universal life and universal life policies. Both provide financial protection for your loved ones, but they differ in their features, benefits, and suitability for different needs. Understanding the key differences between these two policy types can help you make an informed decision about which one is the right fit for your specific circumstances.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the policyholder's entire lifetime, as long as premiums are paid. This policy type combines a death benefit with a cash value component that accumulates over time.

Key Features

Guaranteed Death Benefit: Whole life insurance policies offer a guaranteed death benefit that will be paid out to the beneficiaries upon the policyholder's death, regardless of when it occurs.

Fixed Premiums: Whole life insurance premiums remain the same throughout the lifetime of the policy, making budgeting and financial planning more predictable.

Cash Value Accumulation: A portion of the premiums paid into a whole life policy goes towards building a cash value that can be borrowed against or withdrawn in certain circumstances.

Dividend Payments: Some whole life insurance providers may pay dividends to policyholders, which can be received as cash, used to purchase additional coverage, or left to accumulate.

Advantages of Whole Life Insurance

Lifelong Coverage: Whole life insurance provides coverage that lasts for the policyholder's entire lifetime, as long as premiums are paid.

Stability and Predictability: The fixed premiums and guaranteed death benefit of whole life insurance offer a high degree of financial stability and predictability.

Tax-Deferred Cash Value Growth: The cash value component of a whole life policy grows on a tax-deferred basis, allowing for potential long-term wealth accumulation.

Loan Accessibility: Policyholders can borrow against the cash value of their whole life policy, if needed, for various financial needs.

Considerations for Whole Life Insurance

Higher Premiums: Whole life insurance premiums are generally higher than those of term life insurance, especially in the early years of the policy.

Limited Flexibility: Whole life insurance policies tend to have less flexibility in terms of adjusting coverage amounts or premium payments compared to other policy types.

Potential for Underperformance: The cash value growth in a whole life policy is not guaranteed and may underperform compared to other investment options.

Universal Life Insurance

Definition and Overview

Universal life insurance is a type of permanent life insurance that offers more flexibility than traditional whole life insurance. It combines a death benefit with a cash value component, but allows for more flexibility in premium payments and coverage adjustments.

Key Features

Flexible Premiums: Universal life insurance policyholders can adjust their premium payments within certain limits, allowing them to increase, decrease, or even skip payments as needed.

Adjustable Coverage: The death benefit of a universal life policy can be increased or decreased over time, based on the policyholder's changing needs and financial situation.

Cash Value Accumulation: The cash value component of a universal life policy grows on a tax-deferred basis, similar to whole life insurance.

Investment-Linked Cash Value: The cash value in a universal life policy is often linked to an underlying investment account, which can provide the potential for higher growth compared to a traditional whole life policy.

Advantages of Universal Life Insurance

Flexibility: The ability to adjust premium payments and coverage amounts makes universal life insurance more adaptable to changing financial circumstances.

Potential for Higher Cash Value Growth: The investment-linked cash value component of a universal life policy offers the potential for higher growth compared to the fixed cash value of a whole life policy.

Tax-Deferred Cash Value Growth: The cash value in a universal life policy grows on a tax-deferred basis, similar to whole life insurance.

Potential for Lower Premiums: In some cases, the flexible premium structure of a universal life policy can lead to lower overall premium costs compared to a whole life policy.

Considerations for Universal Life Insurance

Market Risk: The cash value growth in a universal life policy is tied to the performance of the underlying investment account, which can expose the policyholder to market risk.

Potential for Lapse: If premium payments are not made consistently, or if the cash value is used excessively, a universal life policy may lapse, leading to a loss of coverage.

Complexity: Universal life insurance policies can be more complex compared to whole life insurance, which may require more active management and monitoring by the policyholder.

Conclusion

When deciding between a whole life and a universal life insurance policy, it's important to consider your specific needs, financial goals, and risk tolerance. Whole life insurance offers a more stable and predictable approach, with a guaranteed death benefit and fixed premiums, while universal life insurance provides more flexibility in premium payments and coverage adjustments.

Ultimately, the right choice will depend on your individual circumstances and priorities. If you value long-term stability and the potential for cash value growth, a whole life policy may be the better fit. On the other hand, if you prioritize flexibility and the potential for higher cash value growth, a universal life policy could be the more suitable option.

It's always recommended to consult with a financial advisor or insurance professional to help you navigate the nuances of each policy type and make an informed decision that aligns with your unique financial needs and goals.

0 notes

Text

How Does Life Insurance Work: A Comprehensive Guide

How Does Life Insurance Work: Life insurance stands as a cornerstone of financial planning, offering security and peace of mind to individuals and their families. But how exactly does life insurance work?

In this comprehensive guide, we’ll delve deep into the mechanics of life insurance, exploring its purpose, types, processes, benefits, and much more.

How Does Life Insurance Work

Life…

View On WordPress

#cash value life insurance#how does life insurance work#how life insurance works#insurance#life insurance#life insurance 101#life insurance explained#life insurance policy#permanent life insurance#term life insurance#term vs whole life insurance#types of life insurance#universal life insurance#what is life insurance#what is life insurance and how does it work#what is term life insurance#whole life insurance#whole life insurance explained

0 notes

Text

Understanding the Benefits of Term Insurance: A Comprehensive Guide

In a world loaded up with vulnerabilities, guaranteeing the monetary security of your friends and family is a principal concern. This is where term insurance arises as a solid arrangement, offering security and genuine serenity to people and their families. In this article, we'll dive deeply into term insurance, investigating its elements, advantages, and why it's a vital part of any extensive monetary arrangement. Be that as it may, before we plunge into the subtleties, for additional significant bits of knowledge on insurance and related subjects, do visit Bimabandhu.in.

Unraveling Term Insurance: A Brief Overview

Term insurance is a type of extra security that gives coverage to a particular period known as the "term." Unlike entire life coverage, which covers you for your whole lifetime, term insurance offers assurance for a predetermined span, ordinarily going from 5 to 30 years. In case of the policyholder's end during the term, the assigned recipients get a passing advantage payout. In any case, assuming the policyholder endures the term, there is no development esteem or payout.

The Advantages of Term Insurance

Moderateness: Term insurance is eminent for its expense viability, settling on it an optimal decision for those looking for significant coverage on a restricted spending plan. The charges are lower contrasted with long-lasting life coverage approaches.

Adaptability: Term insurance allows you to pick the strategy span per your necessities. Whether you need coverage until your kids graduate or your mortgage is paid off, term insurance can be customized to match your particular achievements.

Basic and Straightforward: The idea of term insurance is clear. You pay a customary premium, and consequently, your recipients get the predetermined payout in the event of your end during the strategy term.

Supplemental Coverage: Term insurance can likewise be utilized to enhance different types of insurance. For example, the boss gave coverage. This guarantees that your friends and family are sufficiently safeguarded regardless of whether your conditions change.

Decoding Term vs. Whole Life Insurance

Comprehending the distinctions between term insurance and whole insurance, settling on an educated conclusion about your insurance needs.

Term Insurance:

Provides coverage for a specific period.

Offers lower premiums.

Focuses solely on the death benefit.

No cash value or investment component.

Whole Life Insurance:

Offers lifelong coverage.

Involves higher premiums.

Combines a death benefit with a savings/investment component.

Accrues cash value over time.

The Significance of Bimabandhu.in

As you dig further into the insurance universe, you could have questions or look for additional insurance blogs. This is where Bimabandhu.in acts the hero. With an abundance of data, blogs, and guides, the stage fills in as your insurance friend, assisting you in exploring the intricacies of insurance effortlessly. Whether you're a fledgling searching for insurance fundamentals or an accomplished individual needing to investigate progressed ideas, Bimabandhu.in takes special care of all your insurance-related questions.

Conclusion

In conclusion, term insurance remains as an immovable gatekeeper of your family's monetary prosperity, offering significant security during basic times of life. Its moderateness, adaptability, and straightforwardness settle on it a well-known decision for people from varying backgrounds. As you consider getting your friends and family's future, remember that term insurance can be customized to line up with your one-of-a-kind necessities. What's more, for additional bits of knowledge into insurance and plenty of different subjects, make a point to visit Bimabandhu.in.

0 notes

Text

Life Insurance in Texas

There are 4 main types of life insurance in Texas. Use TexasInsurance.org/life to know more about the types and uses of life insurance.

Visit our website:

1 note

·

View note

Text

WHAT YOU NEED TO KNOW ABOUT LIFE INSURANCE VS. ACCIDENTAL DEATH & DISMEMBERMENT (AD&D)

When it comes to protecting your family, there are a lot of options to consider. One important decision is whether to purchase life insurance or accidental death and dismemberment (AD&D) insurance. Check our guide to understand the claim amount for personal accidental insurance. Both have their advantages, but it’s important to understand the difference between the two before making a choice. Here’s a quick rundown of what we will cover:

Life insurance is designed to provide financial protection for your loved ones in the event of your death.

AD&D, on the other hand, is designed to provide financial protection in the event of an accident that results in death or dismemberment.

Which one is right for you? It depends on your individual needs and circumstances.

Talk to a financial advisor to learn more about life insurance and AD&D so you can make the best decision for yourself and your family.

Life insurance vs AD&D

Many people might think that accident insurance, life insurance, and its subsidiary accident, death, and dismemberment (AD&D) are the same things but they’re actually quite different.

Life insurance acts as a financial safety net for families who may face financial instability when the breadwinner passes away. It usually pays out a lump sum of money to survive expenses while they adjust to their new situation.

AD&D on the other hand is accident insurance specifically designed to cover accidental death or injury to an individual. It provides coverage if their accident results in serious injury, death, or dismemberment.

Life insurance

Life insurance is meant to provide peace of mind that if something were to happen to you, your family will be taken care of financially. With life insurance, it could mean that if you were to pass away prematurely due to an accident or illness, a lump sum payment from the policy would help your loved ones bridge any sudden financial gaps during a difficult time.

It’s also important to note that accident insurance is another type of coverage that can help protect you and your family by helping pay medical costs related to any accident while they deal with the emotional burden it might cause. Life insurance is designed to protect your family’s financial freedom and peace of mind in times of bereavement or accident.

AD&D

Accidental Death and Dismemberment (AD&D) insurance is a type of accident insurance designed to provide protection and financial security in case of an accident resulting in death or dismemberment. It’s helpful to think of it as “insurance to the max,” because it provides extra coverage that is not automatically included in standard life insurance policies which can help make sure you have adequate financial protection in specific situations. Whether you’re getting ready to start a family, heading off to college, or entering retirement, AD&D may be just what you need for extra financial peace of mind.

Deaths excluded from AD&D coverage

Though AD&D is a type of accident insurance, it does not cover all types of deaths. Examples of deaths excluded from this policy are death due to natural causes, illness or suicide. It is important to understand the specific exclusions listed in your policy before purchasing AD&D coverage.

Something to also note is that AD&D policies typically include a maximum benefit limit and will not pay out more than the amount specified in the policy.

Types of term and permanent life insurance policies

Life insurance comes in two varieties: term and permanent life insurance. Term life insurance is a type of policy that offers coverage for a specific period of time, usually 10 to 30 years. This can provide financial protection when you need it most such as while raising young children or going through a major life event. Permanent life insurance is designed to provide coverage for your entire life with options such as whole and universal life insurance. This type of policy builds cash value, and you can borrow against the cash value if needed.

So which one is right for you? It depends on your individual needs and circumstances

When it comes to finding the right option for you, the best approach is to assess your own needs and consider your individual circumstances. For example, you may want to factor in any special features that may help make your day-to-day life easier or more efficient. You will also need to decide if a particular product fits into your budget and how much you would use it. Taking all this into consideration should help you determine the best choice for you. Ultimately, no one else can make this decision on your behalf, so it’s important to take some time and do what makes sense for you!

Talk to a financial advisor

Knowing that you need life insurance and AD&D is a great first step in protecting yourself and your family. But to ensure that you are making the best decision for you and your loved ones, it’s important to talk to an experienced financial advisor. A qualified financial advisor can assess your current financial health and future objectives, as well as go over different life insurance options so you can make the most informed decision possible. They also have access to special offers or discounts on plans many individuals don’t know about. Taking the time to chat with a financial advisor can improve your knowledge of life insurance and AD&D while providing essential security for your family.

Making sure that you and your family are protected in the event of a tragedy is incredibly important. Life insurance and AD&D are two great options to consider, but they both have their own pros and cons that should be taken into account. Ultimately, it’s a decision that should be made based on your individual financial situation and goals for the future. It can be tough trying to decide between the two, so don’t hesitate to reach out for guidance from a reputable financial advisor. With their professional insight, you can come up with an optimal solution that best meets your needs without feeling overwhelmed or confused. Don’t leave your loved ones vulnerable, make sure you find the right coverage today!

Originally Published At: https://www.thejordaninsuranceagency.com/sb/life-insurance-vs-accidental-death-dismemberment/

0 notes

Text

3 Things to Know About Different Kinds of Basic Life Policies

3 Things to Know About Different Kinds of Basic Life Policies

3 Things to Know About Different Kinds of Basic Life Policies

No one wants to think about life insurance, but it’s essential if you’re going to protect your family.

106 million Americans lack sufficient life insurance coverage, mostly due to a lack of knowledge on the subject. It’s never too early to start thinking about different kinds of basic life policies, which is why we’re here today.

In this post, we’re going to tell you 3 things you need to know about different kinds of life insurance. Keep reading, and you’ll see that life policies don’t just protect your family’s finances; they also put your mind at ease.

1. Term Vs Whole Life Policies

There are two main types of life insurance that most Americans get: term and whole life. Term life insurance has you covered for a specific amount of time, paying the same rates every month. Should you pass away during the term (10-30 years usually), your beneficiaries will receive a payout.

Whole life policies are the simplest to grasp, as they provide coverage for your entire life. Unlike term insurance, whole life includes a cash component, so some of your premium money is put in a cash value account that grows over time and is exempt from taxation.

The biggest difference between these two types of insurance is the cash value. Once your term policy expires, it has no cash value. You can convert your term policy into a whole life policy if you choose.

2. Universal Life Insurance

Universal life insurance is a sort of middle ground between term and whole life insurance. Like whole life, it’s a permanent life insurance policy with a cash value, but the premiums are flexible.

What makes universal life insurance policies desirable is that they allow you to alter the amount that you pay each month to suit your current financial situation. If you have a child, for instance, you may decide to pay less per month, but you may need to make it up down the road.

3. Final Expense Insurance

Older people that haven’t paid into an insurance policy may decide on final expense insurance, also known as burial insurance for seniors. This prevents your loved ones from having to cover the costs of your burial and funeral expenses.

You can take this one step further by getting burial insurance with no waiting period. With other policies, a certain amount of time needs to pass before anything can be withdrawn. With a no waiting period designation, however, this doesn’t apply.

Choosing Between the Kinds of Basic Life Policies

These are a few of the most prominent kinds of basic life policies. Which you choose will depend on what stage of life you’re in and what your financial stability looks like. If you’ve been without insurance for your entire life, it’s important to know that it’s not too late to help your loved ones out.

To discuss your options with a dedicated professional, contact us at USA Life Insurance Services. We’re an independent agency that specializes in affordable final expense insurance. Let us help you put your mind at ease so you can enjoy your life.

https://ifttt.com/images/no_image_card.png

https://usalifeteam.com/3-things-to-know-about-different-kinds-of-basic-life-policies/?utm_source=rss&utm_medium=rss&utm_campaign=3-things-to-know-about-different-kinds-of-basic-life-policies

https://ifttt.com/images/no_image_card.png

https://usalifeteam.wordpress.com/2023/01/07/3-things-to-know-about-different-kinds-of-basic-life-policies/

0 notes