#wiretransfer

Text

Learn Domestic Wire Transfer Meaning for Smooth and Swift U.S. Payments!

Learn more: https://zilmoney.com/domestic-wire-transfer

0 notes

Text

Simplify your International Wire Transfer!

Learn more: https://zil.us/international-wire-transfer/

0 notes

Text

Sending money from Canada to India is now easier than ever, thanks to various options available to remit funds. If you're looking for cost-effective and efficient ways to transfer money in October 2023, this guide will provide you with the best options.

CAD to INR Conversion

One of the fundamental steps in sending money to India is converting Canadian dollars to Indian Rupees (CAD to INR). Ensure you check the current exchange rates to get the most value out of your Canadian dollars.

Wire Transfer from Canada to India

Sending money through a wire transfer is a reliable and secure method. It allows for a direct transfer of funds from your Canadian bank account to the recipient's bank account in India. This method is known for its efficiency and safety.

RemitAnalyst for Hassle-Free Transactions

Consider using RemitAnalyst, a trusted platform for sending money from Canada to India. They offer competitive rates and ensure a smooth transaction process, making it one of the best options available.

Lowest Cost Transfers

If cost-effectiveness is a priority, explore options that provide the lowest transfer fees and favorable exchange rates. Compare various providers to find the most economical solution for transferring money to India.

Best Options for Sending Money

Research and identify the best options available for sending money to India from Canada. Look for reputable financial institutions or online platforms that offer competitive rates, low fees, and a convenient transfer process.

In conclusion, when it comes to sending money from Canada to India, it's essential to choose the most suitable option that aligns with your preferences and requirements. Whether you prioritize low costs, efficient transfers, or reputable platforms, the key is to research and select the best method for your specific needs. Stay updated on the latest exchange rates and make an informed decision to ensure a seamless money transfer experience.❤️❤️❤️

#MoneyTransfer#Remittance#SendMoney#CADtoINR#WireTransfer#RemitAnalyst#CurrencyExchange#FinancialTransfers#CostEffectiveRemittance

0 notes

Text

Understanding Wire Transfers: A Detailed Dive

What is a Wire Transfer?

Wire transfers are electronic funds from one individual or entity to another. Wire transfers have evolved into a digital service that allows instant movement of funds between bank accounts worldwide. The transaction is completed via a network through telecommunication wire networks or digital infrastructures such as SWIFT (Society for Worldwide Interbank Financial Telecommunication). With wire transfers, the transaction can be completed in a matter of minutes or hours and is safe.

International and domestic wire transfer are highly dependable, even though wire transfers have high fees.

How Does It Work?

The process begins when a person sends money from their bank account to another individual's or company's bank account. The sender provides the recipient's name, bank account number, and bank routing number. In the case of international transfers, additional information such as the SWIFT or IBAN (International Bank Account Number) codes of the recipient's bank is required.

Once the details are confirmed, the sender's bank sends a message to the recipient's bank through a secure system, requesting the transfer of funds according to the sender's instructions. Upon the recipient's bank's approval, the funds are debited from the sender's account and credited to the recipient's account. This process can take several hours to a few days, depending on the banks and countries involved.

When to Use a Wire Transfer?

Wire transfers are often used when quick, secure, and direct transfer of funds is necessary. They are especially useful for large and time-sensitive transactions, as they can typically be completed within the same day domestically or one to five business days internationally. Examples of when to use a wire transfer include purchasing a home, sending money to family or friends abroad, paying for an international business transaction, or funding an investment account.

Benefits of Wire Transfer

Wire transfers provide a fast and secure method of transferring funds. They are a preferred method for large transactions as they allow for the immediate availability of funds, which can be crucial in time-sensitive purchases like real estate. They also offer a level of security and reliability, as both sender and receiver must have legitimate bank accounts that have undergone bank verification processes.

Risks Involved While Making a Wire Transfer

Despite their benefits, wire transfers carry some risks. They are often irreversible once the recipient's bank accepts the transfer, making them a common target for fraudsters. If a wire transfer is sent to the wrong account, it can be challenging to retrieve the funds. Also, personal information shared during the process could be at risk if it falls into the wrong hands. Hence, it's vital to double-check all details and only wire money to trusted recipients.

Difference Between Wire Transfer and Bank Transfer

While wire transfers and bank transfers involve moving funds from one account to another, key differences exist. Wire transfers are more immediate, secure, and reliable for large transactions, but they often come with fees, especially for international transfers. On the other hand, regular bank transfers, including ACH (Automated Clearing House) transfers, might take longer but usually come with lower or no fees.

In conclusion, wire transfers are convenient for quickly and securely transferring funds, especially for large amounts or international transactions. However, it's important to use this service wisely, be aware of potential risks, and understand how it differs from other types of bank transfers.

0 notes

Text

Simply send and receive money globally with Wire Transfers!

Learn more: https://zilbank.com/wire-transfers/

0 notes

Text

What is a Wire transfer (Large Value Payment System)?

The Wire transfer is basically a type of Electronic fund transfer that makes the movement of money wirelessly and spontaneously. It can be simplified as a direct bank-to-bank transfer either domestically or internationally. For domestic transactions, each country uses its own wire transfer methods. One of the important country-based wire transfer services is RTGS (Real Time Gross Settlement), which involves secure and fast transactions of the amount over the country.

#paymenttrends#barter#fiatmoney#wiretransfer#moneytransfer#RTGS#NEFT#Banks#Swift#clearinghouse#edtech#finance

0 notes

Text

Zil Money simplifies domestic wire transfer, allowing businesses to manage payments effortlessly. Also enjoy multiple options like ACH, eChecks, credit cards and more. Sign Up Now!

Learn more: https://zilmoney.com/domestic-wire-transfer

Click for interactive demo: https://zilmoney.storylane.io/share/21buz5czraij

0 notes

Text

With Zil.us, Wire Transfer Online is simple and fast. You can transfer funds domestically or internationally at affordable fees. Access anytime via computer, tablet, or smartphone. Try it now!

Learn more: https://zil.us/wire-transfer-online/

Click for interactive demo: https://zil.us/open-online-checking-account-instantly/

0 notes

Text

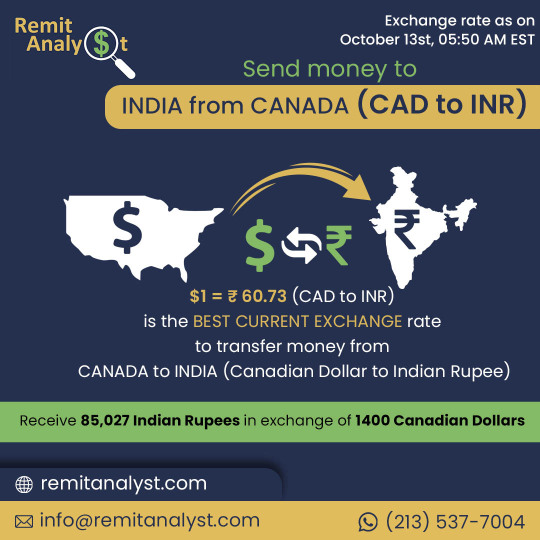

Effortless Money Transfers: Convert CAD to INR at the Best Rates!

Explore the best options to convert Canadian Dollar (CAD) to Indian Rupee (INR) and send money conveniently from Canada to India. Find the lowest cost for money transfers and get the best exchange rates to make your transactions seamless.

Looking for a hassle-free way to convert Canadian Dollar (CAD) to Indian Rupee (INR) and send money to your loved ones in India? RemitAnalyst has you covered! We offer a quick and efficient platform for transferring money from Canada to India, ensuring you get the best current exchange rate and the lowest transfer costs.

At RemitAnalyst, we understand the importance of finding the right exchange rate when transferring money internationally. We strive to provide you with the most competitive CAD to INR exchange rates, making it cost-effective to send money to India from Canada.

Our platform allows you to transfer money from Canada to India seamlessly through wire transfers. Whether you're residing in Canada or the USA, you can use our online service to send money to India with ease. Trust us to deliver a secure and reliable money transfer experience.

Key Features:

Best Exchange Rates: Discover the best current exchange rates to transfer money from Canada to India.

Lowest Transfer Costs: Save on transfer fees and get the most value out of your money when sending funds to India.

Secure Transactions: Rest assured that your money transfers are safe and secure through our trusted platform.

Convenient Online Process: Easily send money to India from the comfort of your home or office using our user-friendly online portal.

Swift Wire Transfers: Experience quick and efficient wire transfers for timely delivery of funds to your recipients in India.

Make your money transfers from Canada to India a breeze with RemitAnalyst. Join us today and enjoy a seamless process, unbeatable exchange rates, and low transfer costs!

#CADtoINR#CurrencyExchange#MoneyTransfer#RemitAnalyst#SendMoneyToIndia#BestExchangeRate#CanadaToIndia#WireTransfer#LowestTransferCosts#OnlineMoneyTransfer

0 notes

Text

With Zil Money, you can handle Wire Transfer Domestic transactions seamlessly. Pay bills, make purchases, and transfer funds using ACH, wire transfers, eChecks, and more. Try now!

Learn more: https://zilmoney.com/domestic-wire-transfer

Click for Interactive Demo: https://zilmoney.com/cheap-checks-online-order

0 notes

Text

Effortless Domestic Wire Transfer for Secure and Fast Payments!

Learn more: https://zil.us/domestic-wire-transfer/

0 notes

Text

What is a Wire Transfer?

Sending money has evolved significantly with the advent of technology, offering a variety of methods such as checks, mobile apps, and electronic transfers. However, when speed and ease of use are paramount, wire transfers emerge as a top choice. This article delves into the world of wire transfers, shedding light on when to use them, where they can be sent, and how to efficiently send money through various methods.

What is a Wire Transfer?

A wire transfer is an electronic method of transferring money from one person or business to another. Unlike cash transactions, no physical currency is exchanged. The sender provides instructions, including recipient details, amount, and sometimes pickup location. Both banks and non-bank entities can facilitate wire transfers, often referred to as "bank wires."

1.1 When to Use Wire Transfers:

Wire transfers are ideal in situations where immediate money transfer is necessary. They are commonly utilized for both domestic and international transfers, particularly for larger sums of money, making them ideal for bill payments, family support, or real estate transactions.

1.2 Where Can Wire Transfers Be Sent:

Wire transfers can be sent domestically within a country or internationally to recipients in other countries. The fees associated with wire transfers vary based on the service provider, destination, and the amount of money being transferred.

1.3 Security Measures:

In terms of security, wire transfers through banks or authorized non-bank providers offer similar levels of security, ensuring the safe transfer of funds.

Sending Wire Transfers Internationally: Methods and Procedures

Sending a wire transfer internationally can be done through multiple methods, including using online banking services, visiting a bank branch in person, making a phone call to the bank, or utilizing specialized money transfer services.

#WireTransfers#MoneyTransfers#ElectronicPayments#SecureTransfers#InternationalMoneyTransfer#DomesticTransfers#Banking#FinancialServices#CurrencyExchange#TransferFees#OnlineBanking#FinancialSecurity#PaymentMethods#TransferProcess#FundsTransfer

0 notes

Text

Don't let borders limit your finances! Wire transfers services simplify sending and receiving money from anywhere in the world. Sign up for ZilBank.com today.

Learn more: https://zilbank.com/wire-transfers/

0 notes