#internationalpayments

Text

The Ultimate Travel Companion: Understanding Travel Forex Cards

Introduction: In today's interconnected world, travel has evolved from a luxury to a lifestyle for many. Whether you're embarking on a backpacking journey through Southeast Asia, exploring the cultural wonders of Europe, or embarking on a business trip halfway across the world, one thing remains constant – the need for seamless and convenient access to your finances. Enter the travel forex card, a versatile and indispensable tool that revolutionizes the way we manage money abroad. In this comprehensive guide, we'll explore everything you need to know about travel forex cards and why they're the ultimate companion for modern-day globetrotters.

1: Understanding Travel Forex Cards In this chapter, we'll delve into the fundamentals of travel forex cards. We'll explore how these cards work, their benefits compared to traditional payment methods, and the various types of travel forex cards available in the market. From single-currency cards to multi-currency variants, we'll unravel the complexities and demystify the intricacies of these financial instruments.

2: The Convenience Factor Travel forex cards offer unparalleled convenience, allowing travelers to load multiple currencies onto a single card. We'll discuss the ease of managing funds, checking balances, and making transactions on the go. Whether you're navigating bustling city streets or remote countryside, your travel forex card ensures that you're always prepared for your financial needs.

3: Safety and Security Safety is paramount when it comes to managing money abroad, and travel forex cards provide peace of mind with robust security features. From chip-and-PIN technology to biometric authentication, we'll explore the layers of protection that safeguard your funds against theft, fraud, and unauthorized access. Additionally, we'll discuss the importance of backup options and contingency plans in case of emergencies.

4: Cost-Efficiency Traditional payment methods often come with hidden fees and unfavorable exchange rates, eating into your travel budget. Travel forex cards offer cost-effective solutions with competitive exchange rates and minimal or zero transaction fees. We'll analyze the potential savings compared to alternatives like cash, credit cards, and traveler's checks, empowering you to make informed financial decisions that maximize value.

5: Global Acceptance and Accessibility Whether you're traversing bustling metropolises or remote off-the-beaten-path destinations, your travel forex card ensures universal acceptance and accessibility. We'll explore the extensive network of merchants, ATMs, and financial institutions that honor these cards worldwide, providing unparalleled convenience and flexibility wherever your adventures take you.

6: 24/7 Support and Assistance Lost your card? Encountering technical issues? Fear not – help is just a phone call away. In this chapter, we'll highlight the importance of reliable customer support and assistance offered by travel forex card providers. From round-the-clock helplines to emergency card replacement services, we'll discuss the peace of mind that comes with knowing that help is readily available whenever you need it most.

Conclusion: Empowering Your Global Journey In conclusion, travel forex cards represent more than just a financial tool – they're a gateway to unparalleled convenience, security, and peace of mind for travelers worldwide. Whether you're embarking on a solo adventure, a family vacation, or a business trip, equipping yourself with a travel forex card ensures that you're prepared for whatever the world throws your way. So, before you set off on your next journey, make sure to arm yourself with the ultimate companion for global adventures – a travel forex card that unlocks the world at your fingertips.

#TravelForexCard#GlobalFinance#CurrencyManagement#TravelTips#InternationalPayments#FinancialFreedom#TravelSmart#MoneyManagement#BudgetTravel#SecureTransactions#ConvenientPayments#TravelEssentials#TravelPreparation#FinancialPlanning#ExploreWithEase

0 notes

Link

Great news for Indian globetrotters! PhonePe, a leading digital payments platform in India, has joined forces with Dubai-based Mashreq Bank to revolutionize how Indian tourists pay in the United Arab Emirates (UAE). This innovative partnership brings the convenience of PhonePe's Unified Payments Interface (UPI) to the UAE, allowing Indian visitors to ditch their international debit cards and make seamless payments using their smartphones. PhonePe Makes Payments a Breeze A Boon for Travelers: Seamless Payments with PhonePe UPI in the UAE This collaboration marks a significant step forward for both PhonePe and UPI. Here's a closer look at how it benefits Indian travelers: Effortless Transactions: Say goodbye to fumbling with foreign currency or international transaction fees. With PhonePe UPI, Indian tourists can simply scan QR codes at Neopay terminals, conveniently located across retail stores, restaurants, and tourist attractions in the UAE. Real-Time Currency Conversion: No more confusion or hidden charges. PhonePe displays the exchange rate during the transaction, ensuring you know exactly how much you're paying in Indian Rupees (INR). Enhanced Security: PhonePe leverages the robust security features of UPI, providing peace of mind for your financial transactions during your UAE trip. A Partnership for Progress: PhonePe and Mashreq Bank Join Forces The success of this initiative hinges on the collaboration between PhonePe and Mashreq Bank. PhonePe, a dominant player in India's digital payments landscape, brings its user-friendly UPI platform to the UAE. Mashreq Bank, a leading financial institution in the UAE, provides its extensive network of Neopay terminals for seamless transactions. This partnership not only benefits Indian travelers but also aligns with the Indian government's vision of expanding UPI's reach beyond national borders. Beyond Payments: PhonePe's Vision for Streamlined Remittances PhonePe's vision extends beyond simplifying payments for travelers. The company plans to introduce inward remittance services in the UAE, leveraging UPI's infrastructure. This service, once activated, will allow Indian expats in the UAE to send money home to India more conveniently. By eliminating the need for lengthy bank account details and IFSC codes, PhonePe aims to streamline the remittance process, making it faster and more user-friendly. PhonePe's Global Expansion: Paving the Way for a UPI-Powered Future The integration of PhonePe UPI in the UAE isn't an isolated event. PhonePe has already established a presence in various international markets, including Singapore, Canada, Oman, Saudi Arabia, France, Sri Lanka, and Nepal. These efforts showcase PhonePe's commitment to expanding its services globally and contributing to the wider adoption of UPI as a secure and efficient digital payment method. FAQs Q: How can Indian travelers in the UAE use PhonePe UPI for payments? A: Indian travelers can use PhonePe UPI in the UAE by scanning QR codes displayed at Neopay terminals located in various retail stores, restaurants, and tourist attractions. Q: Does PhonePe UPI work with local UAE currency (AED)? A: While transactions occur using PhonePe UPI, the exchange rate is displayed during the process, and the final debit amount is reflected in Indian Rupees (INR) within your PhonePe app. Q: Can I use PhonePe UPI in the UAE to send money back to India? A: As of now, the inward remittance service using PhonePe UPI in the UAE is not yet active. However, PhonePe plans to introduce this service soon, allowing Indian expats in the UAE to send money home more easily.

#digitalpayments#GlobalExpansion#Indiantravelers#internationalpayments#MashreqBank#Neopayterminals#PhonePe#PhonePeMakesPaymentsaBreeze#remittanceservices#UAE#UPI

0 notes

Text

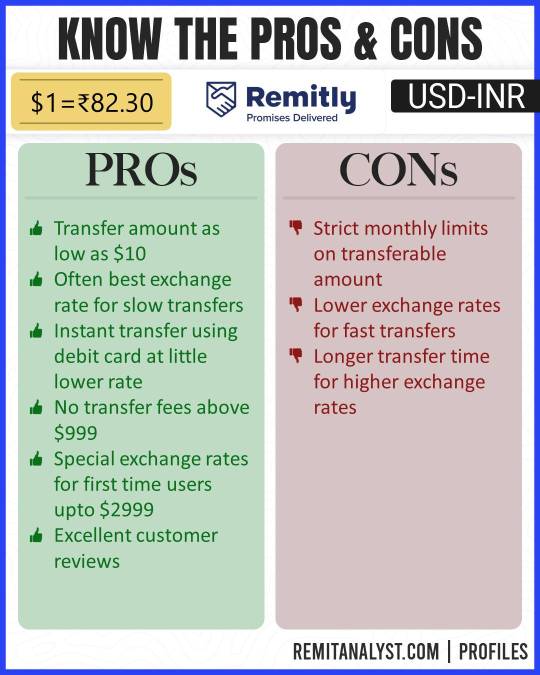

Remitly, a leading remittance service provider, offers a seamless

Remitly, a leading remittance service provider, offers a seamless, secure, and cost-effective solution for transferring money globally. With its user-friendly mobile app, Remitly simplifies the online money transfer process, eliminating the hassles associated with traditional methods, such as paperwork, complex codes, intermediaries, delays, and hidden fees. Headquartered in Seattle, Remitly extends its reach with offices in London, the Philippines, and Nicaragua, serving a vast network of more than 40 countries worldwide.

For those of Indian origin residing in the United States, Remitly specializes in facilitating money transfers to India. With Remitly, you can effortlessly send up to $30,000 from the United States to India in a single transaction. Enjoy the peace of mind that comes with fast deposits and guaranteed on-time delivery. Remitly consistently offers competitive exchange rates for currency conversion, ensuring that your money goes further. Plus, for transactions exceeding $1,000 USD, there are no transfer fees to worry about. Opt for their express money transfer service, and your funds will be available within a mere 4 banking hours.

Choose Remitly for your online remittance needs, and experience a hassle-free, secure, and cost-effective way to send money to your loved ones across the globe.

#Remitly#MoneyTransfer#SendMoney#CurrencyExchange#OnlineRemittance#FinancialServices#SecureTransfers#GlobalMoneyTransfer#CostEffectiveRemittance#TransparentTransfers#Fintech#DigitalPayments#Banking#CrossBorderPayments#NoTransferFees#ExchangeRates#FinancialFreedom#MobileApp#InternationalPayments#FastDeposits

0 notes

Text

The Future of International Payments: Emerging Technologies and Trends

In our interconnected world, international payments serve as the lifeblood of global commerce, facilitating the exchange of goods, services, and capital across borders. These transactions underpin multinational trade, fuel economic growth, and empower businesses and individuals to participate in the global market.

The systems facilitating payments have continually evolved from bartering goods and gold coins to checks, credit cards, and now digital currencies. This change has gained unprecedented momentum in recent years due to the rapid advancement of technology, changing consumer behavior, and evolving business needs.

The Current State of International Payments

Traditional methods like wire transfers, SWIFT payments, and bank drafts have served us for decades, ensuring security and traceability. However, they are often criticized for their speed, cost, and lack of transparency, which is critical in today's fast-paced and digital world.

With high transaction costs, slow processing times, and limited transparency on exchange rates and fees, traditional payment systems have been unable to keep up with the rising demands of instantaneous, cost-effective, and transparent transactions.

Emerging Technologies Reshaping International Payments

Fintech, a blend of 'financial technology,' is revolutionizing how we interact with money. It's dismantling age-old financial infrastructures and replacing them with streamlined, digital-first solutions that offer better user experiences and lower costs.

Real-Time Payments (RTP): A real-time payment is a transfer of funds that occurs immediately. This technology can eliminate one of the biggest challenges in international payments - delays.

Mobile Payments and Digital Wallets: Mobile and digital wallets are ushering in a new era of convenience and accessibility, allowing users to transact anywhere, anytime, with just a few taps on their smartphones.

Exploring Real-Time Payments (RTP)

RTP Explained: Real-Time Payments (RTP) are transfers that are processed instantly, 24/7, providing immediate availability of funds to the recipient. This immediacy is a game-changer in international payments, removing time barriers and enhancing business efficiency.

The Impact of RTP on International Trade: By facilitating instantaneous transactions, RTP can streamline international trade, enabling businesses to optimize their cash flows and reduce the risks associated with currency fluctuations.

Real-Time Settlements: While RTP brings many benefits, implementing it globally presents challenges. Issues such as different time zones, varying regulations, and interoperability need to be addressed for seamless global RTP.

Mobile Payments and Digital Wallets

Rise of Mobile Payments: A Global Perspective The ubiquity of smartphones and internet connectivity has fueled the surge of mobile payments. This growth trend is visible worldwide, providing a convenient and contactless mode of transaction that users appreciate.

Role of Digital Wallets in Enhancing User Experience: Digital wallets enable mobile payments and enhance the user experience by integrating loyalty programs, providing personalized offers, and offering advanced security features.

Regulatory Factors Impacting International Payments

Regulations play a crucial role in shaping the international payments landscape. From central banks to local governments, various entities create rules that dictate how money can be moved across borders.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations are integral to preventing financial crime. However, they also complicate international payments, requiring businesses to undertake due diligence and comply with stringent identification procedures.

Future of International Payments: Trends to Watch

The Increasing Role of AI and Machine Learning: Artificial intelligence (AI) and machine learning (ML) are set to further revolutionize international payments by automating processes, predicting trends, identifying fraud, and personalizing customer experiences.

The Future of Cross-Border Payments: The future belongs to integrated payment systems that can offer seamless experiences to users, regardless of their location. These platforms will cater to all transaction needs, combining different payment methods, currencies, and technologies.

The Environmental Impact: As the world becomes increasingly conscious of environmental impacts, the demand for 'green' or 'sustainable' technologies in payment systems will grow. This trend is expected to influence future innovations in the international payments landscape.

The future of international payments is undeniably exciting. As we look ahead, it's clear that technology will continue to drive innovation, pushing the boundaries of what's possible and transforming how we move money around the world.

In this dynamic landscape, embracing change and innovation will be key. Businesses, financial institutions, and individuals must be ready to adapt to these evolving technologies and trends to thrive in the future of international payments.

1 note

·

View note

Text

Understanding Wire Transfers: A Detailed Dive

What is a Wire Transfer?

Wire transfers are electronic funds from one individual or entity to another. Wire transfers have evolved into a digital service that allows instant movement of funds between bank accounts worldwide. The transaction is completed via a network through telecommunication wire networks or digital infrastructures such as SWIFT (Society for Worldwide Interbank Financial Telecommunication). With wire transfers, the transaction can be completed in a matter of minutes or hours and is safe.

International and domestic wire transfer are highly dependable, even though wire transfers have high fees.

How Does It Work?

The process begins when a person sends money from their bank account to another individual's or company's bank account. The sender provides the recipient's name, bank account number, and bank routing number. In the case of international transfers, additional information such as the SWIFT or IBAN (International Bank Account Number) codes of the recipient's bank is required.

Once the details are confirmed, the sender's bank sends a message to the recipient's bank through a secure system, requesting the transfer of funds according to the sender's instructions. Upon the recipient's bank's approval, the funds are debited from the sender's account and credited to the recipient's account. This process can take several hours to a few days, depending on the banks and countries involved.

When to Use a Wire Transfer?

Wire transfers are often used when quick, secure, and direct transfer of funds is necessary. They are especially useful for large and time-sensitive transactions, as they can typically be completed within the same day domestically or one to five business days internationally. Examples of when to use a wire transfer include purchasing a home, sending money to family or friends abroad, paying for an international business transaction, or funding an investment account.

Benefits of Wire Transfer

Wire transfers provide a fast and secure method of transferring funds. They are a preferred method for large transactions as they allow for the immediate availability of funds, which can be crucial in time-sensitive purchases like real estate. They also offer a level of security and reliability, as both sender and receiver must have legitimate bank accounts that have undergone bank verification processes.

Risks Involved While Making a Wire Transfer

Despite their benefits, wire transfers carry some risks. They are often irreversible once the recipient's bank accepts the transfer, making them a common target for fraudsters. If a wire transfer is sent to the wrong account, it can be challenging to retrieve the funds. Also, personal information shared during the process could be at risk if it falls into the wrong hands. Hence, it's vital to double-check all details and only wire money to trusted recipients.

Difference Between Wire Transfer and Bank Transfer

While wire transfers and bank transfers involve moving funds from one account to another, key differences exist. Wire transfers are more immediate, secure, and reliable for large transactions, but they often come with fees, especially for international transfers. On the other hand, regular bank transfers, including ACH (Automated Clearing House) transfers, might take longer but usually come with lower or no fees.

In conclusion, wire transfers are convenient for quickly and securely transferring funds, especially for large amounts or international transactions. However, it's important to use this service wisely, be aware of potential risks, and understand how it differs from other types of bank transfers.

0 notes

Text

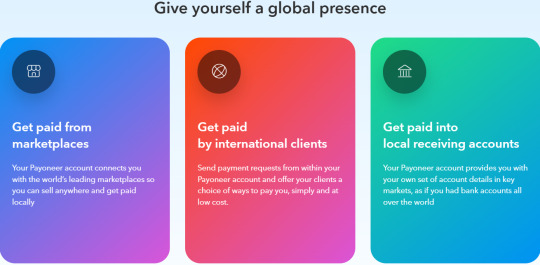

How a Payoneer Account Can Help your Business Grow.

If you're in the market for a global payment platform, you've likely considered Payoneer as an option. Payoneer is a popular payment platform used by many business owners, freelancers, and entrepreneurs around the world.

But how efficient and safe is it? In this review, we'll take a look at the features of Payoneer, the pros and cons of using it, and how it stacks up to the competition.

Payoneer is a secure, global payment platform that allows users to send and receive money from any part of the world. It offers a range of services, including international payments, online banking, and cash management.

The platform is available in over 200 countries and supports multiple currencies, making it a great option for those working with international clients.

Payoneer also offers a range of features that make it a great choice for businesses. For example, the platform provides easy-to-use tools for creating invoices, tracking payments, and monitoring incoming and outgoing funds. Plus, the platform is integrated with popular payment gateways, such as PayPal and Stripe, so you can easily accept payments from customers all over the world.

When it comes to security, Payoneer takes the safety and privacy of its users seriously. The platform features sophisticated encryption technology, as well as two-factor authentication and fraud protection. Also, the platform is PCI compliant, meaning it meets the security standards set by the Payment Card Industry.

Overall, Payoneer is a great choice for those looking for a secure and efficient global payment platform. The platform offers a range of features, such as invoice creation, payment tracking, and fraud protection, which make it an ideal choice for businesses of all sizes. Further, the platform is backed by a team of experts who are available to answer questions and provide support.

Source: Payoneer Official Website

Of course, Payoneer isn't the only global payment platform on the market. Other platforms, such as TransferWise, WorldRemit, and Paypal, offer similar services and features. Your Payoneer account is your ticket to a world of possibilities. Payoneer makes your business accessible to the entire world, whether you're sending or receiving money internationally, running your online business, or getting access to funding.

Realize your potential and join the millions of other businesses.

Enjoy rapid, safe, and affordable money transfers and avoid expensive international wire transfers. Once a payment has been received into your Payoneer account, you can quickly withdraw the money in your home currency to your local bank account or at any ATM around the world.

GO HERE TO GET INSTANT ACCESS TO YOUR PAYONEER ACCOUNT

By using this link to sign up, you’ll enjoy a FREE BONUS of $25 to start off your Payoneer account

#payoneer#payoneeraccount#onlinepayments#onlinebanking#internationalpayments#globalpayments#globalbanking#onlinebankaccount#paypal#skrill#zelle#neteller#payeer#remesas#venezuela#dolartoday#bitcoin#uphold#colombia#dolar#exchange#efecty#giftcard#divisas#argentina#perfectmoney#paypalvenezuela#freelancer#wellsfargo#westerunion

0 notes

Text

online payment, virtual payment, couponglobal.com,

https://www.facebook.com/couponglobal

#globalpaying#globalpayment#internationalpaying#internationalpayment#payingglobal#paymentglobal#payinginternational#paymentinternational#onlinepaying#onlinepayment#virtualpaying#virtualpayment#payingonline#paymentonline#payingvirtual#paymentvirtual#globalpayee#globalpayer#internationalpayee#internationalpayer#payeeglobal#payerglobal#payeeinternational#payerinternational#virtualpayee#onlinepayee#payeevirtual#payeeonline#virtualpayer#onlinepayer

1 note

·

View note

Photo

Paytoglobe's SSL certificate with 256 bit SSL encryption, Embedded 3D secured protocol. PCI DSS compliant provides you highly secure payment gateway.

.

.

0 notes

Text

The Value and Role of Bitcoin in International Payments

Bitcoin has gained popularity worldwide as people see its potential for appreciation and its unique features. However, without additional drivers, the value of bitcoin would be fragile and rely solely on the shared illusion of its worth. This would make it susceptible to becoming a financial bubble like Beanie Babies or tulips.

But bitcoin's true value lies in its ability to enable cross-border payments between different countries and geopolitical clusters. Traditional currencies like the yuan and the dollar pose challenges when it comes to international transactions. Bitcoin provides a solution by serving as a neutral and mutually trusted asset, eliminating the need for intermediaries.

Bitcoin's decentralized nature and blockchain technology allow for secure and transparent transactions. It also offers faster and cheaper cross-border transfers compared to traditional methods. Additionally, bitcoin's divisibility and digital nature make it a convenient option for everyday purchases and large international trade deals.

In conclusion, bitcoin's design makes it well-suited for facilitating international payments. Its neutrality, trustworthiness, and technological advantages position it as a potential alternative to traditional currencies in global transactions.

Read the original article here

Related: #bitcoin, #cryptocurrency, #internationalpayments, #blockchain

0 notes

Text

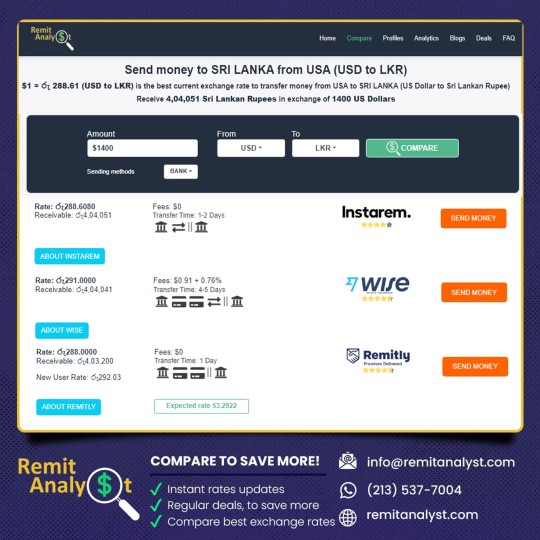

Discover the best current exchange rate and maximize your savings when sending money from the USA to SRI LANKA! 💸🌍💹

💰 With RemitAnalyst, compare rates and choose the most favorable option for your money transfer needs. 💡✅

📉 Convert USD to LKR at the best rates available, ensuring you get more value for your hard-earned money. 💱💹

💸💼 Don't settle for less! Explore the competitive rates and trusted remittance services to send money securely and efficiently. 🏦💪

📈 Start saving more on your international money transfers to SRI LANKA from the USA today! 💸✨

#MoneyTransferSavings#CurrencyExchange#FinancialServices#Remittance#SecureTransfers#InternationalPayments#CostEffectiveRemittance

0 notes

Video

youtube

Best Cheap Web Hosting Services For WordPress🔥 Interserver $2.5 Deal Review 🌐 Check out this Perfect Money Review on Raqmedia! 💸 Learn how to make secure online transactions with low fees and no worries about chargebacks. 🚀 Perfect for international payments! 🌍 Follow the link for the full scoop: https://bit.ly/perfctmny

🔒 Don’t forget to follow and like Raqmedia for more trending articles!

#raqmedia #onlinepayments #PerfectMoney #SecureTransactions #DigitalCurrency #MoneyManagement #InternationalPayments #FinancialFreedom

0 notes

Text

Cross-Border Ecommerce: How to Facilitate Secure and Cost-Effective Online Payments

Businesses have grown to realize the importance of exposure to global markets and audiences and have expanded their business across borders. However, facilitating secure and cost-effective online payments for cross-border ecommerce can be a daunting task. Here are some tips to help businesses overcome these challenges:

Choose the right payment gateway

A payment gateway is a service that processes online payments for businesses. When selecting a payment gateway for cross-border ecommerce, businesses should consider the currencies and payment methods supported by the gateway. It's also important to choose a payment gateway that is compliant with local laws and regulations.

Offer multiple payment options

Customers have different payment preferences depending on their country of origin. Offering multiple payment options, such as credit cards, e-wallets, and bank transfers, can increase customer satisfaction and reduce cart abandonment rates.

Use secure payment methods

Security is crucial when it comes to online payments. Merchants should use secure payment methods, such as tokenization and encryption, to protect customer information. They should also comply with data protection laws, such as the General Data Protection Regulation (GDPR) in the European Union.

Consider currency conversion fees

Currency conversion fees can add up quickly, especially for businesses that operate in multiple countries. Merchants should choose a payment gateway that offers competitive currency conversion rates or use a multi-currency account to reduce conversion fees.

Partner with a reputable payment service provider

Partnering with a reputable payment service provider can simplify cross-border ecommerce payments. Payment service providers can offer customized solutions for businesses, provide support for multiple currencies and payment methods, and ensure compliance with local laws and regulations.

Conclusion

In conclusion, international payments involve different currencies, payment methods, and regulatory frameworks. Businesses need to consider the security and privacy of customer information, compliance with local laws and regulations, and the costs associated with payment processing. By following these tips, businesses can provide a seamless payment experience for customers, reduce costs, and mitigate risks associated with cross-border ecommerce payments.

1 note

·

View note

Photo

If your business is looking to streamline your customer payment service & improve your cashflow, you should be sure that a payment gateway is the best way. They not only make it easy for you but also reflect payment on your account immediately & improve your cashflow.

.

.

#chooseus #paymentgateway #paymentgatewayapi #internationalpayment #internationaltransactions #instantpay #cashlesspayments #digitalpayments #onlinebusiness #paymentsolutions #fintech #securepayments #smallbusiness #business #grocerybusiness #startups

#payment#international payments#paymentgateway#paymentgatewayapi#internationaltransactions#instant payments#instantpayout#cashless#cashless payment#fintech#paymentsolutions#startups#secure payment gateway#cashlesso#business#smallbusiness#digitalpayments

0 notes

Photo

Managing money got easier!

Quit making your employees wait for their paychecks and stop handling the hassle of sending them each one individually each month. With this specific service, you can assess anything from wage payout to vendor payout to bulk refunds.

Perks of having On Demand Payouts for your Business

• Reduces Employee Turnover

• Improves Employee Engagement

• Increase Paperless Process

Switch to #investopay - best payment gateway for hassle-free transactions.

.

.

#investopay #globalpayments #payday #payments #paymentsolutions #fintech #highriskmerchants #ecommerce #marketplace #onlinepayments #solutionproviders #smallbusiness #payoutspecialist #paymentgateway #payouts #merchants #fraud #payout #paymentprocessing #creditcardprocessing #onlinebusiness #businesssolutions #internationalpayments #paymentsolution

0 notes

Text

International bank payment from Nepal 🇳🇵🇳🇵🇳🇵🇳🇵 WhatsApp Viber Imo 9860947238 #internationalbanktransfer #internationalpayment #internationalbankwalletpay #internationalbanktransfernepal #internationalbillpayment #aboardstudynepal #aboardstudynp #jobappointment #australiapaymentnepal #bripayment #indonesiapayment #gcashmepal #paymayanepal #banktransfernepal #visacardpaymentnepal #VisaAppointment #visacardpay #tiktokcoinsnepal #tiktokcoinsinnepal #tiktokwithdrawal #euronepal #europepayments #mastercardpayment #payeertopupnepal #payeerdollarbuy #skrilltopupnepal #skrillfundload #paypalpaymentnepal #cashoutnepal #cashapp #nepalpaymentsolution

0 notes

Photo

In order to avail benefits like reduced transaction time, less errors, more security & the like, switch to Integrated payment system for your business operations.

Paytoglobe offers multiple features & benefits of Integrated payment system for your business.

#paymentgatewayupdates #paymenttips #internationalaymentgateway #paymentgatewayprovider

#paymentgateway #paymentgatewayapi #internationalpayment #internationaltransactions

#paymentgatewaysolution #onlinepayments #paymentgatewayservice

#paymentgatewayprovider #paymentgatewayintegration

#paymentgatewayhigh #paymentgatewaysecurity

#paymentgatewaysystem #integratedpaymentsystem

#Paymentsolutions #merchantservices #globalpaymentgateway #bestpaymentgateway #toppaymentgateway #integratedpaymentsystem #securepayment

0 notes