#which is mosy definitely not the case

Text

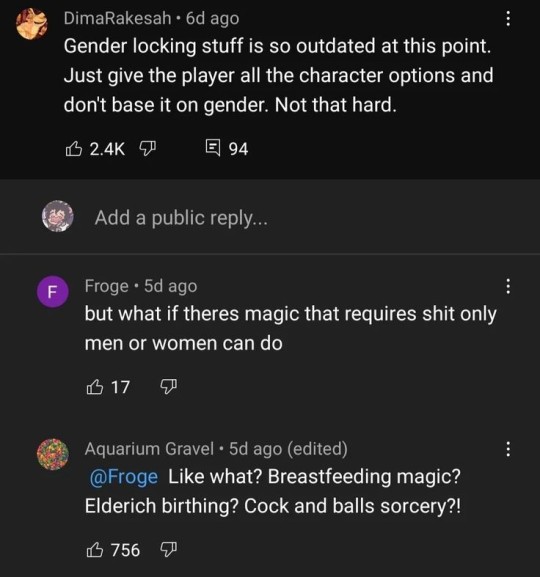

The Wheel of Time be like-

Also from now on I am only referring to saidin as cock and balls sorcery

#wheel of time#the wheel of time#'cock and balls sorcery' LMAOOOOO#i'm sure RJ genuinely thought it was a cool magic system idea#but that was with the assumption that gender=sex#and that both are binary#which is mosy definitely not the case#it would be kinda cool tho if there was a similar and more open#magic system like that#where the type of magic you could access is linked to your gender#but there were as many kinds of magic as there is genders#(which is like an infinite amount)#or maybe just like the 'flavour' or feel of your magic#is based on your gender#either way trans and genderqueer people would have THE COOLEST magic

41 notes

·

View notes

Text

Thinking about Lumen, he really is just an ordinary guy caught up in extraordinary situations. It's super easy to focus on that part of his character and leave the rest of it out, but...

(Putting this all under a read more so that it doesn't take up a lot of scroll space. Lumen Analysis below.)

Jordi Fontanarossa is technically a diaspora, but it almost seems like he feels like he doesn’t belong. He has almost no links to the rest of the Ægir beyond his species, what he has left of his parents (their notes, I'll get back to this later), and what little his uncle would tell him. Which is implied to be not a lot for his own safety, but... it doesn’t change the fact that while this feeling of separation definitely applies to all Ægir Islanders, of all the Iberian Ægirs we know, only Jordi seems to have a lot of obvious feelings about this.

"I mean, I know nothing about the Ægir" is one of his lines that stick to me a lot. Because... he's right, he admits it himself even; but somehow he's supposed to do something about the rift between Iberians and Ægir Islanders as the first Ægir Inquisitor-In-Training since forever, essentially? He isn't even suited to be an Inquisitor in the sense of fighting the Seaborn! His hands are made for tools and not for weapons, but he essentially got press-ganged into the Inquisition at the end of Stultifera Navis because... he knew too much. About the Seaborn, about what's really going on...

And this ordinary guy is now responsible for doing something about the rift between races? Like. I understand that you have to start from somewhere and that it works because Jordi is the mosy harmless guppy ever unless you get a Hand of Purification, but the man just lost his uncle and is grappling with the fact that the ocean is even more dangerous than he thought. Give the fishie a break.

Unfortunately, he isn't getting one, because that's not the kind of world Arknights is; and Jordi is a kind of person who can inspire change. In a small way, but even the smallest speck of light can shine bright enough to dispell the darkness.

In any case, let me continue with this scuffed Lumen analysis. Namely, his disconnect with Ægir as a civilization and culture. Because that line I highlighted about how he knows nothing about the Ægir? It means so much added with certain other things about Jordi.

Now, I can't claim to know every single detail, but when it's all said and done, it's pretty clear that Jordi is disconnected from his culture. Not only is he the only Ægir in Gran Faro, but... he was young enough that it seems like he barely recalls his parents. So he wouldn't necessarily remember too much about whatever culture the Ægir Islanders would have, beyond a few things:

One - the Ægir Civilization is one of the more advanced civilizations technology-wise on Terra.

Related to this, it's mentioned that Jordi's parents left him notes and things relared to engineering. It's said that he holds his tools awkwardly like he taught himself how to use them. It's also implied that he just genuinely taught himself how to do engineering since... well, who would teach him? Maybe his uncle, but for things related to the Golden Age of Iberia? It just doesn't seem likely with the general trauma the older generation of Iberia has due to the Great Silence.

Two - Have you noticed that the Operators related to Ægir the Civilization have a specific kind of fancy? Sure we only see the Abyssal Hunters and that's a small sample size, but I feel like it's enough to at least vaguely pin down a national "style" so to speak.

Relating this to Lumen, look at his normal outfit. It's not quite the same fancy aesthetics as the Abyssal Hunters, but... it's similar enough. Sure it also fits pretty well with the Inquisition, but that's not the point. The point is that it feels like Jordi is trying to keep the memory of something alive by wearing what he wears - it might just be the typical gacha design philosophy, but... if he has only faint memories of his parents, he might recall a particular outfit one of them wore and he's trying to stick to it - to feel that connection with them that he just barely has. Regarding his skin though? That's a pirate shirt. Well, it's probably actually a poet's shirt, but it's that one shirt either vampires, lesbians or pirate's wear; and while Jordi isn't a pirate, out of those three he's more likely to fit in that category. Admittedly this one is my biggest stretch and more headcanon than canon, but I connected some dots at least.

Third: His lines.

Just his lines in general okay. He wonders how the Ægir live under the ocean. He has a line talking about how he knows nothing about the Ægir. There's probably more but as much as I love him, I am not willing to go through the whole of Stultifera Navis just to find every single line. In any case, Jordi's has multiple lines mentioning his lack of information on the Ægir and his own disconnect from the culture he supposedly belongs to as one.

Fourth: His Interlude - Till The Light Shines Bright.

Jordi: Do people out there know the sea better?

Jordi: Do they talk about the great lighthouse, about the legend of the Eye of Iberia?

Local Messenger: Don't be silly, Jordi. The people don't really talk about the sea. As for the great lighthouse, that's a nursery tale that the people of Gran Faro tell their children.

Jordi: ...I see.

Jordi: Thank you for the offer, Rald.

Jordi: But I can't go, not until I've seen the sea and the lighthouse.

Local Messenger: Gran Faro has failed. The dream of Iberia's Golden Age ended decades ago.

Jordi: Don't say that.

Jordi: It's not just a dream for Iberia. It's also a dream for the Ægir...

Jordi: ...For one Ægir.

These lines in his Interlude mean a lot. Actually, his whole Interlude reveals so much. For one thing, he is teaching himself how to do Ægir engineering. We have a very smart guppy on our hands here people. It... also reveals Jordi's fascination with the ocean and the fact that unlike say, Amaia, he isn't interested in pursuing that fascination of his over caring for others. It's just... poignant in a way I don't have words for, really.

All of those just... combine to say that Jordi Fontanarossa is someone who wants to know about the Ægir. He has the opportunity now, but... growing up? All he had was his parents' journals and what little stories his uncle would share.

Why I say "what little stories" in reference to his uncle? Well. I have some thoughts on Thiago and how his death affected Jordi. Especially taking into account a module that Jordi was referenced in: Indigo's module.

However, once they had both left, Lumen raised an alternative, 'small-minded' conjecture, more or less that before an old man sends his granddaughter off to the city, he stuffs the only valuable they own into her suitcase and hopes she'll never come back, or that he'll have passed by the time she does... or thereabouts.

'The elderly are like that. They like to decide everything for you while you're still clueless,' Lumen added.

His lines there are... well, they definitely reveal a lot about what he feels about Thiago now. Not quite bitter, but not quite positive? Thiago has definitely made decisions for Jordi before out of worry for his former wife's last remaining family.

I don't have a lot to say here, but like. I wish we got to explore this more. Jordi is a quiet and well-meaning person who has more negative feelings than he seems to have due to the focus on his ordinary guy-ness and self-depreciation.

TL;DR: So with all this said about his place as an Ægir disconnected from his history and culture, but still trying, and now forced to be a cultural bridge with no culture of his own... I think Jordi should get to go off a little. As a treat and so that we can explore his character more because I think the guppy should be around more.

And that's all.

If you have any thoughts on this, please feel free to reblog or comment. I need to talk about the fishie.

#arknights#arknights lumen#arknights jordi#arknights jordi fontanarossa#character analysis#stultifera navis#lumen#jordi#jordi fontanarossa#the most rained upon fish ever#the thoughts won and i wrote this#discussions appreciated

26 notes

·

View notes

Text

NRC basketball team roster

(As depicted in my fic, Aquarium)

Okay, first of all, I'm really glad I planned for this chapter to take at least 2 weeks from the start, because yesterday I managed to fuck up my knee a little, so my mental energy goes to worrying about it and my physical energy goes towards stretching and working my knee to make sure the bones don't again try to misalign themselves and the joint remains decently pain-free. Definitely didn't need the added stress of "damn, I should be writing", haha.

Anyway, this list has tiny little spoilers, most of which likely won't become apparent until the chapter is published, but I'm warning you just in case.

---

Nima - (unofficial) coach, former center

Savanaclaw, junior. In his last proper year at school he took over the coaching position (because who else is going to do that, Vargas? No thank you). Has a little too much energy and enthusiasm and not enough understanding of the limits of a normal human body. Hopes for Jamil to take over the coach role next year.

3 - Egil - shooting guard

Pomefiore, sophomore. Despite different positions, Gideon's unofficial protege. Everyone is quite unsure if there's something going on between them or if Pomefiore is just Like That. Depending on team composition sometimes plays as a forward, but is not very comfortable in any playmaking role, prefers to defer tactical decisions to others.

5 - Jamil - point guard

Scarabia, sophomore. While versatile about the position he plays in, prefers to stay to the back line to direct his team's play and make long shots from behind the three-pointer line. One of the highest-scoring members of the team.

10 - Floyd - center

Octavinelle, sophomore. Dunk shots are his bread and butter, but he surprisingly enjoys the defense, too - especially when it allows him to bully other players under the basket. In official matches tends to get removed from the court for rule violations way before the end of the game, which annoys him to no end.

11 - Ace - shooting guard

Heartslabyul, freshman. Pretty good at most technical things and able to play a variety of positions, but tends to be impulsive and make rash decisions that lead to mistakes. Has a special talent for provoking the opposing team to foul on him.

13 - Bertram - point guard

Diasomnia, freshman. A bird beastman of generally quiet disposition, though allows himself to express himself more on the court. Tends to be in a (mostly) friendly competition with Ace as a fellow freshman.

17 - Gideon - center/power forward

Pomefiore, junior. The second half of the "rituals are intricate" Pomefiore duo. Tall but lanky, prefers playing forward but often has to sub in for Floyd as center if Floyd breaks the rules too many times.

18 - Mosi - shooting guard

Savanaclaw, junior. In his freshman year he didn't make it into the spelldrive club, and might be still a little bitter about it, but mostly is determined to prove his worth as a basketball player. Has a temper problem on par with Floyd - sometimes they cancel each other out, sometimes the opposite.

22 - Ludwig - small forward

Octavinelle, junior. One of the more versatile players on the team, though he's mainly been playing as forward since his sophomore year when he bulked up. Unlike many others, finds strategy and tactics discussions at practice fascinating.

25 - Ryder - small forward

Scarabia, junior. Compensates for his short stature with almost unnatural speed and jump height. Has been having some problems with discipline and being a team player for the last several months - actually, since winter break. Wonder why that might be.

31 - Jay - power forward

Savanaclaw, sophomore. Accident prone. Didn't train for several months of his freshman year due to a concussion sustained during History class, refuses to elaborate on the details.

#masterofrecords writes#i got tired of this list when i was writing jay sorry#also gotta stretch my knee again so that's it that's all you're getting#not that many people wanted this in the first place lmao#but this team was sure fun to create

13 notes

·

View notes

Photo

Kai-yacking!

Author: Roojin Hooblal

“And so we beat on, boats against the current.”

This is one of the most iconic quotes in English literature. I realized very early on that nearly all the classic books I was drawn to had something to do with water. Moby Dick, The Heart of Darkness and of course, The Old Man and The Sea by Ernest Hemingway.

My first water-induced adrenaline rush was when I first did my first whitewater kayaking down the Batoka gorge in Zambia. When anyone mentions the Victoria Fall, locally known as the Mosi Oa Tunya (‘The smoke that thunders’), my mind immediately remembers my first time on the water. Sure, if anyone has taken on the Zambezi rapids they will tell you that you may be some kind of crazy to start off on such a beast of a river, they will also tell you about the Stairway to Heaven, the Three Ugly Sister, The Devil’s Toilet Bowl, Gulliver’s Travels, and of course the granddaddy of all 24 rapids; rapid number 9, Commercial Suicide!

It started innocently like all great ideas do, among a group of mates, screaming fables over shots of Snake Baijiu in the middle of China. BAD IDEA!! Two months later, there we were, standing at the start point, the gravity of the situation quickly dawning on us as we watched the river crash violently against the rapid number one aptly called Against the Wall. During the expedition I made two vows. The first which I’m certain was going through the mind of a marooned crocodile we came across was that if I made it to the end of the gorge, I would never touch even a cup of water ever again. When We got to the end I made a second vow; that I would have to come back and do it again! Boom!!!! I was hooked. The water had claimed me.

Getting into kayaking could be the most rewarding activity or sport you can get to. Many people may think the kayak is a new way for kids high off energy drinks to do stuff for their YouTube channels. The kayak actually goes back hundreds of years. Man and his affair with the water has a long and fascinating history. The kayak was first used by the indigenous Aleut, Inuit, Yupik and Ainu hunters in the subarctic regions of the world to hunt on inland rivers and lakes. In fact, the word kayak originated from the word qajaq meaning ‘hunter’s boat’. Early qajaqs were made from the stitched hides of animals stretched over a wooden frame and ranged up to approximately 9 meters.

Due to its use in hunting, the kayak was built for optimal maneuverability. The paddler was intended to be able to change direction easily and in the event of an accident, the paddler would be able to rescue a fellow paddler. The kayak’s design focuses on directional stability or tracking Vs maneuverability. The paddler’s body also plays an integral roll in how the kayak will perform and respond. For example, if the paddler is too heavy, the kayak may sin due to excess weight. If the paddler is too light, the paddler may not be able to get the most control of the kayak’s mobility. Ensuring that a kayak is the right size and fit is one of the more crucial steps to an enjoyable experience that can lead to a life-long hobby.

Benefits of KayakingThough there are various styles of kayaking, one thing is for sure; Kayaking is a healthy way of living. What is it about kayaking that becomes an addiction to anyone who decides to pick up the paddle?It is SocialIn water sports, like kayaking, I have had the chance to meet so many interesting people from all walks of life and from all over the world. Each with their own stories of how they got into the sport, the challenges they face and how they overcome them. Personally, through kayaking, I have learned to challenge myself and overcome fear and indecision better. It is always stimulating to hear stories from other paddlers after a long expedition around a campfire looking up at the starry sky.FitnessNothing will get your muscles jumping into action faster than behind a paddle. Kayaking is sure to demand you develop a level of fitness. It is also sure to give you a proper aerobic exercise. But best of all, it gives you concentration. You start to pay attention to things like rhythm and cadence. You start to adjust and understand your body better. You learn how to economize your energy output. You start to learn how the paddle is an extension of you. It definitely will keep you healthy.A Chance at NatureVery few activities will bring you this close to nature. You become mentally aware of currents and undercurrents. You feel winds and even the slightest breeze makes you make tiny adjustments. This is very meditative and calming. And if you love recreational kayaking or for fishing, very few modes of transport will take you closer to schools of fish without agitating them the way a kayak would. Depending on your location, you could even get very close to seals or dolphins that you can touch them. They may curiously swim to you in ways they may not if you were on a motor powered vessel. These encounters can be very rewarding.Whitewater KayaksThese kayaks are roto-molded in a semi-rigid, high impact plastic, usually polyethylene. This type of kayak is ideal for fast-moving water. The plastic hull allows the whitewater kayak to take contact from rocks without breaking or leaking. They range from 1.2 to 3.0m long. Whitewater racing combines a fast, unstable lower hull with a flared upper hull to combine flat water racing speed with added stability in open water. These require the paddler to have substantial skill to achieve stability, due to their extremely narrow hulls. Like all racing kayaks, white-water racing kayaks are made to regulation lengths.

Play boat

Whitewater Kayak

This type of whitewater kayak is short, with a scooped bow and a rounded stern. This ensures high maneuverability over speed and stability because they are already in faster-moving waters. These are pretty much the closest thing to a BMX kayak. They are built for performing tricks. They are the primary kayak used in playboating or freestyle competitions which are also known as rodeo boating. You are more likely to see paddles doing airborne tricks with one of these. Pretty Dope, eh?

Creekboat Whitewater Kayak

These are significantly longer than and more voluminous than play boats, making them more stable, faster and higher floating. They are primarily used for speed on narrow, low volume waterways and rivers because of their stability and speed, which enables them to hit rapids at higher speeds.Sea and Touring KayaksIn 1932, a German man called Oskar Speck, disenfranchised by the economy, hopped into his kayak and only paddled for seven-and-a-half years and over 30,000 miles to Australia. Only to Australia. Unfortunately, after weathering monsoons, mosquito bites, limited fresh water, and crocodile infested water, upon reaching Australia, he was immediately arrested as a war criminal. Oskar eventually was released and wedded an Australian gal. His mode of transport was a Sea kayak. Embarking on such an epic journey definitely requires fortitude and a lot more planning and substance. Of course this challenge was successfully taken on recently by Sandy Robson and she had to use a kayak built to handle such an expedition.

Sea and Touring KayaksSea kayaks, also known as Touring kayaks are built for journeys of hours to weeks long expedition. Their volume above the waterline gives them increased security in rougher conditions and even more room for gear. Yet, the sea kayak offers a low profile to the wind, with a forward-raked design and unique mini-transom, sure to appeal to the sophisticated paddler. Sea kayaks in most cases trade maneuverability for seaworthiness, stability and cargo capacity. They typically have a longer waterline, and provisions for below-deck storage. They can accommodate one to sometimes three paddlers.Sit-on-topsThese are sealed-hull crafts, developed for leisure use and are mainly constructed using polyethylene to ensure strength and affordability. These have scupper holes which are tubes that run from the cockpit to the bottom of the hull so that water that enters the cockpit can be drained out. Sit-on-top kayaks range from one to four paddlers. They are popular for fishing and scuba diving. A disadvantage with this kayak is that its hull may develop perforations that may fill with water over time without the paddler knowing.

A sit-on-top tandem kayakFishing has become a fast growing activity in kayaking. Where a Sit-on-top kayak is not the go-to kayak for paddling for paddling and maneuverability’s sake, it outperforms other kayaks as the best platform for angling/fishing. Its ability to sit shallow allows it to approach schools of fish without scaring them off the way a motor-powered boat wouldn’t. Its very stable and can allow paddlers to spend hours out on the water easy!Inflatable KayaksInflatable kayaks don’t have to mean boring! Au contraire!!! Inflatables have an advantage when it comes to portability. The paddler is able to carry them to their favourite scenic spots with the help of a large enough bag.

Choosing Your KayakBefore you decide on getting a kayak, it is important for you to identify the one that suits the activity you want to be doing, because kayak performance is determined by a varying number of factors. It is important to be practical about how often you think you may need to actually go out kayaking. Is it a hobby you are committing to? Is it an activity you plan to do a few times only? It may be more practical for you to rent rather than hastily purchase one if so. This will allow you to test a wide range of kayaks to find which one appeals to you the most before splurging. However if you are committed to a journey into the world of kayaking, you had better select one that matches the kind of activity you will spend your time doing.Another important feature for the ideal kayak is comfort. You will most likely be spending hours on end in the kayak and the last thing you want is to have your legs go dead on you. You have to ensure it is the right size for your body and that all adjustments are correctly done according to your particular needs. Most importantly, always be safe and have fun!Top Kayaking DestinationsIn an article for Red-Bull, ten-time world champion Claire O’Hara listed some of these kayaking heavens. I have kayaked on only two of these listed, and based on my own experience I am inclined to trust her judgement and also consider this as my Wish list kayak destinations:

1. Slovenia

2. Ottawa River, Canada

3. Zambezi River, Zambia

4. Lake Rotoiti Rotorua, New Zealand

5. Norway

6. White Nile, Uganda

7. The Grand Canyon, USA

3 notes

·

View notes

Text

MoSys and Peraso Announce Merger to Capitalize on mmWave 5G and Multi-Edge Computing

MoSys, a provider of semiconductor solutions that enable fast, intelligent data access for cloud, networking, security, and communications systems, and Peraso Technologies ("Peraso"), a global leader in the development of 5G mmWave silicon devices, have announced the signing of a definitive agreement (the "Arrangement Agreement") for a business combination by way of a statutory plan of arrangement under the Business Corporations Act (Ontario) (the "Business Combination").

Upon the closing of the Business Combination (the "Closing"), the stockholders of Peraso are expected to hold, on a fully-diluted basis, a 61% equity interest in the combined company, with the remaining 39% equity interest to be retained by the stockholders of MoSys, assuming the Escrow Release Conditions (as defined below) are satisfied, or a 57.7% equity interest by the stockholders of Peraso and a 42.3% equity interest by the stockholders of MoSys, assuming the Escrow Release Conditions are not satisfied, in each case, as described further below. On Closing, MoSys will change its name to Peraso Inc. and expects shares of its common stock to continue to trade on the Nasdaq Capital Market under the new ticker symbol PRSO. The Arrangement Agreement and the Business Combination have been approved by MoSys' and Peraso's boards of directors and are subject to approval by MoSys' and Peraso's stockholders. The Business Combination is expected to close in the fourth quarter of 2021.

Management Commentary

"We are pleased to sign the Arrangement Agreement with Peraso, as we believe the Business Combination will provide substantial opportunities for our business across expanded high-growth markets," stated Dan Lewis, MoSys' Chief Executive Officer. "The combination will broaden our product lines, add operating scale, and unlock potential selling synergies across common customers. Together, the company is uniquely positioned to target high-growth opportunities in 5G, as well as telecom and data networks. The deployment of 5G faces two key bottlenecks: the sub-6Ghz spectrum is exhausted and software-only solutions have become a limiting factor in effectively accelerating network hardware. Peraso's market-leading mmWave technology, combined with MoSys' accelerator engine ICs and virtual accelerator engine IP, directly addresses these bottlenecks and the significant spectrum needs of future 5G networks. With a combined IP portfolio of 130 patents, our technologies and solutions provide more bandwidth, better latency, and faster throughput to meet the increased requirements of the more than 70 billion connected devices forecasted by 2030, as well as significantly expanded growth prospects beyond what MoSys can achieve as a standalone company."

"It has been our goal at Peraso to develop market-leading technologies addressing the needs of the 5G market," stated Ronald Glibbery, Chief Executive Officer of Peraso. "By joining with MoSys, we believe we can deliver a broader set of solutions to our combined customer base, using complementary technologies to address the networking and communication needs of our customers from the edge to the core and into the cloud. As a Nasdaq-listed company, Peraso will gain increased visibility and recognition, along with broader access to the global capital markets, which will support our long-term growth initiatives given the forecasted ramp in mmWave and 5G networks in the coming years. We believe the Business Combination provides meaningful benefits to both companies, their stockholders, and other stakeholders. I am excited to become CEO of the combined company and look forward to working closely with Dan and all of the other members of the MoSys and Peraso teams, as we move forward."

Management and Organization

The combined company will be led by Ronald Glibbery, Peraso's CEO, with Dan Lewis, MoSys' President, and CEO, continuing to serve as President. The board of directors is expected to initially comprise five members, including three appointed by Peraso and two by MoSys.

Webcast Presentation

MoSys and Peraso invite all interested parties to view a webcast presentation by Ron Glibbery, Dan Lewis, and Jim Sullivan for an overview of the combined company. The recorded presentation is available for viewing on the Investor Relations section of MoSys' website or by clicking here.

0 notes

Text

February 17th got to be the worst day of my life to date.

I am currently under the worst breed of doctors. I have heard so much about this department but it is something you would not understand unless you experience it firsthand. I could relate to people now saying they had their worst experience here.

They are so mean. When you ask questions, they don’t give you straighforward answers and if things go wrong you get blamed for not getting it done right.

I went looking for motivation online and stumbled upon this blog. I read a few articles and I could definitely relate. For the last 18 days, I feel like I did not learn anything at all and I have no one to blame but myself.

I hated every second I spent in their company. Maybe that is why I could not bring myself to achieceve anything.

For the first time since June 1, I find myself buried deep in sadness and disappointment.

That day was just too stressful for me. Too many monitoring and deliveries. I was scheduled to make a presentation but my laptop crashed and pissed of my resident. We had to reschedule. She said she’s available “anytime” and that is like the mosy difficult time ever. Everytime I talk to her about it she tells me I’m the one who has the problem. When I set the time, she always has something to do first. Then I assissted in the emergency C-section and I messed up big time. I could not get anything right. I am such a disaster, my hair kept coming out of my hair cap and the consultant noticed. I got told I probably wouldn’t get into OB-GYN, (hell yes! That had never been on my plate to begin with. I just did not answer because I did not want to offend anyone)that I am fucking aphasic because I suction at the wrong places and I am wherever they are stitching up, that it’s my second time assisting and I should have learned already on my first try. They talk about you like you’re not there. When the residents, make mistake they laugh it off when the interns make mistake, oh good luck!When I got out of the conference, the monitoring for some shitty prepartum slipped my mind and I got reprimanded for “not having the sense of urgency” because I was too busy worrying about my extension because I failed to do my bloody report on the scheduled time. Some people are just so much to deal with. On my last from duty status, got pissed off by my groupmate for telling me he wont go where we were supposed to go but I later found it he went there and I let it slide because I had too many encounters which people like his gender and it was not always good.

Gosh I could not wait for this to be over.

The only good thing was Surgery Conference—they had really interesting cases these days, especially for pediatric surgery. At least I learned something that day.

0 notes

Text

End of Term 1 & A Trip to Victoria Falls

Well, the end of my first term teaching has come and gone, and I've had the luxury of being able to relax for the last 2 weeks, and still have a couple more to get things sorted out before the start of the next round. I spent about a week travelling with fellow PCVs up around Victoria Falls (or Mosi-oa-Tunya - The Smoke That Thunders, as I recall the translation). We spent 3 nights in Zimbabwe in the town of Victoria Falls and 2 in Livingstone on the Zambia side, plus a day on either side taking a bus for literally 20+ hours each way to and from Windhoek (it definitely wasn't the highlight of the trip). I'll just describe the trip briefly, for now, since I don't have access to the bandwidth necessary to post photos, which I know are all people REALLY want to see of vacations. It'll suffice to say that the falls are beautiful and, more importantly, astonishingly impressive. Not only are they massive in the sense of the width of the Zambezi River where it spills over the cliffs, but the shear volume of water passing through them is colossal, and especially difficult to fathom for someone now used to living in desert environments. I can't help thinking that the sight of so much moving fresh-water would give some members of Grunau community a heart attack. In any case, the areas immediately adjacent to the falls are essentially in perpetual mist and rainfall, to the point that there is moss growing on many of the walkways under an ever-shifting layer of water. The days spent in Victoria Falls, Zimbabwe, were especially nice as it is a true tourist town, meaning a whole lot of western-style fare (in terms of food), which, I think is, something we PCVs were all missing. And, to avoid disappointing those visitors who are looking for something a little more exotic, there were places with various game meats (including crocodile) from the region. Livingstone, on the Zambian side, is more removed from the falls and is clearly a town with a more diverse economy than that of Victoria Falls, and so had a very different feel to it. There's probably a lot to do there, as well, but since our group got our more exciting activities out of the way while in Zimbabwe (e.g. bungee jumping, zip lines, and the like) I found it somewhat less interesting. However, it was on the Zambian side that we were able to hike down to the base of the falls via a valley with a constructed rock stairwell, although the vantage point is shielded from view of any of the actual falls - we mostly gained another perspective of the bridge across the canyon defining the border between Zambia and Zimbabwe. It was defintely cool, though, to see all the turmoil and chaos in the water up close; I think I described it, at the time, as "a chaos theorist's wet dream," though, in truth, it may be more like a nightmare for someone in that field... In any case, it was just interseting, to me, to see the behavior so much moving water, especially in places where it was clear that an underwater current was surfacing, like a jet of water shooting up to the surface in the midst of the bulk of the flow moving perpendicular to it. Anyway, I'll save further description for when I can post a picture or video that will do a better job.

The real benefit of the vacation, though, was that it gave me time to reflect upon the first term, and volunteering thus far, in general, in the company of people who are going through similar experiences. That is to say that the first couple of days that we were all together involved a fair amount of mutual comiseration and complaining about issues we face at our sites and especially at our schools. Personally, I don't think that it's possible to regard my first term teaching as anything other than a failure, at least in terms of the most important aspect of my "project": teaching. There are a lot of potential explanations I can come up with to attempt to find reason for that failure, but the glaring fact is that the average grade in all of my maths classes from grade 4-7 was a U, meaning "Ungraded" - the equivalent of an F in the US. Part of this is that the learners in all of the grades are behind; there is simply no denying that, whatever their past grades have been, they did not know what they were expected to according to the national syllabus. However, that, alone, does not, in my mind, account for such widespread failure. I certainly taught difficult classes in which questions were never recycled; a situation which, based on my observations of other classes and their exams, is atypical, but clearly necessary if they are to actually learn the concepts being taught. It's possible that I was overly ambitious in my pace through the material given the fact that I could tell, from the beginning, that the learners were, on average, far behind where they should have been starting based on the syllabus; even though I was moving at a pace far slower than is required to make it through the syllabus, I could tell that at least some of the kids weren't keeping up.

Ultimately, the main issue is the lack of effort evident in most of the learners, which, I think, was not helped by my rapport with them or my attitude during classes, the latter of which was frequently exasperated, and often (more than I'd like, anyway) boiled over into anger. Despite my efforts at implementing structure to behavioral consequences, I was never able to establish order for long; in my mind, I was never able to get the learners to respect either me or the class, itself. The degree to which this was an issue varied by grade level, but it was an issue with all of them, and I think it is an area that I will focus on in the coming term, at least to start out. And, having already mentioned attitude, I think I'll have to change my approach to conflict resolution since my genetic predisposition to aggresssive verbal disdain doesn't seem to resonate so well. To start out, I think that explaining my expectations of the learners, both in terms of classwork and behavior, explicitly at the beginning of the term as well as the defined consequences of behavioral infractions will be a good start; this is something that I knew should have been done when first establsihing my relationship with the learners at the start of my first term, but it fell to the wayside in the flurry of schedule negotiating and rewriting and the subsequent late start to actual teaching. In retrospect, finding the time for it, then, would have been a wise decision; I suppose that, despite my experiences during Phase II (the integration period at the end of last year where I was not officially responsible for classes), I did not expect the natural state of things to be so grim.

In any case, though it is impossible for me to discern exactly what problems are at the heart of the term's performance, it is obvious that something needs to change. One thing at a time...

1 note

·

View note

Text

Evolving Keyword Research to Match Your Buyer's Journey

Posted by matthew_jkay

Keyword research has been around as long as the SEO industry has. Search engines built a system that revolves around users entering a term or query into a text entry field, hitting return, and receiving a list of relevant results. As the online search market expanded, one clear leader emerged — Google — and with it they brought AdWords (now Google Ads), an advertising platform that allowed organizations to appear on search results pages for keywords that organically they might not.

Within Google Ads came a tool that enabled businesses to look at how many searches there were per month for almost any query. Google Keyword Planner became the de facto tool for keyword research in the industry, and with good reason: it was Google’s data. Not only that, Google gave us the ability to gather further insights due to other metrics Keyword Planner provided: competition and suggested bid. Whilst these keywords were Google Ads-oriented metrics, they gave the SEO industry an indication of how competitive a keyword was.

The reason is obvious. If a keyword or phrase has higher competition (i.e. more advertisers bidding to appear for that term) it’s likely to be more competitive from an organic perspective. Similarly, a term that has a higher suggested bid means it’s more likely to be a competitive term. SEOs dined on this data for years, but when the industry started digging a bit more into the data, we soon realized that while useful, it was not always wholly accurate. Moz, SEMrush, and other tools all started to develop alternative volume and competitive metrics using Clickstream data to give marketers more insights.

Now industry professionals have several software tools and data outlets to conduct their keyword research. These software companies will only improve in the accuracy of their data outputs. Google’s data is unlikely to significantly change; their goal is to sell ad space, not make life easy for SEOs. In fact, they've made life harder by using volume ranges for Google Ads accounts with low activity. SEO tools have investors and customers to appease and must continually improve their products to reduce churn and grow their customer base. This makes things rosy for content-led SEO, right?

Well, not really.

The problem with historical keyword research is twofold:

1. SEOs spend too much time thinking about the decision stage of the buyer’s journey (more on that later).

2. SEOs spend too much time thinking about keywords, rather than categories or topics.

The industry, to its credit, is doing a lot to tackle issue number two. “Topics over keywords” is something that is not new as I’ll briefly come to later. Frameworks for topic-based SEO have started to appear over the last few years. This is a step in the right direction. Organizing site content into categories, adding appropriate internal linking, and understanding that one piece of content can rank for several variations of a phrase is becoming far more commonplace.

What is less well known (but starting to gain traction) is point one. But in order to understand this further, we should dive into what the buyer’s journey actually is.

What is the buyer’s journey?

The buyer’s or customer’s journey is not new. If you open marketing text books from years gone by, get a college degree in marketing, or even just go on general marketing blogs you’ll see it crop up. There are lots of variations of this journey, but they all say a similar thing. No matter what product or service is bought, everyone goes through this journey. This could be online or offline — the main difference is that depending on the product, person, or situation, the amount of time this journey takes will vary — but every buyer goes through it. But what is it, exactly? For the purpose of this article, we’ll focus on three stages: awareness, consideration, & decision.

Awareness

The awareness stage of the buyer’s journey is similar to problem discovery, where a potential customer realizes that they have a problem (or an opportunity) but they may not have figured out exactly what that is yet.

Search terms at this stage are often question-based — users are researching around a particular area.

Consideration

The consideration stage is where a potential consumer has defined what their problem or opportunity is and has begun to look for potential solutions to help solve the issue they face.

Decision

The decision stage is where most organizations focus their attention. Normally consumers are ready to buy at this stage and are often doing product or vendor comparisons, looking at reviews, and searching for pricing information.

To illustrate this process, let’s take two examples: buying an ice cream and buying a holiday.

Being low-value, the former is not a particularly considered purchase, but this journey still takes place. The latter is more considered. It can often take several weeks or months for a consumer to decide on what destination they want to visit, let alone a hotel or excursions. But how does this affect keyword research, and the content which we as marketers should provide?

At each stage, a buyer will have a different thought process. It’s key to note that not every buyer of the same product will have the same thought process but you can see how we can start to formulate a process.

The Buyer’s Journey - Holiday Purchase

The above table illustrates the sort of queries or terms that consumers might use at different stages of their journey. The problem is that most organizations focus all of their efforts on the decision end of the spectrum. This is entirely the right approach to take at the start because you’re targeting consumers who are interested in your product or service then and there. However, in an increasingly competitive online space you should try and find ways to diversify and bring people into your marketing funnel (which in most cases is your website) at different stages.

I agree with the argument that creating content for people earlier in the journey will likely mean lower conversion rates from visitor to customer, but my counter to this would be that you're also potentially missing out on people who will become customers. Further possibilities to at least get these people into your funnel include offering content downloads (gated content) to capture user’s information, or remarketing activity via Facebook, Google Ads, or other retargeting platforms.

Moving from keywords to topics

I’m not going to bang this drum too loudly. I think many in of the SEO community have signed up to the approach that topics are more important than keywords. There are quite a few resources on this listed online, but what forced it home for me was Cyrus Shepard’s Moz article in 2014. Much, if not all, of that post still holds true today.

What I will cover is an adoption of HubSpot’s Topic Cluster model. For those unaccustomed to their model, HubSpot’s approach formalizes and labels what many search marketers have been doing for a while now. The basic premise is instead of having your site fragmented with lots of content across multiple sections, all hyperlinking to each other, you create one really in-depth content piece that covers a topic area broadly (and covers shorter-tail keywords with high search volume), and then supplement this page with content targeting the long-tail, such as blog posts, FAQs, or opinion pieces. HubSpot calls this "pillar" and "cluster" content respectively.

Source: Matt Barby / HubSpot

The process then involves taking these cluster pages and linking back to the pillar page using keyword-rich anchor text. There’s nothing particularly new about this approach aside from formalizing it a bit more. Instead of having your site’s content structured in such a way that it's fragmented and interlinking between lots of different pages and topics, you keep the internal linking within its topic, or content cluster. This video explains this methodology further. While we accept this model may not fit every situation, and nor is it completely perfect, it’s a great way of understanding how search engines are now interpreting content.

At Aira, we’ve taken this approach and tried to evolve it a bit further, tying these topics into the stages of the buyer’s journey while utilizing several data points to make sure our outputs are based off as much data as we can get our hands on. Furthermore, because pillar pages tend to target shorter-tail keywords with high search volume, they're often either awareness- or consideration-stage content, and thus not applicable for decision stage. We term our key decision pages “target pages,” as this should be a primary focus of any activity we conduct.

We’ll also look at the semantic relativity of the keywords reviewed, so that we have a “parent” keyword that we’re targeting a page to rank for, and then children of that keyword or phrase that the page may also rank for, due to its similarity to the parent. Every keyword is categorized according to its stage in the buyer’s journey and whether it's appropriate for a pillar, target, or cluster page. We also add two further classifications to our keywords: track & monitor and ignore. Definitions for these five keyword types are listed below:

Pillar page

A pillar page covers all aspects of a topic on a single page, with room for more in-depth reporting in more detailed cluster blog posts that hyperlink back to the pillar page. A keyword tagged with pillar page will be the primary topic and the focus of a page on the website. Pillar pages should be awareness- or consideration-stage content.

A great pillar page example I often refer to is HubSpot’s Facebook marketing guide or Mosi-guard’s insect bites guide (disclaimer: probably don’t click through if you don’t like close-up shots of insects!).

Cluster page

A cluster topic page for the pillar focuses on providing more detail for a specific long-tail keyword related to the main topic. This type of page is normally associated with a blog article but could be another type of content, like an FAQ page.

Good examples within the Facebook marketing topic listed above are HubSpot’s posts:

How Do Facebook Stories Stack Up to Snapchat?

How to Use Facebook Live: The Ultimate Guide

For Mosi-guard, they’re not utilizing internal links within the copy of the other blogs, but the "older posts" section at the bottom of the blog is referencing this guide:

The malaria map and your guide to traveling safe

Target page

Normally a keyword or phrase linked to a product or service page, e.g. nike trainers or seo services. Target pages are decision-stage content pieces.

HubSpot’s target content is their social media software page, with one of Mosi-guard’s target pages being their natural spray product.

Track & monitor

A keyword or phrase that is not the main focus of a page, but could still rank due to its similarity to the target page keyword. A good example of this might be seo services as the target page keyword, but this page could also rank for seo agency, seo company, etc.

Ignore

A keyword or phrase that has been reviewed but is not recommended to be optimized for, possibly due to a lack of search volume, it’s too competitive, it won’t be profitable, etc.

Once the keyword research is complete, we then map our keywords to existing website pages. This gives us a list of mapped keywords and a list of unmapped keywords, which in turn creates a content gap analysis that often leads to a content plan that could last for three, six, or twelve-plus months.

Putting it into practice

I’m a firm believer in giving an example of how this would work in practice, so I’m going to walk through one with screenshots. I’ll also provide a template of our keyword research document for you to take away.

1. Harvesting keywords

The first step in the process is similar, if not identical, to every other keyword research project. You start off with a batch of keywords from the client or other stakeholders that the site wants to rank for. Most of the industry call this a seed keyword list. That keyword list is normally a minimum of 15–20 keywords, but can often be more if you’re dealing with an e-commerce website with multiple product lines.

This list is often based off nothing more than opinion: “What do we think our potential customers will search for?” It’s a good starting point, but you need the rest of the process to follow on to make sure you’re optimizing based off data, not opinion.

2. Expanding the list

Once you’ve got that keyword list, it’s time to start utilizing some of the tools you have at your disposal. There are lots, of course! We tend to use a combination of Moz Keyword Explorer, Answer the Public, Keywords Everywhere, Google Search Console, Google Analytics, Google Ads, ranking tools, and SEMrush.

The idea of this list is to start thinking about keywords that the organization may not have considered before. Your expanded list will include obvious synonyms from your list. Take the example below:

Seed Keywords

Expanded Keywords

ski chalet

ski chalet

ski chalet rental

ski chalet hire

ski chalet [location name]

etc

There are other examples that should be considered. A client I worked with in the past once gave a seed keyword of “biomass boilers.” But after keyword research was conducted, a more colloquial term for “biomass boilers” in the UK is “wood burners.” This is an important distinction and should be picked up as early in the process as possible. Keyword research tools are not infallible, so if budget and resource allows, you may wish to consult current and potential customers about which terms they might use to find the products or services being offered.

3. Filtering out irrelevant keywords

Once you’ve expanded the seed keyword list, it’s time to start filtering out irrelevant keywords. This is pretty labor-intensive and involves sorting through rows of data. We tend to use Moz’s Keyword Explorer, filter by relevancy, and work our way down. As we go, we’ll add keywords to lists within the platform and start to try and sort things by topic. Topics are fairly subjective, and often you’ll get overlap between them. We’ll group similar keywords and phrases together in a topic based off the semantic relativity of those phrases. For example:

Topic

Keywords

ski chalet

ski chalet

ski chalet rental

ski chalet hire

ski chalet [location name]

catered chalet

catered chalet

luxury catered chalet

catered chalet rental

catered chalet hire

catered chalet [location name]

ski accommodation

ski accommodation

cheap ski accommodation

budget ski accommodation

ski accomodation [location name]

Many of the above keywords are decision-based keywords — particularly those with rental or hire in them. They're showing buying intent. We’ll then try to put ourselves in the mind of the buyer and come up with keywords towards the start of the buyer’s journey.

Topic

Keywords

Buyer’s stage

ski resorts

ski resorts

best ski resorts

ski resorts europe

ski resorts usa

ski resorts canada

top ski resorts

cheap ski resorts

luxury ski resorts

Consideration

skiing

skiing

skiing guide

skiing beginner’s guide

Consideration

family holidays

family holidays

family winter holidays

family trips

Awareness

This helps us cater to customers that might not be in the frame of mind to purchase just yet — they're just doing research. It means we cast the net wider. Conversion rates for these keywords are unlikely to be high (at least, for purchases or enquiries) but if utilized as part of a wider marketing strategy, we should look to capture some form of information, primarily an email address, so we can send people relevant information via email or remarketing ads later down the line.

4. Pulling in data

Once you’ve expanded the seed keywords out, Keyword Explorer’s handy list function enables your to break things down into separate topics. You can then export that data into a CSV and start combining it with other data sources. If you have SEMrush API access, Dave Sottimano’s API Library is a great time saver; otherwise, you may want to consider uploading the keywords into the Keywords Everywhere Chrome extension and manually exporting the data and combining everything together. You should then have a spreadsheet that looks something like this:

You could then add in additional data sources. There’s no reason you couldn’t combine the above with volumes and competition metrics from other SEO tools. Consider including existing keyword ranking information or Google Ads data in this process. Keywords that convert well on PPC should do the same organically and should therefore be considered. Wil Reynolds talks about this particular tactic a lot.

5. Aligning phrases to the buyer’s journey

The next stage of the process is to start categorizing the keywords into the stage of the buyer’s journey. Something we’ve found at Aira is that keywords don’t always fit into a predefined stage. Someone looking for “marketing services” could be doing research about what marketing services are, but they could also be looking for a provider. You may get keywords that could be either awareness/consideration or consideration/decision. Use your judgement, and remember this is subjective. Once complete, you should end up with some data that looks similar to this:

This categorization is important, as it starts to frame what type of content is most appropriate for that keyword or phrase.

The next stage of this process is to start noticing patterns in keyphrases and where they get mapped to in the buyer’s journey. Often you’ll see keywords like “price” or ”cost” at the decision stage and phrases like “how to” at the awareness stage. Once you start identifying these patterns, possibly using a variation of Tom Casano’s keyword clustering approach, you can then try to find a way to automate so that when these terms appear in your keyword column, the intent automatically gets updated.

Once completed, we can then start to define each of our keywords and give them a type:

Pillar page

Cluster page

Target page

Track & monitor

Ignore

We use this document to start thinking about what type of content is most effective for that piece given the search volume available, how competitive that term is, how profitable the keyword could be, and what stage the buyer might be at. We’re trying to find that sweet spot between having enough search volume, ensuring we can actually rank for that keyphrase (there’s no point in a small e-commerce startup trying to rank for “buy nike trainers”), and how important/profitable that phrase could be for the business. The below Venn diagram illustrates this nicely:

We also reorder the keywords so keywords that are semantically similar are bucketed together into parent and child keywords. This helps to inform our on-page recommendations:

From the example above, you can see "digital marketing agency" as the main keyword, but “digital marketing services” & “digital marketing agency uk” sit underneath.

We also use conditional formatting to help identify keyword page types:

And then sheets to separate topics out:

Once this is complete, we have a data-rich spreadsheet of keywords that we then work with clients on to make sure we’ve not missed anything. The document can get pretty big, particularly when you’re dealing with e-commerce websites that have thousands of products.

5. Keyword mapping and content gap analysis

We then map these keywords to existing content to ensure that the site hasn’t already written about the subject in the past. We often use Google Search Console data to do this so we understand how any existing content is being interpreted by the search engines. By doing this we’re creating our own content gap analysis. An example output can be seen below:

The above process takes our keyword research and then applies the usual on-page concepts (such as optimizing meta titles, URLs, descriptions, headings, etc) to existing pages. We’re also ensuring that we’re mapping our user intent and type of page (pillar, cluster, target, etc), which helps us decide what sort of content the piece should be (such as a blog post, webinar, e-book, etc). This process helps us understand what keywords and phrases the site is not already being found for, or is not targeted to.

Free template

I promised a template Google Sheet earlier in this blog post and you can find that here.

Do you have any questions on this process? Ways to improve it? Feel free to post in the comments below or ping me over on Twitter!

Sign up for The Moz Top 10, a semimonthly mailer updating you on the top ten hottest pieces of SEO news, tips, and rad links uncovered by the Moz team. Think of it as your exclusive digest of stuff you don't have time to hunt down but want to read!

0 notes

Photo

New Post has been published on http://simplemlmsponsoring.com/attraction-marketing-formula/seo/evolving-keyword-research-to-match-your-buyerrsquos-journey/

Evolving Keyword Research to Match Your Buyer’s Journey

Posted by matthew_jkay

Keyword research has been around as long as the SEO industry

has. Search engines built a system that revolves around users

entering a term or query into a text entry field, hitting return,

and receiving a list of relevant results. As the online search

market expanded, one clear leader emerged — Google — and with

it they brought AdWords (now Google Ads), an advertising platform

that allowed organizations to appear on search results pages for

keywords that organically they might not.

Within Google Ads came a tool that enabled businesses to look at

how many searches there were per month for almost any query. Google

Keyword Planner became the de facto tool for keyword research in

the industry, and with good reason: it was Google’s data. Not

only that, Google gave us the ability to gather further insights

due to other metrics Keyword Planner provided: competition and

suggested bid. Whilst these keywords were Google Ads-oriented

metrics, they gave the SEO industry an indication of how

competitive a keyword was.

The reason is obvious. If a keyword or phrase has higher

competition (i.e. more advertisers bidding to appear for that term)

it’s likely to be more competitive from an organic perspective.

Similarly, a term that has a higher suggested bid means it’s more

likely to be a competitive term. SEOs dined on this data for years,

but when the industry started digging a bit more into the data, we

soon realized that while useful, it was

not always wholly accurate. Moz, SEMrush, and other tools all

started to develop alternative volume and competitive metrics using

Clickstream

data to give marketers more insights.

Now industry professionals have several software tools and data

outlets to conduct their keyword research. These software companies

will only improve in the accuracy of their data outputs. Google’s

data is unlikely to significantly change; their goal is to sell ad

space, not make life easy for SEOs. In fact, they’ve made life

harder by

using volume ranges for Google Ads accounts with low activity.

SEO tools have investors and customers to appease and must

continually improve their products to reduce churn and grow their

customer base. This makes things rosy for content-led SEO,

right?

Well, not really.

The problem with historical keyword research is

twofold:

1. SEOs spend too much time thinking about the decision stage of

the buyer’s journey (more on that later).

2. SEOs spend too much time thinking about keywords, rather than

categories or topics.

The industry, to its credit, is doing a lot to tackle issue

number two. “Topics over keywords” is something that is

not new as

I’ll briefly come to later. Frameworks for

topic-based SEO have started to appear over the last few years.

This is a step in the right direction. Organizing site content into

categories, adding appropriate internal linking, and understanding

that one piece of content can rank for several variations of a

phrase is becoming far more commonplace.

What is less well known (but starting to gain traction) is point

one. But in order to understand this further, we should dive into

what the buyer’s journey actually is.

What is the buyer’s journey?

The buyer’s or customer’s journey is not new. If you open

marketing text books from years gone by, get a college degree in

marketing, or even just go on general marketing blogs you’ll see

it crop up. There are lots of variations of this journey, but they

all say a similar thing. No matter what product or service is

bought, everyone goes through this journey. This could be online or

offline — the main difference is that depending on the product,

person, or situation, the amount of time this journey takes will

vary — but every buyer goes through it. But what is it, exactly?

For the purpose of this article, we’ll focus on three stages:

awareness, consideration, & decision.

Awareness

The awareness stage of the buyer’s journey is similar to

problem discovery, where a potential customer realizes that they

have a problem (or an opportunity) but they may not have figured

out exactly what that is yet.

Search terms at this stage are often question-based — users

are researching around a particular area.

Consideration

The consideration stage is where a potential consumer has

defined what their problem or opportunity is and has begun to look

for potential solutions to help solve the issue they face.

Decision

The decision stage is where most organizations focus their

attention. Normally consumers are ready to buy at this stage and

are often doing product or vendor comparisons, looking at reviews,

and searching for pricing information.

To illustrate this process, let’s take two examples: buying an

ice cream and buying a holiday.

Being low-value, the former is not a particularly considered

purchase, but this journey still takes place. The latter is more

considered. It can often take several weeks or months for a

consumer to decide on what destination they want to visit, let

alone a hotel or excursions. But how does this affect keyword

research, and the content which we as marketers should provide?

At each stage, a buyer will have a different thought process.

It’s key to note that not every buyer of the same product will

have the same thought process but you can see how we can start to

formulate a process.

The Buyer’s Journey – Holiday Purchase

The above table illustrates the sort of queries or terms that

consumers might use at different stages of their journey. The

problem is that most organizations focus all of their efforts on

the decision end of the spectrum. This is entirely the right

approach to take at the start because you’re targeting consumers

who are interested in your product or service then and there.

However, in an increasingly competitive online space you should try

and find ways to diversify and bring people into your marketing

funnel (which in most cases is your website) at different

stages.

I agree with the argument that creating content for people

earlier in the journey will likely mean lower conversion rates from

visitor to customer, but my counter to this would be that you’re

also potentially missing out on people who will become customers.

Further possibilities to at least get these people into your funnel

include offering content downloads (gated content) to capture

user’s information, or remarketing activity via Facebook, Google

Ads, or other retargeting platforms.

Moving from keywords to topics

I’m not going to bang this drum too loudly. I think many in of

the SEO community have signed up to the approach that topics are

more important than keywords. There are quite a few resources on

this listed online, but what forced it home for me was Cyrus Shepard’s Moz

article in 2014. Much, if not all, of that post still holds

true today.

What I will cover is an adoption of HubSpot’s Topic

Cluster model. For those unaccustomed to their model,

HubSpot’s approach formalizes and labels what many search

marketers have been doing for a while now. The basic premise is

instead of having your site fragmented with lots of content across

multiple sections, all hyperlinking to each other, you create one

really in-depth content piece that covers a topic area broadly (and

covers shorter-tail keywords with high search volume), and then

supplement this page with content targeting the long-tail, such as

blog posts, FAQs, or opinion pieces. HubSpot calls this “pillar”

and “cluster” content respectively.

Source: Matt

Barby / HubSpot

The process then involves taking these cluster pages and linking

back to the pillar page using keyword-rich anchor text. There’s

nothing particularly new about this approach aside from formalizing

it a bit more. Instead of having your site’s content structured

in such a way that it’s fragmented and interlinking between lots of

different pages and topics, you keep the internal linking within

its topic, or content cluster. This video

explains this methodology further. While we accept this model may

not fit every situation, and nor is it completely perfect, it’s a

great way of understanding how search engines are now interpreting

content.

At Aira, we’ve taken this

approach and tried to evolve it a bit further, tying these topics

into the stages of the buyer’s journey while utilizing several

data points to make sure our outputs are based off as much data as

we can get our hands on. Furthermore, because pillar pages tend to

target shorter-tail keywords with high search volume, they’re often

either awareness- or consideration-stage content, and thus not

applicable for decision stage. We term our key decision pages

“target pages,” as this should be a primary focus of any

activity we conduct.

We’ll also look at the semantic relativity of the keywords

reviewed, so that we have a “parent” keyword that we’re

targeting a page to rank for, and then children of that keyword or

phrase that the page may also rank for, due to its similarity to

the parent. Every keyword is categorized according to its stage in

the buyer’s journey and whether it’s appropriate for a pillar,

target, or cluster page. We also add two further classifications to

our keywords: track & monitor and ignore. Definitions for these

five keyword types are listed below:

Pillar page

A pillar page covers all aspects of a topic on a single page,

with room for more in-depth reporting in more detailed cluster blog

posts that hyperlink back to the pillar page. A keyword tagged with

pillar page will be the primary topic and the focus of a page on

the website. Pillar pages should be awareness- or

consideration-stage content.

A great pillar page example I often refer to is HubSpot’s Facebook

marketing guide or

Mosi-guard’s insect bites guide (disclaimer: probably don’t

click through if you don’t like close-up shots of insects!).

Cluster page

A cluster topic page for the pillar focuses on providing more

detail for a specific long-tail keyword related to the main topic.

This type of page is normally associated with a blog article but

could be another type of content, like an FAQ page.

Good examples within the Facebook marketing topic listed above

are HubSpot’s posts:

How

Do Facebook Stories Stack Up to Snapchat?

How to Use

Facebook Live: The Ultimate Guide

For Mosi-guard, they’re not utilizing internal links within

the copy of the other blogs, but the “older posts” section at the

bottom of the blog is referencing this guide:

The malaria map and your guide to traveling safe

Target page

Normally a keyword or phrase linked to a product or service

page, e.g. nike trainers or seo services. Target pages are

decision-stage content pieces.

HubSpot’s target content is their social

media software page, with one of Mosi-guard’s target pages

being their natural

spray product.

Track & monitor

A keyword or phrase that is not the main focus of a page, but

could still rank due to its similarity to the target page keyword.

A good example of this might be seo services as the target page

keyword, but this page could also rank for seo agency, seo company,

etc.

Ignore

A keyword or phrase that has been reviewed but is not

recommended to be optimized for, possibly due to a lack of search

volume, it’s too competitive, it won’t be profitable, etc.

Once the keyword research is complete, we then map our keywords

to existing website pages. This gives us a list of mapped keywords

and a list of unmapped keywords, which in turn creates a content

gap analysis that often leads to a content plan that could last for

three, six, or twelve-plus months.

Putting it into practice

I’m a firm believer in giving an example of how this would

work in practice, so I’m going to walk through one with

screenshots. I’ll also provide a template of our keyword research

document for you to take away.

1. Harvesting keywords

The first step in the process is similar, if not identical, to

every other keyword research project. You start off with a batch of

keywords from the client or other stakeholders that the site wants

to rank for. Most of the industry call this a seed keyword list.

That keyword list is normally a minimum of 15–20 keywords, but

can often be more if you’re dealing with an e-commerce website

with multiple product lines.

This list is often based off nothing more than opinion: “What

do we think our potential customers will search for?” It’s a

good starting point, but you need the rest of the process to follow

on to make sure you’re optimizing based off data, not

opinion.

2. Expanding the list

Once you’ve got that keyword list, it’s time to start

utilizing some of the tools you have at your disposal. There are

lots, of course! We tend to use a combination of Moz Keyword Explorer, Answer the Public, Keywords Everywhere, Google

Search Console, Google Analytics, Google Ads, ranking tools, and

SEMrush.

The idea of this list is to start thinking about keywords that

the organization may not have considered before. Your expanded list

will include obvious synonyms from your list. Take the example

below:

Seed Keywords

Expanded Keywords

ski chalet

ski chalet

ski chalet rental

ski chalet hire

ski chalet [location name]

etc

There are other examples that should be considered. A client I

worked with in the past once gave a seed keyword of “biomass

boilers.” But after keyword research was conducted, a more

colloquial term for “biomass boilers” in the UK is “wood

burners.” This is an important distinction and should be picked

up as early in the process as possible. Keyword research tools are

not infallible, so if budget and resource allows, you may wish to

consult current and potential customers about which terms they

might use to find the products or services being offered.

3. Filtering out irrelevant keywords

Once you’ve expanded the seed keyword list, it’s time to

start filtering out irrelevant keywords. This is pretty

labor-intensive and involves sorting through rows of data. We tend

to use Moz’s Keyword

Explorer, filter by relevancy, and work our way down. As we go,

we’ll add keywords to lists within the platform and start to try

and sort things by topic. Topics are fairly subjective, and often

you’ll get overlap between them. We’ll group similar keywords

and phrases together in a topic based off the semantic relativity

of those phrases. For example:

Topic

Keywords

ski chalet

ski chalet

ski chalet rental

ski chalet hire

ski chalet [location name]

catered chalet

catered chalet

luxury catered chalet

catered chalet rental

catered chalet hire

catered chalet [location name]

ski accommodation

ski accommodation

cheap ski accommodation

budget ski accommodation

ski accomodation [location name]

Many of the above keywords are decision-based keywords —

particularly those with rental or hire in them. They’re showing

buying intent. We’ll then try to put ourselves in the mind of the

buyer and come up with keywords towards the start of the buyer’s

journey.

Topic

Keywords

Buyer’s stage

ski resorts

ski resorts

best ski resorts

ski resorts europe

ski resorts usa

ski resorts canada

top ski resorts

cheap ski resorts

luxury ski resorts

Consideration

skiing

skiing

skiing guide

skiing beginner’s guide

Consideration

family holidays

family holidays

family winter holidays

family trips

Awareness

This helps us cater to customers that might not be in the frame

of mind to purchase just yet — they’re just doing research. It

means we cast the net wider. Conversion rates for these keywords

are unlikely to be high (at least, for purchases or enquiries) but

if utilized as part of a wider marketing strategy, we should look

to capture some form of information, primarily an email address, so

we can send people relevant information via email or remarketing

ads later down the line.

4. Pulling in data

Once you’ve expanded the seed keywords out, Keyword

Explorer’s handy list function enables your to break things down

into separate topics. You can then export that data into a CSV and

start combining it with other data sources. If you have SEMrush API

access,

Dave Sottimano’s API Library is a great time saver;

otherwise, you may want to consider uploading the keywords into the

Keywords Everywhere Chrome extension and manually exporting the

data and combining everything together. You should then have a

spreadsheet that looks something like this:

You could then add in additional data sources. There’s no

reason you couldn’t combine the above with volumes and

competition metrics from other SEO tools. Consider including

existing keyword ranking information or Google Ads data in this

process. Keywords that convert well on PPC should do the same

organically and should therefore be considered. Wil Reynolds talks

about this

particular tactic a lot.

5. Aligning phrases to the buyer’s journey

The next stage of the process is to start categorizing the

keywords into the stage of the buyer’s journey. Something we’ve

found at Aira is that keywords don’t always fit into a predefined

stage. Someone looking for “marketing services” could be doing

research about what marketing services are, but they could also be

looking for a provider. You may get keywords that could be either

awareness/consideration or consideration/decision. Use your

judgement, and remember this is subjective. Once complete, you

should end up with some data that looks similar to this:

This categorization is important, as it starts to frame what