#xdc blockchain

Explore tagged Tumblr posts

Text

These Technologies Will Move the World's Money – You Better Get Used to It

Blockchain isn’t the future—it’s the infrastructure being built right now to move the world’s money. Stand up on this. Take this in. These technologies are not hype—they’re infrastructure. They’re being built right now to move the world’s money. You just saw it: XDC + JPMorgan Chase + TradeFinex – Real-world trade finance on blockchain. Algorand (TPAOS) – Powering CBDCs. Yes, Central Bank…

#Algorand#Blockchain#CBDC#Constellation DAG#Crypto Adoption#Crypto News#decentralized finance#financial infrastructure#generational wealth#Hedera#Hyperledger#IBM#JPMorgan#Overledger#Quant#Ripple#Stellar#XDC#XLM#XRP

0 notes

Text

The Future of Finance: Top Cryptocurrencies Shaping the Financial World 🌍💸

The financial sector is evolving rapidly, and blockchain technology is at the forefront of this transformation. Here’s a quick look at some of the most innovative cryptocurrencies designed to revolutionize payments, trade finance, and enterprise solutions:

1. XRP (Ripple)

💸 XRP is the go-to solution for cross-border payments. Designed for financial institutions, it offers fast, low-cost transactions and helps streamline global liquidity. Ripple is paving the way for a more connected financial world. 🌍

2. XLM (Stellar Lumens)

🌟 XLM focuses on financial inclusion by enabling fast and affordable international transfers. Stellar empowers the unbanked population and facilitates small-scale transactions globally. 💵✨

3. XDC (XinFin Digital Contract)

🚀 XDC is transforming trade finance by digitizing global trade and supply chains. XinFin bridges traditional finance with blockchain technology to create secure, scalable solutions for enterprises. 🌐📄

4. QNT (Quant)

🔗 QNT is all about blockchain interoperability! With its Overledger technology, Quant connects different blockchains and legacy systems, making it easier for enterprises to adopt blockchain solutions seamlessly. 🔒⚡

5. ALGO (Algorand)

⚡ ALGO powers decentralized finance (DeFi) with speed, security, and scalability. From stablecoins to tokenized assets, Algorand is designed for enterprise-grade applications with ultra-low fees. 💎💻

6. HBAR (Hedera Hashgraph)

🌐 HBAR uses Hashgraph technology to deliver enterprise-grade efficiency. It’s perfect for applications like payments, identity verification, and supply chain tracking—all at lightning-fast speeds! 🛠️🔒

7. ADA (Cardano)

📚 ADA is a research-driven blockchain built for scalability and sustainability. Cardano supports smart contracts and decentralized applications while prioritizing security and environmental friendliness. 🌱💡

The Future Is Here 🚀

These cryptocurrencies are shaping the next generation of finance by bridging the gap between traditional systems and blockchain technology. Whether it’s cross-border payments, trade finance, or decentralized applications, these projects are leading the charge toward innovation! 💻✨

#CryptoInnovation#DigitalCurrency#FutureOfFinance#Crypto Blockchain Finance XRP Stellar XLM XDC Quant QNT Algorand ALGO Hedera HBAR Cardano ADA DeFi TradeFinance

1 note

·

View note

Text

youtube

🚀Ce qu'il arrive à la crypto XCN est FOU ! EXPLOSION!

#crypto#altcoin#revue technique des marchés#alex mendes#impact trading#prévisions crypto#crypto news#cryptocurrency#crypto trading#xdc#coin bureau#xrp news#xrp price prediction#xrp ripple#xrp price#ripple xrp#xrp news today#xcn#onyxcoin#onyxcoin crypto#xcn crypto#xcn token#xcn price#xcn coin#onyxcoin blockchain#xcn news#onyxcoin token#onyxcoin prediction#xcn crypto news#chain coin xcn

0 notes

Text

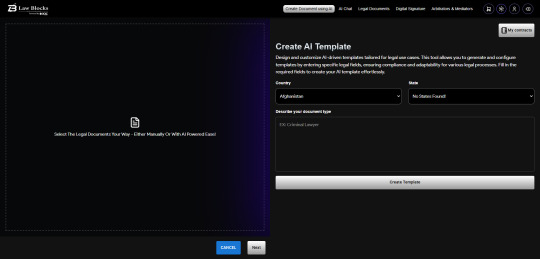

From Conflict to Resolution: Law Blocks' ADR and ODR in Action

In a world driven by digital transformation, the legal landscape is no exception. Traditional approaches to dispute resolution are giving way to innovative methods that are faster, more accessible, and in tune with the times. Enter Law Blocks, a trailblazer in the realm of Alternative Dispute Resolution (ADR) and Online Dispute Resolution (ODR). In this blog, we'll embark on a journey through the intricacies of ADR and ODR, exploring how Law Blocks is reshaping the way conflicts are resolved in the digital era.

The Digital Revolution Meets Legal Innovation

As the digital revolution continues to disrupt industries, the legal sector is undergoing a profound transformation. Gone are the days when resolving disputes meant lengthy court battles, hefty legal fees, and a process that often left parties dissatisfied. With the advent of ADR and ODR, a new era of conflict resolution has emerged—one that's efficient, cost-effective, and tailored to the needs of the parties involved.

Law Blocks: A Catalyst for Change

At the heart of this legal evolution is Law Blocks, a platform that's revolutionizing how disputes are settled. With a suite of innovative tools and technologies, Law Blocks simplifies the process from start to finish. Here's a glimpse of what it offers:

AI Templates: Law Blocks provides AI-driven templates that guide users through the creation of legal documents. These templates aren't just static forms; they're smart, adapting to user inputs and ensuring the resulting documents are accurate and legally sound.

Secure Document Sharing: Collaboration is made seamless with Law Blocks. Users can securely share documents with counterparts, eliminating the need for cumbersome email exchanges and reducing the risk of version conflicts.

Document Editing: Need to make changes to a shared document? Law Blocks allows for real-time, collaborative editing, ensuring that all parties are on the same page, literally.

Cryptographic Signatures: Signatures are a critical part of legal agreements, and Law Blocks employs cryptographic signatures for utmost security. These signatures are tamper-proof, ensuring the integrity of your documents.

Blockchain Integration: Law Blocks leverages blockchain technology to provide an indelible record of transactions. Documents are loaded onto the blockchain, creating a transparent and immutable history of all interactions.

ADR and ODR: The crux of Law Blocks' innovation lies in its ADR and ODR capabilities. Parties can opt for mediation and arbitration courts within the platform, streamlining the dispute resolution process.

The Power of ADR and ODR

So, how do ADR and ODR work in practice? Here's a simplified breakdown:

Mediation: In the event of a dispute, parties can choose mediation. A neutral mediator, agreed upon by the parties involved, facilitates discussions and negotiations. Mediation encourages collaboration and communication, often leading to mutually agreeable resolutions.

Arbitration: If mediation doesn't resolve the issue, the dispute moves to arbitration. Here, smart contracts come into play, ensuring transparency and enforcing the decisions of the arbitrator. It's a faster and more cost-effective alternative to traditional court proceedings.

Law Blocks in Action

The real magic of Law Blocks unfolds when you see these processes in action. Picture this: You need to draft a complex legal agreement with a business partner. With Law Blocks, you access an AI template specifically tailored to your needs. As you work on the document, your partner reviews, edits, and signs it—all within the platform, securely tracked on the blockchain. If a dispute arises, you opt for mediation, facilitated by a neutral mediator. The process is transparent, efficient, and cost-effective, thanks to smart contracts. The result? Conflict to resolution, seamlessly.

The Future of Dispute Resolution

In a world where speed, accessibility, and fairness are paramount, Law Blocks' ADR and ODR innovations are driving change. The legal industry is catching up with the digital age, and Law Blocks is leading the way. As blockchain technology continues to mature and gain acceptance, the synergy between legal expertise and innovation will be the driving force behind the next evolution in dispute resolution.

From conflict to resolution, Law Blocks is rewriting the narrative, offering a vision of legal innovation that's accessible to all. Stay tuned as we continue to redefine the landscape of justice in the digital era.

For more information check here >>

Linkedin : Lawblocks

Discord : https://discord.com/invite/e9cKqusTDB

Reddit : https://www.reddit.com/user/LawBlocks

Twitter : https://twitter.com/lawblockstoken

1 note

·

View note

Text

لماذا تقوم XRP و Stellar و XDC & Gens

مع انخفاض أسعار عدة عملات مشفرة متوافقة مع ISO 20022 ، قد يبدو أن السوق يتعطل. لكن حسب أ المؤثر التشفير، هذه ليست علامة على الفشل ، إنها فرصة خفية. ISO 20022 هو تنسيق مراسلة شائع للأنظمة المالية. يستخدم لغة واضحة ومنظمة (استنادًا إلى XML) بحيث يمكن للبنوك ومقدمي الدفع في جميع أنحاء العالم فهم المعلومات ومشاركتها بسهولة. هذا يساعد على جعل المعاملات أكثر دقة وكفاءة.تم إطلاق ISO 20022 الذي تم إطلاقه في عام 2008 ، ويحل محل الأنظمة القديمة مثل Swift ، ويصل تأثيره إلى التشفير. يمكن تبني العملات المعدنية التي تتبع هذا المعيار بسهولة أكبر من قبل البنوك والمؤسسات المالية. إذا كانت التشفيرات الرئيسية مثل Bitcoin و Ethereum ستدمج ISO 20022 ، فقد يكون ذلك لجعل الأصول المالية التقليدية والأصول الرقمية أقرب من أي وقت مضى.يستعد العالم للعيش بشكل كامل مع ISO 20022 بحلول عام 2025. تتوافق العديد من مشاريع التشفير الأعلى بالفعل مع ISO 20022 أو العمل عن كثب مع الشركاء الذين يتماشون معهم.ما هي العملات المتوافقة مع ISO 20022؟ يتصدر XRP (Ripple) أكثر من 300 شريك مالي للمدفوعات العالمية السريعة. يركز XLM (Stellar) على المعاملات عبر الحدود والإدماج المالي. يجلب XDC (Xinfin) blockchain إلى التمويل التجاري ، في حين توفر الخوارزف (ALGO) حلًا أخضرًا قابل للتطوير يجذب الدعم المؤسسي. تقوم IOTA ببناء إنترنت الأشياء ومدفوعات الآلات إلى الآلة. و HBAR (Hedera) ، بدعم من الشركات الكبرى ، تم تصميمها لبيئات آمنة منظمة. معا ، هذه المشاريع تمهد الطريق للجيل القادم من التمويل العالمي.لماذا يمكن أن يكون هذا التراجع فرصة ذهبيةتم تصميم هذه العملات المعدنية لدعم النظام المالي من الجيل التالي. إن الانخفاض الأخير في أسعارها ليس علامة على الفشل ، ولكنه يشبه "خصم مؤقت". في حين أن البنية التحتية الحقيقية لا تزال قيد التطوير خلف الكواليس ، من المحتمل أن يكون هذا الانخفاض مجرد إلهاء. بالنسبة للمستثمرين على المدى الطويل ، يمكن أن تكون فرصة شراء ذكية بدلاً من شيء للخوف.تم تعيين ISO 20022 لسد الفجوة بين التشفير والتمويل التقليدي من خلال جعل المعاملات أكثر أمانًا وأسرع وأكثر كفاءة.بالنسبة للمشاريع المتوافقة ، يجلب ISO 20022 توافقًا أفضل في النظام ، ومخاطر الاحتيال المنخفض ، واتصالات أقوى مع شبكات الدفع العالمية. نظرًا لأن أكثر من 70 دولة تتبنى هذا المعيار ، فقد تستفيد العملات المعدنية المحاذاة ISO وأكثر ثقة أكبر ، وخاصة من المؤسسات.

0 notes

Text

Legal settlements don’t need to take weeks.

With Law Blocks AI + smart contracts on the XDC blockchain, settlements can be finalized in just a few clicks — fast, secure, and transparent.

Read more: https://lawblocks.medium.com/case-closed-in-clicks-how-law-blocks-speeds-up-settlements-with-smart-contracts-8d57b17e5f78

#LawBlocksAI #XDCNetwork #LegalTech #SmartContracts #XDC

@lawblockstoken @SmartContract

1 note

·

View note

Text

XDC Network Price Prediction and Market Outlook 2025–2030

Explore XDC Network’s price prediction for 2025–2030, market outlook, key use cases, and how its enterprise-grade blockchain is reshaping global trade finance. Plus, don’t miss details on XDC airdrops and staking rewards that Bitrue’s held. As blockchain technology continues to evolve and mature, a new class of enterprise-grade solutions is emerging to serve highly specialized sectors. Among…

0 notes

Text

SecuX and XDC Network Unite to Deliver Secure, Scalable Access to the XDC Ecosystem

SecuX, a global blockchain security company, announces its integration with the XDC Network, delivering secure cold wallet support for managing XDC tokens, interacting with smart contracts, and accessing decentralized applications (DApps). With this update, SecuX hardware wallets provide complete and secure access to XDC Network, one of the fastest-growing blockchain ecosystems. Users can

Read More: You won't believe what happens next... Click here!

0 notes

Text

Understanding the Four Types of Blockchains

Public, Private, Consortium & Hybrid — Which One Powers What?

Blockchain technology isn’t one-size-fits-all. As the technology evolves, we’re seeing different flavors of blockchain emerge — each tailored to specific use cases and governance models. In Episode 4 of Unpacking Blockchain Technology with Thabiso Njoko, we break down the four main types of blockchains and explain how each one functions in the real world.

If you’ve ever wondered why some blockchains are open and others are gated, this episode is your gateway to clarity.

The Four Main Types of Blockchains

Whether you're launching a cryptocurrency, managing a supply chain, or modernizing government services, choosing the right type of blockchain is critical. Here's how they compare:

1. Public Blockchains

These are fully decentralized and open to anyone. Anyone can read, write, or participate in the network. Popular examples include Bitcoin, Ethereum, and Solana.

Features:

Open-source

Transparent and secure

Powered by consensus mechanisms like Proof of Work (PoW) or Proof of Stake (PoS)

Use Cases:

Cryptocurrencies

NFTs

Decentralized Finance (DeFi)

Open-access Web3 applications

“Public blockchains are the backbone of the trustless Web3 world,” says Thabiso.

2. Private Blockchains

These are permissioned systems controlled by a single organization. Only selected participants can access the network or validate transactions.

Features:

High speed and scalability

Restricted access

Centralized authority and governance

Use Cases:

Internal business operations

Financial institutions

Healthcare data management

Think of private blockchains as enterprise-grade solutions for data security and control.

3. Consortium Blockchains

Also known as federated blockchains, these are governed by a group of organizations rather than a single entity. Each participant in the consortium has certain rights.

Features:

Semi-decentralized

Shared control among participants

Collaborative governance

Use Cases:

Supply chain tracking

Trade finance between banks

Joint ventures between corporations

These are ideal for industries that rely on shared infrastructure but don’t want to go fully public.

4. Hybrid Blockchains

As the name suggests, hybrid blockchains combine features of both public and private systems. This offers flexibility—you can keep some data public while keeping sensitive data private.

Features:

Controlled access + transparency

Combines the best of both worlds

Complex but powerful

Use Cases:

Government records (public data + confidential citizen info)

Healthcare systems (open research + private patient data)

Real estate platforms

Hybrid blockchains are perfect when trust, control, and openness need to co-exist.

How Do You Choose the Right One?

Thabiso emphasizes that context determines the blockchain. Ask:

Who needs access?

Who verifies the data?

How sensitive is the information?

What are the trust assumptions?

Each blockchain type serves a purpose. The key is understanding your goals before choosing the structure.

Real-World Examples

A public blockchain like Ethereum is widely used for DeFi and NFTs, while a private blockchain such as Hyperledger Fabric powers IBM's supply chain solutions. In the banking and finance sector, a consortium blockchain like R3 Corda is commonly used. Meanwhile, XinFin (XDC) serves as a hybrid blockchain, particularly effective in trade finance applications.

Final Thoughts from Thabiso

“Not every blockchain has to be open to the world. Some need privacy, speed, and control. But understanding why each model exists helps us build smarter systems.”

As blockchain adoption grows, knowing the differences between these models will shape how we design solutions, collaborate with others, and build trust across systems.

Tune In Now

Catch Episode 4 of Unpacking Blockchain Technology with Thabiso Njoko to hear the full breakdown and use-case comparisons.

Join the Discussion

Which blockchain type best fits your project or organization? Share your thoughts or questions in the comments — let’s unpack it together.

#BlockchainTechnology#Web3#CryptoEducation#DigitalTransformation#FutureOfTech#Decentralization#BlockchainRevolution#CryptoExplained#BlockchainInnovation#TechForAfrica#BlockchainPodcast#Web3Podcast#ThabisoNjoko#UnpackingBlockchain#PodcastSeries#LearnBlockchain#EducationalContent#BlockchainForBeginners#CryptoForEveryone#BlockchainAfrica#EswatiniTech#AfricanInnovation#TechInAfrica#Web3Africa#DigitalAfrica#EswatiniBlockchain

0 notes

Text

Smart Contract Based Dispute Resolution - Law Blocks

In the rapidly evolving landscape of legal technology, a new paradigm is emerging that promises to revolutionize the way disputes are resolved. This paradigm is rooted in the power of smart contracts – self-executing, tamper-proof digital agreements that enable automated and transparent processes. Law Blocks, at the forefront of this technological shift, has harnessed the potential of smart contracts to create a transformative approach to dispute resolution. This article delves into the intricate workings of smart contract-based dispute resolution, the role of Law Blocks in this domain, and the benefits it brings to individuals and businesses alike.

Understanding Smart Contract-Based Dispute Resolution

Traditional dispute resolution mechanisms are often time-consuming, expensive, and reliant on intermediaries. Smart contract-based dispute resolution, on the other hand, offers a decentralized, efficient, and cost-effective alternative. At its core, a smart contract is a self-executing digital contract with predefined rules and conditions. Once these conditions are met, the contract automatically executes the agreed-upon actions, eliminating the need for intermediaries and streamlining the process.

The Role of Law Blocks and XDC Blockchain

Law Blocks leverages the power of the XDC blockchain network to facilitate smart contract-based dispute resolution. The XDC network, powered by XinFin, offers a robust and secure foundation for recording and managing legal data. Its decentralized architecture ensures transparency, immutability, and security – critical factors in ensuring a fair and unbiased dispute resolution process. By integrating smart contracts with the XDC network, Law Blocks creates a seamless and efficient ecosystem that enables parties to resolve conflicts swiftly and without the traditional complexities.

Advantages of Smart Contract-Based Dispute Resolution

The advantages of smart contract-based dispute resolution are manifold. First and foremost, it significantly reduces the time and cost associated with traditional methods. The automation of processes reduces human error and ensures that actions are carried out as agreed upon in the contract. This transparency builds trust among parties and eliminates the need for third-party intervention. Additionally, since smart contracts are immutable and tamper-proof, the integrity of the dispute resolution process is upheld.

The Role of Law Blocks Token (LBT)

Law Blocks Token (LBT) plays a pivotal role in the smart contract-based dispute resolution ecosystem. As the native token of the Law Blocks platform, LBT facilitates transactions, ensures security, and offers various benefits to users. Parties involved in dispute resolution can use LBT to avail themselves of cost-saving benefits, making the process even more accessible and affordable. This tokenized approach aligns perfectly with the principles of decentralization and efficiency that smart contracts bring to the table.

Driving Decentralized and Efficient Justice

In a world where technology is advancing at an unprecedented pace, the legal landscape is not far behind. Law Blocks' smart contract-based dispute resolution is a prime example of how innovation can reshape traditional processes. By embracing the power of smart contracts and the XDC blockchain network, Law Blocks is driving the evolution of decentralized and efficient justice. This approach empowers individuals and businesses to seek fair and timely resolution to their disputes, while ushering in a new era of trust, transparency, and accessibility in the legal realm.

#blockchain#blockchain law#law blocks#smart contracts#digitalcurrency#lawyer#crypto#xdc#crypto token#technology

0 notes

Text

Web3 Connect Mumbai

Web3, Blockchain & Digital Assets—All in One Place! Web3 Connect Mumbai (Feb 15, 2025) is bringing together top minds in blockchain and decentralized finance. Whether you’re an investor, developer, or just Web3-curious, this event is packed with insights and opportunities.

What’s in it for you? Connect with Web3 pioneers & blockchain experts. Explore new projects & partnerships powered by the XDC Network. Gain knowledge on DeFi, digital assets & future innovations.

0 notes

Text

0 notes

Text

XDC Network (XDC) Price Prediction 2025-2029: Will XDC Price Hit $0.35 Soon?

The XDC Network, previously known as the XinFin Network, is a blockchain platform tailored for smart contract development and community engagement. Its native cryptocurrency, XDC, has gained traction due to its hybrid blockchain architecture. Launched in 2019, the platform ensures efficient, scalable, and cost-effective transactions. It uses a delegated Proof of Stake (DPoS) mechanism, allowing…

0 notes

Text

XDC Network Price Prediction and Market Outlook 2025–2030

Explore XDC Network’s price prediction for 2025–2030, market outlook, key use cases, and how its enterprise-grade blockchain is reshaping global trade finance. Plus, don’t miss details on XDC airdrops and staking rewards that Bitrue’s held. As blockchain technology continues to evolve and mature, a new class of enterprise-grade solutions is emerging to serve highly specialized sectors. Among…

0 notes

Text

To date, 8 crypto coins already meet the ISO 20022 standard: XRP (XRP), Stellar Lumens (XLM), XDC Network (XDC), Algorand (ALGO), and Iota (IOTA), Hedera Hashgraph (HBB AR), Quant (QNT) and Cardano (ADA). Two of them do not just comply with ISO 20022, they are members of the ISO 20022 standardization body. These currencies are XRP and Stellar Lumens.

List of ISO 20022 compliant cryptocurrencies in 2024

XRP (XRP)

XRP (XRP), the main cryptocurrency of Ripple, is also one of the largest market cap crypto and is by far the largest compliant ISO 20022 coin.

Ripple is a member of the ISO 20022 standardization body and the second largest fintech company in the United States. The XRP coin is considered to mediate between the crypto and fiat markets and is used for various purposes, including fast and cheap cross-border operations. Today XRP can process about 1,500 transactions per second.

Stellar (XLM)

Stellar appeared after the Ripple hard fork and then became a separate network. As well as its "progenitor", Stellar is a member of the ISO 20022 standardization body. XLM coin, like XRP, is designed to combine the crypto and fiat worlds but focuses on currency conversion for individuals rather than organizations other than XRP. It is also designed to develop central bank digital currencies (CBDC).

Currently, more than 300 financial institutions in 45 countries use XLM as a settlement mechanism, including Santander Bank and Canadian Imperial Bank of Commerce.

Cardano (ADA)

Cardano is a decentralized Proof-of-Stake (PoS) blockchain with an Outdoor algorithm that provides proven security and increased transaction processing speed. It is now the world's largest public PoS blockchain with a strong community that has gained a significant presence in the cryptocurrency market, reflecting its widespread acceptance and interest among investors.

Quant (QNT)

Quant is designed to simplify the interaction between major blockchains such as Bitcoin, Ethereum, and Ripple using its gateway, the Overledger DLT operating system. When using it, the issue of compatibility of various blockchains within one ecosystem is solved.

The Quant network enables the creation of advanced multi-chain applications that take advantage of the unique advantages of different blockchains while maintaining the maximum security and integrity of each blockchain.

QNT is Quant Protocol's own currency and is paid by developers to create and operate dApps on the network.

Algorand (ALGO)

Algorand is a large Level 1 blockchain trying to solve many of the problems inherent with competitors like Ethereum. As it said, it is capable of processing about 1,300 transactions per second. The Pure Proof-of-Stake consensus method facilitates rapid transaction confirmation but also maintains one of the lowest transaction fees in the cryptocurrency world while maintaining environmental awareness.

Hedera HashGraph (HBAR)

This distributed ledger platform is similar to blockchain but has a slightly different mechanism of operation. The Hedera Hashgraph project is designed to overcome many of the limitations of traditional blockchains and can execute 10,000 transactions per second (with some reports up to 500,000 transactions per second) with a high level of security. Unlike competitors, Hedera Hashgraph uses a function called a directed acyclic graph to sequence transactions without dividing them into blocks. HBAR is its own cryptocurrency.

IOTA (MIOTA)

A centralized blockchain registry designed to process Internet of Things (IoT)-based transactions. The uniqueness of IOTA lies in the absence of a standard blockchain from the blockchain in favor of a special acyclic graph called Tangle. This allows any user of the system to be a conditional "miner." Everyone who wants to make a transaction is obliged to take part in the formation of the network and approve the two previous transactions. The processing of the other two operations ensures that consensus is reached on the status of the transactions.

Tangle technology also provides superior scalability compared to many other blockchain-based cryptocurrencies. It also excludes limits on transaction volumes (a capability of many micropayments) and their number.

XDC Network (XDC)

XDC Network is an open-source hybrid blockchain protocol that specializes in tokenization for decentralized finance (DeFi). The network is used as a tool for long-term decentralized management. The most striking and important feature of the network is that it embodies a completely new XDPoS consensus mechanism. Compared to Delegated Proof-of-Stake (DPoS), it is much more energy efficient and faster.

XDC complies with ISO 20022. According to its website, the network "allows enterprises of any type to connect their legacy systems to a network of blockchain using the XDC protocol and ISO 20022 compliant messaging."

Xinfin has partnered with R3, a consortium of more than 200 financial institutions, to act as a bridge and host dApps on the Corda Marketplace. Corda "is compatible with existing and emerging regulations such as ISO 20022."

0 notes