#unpaid retirees benefits

Text

EDITORIAL: Fuelling public service corruption with unpaid retirees benefits

Retirement, which ordinarily is a phase in life redolent with a sense of fulfilment and happiness in other parts of the world, is a nightmare in Nigeria. Workers in the public services in the states of the country retire without being paid their pensions and gratuities for about a decade. Many have slumped and died in endless queues, while undergoing a series of verifications and documentation…

View On WordPress

#corruption#EFCC#Headline1#ICPC#News#Nigeria Union of Pensioners (NUP)#Nigerian news#PREMIUM TIMES#premium times news#public service#unpaid retirees benefits

0 notes

Text

Working in France

In this article, I examine how working conditions and their impact on French living compare to those of the United States.

While I have been a citizen of the U.S.A. for my entire life and have first-hand experience of the working conditions and work benefits, I have never lived in France. The knowledge used to make the comparisons here comes from quantitative reports and first-hand accounts.

Benefits and Pay

Compared to the U.S., workers in France have wonderful benefits. Full-time work weeks are usually 35 hours, of course varying by industry, and employees are assured about 25 days of paid vacation per year, not including holidays. When sick, an employee is guaranteed 50% of their daily pay for up to six months, as long as they have worked there for at least three.

The U.S. currently has no federal minimums for sick leave. However, the Family and Medical Leave Act (FMLA) applies to many companies and public agencies, and mandates twelve weeks of unpaid leave “for certain medical situations”, if an employee has worked for at least twelve months 7.

On average, a U.S. worker has about 11 paid vacation days every year 4. Paid vacation leave is not a legal requirement.

Maternity leave in France is generally around 16 to 48 weeks of paid time off, while paternity leave is up to 28 days of paid leave 2. In the case of paternity leave, employers must pay for three days and social security pays for the rest. In the United States, only 13 states have mandatory amounts of paid parental leave. The time off ranges from 6 to 8 weeks 3. In both countries, the earnings during time off largely depend on what the employee was making during regular work hours.

French health insurance covers employees, retirees, the self-employed, and the unemployed 5. It generally covers 70%-80% of medical fees, or 100% if one has a major illness 6. Major illnesses include Parkinson’s disease, stroke, Crohn’s disease, cancers, diabetes, bipolar disorder, and serious anxiety disorders, as well as many other conditions. Many citizens have secondary insurance to help with what isn’t covered, which is generally around €14-30 per month.

Most health insurance in the United States is private and depends on the agreements negotiated between employers and insurance companies. On average, a U.S. citizen pays around $117 a month through employer health insurance, or about $477 per month if they cannot enroll through their employment 17.

One might qualify for Medicaid or the Children’s Health Insurance plan depending on household size and income. For example, a single person making up to $1,677 each month would qualify for Medicaid and not have to pay a monthly premium or copays 8. Usually, one also has to have lived in the United States for at least five years to qualify, and applying and receiving Medicaid approval can take over six months and be very difficult to navigate 9.

It’s Not Perfect

While employees are more secure in France, they do still face some of the issues that American workers do.

The French minimum wage, as of 2023, is €11.27 before taxes. This is about €1,600 per month. The estimated average cost of living is about €1,027, not including rent 11. As of 2018, about 40% of people also had rent costs to pay 12. It is generally less expensive to live in France than in the United States, but many people there are also facing the housing crisis and inflated costs of basic living.

About 17% of France’s population makes minimum wage 15. This compares to about 1.4% of U.S. workers 16, but the minimum wage there is $7.25 compared to €11.27 in France (12.23 USD).

While the average monthly salary in France is around €2,340 (varying by region) 13, about 14.6% of the population lived in poverty in 2020 14.

Overall, the employee benefit requirements and federal policies of France reflect an investment in its people and a belief in basic rights. Compared to the United States, the government puts effort into taking care of its citizens. They are facing cost of living issues and have not increased the minimum wage to reflect that, but still beat the U.S. in wage minimum, health coverage, and paid time off.

If you have personal experiences relating to French employee benefits and wages, please feel free to add what information you can!

Additional Resources

1. https://ec.europa.eu/social/main.jsp?catId=1110&langId=en&intPageId=4535

2. https://www.safeguardglobal.com/resources/employee-benefits-in-france/

3.https://bipartisanpolicy.org/explainer/state-paid-family-leave-laws-across-the-u-s/#:~:text=Thirteen%20states%20and%20the%20District,are%20not%20yet%20in%20effect.

4. https://www.forbes.com/advisor/business/pto-statistics/

5.https://www.commonwealthfund.org/international-health-policy-center/countries/francef

6. https://www.internations.org/france-expats/guide/healthcare

7. https://www.dol.gov/general/topic/workhours/sickleave

8. https://njfamilycare.dhs.state.nj.us/who_eligbl.aspx

9.https://hnwlaw.com/elder-law/applying-medicaid/medicaid-application-process-in-new-jersey/

10. https://www.eurodev.com/blog/understanding-employee-benefits-in-france

11. https://www.numbeo.com/cost-of-living/country_result.jsp?country=France

12. https://www.brookings.edu/articles/france-rental-housing-markets/

13. https://joinhorizons.com/countries/france/hiring-employees/average-salary/

14. https://www.statista.com/statistics/460446/poverty-rate-france/

15.https://www.lemonde.fr/en/opinion/article/2024/01/22/too-many-french-workers-are-on-minimum-wage_6455732_23.html

16.https://www.statista.com/statistics/188206/share-of-workers-paid-hourly-rates-at-or-below-minimum-wage-since-1979/17.https://www.usatoday.com/money/blueprint/health-insurance/how-much-is-health-insurance/

#France#employment#research#article#politics#working class#resources#minimum wage#fmla#paid leave#family leave#maternity leave#mental health#benefits#health#medicare#paternity leave#parental leave#sick leave#comparison#united states

1 note

·

View note

Link

0 notes

Link

0 notes

Text

Open SmartNews and read "Social Security benefits could be the first to go in a matter of days if the US defaults — and retirees will ‘really suffer’ if Congress doesn’t raise the debt ceiling by then" here: https://share.smartnews.com/YRyyF

To read it on the web, tap here: https://share.smartnews.com/NDEvc

Why is it always the people? It should be the President and every member of Congress goes unpaid with no benefits!!!

0 notes

Text

What Are the Pros & Cons of a Reverse Mortgage

Did you know that a reverse mortgage is a loan that allows elderly homeowners to convert the equity in their home into cash? It can be a great way for seniors to supplement their retirement income, but it's only right for some.

Let's explore some pros and cons of taking out a reverse mortgage. There are many professional available to assist you with reverse mortgage services. So, count on them according to your requirements.

Pros of a Reverse Mortgage

Tax-Free Income –

One of the biggest benefits of a reverse mortgage is that any money you receive is considered loan proceeds and not income, so you won't have to pay taxes on it. This makes reverse mortgages an excellent source of tax-free income for seniors looking for additional ways to fund their retirement.

No Monthly Payments –

Unlike traditional mortgages, reverse mortgages don't require monthly payments. It means you don't have to worry about making payments on your loan every month, giving you more financial freedom as you age.

Access to Equity –

A reverse mortgage gives you access to the equity in your home without having to sell it or take out a second mortgage. This can be particularly beneficial if your home's value has increased since you purchased it, allowing you to tap into this newfound wealth without having to move or part with your property.

Immediate Cash –

If you need cash quickly, a reverse mortgage can provide that. You can use your loan for whatever purpose you desire—home improvements, medical bills, or other expenses—without waiting for months or even years, like with different types of loans.

Peace of Mind –

Finally, taking out a reverse mortgage gives you peace of mind knowing that if anything happens and your finances take a turn for the worse, you'll still have access to an emergency fund in the form of your home's equity should the need arise.

Should I Get a Reverse Mortgage? 5 Reasons to Consider It

1. You Don't Want to Sell Your Home

Many retirees don't want to sell their homes because they have strong emotional ties or are concerned about where they will live if they sell. With a reverse mortgage, you can stay in your home while still getting access to the money tied up in its equity.

2. You Need Cash Now

A reverse mortgage can be an attractive option if you need money but want to avoid taking out a loan or selling your home. Reverse mortgage services is a loan that allows you to borrow against your home's equity without making any monthly payments until you move out or pass away. This can be helpful if you need cash now and want to avoid the burden of making payments on a traditional loan each month.

3. You Need Money for Healthcare Expenses

Reverse mortgages are often used by seniors who need money for healthcare expenses that aren't covered by insurance or other sources of income. Taking out a reverse mortgage could provide relief from high medical bills and related care costs.

4. You Want Flexibility with How You Use the Funds

A great thing about reverse mortgages is that there are zero restrictions on how you use the funds—you can use them however you wish! Whether paying off debts, traveling more, or spending extra money each month, the decision is all yours regarding how you spend the funds from a reverse mortgage loan?

5. You Want Peace of Mind Knowing Your Home Is Protected

Reverse mortgages are federally insured so that if something happens and the lender goes out of business, you will still be protected and won't have to worry about losing your home due to unpaid debt obligations. This peace of mind makes it worth considering a reverse mortgage for many people looking for financial security during their retirement years.

Taking out a reverse mortgage is only right for some, but with the help of reverse mortgage services in Escondido you will have a different experience. Still, it can be an effective way for elderly homeowners to supplement their retirement income while giving them access to their home's equity in case they need it.

Before deciding whether or not this type of loan is right for you, make sure you understand all the pros and cons so that you make informed decisions about whether or not taking out a reverse mortgage is right for your situation.

Mutual of Omaha Mortgage is a trusted name; you can easily count on them for more. Visit their website to learn more about their services and schedule an appointment for support.

0 notes

Text

Mr HH & Mr Haimbe, voluntary retirees unpaid historic debt a dangerous decampaign for you

Mr HH & Mr Haimbe, voluntary retirees unpaid historic debt a dangerous decampaign for you

Mr HH & Mr Haimbe, voluntary retirees unpaid historic debt a dangerous decampaign for you

By Michael B Munyimba

It is yet to be established whether the unjust pain and suffering that justice minister Mulambo Haimbe is inflicting on the voluntary retirees/seperatees is by his own volition, or is in alliance with the highest office on the land.

The voluntary retirees whose benefits have…

View On WordPress

0 notes

Text

OAH Family Launched First Aged Care Crypto-Currency – OAH Coin

Elderly adults may not be getting the integrated care they require, according to a World Health Organization (WHO) study. In a study of 11 high-income nations, up to 41% of older individuals (aged 65 and up) reported problems with care coordination in the previous two years. As per the OAH Family, the world is currently plagued by a dearth of senior age care facilities and services that can meet their needs. “Currently, individuals, organizations, and service verticals function in silos. As a result, a one-stop platform has become necessary.

A blockchain-powered technology built by an Australian business claims to be able to help tackle the main problems in the senior care sector that traditional processes and systems have failed to solve. Blockchain technology is a mechanism that gives ordinary people real power. It deprives a central authority or a set of bodies of decision-making and planning authority.

The power is subsequently dispersed across a number of participants on the blockchain. They get the opportunity to verify data and participate in decision-making. In a decentralized system, everything is open-source yet immutable.

The use of blockchain technology in the care industry will move authority from authoritative or unskilled organizations to elders and their families. Seniors will benefit from such an environment since it will provide them with the finest options for individualized care.

Governments all around the world are grappling with issues in the old age care industry, ranging from unpaid care work to political involvement and security concerns among the elderly, “adding to it are issues surrounding global rehabilitation of an aging society.”

So, what is the purpose of the OAH Coin? Its goal is to provide support for financial services such as pensions in a novel method that transforms the entire program.

Blockchain’s OAH coin (the name of the aged care crypto-currency) combines sophisticated and big data capabilities to provide the elderly with a highly secure, user-friendly, and transparent platform that is powered by smart contracts.

While Nursing Home Administrators can offer the care that the elderly require, they are unable to address the financial issues. Now that the OAH Coin has been officially launched, it will become “the” coin that elders can use to pay for services at a number of Senior Care International’s medical affiliates, including CareNet Medical, Arias Health Care, DBA CareNet Health System, and Kindness-Care Home Health.

Our creativity OAH coin was the world’s first cryptocurrency to be introduced. We have established an incorruptible service with the help of Blockchain technology. The data analytics we’re applying promises that the elderly will have access to an interactive platform that will allow them to conduct any type of transaction.

We will try to make OAH Coin a universally acknowledged digital currency for retirement services, as it will become the face of the worldwide eco-finance scene for retirees.

#OAH Coin Airdrop Program#cryptocurrency Airdrop Program#what does crypto airdrop mean#crypto ico presale#free cryptocurrency airdrop program#airdrop crypto#crypto airdrop#crypto currency airdrop#new crypto launch#cryptocurrency airdrop#what are crypto airdrops#what is a crypto airdrop#what is airdrop#what is airdrop crypto#how does airdrop work#Old Age support#Senior Citizen support#Helping Senior Citizens#online volunteering#free crypto airdrops#how to get crypto airdrops#how to receive airdrop#best crypto for investment#best free cryptocurrency#free crypto currency#new crypto currency#crypto presale#cryptocurrency presale#new crypto presale#presale crypto

0 notes

Photo

Is inheriting a timeshare a good thing?

Did you know that back in the US 9.2 million people own at least one shared vacation product or timeshare? The timeshare industry is enjoying a steady growth. From $4.6 billion in net sales in 2010, the figure has increased to $9.2 billion in 2016.

But half of all new sales comes from existing owners rather than new buyers. It’s common knowledge that timeshare has an unfavorable rep. If this is true, how come existing owners keep on buying timeshares?

Well, it’s hard not to listen to the sales pitches. Timeshare companies have outstanding salespeople who can seduce anybody into buying their product and seriously, there is nothing wrong with that. The fact is, there are many satisfied timeshare owners. How else can the industry enjoy a steady growth if there aren’t?

However, while there are owners who continue to enjoy their vacation lifestyle, there are also timeshare owners who want out. In the US, the average timeshare price nowadays is around $20,000 plus other fees. Some of the owners can no longer afford the rising costs, others are unhappy with the outdated properties or have outgrown the lifestyle.

The thing is, exit timeshare or whenever is difficult. Consider yourself lucky if you can find a buyer who is willing to pay a fraction of your investment; lucky because even though you did not recoup your investment, you can now stop paying for the other fees that go up annually.

One of the selling points in a timeshare is you can pass it on to your children and they can pass it on to theirs. But is that a good thing?

Issues in Inheriting a Timeshare

Children may not afford the lifestyle their parents had. If their parents were retirees at the time they got their timeshare, they had all the time to go on vacation. As a result, they benefited a lot from having the timeshare. If the children who inherited it are still building their careers or raising little kids of their own, vacation will probably take a backseat. The timeshare will be unused and worse, they will have to pay the maintenance fees and others that come with it.

There are instances when people do not know they have inherited a timeshare. It can be passed on not just from parents to children but between siblings. It can happen that a recipient is not informed that he is a beneficiary. Some just had the biggest shock of their life knowing that they own a timeshare that has months of unpaid maintenance fees.

If the beneficiary refuses to accept the timeshare, he can file a disclaimer. It will then go to the next beneficiary under the will. It will always be passed down to somebody.

If you consider the timeshare more of a hassle than an asset, there are ways you can let go of it. No one has to be burdened by unwanted timeshare including the debts and bills that go with it. Help can be had from third-party exit companies that can handle situations on a case-to-case basis. The bottom line is, you can go to the timeshare company, put in writing that you do not want the timeshare and are willing to sell or give it back to them. They cannot go after you because you are not the buyer.

#exit timeshare now#exittimesharenow#exittimesharenow.com.au#timeshare#timeshareadvice#timeshare advice

1 note

·

View note

Link

The first rule for getting out of a hole is to stop digging. But this fall, California voters are being asked to approve four statewide bond measures that would put the state and taxpayers $16 billion deeper into a fiscal hole.

Californians share responsibility for the US federal debt, which is growing at a rate of $1 trillion per year. The widely-reported national debt, which recently surpassed $21 trillion, includes only a portion of federal obligations. Unfunded obligations are a growing problem at all levels of government. When unfunded federal employee retirement obligations, Social Security, Medicare, and other long-term costs are added in, the total federal debt burden is closer to $79 trillion — four times the nation’s Gross Domestic Product (GDP).

Similarly, here in California, state and local governments have extensive unfunded pension and retiree health obligations, plus substantial bonded debt. My review of financial disclosures for the 2015 fiscal year revealed $1.3 trillion of obligations across the state — equal to more than 50 percent of economic output.

While the $16 billion worth of bonds on the statewide ballot this November may look like a mere rounding error next to some of these other massive debt numbers, rejecting the initiatives would give California’s voters a chance signal a desire to stop burdening our children and grandchildren with our unpaid bills.

In thinking about what the state wants to borrow money for, it is useful to revisit the promises made by proponents of previous state bond measures. The high-speed rail bond was supposed to match $10 billion of debt with federal and private funds to build a bullet train that would whisk travelers from Los Angeles to San Francisco by 2020. The cost of the project has skyrocketed, no private funds have materialized, and the completion date has been pushed back to at least 2033.

The $3 billion stem cell bond passed in 2004 created the California Institute for Regenerative Medicine, which has yet to produce a single federally-approved therapy. Nor has it produced the large volume of royalty income proponents predicted. Given disappointments like those, voters should take a skeptical view of the potential benefits of this season’s crop of state bond measures.

5 notes

·

View notes

Link

0 notes

Link

0 notes

Text

Retired headteacher’s claims about unpaid pension benefits untrue – SSNIT

Retired headteacher’s claims about unpaid pension benefits untrue – SSNIT

The Social Security and National Insurance Trust (SSNIT), has said the claims by a retired teacher in the Nanumba North Municipality of the Northern Region, that he has not been able to access his pension benefits for seven years after retiring are untrue.

In a statement issued on Thursday, July 22, 2021, and copied to Citi News, SSNIT explained that the retiree, Napari Manga, qualified and opted…

View On WordPress

0 notes

Text

UNPAID EX-GOVT WORKERS STAGE PROTEST AT STATE HOUSE

UNPAID EX-GOVT WORKERS STAGE PROTEST AT STATE HOUSE

By Victoria Kayeye YambaniFormer Government workers this morning braved the cold to camp outside State House, in a bid to seek an audience with President Hakainde Hichilema over their benefits.

Some of the retirees have not been paid for over 20 years.

They are now seeking President Hakainde Hichilema’s intervention in view of his promises that they would be paid.

One of the retirees, Gibson…

View On WordPress

0 notes

Text

transamerica life insurance scam

BEST ANSWER: Try this site where you can compare quotes from different companies :insurecostfinder.top

transamerica life insurance scam

transamerica life insurance scam. My wife has had a term life insurance with them for 3 years and we do not qualify for any of them through Medica due to a medical issue. We did not qualify for any of them even though they called them, my wife was put on permanent and we now need term… We purchased our whole life insurance for the kids and their families. And as I write this, that term insurance is still being sold on the “buy term and invest the difference” platform by our firm. All the information submitted during our review was 100% false, our agent did not know what he was talking about. They didn’t know a thing about stocks or real estate or health insurance when asking about quotes. They do not know the market like you do about term insurance. If you know anything about term insurance and are unsure about which company to choose for your needs, please do not hesitate to give us a call! We have been in business since 1994, and we’ve.

transamerica life insurance scam! they are not one of the most “expensive” insurance companies in the industry, what better choice than any company! I would rather stay with my mother and friends family as I love talking with the best person on the phone when I need to make amicable claims… for me! Their rates are among the highest in my area! The only negative I have to say about their insurance is the cost. My car insurance is so cheap through an independent carrier. So very expensive that I don t even use insurance for anything. I will only be driving the car occasionally! My boyfriend has had to get his own insurance for the past 6 months. He is the only one I have found that offers insurance for my cars. He refuses to do a regular person an get a quote for someone else s policies. It is also extremely hard to find for a reason, there is no way to get a quote with another company for a new car you must be in at.

transamerica life insurance scam. The entire process could have been thrown your way. If any reason exists that I can help you I would appreciate your response. We ve been a Life and Health Insurance broker since 2002 (when the founder and chief underwriter was an employee of our company). The service we offer provides exceptional value and service guaranteed by Life & Health Insurance Company of Iowa (L&A). We are here for you and your family as you grow wiser. All policyholders are happy to receive the same personal service and help support as they deserve...the peace of mind you seek in life! For the past 14 years, L&A has provided the highest quality insurance programs for individuals and families who cannot find any other insurance company in the market today. L&A offers a full range of insurance products ranging from basic coverage to life insurance. A great service you could never afford for the last 20 years as the underwriter for many years at L&A. It provides a variety of.

Pros and Cons of Transamerica Life Insurance

Pros and Cons of Transamerica Life Insurance Company

Life and medical policy options have varied. Transamerica Life Insurance Company is often considered to be a company with more options than other major auto insurance companies. However, it is another great life insurance company to work with. Transamerica specializes in term life, but it offers many options and a number of payment methods, making it ideal for those looking for a flexible life insurance package.

Transamerica is not a standard life insurance provider for policyholders or policyholders at most times. The company is also known for offering affordable rates on their policies and being an affordable insurance provider for new drivers. Transamerica offers several coverage options for its clients. They offer term and universal life insurance policies for people with multiple family members as well. Transamerica also offers whole life insurance for kids, parents with only one outstanding child, and early retirees (unless required by law). Finally, they provide two for their clients — Annual and Permanent.

Transamica also offers term life insurance.

How to Make a Life Insurance Claim with Transamerica Insurance

How to Make a Life Insurance Claim with Transamerica Insurance is the best way to get affordable, low-cost auto insurance in Georgia. Compare quote now for an individual policy in Georgia. The average Georgia driver pays $4,843 per year for auto insurance, which is 2.3% more than the national average. But in Georgia, we do the calculation and calculates your average yearly premium based on what you drive. Your Georgia Driving Record: Georgia law requires that car insurance companies advertise their services where they can find the highest and lowest rates in Georgia. All insurance companies are required to get minimum liability coverage. In Georgia, when you have an unpaid loan or lease, you are considered a If you do not own your car, you are required by law to get the state minimum in Georgia. If you are looking to buy the minimum amount of coverage, you can try various options to obtain full coverage. If the uninsured motorist coverage in Georgia was $25,000 ($61,000/$18,500/$10,000 coverage) for.

Transamerica Life Insurance Policy Details

Transamerica Life Insurance Policy Details

Annual Variable Annuity Fund (ASO) for selected individuals age 40 and over

Short-term disability benefits

Short-term disability benefit

Full-time equivalent coverage

Short form unemployment and sick leave

Short or temporary insurance

Life insurance policy for youth, under age 25.

Find the right policy - no medical exams - for you and your family

Find the company you want to work with, on your term life insurance

What s your company name?

CompanyName

ProductCode

Find an agent by seeking employment from the company website.

Company History

Founders of Life Insurance

History

History of insurance

Cincinnati American Insurance Company with over 125 years’ experience

Cincinnati Life Insurance Company with over 90 years’ experience

Cincinnati Life & Health Insurance.

How to Contact Transamerica Life Insurance

How to Contact Transamerica Life Insurance

Transamerica Life Insurance Company is a Stock company that was incorporated in 2010-12-03Named after trade names of Transamerica Life Insurance Company and Transamerica Insurance Company, unless otherwise disclosed. In 2006, Transamerica Life Insurance Company wrote and issued a life insurance policy. The policy is underwritten by Transamerica Life Insurance Company and issued on February 7, 2008. That policy is not available in Massachusetts. The insured has access to this company through multiple business relationships and an independent agent.

Transamerica Life Insurance Company and Transamerica Insurance Company are not related entities, and have no control over their privacy practices and policies. Transamerica offers a traditional type of insurance and provides a life insurance policy through an independent agency. The benefits of the life insurance policy are as follows:

1. Transamerica has built something very different;

2. Transamerica offers a better insurance product and a better service.

In.

Consumers Should Carefully Review Their Annuity Purchases From Transamerica Life Insurance Company

Consumers Should Carefully Review Their Annuity Purchases From Transamerica Life Insurance Company

Trans American International Life Insurance Co. of America is an individual insurance company known for having lower insurance scores than the average U.S. consumers, but they don’t seem to have that much of a hold on the financial sector. Transamerica is a strong supporter of the National Association of Insurance Commissioners (NAIC) and they are licensed to practice the legal profession. They have been in business for almost 150 years, and they operate to be one of the largest and most profitable U.S. insurers underwriting insurance. In fact, Transamerica is listed among the top ten insurers in . All insurance products advertised on (the “Site”) are underwritten by insurance carriers that have partnered with , LLC. , LLC may receive compensation from an insurer or other intermediary in connection with your engagement with the website and/or the sale of insurance to you. All decisions regarding any insurance products, including approval for coverage, premium, commissions and fees, will be made.

Overview of Transamerica Life Insurance

Overview of Transamerica Life Insurance, is designed to address specific questions I have about their financial strength. In the following chart we see the monthly cost of a Transamerica life insurance policy from different insurance providers (based on data from LIMRA, their rate data, and all applicable policy costs): Transamerica Life Insurance Company is a privately-held national life insurance company (not a franchisor) that operates across the land in the state of Hawaii. This company has an A rating from the National Association of Insurance Commissioners (NAIC). The first number – 1118/AIM – is the insured’s name. The second number (1) is the policy owner’s name. The 3rd number is the policy’s dollar amount. Transamerica’s name does not have an A.M. Best rating, so they do not get an A rating. In addition, they DO get an A1 from A.M. Best, so there is a little concern that this.

How Does Transamerica Life Insurance Rate?

How Does Transamerica Life Insurance Rate? And How Does It Work? We have created our own unique guide to a life insurance product that is an amalgam of three things: the life insurance product, an agent that you have to deal with, and a few helpful tips and tricks to lower the cost of your policy. But how much life insurance do you actually need? The average life insurance policy is very much in the running because it is a product that has certain benefits that go along with it. There are benefits that will come with the product that could be offered for the lower cost, but these benefits can be very costly and so the life insurance company cannot easily offer them. The most important thing to understand about the value of life insurance is that even if it is not a life insurance product it is actually a policy to sell to the person you want to pass away. It is a great example of why all life insurance products come with a special underwriting process that takes into account your overall health as well as the types.

0 notes

Text

The state of the U.S. Postal Service in 8 charts

The state of the U.S. Postal Service in 8 charts;

A postal carrier walks by One World Trade Center in New York City on April 30. (Noam Galai/Getty Images)

The U.S. Postal Service consistently tops the favorability list in Pew Research Center’s periodic surveys of public views of government agencies. This year, 91% of Americans – and equal 91% shares of Democrats and Republicans – had a favorable view of the agency.

But the Postal Service, already in a deep financial hole, now finds itself caught in a political firestorm. President Donald Trump has long claimed that package shippers, particularly online retailers such as Amazon, aren’t paying enough. He has blocked a $10 billion congressionally approved emergency loan to the cash-strapped agency; threatened to veto any future emergency funds unless the Postal Service quadruples its package shipping prices; and named one of his major donors as the new postmaster general.

Democrats, many outside analysts, Postal Service advocates and the agency itself dispute Trump’s contention that low package rates are the main driver of its money woes. They say that without relief, the Postal Service could run out of operating cash as soon as this fall. A coalition of retailers plans a $2 million lobbying and ad campaign to oppose Trump’s plans and support a massive rescue package.

How has the Postal Service, which turns 50 next year, wound up in such a predicament? We crunched the numbers to find out.

How we did this

We decided to take a look at the U.S. Postal Service after the latest Pew Research Center survey once again placed it at the top of the list of government agencies that Americans view favorably. To analyze the Postal Service’s operations, finances and workforce demographics, we drew from a range of sources. Operating and financial data were compiled from the Postal Service’s annual reports to Congress and the Postal Regulatory Commission; additional background was obtained from news reports and reports from the Congressional Research Service. Demographic data was drawn from the U.S. Census Bureau’s 2018 American Community Survey.

For this analysis, racial groups include those who report being only one race and are non-Hispanic. Hispanics are of any race.

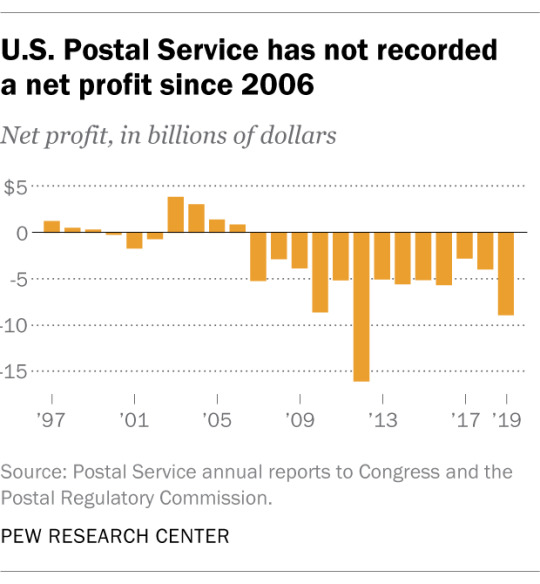

1When Congress created the Postal Service to replace the old Post Office Department, it mandated that the new agency support itself through its own revenues, rather than relying on federal appropriations. However, the last year the Postal Service recorded any profit was 2006, and its cumulative losses since then totaled $83.1 billion as of March 31. The Postal Service also owes $11 billion to the Treasury and more than $59 billion in required but unpaid contributions to its employee pension and retiree-health funds.

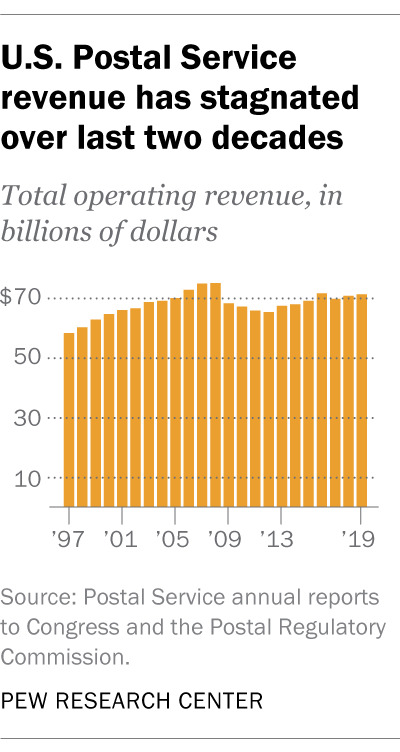

2Compounding the Postal Service’s debt problems has been a lack of revenue growth. The agency’s total revenue in fiscal 2019 was $71.2 billion, enough to place it 43rd on the Fortune 500 (higher than Intel) if it were a private company. But Postal Service revenue has mostly fallen or stagnated since 2008, when it hit a record $74.9 billion.

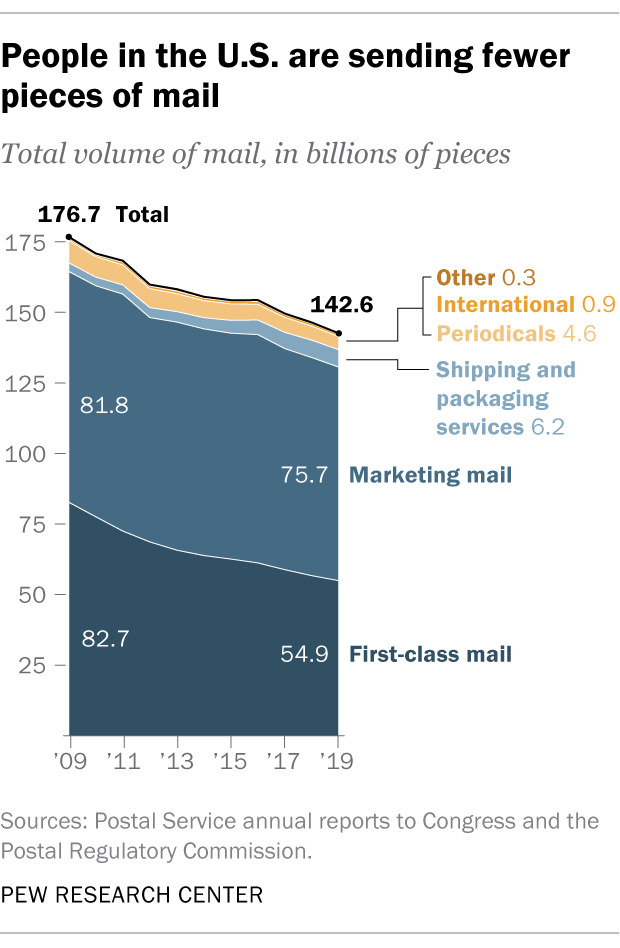

3One key reason the Postal Service’s revenue hasn’t kept pace with expenses is that it’s delivering a lot less mail than it used to. In 2000, the agency delivered 207.9 billion pieces of mail, including everything from postcards to packages. Last year, it delivered 142.6 billion pieces, a 31.4% decline. The drop-off has been especially steep in first-class mail – a highly profitable product line that saw a 33.6% drop in the number of pieces of mail sent over the past decade – and in periodicals, down 41.3% over the same period.

4One bright spot has been shipping and packaging services. Volume in that category has doubled over the past decade, to nearly 6.2 billion pieces last year. Unlike first-class or marketing mail, most of the agency’s shipping and packaging offerings are considered “competitive” services, meaning the Postal Service has more leeway to set rates in line with what it thinks the market will bear. In fiscal 2019, shipping and packaging accounted for just 4.3% of total mail volume but 32% of revenue. By contrast, marketing mail made up 53% of volume but generated just 23% of overall revenue.

5To address its ongoing financial problems, the Postal Service’s management has urged Congress and the Postal Regulatory Commission to authorize major changes in the way it does business – so far to no avail. The proposals include requiring postal retirees to enroll in Medicare, which would relieve the agency of having to pre-fund retiree health benefits, and giving the agency more freedom to raise rates on its non-competitive (i.e., monopoly) services. In the meantime, the agency has tried to save money in other ways, such as by shrinking and reshaping its workforce. Through retirement incentives and attrition, the Postal Service has whittled its workforce down to 633,108 employees as of the end of fiscal 2019, 30% below its peak year of 1999. Just over a fifth (21.5%) of those workers are considered “non-career,” meaning their positions are temporary and they often earn less in salary and benefits than “career” employees.

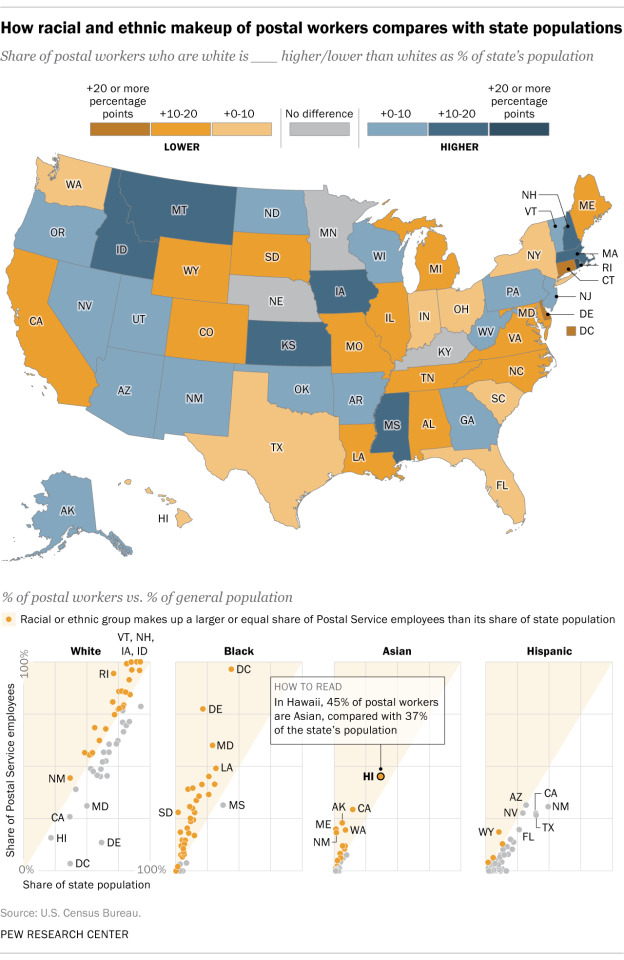

6Efforts to shrink the Postal Service payroll would likely affect racial and ethnic minorities, women and veterans more than others. Postal workers are more racially and ethnically diverse than the U.S. labor force as a whole, according to Census Bureau data from 2018, the most recent year available. About six-in-ten of the agency’s employees – including mail carriers, postal clerks, and mail sorters and processors – are non-Hispanic white (57%), compared with 78% of the overall U.S. workforce. Around a quarter (23%) of Postal Service workers are black, 11% are Hispanic and 7% are Asian. In contrast, black Americans make up 13% of the national workforce, Hispanics 17% and Asian Americans 6%.

In 38 states, 50% or more of Postal Service employees are white, but racial and ethnic differences do exist. For example, in the District of Columbia, Delaware and Maryland, 60% or more of postal workers are black. In Arizona, New Mexico, Nevada, California and Texas, about three-in-ten of them are Hispanic. In Hawaii, slightly fewer than half (45%) of Postal Service employees are of Asian origin, and 25% are of two or more races.

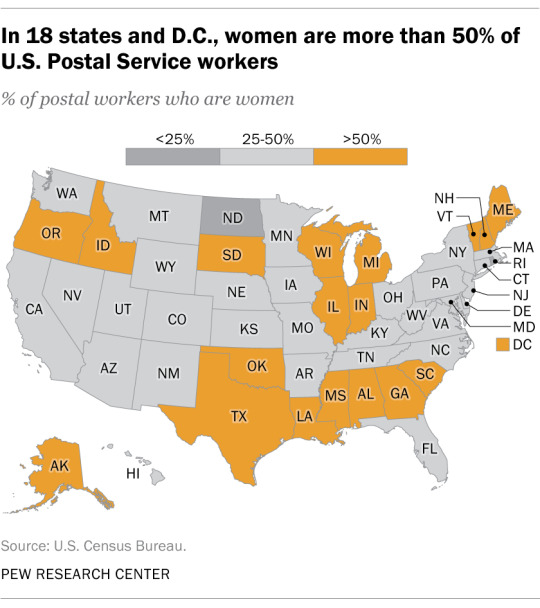

7 In 18 states and the District of Columbia, women make up half or more of Postal Service employees. In D.C., 74% of Postal Service workers are women, and women account for around six-in-ten postal workers in Idaho, Alabama and South Dakota. Nationally, slightly fewer than half of postal workers are women (45%), in line with the U.S. workforce.

8The Postal Service, as of 2018, employs more than 100,000 military veterans, who make up 16% of its workers nationally. Veterans account for just 5.8% of all employed Americans, according to data for 2019.

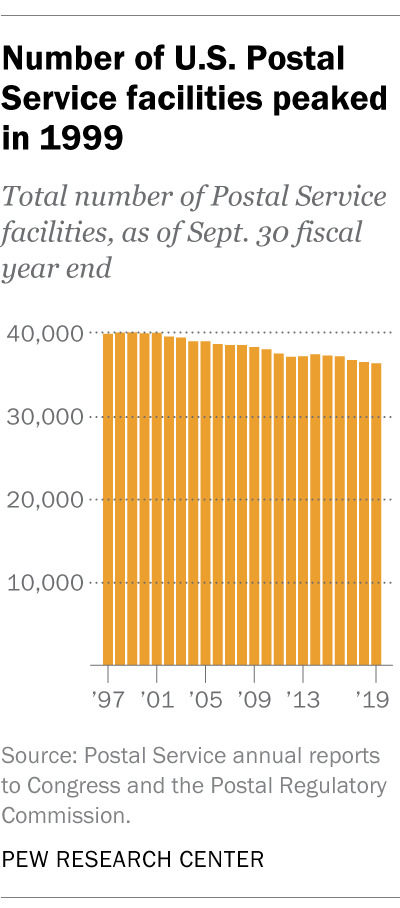

9The Postal Service also has been trying to reduce its physical footprint, despite resistance from communities and, often, their representatives in Congress. The total number of Postal Service facilities has fallen 9.3% over the past two decades, from more than 38,000 nationwide in 1999 to around 34,600 as of Sept. 30. However, the number of individual mailboxes, P.O. boxes, and other “delivery points” – currently 159.9 million – typically grows by 1 million or more each year, adding to the Postal Service’s challenges.

; Blog – Pew Research Center; https://www.pewresearch.org/fact-tank/2020/05/14/the-state-of-the-u-s-postal-service-in-8-charts/; https://www.pewresearch.org/wp-content/uploads/2020/05/FT_20.05.07_USPSFacts_feature.jpg; May 14, 2020 at 11:31AM

0 notes